Abstract

This study examines the announcement effects of convertible and warrant bond issues with embedded refixing option in Korea from January 2001 to December 2018. Refixing option denotes an adjustment right of the conversion price embedded in equity-linked debt when the underlying stock price falls under conversion price. I find statistically significant declines of 2.6 to 2.7 percentage points in cumulative abnormal returns for the inclusion of a refixing clause and especially further declines of 6.2 to 6.3 percentage points during the period from 2016 to 2018. This result implies that the market’s concerns about the dilution of existing shareholder value due to the exercise of the refixing rights are reflected in the market response. I further find that the degree of negative market response varies according to the changes in macroeconomic conditions and the stock exchange on which the issuing firms are listed. The findings are robust after controlling for the effect of firm-, issue-, and market-specific characteristics.

1. Introduction

Recently, the issuances of equity-linked debt have shown explosive growth in Korea. The issuance of equity-linked debt, which hit a low of 1.7 trillion won in 2014, more than tripled over the next 4 years, reaching about 5.5 trillion won in 2018 (see endnote 1 in Appendix B). Behind this growth lies the inherent nature of equity-linked debt. Equity-linked debt such as convertible bond (hereafter referred to as CB) and bond with warrant (hereafter referred to as BW) are considered as hybrid securities that form an intermediate class of securities between equity and debt [1]. This distinctive characteristic of equity-linked debt provides several benefits to issuers. First, the conversion rights embedded in equity-linked debt securities allow the issuer to offer investors a lower yield than a nonconvertible corporate bond, implying that the issuer can raise capital at relatively lower financing costs [2]. Second, if the common share price rises above the conversion price and the conversion rights are exercised, then the issuers can expect their debt ratio to decrease as the debt becomes capitalized [3] (see endnote 2 in Appendix B).

Firms with low creditworthiness, but high growth potential, may maximize their profit using these characteristics. In the early stage of business cycle, the issuer pays a lower coupon to its investors. After the firm generates profits from the business and the share price rises accordingly, investors may exercise their conversion rights to obtain the difference between the share price and the conversion price or receive a stream of dividend income thereafter. In this regard, equity-linked debt provides the advantage of distributing the risk of cash outflows over time compared to the case of the issuance of general corporate bonds where relatively high interests should be paid to the investors from the beginning of the business cycle, or the case of a paid-in capital increase where issuers have a burden of paying dividends even before the profit is generated. Therefore, equity-linked debt is used as a channel for raising capital for small businesses [4]. From an investor’s perspective, they also have the advantage of being a tool to mitigate agency conflicts between shareholders and creditors caused by information asymmetry. In general, shareholders with limited liability to the firm are likely to be motivated to maximize their value by allocating resources in investments with relatively high risk, but high expected returns. Accordingly, creditors who invest in general corporate bonds issued by the company may be threatened by such actions. In contrast, equity-linked debt with embedded conversion features can help protect investors’ rights by aligning the direction of future cash flows with those of the shareholders [5,6,7,8,9].

In addition to the inherent characteristics of equity-linked debt, the recent macroeconomic market conditions and policies of financial authorities in Korea also contributed to the rapid growth of the equity-linked debt market. First of all, the environment of the financial market, where expected returns have been declining such as the recent low interest rate trend or the stock market that has not shown a clear direction, have led to large investment in this market. The authorities’ policy to promote the growth of the venture companies and SMEs has also had a significant influence on the expansion of the base of equity-linked debt investors. In particular, the KOSDAQ Venture Funds, which was launched in 2018, have contributed to the inflow of funds into the equity-linked debt market as it was required to invest more than 50% of the total fund in stocks or equity-linked debt of venture companies and KOSDAQ-listed firms.

While the equity-linked market clearly serves as a much-needed source of funds for small and financially distressed companies, it is also true that there are concerns in the market about the rapid growth. Basically, since the exercise of the conversion rights in CBs or BWs occurs when the stock price is higher than the conversion price, it is inevitably accompanied by a transfer of the existing shareholders’ wealth to those exercising their conversion rights [10,11,12]. Numerous previous literature analyzes the announcement effects of CB and BW offerings and mostly report negative market responses. Dann and Mikkelson [13] analyze 132 CBs issued by 124 firms in US market and show that significant negative cumulative return after the issuance announcement. Following literatures [2,14,15,16,17,18,19,20,21,22,23,24] also report similar negative announcement effect of CB offerings. Ammann et al. [25] find evidence that the announcement effects of CBs and EBs (exchangeable bonds) are negative and significant in Germany and Switzerland. Duca et al. [26] show that the negative announcement effects of CBs are more than twice in the period from 2000 to 2008 than in the period from 1984 to 1999. For BW, Long and Sefcik [2] and Phelps et al. [21] report significant negative market reactions to issuance announcement. On the other hand, relatively few but some opposite results are reported. Kang and Stulz [27] find significant positive announcement effect of CB and BW offerings in Japan, and Abhyankar and Dunning [28] and Kim and Han [29] show positive market responses to CB issuance announcements for the purpose of capital expenditure in UK and Korea, respectively. Billingsley et al. [30], Jayaraman et al. [31], and Roon and Veld [32] also report positive or insignificant announcement effect of BW offerings.

Another concern of market participants is that a provision, specifically refixing option, generally embedded in many recently issued equity-linked debts potentially makes the dilution of existing shareholders’ wealth worse. The refixing option embedded in equity-linked debt allows for the adjustment of the conversion price in line with a fall in stock prices. Consequently, investors can make profits even if the stock price of issuing firm falls under the conversion price at the time of issuance. On the other hand, existing shareholders face situations where not only the stock price declines but the dilution of the stock value increases due to the exercise of the conversion rights. In particular, while Article 5-23 of Regulations on Issuance, Public Disclosure, etc. of Securities stipulates that the conversion price after adjustment for a decline in price shall not be less than 70% of the conversion price at the time of issuance, at the same time, Article 5-23 also specifies that the conversion value can be adjusted less than 70% if articles of incorporation stipulate that matters concerning the adjustment of conversion price shall be determined by a special resolution at the general meeting of stockholders, and if the general meeting of stockholders determines the minimum adjusted price and the amount of bonds specifically. This implies that the conversion price can be easily adjusted to the par value of stock according to the will of majority shareholders. Actually, the downward adjustments of conversion price to less than 70% of initial conversion price have been observed in many recent cases. While only 16% of the total issuances are allowed to adjust the conversion price less than 70% among the equity-linked debt issued from 2000 to 2016, this proportion increases to about 33% from 2017 to 2018.

Regarding the discussion above, an interesting pattern is found in the recent expansion of equity-linked debt market in Korea. That is, BWs had been mainly issued until 2013, and after that, it is completely converted to a CB-centric issuance market. The reason for this change can be found in the ban on issuance of detachable BW in 2013 (see endnote 3 in Appendix B). The detachable BW (or bond with detachable warrant) refers to equity-linked debt that can be sold separately from the bond for the right to buy the underlying asset. The majority shareholders or the related third party may buy back the warrants separately from investors and want to exercise them to enhance their control rights. Kim et al. [33] also find the evidence that are less consistent with the last resort financing hypothesis, but rather consistent with the control enhancing hypothesis in Korea. The Korean financial authorities, therefore, banned the issuance of detachable BW because the right and interest of existing shareholders could be infringed if the major shareholder set the exercise price low and then purchase the detachable warrant to increase their stake. However, since CB with call provision can replicate the functionality of detachable BW, investors recognized BW and CB as practically the same instruments and replaced BW with CB after 2013. The call provision embedded in CB means the right of an issuer or a third party designated by the issuer to buy back the security issued within the contracted amount from the investors.

While this unique characteristic provides meaningful implication to raise capital of firms, only a few researches have been reported because equity-linked debts with embedded the refixing option are almost issued only in Korea and Japan [34]. In the U.S. market, “death spiral convertible bonds” or “floating-priced convertible bonds” are somewhat similar to the CBs with the embedded refixing option. However, they are different in terms of the adjustment mechanics that it is automatically adjusted according to the conversion rate predefined in the prospectus. In addition, only 326 of floating-priced convertible bond from 30 firms are issued in the U.S. market from 2010 to 2016, which is smaller than the number issued in the Korean market in 2016 [35].

Related literatures argue that the refixing option is a provision that gives an advantage to investors. Yoon [34] raises the issue of the system of privately placed detachable BWs and reports that the largest shareholder can obtain an average annual return of 460% by using the refixing option. Byun and Park [36] show that the announcement effect of CB offerings containing the refixing option is reported to be a greater negative than the refixing option is not included. Yoon [34] analyzes privately placed detachable BWs where the affiliated persons, including the largest shareholder, repurchase warrants and shows that the announcement effect is negatively significant and the affiliated persons can obtain additional return of 674% by using the refixing options. Based on these findings, Yoon [37] suggests to reduce the advantage of the refixing option or apply the differentiated refixing range of the exercise price.

Accordingly, this study analyzes the announcement effect of equity-linked debt with the embedded refixing option. To do this, the cumulative abnormal returns are calculated around the issuance disclosure of all CBs and BWs recorded in the Financial Supervisory Service (FSS) Disclosure System from January 2001 to December 2018 as market responses. Then, the effect of the inclusion of a refixing clause on the market responses are examined with the firm-, issue-, and market-specific control variables.

The main findings of this study are as follows. First, the stock market investors lower the value of firms issuing equity-linked debt with the refixing option by 2.6 to 2.7 percentage points in terms of the cumulative abnormal return over the period (−1, +1) around the announcement, compared to those without the refixing option. This result indicates that market concern about the dilution of existing shareholder value due to the downward adjustment of conversion price resulting from the stock price decline are effectively reflected in the valuation. I further find that the negative market response on the inclusion of the refixing clause strengthens in the recent period (2016–2018), with 6.2 to 6.3 percentage point discounts on the value of such firms. Second, the effect of refixing option occurs intensively when the macroeconomic environment deteriorates. I find that the negative market responses to the refixing option are only significant when the indexes of macroeconomic conditions worsen or the negative effects are reduced under the speculative period. Third, while the type of equity-linked debt issued does not affect the market response to the refixing option, the negative effect differs depending on the stock exchange to which the issuer belongs. The market responses to the firms listed on the KOSDAQ market are lower by 1.3 percentage points than those of KOSPI-listed firms.

This paper offers several contributions to the literature that differ from those of previous studies. Yoon [34,37] examines the market response to the refixing option and warrant-repurchase by the largest shareholder and affiliated persons, but limits the study to bonds with warrants, and analyzes data prior to August 2013, that is, before the detachable BWs were banned. Byun and Park [36] also analyze the announcement effect of CB offerings with the refixing option, but not those of BW offerings and covers CB announcements until 2015, a period before the rapid increase in CBs issuance. In addition, the mentioned studies have a limitation in that they show the negative market reaction to the inclusion of the refixing option through univariate analysis. On the other hand, this study comprehensively examines the effects of inclusion of the refixing clause in BW and CB offerings during the period from 2001 to 2018 with particular emphasis on the recent period from 2016 to 2018, when the amounts of issuance increased rapidly using multivariate analysis. In particular, since CBs have replaced BWs due to the change in the regulation and these two products has been recognized by investors as instruments of practically same function, it is deemed essential to examine them in an integrated manner to analyze the equity-linked debt market in Korea.

2. Hypothesis Development and Research Methodology

2.1. Hypothesis Development

As previously discussed, firms that are in financial distress or small companies that have difficulties raising funds may secure much needed funds through equity-linked debt despite the dilution of shareholders’ wealth. However, the refixing option may make the existing shareholders suffer from not only the dilution of shareholders’ value but also the decline of stock price by lowering the conversion price when the stock price of issuing firm falls. Investors, on the other hand, can make a profit from this structure. Therefore, if these market concerns about the refixing option are valid, then it can be expected that the market will react negatively to the inclusion of the refixing clause. Based on the discussion of the influence of the refixing option on the shareholders’ wealth dilution, I set the main hypothesis as follows:

Hypothesis 1:

The announcement effects of CBs and BWs with the embedded refixing option are negative.

In addition, several recent studies mention that behavior of investors under different macroeconomic conditions may affect the announcement effect. Mian and Sankaraguruswamy [38] examine the impact of investors’ behavioral biases and show that stock price sensitivity to good (bad) earning news is higher during periods of high (low) sentiment. Shin et al. [39] also find the evidence that positive (negative) post-earning announcement drift occurs when the market sentiment continues to shift upward (downward). While these studies focus on the impact of investors’ behavior on the market responses to the earning announcement, I predict that the investors’ biases on incorporating information about the announcement of CBs and BWs to firm valuation would be also related to the market response. I therefore set the second hypothesis as follow:

Hypothesis 2:

The negative market responses to the inclusion of the refixing clause in CBs and BWs are worsened when the macroeconomic condition deteriorates.

2.2. Data

I obtain announcement data of CB and BW offerings between January 2001 to December 2018 from the Financial Supervisory Service (FSS) Disclosure System of Korea. To be included in the final data set, the samples are required to meet following criteria: (1) the issuance firm belongs to KOSPI or KOSDAQ market at the time of initial issuance announcement, (2) daily return series of issuance company are available from 60 days before the announcement date (−60) and 30 days after the announcement date (+30), (3) firm-specific accounting data and issue-specific security data corresponding to the announcement date is available, (4) no other events such as earnings announcements or mergers and acquisitions occur from −4 to +4 days surrounding announcement date. All firm-specific accounting data is measured at the fiscal year-end preceding the equity-linked debt announcement date. Consequently, samples of 4357 announcements are selected that consists of 2802 CBs and 1555 BWs from 1195 firms. Announcements by the same firm on the same date are consolidated. The number of announcements with the refixing option are 4006, accounting for 91.9% of the total. Table 1 shows the number of announcements with/without the refixing option on an annual basis.

Table 1.

Number of convertible bonds (CBs) and bonds with warrants (BWs) issuances by year.

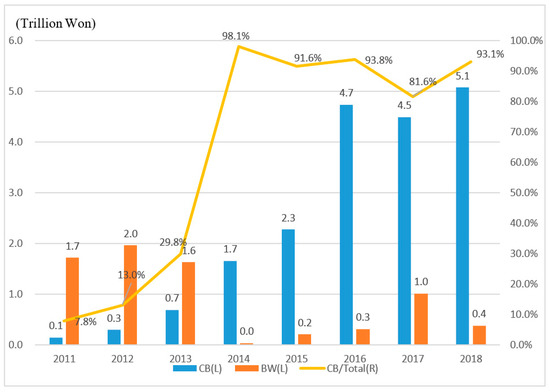

Figure 1 shows the aggregate amount of CBs and BWs announced in the initial disclosure by year. Before the issuance of the detachable BW were banned, the amount of BW accounts for about 82% of the total. However, the majority player of the equity-linked debt market has been changed to CB since 2014 and the issuance amount in 2016 recorded 4.7 trillion won, more than doubled from the previous year. From 2016 to 2018, the aggregate amount of CB totaled 14.3 trillion won, which is account for about 90% of the total amount.

Figure 1.

Amount of CBs and BWs issued by year.

2.3. Research Design and Variable Descriptions

In this study, I analyze the announcement effect of equity-linked debt with the refixing option. First, abnormal returns of individual firms are estimated using market model following Dutordoir et al. [1] and Li et al. [40].

where denotes daily return for firm i on day t and is the market portfolio return on day t. is the estimated abnormal return for firm i on day t. and are the estimated constant and beta coefficient over trading days −60 to −31 prior to the announcement date by regressing daily return of firm i on market return. Using and , daily abnormal return over trading days −30 to +30 is obtained based on Equation (1). Then, cumulative abnormal returns (CARs) are calculated based on Equation (2).

I construct the cumulative abnormal return over trading days −1 to +1 surrounding announcement dates and apply it as a main dependent variable, which represents market response to announcement. Considering the potential influence of information leakage, I set the start date of the cumulative abnormal return one day prior to announcement date. To explore the effect of the refixing option on the cumulative abnormal returns, the dummy variable (Refix) that equals to 1 if the refixing option is embedded in CBs or BWs issued and 0 otherwise is included. A conventional event study is then implemented based on Equation (3) as follows:

Following Dutordoir et al. [1], Li et al. [40], Kwak [3], and Kim [4], I control for the firm-, issue-, and market-specific characteristics. Appendix A provides the classification and the detailed definition of the variables used in this study. For the firm-specific control variables, four accounting variables such as Ln_asset, Lev, Perf, BTM and three stock return related variables such as Stock_run-up, Stock_vol, and CW are included. Ln_asset is the natural logarithm of total assets. Li et al. [40] mention that the relation between firm size and abnormal return can be positive or negative. Since larger firms have a lower level of information asymmetry with greater number of analysts, investors may discount less for relatively big-sized firms that causes the positive relation between firm size and abnormal returns [1,28]. On the other hand, smaller firms can benefit more from the issuance of CBs or BWs because they face higher equity-related financing costs and the issuance of securities follows a substantial increase in stock price [20]. In this rationale, I expect a negative relation between firm size and abnormal returns. Lev denotes debt ratio defined as the ratio of total debt to total assets. Stein [41] argues that firms issue CBs to increase the equity to debt ratio indirectly in order to reduce the adverse selection cost that firms should bear when they issue pure equity. Therefore, firms with higher debt ratio may benefit more [40] and I expect a positive impact of debt ratio on abnormal returns.

Perf is the operating cash flow divided by total assets as a proxy of firm performance. Jung et al. [42] argue that the issuance of securities could further amplify the agency costs between shareholders and manager by expanding the discretion of managers on corporate resources, resulting in a fall in stock prices. Consequently, stock market investors are likely to consider the agency cost of managerial discretion to be higher when a firm attempts to raise additional external capital despite its better realized performance. In this regard, abnormal returns are expected to be negatively affected by firm performance. BTM, book-to-market ratio, is included as a proxy for the inverse of growth opportunity and profitability of future investment decision. The expectation of the relation between book-to-market ratio and abnormal returns is unclear. While De Jong and Veld [43] mention that market expectation of the profitability reduce the asset substitution and adverse selection problem, Lewis et al. [20] suggest that firms with high growth opportunities are likely to face significant asymmetric information problems.

Stock_run-up is the cumulative stock return over trading days between −60 and −4 relative to the announcement date. Dutordoir and Van de Gucht [44] mention that the investors are likely to consider a firm with high stock run-up as an overvalued stock. Lewis et al. [20] and Krasker [45] argue that equity-related financing costs are higher for firms with higher stock run-up. Therefore, Stock_run-up is expected to be negatively related to abnormal returns. Stock_vol is the stock return volatility calculated from daily return over trading days between −60 and −4. Since the stock return volatility captures asset substitution costs [46] and risk uncertainty [47], it is expected to be negatively related to abnormal returns. CW denotes the effective bid-ask spread of individual stock measured following the procedure suggested by Corwin and Schultz [48]. Huang et al. [49] argue that an improved trading liquidity raise stock price due to the decease in a firm’s cost of capital. Consequently, I expect a negative relation between the effective bid-ask spread and market response.

For issue-specific control variables, Ln_maturity, CV_prm, GRT, and CP_prm are included. Ln_maturity is the natural logarithm of the days between the announcement date and the date on which the security issued is allowed to be converted to the shares of common stock. As previous literature [50,51] mention that firms with better expected stock price performance have incentive to issue convertible bonds with longer maturity to delay the conversion, I expect a positive relation between maturity and abnormal returns. CV_prm denotes the conversion premium calculated by dividing the conversion price by the stock price on 5 days prior to the announcement date following [40]. A high conversion premium means a lower conversion probability. Since the market response on announcement would be relatively positive as the expected value of embedded common stock decreases [11], conversion premium is expected to be positively related to market response.

GRT is a dummy variable that equals to 1 if the security issued is guaranteed and 0 otherwise. Myers and Majluf [11] also argue that the higher the risk of securities issued, the greater the negative impact on the market response. Since creditworthy firms, or less risky firms, are more likely to prefer financing through the issuance of non-guaranteed securities over the guaranteed securities that incur excessive guarantee fees, I therefore expect a negative coefficient on GRT [3,4]. CP_Prm is the coupon premium defined as the difference between coupon rate and the risk-free rate, 3-year maturity government bond yield. Consequently, a higher coupon premium implies a higher issuing cost. I therefore expect a negative relation between coupon premium and abnormal returns.

For market-specific control variables, MKT_run-up and MKT_vol are included following Dutordoir et al. [1] and Li et al. [40]. MKT_run-up is the KOSPI index cumulative return over trading days between −60 and −4 relative to the announcement date, which controls for the overall market and macroeconomic condition. MKT_vol denotes the market return volatility, which captures the economy-wide level of debt-related financing costs and information asymmetry. MKT_vol is calculated from daily return on KOSPI index over trading days between −60 and −4.

Table 2 presents the summary statistics of the firm-, issue-, and market-specific variables used in the regression analysis, including the mean and the standard deviation of each variable as well as the 5th, 25th, 50th, 75th, and 95th percentile values. Table 2 shows that the mean value of Refix is 0.919, indicating that 91.9% of equity-linked debts issued include the refixing clause. I also find that the mean value of Stock_run-up (23.5%) is substantially higher than the median value (−1.9%). This result is likely to be driven by the overvalued stocks before the equity-linked debts issued as shown in the 95th percentile value (112.8%). The mean value of CV_prm implies that the issuers set the conversion price at 23.8% above the market price on average. I further notice that the average value of coupon rate is only 2 percentage points higher than the risk-free rate. Considering that the average credit spread calculated by the difference in yields between 3-year maturity corporate bond of BBB− and treasury bond is 5.76% from 2001 to 2018, equity-linked debt offers an alternative opportunity that reduce financing costs for small and risky firms. Table 3 shows correlation matrix of the independent variables.

Table 2.

Summary Statistics.

Table 3.

Correlation Matrix.

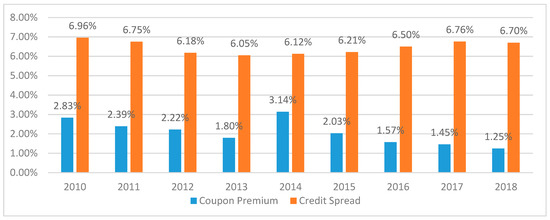

Figure 2 presents the annual trend of coupon premium and credit spread. Credit spreads do not show a marked decline, compared with a broadly reduced coupon premium of 2.83% in 2010 to 1.25% in 2018. These different trends imply that while the financing costs in the bond market has not changed, those in the equity-linked debt market has gradually decreased. This is possible because the conversion price is adjusted when the stock price falls according to the exercise of refixing option so that the profit of investors can be protected from lowered coupon rates. The trend shown in Figure 2 also explains why the proportion of equity-linked debt with the refixing option remains high above 90%.

Figure 2.

Annual trend of Coupon premium and Credit Spread.

3. Empirical Analyses Results

3.1. Refixing Option and Market Response

In this section, I implement regression analyses to explore the market response to the inclusion of the refixing option. If market concerns about the refixing option that causes the dilution of shareholder value are valid and reasonable, then I can expect that the market reacts negatively to the announcement of equity-linked debt issuance with embedded the refixing option.

Table 4 reports the regression results. Model (1) of Table 4 examines the effect of Refix after controlling for the effect of firm-specific characteristics such as accounting-related and stock-return-related variables. I additionally control for the issue-specific characteristics in Model (2) and issue-specific and market-specific characteristics in Model (3), respectively. First, the coefficients of Refix in Models (1)–(3) range from −0.026 to −0.027 and are all statistically significant at the 1% level. It means that the market lowered the valuation of the issuer by 2.6 to 2.7 percentage points when the equity-linked debt includes the refixing clause.

Table 4.

Market response to refixing option.

I further examine the effect of Refix in the recent period by adding a cross-interaction term, RefixDR and report the results in Models (4)–(6). DR is a dummy variable equals to 1 if the issuance of CBs or BWs announce from 2016 to 2018 and 0 otherwise. The coefficient of RefixDR is also significant at the 5% level and ranges between −0.044 to −0.046, implying that the market additionally lowers the issuer’s value by about 4.4 to 4.6 percentage points in the recent period. These results reflect the market’s concerns about the dilution of shareholder value caused by the exercise of the refixing option. Among the control variables, the coefficients of Ln_asset are negative and significant and those of BTM are positively significant at the 1% level for all the regression models, consistent with Lewis et al. [20]. As previously discussed, they suggest that smaller firms tend to benefit more from the issuance of equity-linked debts and firms with high growth opportunities are likely to face significant asymmetric information problems.

I additionally examine the effect of the refixing option in equity-linked debts on market response by splitting the cumulative abnormal returns and report the estimated results in Table 5. Model (1) and Model (2) report the market response over trading days −1 to 0 relative to the announcement date, CAR(−1,0), on the refixing option. Model (3) and Model (4) reports the market response over trading days 0 to +1, CAR(0,+1). I find interesting results that the inclusion of the refixing option in equity-linked debts affects more on CAR(0,+1) rather than CAR(−0,1). While the estimated coefficient of Refix on CAR(0,+1) is −0.012 and significant at the 5% level in Model (1) and Model (2), on the other hand, the coefficients of Refix on CAR(0,+1) estimated in Model (3) and Model (4) are both negative and significant at the 1% level and the absolute values are larger than those on CAR(−1,0). These results clearly indicate that the negative effect of Refix on market response is largely due to the market reaction after the announcement rather than the information leakage. The significances of the control variables such as Stock_run-up, Ln_maturity, and GRT also vary according to the interval of market response. The coefficients of Stock_run-up and GRT are significant only on CAR(−1,0), implying that investors lower the value of firms that are overvalued and issue guaranteed equity-linked debts using information leaked, respectively. On the other hand, Model (4) shows the effect of Ln_maturity is positively and significantly related only with CAR(0,+1) rather than CAR(−1,0). This result indicates that the market reacts to the number of days between the announcement date and the date on which the issue is allowed to be converted after its announcement.

Table 5.

Split market response to refixing option.

3.2. Market Response to Changes in the Macroeconomic Environment

This section examines whether the market response to the announcement of equity-linked debt issuance with the refixing option clause is affected by changes in the macroeconomic environment. It is measured based on the changes in the consumer composite sentiment index (CCSI) and the credit spread compared to the prior month (see endnote 4 in Appendix B). The credit spread is calculated by subtracting the 3-year maturity Korean government bond yield from the average 3-year maturity corporate bond yield of BBB−. The analysis results are shown in Table 6. First, when the level of consumer sentiment index increases compared to the prior month, the market does not show a statistically significant response to the refixing option (Model (1)). On the other hand, when the consumer sentiment index declined, that is, when the economic outlook deteriorates, the market discounts the stock value of issuer −3.8 percentage points for the refixing option (Model (2)). Similarly, while when the credit spread narrows, the market’s response to the clause is not significant, when the credit spread widens, indicating that the corporate funding environments worsen; the coefficient of the refixing option is −0.034 and significant at the 1% level (Model (3) and Model (4)). These results show that the market more sensitively and negatively reacts to the inclusion of the refixing option when macroeconomic conditions deteriorate (see endnote 5 in Appendix B).

Table 6.

Market response to changes in the macroeconomic environment.

3.3. Market Response According to Type of Equity-linked Debt and Stock Exchange

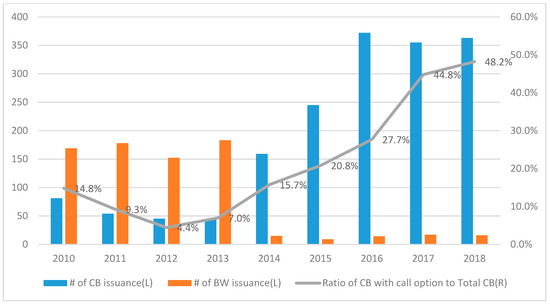

This section examines whether the type of equity-linked debt or the stock exchange affect the market response to the refixing option. First, I construct a dummy variable, CB, that equals to 1 if the type of equity-linked debt issued is a convertible bond and 0 if the type belong to a bond with warrant to explore whether the market response varies according to the type of equity-linked debt issued. Then, the regression analyses are implemented with the interaction term, RefixCB, and report the results in Model (1) and Model (2) of Table 7. While the coefficients of Refix are −0.029 and significant at the 1% level, the coefficients of RefixCB are not significant for both models, implying that the type of equity-linked debt issued has no effect on the market response to Refix. Since CB with call provision has a structure that is substantially similar to those of the detachable BW, investors are likely to regard the two equity-linked debts as the same financial instruments. Figure 3 shows the trend of replacing BWs with CBs after the issuance of detachable BWs were banned in August 2013. In this regard, I can conclude that the effect of Refix on the abnormal returns does not depend on the type of equity-linked debt.

Table 7.

Market response according to type of equity-linked debt and stock exchange.

Figure 3.

Trend of replacing BWs with CBs by year.

Second, I examine whether the effect of Refix on market response according to the stock exchange on which the issuer is listed. Similar to CB, I construct a dummy variable, KOSDAQ, that equals to 1 if issuer is listed on KOSDAQ market at the announcement date and 0 if issuer is listed on KOSPI market, and the interaction term RefixKOSDAQ is included in the regression model. The estimated results are reported in Model (3) and Model (4) of Table 7. The coefficients of RefixKOSDAQ are −0.013 and significant at the 1% level as well as the coefficients of Refix are still negative and significant for both models. The results reflect the investors’ concerns about firms listed on the KOSDAQ market, since they are generally considered to be smaller in size and have a higher level of information asymmetry compared to those listed on the KOSPI market. An alternative explanation is that relatively higher participation of individual investors in the KOSDAQ market may cause higher behavioral biases in incorporating information from the announcement into firm valuation [39].

3.4. Robustness Test

This section examines whether the market responses to the refixing option discussed in Section 3.1 change when the analyses are implemented for the extended days or alternative measure of market response. Since information leakage could occur earlier than one day prior to the announcement date or the announcement effect could be delayed more than one day, the longer interval of market response is adopted as dependent variables, that is, CAR(−3,+3), to analyze the effect of the refixing option. Models (1)–(3) of Table 8 show that the effect of Refix is still negative and significant at the 1% level. I further find that the negative effect of Refix is strengthened in the recent period as the interval of market response is extended (Models (4)–(6)). The investors additionally discount the value of issuer by 8.8 to 9.4 percentage points in the recent period when the extended market response are adopted that are 4.4 to 4.8 percentage points lower compared to the results of Table 4. In addition, Model (6) shows that while the effect of RefixDR in the recent period is still significant, the significance of Refix disappears after controlling for the effect of market-specific variables.

Table 8.

Robustness Test: Extended Market Response.

I further find that several control variables turn out to be significant compared to the results in Table 4 when adopting extended market response, CAR(−3,+3), as a dependent variable. First, the coefficients of Stock_run-up are negative and significant after controlling for the effect of firm-, issue-, and market-specific variables. Ln_maturity and CV_prm also have positive and significant coefficients for all regression models in Table 8. The signs of coefficients for three control variables above are also all in line with the expectations discussed in Section 3.2.

The robustness test is further implemented using the cumulative market-adjusted return as dependent variables. To obtain the market-adjusted return, the difference between individual firm’s return and the KOSPI index’s return is calculated. Then, the cumulative market-adjusted return over trading days −1 to +1 surrounding announcement dates, CMAR(−1,1), is estimated. Table 9 shows the regression results. The coefficients on Refix are still negative and significant and the coefficients on interaction term between Refix and DR are also significantly negative.

Table 9.

Robustness Test: Market Adjusted Return.

4. Conclusions

Refixing option denotes an adjustment right of the conversion price embedded in equity-linked debt when the underlying stock price falls under conversion price. While investors can make profits using this option even if the price of underlying stock falls under the initial conversion price, existing shareholders face not only a decline in stock prices but also the dilution of stock value due to the exercise of the conversion rights. Therefore, market participants have been concerned about the effect of the refixing option on the stock market as the issuance of equity-linked debts have been increased rapidly in the recent period.

Accordingly, this study empirically analyzes the market response to the issuance of equity-linked debts with the refixing option during the period from January 2001 to December 2018 in Korea. The results show statistically significant declines of 2.6 to 2.7 percentage points in cumulative abnormal returns for the inclusion of refixing clause and especially further declines of 4.4 to 4.6 percentage points during the period from 2016 to 2018. This implies that the market’s concerns about the dilution of existing shareholder value due to the exercise of the refixing option are effectively reflected in the market response. I further find that the degree of negative market responses varies according to the changes in macroeconomic conditions and the stock exchange on which the issuing firms are listed. The findings are robust after controlling for the effect of firm-, issue-, and market-specific characteristics.

This paper provides some policy implications. The empirical findings in this paper show that equity-linked debt market plays a positive role in raising capital for firms that are small in size or suffer from financial distress, while it performs the negative function of issuing firms’ value falling by certain provision embedded in equity-linked debt. Therefore, appropriate regulation to the adjustment of conversion price of equity-linked debt including CB and BW can support to enhance the stability of emerging capital markets that are relatively unreliable.

Funding

This research received no external funding.

Conflicts of Interest

The opinions in this paper correspond to the author and do not necessarily reflect the point of view of Korea Exchange. The authors declare no conflict of interest.

Appendix A

Table A1.

Variable Definitions.

Table A1.

Variable Definitions.

| Variable | Classification | Definition |

|---|---|---|

| Ln_asset | Firm-specific | Natural logarithm of total assets |

| Lev | Firm-specific | Debt ratio, calculated as the total debt divided by total assets |

| Perf | Firm-specific | Operating cash flow divided by total assets |

| BTM | Firm-specific | Book-to-market ratio, calculated as book value of common equity divided by market value |

| Stock_run-up | Firm-specific | Cumulative stock return over the window (−60, −4) relative to the announcement date |

| Stock_vol | Firm-specific | Stock return volatility calculated from daily return over the window (−60, −4) relative to the announcement date |

| CW | Firm-specific | Effective bid-ask spread measured following the procedure suggested by Corwin and Schultz (2012) |

| Ln_maturity | Issue-specific | Natural logarithm of the days between the announcement date and the date on which equity-linked debt issued is allowed to be converted to the common stock |

| CV_prm | Issue-specific | Conversion premium, calculated as the conversion price divided by the stock price on five days prior to the announcement date |

| GRT | Issue-specific | Dummy variable that equals to one if equity-linked debt issued is guaranteed and zero otherwise |

| CP_prm | Issue-specific | Coupon premium, calculated as the difference between coupon rate and the risk-free rate, 3-year maturity government bond yield |

| Market_run-up | Market-specific | Cumulative return of KOSPI index over the window (−60, −4) relative to the announcement date |

| Market_vol | Market-specific | Market volatility calculated from daily KOSPI index return over the window (−60, −4) relative to the announcement date |

| Refix | Issue-specific, Target | Dummy variable that equals to one if refixing option is embedded in equity-linked debt issued and zero otherwise |

| DR | Period | Dummy variable that equals to one if the issuance of equity-linked debt announce from 2016 to 2018 and zero otherwise |

Appendix B

- Source: own calculations based on data from the Financial Supervisory Service (FSS) Disclosure System of Korea

- In the case of bond with warrant, if the stock price rises above the exercise price and the warrants are exercised, then the new capital flows into the capital account and the company’s debt ratio falls. This paper uses terms centered on convertible bond such as conversion price and conversion rights for the unity and brevity.

- Article 165-10(2) of the Financial Investment Services and Capital Markets Act of Korea stipulates as follows: “In issuing bonds provided for in Article 516-2 (1) of the Commercial Act, no stock-listed corporation may issue corporate bonds allowing a bondholder to transfer only the securities from the preemptive right to new stocks through private placement, notwithstanding Article 516-2 (2) 4 of the same Act. <Amended by Act No. 13448, Jul. 24, 2015>” Since the financial authorities allowed the issuance of public-offering detachable BW again in 2015, only the issuance of privately-placed detachable BW is currently restricted.

- The consumer composite sentiment index is designed to determine the overall perception of consumers of the economy. It is a composite index that utilizes individual indices for 6 consumer sentiments, including current living standards, prospects for living standards, household income outlook, consumption expenditure outlook, current economic judgment, and future economic outlook. Since the relevant data are available from 2003, we implement the regression analysis during the period from 2003 to 2018.

- I further examine the market responses by dividing the full sample into speculative period and investment period. The results are quantitatively and qualitatively similar that the negative announcement effects are weakened during the speculative period. The results are not reported here for the sake of brevity, but are available upon request.

References

- Dutordoir, M.; Li, H.; Liu, F.H.; Verwijmeren, P. Convertible bond announcement effects: Why is Japan different? J. Corp. Financ. 2016, 37, 76–92. [Google Scholar] [CrossRef]

- Long, M.S.; Sefcik, S.E. Participation financing: A comparison of the characteristics of convertible debt and straight bonds issued in conjunction with warrants. Financ. Manag. 1990, 19, 23–34. [Google Scholar] [CrossRef]

- Kwak, Y. An Empirical Analysis of Convertible Bond Issues: Focused on Characteristics of Convertible Bonds and Issuing Firms. Korean Int. Account. Rev. 2012, 41, 525–548. [Google Scholar]

- Kim, Y. An Empirical Analysis of Information Effect and Their Determinants of Issuance Announcement of Convertible Bonds. Korean J. Bus. Adm. 2001, 29, 205–230. [Google Scholar]

- Mayers, D. Why firms issue convertible bonds: The matching of financial and real investment options. J. Financ. Econ. 1998, 47, 83–102. [Google Scholar] [CrossRef]

- Isagawa, N. Convertible debt: An effective financial instrument to control managerial opportunism. Rev. Financ. Econ. 2000, 9, 15–26. [Google Scholar] [CrossRef]

- Lyandres, E.; Zhdanov, A. Convertible debt and investment timing. J. Corp. Financ. 2014, 24, 21–37. [Google Scholar] [CrossRef]

- Dutordoir, M.; Strong, N.; Ziegan, M.C. Does corporate governance influence convertible bond issuance? J. Corp. Financ. 2014, 24, 80–100. [Google Scholar] [CrossRef]

- Huerga, A.; Rodríguez-Monroy, C. Mandatory Convertible Bonds and the Agency Problem. Sustainability 2019, 11, 4074. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure: The incentive-signalling approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Smith, C.W., Jr. Investment banking and the capital acquisition process. J. Financ. Econ. 1986, 15, 3–29. [Google Scholar] [CrossRef]

- Dann, L.Y.; Mikkelson, W.H. Convertible debt issuance, capital structure change and financing-related information: Some new evidence. J. Financ. Econ. 1984, 13, 157–186. [Google Scholar] [CrossRef]

- Eckbo, B.E. Valuation effects of corporate debt offerings. J. Financ. Econ. 1986, 15, 119–151. [Google Scholar] [CrossRef]

- Mikkelson, W.H.; Partch, M.M. Valuation effects of security offerings and the issuance process. J. Financ. Econ. 1986, 15, 31–60. [Google Scholar] [CrossRef]

- Hansen, R.S.; Crutchley, C. Corporate earnings and financings: An empirical analysis. J. Bus. 1990, 63, 347–371. [Google Scholar] [CrossRef]

- Billingsley, R.S.; Smith, D.M. Why do firms issue convertible debt? Financ. Manag. 1996, 25, 93–99. [Google Scholar] [CrossRef]

- Kim, Y.C.; Stulz, R.M. Is there a global market for convertible bonds? J. Bus. 1992, 65, 75–91. [Google Scholar] [CrossRef]

- Brennan, M.J.; Her, C. Convertible Bonds: Test of a Financial Signalling Model; University of California: Los Angeles, CA, USA, 1995. [Google Scholar]

- Lewis, C.M.; Rogalski, R.J.; Seward, J.K. Industry conditions, growth opportunities and market reactions to convertible debt financing decisions. J. Bank. Financ. 2003, 27, 153–181. [Google Scholar] [CrossRef]

- Phelps, K.L.; Moore, W.T.; Roenfeldt, R.L. Equity valuation effects of warrant-debt financing. J. Financ. Res. 1991, 14, 93–103. [Google Scholar] [CrossRef]

- Chang, C.C.; Kam, T.Y.; Chien, C.C.; Su, W.T. The Impact of Financial Constraints on the Convertible Bond Announcement Returns. Economies 2019, 7, 32. [Google Scholar] [CrossRef]

- Hackney, J.; Henry, T.R.; Koski, J.L. Arbitrage vs. informed short selling: Evidence from convertible bond issuers. J. Corp. Financ. 2020, 65, 101687. [Google Scholar] [CrossRef]

- Loncarski, I.; Ter Horst, J.; Veld, C. Why do companies issue convertible bonds? A review of theory and empirical evidence. In Advances in Corporate Finance and Asset Pricing; Elsevier: Amsterdam, The Netherlands, 2006; pp. 311–339. [Google Scholar]

- Ammann, M.; Fehr, M.; Seiz, R. New evidence on the announcement effect of convertible and exchangeable bonds. J. Multinatl. Financ. Manag. 2006, 16, 43–63. [Google Scholar] [CrossRef]

- Duca, E.; Dutordoir, M.; Veld, C.; Verwijmeren, P. Why are convertible bond announcements associated with increasingly negative issuer stock returns? An arbitrage-based explanation. J. Bank. Financ. 2012, 36, 2884–2899. [Google Scholar] [CrossRef]

- Kang, J.K.; Stulz, R.M. How different is Japanese corporate finance? An investigation of the information content of new security issues. Rev. Financ. Stud. 1996, 9, 109–139. [Google Scholar] [CrossRef]

- Abhyankar, A.; Dunning, A. Wealth effects of convertible bond and convertible preference share issues: An empirical analysis of the UK market. J. Bank. Financ. 1999, 23, 1043–1065. [Google Scholar] [CrossRef]

- Kim, H.J.; Han, S.H. Convertible bond announcement returns, capital expenditures, and investment opportunities: Evidence from Korea. Pac. Basin Financ. J. 2019, 53, 331–348. [Google Scholar] [CrossRef]

- Billingsley, R.S.; Lamy, R.E.; Smith, D.M. Units of Debt with Warrants: Evidence Of The “Penalty-Free” Issuance Of An Equity-Like Security. J. Financ. Res. 1990, 13, 187–199. [Google Scholar] [CrossRef]

- Jayaraman, N.; Shastri, K.; Tandon, K. The Valuation Effects of Warrants in New Security Issues; Salomon Brothers Center for the Study of Financial Institutions, Leonard N. Stern School of Business, New York University: New York, NY, USA, 1990. [Google Scholar]

- De Roon, F.; Veld, C. Announcement effects of convertible bond loans and warrant-bond loans: An empirical analysis for the Dutch market. J. Bank. Financ. 1998, 22, 1481–1506. [Google Scholar] [CrossRef]

- Kim, W.; Kim, W.; Kim, H. Death spiral issues in emerging market: A control related perspective. Pac. Basin Financ. J. 2013, 22, 14–36. [Google Scholar] [CrossRef][Green Version]

- Yoon, P. Problems with Privately-placed Detachable Warrant Bonds Issuance System in Korea. Korean J. Financ. Stud. 2015, 44, 25–51. [Google Scholar]

- Dwyer, A.; Lechner, T.; Zhang, Y. An Investigation of Death Spiral Convertible Bonds; Working Paper; Tennessee State University: Nashville, TN, USA, 2018. [Google Scholar]

- Byun, J.; Park, K. The Effect of the Refixing Option in Convertible Bond on Shareholders’ Wealth. Working Paper. 2017. Available online: https://www.earticle.net/Article/A302007 (accessed on 27 October 2020).

- Yoon, P. Refixing Option and Privately-Placed BW Warrant Returns. Korean J. Financ. Stud. 2019, 48, 129–155. [Google Scholar] [CrossRef]

- Mian, G.M.; Sankaraguruswamy, S. Investor sentiment and stock market response to earnings news. Account. Rev. 2012, 87, 1357–1384. [Google Scholar] [CrossRef]

- Shin, H.; Shin, H.; Kim, S.I. The Market Sentiment Trend, Investor Inertia, and Post-Earnings Announcement Drift: Evidence from Korea’s Stock Market. Sustainability 2019, 11, 5137. [Google Scholar] [CrossRef]

- Li, H.; Liu, H.; Siganos, A. A comparison of the stock market reactions of convertible bond offerings between financial and non-financial institutions: Do they differ? Int. Rev. Financ. Anal. 2016, 45, 356–366. [Google Scholar] [CrossRef]

- Stein, J.C. Convertible bonds as backdoor equity financing. J. Financ. Econ. 1992, 32, 3–21. [Google Scholar] [CrossRef]

- Jung, K.; Kim, Y.C.; Stulz, R. Timing, investment opportunities, managerial discretion, and the security issue decision. J. Financ. Econ. 1996, 42, 159–185. [Google Scholar] [CrossRef]

- De Jong, A.; Veld, C. An empirical analysis of incremental capital structure decisions under managerial entrenchment. J. Bank. Financ. 2001, 25, 1857–1895. [Google Scholar] [CrossRef]

- Dutordoir, M.; Van de Gucht, L. Are there windows of opportunity for convertible debt issuance? Evidence for Western Europe. J. Bank. Financ. 2007, 31, 2828–2846. [Google Scholar] [CrossRef]

- Krasker, W.S. Stock price movements in response to stock issues under asymmetric information. J. Financ. 1986, 41, 93–105. [Google Scholar] [CrossRef]

- Green, R.C. Investment incentives, debt, and warrants. J. Financ. Econ. 1984, 13, 115–136. [Google Scholar] [CrossRef]

- Brennan, M.J.; Schwartz, E.S. The case for convertibles. J. Appl. Corp. Financ. 1988, 1, 55–64. [Google Scholar] [CrossRef]

- Corwin, S.A.; Schultz, P. A simple way to estimate bid-ask spreads from daily high and low prices. J. Financ. 2012, 67, 719–760. [Google Scholar] [CrossRef]

- Huang, G.C.; Liano, K.; Manakyan, H.; Pan, M.S. The information content of multiple stock splits. Financ. Rev. 2008, 43, 543–567. [Google Scholar] [CrossRef]

- Datta, S.; Iskandar-Datta, M.; Patel, A. Some evidence on the uniqueness of initial public debt offerings. J. Financ. 2000, 55, 715–743. [Google Scholar] [CrossRef]

- Easterbrook, F.H. Two agency-cost explanations of dividends. Am. Econ. Rev. 1984, 74, 650–659. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).