Abstract

The principal aim of this study is to discern the implications of technology shocks in the sphere of cross-border e-commerce on the macroeconomic indices of South Korea. Leveraging Bayesian estimation techniques, we scrutinized quarterly data from the inaugural quarter of 2000 through to the first quarter of 2022 to perform an empirical exploration. Deductions drawn from the impulse response function indicate that a positive perturbation in the technology of sustainable cross-border e-commerce production instigated a swell in output and investment for both non-tradable and cross-border e-commerce goods producers. Conversely, the sector of traditional tradable goods exhibited a decrease in output and investment. Additionally, this favorable technology shock appears to have amplified household consumption and employment, along with wages in the non-tradable and sustainable cross-border e-commerce goods sectors. In stark contrast, the traditional tradable sector demonstrated a decline in household consumption, employment, and wages. Intriguingly, the technology shock also exerted an influence on the pricing system, causing a rise in the prices of non-tradable goods and cross-border e-commerce goods. On the other hand, the prices of traditional tradable goods experienced a downward turn. These insights provide a pathway to an understanding of how advancements in sustainable e-commerce technology can mold an array of macroeconomic factors in a digitally evolved economy such as South Korea.

1. Introduction

As a global harbinger of technological advancement and digital interconnectivity, South Korea is sculpting a resilient and dynamic e-commerce landscape that seamlessly integrates the principles of sustainability. Guided by a cabal of multinational corporations, the nation is reframing the international discourse on e-commerce, placing sustainable expansion at its nucleus. Within this vibrant digital framework, cross-border e-commerce has materialized as the pivotal axis, fueling sustainable advancement and considerably shaping green macroeconomic metrics. To fully comprehend the economic and environmental implications of this digital upheaval, it is crucial to navigate the academic dialogue that unravels these complex, green-conscious correlations. South Korea’s digital economy is punctuated by the commanding presence of multiple multinational e-commerce powerhouses. Multinational powerhouses such as Coupang, Gmarket, and WeMakePrice are significantly transfiguring the economic tapestry of South Korea. The swift evolution and advancement of their cross-border e-commerce technologies impart a novel impetus, fostering the sustainable trajectory of South Korea’s economy. This robust ascension of sustainable cross-border e-commerce has ushered the nation into a new epoch characterized by environmentally-centered economic intricacy and potential. Academicians [,] and policy strategists are demonstrating an escalating awareness of e-commerce’s role in advancing sustainable macroeconomic methodologies. An expanding corpus of scholarly literature offers insights into the symbiosis between cross-border e-commerce and an array of green macroeconomic factors. Pioneering research such as Lee et al. [] examined the impact of sustainable e-commerce on South Korea’s green output and employment patterns, underscoring its pivotal role in fostering environmental preservation. Concurrently, detailed explorations such as Kim et al. [] shed light on the sustainability transitions enacted by traditional sectors amid the e-commerce wave. Nevertheless, the multifaceted influence of sustainable cross-border e-commerce on South Korea’s green macroeconomic panorama necessitates a more profound and intricate understanding.

In addition, the continual technological upgrade within the realm of cross-border e-commerce carries implications for the sustainable operation of South Korea’s macroeconomy. The integration of advanced technologies, such as artificial intelligence, blockchain, and big data analytics, has not only heightened efficiency and productivity but has also opened new avenues for environmentally conscious operations. For instance, the research by Prajapati [] and Kathuria et al. [] elucidated how artificial intelligence, employed within cross-border e-commerce platforms, could optimize logistics and supply chain management, leading to significant reductions in carbon emissions and promoting a green supply chain. Moreover, the insightful studies by Zhou and Liu [], Lee and Yeon [], and Chang et al. [] explored how the implementation of blockchain technology in cross-border transactions could enhance transparency and trust, foster ethical trade practices, and promote social sustainability. Simultaneously, big data analytics, as demonstrated by Peng et al. [], Modgil et al. [], and Nham [], could facilitate predictive analysis and targeted marketing, reducing resource waste and promoting circular economy principles. In a macroeconomic context, such technological innovations contribute to the ‘green growth’ paradigm, where economic progress does not compromise environmental sustainability. As highlighted by Song et al. [], Wang et al. [], and Ma and Zhu [], these technological advancements could steer South Korea toward a more sustainable and resilient macroeconomic structure, fostering economic growth while mitigating environmental impacts. Yet, as underlined by the studies of Shin [], Holroyd [], Powell [], and Shin [], this digital leap toward sustainability demands regulatory and policy support to address potential socioeconomic disparities and ensure inclusive growth. Thus, the technological evolution in cross-border e-commerce emerges as a pivotal force driving the sustainability agenda within South Korea’s macroeconomy. While prior research has illuminated certain aspects, the fluidity and rapid evolution of the e-commerce landscape underscore the need for continual exploration. Specifically, the macroeconomic implications of technology shocks within the sustainable sphere of cross-border e-commerce, a domain yet to be fully explored, warrant further scholarly investigation.

This study endeavors to bridge an existing gap in academic discourse by scrutinizing the impact of technology shocks within South Korea’s burgeoning cross-border e-commerce sector on the wider macroeconomic context. Utilizing the robustness of a Bayesian estimation methodology, we critically analyze quarterly data that spans from the first quarter of 2000 up to the first quarter of 2022, enabling an extensive empirical exploration. Inferences drawn from the impulse response function suggest that a favorable upheaval in the production technology of cross-border e-commerce triggers a corresponding swell in output and investment within both the non-tradable and cross-border e-commerce goods production arenas. Conversely, there is a discernible contraction of output and investment within the realm of traditional tradable goods producers. In addition, such a constructive technological shock appears to bolster household consumption and employment levels, along with wages in both the non-tradable sector and the cross-border e-commerce goods sector. On the flip side, the traditional tradable sector registers a decrement in household consumption, employment, and wage levels. Intriguingly, this technology shock also permeates the price architecture, inciting a rise in the price of non-tradable goods and cross-border e-commerce goods. However, it prompts a downturn in the price of traditional tradable goods. As cross-border e-commerce enterprises harness technological advancements to heighten their distinctiveness and competitiveness, it can potentially drive an amplification in demand for goods offered through this channel. Consequently, this surge in demand can precipitate an escalation in the price of cross-border e-commerce goods. Concurrently, the unrestricted mobility of capital and labor in the marketplace catalyzes a rise in the price of non-tradable goods. However, this burgeoning demand for cross-border e-commerce goods may supplant the demand for traditionally traded goods, thereby instigating a contraction in the price of these conventional commodities. These intricate observations pave the way for a deeper comprehension of how technological advances within the e-commerce industry can sculpt a broad spectrum of macroeconomic variables in a digitally driven economy such as South Korea.

This study provides several substantial contributions to the existing body of knowledge within the realm of South Korea’s macroeconomic context, particularly in relation to the influence of technology shocks in cross-border e-commerce. Firstly, our research stands out as one of the pioneering studies to explicitly quantify the impact of cross-border e-commerce production technology shocks on a set of macroeconomic indicators in South Korea. While previous studies [,] have broadly examined the impact of e-commerce, the specific focus on technological shocks within cross-border e-commerce provides a fresh perspective in the field. Secondly, our use of a Bayesian estimation approach offers a nuanced methodology for investigating these effects. This analytical framework lends greater precision and reliability to our findings, fortifying the evidential basis for understanding these complex interactions. Thirdly, we delve into not only the implications for traditional sectors but also the non-tradable and cross-border e-commerce sectors. This multi-sectoral approach contributes to a more understanding of how shifts in e-commerce technology reverberate throughout the entire economy. Fourthly, our study introduces a more granular perspective on how households and employment markets react to technology shocks in the e-commerce domain. The nuanced findings concerning household consumption, employment, and wage dynamics across different sectors present new insights that enrich the existing literature []. Lastly, we contribute to the discourse on price dynamics by detailing the impact of e-commerce technology shocks on the pricing of both tradable and non-tradable goods. The observed price changes provide compelling insights into how technology-driven transformations in the e-commerce sector can percolate through to consumer prices. Collectively, these contributions enhance our understanding of the intricate ways in which technological progress in cross-border e-commerce can shape an array of macroeconomic variables in digitally advanced economies, such as South Korea.

The ensuing composition of this manuscript unfolds as follows: Section 2 embarks on a review of the pertinent scholarly antecedents; Section 3 proceeds to delineate the analytical model deployed in this study; Section 4 offers in-depth scrutiny and synthesis of the derived outcomes; ultimately, Section 5 culminates in encapsulating the significant takeaways from this investigation.

2. Literature Review

The impact of cross-border e-commerce on South Korea’s macroeconomic parameters has been an intriguing topic in the academic realm. Leveraging the robust empirical findings from seminal and pioneering research, our study seeks to delineate the intricate nuances of this trans-formative process, especially in the context of its temporal trajectory, employed methodologies, and consequent results. Through a review of these leading studies, we aim to establish a theoretical bedrock for our investigation.

The analysis of the time-oriented impacts of cross-border e-commerce on South Korea’s macroeconomic factors is an enlightening endeavor. Commencing with a temporal scope, Cheong and Yoo’s [] longitudinal study over a span of ten years offered insights into the dynamics of employment and wage augmentation within non-traditional sectors, predominantly those encompassed by the burgeoning e-commerce industry. Their study signposted a shift in the labor market paradigm towards digitally driven professions, which unraveled complex considerations about the future work landscape. This inflection in employment trends incited academic discourse regarding the stability and caliber of these nascent roles. In alignment with Cheong and Yoo’s findings, Park et al. [] presented a compelling exploration into the changing composition of South Korea’s labor market, emphasizing the proliferation of digital employment and its implications on income disparity and job security. Furthermore, Pei and Kim’s [] nuanced analysis highlights the dramatic expansion in non-traditional employment, correlating it to the buoyant growth of South Korea’s cross-border e-commerce sector. Concurrently, Kang [], through their sector-specific lens, investigated the metamorphosis of traditional industries amidst the digital tsunami. Their research, conducted over the preceding five years, documented a noticeable contraction in the productivity of traditional tradable goods producers, contrasted with a corresponding rise in the digital and non-tradable sectors. Such significant industrial recalibration underscored the pressing challenges incumbent industries grapple with in this digital age. Further supporting Kang’s arguments, Ahn [] shed light on the emergent digitization patterns within traditional industries, underscoring the struggle of traditional sectors to integrate digital platforms into their business models. Similarly, Jo et al. [] reported a conspicuous shift toward digital commerce, suggesting an urgent need for traditional industries to adapt and evolve in response to the sweeping digital revolution. Additionally, the studies by Kim and Park [] and Kim [] delved into the complexities traditional sectors face in adapting to an increasingly e-commerce-driven economic milieu. Overall, the narratives woven by these sophisticated analyses culminated in a view of the transformative power of e-commerce, helping illuminate the intricate impacts it exerts on the South Korean macroeconomic landscape.

The investigation into the intricate relationship between cross-border e-commerce and price levels presents a granular perspective of South Korea’s macroeconomic dynamics. A contribution to this area of research is Yim et al. []’s study, which scrutinized the correlation between e-commerce adoption and inflation trends. As per their discerning findings, an escalation in e-commerce integration correlated with a notable increase in prices for non-tradable and cross-border e-commerce goods. This phenomenon sparked an engaging academic discourse about the potential implications of widespread digitization on consumer welfare and cost-of-living indicators. In a complementary vein, the work of Hillen and Fedoseeva [] extended this discourse, highlighting how the expansion of e-commerce contributes to inflationary pressures in certain sectors while simultaneously fostering price competitiveness in others. Similarly, Hwang et al. [] delved into the role of e-commerce in shaping the pricing strategies of South Korean enterprises, revealing its impact on broader price level dynamics. From a more aggregated macroeconomic standpoint, Jung et al.’s [] research offered pivotal insights into the overarching repercussions of technology shocks within the domain of e-commerce. Leveraging the analytical power of the impulse response function embedded in a dynamic stochastic general equilibrium model, they illuminated a clear augmentation in output and investment among non-tradable and cross-border e-commerce goods producers following a positive technology shock. This intriguing association incited intellectual debates concerning the transformative role of technology in molding production frontiers and informing investment decisions. Reinforcing Choi et al.’s findings, the research by Milani and Park [] underscored the multi-dimensional impacts of technology shocks on South Korea’s macroeconomic indicators, particularly emphasizing their influence on sectoral investments. Further, the studies by Kim and Lee [] and Kim and Yoon [] built on this discourse, illustrating how technological advancements within the e-commerce sphere could precipitate significant shifts in the nation’s economic output and investment patterns. Together, these authoritative and cutting-edge studies collectively constructed an enriched understanding of the complex interplay between e-commerce, price levels, and other macroeconomic variables, providing fertile ground for continued research and debate.

Delving deeper into the consumer behavior sphere, the study conducted by Sang-Bae [] deftly delineated the direct impacts of e-commerce on household consumption trends. Implementing panel data models over a half-decade span, their insightful work brought to light the positive correlation between the proliferation of e-commerce and a substantial surge in consumer expenditure. This finding gestured towards the broader implications of e-commerce on the indicators of economic growth and prosperity, lending to a more nuanced understanding of the digital transition within South Korea’s economic landscape. Parallel to this investigation, Jo et al. []’s study enhanced our comprehension of the shift in consumer patterns and preferences in response to the digital boom. They underscored how e-commerce platforms, with their accessibility and convenience, could significantly augment household spending by altering consumption behaviors. A similar theme is echoed in the work of Choi et al. [], who explored how the expansive nature of e-commerce contributed to enhanced consumer accessibility and, thus, larger spending. Extending the inquiry further, the research of Kim [] offered a microeconomic perspective on how e-commerce has influenced savings rates, finding an inverse relationship with consumer spending. Building upon this discourse, the empirical analyses by Cho [] shed light on the nuanced interplay between e-commerce, household consumption, and the broader economic well-being of households. Adding another layer of complexity, the study by Kim et al. [] probed into the sector-specific implications of e-commerce on consumption trends, uncovering sectoral heterogeneities that enriched our understanding of digital commerce’s impacts. Taken together, these scholarly investigations underscore the pervasive and transformative impact of cross-border e-commerce on the framework of South Korea’s macroeconomy. Yet the narrative is neither singular nor monolithic, remaining subject to challenge and reinterpretation. The multifaceted dimensions of this digital revolution demand ongoing exploration, urging future research to continue probing into this evolving nexus of e-commerce and macroeconomic indicators.

3. Model

3.1. Household

In the present study, we adopt the framework of an instantaneous utility function, drawing upon the canonical economic construct of a representative household conceived as having an infinite temporal horizon. This archetypal household derives income from its labor contribution and reaps utility from indulgence in leisure pursuits. The crux of the household’s strategic behavior, therefore, hinges on the astute calibration of labor-leisure allocation with an aim to maximize its utility over the course of its perpetually extending lifespan. Expanding upon the work of He and Lee [], we propose a distinct formulation to characterize the utility function of our representative household.

Herein, is utilized as the symbol denoting the mathematical expectation operator, applying to future values across all variables; signifies a discount factor encapsulating the time value of resources; and stands for the cumulative present values of the lifetime utility of the paradigmatic household. and , respectively, denote consumption and labor supply. This study assumes a utility function exhibiting constant relative risk aversion. The mathematical representation of this function is presented as follows:

In Equation (2), captures the disutility of labor, embodies the relative risk aversion parameter, and corresponds to the inverse of the labor supply elasticity. Consistent with our theoretical conception of a representative household, it operates under logical budget constraints, implying that the aggregate outlays can never surpass the total income. In Equation (3), the totality of expenditures is encapsulated on the left side, whereas the aggregate income is signified on the right. The mathematical representation of this budget constraint is delineated as follows:

In our framework, is perceived as a composite consumption metric, acknowledging that domestic residents partake in a consumption mix comprising non-tradable goods originating from the domestic economy, denoted as , in tandem with imported commodities from foreign territories, symbolized as . Specifically, . embodies the inclination of inhabitants towards the consumption of domestically produced non-tradable goods, a reflection of their consumption preferences. Meanwhile, symbolizes the elasticity of substitution, gauging the responsiveness of the substitution rate between home-produced non-tradables () and imported foreign goods () to changes in their relative consumption ratios. Drawing from the functional representation of consumer goods demand, we can derive a composite function corresponding to the domestic consumer price index, represented here as . Specifically, . Herein, signifies the import trade tax, primarily encompassing import tariffs, value-added taxes on imports, and import consumption taxes. This tax measure’s logarithmic expression follows an AR(1) process, denoted by . Furthermore, signifies the price index of domestically produced non-tradable goods consumed by domestic consumers, while is used to represent the price index of imported goods consumed within the domestic market. The constraint encountered by domestic residents within the context of the consumption composite function is articulated as . In Equation (3), stands for the domestic currency exchange rate computed via the direct quotation method. Capital investment by producers of non-tradables, cross-border e-commerce goods, and traditional tradables are represented as , , and , respectively. The concluding capital stock held by these producers is denoted by , , and , respectively. We employ to indicate the nominal risk-free interest rate, while symbolizes the risk-free interest rate applicable to international bonds. The return on capital for producers of non-tradables, cross-border e-commerce goods, and traditional tradables is characterized by , , and , respectively. The nominal wages paid by these various producers, including cross-border e-commerce export trade intermediaries, are expressed as , , , and . The labor time contributed by households to these different production and trade sectors is marked by , , , and , respectively (). The price metrics for non-tradables, cross-border e-commerce commodities, and traditional tradables are depicted as , , and , respectively. Lastly, denotes the domestic government bonds purchased by residents, signifies international bonds purchased by residents, and D encapsulates the profit accrued by the import sector.

3.2. Firm

Within our model, we discern three distinct strata of producers operating within the economic ecosystem: producers of non-tradable goods, traditional tradable goods, and goods associated with cross-border e-commerce. We proceed under the fundamental assumption, in line with neoclassical economic theory, that these players are engaged in a perfectly competitive marketplace, thus embodying the principles of market efficiency and perfect information, as explored in depth by Adolfson et al. []. These entities are posited to engage in production activities adhering to a pre-defined production function. This function underscores the process by which these firms convert their respective inputs into outputs. It provides a quantitative lens to understand the mechanics of production, the interplay of various input factors, and the implications of strategic decisions in a highly competitive environment. This premise aligns well with the analysis by Wang and Wen [], which elucidates the intricacies of production functions in diverse market scenarios. We posit that the production entities operate within a framework of perfect competition, manifesting a state of market equilibrium dictated by the forces of supply and demand. These entities adhere to a predetermined production function, which dictates the transformation of inputs into outputs, as presented subsequently:

Within Equations (1)–(3), denotes the output. is utilized as a symbol for the total factor productivity level, a vital determinant of economic performance that encapsulates the efficiency of all input factors. This metric, when rendered in its logarithmic form, adheres to the AR(1) process, represented by , , and . stands for the output elasticity of capital and labor, indicating the responsiveness of output to changes in these inputs. Capital and labor inputs are, respectively, represented by and . The capital accumulation equation, describing the growth of capital over time across the three distinctive sectors, is presented in the following form:

In Equations (7)–(9), is employed to denote the depreciation rate, which provides a measure of the decline in value of the capital stock over a given period due to factors such as physical wear and tear, obsolescence, and aging.

3.3. Importer

Situated within the import sector, entities procure goods from international markets at a price denoted by . Post-procurement, these goods undergo a transformation process involving repackaging, after which they are retailed to domestic consumers at a price labeled . This systematic process of value addition establishes a critical interface connecting foreign producers and domestic consumers. In the context of our model, it’s important to note that the markup on tradables is represented by . This suggests the import sector’s ability to wield monopoly pricing power, indicating its unique position within the market to influence price levels without facing significant competition. An inherent element of the sector’s pricing strategy is the probability of procuring a price adjustment opportunity in each period, symbolized by . This possibility underscores the sector’s dynamic pricing mechanism, which adjusts to market variations and consumer demand fluctuations. With these considerations, we derive a nuanced formulation of the Phillips curve specific to the context of the pricing of imported products. Traditionally, the Phillips curve illustrates the inverse relationship between rates of unemployment and inflation in an economy. However, in our application, the curve manifests a unique representation to encapsulate the interplay between the prices of imported goods and domestic economic indicators. The mathematical exposition of this adapted Phillips Curve is to follow:

3.4. Intermediaries

Within the vibrant landscape of cross-border e-commerce, the role of export trade intermediaries stands out as critical. These entities leverage labor resources to deliver a diverse array of export services for product manufacturers, thereby accruing earnings through commission-based models. Their service portfolio is comprehensive, encompassing the provision of information, facilitation of payments, coordination of transportation, management of storage logistics, and delivery of a multitude of financial services. In their function as intermediaries, they essentially act as a bridge between manufacturers and the global marketplace. By skillfully navigating the complexities of international commerce, they bring efficiency and seamlessness to the export process. As we delve further into the intricacies of this role, we shall present the production function that outlines the relationship between their inputs and outputs, elucidating the mechanics of their operation. This narrative draws inspiration from an array of scholarly research that highlights the crucial interplay between labor, services, and production in the digital marketplace. The innovative strategies deployed by these intermediaries underscore the evolving dynamics of cross-border e-commerce, shaping the future of global trade.

Situated within the nexus of cross-border e-commerce lies an intrinsic parameter, . This element signifies the level of technology deployed in cross-border e-commerce operations, reflecting the sophistication and efficiency of the digital tools employed. To facilitate our analysis, we adopt its logarithmic form, which follows an AR (1) process. Specifically, . Simultaneously, denotes the labor input, encapsulating the human capital engaged in the operations of these export trade intermediaries. This workforce is not just quantitatively significant but also qualitatively pivotal, as it brings expertise, creativity, and strategic thinking to the table. In light of these factors, we then venture into the strategic core of these intermediaries’ operations: their pursuit of profit maximization. To unravel this, we present the formulation of the profit maximization problem that these intermediaries grapple with. This mathematical representation will underscore how the interplay between technological level and labor input dictates the profit trajectory for these entities, demonstrating the crucial role of resource allocation and strategic planning in their pursuit of maximum gains.

In the intricate tapestry of cross-border e-commerce transactions, a particular variable, denoted as , commands notable attention. This variable signifies the commission rate levied by the intermediaries involved in cross-border e-commerce trade. This commission rate essentially represents the intermediary’s share of the transaction value, a fee that they command in exchange for the range of services they offer.

3.5. Central Bank

Building upon the insights put forth by He and Wang [], we can comprehend the potency of a central bank’s authority in shaping the contours of monetary policy. This authority is distinctly manifested in the determination of the nominal interest rate, a pivotal economic lever with far-reaching implications. Notably, this interest rate-setting process is guided by a robust policy framework, specifically the Taylor Rule, a widely acknowledged monetary policy rule. Its form is shown as follows:

In the choreographed sequence of central bank decision-making, several vital coefficients take center stage. Firstly, signifies the interest rate smoothing coefficient, a term that encapsulates the central bank’s propensity for gradual adjustments in the interest rate, thereby mitigating abrupt shocks to the economic system. Further, the reaction coefficients , and serve to quantify the responsiveness of the central bank’s interest rate to shifts in inflation, the output gap, and the exchange rate, respectively. These components collectively shape the Taylor rule’s framework, anchoring its mathematical formulation and rendering it a powerful tool in the hands of policymakers for fostering economic stability and growth.

3.6. Market Clearing Conditions

The state of market equilibrium, an ideal where supply precisely meets demand, is accomplished under specific conditions known as market-clearing conditions. Its form is shown as follows:

3.7. Foreign Sectors

Foreign sector is shown in Appendix A.

4. Results and Discussion

4.1. Parameter Calibration and Estimation

In the present study, the parameters we employed were derived from two different yet complementary sources, ensuring a breadth of perspective and an enhanced level of accuracy in our research. First, we delved into the repository of authoritative literature stemming from South Korea, extracting and refining valuable documents to shape our parameters. The second source was of a more empirical nature, capitalizing on the rich dataset available. Leveraging the statistical tool of Bayesian estimation, we harnessed this data to produce our parameters. This method integrates prior knowledge with observed data, providing robust and refined estimates. By synergizing these two distinct yet complementary sources—the theoretical foundation from academic literature and empirical results from Bayesian estimation—we aimed to cultivate a set of parameters that are both firmly rooted in academic literature and closely tied to the realities of the South Korean context.

In calibrating the parameters of this investigation, an effort was made to ground our selection in the scholarly literature specifically devoted to the South Korean context. In accordance with the work of He and Lee [] and He [], the parameter characterizing the disutility of labor was fixed at 0.34 (), thereby representing the burden associated with labor in our model. In addition, the discount factor, which underscores the time preference of consumers, was set at a value of 0.99 (), substantiating the notion of a high predilection for immediate over future consumption. Building on the work of Yie and Yoo [], we incorporated their insights to establish the preference of domestic consumers for non-tradable goods produced within the country and assigned a value of 0.7 (). This parameter signifies a robust inclination among consumers for domestic non-tradable goods. To further our calibration process, we referred to You [], whose work provided guidance on the output elasticity of capital and labor, which was consequently set at 0.5 (). This value represents an equitable contribution of capital and labor to the production mechanism. Meanwhile, the depreciation rate was determined to be 0.025 (), reflecting the standard decline in the value of assets over time. Lastly, we drew upon the research of Kang and Suh [], which helped establish the probability of encountering a non-adjustment period for prices, setting it at 0.2 (). This value captures the degree of price rigidity prevalent in the market. In conclusion, this process of calibration, entrenched deeply in South Korean-centric scholarship, ensures a potent blend of theoretical robustness and regional relevance in our model.

In order to maintain a robust and pertinent data set for this study, we leverage both domestic and international indicators to perform Bayesian estimation. We harness data from South Korea, utilizing real GDP, the consumer price index, and the exchange rate between the won and the US dollar. The triad of data employed in this study has been sourced from the Economic Statistics System provided by the Bank of Korea (https://ecos.bok.or.kr/#/SearchStat, accessed on 10 June 2023). Following He [], these data points are subjected to a thorough process of seasonal adjustment and then detrended employing the Hodrick–Prescott filter, ensuring the mitigation of cyclical fluctuations and irregular components. On the international spectrum, the focus is directed toward the United States as a representative foreign entity. The period of analysis spans over two decades, starting from the first quarter of 2000 and extending through the first quarter of 2022, thereby providing a temporal landscape for our examination. In order to optimize the precision of our estimations and facilitate effective execution, we employ the Markov Chain Monte Carlo simulation method. This computational algorithm enables us to perform a large number of random samplings, specifically 40,000 in total. Recognizing the importance of stability in the simulation process, the initial 20,000 samples are discarded to mitigate potential errors introduced during the initial phase. This approach to data selection and methodological application serves to enhance the reliability and validity of our research findings (Table 1).

Table 1.

Results of prior and posterior distributions.

4.2. The Effect of Cross-Border E-Commerce Production Technology Shock on Korean Macroeconomic Indicators

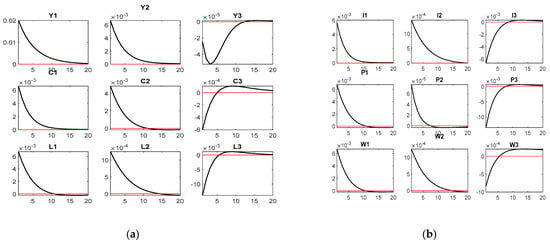

The objective of this subsection is to scrutinize the repercussions of shocks to the production technology of cross-border e-commerce on an array of integral macroeconomic indicators within the South Korean economy. These indicators embody the outputs and employment rates across three distinct sectors: non-tradable producers, cross-border e-commerce goods producers, and traditional tradable producers. Simultaneously, the consumption patterns related to non-tradable goods, cross-border e-commerce goods, and traditional tradable goods are evaluated. Furthermore, this examination extends to an analysis of investments deployed within these sectors. Subsequently, an exploration into the price dynamics of goods derived from these sectors takes place, investigating the potential impact of technology shocks on the price of non-tradable goods, cross-border e-commerce goods, and traditional tradable goods. Lastly, the wage fluctuations among non-tradable producers, cross-border e-commerce goods producers, and traditional tradable producers in the wake of such a shock are given careful consideration. The consequences of this investigation, providing invaluable insights into the intricate dynamics of technology shocks within the rapidly evolving cross-border e-commerce industry, are visually presented in Figure 1. This graphic representation allows for an intuitive understanding of the multifaceted impacts on the South Korean economy, thereby aiding in the development of informed, effective strategies to navigate the consequences of such shocks in the future.

Figure 1.

Results of simulation: (a) Y1 output of non-tradable producer; Y2 output of cross-border e-commerce goods producer; Y3 output of traditional tradable producer; C1 L1 employment of non-tradable producer; L2 employment of cross-border e-commerce goods producer; L3 employment of traditional tradable producer; (b) I1 investment of non-tradable producer; I2 investment of cross-border e-commerce goods producer; I3 investment of traditional tradable producer; P1 price of non-tradable goods; P2 price of cross-border e-commerce goods; P3 price of traditional tradable goods; W1 wage of non-tradable producer; W2 wage of cross-border e-commerce goods producer; W3 wage of traditional tradable producer.

The observations articulated in Figure 1 can be explained through the lens of several key macroeconomic principles. An optimistic technology shock in the cross-border e-commerce sector increases its output as the sector becomes more efficient, reduces operational costs, and potentially enhances its product quality or variety. This change consequently triggers an increase in employment within this sector as businesses expand their operations. Simultaneously, the improvements in the e-commerce sector stimulate the non-tradable goods sector, which provides inputs or complements to cross-border e-commerce goods. This stimulation drives the expansion of output, consumption, and employment in the non-tradable sector, creating a synergy between the two sectors. Conversely, the traditional tradable goods sector experiences a decrease in output, consumption, and employment. This decline could be attributed to a shift in consumer preferences and resources towards the technologically advanced e-commerce sector. These results are significant from a macroeconomic perspective as they underscore the potential of technological advancements to restructure economies. They illuminate how technological progress in one sector can ripple through other sectors, shaping employment, consumption, and investment patterns. This study resonates with existing literature that explores the impacts of technology shocks in the context of international trade and e-commerce. For instance, Dolfen et al. [] documented similar impacts of technology shocks in the broader e-commerce sector, while Bieron and Ahmed [] illustrated how these shocks can affect international trade flows. However, this study also carves out a unique niche within this body of literature by focusing specifically on cross-border e-commerce in South Korea. While previous research tended to concentrate on larger economies or analyze the global e-commerce sector as a whole, this study’s country-specific and sector-specific focus makes a distinct contribution to the field. Despite the similarities with some aspects of existing work, this study also deviates from conventional macroeconomic theories, such as the Solow–Swan growth model [], which typically emphasizes the role of technological shocks in boosting productivity uniformly across all sectors. This discrepancy highlights the complexity of real-world economies, where technological progress can have differential impacts across sectors. Overall, this study builds on and extends the current understanding of how technology shocks can reshape economies. By documenting the sector-specific impacts of a technology shock in cross-border e-commerce, it provides valuable insights into the dynamics of South Korea’s digitally driven economy. Its findings help to inform policy decisions and business strategies, thereby adding a valuable layer to the existing body of knowledge in this field.

4.3. Robustness Test

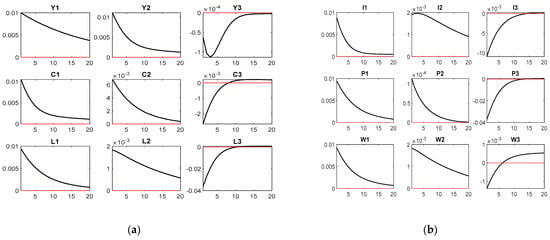

Drawing on the seminal contributions of scholars such as Koop et al. [], Martin and Xavier [], and Leamer [], it becomes unequivocally evident that an in-depth, precise examination is necessary for unraveling the effects of positive shocks in cross-border e-commerce production technologies on varied macroeconomic indicators in the context of Korea. The intricacies of these effects are intimately intertwined with the distinct modeling presumptions deployed and the particular data manipulation techniques utilized. The necessity for robustness checks emerges from an essential need to critically appraise the resilience of the study’s findings against alternative model specifications or analytical methodologies. This level of assessment enhances the degree of trust placed in our comprehension of the phenomena under investigation, consequently bolstering the credibility of the derived conclusions. Furthermore, the explanatory prowess of this investigation is anchored firmly in the calibration of certain parameters in alignment with preceding research. The robustness checks offer an indispensable avenue to uncover the sensitivity of the study’s conclusions to these critical parameter values, thereby consolidating the fundamental underpinnings of the investigation. In the spirit of this robustness testing, we modulate the elasticity of substitution between cross-border e-commerce products and traditional tradables to 3, deviating from the benchmark value of 1.58. This modulation is designed to reflect a scenario where foreign residents exhibit greater sensitivity to the price of products as the diversity of cross-border e-commerce goods exported by China expands. Concurrently, we adjust the preference degree of residents for domestic non-tradables to 0.5, a departure from the benchmark value of 0.7. The ensuing robustness test results are presented compellingly in Figure 2, adding a further layer of rigor to our understanding of the dynamic interplay between technology shocks in cross-border e-commerce and macroeconomic indicators.

Figure 2.

Results of robustness test: (a) Y1 output of non-tradable producer; Y2 output of cross-border e-commerce goods producer; Y3 output of traditional tradable producer; C1 consumption of non-tradable goods; C2 consumption of cross-border e-commerce goods; C3 consumption of traditional tradable goods; L1 employment of non-tradable producer; L2 employment of cross-border e-commerce goods producer; L3 employment of traditional tradable producer; (b) I1 investment of non-tradable producer; I2 investment of cross-border e-commerce goods producer; I3 investment of traditional tradable producer; P1 price of non-tradable goods; P2 price of cross-border e-commerce goods; P3 price of traditional tradable goods; W1 wage of non-tradable producer; W2 wage of cross-border e-commerce goods producer; W3 wage of traditional tradable producer.

Through the lens of core macroeconomic theories, the insights divulged in Figure 2 unfold a compelling narrative of how an optimistic technology shock in the cross-border e-commerce sector can stimulate a trans-formative ripple effect. The emergent uptick in output triggered by heightened efficiency, cost reductions, and potential enhancements in product quality or diversity is a remarkable testament to the far-reaching impact of technological progression. This transformation is instrumental in fueling employment growth within the sector as business activities scale. Parallel to this evolution, the non-tradable goods sector, a key player providing essential inputs or complements to cross-border e-commerce goods, is sparked into action. It responds to the wave of innovation with an upswing in output, consumption, and employment, fostering a mutually beneficial synergy with the e-commerce sector. This positive interaction stands in stark contrast with the traditional tradable goods sector, which witnesses a downturn in output, consumption, and employment. The shift in consumer preferences and resource allocation towards the more technologically advanced e-commerce sector could likely be the underlying cause of this decline. From a macroeconomic vantage point, these findings hold considerable weight. They underscore the transformative potential of technological advancements and their power to radically reconfigure economies. They shed light on how innovation in one sector can instigate changes across diverse sectors, sculpting the contours of employment, consumption, and investment patterns. In the grand tapestry of scholarly discourse exploring the repercussions of technological shocks within the realms of international trade and e-commerce, this study weaves its unique thread. It aligns with influential work such as that of Quayle [], who documented the reverberations of technology shocks in the wider e-commerce arena, and Eaton and Kortum [], who explained the impact of such shocks on international trade dynamics. Nevertheless, our study carves its niche by focusing specifically on the cross-border e-commerce landscape within South Korea, deviating from the common practice of targeting larger economies or analyzing the global e-commerce sector as a whole. While our work shares some elements with previous studies, it also diverges from conventional macroeconomic theories, such as the Solow-Swan growth model expounded by Howitt and Aghion []. These classical models usually underline the uniform productivity-boosting role of technological shocks across all sectors. However, this study unveils the intricate nuances of real-world economies, highlighting the sector-specific impacts of technological progress. This work, therefore, stands as a meaningful augmentation to the current understanding of how technology shocks can re-calibrate economies. By documenting the sector-specific impacts of a technology shock in cross-border e-commerce, it furnishes crucial insights into the intricate dynamics of South Korea’s digital economy. Its findings carry implications for policy formulation and business strategy development, thereby enriching the existing knowledge reservoir in this field. Examining the results displayed in Figure 2, a striking similarity to those in Figure 1 is apparent, with minor deviations in the fluctuation amplitude and convergence time to the steady state. This consistency bolsters the robustness and reliability of our findings, adding an additional layer of confidence in the study’s conclusions.

4.4. Discussion

The results drawn from this investigation construct a narrative on the transformative power of technology shocks, with a concentrated focus on South Korea’s cross-border e-commerce milieu. The study illuminates the sweeping effects of such advancements, as evidenced by the escalated output, streamlined efficiency, cost efficiencies, and potential augmentations in product quality and assortment. These transformative shifts not only drive employment proliferation within the sector but also echo positively within the non-tradable goods sector. This latter sector, intricately intertwined with the e-commerce industry by supplying indispensable inputs or complements to e-commerce commodities, undergoes an expansion in output, consumption, and employment, showcasing the symbiotic interdependency of these sectors. In stark contrast, the traditional tradable goods sector is facing a recession in output, consumption, and employment, potentially due to resource reallocation and shifting consumer predilections towards the technologically superior e-commerce domain. These findings underscore the nuanced complexity of economic networks and the multi-dimensional repercussions of technological evolution. The ensuing discourse enriches our comprehension of the expansive economic restructuring that technology shocks can instigate, particularly underscoring the centrality of cross-border e-commerce.

The resulting implications serve to not only guide policy deliberations and strategic business maneuvers but also enrich scholarly dialogue in this field, asserting the essentiality of sector-oriented analyses in decoding the mechanics of digital-centric economies. Considering that an optimistic technology shock within the cross-border e-commerce sector catalyzes a surge in output and investment within the non-tradable and e-commerce sectors, it accentuates the necessity of sustained backing and investment in technological ingenuity. Policy architects could consider creating an enabling ecosystem for technological progression within the e-commerce realm through regulatory stimuli, such as fiscal concessions or subsidies allocated for research and innovation. They could further propel innovation by fostering industry-academia collaborations. Concurrently, the observed decline among traditional traders of tradable goods accentuates the imperative for strategic defenses to cushion this sector against such shocks. In response, policymakers may envisage measures to expedite this sector’s digital transition or diversification of operations, thereby mitigating the potential negative ramifications of technology shocks. The ramifications of technology shock on household expenditure, employment, and wages across both non-tradable and cross-border e-commerce goods sectors, contrasted against the traditional tradable sector, signal that policymakers should accord priority to capacity-building programs. These initiatives should aim to equip the labor force with the requisite skills to navigate the evolving digital terrain, thereby ensuring labor market resilience. In addition, the restructuring of pricing systems for non-tradable goods, cross-border e-commerce goods, and traditional tradable goods necessitates the adoption of dynamic pricing policies that echo these transformations, potentially including regulations to curb potential price inflation within the non-tradable and e-commerce sectors. These suggestions highlight the importance of proactive and flexible policy responses in the face of technological shifts and emphasize the need to contextualize these policies within a broader socioeconomic narrative. This nuanced comprehension and strategic policy orientation can significantly contribute towards leveraging the potential of technological progression in e-commerce, thereby sculpting South Korea’s digital economy into a more resilient and inclusive entity.

5. Conclusions

In this examination, the primary thrust lies in discerning the ramifications of technology shocks, particularly within the sphere of cross-border e-commerce, on key macroeconomic facets specific to South Korea. An empirical investigation is carried out by employing a Bayesian estimation methodology and examining quarterly data spanning from the initial quarter of 2000 through the first quarter of 2022. The data elucidates compelling inferences from the impulse response function, suggesting that a favorable disturbance in the technology of cross-border e-commerce production triggers an upswing in the output and investment activities of both non-tradable and cross-border e-commerce goods producers. Contrastingly, the traditional tradable goods producers sector experiences a dip in its output and investment. Furthermore, this positive technology shock seemingly elevates household consumption and employment levels, coupled with wage augmentation in both the non-tradable and cross-border e-commerce goods sectors. However, the traditional tradable sector registers a decrease in household consumption, employment, and wages. The technology shock interestingly impinges on the pricing framework as well, causing an upward trajectory in the prices of non-tradable goods and cross-border e-commerce goods while instigating a downward spiral in the prices of traditional tradable goods. These intricate revelations chart the path towards a comprehension of the role played by technological advancement in e-commerce in influencing a wide array of macroeconomic determinants in a digital economy such as that of South Korea.

In light of this investigation’s central tenet—the evaluation of the repercussions of technological upheavals within cross-border e-commerce on the macroeconomic dynamics of South Korea—several critical policy inferences have emerged that could potentially steer policy formulation. Regarding theoretical policy implications: (1) The elucidation of the disparate and profound impacts that technological evolution can impose on diverse economic sectors necessitates the reevaluation and adjustment of conventional macroeconomic paradigms to reflect these technology shocks, thereby ensuring a more accurate portrayal of contemporary economies. (2) The study underscores the need for refining extant theories associated with labor economics and employment market dynamics, given the divergent effects of technology shocks on employment across varying sectors. This endeavor is pivotal for the integration of the role of technological progress within these theoretical constructs. (3) The discernment of the differential impact of technology shocks on wages within separate sectors necessitates a deeper exploration and enhancement of theories pertaining to income inequality and wage disparities, particularly in the context of digital transformations. (4) The finding that technology shocks can substantially alter pricing mechanisms mandates an augmentation of traditional pricing theories to encapsulate the prospective influences of digital progression on price determination. On the subject of practical policy implications: (1) The noted enhancement in output and investment operations within the e-commerce sector implies that strategic policy measures need to be devised to bolster this sector’s development and leverage its growth potential. Concurrently, intervention strategies should be enacted to support the traditional tradable goods sector in adapting to these technological changes. (2) Acknowledging the sector-specific impact on employment, labor market policies need to be formulated with the objective of safeguarding jobs and fostering skill development in sectors confronting contraction. In tandem, initiatives aimed at promoting job creation in burgeoning sectors should be encouraged. (3) With respect to the observed wage impact variations, policymakers are obliged to strategize solutions to curb escalating income disparities. This may require the implementation of income support initiatives or wage equalization policies to thwart further amplification of wage gaps. (4) Given the highlighted potential for significant price fluctuations following technology shocks, regulatory bodies might find it imperative to monitor these changes and, if necessary, enforce pricing controls or guidelines to maintain market stability and safeguard consumer interests.

While this investigation provides an enlightening examination of the implications of technological disruptions in the realm of cross-border e-commerce on the macroeconomic fabric of South Korea, it simultaneously acknowledges certain constraints and highlights potential opportunities for future scholarly engagement. (1) One limiting aspect of the study pertains to its confined temporal breadth, specifically extending from the first quarter of 2000 until the initial quarter of 2022. This constricted time period may curtail the full understanding of technology shocks’ historical consequences or the forecasting of future tendencies and enduring ramifications. (2) The geographical specificity of the study, focusing solely on the digital economy of South Korea, could potentially restrict the universal applicability of the findings. Aspects such as local policy dynamics, societal tendencies, and the state of technological maturity might result in the study’s inferences not being uniformly pertinent across distinct countries or regions. (3) The division of sectors into non-tradable goods, cross-border e-commerce, and traditional tradable goods might fail to adequately address potential repercussions on nuanced sub-sectors or specific industries nested within these larger categories. The differential degrees of technological assimilation and adaptation across industries could lead to disparate impacts. (4) Furthermore, while the study recognizes shifts in pricing structures subsequent to a technology shock, it refrains from delving into the causative mechanisms instigating these pricing alterations or assessing the potential protracted effects of such pricing transitions on market equilibrium and consumer tendencies. (1) As potential avenues for future investigations, it is suggested that subsequent research endeavors might consider broadening the temporal expanse to encompass an elongated timeframe, covering historical as well as future trajectories. This would allow a more comprehension of technology shocks’ impact over time and furnish more fortified prognostications. (2) Additionally, undertaking comparative analysis involving nations at differing stages of digital economy maturity could yield insightful revelations. Such an approach would facilitate a more multifaceted understanding of both universal and nation-specific repercussions of technology disruptions in the e-commerce sphere. (3) Future studies could delve into a granular exploration of the impact of technological disruptions on individual industries or sub-sectors. Such findings could elucidate industries that demonstrate higher vulnerability or resilience to technological innovations, thereby offering strategic insights for stakeholders within these industries. (4) Future inquiries could also concentrate on unearthing the causal pathways influencing pricing shifts following a technology shock. Moreover, an in-depth exploration of the possible enduring implications of such price alterations on market stability, consumer behavior, and overall economic wellness is warranted.

Author Contributions

Conceptualization, Y.H.; methodology, Y.L.; software, Y.L.; validation, R.W.; formal analysis, R.W.; investigation, Y.L.; resources, R.W.; data curation, Y.L.; writing—original draft preparation, Y.L.; writing—review and editing, Y.H.; visualization, Y.L.; supervision, Y.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available from the authors upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Foreign sector: In the conceptual framework of this study, the dichotomy between the domestic and foreign segments manifests through two distinct facets: Firstly, there is a variance in the type of tradable goods produced by both segments. According to a report published by the Korea Trade-Investment Promotion Agency (KOTRA) on 28 February 2023, a surge in international interest in Korean cosmetics and culture has culminated in a record-breaking volume of transactions for Korean goods purchased abroad. The report indicates that South Korea’s cross-border e-commerce exports climbed by 6.1% year-on-year, reaching an unprecedented $910 million in the previous year, setting a new record for the fifth year in a row. These figures testify to the robust performance of South Korea’s cross-border e-commerce exports, which continued their upward trajectory, registering a surge exceeding 100% in 2020 and 2021, despite a 14.7% contraction in orders during the previous year. In light of these trends, this study postulates that the domestic producers of tradable goods constitute a heterogeneous group, incorporating both traditional and cross-border e-commerce goods producers, while their foreign counterparts remain homogenous. Secondly, there is a differential in consumption patterns between domestic and foreign residents. Foreign residents’ consumption is characterized by a mixture of domestic goods, imported cross-border e-commerce goods, and traditional tradable goods, whereas the consumption of domestic residents is exclusively comprised of domestic non-tradable goods and imported foreign goods. Presuming a similarity in the utility functions of representative foreign residents and their domestic counterparts, the intertemporal utility function can be portrayed as follows:

* denotes the foreign country. The mathematical representation of this function is presented as follows:

The mathematical representation of this budget constraint is delineated as follows:

Constraint of consumption composite function:

Consumption composite function:

Function of imported goods:

Foreign consumer price index function:

Price index function of foreign non-tradables:

Price index function of cross-border e-commerce goods consumed by foreign consumers:

Assume that producers are perfectly competitive and produce according to the following production function:

Phillips curve corresponding to the price of foreign traditional tradeables:

References

- Cheba, K.; Kiba-Janiak, M.; Baraniecka, A.; Kolakowski, T. Impact of external factors on e-commerce market in cities and its implications on environment. Sustain. Cities Soc. 2021, 72, 103032. [Google Scholar] [CrossRef]

- Moiseev, N.; Mikhaylov, A.; Dinçer, H.; Yüksel, S. Market capitalization shock effects on open innovation models in e-commerce: Golden cut q-rung orthopair fuzzy multicriteria decision-making analysis. Financ. Innov. 2023, 9, 55. [Google Scholar] [CrossRef] [PubMed]

- Lee, K.Y.; Bae, C.; Lee, S.; Park, J.H.; Yoo, S. Trade, Jobs, and E-Commerce: Evidence from Korea; KIEP Research Paper, World Economy Brief 18-06; Korea Insitute for International Economic Policy: Sejong City, Republic of Korea, 2018; Volume 8, pp. 1–4. [Google Scholar]

- Kim, J.; Kim, M.; Im, S.; Choi, D. Competitiveness of E Commerce firms through ESG logistics. Sustainability 2021, 13, 11548. [Google Scholar] [CrossRef]

- Prajapati, D.; Chan, F.T.; Chelladurai, H.; Lakshay, L.; Pratap, S. An Internet of Things Embedded Sustainable Supply Chain Management of B2B E-Commerce. Sustainability 2022, 14, 5066. [Google Scholar] [CrossRef]

- Kathuria, S.; Grover, A.; Perego, V.M.E.; Mattoo, A.; Banerjee, P. Unleashing e-Commerce for South Asian Integration; World Bank Publications: Washington, DC, USA, 2019. [Google Scholar]

- Zhou, F.; Liu, Y. Blockchain-Enabled Cross-Border E-Commerce Supply Chain Management: A Bibliometric Systematic Review. Sustainability 2022, 14, 15918. [Google Scholar] [CrossRef]

- Lee, H.; Yeon, C. Blockchain-based traceability for anti-counterfeit in cross-border e-commerce transactions. Sustainability 2021, 13, 11057. [Google Scholar] [CrossRef]

- Chang, Y.; Iakovou, E.; Shi, W. Blockchain in global supply chains and cross border trade: A critical synthesis of the state-of-the-art, challenges and opportunities. Int. J. Prod. Res. 2020, 58, 2082–2099. [Google Scholar] [CrossRef]

- Peng, X.; Li, X.; Yang, X. Analysis of circular economy of E-commerce market based on grey model under the background of big data. J. Enterp. Inf. Manag. 2022, 35, 1148–1167. [Google Scholar] [CrossRef]

- Modgil, S.; Gupta, S.; Sivarajah, U.; Bhushan, B. Big data-enabled large-scale group decision making for circular economy: An emerging market context. Technol. Forecast. Soc. Chang. 2021, 166, 120607. [Google Scholar] [CrossRef]

- Nham, N.T.H. Making the circular economy digital or the digital economy circular? Empirical evidence from the European region. Technol. Soc. 2022, 70, 102023. [Google Scholar] [CrossRef]

- Song, M.; Fisher, R.; Kwoh, Y. Technological challenges of green innovation and sustainable resource management with large scale data. Technol. Forecast. Soc. Chang. 2019, 144, 361–368. [Google Scholar] [CrossRef]

- Wang, M.; Ding, X.; Choi, B. FDI or International-Trade-Driven Green Growth of 24 Korean Manufacturing Industries? Evidence from Heterogeneous Panel Based on Non-Causality Test. Sustainability 2023, 15, 5753. [Google Scholar] [CrossRef]

- Ma, D.; Zhu, Q. Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 2022, 145, 801–813. [Google Scholar] [CrossRef]

- Shin, D. A socio-technical framework for Internet-of-Things design: A human-centered design for the Internet of Things. Telemat. Inform. 2014, 31, 519–531. [Google Scholar] [CrossRef]

- Holroyd, C. Digital content promotion in Japan and South Korea: Government strategies for an emerging economic sector. Asia Pac. Policy Stud. 2019, 6, 290–307. [Google Scholar] [CrossRef]

- Powell, W. China, Trust and Digital Supply Chains: Dynamics of a Zero Trust World; Taylor & Francis: Abingdon, UK, 2022. [Google Scholar]

- Shin, D.-H. A socio-technical framework for cyber-infrastructure design: Implication for Korean cyber-infrastructure vision. Technol. Forecast. Soc. Chang. 2010, 77, 783–795. [Google Scholar] [CrossRef]

- Erdmann, A.; Ponzoa, J.M. Digital inbound marketing: Measuring the economic performance of grocery e-commerce in Europe and the USA. Technol. Forecast. Soc. Chang. 2021, 162, 120373. [Google Scholar] [CrossRef]

- Karpunina, E.K.; Isaeva, E.A.; Galieva, G.F.; Sobolevskaya, T.G.; Rodin, A.Y. E-commerce as a driver of economic growth in Russia. In Modern Global Economic System: Evolutional Development vs. Revolutionary Leap; Springer: Cham, Switzerland, 2019; pp. 1622–1633. [Google Scholar]

- Valarezo, Á.; Pérez-Amaral, T.; Garín-Muñoz, T.; García, I.H.; López, R. Drivers and barriers to cross-border e-commerce: Evidence from Spanish individual behavior. Telecommun. Policy 2018, 42, 464–473. [Google Scholar] [CrossRef]

- Cheong, I.; Yoo, J. A Study on the Characteristics of Intra-Industry Trade for Korea’s E-Commerce Trade. J. Int. Logist. Trade 2020, 18, 1–11. [Google Scholar] [CrossRef]

- Park, H.M.; Patel, P.; Varma, A.; Jaiswal, A. The challenges for macro talent management in the mature emerging market of South Korea: A review and research agenda. Thunderbird Int. Bus. Rev. 2022, 64, 393–404. [Google Scholar] [CrossRef]

- Pei, Y.; Kim, S.K. Digital trade: A new chance for China-South Korea-Japan trilateral cooperation? Asian Aff. Am. Rev. 2023, 50, 120–137. [Google Scholar] [CrossRef]

- Kang, K. Import Variety and Productivity: Positive or Negative? Korean Econ. Rev. 2022, 38, 43–72. [Google Scholar]

- Ahn, S.-J. Three characteristics of technology competition by IoT-driven digitization. Technol. Forecast. Soc. Chang. 2020, 157, 120062. [Google Scholar] [CrossRef]

- Jo, S.-S.; Han, H.; Leem, Y.; Lee, S.-H. Sustainable smart cities and industrial ecosystem: Structural and relational changes of the smart city industries in Korea. Sustainability 2021, 13, 9917. [Google Scholar] [CrossRef]

- Kim, S.; Park, H. Effects of various characteristics of social commerce (s-commerce) on consumers’ trust and trust performance. Int. J. Inf. Manag. 2013, 33, 318–332. [Google Scholar] [CrossRef]

- Kim, E.Y. E-commerce in South Korean FTAs: Policy priorities and provisional inconsistencies. World Trade Rev. 2019, 18, S85–S98. [Google Scholar] [CrossRef]

- Yim, S.T.; Son, J.C.; Lee, J. Spread of E-commerce, prices and inflation dynamics: Evidence from online price big data in Korea. J. Asian Econ. 2022, 80, 101475. [Google Scholar] [CrossRef]

- Hillen, J.; Fedoseeva, S. E-Commerce and the End of Price Rigidity? J. Bus. Res. 2021, 125, 63–73. [Google Scholar] [CrossRef]

- Hwang, W.; Jung, H.-S.; Salvendy, G. Internationalisation of e-commerce: A comparison of online shopping preferences among Korean, Turkish and US populations. Behav. Inf. Technol. 2006, 25, 3–18. [Google Scholar] [CrossRef]

- Jung, H.; Park, M.; Hong, K.; Hyun, E. The impact of an epidemic outbreak on consumer expenditures: An empirical assessment for MERS Korea. Sustainability 2016, 8, 454. [Google Scholar] [CrossRef]

- Milani, F.; Park, S.H. The effects of globalization on macroeconomic dynamics in a trade-dependent economy: The case of Korea. Econ. Model. 2015, 48, 292–305. [Google Scholar] [CrossRef][Green Version]

- Kim, T.B.; Lee, H. Macroeconomic Shocks and Dynamics of Labor Markets in Korea; Bank of Korea: Seoul, Republic of Korea, 2015; Volume 26. [Google Scholar]

- Kim, J.Y.; Yoon, J.H. Investment-specific technology shock in an international real business cycle model: The Korea case. Korean Econ. Rev. 2004, 20, 75–94. [Google Scholar]

- Sang-Bae, K. Korea’s E-commerce: Present and Future. Asia Pac. Rev. 2001, 8, 75–85. [Google Scholar] [CrossRef]

- Jo, H.; Shin, E.; Kim, H. Changes in consumer behaviour in the post-COVID-19 era in Seoul, South Korea. Sustainability 2020, 13, 136. [Google Scholar] [CrossRef]

- Choi, J.; Seol, H.; Lee, S.; Cho, H.; Park, Y. Customer satisfaction factors of mobile commerce in Korea. Internet Res. 2008, 18, 313–335. [Google Scholar] [CrossRef]

- Kim, S.S. Purchase intention in the online open market: Do concerns for e-commerce really matter? Sustainability 2020, 12, 773. [Google Scholar] [CrossRef]

- Cho, Y.; Kim, T.; Roh, J. An analysis of the effects of electronic commerce on the Korean economy using the CGE model. Electron. Commer. Res. 2021, 21, 831–854. [Google Scholar] [CrossRef]

- Kim, D.J.; Yim, M.-S.; Sugumaran, V.; Rao, H.R. Web assurance seal services, trust and consumers’ concerns: An investigation of e-commerce transaction intentions across two nations. Eur. J. Inf. Syst. 2016, 25, 252–273. [Google Scholar] [CrossRef]

- He, Y.; Lee, M. Macroeconomic Effects of Energy Price: New Insight from Korea? Mathematics 2022, 10, 2653. [Google Scholar] [CrossRef]

- Adolfson, M.; Laséen, S.; Lindé, J.; Villani, M. The role of sticky prices in an open economy DSGE model: A Bayesian investigation. J. Eur. Econ. Assoc. 2005, 3, 444–457. [Google Scholar] [CrossRef]

- Wang, P.; Wen, Y. Imperfect competition and indeterminacy of aggregate output. J. Econ. Theory 2008, 143, 519–540. [Google Scholar] [CrossRef]

- He, Y.; Wang, Y. Macroeconomic Effects of COVID-19 Pandemic: Fresh Evidence from Korea. Sustainability 2022, 14, 5100. [Google Scholar] [CrossRef]

- He, Y. Home Production: Does It Matter for the Korean Macroeconomy during the COVID-19 Pandemic? Mathematics 2022, 10, 2029. [Google Scholar] [CrossRef]

- Yie, M.-S.; Yoo, B.H. The role of foreign debt and financial frictions in a small open economy DSGE model. Singap. Econ. Rev. 2016, 61, 1550077. [Google Scholar] [CrossRef]

- You, T. Behavioural biases and nonlinear adjustment: Evidence from the housing market. Appl. Econ. 2020, 52, 5046–5059. [Google Scholar] [CrossRef]

- Kang, H.; Suh, H. Macroeconomic dynamics in korea during and after the global financial crisis: A bayesian DSGE approach. Int. Rev. Econ. Financ. 2017, 49, 386–421. [Google Scholar] [CrossRef]

- He, Y. Unraveling the COVID-19 Pandemic’s Impact on South Korea’s Macroeconomy: Unearthing Novel Transmission Channels within the Energy Sector and Production Technologies. Energies 2023, 16, 3691. [Google Scholar] [CrossRef]

- Dolfen, P.; Einav, L.; Klenow, P.J.; Klopack, B.; Levin, J.D.; Levin, L.; Best, W. Assessing the gains from e-commerce. Am. Econ. J. Macroecon. 2023, 15, 342–370. [Google Scholar] [CrossRef]

- Bieron, B.; Ahmed, U. Regulating e-commerce through international policy: Understanding the international trade law issues of e-commerce. J. World Trade 2012, 46, 545–570. [Google Scholar]

- Dohtani, A. A growth-cycle model of Solow–Swan type, I. J. Econ. Behav. Organ. 2010, 76, 428–444. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Martin, I.; Xavier, S. I just ran two millions regressions. Am. Econ. Rev. 1997, 87, 178–183. [Google Scholar]

- Leamer, E.E. Let’s take the con out of econometrics. Am. Econ. Rev. 1983, 73, 31–43. [Google Scholar]

- Quayle, M. E-commerce: The challenge for UK SMEs in the twenty-first century. Int. J. Oper. Prod. Manag. 2002, 22, 1148–1161. [Google Scholar] [CrossRef]

- Eaton, J.; Kortum, S. Technology, geography, and trade. Econometrica 2002, 70, 1741–1779. [Google Scholar] [CrossRef]

- Howitt, P.; Aghion, P. Capital accumulation and innovation as complementary factors in long-run growth. J. Econ. Growth 1998, 3, 111–130. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).