Abstract

International joint ventures (IJVs) have long been considered a vibrant venue for innovation, one source of sustainable competitive advantage. Nonetheless, there is a paucity of research that seeks to understand what determines their innovative performance. We draw attention to and examine the control structure of IJVs as a determinant of innovation. Using the complementary lenses of local embeddedness, the liability of outsidership, and open innovation, we argue that foreign managerial control reduces IJV innovation and that equity ownership balance between foreign and local parent firms and affiliation of IJVs with local market business groups weaken this negative relationship. Using panel data of 48 IJVs in Korea during the periods between 2000 and 2016, we find empirical support for these arguments. This study contributes to the literature by extending our understanding of how to design IJVs for enhancing innovative output and consequently improving their sustainability.

1. Introduction

International joint ventures (IJVs) refer to organizations that are newly created and jointly managed by two or more parent firms headquartered in different countries in the quest for common goals, such as synergy and complementarity, that cannot be accomplished by each alone. The fact that all the parent firms involved ought to inject initial capital, resources, and capabilities into the new organization for achieving the common goals forges not just a mutual destiny, but a collaboration imperative. This collaboration imperative induces the parent firms to exert coordinative efforts when organizing their IJVs’ business activities to pool, share, and combine resources and capabilities, such as knowledge and technologies, offered by the parent firms. Given that innovation develops as a result of the “recombinatory search” or “mixing and matching” [1,2,3,4,5,6], it is not surprising that IJVs have grown to prominence as an organizational method for technological innovation through these activities of pooling, sharing, and combining of different technologies [7,8,9,10].

However, it is not easy to effectively organize the activities of pooling, sharing, and combining different knowledge in IJVs due in large part to their shared management and control over decision-making between local and foreign parent firms [11,12,13]. Any organizing efforts to develop innovation in IJVs, therefore, call for well-crafted control arrangements that bolster the collaboration imperative and keep in check the divergent interests of the parent firms [14]. Even so, there is a paucity of studies exploring the optimal control structure of IJVs to enhance their innovation output (see [10]). We seek to fill this void by linking IJV control structure [12,13] to three interrelated theoretical conceptions that arguably determine the efficacy of the innovation process of IJVs: local embeddedness [15,16,17], the liability of outsidership [16], and open innovation [18,19].

A growing body of literature on open innovation demonstrates that the locus of innovation does not reside so much inside the firm as outside the organizational boundary, underscoring the importance of the external sources of innovation [18,19]. Implicit in this research stream is a presumption that potentially useful knowledge to an organization is chiefly dispersed outside the organization, rendering it indispensable to stay on the lookout for external knowledge and manage its inflows [20]. As the innovative process involves not merely generating new ideas, but also putting them to a commercial use [21], external knowledge for innovation comes both from upstream research and development (R&D) activities and from downstream manufacturing and marketing activities along the value chain [18]. So, the question of how best to manage inflows of external knowledge for innovation arguably boils down to the question of how best to manage relations with exchange partners along the value chain [22,23,24,25,26].

Foreign parent firms, however, are at a serious disadvantage in establishing and managing relations with exchange partners along the local market value chain in part because they are not accustomed to the taken-for-granted rules of social interactions or institutions, such as norms, customs, traditions, and conventions in the local market environment [27,28,29], and in part because they are not yet known to local market players as reliable exchange partners [29,30,31]. Relational disadvantage of this sort confronting foreign parent firms in the local market is well summarized by the liability of outsidership (this conception has a close bearing on “the liability of unconnectedness” in social network literature [32]; understood as a disadvantage from being located outside a relevant network, the liability of outsidership puts an added emphasis on the role of locally embedded relations in alleviating the liability of foreignness that foreign firms typically suffer in the local market when starting business [16,33,34]), the concept introduced by Johanson and Vahlne [16]. Defined as costs of being located outside a relevant network in the local market, the liability of outsidership conceptualizes the business environment as networks of exchange partners through which to create knowledge and learn, highlighting the primacy of managing the networks in internationalization. Consequently, foreign parent firms will fail to adequately secure the main sources of external knowledge and, therefore, suffer a substantial shrinkage in knowledge inflows [34]. Echoing this viewpoint, Andersson and colleagues argue that “IJVs should be locally embedded in the ongoing relations with suppliers, buyers, consumers, and even government bodies to improve knowledge creation and local innovation” (2005, p. 526).

Foreign parent firms may wish to bring the embedded relations from their home countries as external sources of knowledge to bear on this liability of outsidership. So, this attempt is deemed a kind of substitution strategy. However, doing so seems fruitless owing to geographical distance limiting intimate social interactions for knowledge transfer. Geographical proximity is reported to facilitate innovation by expediting face-to-face interactions [35], in which information transfer is most enriched enough to transpose and migrate even tacit knowledge [36]. Despite the development of information and communications technology, the depth and breadth of information transferred through face-to-face interactions are unrivaled by those of information conveyed through online media. In line with this, research shows that there is a strong tendency to collaborate with geographically proximate players [37,38,39]. It follows that taking advantage of far-flung firms in their home countries as sources of external knowledge may not be very helpful in enhancing the innovation rate of IJVs [34].

The only option left for foreign parent firms may be to turn to their local partner firms. Local firms are an invaluable complementary asset to foreign parent firms, as they are already deeply embedded in networks of various market agents in the local market or a sort of innovation infrastructure [15,33]. Hence, it seems ideal for foreign parent firms to count on their local partners. Nonetheless, the extent to which foreign parent firms can get access to and find support from the local networks of their local partners arguably varies according to the way control apparatuses are built in their IJVs.

We examine this variance by considering two facets of IJV control: foreign managerial control [12] and equity ownership balance [10]. Because managerial control and equity ownership alike represent the right to intervene in the decision-making process about formulating and implementing proposals for resource utilization [40], both influence innovation development processes [21]. In view of the relational disadvantage foreign parent firms suffer in the local market [15,16,22], we argue that managerial control by foreign parent firms will hurt IJV innovation and that equity ownership balance will alleviate this effect since local parent firms, under balanced ownership, get to have incentives to assist the troubled foreign partners using their embedded relations in the local market. We also allow for two additional factors that are thought to alter the capability of foreign parent firms to develop innovation: IJV tenure and business group affiliation.

We test these hypotheses using panel data of 48 IJVs in Korea during the period between 2000 and 2016. Consistently with our expectations, we find that managerial control by foreign parent firms decreases innovation. We also find that this negative effect of foreign managerial control is alleviated when there is an ownership balance between foreign and local parent firms and when IJVs are affiliated with business groups operating in the local market.

The remainder of the paper is organized as follows. In the next section, we develop the theory and hypotheses. Subsequently, we offer details about our data and methods and conduct an empirical analysis. Then, we report the results. Finally, we discuss the implications of the findings and conclude by distilling the theoretical and practical insights that emerged from this study.

2. Theory and Hypotheses

2.1. International Joint Ventures and Innovation

IJVs involve the creation of a legally distinct organization, the initial resources and capabilities of which are endowed by two or more parent firms from different countries in the quest of common goals that cannot be realized by each parent firm alone [12,41,42]. Interdependence and complementarity of this sort foster a symbiotic relationship between the local and the foreign partners. For this relationship to fulfill its promise, however, it is crucial to readily access and exploit each other’s organizational assets that are put on the table. In this regard, IJVs are viewed as an organizational device for pooling, sharing, and combining potentially different resources and capabilities from their parent firms [7,43].

That IJVs offer opportunities for new combinations of resources, capabilities, and knowledge bears a conceptual linkage to the research tradition that views innovation as a result of the “recombinatory search” or the brute-force “mixing and matching” trials (([1], p. 65), [2,3,44,45]). According to this view, the key to innovation amounts to expanding the recombination set of knowledge and technology. One way to achieve this aim is to use inter-organizational arrangements [5,46]. For example, such inter-organizational arrangements as alliances and mergers and acquisitions (M&A) are found to promote inter-organizational transfer, sharing, and, ultimately, recombination of knowledge by fusing organizational boundaries [47,48,49].

Furthermore, inter-organizational arrangements are argued to extend the source of knowledge and technology even up to the involved parties’ networks. This argument is rooted in the network literature conceptualizing a firm as “embedded in networks of social, professional, and exchange relationships with other organizational actors” ([50], p. 203). For instance, Hernandez and Shaver show that any collaborative forms of inter-firm organization necessarily induce amalgamation of the participants’ networks [47].

The previous discussion implies that IJVs, as one of such inter-organizational arrangements, can similarly broaden their external source of knowledge and technology up to their parents’ relational partners or networks—be they horizontal or vertical [51,52]. The relational exchange partners include firms (firms can be further decomposed into such categories as suppliers, customers, competitors, and potential cooperative partners [53].), individuals, universities, government agencies, and private nonprofit organizations [18,21,54]. All the relations with actual and potential partners and the resulting expanded knowledge set can function as sources of innovation for IJVs. Consistently, Gulati [55] underscores the primacy of this expanded set of knowledge and information in generating competitive advantage by coining the term “network resources.” So viewed, IJVs are an enterprise for combining knowledge from their parent firms’ networks, thereby becoming a spawning ground for technological innovation [7,10,18,56].

Notably, however, the networks brought up and contributed by foreign parent firms to IJVs may be of little use for the innovation activity that typically occurs in the local market where IJVs are physically located [34]. Underlying this logic is the inherent geographical limit to social interactions. Research evidence demonstrates that spatial distance demarcates the radius of social interactions that serve as an important basis of information and knowledge transfer [57]. It is also shown that geographical propinquity enhances the richness and bandwidth of information transfer by promoting intimate interactions [35,57]. Only with face-to-face interactions can various types of knowledge, including tacit knowledge, be transferred expeditiously [36,58]. This inherently narrow geographical radius of social interactions constrains the market players in quest of innovation to geographically agglomerate [38], contributing to the formation of regional technology clusters like Silicon Valley in San Francisco and Route 128 in Boston [37,39]. Accordingly, the networks that foreign parent firms headquartered far outside the local market can bring to IJVs are arguably less than useful for the innovation activities hosted in the local market because of the geographical limit to social interactions; subsequently, the foreign parent firms become very dependent on the networks their local partner firms bring [15,33].

2.2. Foreign Managerial Control, Local Embeddedness, and Innovation

IJVs are legal entities jointly created and shared by local and foreign parent firms. This definition implies that a parent firm necessarily relinquishes a certain portion of equity ownership and admits its partner firms’ control and influence in managing an IJV. Typically, control in a standalone firm is a process whereby power or authority is exercised over the organization’s behavior, such as decision-making, to achieve its desired end. On the other hand, in an IJV, the crux of the control problem lies in reconciling the potentially divergent interests between its parent firms. So, it is viewed as the activity or process “through which a parent company ensures that the way an IJV is managed conforms to its own interests” ([41], p. 32), ordinarily with recourse to such mechanisms as control or power [12]. In consequence, an IJV’s control reflects whose interests, strategic intent, and capabilities have a greater say in its behaviors and outcomes. This aspect partly explains why control distribution has taken the lion’s share in explaining strategic choices and their outcomes in the context of IJVs (([12], see for a review), [14]). In keeping with the prior literature, we herein focus on managerial control and its implications [41,59], given that managerial control more directly regulates decision-making than the other structural control mechanisms do [60]. For instance, ownership-based control on the pro-rata basis of the right to vote (equity ownership is one of fundamental sources of control, which rests on the right to vote on strategic choices. The parent firm with greater equity ownership can secure greater control by acting on the representation of board members [12,41]. Ownership control is translated into managerial control because the board has the authority to appoint key personnel in the top managerial positions. However, it is top managers who formulate and implement strategic plans. In this regard, managerial control has more direct influence than ownership-based control) should be intermediated by managerial control to influence the managerial decision [12].

That foreign parent firms take managerial control over their IJVs means that the right to make managerial decisions as regards formulation and implementation of innovation strategy rests with the foreign parent firms. As mentioned before, however, foreign parent firms are generally deficient in “on-going relations with suppliers, buyers, consumers, and even government bodies to improve knowledge creation and … innovation” in the local market ([59] p. 526). This lack of embedded relations is detrimental to innovation, insofar as embedded relations are deemed grist to the mill of knowledge creation and innovation [1]. Research evidence shows that embeddedness facilitates fine-grained information transfer and promotes joint problem-solving activities [61,62] “by generating trust and discouraging malfeasance” ([63], p. 490) or “bringing order to economic life” ([63], p. 501). Absent mutual trust, firms should be reluctant to transfer to their partners key resources, core competence, or “technological cores” that are essential for innovation ([12], p. 236) for fear of appropriation hazards [64,65]. From the viewpoint of local market actors, foreign firms are just outsiders that are hard to trust [29]. Therefore, as foreign parent firms take greater managerial control, their IJVs will be viewed more as outsiders and will find it more difficult to collaborate with local market actors, a crucial external knowledge source of innovation.

It is at this juncture that foreign parent firms face a thorny dilemma as to whether to build embedded relations in the local market from scratch. The wholesale importation of embedded relations from their home countries is infeasible as it means the physical relocation of all the relational partners. This infeasibility derives from the requirement that embedded relations be concrete [63] and hence be geographically circumscribed [57]. As discussed earlier, “geographical propinquity” promotes social interactions and economic exchange, giving birth to the geographical clustering of economic activities in the development process of innovation ([37], ([57], p.1547), [66]). On the other hand, it is neither ideal nor efficient to build embedded relations from scratch, in part because it takes an enormous amount of time and number of commitments [16], and in part because they are not used to the taken-for-granted rules of social interactions in the local market [29]. A better way to address this disadvantage is to turn to the local parent firm’s embedded relations, which incurs virtually zero costs. Indeed, this might be one of the reasons why foreign firms establish IJVs with local partner firms in the first place, even if doing so has non-trivial drawbacks [67,68].

Unfortunately, however, gaining access to and extracting intended benefits from the local parent firm’s embedded relations is not straightforward, either. To make the best use of embedded relations of local parent firms, one has to have an accurate network map of embedded relations concerning “who has what” [4] or “whom to pick.” However, such a cognitive network map is inherently tacit and not perfectly transferrable to others [59,69]. Furthermore, trust and reputation derived from embedded relations safeguarding the appropriation concern cannot be separated from the relations and transferred to others [70,71]. It follows that the recipient of benefits from embedded relations cannot be someone other than the one in real possession of the relations. In other words, to fully exploit locally embedded relations for innovation, it should be local parent firms that take managerial control of IJVs [34]. Only then could the development process of IJVs tap into locally embedded relations and network resources therein to their full potential. Given this lack of embedded relations with external local market partners, foreign managerial control is liable to harm IJV innovation.

In parallel with this lack of embedded relations with external local market players, foreign parent firms may also find it challenging to establish and take advantage of internal relations with local employees in their IJVs due to their inadequate knowledge of social norms, values, managerial practices, and culture of the local market [72,73]. Furthermore, foreign nationals are perceived as outsiders to the local market employees, triggering in-group favoritism and out-group biases [74]. These biases against the outsiders deflate local employees’ trust in foreign managers and impair their emotional attachment to the firms managed by foreign managers [75]. Given that innovation necessitates well-organized R&D inputs from various levels of employees and development teams, such a lack of trust and emotional attachment arguably hurts the effectiveness and efficiency of the innovation development process. In contrast, local managers are superior to foreign managers at garnering support from local employees because they share the same identity and are well cognizant of the taken-for-granted rules of social interactions [73,76] and culture [77]. The resulting trust, emotional attachment, and heightened morale improve innovation development processes. Taking all these together, we hypothesize:

Hypothesis 1 (H1).

Foreign parent firms’ managerial control is negatively associated with the innovation of international joint ventures.

2.3. Factors Regulating the Cost of Foreign Managerial Control

The preceding discussion is reduced to one question: “For innovation, how best to take advantage of embedded relations that local parent firms exclusively possess?” We argued that because foreign managers are less able to use locally embedded relations, they stifle IJV innovation. We henceforth consider several factors that moderate this negative effect of foreign managerial control on IJV innovation.

Ownership balance. Ownership balance refers to the extent to which equity ownership is shared between foreign and local parent firms [10]. Given that parent firms can exercise control over managerial decisions in proportion to their equity stake [40,78], balanced ownership begets a situation where one cannot dominate the other. Then, a collaborative and cooperative atmosphere between local and foreign parent firms may emerge. There is abundant research evidence in support of this view that IJVs with split or shared ownership perform better (e.g., [14,79,80]). So, derived collaborative atmosphere, in turn, cultivates mutual trust that leads the parent firms to prioritize the joint utility over individual utilities. When realizing that foreign managers suffer from the inability to take advantage of local embedded relations, local parent firms will be very forthcoming and willingly assist them in using their embedded relations. Therefore, foreign managers’ ability to tap locally embedded relations will improve when equity ownership is balanced. Thus, we hypothesize:

Hypothesis 2a (H2a).

The relation between foreign parent firms’ managerial control and innovation is positively moderated by ownership balance, such that the negative relation becomes weaker when ownership is balanced.

IJV tenure. Foreign managers are clumsy at taking advantage of local parent firms’ embedded relations in part because they lack knowledge about potential relational partners in the local market. As discussed, the knowledge of “whom to work with” is tacit and, therefore, less articulable and transferrable. The only way to acquire tacit knowledge is learning by experience, be it direct or vicarious [81,82]. So, the ability to acquire tacit knowledge presumably improves over time as direct interactions with local firms and observations of what local partner firms do accumulate [68,81,83]. Furthermore, through the “time-based learning” process [84] and accumulation of relational assets [22], parent firms become more able to transfer tacit knowledge between them over time.

In addition, IJVs become more visible to the local market players with time [85]. In other words, their cognitive awareness and familiarity arguably rise among the local market exchange partners over time. IJVs get increasingly regarded as reliable potential exchange partners by the local market actors over time, mitigating the liability of outsidership that interferes with establishing embedded relations with the local market players. On balance, we hypothesize:

Hypothesis 2b (H2b).

The relation between foreign parent firms’ managerial control and innovation is positively moderated by the longevity of IJVs, such that the negative relation becomes weaker as IJVs age.

Business group affiliation. Business groups are defined as a collection of legally independent firms interlaced by informal and/or formal relations in the pursuit of coordinated and concerted actions for mutual objectives [86,87,88,89,90]. Their inter-affiliate firm relations constitute the internal market for knowledge or an innovation infrastructure within which knowledge transfer accelerates as well as deepens [7,91,92]. In support of this view, research evidence shows that business groups are an organizational arrangement that boosts innovation [87,91,93]. This discussion indicates that if IJVs are affiliated with business groups, foreign parent firms can reduce the need for embedded relations for innovation by relying on the inter-affiliate networks of the business groups with which their local partner firms are affiliated [7]. Thus, we hypothesize:

Hypothesis 2c (H2c).

The relation between foreign parent firms’ managerial control and innovation is positively moderated by business group affiliations of IJVs, such that the negative relation becomes weaker with business group affiliation.

3. Research Design

3.1. Sample and Data

We chose Korea as our research setting for several reasons. Korea has grown to prominence as a location for R&D activities and technology sourcing [94]. So, IJVs have been widely used by multinational enterprises (MNEs) as an organizational method for innovation in Korea. Furthermore, there has been a steady increase in new IJV establishments over the last ten years, except in the periods of global economic downturn, implying that IJVs have continued to be a crucial form of international collaborative activities in Korea.

Our initial sample came from the database of joint ventures collected and offered by the Ministry of Knowledge Economy of Korea. This database includes a comprehensive set of IJV information including registration date, address, phone number, industry code and industry-specific information, main products and investments, and country of origin. This database has been widely used by prior studies (e.g., [95]), lending credence to its reliability. Following prior literature [96,97], we viewed as IJVs only international inter-firm arrangements in which equity ownership of foreign parent firms falls between 5% and 95%. We excluded financial industries for the sake of comparability. Most of the chosen industries were technology-intensive ones in which the intensity of innovative activities is relatively high [9].

Then, we gathered financial information about the sample from KISLINE. KISLINE, which is equivalent to COMPUSTAT in the United States, provides an extensive set of firm-level financial and other qualitative information. Its credibility is evidenced by its extensive use in prior studies (e.g., [98,99]). In particular, we selected IJVs founded between 2000 and 2010 and constructed their panel data from 2000 to 2016. We adopted this sampling scheme with the consideration that R&D efforts require lead times to be translated into innovation in mind. All the information on control distribution in terms of equity ownership and CEO nationality came from the DART (Data Analysis, Retrieval, and Transfer System) offered by the Korea Financial Supervisory Service (http://dart.fss.or.kr/). After this procedure, our final sample consisted of 48 IJVs and 445 IJV–year observations.

3.2. Dependent Variable

Innovation. We measured IJV innovation as the number of successful (or granted) patent applications filed to the Korean Intellectual Property Office (KIPO)—the Korean counterpart of the United States Patent and Trademark Office (USPTO)—by the focal IJV in year t. The number of successful patent applications has been widely used as a measure of the innovative output of a firm including an IJV [7,100]. A patent is soundly regarded as innovation because it is granted only to an invention that solves a specific technological problem and improves existing products in terms of performance and functionality. Some critics raise the concern about the industry heterogeneity in patentability. To address this concern, we controlled for industry propensity to patent, as will be detailed below [7,101] (we also ran the empirical test by using industry dummies and found a similar pattern).

3.3. Independent Variable

Foreign managerial control. We operationalized foreign managerial control with reference to whether foreign expatriates take up the top management or the CEO position. Specifically, we created a dummy variable that is coded as one if the CEO of the focal IJV was a foreigner and zero otherwise [102]. We determined the CEO nationality on the name basis because Korean names are unique enough to be readily and precisely distinguished from the names from other foreign countries.

3.4. Moderating Variables

Ownership balance. Following prior studies [10], we operationalized this variable as a Herfindahl index as follows:

where denotes the equity share of the foreign partner firm, and denotes the equity share of the local partner firm (we re-conducted all of the analyses by using an entropy index and observed a consistent pattern). This measure has a maximum of 0.5, where the ownership is evenly shared between the foreign and local partner firms.

IJV tenure. We operationalized IJV tenure as the focal year minus the founding year of the focal IJV [10]. This variable was measured at time t.

Business group affiliation. Business groups are generally defined as a set of legally independent firms bound together via formal/informal ties [87]. While there are various types of ties that bind the firms, equity ties are the most widely used basis on which to identify business groups [93,103]. So, if two or more firms are tied through equity ownership, they constitute a business group. We collected equity relations of all the audited firms in Korea from KISVALUE. We operationalized business group affiliation as a dummy variable that is coded as one if the local partner firm is affiliated with a business group and is coded as zero otherwise [91].

3.5. Control Variables

We included several control variables that could confound our arguments. We first controlled for two industry heterogeneities: industry concentration and industry propensity to patent [1,104,105]. Market power can reduce competitive pressure to innovate. We operationalize industry concentration as one minus the Herfindahl index at the Standard Industrial Classification (SIC) two-digit level. To control for industry variance in propensity to patent, we controlled for industry propensity to patent, which is measured as the mean value of a firm’s patent applications at the SIC two-digit level in the focal year t. Then, we controlled for IJV attributes related to alternative explanations. Following the prior literature, we controlled for cultural distance (e.g., [106]). To operationalize cultural distance, we first obtained the latest scores from Hofstede’s [107] cultural dimensions on his official website (https://www.hofstede-insights.com/product/compare-countries/), where national culture consists of six dimensions: power distance, individuality, masculinity, uncertainty avoidance, indulgence, and long-term orientation. Then, we calculate the cultural distance between the foreign and Korean parent firm in the focal IJV as a Euclidean distance as follows:

where and are scores of a cultural dimension i for the foreign country and Korea, respectively.

We also controlled for IJV size to rule out the size effect on innovation [1,108]. IJV size was measured as the log-transformed value of the focal IJV’s total sales. We controlled for IJV R&D intensity and IJV advertising intensity, which are measured as R&D and advertising expenditure divided by sales of the focal IJV, respectively. Because organizational slacks are found to influence innovation [109], we also controlled for two organizational slack variables: IJV current ratio (unabsorbed slack) and IJV debt-to-equity ratio (potential slack) [110]. We operationalized IJV current ratio as current assets divided by current liability and IJV debt-to-equity ratio as total debt divided by the equity of the focal IJV [110]. According to a behavioral theory, firm performance may also impinge upon the incentive to innovate [110,111]. So, we also controlled for IJV profitability, which is operationalized as net income as a proportion to the total assets. Moreover, given that managerial control of IJVs is more often than not shared between foreign and local firms, we controlled for IJV co-management. This variable is operationalized as a dummy variable that is coded one if the CEO position is shared by foreign and local managers and zero otherwise. Finally, we also included year dummies to control for macroeconomic effects.

3.6. Statistical Method

For the empirical analysis, we used a random-effects negative binomial estimator. Our dependent variable is a count variable characterized by its discrete nature and preponderance of zeros and small values. These features call for the use of such econometric approaches as Poisson and negative binomial models [112,113]. One implicit assumption of the Poisson model, however, is that the mean is equal to the variance, which rarely holds in practice and generates overly significant estimates. So, we opted for the negative binomial model that relaxes the restrictive equi-dispersion by introducing an individual, unobserved heterogeneity into the conditional mean function of the count variable [112] as follows:

where is a probability mass function, a count variable, an individual heterogeneity, the expected number of events per period, a vector for regressors, and a vector for parameters to be estimated.

In parallel, our data are a panel in which a unit has multiple observations at different points in time. Thus, residuals are likely correlated within the observational units, necessitating econometric treatments for addressing autocorrelation. There are two distinct kinds of estimators proposed to address this issue: (1) the fixed-effects and (2) the random-effects estimators. Even if the literature shows a mild preference for the fixed-effects estimator, we decided to employ the random-effects estimator for the following reasons. First, the fixed-effects estimator can be biased when the panels have short periods [114,115,116]. Second, the fixed-effects estimator yields statistically poor estimates when there is little within-group variance [117]. This point is vital because our focal variables—foreign managerial control and ownership balance—seldom change after the formation of IJVs.

Third, the fixed-effects estimator for the negative binomial models requires that at least one observation of the dependent variable be nonzero for estimation [112]. The observational units that do not meet this condition are automatically dropped out of the estimation, which damages statistical efficiency. This condition is not satisfied in a non-trivial portion of our sample. Last but by no means the least, the fixed-effects estimator is, in essence, focused on within-unit changes. This is why it is often called the within estimator. Contrarily, our question is not so much of intra-unit comparisons as of inter-unit (i.e., inter-IJV) comparisons. Put differently, we seek to evaluate the effect of foreign parent firm control across unit observations or IJVs (see [118], pp. 342–343). Furthermore, it is noteworthy that the level is more important than the difference in evaluating the effect of ownership and control. All in all, the fixed-effects estimator is less appropriate in our analysis. Therefore, we chose the random-effects negative binomial estimator.

4. Results

Table 1 provides the descriptive statistics and correlation matrix for the variables used in our analysis. According to the results, the number of successful (or granted) patent applications per year of IJVs, our dependent variable, is two. Only about 28% of foreigners were appointed as CEOs, suggesting that IJVs generally favor local CEOs. On the other hand, that ownership balance, whose maximum value is 0.5, was over 0.38 indicates that equity distribution between foreign and local firms is more or less symmetric. Since some of the correlation coefficients were higher than 0.4, we computed variance inflation factors (VIFs) in all models. The largest VIF was 6.43 in the full model, with all the mean VIFs below 2.5 in all models. Thus, the results are relatively safe from the multicollinearity concern.

Table 1.

Descriptive statistics and correlation matrix.

Table 2 presents the random-effects panel negative binomial estimates. Model 1 is the baseline model that includes only control variables. Consistently with conventional wisdom, R&D intensity increases innovation. Moreover, industry concentration is negatively associated with innovation (p < 0.05), confirming the view that competition drives firms to innovate [105]. Interestingly, ownership balance has a negative influence on innovation, which is consistent with some studies that highlighted a negative impact of shared control on IJV performance (e.g., [12,119,120]). Model 2 inserts foreign managerial control, our focal variable. According to the result, foreign managerial control is negatively associated with innovation (β = −1.404, p < 0.05). Practically, this means that if foreign parent firms take managerial control, the innovation output of their IJVs decreases by 75.4% (=100* than if local parent firms take managerial control. Thus, we find support for Hypothesis 1.

Table 2.

Random-effects panel negative binomial estimates a,b.

In models 3 to 6, we insert the interaction terms with moderating variables. In model 3, we insert the interaction term with ownership balance. The result indicates that ownership balance positively moderates the negative relationship between foreign managerial control and innovation, lending support to Hypothesis 2a (β = 12.788, p < 0.05). In model 4, we add the interaction term with IJV tenure. The coefficient for the interaction term is insignificant. So, we find no support for Hypothesis 2b. In model 5, we introduce the interaction term with business group affiliation. Consistently with our expectation, business group affiliation alleviates the negative effect of foreign managerial control on innovation (β = 3.514, p < 0.05). Thus, we find support for Hypothesis 2c. In model 6, we insert all the interaction terms into the baseline model at once. While we find continued support for the interaction with business group affiliation, the effects of other variables turn insignificant. This finding is partly attributable to inherently excessive correlations among interaction terms that partial one another out [121,122].

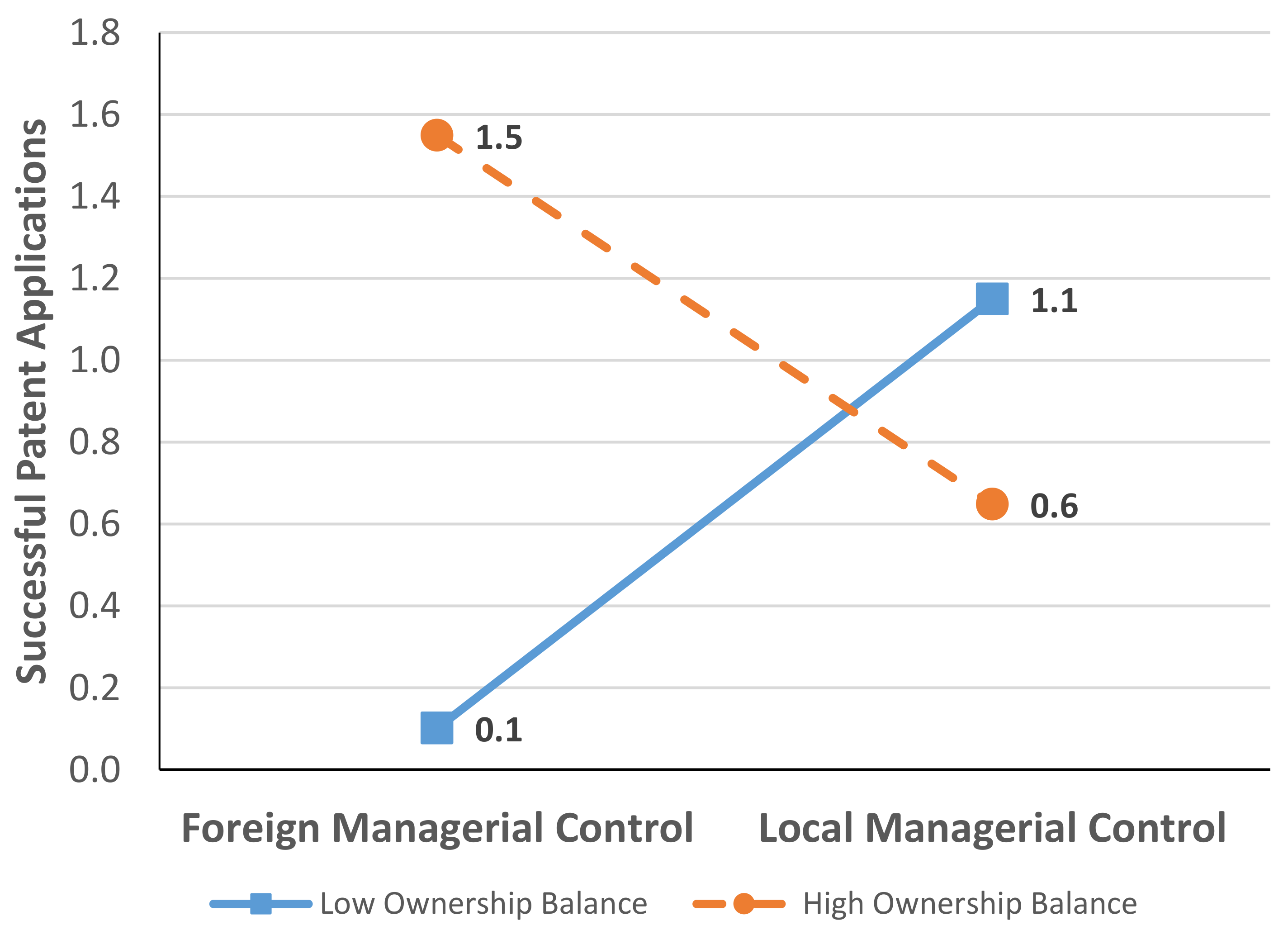

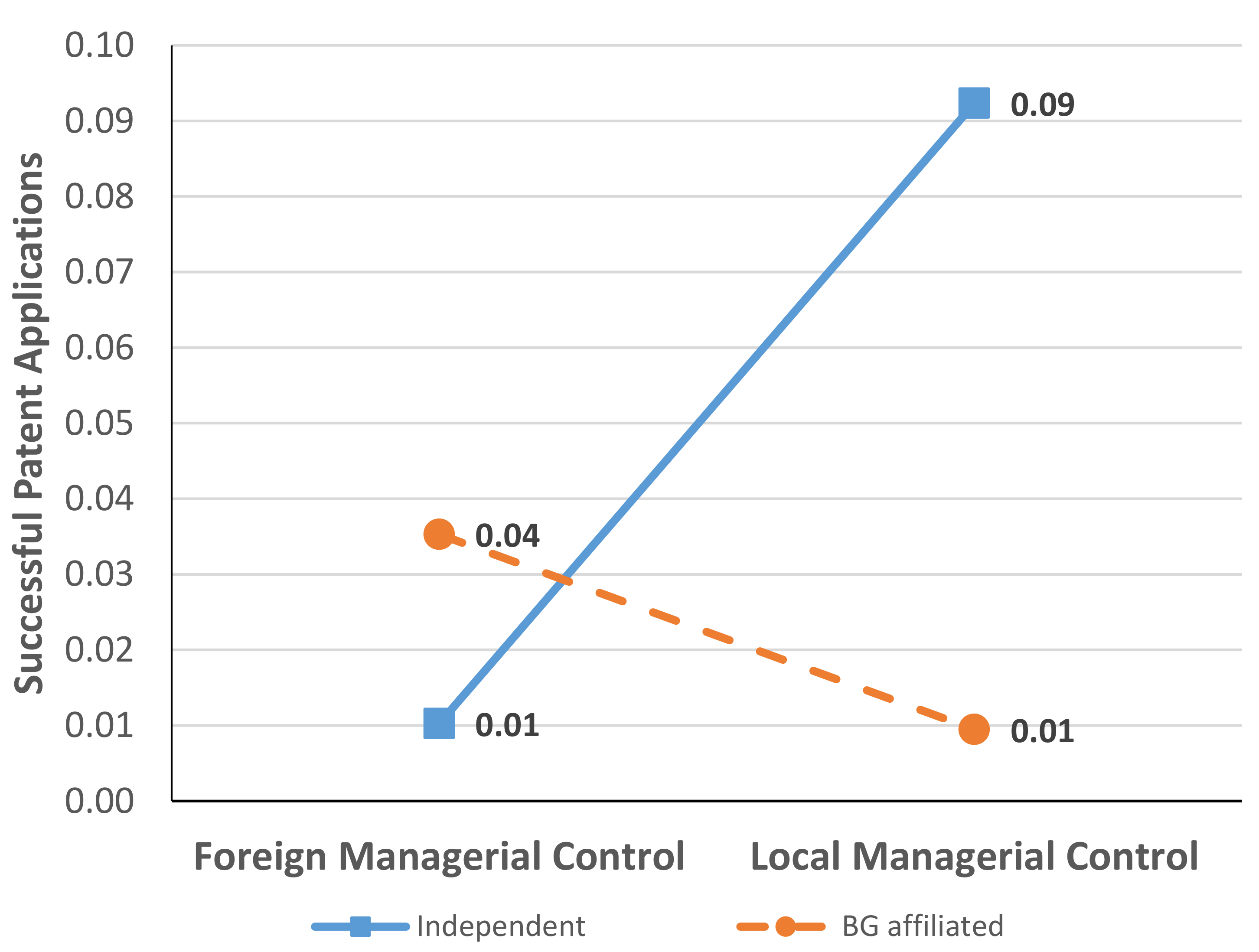

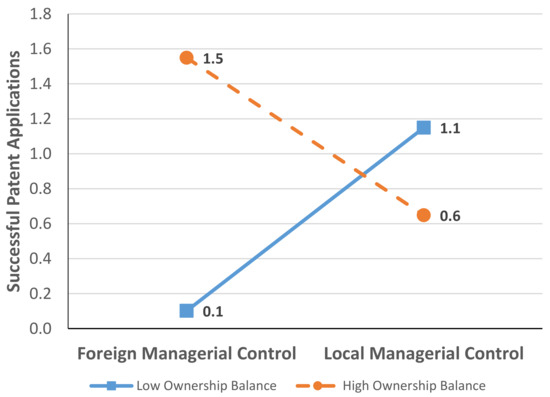

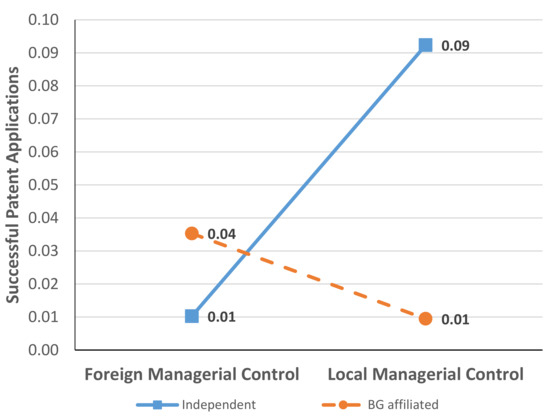

For a more intuitive understanding of these results and to take into account the non-linear nature of negative binomial regression models, we offer interaction graphs in Figure 1 and Figure 2 (we used mean values for control variables and values one standard deviation above and below the mean for all the independent and interacting variables, except business group affiliation, for which we used 0 (i.e., non-affiliated) and 1 (i.e., affiliated) instead.). Figure 1 displays the interaction effect of ownership balance on the relationship between foreign managerial control and innovation. When equity ownership is imbalanced between foreign and local parent firms, IJVs managed by foreign parent firms (0.1 successful patent applications per year) are inferior to those managed by local parent firms (1.1 successful patent applications per year). However, if equity ownership strikes a balance, IJVs managed by foreign parent firms (1.5 successful patent applications per year) become superior to those managed by local parent firms (0.6 successful patent applications per year). Figure 2 displays an interaction effect of business group affiliation. When independent, IJVs managed by local parent firms (0.09 successful patent applications per year) are better performing than those managed by foreign parent firms (0.01 successful patent applications per year). When affiliated with business groups, IJVs managed by foreign parent firms (0.04 successful patent applications per year) become superior to those managed by local parent firms (0.01 successful patent applications per year). All these results lend consistent support to our theory.

Figure 1.

Interaction of foreign managerial control and ownership balance on innovation.

Figure 2.

Interaction of foreign managerial control and business group affiliation on innovation.

5. Discussion and Conclusions

In this study, we explored the optimal control structure of IJVs for developing innovation. We also examined how several IJV attributes alter the optimal control structure. Drawing on the conceptions of local embeddedness [123], the liability of outsidership [16], and open innovation [19], we argued that foreign managerial control suppresses the ability of IJVs to access the local networks for innovation—a local innovation platform—resulting in a lowered innovation output of IJVs. We argued and found evidence that this negative effect of foreign managerial control on innovation weakens with ownership balance and business group affiliation. These findings offer both theoretical and practical insights.

Our theory draws attention to the heterogeneity in capabilities to develop innovation between local and foreign parent firms. Admittedly the innovation development process calls for internal efforts to process R&D inputs into innovative outcomes. However, such internal efforts are by no means sufficient. It also necessitates the management of external knowledge inflows from the buyers/suppliers along the vertical value chain [24,26] as well as ongoing horizontal relations with various constituencies in the local organizational field [15,59,123,124]. However, foreign parent firms are typically less capable of managing the external knowledge inflows in part because they have yet to secure acceptance from the local players as reliable exchange partners that could uphold such close relationships [125,126,127]. Viewed through the lens of open innovation, this finding indicates that foreign managerial control hampers the ability of IJVs to reap the benefit of open innovation. Consequently, IJVs may need to rely on local managers at least for a while to encourage themselves to open up their innovation processes to external innovative players on the market [128,129,130]

In stark contrast, local parent firms are equipped with all that foreign parent firms lack. Hence, our finding offers insights into the extent to which roles could be delegated to local parent firms as far as innovation development is concerned [131]. Even in the case where local parent firms do not have state-of-the-art technology in comparison with foreign parent firms, they should not remain as mere bystanders in the innovation process. Instead, they should assume a vital role in developing innovation by helping locate quality local firms to collaborate with and by alleviating uncertainty stemming from their lesser-known foreign partner firms. This finding, thus, implies that the successful development of innovation hinges upon a well-executed division of labor, coordination, and cooperation between local and foreign parent firms [132].

Relatedly, our study also points to the way such division of labor is effectively administered. According to our results, the negative effect of foreign managerial control on innovation decreases when ownership is balanced. This result implies that although foreign parent firms are in trouble, local parent firms may not have many incentives to help their foreign partners out if their ownership stake is marginal. Hence, foreign parent firms should cede more equity stake to their local partner firms than initially conceived because they may have to ask for more help later on in the innovation development process, particularly as regards locally embedded relations.

We find that the negative relation between foreign managerial control and innovation does not subside as IJVs mature. Our initial expectation was that foreign parent firms could successfully accumulate knowledge about how to establish and maintain embedded relations with local market players as they practice learning by doing and learning by observation over time and become used to the rules of social interactions. Simply put, we expected that the liability of outsidership would decrease over time. Contrary to our expectation, our finding indicates that such learning may not be completed quickly, such as within a decade or so, painting a grim picture of IJVs’ ability to adapt to different institutional environments; that is, it may take a considerable amount of time for foreign parent firms to get themselves locally embedded and alleviate the liability of outsidership. From a slightly different angle, this finding predicts the long-run stability of IJVs when foreign parent firms take managerial control and give top priority to innovation because their dependence on the local parent firms will persist [133].

Our finding also suggests that business groups and inter-affiliate relations therein can functionally substitute for locally embedded relations. Defined as “sets of legally separate firms bound together in persistent formal and/or informal ways” ([87], p. 429), business groups are de facto a single entity sharing identity and destiny as well as fostering strong solidarity [87]. Therefore, their inter-affiliate relations are much stronger and more effective in transferring knowledge than the relations found in the market [93,100,134]. So viewed, our finding recommends foreign firms aimed at establishing an IJV to look for local partners affiliated with business groups, especially if their primary objective is innovation.

Our finding also offers an implication for policymakers. Given that foreign managerial control can reduce innovation output, policymakers may need to contemplate a regulation that prohibits foreign managerial control up to a certain point at which foreign managers sufficiently address the liability of foreignness and outsidership and the lack of local embeddedness. This point becomes all the more germane to the economic society in that innovation not only contributes to an individual organization’s sustainability [1,21,54] but also improves the sustainability of the economic society as a whole by improving social welfare on the basis of the spillover effects [135].

To conclude, this study furthers our understanding by offering insights into how to design IJVs for maximizing innovation output, with an added emphasis on the control structure of IJVs.

6. Limitations and Future Research

As with all studies, our study has some limitations that may provide directions for future research. First, this study assumes that foreign firms take managerial control over their IJVs when they take up the CEO position. Granted, the roles, responsibilities, and influence of CEOs cannot be over-emphasized in the analysis of management in general and strategic choices in particular [136,137]. Even so, it is also true that what CEOs do for an organization performs just one functional part of all the managerial activities. In line with this reasoning, the role of middle managers as agents for channeling communication has attracted considerable scholarly attention in a variety of managerial topics (e.g., [138,139]). Future studies should continue to allow for control through various managerial layers other than through the top management in understanding the effect of foreign managerial control on the innovative performance of IJVs (cf. [140]).

Furthermore, this study does not take alliance history into account [30,31,141]. Network literature has revealed that repeated interactions engender inter-firm trust [30] and “pressures for conformity to expectations” ([142], p. 63). Then, the analysis of the control structure to the exclusion of alliance history may overestimate the effect sizes of the purely economics-based explanation [63]. Relatedly, this study does not take into account other types of embeddedness, such as positional and structural embeddedness [31]. Future studies may benefit from considering the effects of these factors of networks.

Although this study measured innovative performance based on successful patent applications, there are alternative ways to measure it (e.g., [10]). For instance, the number of patent applications can be used instead, regardless of whether they are eventually granted. However, research evidence suggests that the number of successful patent applications and that of patent applications are practically the same, on the grounds that most applications are ultimately granted, with the grant rate being in the neighborhood of 90% [143]. Furthermore, even if it takes 28 months on average for a patent application to be granted [144], quality inventions tend to be granted much quicker. From a slightly different angle, it would be of value to attend to the quality of innovative outputs by using the number of citations [5].

Finally, our study is based on a single-country data sample. The advantage of such a single country setting is that it does not create the need for controlling for heterogeneous institutional settings, which are typically challenging to operationalize. The disadvantage, however, is that the results derived from such a single country study unavoidably suffer from limited generalizability. So, we believe that further investigation into other countries holds promise for enriching our knowledge.

Author Contributions

K.J. (conceptualization, theory development, methodology, writing—original draft); C.P. (investigation, data collection, methodology, writin—review & editing); J.L. (conceptualization, project administration, resources, supervision, writin—review & editing, funding acquisition). All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the 2019 Research Fund of Myongji University.

Conflicts of Interest

The authors declare no conflict of interest

References

- Ahuja, G.; Lampert, C.M.; Tandon, V. Moving Beyond Schumpeter: Management Research on the Determinants of Technological Innovation. Acad. Manag. Ann. 2008, 2, 1–98. [Google Scholar] [CrossRef]

- Fleming, L.; Sorenson, O. Technology as a complex adaptive system: Evidence from patent data. Res. Policy 2001, 30, 1019–1039. [Google Scholar] [CrossRef]

- Fleming, L.; Sorenson, O. Science as a map in technological search. Strateg. Manag. J. 2004, 25, 909–928. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowldege of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strateg. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Chun, M.Y.-S.; Nhung, D.T.H.; Lee, J. The Transition of Samsung Electronics through Its M&A with Harman International. J. Open Innov. Technol. Mark. Complex. 2019, 5, 51. [Google Scholar]

- Mahmood, I.P.; Zheng, W.T. Whether and how: Effects of international joint ventures on local innovation in an emerging economy. Res. Policy 2009, 38, 1489–1503. [Google Scholar] [CrossRef]

- Shao, Y.; Shi, L. Cross-border open innovation of early stage tech incubation: A case study of forge, the first UK-China accelerator program. J. Open Innov. Technol. Mark. Complex. 2018, 4, 37. [Google Scholar] [CrossRef]

- Zhang, Y.; Lil, H.Y.; Hitt, M.A.; Cui, G. R&D intensity and international joint venture performance in an emerging market: Moderating effects of market focus and ownership structure. J. Int. Bus. Stud. 2007, 38, 944–960. [Google Scholar] [CrossRef]

- Zhou, C.; Li, J. Product innovation in emerging market-based international joint ventures: An organizational ecology perspective. J. Int. Bus. Stud. 2008, 39, 1114–1132. [Google Scholar] [CrossRef]

- Barkema, H.G.; Shenkar, O.; Vermeulen, F.; Bell, J.H. Working abroad, working with others: How firms learn to operate international joint ventures. Acad. Manag. J. 1997, 40, 426–442. [Google Scholar]

- Geringer, J.M.; Hebert, L. Control and performance of international joint ventures. J. Int. Bus. Stud. 1989, 20, 235–254. [Google Scholar] [CrossRef]

- Yan, A.; Gray, B. Antecedents and effects of parent control in international joint ventures. J. Manag. Stud. 2001, 38, 393–416. [Google Scholar] [CrossRef]

- Beamish, P.W.; Lupton, N.C. Managing Joint Ventures. Acad. Manag. Perspect. 2009, 23, 75–94. [Google Scholar] [CrossRef]

- Andersson, U.; Forsgren, M. Subsidiary Embeddedness and Control in the Multinational Corporation. Int. Bus. Rev. 1996, 5, 487–508. [Google Scholar] [CrossRef]

- Johanson, J.; Vahlne, J.E. The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership. J. Int. Bus. Stud. 2009, 40, 1411–1431. [Google Scholar] [CrossRef]

- Mainela, T.; Puhakka, V. Embeddedness and networking as drivers in developing an international joint venture. Scand. J. Manag. 2008, 24, 17–32. [Google Scholar] [CrossRef]

- Chesbrough, H.; Bogers, M. Explicating open innovation: Clarifying an emerging paradigm for understanding innovation. In New Frontiers in Open Innovation; Oxford University Press: Oxford, UK, 2014; pp. 3–28. [Google Scholar]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Boston, MA, USA, 2003; ISBN 1-57851-837-7. [Google Scholar]

- Bogers, M.; Chesbrough, H.; Heaton, S.; Teece, D.J. Strategic management of open innovation: A dynamic capabilities perspective. Calif. Manag. Rev. 2019, 62, 77–94. [Google Scholar] [CrossRef]

- Schilling, M.A. Strategic Management of Technological Innovation, 5th ed.; McGraw-Hill Education: New York, NY, USA, 2016. [Google Scholar]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Ganotakis, P.; Love, J.H. The innovation value chain in new technology-based firms: Evidence from the UK. J. Prod. Innov. Manag. 2012, 29, 839–860. [Google Scholar] [CrossRef]

- Kapoor, R. Persistence of integration in the face of specialization: How firms navigated the winds of disintegration and shaped the architecture of the semiconductor industry. Organ. Sci. 2013, 24, 1195–1213. [Google Scholar] [CrossRef]

- Roper, S.; Du, J.; Love, J.H. Modelling the innovation value chain. Res. Policy 2008, 37, 961–977. [Google Scholar] [CrossRef]

- Yun, J.J.; Yigitcanlar, T. Open Innovation in Value Chain for Sustainability of Firms. Sustainability 2017, 9, 811. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Zaheer, S. Overcoming the Liability of Foreignness. Acad. Manag. J. 1995, 38, 341–363. [Google Scholar] [CrossRef]

- Gulati, R. Does familiarity breed trust? The implications of repeated ties for contractual choice in alliances. Acad. Manag. J. 1995, 38, 85–112. [Google Scholar]

- Gulati, R.; Gargiulo, M. Where Do Interorganizational Networks Come From? Am. J. Sociol. 1999, 104, 1439–1493. [Google Scholar] [CrossRef]

- Kilduff, M.; Tsai, W. Social Networks and Organizations; Sage Publications: London, UK, 2003. [Google Scholar]

- Andersson, U.; Forsgren, M.; Holm, U. Subsidiary embeddedness and competence development in MNCs—A multi-level analysis. Organ. Stud. 2001, 22, 1013–1034. [Google Scholar] [CrossRef]

- Schmidt, T.; Sofka, W. Liability of foreignness as a barrier to knowledge spillovers: Lost in translation? J. Int. Manag. 2009, 15, 460–474. [Google Scholar] [CrossRef]

- Knoben, J.; Oerlemans, L.A. Proximity and inter-organizational collaboration: A literature review. Int. J. Manag. Rev. 2006, 8, 71–89. [Google Scholar] [CrossRef]

- Shaw, A.T.; Gilly, J.-P. On the analytical dimension of proximity dynamics. Reg. Stud. 2000, 34, 169–180. [Google Scholar] [CrossRef]

- Breschi, S.; Malerba, F. The geography of innovation and economic clustering: Some introductory notes. Ind. Corp. Chang. 2001, 10, 817–833. [Google Scholar] [CrossRef]

- Hoekman, J.; Frenken, K.; Tijssen, R.J. Research collaboration at a distance: Changing spatial patterns of scientific collaboration within Europe. Res. Policy 2010, 39, 662–673. [Google Scholar] [CrossRef]

- Pouder, R.; St John, C.H. Hot spots and blind spots: Geographical clusters of firms and innovation. Acad. Manag. Rev. 1996, 21, 1192–1225. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Ding, D.Z. Control, conflict, and performance: A study of US-Chinese joint ventures. J. Int. Mark. 1997, 5, 31–45. [Google Scholar] [CrossRef]

- Kogut, B. Joint Ventures: Theoretical and Empirical Perspectives. Strateg. Manag. J. 1988, 9, 319–332. [Google Scholar] [CrossRef]

- Lane, P.J.; Salk, J.E.; Lyles, M.A. Absorptive capacity, learning, and performance in international joint ventures. Strateg. Manag. J. 2001, 22, 1139–1161. [Google Scholar] [CrossRef]

- Galunic, D.C.; Rodan, S. Resource recombinations in the firm: Knowledge structures and the potential for schumpeterian innovation. Strateg. Manag. J. 1998, 19, 1193–1201. [Google Scholar] [CrossRef]

- Henderson, R.M.; Clark, K.B. Architectural Innovation—The Reconfiguration of Existing Product Technologies and the Failure of Established Firms. Adm. Sci. Q. 1990, 35, 9–30. [Google Scholar] [CrossRef]

- Henderson, R.; Cockburn, I. Measuring competence? Exploring firm effects in pharmaceutical research. Strateg. Manag. J. 1994, 15, 63–84. [Google Scholar] [CrossRef]

- Hernandez, E.; Shaver, J.M. Network synergy. Adm. Sci. Q. 2019, 64, 171–202. [Google Scholar] [CrossRef]

- Katila, R.; Ahuja, G. Something old, something new: A longitudinal study of search behavior and new product introduction. Acad. Manag. J. 2002, 45, 1183–1194. [Google Scholar]

- Puranam, P.; Singh, H.; Zollo, M. Organizing for innovation: Managing the coordination-autonomy dilemma in technology acquisitions. Acad. Manag. J. 2006, 49, 263–280. [Google Scholar] [CrossRef]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic Networks. Strateg. Manag. J. 2000, 21, 203–215. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W. Social capital, networks, and knowledge transfer. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef]

- Meschi, P.-X.; Wassmer, U. The effect of foreign partner network embeddedness on international joint venture failure: Evidence from European firms’ investments in emerging economies. Int. Bus. Rev. 2013, 22, 713–724. [Google Scholar] [CrossRef]

- Hansen, M.T.; Birkinshaw, J. The innovation value chain. Harv. Bus. Rev. 2007, 85, 121. [Google Scholar]

- Shane, S. Technology Strategy for Managers and Entrepreneurs; Pearson/Prentice Hall: Upper Saddle River, NJ, USA, 2009; ISBN 0-13-187932-4. [Google Scholar]

- Gulati, R. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strateg. Manag. J. 1999, 20, 397–420. [Google Scholar] [CrossRef]

- Bruton, G.D.; White, M.A. Strategic Management of Technology and Innovation; South-Western Cengage Learning: Mason, OH, USA, 2011. [Google Scholar]

- Sorenson, O.; Stuart, T.E. Syndication networks and the spatial distribution of venture capital investments. Am. J. Sociol. 2001, 106, 1546–1588. [Google Scholar] [CrossRef]

- Nelson, R.R.; Winter, S. An Evolutionary Theory of Economic Change; Harvard University Press: Cambridge, MA, USA, 1982. [Google Scholar]

- Andersson, U.; Bjorkman, I.; Forsgren, M. Managing subsidiary knowledge creation: The effect of control mechanisms on subsidiary local embeddedness. Int. Bus. Rev. 2005, 14, 521–538. [Google Scholar] [CrossRef]

- Finkelstein, S. Power in Top Management Teams—Dimensions, Measurement, and Validation. Acad. Manag. J. 1992, 35, 505–538. [Google Scholar]

- Uzzi, B. The sources and consequences of embeddedness for the economic performance of organizations: The network effect. Am. Sociol. Rev. 1996, 61, 674–698. [Google Scholar] [CrossRef]

- Uzzi, B. Social structure and competition in interfirm networks: The paradox of embeddedness. Adm. Sci. Q. 1997, 42, 35–67. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: A theory of embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Hennart, J.-F. A transaction costs theory of equity joint ventures. Strateg. Manag. J. 1988, 9, 361–374. [Google Scholar] [CrossRef]

- Hennart, J.-F. The transaction costs theory of joint ventures: An empirical study of Japanese subsidiaries in the united states. Manag. Sci. 1991, 37, 483–497. [Google Scholar] [CrossRef]

- McEvily, B.; Zaheer, A. Bridging ties: A source of firm heterogeneity in competitive capabilities. Strateg. Manag. J. 1999, 20, 1133–1157. [Google Scholar] [CrossRef]

- Kim, J.; Kim, K. How does local partners network embeddedness affect international joint venture survival in different subnational contexts? Asia Pac. J. Manag. 2018, 35, 1055–1080. [Google Scholar] [CrossRef]

- Martin, X.; Salomon, R. Tacitness, learning, and international expansion: A study of foreign direct investment in a knowledge-intensive industry. Organ. Sci. 2003, 14, 297–311. [Google Scholar] [CrossRef]

- Polanyi, M. Personal Knowledge: Towards a Post-Critical Philosophy; University of Chicago Press: Chicago, IL, USA, 2015. [Google Scholar]

- Arrow, K.J. The Limits of Organization; WW Norton & Company: New York, NY, USA, 1974. [Google Scholar]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Harzing, A.-W. Who’s in charge? An empirical study of executive staffing practices in foreign subsidiaries. Hum. Resour. Manag. Publ. Coop. Sch. Bus. Adm. Univ. Mich. Alliance Soc. Hum. Resour. Manag. 2001, 40, 139–158. [Google Scholar] [CrossRef]

- Tan, D.; Mahoney, J.T. Explaining the utilization of managerial expatriates from the perspectives of resource-based, agency, and transaction costs theories. Adv. Int. Manag. 2003, 15, 179–205. [Google Scholar]

- Bebenroth, R.; Froese, F.J. Consequences of expatriate top manager replacement on foreign subsidiary performance. J. Int. Manag. 2020, 26, 100730. [Google Scholar] [CrossRef]

- Yu, B.B.; Egri, C.P. Human resource management practices and affective organizational commitment: A comparison of Chinese employees in a state-owned enterprise and a joint venture. Asia Pac. J. Hum. Resour. 2005, 43, 332–360. [Google Scholar] [CrossRef]

- Du, J.; Choi, J.N. Pay for performance in emerging markets: Insights from China. J. Int. Bus. Stud. 2010, 41, 671–689. [Google Scholar] [CrossRef]

- Shin, S.J.; Morgeson, F.P.; Campion, M.A. What you do depends on where you are: Understanding how domestic and expatriate work requirements depend upon the cultural context. J. Int. Bus. Stud. 2007, 38, 64–83. [Google Scholar] [CrossRef]

- Walsh, J.P.; Seward, J.K. On the efficiency of internal and external corporate control mechanims. Acad. Manag. Rev. 1990, 15, 421–458. [Google Scholar] [CrossRef]

- Bleeke, J.; Ernst, D. The way to win in cross-border alliances. Harv. Bus. Rev. 1991, 69, 127–135. [Google Scholar]

- Steensma, H.K.; Lyles, M.A. Explaining IJV survival in a transitional economy through social exchange and knowledge-based perspectives. Strateg. Manag. J. 2000, 21, 831–851. [Google Scholar] [CrossRef]

- Huber, G.P. Organizational learning: The contributing processes and the literatures. Organ. Sci. 1991, 2, 88–115. [Google Scholar] [CrossRef]

- Levitt, B.; March, J.G. Organizational Learning. Annu. Rev. Sociol. 1988, 14, 319–340. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Crossan, M.M. Believing Is Seeing: Joint Ventures and Organization Learning. J. Manag. Stud. 1995, 32, 595–618. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Lyles, M.A.; Steensma, H.K.; Tihanyi, L. Managing tacit and explicit knowledge transfer in IJVs: The role of relational embeddedness and the impact on performance. J. Int. Bus. Stud. 2004, 35, 428–442. [Google Scholar] [CrossRef]

- Zaheer, S.; Mosakowski, E. The dynamics of the liability of foreignness: A global study of survival in financial services. Strateg. Manag. J. 1997, 18, 439–463. [Google Scholar] [CrossRef]

- Granovetter, M. Business Groups. In The Handbook of Economic Sociology; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 1994; pp. 453–475. [Google Scholar]

- Granovetter, M. Business Groups and Social Organization. In The Handbook of Economic Sociology; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 2005; pp. 429–450. [Google Scholar]

- Khanna, T.; Rivkin, J.W. Estimating the performance effects of business groups in emerging markets. Strateg. Manag. J. 2001, 22, 45–74. [Google Scholar] [CrossRef]

- Khanna, T.; Rivkin, J.W. Interorganizational ties and business group boundaries: Evidence from an emerging economy. Organ. Sci. 2006, 17, 333–352. [Google Scholar] [CrossRef]

- Leff, N.H. Industrial Organization and Entrepreneurship in Developing-Countries—Economic Groups. Econ. Dev. Cult. Chang. 1978, 26, 661–675. [Google Scholar] [CrossRef]

- Chang, S.-J.; Chung, C.-N.; Mahmood, I.P. When and how does business group affiliation promote firm innovation? A tale of two emerging economies. Organ. Sci. 2006, 17, 637–656. [Google Scholar] [CrossRef]

- Mahmood, I.P.; Mitchell, W. Two faces: Effects of business groups on innovation in emerging economies. Manag. Sci. 2004, 50, 1348–1365. [Google Scholar] [CrossRef]

- Belenzon, S.; Berkovitz, T. Innovation in Business Groups. Manag. Sci. 2010, 56, 519–535. [Google Scholar] [CrossRef]

- Nepelski, D.; De Prato, G. Internationalisation of ICT R&D: A comparative analysis of Asia, the European Union, Japan, United States and the rest of the world. Asian J. Technol. Innov. 2012, 20, 219–238. [Google Scholar]

- Buckley, P.J.; Park, B.I. Realised absorptive capacity, technology acquisition and performance in international collaborative formations: An empirical examination in the Korean context. Asia Pac. Bus. Rev. 2014, 20, 109–135. [Google Scholar] [CrossRef]

- Blodgett, L.L. Research notes and communications factors in the instability of international joint ventures: An event history analysis. Strateg. Manag. J. 1992, 13, 475–481. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Beamish, P.W. Effect of equity ownership on the survival of international joint ventures. Strateg. Manag. J. 2004, 25, 295–305. [Google Scholar] [CrossRef]

- Chang, S.J. The Rise and Fall of Chaebols: Financial Crisis and Transformation of Korean Business Groups; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Chang, S.J.; Hong, J. Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Acad. Manag. J. 2000, 43, 429–448. [Google Scholar]

- Mahmood, I.P.; Zhu, H.; Zajac, E.J. Where can capabilities come from? Network ties and capability acquisition in business groups. Strateg. Manag. J. 2011, 32, 820–848. [Google Scholar] [CrossRef]

- Cohen, W.M.; Nelson, R.R.; Walsh, J.P. Protecting Their Intellectual Assets: Appropriability Conditions and Why US Manufacturing Firms Patent (or Not); National Bureau of Economic Research: Cambridge, MA, USA, 2000. [Google Scholar] [CrossRef]

- Frear, K.A.; Cao, Y.; Zhao, W. CEO background and the adoption of Western-style human resource practices in China. Int. J. Hum. Resour. Manag. 2012, 23, 4009–4024. [Google Scholar] [CrossRef]

- Almeida, H.; Wolfenzon, D. A theory of pyramidal ownership and family business groups. J. Financ. 2006, 61, 2637–2680. [Google Scholar] [CrossRef]

- Scherer, F.M. Firm size, market structure, opportunity, and the output of patented inventions. Am. Econ. Rev. 1965, 55, 1097–1125. [Google Scholar]

- Scherer, F.M. The propensity to patent. Int. J. Ind. Organ. 1983, 1, 107–128. [Google Scholar] [CrossRef]

- Tey, L.S.; Idris, A. Cultural fit, knowledge transfer and innovation performance: A study of Malaysian offshore international joint ventures. Asian J. Technol. Innov. 2012, 20, 201–218. [Google Scholar] [CrossRef]

- Hofstede, G.H. Culture’s Consequences: Comparing Values, Behaviors, Institutions, and Organizations Across Nations, 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2001; ISBN 0-8039-7323-3. [Google Scholar]

- Dutta, D.K.; Beamish, P.W. Expatriate Managers, Product Relatedness, and IJV Performance: A Resource and Knowledge-based Perspective. J. Int. Manag. 2013, 19, 152–162. [Google Scholar] [CrossRef]

- Nohria, N.; Gulati, R. Is slack good or bad for innovation? Acad. Manag. J. 1996, 39, 1245–1264. [Google Scholar] [CrossRef]

- Greve, H.R. A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Acad. Manag. J. 2003, 46, 685–702. [Google Scholar]

- Baum, J.A.C.; Rowley, T.J.; Shipilov, A.V.; Chuang, Y. Dancing with Strangers: Aspiration Performance and the Search for Underwriting Syndicate Partners. Adm. Sci. Q. 2005, 50, 536–575. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 7th ed.; Prentice Hall: Boston, MA, USA, 2012; ISBN 0-13-139538-6. [Google Scholar]

- Hausman, J.; Hall, B.H.; Griliches, Z. Econometric-Models for Count Data with an Application to the Patents R and D Relationship. Econometrica 1984, 52, 909–938. [Google Scholar] [CrossRef]

- Heckman, J. Statistical Models for Discrete Panel Data. In The Econometrics of Panel Data; McFadden, D., Manski, C., Eds.; MIT Press: Cambridge, MA, USA, 1981. [Google Scholar]

- Heckman, J. Heterogeneity and State Dependence. In Studies in Labor Markets; Rosen, S., Ed.; University of Chicago Press: Chicago, IL, USA, 1981; pp. 91–139. [Google Scholar]

- Hsiao, C. Analysis of Panel Data; Econometric Society monographs; Cambridge University Press: Cambridge, NY, USA, 1986; ISBN 0-521-25150-8. [Google Scholar]

- Plumper, T.; Troeger, V.E. Efficient estimation of time-invariant and rarely changing variables in finite sample panel analyses with unit fixed effects. Polit. Anal. 2007, 15, 124–139. [Google Scholar] [CrossRef]

- Petersen, T. Analyzing Panel Data: Fixed- and Random-Effects Models. In Handbook of Data Analysis; SAGE Publications: London, UK, 2004; pp. 332–345. ISBN 978-0-7619-6652-4. [Google Scholar]

- Killing, P.J. Strategies for Joint Venture Success; Praeger: New York, NY, USA, 1983. [Google Scholar]

- Yan, A.; Zeng, M. International joint venture instability: A critique of previous research, a reconceptualization, and directions for future research. J. Int. Bus. Stud. 1999, 30, 397–414. [Google Scholar] [CrossRef]

- Cohen, J.; Cohen, P.; West, P.W.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences, 3rd ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 2003. [Google Scholar]

- Pollock, T.G.; Lee, P.M.; Jin, K.; Lashley, K. (Un) Tangled Exploring the Asymmetric Coevolution of New Venture Capital Firms’ Reputation and Status. Adm. Sci. Q. 2015, 60, 482–517. [Google Scholar] [CrossRef]

- Andersson, U.; Forsgren, M.; Holm, U. The strategic impact of external networks: Subsidiary performance and competence development in the multinational corporation. Strateg. Manag. J. 2002, 23, 979–996. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Burt, R.S. Brokerage & Closure. An Introduction to Social Capital; Oxford University Press: New York, NY, USA, 2005. [Google Scholar]

- Coleman, J.S. Social Capital in the Creation of Human Capital. Am. J. Sociol. 1988, 94, S95–S120. [Google Scholar] [CrossRef]

- Walker, G.; Kogut, B.; Shan, W. Social capital, structural holes and the formation of an industry network. Organ. Sci. 1997, 8, 109–125. [Google Scholar] [CrossRef]

- Rasiah, R. Building networks to harness innovation synergies: Towards an open systems approach to sustainable development. J. Open Innov. Technol. Mark. Complex. 2019, 5, 70. [Google Scholar] [CrossRef]

- Tajudeen, F.P.; Jaafar, N.I.; Sulaiman, A. External Technology Acquisition and External Technology Exploitation: The Difference of Open Innovation Effects. J. Open Innov. Technol. Mark. Complex. 2019, 5, 97. [Google Scholar] [CrossRef]

- Uribe-Echeberria, R.; Igartua, J.I.; Lizarralde, R. Implementing Open Innovation in Research and Technology Organisations: Approaches and Impact. J. Open Innov. Technol. Mark. Complex. 2019, 5, 91. [Google Scholar] [CrossRef]

- Choi, C.B.; Beamish, P.W. Split management control and international joint venture performance. J. Int. Bus. Stud. 2004, 35, 201–215. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.S. Between trust and control: Developing confidence in partner cooperation in alliances. Acad. Manag. Rev. 1998, 23, 491–512. [Google Scholar] [CrossRef]

- Hamel, G. Competition for Competence and Inter-Partner Learning Within International Strategic Alliances. Strateg. Manag. J. 1991, 12, 83–103. [Google Scholar] [CrossRef]

- Krackhardt, D. Simmelian ties: Super strong and sticky. In Power and Influence in Organizations; Kramer, R.M., Neale, M.A., Eds.; Sage: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Knott, A.M. Persistent heterogeneity and sustainable innovation. Strateg. Manag. J. 2003, 24, 687–705. [Google Scholar] [CrossRef]

- Child, J. Organizational Structure, Environment and Performance: The Role of Strategic Choice. Sociol. J. Br. Sociol. Assoc. 1972, 6, 1–22. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper Echelons: The Organization as a Reflection of Its Top Managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Ren, C.R.; Guo, C. Middle managers’ strategic role in the corporate entrepreneurial process: Attention-based effects. J. Manag. 2011, 37, 1586–1610. [Google Scholar] [CrossRef]

- Rouleau, L. Micro-practices of strategic sensemaking and sensegiving: How middle managers interpret and sell change every day. J. Manag. Stud. 2005, 42, 1413–1441. [Google Scholar] [CrossRef]

- Bantel, K.A.; Jackson, S.E. Top Management and Innovations in Banking—Does the Composition of the Top Team Make a Difference. Strateg. Manag. J. 1989, 10, 107–124. [Google Scholar] [CrossRef]

- Kim, S.; Jin, K. Organizational governance of inter-firm resource combinations: The impact of structural embeddedness and vertical resource relatedness. J. Manag. Organ. 2017, 23, 524–544. [Google Scholar] [CrossRef]

- Macaulay, S. Non-contractual relations in business: A preliminary study. Am. Sociol. Rev. 1963, 55–67. [Google Scholar] [CrossRef]

- Gans, J.S.; Hsu, D.H.; Stern, S. The impact of uncertain intellectual property rights on the market for ideas: Evidence from patent grant delays. Manag. Sci. 2008, 54, 982–997. [Google Scholar] [CrossRef]

- Popp, D.; Juhl, T.; Johnson, D. Time in purgatory: Determinants of the grant lag for US patent applications. Top. Econ. Anal. Policy 2004, 4. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).