Abstract

Through the use of 30 provincial panel datasets covering the years from 2013 to 2017, on the basis of constructing the regional green development indicator system, this paper used the fixed-base range entropy weight method to measure the regional green development level. The difference-in-differences model was used to test the policy effect, the mechanism of the establishment of the green financial reform, and the innovation pilot zone on green development. The results showed that: (1) the establishment of the pilot zone promotes regional green development and shows regional differences; (2) under the guidance of policies, the provinces that set up the pilot zone affect the level of regional green development mainly through the upgrading of industrial structure and technological innovation; further research has found (3) a high level of financial investment in environmental protection and marketization, which will help the pilot zone to further play a positive role in promoting the green development of the region. The results of this article indicated that China should continue to expand the scope of green finance reform and innovation pilot zones and make reasonable arrangements among regions according to local conditions to explore new ways of promoting green development. At the same time, the government should actively play the role of green finance in the pilot zone to promote industrial structure upgrading and technological innovation and guide market players to establish green development concepts to gradually build an environmentally friendly, circular model economy to enhance the overall green development capacity of the region.

1. Introduction

The report of the 19th National Congress of the Communist Party of China pointed out that “to accelerate the reform of the ecological civilization system and build a beautiful China, one strategy is to promote green development”. The connotation of green development is the continuous increase of the proportion of the green economy and the understanding that the continuous development of environmentally friendly industries with green technology, green energy, and green capital emphasizing low resource consumption, low pollution emissions, moderate economic and social development, and compensation for damage all balance each other [1]. Banks and other financial institutions rely on their powerful resource allocation capabilities to become an indispensable part of the modern economic system, especially in the realization of public policies and economic performance, as well as all forms of business and industry [2,3]. At first, environmental issues did not arouse the attention of the banking and financial industries [4]. With the increasing awareness of environmental protection and the strict implementation of environmental standards, the relationship between the financial industry and environmental protection has been recognized [5]. As a bridge between the financial industry and the environmental industry, green finance regards environmental protection as an important starting point for its investment and financing decisions. Furthermore, green finance guides social resources under the condition of the full consideration of potential environmental risks so that funds are withdrawn from polluting industries and more financial support becomes available to green industries, green projects, or green enterprises. Green finance also relies on diversified capital markets to diversify environmental investment risks, achieve the purpose of proactively managing environmental risks, and promote sustainable economic and social development [6,7,8]. Green finance, as a necessary condition for sustainable development, is also the basis for achieving high-quality economic development [9], making scholars increasingly aware of the important role that the development of green finance plays in transferring environmental risks, improving environmental quality, and promoting green development.

As a new attempt to develop green finance, the construction of a pilot zone for green finance reform and innovation has become the focus of attention. In April 2016, Chen Yulu, the Vice Governor of the People’s Bank of China, stated that the first batch of pilot zones for green finance would soon be launched. In June 2017, the State Council executive meeting decided that there would be five pilot zones, including Zhejiang, Guangdong, Xinjiang, Guizhou, and Jiangxi Provinces, where financial institutions would be supported to establish green finance business units or green sub-branches, encouraging the development of green credit, exploring the establishment of environmental rights trading markets, such as pollution rights, water rights, and energy rights, establishing government service channels that give priority to green industries and projects, and establish a green financial risk prevention mechanism, etc. Generally speaking, after the policy is put into effect, the pilot zone will form a two-way dynamic model combining government supervision and market incentives. On the one hand, government departments have issued relevant green finance policies to standardize green finance development mechanisms to guide the financial system to improve risks and increase investment preferences for green projects in the fields of environmental protection, energy conservation, clean energy, and green transportation. Green finance promotes the green transformation of the economic structure through capital formation, capital leveraging, and industrial integration [1,10]; at the same time, under the guidance of green finance policies, financial institutions implement measures, such as stopping loans and restricting loans for the two high enterprises, forcing them to transition to a high-tech, pollution-free industry practices. Financial institutions accelerate the tilt of financial resources to green industries, thereby accelerating industrial green upgrading [11,12] and realizing a green transformation. On the other hand, the capital allocation effect of financial institutions appears under the market-oriented operating mechanism, which leads the investment trend of micro-main enterprises to change. In order to ensure investment returns, enterprises or individuals will supervise the entire operation process of the funded projects to ensure that the investment direction and use of the projects meet the green standards. Green finance reduces the time lag effect of traditional government financial resources on environmental protection support through market mechanisms, thereby improving the efficiency of green finance policy implementation and accelerating the flow of funds to the environmental protection industry [13]. Market players will gradually reduce their investment in low-end industries, such as environmental pollution, and increase their investment in sunrise industries, such as new energy industries [14,15,16,17]. It can not only promote high-quality economic development that is not at the cost of environmental damage, but also ultimately improve the level of regional green development to achieve the goal of green environmental governance. So, as the first batch of green finance reform and innovation pilot zones and as an important measure for financial supply-side reforms to accurately support the green development system, can they verify their impact on regional green development from an empirical point of view? At the same time, what channel mechanism does the pilot zone use to influence regional green development? As a large developing country, China plays an important role in realizing global environmental governance. This article mainly studies the green development effect achieved by China’s green finance policy reform. It will not only help China to explore reproducible and extendable experiences, but also have important significance for the design of global green finance policies in the future.

At present, research on green finance at the theoretical level is facing an important, fundamental problem: the vast majority of research regards the promotion of green development through finance as an important theoretical premise, but this premise itself has not been fully demonstrated. Can green finance promote green development? Is there any empirical evidence? There is almost no detailed academic analysis. From the perspective of the definition of green finance, scholars have given different definitions for the concept of green finance [18,19,20], but there are several connotations that are consistent: first, the foothold of green finance is finance, including not only financial products and financial markets but also financial policies and institutions. Second, these financial activities are related to energy conservation and environmental protection, with the aim of serving the green development of the economy. Early research on green finance proposed the role of financial institutions in environmental protection and sustainable development [21]. On this basis, scholars have discussed a variety of green financial products [22]. In recent years, more and more documents have discussed green finance based on social responsibility theory applied to financial institutions [23]. Regardless of the research on green financial products or the environmental responsibility of financial institutions, the basic theoretical premise is that green finance can promote green development. However, existing studies have rarely applied this important premise. From an empirical point of view, in the process of quantitative analysis of green finance, scholars have not unified the selection of green finance indicators [24,25]. This article takes the macro policy of green finance reform as a breakthrough point which can alleviate the endogenous problems that may exist in selecting green finance indicators to a greater extent. At the same time, according to the measures taken by China to promote green development, we refer to the research of relevant scholars, select the relevant indicators to measure green development, and analyze the relationship between green finance reform and green development through empirical methods, hoping to enrich the research in related fields.

Based on the above-mentioned realistic background and research progress, this paper used the difference-in-differences (DID) model to evaluate the impact of the green financial innovation pilot zone on the regional green development level and analyze its mechanism. Compared with the existing research, the main contributions of this paper are as follows: (1) previous studies on the outcome variables of the establishment of green financial innovation pilot zones on the regional environment mainly focused on unilateral factors, such as pollution control or energy conservation and consumption reduction, and cannot reflect the comprehensive impact of the establishment of the pilot zone on the improvement of the regional green development level [26,27]. In this paper, by selecting the relevant indicators for constructing green development, using the fixed-base range entropy weight method to measure the regional green development level, we reflect more comprehensively the impact of the test area on the regional green governance level. (2) The difference-in-differences (DID) model was used to evaluate the policy effect of the test area on the level of green development in the region as a whole and the test areas are divided into groups to test the green development performance of different groups of test areas, carrying out the relevant robustness test to the double difference conclusion. Finally, (3) we further explore the factors that influence the regional green development mechanism in the green financial reform and innovation pilot zone from the two aspects of industrial structure and technological innovation and, at the same time, explore the heterogeneity of policy effects in combination with local fiscal investment in environmental protection and level of marketization.

2. Research Method and Data

2.1. Model Setting

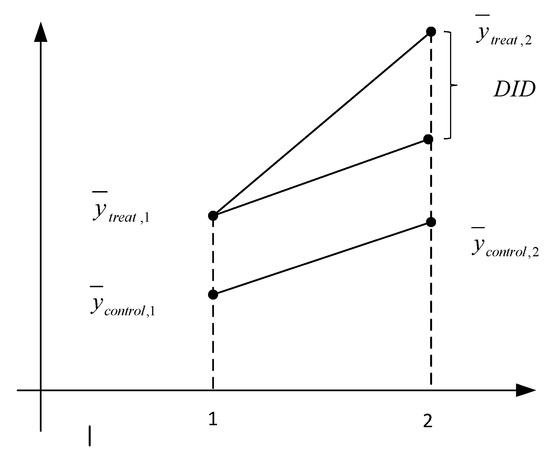

After the establishment of the green finance reform and innovation pilot zone, the total effect of the changes in the provincial green development level is composed of two parts: The first is the “time effect”—that is, the part of the green development level change caused by its original “inertia,” such as its own development characteristics or environmental situation; the second is the “policy treatment effect”—that is, the part of the green development level change caused by the establishment of the pilot zone. Therefore, the key to the policy evaluation for the establishment of the experimental zone is how to reasonably distinguish the green development changes caused by time or by the “policy treatment effect” of the establishment of the experimental zone. The difference-in-differences method (DID), as a causal effect parameter identification strategy, regards the establishment of the experimental area as a “quasi-natural experiment”. By comparing and analyzing the differences between the two types of main policies before and after the implementation, we can effectively separate the “time effect” and the “policy treatment effect”, eliminating the influence of unobserved confounding factors. As a mature econometric model, the DID has been widely used in the empirical economic evaluation of policy effects. China’s existing literature on the effects of DID policy focuses on the following two aspects: First, the performance of macro policies at the macro-level. It has evaluated the impact of the comprehensive innovation reform pilot zone on regional innovation capabilities from an empirical point of view [28], the “Belt and Road” initiative’s promotion of the growth of premium income of provinces along the route, its impact on trade scale and trade efficiency, etc. [29,30]. The second focus has been the performance of macro policies at the micro-level. Scholars have analyzed the impact of green credit policies on the excessive investment of polluting companies [31] and the impact of political costs on the earnings management of polluting companies [32]. Drawing on existing research, this article starts from the macro-level policy effects and uses this more mature measurement model to empirically test the effects of the establishment of the experimental area. The effect of establishing the policy of the pilot zone is generally expressed as Formula (1), which is visually expressed as shown in Figure 1:

Figure 1.

Intuitive schematic diagram.

Assuming that the establishment of the test area in provinces has the same time-effect trend as the green development level of provinces with no test area, set up provinces in the experimental area as the treatment group and the other provinces as the control group. The DID model is as follows:

Here, represents the regional green development level; indicates whether it is a green finance reform and innovation pilot zone. If it is the test area, the assigned value is 1, while other areas are assigned 0; Post indicates the time when the test area was established. The time before the establishment of the test area is 0 while the time after the establishment is 1; DID represents the policy effect of the establishment on the experimental area; Controls represents a series of control variables that affect the level of green development at the provincial level; ε represents a random disturbance term. The expected coefficient of ω is positive, showing that the establishment of a pilot zone of green finance reform and innovation will help improve the level of regional green development.

2.2. Data and Variable Selection Instructions

2.2.1. Sample Selection Instructions

This article uses the panel data of 30 provinces in China from 2013 to 2017 as the research sample (except for Tibet, Hong Kong, Taiwan, and Macao due to lack of data availability). The original data came from the China Statistical Yearbook, China Environmental Statistics Yearbook, China Science and Technology Statistical Yearbook, China Economic and Social Statistical Development Database, and China Information Bank database of the relevant years. The reasons for selecting the 2013–2017 period as the research interval are as follows:

- (1)

- In 2012, the China Banking Regulatory Commission issued the “Green Credit Guidelines” notice, as well as the state’s implementation of testing PM2.5 in key cities, resulting in changes in the level of green governance in relevant regions. In order to control the interference of these policy factors, this article selects 2013 as the beginning of the research interval.

- (2)

- In 2016, the pilot zones actively carried out preparatory work to accelerate the issuance of various green financial policy opinions. The release of policy signals, as a “weathervane” guiding the actions of market entities, can speed up the development of regional green finance and affect regional green development. When the green finance reform and innovation pilot zone plan was officially passed in 2017, the policy’s effect was quickly released. Therefore, considering the rationale behind the implementation time for the establishment of the pilot zone policy, it is reasonable to use the data of 2016 and 2017 to represent the policy implementation.

- (3)

- Although the scope of the pilot program was not expanded in 2018, all provinces (municipalities) have begun to issue relevant implementation opinions or development plans involving green finance, which will increase the interference with the measurement of policy effects. Therefore, the data from up to 2017 was included.

2.2.2. Variable Definitions

- (1)

- The explained variable (ECO_de). The index method is mainly used to measure the level of regional green development. As our country is still in the period of industrial transformation, the measures currently used to promote green development are mainly reflected in energy conservation, emission reduction and environmental governance, search for pollution control technologies, formulation and implementation of pollution control laws, etc. These measures are mainly used to solve the environmental pollution problems caused by industrial development [17]. Therefore, this article is based on the main measures used by China to promote environmental governance and green development and also refers to previous studies [33] to select relevant indicators as proxy indicators for green development levels, as shown in Table 1.

Table 1. Measurement indicators of the Green Development Index.

Table 1. Measurement indicators of the Green Development Index.

The most critical link in the measurement of the Green Development Index is the determination of the weight of each level index and the calculation of the comprehensive index. Therefore, this paper uses the fixed-base range entropy method [34] to solve these two problems. The fixed-base range entropy weight method is a combination of the entropy weight method and the fixed-base range method. The entropy weight method is used to determine the index weight. The fixed-base range method is a non-dimensional processing of the original data of the indicator based on the improved range standardization method. Finally, the index weights and dimensionless index data are weighted to obtain the provincial green development index. The measurement steps of the fixed base range entropy weight method are as follows:

Step 1: Calculate the proportion of indicators. Suppose is the proportion of province of the index of year in the index. The calculation formula is:

In Formula (3), if the specific gravity value , is defined; is the index data after the range standardization process.

Step 2: Calculate the index information entropy. Let be the information entropy of index of year. The calculation formula is:

In Formula (4), information entropy is . The smaller the index information entropy, the greater the degree of dispersion, indicating that the amount of information provided by the index is greater, so the index weight is also greater; on the contrary, the index weight is smaller.

Step 3: Calculate indicator weights. Suppose is the weight of the index. The greater the weight of the indicator, the greater the contribution of the indicator to the measurement result. The calculation formula is:

Step 4: Fix the base range to process the original data. This article uses 2005 as the base year. The calculation formula is:

In Formula (6), is the dimensionless index value processed by the fixed-base range method for the index of year . is the original data. and are the maximum and minimum of the index in the original data of all provinces in the base year value, respectively.

Step 5: Calculate the composite index. Suppose is the comprehensive index of the province of the year, and the index weight determined by the entropy weight method and the dimensionless index value processed by the fixed-base range method are weighted to finally obtain the comprehensive index. The calculation formula is:

- (2)

- The core explanatory variable of this article is DID. Take whether to establish a green finance reform and innovation pilot zone as a policy dummy variable (Treat). If it is established, the value is 1, otherwise, it is 0; the time dummy variable for the establishment of the pilot zone is Post. If it is within the implementation time, the value is 1, otherwise, it is 0. The product of the two is DID to analyze the changes in the level of green development brought about by the green financial reform and innovation pilot zone. Based on this, we identified Zhejiang, Guangdong, Xinjiang, Guizhou, and Jiangxi as the test group and the other provinces as control provinces based on the sample period from 2013 to 2017.

- (3)

- Control variables (). The control variables mainly select other variables that have an important impact on the level of green development, and the specific description is as follows. ① The lagging period of the green development index (ECO_lag): Promoting regional green development is a long-term process, and the current green investment and governance level will have an impact on the next green development level. Therefore, the model incorporates the lag phase variables into the control variables. ② Foreign direct investment (FDI): Studies have shown that foreign-funded enterprises generally implement stricter environmental standards, which can promote the development of environmental technologies in host countries, effectively reduce local pollution emissions, and thus help improve environmental quality [35,36]. The FDI is expressed by the logarithm of foreign direct investment per capita. ③ The level of urbanization (urban): The level of urbanization is measured by the proportion of the urban population of each province in the total population. Deng and Zheng [37] and Liang et al. [38] believe that the higher the urbanization rate in China, the more serious the environmental problems will be, and therefore, more environmental protection investment is needed. Therefore, urbanization will affect the level of green development in the region. ④ Human capital (LHC): This article uses the logarithm of the product of the average years of education of the population of each province and the total population to measure the level of human capital. Yao et al. [39] and Ahmed et al. [40] believe that the improvement of human capital is conducive to reducing emissions and promoting environmental governance. At the same time, in order to attract talent, the pilot zone will focus on improving the local environment, increasing investment in environmental protection, and raising the level of green development in the region. The descriptive statistics of each variable are shown in Table 2.

Table 2. Descriptive statistics of variables.

Table 2. Descriptive statistics of variables.

3. Empirical Results and Discussion

3.1. Empirical Results of the Difference-in-Differences Model

Before regression, the model (2) was tested, resulting in a test value of 52.76 at the 1% significance level, indicating that the null hypothesis of using the random effects model can be rejected, so using the fixed effects difference model (the results are shown in Table 3) is more reasonable. First, the control variables are not included in the national-level difference (as shown in column (1) of Table 3), and the coefficient value is 0.0588, which is significant at the 10% level after the control variables are included in column (2). Although the coefficient has changed, is still significant at the 10% level, which is 0.00592. Restricted by the economic environment and geographical conditions, different regions have different response effects to a policy. Based on this, this article divides the eastern region and the central and western regions into two groups to measure their differences, as shown in columns (3) and (4), respectively. It can be seen that the coefficient in the eastern region is 0.0127, which is significantly positive at the 1% level, while the coefficient in the central and western regions is positive but not significant. This shows that the economically developed regions are more capable of fully responding to the country’s policy calls. More economically developed regions can actively increase green investment to improve the level of regional green development, so the establishment of the green financial reform and innovation pilot zones will bring stronger green development effects.

Table 3.

Test of the effect of the establishment of the Green Finance Reform and Innovation Pilot Zone.

The economically developed regions in the east are moving towards a stage of high-quality economic development. While maintaining rapid economic growth, they can actively follow the guidelines of the national green development policy to encourage enterprises to reduce pollution emissions. At the same time, companies can also adjust their own development strategies in accordance with the development of the economic environment and fulfill their environmental responsibilities. Guangdong Province can be taken as an example. Since the establishment of the green finance reform and innovation pilot zone, as of 2018, financial institutions had provided financing for green companies with more than 7 billion yuan, and major banking institutions had issued more than 2.2 billion yuan in loans to support green transformation projects, and 160 green projects and enterprises were identified. At the same time, companies and financial institutions that contributed to green development had provided green credit subsidies of more than 16 million yuan and green insurance subsidies of more than 5 million yuan, encouraging the green technology of enterprises and the innovation of green financial products by the financial institutions in the jurisdiction.

3.2. Robustness Test

3.2.1. Parallel Trend Test

Parallel trends assume that the double differential model effectively separates the “time effect” and the “policy processing effect”, which is the prerequisite for analyzing the policy effect of the green financial reform and innovation pilot zone. Its meaning is that when there is no policy for establishing the test area, the green development trend of the treatment group and the control group will remain consistent. If the level of green development does not meet the parallel trend assumption, the difference between the treatment group and the control group may come from other factors outside of the treatment group, and the policy evaluation results of double difference may not be credible. Therefore, it is necessary to conduct parallel trend testing prior to the policy effect evaluation. Drawing on the practice of parallel trend testing in the relevant literature [41,42], the dynamic analysis is used to test whether the trends between regions are similar, that is, by generating interactive dummy variables at different time points. This article uses the 3 years before the establishment of the test area, 2 years before the establishment of the test area, 1 year before the establishment of the test area, the year of establishment of the test area, and 1 year after the establishment of the test area to form interactive dummy variables. All interactive dummy variables are included as variables in the regression model. If the policy effect is not significant before the establishment of the test area, it indicates that the parallel trend assumption is met. The specific results are shown in Table 4. Columns (1) and (2) of Table 4 show the dynamic test results of not including the control variables and of including the control variables, respectively. It can be seen that the interaction term is not significant in the 3 years before the establishment of the experimental area. In the year of and the year after the establishment of the pilot zone, the coefficient of the interaction term is significant, indicating that the establishment of the pilot zone for green finance reform and innovation is the reason that the green development level of the pilot area is higher than that of other provinces. The above results indicate that the assumption of parallel trends is met.

Table 4.

Dynamic regression results.

After passing the parallel trend test, a robustness test is needed to test the reliability of the model results. The following will use two methods of placebo testing and changing the outcome variable to test the robustness of the regression results.

3.2.2. Placebo Test

In order to test whether the green development effect of the green financial reform and the innovation pilot zone is affected by the choice of time point, the time hypothesis for the establishment of the pilot zone in the robustness test was officially proposed as 2014. The China Banking and Insurance Regulatory Commission issued the “Green Credit Guidelines” in 2012, and the relevant green finance reform and innovation pilot provinces also issued relevant green credit guidelines in 2012. If 2013 is chosen as the time for the pilot change, this may have a certain influence on the test results. The result is shown in column (1) of Table 5. The coefficient is 0.00194, but it is not significant.

Table 5.

Robustness test.

3.2.3. Replacement Result Variable Test

In order to further determine the effect of the establishment of the green financial reform and innovation pilot zone on the improvement of the regional green development level, the dependent variable indicators were replaced. The pollution control investment amount/national pollution control investment () of the three-level indicator in the green development measurement index was set as the dependent variable. At the same time, in order to prevent the occurrence of heteroscedasticity and multicollinearity, some control variables were changed. The lagging period of the green development index and human capital were no longer used, and the industrial structure upgrade index (ISR) was added. Some scholars have pointed out that the current serious environmental pollution problems in China are mainly related to the highly polluting industrial structure and energy structure [43,44]. Therefore, a large amount of investment in the treatment of environmental pollution is still needed to promote green development. We used the method applied in previous research [45] to construct the industrial structure upgrading index: . Here, represents the proportion of the added value of the primary industry in the regional GDP, represents the proportion of the added value of the secondary industry in the regional GDP, and indicates the proportion of the added value of the tertiary industry in the regional GDP. For the regression results, see columns (2) and (3) of Table 5. Columns (2) and (3) show the results of not including and of including the control variables, respectively. It can be seen that before and after the control variables are included, the coefficients of the DID are 0.00621 and 0.0075, which are significant at the levels of 10% and 5%, respectively. This shows that the establishment of the green finance reform and innovation pilot zone has significantly increased investment in pollution control and has had a positive effect on the improvement of environmental protection. It is basically showing the same as the previous regression results, determining that the establishment of the pilot zone has improved the green development level of the pilot area and sped up the pace of ecological civilization construction in the pilot areas.

4. Further Analysis

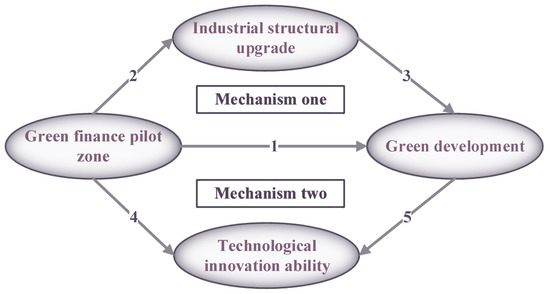

The above has verified that the green finance reform and innovation pilot zone has improved the level of regional green development. Therefore, what mechanism does the pilot zone policy use to influence the level of regional green development? Based on the development stage and content characteristics of the current policies, this article mainly focused on the two channels of regional industrial structure upgrading and technological innovation capability improvement to analyze the mechanism of the green financial reform and innovation pilot zone on the regional green development level. Thus, we propose two theoretical hypotheses.

4.1. Theoretical Hypothesis Analysis

Accelerating the green transformation of traditional industries and the development of the green industry itself are the two core contents of the industrial structure’s transformation and upgrading [46,47,48]. After the establishment of the green financial reform and the innovation pilot zone, the government and financial institutions have actively cooperated to combine preferential policies for industrial upgrading and preferential loan interest rates to fully mobilize the enthusiasm of enterprises for green investment. The government and financial institutions restrict the availability of funds for high polluting and high consumption industries by strictly implementing relevant green financial policies, controlling the expansion of such enterprises, and forcing them to transform and upgrade [49,50]. On the other hand, green finance forms the green capital required for the development of green industries through the formation of capital guidance, granting credit incentives to energy-saving and environmentally friendly industries with low energy consumption and low environmental pollution, and guiding green industry capital to adjust from the “two highs” industry to the “two lows” industry [51,52]. This achieves the optimal allocation of existing resources and capital, accelerates the realization of industrial transformation and upgrades goals, ultimately improving the level of regional green development [53].

Hypothesis 1a.

The green finance reform and innovation pilot zone influences the level of regional green development through industrial structure upgrading.

Higher technological innovation ability is an important guarantee for the rapid improvement of the regional green development level. Technological innovation can enhance the potential of regional green development and improve its efficiency [54,55]. However, technological innovation itself requires a large amount of investment in research and development. It is difficult to achieve high-quality green innovation in a company if it only relies on its own funds. Therefore, external financial resources have become a key source of regional technological innovation. Under the guidance of the green finance reform and the innovation pilot zone policy, the pilot zones use various financing mechanisms in the market to convert green funds into capital to support enterprises in actively investing in environmental protection and green technology innovation [12,56]. Through emerging diversified green financial financing models, policy subsidies, and supporting services, the level of technological research and development of green industries is be improved [57,58]. In addition, integrating ecological environmental protection technology into the operation of the green industry creates new ecological and environmental value to improve the regional green governance capacity and green development levels [59,60].

Hypothesis 1b.

The green finance reform pilot zone influences the level of regional green development through technological innovation.

4.2. Construction of the Intermediary Effect Model

On the basis of the aforementioned hypothetical analysis, the intermediary effect model [61] is used to further test whether the intermediary effects of industrial structure and technological innovation in the green financial reform and innovation pilot zone influence the level of green development. Based on the above research hypothesis and the benchmark regression model (2), set the models (8) and (9) as follows:

In Equations (8) and (9), represents the intermediary variable, using the industrial structure upgrade and technological innovation level for the test; the industrial structure upgrade indicators are the same as those mentioned above. Usually, indicators that characterize the level of technological innovation include input and output, but input indicators, such as R&D investment, cannot fully reflect the innovation capability of a region. In terms of output indicators, patent data is still the most economically valuable part of regional innovation resources. This article refers to related research [62,63], and uses the number of patents granted per 100,000 people to represent technological innovation capabilities; the meaning of other variables is consistent with Formula (2). Model (8) examines the impact of the green finance reform and innovation pilot zone policy on the intermediary variables. The sign of the expected coefficient is positive, indicating that the green finance reform and innovation pilot zone can affect the intermediary variables ; model (9) shows the total effect, testing the influence of the establishment of the test area on the level of green development when controlling for the intermediate variables . The coefficient represents the direct effect of the establishment of the experimental area on the regional green development level, and the product of the coefficient and coefficient represents the mediating effect of the mediating variable .

The test procedure for the mediation effect is as follows. Take the upgrading of industrial structure as an example. First, test the significance of the coefficient in model (2) (path 1, as shown in Figure 2). The previous article has verified that the significance is positive. Therefore, models (8) and (9) can be directly tested. When the coefficient (path 2) and the coefficient (path 3) are both significant, if the coefficient is also significant, it indicates that there is a partial mediation effect; if the coefficient is not significant, it indicates that there is a complete mediation effect. If at least one of the coefficients and fails the significance test, the bootstrapping method is used for analysis.

Figure 2.

The intermediary effect mechanism of the green finance reform and innovation pilot zone.

4.3. Analysis of Empirical Results of Intermediary Effect Mechanism

4.3.1. The Mediation Effect of Industrial Structure Upgrading

After the establishment of the green finance reform and innovation pilot zone, the pilot areas actively introduced relevant green finance policies. For example, Guangdong Huadu issued the “1 + 4 Supporting Policy System for Green Finance and Green Development” in the Huadu District of Guangzhou City, which passed the green fund, green credit, green bonds, green insurance, etc., to support the development of green industries; emphasized the gradual withdrawal of investment in high pollution and high consumption industries; strengthened investment support for energy conservation, environmental protection, and clean energy; and promoted the upgrading of industrial structure and improvement of the level of green development. The regression results are shown in columns (1) and (2) in Table 6. Column (1) of Table 6 shows that the coefficient of is 0.0174, significant at the 10% level, and the and in column (2) are positive but not significant. We continued with the bootstrapping test, but the results had no indirect effects and failed the total effect test. This shows that the green finance reform and innovation pilot zone are conducive to the upgrading of the industrial structure, but at the current research stage, the mediating effect of the industrial structure upgrade in the effectiveness of the green finance reform and innovation pilot zones to promote green development has not yet been reflected.

Table 6.

Mechanism test of Green Finance Reform and Innovation Pilot Zone.

4.3.2. The Intermediary Effect of Technological Innovation

The regression results are shown in columns (3) and (4) of Table 6. Column (3) shows that is 0.212, which is significant at the 1% level, and the and are 0.00283 and 0.00496, significant at the 5% and 10% levels, respectively. It shows that the improvement of technological innovation capabilities has played a part in the intermediary effect on promoting the regional green development level in the green financial reform and innovation pilot zones. In the process of realizing green development, the improvement of the technological innovation level is an important driving force for promoting green development. By constructing a market-oriented technological innovation service system, the pilot zone actively builds a policy system for green finance to serve the technological innovation of the green industry [64] and provides financial support for enterprises engaged in technological innovation research and development but that have limited financing channels, and reduces the risk faced by enterprises engaged in the process of green technology research and development. Therefore, the pilot zone policy should actively play a guiding role in technological innovation, urge green finance to provide financial support for the technological progress of green environmental protection enterprises so as to promote the improvement of regional technological innovation capabilities [65] and realize the technological transformation of traditional industries and development of green enterprise technology, ultimately promoting the improvement of the regional green development level.

4.4. Analysis of Heterogeneity Conditions

The provinces included in the green financial reform and innovation pilot zones are representative regions for financial reforms. Playing the role of the green financial reform pilot zone in promoting green development is inseparable from a certain external environment, particularly the guidance of the government’s environmental protection behavior and the support for marketization. Therefore, this article mainly empirically analyzes the heterogeneity of the green finance reform pilot zones with regards to the two environments of fiscal investment in environmental protection and marketization level.

4.4.1. Impact of Fiscal Investment in Environmental Protection

This article mainly examines the impact of local fiscal environmental protection expenditures () on the level of local green development, using the median of environmental protection expenditures in provincial fiscal expenditures as the dividing point, and dividing provinces into two groups for the test: those with high and low fiscal expenditures on environmental protection. See columns (1) and (2) of Table 7 for details. The results showed that in areas with high fiscal expenditure on environmental protection, the coefficient of the interaction term was significant, with a DID coefficient of 0.0138 and a t-value of 1.786. In areas with low fiscal expenditure on environmental protection, the DID coefficient was 0.000971, with a value of 0.263, while the coefficient was not significant. These results indicate that the government’s environmental protection expenditure has a positive guiding effect on the improvement of the regional environment, which is more in line with the reality of China’s current green development. In China, the measures and policies adopted by the government to promote green development can play a role as a “vane”. Whether it is the implementation of air pollution monitoring in 2012, the introduction of green credit guidelines, or the revision of the environmental protection law, it is clear that the government can play a positive role in promoting environmental governance.

Table 7.

Test of heterogeneity conditions.

4.4.2. Influence of Marketization Level

This article refers to the general practice of Wang Xiaolu, Fan Gang, and others outlined in the “Report on China’s Marketization Index by Provinces” (2018), and uses the proportion of the main business income of non-state-owned enterprises in each province in the main business income of the enterprises above to indicate the level of marketization (market). Divided by the median of the marketization level, as shown in the results of columns (3) and (4) of Table 7, in regions with a high level of marketization, the coefficient of the interaction term is significant, with a DID coefficient of 0.00914 and a t-value of 1.705. In areas with a low level of marketization, the coefficient of the interaction term is negative, and the coefficient of DID is −0.000644, with a t-value of −0.618, which is not significant. These results show that the improvement of the level of marketization has a positive effect on the promotion of green development in the green financial reform and in innovation pilot zones. Considering the significant amount of funds spent on environmental governance, the establishment of the experimental zone will undoubtedly reveal their important role of the market. In the development of China’s green finance, the government, as the main creator of green finance rules, can promote the sound and healthy development of green finance through administrative and legal regulations. However, local governments also need to rely on market forces to adjust and introduce green incentive mechanisms [66]. When the financial regulatory authority announces that the first batch of green finance reform pilot zones will soon be launched, it will send a positive signal to the market, and the positive effects of the pilot zone policies will further be brought into play with market forces [12,67,68]. Green finance uses the “invisible hand” of the market to improve operational efficiency and attract more social funds to provide a fertile soil for the green industry [69]. On the basis of an effective market, all provinces have proactively introduced relevant green finance policies and have created a multi-level green finance organization system to strengthen the innovation of green finance products and service methods to promote green development.

5. Conclusions and Implications

The Chinese economy has shifted from a stage of rapid growth to a stage of high-quality development, and high-quality development puts forth higher requirements for green development. As new attempts to develop green finance, the “Green Finance Reform” and the “Innovation Pilot Zone” not only make important contributions to promoting regional green development but also play an important role in implementing new development concepts across the country and providing an extensible experience for reference. Starting from an empirical point of view, this paper examines the impact of green finance reform and innovation policies on regional green development by measuring the level of regional green development. The results show that: (1) the establishment of the green finance reform and innovation pilot zone can drive the green development of the province and that the policy effect of the green finance reform has certain regional differences, that is, the eastern policy effect is more obvious; (2) under the guidance of these policies, the provinces in the pilot zone use the function of green financial resource allocation, mainly through the upgrading of industrial structure and the improvement of technological innovation, to affect the level of regional green development; (3) the environment, with a relatively high level of financial investment in environmental protection and marketization, helps the green finance reform policy to further promote the positive role of regional green development. Based on our research results, we believe that the eastern region is now gradually entering a stage of high-quality development and adjusting its own development plans closely following the national environmental policy and actively promoting regional green development. The regional coordinated development strategy implemented by China may adopt relatively loose environmental policies for the central and western regions. Therefore, the green finance reform and innovation policies in the central and western regions are not in place during the implementation process. Therefore, the policy effects are different between the east, the center, and the west, which is relatively in line with the research of scholars who analyze the differences in the implementation effects of related policies [20]. Research by scholars in China has shown that green finance can promote technological innovation and industrial structure upgrading [50,70]. Although in the research results of this article the mediating effect of the industrial structure did not pass the test, we see that the green finance reform and innovation policy has promoted the upgrading of the industrial structure. We believe that the upgrading of industrial structure is a long-term development process, but in our current research, the mediating effect of industrial structure upgrading could not be shown. With the further optimization of the green finance reform policy design, the green development effect brought about by the upgrading of industrial structure will appear in the future. According to the current status of China’s promotion of green finance development, we believe that fiscal investment in environmental protection and the level of marketization will have an impact on the level of green finance reform and innovation in the region. This result is also in line with our hypothesis, which is more consistent with existing research; that is, fiscal investment in environmental protection and the level of marketization affect environmental governance. According to different development situations and goals, green finance reform and innovation policies will inevitably be adjusted. Therefore, we should not only pay attention to the necessary conditions for the current green finance reform and innovation for green development, but we should also examine the factors that green finance will need to promote green development in the future. This article is mainly limited to the current status quo.

In response to the aforementioned research conclusions, this article proposes the following policy recommendations: (1) the state should continue to expand the scope of green finance reform and innovation pilot zones and make reasonable arrangements among regions according to local conditions to explore new ways of promoting green development; (2) the pilot zones should accelerate the pace of green financing to promote the upgrading of industrial structure and promote the green sustainability of the entire industrial chain, while at the same time, it is necessary to strengthen the financial support of green finance for green technology innovation, guide enterprises to enhance their green technology innovation capabilities, and enhance the overall green development capabilities of the region; (3) in addition, government departments should strengthen the financial support of green finance for green technology innovation, actively build an innovation resource platform with green technology as the core, form an interconnected green technology innovation resource network, and guide enterprises in the pilot zone to improve green technology innovation capabilities to enhance the overall region green development capability.

In the ongoing research at this stage, we must pay attention to the background of China’s promotion of green development and the country’s use of the ability of green finance to serve green development as an indispensable means of environmental governance. As an important “window,” the green finance reform and innovation pilot zone is an important top-level design for exploring new development models of green finance. The upgrading of industrial structure and the improvement of technological innovation capabilities are inevitable topics of China’s future environmental governance, and it is of great practical significance to promote the development of these two aspects. Promoting green development requires the concerted efforts of the government and the market to truly realize a green China in the future. China’s green financial policy reform to achieve green development has a certain inspiration for global green policy formulation and reforms. In future research, we should not only pay attention to the policy designs of a certain country or region to achieve green development but also see the efforts made by relevant international organizations to achieve global green development. Relevant international organizations can combine the characteristics of different countries or regions to adopt appropriate global green financial policies to promote universal green development. Moreover, relevant international organizations can see how green finance can accelerate green development at the national level, which will provide sufficient impetus for the realization of global green and low-carbon development in the future.

Author Contributions

Conceptualization, Y.W. and N.Z.; data curation, N.Z.; formal analysis, N.Z.; funding acquisition, Y.W.; methodology, N.Z.; software, N.Z.; supervision, Y.W. and R.L.; validation, X.L. and R.L.; writing—original draft, N.Z.; writing—review and editing, Y.W., N.Z., X.L., and R.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Project of National Social Science Foundation of China, grant number 20BJY079.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hu, A.G.; Zhou, S. Green development: Functional definition, mechanism analysis and development strategy. China Popul. Resour. Environ. 2014, 24, 14–20. [Google Scholar]

- Contreras, G.; Bos, J.; Kleimeier, S. Self-regulation in sustainable finance: The adoption of the Equator Principles. World Dev. 2019, 122, 306–324. [Google Scholar] [CrossRef]

- Anderson, J. Environmental finance. In Handbook of Environmental and Sustainable Finance; Academic Press: San Diego, CA, USA, 2016; pp. 307–333. [Google Scholar]

- Finger, M.; Gavious, I.; Manos, R. Environmental risk management and financial performance in the banking industry: A cross-country comparison. J. Int. Financ. Mark. Inst. Money 2018, 52, 240–261. [Google Scholar] [CrossRef]

- Zhang, B.; Yang, Y.; Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. J. Environ. Manag. 2011, 92, 1321–1327. [Google Scholar] [CrossRef]

- Salazar, J. Environmental Finance: Linking Two World. In Proceedings of the Workshop on Financial Innovations for Biodiversity Bratislava, Bratislava, Slovakia, 1–3 May 1998; Volume 1, pp. 2–18. [Google Scholar]

- Labatt, S.; White, R.R. Environmental finance: A guide to environmental risk assessment and financial products. Transplantation 2012, 66, 405–409. [Google Scholar]

- Gilbert, S.; Zhou, L. The Knowns and Unknowns of China’s Green Finance; New Climate Economy: London, UK; Washington, DC, USA, 2017. [Google Scholar]

- Su, S.; Zhang, F. Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit mode. J. Environ. Manag. 2020, 261, 110227. [Google Scholar]

- Zhou, C.Y.; Tian, F.; Zhou, T. Green finance and high-quality development: Mechanism and effects. J. Chongqing Univ. 2021, 5, 1–13. [Google Scholar]

- Levine, R. Finance and Growth: Theory, Evidence and Mechanisms; National Bureau of Economic Research: Cambridge, MA, USA, 2003. [Google Scholar]

- Wang, Y.; Zhi, Q. The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Lioui, A.; Sharma, Z. Environmental corporate social responsibility and financial performance: Disentangling direct and indirect effects. J. Ecol. Econ. 2012, 78, 100–111. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. The way to induce private participation in green finance and investment. Financ. Res. Lett. 2019, 31, 98–103. [Google Scholar] [CrossRef]

- Liao, X.; Shi, X.R. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- He, L.Y.; Liu, R.Y.; Zhong, Z.Q.; Wang, D.Q.; Xia, Y.F. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Liu, X.M. Support ecological civilization with “dark green”. China Dev. Obs. 2013, 8, 26–27. [Google Scholar]

- White, M.A. Environmental finance: Value and risk in an age of ecology. J. Bus. Strategy Environ. 1996, 5, 198–206. [Google Scholar] [CrossRef]

- Lindenberg, N. Definition of Green Finance; Deutsches Institut für Entwicklungspolitik: Bonn, Germany, 2014. [Google Scholar]

- Hugh, W.; Xun, C.; Bumba, M. State Capacity and the Environmental Investment Gap in Authoritarian States. Comp. Political Stud. 2014, 47, 309–343. [Google Scholar]

- Jeucken, M. Sustainable Finance and Banking; Earthscan Publications Ltd.: London, UK, 2001. [Google Scholar]

- Liu, J.Y.; Xia, Y.; Lin, S.M. The short, medium and long term effects of green credit policy in China based on a financial CGE Model. Chin. J. Manag. Sci. 2015, 2015, 46–52. [Google Scholar]

- Linnenluecke, M.K.; Smith, T.; Mcknight, B. Environmental finance: A research agenda for interdisciplinary finance research. Econ. Model. 2016, 59, 124–130. [Google Scholar] [CrossRef]

- Xie, T.T.; Liu, H. How does green credit affect China’s green economy growth? China Popul. Resour. Environ. 2019, 29, 83–90. [Google Scholar]

- Zhang, Y.H.; Zhao, J.H. Green Credit, technological progress and industrial structure optimization—An Empirical Analysis Based on PVAR Model. J. Financ. Econ. 2019, 4, 43–48. [Google Scholar]

- Huang, H.; Zhang, J. Research on the environmental effect of green finance policy based on the analysis of pilot zones for green finance reform and innovations. Sustainability 2021, 13, 3754. [Google Scholar] [CrossRef]

- Shen, T.; Cao, M.Z. Does the green finance pilot reduce the energy intensity? J. Financ. Dev. Res. 2020, 39, 3–10. [Google Scholar]

- Lin, S.F.; Dong, X.Q. Research on the effect of comprehensive innovation reform experiment on regional innovation capability and its transmission mechanism. Sci. Technol. Prog. Policy 2021, in press. [Google Scholar]

- Wu, C.H.; Li, C.H. The effect of the belt and road initiative on increase in premium income of provinces involved: A difference-in-differences analysis. J. Cent. Univ. Financ. Econ. 2018, 10, 24–32. [Google Scholar]

- Zhang, Q.Q.; Liu, R.N.; Ding, R.J. The impact of the Belt and Road initiative on the trade scale and efficiency in China’s provinces. Humanit. Soc. Sci. J. Hainan Univ. 2020, 38, 46–55. [Google Scholar]

- Ning, J.H.; Yuan, Z.M.; Wang, X.Q. Green credit policy and enterprise over-investment. Financ. Forum 2021, 26, 7–16. [Google Scholar]

- Huang, R.B.; Zhou, H.F. The impact of the revised environmental protection law on earnings management of heavy polluting enterprises-An empirical test based on the political cost hypothesis. Chin. J. Environ. Manag. 2021, 13, 63–71. [Google Scholar]

- Fang, J.G.; Lin, F.L. Study on convergence of China’s regional green finance development. J. Univ. Electron. Sci. Technol. China 2019, 21, 1–12. [Google Scholar]

- Zhou, X.L.; Wu, W.L. The measurement and analysis of the inclusive green growth in China. J. Quant. Tech. Econ. 2018, 35, 3–20. [Google Scholar]

- Omri, A.; Hadj, T.B. Foreign investment and air pollution: Do good governance and technological innovation matter? Environ. Res. 2020, 185, 109469. [Google Scholar] [CrossRef]

- Frankel, J.A. The Environment and Globalization; National Bureau of Economic Research: Cambridge, MA, USA, 2003. [Google Scholar]

- Deng, H.H.; Zheng, X.Y. Strategic interaction spending on environmental protection: Spatial evidence from Chinese cities. China World Econ. 2012, 20, 103–120. [Google Scholar] [CrossRef]

- Liang, L.W.; Wang, Z.B.; Li, J.X. The effect of urbanization on environmental pollution in rapidly developing urban agglomerations. J. Clean. Prod. 2019, 237, 117649. [Google Scholar] [CrossRef]

- Yao, Y.; Ivanovski, K.; Inekwe, J.; Smyth, R. Human capital and energy consumption: Evidence from OECD countries. Energy Econ. 2019, 84, 104534. [Google Scholar] [CrossRef]

- Ahmed, Z.; Asghar, M.M.; Malik, M.N.; Nawaz, K. Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Kudamatsu, M. Has democratization reduced infant mortality in sub-Saharan Africa? Evidence from Micro data. J. Eur. Econ. Assoc. 2012, 10, 1294–1317. [Google Scholar] [CrossRef] [Green Version]

- Alderetal, S.; Shao, L.; Zilibotti, F. Economic reforms and industrial policy in a panel of Chinese cities. J. Econ. Growth 2013, 21, 1–45. [Google Scholar]

- Wang, Y.; Jia, C.; Tao, J.; Zhang, L.; Liang, X.; Ma, J.; Gao, H.; Huang, T.; Zhang, K. Chemical characterization and source apportionment of PM 2.5 in a semi-arid and petrochemical-industrialized city, Northwest China. Sci. Total Environ. 2016, 573, 1031–1040. [Google Scholar] [CrossRef]

- Zhu, L.; Hao, Y.; Lu, Z.N.; Wu, H.; Ran, Q. Do economic activities cause air pollution? Evidence from China’s major cities. Sustain. Cities Soc. 2019, 49, 101593. [Google Scholar] [CrossRef]

- Ren, L.; Zhu, D.B. Is China’s financial development green—Also on the hypothesis of China’s environmental Kuznets Curve. Econ. Perspect. 2017, 11, 58–73. [Google Scholar]

- Li, Z. Research on green finance innovation and my country’s industrial transformation. Contemp. Econ. 2011, 7, 6–8. [Google Scholar]

- Kemp, R.; Never, B. Green transition, industrial policy, and economic development. Oxf. Rev. Econ. Policy 2017, 33, 66–84. [Google Scholar] [CrossRef]

- Hou, J.; Teo, T.S.H.; Zhou, F.L.; Lim, M.K.; Chen, H. Does industrial green transformation successfully facilitate a decrease in carbon intensity in China? An environmental regulation perspective. J. Clean. Prod. 2018, 184, 1060–1071. [Google Scholar] [CrossRef]

- Yang, D.; Chen, Z.; Yang, Y.; Nie, P. Green financial policies and capital flows. Phys. A Stat. Mech. Appl. 2019, 522, 135–146. [Google Scholar] [CrossRef]

- Qi, Y.; Wang, M. The game research of enterprise technology innovation driven by green finance policy. J. Ind. Technol. Econ. 2019, 38, 3–10. [Google Scholar]

- Moledina, A.A.; Coggins, J.S.; Polasky, S.; Costello, C. Dynamic environmental policy with strategic firms: Prices versus quantities. J. Environ. Econ. Manag. 2003, 45, 356–376. [Google Scholar] [CrossRef] [Green Version]

- Xiao, H.; Tang, H.; Zhou, J. On the LCEFT multi-player collaborative innovation evolutionary game with the support of green finance. Ekoloji 2019, 28, 1349–1364. [Google Scholar]

- Han, J.; Sun, Y.W.; Chen, C.F.; Lan, Q.X. Does industrial upgrading promote the green growth of Chinese cities? J. Beijing Norm. Univ. 2019, 3, 139–151. [Google Scholar]

- Chen, S.; Golley, J. Green productivity growth in China’s industrial economy. Energy Econ. 2014, 44, 89–98. [Google Scholar] [CrossRef]

- Zhang, J.X.; Chang, Y.; Zhang, L.X.; Li, D. Do technological innovations promote urban green development? A spatial econometric analysis of 105 cities in China. J. Clean. Prod. 2018, 182, 395–403. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance, entrepreneurship and growth: Theory and evidence. J. Monet. Econ. 1993, 32, 513–542. [Google Scholar] [CrossRef]

- Huang, X.R.; Wen, L.R. Research on the efficiency and influencing factors of financial support for the enterprises in environmental protection industry. Econ. Manag. 2017, 31, 45–50. [Google Scholar]

- Ji, Q.; Zhang, D.Y. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Guo, J. The effects of environmental regulation on green technology innovation—Evidence of the porter effect in China. Financ. Trade Econ. 2019, 40, 147–160. [Google Scholar]

- Ouyang, X.L.; Li, Q.; Du, K.R. How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 2020, 139, 111310. [Google Scholar] [CrossRef]

- Wen, Z.L.; Ye, B.J. Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Du, K.; Li, J. Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Du, K.; Li, P.; Yan, Z. Do green technology innovations contribute to carbon? dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Chang. 2019, 146, 297–303. [Google Scholar] [CrossRef]

- Ma, J.; An, G.J.; Liu, J.L. Build a financial service system that supports green technology innovation. Financ. Theory Pract. 2020, 5, 1–8. [Google Scholar]

- Wang, C.G.; Qiao, C.X.; Ahmed, R.I.; Kirikkaleli, D.K. Institutional Quality, Bank Finance and Technological Innovation: A way forward for Fourth Industrial Revolution in BRICS Economies. Technol. Forecast. Soc. Chang. 2021, 163, 120427. [Google Scholar] [CrossRef]

- Han, L.Y.; You, M.; Wei, X.Y. Innovation mechanism for green finance under the guidance of government. China Soft Sci. 2010, 11, 12–18. [Google Scholar]

- Jin, D.; Mengqi, N. The paradox of green credit in China. Energy Procedia 2011, 5, 1979–1986. [Google Scholar] [CrossRef] [Green Version]

- Li, P.L.; Ye, J.T. Green finance: Development logic, evolution path and China’s practice. Southwest Financ. 2019, 10, 81–89. [Google Scholar]

- Cui, H.R.; Wang, R.Y.; Wang, H.R. An evolutionary analysis of green finance sustainability based on multi-agent game. J. Clean. Prod. 2020, 269, 121799. [Google Scholar] [CrossRef]

- Hu, Y.; Jiang, H.; Zhong, Z. Impact of green credit on industrial structure in China: Theoretical mechanism and empirical analysis. Environ. Sci. Pollut. Res. 2020, 27, 10506–10519. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).