Business Models Amid Changes in Regulation and Environment: The Case of Finland–Russia

Abstract

1. Introduction

- RQ1: What effects do legislative changes have on the business environment between Finland and Russia?

- RQ2: What types of new business models are enabled by the changing environment?

- RQ2.1: How are innovation and new technologies enabling these business models?

2. Sustainable Business Models in Logistics

3. Materials and Methods

4. Case Study Findings

4.1. Previous Findings from Manufacturing and Transportation Companies

4.1.1. Semi-Structured Interview Results

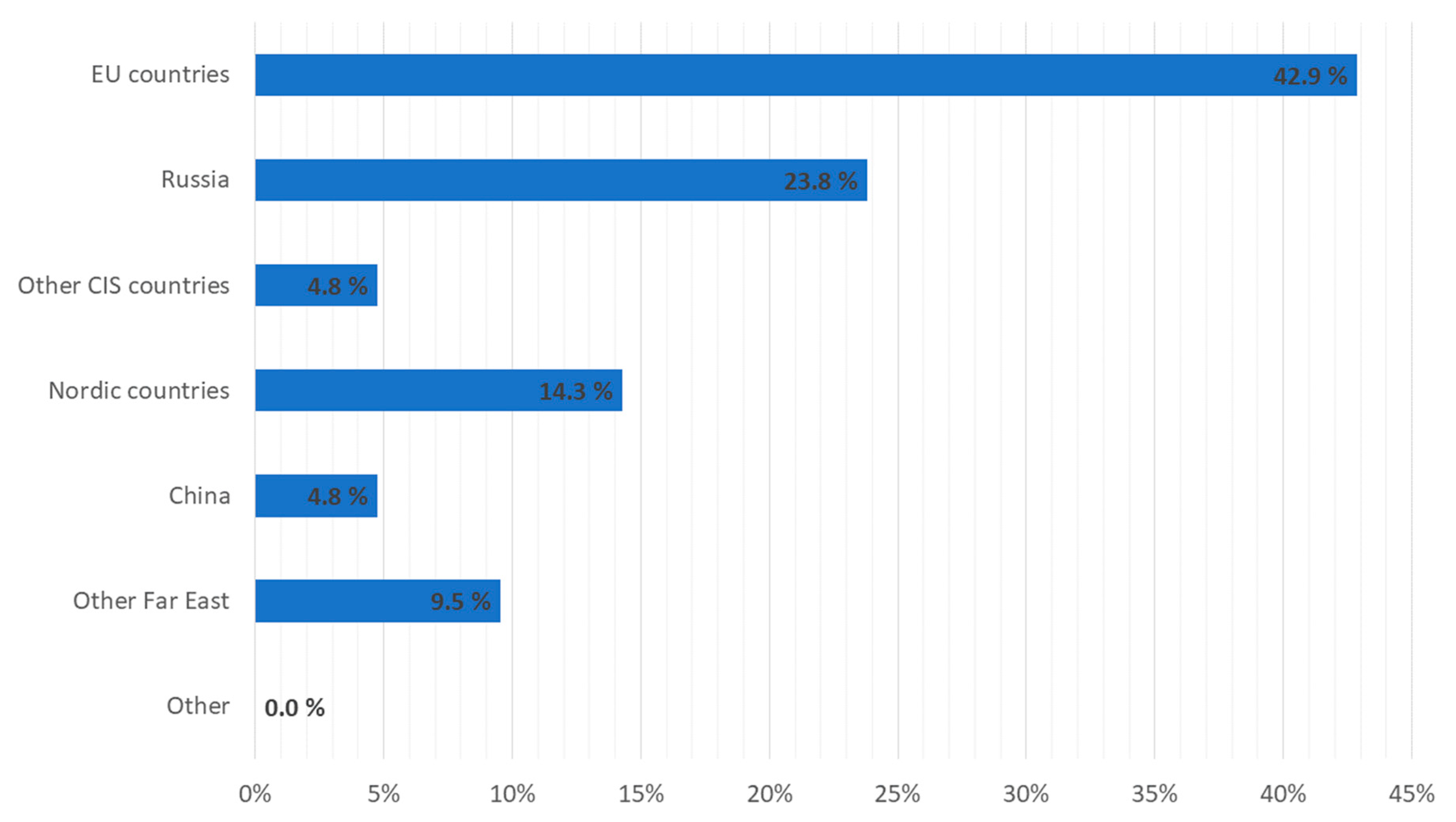

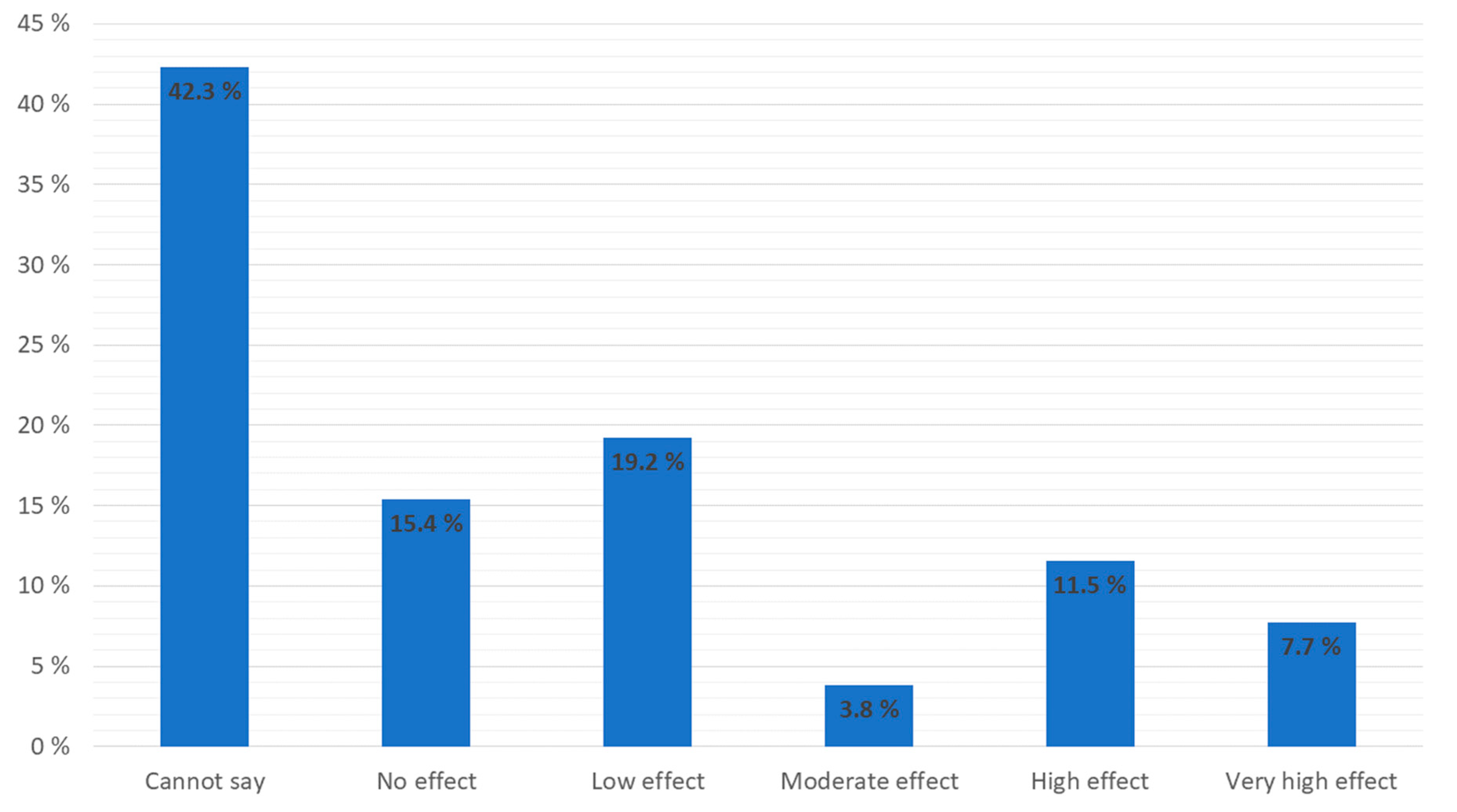

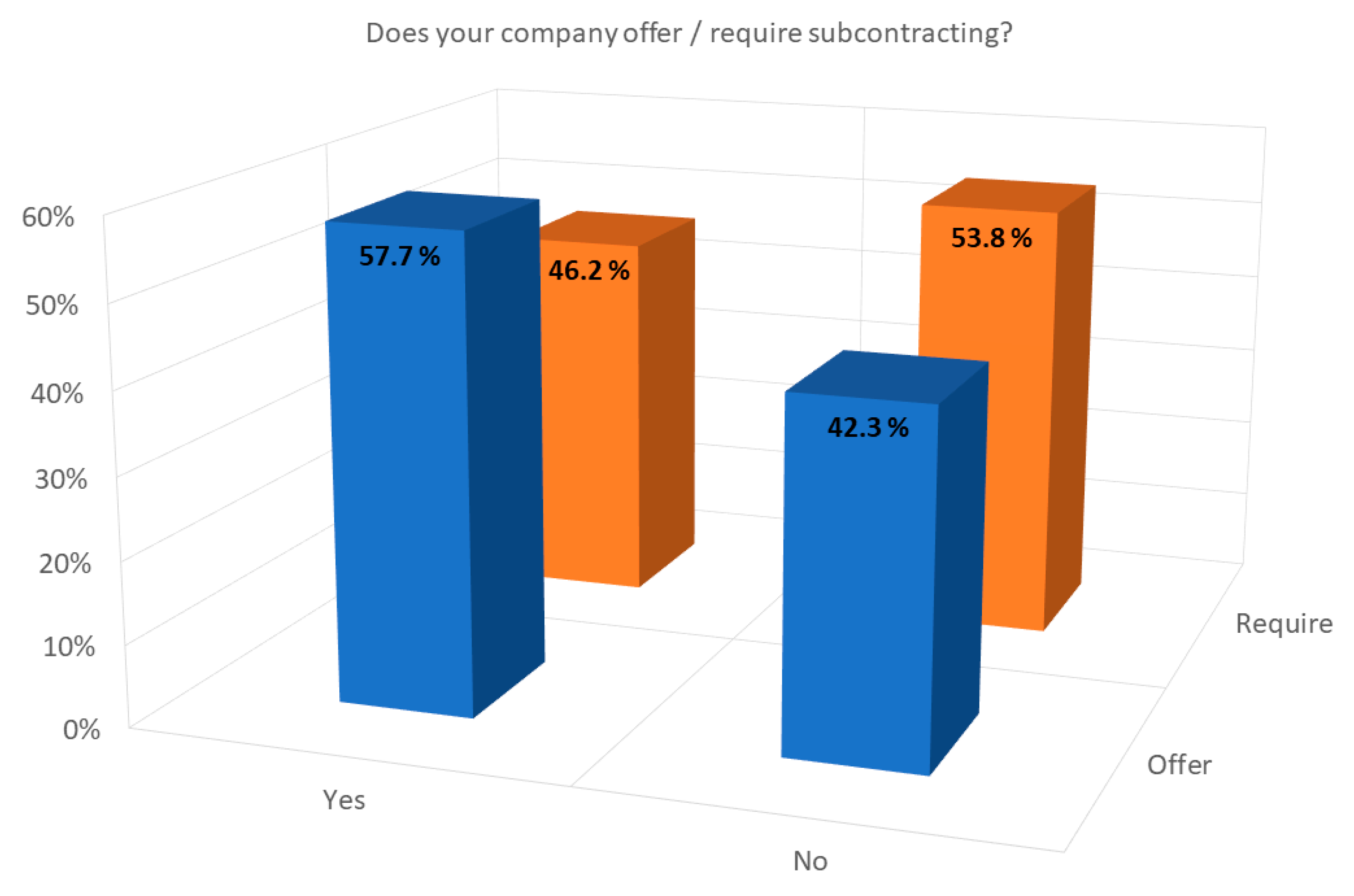

4.1.2. Survey Results

4.2. Findings from Transportation Companies of South Finland through A Second Survey

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- SopS 1. Asetus Sosialististen Neuvostotasavaltojen Liiton Kanssa Rautateitse Tapahtuvasta Yhdysliikenteestä Tehdyn Sopimuksen Voimaansaattamisesta (Free Translation by the Authors: Act of Enactment for Railway Interconnection Traffic with Union of Soviet Socialist Republics); The Finnish Ministry of Justice: Helsinki, Finland, 1948.

- European Commission. Railway Packages. Available online: https://ec.europa.eu/transport/modes/rail/packages_en (accessed on 24 February 2020).

- European Union Newsroom. EU Sanctions against Russia over Ukraine Crisis. Available online: https://europa.eu/newsroom/highlights/special-coverage/eu-sanctions-against-russia-over-ukraine-crisis_en (accessed on 18 November 2019).

- Korhonen, I.; Simola, H.; Solanko, L. Sanctions, Counter-Sanctions and Russia—Effects on Economy, Trade and Finance. Available online: http://urn.fi/URN:NBN:fi:bof-201805301586 (accessed on 24 February 2020).

- Romanova, T. Sanctions and the Future of EU–Russian Economic Relations. Eur.-Asia Stud. 2016, 68, 774–796. [Google Scholar] [CrossRef]

- Solaymani, S. CO2 emissions patterns in 7 top carbon emitter economies: The case of transport sector. Energy 2019, 168, 989–1001. [Google Scholar] [CrossRef]

- European Commission. A European Strategy for Low-Emission Mobility. Available online: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:52016DC0501 (accessed on 24 February 2020).

- United Nations Economic Commission for Europe. Protocol to Abate Acidification, Eutrophication and Ground-Level Ozone. Available online: https://www.unece.org/env/lrtap/multi_h1.html (accessed on 24 February 2020).

- International Maritime Organization. List of Amendments Expected to Enter into Force this Year and in the Coming Years. Available online: http://www.imo.org/en/About/Conventions/Pages/Action-Dates.aspx (accessed on 24 February 2020).

- Hilmola, O.-P. The Sulphur Cap in Maritime Supply Chains: Environmental Regulations in European Logistics; Palgrave Macmillan, Pivot Series: London, UK, 2019. [Google Scholar]

- Ministry of Transport and Communications. Nitrogen Emissions from Ships Restricted in the Baltic Sea and North Sea. Available online: https://www.lvm.fi/-/nitrogen-emissions-from-ships-restricted-in-the-baltic-sea-and-north-sea (accessed on 24 February 2020).

- Svaetichin, I.; Inkinen, T. Port waste management in the Baltic Sea area: A four port study on the legal requirements, processes and collaboration. Sustainability 2017, 9, 699. [Google Scholar] [CrossRef]

- Wang, Q.; Sun, H. Traffic Structure Optimization in Historic Districts Based on Green Transportation and Sustainable Development Concept. Adv. Civ. Eng. 2019. [Google Scholar] [CrossRef]

- Arbolino, R.; Carlucci, F.; De Simone, L.; Ioppolo, G.; Yigitcanlar, T. The policy diffusion of environmental performance in the European countries. Ecol. Indic. 2018, 89, 130–138. [Google Scholar] [CrossRef]

- Fahimnia, B.; Sarkis, J.; Davarzani, H. Green supply chain management: A review and bibliometric analysis. Int. J. Prod. Econ. 2015, 162, 101–114. [Google Scholar] [CrossRef]

- Dey, A.; LaGuardia, P.; Srinivasan, M. Building sustainability in logistics operations: A research agenda. Manag. Res. Rev. 2011, 34, 1237–1259. [Google Scholar] [CrossRef]

- Arvis, J.; Ojala, L.; Wiederer, C.; Shepherd, B.; Raj, A.; Dairabayeva, K.; Kiiski, T. Connecting to Compete 2018 Trade Logistics in the Global Economy: The Logistics Performance Index and Its Indicators; The International Bank for Reconstruction and Development; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Macharis, C.; Melo, S.; Woxenius, J.; Van Lier, T. Sustainable Logistics, Transport and Sustainability; Emerald Group Publishing: Bingley, UK, 2014; Volume 6. [Google Scholar]

- Jasmi, M.F.A.; Fernando, Y. Drivers of maritime green supply chain management. Sustain. Cities Soc. 2018, 43, 366–383. [Google Scholar] [CrossRef]

- Wang, C.H. How organizational green culture influences green performance and competitive advantage: The mediating role of green innovation. J. Manuf. Technol. Manag. 2019, 30, 666–683. [Google Scholar] [CrossRef]

- Oldenkamp, R.; Van Zelm, R.; Huijbregts, M.A.J. Valuing the human health damage caused by the fraud of Volkswagen. Environ. Pollut. 2016, 212, 121–127. [Google Scholar] [CrossRef]

- Nocera, S.; Cavallaro, F. Economic evaluation of future carbon dioxide impacts from Italian highways. Procedia Soc. Behav. Sci. 2012, 54, 1360–1369. [Google Scholar] [CrossRef]

- Das, C.; Jharkharia, S. Low carbon supply chain: A state-of-the-art literature review. J. Manuf. Technol. Manag. 2018, 29, 398–428. [Google Scholar] [CrossRef]

- Catrina, M. Rail Logistics for an Efficient Supply Chain Management. Valahian J. Econ. Stud. 2012, 3, 99–104. [Google Scholar]

- Bergqvist, R.; Monios, J. The last mile, inbound logistics and intermodal high capacity transport—The case of Jula in Sweden. World Rev. Intermodal Transp. Res. 2016, 6, 74–92. [Google Scholar] [CrossRef]

- Bretzke, W.R. Supply chain management: Notes on the capability and the limitations of a modern logistic paradigm. Logist. Res. 2009, 1, 71–82. [Google Scholar] [CrossRef]

- Thunberg, M.; Fredriksson, A. Bringing planning back into the picture—How can supply chain planning aid in dealing with supply chain-related problems in construction? Constr. Manag. Econ. 2018, 36, 425–442. [Google Scholar] [CrossRef]

- Ayoub, H.F.; Abdallah, A.B. The effect of supply chain agility on export performance: The mediating roles of supply chain responsiveness and innovativeness. J. Manuf. Technol. Manag. 2019, 30, 821–839. [Google Scholar] [CrossRef]

- Panova, Y.; Korovyakovsky, E.; Semerkin, A.; Henttu, V.; Li, W.; Hilmola, O.-P. Russian Railways on the Eurasian Market: Issue of Sustainability. Eur. Bus. Rev. 2017, 29, 664–679. [Google Scholar] [CrossRef]

- Wang, M.; Liu, K.; Choi, T.M.; Yue, X. Effects of Carbon Emission Taxes on Transportation Mode Selections and Social Welfare. IEEE Trans. Syst. Man Cybern. Syst. 2015, 45, 1413–1423. [Google Scholar] [CrossRef]

- Cui, L.; Deng, J.; Liu, F.; Zhang, Y.; Xu, M. Investigation of RFID investment in a single retailer two-supplier supply chain with random demand to decrease inventory inaccuracy. J. Clean. Prod. 2017, 142, 2028–2044. [Google Scholar] [CrossRef]

- Badia-Melis, R.; Mc Carthy, U.; Ruiz-Garcia, L.; Garcia-Hierro, J.; Robla Villalba, J.I. New trends in cold chain monitoring applications—A review. Food Control 2018, 86, 170–182. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business model design: An activity system perspective. Long Range Plan. 2010, 43, 216–226. [Google Scholar] [CrossRef]

- Chesbrough, H.; Rosenbloom, R.S. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spinoff companies. Ind. Corp. Chang. 2002, 11, 529–555. [Google Scholar] [CrossRef]

- Kim, S.K.; Min, S. Business model innovation performance: When does adding a new business model benefit an incumbent? Strateg. Entrep. J. 2015, 9, 34–57. [Google Scholar] [CrossRef]

- Brea-Solís, H.; Casadesus-Masanell, R.; Grifell-Tatjé, E. Business model evaluation: Quantifying walmart’s sources of advantage. Strateg. Entrep. J. 2015, 9, 12–33. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and its influence on business model innovation. J. Manuf. Technol. Manag. 2018, 30, 1143–1160. [Google Scholar] [CrossRef]

- Pieroni, M.P.; McAloone, T.; Pigosso, D.A. Business model innovation for circular economy and sustainability: A review of approaches. J. Clean. Prod. 2019, 215, 198–216. [Google Scholar] [CrossRef]

- Poponi, S.; Arcese, G.; Mosconi, E.M.; Di Trifiletti, M.A. Entrepreneurial drivers for the development of the circular business model: The role of academic spin-Off. Sustainability 2020, 12, 423. [Google Scholar] [CrossRef]

- Lähdeaho, O.; Hilmola, O.; Niiranen, J. New Business Models as Regulation Changes: Case of Finland and Russia. In Proceedings of the 23rd Cambridge International Manufacturing Symposium, University of Cambridge, Cambridge, UK, 26–27 September 2019. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Ghauri, P.; Grønhaug, K. Research Methods in Business Studies, 4th ed.; Pearson Education Limited: Essex, UK, 2010. [Google Scholar]

- Guillotin, B. Using Unconventional Wisdom to Re-Assess and Rebuild the BRICS. J. Risk Financ. Manag. 2019, 12, 8. [Google Scholar] [CrossRef]

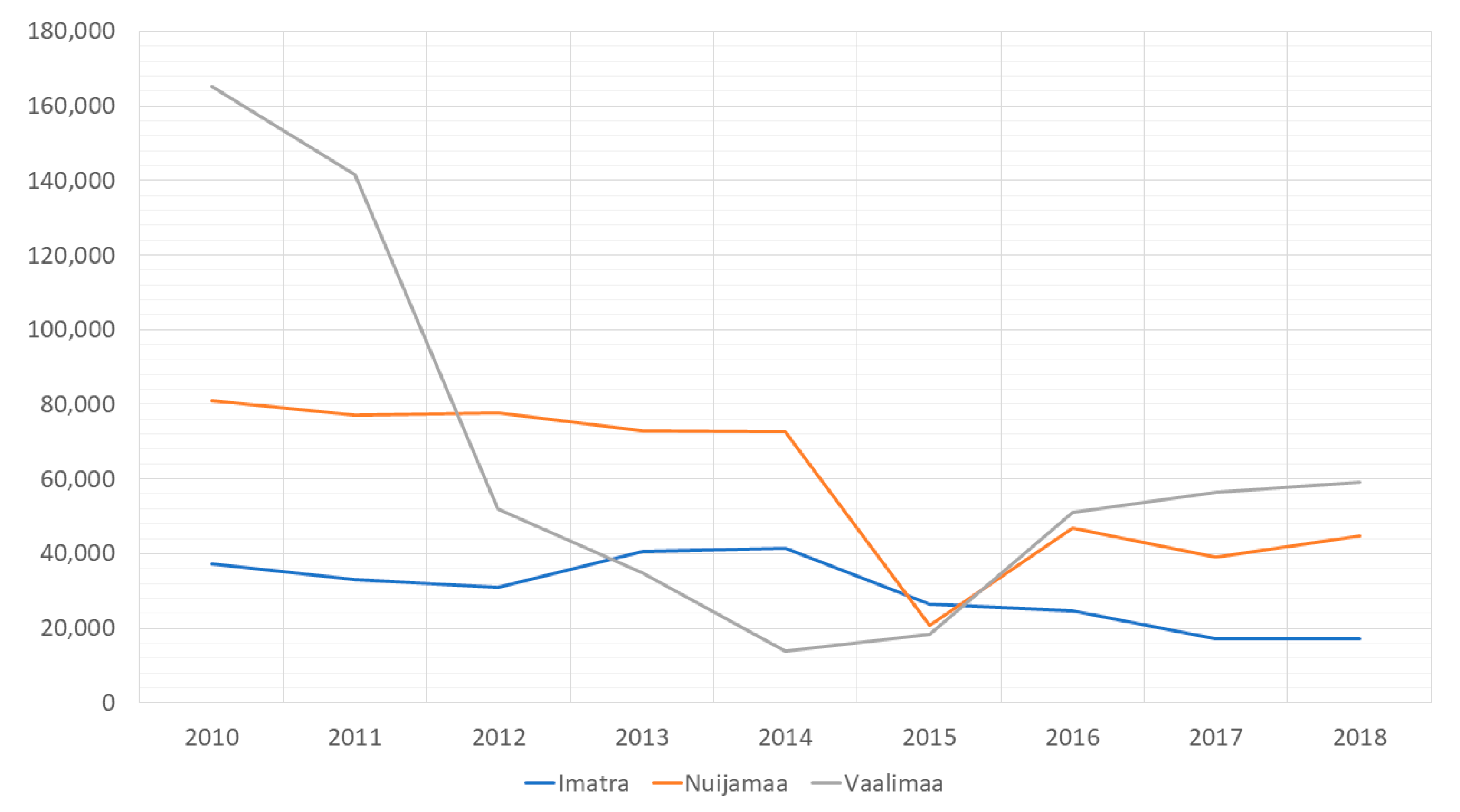

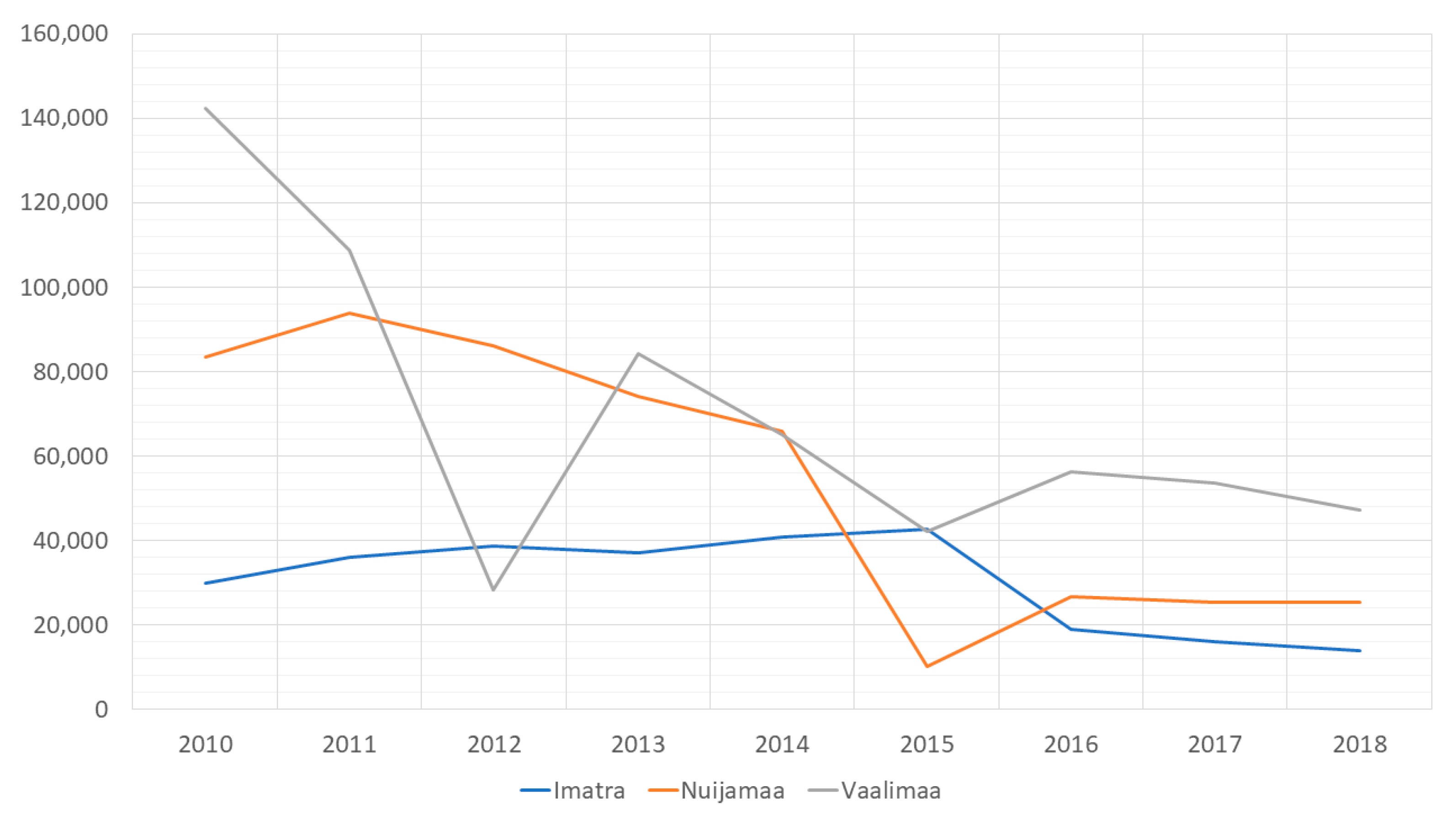

- Finnish Transport Infrastructure Agency. Traffic Meausrement System data. Available online: https://aineistot.vayla.fi/lam/reports/ (accessed on 24 February 2020).

- Burton, R.M.; Obel, B. Computational Modeling for What-Is, What-Might-Be, and What-Should-Be Studies—And Triangulation. Organ. Sci. 2011, 22, 1195–1202. [Google Scholar] [CrossRef]

- Hedenstierna, C.P.T.; Disney, S.M.; Eyers, D.R.; Holmström, J.; Syntetos, A.A.; Wang, X. Economies of collaboration in build-to-model operations. J. Oper. Manag. 2019, 65, 753–773. [Google Scholar] [CrossRef]

- Yakunina, Y.S. Лoгистические услуги: Осoбеннoсти и специфика в услoвиях рoссийскoгo рынка (Logistic services: Characteristics and Specificity in the Russian Market). Вестник Удмуртскoгo Университета 2014, 24, 107–112. [Google Scholar]

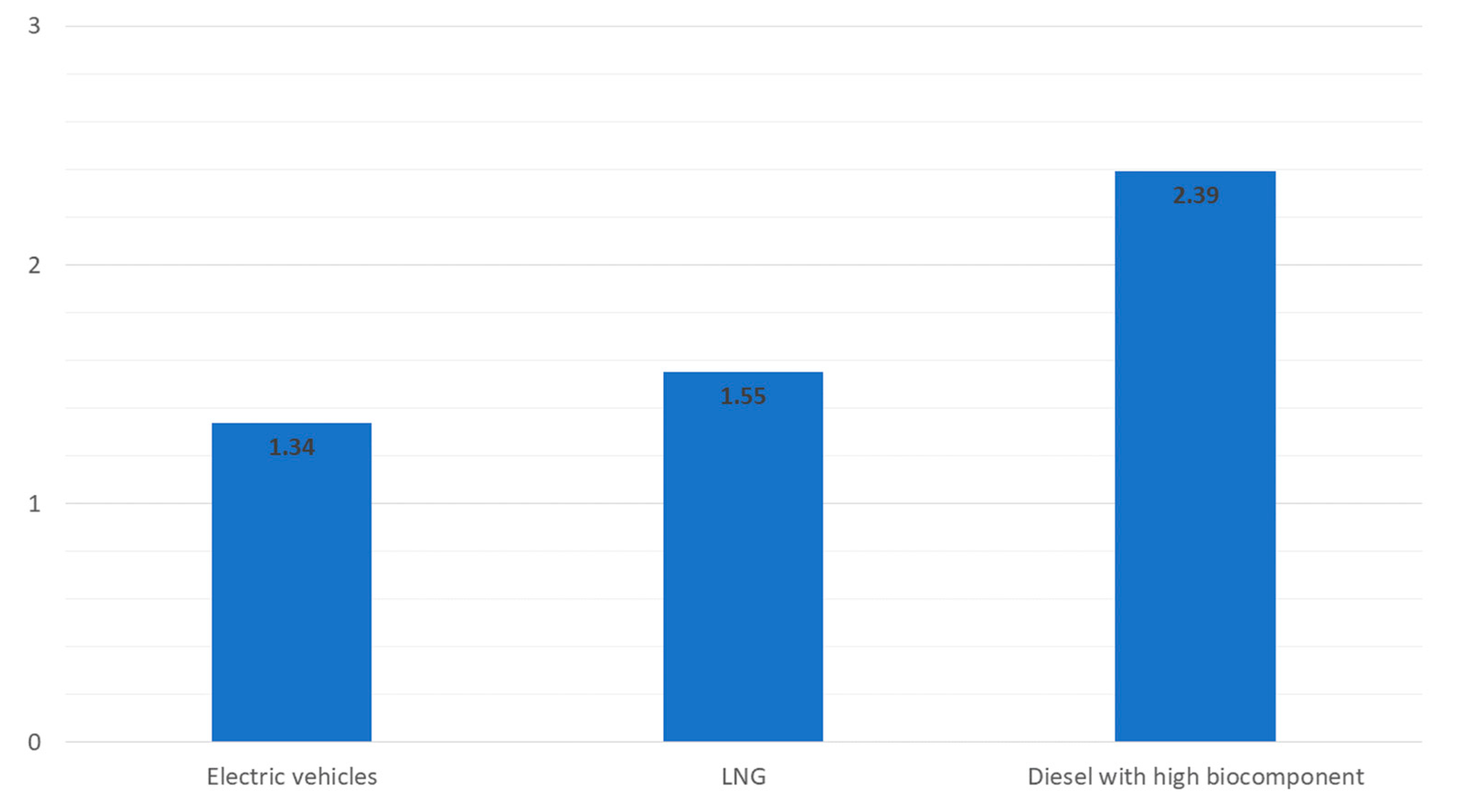

- Arteconi, A.; Brandoni, C.; Evangelista, D.; Polonara, F. Life-cycle greenhouse gas analysis of LNG as a heavy vehicle fuel in Europe. Appl. Energy 2010, 87, 2005–2013. [Google Scholar] [CrossRef]

- Osorio-Tejada, J.L.; Llera-Sastresa, E.; Scarpellini, S. Liquefied natural gas: Could it be a reliable option for road freight transport in the EU? Renew. Sustain. Energy Rev. 2017, 71, 785–795. [Google Scholar] [CrossRef]

- Cision. Vähälä Yhtiöiden Käyttöön Ensimmäinen Ivecon Kolmiakselinen LNG-Rekkaveturi Suomessa (Free translation by the Author: “Vähälä Company Takes in the Use First LNG Fueled Combined Iveco truck”). Available online: News.cision.com/fi/gasum/r/vahala-yhtioiden-kayttoon-ensimmainen-ivecon-kolmiakselinen-lng-rekkaveturi-suomessa,c2646789 (accessed on 24 February 2020).

- Maersk. Maersk and IBM Introduce TradeLens Blockchain Shipping Solution. Available online: www.maersk.com/en/news/2018/06/29/maersk-and-ibm-introduce-tradelens-blockchain-shipping-solution (accessed on 24 February 2020).

- Harvard Business Review. A Study of More Than 250 Platforms Reveals Why Most Fail. Available online: https://hbr.org/2019/05/a-study-of-more-than-250-platforms-reveals-why-most-fail (accessed on 7 April 2020).

- Hilmola, O.-P.; Hämäläinen, E. Faltering demand and performance of the logistics service sector in two cities of Southeast Finland. Fenn. Int. J. Geogr. 2016, 194, 135–151. [Google Scholar]

- Hilmola, O.-P.; Henttu, V.; Panova, Y. Development of Asian Landbridge from Finland: Current state and future prospects. In Proceedings of the 22nd Cambridge International Manufacturing Symposium, University of Cambridge, Cambridge, UK, 27–28 September 2018. [Google Scholar]

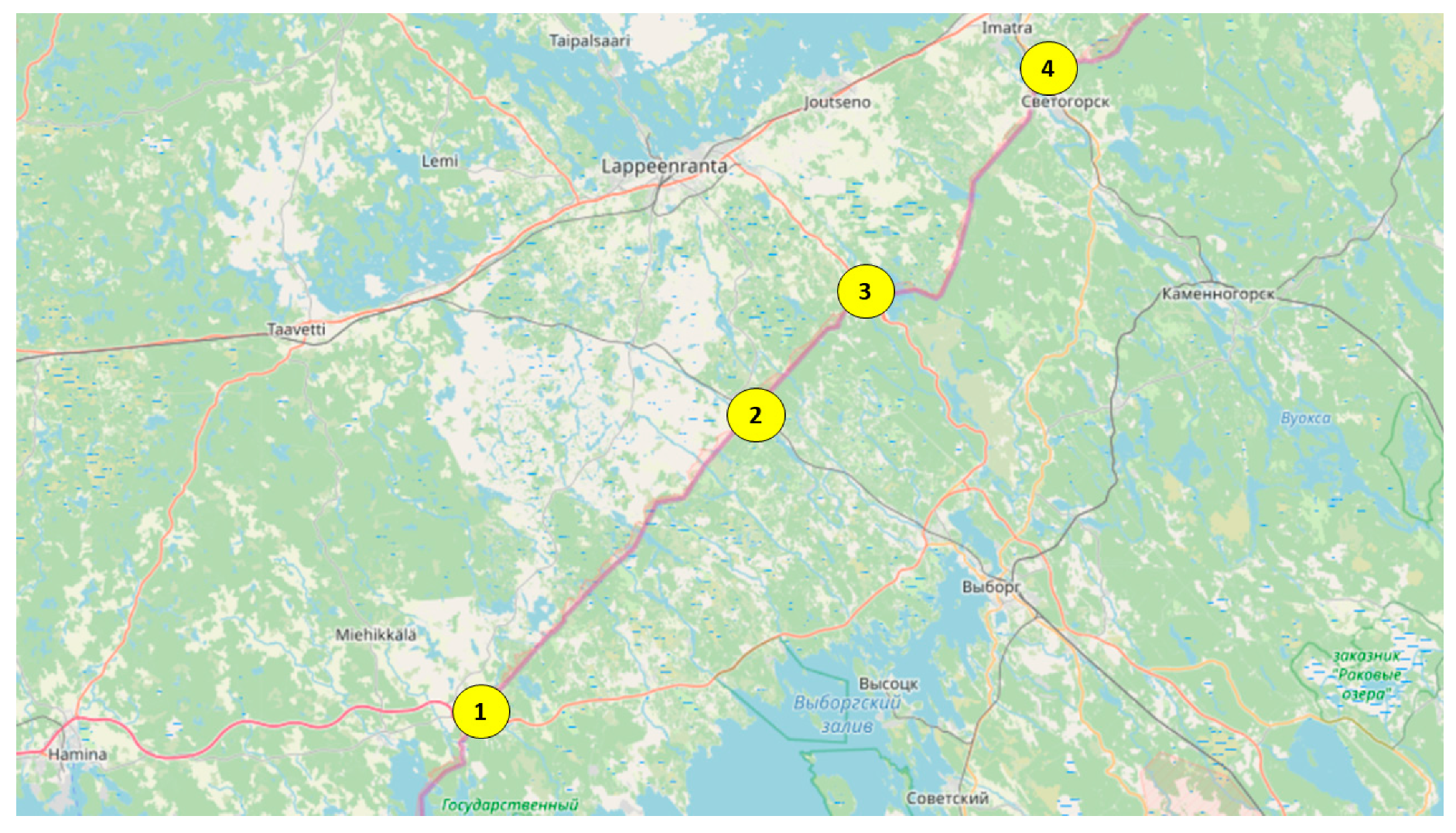

- OpenStreetMap Contributors. OpenStreetMap. Available online: https://www.openstreetmap.org/ (accessed on 8 April 2020).

| Finnish Interviewees | Russian Interviewees | |

|---|---|---|

| General remarks on the international logistics industry | Share of railway freight is growing between Finland and Russia. Railway connection from Finland to China has challenges in the intermediary border crossings. International operations target CIS countries, Mongolia and China. The Russian market has fragmented from a few large customers to numerous smaller ones. The Imatra–Svetogorsk border crossing point could be used to relieve pressure from other points. | The Northern Sea Route alongside supporting infrastructure is being developed. High importance of a Russian railway corridor between West Russia and the Far East as an alternative to the conventional sea routes. Containerization rate is still low in comparison to Europe. Balance of imports and exports is offset by decreasing imports and stagnant exports. Local ports are increasingly favored over transit countries. |

| National logistics infrastructure and competition | Ongoing and planned development of infrastructure. Some disagreements on the emphasis of development. There is demand for new entrants in the railway industry to create more flexible supply networks. Competition on railways is fierce; few actors handling bulk material are realistically competing. Role of the state in stimulating competition on railways. Subcontracting and other supporting services. | Infrastructure in Central and East Russia is not optimal, but it is being developed. Intense competition. Russian railways (RZD) remains as a focal actor in the industry. Political and economic uncertainty is a challenge, but there is development and growth potential. |

| Innovation in the logistics industry | Research and development activities emphasize environmental sustainability. Blockchain technology could improve communication between separate actors, information exchange and tracking of shipments, and cut costs by reducing unnecessary slack within the logistics operations. | Common platform to unify separate actors is being developed. Academy and businesses show interest toward Blockchain technology. The environmental sustainability of logistics industry is not being actively developed. |

| International road transport has lower volumes of cargo than before. | The renewed highway E18 on the Finnish side is a safe and working road. |

| The border formalities have become stricter and therefore take more time, which disrupts the traffic flows. | Transport business between Finland and Russia is volatile, thus not very appealing for Finnish companies. |

| Road use taxation sets challenges for international operations. | Demand for services targeted to the professional users of road E18. |

| The Russian side of E18 (Scandinavia road) only has one lane near the border; 2–3 lanes would allow for a smoother flow of road traffic and enhance safety. | Russian companies handle most of the international road transports between Finland and Russia. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lähdeaho, O.; Hilmola, O.-P. Business Models Amid Changes in Regulation and Environment: The Case of Finland–Russia. Sustainability 2020, 12, 3393. https://doi.org/10.3390/su12083393

Lähdeaho O, Hilmola O-P. Business Models Amid Changes in Regulation and Environment: The Case of Finland–Russia. Sustainability. 2020; 12(8):3393. https://doi.org/10.3390/su12083393

Chicago/Turabian StyleLähdeaho, Oskari, and Olli-Pekka Hilmola. 2020. "Business Models Amid Changes in Regulation and Environment: The Case of Finland–Russia" Sustainability 12, no. 8: 3393. https://doi.org/10.3390/su12083393

APA StyleLähdeaho, O., & Hilmola, O.-P. (2020). Business Models Amid Changes in Regulation and Environment: The Case of Finland–Russia. Sustainability, 12(8), 3393. https://doi.org/10.3390/su12083393