Abstract

Sustainable foreign direct investment (SFDI) contributes to the development of the economic, environmental, and social aspects in rational governance practices in Malaysia. Prior studies lack the integration and synthesis of the SFDI attributes from the policymakers and foreign investors’ perceptions. These attributes are measured through the qualitative information and subjective perceptions and need to transform into comparable values. The fuzzy Delphi method is applied to identify the valid set of SFDI attributes and confirms the validity and reliability of these attributes. Moreover, prior studies have not examined the importance and performance of those valid attributes in qualitative information. The fuzzy importance and performance analysis is proposed to assess the attributes’ importance and performance level. The results show that financial, macroeconomic, and institutional policy aspects are among the most important SFDI attributes, together with environmental and social aspects. This study identifies the discrepancies between policymakers and foreign investors and suggests that the financial aspect is the priority of foreign investors that needs to be concentrated for improvements; meanwhile, the institutional and policies and social aspects in performance level are presented as a big contradistinction. The theoretical and policy implications are discussed.

1. Introduction

Sustainable foreign direct investment (SFDI) involves contribution on the economic, social, and environmental development within a rational governance practice [1]. This implies that the SFDI is not concerned only with the economic or financial gains, which usually is the sole focus in FDI, but also considers the social and environmental impacts to reduce negative spillover in Malaysia. The governance has to strictly ensure the FDI quality and not just encourage more capital inflows that are unconcerned with their externalities. Moreover, the FDI’s quality has become the priority since the globalization process [1]. Malaysia, as an emerging economy that relies heavily on FDI inflows, cannot escape this phenomenon. This is because the inward FDI is needed to fulfill the capital shortage for local development. However, Malaysia is focusing less on the FDI quality due to the lack of awareness and inadequate regulations, and this might offer opportunities for foreign investors to reallocate their investment [2]. This study sheds light on the attributes that are needed to create a sustainable investment environment for the stakeholders. This study incorporates attributes from social, environmental, and economic aspects in order to measure SFDI (triple bottom line, or TBL).

Prior studies lack to integrate the multi-aspects in SFDI and their features are divided into four aspects, which are economic, social, environmental, and governance [1,3,4,5]. For instance, the economic, social, and political aspects encouraging to have more FDI inflows [6]. The social, economic, and financial aspects showed the attraction toward FDI, together with the regulatory and political aspects [7]. Besides, the FDI allocation is determined by social, financial, political, and institutional aspects, especially for terrorist activity, which will hamper the FDI inflows [8]. The social aspect’s attributes, such as technology, culture, innovation, and human capital, captivate the inwards FDI, together with the macroeconomic aspect also proven [9,10]. This indicates that the TBL aspects and governance aspect are necessary for SFDI inflows. There are only environmental and governance aspects able to realize the sustainability in FDI inflows [4]. However, institutional and governance require policies to monitor and supervise the investment operation. These policies are necessary to make sure compliance with the rules and regulations and ensure SFDI conducted in a sustainable manner without endangering the local community.

In addition, the government’s supporting policies argued as a requirement in boosting SFDI inflows. For instance, FDI allocation is mainly contributed to the government’s policies and macroeconomic aspects [11]. In the same vein, the integration of government’s supporting policies, macroeconomic, and natural conditions in attracting inward FDI have been proven [12,13]. The public interventions and investment environment were the key FDI aspects, although their effects may vary in different finance sources [14]. These studies ascertained that the government’s support policies increase the inwards FDI flows, whereas it could reduce the investment costs, as well as provide necessary protection and guarantee to the foreign investors. Prior studies suggested that the FDI distribution was mainly credited to the TBL aspects and also the government’s support policies. However, these studies are focused on the FDI attributes, and few studies integrate those valid attributes, such as economic and financials, environmental, social, institutional, and policies, to explore on the SFDI attributes. There is a lack of studies to focus and structure the SFDI attributes from the policymakers and foreign investors’ perspectives. The understanding between different policymakers and foreign investors’ perspective is necessary to provide useful input for policymakers in formulating future policies that will attract more capital inflows. Policymakers required the opinion of the public, such as stakeholders, to develop policy plans that could meet their expectations [15]. Direct interaction with practitioners is essential for knowing their opinions and perceptions [2]. In practices, the perception on SFDI attributes in qualitative information is hard to measure and quantify into crisp value.

Hence, this has produced unclear information on the attractiveness of these SFDI attributes due to FDI attributes collected from literature and depend on the data’s availability [4,13,14]. This study provides a set of important attributes to encourage more FDI inflows toward sustainability. These attributes are essential to improve and enhance the attractiveness on foreign investment. However, these studies are not to examine the attributes of the importance and performance level. There is a need to evaluate the current performance of these attributes through an assessment. For that reason, identifying the SFDI’s important attributes and understanding the performance of these attributes is needed to strengthen and enrich the attractiveness towards SFDI. The objectives of this study was to evaluate the attributes as follows:

- To identify the valid SFDI attributes based on qualitative information.

- To assess the attributes’ importance and performance level in subjective perception

- To justify and suggest the improvement action strategy from experts’ perception.

The SFDI attributes are related to the person’s judgment in relevant stakeholders that requires human subjective perceptions. This study utilizes these subjective perceptions to assess qualitative information. The uncertainty and vagueness of the experts’ subjective perceptions were addressed through the fuzzy set theory and converted into a comparable value. However, the qualitative information from the expert’s subjective perception has to be handle uncertain information. This study adopts the fuzzy Delphi method (FDM) to identify the essential attributes for SFDI due to this uncertain information. In the practical assessment, the importance of the government’s support policies could be examined individually, and the identification of essential attributes is based on a set of potential attributes. This assessment improves the reliability and validity of the attributes’ selection and evaluates the ranks and positions the valid attributes using fuzzy importance and performance analysis (FIPA). FIPA is collecting and analyzing the data under uncertainties.

This study has contributed in threefold: (1) identifying the essential and valid set of SFDI attributes; (2) assessing the rankings and the performance’s position of valid attributes using the FIPA; and (3) suggesting the improvement SFDI plan for Malaysia to enhancing the attractiveness. This study contributes to the policymakers’ side to develop a set of attributes grounded in theory and experts’ subjective perception from the qualitative information. The performances of the set of important attributes are evaluate through the qualitative information of the involved experts’, and this could be used to come up with a robust and reliable suggestion by focusing on that underperformance, but with highly important attributes directly, as the resources of the policymakers may not focus enough on the whole set of important attributes.

The structure of this study is organized in the following sections. The literature of SFDI and their attributes, together with the proposed method, are presented in Section 2. Section 3 briefly explains the case background and the details of the research methods. Section 4 demonstrates the results of the FDM and FIPA, while the implications are provided in Section 5. The limitations and suggestion for future study are discussed in the last section.

2. Literature Review

This section briefly discusses the SFDI, together with the proposed attributes. The proposed method of the study is described in the section.

2.1. Sustainable Foreign Direct Investment

SFDI is the investment practices in one country to another country and considers all TBL aspects development, together with the governance practices [1,5]. This is important as the foreign investor usually focuses only on their profitability and is not concerned on the negative impacts of the investment. Although FDI contributes to economic growth and offers more jobs opportunity, investors generate more profits by enlarging their investments in foreign markets [16]. However, many studies have remarked on the negative impacts of FDI activities, especially on environmental and social aspects [17,18,19]. For example, the local labor market was destructed by the FDI activities due to the competition pressure and also labor-saving techniques to minimize the costs [17]. FDI caused environmental devastation and has not contributed to environmental sustainability [18]. FDI has adverse consequences on climate actions, although the FDI decisive role on economic growth remarks especially on basic infrastructure, clean water, sanitation, and renewable energy [19]. This has provided evidence of the FDI’s negative impact, although it does not concern sustainability [3]. In sum, SFDI is known as the solution to overcome the cross-border investment’s negative spillover with aims to minimize the destruction of economic, environmental, social, and governance aspects.

In the literature, the SFDI areas that need to be focused on have been provided [1,4]. For instance, economic aspect is concern with employment, infrastructure, and research and development. The characteristics of the environmental aspect include carbon emission, water usage and management, and pollution control. The social aspect is related to gender equality, fair wages, public health, and labor rights. Transparency, corruption control, and efficient management practices are the features under the governance aspect. All of these are important to achieving SFDI to benefit all aspects. The cross-border investment must be conducted in a sustainable way to reduce the negative externalities on the local community. Foreign investors look for sustainability in the market, as well as financial gains [20]. This proves that investment sustainability is important for foreign investors as they are concerned about the investment relevancy and maintaining in the economy. The SFDI also ensures that the cross-border investment remains competitive and provides a conducive investment environment for all stakeholders.

2.2. Proposed Method

Prior studies have used the secondary quantitative approach to assess the determinants in different contexts, such as econometric methods [21,22,23], semi-structured interview, and questionnaire approaches [7,11]. Only a few studies have used primary qualitative approaches, such as literature review and expert opinions [12], and analytic hierarchy process [13], although the quantitative approaches, such as panel generalized method of moments and panel fixed or random effect, dominated in prior studies. The main limitation of this quantitative approach is that it is unable to assess the influence of government policies, which may serve as an attractor to the FDI flows. The host economy usually executes few policies simultaneously; hence, it cannot assess the influence of these policies independently [13]. The attributes’ selection in the econometric approaches relies more on the literature and the data’s availability [13]. Therefore, getting qualitative information from the expert’s subjective perceptions could be measure and compare the expert’s judgments as they tend to be ignored in prior studies due to the unavailability of data. Direct interaction with the experts is essential to understand their opinions and emphasized perceptions [2,12,13].

The FDM was proposed to identify the important attributes and exclude those unimportant attributes based on the experts’ judgment. The Delphi method consolidates the opinion of experts and removes irrelevant attributes [24]. The classical Delphi method was revised with the fuzzy set theory to understand the human perceptions that are unable to measure accurately [25]. Human judgment tends to be subjective; thus, it comes with high uncertainties. The subjective perceptions’ characteristics remain in FDM, although those experts’ subjective perceptions have been transformed into comparable quantitative values using the fuzzy set theory [26]. Those experts exchange their judgments according to their knowledge and experience, and this simplified method has addressed the uncertainty problem in the survey method [27,28,29].

The study continues to use the FIPA to define the rank and position of importance and performance for each attribute after a set of essential SFDI attributes determined in FDM. The vagueness and uncertainty in human linguistics preferences were solved through the fuzzy set theory as those human linguistics preferences further converted into a comparable value based on the degree of membership function [30]. In the IPA technique, the quadrant of each attribute could precisely be located; therefore, the relevant strategies could be identified for managerial actions [31]. Few studies have applied this FIPA method to identify the attributes that need to be the focus for further improvements under the uncertainty and vagueness of the experts’ subjective perceptions [30,32,33].

2.3. Proposed Attributes

Prior studies have partially examined aspects on SFDI, such as institutional environment, macroeconomic environment, natural condition, and supporting policies [12,13]. The abundance of resources have been studied together with economic support policy and institutional quality [9]. The influence of public interventions, international public finance, and investment environment on the FDI inflows was assessed [14]. The social aspects were studied together with regulatory, economic and financial, and political aspects [7]. As aforementioned, the macroeconomic aspect seems to be an essential attribute that cannot be omitted. The influences of the institutional attributes has also gained much attention [34,35,36]. Few studies that focused on the FDI in renewable energy sectors further confirmed the importance of the government’s policies on the location decision [12,13,14]. Therefore, a proper selection of the essential SFDI attribute is important to obtain reliable and robust findings. This study confirmed the valid attributes in prior studies through the FDM and categorized the criteria that may influence the FDI toward sustainability into five aspects, namely environmental (AS1), financial (AS2), macroeconomic (AS3), institutional and policies (AS4), and social (AS5).

Among the proposed SFDI attributes, the SFDI distribution is related to the access to land (C1) [13]. This is the only valid criteria under the environmental aspect (AS1) and implies that foreign investors concerned about the procedure of land acquisition during their investment allocation. In the financial aspect (AS2), the financial market development (C3) is essential to encourage more capital inflows as the investors have to utilize the financial instrument in their investment decision [37]. Foreign investors are concerned about access to local finance (C2) [13]. This is not only local financial facilities, but also the SFDI allocation determined by international public finance (C5) [14]. The investment costs (C6) could promote incoming foreign investment was also proven [38]. However, the capital inflows might be hindered by the interest rate (C4) [39,40]. Labor costs (C7) might hamper the incoming investment, which has also been proposed [13,23]. The cross-border capital inflows encumbered by profitability (C8) is documented in Reference [36].

Among the macroeconomics aspect (AS3) that might promote SFDI, the capital inflows are attracted by the market openness (C13) and market potential (C14) [11,13]. The high productivity (C15) is the main attribute that encourages investment inflows also supported [41]. The export intensity (C10) of the host economy attracts more incoming investment [36]. The convenience of the national transportation systems, such as airways (C16), roadways (C17), and waterways (C18), is needed to promote more foreign investment inflows [42]. However, the SFDI distribution might be impeded by the communication infrastructure (C12) [20]. The business sophistication (C9) and goods market efficiency (C11) do not encourage more capital inflows [37]. Moreover, foreign investors are likely to invest in an economy with stable and riskless environments. Several types of stabilities have been investigated in prior studies, such as price stability (C23), exchange rate stability (C21), banking stability (C19), and monetary policy uncertainty (C22) [11,13,43]. For instance, the fluctuation of the exchange rate could be an additional cost and thus encumber the foreign capital inflows [8,13]. The monetary policy uncertainty discourages foreign investment, while banking stability promotes foreign capital inflows [43]. Country risk (C20) could promote foreign investment inflows also remarked [38]. The attractiveness of world uncertainty (C24) towards the cross-border investment inflows has also been studied [44]. Prior studies clearly show that the SFDI allocation is more attracted by the attributes that could minimize the operating or investment costs, such as the convenience of the infrastructure, financial facilities, and the demand of the markets, while the higher tax and interest rate and other attributes might obstruct the inward capital flows. In addition, different stabilities could behave as attractors and obstacles for attracting foreign investment. If the attribute does not increase the operating costs of investment, then it could be attractors which would offer opportunities to gain profits.

In recent years, the institutional and policies aspect (AS4) has been focused on SFDI’s studies. For instance, better bureaucracy quality (C25) stimulates inwards capital flows was proposed by Reference [45]. In a meta-analysis study, the rule of law (C26) could encourage more foreign investment was confirmed by Reference [35]. The different measurements of freedom in the index of economic freedom, such as business freedom (C27), financial freedom (C29), investment freedom (C31), and labor freedom (C32), lean towards encouraging more capital inflows [22]. The same positive influence of economic freedom (C28) was also reported in Reference [42]. Prior studies remarked on the relationship between the institutional attributes, such as control of corruption, political stability, and rule of law, with the attractiveness towards foreign capital inflows [44,45,46]. Different influences of institutional freedom (C30) have been documented, wherein the democracy attribute only influences Kenya, while Malaysian is affected by the governance attribute [47]. The inward capital flows are concerned with the priority access to the electric grid (C35) and social acceptance (C37) [13]. Protection for foreign investors (C36) is essential for foreign investment because economic partnerships agreement and free trade agreements (C34) tend to encourage more SFDI inflows [39,42]. As expected, business regulation (C33) and minimum wages are likely to impede foreign capital inflows [48].

By focusing on the social aspect (AS5), reinforcing technology, including technology readiness (C40), has a tendency to attract foreign investors [10]. The total labor force and skilled labor (C39) could encourage more foreign investment inflows as suggested by Reference [23,46]. However, foreign investors are not likely to invest in the destination with higher criminal activities (C38) [49]. The valid SFDI attributes are presented in Table 1 below. The complete and invalid set of proposed SFDI attributes is provided in Appendix Table A1.

Table 1.

Sustainable foreign direct investment (SFDI) aspects and attributes.

3. Materials and Methods

This section provides a brief discussion on SFDI in Malaysia. The evaluation methods of FDM and FIPA are explained in the following sections.

3.1. Case Background

Malaysian global ranking in the World Bank Group’s Doing Business 2020 has risen, as shown in the commitments of the Malaysian government in rectifying the institutional and legal systems, and restoring the fiscal health of the federal government’s budget has also been recognized [50]. This effort is needed to improve and enhance the investment environment in Malaysia. However, the total amount of inward FDI showed a continually decreasing trend from $12.20 billion in 2011 to $8.09 billion in 2018, although the total inward FDI of developing economies was raised from $665.07 billion to $706.04 billion in the period [51]. This implies the improvement efforts failed to attract the interest of foreign investors. Malaysia seems to lose its attractiveness as an ideal investment destination for foreign investors compared to other developing economies. Moreover, FDI directly impacts Malaysian economic growth [47]. However, Malaysians have been over-relying on multinational corporations and FDI in enhancing their exports and technology transfer [52]. Thus, to promote the economic growth in Malaysia, the continued capital flows from foreign investors is required as it needs to satisfy the capital shortage in the local financial market. There is a need to understand SFDI attributes to improve and enhance their attractiveness towards the sustainable foreign capital inflows.

SFDI is considered the contribution of economic, environmental, and social aspects with fair governance practices in order to continually improve and enhance the attractiveness of Malaysia to become a preferred investment destination for foreign investors. Several stakeholders, such as those at the federal, state, and agency levels, have to work together in reforming the investment environment. The establishment of a conducive and sustainable investment environment requires support from several aspects. For instance, the policymakers have to identify important attributes that are favorable to attract foreign investors’ attention. Besides that, understanding their current performance is also important to introduce the appropriate strategy to empower and strengthen the performance of these important attributes. The attributes identification and performance assessment through the experts’ linguistics preferences are expected to have useful information for stakeholders to increase the desirability of SFDI inflows. In this study, a panel of experts consists of 9 foreign investors and 14 policymakers from the relevant ministries and authorities in Malaysia. The foreign investors originated from China and Taiwan, and they have from 5 to 30 years of investment experience in Malaysia. In recent years, Malaysia has been the primary host country for Chinese investors due to the Belt Road initiative, as well as the New Southbound Policy introduced by the Taiwanese government. Therefore, both investor groups are realizing their governments’ policies by providing capital to enhance their international relations with other countries. The experts that have an average of 12 years working experience in the field from the different relevance ministries and agencies in Malaysia, such as Ministry of International Trade & Industry (MITI, Kuala Lumpur, Malaysia), Malaysian Investment Development Authority (MIDA, Kuala Lumpur, Malaysia), and Ministry of Finance (MoF, Putrajaya, Malaysia), were invited to provide their precious perspectives. The description of foreign investors and policymakers provided in Appendix Table A2 and Table A3.

3.2. Fuzzy Delphi Method

The FDM introduced by Reference [53] integrated the classical Delphi method with the fuzzy set theory due to the vagueness and uncertainty in the humans’ judgments. This is because these subjective perceptions are difficult to achieve a consensus. Therefore, the FDM adopted was to achieve a group decision for a specific issue. Some advantages offered by FDM, such as the method, could reduce the sample of interviews and research time, as well as optimize experts’ knowledge in the field [28].

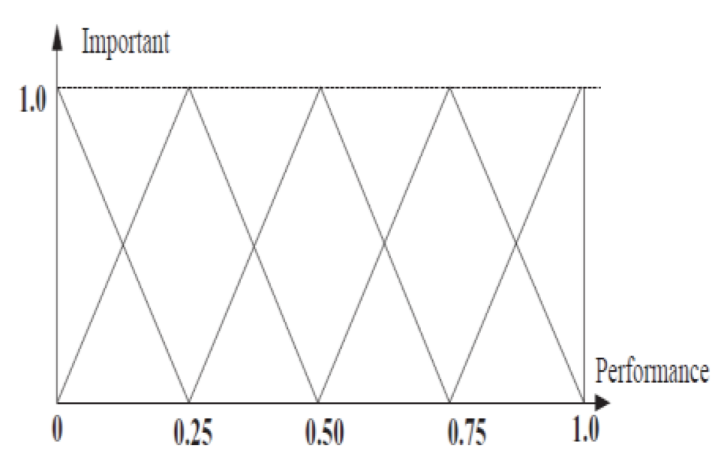

In this method, the significant value of attribute estimated by an expert , where , ; . The weight of for attribute is , while , and . The subjective perceptions of each expert is then converted into the comparable value using the triangular fuzzy numbers (TFN), as provided in Table 2.

Table 2.

Transformation table of linguistic terms.

The equation below is used to find the convex combination values of , through the cut.

As the experts’ judgment assesses in FDM, the values of could range from 0 to 1, depending on whether the experts are positive or negative perceivers. The rule of thumb suggests that the median of values is 0.5. The value of then is obtained using the following equation.

where represents the positivity level of a decision-maker and utilizes it to achieve the primary consensus within the experts. Next, represents the threshold level used to reject those unnecessary attributes. The attribute is rejected if , and vice versa.

3.3. Fuzzy Importance-Performance Analysis

The IPA introduced by Reference [31] used to assess the rankings between the importance and performance level of each attribute. The IPA was integrated with the fuzzy set theory to address the vagueness and uncertainty of the humans’ perception. In FIPA, the two-dimensional matrix is adopted to provide the graphical evidence on the ranking and position for each attribute. Quadrant (I) has the highest importance and performance rankings. The attributes in this quadrant should keep their momentum to maintain their performance. Quadrant (II) focuses on the attributes that performed well but are less important and suggests that the policymakers should not focus too much on these attributes as it is wasting resources or skills. Quadrant (III) represents the attributes with a low priority for any improvement. The attributes in this quadrant are not necessary for establishing a sustainable environment for foreign investment. Lastly, quadrant (IV) refers to the attributes that are highly important but performed poorly. The policymakers should give their concentration to improving the attributes located in this quadrant, as they are crucial to success. The country’s competitive advantages appear in quadrant (I), while the resources tend to be wrongly allocated for the attributes in quadrant (II) [33]. From the graphical result, the policymakers can understand the current position for each attribute. This could help them to plan and implement the desired policies that might improve and enhance the foreign investment environment toward sustainability.

Since the experts are required to rate the importance and performance level of each attribute, there are two weights, namely importance weight () and performance weight (). Both weights are assumed to be the same importance for each expert. The equation below used to calculate the weights ():

4. Results

This section presents the analysis results. The FDM results are first presented and followed with the FIPA’s results and figures. The FIPA comparison between two expert groups also provided to show the distinctions.

4.1. Fuzzy Delphi Method

The FDM is used to identify the important aspects and criteria based on the experts’ experiences and knowledge. The subjective perceptions of experts’ judgments are transformed into corresponding TFN. These subjective perceptions data then defuzzied using Equations (1) and (2). Those proposed attributes are rejected if their value is lower than the threshold value, otherwise accepted. The FDM results of aspects and criteria are provided in Table 3 and Table 4 with the threshold value of 0.557 and 0.408. Table 3 shown that five aspects are accepted and implied that these five aspects are important for SFDI. Among the aspects, the financials (AS2), macroeconomics, (AS3) and government’s policies (AS3) were the top three important aspects, together with environmental (AS1) and social (AS5), which were also accepted as valid aspects for SFDI. Table 4 demonstrates the FDM results of 40 accepted SFDI criteria. Within the 40 accepted criteria, market openness (C13) is the most important criteria, followed by the country stability (C20) and transportation system—Roadways (C17), while the exchange rate stability (C21) and profitability (C8) also ranked in the top five important criteria for SFDI.

Table 3.

Fuzzy Delphi method (FDM) result of aspects.

Table 4.

FDM result of criteria.

4.2. Fuzzy Importance and Performance Analysis

In FIPA, the valid attributes resulted from FDM were measured by their current rankings and performances. The attributes are plotted into four quadrants in the figure, which represents a different level of importance and performance according to the judgments of experts. The judgment and perceptions for each expert are integrated with assigned weights and defuzzified into the comparable values. Equation (3) is used to estimate the weights of aspects and criteria. Table 5, Table 6 and Table 7 present the FIPA results of aspects using the TFN for three samples in this study. In Table 5, the average value of importance and performance level for aspects in the overall sample are 0.801 and 0.707. The means of the aspects’ importance and performance values for policymakers are 0.824 and 0.744, as shown in Table 6. In Table 7, foreign investors have the lowest importance and performance values (0.769 and 0.658) for all aspects. The positive values of (I-P) show that the aspects are highly important, but their performance is not satisfied. Among the aspects of three samples, only the environmental aspect in foreign investors shows the negative (I-P) value. This implied that foreign investors are gratified with the environment’s performance.

Table 5.

Fuzzy importance and performance analysis (FIPA) results of aspects for the overall sample.

Table 6.

FIPA results of aspects for policymakers.

Table 7.

FIPA results of aspects for foreign investors.

The FIPA results of SFDI criteria is presented in Table 8 for all three samples. The average values of importance and performance level is provided in the last row of Table 8 and shows that the important values are greater than the performance values in all three samples. This positive (I-P) values imply the poor performance of the SFDI criteria and need improvement immediately. However, two criteria have negative (I-P) values in the overall sample: investment cost (C6) and investment freedom (C31). Besides the investment costs (C6), four more criteria with negative (I-P) values in policymakers’ sample are access to local finance (C2), international public finance (C5), rule of law (C26), and institution freedom (C30). In the foreign investors sample, nine criteria have the negative (I-P) values, including investment cost (C6), export intensity (C10), business freedom (C27), economic freedom (C28), investment freedom (C31), labor freedom (C32), economic partnerships/ free trade agreements (C34), social acceptance (C37), and criminal activities (C38). The negative (I-P) values suggest that the criteria are overperformed, as the performance value is greater than the importance value. The inconsistent findings show that there is variation between the policymakers and foreign investors’ viewpoint, as the foreign investors look like they are more satisfied with the SFDI criteria performances, especially for the criteria with negative (I-P) values.

Table 8.

FIPA results of criteria.

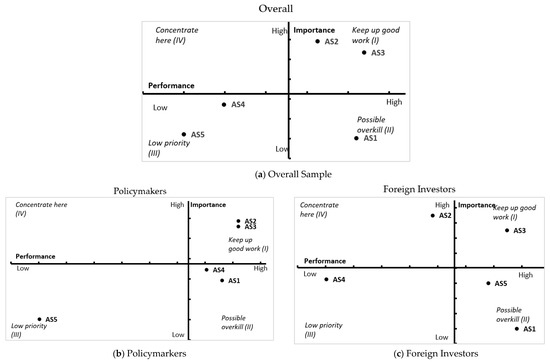

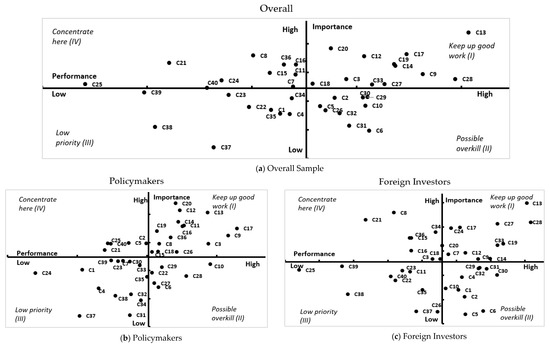

Figure 1 shows the IPA plot for five SFDI aspects into four-quadrants using the importance and performance’s defuzzified values. Overall, financials (AS2) and macroeconomics (AS3) stand at quadrant I, which has a high importance and performance level. Environmental (AS1) falls in quadrant II, and this suggests that the environmental aspect is wasting the resources, as the importance level is low. Institutional and policies (AS4) and social (AS5) are placed in quadrant III, which is the low priority area. This implies that the importance and performance level of these aspects are low and do not need any improvements. In addition, Figure 1 indicates the distinction between two expert’s groups. For policymakers, financials (AS2) and macroeconomics (AS3) are located in quadrant I. This suggests that the importance and performances of both aspects are high. In quadrant II, the environmental (AS1) and institutional and policies (AS4) fall in this possible overkill area. The social (AS5) is placed in quadrant III, which is not particularly important for SFDI. For foreign investors, only macroeconomics (AS3) falls in quadrant I, which is the high importance and performance quadrant. The environmental (AS1) and social (AS5) are placed in quadrant II, which suggests a possible overuse of resources, as these aspects have low importance level. In the low priority area, quadrant III, institutional and policies (AS4) stands in this area and suggests that the importance and performance level of institutional and policies are low. Lastly, the financials (AS2) fall in quadrant IV. This suggests that the attention of improvement should concentrate on this aspect, as the level of importance is high, but the performance level is low. Specifically, macroeconomics (AS3) is the aspect which is located in quadrant I in all samples, the same as environmental (AS1), which is placed in quadrant II in all IPA plots.

Figure 1.

IPA plot for aspects. (a) Overall sample, (b) policymarkers and (c) foreign investors.

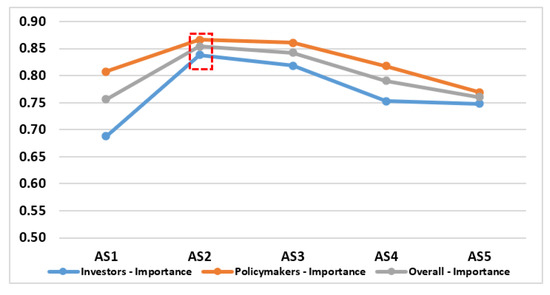

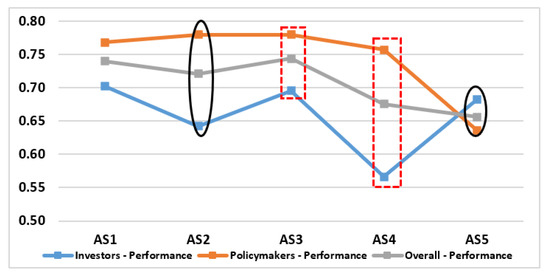

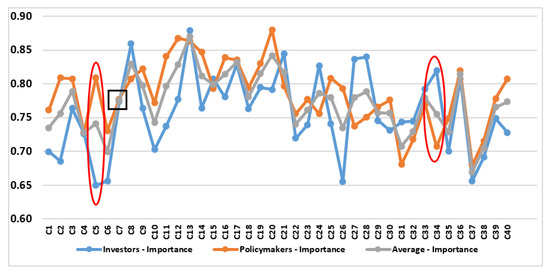

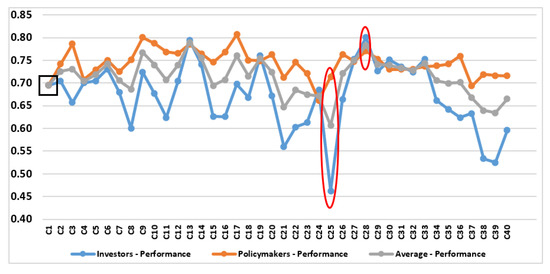

Figure 2 and Figure 3 show the comparison of aspects on the importance and performance level between two sub-samples with the overall sample. In Figure 2, the policymakers’ importance level is constantly higher than the foreign investors in all five aspects, especially in the environmental aspect (AS1), which shows the largest differences, while social aspects (AS5) show the closest differences. The trends of the importance level in both samples are moved in the same direction. However, the increase in importance level of the foreign investors’ financials aspect (AS2) is greater than policymakers, but their average values are still below the policymakers. In Figure 3, the performances level of policymakers is greater than foreign investors in all aspects, except the social aspect (AS5). Besides that, the performance level of foreign investors on the financial aspect (AS2) was dropped, while policymakers had an increasing trend. For the macroeconomics aspect (AS3), the performance level for policymakers is the same as the financial aspect (AS2), but foreign investors have better performance in macroeconomics aspect (AS3). Moreover, the degree of decrease in the performance of institutional and policies (AS4) is larger for foreign investors compared with policymakers. Both figures show that policymakers and foreign investors have slightly different importance and performance level for all five aspects. Therefore, understanding these variations could be an interest in finding ways to improve and enhance the SFDI investment environment.

Figure 2.

Comparison of aspects between policymakers and foreign investors.

Figure 3.

Comparison of aspects between policymakers and foreign investors.

Figure 4 displayed the IPA plot of SFDI criteria for the overall sample and two sub-samples: policymakers and foreign investors. The first IPA plot presents the criteria for the overall sample. The summary of the IPA was listed as follows:

Figure 4.

IPA plot for criteria. (a) Overall sample, (b) policymarkers and (c) foreign investors.

- Quadrant 1 consists of financial market development (C3), business sophistication (C9), infrastructure—Communication (C12), market openness (C13), market potential (C14), transportation system—Roadways (C17), transportation system—Waterways (C18), banking stability (C19), country stability (C20), business freedom (C27), economic freedom (C28), and business regulation (C33).

- Quadrant II contains nine criteria, including access to local finance (C2), international public finance (C5), investment cost (C6), export intensity (C10), rule of law (C26), financial freedom (C29), institutional freedom (C30), investment freedom (C31) and labor freedom (C32).

- Quadrant III included access to land (C1), interest rate (C4), monetary policy uncertainty (C22), price stability (C23), economic partnerships/free trade agreements (C34), guaranteed access to the electric grid (C35), social acceptance (C37), criminal activities (C38), and labor force (C39).

- Quadrant IV concentrates on 10 criteria, comprised of labor cost (C7), profitability (C8), goods market efficiency (C11), productivity (C15), transportation system—Airways (C16), exchange rate stability (C21), world economy uncertainty (C24), bureaucratic quality (C25), protection of foreign investors (C36), and technology readiness (C40). This implies that these criteria need to be focused on for improvement, as they are the key to achieve the SFDI.

The IPA plot for the policymaker showed slightly different findings, as the criteria are reallocated within the four-quadrant graph.

- Quadrant I has 15 criteria, including financial market development (C3), profitability (C8), business sophistication (C9), goods market efficiency (C11), infrastructure—Communication (C12), market openness (C13), market potential (C14), productivity (C15), transportation system—Airways (C16), transportation system—Roadways (C17), transportation system—Waterways (C18), banking stability (C19), country stability (C20), rule of law (C26), and protection of foreign investors (C36).

- Quadrant II includes investment cost (C6), export intensity (C10), monetary policy uncertainty (C22), business freedom (C27), economic freedom (C28), and financial freedom (C29).

- Quadrant III contains access to land (C1), interest rate (C4), labor cost (C7), price stability (C23), world economic uncertainty (C24), institution freedom (C30), investment freedom (C31), labor freedom (C32), business regulation (C33), economic partnerships/free trade agreements (C34), guaranteed access to the electric grid (C35), social acceptance (C37), criminal activities (C38), and labor force (C39).

- Quadrant IV only has five highly important criteria, but the performance is not satisfied. The extra attention has to concentrate on these criteria, which are access to local finance (C2), international public finance (C5), exchange rate stability (C21), bureaucratic quality (C25), and technology readiness (C40).

The foreign investors expressed a different perception, whereas the SFDI criteria located in different quadrants is compared to policymakers and overall sample as demonstrated in the foreign investors’ IPA plot.

- Quadrant I contains labor cost (C7), business sophistication (C9), infrastructure—Communication (C12), market openness (C13), market potential (C14), transportation system—Roadways (C17), banking stability (C19), country stability (C20), world economy uncertainty (C24), business freedom (C27), economic freedom (C28), and business regulation (C33).

- Quadrant II is comprised of the criteria that are well-performed but less important for SFDI, including access to land (C1), access to local finance (C2), interest rate (C4), international public finance (C5), investment cost (C6), export intensity (C10), financial freedom (C29), institution freedom (C30), investment freedom (C31), and labor freedom (C32).

- Quadrant III consists of good market efficiency (C11), monetary policy uncertainty (C22), price stability (C23), bureaucratic quality (C25), rule of law (C26), guaranteed access to the electric grid (C35), social acceptance (C37), criminal activities (C38), labor force (C39), and technology readiness (C40).

- Quadrant IV concentrates on the criteria that should be the focus in improving the SFDI investment environment. These criteria are financial market development (C3), profitability (C8), productivity (C15), transportation system—Airways (C16), transportation system—Waterways (C18), exchange rate stability (21), economic partnerships/free trade agreements (C34), and protection of foreign investors (C36).

The comparison between two sub-samples with overall samples for each criteria is presented in Figure 5 and Figure 6. Figure 5 indicates that the policymakers’ importance level is higher than foreign investors in all criteria, except for profitability (C8), market openness (C13), productivity (C15), exchange rate stability (C21), world economy uncertainty (C24), business freedom (C27), economic freedom (C28), investment freedom (C31), labor freedom (C32), business regulation (C33), and economic partnerships/free trade agreements (C34). This implies that these 11 criteria are more important for foreign investors than policymakers.

Figure 5.

Comparison of importance level of criteria among sub-samples with the overall sample.

Figure 6.

Comparison of the performance level of criteria among sub-samples with the overall sample.

The international public finance (C5) is more important for policymakers compared to foreign investors, as exhibited the largest gap in Figure 5. A total of 20 criteria show the different direction of movements between the two sub-samples. For instance, access to local finance (C2), international public finance (C5), business sophistication (C9), transportation system—Airways (C16), country stability (C20), bureaucratic quality (C25), financial freedom (C29), institution freedom (C30), priority access to the electric grid (C35), and technology readiness (C40) are becoming important for policymakers. Foreign investors are more concerned with financial market development (C3), investment costs (C6), market openness (C13), productivity (C15), transportation system—Roadways (C17), exchange rate stability (C21), world economy uncertainty (C24), business freedom (C27), investment freedom (C31), and economic partnerships/free trade agreements (C34).

The policymakers are more satisfied with the SFDI criteria performances, as provided in Figure 6. From the foreign investors’ perception, only eight criteria performed better than policymakers. These criteria included market openness (C13), banking stability (C19), world economy uncertainty (C24), business freedom (C27), economics freedom (C28), institution freedom (C30), investment freedom (C31), and business regulation (C33). Foreign investors are very unsatisfied with the performance of bureaucratic quality (C25) compared with the perception of policymakers, and there is the largest gap. The performance of eight criteria was raised for policymakers, although foreign investors have the opposite opinion. These criteria include financial market development (C3), profitability (C8), country stability (C20), bureaucratic quality (C25), economic partnerships/free trade agreements (C34), priority access to the electric grid (C35), protection of foreign investors (C36), and criminal activities (C38). Foreign investors rated higher performance on eight criteria, including the interest rate (C4), infrastructure—Communication (C12), banking stability (C19), price stability (C23), world economy uncertainty (C24), business freedom (C27), institution freedom (C30), and social acceptance (C37), although policymakers assessed it with lower performance. This different perception and judgment between two sub-samples provided an important implication.

5. Discussion

This study provided both theoretical and policy implications, and both are discussed in this section. As the comparison between sub-samples has been made in the previous section, the different implication of the sub-samples is also explained in this section.

5.1. Theoretical Implications

This study provided evidence of the attributes that caused SFDI from the experts’ perceptions. Five aspects that are essential in establishing a sustainable environment for cross-border investment were identified through the FDM. These aspects include financials (AS2), macroeconomics (AS3), institutional and policies (AS4), environmental (AS1), and social (AS5). This study highlighted that the aspects could be measured based on importance and performance levels. This study contributed to the existing literature by offering evidence on the SFDI attributes including TBL aspects, as well as institutional and policies aspects, in line with recent literature. This indicated that SFDI contributes to development in economic or financial, social and environmental aspects with fair governance practices [1]. This study presented a comprehensive assessment tool for evaluating SFDI’s importance and performance level through the experts’ subjective perceptions. This study revealed that the financials (AS2) and macroeconomics (AS3) aspects have a higher importance level, but another three aspects have a lower importance level in all samples. From the performance level, environmental (AS1), financials (AS2), and macroeconomics (AS3) have the highest performances, while institutional and policies (AS4) and socials (AS5) recorded the lowest performance level in FIPA.

The result shows that financial aspect (AS2) is one of the essential SFDI aspects. This suggests that the financial advantages, like labor costs, profitability, and sources of finance, could encourage more foreign investment. This finding confirmed the economic aspects in TBL aspects, whereas the financials attributes were the concern for foreign investors in conducting cross-border investments. The performance of the financial aspect in the FIPA suggests that policymakers are more satisfied with the performances rather than foreign investors. This implies that foreign investors expect more financial benefits from the investment and need more efforts to improve their performances. This finding is crucial, as the financial aspect’s performance has to be evaluated carefully, although the importance of the aspect is proven. As revealed in this study, different experts group have a different perception on the aspect performance. This provides new insights in literature, whereas the financial aspect performance needs to be considered in attracting inwards SFDI flows because prior studies only assessed the attractiveness of financial aspect over the FDI inflows.

The macroeconomics aspect (AS3) is recognized as the essential aspect and confirmed the economic aspects in TBL aspects, whereas the macroeconomics attributes are important in determining the SFDI inflows. That the macroeconomic environment, such as infrastructure facilities, market openness, and productivity, is important in stimulating foreign capital inflows is consistent with the locational advantages in Dunning’s eclectic theory [54]. This study assessed the aspects’ performance using the FIPA and suggested that the macroeconomics aspect has a higher importance level for policymakers than foreign investors, while the performance is poor from the view of foreign investors. The authorities or policymakers have to improve and enhance the performances of the macroeconomics attributes, as their performance is not compatible with their importance level to establish a conducive environment for SFDI.

The significant role of institutional and policies (AS4) in attracting SFDI have been proven in this study. This shows that the institutional and policies attributes might influence the attractiveness of foreign investment towards sustainability. This finding suggest that the institutional aspects and policies have to integrate with TBL aspects to evaluate the SFDI attributes, as it is an essential aspect. Moreover, the role of institutional and policies have to incorporate into the locational advantages of eclectic theory [54], as the institutional and policies might create competitive advantages in attracting foreign investment. However, this study found that both expert groups are not satisfied with their current performances, whereas the importance level of the institutional and policies is higher than their performance level. This indicates that there is room for further improvement to create an encouraging SFDI environment.

Besides the economic and financial aspect, the environmental (AS1) and social (AS5) aspects of TBL also confirmed in SFDI, although it has lower importance and the performance level than other aspects. These findings verified that cross-border investments consider the environment and social developments, as well. Therefore, these attributes have to include to stimulate incoming investment as these attributes contribute to the environment and social developments in establishing a sustainable environment for foreign investment. The relevant attributes in the environment and socials aspects, such as availability of natural resources, labor force, and technology readiness, could offer the competitive advantages in promoting SFDI. This study found the different findings among policymakers and foreign investors, whereas the importance and performance level of social aspect is low for policymakers, and foreign investors are more satisfied with their performance. However, the improvement action should not focus on these two aspects as the importance level are low and therefore, any additional improvements effort could lead to the resource wasting.

In summary, this study contributed to the literature by providing evidence on the SFDI attributes through the subjective perceptions approach using the FDM and FIPA analysis. The findings confirmed the TBL aspects in determining the sustainable cross-border investment and also proved that the institutional and policies are essential in improving the attractiveness. In addition, this finding showed the importance of locational advantages in eclectic theory [54], but have to extend to integrated the institutional and policies to determine the SFDI inflows. Furthermore, this study also indicated the importance of social and environmental attributes in sustaining foreign investment to minimize social and environmental impacts. The performance of these important aspects was firstly assessed using qualitative information, and it could provide more reliable and useful theoretical implication as the resources and capabilities have to be considered in determining the SFDI attributes. The host economies might fail in attracting foreign investment and short of capabilities to utilize their resources. Therefore, any improvement in unimportance aspects or well-performed aspects may waste the resources due to the limited resources. The improvements have to focus on those critical aspects to improve the environment of SFDI.

5.2. Policy Implications

This study identified valid SFDI attributes using subjective perceptions from a group of experts. This provides a more reliable and robust insight as the input is directly collected from the stakeholders. From the FIPA analysis, the attributes located in quadrant IV have to focus on the improvement as these attributes’ performance is not equivalent to the importance level. This suggests that the authorities or policymakers have to place more attention on these attributes to provide a conducive environment for SFDI. From the overall sample, the results show that 10 criteria are plotted in this quadrant. These criteria consist of labor cost (C7), profitability (C8), goods market efficiency (C11), productivity (C15), transportation system–airways (C16), exchange rate stability (C21), world economy uncertainty (C24), bureaucratic quality (C25), protection of foreign investors (C36), and technology readiness (C40). Within the 10 criteria, the top five criteria with the largest (I-P) values are focused on the policy implications.

Profitability (C8) is the ability of the investment to yield profit or financial gain. The main purpose of an investment is to gain profit and continue to sustain in the market. Only profitable investments can survive in the market and conduct more additional investments. This study found that the performance of profitability is not satisfied compared with the importance level. This shows that the foreign investors are challenging to earn satisfactory profit and this might dampen the willingness of foreign investors to invest. Thus, the policymakers have to ensure the foreign investors able to gain adequate profit in their investment, as the profitability is crucial for them to continue to sustain in the market and contribute to the economic, social, and environmental developments. To address this, the authorities or policymakers should not intervene in the market operation and let the market equilibrium decide, especially for the demand and supply and the price in the market. Moreover, the authorities or policymakers should give more freedom to the market, such as remove the capital movement and investment restriction. However, in certain essential needs industries or public facilities, the authorities or policymakers might set a minimum profit threshold to ensure the investors have sufficient profits to survive.

The stable exchange rate (C21) is essential for attracting more SFDI inflows. The foreign investment is a cross-border investment to fulfill the capital shortage; therefore, it involves currency exchange between two economies. The exchange rate exposure is the additional risk that foreign investors have to consider. Besides, cross-border investment usually requires a long-term period to generate profits. The volatility of the exchange rate could be an additional cost for foreign investors if the exchange rate exposure is not hedged properly. For that reason, a less volatile exchange rate is preferred as it could reduce the exchange rate risk in foreign investment. Moreover, if the investments are intents to export their products in international markets, the exchange rate stability could impact their profitability as the products’ price may differ according to the exchange rate. For example, the price of a product may become cheaper when the exchange rate of local currency depreciated, and this reduces the profitability of the investments, and vice versa. However, this study found that the performances of exchange rate stability are low. To overcome this problem, the authorities and policymakers have to prevent the overvaluation in their exchange rate, as this could destruct the market operation. In order to avoid excessive instability, an appropriate intervention is necessary.

Malaysia as a developing economy that heavily depending on international trade. It is expected to be influenced by world economic uncertainty (C24). The world economy uncertainty is the uncertainty in another region or economy that might influence the local economy attractiveness towards SFDI inflows. The authorities or policymakers have to ensure the local economic activities are not over-reliant on the international trade or global markets. When the world economy became integrated, the local economy could not escape from any uncertainty nor crisis in the international market or world economy. However, the result revealed that the world economic uncertainty has poor performance, despite the high importance level. The authorities or policymakers must diversify economic development without over-reliance on certain industries, such as oil and natural gas, palm oil, and electronic and electrical products, in Malaysia’s case. In any policies or budget planning or formulation, global economic changes must be considered to mitigate the potential impact of global uncertainty on the local economy.

The bureaucratic quality (C25) is important in attracting SFDI. Bureaucratic quality is related to the strength and expertise of the government officers to administrate public services. The good and efficient administrative procedure could increase investors’ confidence. Therefore, the authorities and policymakers have to enhance their administrative quality and capabilities to ensure the smoothness in implementing the policies. This study suggests that authorities should prepare for more training of their officers to increase their ability in handling the daily administrative works and provide better public services to the community, including foreign investors. As foreign investors need to apply for several permits and approval before investing in Malaysia, excellent public services and efficient administrative services might attract more inwards SFDI. The authorities and policymakers should simplify the procedure and application process and become more investor-friendly. If possible, establish a special unit that coordinated all ministries and agencies to improve the efficiency of the application in the required permits or approval would be a better solution.

The finding highlighted the importance of foreign investment protection (C36) for encouraging more SFDI inflows. However, the finding shows that the performance of foreign investors protection at a lower level. The foreign investors may not familiar with the regulations and culture and this may be caused them to break the rules or customs unintentionally. The authorities or policymakers have to provide a certain level of protection for foreign investors, especially on their investment wealth and safety. For instance, signing protection agreements between the home country and host economies, like Investment Guarantee Agreements (IGAs), promise foreign investors to repatriate their investment and profits back to their home country. Malaysia has signed IGAs with 64 economies or regions [55]. This number is far away from a total of 195 countries around the world. The authorities or policymakers have to provide more protection for foreign investors, as this could raise their spirits to invest.

The IPA plot also shows that 12 criteria located in quadrant I, which are the competitive advantage and strength of Malaysia, including market development (C3), business sophistication (C9), infrastructure—Communication (C12), market openness (C13), market potential (C14), transportation system—Roadways (C17), transportation system—Waterways (C18), banking stability (C19), country stability (C20), business freedom (C27), economic freedom (C28), and business regulation (C33). All these criteria have achieved the highest level of importance and performance from the experts’ views. The Malaysian government and authorities should maintain the performance of these criteria as it is necessary to stimulate the SFDI inflows.

5.2.1. Policymakers

This study revealed differences between the two experts’ groups. From the policymakers’ perception, five criteria are located in quadrant IV and suggests that only these criteria that need to concentrate on promotes SFDI inflows. These criteria include access to local finance (C2), international public finance (C5), exchange rate stability (C21), bureaucratic quality (C25), and technology readiness (C40). However, only two criteria are not the same as the overall sample, which are access to local finance (C2) and international public finance (C5). This indicates that policymakers are specially concerned with the source of finance, including local financial facilities and public financial flows from abroad. These findings show that the source of capital from local and international markets is crucial in sustaining SFDI, especially for developing economies that need more capital for development. In addition, the finding found that the performance of these two criteria needs further improvements, as their current performance are low.

Foreign investors may need to fund their investment plans with financial institutions to carry out their projects. Existing investors may also need external funds for additional investment when they have limited capital for long-term investment. As such, policymakers need to ensure the local financial facilities are accessible (C2), such as the local banking system or financial institutions, are well functioning, and are able to provide funds for foreign investors. Investors can increase their credibility in Malaysia by obtaining financing from local financial institutions and helping foreign investors to hedge the foreign exchange risk, as the local currency is used in transactions.

Moreover, policymakers should also remove financial restrictions or barriers that might hinder foreign capital inflows for investment and local development, such as public finance flows from national development banks or Development Finance Institutions (DFIs). International public finance (C3) flows play an important role in sustainable development investments, such as renewable energy, poverty reduction, and social development. A local commercial bank or financial institutions might not be interested in financing such projects that have longer investment periods and higher uncertainty. Overall, the performance of funding sources, including local financing facilities and international public finance, is urgently needed to further improvement to attracting SFDI inflows.

In addition, three other criteria that are similar to the overall sample are exchange rate stability (C21), bureaucratic quality (C25), and technology readiness (C40). Technology readiness (C40) is required for SFDI as the local community could benefit from the technology transfers through foreign investment, while production productivity is enhanced when Malaysia is ready and able to adopt the latest technology. This could enhance cross-border investment sustainability because high productivity can reduce production costs and maximize investment revenue. Therefore, industry players need to ready in adopting the latest and greatest technologies in their production. In general, these findings suggest that SFDI should consider the social and institutional, as well as macroeconomic and financial, aspects. From the policymakers’ perspective, financial criteria, especially local financial facilities and international public finance, bureaucratic quality, exchange rate stability, and technology readiness, should be prioritized for further improvements.

From the policymakers’ perspective, they are trying to provide a competitive and most sustainable investment environment for foreign investors. This is supported by the IPA plot, where as much as 15 criteria were plotted in quadrant I, which have the highest importance and performance level. Among these criteria, majority criteria are related with the financial and macroeconomic aspects, like financial market development (C3), profitability (C8), business sophistication (C9), goods market efficiency (C11), infrastructure—Communication (C12), market openness (C13), market potential (C14), productivity (C15), transportation system—Airways (C16), transportation system—Roadways (C17), and transportation system—Waterways (C18). However, other criteria that have achieved the highest degree of importance and performance level are banking stability (C19), country stability (C20), rule of law (C26), and protection of foreign investors (C36). This indicates that policymakers may consider that the conducive foreign investment environment in Malaysia has been established for the convenience of foreign investors.

5.2.2. Foreign Investors

Eight criteria need to be focused on improvements, which are placed in quadrant IV. These criteria include financial market development (C3), profitability (C8), productivity (C15), transportation system—Airways (C16), transportation system—Waterways (C18), exchange rate stability (C21), economic partnerships/ free trade agreements (C34), and protection of foreign investors (C36). Out of these eight criteria, only five criteria are the same as the overall sample. This implies that three other criteria, financial market development (C3), transportation system—Waterways (C18), and economic partnerships/ free trade agreements (C34), are among the priorities of foreign investors.

The financial market development (C3) is about the well-established and functioning financial systems. Malaysian financial system operates in dual-systems, comprised of generic and Islamic systems. The Islamic financial system was introduced as an alternative to the generic financial system that has been hit by several financial crises. In this study, both systems may contribute to the high importance and the lower performance on SFDI. This suggests that the complex and diverse of the two systems create obstacles for foreign investors to use. This is because the Islamic financial system is based on the Shariah principles and completely different approaches to the generic financial system. Therefore, banking institutions need to simplify and transform the financial systems to be more user friendly, such as in different languages for the convenience of foreign investors.

Besides that, foreign investors need to transport their products from their factories to other destinations using the transportation infrastructure. Therefore, well-developed transportation infrastructure is crucial in attracting cross-border investment. This is because an integrated, efficient and inexpensive national transportation system can reduce the costs of doing business and maximize profit. From the results of this study, the performance of the water transport system (C18) needed for further improvements as foreign investors is less satisfied with the current performance. This shows that the current water transport system may not be well prepared by local authorities and might not meet the investors’ needs. Thus, the authorities should invest in ports and accessible water facilities. Moreover, increasing the accessibility to the water transport system and ensuring the system is available to everyone could improve the performance of the water transport system that is essential to achieve the SFDI.

As the world becomes more integrated through globalization, this study finds that economic partnerships/free trade agreements (C28) are required in SFDI. In an integrated world, the market is not limited. Thus, economic integration or partnerships, as well as free trade agreements, can sustain the foreign investment because they are free to export and import the products to more other economies that have joined economic integration or signed agreements. This can expand market size and demand, reduce production costs, and then increase the revenue of investment. Investment is more sustainable through the concept of economies of scale with greater market demand. Furthermore, the international standard may apply in local investment and production when an economy joined the partnerships or agreements. This can drive the ethical and better production indirectly because investors need to adhere to these international standards if they want to export products to the global market.

In addition, similar with the overall sample, profitability (C8), productivity (C15), transportation system—Airways (C16), exchange rate stability (C21), and protection of foreign investors (C36) is also located in quadrant IV. For instance, the authorities should review the existing education system and provide more training to the workers to improve the worker’s skills and abilities. The marginal profitability improved when the workers’ productivity (C15) increases. Therefore, improving workers’ productivity is favorable in attracting inwards SFDI. The finding also shows that the performance of airways transport systems (C16) requires further improvement. The authorities need to plan an integrated national airways transport system, including strategically located airports, adequate low-cost carrier services, and others ways to provide an attractive investment environment. In general, these findings show that the foreign investors feel that these criteria are key attributes to success the SFDI but require further improvements on the performances. The government or the authorities should ensure that the investment environment is investor friendly, which is no harm to the foreign investors’ investment, especially for profitability, high productivity, friendly and convenient national transportation systems, stable exchange rate, protection of foreign investors, etc.

Moreover, the findings from foreign investors further show that Malaysians have a certain strength in boosting the interest of foreign investors. These criteria are plotted in quadrant I, including labor cost (C7), business sophistication (C9), infrastructure—Communication (C12), market openness (C13), market potential (C14), transportation system—Roadways (C17), banking stability (C19), country stability (C20), world economy uncertainty (C24), business freedom (C27), economic freedom (C28), and business regulation (C33). However, there are certain differences between policymaker and foreign investors’ perspectives. From the foreign investors’ view, labor cost (C7), world economy uncertainty (C2), business freedom (C27), economic freedom (C28), and business regulation (C33) were the competitive advantages of Malaysia, while the findings of policymakers’ perspective found that financial market development (C3), profitability (C8), goods market efficiency (C11), productivity (C15), transportation system—Airways (C16), transportation system—Waterways (C18), rule of law (C26), and protection of foreign investors (C36) were the strengths provided by Malaysia. The differences between both should be aligned and reconciled to ensure the investment environment provided by the policymaker meet with foreign investors’ expectation and requirements as they are the one who conducting the SFDI in Malaysia.

In short, the cross-border investment environment in Malaysia is currently facing challenges in sustainability. The SFDI attributes were used to get over such challenges. However, this study disclosed that the performance of several valid criteria was at a low level. The criteria that fall in quadrant IV are urgent and to be the priority for further improvements in establishing a conducive environment for SFDI.

6. Conclusions

SFDI involves the alternative capital flows for cross-border investments, as it contributes to economic, environmental, and social development. Hence, this study attempted to demonstrate the primary attributes of SFDI from the experts’ opinion. A set of 109 attributes categorized into nine aspects, including environmental, financials, macroeconomics, institutional, fiscal environment, freedomness, policies, stability, and social, was proposed for the assessment using FDM. In FDM, the experts’ qualitative information is converted into a comparable value through the fuzzy set theory. The unnecessary attributes are removed in FDM, and the attributes with greater an importance value than the threshold value remain. Therefore, reliable and robust results are provided, as the input of assessment is directly collected from the experts’ subjective perceptions. Lastly, this study identified the critical SFDI attributes that require special attention by plotting the primary attributes in the importance-performance matrix using the FIPA approach.

This study revealed that financials, macroeconomics, institutional policies, environmental, and social are the most important aspects of driving SFDI inflows. In particular, 40 criteria are identified as primary attributes, whereas market openness, country stability, roadways transport system, exchange rate stability, and profitability are defined as the top five attributes. These attributes play a substantial role in stimulating SFDI inflows, which requires policymakers to pay great attention to achieve sustainability targets. However, the results show that the performance of financial aspects is not satisfactory from the foreign investors’ perspective. This primary aspect needs to be improved to encourage more foreign capital inflows. The result also showed that profitability, the stability of exchange rate, world economic uncertainty, bureaucratic quality, and protection for foreign investors are among the top common attributes in the overall sample that are highly important but with low performance. The distinctions between experts are addressed. Access to local finance and international public finance are found to be the most critical attributes that need further improvement from the view of policymakers, while financial market development, waterways transport system, and economic partnerships or free trade agreement are the focus of foreign investors. The FIPA matrix is an easy tool for assessing the importance and performance level of SFDI attributes.

This study contributes to the literature by identifying the primary attributes that cause SFDI and offers both theoretical and policy implications. Financials, macroeconomics, and institutional policies have been found to be critical aspects of SFDI inflows. Therefore, the authorities or policymakers should emphasize these aspects to enhance foreign capital inflows. Additionally, the authorities and policymakers are required to pay special attention on certain key attributes that are highly important but with low performances, including profitability, the stability of exchange rate, world economic uncertainty, bureaucratic quality, and protection for foreign investors. Recommendations are suggested for authorities and policymakers to make appropriate decisions in stimulating SFDI inflows. The action plans are focused on these attributes and suggest a better solution to achieve the conducive investment environment.

Nevertheless, this study has some limitations. First, the proposed attributes were collected from prior studies. Hence, the attributes proposed in the study might not be able to capture the whole SFDI information. Therefore, revision of the research framework by adding or removing attributes to develop a more comprehensive framework should be encouraged in future studies. Next, this study applied the FDM to evaluate the attributes and confirm validity and reliability. However, the number of experts should be increased to ensure consistency and avoid biases in the assessment process. Third, the finding of this study cannot be generalized, as it only focused on the SFDI in Malaysia. Future studies may use this framework in other countries to increase the generalizability of the study. The comparison between countries is encouraged to enrich the literature.

Author Contributions

Conceptualization, M.-L.T. and P.-S.L.; methodology, M.-L.T.; software, M.-L.T.; validation, M.-L.T.; formal analysis, P.-S.L.; investigation, M.-L.T.; data curation, P.-S.L.; writing—original draft preparation, P.-S.L.; writing—review and editing, M.-L.T. and M.K.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding and the APC was partially funded by Centre for Research and Development, University College of Technology Sarawak.

Acknowledgments

The first author would like to acknowledge the financial support provided by the Ministry of Foreign Affairs of the Republic of China under Taiwan Fellowship Program and Institute of Innovation and Circular Economy, Asia University for hosting him during the research period in Taiwan.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Proposed Measures.

Table A1.

Proposed Measures.

| Proposed Aspect | Proposed Criteria | Description | References | ||

|---|---|---|---|---|---|

| PA1 | Environmental | PC1 | Access to Land | The degree of ease of acquiring the land in the host country that required to develop projects. | [9,13,36,44] |

| PC2 | Carbon Dioxide (CO2) Emissions | The total carbon dioxide (CO2) emissions in the host country. | |||

| PC3 | Environmental Regulation | The host country has adequate regulation to protect the environmental resources. | |||

| PC4 | Abundance of Natural Resources | The availability of natural resources in the host country. | |||

| PC5 | Non-Renewable Natural Resources | The availability of non-renewable resources in the host country, such as coal, natural gas, and oil. | |||

| PC6 | Renewable Energy Resources | The availability of renewable energy resources in the host country. | |||

| PA2 | Financials | PC7 | Access to local finance | The degree of ease of obtaining financing in the host country’s financial market. | [13,14,20,21,36,37,38,39,40] |

| PC8 | Financial Market Development | The existence of functioning financial market in the host country. | |||

| PC9 | Interest Rate | The costs of financial loan in the host country. | |||

| PC10 | International Public Finance | The financial flows from multilateral or national development banks (outside the host country). | |||

| PC11 | Investment Cost | The amount of capital that investors need for investment in the host country. | |||

| PC12 | Labor Cost | The costs of labor in the host country. | |||

| PC13 | Natural Resources Rental/Costs | The costs of using natural resources in the host country. | |||

| PC14 | Profitability | The degree to which the investments yield profit or financial gain. | |||

| PC15 | Tariff Rate | The tax imposed by the host government on goods and services imported from other countries. | |||

| PC16 | Tax Rate/Burden | The business profit tax paid to the host government or authorities. | |||

| PA3 | Macroeconomics | PC17 | Bilateral Trade/Trade | The exchange of capital, goods, and services between the host country and investors’ home country. | [11,12,20,22,36,37,41,42,56] |

| PC18 | Business Sophistication | The quality of the environment in host country which businesses operate (Business Climate). | |||