Abstract

Businesses are facing consistent pressures from stakeholders to be socially responsible although the economic benefits of corporate social responsibility (CSR) have been found to be mixed. We aim to reveal stakeholders’ motivations for demanding CSR by studying stakeholders’ stated preferences on companies’ contribution to the United Nations’ Sustainable Development Goals (SDGs) in three different contexts, purchasing, investing, and job-seeking. We conducted conjoint survey experiments—embedded information treatments targeting the public in Japan (n = 12,098) in 2019 and 2020. The results showed that stakeholders demanded corporations to contribute to international-related issues rather than domestic-related issues. Stakeholders’ support was low when the companies profited from contributing to the SDGs. These results suggest that social context reflects the preferences of stakeholders on corporates’ SDG activities. Overall, raising awareness had effects on stakeholders’ support and to what extent the information affected the decisions of stakeholders was varied by stakeholders.

1. Introduction

Corporate social responsibility (CSR) is demanded by society [1,2] and it has become indispensable for businesses to comply with societal expectations regarding corporate practice [3]. However, while the public sees it as a positive cause, some economists also claim negative aspects of CSR [4]. This is illustrated by a study that shows that CSR benefits firms by profiting, but employees have to compensate by accepting lower income [5]. A field experiment finds that CSR increases the misbehavior of employees, which harms the firm [6]. While some argue that there are business cases for CSR, some oppose, claiming that corporations sacrifice some profits by behaving prosocially [1]. Is pushing corporations to get involved in CSR create a sustainable future? Bénabou and Tirole (2010) attempted to classify the visions for CSR into three categories: (1) corporations make a profit through doing socially good, (2) stakeholders such as investors, employees, and consumers demand corporations do socially good on behalf of them, and (3) corporate insiders do socially good to fulfill their prosocial preferences rather than maximizing corporation’s profit, which is called insider-initiated corporate philanthropy [1]. Stakeholders are motivated by a complex mix of intrinsic altruism, financial incentives, and social- and self-esteem concerns; thus, understanding individual prosocial behavior further contributes in prosocial policy-making [1]. We thus aim to examine stakeholders’ motivation to demand socially responsible companies. We especially focus on the situation where corporations incorporate the Sustainable Development Goals (SDGs), a set of 17 internationally agreed global goals to be achieved by 2030.

This study investigates motivations of stakeholders, namely, consumers, investors, and job-seekers, for demanding CSR, using a national-level dataset (n = 12,098) collected in Japan in March 2019 and 2020. We use a conjoint survey experiment [7] to test what motivates stakeholder preferences for demanding CSR. Traditional economics, which assumes homo economicus who is selfish and makes perfect rational decisions as a prototypical agent, explains individuals’ behavior by utility maximization and neglect other-regarding preferences. The development in behavioral economics revealed that human beings are altruistic and have prosocial preferences (for example, [8,9]). Other-regarding preferences which are explained as two types: (1) non-selfish motives or prosocial preferences, and (2) self-image concerns [9] are not always motivated by positive reasons. Because the SDGs include a wide range of issues, studying stakeholders’ preferences for companies contributing to the SDGs (SDG-minded companies) allows us to understand the motivations of individuals’ other-regarding preferences.

Furthermore, as previous literature on bounded rationality [10] shows that an individual’s decision-making can be restricted due to limited knowledge and cognitive capacity, we embed an information treatment experiment, in which respondents are randomly exposed to different sets of information, into the conjoint survey. As humans are not always rational thinkers, raising awareness about sustainable-related value influences an individual’s decision-making in a sustainable way [11]. The information treatment experiments allow us to test to what extent raising awareness affects making an informed decision.

This study provides novel insights into empirical studies of CSR in several ways. Consumers, investors, and employees are usually discussed as primary stakeholders in previous literature on CSR (for example, [1,4]); however, little research has been conducted to investigate the behavior of these three groups in one empirical design. First, this study investigates three different contexts: purchasing, investing, and job-seeking. Second, while similar studies commonly utilize economic games, this study uses a novel methodology in experimental economics, namely, a conjoint survey experiment that has been widely used in political science. By conducting a conjoint survey targeting a large-scale sample in Japan for two consecutive years, we have confirmed the robustness of our empirical strategy. Third, this study examines the effects of implementing the SDGs even though little study has been conducted on SDG implementation.

Our findings add unique evidence to the existing literature. First, our results show that consumers are more likely than other stakeholders to select companies that contribute to the SDGs. This finding suggests that stakeholders delegate corporations to contribute something they cannot do. Second, our study finds that while consumers support international-issue-related goals, job-seekers support companies that contribute to a job-related goal, which indicates that different stakeholders demand corporations to contribute to different issues. Third, the support of stakeholders to profiting through SDG contributions is lower than directly contributing to each goal. These results suggest that social context reflects the preferences of stakeholders on corporates’ SDG activities. Overall, raising awareness had effects on stakeholders’ support and to what extent the information affected the decisions of stakeholders was varied by stakeholders.

The remainder of this paper is structured as follows: Section 2 introduces the background of the study. Section 3 presents the methodology, including survey design and data collection, and Section 4 presents the empirical strategy. Results are presented in Section 5 and then discussed alongside implications and suggestions for future research in Section 6.

3. Material and Methodology

There are some critical views on using survey data to analyze real-world decision-making because self-reporting data can be biased; for example, respondents’ self-reporting attitudes and actual behavior may differ. To overcome the limitation of the survey, we utilized a conjoint survey experiment which was originally designed to study multidimensional voting choice behavior [7] and is rigorously being applied to policy analyses in different fields. When a study is drawn from a small sample size dataset, there can be a gap between actual behavior and conjoint survey results. However, when the survey is conducted in a large-scale national population distribution, the real-life and the survey outcomes were consistent [18]. The current study is drawn from nation-wide conjoint survey experiments conducted in Japan in two consecutive years. This section introduces survey experiment design and data collection procedures.

3.1. Survey Experiment Design

Materials used for the survey experiment are provided in Supplementary Materials (hereafter, S before figure or table number indicates those provided in Supplementary Materials). Before starting the conjoint survey, respondents were randomly assigned up to three pieces of information and instructed to read them carefully. They were given quizzes to examine if they understood the information after each was provided. The original texts and the English translations are provided in Supplementary Materials. First, all respondents were exposed to information about the SDGs (Figure S2.1). Second, half of all respondents were randomly exposed to treatment information 1 (T1) (Figure S3.1), which addressed that businesses are expected to incorporate sustainability in their usual practice and profit through their sustainable contribution; in doing so, they can contribute to achieving a sustainable society. Third, half of all respondents were randomly exposed to treatment information 2 (T2) (Figure S4.1), which contained a graph that showed the levels of achievement for each goal separately for developed and developing countries, taken from [19]. The above assignment of information treatment divided respondents into four groups: control (neither T1 nor T2), T1, T2, and both T1&T2.

Then, all respondents were randomly assigned to one of three context groups, which were provided with one of three conjoint questions: (1) purchasing a product, (2) investing in a company, and (3) seeking a company to work for. After completing the conjoint survey tasks, all the respondents were asked to answer additional questions such as their basic personal and household characteristics and their perceptions of sustainable development.

Although the survey design remained unchanged in 2020, we made one primary change to the design, a form of the quiz for T1 and T2. In 2019, respondents were asked to confirm their understanding by choosing yes or no on provided statements. Information was provided again if the respondent failed the quizzes, but quizzes were not repeated. However, in 2020, respondents were requested to write a short reflection passage on information content. This allows us to understand how respondents perceived information. Quizzes for the general information were kept unchanged to measure changes over the periods, which means that the survey design for the control groups was the same across two survey years. Both information treatment and context groups were randomly assigned to respondents in 2019, and in 2020 assignment did not consider the previous year’s group allocations.

3.2. Conjoint Survey Design

We used the same attribute design for three different context groups to test how context affects CSR demands. As shown in Table 1, our conjoint design included seven attributes: six SDGs and a direct economic return from SDG-related activities with two levels each. As discussed in Section 2, the SDGs include a variety of challenges. We selected six goals out of 17 because using all of them increases the respondents’ burden. The current study aims not to test which SDG contributions received higher preferences, but motivations of stakeholders to support the corporation’s sustainable contributions. According to Tilman et al., (2019)’s localized pro-sociality assumption, individuals care about local or domestic issues rather than global ones [20]. Therefore, we classified them into three categories of issues: domestic, international, and both.

Table 1.

Conjoint survey experiment attribute design (Adapted from Yamane and Kaneko, 2021 [21]).

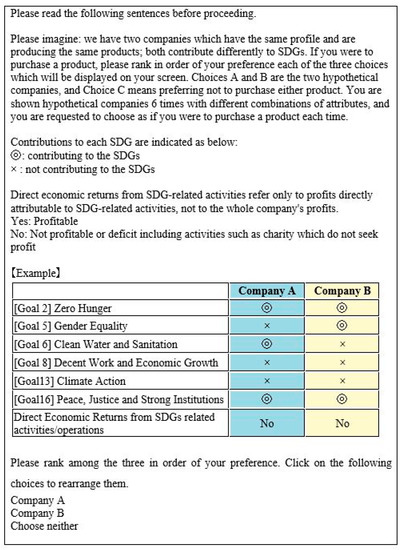

First, respondents were instructed to imagine two hypothetical SDG-minded companies with the same characteristics and offering the same product, stock, or job, but whose contributions to the SDGs are different. Then, each respondent was given two randomly assigned hypothetical SDG-minded companies of differing characteristics and was asked to rank three choices: Company A, Company B and Choose neither. This task was repeated six times per respondent. Figure 1 shows an English translation scenario given to respondents for the purchasing context group.

Figure 1.

Example of conjoint survey experiment scenarios (Adapted from Yamane and Kaneko, 2021 [21]). This shows the scenario given to the purchasing group. The other two groups were given a similar scenario; the minor difference is that respondents were asked to respond as if they are investing in a company or seeking a company to work for rather than purchasing a product. Note that to ensure diversity in participation, we developed a device-friendly experiment website, and the website was optimized to a respondent’s device, which applies to the entire survey.

3.3. Data Collection and Sampling

An online survey was conducted targeting 18 to 74-year-old Japanese adults in March 2019 and 2020 using Qualtrics, an online survey platform. Respondents were supplied by Rakuten Insight, Inc, which has 2.2 million registered panelists within Japan. In 2019, approximately 50,000 panelists were invited through an email, and 6043 respondents completed the entire survey out of 8957 who participated. To ensure an unbiased sample, we used region, age group and gender quotas, and the final sample matched the quota. In 2020, to construct a panel dataset, first, the 6043 participants from the previous year were invited to participate; 3227 completed the survey. Then an invitation was sent to different panelists and the rest of the sample was filled to match the demographic quota. A total of 6055 respondents completed the survey out of 8478 participants in 2020. Altogether, the dataset contains 12,098 responses. Because some respondents participated in both years, the number of actual people who participated was 8871, including 2816 in 2019, 2828 only in 2020, and 3227 in both years. Table 2 presents descriptive statistics.

Table 2.

Descriptive statistics.

4. Empirical Strategy

In a conjoint survey experiment, respondents are asked to evaluate proposed profiles in which levels of each attribute are randomly shown on their screen and to repeat this task multiple times. This survey design allows researchers to estimate causal effects of a given attribute, average marginal component effects (AMCE), using simple ordinary least square (OLS) dummy variable regression without any control variables [7]. The AMCE is known as an effective and robust estimator [22]. Estimating the AMCE in subgroup analyses and interaction effects are shown to be an effective way to estimate heterogeneous effects when the number of candidate variables is small [7]. However, when candidate heterogeneous effects are large, model selection and interpretation of estimated results are difficult. Our study has at least 24 candidate groups (3 contexts 4 information treatment groups 2 years), and we try to estimate the effects of individual characteristics on the choice probability. Thus, we use a novel method, LASSO (Least Absolute Shrinkage and Selection Operator) plus, proposed by [23], to estimate AMCEs and interaction effects. LASSOplus selects relevant interaction effects and reports point estimator and significant levels.

4.1. Average Marginal Component Effect (AMCE)

AMCE represents the average causal effect of SDG contributions on the likelihood that a given company is chosen relative to a reference level across all possible combinations and among all respondents. AMCEs can be estimated using OLS with clustered standard errors; the outcome binary variable is regressed on dummy variables for all attributes, excluding the referencing levels. AMCE for the choice of individual i regarding profile j in task is defined as:

where is a vector of levels of each attribute excluding a reference category (no contribution to SDG or no profit) or binary treatment variables for the presence of a certain level referred to a reference; is a causal effect and a corresponding coefficient to be estimated; is a constant term; and is the error term. The outcome variable, is dichotomous, with a value of 1 if the respondent i’s preference rank of a profile j in task is higher than its alternative and 0 otherwise.

4.2. Average Marginal Component Effect and Its Interaction Effects

LASSOplus extends the AMCE as follows:

where is a vector of the levels excluding the reference; is a baseline effect and a corresponding coefficient to be estimated; is a vector of heterogeneous treatment variables (Table 3 shows the list of the variables and descriptive statistics); is an interaction effect in which a point estimator is reported only when it has a nonzero effect and also a corresponding coefficient to be estimated; is a constant term; and is the error term. The outcome variable, is dichotomous, with a value of 1 if the respondent i’s preference rank of a profile j in task is higher than its alternative and 0 otherwise.

Table 3.

List of heterogeneous treatment variables and descriptive statistics.

4.3. Overall Support for SDG Minded Company

In this study, we also predict overall support for an SDG-minded company as follows:

where is a vector of levels of each attribute excluding a reference or binary treatment variable for the presence of a certain level referring to a reference category; is a causal effect and a corresponding coefficient to be estimated; is a vector of heterogeneous treatment variables (context group and survey year); is a treatment effect; and is the error term. Here, is dichotomous, with a value of 1 if the respondent i’s preference rank of a profile j in task is higher than the status quo (choosing none of two proposed profiles) and 0 otherwise. We used a different outcome variable than the one used for the AMCE. The aim here is to estimate aggregated demand to examine to what extent any proposed SDG-minded company is chosen over the status quo. After running OLS regression, we predict the fitted value for all the observations.

5. Results

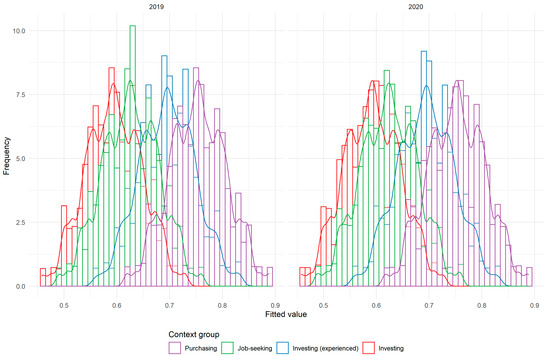

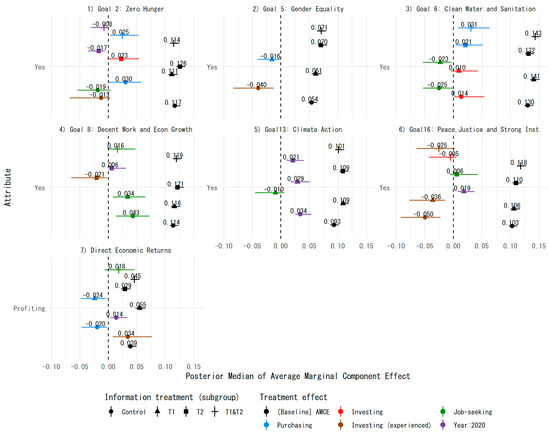

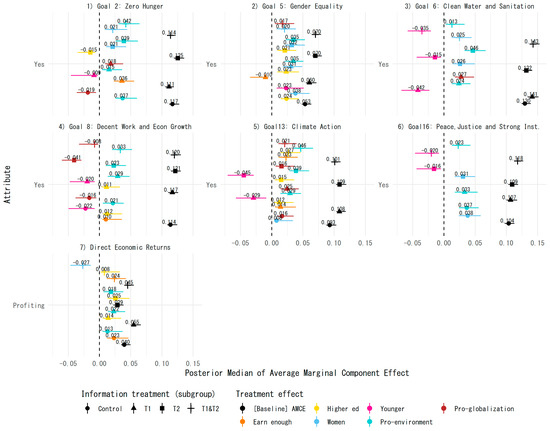

First, we predicted overall support for the proposed hypothetical SDG-minded companies in three different contexts—purchasing, investing, and job-seeking. We divided the investing context respondents into two groups: those with and those without the investing experience because asking randomly assigned respondents without investing experience may not capture real investors’ preferences. In Figure 2, frequencies of the fitted values for each context are plotted by years. In addition to the overall support, we estimated AMCEs to test (1) how each attribute affects the selection of a company with SDG contributions, and (2) if interaction or partial effects of contexts and survey year (Figure 3) and individual characteristics and pro-sustainable behavior (Figure 4) on each AMCE can be observed. As discussed in Section 4, we used LASSOplus to effectively select the most relevant interaction variables and estimated interaction effects in addition to the baseline, which is AMCE. Specifically, we ran LASSOplus by splitting the sample into four information treatment groups. Estimated OLS sub-group analysis results are presented in Figures S5.1 and S5.2 in the Supplementary Materials.

Figure 2.

Estimated overall support for the SDG-minded companies. Frequencies of fitted value are calculated based on the estimation strategy presented in Section 4.3 by the context group and plotted by survey year.

Figure 3.

Estimated AMCE and interaction effect of context and survey year. AMCEs and interaction effects are estimated based on the estimation strategy presented in Section 4.2. Attributes are separately displayed in panels. Values in black markers show the baseline AMCEs. LASSOplus selected values, in non-black colors, show interaction effects to the baseline. Error bars indicate 95% confidence intervals.

Figure 4.

Estimated AMCE and interaction effect of heterogeneity. AMCEs and interaction effects are estimated based on the estimation strategy presented in Section 4.2. Attributes are separately displayed in panels. Point estimators in black markers show the baseline AMCEs. LASSOplus selected values in non-black colors show interaction effects to the baseline.

Before discussing the results, we show how to read Figure 3 and Figure 4. Each attribute is shown separately in different panels. The baseline AMCEs are displayed as black markers, and selected interaction effects are displayed as non-black colored markers. If interaction effects are not shown in those figures, this indicates that those interaction effects are found to have zero effects, so that values are not reported. For example, the black circle marker in Figure 3’s Panel 1 shows that contributing to Goal 2 increases the probabilities of respondents in the control group to select the company by 11.7% versus not contributing to Goal 2. Being in the job-seeking context decreases the above baseline effect by 1.9%, which can be interpreted that contributing to Goal 2 increases the support for the company by 9.8%. Being in the investing (experienced) context decreases the above baseline effect by 1.3%. The other contexts and survey years have zero effects on the baseline AMCE.

SDG-minded companies are more likely to be chosen in the purchasing context followed by investing (with experience), job-seeking, and the investing (with no experience) context (Figure 2). This tendency can be observed across all contexts and treatment groups in both 2019 and 2020. Furthermore, in Figure 3, interaction effects of 2020 have a nonzero effect only on Goal 13: Climate Action and Direct Economic Returns in the control groups, indicating that changes in a year were observed only in these two attributes. These tendencies of having similar results over the years reinforce the robustness of the methodologies utilized in this study.

For treatment groups, interaction effects of year 2020 are observed mostly in the T2 group, which is potentially affected by the survey design change, as discussed in Section 3.2. In the 2019 design, the T2 group was given a confirmation question that Japan is behind in achieving Goals 5 and 13; however, in the 2020 design, respondents in the T2 group were requested to freely write down their reflection on the information provided.

Demand for companies to contribute to the attributes tested in the experiments was varied between the contexts (Figure 3 and Figure 4). Generally, companies contributing to any tested attribute had positive causal effects (baselines, shown in black markers of Figure 3). T1 positively affected direct economic returns, as expected. T1 also positively affected SDG attributes except for Goal 2: Zero Hunger. T2 positively affected all the tested goals, but negatively affected direct economic returns. Effects of T1&T2 were observed in three patterns. The first pattern is that T1&T2 has additional effects. The degree of support for Goals 6 and 16 was the most positive, indicating that giving two different pieces of information has more positive effects than a single piece of information. The second pattern is that T1&T2 decreased the effects of T1 or T2. The degree of support for Goal 13 was the most negative. The third pattern is that T1&T2 has a diluting effect of T1 or T2. For Goals 2, 5, and 8 and Direct Economic Returns, T1&T2 falls between T1 and T2.

Some interaction effects of the context were selected, which means that these selected contexts affect the demand for SDG-minded companies. Respondents in the job-seeking context preferred a job-related goal more than others. The job-seeking context (green marker in Figure 3) has negative interaction effects on international-issue-related goals, such as Goals 2 and 6, which may not directly affect the work environment. However, the context has positive interaction effects on Goal 8: Decent Work and Economic Growth in all groups except for T2. When provided with the information that the progress toward achieving other goals was behind (T2), the job-seeking context’s interaction effects on Goal 8 disappeared.

In the purchasing context, we observe negative interaction effects on Direct Economic Returns, indicating that consumers are less likely to support corporations that profit from contributions than the other stakeholders. However, T2 eliminated such effects. The purchasing context has positive interaction effects on Goal 2 in the control and T1&T2 groups and Goal 6 in T2 and T1&T2 groups, indicating that purchasing context is more likely to support international-issue-related goals than the other contexts.

In the investing context, the actual investor group (Brown market in Figure 3) has positive interaction effects in Direct Economic Returns in the control groups. In contrast, it has negative interaction effects on Goals 2, 5 and 16 in the control groups. Investors were more likely to support profit generation through SDG contributions; however, they were less likely to support contributions to social causes.

To further examine the demand for SDG-minded companies, we added heterogeneous variables to estimate interaction effects (Figure 4). We used personal characteristic variables such as education level, income, gender, and generation and pro-sustainable behavior as potential interaction variables (For descriptive statistics and definitions of variables, refer to Table 3). Regarding pro-sustainable behaviors, while pro-environmental behavior generally has a positive interaction effect on most attributes (turquoise markers), pro-globalization behavior has negative interaction effects to Goals 2 and 8 in the control group (brown markers). Pro-environmental behavior is especially responsive to information treatments that have positive effects. Regarding gender, being a woman positively affects Goal 5: Gender Equality and Goal 16: Peace, Justice and Strong Institutions (pale blue marker). Respondents in the younger generation (aged 18–30) are negatively affected by information treatment regarding Goals 2, 6, 8, 13, and 16 (pink marker). However, being young has positive effects on Goal 5. Earning enough (household income is more than their hopeful income) increases the likelihood of supporting companies profiting from the SDG contributions (orange marker). These results suggest that stakeholders’ demands for SDG-minded companies were varied by personal characteristics.

6. Discussion and Conclusions

While CSR has become something companies cannot avoid and stakeholders demand, such demand is not well explained. Some studies have claimed that CSR has negative causes. How stakeholders demand CSR is essential in shaping a sustainable future. This study, thus, aimed to investigate what motivates stakeholders to demand corporations to behave in socially responsible manners. With limited knowledge about sustainable development, stakeholders may not be able to make an informed decision towards creating a sustainable future; therefore, we tested the effects of providing sets of different information to stakeholders on changing the support for the SDG-minded companies. In this section, we discuss the main findings of the survey experiment and offer practical implications to promote sustainable development.

6.1. Main Findings

Our results showed that stakeholders demanded corporations to contribute to international- related issues rather than domestic-related issues, unlike Tilman et al., (2019)’s localized pro-sociality assumption, which is discussed in the earlier section [20]. The international-issue-related goals, Goals 2 and 6, had the highest stakeholder support among all goals, which is consistent with previous surveys targeting Japanese people [24,25]. Even when the respondents were exposed to the information that Japan is not facing challenges in achieving these goals, support for these goals slightly increased. Consumers demanded corporations to contribute to international-issue-related goals more than other stakeholders. Consumers’ motivation for demanding CSR can be explained by delegating companies to do good, so that they are more likely to support non-localized contributions such as international-issue-related goals than the other stakeholders. The job-seekers demanded corporations to contribute to the job-related goal more than the other stakeholders. However, stronger preferences for the job-related goal were not observed when respondents in the job-seeking context were informed that the other goals were lagging behind. These findings demonstrated that stakeholders have non-selfish motivations for CSR.

Furthermore, the results on investors showed that their preferences were similar to the current corporate practices. The Environmental, social, and governance (ESG) scorecard has shown that overall Japanese companies fall behind the US and European companies in meeting expected outcomes. While environmental performance was well performed, social and governance performance was lagging behind in Japan [26]. This trend is reflected in the investors’ preferences, who also favored environmental issues over social and governance issues. Contributing to social issues such as Goals 2 and 5, and governance challenges, Goal 16, were less likely to gain support in the control group. However, these negative interaction effects disappeared when information was provided except for Goal 16’s T1 and T1&T2.

One reason why corporations implement CSR is that they can make profits by contributing to social challenges. When corporations can make profits through SDG contributions, it may be an effective means for SDG achievement. For example, corporations can indirectly solve hunger or improve sanitation if corporations can gain economic returns through SDG contributions and supply decent work or accelerate economic growth. However, the support of stakeholders to profiting through SDG contributions was as low as 3.9%, while contributing directly to each goal had around 10% of support, except for Goal 5. When the information that profiting through SDG contribution can achieve a sustainable future (T1) was given to the respondents, the support increased to 5.5%. On the other hand, exposure to SDG achievement information (T2) decreased the support to 2.9%, while T2 positively affected support for each goal; giving two pieces of information (T1&T2) moderated the effect of T1. Furthermore, economic returns through SDG contribution increased investors’ support by 7.5%, but T1 decreased to 5.5% and T2 to 2.9%. Those results indicated that raising awareness has a certain level of effects in changing stakeholders’ preferences to support corporations profiting through contributing to the SDGs.

6.2. Implications

CSR has become imperative [27] and many companies have started developing corporate strategies around the SDGs [21]. Understanding stakeholders’ motivation to support SDG-minded companies helps practitioners formulate effective strategies to promote sustainable development. Our findings suggest that simply reflecting stakeholders’ preferences when developing corporate strategy may not push society toward a sustainable future. We found that social context reflects the preferences of stakeholders on corporate SDG activities and that the change of social norms may have to happen in order to increase support for SDG-minded companies.

Support for gender equality and profiting directly from SDG contribution was the lowest among seven attributes, which may be reflecting Japanese cultural contexts. As Japan ranked 121th out of 153 countries in the recent Global Gender Gap Index [28], gender inequality is a deep-rooted social issue in Japan. Traditional gender roles, which expect women to play more prominent roles in the household and childbearing responsibility, limit the opportunity for women, especially in politics and businesses [29]. The government has been promoting gender equality as one of its priorities, although little progress has been made [30]. Furthermore, stakeholders were less likely to support companies making a profit through doing good. It may be more rational for companies to do socially good and profit through it; however, such a framework is less likely to be supported, especially by consumers. Our results were consistent with Japanese social norms, suggesting that making a profit through socially good causes is not well accepted [31]. Our findings suggest that raising awareness may be one way to influence stakeholders’ demands. In the study, we tested the effects of raising awareness and those results are informative in developing a policy toward changing such social norms.

Overall, raising awareness had effects on stakeholders’ support and to what extent the information affected the decisions of stakeholders was varied by stakeholders. The information we tested in this study had a slightly negative effect on consumers’ support on companies gaining direct economic returns, although it had a positive effect on job-seekers and investors’ support. Therefore, it requires different contents of information for consumers to increase support for companies making profits through SDG contributions. Job-seekers, potential future corporate insiders, had stronger preferences on a job-related goal. After they were informed that other goals were lagging behind, they did not insist on the job-related goals. Investors had relatively lower support for social and governance-related SDG contributions. Investors’ support to corporations contributing to gender equality was minimum. It is critical to raise investors’ awareness. The achievement gap information positively affected the investors to support for social and governance contributions. Also, those effects of information treatment had heterogeneity. Pro-environmental stakeholders were more responsive to information. Environmentally conscious stakeholders do not only support environmentally friendly causes, but also other social causes.

6.3. Future Directions of Research

The current study provides novel evidence on stakeholders’ motivation for CSR and how the SDGs are supported by stakeholders. This study found that social norms affect stakeholders’ decisions to support companies contributing the SDGs. We used a survey experiment dataset conducted only in Japan. Therefore, implications of the current study may apply only to Japan. Expanding the study to other countries or cultures, including developing countries, may better explain the complex mechanism of stakeholder’s demand for CSR. Furthermore, this study was able to provide novel insights on effectiveness of raising awareness on stakeholders’ decisions. However, this study is limited because we only examined to what the extent two contents affected stakeholders’ support for SDG-minded companies. Future research needs to test impacts of raising awareness using different contents of information and how such information is perceived by stakeholders.

Supplementary Materials

The following are available online at https://www.mdpi.com/article/10.3390/su13158313/s1. Figure S1: Informed consent document provided before starting the survey, Figure S2. The information given to all the respondents at the beginning, S3 Information treatment 1, S4. Information treatment 2, Figure S5. Scenario given to respondents, Figure S6.1 Estimated AMCEs using the dataset of year 2020, and Figure S6.2 Estimated AMCEs using the dataset of year 2019.

Author Contributions

Research design, T.Y. and S.K.; Formal analysis, T.Y.; writing—original draft preparation, T.Y.; writing—review and editing, T.Y. and S.K.; funding acquisition, T.Y. and S.K. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Hiroshima University Women’s Researcher Joint Research Grant Program, the Hiroshima University TAOYAKA Program for creating a flexible, enduring, peaceful society funded by the Program for Leading Graduate Schools, Ministry of Education, Culture, Sports, Science and Technology; and MEXT KAKENHI (grant number 18K12798, 20H00648).

Institutional Review Board Statement

The study design was approved by the Ethics Committee of Graduate School for International Development and Cooperation, Hiroshima University on 8 January 2020.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study is openly available in the Harvard dataverse at https://doi.org/10.7910/DVN/CUPCKU.

Acknowledgments

We thank the editors and the three anonymous reviewers for providing helpful comments on earlier drafts of the manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bénabou, R.; Tirole, J. Individual and Corporate Social Responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Kitzmueller, M.; Shimshack, J. Economic Perspectives on Corporate Social Responsibility. J. Econ. Lit. 2012, 50, 51–84. [Google Scholar] [CrossRef] [Green Version]

- Agudelo, M.A.L.; Jóhannsdóttir, L.; Davídsdóttir, B. A Literature Review of the History and Evolution of Corporate Social Responsibility. Int. J. Corp. Soc. Responsib. 2019, 4, 1. [Google Scholar] [CrossRef] [Green Version]

- Schmitz, J.; Schrader, J. Corporate Social Responsibility: A Microeconomic Review of the Literature. J. Econ. Surv. 2015, 29, 27–45. [Google Scholar] [CrossRef]

- Briscese, G.; Feltovich, N.; Slonim, R.L. Who Benefits from Corporate Social Responsibility? Reciprocity in the Presence of Social Incentives and Self-Selection. Games Econ. Behav. 2021, 126, 288–304. [Google Scholar] [CrossRef]

- List, J.A.; Momeni, F. When Corporate Social Responsibility Backfires: Theory and Evidence from a Natural Field Experiment. NBER Working Paper. 2017. Available online: http://www.nber.org/papers/w24169 (accessed on 5 March 2021).

- Hainmueller, J.; Hopkins, D.J.; Yamamoto, T. Causal Inference in Conjoint Analysis: Understanding Multidimensional Choices via Stated Preference Experiments. Polit. Anal. 2014, 22, 1–30. [Google Scholar] [CrossRef]

- Camerer, C.F. When Does “Economic Man” Dominate Social Behavior? Science 2006, 311, 47–52. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Gsottbauer, E.; van den Bergh, J.C.J.M. Environmental Policy Theory Given Bounded Rationality and Other-regarding Preferences. Environ. Resour. Econ. 2011, 49, 263–304. [Google Scholar] [CrossRef] [Green Version]

- Reinhard, S. Bounded Rationality. J. Inst. Theor. Econ. 1990, 146, 649–658. [Google Scholar]

- Bolis, I.; Morioka, S.N.; Sznelwar, L.I. Are We Making Decisions in a Sustainable Way? A Comprehensive Literature Review about Rationalities for Sustainable Development. J. Clean. Prod. 2017, 145, 310–322. [Google Scholar] [CrossRef]

- The World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Foxon, T.J.; Köhler, J.; Michie, J.; Oughton, C. Towards a New Complexity Economics for Sustainability. Camb. J. Econ. 2013, 37, 187–208. [Google Scholar] [CrossRef]

- Caballero, P. The SDGs: Changing How Development is Understood. Glob. Policy 2019, 10, 138–140. [Google Scholar] [CrossRef] [Green Version]

- United Nations Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/content/documents/21252030%20Agenda%20for%20Sustainable%20Development%20web.pdf (accessed on 25 April 2019).

- Barbier, E.B.; Burgess, J.C. Sustainable Development Goal Indicators: Analyzing Trade-Offs and Complementarities. World Dev. 2019, 122, 295–305. [Google Scholar] [CrossRef]

- Polasky, S.; Kling, C.L.; Levin, S.A.; Carpenter, S.R.; Daily, G.C.; Ehrlich, P.R.; Heal, G.M.; Lubchenco, J. Role of Economics in Analyzing the Environment and Sustainable Development. Proc. Natl. Acad. Sci. USA 2019, 116, 5233–5238. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hainmueller, J.; Hangartner, D.; Yamamoto, T. Validating Vignette and Conjoint Survey Experiments Against Real-World Behavior. Proc. Natl. Acad. Sci. USA 2015, 112, 2395–2400. [Google Scholar] [CrossRef] [Green Version]

- The Bertelsmann Stiftung. Sustainable Development Solutions Network SDG Index and Dashboards Report 2018 Implementing the Goals Global Responsibilities. Available online: https://www.sdgindex.org/reports/2018/ (accessed on 7 June 2019).

- Tilman, A.R.; Dixit, A.K.; Levin, S.A. Localized Prosocial Preferences, Public Goods, and Common-Pool Resources. Proc. Natl. Acad. Sci. USA 2019, 116, 5305–5310. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Yamane, T.; Kaneko, S. Impact of Raising Awareness of Sustainable Development Goals: A Survey Experiment Eliciting Stakeholder Preferences for Corporate Behavior. J. Clean. Prod. 2021, 285, 125291. [Google Scholar] [CrossRef]

- Bansak, K.; Hainmueller, J.; Hopkins, D.J.; Yamamoto, T. Using Conjoint Experiments to Analyze Elections: The Essential Role of the Average Marginal Component Effect (AMCE). SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Ratkovic, M.; Tingley, D. Sparse Estimation and Uncertainty with Application to Subgroup Analysis. Polit. Anal. 2017, 25, 1–40. [Google Scholar] [CrossRef] [Green Version]

- Keizai Koho Center SDGs Nikanshuru Isiki Tyosa Kekka Houkoku [Public Awareness Regarding SDGs: Result Reporting]. Available online: https://www.kkc.or.jp/data/release/00000151-1.pdf (accessed on 21 January 2020).

- Chapman, A.; Shigetomi, Y. Developing National Frameworks for Inclusive Sustainable Development Incorporating Lifestyle Factor Importance. J. Clean. Prod. 2018, 200, 39–47. [Google Scholar] [CrossRef]

- Cremers, V.; Goerg, M.; Grundin, G.; Nuttall, R.; Yamada, Y. Charting a Path From the Shuchu Kiyaku to ESG for Japanese Companies. Available online: https://www.mckinsey.com/business-functions/sustainability/our-insights/charting-a-path-from-the-shuchu-kiyaku-to-esg-for-japanese-companies (accessed on 2 July 2021).

- Baskentli, S.; Sen, S.; Du, S.; Bhattacharya, C.B. Consumer Reactions to Corporate Social Responsibility: The Role of CSR Domains. J. Bus. Res. 2019, 95, 502–513. [Google Scholar] [CrossRef]

- Global Gender Gap Report 2020: Insight Report. World Economic Forum. Available online: http://www3.weforum.org/docs/WEF_GGGR_2020.pdf (accessed on 5 March 2021).

- The Associated Press. Japan Delays Gender-Equality Goals in New Five-Year Plan. In The Asahi Shimbun. 2020. Available online: http://www.asahi.com/ajw/articles/14060243 (accessed on 5 March 2021).

- The Asahi Shimbun. Gender Equality Goals Face Delay of Up To 10 Years to Be Reached. In The Asahi Shimbun. 2020. Available online: http://www.asahi.com/ajw/articles/13924170 (accessed on 5 March 2021).

- Kim, R.C. Can Creating Shared Value (CSV) and the United Nations Sustainable Development Goals (UN SDGs) Collaborate for a Better World? Insights from East Asia. Sustainability 2018, 10, 4128. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).