Abstract

The objective of this study was to examine the potential moderating effects of the relationship between macroeconomic variables and the financial liquidity of enterprises. Given the significance of liquidity for companies and the profound impact of the macroeconomic environment, a research gap was identified in relation to the limited number of studies investigating the influence of macroeconomic factors on corporate liquidity. Additionally, the limited scope of companies surveyed in this area, in terms of sector, size, capital market presence, and the limited range of macroeconomic variables examined were notable. Most importantly, the absence of studies examining moderators of the relationship between macroeconomic factors and liquidity was a significant concern. To this end, two main research questions were formulated. First, what factors moderate the relationship between macroeconomic variables and the financial liquidity of companies? Second, what is the nature of the moderating effects on the relationship between macroeconomic variables and corporate financial liquidity? This research employed panel data analysis on an unbalanced panel comprising 5327 Polish enterprises spanning from 2003 to 2021. The primary analytical technique utilised was linear regression (pooled OLS) with robust standard errors clustered at the firm level. The main results of this study indicate that: (1) debt level, profitability, and the fixed assets to total assets ratio are significant moderators of some of the relationships between macroeconomic variables and corporate liquidity; (2) debt level moderates the relationship between the ratio of internal expenditures on research and development to GDP and financial liquidity, as well as the relationship between inflation rate and liquidity; the relationship is statistically significant and positive only for those enterprises with above-median debt levels; (3) profitability moderates the relationship between the employment coefficient and financial liquidity, as well as the relationship between the inflation rate and liquidity; in the high-profitability group, those relationships are positive, whereas in the low-profitability group, they are negative; (4) the ratio of fixed assets to total assets moderates the relationship between the money supply and corporate financial liquidity; for enterprises with low asset flexibility, there is a negative relationship between the money supply and financial liquidity; conversely, for enterprises with high asset flexibility, there is a positive relationship between the money supply and financial liquidity; (5) the rationale behind these findings can be derived from capital structure theory and financial analysis theory. The results of this study represent a step towards a more comprehensive understanding of the relationship between the macro environment and corporate liquidity, as well as the factors that moderate this relationship from both a microeconomic and a macroeconomic perspective. The findings of this study may also inform policy decisions governing the corporate sector due to a more nuanced understanding of the relationships between macroeconomic factors and corporate liquidity.

1. Introduction

This article examines the relationship between the level of macroeconomic factors and the financial liquidity of enterprises. The study in question focuses on the moderation effects in the relationship between macroeconomic factors and corporate financial liquidity. In a broader context, this study examines the connection between the macro environment and corporate performance, with a specific focus on financial liquidity.

Financial liquidity is a crucial aspect of financial analysis [1]. Its significance in evaluating a company’s economic position and financial management stems from the fact that a lack of financial liquidity can result in bankruptcy. Therefore, it is vital to comprehend the mechanisms and factors influencing a company’s financial liquidity in order to effectively manage financial resources.

The macroeconomic environment exerts a profound influence on the financial liquidity of enterprises and shapes the conditions for their functioning. A study by Batra and Kalia [2] indicated that companies are significantly exposed to numerous threats related to the unstable and uncertain business environment, both at the level of individual countries and the global economy.

However, the relationship between changes in macroeconomic factors and the financial liquidity of enterprises remains relatively under-researched within the field of economic analysis. The existing lack of both theoretical considerations and empirical research served as one of the premises for dedicating these studies to this issue. Scientific evidence is relatively scarce. While research on the impact of macroeconomic factors on firm performance has been conducted [3,4,5,6], the analysis of the determinants of firm liquidity has been less frequently conducted and has generally focused on firm-specific factors [7,8,9,10,11,12,13,14,15,16,17]. Studies on the impact of macroeconomic factors on corporate liquidity are much less frequent, but point to the importance of macroeconomic factors [18,19,20]. This represents an important research gap. Furthermore, a review of the literature identified additional dimensions of the research gap. These relate to the scope of existing research, for example, research in relation to European emerging economies, such as Poland, where the impact of macroeconomic variables is poorly studied [21]. Moreover, previous studies have either concentrated on companies within a single industry [22] or only on listed companies [21]. Most notably, the list of macroeconomic variables analysed was limited to a few basic variables, such as GDP, inflation, unemployment, and interest rates [19,20,23]. However, the most significant research gap pertains to moderation analysis, which has not yet been employed to assess the influence of macroeconomic variables on corporate liquidity, and has also been rarely addressed in studies conducted in related areas [24,25,26].

Furthermore, previous studies did not cover such a long and recent temporal scope as in the proposed research [21,22]. This period is characterised by varying levels of economic variables, including the two years of the COVID-19 pandemic. However, previous research did not address the analysis of moderators in the relationship between macroeconomic variables and corporate financial liquidity.

In light of the existing research gaps, the objective of the present study is to examine the potential moderating effects of the relationship between macroeconomic variables and the financial liquidity of enterprises.

The novelty of this research lies in filling the identified research gaps, in particular with regard to the analysis of moderators of the relationship between macroeconomic variables and corporate liquidity. This topic has not yet been the subject of research. It is of particular importance for corporate finance, as well as from the perspective of macro-environmental analysis used in the strategic or fundamental analysis of companies and from the perspective of macroeconomics. The achievement of this study’s objectives will contribute to a more comprehensive understanding of the relationship between the macro environment and corporate liquidity, as well as the factors moderating it from a microeconomic perspective. Furthermore, it will enrich the analysis of these phenomena from a macroeconomic perspective.

The objective was achieved through empirical research conducted on Polish enterprises. This study analysed data from initially nearly 6300 enterprises, representing 21 industries classified according to the Polish Classification of Activities (300 companies × 21 industries = 6300). Financial data for the enterprises were obtained from the EMIS (Emerging Markets Information Service) database, while macroeconomic data came from the Macroeconomic Data Bank. The analysis spanned the years 2003 to 2021. The primary research method employed was linear regression on panel data (pooled OLS) with robust standard errors clustered by firm, conducted on an unbalanced panel of 5327 enterprises from 2003 to 2021. The main dependent variable was the logarithm of the current liquidity ratio. As part of the robustness tests, the quick ratio, treasury ratio, and coverage ratio were utilised. Among the macroeconomic variables, several were examined, and only for some of them was a statistically significant relationship observed with corporate financial liquidity. This study used control variables based on previous research, as well as binary variables for industries and years, accounting for their fixed effects. Subsequently, the presence of moderators in the relationship between macroeconomic variables and financial liquidity was examined. This was performed using interaction variables and an F-change test. In each case, the moderation sought was based on theoretical justification.

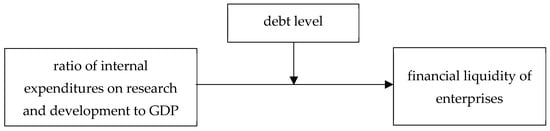

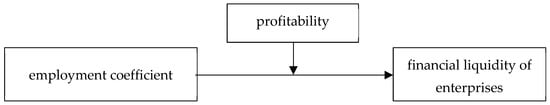

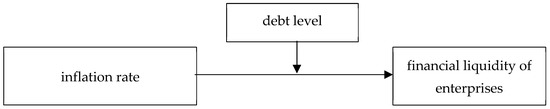

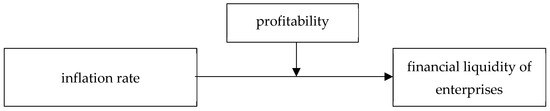

The most significant findings of our study pertain to the moderation analysis. Theoretical conjectures derived from capital structure theory and corporate financial analysis theory, as well as previous research on factors affecting liquidity, were employed to identify potential moderators of the impact of macroeconomic factors on liquidity. These included debt levels, profitability, and asset structure. Path diagrams of the relationships discovered are presented in Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5.

Figure 1.

Path diagram—the moderating effect of debt level on the relationship between the ratio of internal expenditures on research and development to GDP and the financial liquidity of enterprises.

Figure 2.

Path diagram—the moderating effect of profitability on the relationship between the employment coefficient and the financial liquidity of enterprises.

Figure 3.

Path diagram—the moderating effect of debt level on the relationship between the inflation rate and financial liquidity of enterprises.

Figure 4.

Path diagram—the moderating effect of profitability on the relationship between the inflation rate and financial liquidity of enterprises.

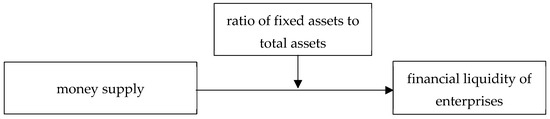

Figure 5.

Path diagram—the moderating effect of fixed assets to total assets ratio on the relationship between money supply and the financial liquidity of enterprises.

Our findings indicate that the debt level exerts a moderating effect on the relationship between the ratio of internal expenditures on research and development to GDP and corporate financial liquidity, as well as on the relationship between the inflation rate and corporate liquidity. In both cases, the relationship between the IRDcapexToGDP variable and financial liquidity, as well as the CPI and financial liquidity, is statistically significant and positive only for those enterprises with above-median debt levels. Furthermore, our research identified a moderating effect of profitability on the relationship between the employment coefficient and financial liquidity of enterprises, as well as on the relationship between the inflation rate and corporate liquidity. In both cases, the relationship between the employment coefficient and financial liquidity, as well as the inflation rate and liquidity, was statistically significant for both enterprises with high profitability and those with low profitability. However, in the high-profitability group, this relationship was positive, whereas in enterprises with low profitability, it was negative. Finally, we explored the moderating effect of the fixed assets to total assets ratio on the relationship between money supply and corporate financial liquidity. Our findings indicate that, for enterprises with low asset flexibility, there is a negative relationship between money supply and financial liquidity. Conversely, for enterprises with high asset flexibility, this relationship is positive. The study results may be useful not only for the corporate sector, but also for policymakers. The examination of macroeconomic factors from areas overlooked in previous studies, such as the institutional and technical environment, is significant from the perspective of sustainability. The description of the moderators of relationships with corporate liquidity in the case of two such factors (the ratio of internal research and development expenditures to GDP from the technical environment and the employment coefficient from the informal institutional environment) is of particular importance in this context. Consequently, the identification of the manner in which diverse macroeconomic variables interact with enterprises with varying levels of debt, profitability, or asset flexibility should inform the decision-making process of policymakers. In addition to the theoretical contribution presented, the methodological contribution of the current article is worthy of attention. It consists, on the one hand, of the application of moderation analysis to the impact of macroeconomic variables on corporate liquidity, which has not been performed before in studies of this type. On the other hand, it refers to the use of new data sources and better sampling in studies of this type.

The following structure is employed in the paper: Section 2 presents the literature review and research questions; Section 3 describes the methodology used in this study (including sample, variables, and analytical approach); Section 4 shows the results of the research with discussion relating to previous studies, as well as the future research directions; finally, Section 5 contains the conclusions.

2. Literature Review and Research Questions

It is of paramount importance for a company to maintain financial liquidity, as the loss of this liquidity is a direct cause of corporate bankruptcies. The impact of macroeconomic factors on corporate financial liquidity can be situated within the broader context of research on corporate performance.

Although the literature suggests that internal factors have a greater impact on firm performance than external factors [27], it is important to recognise the influence of factors from the environment surrounding the company [28].

The macroeconomic environment exerts a profound influence on the financial liquidity of companies and shapes the conditions for their operation. A growing body of research indicates that companies are significantly exposed to a multitude of threats related to an unstable and uncertain business environment, both at the level of individual countries and the global economy [2].

However, the relationship between changes in macroeconomic factors and the financial liquidity of companies remains relatively under-researched within the framework of economic analysis. The existing scarcity of both theoretical considerations and empirical research serves as one of the motivations for dedicating these studies to this issue. Scientific evidence is relatively limited, and the cognitive results presented in them often lack consistency. Moreover, the range of macroeconomic variables that have been previously studied appears to be incomplete, suggesting that there are numerous potentially significant variables that have not yet been investigated in terms of their impact on corporate financial liquidity.

Previous research on the impact of macroeconomic factors on company performance has often focused more on profitability than financial liquidity. These studies frequently centred on the banking sector. For instance, research in the banking sector [29] highlighted that bank profitability was influenced not only by bank characteristics, taxation, and financial structure, but also by macroeconomic conditions, such as GDP and industry-specific factors, like market concentration. Other studies in the banking sector [4] indicated a significant negative relationship between the return on assets (ROA) and the annual GDP growth rate and inflation rate. Further research [6,30] revealed that economic growth negatively impacted the profitability of Malaysian banks, while higher inflation had a positive effect. Conversely, a later study involving 47 banks from 14 European countries [3] found that GDP growth rate, inflation rate, and market concentration positively influenced bank profitability. Studies on the determinants of profitability in manufacturing firms demonstrated a relationship between industry concentration levels and realised margins in terms of their cyclicality and acyclicality [31]. Subsequent research on Greek companies [32] indicated that significant macroeconomic changes, such as joining the Economic and Monetary Union and adopting the euro currency, had a negative effect on corporate profitability. In other studies [5], the occurrence of country-level crises and international crises had a significant impact on firm profitability.

It is understandable that research has focused on the impact of macroeconomic factors on company performance, particularly profitability, rather than financial liquidity. Profitability is one of the key drivers of a company’s value, and it is widely recognised that businesses in a market economy should seek to maximise value [33]. It is also important to acknowledge that, from the perspective of the biological theories of the firm, the fundamental goal of enterprises is survival [34,35]. This can be translated into the language of corporate finance, where the objective of a company is to maintain financial liquidity, as its loss leads to bankruptcy.

Previous research on financial liquidity has frequently concentrated on the relationship between financial liquidity and profitability, with the results of these studies being inconclusive. Some studies have confirmed a positive association between financial liquidity and short-term performance [36,37], while others have found no relationship [38,39], or most commonly, a negative relationship [40,41]. This negative relationship may only manifest in the short term. In the medium to long term, inadequate liquidity can lead to reduced profitability, increased credit demand, and insufficient cash flow, which, in turn, adversely affects a company’s performance [42].

Although the literature on research regarding financial liquidity is quite extensive [7,11,14,15,17,23], it typically focuses on the impact of firm-specific factors on financial liquidity. The extant literature in this field indicates that firm-specific factors exert a significant influence on the liquidity of entities. Among the most commonly cited factors are profitability, asset structure and debt levels [8,9,10,12,13,16]. This relationship was subsequently employed further in the paper to identify potential moderators of the relationship between macroeconomic variables and liquidity.

Research on the impact of macroeconomic variables on financial liquidity is much less common. For example, an international study [23] investigates the impact of macroeconomic conditions on corporate liquidity (cash holdings) in 45 countries from 1994 to 2005. It considers variables such as GDP growth rate, inflation, short-term interest rate, and government deficit. The findings indicate that macroeconomic variables, in addition to traditional firm-specific factors, play a significant role in determining corporate liquidity. It is noteworthy that this type of study considers cash holdings (ratio of cash to total net assets of cash) as a variable that describes financial liquidity.

Studies on the impact of macroeconomic variables on cash holdings have typically focused on a limited set of macroeconomic variables. However, some of these studies have indicated that the role of macroeconomic factors in relation to liquidity is significant [19,20]. A study by Dottori and Micucci [18] indicated that the increase in the liquidity levels of Italian firms between 2011 and 2015 was mainly due to macroeconomic factors, such as the fall in interest rates. Furthermore, a study by Wang [19] suggested that the impact of uncertainty on cash policy is increased when a firm has difficulty raising external capital. This observation is pertinent in the context of identifying moderators in our analysis, as the list of potential moderators includes the level of debt, which is generally correlated with potential difficulties in raising external capital.

Other research in this area indicates that the level of cash holdings is dependent on the prevailing macroeconomic situation and the associated uncertainty in both developed and emerging economies [28,43,44,45]. A research gap can be identified in relation to European emerging markets, such as Poland, where the impact of macroeconomic data on cash holdings is poorly studied. In a study by Gajdka and Pietraszewski [21], which included both firm-specific and macroeconomic variables, a statistically significant relationship could only be observed for GDP growth, and it was a positive relationship. The other macroeconomic variables were statistically insignificant in all models. This was due, in part, to the fact that the study had a small sample size comprising only listed companies. Consequently, this represents a research gap that requires further investigation.

A further study [46] examined the relationship between profitability and financial liquidity across 16 economies. It concluded that the impact of profitability on liquidity is diverse and influenced by macroeconomic and institutional conditions. Notably, private sector crediting and capital market development act as significant moderators in this relationship.

Some research on the macroeconomic impact has focused on the financial liquidity of specific economic entities, such as banks. For instance, the study by Mahmood et al. [47] provides insights into the impact of various factors on bank liquidity, despite focusing solely on Pakistani banks. It discussed how GDP, monetary policy, bank size, and profitability affect liquidity. The findings indicate that total deposits, GDP, bank size, and unemployment have negative impacts on the liquidity of the bank. Conversely, monetary policy, bank crisis, and profitability have a positive impact on liquidity. Inflation has been found to have an insignificant relationship with liquidity. These findings were corroborated by a study of Polish cooperative banks, which demonstrated that GDP exerts a positive influence on liquidity, albeit only for large banks [9].

The study by Qehaja et al. [48] also considered the impact of macroeconomic factors on bank liquidity. It revealed that GDP per capita and the unemployment rate have a positive effect on bank liquidity, whereas the inflation rate exerts a negative influence.

A parallel can be drawn between the topic discussed in this article and the subject of research into the effect of macroeconomic factors on working capital management. A review of working capital management studies conducted by Jaworski and Czerwonka [22] revealed that only 3 of the 16 studies considered a macroeconomic factor to be a determinant of liquidity. This factor was GDP [11,49,50]. A recent study in this field [51] examined the impact of economic policy uncertainty (EPU) and foreign exchange risk (FX risk), two of the most significant macroeconomic risk factors, on WCM and, consequently, firm performance. The study employed two measures of macroeconomic risk factors: the EPU index and FX risk. The cash conversion cycle was used as an indicator of working capital management. The findings indicated that US, German, and Chinese firms tend to adopt a more conservative approach to maintaining WCM during economic policy uncertainty. Conversely, the USA, the UK, and Chinese firms tend to lengthen their cash conversion cycle due to concerns about potential value loss. In contrast, German firms tend to adopt a more aggressive approach. Jaworski and Czerwonka [22] conducted a study investigating the impact of firm-specific and macroeconomic factors on the liquidity of companies in the energy sector within the EU. Their findings revealed a negative correlation between GDP growth and liquidity, as well as a positive correlation between unemployment and liquidity. While their study focused on the energy sector and employed a limited set of variables, it underscored the necessity to consider macroeconomic variables as potential determinants of liquidity.

A review of the existing literature reveals a paucity of research investigating the relationship between macroeconomic factors and the financial liquidity of companies within the context of economic analysis. The dearth of theoretical considerations and empirical research in this area serves as one of the motivating factors for the present study. The existing body of scientific evidence is relatively limited, and the spectrum of previously studied macroeconomic variables appears incomplete. This implies that there are many potentially significant variables that have not yet been investigated in terms of their impact on corporate financial liquidity.

While the impact of firm-specific factors on corporate liquidity has been widely reported [8,9,10,12,13,16], the impact of macroeconomic factors remains a research gap. However, there are studies that highlight the importance of studying macroeconomic factors for corporate liquidity [18,19,20]. Moreover, the literature on corporate financial distress explicitly states that the addition of macroeconomic variables significantly improves the explained relationships relative to when only firm-specific variables are considered [52,53,54].

To date, studies on the impact of macroeconomic factors on corporate liquidity have been limited in scope. Either they have focused on companies in a single sector [22] or only listed companies [21]. Most importantly, however, the list of macroeconomic variables considered in the studies was limited and focused on a few basic macroeconomic variables, such as GDP or its growth, inflation, unemployment, or interest rates [19,20,23]. This constitutes an important research gap that the present study was designed to fill. The study included a representative sample of Polish companies from all sectors, both listed and unlisted, including small, medium, and large entities. With regard to the range of macroeconomic variables, the initial phase of this study included a list of 74 variables from different areas, which was then reduced on the basis of their statistical significance in regression models.

Furthermore, it should be noted that moderation analysis has not been employed in studies on the impact of the macro environment on liquidity to date, and has also been rarely addressed in studies from related areas. When topics have been addressed, research has been about firm size moderating the impact of profitability on financial performance [26], audit quality moderating the impact of firm-specific variables on financial distress [24], or interest rates and inflation rates moderating the impact of firm-specific factors on liquidity [25]. This represents a research gap that this study aims to address.

Consequently, before conducting an analysis of the moderation of the relationship between macroeconomic variables and the financial liquidity of enterprises, which is a comprehensive undertaking, it was necessary to systematically examine a comprehensive list of 74 potential macroeconomic variables in terms of their impact on the liquidity of enterprises. This was achieved by utilising a classification of macroeconomic variables that divides them into the following groups [55]:

- Variables reflecting the overall efficiency of the economic system (e.g., gross domestic product and other indicators describing the economic cycle, exchange rates, inflation rates, interest rates, etc.);

- Variables related to the formal institutional environment (e.g., the pace of technological changes, government spending on research and development, the level of telecommunications infrastructure development, transportation infrastructure development, the overall innovativeness of the economy, etc.);

- Variables related to the informal institutional environment (e.g., the number and complexity of legal acts governing business operations, permits for construction, antitrust laws, etc.);

- Variables reflecting the technical environment (e.g., demographic factors, such as societal mobility, employment levels, educational attainment, life expectancy of the population, etc.).

In previous studies, the relationships between macroeconomic variables and firms’ performance were typically investigated in terms of variables reflecting the overall efficiency of the economic system. However, the relationships with macroeconomic variables from other areas were rarely investigated [9,18,19,20,22,23,47,48].

Given the significance of macroeconomic variables from these four areas for business entities, an in-depth analysis of the relationship between those variables and corporate financial liquidity is necessary. This is because the moderators of this relationship have not been previously examined. The role of moderation analysis in understanding the strength and direction of the link between variables cannot be overstated. The identification of moderators in the relationship between macroeconomic variables and corporate liquidity can contribute to the search for new theories that explain the nature of such dependencies [46].

In our investigation of the relationship between macroeconomic variables and corporate financial liquidity, we rely on well-established theoretical frameworks in finance, as well as findings of empirical research. The empirical rationale is that studies of the determinants of liquidity, as previously mentioned, point to profitability, asset structure and debt level [8,9,10,12,13]. From a theoretical perspective, our study is grounded in the tenets of capital structure theory and financial analysis theory. Based on these theoretical foundations, we sought to identify potential moderators, including debt level, profitability, and asset structure of enterprises.

The capital structure theory, particularly the trade-off theory, provides a robust foundation for investigating the moderating influence of macroeconomic variables on the financial liquidity of enterprises in relation to their debt levels. The trade-off theory challenges certain assumptions inherent in Modigliani and Miller’s models [56,57] by seeking an optimal capital structure—one where the weighted average cost of capital is minimised while maximising the firm’s value. This theory postulates that any change in the debt-to-equity ratio entails both benefits and costs. Increasing debt levels, for instance, reduces capital costs due to tax shields and increases reliance on cheaper financing sources. Conversely, it raises the weighted average cost of capital by increasing financial risk and affects debt costs, which in turn leads to decreased free cash flows due to a higher likelihood of financial distress [58,59]. The trade-off theory considers both direct and indirect costs of financial distress, as well as the dual relationship between debt levels and agency costs. It posits that debt levels discipline managers through various mechanisms, including potential agency conflicts arising with higher debt levels, which may include conflicts of interest between creditors and owners [60,61].

It can be reasonably assumed that the debt level exerts a significant influence on the strength and direction of the impact of certain macroeconomic variables on the financial liquidity of enterprises. This is because a higher debt level modifies the expectations and behaviours of enterprises in terms of expected efficiency. For instance, the aforementioned disciplining effect of debt on managers may lead to noticeable effects of certain macroeconomic factors on liquidity at high debt levels, while at lower debt levels, these effects may not be present, or their direction may change. It is anticipated that such moderation will be particularly evident in variables that reflect the overall efficiency of the economic system and those that reflect the technical environment.

However, the precise nature of this moderation is difficult to predict. According to the trade-off theory, increasing debt levels entail both benefits and costs, and it remains uncertain which effect will dominate. Additionally, the shape of these relationships can be influenced by the fact that macroeconomic variables partially determine the level of benefits and costs associated with debt. For example, tax shields depend on the level of income taxation, which is influenced by factors from the formal institutional environment. Furthermore, the interest rates on debt are influenced by the key interest rates, which are part of the economic environment. Tax shields are also influenced by the overall income of the entity, shaped by factors both internal and external to the business. Conversely, the risk of bankruptcy is associated with the magnitude of direct bankruptcy costs, which are significantly influenced by factors from both the formal institutional environment and the informal institutional environment. Additionally, indirect financial distress costs, which are primarily shaped by internal factors and those originating from the microenvironment of the entity, also contribute to the overall risk of bankruptcy.

The rationale for investigating the moderating effects of profitability can be found in the theory of corporate financial analysis. Profitability represents a key area of analysis that illustrates the efficiency of business operations [1]. It is well established that the level of firm performance exerts a significant influence on the behaviour of enterprises, including aspects related to investment activities and the treatment of employees [62,63,64]. Consequently, it can be anticipated that the moderating effect of profitability will be observed in its impact on the financial liquidity of enterprises, particularly in relation to those macroeconomic variables that reflect the overall efficiency of the economic system and the informal institutional environment.

The theoretical justification for a potential moderator, such as asset structure, can also be found in the theory of financial analysis [1]. According to this theory, the ratio of fixed assets to total assets informs us about the level of asset flexibility. It is generally accepted that a higher proportion of current assets indicates greater asset flexibility, while a higher proportion of fixed assets signifies reduced flexibility (immobilisation) of assets. This relationship arises from the connection between asset flexibility (or immobilisation) and the level of fixed operating costs and operational risk. Low asset flexibility is typically associated with high fixed operating costs, whereas high asset flexibility corresponds to low fixed operating costs [1]. This relationship can impact an organisation’s ability to respond to changes in economic and market conditions, while the level of organisational flexibility influences its performance [65]. Therefore, concerning the impact of macroeconomic factors on the financial liquidity of enterprises, one can expect a moderating effect of asset structure, especially for those variables related to economic conditions—variables reflecting the overall efficiency of the economic system and the technical environment.

In light of the existing knowledge on this topic, the following research questions were formulated:

- What factors moderate the relationship between macroeconomic variables and financial liquidity of companies?

- What is the nature of the moderating effects on the relationship between macroeconomic variables and corporate financial liquidity?

It is noteworthy that this study did not rigidly formulate hypotheses, but rather focused on posing questions and research problems. This approach generated numerous intriguing interpretations, which is deemed acceptable in the realms of economics, finance, and management sciences. In line with recommendations from scientific methodologists, it was acknowledged that hypotheses are not always essential in these scientific domains. Even if they were deemed necessary, they would have to simultaneously meet the criteria of being novel, broad, precise, non-contradictory, and testable. Nevertheless, the authors concluded that meeting all these conditions would be somewhat impractical, in part due to the nature of the subject matter addressed, the methodology employed in this study, and its constrained framework.

3. Methodology

3.1. Sample

This study utilised databases, primarily the EMIS database and the Macroeconomic Data Bank. Data related to companies were obtained from the EMIS database. Data related to macroeconomic factors were obtained from the Macroeconomic Data Bank. This study focused on companies registered in Poland from 21 sections of the Polish classification of economic activity (PKD), which automatically defined the spatial scope of this research. The data sources provided access to information on over 682,000 companies registered in Poland. This study included all companies for which it was possible to obtain the necessary financial data to calculate selected indicators. In addition to data availability, other criteria were employed to limit the selection of companies, with the objective of including smaller entities that are typically overlooked in various economic studies. The inclusion of the full spectrum of entities in the research sample, including small businesses, is one of the advantages of this study. This study’s time frame covered the years 2003–2021.

The choice of time range was primarily driven by the desire to encompass as extensive a period as possible, encompassing years with varying levels of macroeconomic variables. The period from 2003 to 2021 fulfils this criterion. The decision to commence the analysis in 2003 was primarily influenced by the availability of data and their comparability. The selected time frame encompassed a period during which the financial data of the sampled companies remained relatively consistent in terms of changes in accounting legislation. The year 2021 represented the most recent year for which complete financial data were available at the time of data acquisition.

In order to minimise the number of observations with missing variables that are components of relevant financial ratios, EMIS randomly selected an initial sample of 300 companies for each of 21 industries within its on-demand data service. The sample size was determined based on statistical requirements. The minimum sample size commonly used in straightforward economic studies depends on the methodology and variables used in the study [66]. The minimum sample size is 96 observations (with alpha 1.96 and an estimation error of 0.10), while the preferred size is 272 observations (with alpha 1.65 and an estimation error of 0.05). In this study, the value was rounded up to 300. With regard to the 21 PKD sections, the initial assumption was that a sample of 6300 companies (300 × 21 = 6300) would be appropriate. However, the final number of observations was slightly lower due to the specifics of panel research [67] and the limited representation (below 300 companies) in some PKD sections. It should be noted that the sample, consisting of companies that reliably report financial data, may have some bias, although this may not be a significant issue.

After eliminating outliers and observations with missing data, as is required by the adopted research methodology, this study utilised fewer than 6300 companies and the number of companies varied over time. To eliminate univariate outliers, the interquartile range (IQR) was utilised [68]. An observation was considered an outlier if its value was less than the first quartile minus 150% of the interquartile range (IQR) or exceeded the third quartile plus 150% of the IQR [69]. Outlying values were removed from the sample.

The intersection of two data sets with the aforementioned limitations resulted in an unbalanced panel of 74,067 firm–year observations, comprising 5327 unique firms over the period of 2003–2021.

3.2. Variables

3.2.1. Dependent Variable

The primary dependent variable was the logarithm of the current ratio. The current ratio is defined as the ratio of current assets to short-term liabilities, according to the formula:

current ratio = current assets/current liabilities,

The transformation of this variable was performed using the decimal logarithm in order to remove the skewness of its distribution and approximate it to a normal distribution [66]. As part of the robustness tests, the following ratios were utilised: quick ratio, treasury ratio, and coverage ratio, calculated according to the following formulas:

quick ratio = (current assets − inventories − short-term deferred assets)/current liabilities,

treasury ratio = cash and cash equivalents/current liabilities,

coverage ratio = operating profit/interests,

All these variables were transformed using the decimal logarithm.

3.2.2. Macroeconomic Variables

Among the numerous macroeconomic variables that were examined, a statistically significant relationship with the financial liquidity of companies was identified for several of them. The investigation into the relationship between macroeconomic variables and corporate financial liquidity was conducted by dividing them into four groups [55]:

- Variables reflecting the overall efficiency of the economic system;

- Variables related to the formal institutional environment;

- Variables related to the informal institutional environment;

- Variables reflecting the technical environment.

With regard to the first group of macroeconomic variables, the following variables were included in the analysis:

- GDP per capita (variable GDPperCapita);

- Ratio of consumption to GDP (variable ConsumptionToGDP);

- Ratio of foreign trade goods balance to GDP (variable ForeignTradeGoodsBalanceToGDP);

- Consumer price index (variable CPI);

- Money supply (logarithm − variable LogMoneySupply).

The representative of formal institutional variables is the number of flats for which permits have been issued or notifications have been made with a building project (variable LogFlatsPermits). This variable was also transformed using a decimal logarithm.

Among the informal institutional environment variables, one can include the following:

- Employment coefficient (variable EmploymentCoeff);

- Pre-working-age population percentage ratio (variable PreworkingAgePopulationPercenta).

The representative of technical environment variables is the ratio of research and development internal (domestic) expenditures to GDP (variable IRDcapexToGDP).

It is noteworthy that, in previous studies, the relationships between macroeconomic variables typically involved variables reflecting the overall efficiency of the economic system. However, the relationships with macroeconomic variables from other areas were rarely investigated [9,18,19,20,22,23,47,48].

3.2.3. Control Variables

Based on previous studies [7,11,14,15,17], the following control variables were considered in the analysis:

- Age of a company in years (variable CompanysAge);

- Relation of liabilities to total assets (variable LiabilitiesToAssets);

- Relation of non-current assets to total assets (variable NoncurrentAssetsToAssets);

- Size of the firm measured by the decimal logarithm of total assets (variable LogAssets);

- Profitability measured by return on sales computed as the ratio of operating profit to revenues from sales (variable ROSoperational).

Additionally, dummy variables were included in the analysis to reflect industry effects and year effects.

3.3. Research Design

The primary research method employed was regression analysis. Within this framework, a linear regression model was utilised, with its parameters estimated using the ordinary least squares method. Panel data analysis was conducted on an unbalanced panel of 5327 Polish enterprises over the period of 2003–2021. In each model, the estimated standard errors were adjusted for heteroskedasticity and the standard errors were clustered at the firm level [70].

The conducted regression analysis, as part of the research, encompassed all information from the sample (pooled OLS). The basic form of the linear regression model is as follows:

where:

LogCR = α0 + β1MACRO + β2CompanysAge + β3LiabilitiesToAssets + β4NoncurrentAssetsToAssets + β5LogAssets + β6ROSoperational + IndustryEff + YearEff + ε

- LogCR—dependent variable, representing the logarithm of the current ratio;

- MACRO—one of the macroeconomic variables i.e., GDPperCapita, ConsumptionToGDP, ForeignTradeGoodsBalanceToGDP, CPI, LogMoneySupply, LogFlatsPermits, EmploymentCoeff, PreworkingAgePopulationPercenta, or IRDcapexToGDP;

- Variables 2 to 6—control variables, i.e., CompanysAge, LiabilitiesToAssets, NoncurrentAssetsToAssets, LogAssets and ROSoperational;

- IndustryEff, YearEff—variables corresponding to fixed effects for industries and years.

The initial linear regression analysis aimed to examine the impact of macroeconomic variables on the financial liquidity of enterprises. Given that corporate liquidity is contingent upon the industry in which they operate and exhibits variations over time, the modelling employed industry and year dummy variables to account for industry and year fixed effects, respectively. Each successive macroeconomic variable was introduced into the model, resulting in ten statistically significant linear regression models. Subsequently, the main goal of the study was pursued, namely the examination of the presence of moderators in the relationship between macroeconomic variables and financial liquidity. As described in Section 2, the theoretical justification served as the basis for seeking moderation in each case. Once the models had been created in which both the explanatory variable (macroeconomic) and the control variables were statistically significant, interaction variables were created. In order to account for the different measurement units of the individual variables, standardisation of the variables was applied, followed by the calculation of the interaction variables (which represent the product of the explanatory variable and the potential moderating variable) that were incorporated into the models. For the statistically significant interaction variables, moderation analysis was conducted using the F-change test. If a statistically significant F-change result was obtained, the nature of the interaction was determined. To achieve this, the sample was divided into two subsamples based on the median size, and separate linear regression models (with robust standard errors clustered at the firm level) were estimated for both subsamples, allowing for the characterisation of moderation.

To conduct the analyses, SPSS and Gretl software were utilised.

4. Results and Discussion

4.1. Descriptive Statistics of Regression Variables

A regression analysis was conducted on an unbalanced panel of Polish companies. The final sample comprised 74,097 observations representing 5327 unique firms between 2003 and 2021. Table 1 reports the descriptive statistics for the dependent, independent, and control variables in the initial phase of our study. Table 2 reports the Pearson correlation coefficients between the relevant variables.

Table 1.

Descriptive statistics for regression variables.

Table 2.

Pearson correlation coefficients between regression variables.

As presented in Table 1, both the mean and median of the current liquidity ratio for companies in the research sample were at a level that, according to the literature, did not indicate financial liquidity problems [1]. However, the first quartile represented a level that may suggest some liquidity issues.

With regard to Table 2, the Pearson correlation coefficients between the independent variables (macroeconomic as well as control) and the dependent variable were relatively low, which was beneficial for modelling. Only two variables exhibited an absolute value exceeding 0.05, namely −0.263 for the variable NoncurrentAssetsToAssets and −0.075 for the variable LogAssets. These were statistically significant at the 0.01 level. Table 2 also demonstrates a high correlation between macroeconomic variables. However, this was not a concern given the modelling approach, as economic variables were introduced into the models individually. It is also noteworthy that the correlation between macroeconomic variables and control variables was low.

4.2. Multivariate Regression Analysis and Discussion

The search for moderators of the relationship between macroeconomic variables and financial liquidity of enterprises commenced with a research procedure designed to identify the relationship between macroeconomic variables and corporate financial liquidity. To examine this relationship, we regressed the log-transformed current ratio on various macroeconomic and control variables using pooled panel (cross-sectional time-series) regressions with robust standard errors clustered at the firm level. To ensure the robustness of our findings, we conducted our analysis again using the quick ratio, treasury ratio, and coverage ratio as dependent variables. Our conclusions remained consistent.

Statistically significant relationships were found for ten macro variables for which linear regression models were constructed. These variables include:

- GDP per capita (variable GDPperCapita);

- Ratio of consumption to GDP (variable ConsumptionToGDP);

- Ratio of foreign trade goods balance to GDP (variable ForeignTradeGoodsBalanceToGDP);

- Consumer price index (variable CPI);

- Money supply (logarithm − variable LogMoneySupply);

- Number of flats for which permits have been issued or notifications have been made with a building project (logarithm − variable LogFlatsPermits);

- Employment coefficient (variable EmploymentCoeff);

- Pre-working-age population percentage ratio (variable PreworkingAgePopulationPercenta);

- Ratio of domestic (internal) research and development expenditures to GDP (variable IRDcapexToGDP).

All models were statistically significant (p-value < 0.01) and there was no issue of multicollinearity among the variables in the models (VIF significantly lower than 10 for all variables). Based on the results of the linear regression for the baseline models, the search for moderators of the relationship between macroeconomic variables and corporate financial liquidity was initiated.

During this phase, we focused on exploring the moderating factors influencing the relationship between macroeconomic variables and the financial liquidity of enterprises. It is therefore crucial to understand these moderating factors in order to comprehend the nuanced dynamics between macroeconomic indicators and corporate financial liquidity.

Based on the potential theoretical justification (described in Section 2), and subsequent analysis of interaction variables (described in Section 3), the following moderating effects were identified:

- The moderating effect of debt level (variable LiabilitiesToAssets) on the relationship between the ratio of internal expenditures on research and development to GDP (variable IRDcapexToGDP) and financial liquidity of enterprises;

- The moderating effect of profitability (variable ROSoperational) on the relationship between the employment coefficient (variable EmploymentCoeff) and financial liquidity of enterprises;

- The moderating effect of debt level (variable LiabilitiesToAssets) on the relationship between inflation rate (variable CPI) and financial liquidity of enterprises;

- The moderating effect of profitability (variable ROSoperational) on the relationship between inflation rate (variable CPI) and financial liquidity of enterprises;

- The moderating effect of fixed assets to total assets ratio (variable NoncurrentAssetsToAssets) on the relationship between money supply (variable LogMoneySupply) and financial liquidity of enterprises.

Table 3 presents the results of the analysis concerning the moderating effect of debt level on the relationship between the ratio of internal expenditures on research and development to GDP and financial liquidity of enterprises. To determine the nature of the interaction, the sample was divided into two subsamples based on the median of the moderating factor (above the median and below the median). Separate linear regression models (with robust standard errors clustered at the firm level) were then estimated for both subsamples, allowing for the characterisation of moderation. The interaction variable, which was the product of LiabilitiesToAssets and IRDcapexToGDP variables, was statistically significant at the 10% level. Furthermore, the F-change-statistic (1, 5326) for the addition of the interaction variable was statistically significant (p-value < 0.10). Additionally, there was no issue of multicollinearity among the variables in the presented models. All variables had a variance inflation factor (VIF) lower than 5.

Table 3.

The results of the moderation analysis—moderating effect of debt level (variable LiabilitiesToAssets) on the relationship between the ratio of internal expenditures on research and development to GDP (variable IRDcapexToGDP) and financial liquidity of enterprises.

As indicated by the table, the impact of the internal expenditures on R&D to GDP ratio on corporate financial liquidity was moderated by debt level. The relationship between the variables IRDcapexToGDP and LogCR was statistically significant only for those enterprises with higher debt levels (above the median). Notably, this relationship was positive, indicating that, as the R&D-to-GDP ratio increased, corporate liquidity also increased.

The theoretical rationale for this moderation effect can be traced back to capital structure theory, which posits that higher debt levels impose stricter efficiency criteria on businesses (the disciplining effect of debt on managers) [59,60]. Consequently, the observed moderating impact of debt level can be explained by the fact that, at higher debt levels, there are tighter efficiency standards. Therefore, increased investment in research and development within the economy can positively influence the financial liquidity of enterprises.

This finding underscores the importance of considering debt levels when assessing the impact of R&D investments on corporate liquidity. It is a delicate balance between leveraging debt for growth and maintaining financial stability.

Table 4 presents the results of the analysis concerning the moderating effect of profitability on the relationship between the employment coefficient and financial liquidity of enterprises. As previously stated, to determine the nature of the interaction, the sample was divided into two subsamples based on the median of the moderating factor (above the median and below the median). Separate linear regression models (with robust standard errors clustered at the firm level) were then estimated for both subsamples, allowing for the characterisation of moderation. The interaction variable (product of ROSoperational and EmploymentCoeff variables) was statistically significant at the 1% level and the F-change statistic (1, 5326) for the addition of the interaction variable was statistically significant (p-value < 0.01). Furthermore, there was no issue of multicollinearity among the variables in the presented models, as all variables had a variance inflation factor (VIF) lower than 4.

Table 4.

The results of the moderation analysis—moderating effect of profitability (variable ROSoperational) on the relationship between the employment coefficient (variable EmploymentCoeff) and financial liquidity of enterprises.

As indicated by the table, sales profitability moderates the impact of the employment coefficient on the financial liquidity of enterprises. The relationship between the variables EmploymentCoeff and LogCR was statistically significant for both enterprises with high profitability and those with low profitability. However, the nature of this relationship differed. In the high-profitability group, a higher employment coefficient (lower unemployment) positively influenced financial liquidity. In other words, as the employment coefficient increased, financial liquidity also increased. Conversely, for enterprises with low profitability, a higher employment rate in the economy negatively affected financial liquidity—as the employment coefficient increased, financial liquidity decreased.

This relationship can be explained by the fact that high profitability requires high-quality employees [64]. Therefore, a decrease in unemployment does not lead to as significant a wage pressure as observed in enterprises with lower profitability.

Table 5 presents the results of the analysis concerning the moderating effect of debt level on the relationship between inflation rate and the financial liquidity of enterprises. The research procedure was identical to that employed in previous cases. The interaction variable (product of LiabilitiesToAssets and CPI variables) was found to be statistically significant at the 1% level, with the F-change statistic (1, 5326) for the addition of the interaction variable being statistically significant (p-value < 0.01). Furthermore, no issues of multicollinearity were evident among the variables presented in the models. All variables exhibited a variance inflation factor (VIF) below 7.

Table 5.

The results of the moderation analysis—moderating effect of debt level (variable LiabilitiesToAssets) on the relationship between inflation rate (variable CPI) and financial liquidity of enterprises.

As indicated by the table, the debt level moderated the impact of the inflation rate on corporate financial liquidity. The relationship between the variables CPI and LogCR was statistically significant only for enterprises with high debt levels, and it was a positive relationship (meaning that as the CPI increased, LogCR also increased). The theoretical justification for this effect can be found in capital structure theory, which describes the disciplining impact of debt on managers [59,60]. At higher debt levels, stricter efficiency criteria come into play, leading to greater attention to changes in selling prices, especially when profit margins are affected by inflation-induced cost increases.

Table 6 presents the results of the analysis concerning the moderating effect of profitability on the relationship between the employment coefficient and financial liquidity of enterprises. The research procedure was identical to that employed in previous cases. The interaction variable (product of ROSoperational and CPI variables) was found to be statistically significant at the 1% level, with the F-change-statistic (1, 5326) for the addition of the interaction variable being statistically significant (p-value < 0.01). Furthermore, no issues of multicollinearity were evident among the variables presented in the models. All variables exhibited a variance inflation factor (VIF) below 7.

Table 6.

The results of the moderation analysis—moderating effect of profitability (variable ROSoperational) on the relationship between inflation rate (variable CPI) and financial liquidity of enterprises.

As demonstrated in Table 6, profitability moderated the impact of the inflation rate on corporate financial liquidity. The relationship between the variables CPI and LogCR was statistically significant for both enterprises with high profitability and those with low profitability. However, the nature of this relationship differed. In the high-profitability group, a higher inflation rate positively influenced financial liquidity. In other words, as the CPI increased, financial liquidity also increased. Conversely, for enterprises with low profitability, a higher inflation rate in the economy had a negative effect on financial liquidity. As the CPI increased, financial liquidity decreased. It can be argued that highly profitable enterprises may pass on the cost increases resulting from inflation to customers, while enterprises with lower profitability absorb a greater share of the cost increases stemming from overall price growth in the economy, thereby impacting their financial liquidity.

Table 7 presents the findings pertaining to the moderating effect of the fixed assets ratio on the relationship between money supply and the financial liquidity of enterprises. The research methodology was consistent with that employed in previous cases. The interaction variable (product of NoncurrentAssetsToAssets and LogMoneySupply variables) was found to be statistically significant at the 5% level, with the F-change-statistic (1, 5326) for the addition of interaction variable being statistically significant (p-value < 0.05). Furthermore, no issues of multicollinearity were evident among the variables presented in the models. All variables exhibited a variance inflation factor (VIF) lower than 4.

Table 7.

The results of the moderation analysis—moderating effect of the fixed assets to total assets ratio (variable NoncurrentAssetsToAssets) on the relationship between money supply (variable LogMoneySupply) and financial liquidity of enterprises.

As Table 7 illustrates, the level of asset flexibility moderates the impact of money supply on the financial liquidity of enterprises. The ratio of fixed assets to total assets provides insight into the level of asset flexibility. In general, a higher proportion of current assets indicates greater asset flexibility, while a higher proportion of fixed assets implies less flexibility (asset immobilisation).

The data in the table reveal the following patterns. For enterprises with low asset flexibility (high asset immobilisation), there is a negative relationship between money supply and financial liquidity. In other words, as the money supply increases, financial liquidity decreases. Conversely, for enterprises with high asset flexibility, the relationship between money supply and financial liquidity is positive. As the money supply grows, financial liquidity improves.

The explanation for this phenomenon is related to the connection between asset flexibility (or immobilisation) and the level of fixed operating costs and operational risk. Low asset flexibility is often associated with high fixed operating costs, while high asset flexibility corresponds to lower fixed operating costs [1].

It can be argued that increasing the money supply positively impacts the financial liquidity of enterprises with more flexible assets (lower fixed operating costs), while it negatively affects those with less flexibility (higher fixed operating costs). It can be argued that an expanding money supply contributes to economic revival, benefiting more flexible enterprises [65]. Consequently, competition for capital favours the more flexible businesses, enhancing their financial liquidity, while potentially disadvantaging those with less flexibility.

In conclusion, the results obtained are only partially consistent with theoretical expectations and those of previous studies. In terms of the direct relationships presented in this article, the positive relationship between the inflation rate and corporate liquidity and between the money supply and liquidity confirms the results of earlier studies by Chen and Mahajan [23], which means that it does not confirm studies with opposite results [48]. The positive relationship between the variables is theoretically justified by the assertion that an increase in the money supply, which, according to monetary theory, leads to inflation, is generally associated with growth in the economy, which translates into an increase in corporate performance [71]. The positive relationship between the employment ratio and liquidity negates previous findings in this regard [22,48], but finds theoretical justification in the fact that an increase in the employment ratio implies greater supply in the labour market, which, by reducing wage pressures, has a beneficial effect on firm performance, including liquidity [71]. The positive relationship between the ratio of internal expenditure on R&D to GDP and liquidity, as presented in this paper, has not been previously investigated by other studies. However, this relationship is consistent with theoretical expectations, as higher levels of innovation have a positive impact on the economy as a whole [72].

Furthermore, the results of the moderation analysis indicate that debt level, profitability, and tangible assets ratio are not only important firm-specific factors that shape corporate liquidity, as previous studies have indicated [8,9,10,12,13], but also statistically significantly moderate the impact of macroeconomic factors on corporate liquidity. The results indicate that the level of debt exerts a moderating effect on the relationship between the ratio of internal expenditures on research and development to GDP and the financial liquidity of enterprises. Furthermore, the relationship between the inflation rate and financial liquidity of enterprises is also influenced by debt level. In both cases, the relationship between the IRDcapexToGDP variable and financial liquidity, as well as the CPI and financial liquidity, is statistically significant and positive only for those enterprises with above-median debt levels. Furthermore, we identified a moderating effect of profitability on the relationship between the employment coefficient and corporate financial liquidity, as well as on the relationship between the inflation rate and financial liquidity. In both cases, the relationship between the employment coefficient and financial liquidity, as well as the inflation rate and financial liquidity, was statistically significant for both enterprises with high profitability and those with low profitability. However, in the high-profitability group, this relationship was positive, whereas in enterprises with low profitability, it was negative. Finally, we explored the moderating effect of the fixed assets to total assets ratio on the relationship between money supply and financial liquidity of enterprises. Our findings indicate that, for enterprises with low asset flexibility, there is a negative relationship between money supply and financial liquidity. Conversely, for enterprises with high asset flexibility, this relationship is positive.

Although the results of this study are directly concerned with the factors that shape corporate financial liquidity, they also relate to the impact of macroeconomic factors on financial liquidity and factors that moderate this relationship. Consequently, they have a broader scope of influence than is apparent from the significant impact of corporate sector financial liquidity on overall economies. In the long term, our findings can enhance sustainable development because they reveal interactive effects for macroeconomic variables from areas previously omitted in research, such as the institutional and technical environment. These areas are particularly relevant from the perspective of sustainable development. The outcomes of our research, which demonstrate the manner and character of moderating the influence of macro variables on financial liquidity for enterprises with different levels of debt, profitability, or asset flexibility, should be utilised by policymakers in selecting appropriate tools to impact enterprises with different characteristics as part of strengthening the pillars of sustainable development. The results demonstrate that the impact of macroeconomic factors on enterprises varies depending on their specific characteristics, such as the level of debt, profitability, or asset flexibility. For instance, increasing the internal expenditures on the R&D to GDP ratio by the government affects the liquidity of enterprises with high levels of debt, but has no significant effect on enterprises with low levels of debt. This highlights the utility of the findings of our study for policymakers.

This study is subject to certain limitations, including those pertaining to sample selection and the method employed. In particular, the sample was biased towards a single country, which reduces the generalisability of the findings. Secondly, although linear regression analysis of panel data is a commonly used method for studies of this kind and therefore ensures comparability with previous studies, the method itself has its limitations. Nevertheless, best-practice solutions were selected in order to ensure correct inference. Future research should focus on expanding the geographic scope while maintaining a broad spectrum of macroeconomic variables. Another direction for continued research could be to examine the relationships in selected groups of companies and selected periods, which could broaden the scope of inference on the factors influencing the observed relationships.

5. Conclusions

The objective of this study was to investigate the potential moderating effects of the relationship between macroeconomic variables and the financial liquidity of enterprises.

The principal advantage of our study is the analysis of the factors moderating the relationship between macroeconomic variables and corporate liquidity, which significantly expands the current state of knowledge. Another distinctive aspect of this study is that, from the initial phase of analysis of the relationship between macroeconomic factors and the corporate financial liquidity, a broad range of macroeconomic variables was encompassed. A multitude of macroeconomic factors were examined and categorised into four groups based on Dawidziuk’s classification [55]: the overall efficiency of the economic system, the formal institutional environment, the informal institutional environment, and the technical environment. The moderation analysis presented in this article was conducted only for those factors where statistically significant relationships were identified. One advantage of this approach is that it revealed macroeconomic variables whose relationships with corporate financial liquidity had not previously been explored. For example, in previous studies, the focus was typically on variables reflecting the overall efficiency of the economic system. However, examination of the relationships with macroeconomic variables from other areas covered in the current study was seldom conducted [9,18,19,20,22,23,47,48]. These include variables related to the formal and informal institutional environment, as well as variables reflecting the technical environment. In addition to examining a multitude of variables from these understudied domains, we sought to ascertain their influence on the financial liquidity of enterprises. In the case of two such factors (the ratio of internal research and development expenditures to GDP, which pertains to the technical environment, and the employment coefficient, which pertains to the informal institutional environment), we identified and delineated the moderating effects on these relationships. This is of particular importance from the perspective of sustainability, as the shaping of economic relationships in these areas can support sustainable development. Consequently, the indication of how diverse macroeconomic variables interact with enterprises of varying levels of debt, profitability, or asset flexibility should inform the decision-making of policymakers.

The principal outcomes of our study are outlined below. The results of the moderation analysis indicate that the debt level, profitability, and tangible assets ratio are not only important firm-specific factors that shape corporate liquidity, as previous studies have indicated [8,9,10,12,13], but also significantly moderate the impact of macroeconomic factors on corporate liquidity. Our research revealed a moderating effect of debt level on the relationship between the ratio of internal expenditures on research and development to gross domestic product (GDP) and financial liquidity of enterprises, as well as on the relationship between the inflation rate and corporate liquidity. In both cases, the relationship between the IRDcapexToGDP variable and financial liquidity, as well as the consumer price index (CPI) and financial liquidity, was statistically significant and positive only for those enterprises with above-median debt levels. Furthermore, our research identified a moderating effect of profitability on the relationship between the employment coefficient and financial liquidity of enterprises, as well as on the relationship between the inflation rate and corporate liquidity. In both cases, the relationship between the employment coefficient and financial liquidity, as well as the inflation rate and liquidity, was statistically significant for both enterprises with high profitability and those with low profitability. However, in the high-profitability group, this relationship was positive, whereas in enterprises with low profitability, it was negative. Finally, we explored the moderating effect of the fixed assets to total assets ratio on the relationship between money supply and the financial liquidity of enterprises. Our findings indicate that, for enterprises with low asset flexibility, there is a negative relationship between money supply and financial liquidity. Conversely, for enterprises with high asset flexibility, this relationship is positive. Our rationale for these effects is based on the findings of capital structure theory and financial analysis theory, and to some extent, macroeconomic analysis.

In addition to the theoretical contribution presented, the methodological contribution of the current article is worthy of attention. It consists, on the one hand, of the application of moderation analysis to the impact of macroeconomic variables on corporate liquidity, which has not previously been performed in studies of this type. On the other hand, it refers to the use of new data sources and better sampling in studies of this type. The research sample for this study was randomly selected companies representing 21 industries. The database used was EMIS, which enabled the inclusion of a diverse range of entities, encompassing various categories, such as listed and unlisted large, medium, and small enterprises. This approach offers a significant advantage over many other studies that predominantly concentrate on listed companies, primarily associated with large enterprises [21]. It has a positive effect on the generalisation of the results obtained.

It is important to note that this is the inaugural study in this field to examine the moderators of the relationship between macroeconomic variables and corporate liquidity. Additionally, it is one of the few studies to include a moderation analysis of the determinants of corporate performance [24,25,26].

The implications of the research results on moderators of the relationship between macroeconomic variables and corporate liquidity can be seen in several dimensions. In the academic dimension, the findings can initiate moderation research in this area, which is particularly relevant not only from the perspective of corporate finance, strategic analysis, or fundamental analysis of companies, but also from a macroeconomic perspective. The results of this study represent a step towards a better understanding of the relationship between the macro environment and corporate liquidity, and the factors moderating it from both a microeconomic and a macroeconomic perspective. The findings of this study may also inform the policy decisions governing the corporate sector. By identifying debt levels, profitability and asset structures as moderators of the relationship between macroeconomic variables and liquidity, a more nuanced understanding of these relationships can be achieved. This, in turn, enables the targeting of macroeconomic policy actions to specific groups of companies with greater precision.

Author Contributions

Conceptualisation, J.N., P.R. and D.S.; methodology, J.N., P.R. and D.S.; validation, J.N., P.R. and D.S.; formal analysis, J.N.; investigation, J.N.; resources, J.N., P.R. and D.S.; data curation, J.N., P.R. and D.S.; writing—original draft preparation, J.N., P.R. and D.S.; writing—review and editing, J.N., P.R. and D.S.; funding acquisition, D.S. All authors have read and agreed to the published version of the manuscript.

Funding

This publication was financed from the state budget under the program of the Minister of Education and Science (Poland) under the name “Science for Society”. Project number: NdS/543640/2021/2022, amount of co-financing: 155.125 PLN, total value of the project: 699.200 PLN.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available on the paid platform EMIS provided by an ISI Emerging Markets Group company.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Mikołajewicz, G.; Nowicki, J. Analiza Finansowa Przedsiębiorstwa z Elementami Zrównoważonego Rozwoju; Wydawnictwo Uniwersytetu Ekonomicznego w Poznaniu: Poznań, Poland, 2021. [Google Scholar]

- Batra, R.; Kalia, A. Rethinking and redefining the determinants of corporate profitability. Glob. Bus. Rev. 2016, 17, 921–933. [Google Scholar] [CrossRef]

- Karadzic, V.; Dalovic, N. Profitability determinants of big European banks. J. Cent. Bank. Theory Pract. 2021, 10, 39–56. [Google Scholar] [CrossRef]

- Khrawish, H.A. Determinants of commercial banks performance: Evidence from Jordan. Int. Res. J. Financ. Econ. 2011, 81, 148–159. [Google Scholar]

- Sami, B.; Mohamed, G. Determinants of tourism hotel profitability in Tunisia. Tour. Hosp. Res. 2014, 14, 163–175. [Google Scholar] [CrossRef]

- Sufian, F.; Noor, M.A.N. Determinants of bank performance in a developing economy. Does bank origins matter? Glob. Bus. Rev. 2012, 13, 1–23. [Google Scholar] [CrossRef]

- Arslan-Ayaydin, Ö.; Florackis, C.; Ozkan, A. Financial flexibility, corporate investment and performance: Evidence from financial crises. Rev. Quant. Financ. Account. 2014, 42, 211–250. [Google Scholar] [CrossRef]

- Cheng, Y.; Liu, C. The Effects of M/B Ratio Components on Corporate Liquidity Choices. Glob. J. Account. Financ. 2022, 6, 22. [Google Scholar]

- Ciukaj, R.; Kil, K. Determinants of Polish Co-operative Banks’ Financial Liquidity in the Post-Crisis Perspective. Financ. A Úvěr-Czech J. Econ. Financ. 2020, 70, 350. [Google Scholar]

- Czerwińska-Kayzer, D.; Florek, J. Determinants of financial liquidity in feed enterprises. Ann. Pol. Assoc. Agric. Agribus. Econ. 2018, XX, 41–48. [Google Scholar] [CrossRef]