Abstract

Local government debt is the biggest “gray rhino” of China’s economy and one of the most significant factors affecting the sustainability of economic growth. We use the macroeconomic data of China’s real economy development level and local government debt from 2000 to 2020 to investigate the impact of local government debt on the real economy using the spatial Durbin model, focusing on the impact of the local government debt scale on the development of the real economy in jurisdictions and non-jurisdictions and the intermediation effect of finance under the geospatial correlation characteristics of economic development. The results show that the spatial correlation of the real economy between jurisdictions prevails and the correlation deepens over time. The scale of local government debt in China has exceeded a reasonable threshold, and the crowding-out effect of debt expansion on the real economy is obvious and not limited by jurisdictions, with significant spatial spillover effects. Financial marketization can effectively mitigate the crowding-out effect of local government debt on the real economy. These findings provide useful references for mapping the correlated development characteristics of local government debt and the real economy in China, effectively preventing local government debt risks and high leverage of the real economy and financial systemic risks, and providing effective insights for other countries to resolve government debt problems, prevent crises, and promote local economic development.

1. Introduction

COVID-19 has exacerbated the debt crisis that has been brewing since the 2008 global recession. According to data in the 2021 International Monetary Fund’s World Economic Outlook, Japan, Sudan, and Greece have debt-to-GDP ratios of more than 200 percent. Local government debt has become a thorny issue around the world, and this paper focus on China’s local government debt problem to enlighten other countries that are experiencing the same situation.

China’s 14th Five-Year Plan and the outline of the 2035 Vision proposed to “better play the role of the foundation and important pillar of finance in national governance” and emphasized “enhancing the capacity of financial services for the real economy and improving the fiscal and financial system that meets the requirements of high-quality development”. This reflects the organic linkage between government finance, finance, and the real economy. In the context of China’s unique socio-economic structure, local government finance is the foundation of economic development, which affects the development direction and mode of the fictitious and real economy. In particular, what has a long-term impact on economic development is the allocation of resources, so the government’s allocation decision to direct funds to speculative bubble industries or real industries through the financial market is crucial, which directly affects the growth structure and development sustainability of the local economy. Based on the peculiarities of China’s local finance affecting real economic activities through government debt, combined with the practical experience of China’s economic growth, and the cyclical characteristics of financial markets, this paper asks the following questions: (1) What are the motives for local governments to raise debt? What is its impact on sustainable economic development? (2) What are the characteristics of the impact of local government debt on China’s real economy? Is there a regional spatial effect? (3) Is financial marketization an effective way to relieve the pressure of local government debt and the shackles of real economy development in China? Or is financial marketization only a booster for the expansion of the local government debt size?

The real economy is the key to sustainable economic development. Taking the real economy as the main force of development is a major strategic direction and policy direction for China’s economic development [1]. The financial industry accelerates the development of the real economy through the rational allocation of capital and supervision of capital flow. In general, the development of the real economy requires flexible and abundant financial instruments, which are strictly dependent on the financial market, and the wealth accumulated in the real economy will have a positive feedback effect on the financial market. However, in reality, the profit-seeking nature of capital itself tends to drive many social funds to financial speculation rather than productive activities, which will lead to an imbalance in the allocation of social funds and the “de-realization of funds to the virtual”. At this point, the role of local governments is particularly critical because they can guide financial services to the real economy through active policies, i.e., guiding the financial market to play a positive role in optimizing the allocation of resources, escorting the real economy, reducing the liquidity costs of the market, and improving the allocation efficiency of social capital [2].

With the stimulus policies implemented by the central government, the local financial resources at their disposal increase, and the behavior of financial institutions guided by local finance may become the main source of market economic dynamics. Although the economic pattern in this particular relationship between finance and the real economy can generate a series of allocative optimization effects, the existing literature neglects the incentive conflicts arising from the fact that local governments can also be involved in economic activities and the resistance of cyclical factors to economic development. The pressure on government finances and the need for performance by officials have intensified local government borrowing, which makes the resource allocation of financial institutions more complicated. Under China’s unique administrative system and policy environment, local governments are the concrete implementers of policies and the main issuers of debt. Local government debt is an important fiscal policy tool to alleviate local financial constraints, promote local economic development, and maintain local social stability. However, to cope with future uncertain changes (trans-action risk and interest rate changes), the return on local government debt is generally lower than the expected value, and the contribution of debt to economic growth is not significant in the long run [3]. Meanwhile, some studies have proved that the expansion of government investment, tax incentives, and debt swaps not only have a crowding-out effect but also a crowding-in effect on private investment and real economy development [4]. On the one hand, unlike general financial lending/borrowing activities, local governments, as the carrier of the existence of real enterprises, always hope to improve the local investment and financing, and the business environment to promote real economic growth through the injection of funds to obtain more tax revenue [5]. On the other hand, local governments issue debt or squeeze out the market share of the real economy and increase the leverage of the real economy [6]. This problem is exacerbated in the context of external shocks, such as the COVID-19 epidemic. Since the COVID-19 epidemic, enterprises have stopped production, residents’ income has decreased, consumption has declined, and the downside risk to the economy has risen sharply, which has led to increased financial pressure on the government and encouraged local governments to further expand the debt scale to stimulate the economy and promote economic growth; however, it has also squeezed out the market share of private investment and inhibited the scientific development of economic diversification [7]. Meanwhile, external shocks can also affect the cyclical movements of finance, further affecting economic development, leading to a series of “chain” effects. As we can see, local governments use debt to increase demand to drive local economic growth while crowding out some corporate financing, affecting the development of enterprises. How to strike a balance between these effects to improve financial efficiency is particularly critical.

The local government mainly relies on financial platforms to borrow and can also formulate policies to intervene in the financial institution. Governments are prone to excessive borrowing, which will crowd out corporate financing [8]. Whether it is government financing or corporate financing, the final flow of capital determines the level of financial efficiency. Some studies have proven that a strict capital flow steering policy can effectively mitigate capital mismatch and promote real economic growth [9]. In addition, financial marketization is an effective way to alleviate the crowding-out effect of local government debt. The deepening of financial marketization will enrich the financial resources available to enterprises, reduce the financing constraints caused by information asymmetry, and further improve the financing availability of enterprises [10,11].

Therefore, this paper takes 31 provinces (autonomous regions and municipalities directly under the central government, excluding Hong Kong, Macao, and Taiwan) in China from 2000 to 2020 as the research sample and collects and collates relevant data on local government finance to determine the size of each local government debt. Local industrial value added and financial cycle are taken as proxy variables for the real economy and financial marketization, respectively. Additionally, we use financial marketization as an intermediate variable and introduce other control variables to explore the role and heterogeneity of local government debt expansion on the real economy. We also examine the mediating role played by the financial cycle in the process of local government debt influencing economic development and examine the mediating effect of finance. The empirical test finds that there is a significant positive spatial correlation effect between provinces (autonomous regions and municipalities directly under the central government) and this correlation deepens over time. The data performance during the comprehensive sample period shows that the current local government debt scale has exceeded the threshold value. The debt pressure is high, and further expansion of debt will have a significant crowding-out effect on the local real economy and a positive spatial spillover effect on the real economy of economic neighbors, i.e., there is significant heterogeneity in the impact of local government on the real economy within and outside the jurisdiction. The financial market assumes an important intermediary role in the process of local government debt acting on the real economy. Finance contributes to the development of the real economy and improving the service level of the financial sector is an effective strategy to cope with the requirements of sustainable development. The findings of this paper show that financial institutions compensate for the crowding-out effect of local governments’ uncontrolled debt on the real economy in the form of third-party economic activities and that financial marketization helps to alleviate the difficulties in investment and financing of real enterprises, reduce the friction between local governments and local enterprises, and thus strengthen the efficiency of financial services to the real economy. This also responds to the organic link between finance and the real economy and inspires the government to further guide the formulation and implementation of policies to strengthen financial services for the real economy to alleviate debt pressure.

The main contributions of this paper are as follows: First, this paper provides a perspective on the development of the real economy under the geospatial correlation of the economy, enriches and develops the theories related to economic development, extends the temporal correlation of the real economy to the spatial correlation, and explores the complex interactions among local governments, financial markets, and real economic agents through common economic activities based on different development goals. At the same time, China is facing a development environment in which policies and measures for financial support to the real economy are being implemented one by one and placing local government debt in the real economy development environment enriches the study of economic development under the guidance of proactive real economy policies. Second, this paper explores the impact of financial marketization on the real economy from the perspective of the financial cycle and explains the positive intermediary role played by the financial cycle in the process of local government debt acting on the real economy. The existing literature on the real economy mainly focuses on the relationship between the virtual economy and the real economy and the financialization of enterprises while this paper puts the financial cycle in the context of local government participation in economic activities, and proposes that financial marketization can help alleviate the “communication frictions” between local government debt and the real economy. In addition, the difficulty of enterprise financing due to the expansion of local government debt is a key obstacle to the development of the real economy. By removing the influence of the financial cycle from local government debt, this paper verifies the effectiveness of financial services to the real economy, which inspires a deeper understanding of the financing constraints as the key to breaking the shackles of the development of enterprises and the necessity of financial marketization. Finally, the research in this paper complements the understanding of the role of local government debt in the real economy and reveals the inhibitory impact of local government debt on the real economy in a substantive way.

2. Theoretical Analysis and Research Hypothesis

2.1. The Logic of Local Government Debt Formation

Before systematically analyzing the impact of local government debt on the financial cycle and the real economy, it is necessary to elaborate on why local governments issue debt. The debt issuance behavior of local governments can be broadly divided into two categories: passive debt issuance and active debt issuance, among which the reasons for passive debt include: (1) local government-led urban planning and construction has a massive capital demand, especially when the government land transfer revenue reaches its maximum over time. The economic downturn has led to a widening gap in government revenue and expenditure and increased government financial pressure; (2) local governments have a huge demand for funds for performance assessments such as GDP, promotion of “stable” economic growth, and repayment of old debts. In the face of limited fiscal revenue, local governments have an increased incentive to go into debt [12]. The reasons for active indebtedness are as follows: First, local governments stimulate demand and production through loan consumption to boost local economic growth. Additionally, the economic downturn also leads to a decline in local government tax revenues. Second, there is competition among local governments for economic development, especially as, after the reform of the central and local taxation system, local governments have become the main body of local economic development. The reduction in taxes and burdens for local enterprises has increased the pressure on local finances, and the scale of local government debt has expanded. Third, the incentive of the “soft constraint” of budget and the separation of authority and responsibility of local government debt also encourage local governments to raise debt [13,14].

2.2. Mechanisms by Which Local Government Debt Affects the Real Economy

2.2.1. Local Government Debt Affects the Real Economy through the Financial Market

First, local government debt can affect the financial cycle through a variety of mechanisms. Local government debt is the linkage of the fiscal and financial system, and the association between local government debt and the financial cycle deepens with the expansion of debt size [15,16]. Among them, the enthusiasm of local governments for debt issuance more often affects the financial cycle. Specifically, local government debt affects the financial cycle mainly through the following channels: (1) The real estate market. Local governments are highly dependent on land finance, which affects local land prices and real estate prices [17,18]. Meanwhile, the siphoning effect of the real estate market leads to a high degree of financialization of the real estate market, which in turn affects the financial cycle. (2) Credit constraints. The expansion of local government debt leads to an increase in leverage, which changes the credit constraint in the financial market and thus affects the financial cycle. In particular, after the implementation of the new budget law, the main financing channel of local governments has been transformed from “land finance + financing platform” to “land finance + hidden loans” [19]. (3) Policies. The use of some local government debt (special debt) is closely related to the realization of relevant policies, such as policies to strengthen financial support for small, medium, and micro-enterprises, which in turn affects the financial cycle [20].

Second, fluctuations in the financial cycle will affect the real economy. Generally speaking, the stronger the upward trend of the financial cycle, the fewer financing constraints and the greater development momentum of real enterprises, and vice versa. General Secretary Xi Jinping pointed out that “finance is the bloodline of the real economy, for the real economy is the vocation of finance, is the purpose of finance, but also to prevent and resolve the financial risks of the fundamental measures”. Finance and the real economy have an inseparable linkage. Macroeconomic fluctuations of a country are significantly affected by credit expansion while there is also a clear synergistic relationship between the peak of the financial cycle and the downward trend of the real economy, which is because the peak of the financial cycle implies a financial crisis, and the downward trend of the economy after the financial crisis is the trend of economic normalization [21]. Moreover, in the context of high leverage in the non-financial corporate sector, the financing constraint remains a major challenge for the development of entity enterprises, which implies that finance plays an important role in the investment and financing process of entity enterprises, and thus financial cycle movements are bound to affect the real economy [22]. Finally, the financial cycle also affects the real economy by influencing the technology cycle, for example, in the upward period of the financial cycle, financial markets have a positive effect on technology inputs across the industry; additionally, in the downward period, financial markets have a stronger restrictive effect on industries with high technology level inputs, and a smaller effect on industries with a low technology level [23].

2.2.2. The Direct Impact of Local Government Debt on the Real Economy

First, local government debt affects the real economy in the jurisdiction through “crowding-out + stimulation”. In the Chinese institutional context, there is a significant credit crowding-out effect of local government debt expansion [24]. This is mainly due to the local financing platform that squeezes out the scale of loans that local enterprises may obtain from banks and other financial institutions, i.e., it tightens the supply of credit from banks and other local enterprises and squeezes out the investment and financing development of real enterprises. Although the local government’s debt-raising behavior directly squeezes out the share of investment and financing of real enterprises, the use of local government debt may help the development of real enterprises, such as improving infrastructure to facilitate local enterprises. The game of “crowding-out” and “stimulating” ultimately determines the effect of local government debt on the real economy.

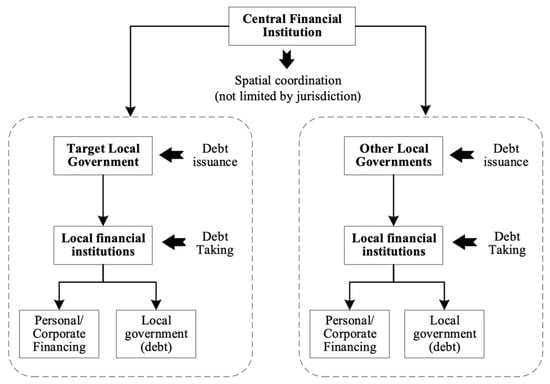

Second, local government debt affects the non-jurisdictional real economy through “competition”. (1) Government tax reduction and debt investment in infrastructure optimize the local business environment and help attract investment and enterprise development, and this double gravitational force inevitably leads to inter-regional competition [25]. Ferraresi et al. [26] studied the fiscal interaction of Italian municipalities using a spatial econometric model and found that there is a significant dependence on governmental public spending, mainly in the form of a significant boost in one municipality’s spending on its neighboring municipalities’ spending. (2) Wang et al. [27] found that there is a significant spatial correlation among local governments, and its characteristic is that the development of local governments is influenced by the “rival” local governments in the long run. In short, there is significant spatial competition among local governments in the economic space. The influence of local governments on the economy is both “concentrated” and “decentralized”. The “concentration” is reflected in the positive contribution of local government policy guidance to the local economy while the decentralization is reflected in the spatial spillover effect of local government debt issuance to stimulate the economy to the “rival” side. Borck et al. [28] used spatial econometric methods to study the effects of debt competition among German jurisdictions and found a significant and robust interaction between the debt levels of German municipalities. Moreover, the negative impact and spatial spillover effect of local competition leading to “diminishing returns to scale” in debt performance have also been confirmed [29]. Figure 1 explains the spatial spillover effects of local government debt.

Figure 1.

System of spatial spillover effects of local government debt. Drawn by the author.

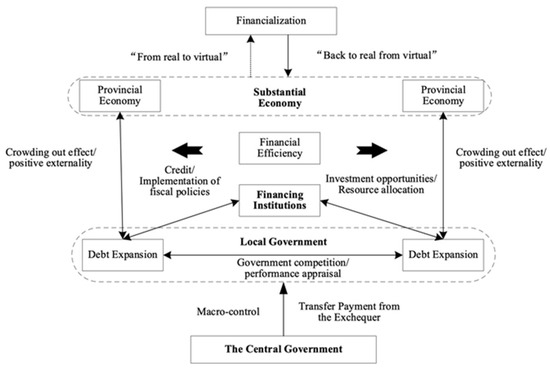

In general, the development of a local economy often has different subjects forming different forms of development situations based on different economic goals. Therefore, it is necessary to explore the characteristics of the economic development situation by combining local government, financial, and real economy. Based on the experience of China’s economic development, the relationship between the central government and local governments, the real economy, and finance, and referring to Breton’s [30] concept of “Competitive Governments” and Zhou et al.’s [31] analysis, the mechanism of local government and finance influencing the real economy is presented in Figure 2.

Figure 2.

Diagram of the mechanism of government and financial influence on the real economy. The “government competition” in this figure is the jurisdictional competition among local governments. Drawn by the author.

According to Figure 1, macroeconomic regulations such as fiscal transfers and resource allocation strategies of the central government are the underpinnings of economic development, and the competition caused by the performance assessment of local governments also plays a role in economic development. Financial institutions participate in the economy mainly through credit activities and play the role of resource reallocation in the economy. Local governments affect the development of the real economy through financial institutions, which have a direct impact on the real economy. The final result may be that funds circulate within the financial sector without entering the real economy, and the main influence on the deviation of the results depends on the government’s reasonable and effective guidance of economic development.

Therefore, to avoid funds being diverted out of the real economy, local governments’ participation in economic activities will be more prudent. In the past, researchers have focused more on the debt problem itself caused by the financial system [32,33]. At present, it is well established that a slump in the real economy can cause default risk on the debt of non-financial corporate institutions [34]. Fundamentally speaking, financial performance depends on the quality of real economic development, and the increased efficiency of financial markets will achieve flexible resource allocation in the real economy [35,36]. By expanding the theoretical framework of the financial cycle, it has been proved that there is a special correlation and influence mechanism between the financial cycle, risk, and macroeconomic fluctuations. Currently, China’s financial system is being restructured, and the economy is undergoing structural transformation. External shocks such as foreign trade frictions and COVID-19 epidemics constantly occur, making policy regulation under multiple objectives significantly more stressful and difficult. The economic activities of local governments under pressure may enhance the crowding-out effect on the development of the real economy. The active participation of local governments in economic activities will stimulate the efficiency of the financial market, and the high-quality financial market will help improve the investment and financing efficiency of the real economy.

2.2.3. Research Hypothesis

Local government debt is expressed as the funds that local governments receive from social financing to develop the local economy. Banks’ lending resources are limited. When faced with the financing needs of government and private enterprises, banks can easily choose local governments, which reduces the amount of financing available to private enterprises and limits their access to financing. Correspondingly, the increase in debt size will have a crowding-out effect on the real economy. In addition, there is a spatial correlation between local government debt activities, and the expansion of local government debt will stimulate other local government debt, which in turn will affect the development of the real economy in the jurisdiction and outside the jurisdiction [37]. These linkages and spillover relationships of governmental actions will shorten the spatial distance with the development of transportation facilitation and the digital economy, etc. Therefore, this paper proposes the following Hypothesis 1.

Hypothesis 1.

Other things being equal, the impact of local government debt expansion on the real economy is not restricted by jurisdiction, significantly inhibiting the development of the local real economy but providing good external conditions for the real economy in other regions.

To further argue the negative impact of local government debt expansion, this paper tests the following corollary based on Hypothesis 1. In the past, the government could not issue debt on its own, and to meet the local government’s huge capital demand for urban construction and resolve the dilemma of inequality between affairs and financial powers and financing constraints, local governments raised funds through local financing platforms in the name of corporate borrowing with little regulatory constraints, and the debt scale of local governments gradually developed. In 2015, the new Budget Law came into effect. It gives local governments more freedom to raise debt by empowering them to repay old debts and achieve new development goals, and local governments will further expand their debt scale. Mao and Huang [7] confirmed that local government debt will have a significant crowding-out effect on the real economy only after breaking a certain threshold. This implies that if Hypothesis 1 holds, the paper can draw the following inference:

Corollary:

The debt size of each local government has generally reached the carrying threshold.

What is the key to mitigating the inhibitory effect of local government debt on the real economy? This requires further exploration of the nature of the development constraint faced by real enterprises, i.e., the nature of the financing constraint, followed by solutions based on how to broaden enterprises’ financing channels and reduce financing costs. Generally, the effective allocation of resources is the main manifestation of social efficiency. Liu et al.’s [38] study proves that financial marketization has mitigated the risks faced by real enterprises and improved the efficiency of investment and financing of real enterprises. The financial cycle is a timely portrayal of the cyclical fluctuation characteristic of financial market activities. The microscopic mechanism of the financial cycle on economic fluctuations is manifested in the impact on the business capacity and financing capacity of enterprises and on the change in the leverage ratio of enterprises [39,40]. Thus, the more developed the financial market is, the more moderate the investment and financing constraints of enterprises will be, in terms of the crowding-out effect of the expansion of the government debt scale on the investment and financing activities. Therefore, this paper proposes the following Hypothesis 2.

Hypothesis 2.

The financial cycle assumes an important intermediary buffer role in the process of local government debt affecting the real economy.

Finally, the following Hypothesis 3 is proposed based on the validity of Hypothesis 1 and Hypothesis 2.

Hypothesis 3.

Finance effectively contributes to the development of the real economy.

2.2.4. Comparison with Previous Studies

Based on the above theoretical analysis and assumptions, this part collates and summarizes the articles related to the main body of this study in recent years (see Table 1), and then combines the problems solved in this paper with the relevant analysis to visually state the differences and desirability of this paper compared with previous studies.

Table 1.

Studies related to this paper.

Table 1 shows that the existing literature related to the research theme of this paper focuses on the discussion of tax, expenditure competition, and debt risk spillover, and a few articles discuss the spatial interaction of public debt, which mainly proves that there is a spatial correlation between government debt behavior. Other articles have studied the relationship between local government debt and economic growth but have focused on emphasizing debt sustainability rather than economic sustainability. Among them, the research on finance mainly focuses on the role of the financial development environment on economic growth and on alleviating the debt repayment pressure and borrowing capacity of local governments. Unlike previous literature, this paper takes local government debt as the starting point and the foundation of sustainable economic development: the real economy as the foothold, focusing on the spatial correlation between local government debt and the real economy and analyzing the spillover effect of local government debt on the real economy to provide new literature support for government debt competition. Considering the specific role of the financial cycle as an intermediary variable in the process of local governments acting on the real economy, this paper provides corresponding solutions to the problems found in the previous empirical study.

In addition, the methods used in the articles related to this study are mainly social network analysis methods and spatial metrology methods. Social network analysis methods can only determine and describe the association between nodes (agents), the characteristics of the association network, and the location of nodes in the association network. The expression of the spatial metrology model is a mathematical model, which can further carry out regression based on correlation to analyze the relationship between explained variables and explanatory variables. The correlation involved in both methods can be geography, economic geography, and so on. Comparatively speaking, based on the existence of correlation, the social network analysis method is suitable for intuitive analysis of the correlation between nodes while the spatial econometrics model is suitable for regression analysis. At present, many scholars use spatial econometrics models to study a series of economic problems, such as Wang et al. [44]. Therefore, this paper uses spatial metrology to explore the mechanism between local government debt, the financial cycle, and the real economy.

The salient points and novelties of this paper are: In terms of model and methodology, this paper is an early extension and the use of a spatial econometric form of an intermediation model to study the relationship between local government debt, financial cycles, and sustainable economic development. At the same time, the specific role of financial marketization on the real economy is elucidated by indirectly excluding financial cycle effects.

3. Study Design

3.1. Sample Selection and Data Sources

The research sample of this paper is 31 provinces in China from 2000 to 2020. The data sources of the research sample are as follows: Local government debt balance data are mainly collected and collated from the Wind database. Additionally, this paper is based on the local government debt audit results published by the National Audit Office of China (nearly 90% of local government debt is used in capital project investments with long-term benefits rather than recurrent expenditures, and Chinese local government debt always adheres to the principle of intergenerational equity in government borrowing), according to the special characteristics of local government debt fund investment announced by the Audit Office, and drawing on the relevant study by Chen [50], who reallocated the local government debt balance by weighting the local share of the total social fixed asset investment allocation. This paper uses the local fixed asset investment ratio to derive the missing value of the local government debt balance. Other financial and economic fundamentals data were mainly obtained from the database of the National Bureau of Statistics, Wind database, and Flush database. In addition, this paper takes provinces as the basic regional unit, with a total of 31 cities. For the spatial analysis, the provincial capitals or central cities of each province are taken as measurement points to calculate the geographical distance between local government jurisdictions. To eliminate the influence of dimensional differences, all continuous variables in the model are normalized in this paper. The calculation formula is as follows:

3.2. Model Setting and Variable Definition

3.2.1. Model Setting

Spatial econometric models are mainly classified into spatial autoregressive models, spatial error models, and spatial Durbin models according to the form of spatial dependence [51]. Rüttenauer [52] found that the spatial autoregressive model and spatial error model have serious shortcomings while the spatial Durbin models provide accurate estimates of direct effects and there is robustness in this result. Therefore, to test Hypothesis 1, referring to LeSage and Pace [53], the following spatial econometric regression model is used in this paper:

where is the size of the real economy of the region in the year , is the spatial weight matrix element, is the size of the local government debt of the region in the year , is the control variable, is the individual fixed effect, is the time fixed effect, and is the random disturbance term. is the coefficient of the spatial lag of the explanatory variable for the real economy, and is the coefficient of the spatial lag of the explanatory variable .

is the core coefficient in this paper. Based on judging whether the coefficients of the direct effect, indirect effect, and total effect of the spatial Durbin model are significant, if is significantly not 0, it indicates the existence of the spatial spillover effect of local government debt; the sign of is positive or negative, which corresponds to the crowding-in effect and crowding-out effect of the spatial spillover effect of local government debt on the real economy; and the magnitude of indicates the intensity of the spatial spillover effect of local government debt on the real economy. Through Model (2), we expect and to have different signs.

The effect of local government debt on the financial cycle is tested using the following model:

where is the financial cycle and the other letters have the same meaning as above.

To test Hypothesis 2, according to the three-step method of testing mediating effects, the financial cycle variable is added to Model (2) to obtain Model (4) to test the role played by the financial cycle in the process of local government debt affecting the real economy:

To test Hypothesis 3, we replace the variable with the financial cycle adjusted variable and test Hypothesis 2 using Model (2) with a significantly negative expected coefficient. The cyclical adjustment process is as follows:

The regression using Model (4) yields the estimated results of , , : , , .

Second, according to Equation (6), substituting , , , and gives an estimate of the financial cycle of debt , which is the “financial cyclical” component of debt in local government debt balances:

Third, the “financial cyclicality” component in the actual debt balance is excluded. To exclude the financial cyclicality from the local government debt balance , the difference between and is assessed according to Equation (7), and the final estimate of the local government debt balance without the financial cyclicality and trend is :

Finally, to test the robustness of the model and minimize the existence of endogeneity problems, this paper improves the model and regression analysis in the following three aspects: (1) introducing the in-space lagged terms of the explanatory variables and using the great likelihood estimation method; (2) introducing as many control variables as possible to prevent the endogeneity problems caused by omitted variables; and (3) replacing the spatial weight matrix and using 0–1, inverse distance, and economic spatial weight matrices to regress the model again to corroborate the robustness of the empirical results.

3.2.2. Variable Definition

Explained variable: real economy. Finance essentially generates returns by optimizing the allocation of resources and allocating capital to investments with high rates of return. The root of such returns comes from the productive activities of the real economy. The real economy increases its rate of return through innovation to drive sustainable economic growth, and in turn its prosperity increases local government revenues, reduces financial risks, and further stabilizes the sustainability of the economy. Concerning He et al.’s [54] studies on the real economy, the data of the industrial value-added growth rate expresses the final results and economic benefits of local industrial production activities, and this paper uses the real industrial value-added growth rate of local governments (annual) as a proxy variable for the real economy, which is recorded as .

Key explanatory variable: local government debt. Local government debt is the main stock indicator of the local fiscal space. In this paper, the local government indebtedness ratio (year-end debt balance/current year GDP) is used as a proxy variable for local government debt, where the debt balance is estimated regarding Pan [55].

Core explanatory variable: financial cycle. In this paper, the Financial Conditions Index (FCI) is used as a proxy variable for the financial cycle, and the FCI can provide information on financial conditions such as the money market and credit market by extracting the cyclical components of financial indicators. Since there is no unified paradigm for the selection of financial variables and the allocation of indicator weights in the FCI, this paper selects total credit and real estate prices as the main variables affecting financial cyclicality based on the basic idea of measuring financial cycles of the Bank for International Settlements [56]. Additionally, considering the joint role of credit and money supply in supporting the financial market and the reality that with the opening up of finance to the outside world, the exchange rate has gradually deepened its influence on finance. Additionally, this paper refers to the study of Wang et al. [57] to include both the money supply and exchange rate into the variable system affecting FCI fluctuations.

It should be noted that financial cycles are generally calculated on a country-wide basis due to the availability of data and the characteristics of indicators, etc. However, considering the vast geographical area of China and the heterogeneity of local government development contexts, especially the differences in house prices between regions, this paper structurally adjusts the data in the calculation of financial cycles. The adjustment process is as follows: firstly, the credit level, monetary policy, and exchange rate faced by each local government are theoretically consistent, so the credit, money supply, and exchange rate levels of all local governments are consistent; secondly, the level of development of local governments is not consistent and there are significant differences in house prices, thus the house price indicators of local governments need to consider heterogeneity; finally, combining consistency and heterogeneity yields the financial cycle index with differences in convergence. The process of calculating the financial cycle FCI index is as follows: (1) drawing on the Hamilton [58] proposed boosted HP filtering method, obtain the cyclical components of credit, real estate prices, money supply, and exchange rate; (2) normalize the cyclical components obtained in the first step to eliminate the difference in magnitude; and (3) obtain the financial cycle composite index (FCI) through principal component analysis.

According to the results reported in the principal component analysis, the value of KMO is 0.734, which is greater than 0.6, while the results of Bartlett’s spherical test are significant at the significance level of 0.01, indicating that the variables are correlated and the principal component analysis is valid. According to the variance interpretation results in Table 2, the first principal component was selected to explain the original data information and assigned to calculate FCI.

Table 2.

Results of principal component analysis.

Variables control. Based on the development of the real economy in China’s special economic and socio-political ecosystem, and considering the behavior of local governments to stimulate the economy financially and the motivation to control debt growth, the following control variables are introduced in this paper: the level of urban development (Urban), defined as the ratio of the urban population to the total population in the current region, is located in different geographic areas, and local governments have different urban development. Additionally, cities with high urbanization and real economic development are also generally stronger and less susceptible to the size of the debt. Openness to the outside world (Oe), defined as the ratio of total regional imports and exports to GDP, affects local economic development in general and the real economy in particular. Human capital (Hc) is expressed as regional general higher education students (college and above) / total population. Fiscal revenue ratio (Gr) is expressed as local fiscal revenue for the year/GDP. Industrial structure (IS) is defined as the value added of the tertiary sector/GDP of the region. The fiscal revenue decentralization degree (Fdr) is defined as the local government fiscal revenue/national fiscal revenue [59].

Spatial weight matrix. Considering the economic and official mobility between governments, this paper uses the classical economic distance matrix as the spatial weight matrix of the main model, calculated by:

where is the original economic distance matrix among local governments; and is the mean value of local governments during the sample period. Further, to remove redundant information, the above matrix is processed as follows:

where is the economic distance threshold between local governments, obtained by averaging the economic distance matrix ; and is the spatial weight matrix.

4. Empirical Test and Analysis

4.1. Descriptive Statistical Analysis

Table 3 reports the main variables defined in this paper and the results of the descriptive statistical analysis of the main variables. The results show that the basic statistics of the variables are within the expected range of variation, except for the economic development status Pgdp variable, which has a large difference in magnitude. The relationship between the standard deviation and the mean value indicates that there are no missing values, significant outliers, or extreme values characteristic of the data of each variable. Among them, it should be noted that the small difference in the standard deviation of the original data is since the original data is the growth rate or other forms of ratio data. Due to the existence of economic development status Pgdp variables, there are large dimensional differences between variables, so all data are normalized (normalization) before conducting the empirical analysis.

Table 3.

Definitions of the variables and results of the descriptive statistical analysis.

4.2. Main Empirical Result

4.2.1. Test of the Model

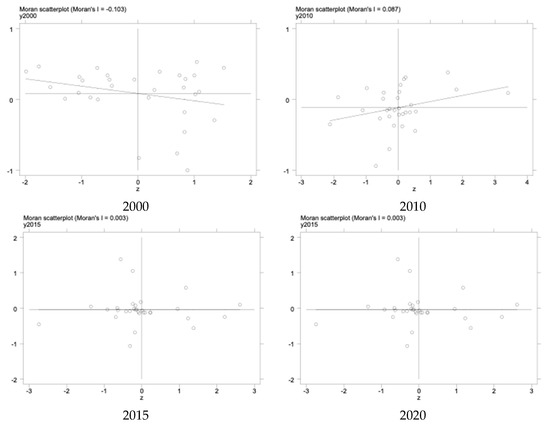

First, the existence of spatial autocorrelation of the real economy (Stjj) variables is tested; second, the form of the existence of spatial dependence determines the form and effect of the spatial econometric model. In this paper, Moran’s I test is used to conclude that the explanatory variable real economy has significant spatial autocorrelation (see Figure 3), and then the LM test, LR test, and Hausman test are conducted to determine the form of the final model (see Table 4). The original hypothesis of “no spatial autocorrelation between the main explanatory variable local government debt (Debt) and the explanatory variable real economy (Stjj)” is rejected at the significance level of 0.01, indicating that the use of the spatial error model or spatial lag model alone cannot truly reflect the true association between the data and the results, and the results may be inaccurate. So, this paper further conducts the Hausman test to determine the effect of SDM, and the test results show that the original hypothesis of “random effects are most effective” is rejected at the significance level of 0.01. Therefore, SDM, with both space and time fixed, is chosen as the main model in this paper, i.e., Model (1).

Figure 3.

Moran scatter plot for 2000, 2010, 2015, and 2020. Drawn by the author.

Figure 3 shows the Moran scatter plot for the main years of the explanatory variable real economy, where the Moran value is negative in 2000, but its p-value is not significant.

Table 4.

A formal test of spatial model selection.

Table 4.

A formal test of spatial model selection.

| Inspection | Statistical Quantities |

|---|---|

| q | 461.277 *** |

| Robust-LM-Lag test | 76.024 *** |

| LM-Error test | 395.098 *** |

| Robust-LM-Error test | 9.8455 *** |

| Hausman test | 34.17 *** |

Note: *** represents: p < 0.01; estimates are above parentheses; standard errors of variables are in parentheses; same as in the following table.

4.2.2. Analysis of the Impact of Local Government Debt on the Real Economy

Table 5 reports the empirical results of the ordinary panel data model (PDM) and Model (1) (SDM). The regression results of PDM show that the regression coefficient of local government debt (Debt) is not significant. The regression results of Model (1) show that the coefficient of local government debt is significantly negative at the 1% significance level, with coefficients of –0.079 and –0.078 for both no control variables and added control variables (column (4)), respectively. These results indicate that local government debt expansion has a significant spatial effect, and debt expansion squeezes out the development of the local real economy. Similarly, the results in columns (3–4) show that the coefficients of the spatial term of local government debt are significantly positive at the 1% and 0.5% levels of significance, respectively, indicating that the growth of local government debt leads to the positive development of the real economy of other local governments. In terms of economic significance, when local governments expand their debts, it will have a crowding-out effect on the local real economy, but it will also stimulate the development of the real economy of neighboring local governments, indicating the heterogeneity of the impact of local government debt on the real economy of different jurisdictions, which verifies Hypothesis 1 proposed in this paper. Significant results and the empirical results are more robust.

In the case of comparable coefficient sizes (0.1 > 0.08), local government debt issuance during the sample period is beneficial to the real economy (regardless of jurisdiction). Observing the regression results of the control variables, in the regression results (column 4) of Model (1), the coefficient of industrial structure (Is) is significantly positive at the 0.1% significance level with a magnitude of 0.064, indicating that the upgrading of industrial structure is beneficial to the local real economy. Similarly, it can be observed that the degree of fiscal revenue decentralization (Fdr) has a significant negative limiting effect on the real economy, i.e., the greater the revenue decentralization power of the government, the greater the limitations on the development of the local real economy. Since fiscal decentralization has a significant critical value effect on economic growth, if the degree of fiscal decentralization is too low, increasing the degree of fiscal decentralization will contribute to economic growth, and otherwise inhibit eco-nomic growth [60]. Therefore, according to the empirical results, the current degree of fiscal decentralization of local governments has exceeded the critical value (optimal value) and has a negative externality on the development of the local real economy.

Finally, we observe that the coefficients of the spatial rho terms in columns (3) and (4) of Table 5 are significant and positive at the 1% significance level, indicating that the real economy has a significant positive spatial–geographic correlation. The growth of the real economy in one region stimulates the development of the real economy in the local governments adjacent to the economic distance. This, to some extent, also supports the suitability of applying Model (1) in this study.

Table 5.

Local government debt and the real economy.

Table 5.

Local government debt and the real economy.

| Variables | PDM | SDM | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Local government debt | 0.032 (0.059) | 0.037 (0.059) | –0.129 * (0.077) | –0.128 * (0.077) |

| Human Capital | –0.011 (0.066) | 0.002 (0.057) | ||

| Degree of openness to the outside world | –0.203 *** (0.061) | –0.043 (0.053) | ||

| Urbanization level | 0.030 (0.083) | –0.015 (0.071) | ||

| Fiscal revenue ratio | 0.003 (0.080) | 0.046 (0.068) | ||

| Industry Structure | 0.451 *** (0.084) | 0.304 *** (0.072) | ||

| Degree of fiscal revenue decentralization | –0.148 (0.119) | –0.167 * (0.101) | ||

| GDP per capita | –0.177 *** (0.065) | –0.074 * (0.056) | ||

| 0.173 * (0.093) | 0.197 ** (0.095) | |||

| Spatial rho | 0.713 *** (0.042) | 0.668 *** (0.046) | ||

| Individual/time Effect | Control | Control | Control | Control |

| N | 651 | 651 | 651 | 651 |

| Log-likelihood | 608.933 | 642.022 | 702.135 | 717.179 |

| Adj. R2 | 0.000 | 0.097 | 0.007 | 0.032 |

Note: * represents p < 0.1; ** represents p < 0.05; *** represents p < 0.01; estimates are above parentheses; standard errors of variables are in parentheses; same as in the following table.

Further, in Table 5, the coefficient rho of the spatial lagged term of the explanatory variable real economy (Stjj) is significantly not zero at the 1% significance level. Since the regression coefficients of the spatial Durbin model do not directly respond to the extent of the effect of the explanatory variables, the regression coefficients and of and are not the indirect effects (spatial spillover effects) and direct effects of local government debt on real economic development. Therefore, this paper draws on Lesage and Fischer [61]. We decompose and explain the direct effect and spatial spillover effect using the partial differential method of the proposed spatial econometric model. The decomposition results are shown in Table 6, where column (1) represents the regression results without adding control variables, and column (2) is the regression results considering the series of control variables.

Table 6.

Decomposition of the effect of local government debt on the real economy.

According to Table 6, the direct effect of local government debt () on the real economy is significantly negative, and the spatial spillover effect is significantly positive, indicating that local government debt expansion squeezes out the local real economy development space but will drive the real economic development of local government in the economic distance adjacent to it. This is consistent with the regression results of Model (1). Meanwhile, with comparable coefficient sizes, the absolute value of the direct effect is strictly smaller than the size of the spatial spillover effect, and the direct effect accounts for only 38% of the spatial spillover effect, indicating that the impact of local government debt expansion on the real economy is positive, thus local government debt expansion is beneficial to the development of the real economy. Here, it should be noted that although the total effect result is not significant, the decomposition effect of local government debt on the real economy cannot be rejected.

4.2.3. Intermediation of the Financial Cycle

- (1)

- Analysis of the impact of local government debt on the financial cycle

To test whether the financial cycle has a mediating role in the process of local government debt on the real economy, we first need to estimate Model (2) to verify whether local government debt significantly affects the financial cycle. Table 7 reports the results of the panel data regression and the estimation of Model (2), according to which it can be found that local government debt has a significant effect on the financial cycle. Among them, although the results of the panel data regression of column (1) without any control variables show a significant negative correlation between local government debt and the financial cycle, its log-likelihood and R2 show that its statistical significance is less reliable than columns (2–4), so this bias can be ignored. The regression results of Model (2) are shown in column (4) in Table 7, where there is a significant positive effect of local government debt on the financial cycle, indicating the existence of a significant positive effect of local government debt on the real financial cycle. This result is consistent with the fact that financial crises tend to coincide with the peak of the financial cycle, and when faced with a financial crisis, the Chinese government is bound to face “unexpected” debt in the short term and decreased debt pressure in the long term. The same results are shown in columns (2) and (3), indicating that the regression results of Model (2) are strongly robust.

Table 7.

Impact of local government debt on the financial cycle.

Similarly, the specific effects of local government debt on the financial cycle are further explored in terms of decomposition effects, and the results are shown in Table 8, where columns (1–2) are decompositions of the effects in columns (3–4) of Table 8, respectively. According to the results, the impact of local government debt on the financial cycle within the jurisdiction and the financial cycle of adjacent jurisdictions are both positive, indicating that there is no significant heterogeneity in the impact of local government debt on the financial cycle of different jurisdictions; however, there is a significant difference in the degree of impact (comparable coefficients of decomposition effect results) because the degree of impact of local government debt on the local financial cycle accounts for only 20.7% of the spatial spillover effect, indicating that local government debt expansion has a greater positive effect on the financial cycle in the adjacent part of the economy. The positive total effect implies that changes in local government debt significantly drive financial cycle fluctuations in China. This is consistent with the fact that local government debt expansion leads to a climb in financial leverage and a financial boom, i.e., local government debt is procyclical in the same frequency as the financial cycle.

Table 8.

Decomposition of the effect of local government debt on the financial cycle.

- (2)

- Intermediation effect of the financial cycle

The empirical results of Model (1) show that local government debt expansion significantly inhibits the development of the local real economy but effectively promotes the development of the real economy of the local governments adjacent to the economy. Additionally, the estimation results of Model (2) suggest that local government debt significantly contributes to the fluctuation of the (jurisdiction-independent) financial cycle. Hypothesis 2 is tested by estimating Model (3): the financial cycle assumes a significant mediating role in the impact of local government debt on the real economy. Table 9 reports the estimation results of the panel data model and Model (3). In columns (2–4) of Table 9, the coefficients of the financial cycle (FCI) are all significantly positive, indicating that the financial cycle has a significant positive impact on the real economy. Combining the estimation results in Table 5 and Table 9, it is clear that the financial cycle plays a significant mediating role in the process of local government debt affecting the real economy according to the three-step method of the intermediation effect test. In addition, since the coefficient of local government debt is not significant in the estimation results of column (2), it can be defined that the financial cycle assumes an important mediating role in the process of local government debt affecting the real economy. Meanwhile, the estimation results of columns (3–4) show that the coefficients of local government debt and its spatial term remain significant after the inclusion of financial cycle variables, indicating that the financial cycle plays a significant but limited mediating role in the process of local government debt acting on the real economy within the unlimited jurisdiction.

Table 9.

Impact of local government debt and the financial cycle on the real economy.

Table 10 reports the decomposition of the spatial effect of local government debt on the real economy after considering the financial cycle. It can be found that the results are consistent with those obtained from Model (1), indicating a significant direct crowding-out effect and a positive spatial spillover effect of local government debt on the real economy. This result also indirectly proves the robustness of the model.

Table 10.

Decomposition of the impact effect of local government debt.

5. Further Analysis

According to the logic of the article, based on the proof of Hypothesis 1 and Hypothesis 2, this section examines the impact of local government debt on the real economy after the “de-financialization cycle” on account of the strong correlation between local government debt and the financial cycle to verify the effectiveness of financial services to the real economy and the fact that finance also affects the real economy through local government debt.

5.1. Local Government Debt after Financial Cycle Adjustment

Panel A of Table 11 gives the regression results of Model (4). In the empirical results, the trend variable (T) and financial cycle (FCI) are significant at the 1% and 10% significance levels, respectively, and the value of log-likelihood is 568.298, which indicates the goodness of fit of Model (4). Based on the results, we can obtain the formula for the predicted value of local government debt balance in China, which is Equation (5). Bringing the coefficients of FCI and T, the constant terms into Equation (5) can calculate the predicted value of the cyclical component of local government debt, and then Equation (6) is applied to obtain the actual value of the local government debt variable , with the effects of financial cyclicality and time trends removed. Panel B of Table 11 reports the mean and standard deviation of the growth rate of the local government debt ratio before and after the financial cyclicality treatment. Based on the results, it is clear that the cyclical treatment is much less volatile, indicating that the cyclical fluctuations in finance on the data have a significant impact on local government debt.

Table 11.

Analysis of the results of “de-colocalization” of local government debt.

5.2. Analysis of the Impact of Cyclically Adjusted Local Government Debt on the Real Economy

The regression analysis is conducted based on the true debt balance value of , STJJ, and control variables using Model (1), and the empirical results are shown in Table 12, where columns (1–2) are the regression results of the panel data and columns (3–4) are the regression results of the SDM. According to Table 12, the coefficient of “de-financialized” local government debt is significantly negative at the 10% significance level, and the coefficient of the spatial term is significantly positive at the 5% significance level. The coefficient of the spatial term is significantly positive at the 5% significance level, indicating that there is a crowding-out effect of local government debt on local real enterprises and a significant positive promotion effect on the development of real enterprises in neighboring areas. To a certain extent, this result reveals the phenomenon of “free-riding” in the expansion of local government debt, i.e., local real enterprises suffer from negative externalities while neighboring real enterprises gain positive externalities due to the improvement of the development environment.

Combining Table 5 and Table 12, the coefficients of local government debt are –0.129 and –0.128, respectively, and the coefficients of “post-financial cycle” local government debt are –0.081 and –0.076, respectively, corresponding to the spatial coefficients of 0.173 and 0.197 and 0.094 and 0.113. We found that the crowding-out effect of local government debt issuance on local real enterprises and the positive spatial externality on neighboring places are reduced after the financial cycle adjustment, which illustrates the pro-cyclical change characteristics of the financial cycle and local governments. In addition, the range of differences between local government debt and its spatial term coefficients is narrowing, and the positive role played by the financial cycle in the process of local government debt crowding-out the share of local real economy development acts as a buffer in the spatial spillover effect. This result suggests that the more developed local finance is, the higher its effectiveness in serving the local real economy and curbing the spillover of this benefit.

Table 12.

Local government debt and the real economy after the “de-financialization” cycle.

Table 12.

Local government debt and the real economy after the “de-financialization” cycle.

| Variables | PDM | SDM | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| “De-Financing Cycle” Local Government Debt | –0.022 (0.037) | 0.010 (0.036) | –0.081 * (0.046) | –0.076 * (0.046) |

| Human Capital | –0.011 (0.067) | –0.000 (0.057) | ||

| Degree of openness to the outside world | –0.204 *** (0.061) | –0.044 (0.053) | ||

| Urbanization level | 0.025 (0.080) | –0.016 (0.068) | ||

| Fiscal revenue ratio | 0.002 (0.043) | 0.022 (0.036) | ||

| Industry Structure | 0.449 *** (0.084) | 0.302 *** (0.072) | ||

| Degree of fiscal revenue decentralization | –0.147 (0.119) | –0.165 * (0.101) | ||

| GDP per capita | –0.178 *** (0.065) | –0.079 * (0.056) | ||

| 0.094 * (0.058) | 0.113 ** (0.058) | |||

| Spatial rho | 0.715 *** (0.041) | 0.670 *** (0.046) | ||

| Individual/time Effect | Control | Control | Control | Control |

| N | 651 | 651 | 651 | 651 |

| Log-likelihood | 608.967 | 641.858 | 701.992 | 716.997 |

| Adj. R2 | 0.001 | 0.097 | 0.003 | 0.031 |

Note: * represents p < 0.1; ** represents p < 0.05; *** represents p < 0.01; estimates are above parentheses; standard errors of variables are in parentheses; same as in the following table.

Table 13 reports the decomposition results of the spatial effect of local government debt after “de-financialization”. Combining Table 6 and Table 13, the direct effect of local government debt decreased by 40.34% and the spatial spillover effect decreased by 41.21% after the “de-financialization cycle”, which again verifies the pro-cyclical characteristics of the financial cycle and local government debt. Second, in the context of local government competition, the two changes are consistent, suggesting that the financial causes the local government debt expansion to benefit the local real economy and, to some extent, the neighboring real economies. This finding verifies Hypothesis 3, which suggests that the financial cycle effectively promotes the real economy.

Table 13.

Decomposition results from the effect of local government debt after the “de-financialization cycle”.

Overall, with consistent model and control variables, the effects of local government debt on the real economy are comparable to those of the “post-de-financial cycle” local government debt. First, the coefficients of local government debt are both negative, indicating that there is a significant and robust crowding-out effect of local government debt expansion on the local real economy, which leads to the inference of Hypothesis 1 that the scale of local government debt in China has reached or exceeded a reasonable threshold level. Meanwhile, the spatial coefficients of local government debt are positive, indicating the existence of a significant positive externality of local government on the real economy of neighboring regions. Second, the absolute value of the coefficient is smaller after the “de-financial cycle”, indicating that finance plays an obvious positive role in the process of local government debt affecting the real economy, buffering the crowding-out effect of local government debt expansion on the local real economy and the positive spatial spillover effect on the real economy of the neighboring economies. The empirical conclusion cited Hypothesis 2: the financial cycle plays an important intermediary role in the process of local government debt affecting the real economy. Finally, combining local government competition (between jurisdictions), and finance buffers the crowding-out effect of debt expansion on the local real economy and limits the positive spatial spillover effect of local government debt. Overall, finance is beneficial to the development of the local real economy, which also reaffirms Hypothesis 3: finance effectively serves the real economy. In particular, this is in line with the main theme of China’s financial services for the real economy.

Due to the special attributes of local governments under the central government and the interaction of local officials, competition for government debt is inevitable and thus may lead to the results of Hypothesis 1. Similarly, under the policy guidance of the central government and the central bank, the development direction of “financial services for the real economy” is very clear, which may lead to the results of Hypotheses 2 and 3, but the direction and extent of the role and channels need to be confirmed by empirical tests. This paper clarifies the direction and extent of this role by expanding the intermediation model and extracting the attributes of the financial cycle and explores the specific role of finance on the real economy through the channel of local government debt.

6. Robustness Test

To test the robustness of the above empirical results, the following robustness tests are conducted: first, the spatial weight matrix is replaced by the inverse distance matrix and the 0–1 adjacency matrix, where the inverse distance matrix takes the inverse of the straight-line distance between the capital cities of the two regions as an element. The 0–1 adjacency matrix is based on whether the regions are bordering each other, and the value is 1 if they are bordering; otherwise, it is 0. In Panel A, columns (1) and (3) are the regression results of the original data, and columns (2) and (4) are the regression results of the “de-financial cycle” data. Second, the main explanatory variable, the local government debt ratio, is replaced by the fiscal space of local governments: the difference between general budget revenue and expenditure. These two variables reveal the fiscal behavior of local governments from two sides, and the test results are shown in Panel B of Table 14. According to the results of the robustness test, it is known that the results of this paper remain robust.

Table 14.

Robustness test results.

7. Conclusions and Policy Implications

Local government debt is one of the important reasons for the financial pressure on local governments. Especially, the current deterioration of the external environment such as the COVID-19 epidemic and the trade friction between China and the U.S. has further exacerbated local government fiscal and economic development sustainability problems. In this paper, the relationship between local government debt, financial cycle, and the real economy were analyzed using the ordinary panel regression model and spatial Durbin model during the sample period 2000–2020 with Chinese local governments, not only investigating the impact of local governments on the local real economy but also clarifying the intermediary role of the financial cycle in the process of local government debt acting on the real economy. According to the empirical results of the article, the following conclusions can be obtained: firstly, there is heterogeneity in the impact of local government debt on the real economy, in which local government debt significantly inhibits the development of the local real economy and favors the development of the real economy in the economic neighborhood; overall, it seems to favor the development of the real economy. Secondly, as for the crowding-out effect of local government debt on the local real economy, we know that the scale of local government debt in China has reached or exceeded a reasonable threshold. Thirdly, the financial cycle plays a significant mediating role in the impact of local government debt on the real economy; finance helps buffer the crowding-out effect of local government debt on the local real economy and also limits the positive spatial spillover effect on the real economy in the economic neighbor. Lastly, there is a significant pro-cyclical feature between finance and local government debt.

For future research related to the topic of this paper, combining the findings of this paper and the current situation of China’s economic and financial development, this paper proposes the following outlook. Given that digital finance will become a “new engine” to drive China’s economic development, and finance is a major catalyst to relieve the pressure of local government debt and promote sustainable economic growth, future research can combine digital finance with local government debt and explore digitally driven solutions to the information asymmetry between the central government and local governments, policy commanders and implementers, etc. In addition, considering the series of challenges brought by digital finance such as digital security, privacy risks, and technological advances, the future development of digital finance will certainly break through these shackles, reduce transaction costs, bring financial convenience, and become one of the important driving forces for sustainable economic development.

Based on the above findings, the following policy insights are obtained: first, although local government debt expansion will have a significant crowding-out effect on the local real economy, combined with positive spatial spillover effects, it is generally beneficial to the development of the real economy, and it is suggested that the government should set up relevant departments to track and monitor the use of debt, consider the crowding-out effect on the local real economy when formulating policies, and provide assistance to local real enterprises when necessary, where the direction of aid should be to give subsidies and provide corresponding financing facilities. Second, considering sustainable economic development, the current local government debt scale has exceeded a reasonable threshold, so it is not possible to continue debt expansion due to its positive spatial spillover effect, and it is recommended that local governments plan their debt with the goal of developing the real economy within their jurisdictions. Third, attention should be paid to the intermediary role played by the financial cycle in the process of local governments’ influence on the real economy, playing the intermediary function of financial institutions to alleviate the investment and financing problems of the real economy under the jurisdiction of local governments, and using finance as an articulation point to open up the investment and financing blockages between local governments and real enterprises, especially to seize the opportunities of digital finance. Fifth, because of the pro-cyclical characteristics of financial and local government debt, it is recommended that the regulatory authorities should pay close attention to the linkage effect of debt expansion and financial cycle changes, and always supervise to avoid crisis events caused by abnormal ringing. Last, the government should strengthen the development of digital finance and financial service quality, which will reduce information asymmetry, diminish the financing cost, and channel capital for enterprise innovation, to promote sustainable economic development.

Government debt is a common problem faced by all countries in the world. The findings of this paper have the following implications for other countries in the world that are also facing debt problems: (1) identify the specific rights and responsibilities of the government and the debt issuance quota in the jurisdiction; (2) strong supervision over the issuance and use of government debt and control the negative spatial correlation of government debt; (3) since the development environments of developed countries such as the United States, Europe, and Japan are different from that of China, when considering the interests of financial promotion and economic sustainability, we should first check the actual debt level within the government jurisdiction and abide by “living within our means” and the government debt golden rule. (4) Since the financial and local government debt may have a general pro-cyclical characteristic, it is possible to indirectly observe the changes in the level of government debt from the financial perspective, and then grasp the status of debt in many aspects.

Funding

This research received no external funding.

Institutional Review Board Statement

Ethical review and approval were waived for this research because of the use of survey responses from the employees of SMEs in China, which is subject to social science-based research and not relevant to any human/clinical trial.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Huang, Q.H. The Development of China’s Real Economy in the New Era. China Ind. Econ. 2017, 9, 5–24. [Google Scholar] [CrossRef]

- Li, Y. “Financial Services for the Real Economy” Identification. Econ. Res. 2017, 52, 4–16. [Google Scholar]

- Cohen, D.; Sachs, J. Growth and External Debt Under Risk of Debt Repudiation. NBER Work. Pap. 1985, 30, 529–560. [Google Scholar]

- Chen, K.; Zhang, C.; Feng, Z.; Zhang, Y.; Ning, L. Technology Transfer Systems and Modes of National Research Institutes: Evidence from the Chinese Academy of Sciences. Res. Policy 2022, 51, 104471. [Google Scholar] [CrossRef]

- Spilioti, S.; Vamvoukas, G. The Impact of Government Debt on Economic Growth: An Empirical Investigation of the Greek Market. J. Econ. Asymmetries 2015, 12, 34–40. [Google Scholar] [CrossRef]

- Liu, J.Q.; Li, L. Research on the Influence of Real Enterprise Financialization on Financial Stability. Economist 2021, 3, 82–90. [Google Scholar] [CrossRef]

- Mao, J.; Huang, C.Y. Local Debt, Regional Differences and Economic Growth: A Validation Based on Data from Prefecture-Level Cities in China. Financ. Res. 2018, 5, 1–19. [Google Scholar]

- Graham, J.R.; Leary, M.T.; Roberts, M.R. A Century of Capital Structure: The Leveraging of Corporate America. J. Financ. Econ. 2015, 118, 658–683. [Google Scholar] [CrossRef]

- Gersbach, H.; Rochet, J.C. Capital Regulation and Credit Fluctuations. J. Monetary Econ. 2017, 90, 113–124. [Google Scholar] [CrossRef]

- Chan, K.S.; Dang, V.Q.; Yan, I.K. Financial Reform and Financing Constraints: Some Evidence from Listed Chinese Firms. China Econ. Rev. 2012, 23, 482–497. [Google Scholar] [CrossRef]

- Gorodnichenko, Y.; Schnitzer, M. Financial Constraints and Innovation: Why Poor Countries Don’t Catch Up. J. Eur. Econ. Assoc. 2013, 11, 1115–1152. [Google Scholar] [CrossRef]

- Pang, B.Q.; Chen, S. The Causes, Scale and Risks of Local Government Debt Under the Centralized Fiscal Pattern. Econ. Soc. Syst. Comp. 2015, 5, 45–57. [Google Scholar]