Abstract

More than 10 years have passed since studies on green buildings gained attention in the academic and industrial literature. Many studies report the economic value of green buildings, mainly in the U.S. and European markets. An empirical clarification of the dynamics of green premiums has significant implications for future urban sustainability. This study constructed a dataset of Tokyo office rents from 2009 to 2019. We estimated the green office rental premium using a hedonic approach. Our results show that, on average, an office property with a green label gains a premium of approximately 6.5% on contract rents. The Tokyo office market is heterogeneous, and endogeneity is an issue when identifying the green premium. We addressed the endogeneity issue with propensity score clustering. As a result of our estimation, the premium was approximately +5.4% for medium-sized old buildings and +2.6% for large-sized new buildings.

1. Introduction

The value of a green building’s economic performance is crucial for incentivizing real estate developers to supply green buildings. In addition, identifying this green premium can provide vital information and parameters for green building policy design. Green real estate is expected to increase sales and lower costs for tenants by conserving energy consumption and making employees healthier. Tenants will be willing to pay more rent for green properties. Higher rents will also lead to higher transaction prices. If prices are expected to rise for developers and investors, then supply and investment in green real estate becomes a rational decision. The existence of a positive rent premium is an important issue in predicting whether the market will function on green values and whether the green real estate stock will increase. Several pioneering studies have been published that empirically identify the economic benefits of greenness in the office market [,,,,,]. In recent years, research results on the green premium of rent have accumulated, and many studies have reported positive premiums [,,,]. Most of these studies are in the US office market where data are available. However, this limits the extent to which the results can be generalized to other markets and social-economic environments.

Several studies have been published on the green premium in Japan. Shimizu [,] documents a premium of 5.8% on the offering price and 4.7% on the transaction price for a condominium in Tokyo. Shimizu’s findings are further verified by Yoshida and Sugiura [] and Fuerst and Shimizu []. These studies echo the literature on green premiums documented in the residential property markets in other countries [,,,,,,,]. In Japan’s office market, Yoshida et al. [] provide evidence as to what causes the positive association between green building labels and office rents. In this study, we verify whether there is a significant premium from green labels for new contract rents, using a valuable dataset consisting of 37,346 rental properties in Tokyo’s office market.

There are several empirical challenges to identifying green buildings’ economic value in a highly heterogeneous market such as Tokyo. In identifying the economic value of the green label, it is expected that the choice to earn or not to earn environmental certification will vary according to the characteristics of the property. This suggests that covariates will differ between the treatment and control groups in the sample, assuming that green labeling is an intervention in the effectiveness test. In particular, commercial real estate is highly heterogeneous, so estimating the premium requires careful control of the characteristics of the property. If no action is taken to estimate the effect, the estimate will include sample selection bias, which is one of the endogenous biases. Sample selection bias can be dealt with by using instrumental variables, difference-in-difference (DID), and propensity score. In DID, to control for the systematic difference between the certified and non-certified buildings, two observations are used for each building: one before certification and one after. DID allows controlling for unobserved effects, thereby mitigating a potential omitted variable bias present in many cross-sectional studies []. Propensity scores form a sample with similar covariates, using the probability that an intervention will take place. To control more precisely for the variations in the measured and unmeasured characteristics of rated buildings and the nearby control buildings, we estimate propensity scores for all buildings in the rental sample and the sample of transacted buildings []. Propensity score matching (PSM) is also expected to be comparable with that in other countries. However, to match the samples with and without green labels, PSM discards many of the samples that do not have green labels. It is assumed that many of the samples that will be discarded are samples of older, small to mid-sized buildings that have little investment capacity and are difficult to invest in to obtain a green label. The submarkets that these samples comprise account for a large portion of Tokyo’s office stock, and have a different market structure than the prime buildings, making the spread of green labels a challenge. Thus, PSM may not be able to investigate the effect of green labeling in submarkets that consist of older, small and medium-sized buildings with few green buildings. To address this issue, we used propensity score-based clustering to divide the sample into prime and affordable buildings, and tested the effectiveness of green labels in each category. We aimed to empirically verify that the magnitude of the green premium varied across submarkets.

2. Data and Methods

2.1. Data

To construct the analytical dataset, we gathered and assembled data on rent and green labels. First, we utilized Xymax Corporation’s rent database for office buildings. Xymax is one of the leading property management firms in Japan. https://www.xymax.co.jp/english/ Xymax had collected data on 4988 properties and 51,219 cases (from Tokyo’s 23 wards, with a gross building area of more than 300 tsubo, approximately 1000 square meters) as of the end of 2019. Xymax regularly obtains information on contracted cases not only from its portfolio but also from several major leasing agents. In the Japanese office leasing market, it is rare for tenants and owners to sign contracts directly without going through an agent, so we thought there would be no major bias in understanding the Tokyo office market.

We now explain the scope of rent included in our analysis. First, rents include management fees. This is because tenants negotiate with agents and landlords for rents that include management fees. Second, the term of the contract is generally 2 years, according to the business practice of office leases in Japan. However, there is an automatic renewal clause when the contract expires, and tenants can terminate the contract even within the contract period by giving a certain period of notice; therefore, we believe that the length of the contract period has little impact on rents. The rent-free period is not taken into account due to data limitations, so rents may be higher in cases where a long rent-free period is set. Electricity and water are rarely included in the rent but are charged by the landlord according to the amount consumed.

Many building characteristics that measure the size, facility, location, and contact details are included in this database. For example, the variables include the gross building area, the building’s age and air-conditioning system, the amount of time it takes to walk to the nearest metro station, the property’s neighborhood, and the duration of the contract. To be assured of the consistency of our empirical analysis, we confined the contract cases to Tokyo’s 23 wards, and properties with a gross building area of more than 300 tsubo (approximately 1000 square meters), and the contracts selected were completed between 2009 and 2019. As a result, our final cleaned sample consisted of 37,346 new contract rent cases.

Next, for the green label presence or absence data, we collected and organized the published information from the homepages of certification organizations of green labels. For this analysis, we used the following green label systems: CASBEE, CASBEE for Real Estate, and DBJ Green Building Certification (please refer to Appendix A for the history of each of the green label systems and the characteristics of the evaluation items).

The selection of the above-listed systems is for three reasons. First, these three green labeling systems are certified on a property-by-property basis. This allows for integration with rent data. Some green labeling systems assess on a firm or portfolio basis, but we did not use them in our study because they cannot be combined with rent data. Second, these three green labeling systems evaluate comprehensive environmental performance, including the building’s energy consumption and reduction of environmental effect, user utility, and management policy. Third, in these certification systems, a third-party organization performs an assessment based on the standards established by these systems. In Japan, several green labels were created in the 2010s, but none of the certifications are currently dominant. Therefore, if only individual certification systems were used, the number of samples obtained would have been insufficient for the analysis. Although the assessment items vary from system to system, they all evaluate the overall environmental performance of a property. Therefore, we do not see a problem in integrating their data into the analysis of this study. However, systems that evaluate only energy-saving performance are excluded from the analysis.

If a building has one of the above green labels, the green label dummy is set to 1, otherwise, it is set to 0. The rent data was combined with these dummy variables. In our dataset, there are 1981 cases with a green label dummy value of 1, accounting for 5.3% of the full sample. The percentage of green buildings is 5.3% less in the whole sample, but this can be attributed to two reasons. First, the huge market of Tokyo includes many small and medium-sized buildings. Owners of small and medium-sized buildings are not financially strong and it is difficult for them to make additional investments in acquiring a green label. Second, the percentage of green buildings is changing with time. It was only 0.064% in 2009 when the certification program was fully launched, but it increased to 9.7% in 2019.

Table 1 shows the variables used in this study’s analysis, while Table 2 shows the summary statistics.

Table 1.

Variables and description.

Table 2.

Summary statistics of the dataset.

2.2. Base Model

The new contract rent of office buildings is a function of office building characteristics and green label acquisition conditions, and the rent function is generally expressed as a hedonic price model, as shown below:

where Ri on the left-hand side of Equation (1) shows the contract rent per square meter of the contract case i. greeni = (0, 1) is the green label dummy. xi′ = (x1i, x2i, …, xni) is the vector that represents the n characteristics of the contract case i. We use the log-linear function form in this research:

where lnRi (contract rent per square meter, in logarithm) is the dependent variable, α is the constant term, greeni and xi are independent variables, and εi is the error term. Here, the parameters to be estimated are α, β, γ, and the coefficients corresponding to each independent variable are represented by the vector β′ = (β1, β2, …, βn ), and γ′ = (γ1, γ2, …, γn). The independent variable xi in Equation (2) concludes the following building characteristics; building age, gross building area, renovation, time taken to walk to the nearest metro station, zone air conditioning, card-key security system, and raised floor.

Further, to control for the omitted variables of location and market condition, our model includes the area dummy and the time dummy. As the area dummies to adjust to the quality of the effects on rents, we used the wards where the properties were located. The five central wards (Chiyoda-ward, Chuo-ward, Minato-ward, Shinjuku-ward, and Shibuya-ward) are in the central business district, where 75% of the office building stock is concentrated. As the time dummies reflect the supply and demand conditions in the market, we used the quarter that includes the time when the contract occurred. The study period, from January 2009 to December 2019, was divided into 44 quarters.

2.3. Expanded Models: Repeat Sales and Propensity Score Analysis

The summary statistics for green buildings and non-green buildings are shown in Columns 2 and 3 of Table 2. The means for gross building area and building age for green subsamples are 63,746 square meters and 11.8 years, respectively. In contrast, the means for non-green subsamples were 17,317 square meters and 23.7 years, respectively, showing that these buildings tend to be smaller and older. Further, the percentage biases were 84.9% in gross building area and −111.1% in age. The percentage bias assesses the balance between green and non-green buildings. It is the difference in the sample means between the green and non-green subsamples as a percentage of the square root of the average of the sample variances in the green and non-green groups (Rosenbaum and Rubin []).

When the acquisition of the green label is influenced by covariates such as building size newness, and location, the coefficient estimates of the green dummy in the naïve ordinary least squares (OLS) regression will contain endogenous bias, making it difficult to identify a green premium.

Therefore, we employed three approaches to address endogeneity concerns. All three methods extracted a sample with balanced covariates in two groups (green buildings and non-green buildings). After extracting a sample with balanced covariates, we estimated the effect of green labeling on new contract rents. By proceeding with the analysis in this way, we addressed endogeneity.

The first approach was repeat sales (RS) sampling. In this approach, we extracted paired cases where new contracts occurred in the same building both before and after the acquisition of the green label (it was considered that tenants before and after acquisition of the green label were not nearly the same). The RS we adopted can be said to be an approach similar to the DID list in Section 1. However, due to data limitations, we did not focus on temporal changes in premium size in our study. The means of the covariates for repeat sales were as follows: gross building area was 37,431 sq m (equal in GB and non-GB); five city-center dummy was 0.786 (equal in GB and non-GB); age was 13.542 years in GB and 11.824 years in non-GB; renewal dummy was 0.191 for GB and 0.160 for non-GB. The summary statistics of RS sampling are shown in Column 1 of Table 3. The percentage biases were reduced, 0% in gross building area and 15.3% in age. As the covariates other than building age were equal for green and non-green buildings, we expected to address the endogeneity issue. RS controls for covariates (other than age), which is an effective way to deal with endogeneity, but it was a very small sample, making it difficult to discuss the overall market effect. We needed a way to control for covariates while maintaining some sample size. PS matching creates paired data with similar covariates in the regression space. Multiple methods are used to check the robustness of the analysis.

Table 3.

Summary statistics of the dataset (repeat sales and propensity score matching).

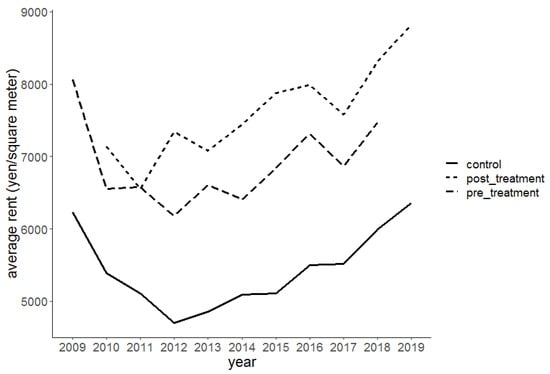

In our repeat sales sample, there were, on average, approximately 10 observations each before and after earning the green label. Due to the concern that endogeneity remained after repeat sales sampling, we checked the parallel trend and found that the pre-treatment and control groups remained parallel in time (Appendix B).

However, a concern exists that estimates of the effect of repeat sales sampling may contain a sample selection bias. Clapp and Giaccotto [] point out that repeat sales measures suffer from sample selection bias because houses traded multiple times have different characteristics. This is because the repeat sales sample employs only a very limited fraction of the total number of observations.

The second approach was using PSM. PSM has the potential to include a larger number of samples in the analysis as compared to repeat sale sampling. In PSM, we first estimated the following probit model of the probability of obtaining a green label:

where β is a vector of elements (β1, …, βi)’. x is the vector that expresses n characteristics of the buildings. The results of the probit regression in our dataset show that the coefficients of both building age and gross building area were significantly positive, and the coefficients of raised floor, zone air conditioning, and card-key security system were positive, though not significant. The results show that the newer, larger, better equipped, and higher quality the product is, the easier it is to get the green label. Next, we estimated the propensity score for each sample using the probit model described above. Then, for each certified sample, we matched the sample with the nearest neighbor propensity score among the uncertified samples. The means of the covariates in PSM were as follows: gross building area was 63,746 sq m in GB and 63,104 sq m in non-GB; five city-center dummy was 0.831 in GB and 0.828 in non-GB; age was 11.829 years in GB and 12.339 years in non-GB; renewal dummy was 0.172 in GB and 0.185 in non-GB. The summary statistics of PSM sampling are shown in Column 2 of Table 3. The percentage biases were reduced, 0.9% in gross building area and −5.2% in age. As the explanatory variables of the probit model for estimating propensity scores were covariates such as size and newness, we could expect the matched pair covariates to be similar.

However, there is a limit to considering the PSM results as the effect of green labeling. This is because the Tokyo office market is huge and extremely heterogeneous, mixing prime and affordable markets. Nishi et al. [] point out that under conditions of a market mixture, estimation with a single hedonic function is an illusion and requires reasonable market segmentation.

The third approach was propensity score (PS) clustering. For reasonable segmentation, the sample was divided into five clusters based on the estimated propensity score. Five quartiles were used as cluster boundaries, and the number of samples in each cluster was approximately the same. Two similar groups were created in each cluster so that large differences between these groups indicated the green label presence. Our analysis was not intended to be an economic model. It was merely an empirical challenge. There were differences in the structure of rents between prime and affordable markets, and we wanted to do a proper segmentation of the markets.

3. Results and Discussion

We divide this section into the following subheadings so that it can provide a concise and precise description of the experimental results, their interpretation, as well as the experimental conclusions that can be drawn.

3.1. Base Model, Repeat Sales, and Propensity Score Matching

We carried out the OLS estimates from Equation (2), and the base model results are shown in Column 1 of Table 4. The estimated coefficient of the green label dummy was +0.065 (0.005), indicating that it was positive and significant (the value in parentheses represents the standard error). This indicates that contact rents in certified buildings were 6.5% higher than non-certified buildings. Column 2 of Table 4 shows the results of the OLS estimation in Equation (2) after repeat sales sampling, using the same variables as in the base model. The estimated result was 6.1%. The standard error was 0.034, larger than that of the base model, and was not significant at the 5% level. When we controlled for the building dummy instead of the characteristics and location dummy, the estimate for green premium was +0.0148 and its standard error was +0.0337, which is not significant. In addition, the sample size was small (262) because of the repeat sales condition. Column 3 of Table 4 shows the results of the OLS estimation using Equation (2) with the same variables as in the base model, after we matched the sample with 140, the nearest neighbor propensity score among the uncertified samples, for each certified sample by PSM. The estimation result was +3.2%, which is significant even at the 1% level. The sample size was 3962, which was larger than that of the repeat sales sample. Both models had an adjusted R-squared of approximately 0.6. There were some unobserved variables such as tenant and owner attributes that could not be captured due to data limitations. In our estimation model, we considered these missing variables to be homogeneous.

Table 4.

Results of hedonic regression.

To confirm that the three green label systems we used were interchangeable, we estimated the green premium for each green label system. The regression results were +0.058 (0.007) for DBJ Green Building Certification, 0.043 (0.097) for CASBEE, and 0.061 (0.018) for CASBEE for Real Estate (standard errors in parentheses). CASBEE was not significant due to the small sample size, but both were at a similar level of 5–7%. Based on this result and the similarity of the evaluation items (see Appendix A), we believe that the three green labeling systems are interchangeable.

The base model estimation results suggest that the acquisition of green labels is an economically rational behavior with an expectation of higher returns. However, it should be noted that other factors affect both green labels and office rents, and some of the base model estimates contain endogenous bias.

The first background for endogeneity is the cost of earning the green label for existing buildings. The Tokyo office market is large and heterogeneous, with existing buildings accounting for the majority of it. While new buildings can be designed from the planning stage to earn the green label, earning the green label for existing buildings requires a large financial and human resource burden, including large-scale renovation work and the maintenance of energy data. For small and medium-sized building owners, who make up the majority of the Tokyo office market, additional investment to earn the green label is a difficult decision to make. Another factor to consider is that momentum for environmental improvement in the city at the moment is not strong. In Tokyo, after the economic growth of the 1960s and the pollution problems of the 1970s, the energy efficiency of buildings was raised, and Tokyo became cleaner and has better air and water quality. Today, most real estate players do not have a strong motivation to improve the urban environment except for the large companies. Although environmental regulations, including the Act on the Rational Use of Energy and the Basic Plan for Environmental Protection (see Appendix A), are already in place in Tokyo, earning the green label for office buildings is not mandatory and is left to the decision of the building owners. Therefore, the decision-making process is primarily economically motivated, while there may be biases due to an individual’s social convictions towards the environment. However, renters rarely express their political beliefs or partisan sentiment. In summary, when estimating the green premium in the Tokyo office market, factors such as size, newness, and facilities may be proxy variables for the green label.

Therefore, the estimation result of (1) in Table 4 concludes that an endogenous bias and the green premium cannot be correctly identified.

The results of repeat sales and PSM, which address endogeneity, were both positive. However, it is difficult to conclude from these results that a green premium exists in the Tokyo office market as a whole.

RS does not provide reliable estimation results with large estimation errors, owing to the extremely limited sample size.

At the same time, PSM can extract a relatively large number of samples while maintaining covariates balance. However, the average value of PSM in Table 2 shows that the samples were mainly large-sized new buildings, and the estimation result of PSM represents the green premium in the prime market rather than the affordable market. As prime market buildings have many characteristics attractive to tenants, the green label’s value is buried, and the estimated result of +3.2% is smaller than that of the base model and RS.

3.2. Results of Propensity Score Clustering

The Tokyo office market is heterogeneous, with a mix of prime and affordable markets. Therefore, we used propensity score clustering, as shown in Section 2.3, to perform the segmentation. In our study, the cluster with the highest propensity score (large-sized new buildings) and the cluster with the next highest propensity score (medium-sized old buildings) was extracted and analyzed. The remaining three layers were small and mainly built-up properties, and few samples had obtained environmental certification; there were few statistically significant results and suggestions, so they were excluded from consideration.

First, we compared the covariates with and without the green label in each cluster. In large-sized new buildings, the average total floor area was 69,018 square meters for green buildings, 50,417 square meters for non-green buildings, and the average age was 10.3 years for green buildings and 13.8 years for non-green buildings. The percentage biases were reduced compared to the base model, 28.3% in gross building area and −39.5% in age. It was homogenized compared to all the samples (Table 2). Furthermore, in medium-sized old buildings, the average was 28,118 square meters and 23.2 years for green buildings, and 17,992 square meters and 22.0 years for non-green buildings. Compared to the base model, the percentage biases were reduced; 26.1% in gross building area and 11.4% in age. It can also be observed that green buildings and non-green buildings were homogenized by propensity score clustering. The sample split by propensity score clustering had similar results to the grading used by market participants. In Tokyo, office buildings are graded according to specifications such as size and newness; the CBRE [] defines the Grade A category as one which has a total area of at least 33,000 square meters and an age of less than 15 years. The Grade A minus category is defined as one with a total area of at least 23,000 square meters, and which also complies with the new earthquake resistance standards (built after 1981). The Grade B category is defined as one with a total area of 6600 square meters or more, and which also complies with the new earthquake resistance standards. Comparing the CBRE grades with our propensity score clustering results, large-sized new buildings were classified as 86% of the grade A sample, 64% of the grade A minus sample, 26% of the grade B sample, and 6% of the no grade sample. Medium-sized old buildings were classified as 9% of the Grade A sample, 18% of the Grade A minus sample, 33% of the Grade B sample, and 16% of the No Grade sample. The higher the grade, the higher the propensity score clustering tended to be.

Next, the results of subsample regression that addressed endogeneity by propensity score clustering are listed in Columns 2 and 3 of Table 5. In large-sized new buildings, the result of the regression was +0.026 (0.005), which is a significant and positive effect. At the same time, in medium-sized old buildings, the result of regression was +0.054 (0.016), which is a significant and positive effect.

Table 5.

Results of hedonic regression (propensity score clustering).

The green label rent premium was not homogenous across all market segments. In the segment consisting of new and large buildings, the green premium was smaller; in the segment consisting of old, medium-sized buildings, the green premium was larger. The result of larger premiums for older buildings is consistent with the results of Yoshida and Sugiura [] for Tokyo condominiums. In our study, the results of our estimation show that older properties tended to have a larger age coefficient (less negative).

The reasons for this are as follows: in the prime building market, which has many attractive elements such as scale, newness, and equipment, green labels are becoming widespread, and the attractiveness of green labels tends to be relatively buried. In contrast, in the old and medium-sized building market, which lacks attractive elements, green labels are not widely used, and green buildings are sufficiently attractive for companies seeking offices.

Even though the results were stratified by propensity score, there may be a certain influence between the age of the building and the environmental certification dummy. To adjust for this effect, we estimated Equation (2) by adding the cross term of building age and green label as a robustness check. As a result, for medium-sized old buildings, the coefficient of the green label dummy was −0.025 (0.033), which is insignificant, and the coefficient of the cross term of age and green label dummy was 0.003 (0.001), which is positive and significant. For large-sized new buildings, the coefficient of the green label was 0.019 (0.009), which is significant, and the coefficient of the cross term of age and green label was 0.0007 (0.0006), which is not significant. The results suggest that in medium-sized and old buildings, the difference in depreciation over time increases with the age of the building due to the difference in maintenance, suggesting that the green label functions more as a differentiating factor. In the case of large-sized new buildings, the green label does not function as a differentiating factor, so the same result was not obtained.

Based on the results and discussions above, we explored the underlying mechanism that contributes to the green premium. Eichholtz et al. [] summarize the distinct ways in which investment in green buildings can lead to economic benefits such as (1) energy savings and waste reduction, (2) higher employee productivity, (3) a signal of social awareness and superior sense of social responsibility of the occupants, and (4) longer economic lives.

For (1) energy saving, the premium can be estimated by evaluating the efficiency of energy and water consumption. In Japanese rent contracts, tenants primarily bear utility costs. Savings in utility costs will lead to profits for tenants. For (2) employee productivity, the premium can be estimated by evaluating the indoor environment, including air and lighting, which plays a role in employee health and ease of work. This discussion could also be extended to an analysis of the quality of life benefits of a green office building. Employee health brings benefits to companies through the prevention of employee turnover and the improvement of work efficiency. The green labels in our study include evaluation items related to indoor environment and service quality, suggesting that green offices may be evaluated from the aspect of employee productivity and health. However, this does not distinguish between energy savings and resilience, and so the direct benefits to employees are out of our scope. Certification systems that focus more on employee health, such as the WELL Building Standard, have emerged. In Japan, the CASBEE Wellness Office was launched in 2019. Through the development of these data, it may be possible to identify the benefits to employees of a rent premium in detail. The green label used in our study is a comprehensive index that includes not only energy but also equipment, operation, water, material, interior, site and surroundings, transport, waste, and containment (Appendix A). Therefore, the premium we estimate is likely to include economic benefits attributable to (1) energy saving and (2) employee productivity. Yoshida et al. [] confirm that the green premium disappears when energy and water consumption are added as explanatory variables. Their study concludes that a rent premium observed for green buildings is paid by tenants not for a brand associated with green building labels but for material benefits of green buildings with respect to lower costs of energy and water. In our study, it was difficult to collect energy and water data, especially for non-certified buildings, and as a result we could not identify only energy and water savings specifically in our estimates.

Moreover, the green label we used favors a long-life structure. As a result, certified buildings have a smaller depreciation value and a larger premium. Our study segmented the market appropriately through PS clustering and observed a more significant premium for older buildings. This result shows the economic benefit of (4) longer economic lives. The result of more significant premiums for older buildings is consistent with the results of Yoshida and Sugiura [] for Tokyo condominiums.

In contrast, the (3) signal of a sense of social responsibility of the occupants was not included in the evaluation items of the green label we used. As a result, we could not explicitly verify it. However, green buildings may attract companies with higher social responsibility and were included in our estimate of the premium. To clarify the economic benefits in this way, we must add variables that reflect corporate social responsibility, such as credit score, to the model. Data on tenants’ social responsibility was not available, so it could not be included in this study.

4. Conclusions

This study empirically estimated the green premium in the Tokyo office market, a large, heterogeneous market with advanced environmental technology. Adjusting for building quality with the hedonic approach, we analyzed the economic premium of the green label on a sample of 37,346 contracted cases in Tokyo office buildings from 2009 to 2019. The findings are summarized as follows:

- Green labels showed a significant effect of 6.5% on new contract rents in our OLS regression. However, as the covariates differed greatly depending on green label presence or absence, estimates of a green premium included endogenous bias and were overestimated.

- When divided by propensity score clustering to address endogeneity, two homogeneous subsamples could be constructed.

- The estimated green premium for homogeneous subsamples was +5.4% for medium-sized old buildings and +2.6% for large-sized new buildings (both significant).

This series of empirical results provides implications regarding green labels in the real estate market. First, we showed empirically that green premiums vary by market segment, i.e., the size of the green premium is a function of the spread and relative attractiveness of a green label within each segment.

In addition, our study was based on some assumptions. First, we considered the renting companies to be homogenous. Among similar green real estate properties, the degree to which green value is recognized could differ depending on the industry or the tenant’s company size.

Second, there is room to consider the risk of spatial dependency. There was no significant difference in the mean of the five wards dummy in Table 2 (green building: 0.831, non-green building: 0.778), so we believe that the risk of spatial dependency is small. This is because our analysis focused on a single city, Tokyo; therefore, there was no geographical difference in terms of environmental regulations and certification items. For example, the risk of earthquakes is the same in the 23 wards of Tokyo. However, there may be differences in more detailed geographical conditions (susceptibility to flooding, strength of the ground). We did not include these in our analysis due to data limitations.

Further, we must verify whether the green label had an independent effect while considering the actual energy consumption and management conditions. Finally, we assumed that the green premium was constant over time. It may be possible to analyze external shocks to utility consumption such as tsunamis and Fukushima-like events. The time period for our dataset was from 2009 to 2019, including the years before and after the 2011 tsunami and the subsequent nuclear accident. As the green labels of our study are comprehensive, it is necessary to separate the effects of utility cost-saving. Alternatively, we could use the certification system that specializes in energy consumption, such as BELS, or the data reported on energy consumption required by the Tokyo metropolitan government regulation.

In our study, we did not show the difference in the magnitude of the premium between high and low environmental performances. As the green label is not yet widespread in the Japanese office leasing market, we focused on estimating the average effect of the green label. Each green label system shares the same overall environmental performance rating, but the number of grades and their criteria are different. Additional data development and analysis are needed to analyze the premium for high environmental performance, but due to data limitations, they were not included in our study.

We expect that as the green label becomes more widespread, its relative attractiveness will decrease, and the green premium will become smaller. Therefore, it is necessary to examine the market dynamics of how premiums change as they enter the market, are accepted by early adopters, and become widespread.

These problems form an interesting and important avenue for research in future studies.

Author Contributions

J.O., Y.D. and C.S. contributed equally to this paper. They conducted the analyses and wrote the paper together. All authors have read and agreed to the published version of the manuscript.

Funding

Financial supports from JSPS KAKEN (A)\#20H00082 for this research are gratefully acknowledged.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are not publicly available, though the data may be made available on request from the corresponding author.

Acknowledgments

We are grateful to Siqi Zeng, Jiro Yoshida, Daniel McMillen, Tien Foo Sing, and participants at the “Green Cities in Asia” Workshop, Hang Lung Center for Real Estate, Tsinghua University. This paper is based on a presentation given at the Joint Workshop Series on Sustainable Property Market jointly organized by CSIS-The University of Tokyo and CRERC-University of Cambridge. The publication fee is financially subsidized by the University of Tokyo.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The following table shows the environmental certification systems (green labeling systems) currently in existence worldwide. Green labeling systems can be classified into three general categories. First, some certifications specifically focus on building energy efficiency. Examples are Energy Star in the United States, EPCs in the United Kingdom, and BELS in Japan. The next type is a certification system that evaluates a building’s overall environmental performance. This type of certification examines a building’s energy conservation capacity and assesses it on a variety of environmental factors, such as water use, construction materials, in-room environment, traffic, and impact on the surrounding environment. LEED in the United States, BREEAM in the United Kingdom, and CASBEE in Japan are examples. Finally, there is GRESB, which does not evaluate individual buildings but is a portfolio-level sustainability assessment benchmark used to assess corporations and other holdings that own and operate real estate. A European pension fund was responsible for creating GRESB.

Table A1.

Selected green labels.

Table A1.

Selected green labels.

| LEED | Energy Star | BREEAM | EPCs | HQE | GRESB | ||

| Used in this study | - | - | - | - | - | - | |

| Development | U.S. Green Building Council (US) | U.S. Environmental Protection Agency (US) | Building Reserch Establishment (UK) | UK Government (UK) | HQE Association (France) | GRESB (The Netherlands) | |

| Since | 1998 | 1995 | 1990 | 2006 | 1996 | 2010 | |

| Target | Buildings | Buildings | Buildings | Buildings | Buildings | Firm | |

| Focus | Comprehensive | Energy Efficiency | Comprehensive | Energy Efficiency | Comprehensive | Comprehensive | |

| Output | 4 ranks | Energy Star ≥75 | 5 ranks | 8 ranks | 4 ranks | 4 quadrants | |

| Assessment items | Equipment | Yes | - | Yes | Yes | Yes | - |

| Operation | Yes | Yes | Yes | - | - | Yes | |

| Water | Yes | - | Yes | - | Yes | Yes | |

| Material | Yes | - | Yes | - | Yes | - | |

| Interior | Yes | - | Yes | - | Yes | Yes | |

| Site | Yes | - | Yes | - | Yes | - | |

| Transport | Yes | - | Yes | - | - | - | |

| Waste | Yes | - | Yes | - | Yes | - | |

| Containment | Yes | - | Yes | - | Yes | - | |

| Other | - | - | Management, performance verification | - | - | Organization, disclosure, risk assessment, green lease | |

| Source | [] | [] | [] | [] | [] | [] | |

| Greenstar | NABERS | CASBEE | CASBEE for Real Estate | DBJ Green Building Certificate | BELS | ||

| Used in this study | - | - | Yes | Yes | Yes | - | |

| Development | Green Building Council of Australia (Australia) | Australian Government (Australia) | MLIT (Japan) | MLIT (Japan) | Development Bank of Japan (Japan) | MLIT (Japan) | |

| Since | 2003 | 1990 | 2004 | 2012 | 2011 | 2014 | |

| Target | Buildings | Buildings | Buildings | Buildings | Buildings | Buildings | |

| Focus | Comprehensive | Energy Efficiency | Comprehensive | Comprehensive | Comprehensive | Energy Efficiency | |

| Output | 6 ranks | 5 ranks | 5 ranks | 4 ranks | 5 ranks | 5 ranks | |

| Assessment items | Equipment | Yes | - | Yes | Yes | Yes | Yes |

| Operation | Yes | Yes | - | Yes | - | - | |

| Water | Yes | Yes | Yes | Yes | Yes | - | |

| Material | Yes | - | Yes | Yes | - | - | |

| Interior | Yes | Yes | Yes | Yes | Yes | - | |

| Site | Yes | - | Yes | Yes | Yes | - | |

| Transport | Yes | - | Yes | Yes | Yes | - | |

| Waste | Yes | Yes | - | - | Yes | - | |

| Containment | Yes | - | Yes | - | - | - | |

| Other | Management, Innovation | - | Earthquake resistance, handicapped accessible | Earthquake resistance, useful life, disaster risk | Environment risk, crime prevention, tenant relation | - | |

| Source | [] | [] | [] | [] | [] | [] | |

Here is an explanation of the Japanese green label. In Japan, energy efficiency has been the focus of attention since the oil crisis of the 1970s. In 1979, the Act on the Rational Use of Energy was enacted, and regulations were imposed on factories, vehicles, and household appliances. This law was amended in 2005 to include buildings.

Regulations and assessment systems are also in place at the local government level. The Tokyo Metropolitan Government enacted the Basic Plan for Environmental Protection (BPEP) in 1997 and the Tokyo Metropolitan Ordinance on Environment and Safety in 2000. Since 2005, developers of large condominium projects have been required to present an itemized green score to potential buyers. In addition, the submission system of building environment plan was introduced in June 2002. Under this system, new buildings to be built or expanded with a total floor area of more than 5000 square meters are required to submit a building environment plan. In addition, buildings to be newly constructed or expanded with a total floor area of more than 2000 square meters can voluntarily submit a built environment plan. The evaluation results are available on the official website of the Tokyo Metropolitan Government. The system for submitting the built environment plan has four evaluation points: “rational use of energy”, “appropriate use of resources”, “protection of the natural environment”, and “mitigation of the heat island effect” []. In addition, in January 2010, it became mandatory to consider the installation of equipment that uses renewable energy.

In 2001, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) launched a green building certification initiative called CASBEE. Like BREEAM and LEED, CASBEE uses a multifaceted approach to evaluate various aspects of sustainability, including (1) indoor environment, (2) quality of services, (3) outdoor environment of the site, (4) energy, (5) resources, and materials, and (6) off-site environment. CASBEE provides a comprehensive index called the Building Environment Efficiency (BEE), which is the ratio of the “environmental quality” (Q) value to the “environmental impact” (L) value. As of August 2021, 482 buildings have been certified. In 2012, a variation of CASBEE called CASBEE Real Estate was launched. It is a simplified version of CASBEE, designed to reduce the time and cost of the assessment. In addition, the MLIT has established the Building–Housing Energy Efficiency Labeling System (BELS) to certify the energy consumption performance (energy-saving performance) of buildings. Developers, sellers, and lessors are required to display energy-saving performance, and the evaluation and display of energy-saving performance, etc., is done with a five-point star mark.

The private sector has also established its green building certification programs. Primarily promoted by financial institutions, the Development Bank of Japan and Sumitomo Mitsui Banking Corporation have launched their certification programs. For example, the DBJ Green Building Certificate, established in 2011, evaluates a wide range of sustainability indicators. It assesses (1) ecology, (2) amenities, (3) community, (4) risk management, and (5) partnership among stakeholders. The evaluation process is simple, and as of August 2021, 943 buildings (of which 413 are office buildings) had been certified.

The green labeling systems (CASBEE, CASBEE Real Estate, DBJ Green Building Certification) used for analysis in this study do not necessarily match the items they evaluate or in their evaluation methods compared to LEED and BREEAM. However, they all form a comprehensive environmental certification system, having many commonalities in a wide range of categories. The three green labeling systems used in our survey have not yet spread to the entire office stock in Tokyo, so the number of observations for each is small. This is difficult to see due to data limitations.

Appendix B

As the repeat sales analysis may still have endogeneity issues, we checked the parallel trend. The data were divided into treatment and control groups based on whether or not they were subject to repeat sales sampling. The following figure shows the time trend of the average rent in the treatment group before obtaining the green label (pre-treatment), in the treatment group after obtaining the green label (post-treatment) and in the control group. The figure shows that the pre-treatment and control groups were trending in parallel, and the assumption of a parallel trend was not violated.

Figure A1.

Graphing time-series of rents around a certification event (parallel trend test).

References

- Eichholtz, P.M.A.; Kok, N.; Quigley, J.M. Why Do Companies Rent Green? Real Property and Corporate Social Responsibility. Program on Housing and Urban Policy Working Paper W09-004. 2009. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1521702 (accessed on 13 October 2021). [CrossRef] [Green Version]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing well by doing good? Green office buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef] [Green Version]

- Eichholtz, P.; Quigley, J.M. Green building finance and investments: Practice, policy and research. Eur. Econ. Rev. 2012, 56, 903–904. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Eco-labelling in commercial office markets: Do LEED and Energy Star offices obtain multiple premiums? Ecol. Econ. 2011, 70, 1220–1230. [Google Scholar] [CrossRef]

- Miller, N.; Spivey, J.; Florance, A. Does green pay off? J. Real Estate Portfol. Manag. 2008, 14, 385–400. [Google Scholar] [CrossRef]

- Reichardt, A.; Fuerst, F.; Rottke, N.; Zietz, J. The business case of sustainable building certification: A panel data approach. J. Real Estate Res. 2012, 34, 99–126. [Google Scholar] [CrossRef]

- Holtermans, R.; Kok, N. On the Value of Environmental Certification in the Commercial Real Estate Market. Real Estate Econ. 2019, 47. [Google Scholar] [CrossRef]

- Szumilo, N.; Fuerst, F. Income Risk in Energy Efficient Office Buildings. Sustain. Cities Soc. 2017, 34, 309–320. [Google Scholar] [CrossRef]

- Ott, C.; Hahn, J. Green Pay off in Commercial Real Estate in Germany: Assessing the Role of Super Trophy Status. J. Prop. Invest. Financ. 2018, 36. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Lee, E.; Kern, A. Demand for Green Buildings: Office Tenants’ Stated Willingness-to-Pay for Green Features. J. Real Estate Res. 2016, 38. [Google Scholar] [CrossRef]

- Shimizu, C. Will Green Buildings Be Appropriately Valued by the Market? Keizai shakai Sougou Kenkyu Cent. Work. Pap. 2010, 40, 1–28. [Google Scholar]

- Shimizu, C. Sustainable Measures and Economic Value in Green Housing. Open House Int. 2013, 38, 57–63. [Google Scholar] [CrossRef]

- Yoshida, J.; Sugiura, A. The effects of multiple green factors on condominium prices. J. Real Estate Finan. Econ. 2015, 50, 412–437. [Google Scholar] [CrossRef]

- Fuerst, F.; Shimizu, C. The rise of eco-labels in the Japanese housing market. J. Jpn. Int. Econ. 2016, 39, 108–122. [Google Scholar] [CrossRef]

- Banfi, S.; Farsi, M.; Filippini, M.; Jakob, M. Willingness to pay for energy-saving measures in residential buildings. Energy Econ. 2008, 30, 503–516. [Google Scholar] [CrossRef] [Green Version]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef] [Green Version]

- Brounen, D.; Kok, N. On the economics of energy labels in the housing market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef] [Green Version]

- Zheng, S.; Wu, J.; Kahn, M.E.; Deng, Y. The nascent market for “green” real estate in Beijing. Eur. Econ. Rev. 2012, 56, 974–984. [Google Scholar] [CrossRef]

- Deng, Y.; Li, Z.; Quigley, J.M. Economic returns to energy-efficient investments in the housing market: Evidence from Singapore. Reg. Sci. Urban Econ. 2012, 42, 506–515. [Google Scholar] [CrossRef] [Green Version]

- Deng, Y.; Wu, J. Economic Returns to Residential Green Building Investment: The Developers’ Perspective. Reg. Sci. Urban Econ. 2014, 47, 35–44. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalisation of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Hyland, M.; Lyons, R.C.; Lyons, S. The Value of Domestic Building Energy Efficiency—Evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef] [Green Version]

- Yoshida, J.; Onishi, J.; Shimizu, C. Energy Efficiency and Green Building Markets in Japan. Energy Effic. Future Real Estate. 2017, 139–159. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The Bias Due to Incomplete Matching. Biometrics 1985, 41, 103. [Google Scholar] [CrossRef]

- Clapp, J.M.; Giaccotto, C. Estimating price indices for residential property: A comparison of repeat sales and assessed value methods. J. Am. Stat. Assoc. 1992, 87, 300–306. [Google Scholar] [CrossRef]

- Nishi, H.; Asami, Y.; Shimizu, C. The Illusion of a Hedonic Price Function: Nonparametric Interpretable Segmentation for Hedonic Inference. J. Hous. Econ. 2021, 52, 101764. [Google Scholar] [CrossRef]

- CBRE. Japan Office MarketView Provides a Quarterly Survey of Commercial Real Estate Trends Across The Nation, Providing Local Market Views of 13 Cities. Available online: https://www.cbre.co.jp/th-th/research-reports/office-marketview (accessed on 13 October 2021).

- U.S. Green Building Council. Available online: https://www.usgbc.org/resources/leed-v4-building-design-and-construction-current-version (accessed on 13 October 2021).

- ENERGY STAR. Commercial Real Estate: An Overview of Energy Use and Energy Efficiency Opportunities. Available online: https://www.energystar.gov/sites/default/files/buildings/tools/CommercialRealEstate.pdf (accessed on 13 October 2021).

- Building Research Establishment Ltd. Available online: https://www.breeam.com/discover/how-breeam-certification-works/ (accessed on 13 October 2021).

- Energy Saving Trust. Guide to Energy Performance Certificates. Available online: https://energysavingtrust.org.uk/advice/guide-to-energy-performance-certificates-epcs/ (accessed on 13 October 2021).

- Behqe. HQE CERTIFICATION. Available online: https://www.behqe.com/hqecertification (accessed on 13 October 2021).

- GRESB. GRESB Real Estate Assessment. Available online: https://gresb.com/nl-en/real-estate-assessment/ (accessed on 13 October 2021).

- Green Building Counsil Australia. Introducing Green Star. Available online: https://gbca-web.s3.amazonaws.com/media/documents/introducing-green-star.pdf (accessed on 13 October 2021).

- NABERS. What is NABERS? Available online: https://www.nabers.gov.au/about/what-nabers (accessed on 13 October 2021).

- Institute for Building Environment and Energy Conservation (IBEC). Built Environment Efficiency (BEE). Available online: https://www.ibec.or.jp/CASBEE/english/beeE.htm (accessed on 13 October 2021).

- Development Bank of Japan. DBJ Green Building. Available online: https://www.dbj.jp/en/pdf/service/finance/g_building/gb_presentation.pdf (accessed on 13 October 2021).

- Housing Performance Evaluation and Display Association. Available online: https://www.hyoukakyoukai.or.jp/bels/bels.html (accessed on 13 October 2021).

- Tokyo Building Environmental Plan System. Bureau of Environment, Tokyo Metropolitan Government. Available online: https://www7.kankyo.metro.tokyo.lg.jp/building/outline_2020.html (accessed on 29 August 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).