Abstract

A global real estate revolution has been transforming the urban landscape everywhere. Development and redevelopment projects have mixed with, if not become an integral part of, real estate construction. At the same time, there is a drive to commodification in this revolution, as shown by a growing trend to conserve built heritage in new development projects characterised by the rise of museums. This paper reviews some examples of attempts in various parts of the world to combine real estate development and conservation and applies the fourth Coase theorem to explore how built heritage conservation and urban renewal in Hong Kong, hitherto problematic in terms of their invasion of private property, can become a win-win outcome in the context of this global real estate revolution.

1. Introduction: Global Real Estate and Heritage Conservation

Like it or not, real estate everywhere has become a rising sector and a real estate revolution has happened quickly to transform the face of the Earth. When the term “real estate revolution” was coined in 1980 when a book [1] with that title came out, the notion became connected with huge realty brokerage firms, speculation, and bubbles that can be traced back to the rise and fall of the Dutch tulip market in 1637. Almost 40 years have elapsed and the nature of this so-called revolution, the relevant literature of which will be canvassed in Section 3, which has become globalized to involve huge amounts of financial and human capital, has not yet been articulated on a positive foundation that goes beyond personal and collective greed, conspicuous consumerism, and the unintended consequences of governments’ monetary policies.

In this context, real estate development is often perceived as a natural enemy of built heritage, as the latter is often completely demolished to make room for new projects. From this stance, the conflict between real estate development and built heritage conservation can only be averted by having the new project constructed completely below or above the old buildings or en bloc relocation of an older building (as in the case of relocating the Abu Simbel temples and other structures before the Aswan Dam was built) without altering the pre-existing structures or the removal of a collection of older buildings to a new location to form a new settlement, as in the case of Vigan City, the Philippines, which UNESCO declared a world heritage city. Between these polarised scenarios, there exists a range of ways to accommodate and/or make a better use of old buildings that would otherwise be completely destroyed. These include adaptively reusing all heritage buildings and retaining the façades of just a few pre-existing buildings.

This paper addresses the potential of real estate development in light of the “revolution” and built heritage conservation from a perspective that, in principle, holds that both real estate development and heritage conservation can be mutually compatible, especially in government led-urban renewal projects. It offers an analytical model for policy direction, but not a narrow empirical test on a past or existing urban renewal project. It disagrees with the view of heritage conservation as being purely subjective and obstructive by subverting creative activities, although it can be corrupted by uncompromising interest groups. The rationale behind this is that built heritage and real estate development have a common foundation both physically and semiotically, meaning that intangible assets related to historic real estate are important. The reasons involved are best explained by a comparison between the real estate and industrial revolution. An econ model is applied to demonstrate the ideas in the case of Hong Kong in a global context.

2. Theoretical Foundation and Context: The Fourth Coase Theorem and Yu’s Model

Many have wrongly subscribed to the view that Coasian analysis is anti-government. A careful reading of Nobel Prize in Economics laureate Ronald Coase’s works [2] would show that the state or government can design rules that enlarge an existing market without getting involved as a provider. Lai and Lorne called this the fourth Coase theorem [3]. This theorem accepts that the plan–market dichotomy is a false one. For one thing, the market necessarily operates in a framework (whether cadastral, policy, or legislative) provided by and market solutions ultimately enforced by the state. It can also adopt oppressive practices that can be socially harmful. On the other hand, state plans can be implemented contractually by the parties involved rather than by edict. In real estate development, a good example of this is government-led urban renewal.

Before proceeding to urban renewal, one needs to appreciate the conditions of the fourth Coase theorem as specified by Lai and Lorne for urban renewal.

- (1)

- The government must be involved.

- (2)

- The government must make rules for a market.

- (3)

- The market is existing.

- (4)

- The market accepts, adopts, and applies the rules.

- (5)

- The transaction costs of renewal are reduced.

- (6)

- The market expands, rather than contracts.

- (7)

- The above rules do not create a new government monopoly.

Urban renewal can be and is often sadly and purely interventionist—involving state action to expropriate private land that allegedly suffers from unredeemable urban decay before passing these seized land parcels to developers to make a profit according to government layouts or schemes worked out by the developers themselves. This approach is hardly a genuine ‘market’, not to mention libertarian, solution to urban problems, as it based on neither the consent nor empowerment of the affected stakeholders. It brutally erodes private property rights for another private purpose as explained by Lai et al. [4] and Lai [5]. ‘Urban renewal’, the subject of this special issue on in most cases, involves urban property redevelopment and densification. The reality is that there is a drive for real estate redevelopment in major cities, even though it has nothing to do with authentic real renewal. Built heritage would vanish and the likely outcome is a completely new project in place of an old urban fabric. A perfunctory nod could be given to heritage conservation through the retention of a small part of the old building cluster—as long as it does not affect the overall brand-new development.

However, the government can utilize the power of the market to promote both real estate development and built heritage conservation by setting and enforcing rules of urban planning and property boundary re-delineation. One important and well-known rule is the ‘transfer of development rights’ (TDR), which basically frees a site’s development potential from existing cadastral boundaries. Recognised built heritage with redevelopment potential can be saved, revitalised, and functionally and socially integrated into a modern real estate redevelopment with a lower impact on the existing heritage.

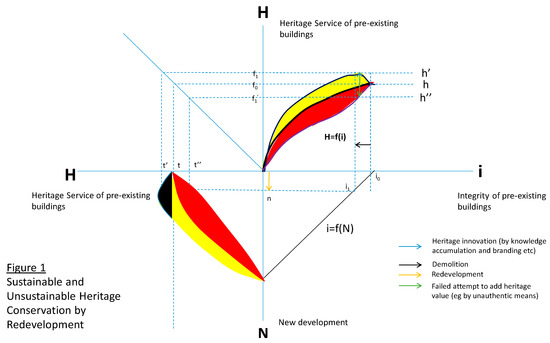

This approach can be formalized using Yu’s four-quadrant model of sustainable development based on innovations enabled by some rules of entitlement that do not prelude those made by the state, Yu et al. (2000) [6] as shown in Figure 1, as specified by authors to a discussion of redevelopment and conservation. These rules of entitlement are Coasian as property rights arrangements that are important in the real world of positive transaction costs. Two goods, H and N, are both related to i, the integrity of existing buildings. H is the heritage service to the community, which has a positive relationship with i, which is denoted by a neo-classical production function h in the NE (top-right) quadrant. However, note that the relationship is stochastic rather than deterministic in that heritage service is a matter of human inputs put into servicing the integrity of heritage, which is a of kind historical record left in a locality from the past, usually physical objects identifying particular historical happenings in a particular locality, often pointing to the future. Heritage services illustrating and/or modifying physical historical objects can be expressed in various forms and varying details, depending largely on the innovative efforts and branding that are put into it. Thus, how the present generation remembers the past is a matter of degree. Illustratively, the relationship between physical objects of the past and heritage service is a belt as shaped as a balloon in the NE quadrant. N is the new development, which by necessity can only be created by compromising i. New development necessarily destroys some physical objects of the past. In the limiting case where nothing is left behind with everything removed, i is zero. Most reconstructions without heritage considerations (or no particular incidents worth remembering) will choose i equals to zero. However, in many redevelopment projects, there is a tradeoff between N and i, as indicated in the SE (bottom-right) quadrant. Because preservation in a binary, “yes or no” decision yes means preserving a particular object and no means removing it, the relationship between N and i is a physical relationship. Through a transformation line in the NW (top-left) quadrant, the relationship between H and N is shown by a mirror image of the neoclassical production relationship h as t in the SW (bottom-left) quadrant. The relationship characterised by t is a negative one and, hence, there is no possibility of a win-win outcome. This would ALWAYS be unsustainable and the tradeoff wired in due to an assumed deterministic nature of h. For the same reasons articulated in the NE quadrant, the relationship of heritage services and new development is actually a belt or a balloon.

Figure 1.

Yu’s model applied to heritage conservation and urban renewal.

This model could be useful for exposition purposes in policy discussions. For example, a redevelopment without any heritage consideration is a point of zero in the i dimension; and a policy of total conservation is the maximum value of i. The actual outcome of a project can be identified in this dimension from the minimum value of zero to its maximum value. The question is: if private parties are left to sort things out themselves, whether the i chosen will be the i that achieves the black shaded area in the diagram. The government indeed may have a role to play in being part of the contracting parties; and in so doing, the actual i chosen would indeed be higher or lower than the privately competed-out solution. This is the illustration of the fourth Coase theorem in the context of this model.

Yu et al. argued that this function can become a fuzzy area due to Schumpeterian innovations, which are creatively-destructive. According to this line of thought, suppose a redevelopment project of genuine urban renewal that respects the existing architecture stimulates or includes an innovation through knowledge accumulation and re-branding through the rehabilitation of the conserved portion of i and the opening of a heritage museum [7]. Then H may shoot up to h’, in which case a bulge would appear in the SW (bottom-left) quadrant. That bulge is an area of win-win combinations in redevelopment to increase modern floor space and heritage conservation. This model (as shown in Figure 1), however, does not naively suppose that redevelopment will always bring about this ideal outcome. Heritage innovations can fail, especially if the means are poor and unauthentic. They would drag H down to h”, while t remains negatively sloped in the SW (bottom-left) quadrant. How redevelopment through urban renewal may create the bulge is a challenge to the project manager.

In the real world, many forms of European architecture exhibit this possibility. The combination of conserved Mancunian canals and modern property development in Manchester, along with the expansion of religious buildings that incorporate parts of ancient designs into modern structures (Mary Major in Rome, for instance), are cases in point.

The relationship between Coase theorems and Yu’s model needs spelling out. There is no room for innovation, whether Schumpeterian or not, as information is perfect and the technology is given as the best under either of the two versions of the Coase theorem, as formulated by George Stigler, namely the invariant and optimality theorems [8]. The pattern of property rights or institutional arrangements does not matter either, as transaction costs are assumed zero. In the real world of positive transaction costs, however, there is always room for a breakthrough or improvement in technology provided that there are appropriate institutional arrangements (notably those regarding IP) on which the state often exerts a great influence—this is heart of the fourth Coase theorem as a kind of the so-called “corollary of the Coase Theorem” [8,9].

Yu’s model, as explained, is predicated on Schumpeterian innovations in response to a threat. Such innovations can only happen under enabling IP arrangements, which would protect innovators’ incomes from unfair infringements. Implicit in the model is the sense that IP arrangements, as parameters or underlying assumptions, do not feature in the model as lines. That it assumes a fuzzy shape implies that there are supporting institutional (property rights) arrangements.

3. The Nature of the Real Estate Revolution as Compared to the Industrial Revolution

The term, “real estate revolution”, is an under-researched concept. It has been used loosely in either a practical or a pejorative sense. Real estate practitioners use this term in a positive sense to discuss new ways to improve or understand their practices in a changing environment. Examples are the works of Erwin [1], Lyne [10], and Miller et al. [11]. Commentators who are interested in social justice (like Carol [12]) use it in a negative sense to describe the adverse social patterns or impacts of certain practices in the industry. There are also some references to the term in a descriptive sense, as in the case of Ross and Rosen [13], who described what happened in China’s land market during the 1990s. Cited in Kan [14] and several books and doctoral theses on China, Ross and Rosen’s work did not probe the nature of what they considered a revolution, as opposed to a “take-off” in industrialization. By and large, the term “revolution” is used mainly as an eye-catching expression to promote expert opinions and is unwelcome by heritage conservationists.

The Industrial Revolution was about lowering the marginal and average costs of production for standardized units of goods that could be moved from place to place and were usually manufactured in some sort of employer-employee production mode in the form of scalable factories. Its essential feature of production was the design and operation of a mechanical/chemical production line using cheap inputs. Its economics were easily summarised by a neo-classical production function, while its economy could be simplified by an input–output table.

The real estate revolution has six salient features. First, for most economies, real estate now constitutes a greater percentage of the investment flows of their GDPs. In the U.S., for example, real estate statistics have been used as an important leading indicator for tracking its economy. Second, in business accounting, firms’ asset values are increasingly dominated by real estate portfolios not merely for the purpose of accounting, but with powerful leverage used as collateral to obtain new loans. Third, experts in real property valuation and private property development are in growing demand and universities have responded in offering more and more courses to train appraisers (estate surveyors) [15]. Fourth, daily life routines like shopping and riding public transport (including aviation) are better accommodated under the umbrella of effective real estate planning and modern facility management, a concept that has superseded “property management”. Fifth, new housing construction as high-value areas, often gated, has become a huge project covering a large area and transforming many cityscapes, in way to make cities areas look more alike each other. Sixth, the state has responded institutionally to the internationalization of real estate [16].

The real estate revolution cannot be reduced to a matter of physical demolition of old buildings and the construction of new ones. It is not simply a matter of piling up more floor space onto a site to gain more profits by widening the land revenue (as a function of floor space) and land cost (assumed zero) gap (rent) on a plot of land by utilizing the same cost function as that to provide living space. Nor is it just a matter of proliferation of real estate agent shops in the neighbourhood or rent-seeking by developers who manipulated zoning rules to obtain more or better development rights using standard theories that prevail in the political economy literature.

It is submitted by the authors that the real estate revolution is about increasing the value of land in locationally specific places by partitioning and unitizing it while using it as a platform/storage/depot for accumulating goods and services. The feature of the production outcome cannot be easily captured by the mathematical equations of the neoclassical production functions that are widely used and estimated in the economics literature. The production outcome is procedural (i.e., not just about putting various factors of production together) and run through a neoclassical production function that is mathematically described. The outcome is usable outputs that are definitely physical, but it is more than that.

A real estate development project has functional services in terms of providing needed space, physical facilities, and location (accessibility). It also has a sign foundation in terms of many observable attributes. These include naming and branding a property that point not only to its functions, as such terms as “villas” or “centres” indicate, but also to a way of life or business that uses or occupies the premises. Modern real estate developments are typically marketed with well-chosen property names [17] which can be interpreted as a form of place branding [18], rather than just a lot or street number. This is a phenomenon that has attracted research on the basis of memetics [19], a branch of studies on information that laid the foundation of the empirical research by Exner et al. [20] on land ownership that appeared in the planning literature in Vasishth [21], Mehmood [22], and Lai et al. [23]. So far, no attempt has been made to interpret built heritage as objective signs, though Robertson [24] had related memes and Poddubnykh [25] memory to heritage conservation interpretation.

Prior to explaining the sign dimension of conserving a heritage building, the authors should point out that the building in itself is already real estate. What was once new has since become something of significance and identifies as “heritage”—something passed on from the past to the present. That means the identification and conservation of some existing or lost buildings as “heritage” is part of a land conversion process, in which something created as real estate in the past is now considered worthy of conservation for the foreseeable future in light of a proposed redevelopment scheme, as a real threat. Preservation may not be able to take advantage of new place branding and other means of catallaxis envisaged in the Yu’s model. Apart from reasons that have connections to nostalgia or melancholy, pinpointing a building constructed some time ago for conservation is a commitment that is future-oriented. As such, the building is a physical sign conserved for a prospect so its users can be “living today from tomorrow”. Conservation in the sense of sustainable development is not backward-looking, but for the beneficial use of the present and future generations. We do not agree with preservation for its own sake, as that can be a kind of idolatry. The concept of sign used in this paper is not that of the consumerist approach of Freire [18] that people consume signs rather than actual products. Rather such products as part of a development process are for a communitarian enjoyment and rediscovery that point the user towards the future.

Above all, the testimony of Skramstad [26] showed that in many American settlements the construction of museums, real estate for heritage conservation and education, and other civic buildings ran ahead of population build-up. The same early dedication of resources to introduce museums at an early stage of urban development can be found in Taiwan during Japanese colonial rule for cultural purposes [27]. As museums are important places for keeping and showing heritage articles and are themselves signifiers, these two examples demonstrated the historical importance of signs in the development process.

4. Some Real-World Examples of Win-Win Outcomes between Real Estate Revolution and Heritage Conservation

The common sign and physical foundation for heritage and real estate development allows for fruitful complementarity, although a real estate revolution carried out without regard for the value of heritage can destroy the results of generations of cultural activities within a few hours. All projects discussed in this section involved a degree of heritage conservation as they all have museum operations. These museums may be compared to family albums, memorial halls, or ancestral halls that help avoid the impractical option of preserving all buildings of entire places for the sake of holding onto the past at all costs. Less important buildings or parts of buildings can be modified by “creative destruction” to renew the place with new buildings. In an excellent paper by Holman and Ahlfeldt [28], an opinion survey of London’s residents found, that in line with extant research on the good effect on values due to conservation, retention of built heritage would enhance property rights. More importantly, the residents did not blindly reject new development applications but only “object to those that would spoil the character of the area” (p.181).

Real estate development can hence be mutually compatible with heritage conservation, the latter of which can be part of a resistance movement to, a collaborator or a beneficiary of a real estate revolution. Above all, a real estate revolution can also benefit heritage conservation. Site formation for a new building by excavation, while replacing part or whole of a much-treasured existing structure, may expose interesting heritage hidden or buried in the site. Therefore, a revolutionary real estate use of a site may rediscover the forgotten past and this resource can be exploited to enrich the new development. Two of the examples discussed below testify to this point as we shall see.

As a key player in institutional designs, the state can be involved in all of these possibilities and play very different roles, depending on the preferences of the public and institutional options of the state. These are discussed below in a setting that a “neo-liberal global economic agenda” of the state has assigned many built heritage to the private or voluntary sector [29] (Negussie 2006). This leads to our ultimate target of canvassing government-led urban renewal in Hong Kong as a possible means to conserve its built heritage more successfully via real estate development, as informed by the fourth Coase theorem. Parallels will be drawn between these cases and those that already happened or could happen in Hong Kong’s urban renewal projects.

4.1. Heritage Conservation as a Resistance Movement

As a resistance movement, heritage conservation can seek to frustrate and halt real estate redevelopment, freezing it in one point in time. The most common way to do this is to get the buildings on a list of declared monuments. This can save them from demolition or alteration by developers, but does not necessarily make them more useful for public enjoyment. Therefore, conservationists also need to lobby the state to rehabilitate them using public funds and museums are often the result. Yet, given limited resources, the state normally seeks to generate revenue from these protected buildings, so a real estate revolution still must occur sooner or later. The Darling Harbour industrial area redevelopment in Australia is a case in point.

Originally a hectic wharf connected to nearby industries via interstate railways and highways Darling Harbour was also a short walk from Sydney’s Chinatown. The Darling Harbour goods yard area declined from the 1970s after its largest reclamation of the 1960s. Certain groups wanted to preserve its industrial heritage in the form of historical buildings (like a powerhouse) and complained about a lack of foreshore access to the harbor—a point well studied by all Sydney planning students of the 1980s. However, that alone was not financially viable in the long run, especially if the derelict landscape were also retained. What happened eventually was that the whole area was converted into a harbourfront cultural, recreational, and entertainment area with two museums the Australian National Maritime Museum and the Powerhouse Museum and catering facilities along with modern commercial real estate. Little remains of the once-dominant industrial landscape or the aboriginal presence in Cockle Bay. However, Chinatown gained some benefits from this real estate revolution, as a huge multi-storey car park and entertainment centre were built between the two locales. However, there has been little heritage conservation effort in the place to tell the story of the history or significance of the old wharf. Industrial heritage conservation in NSW has been much criticised for its lack of respect for history (see Spearritt [30]) and the development of the place was considered the resultant of the forces a powerful state government and a “disempowered” city council for public space favouring tourism and entertainment rather than heritage conservation. [31]. Indeed, the conversion of the Haymarket section of Chinatown as a gated high-rise development that dominates the area has turned its surroundings into insignificant low-rises.

On the other hand, Jinguashi in Taiwan managed to conserve its original industrial character in the form of a state managed gold ecological park with a museum, opened in 2004, being its hallmark. [32]. Jinguashi has one of the largest gold reserves in the world, while nearby Jiufen used to be a residential area for miners. Gold and other metals like silver and copper were extracted from Jinguashi from the Japanese colonial period to 1987, when mining was halted due to a fall in the international prices of coloured metals. The location, under unitary land ownership and with good sea and mountain views, could have been transformed into a luxurious residential area, but the state preferred to designate it as a cultural–ecological and heritage site and operate a museum park there to raise revenue to support the heritage conservation. The museum here is large and, like Darling Harbour, is well-patronised. The site has not witnessed much commercial real estate re-development but the museum has generated a positive externality for nearby Jiufen (a place originally occupied by nine migrant families from Fukien who started mining in this hilly region). As the gold mine in Jinguashi closed, the original mining town declined, but the operation of the museum, facilitated by the publicity of a popular Japanese cartoon that used a property in the area as an icon, allowed Jiufen to become a tourist stop famous for artwork and food. There is little comprehensive master plan-type redevelopment and its crowded, long, and narrow alleys are prone to fire. Real estate activities are mainly disorganized improvisations of pre-existing dwellings for miners in the form of art galleries and snack shops. How Jinguashi and Jiufen will co-evolve in the future remains to be seen.

4.2. Heritage Conservation as a Collaborator and Beneficiary of the Real Estate Revolution

A private real estate project can become a conservation site. A good example is Park Güell, Barcelona. However, far more significant for this discussion are successful attempts to link heritage conservation with a real estate revolution, as it is far more challenging for policymakers and conservationists. One attempt is Canary Wharf, London. As summarised by Brown ([33], p. 70), “Canary Wharf is now arguably Britain’s premier banking centre, employing over 100,000 people. However, this is a relatively new phenomenon. A declining area until the mid-1980s, London’s increasingly derelict Docklands had been haemorrhaging jobs and people since the mid-1960s.” With the rise of containerization, London’s docklands went into disuse and disrepair. The site was designated an “urban enterprise zone” in 1982 and this converted into a vast real estate development. A Museum of London Docklands, constructed in 2003 in an 1802 vintage sugar warehouse, benefits from this successful project, as it provides good supporting facilities.

In comparison, a museum of mining on Britannia Beach, Vancouver, opened in 1975 has been less spectacular as a success. This place was a famous copper mine in the British Empire, but depopulated from the 1970s [34]. Theoretically, there could be a win-win outcome combining heritage conservation and real estate development [35]. Yet, greater synergy between the museum, which does not convey its mining origins clearly, and the housing projects in the nearby town awaits further development. Potential tourist flow is diverted to a cable car (Sea to Sky Gondola) attraction up a neighbouring hill.

4.3. Real Estate Revolution Free-Riding on Heritage Conservation

The most famous example in the world of “free-riding” on heritage is, perhaps, the Louvre Palace shopping mall, which connects to the famous museum of the same name via the glass pyramid designed by I. M. Pei and a public road network via an underground vehicle park. This facility was also an archaeological project, as its construction gave archaeologists an opportunity to trace the old city walls of Paris.

All of these examples are similar in terms of state commitment, but differ in terms of the approaches taken. The Sydney, London, and Paris examples discussed above used market forces to various degrees, whereas the Taiwan example mainly relied on state support. The Sydney project was, in a sense, “event-driven” and received top-down state government blessing and support due to the 1988 Bicentenary celebration and 2000 Summer Olympics [36]. In contrast, the Canary Wharf project, a Thatcherian government baby, was basically market-driven. It was heavily-criticised during its inception and the real property slump in 1992 [37], but has proven a success. Now it is appreciated not just as a commercial hub, but also for its architectural iconic value. [38] The Jinguashi museum was part of a “memory bloom” of the 1990s by the Taiwanese to recall Japanese colonial rule and affirm their own identity [39,40]. Here, economic value was never considered and the recollection was more a referent for the future than one of nostalgia. The museum park points to the future for Taiwan. Although the Hong Kong example has cost its government a lot, it still evolves, as it is uncertain if the MTR station’s real estate development will or will not capitalize on the archaeological discovery.

The above examples can demonstrate how well, if at all, a Coasian–Schumpeterian approach as elucidated by Yu et al. [6] has played out. They show if and how real estate development can co-develop with heritage conservation in a viable manner. This approach advances that in the presence of transaction costs, an appropriate re-arrangement of property rights (which refer to a degree of entitlements) to a resource would encourage investment and innovations. Innovations may be said to be Schumpeterian and conducive to sustainable development where they lead to win-win outcomes. These in our discussion mean the complementarity between real estate development and heritage conservation.

The cases discussed, with heritage conservation in different degree, surely involved new Coasian institutional re-arrangements by state-enforced re-delineation of property rights. Rezoning or new zoning under respective planning legislation was involved in the cases of Darling Harbour and Canary Wharf. The gold-mining function in Jinguashi, which ceased operations in 1987 and sold to two state enterprises, was replaced by a state museum in 2004.

Innovations have also been seen to work in all examples. Darling Harbour and Canary Wharf, with different planned objectives, have turned out to be successful with significant private sector participation. Like the Sydney example, the Taiwanese and French museums are well-visited and both have enough space and heritage resources for ongoing adaptations and development in new directions. However, innovations properly so-called “Schumpeterian creatively-destructive” may be said only of Canary Wharf and (the Louvre where the vitality of the market in the absence of much state intervention is demonstrated, though it is doubtful if conservationists would agree that the former has a greater cultural heritage sign value than the latter.

In terms of policy, two real estate revolution phenomena are relevant: the emerging heritage impact assessments (HIA) and the growing popularity of interpretation rooms for new projects. The contribution of HIA has been well understood. In light of our analysis, the establishment of heritage interpretation rooms in real estate projects, which has grown in popularity for property branding purposes, deserve greater recognition and should be encouraged by the government and industry. These rooms are mini-museums, managed by trained people and open to the public for real estate projects. They would not only add value to the development projects for occupiers but also for the benefit of the wider community beyond the physical boundaries of these real estate in time and space. These rooms should above all take advantage of the HIA conducted prior to development and use them as referents to show the idiosyncratic sign functions of the present building and/or its sites in relation to the past and future and for critical evaluation of the success or otherwise of the vision for the projects.

5. The Case of Hong Kong’s Urban Renewal and Heritage Conservation in Retrospect and in the Future

While it is true that “bygones are bygones”, a review of some less-than-successful urban renewal projects can help make future projects successful. Having set the wider global context, we turn now to Hong Kong.

In Hong Kong, the best example of “heritage conservation” as a resistance movement for frustrating urban renewal is the saga of the Urban Renewal Authority’s (URA) Wing Lee Street renewal scheme. If approved and carried out, it would have affected those street shops in post-war buildings erected during the 1950s and 1960s along this poorly-accessible street below Caine Road. Due to the nostalgia that a local, award-winning movie generated for this area, the URA gave up on the scheme because the Town Planning Board (TPB), influenced by public opposition, did not favour its plan. Thus, the street has been preserved, but it remains an urban backwater and its shops enjoy little business or cultural vitality in the absence of investment. Its fame remains purely cinematic and few people actually visit the place. This is a typical lose-lose outcome.

An example of built heritage conservation in collaboration with and as a beneficiary of the real estate revolution, as described in Section 4.2, is the first government conservation project that was made by the Lands Development Corporation (LDC), which was the URA’s predecessor. This was the preservation of Western Market, a heritage building in Hong Kong that is also a declared monument. It was restored as a tourist attraction and to re-accommodate, as tenants, Chinese textile shops displaced by urban renewal projects in other parts of the city.

One can argue that the Western Market is well-preserved and managed, but it remains a solitary, older building surrounded by high-rise private developments that do not communicate well with its surroundings architecturally or commercially. This is so even though it is connected to nearby public transport by the famous Central-Sheung Wan footbridge system.

The best example of a real estate revolution taking advantage of heritage conservation is the conservation of the façade of the pre-war Wanchai Market on Queen’s Road East and Wanchai Road. On top of it was built a high-rise URA complex. This is an example of façadism and the addition makes use of some Bauhaus elements of the market in shaping the project.

Another example is Mass Transit Railway (MTR) station development, which is usually a source of huge profits because the MTRC develops and sells housing units built on top of some stations on government land acquired at concessionary prices. In constructing the new To Kwan Wan station, it uncovered six wells and granite drains and 239 village relics dating back to the Sung or Yuan Dynasties. The rail and station alignments had to be altered at huge cost to conserve these rare heritage items, which will be displayed in the new station. A precedent is the archaeological display at the Beimen (North Gate) MRT station in Taipei. It remains to be seen if these extra costs will become good investments by promoting the value of the locality in which URA projects are present.

The relationship between the conditions for the fourth Coase theorem, as elucidated in Section 2, and the Hong Kong examples of urban renewal is as follows: First the government is involved in setting up an urban renewal agency as a statutory body. Second, this agency has devised rules to facilitate urban renewal of privately developed urban areas using a market mechanism with the supposition that it respects private property while making more efficient use of land resources and conserving heritage. Third, the property market, based on a leasehold system, is existing. Fourth, developers accept, adopt, and apply the rules laid down by the renewal agency. Fifth, obviously, transaction costs of renewal have been reduced as more and more projects have been implemented. Sixth, the redevelopment market has expanded. Seventh, the renewal agency does not monopolize the redevelopment market and many redevelopments occur without the help of the renewal agency.

The problem is that the practices of the agency, backed by land resumption power, often infringe on private property rights and may not always practice built heritage conservation.

That the fourth Coase theorem is not fully present in these Hong Kong examples of heritage conservation in real estate projects should not deter one from promoting heritage conservation within urban renewal through appropriate government-set rules. The most encouraging case is the “adaptive reuse” heritage policy for graded heritage buildings, even though they are not urban renewal projects. Two examples are worth mentioning: the former marine police stations, which were converted into boutique hotels with typical designs (lavish interior decorations) and management features of a real estate revolution. One is in the fishing town of Tai Lo on Lantau Island and the other is right in the heart of Tsimshatsui. Both examples involved the government making rules for an urban market. Moreover, the market is pre-existing and accepts, adopts, and applies the rules. Its transaction costs of renewal are reduced and the market expands, rather than contracts. Most importantly, these rules do not create a new government monopoly.

6. Conclusions

A real estate revolution that is reshaping the world at a fast pace and swallowing up land previously held by small owners who were mainly farmers and families. In China, this happened in just two generations [41]. Interestingly, economic texts and journals have had little to say about these visible changes to their economies, even though real estate development is now a very important component of many economies [42] and not just a purely financial phenomenon. This revolution is radically different from the Industrial Revolution. While many see real estate development as an enemy to heritage conservation, this paper uses examples of win-win outcomes within a Coasian–Schumpeterian framework [6] to show that this is too negative a view. The fact that heritage buildings are still real estate provides a common ground for new real estate that brings about a revolution to benefit and/or take advantage of a real estate project, depending on the preferences of stakeholders and decision-makers.

This paper adapts an analytical model rooted in Coasian and Schumpeterian economics to offer a way to focus on the possibilities of Catallaxis for redevelopment on the one hand and built heritage conservation on the other via innovations as a way to sustainable development. Some real-life cases with various degrees of success are presented. The case of Hong Kong is discussed with particular reference to urban renewal, the subject matter of this special issue. A win-win solution to the threat of loss of heritage in real estate redevelopment is only a possibility and relies on a change in mindset of stakeholders, including the state, in appreciating and fostering such an ideal outcome.

Author Contributions

Conceptulisation: L.W.C.L., validation: F.T.L.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ervin, T. Real Estate Revolution! Who Will Survive? Real Estate Education Company: Chicago, IL, USA, 1980. [Google Scholar]

- Coase, R.H. The Firm, the Law and the Market; University of Chicago Press: Chicago, IL, USA, 1988. [Google Scholar]

- Lai, L.W.C.; Lorne, F.T. The Fourth Coase Theorem: State planning rules and spontaneity in action. Plan. Theory 2015, 14, 44–69. [Google Scholar] [CrossRef]

- See Lai, L.W.C.; Chau, K.W.; Cheung, P.A.C.W. Urban renewal and redevelopment: Social justice and property rights with reference to Hong Kong’s constitutional capitalism. Cities 2018, 74, 240–248. [Google Scholar]

- Lai, L.W.C. A Fable and Dialogue on Taking the Property of Another under Constitutional Capitalism. In Routledge Handbook of Contemporary Issues in Expropriation, 1st ed.; Plimmer, F., McCluskey, W., Eds.; Routledge: Hong Kong, China, 2018; pp. 262–272. [Google Scholar]

- Yu, B.T.; Shaw, D.; Fu, T.T.; Lai, L.W.C. Property rights and contractual approach to sustainable development. Environ. Econ. Policy Stud. 2000, 3, 291–309. [Google Scholar] [CrossRef]

- Chua, M.H. A Triadic Framework for Heritage Conservation: Bridging the Objective-Subjectivist Dichotomy. Ph.D. Thesis, University of Hong Kong, Lung Fu Shan, Hong Kong, 2017. [Google Scholar]

- Lai, L.W.C.; Hung, C.W. The inner logic of the Coase Theorem and a Coasian planning research agenda. Environ. Plan. B: Plan. Des. 2008, 35, 207–226. [Google Scholar] [CrossRef]

- Lai, L.W.; Wong, S.K.; Ho, E.C.; Chau, K.W. Time is of the essence? An empirical application of the corollary of the Coase Theorem. Rev. Urban Reg. Dev. Stud. 2008, 20, 34–51. [Google Scholar] [CrossRef]

- Lyne, J. IDRC’s real estate revolution: Occupancy costs plummet, productivity crests. Site Sel. 1995, 40, 198–220. [Google Scholar]

- Miller, R.; Strombom, D.; Iammarino, M.; Black, B. The Commercial Real Estate Revolution; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Carol, M. Raisin, Race, and the Real Estate Revolution of the Early 20th Century. Arizona Legal Studies Discussion Paper; 2017. Available online: https://ssrn.com/abstract=3055372 (accessed on 26 January 2019).

- Rosa, J.J. The Second Twentieth Century: How the Information Revolution Shapes Business, States, and Nations; Hoover Institution Press: Stanford, CA, USA, 2000; Volume 547. [Google Scholar]

- Kan, K. The (geo) politics of land and foreign real estate investment in China: The case of Hong Kong FDI. Int. J. Hous. Policy 2017, 17, 35–55. [Google Scholar] [CrossRef]

- Wells, G.J.; Williams, N.A. Real estate brokers view the college curriculum. J. Educ. Bus. 1993, 68, 237–242. [Google Scholar] [CrossRef]

- D’Arcy, É. The evolution of institutional arrangements to support the internationalisation of real estate involvements: Some evidence from Europe. J. Eur. Real Estate Res. 2009, 2, 280–293. [Google Scholar] [CrossRef]

- King, A.D. Notes towards a global historical sociology of building types. In Re-Shaping Cities: How Global Mobility Transforms Architecture and Urban Form; Routledge: Abingdon, UK, 2009; pp. 21–42. [Google Scholar]

- Freire, J.R. Geo-branding, are we talking nonsense? A theoretical reflection on brands applied to places. Place Branding 2005, 1, 347–362. [Google Scholar] [CrossRef]

- Zeng, Z.; Liu, Y.Q. On the names of real estate from the perspective of meme—Nanchang as an Example. J. Jiangxi Inst. Educ. 2011, 32, 117–120. [Google Scholar]

- Exner, P.; Šeba, P.; Vašata, D. The distribution of landed property. Phys. A: Stat. Mech. Its Appl. 2009, 388, 4619–4623. [Google Scholar] [CrossRef]

- Vasishth, A. A scale-hierarchic ecosystem approach to integrative ecological planning. Prog. Plan. 2008, 70, 99–132. [Google Scholar] [CrossRef]

- Mehmood, A. On the history and potentials of evolutionary metaphors in urban planning. Plan. Theory 2010, 9, 63–87. [Google Scholar] [CrossRef]

- Lai, L.W.C.; Chau, K.W.; Lee, C.K.K.; Lorne, F.T. “The informational dimension of real estate development: A case of a “positive non-interventionist” application of the Coase Theorem. Land Use Policy 2014, 41, 225–232. [Google Scholar] [CrossRef]

- Robertson, M.H. Heritage interpretation, place branding and experiential marketing in the destination management of geotourism. Transl. Spaces 2015, 4, 289–309. [Google Scholar] [CrossRef]

- Poddubnykh, T. Heritage as a Concept through the Prism of Time. Soc. Evol. Hist. 2015, 14, 108–131. [Google Scholar]

- Skramstad, H. An agenda for American museums in the twenty-first century. Daedalus 1999, 128, 109–128. [Google Scholar]

- Chun, K.S. A trial of the history of anthropology in Taiwan during the Japanese occupation: Focusing on Inou Kanori, Utsurikawa Nenozo, and Kanaseki Takeo. South Pac. Stud. 2016, 36, 79–102. [Google Scholar]

- Holman, N.; Ahlfeldt, G.M. No escape? The coordination problem in heritage preservation. Environ. Plan. A 2015, 47, 172–187. [Google Scholar] [CrossRef]

- Negussie, E. Implications of neo-liberalism for built heritage management: Institutional and ownership structures in Ireland and Sweden. Urban Stud. 2006, 43, 1803–1824. [Google Scholar] [CrossRef]

- Spearritt, P. Money, taste and industrial heritage. Aust. Hist. Stud. 1991, 24, 33–45. [Google Scholar] [CrossRef]

- Edwards, D.; Griffin, T.; Hayllar, B. Darling Harbour: Looking back and moving forward. In City Spaces—Tourist Places; Butterworth-Heinemann: Oxford, UK, 2010; pp. 275–294. [Google Scholar]

- Tsai, T.H. The relationship between the development of industrial heritage tourism and communities; the upcoming 10th anniversary of the gold museum, New Taipei City government. Gold Mus. New Taipei City Gov. J. 2014, 2, 6–20. [Google Scholar]

- Brown, J. If you build it, they will come: The role of Individuals in the emergence of Canary Wharf, 1985–1987. Lond. J. 2017, 42, 70–92. [Google Scholar] [CrossRef]

- Rhatigan, J. Afterlife of a Mine: The Tangled Legacies of the Britannia Mine. Master’s Thesis, University of British Columbia, Vancouver, BC, Canada, 2016. [Google Scholar]

- Lai, L.W.C.; Lorne, F.T. The Coase Theorem and planning for sustainable development. Town Plan. Rev. 2006, 77, 41–73. [Google Scholar] [CrossRef]

- Hall, C.M. The politics of decision making and top-down planning: Darling Harbour, Sydney. In Managing Tourism in Cities: Policy, Process and Practice; Wiley: Hoboken, NJ, USA, 1998. [Google Scholar]

- Gordon, D. The resurrection of Canary Wharf. Plan. Theory Pract. 2001, 2, 149–168. [Google Scholar] [CrossRef]

- Keeling, D.J. Iconic landscapes: The lyrical links of songs and cities. Focus Geogr. 2011, 54, 113–125. [Google Scholar] [CrossRef]

- Chang, L.; Chiang, M.K. From colonial site to cultural heritage. IIAS Newsl. 2012, 59, 28–29. [Google Scholar]

- Chiang, M.C. Memory Contested, Locality Transformed: Representing Japanese Colonial ‘Heritage’ in Taiwan; Leiden University Press (LUP): Leiden, The Netherlands, 2012. [Google Scholar]

- Haila, A. The market as the new emperor. Int. J. Urban Reg. Res. 2007, 31, 3–20. [Google Scholar] [CrossRef]

- Lau, S.S.Y.; Martínez, P.G. Sustainable: The urban model based on high-density, high-rise and multiple, intensive land use: The case of Hong Kong. ACE Archit. City Environ. 2012, 7, 81–94. [Google Scholar]

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).