Identification of Overall Innovation Behavior by Using a Decision Tree: The Case of a Korean Manufacturer

Abstract

1. Introduction

2. Literature Review

3. Research Design

3.1. Data and Variables

3.2. Methodologies

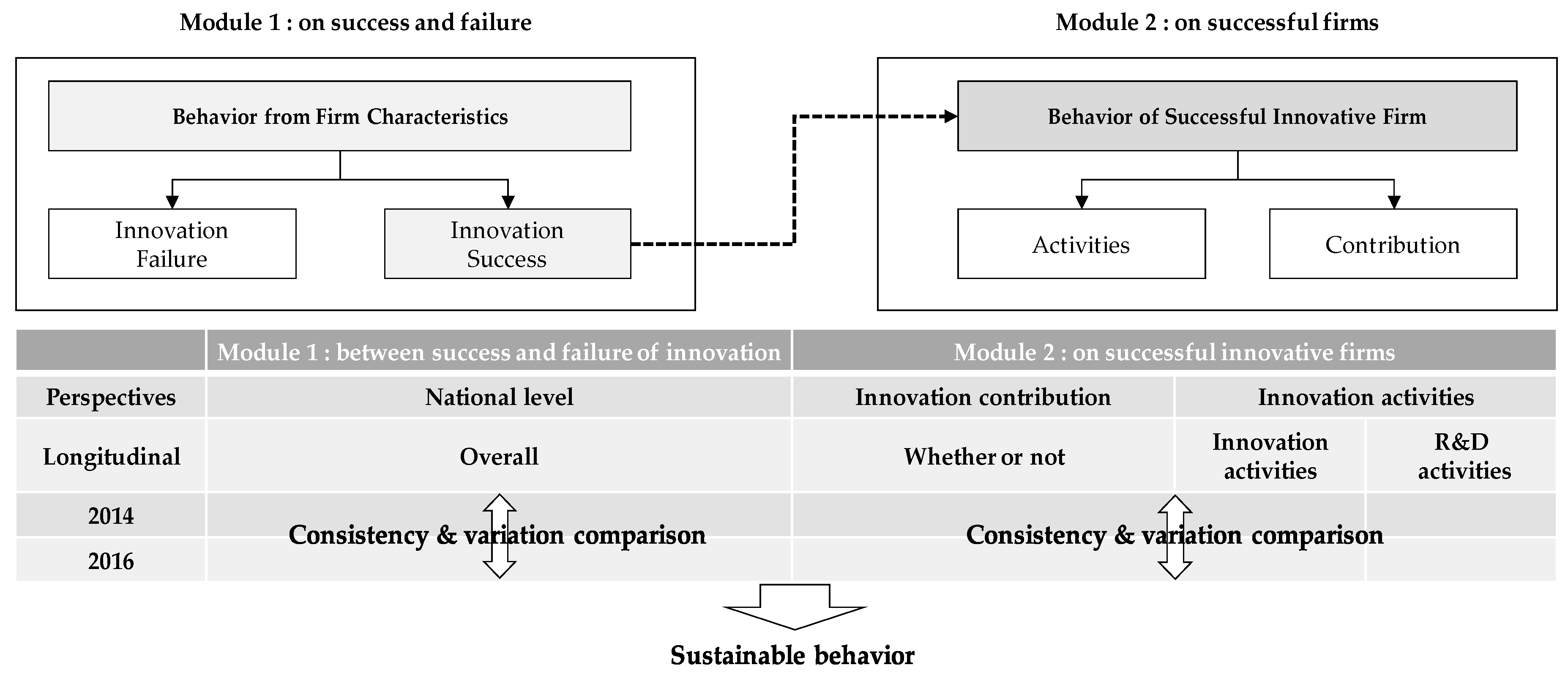

3.3. Research Framework

4. Results and Discussion

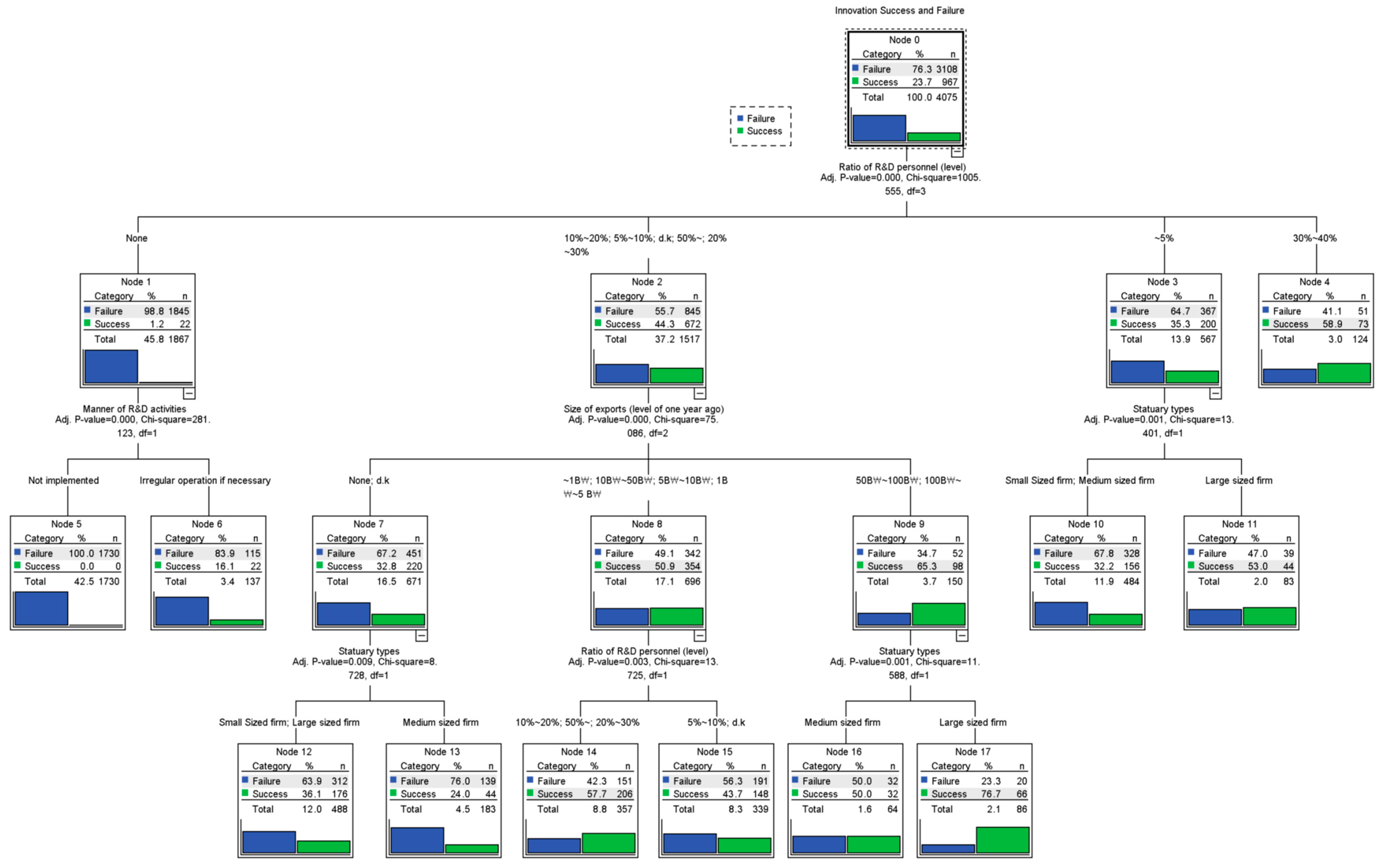

4.1. Overall Influencing Factors and Behaviors between Innovation Success and Failure

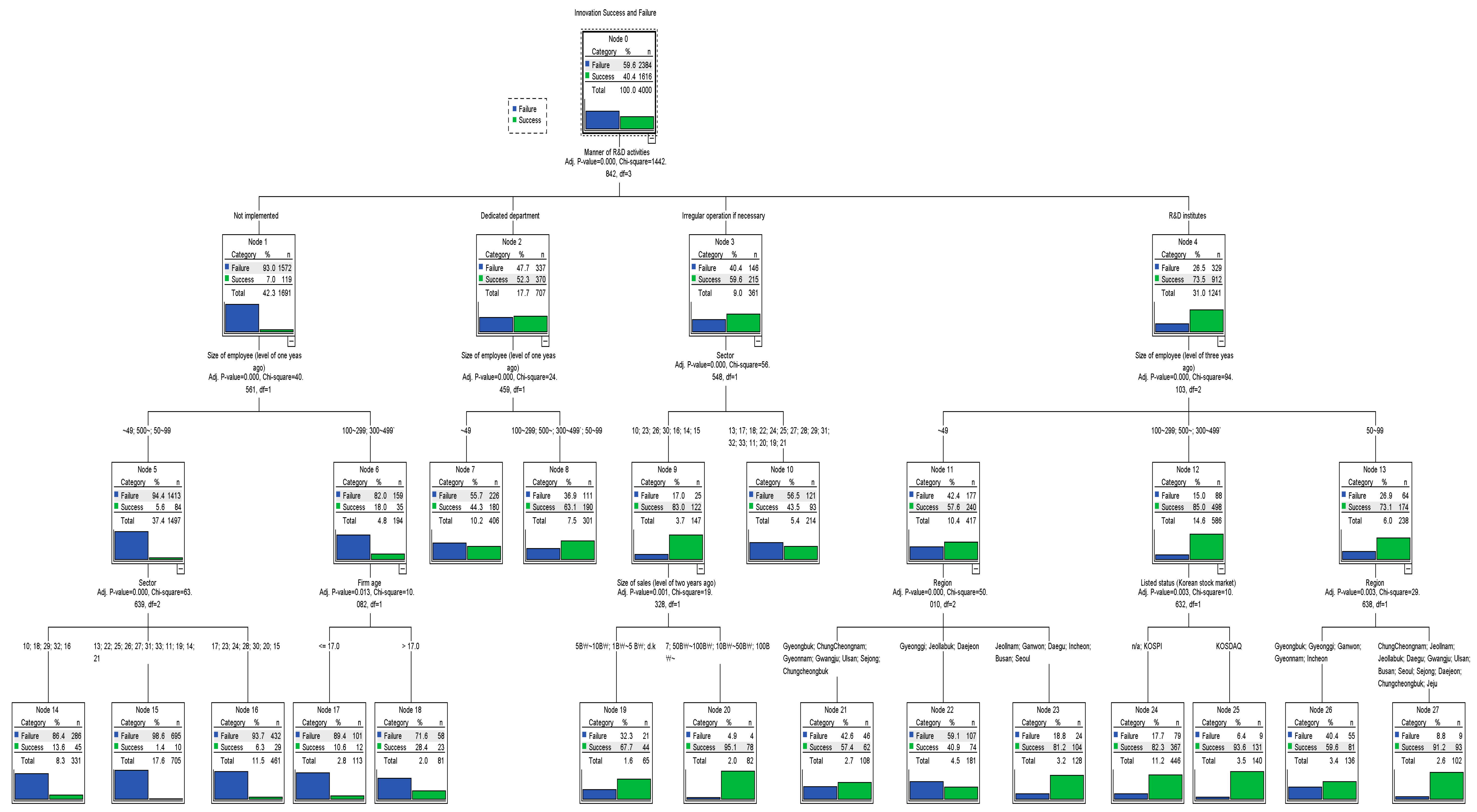

4.2. Factors and Behaviors Influencing Successful Innovative Firms

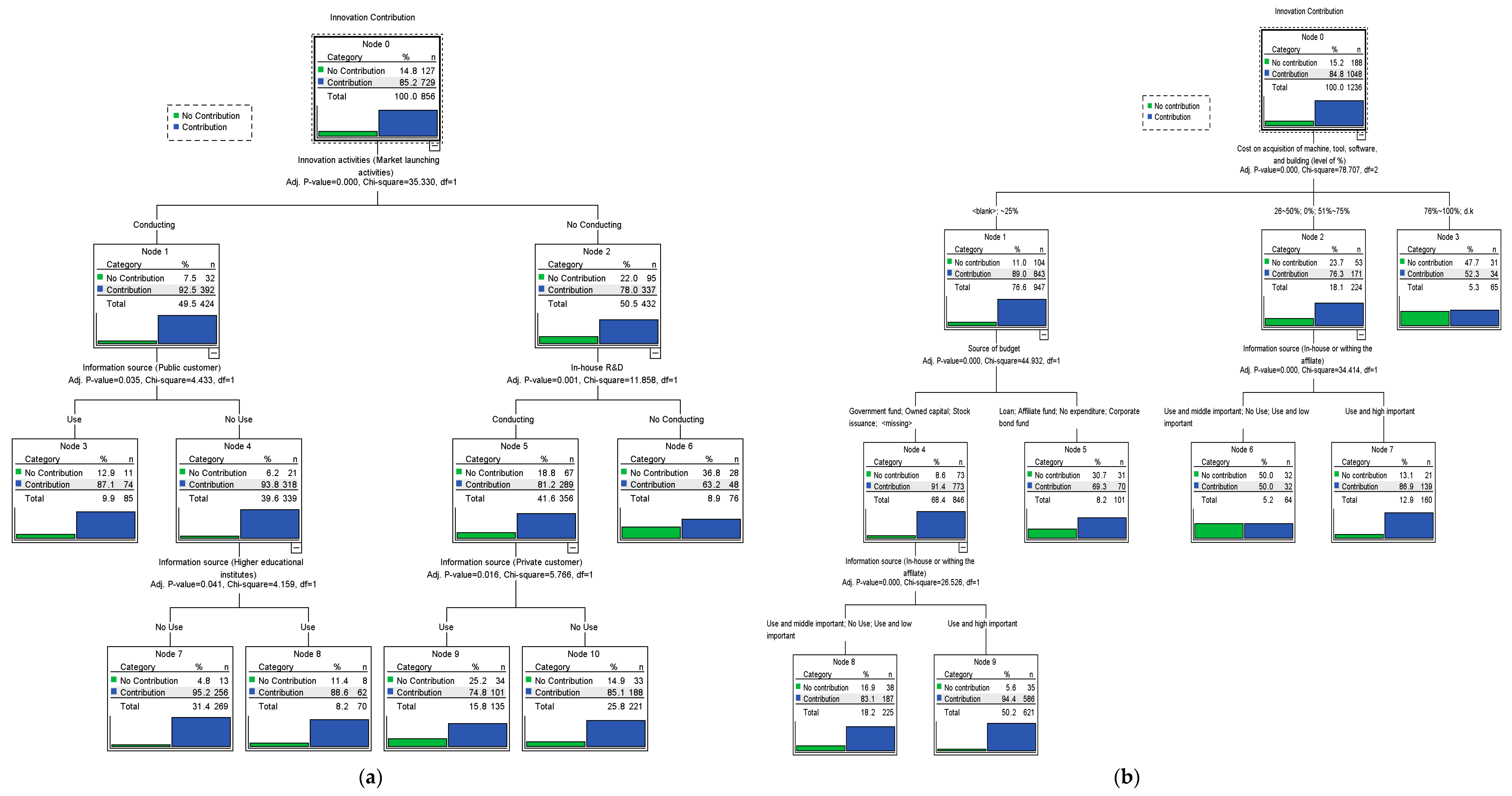

4.2.1. Contribution of Innovation

4.2.2. Innovation Activities

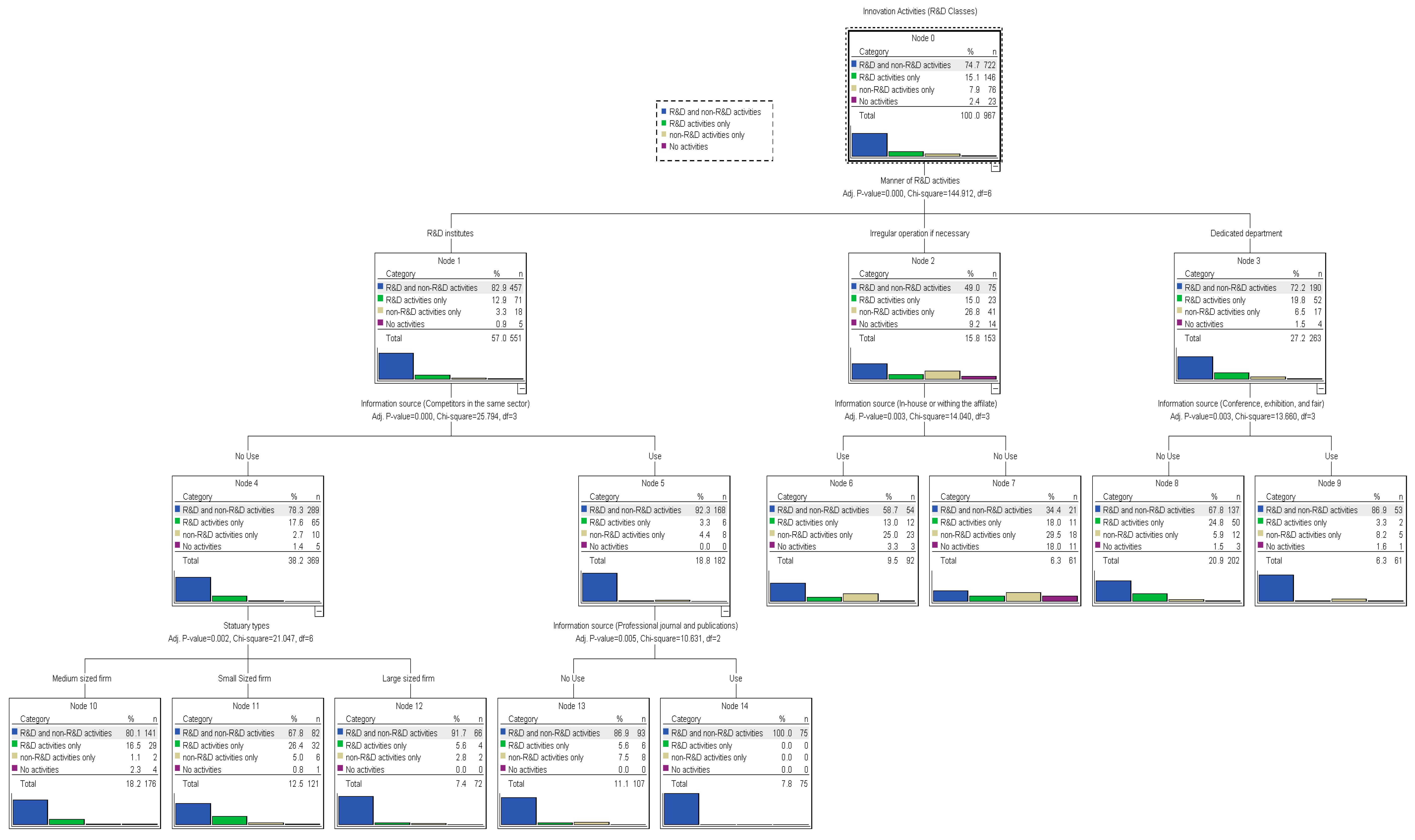

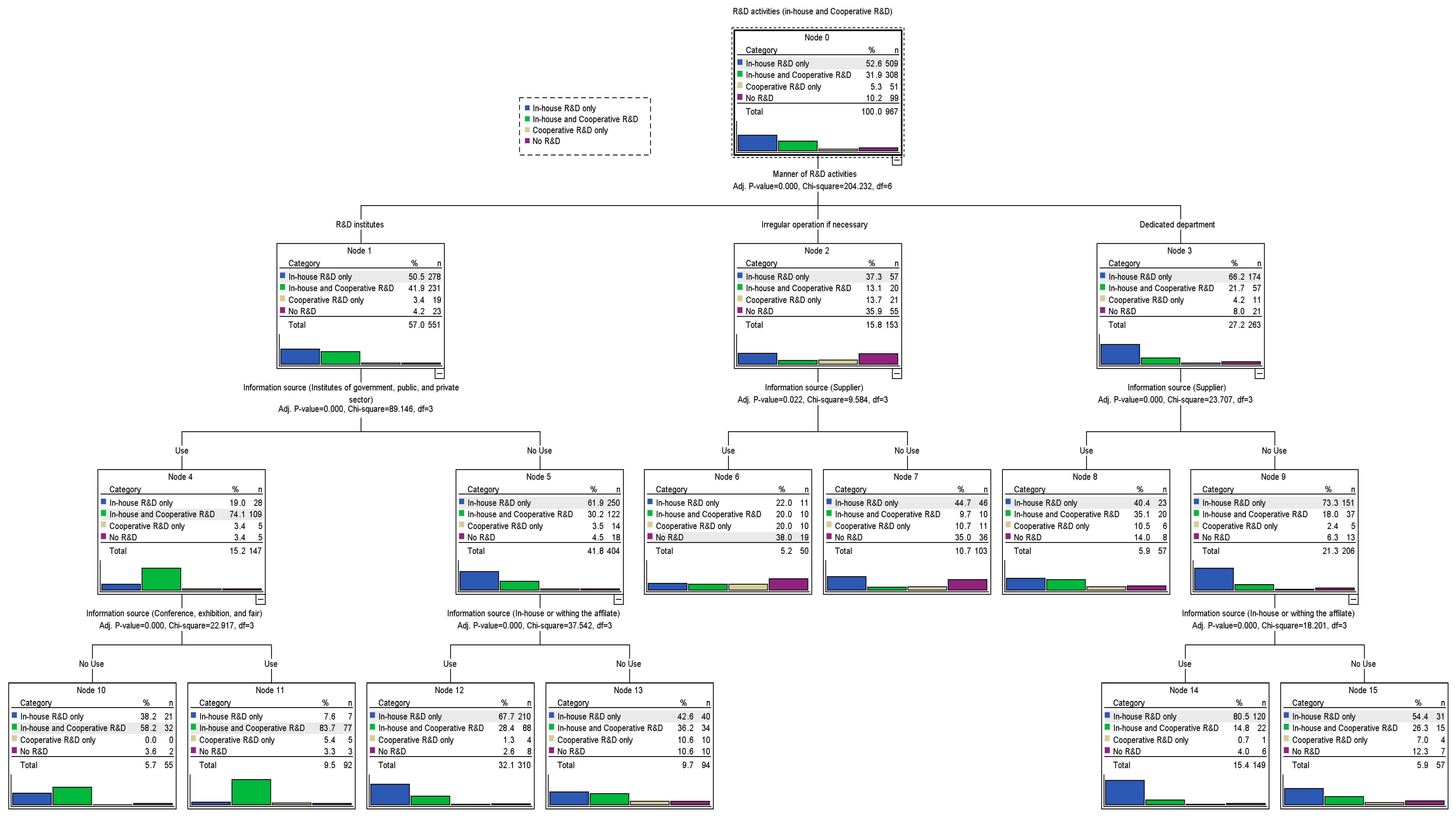

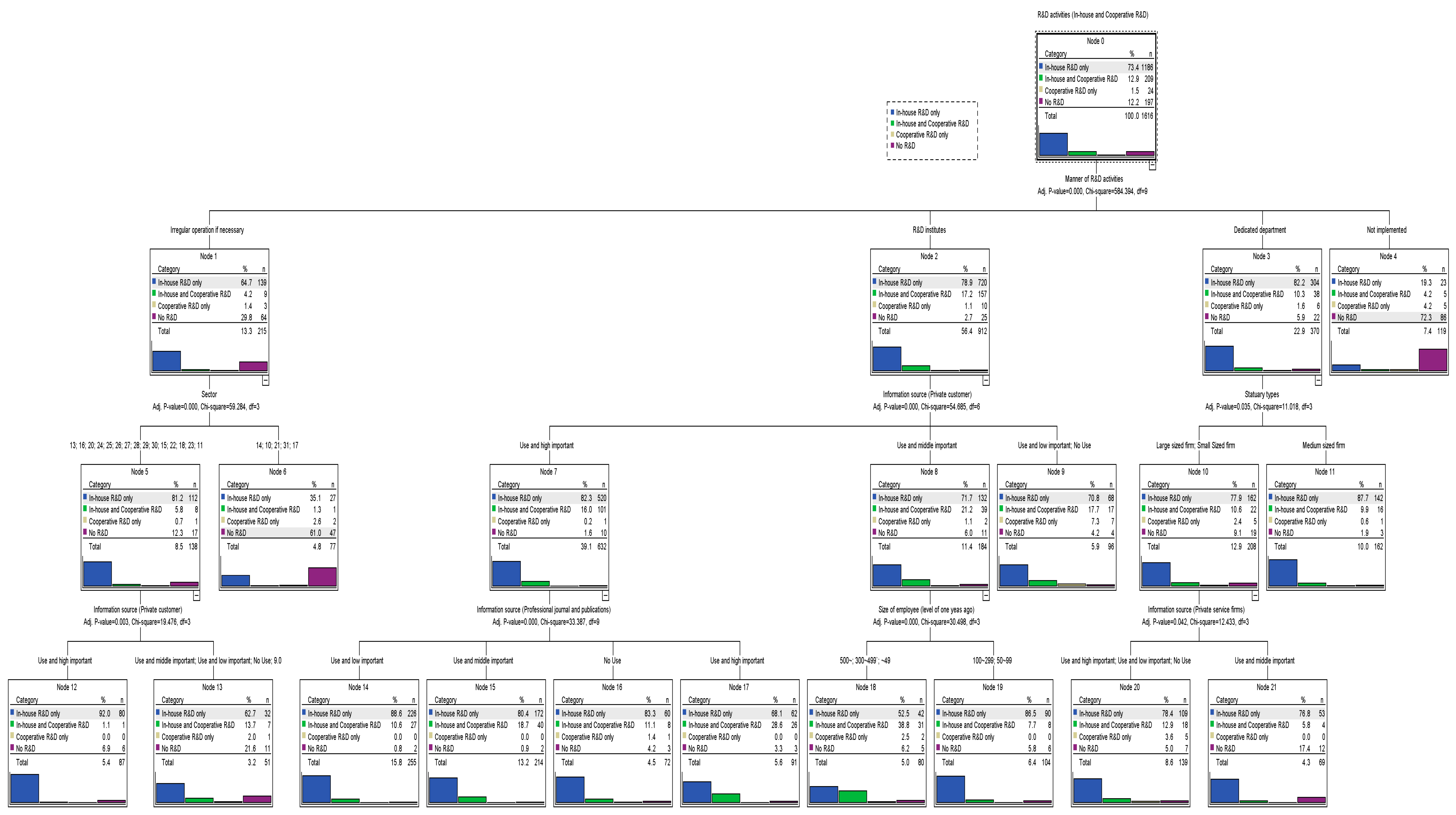

4.2.3. R&D Activities

5. Regional and Sectoral Differences of Innovation

5.1. Hypotheses on Regional and Sectoral Differences of Innovation

5.2. Hypotheses Testing Result and Discussion on Regional and Sectoral Differences of Innovation

6. Implications and Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variable Code | Measurement Description | Variable Value | Response | Type | |

|---|---|---|---|---|---|

| KIS 2014 | KIS 2016 | ||||

| Q 1_1 | Form of firm | Independent company | 1 | Nominal | |

| Affiliates of a domestic company | 2 | ||||

| Affiliates of a foreign company | 3 | ||||

| Q 1_2 | Statuary types (by the size of employee from sample selection) | Large-sized company | 1 | Nominal | |

| Medium-sized company | 2 | ||||

| Small-sized company | 3 | ||||

| Q 1_3_1 | Designation status on corporative certification in Korea | Venture company | 1 | Nominal | |

| Q 1_3_2 | InnoBiz (certificated as innovative small and medium-sized firm) | 2 | |||

| Q 1_3_3 | n/a | 3 | |||

| Q 1_4 | Listed status in Korean stock market | KOSPI | 1 | Nominal | |

| KOSDAQ | 2 | ||||

| n/a | 3 | ||||

| Q 2_1_1 | size of sales | Level of actual sales in three years ago | 0. None 1. ~1 B₩ 2. 1 B₩~5 B₩ 3. 5 B₩~10 B₩ 4. 10 B₩~50 B₩ 5. 50 B₩~100 B₩ 6. 100 B₩~ d.k. unknown | Ordinal | |

| Q 2_1_2 | Level of actual sales in two years ago | ||||

| Q 2_1_3 | Level of actual sales in one year ago | ||||

| Q 2_2_1 | size of exports | Level of actual exports in three years ago | |||

| Q 2_2_2 | Level of actual exports in two years ago | ||||

| Q 2_2_3 | Level of actual exports in one year ago | ||||

| Q 3_1_1 | Q 3_1 | size of employee | Level of actual employee in three years ago | 1. ~49 2. 50~99 3. 100~299 4. 300~499 5. 500~ | Ordinal |

| Q 3_1_2 | Q 3_2 | Level of actual employee in two years ago | |||

| Q 3_1_3 | Q 3_3 | Level of actual employee in one year ago | |||

| Q 3_1_6 | Q 3_4_3 | Ratio of R&D personnel | Level of percentage of R&D personnel in the last year | 1. none 2. ~5% 3. 5%~10% 4. 10%~20% 5. 20%~30% 6. 30%~50% 7. 50%~ | Ordinal |

| Q 5_1 | Main regional target market in the world (multiple response) | Domestic | If yes, 1; else, blank | Nominal | |

| Q 5_2 | Asia | If yes, 2; else, blank | |||

| Q 5_3 | Europe | If yes, 3; else, blank | |||

| Q 5_4 | North America | If yes, 4; else, blank | |||

| Q 5_5 | Others | If yes, 5; else, blank | |||

| Q 6 | Manner of R&D activities (main ways performing R&D) | R&D institutes | 1 | Nominal | |

| Dedicated department | 2 | ||||

| Irregular operation if necessary | 3 | ||||

| Not implemented | 4 | ||||

| Q8_1 | Q7 | Main customer types | Private company | 1 | Nominal |

| Government and public sector | 2 | ||||

| Individual customer | 3 | ||||

| Overseas market | 4 | ||||

| Others | 5 | ||||

| Ind_mid | Industrial code | 23 codes in the manufacturing industry are in Appendix B | Code number | Nominal | |

| Region | Region (17 area) | Seoul, busan, daejeon, daegu, incheon, gwangju, sejong, ulsan, Gyeonggi, Chungcheongbuk, ChungCheongnam, Ganwon, Gyeongbuk, Gyeonnam, Jeollabuk, Jeollnam, Jeju | Region name | Nominal | |

| Age | Firm age | Firm age | Number | Interval | |

| Variable Code | Measurement Description | Variable Value | Response | Scale | |

|---|---|---|---|---|---|

| KIS 2014 | KIS 2016 | ||||

| Q 18_1 | In-house R&D | Performing in-house R&D in last three years | If yes, 1; else, 2 | Nominal | |

| Q 18_2 | Cooperative R&D | Performing cooperative R&D in last three years | |||

| Q 18_3 | External R&D | Performing external R&D in last three years | |||

| Q 18_4 | Acquiring machine, tool, software, and building | Acquiring machine, tool, software, and buildingin last three years | |||

| Q 18_5 | Procuring external knowledge | Procuring external knowledge in last three years | |||

| Q 18_6 | Providing job training | Providing job training in last three years | |||

| Q 18_7 | Market launching activities | Market launching activities in last three years | |||

| Q 18_8 | Design activities | Design activities in last three years | |||

| Q 18_9 | Others | Others in last three years | |||

| Q 19 t | Q 19 | Total innovation cost for all innovation activities in the last year | Level of total cost for innovation activities in the last year | 0. None 1. ~0.1 B₩ 2. 0.1 B₩~0.5 B₩ 3. 0.5 B₩~1 B₩ 4. 1 B₩~5 B₩ 5. 5 B₩~10 B₩ 6. 10 B₩~50 B₩ 7. 50 B₩~100 B₩ 8. 100 B₩~ d.k. unknown | Ordinal |

| Q 19_1 | Level of percentage of each innovation activity cost | Level of percentage of cost on in-house R&D | 0. 0% 1. ~25% 2. 26%~50% 3. 51%~75% 4. 76%~100% d.k. unknown | Ordinal | |

| Q 19_2 | Level of percentage of cost on external R&D | ||||

| Q 19_3 | Level of percentage of cost on acquisition of machine, tool, software, and building | ||||

| Q 19_4 | Level of percentage of cost on buying external knowledge | ||||

| Q 19_5 | Level of percentage of cost on others | ||||

| Q 20 | Source of budget in the last three years | Owned capital | 1 | Nominal | |

| Affiliate fund | 2 | ||||

| Government fund | 3 | ||||

| Loan | 4 | ||||

| Stock Issuance | 5 | ||||

| Corporate Bond fund | 6 | ||||

| No expenditure | 7 | ||||

| Others | 8 | ||||

| Q 21 a1 | Q 21_1 | Information source for innovation | In-house or within the affiliate | In 2014, use or not If yes, 1; else, 2 In 2016, Use and importance 0. No use 1. Use and low importance 2. Use and middle importance 3. Use and high importance | Nominal |

| Q 21 a2 | Q 21_2 | Supplier | |||

| Q 21 a3 | Q 21_3 | Private customer | |||

| Q 21 a4 | Q 21_4 | Public customer | |||

| Q 21 a5 | Q 21_5 | Competitors in the same sector | |||

| Q 21 a6 | Q 21_6 | Private service firms | |||

| Q 21 a7 | Q 21_7 | Higher educational institutes | |||

| Q 21 a8 | Q 21_8 | Institutes of government, public, and private sector | |||

| Q 21 a9 | Q 21_9 | Conference, exhibition, and fair | |||

| Q 21 a10 | Q 21_10 | Professional journal and publications | |||

| Q 21 a11 | Q 21_11 | Industrial association | |||

| Q 22 | Cooperative activities | Whether or not cooperative activity implement | If yes, 1; else, 2 | Nominal | |

| Q 23_1 | Cooperative partner | Affiliates | If yes, 1; else, 0 | Nominal | |

| Q 23_2 | Supplier | ||||

| Q 23_3 | Private customer | ||||

| Q 23_4 | Public customer | ||||

| Q 23_5 | Competitors in the same sector | ||||

| Q 23_6 | Private service firms | ||||

| Q 23_7 | Higher educational institutes | ||||

| Q 23_8 | Institutes of government, public, and private sector | ||||

| Q 24 | Best cooperative partner | Affiliates | 1 | Nominal | |

| Supplier | 2 | ||||

| Private customer | 3 | ||||

| Public customer | 4 | ||||

| Competitors in the same sector | 5 | ||||

| Private service firms | 6 | ||||

| Higher educational institutes | 7 | ||||

| Institutes of government, public, and private sector | 8 | ||||

Appendix B

| The Manufacturing Industry | |

|---|---|

| Code | Description |

| 10 | Manufacture of food products |

| 11 | Manufacture of beverages |

| 13 | Manufacture of textiles, except apparel |

| 14 | Manufacture of wearing apparel, clothing accessories and fur articles |

| 15 | Manufacture of leather, luggage and footwear |

| 16 | Manufacture of wood and of products of wood and cork; except furniture |

| 17 | Manufacture of pulp, paper and paper products |

| 18 | Printing and reproduction of recorded media |

| 19 | Manufacture of coke, briquettes and refined petroleum products |

| 20 | Manufacture of chemicals and chemical products; except pharmaceuticals and medicinal chemicals |

| 21 | Manufacture of pharmaceuticals, medicinal chemical and botanical products |

| 22 | Manufacture of rubber and plastics products |

| 23 | Manufacture of other non-metallic mineral products |

| 24 | Manufacture of basic metals |

| 25 | Manufacture of fabricated metal products, except machinery and furniture |

| 26 | Manufacture of electronic components, computer; visual, sounding and communication equipment |

| 27 | Manufacture of medical, precision and optical instruments, watches and clocks |

| 28 | Manufacture of electrical equipment |

| 29 | Manufacture of other machinery and equipment |

| 30 | Manufacture of motor vehicles, trailers and semitrailers |

| 31 | Manufacture of other transport equipment |

| 32 | Manufacture of furniture |

| 33 | Other manufacturing |

Appendix C

Appendix D

| Sectors | Innovation | Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Failure | Success | ||||||||||||||

| Count | Expected Count | % Within Innovation | % Within Sector | % of Total | Count | Expected Count | % Within Innovation | % Within Sector | % of Total | Count | Expected Count | % Within Innovation | % Within Sector | % of Total | |

| 10 | 158 | 183.0 | 5.1% | 65.8% | 3.9% | 82 | 57.0 | 8.5% | 34.2% | 2.0% | 240 | 240.0 | 5.9% | 100.0% | 5.9% |

| 11 | 12 | 13.7 | 0.4% | 66.7% | 0.3% | 6 | 4.3 | 0.6% | 33.3% | 0.1% | 18 | 18.0 | 0.4% | 100.0% | 0.4% |

| 13 | 145 | 128.1 | 4.7% | 86.3% | 3.6% | 23 | 39.9 | 2.4% | 13.7% | 0.6% | 168 | 168.0 | 4.1% | 100.0% | 4.1% |

| 14 | 97 | 83.9 | 3.1% | 88.2% | 2.4% | 13 | 26.1 | 1.3% | 11.8% | 0.3% | 110 | 110.0 | 2.7% | 100.0% | 2.7% |

| 15 | 27 | 27.5 | 0.9% | 75.0% | 0.7% | 9 | 8.5 | 0.9% | 25.0% | 0.2% | 36 | 36.0 | 0.9% | 100.0% | 0.9% |

| 16 | 33 | 30.5 | 1.1% | 82.5% | 0.8% | 7 | 9.5 | 0.7% | 17.5% | 0.2% | 40 | 40.0 | 1.0% | 100.0% | 1.0% |

| 17 | 81 | 70.9 | 2.6% | 87.1% | 2.0% | 12 | 22.1 | 1.2% | 12.9% | 0.3% | 93 | 93.0 | 2.3% | 100.0% | 2.3% |

| 18 | 55 | 48.1 | 1.8% | 87.3% | 1.3% | 8 | 14.9 | 0.8% | 12.7% | 0.2% | 63 | 63.0 | 1.5% | 100.0% | 1.5% |

| 19 | 16 | 13.0 | 0.5% | 94.1% | 0.4% | 1 | 4.0 | 0.1% | 5.9% | 0.0% | 17 | 17.0 | 0.4% | 100.0% | 0.4% |

| 20 | 109 | 131.9 | 3.5% | 63.0% | 2.7% | 64 | 41.1 | 6.6% | 37.0% | 1.6% | 173 | 173.0 | 4.2% | 100.0% | 4.2% |

| 21 | 25 | 41.9 | 0.8% | 45.5% | 0.6% | 30 | 13.1 | 3.1% | 54.5% | 0.7% | 55 | 55.0 | 1.3% | 100.0% | 1.3% |

| 22 | 237 | 228.8 | 7.6% | 79.0% | 5.8% | 63 | 71.2 | 6.5% | 21.0% | 1.5% | 300 | 300.0 | 7.4% | 100.0% | 7.4% |

| 23 | 136 | 125.8 | 4.4% | 82.4% | 3.3% | 29 | 39.2 | 3.0% | 17.6% | 0.7% | 165 | 165.0 | 4.0% | 100.0% | 4.0% |

| 24 | 154 | 137.3 | 5.0% | 85.6% | 3.8% | 26 | 42.7 | 2.7% | 14.4% | 0.6% | 180 | 180.0 | 4.4% | 100.0% | 4.4% |

| 25 | 424 | 386.7 | 13.6% | 83.6% | 10.4% | 83 | 120.3 | 8.6% | 16.4% | 2.0% | 507 | 507.0 | 12.4% | 100.0% | 12.4% |

| 26 | 218 | 254.0 | 7.0% | 65.5% | 5.3% | 115 | 79.0 | 11.9% | 34.5% | 2.8% | 333 | 333.0 | 8.2% | 100.0% | 8.2% |

| 27 | 86 | 109.1 | 2.8% | 60.1% | 2.1% | 57 | 33.9 | 5.9% | 39.9% | 1.4% | 143 | 143.0 | 3.5% | 100.0% | 3.5% |

| 28 | 165 | 199.8 | 5.3% | 63.0% | 4.0% | 97 | 62.2 | 10.0% | 37.0% | 2.4% | 262 | 262.0 | 6.4% | 100.0% | 6.4% |

| 29 | 436 | 435.5 | 14.0% | 76.4% | 10.7% | 135 | 135.5 | 14.0% | 23.6% | 3.3% | 571 | 571.0 | 14.0% | 100.0% | 14.0% |

| 30 | 249 | 244.8 | 8.0% | 77.6% | 6.1% | 72 | 76.2 | 7.4% | 22.4% | 1.8% | 321 | 321.0 | 7.9% | 100.0% | 7.9% |

| 31 | 144 | 117.5 | 4.6% | 93.5% | 3.5% | 10 | 36.5 | 1.0% | 6.5% | 0.2% | 154 | 154.0 | 3.8% | 100.0% | 3.8% |

| 32 | 45 | 45.0 | 1.4% | 76.3% | 1.1% | 14 | 14.0 | 1.4% | 23.7% | 0.3% | 59 | 59.0 | 1.4% | 100.0% | 1.4% |

| 33 | 56 | 51.1 | 1.8% | 83.6% | 1.4% | 11 | 15.9 | 1.1% | 16.4% | 0.3% | 67 | 67.0 | 1.6% | 100.0% | 1.6% |

| Total | 3108 | 3108.0 | 100.0% | 76.3% | 76.3% | 967 | 967.0 | 100.0% | 23.7% | 23.7% | 4075 | 4075.0 | 100.0% | 100.0% | 100.0% |

| Sectors | Innovation | Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Failure | Success | ||||||||||||||

| Count | Expected Count | % Within Innovation | % Within Sector | % of Total | Count | Expected Count | % Within Innovation | % Within Sector | % of Total | Count | Expected Count | % Within Innovation | % Within Sector | % of Total | |

| 10 | 98 | 124.6 | 4.1% | 46.9% | 2.5% | 111 | 84.4 | 6.9% | 53.1% | 2.8% | 209 | 209.0 | 5.2% | 100.0% | 5.2% |

| 11 | 14 | 11.9 | 0.6% | 70.0% | 0.4% | 6 | 8.1 | 0.4% | 30.0% | 0.2% | 20 | 20.0 | 0.5% | 100.0% | 0.5% |

| 13 | 109 | 74.5 | 4.6% | 87.2% | 2.7% | 16 | 50.5 | 1.0% | 12.8% | 0.4% | 125 | 125.0 | 3.1% | 100.0% | 3.1% |

| 14 | 78 | 68.5 | 3.3% | 67.8% | 2.0% | 37 | 46.5 | 2.3% | 32.2% | 0.9% | 115 | 115.0 | 2.9% | 100.0% | 2.9% |

| 15 | 16 | 16.1 | 0.7% | 59.3% | 0.4% | 11 | 10.9 | 0.7% | 40.7% | 0.3% | 27 | 27.0 | 0.7% | 100.0% | 0.7% |

| 16 | 16 | 19.7 | 0.7% | 48.5% | 0.4% | 17 | 13.3 | 1.1% | 51.5% | 0.4% | 33 | 33.0 | 0.8% | 100.0% | 0.8% |

| 17 | 56 | 54.8 | 2.3% | 60.9% | 1.4% | 36 | 37.2 | 2.2% | 39.1% | 0.9% | 92 | 92.0 | 2.3% | 100.0% | 2.3% |

| 18 | 34 | 25.0 | 1.4% | 81.0% | 0.9% | 8 | 17.0 | 0.5% | 19.0% | 0.2% | 42 | 42.0 | 1.1% | 100.0% | 1.1% |

| 19 | 16 | 11.3 | 0.7% | 84.2% | 0.4% | 3 | 7.7 | 0.2% | 15.8% | 0.1% | 19 | 19.0 | 0.5% | 100.0% | 0.5% |

| 20 | 99 | 97.7 | 4.2% | 60.4% | 2.5% | 65 | 66.3 | 4.0% | 39.6% | 1.6% | 164 | 164.0 | 4.1% | 100.0% | 4.1% |

| 21 | 6 | 17.3 | 0.3% | 20.7% | 0.2% | 23 | 11.7 | 1.4% | 79.3% | 0.6% | 29 | 29.0 | 0.7% | 100.0% | 0.7% |

| 22 | 226 | 217.5 | 9.5% | 61.9% | 5.7% | 139 | 147.5 | 8.6% | 38.1% | 3.5% | 365 | 365.0 | 9.1% | 100.0% | 9.1% |

| 23 | 96 | 78.7 | 4.0% | 72.7% | 2.4% | 36 | 53.3 | 2.2% | 27.3% | 0.9% | 132 | 132.0 | 3.3% | 100.0% | 3.3% |

| 24 | 158 | 123.4 | 6.6% | 76.3% | 4.0% | 49 | 83.6 | 3.0% | 23.7% | 1.2% | 207 | 207.0 | 5.2% | 100.0% | 5.2% |

| 25 | 314 | 240.8 | 13.2% | 77.7% | 7.9% | 90 | 163.2 | 5.6% | 22.3% | 2.3% | 404 | 404.0 | 10.1% | 100.0% | 10.1% |

| 26 | 154 | 214.6 | 6.5% | 42.8% | 3.9% | 206 | 145.4 | 12.7% | 57.2% | 5.2% | 360 | 360.0 | 9.0% | 100.0% | 9.0% |

| 27 | 94 | 99.5 | 3.9% | 56.3% | 2.4% | 73 | 67.5 | 4.5% | 43.7% | 1.8% | 167 | 167.0 | 4.2% | 100.0% | 4.2% |

| 28 | 152 | 170.5 | 6.4% | 53.1% | 3.8% | 134 | 115.5 | 8.3% | 46.9% | 3.4% | 286 | 286.0 | 7.2% | 100.0% | 7.2% |

| 29 | 258 | 340.3 | 10.8% | 45.2% | 6.5% | 313 | 230.7 | 19.4% | 54.8% | 7.8% | 571 | 571.0 | 14.3% | 100.0% | 14.3% |

| 30 | 200 | 238.4 | 8.4% | 50.0% | 5.0% | 200 | 161.6 | 12.4% | 50.0% | 5.0% | 400 | 400.0 | 10.0% | 100.0% | 10.0% |

| 31 | 108 | 76.9 | 4.5% | 83.7% | 2.7% | 21 | 52.1 | 1.3% | 16.3% | 0.5% | 129 | 129.0 | 3.2% | 100.0% | 3.2% |

| 32 | 51 | 40.5 | 2.1% | 75.0% | 1.3% | 17 | 27.5 | 1.1% | 25.0% | 0.4% | 68 | 68.0 | 1.7% | 100.0% | 1.7% |

| 33 | 31 | 21.5 | 1.3% | 86.1% | 0.8% | 5 | 14.5 | 0.3% | 13.9% | 0.1% | 36 | 36.0 | 0.9% | 100.0% | 0.9% |

| Total | 2384 | 2384.0 | 100.0% | 59.6% | 59.6% | 1616 | 1616.0 | 100.0% | 40.4% | 40.4% | 4000 | 4000.0 | 100.0% | 100.0% | 100.0% |

| Region | Innovation | Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Failure | Success | ||||||||||||||

| Count | Expected Count | % Within Innovation | % Within Region | % of Total | Count | Expected Count | % Within Innovation | % Within Region | % of Total | Count | Expected Count | % Within Innovation | % Within Region | % of Total | |

| Busan | 303 | 289.1 | 79.9% | 9.7% | 7.4% | 76 | 89.9 | 20.1% | 7.9% | 1.9% | 379 | 379.0 | 100.0% | 9.3% | 9.3% |

| Chungcheongbuk | 133 | 135.0 | 75.1% | 4.3% | 3.3% | 44 | 42.0 | 24.9% | 4.6% | 1.1% | 177 | 177.0 | 100.0% | 4.3% | 4.3% |

| ChungCheongnam | 162 | 159.4 | 77.5% | 5.2% | 4.0% | 47 | 49.6 | 22.5% | 4.9% | 1.2% | 209 | 209.0 | 100.0% | 5.1% | 5.1% |

| Daegu | 146 | 144.9 | 76.8% | 4.7% | 3.6% | 44 | 45.1 | 23.2% | 4.6% | 1.1% | 190 | 190.0 | 100.0% | 4.7% | 4.7% |

| Daejeon | 69 | 77.8 | 67.6% | 2.2% | 1.7% | 33 | 24.2 | 32.4% | 3.4% | 0.8% | 102 | 102.0 | 100.0% | 2.5% | 2.5% |

| Ganwon | 43 | 42.7 | 76.8% | 1.4% | 1.1% | 13 | 13.3 | 23.2% | 1.3% | 0.3% | 56 | 56.0 | 100.0% | 1.4% | 1.4% |

| Gwangju | 77 | 72.5 | 81.1% | 2.5% | 1.9% | 18 | 22.5 | 18.9% | 1.9% | 0.4% | 95 | 95.0 | 100.0% | 2.3% | 2.3% |

| Gyeongbuk | 232 | 212.8 | 83.2% | 7.5% | 5.7% | 47 | 66.2 | 16.8% | 4.9% | 1.2% | 279 | 279.0 | 100.0% | 6.8% | 6.8% |

| Gyeonggi | 874 | 900.0 | 74.1% | 28.1% | 21.4% | 306 | 280.0 | 25.9% | 31.6% | 7.5% | 1180 | 1180.0 | 100.0% | 29.0% | 29.0% |

| Gyeonnam | 283 | 264.7 | 81.6% | 9.1% | 6.9% | 64 | 82.3 | 18.4% | 6.6% | 1.6% | 347 | 347.0 | 100.0% | 8.5% | 8.5% |

| Incheon | 139 | 149.5 | 70.9% | 4.5% | 3.4% | 57 | 46.5 | 29.1% | 5.9% | 1.4% | 196 | 196.0 | 100.0% | 4.8% | 4.8% |

| Jeju | 3 | 5.3 | 42.9% | 0.1% | 0.1% | 4 | 1.7 | 57.1% | .4% | 0.1% | 7 | 7.0 | 100.0% | 0.2% | 0.2% |

| Jeollabuk | 110 | 96.1 | 87.3% | 3.5% | 2.7% | 16 | 29.9 | 12.7% | 1.7% | 0.4% | 126 | 126.0 | 100.0% | 3.1% | 3.1% |

| Jeollnam | 86 | 79.3 | 82.7% | 2.8% | 2.1% | 18 | 24.7 | 17.3% | 1.9% | 0.4% | 104 | 104.0 | 100.0% | 2.6% | 2.6% |

| Sejong | 5 | 5.3 | 71.4% | 0.2% | 0.1% | 2 | 1.7 | 28.6% | .2% | 0.0% | 7 | 7.0 | 100.0% | 0.2% | 0.2% |

| Seoul | 315 | 363.8 | 66.0% | 10.1% | 7.7% | 162 | 113.2 | 34.0% | 16.8% | 4.0% | 477 | 477.0 | 100.0% | 11.7% | 11.7% |

| Ulsan | 128 | 109.8 | 88.9% | 4.1% | 3.1% | 16 | 34.2 | 11.1% | 1.7% | 0.4% | 144 | 144.0 | 100.0% | 3.5% | 3.5% |

| Total | 3108 | 3108.0 | 76.3% | 100.0% | 76.3% | 967 | 967.0 | 23.7% | 100.0% | 23.7% | 4075 | 4075.0 | 100.0% | 100.0% | 100.0% |

| Region | Innovation | Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Failure | Success | ||||||||||||||

| Count | Expected Count | % Within Innovation | % Within Region | % of Total | Count | Expected Count | % Within Innovation | % Within Region | % of Total | Count | Expected Count | % Within Innovation | % Within Region | % of Total | |

| Busan | 128 | 147.8 | 5.4% | 51.6% | 3.2% | 120 | 100.2 | 7.4% | 48.4% | 3.0% | 248 | 248.0 | 6.2% | 100.0% | 6.2% |

| Chungcheongbuk | 87 | 103.1 | 3.6% | 50.3% | 2.2% | 86 | 69.9 | 5.3% | 49.7% | 2.2% | 173 | 173.0 | 4.3% | 100.0% | 4.3% |

| ChungCheongnam | 114 | 133.5 | 4.8% | 50.9% | 2.9% | 110 | 90.5 | 6.8% | 49.1% | 2.8% | 224 | 224.0 | 5.6% | 100.0% | 5.6% |

| Daegu | 87 | 118.0 | 3.6% | 43.9% | 2.2% | 111 | 80.0 | 6.9% | 56.1% | 2.8% | 198 | 198.0 | 5.0% | 100.0% | 5.0% |

| Daejeon | 33 | 46.5 | 1.4% | 42.3% | 0.8% | 45 | 31.5 | 2.8% | 57.7% | 1.1% | 78 | 78.0 | 2.0% | 100.0% | 2.0% |

| Ganwon | 39 | 32.8 | 1.6% | 70.9% | 1.0% | 16 | 22.2 | 1.0% | 29.1% | 0.4% | 55 | 55.0 | 1.4% | 100.0% | 1.4% |

| Gwangju | 55 | 53.6 | 2.3% | 61.1% | 1.4% | 35 | 36.4 | 2.2% | 38.9% | 0.9% | 90 | 90.0 | 2.3% | 100.0% | 2.3% |

| Gyeongbuk | 197 | 187.7 | 8.3% | 62.5% | 4.9% | 118 | 127.3 | 7.3% | 37.5% | 3.0% | 315 | 315.0 | 7.9% | 100.0% | 7.9% |

| Gyeonggi | 887 | 770.6 | 37.2% | 68.6% | 22.2% | 406 | 522.4 | 25.1% | 31.4% | 10.2% | 1293 | 1293.0 | 32.3% | 100.0% | 32.3% |

| Gyeonnam | 272 | 243.2 | 11.4% | 66.7% | 6.8% | 136 | 164.8 | 8.4% | 33.3% | 3.4% | 408 | 408.0 | 10.2% | 100.0% | 10.2% |

| Incheon | 149 | 193.7 | 6.3% | 45.8% | 3.7% | 176 | 131.3 | 10.9% | 54.2% | 4.4% | 325 | 325.0 | 8.1% | 100.0% | 8.1% |

| Jeju | 2 | 2.4 | 0.1% | 50.0% | 0.1% | 2 | 1.6 | 0.1% | 50.0% | 0.1% | 4 | 4.0 | 0.1% | 100.0% | 0.1% |

| Jeollabuk | 60 | 53.0 | 2.5% | 67.4% | 1.5% | 29 | 36.0 | 1.8% | 32.6% | 0.7% | 89 | 89.0 | 2.2% | 100.0% | 2.2% |

| Jeollnam | 62 | 54.2 | 2.6% | 68.1% | 1.6% | 29 | 36.8 | 1.8% | 31.9% | 0.7% | 91 | 91.0 | 2.3% | 100.0% | 2.3% |

| Sejong | 7 | 12.5 | 0.3% | 33.3% | 0.2% | 14 | 8.5 | 0.9% | 66.7% | 0.4% | 21 | 21.0 | 0.5% | 100.0% | 0.5% |

| Seoul | 115 | 152.6 | 4.8% | 44.9% | 2.9% | 141 | 103.4 | 8.7% | 55.1% | 3.5% | 256 | 256.0 | 6.4% | 100.0% | 6.4% |

| Ulsan | 90 | 78.7 | 3.8% | 68.2% | 2.3% | 42 | 53.3 | 2.6% | 31.8% | 1.1% | 132 | 132.0 | 3.3% | 100.0% | 3.3% |

| Total | 2384 | 2384.0 | 100.0% | 59.6% | 59.6% | 1616 | 1616.0 | 100.0% | 40.4% | 40.4% | 4000 | 4000.0 | 100.0% | 100.0% | 100.0% |

| Sector | Total | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10 | 11 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | ||||

| Region | Busan | Count | 2 | 0 | 4 | 2 | 3 | 1 | 0 | 0 | 0 | 5 | 0 | 3 | 0 | 1 | 13 | 2 | 2 | 8 | 19 | 6 | 2 | 2 | 1 | 76 |

| Expected Count | 6.4 | 0.5 | 1.8 | 1.0 | 0.7 | 0.6 | 0.9 | 0.6 | 0.1 | 5.0 | 2.4 | 5.0 | 2.3 | 2.0 | 6.5 | 9.0 | 4.5 | 7.6 | 10.6 | 5.7 | .8 | 1.1 | 0.9 | 76.0 | ||

| % within region | 2.6% | 0.0% | 5.3% | 2.6% | 3.9% | 1.3% | 0.0% | 0.0% | 0.0% | 6.6% | 0.0% | 3.9% | 0.0% | 1.3% | 17.1% | 2.6% | 2.6% | 10.5% | 25.0% | 7.9% | 2.6% | 2.6% | 1.3% | 100.0% | ||

| % within sector | 2.4% | 0.0% | 17.4% | 15.4% | 33.3% | 14.3% | 0.0% | 0.0% | 0.0% | 7.8% | 0.0% | 4.8% | 0.0% | 3.8% | 15.7% | 1.7% | 3.5% | 8.2% | 14.1% | 8.3% | 20.0% | 14.3% | 9.1% | 7.9% | ||

| % of Total | 0.2% | 0.0% | 0.4% | 0.2% | 0.3% | 0.1% | 0.0% | 0.0% | 0.0% | 0.5% | 0.0% | 0.3% | 0.0% | 0.1% | 1.3% | 0.2% | 0.2% | 0.8% | 2.0% | 0.6% | 0.2% | 0.2% | 0.1% | 7.9% | ||

| Chungcheongbuk | Count | 12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 3 | 4 | 2 | 1 | 3 | 5 | 0 | 0 | 4 | 3 | 0 | 0 | 0 | 44 | |

| Expected Count | 3.7 | 0.3 | 1.0 | 0.6 | 0.4 | 0.3 | 0.5 | 0.4 | 0.0 | 2.9 | 1.4 | 2.9 | 1.3 | 1.2 | 3.8 | 5.2 | 2.6 | 4.4 | 6.1 | 3.3 | 0.5 | 0.6 | 0.5 | 44.0 | ||

| % within region | 27.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 15.9% | 6.8% | 9.1% | 4.5% | 2.3% | 6.8% | 11.4% | 0.0% | 0.0% | 9.1% | 6.8% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 14.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 10.9% | 10.0% | 6.3% | 6.9% | 3.8% | 3.6% | 4.3% | 0.0% | 0.0% | 3.0% | 4.2% | 0.0% | 0.0% | 0.0% | 4.6% | ||

| % of Total | 1.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.7% | 0.3% | 0.4% | 0.2% | 0.1% | 0.3% | 0.5% | 0.0% | 0.0% | 0.4% | 0.3% | 0.0% | 0.0% | 0.0% | 4.6% | ||

| ChungCheongnam | Count | 7 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 3 | 0 | 5 | 2 | 3 | 2 | 7 | 1 | 1 | 9 | 5 | 1 | 0 | 0 | 47 | |

| Expected Count | 4.0 | 0.3 | 1.1 | 0.6 | 0.4 | 0.3 | 0.6 | 0.4 | 0.0 | 3.1 | 1.5 | 3.1 | 1.4 | 1.3 | 4.0 | 5.6 | 2.8 | 4.7 | 6.6 | 3.5 | 0.5 | 0.7 | 0.5 | 47.0 | ||

| % within region | 14.9% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.1% | 0.0% | 0.0% | 6.4% | 0.0% | 10.6% | 4.3% | 6.4% | 4.3% | 14.9% | 2.1% | 2.1% | 19.1% | 10.6% | 2.1% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 8.5% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 8.3% | 0.0% | 0.0% | 4.7% | 0.0% | 7.9% | 6.9% | 11.5% | 2.4% | 6.1% | 1.8% | 1.0% | 6.7% | 6.9% | 10.0% | 0.0% | 0.0% | 4.9% | ||

| % of Total | 0.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.3% | 0.0% | 0.5% | 0.2% | 0.3% | 0.2% | 0.7% | 0.1% | 0.1% | 0.9% | 0.5% | 0.1% | 0.0% | 0.0% | 4.9% | ||

| Daegu | Count | 1 | 0 | 4 | 1 | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 3 | 2 | 0 | 7 | 0 | 3 | 5 | 8 | 7 | 0 | 0 | 0 | 44 | |

| Expected Count | 3.7 | 0.3 | 1.0 | 0.6 | 0.4 | 0.3 | 0.5 | 0.4 | 0.0 | 2.9 | 1.4 | 2.9 | 1.3 | 1.2 | 3.8 | 5.2 | 2.6 | 4.4 | 6.1 | 3.3 | 0.5 | 0.6 | 0.5 | 44.0 | ||

| % within region | 2.3% | 0.0% | 9.1% | 2.3% | 0.0% | 0.0% | 2.3% | 4.5% | 0.0% | 0.0% | 0.0% | 6.8% | 4.5% | 0.0% | 15.9% | 0.0% | 6.8% | 11.4% | 18.2% | 15.9% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 1.2% | 0.0% | 17.4% | 7.7% | 0.0% | 0.0% | 8.3% | 25.0% | 0.0% | 0.0% | 0.0% | 4.8% | 6.9% | 0.0% | 8.4% | 0.0% | 5.3% | 5.2% | 5.9% | 9.7% | 0.0% | 0.0% | 0.0% | 4.6% | ||

| % of Total | 0.1% | 0.0% | 0.4% | 0.1% | 0.0% | 0.0% | 0.1% | 0.2% | 0.0% | 0.0% | 0.0% | 0.3% | 0.2% | 0.0% | 0.7% | 0.0% | 0.3% | 0.5% | 0.8% | 0.7% | 0.0% | 0.0% | 0.0% | 4.6% | ||

| Daejeon | Count | 0 | 2 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 1 | 0 | 1 | 0 | 1 | 7 | 9 | 1 | 7 | 0 | 0 | 0 | 1 | 33 | |

| Expected Count | 2.8 | 0.2 | 0.8 | 0.4 | 0.3 | 0.2 | 0.4 | 0.3 | 0.0 | 2.2 | 1.0 | 2.1 | 1.0 | 0.9 | 2.8 | 3.9 | 1.9 | 3.3 | 4.6 | 2.5 | 0.3 | 0.5 | 0.4 | 33.0 | ||

| % within region | 0.0% | 6.1% | 3.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 6.1% | 3.0% | 0.0% | 3.0% | 0.0% | 3.0% | 21.2% | 27.3% | 3.0% | 21.2% | 0.0% | 0.0% | 0.0% | 3.0% | 100.0% | ||

| % within sector | 0.0% | 33.3% | 4.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 3.1% | 3.3% | 0.0% | 3.4% | 0.0% | 1.2% | 6.1% | 15.8% | 1.0% | 5.2% | 0.0% | 0.0% | 0.0% | 9.1% | 3.4% | ||

| % of Total | 0.0% | 0.2% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.2% | 0.1% | 0.0% | 0.1% | 0.0% | 0.1% | 0.7% | 0.9% | 0.1% | 0.7% | 0.0% | 0.0% | 0.0% | 0.1% | 3.4% | ||

| Ganwon | Count | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 2 | 2 | 0 | 0 | 0 | 3 | 0 | 1 | 1 | 0 | 0 | 0 | 13 | |

| Expected Count | 1.1 | 0.1 | 0.3 | 0.2 | 0.1 | 0.1 | 0.2 | 0.1 | 0.0 | 0.9 | 0.4 | 0.8 | 0.4 | 0.3 | 1.1 | 1.5 | 0.8 | 1.3 | 1.8 | 1.0 | 0.1 | 0.2 | 0.1 | 13.0 | ||

| % within region | 15.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 7.7% | 7.7% | 15.4% | 15.4% | 0.0% | 0.0% | 0.0% | 23.1% | 0.0% | 7.7% | 7.7% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 2.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.6% | 3.3% | 3.2% | 6.9% | 0.0% | 0.0% | 0.0% | 5.3% | 0.0% | 0.7% | 1.4% | 0.0% | 0.0% | 0.0% | 1.3% | ||

| % of Total | 0.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.1% | 0.2% | 0.2% | 0.0% | 0.0% | 0.0% | 0.3% | 0.0% | 0.1% | 0.1% | 0.0% | 0.0% | 0.0% | 1.3% | ||

| Gwangju | Count | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 4 | 3 | 3 | 2 | 1 | 0 | 2 | 0 | 18 | |

| Expected Count | 1.5 | 0.1 | 0.4 | 0.2 | 0.2 | 0.1 | 0.2 | 0.1 | 0.0 | 1.2 | 0.6 | 1.2 | 0.5 | 0.5 | 1.5 | 2.1 | 1.1 | 1.8 | 2.5 | 1.3 | 0.2 | 0.3 | 0.2 | 18.0 | ||

| % within region | 5.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 11.1% | 22.2% | 16.7% | 16.7% | 11.1% | 5.6% | 0.0% | 11.1% | 0.0% | 100.0% | ||

| % within sector | 1.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.4% | 3.5% | 5.3% | 3.1% | 1.5% | 1.4% | 0.0% | 14.3% | 0.0% | 1.9% | ||

| % of Total | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.2% | 0.4% | 0.3% | 0.3% | 0.2% | 0.1% | 0.0% | 0.2% | 0.0% | 1.9% | ||

| Gyeongbuk | Count | 6 | 1 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | 4 | 0 | 6 | 5 | 1 | 2 | 5 | 0 | 0 | 4 | 9 | 0 | 1 | 0 | 47 | |

| Expected Count | 4.0 | 0.3 | 1.1 | 0.6 | 0.4 | 0.3 | 0.6 | 0.4 | 0.0 | 3.1 | 1.5 | 3.1 | 1.4 | 1.3 | 4.0 | 5.6 | 2.8 | 4.7 | 6.6 | 3.5 | 0.5 | 0.7 | 0.5 | 47.0 | ||

| % within region | 12.8% | 2.1% | 2.1% | 0.0% | 0.0% | 2.1% | 2.1% | 0.0% | 0.0% | 8.5% | 0.0% | 12.8% | 10.6% | 2.1% | 4.3% | 10.6% | 0.0% | 0.0% | 8.5% | 19.1% | 0.0% | 2.1% | 0.0% | 100.0% | ||

| % within sector | 7.3% | 16.7% | 4.3% | 0.0% | 0.0% | 14.3% | 8.3% | 0.0% | 0.0% | 6.3% | 0.0% | 9.5% | 17.2% | 3.8% | 2.4% | 4.3% | 0.0% | 0.0% | 3.0% | 12.5% | 0.0% | 7.1% | 0.0% | 4.9% | ||

| % of Total | 0.6% | 0.1% | 0.1% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.0% | 0.4% | 0.0% | 0.6% | 0.5% | 0.1% | 0.2% | 0.5% | 0.0% | 0.0% | 0.4% | 0.9% | 0.0% | 0.1% | 0.0% | 4.9% | ||

| Gyeonggi | Count | 12 | 0 | 3 | 3 | 2 | 2 | 7 | 4 | 0 | 17 | 5 | 22 | 9 | 7 | 23 | 54 | 21 | 43 | 39 | 24 | 1 | 7 | 1 | 306 | |

| Expected Count | 25.9 | 1.9 | 7.3 | 4.1 | 2.8 | 2.2 | 3.8 | 2.5 | 0.3 | 20.3 | 9.5 | 19.9 | 9.2 | 8.2 | 26.3 | 36.4 | 18.0 | 30.7 | 42.7 | 22.8 | 3.2 | 4.4 | 3.5 | 306.0 | ||

| % within region | 3.9% | 0.0% | 1.0% | 1.0% | 0.7% | 0.7% | 2.3% | 1.3% | 0.0% | 5.6% | 1.6% | 7.2% | 2.9% | 2.3% | 7.5% | 17.6% | 6.9% | 14.1% | 12.7% | 7.8% | 0.3% | 2.3% | 0.3% | 100.0% | ||

| % within sector | 14.6% | 0.0% | 13.0% | 23.1% | 22.2% | 28.6% | 58.3% | 50.0% | 0.0% | 26.6% | 16.7% | 34.9% | 31.0% | 26.9% | 27.7% | 47.0% | 36.8% | 44.3% | 28.9% | 33.3% | 10.0% | 50.0% | 9.1% | 31.6% | ||

| % of Total | 1.2% | 0.0% | 0.3% | 0.3% | 0.2% | 0.2% | 0.7% | 0.4% | 0.0% | 1.8% | 0.5% | 2.3% | 0.9% | 0.7% | 2.4% | 5.6% | 2.2% | 4.4% | 4.0% | 2.5% | 0.1% | 0.7% | 0.1% | 31.6% | ||

| Gyeonnam | Count | 7 | 0 | 2 | 0 | 3 | 0 | 0 | 0 | 0 | 5 | 0 | 8 | 1 | 4 | 8 | 1 | 0 | 4 | 12 | 6 | 3 | 0 | 0 | 64 | |

| Expected Count | 5.4 | 0.4 | 1.5 | 0.9 | 0.6 | 0.5 | 0.8 | 0.5 | 0.1 | 4.2 | 2.0 | 4.2 | 1.9 | 1.7 | 5.5 | 7.6 | 3.8 | 6.4 | 8.9 | 4.8 | 0.7 | 0.9 | 0.7 | 64.0 | ||

| % within region | 10.9% | 0.0% | 3.1% | 0.0% | 4.7% | 0.0% | 0.0% | 0.0% | 0.0% | 7.8% | 0.0% | 12.5% | 1.6% | 6.3% | 12.5% | 1.6% | 0.0% | 6.3% | 18.8% | 9.4% | 4.7% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 8.5% | 0.0% | 8.7% | 0.0% | 33.3% | 0.0% | 0.0% | 0.0% | 0.0% | 7.8% | 0.0% | 12.7% | 3.4% | 15.4% | 9.6% | 0.9% | 0.0% | 4.1% | 8.9% | 8.3% | 30.0% | 0.0% | 0.0% | 6.6% | ||

| % of Total | 0.7% | 0.0% | 0.2% | 0.0% | 0.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.5% | 0.0% | 0.8% | 0.1% | 0.4% | 0.8% | 0.1% | 0.0% | 0.4% | 1.2% | 0.6% | 0.3% | 0.0% | 0.0% | 6.6% | ||

| Incheon | Count | 4 | 0 | 0 | 0 | 0 | 2 | 0 | 1 | 0 | 6 | 0 | 4 | 1 | 1 | 4 | 5 | 3 | 10 | 10 | 2 | 0 | 1 | 3 | 57 | |

| Expected Count | 4.8 | 0.4 | 1.4 | 0.8 | 0.5 | 0.4 | 0.7 | 0.5 | 0.1 | 3.8 | 1.8 | 3.7 | 1.7 | 1.5 | 4.9 | 6.8 | 3.4 | 5.7 | 8.0 | 4.2 | 0.6 | 0.8 | 0.6 | 57.0 | ||

| % within region | 7.0% | 0.0% | 0.0% | 0.0% | 0.0% | 3.5% | 0.0% | 1.8% | 0.0% | 10.5% | 0.0% | 7.0% | 1.8% | 1.8% | 7.0% | 8.8% | 5.3% | 17.5% | 17.5% | 3.5% | 0.0% | 1.8% | 5.3% | 100.0% | ||

| % within sector | 4.9% | 0.0% | 0.0% | 0.0% | 0.0% | 28.6% | 0.0% | 12.5% | 0.0% | 9.4% | 0.0% | 6.3% | 3.4% | 3.8% | 4.8% | 4.3% | 5.3% | 10.3% | 7.4% | 2.8% | 0.0% | 7.1% | 27.3% | 5.9% | ||

| % of Total | 0.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.2% | 0.0% | 0.1% | 0.0% | 0.6% | 0.0% | 0.4% | 0.1% | 0.1% | 0.4% | 0.5% | 0.3% | 1.0% | 1.0% | 0.2% | 0.0% | 0.1% | 0.3% | 5.9% | ||

| Jeju | Count | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | |

| Expected Count | 0.3 | 0.0 | 0.1 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.1 | 0.3 | 0.1 | 0.1 | 0.3 | 0.5 | 0.2 | 0.4 | 0.6 | 0.3 | 0.0 | 0.1 | 0.0 | 4.0 | ||

| % within region | 75.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 25.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 3.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.4% | ||

| % of Total | 0.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.4% | ||

| Jeollabuk | Count | 5 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | 2 | 2 | 0 | 0 | 1 | 0 | 16 | |

| Expected Count | 1.4 | 0.1 | 0.4 | 0.2 | 0.1 | 0.1 | 0.2 | 0.1 | 0.0 | 1.1 | 0.5 | 1.0 | 0.5 | 0.4 | 1.4 | 1.9 | 0.9 | 1.6 | 2.2 | 1.2 | 0.2 | 0.2 | 0.2 | 16.0 | ||

| % within region | 31.3% | 0.0% | 6.3% | 6.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 6.3% | 0.0% | 6.3% | 0.0% | 6.3% | 0.0% | 6.3% | 0.0% | 12.5% | 12.5% | 0.0% | 0.0% | 6.3% | 0.0% | 100.0% | ||

| % within sector | 6.1% | 0.0% | 4.3% | 7.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.6% | 0.0% | 1.6% | 0.0% | 3.8% | 0.0% | 0.9% | 0.0% | 2.1% | 1.5% | 0.0% | 0.0% | 7.1% | 0.0% | 1.7% | ||

| % of Total | 0.5% | 0.0% | 0.1% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.1% | 0.0% | 0.1% | 0.0% | 0.1% | 0.0% | 0.2% | 0.2% | 0.0% | 0.0% | 0.1% | 0.0% | 1.7% | ||

| Jeollnam | Count | 4 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 1 | 1 | 2 | 3 | 0 | 0 | 1 | 2 | 1 | 0 | 0 | 0 | 18 | |

| Expected Count | 1.5 | 0.1 | 0.4 | 0.2 | 0.2 | 0.1 | 0.2 | 0.1 | 0.0 | 1.2 | 0.6 | 1.2 | 0.5 | 0.5 | 1.5 | 2.1 | 1.1 | 1.8 | 2.5 | 1.3 | 0.2 | 0.3 | 0.2 | 18.0 | ||

| % within region | 22.2% | 5.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 11.1% | 0.0% | 5.6% | 5.6% | 11.1% | 16.7% | 0.0% | 0.0% | 5.6% | 11.1% | 5.6% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 4.9% | 16.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 3.1% | 0.0% | 1.6% | 3.4% | 7.7% | 3.6% | 0.0% | 0.0% | 1.0% | 1.5% | 1.4% | 0.0% | 0.0% | 0.0% | 1.9% | ||

| % of Total | 0.4% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.2% | 0.0% | 0.1% | 0.1% | 0.2% | 0.3% | 0.0% | 0.0% | 0.1% | 0.2% | 0.1% | 0.0% | 0.0% | 0.0% | 1.9% | ||

| Sejong | Count | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 2 | |

| Expected Count | 0.2 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.2 | 0.2 | 0.1 | 0.2 | 0.3 | 0.1 | 0.0 | 0.0 | 0.0 | 2.0 | ||

| % within region | 50.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 50.0% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 1.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.4% | 0.0% | 0.0% | 0.0% | 0.2% | ||

| % of Total | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.2% | ||

| Seoul | Count | 15 | 2 | 7 | 6 | 1 | 0 | 2 | 1 | 1 | 8 | 20 | 3 | 3 | 3 | 14 | 22 | 12 | 18 | 15 | 3 | 1 | 0 | 5 | 162 | |

| Expected Count | 13.7 | 1.0 | 3.9 | 2.2 | 1.5 | 1.2 | 2.0 | 1.3 | 0.2 | 10.7 | 5.0 | 10.6 | 4.9 | 4.4 | 13.9 | 19.3 | 9.5 | 16.3 | 22.6 | 12.1 | 1.7 | 2.3 | 1.8 | 162.0 | ||

| % within region | 9.3% | 1.2% | 4.3% | 3.7% | 0.6% | 0.0% | 1.2% | 0.6% | 0.6% | 4.9% | 12.3% | 1.9% | 1.9% | 1.9% | 8.6% | 13.6% | 7.4% | 11.1% | 9.3% | 1.9% | 0.6% | 0.0% | 3.1% | 100.0% | ||

| % within sector | 18.3% | 33.3% | 30.4% | 46.2% | 11.1% | 0.0% | 16.7% | 12.5% | 100.0% | 12.5% | 66.7% | 4.8% | 10.3% | 11.5% | 16.9% | 19.1% | 21.1% | 18.6% | 11.1% | 4.2% | 10.0% | 0.0% | 45.5% | 16.8% | ||

| % of Total | 1.6% | 0.2% | 0.7% | 0.6% | 0.1% | 0.0% | 0.2% | 0.1% | 0.1% | 0.8% | 2.1% | 0.3% | 0.3% | 0.3% | 1.4% | 2.3% | 1.2% | 1.9% | 1.6% | 0.3% | 0.1% | 0.0% | 0.5% | 16.8% | ||

| Ulsan | Count | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 2 | 0 | 1 | 0 | 2 | 1 | 2 | 0 | 1 | 1 | 3 | 2 | 0 | 0 | 16 | |

| Expected Count | 1.4 | 0.1 | 0.4 | 0.2 | 0.1 | 0.1 | 0.2 | 0.1 | 0.0 | 1.1 | 0.5 | 1.0 | 0.5 | 0.4 | 1.4 | 1.9 | 0.9 | 1.6 | 2.2 | 1.2 | 0.2 | 0.2 | 0.2 | 16.0 | ||

| % within region | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 6.3% | 0.0% | 0.0% | 0.0% | 12.5% | 0.0% | 6.3% | 0.0% | 12.5% | 6.3% | 12.5% | 0.0% | 6.3% | 6.3% | 18.8% | 12.5% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 14.3% | 0.0% | 0.0% | 0.0% | 3.1% | 0.0% | 1.6% | 0.0% | 7.7% | 1.2% | 1.7% | 0.0% | 1.0% | 0.7% | 4.2% | 20.0% | 0.0% | 0.0% | 1.7% | ||

| % of Total | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.2% | 0.0% | 0.1% | 0.0% | 0.2% | 0.1% | 0.2% | 0.0% | 0.1% | 0.1% | 0.3% | 0.2% | 0.0% | 0.0% | 1.7% | ||

| Total | Count | 82 | 6 | 23 | 13 | 9 | 7 | 12 | 8 | 1 | 64 | 30 | 63 | 29 | 26 | 83 | 115 | 57 | 97 | 135 | 72 | 10 | 14 | 11 | 967 | |

| Expected Count | 82.0 | 6.0 | 23.0 | 13.0 | 9.0 | 7.0 | 12.0 | 8.0 | 1.0 | 64.0 | 30.0 | 63.0 | 29.0 | 26.0 | 83.0 | 115.0 | 57.0 | 97.0 | 135.0 | 72.0 | 10.0 | 14.0 | 11.0 | 967.0 | ||

| % within region | 8.5% | .6% | 2.4% | 1.3% | 0.9% | 0.7% | 1.2% | 0.8% | 0.1% | 6.6% | 3.1% | 6.5% | 3.0% | 2.7% | 8.6% | 11.9% | 5.9% | 10.0% | 14.0% | 7.4% | 1.0% | 1.4% | 1.1% | 100.0% | ||

| % within sector | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | ||

| % of Total | 8.5% | 0.6% | 2.4% | 1.3% | 0.9% | 0.7% | 1.2% | 0.8% | 0.1% | 6.6% | 3.1% | 6.5% | 3.0% | 2.7% | 8.6% | 11.9% | 5.9% | 10.0% | 14.0% | 7.4% | 1.0% | 1.4% | 1.1% | 100.0% | ||

| Sector | Total | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10 | 11 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | ||||

| Region | Busan | Count | 11 | 1 | 1 | 0 | 3 | 2 | 2 | 0 | 1 | 6 | 1 | 13 | 1 | 7 | 7 | 5 | 1 | 13 | 30 | 10 | 3 | 2 | 0 | 120 |

| Expected Count | 8.2 | .4 | 1.2 | 2.7 | .8 | 1.3 | 2.7 | .6 | .2 | 4.8 | 1.7 | 10.3 | 2.7 | 3.6 | 6.7 | 15.3 | 5.4 | 10.0 | 23.2 | 14.9 | 1.6 | 1.3 | .4 | 120.0 | ||

| % within region | 9.2% | 0.8% | 0.8% | 0.0% | 2.5% | 1.7% | 1.7% | 0.0% | 0.8% | 5.0% | 0.8% | 10.8% | 0.8% | 5.8% | 5.8% | 4.2% | 0.8% | 10.8% | 25.0% | 8.3% | 2.5% | 1.7% | 0.0% | 100.0% | ||

| % within sector | 9.9% | 16.7% | 6.3% | 0.0% | 27.3% | 11.8% | 5.6% | 0.0% | 33.3% | 9.2% | 4.3% | 9.4% | 2.8% | 14.3% | 7.8% | 2.4% | 1.4% | 9.7% | 9.6% | 5.0% | 14.3% | 11.8% | 0.0% | 7.4% | ||

| % of Total | 0.7% | 0.1% | 0.1% | 0.0% | 0.2% | 0.1% | 0.1% | 0.0% | 0.1% | 0.4% | 0.1% | 0.8% | 0.1% | 0.4% | 0.4% | 0.3% | 0.1% | 0.8% | 1.9% | 0.6% | 0.2% | 0.1% | 0.0% | 7.4% | ||

| Chungcheongbuk | Count | 11 | 1 | 2 | 0 | 1 | 0 | 2 | 0 | 0 | 7 | 3 | 14 | 2 | 1 | 4 | 9 | 3 | 7 | 11 | 7 | 0 | 1 | 0 | 86 | |

| Expected Count | 5.9 | .3 | .9 | 2.0 | .6 | .9 | 1.9 | .4 | .2 | 3.5 | 1.2 | 7.4 | 1.9 | 2.6 | 4.8 | 11.0 | 3.9 | 7.1 | 16.7 | 10.6 | 1.1 | .9 | .3 | 86.0 | ||

| % within region | 12.8% | 1.2% | 2.3% | 0.0% | 1.2% | 0.0% | 2.3% | 0.0% | 0.0% | 8.1% | 3.5% | 16.3% | 2.3% | 1.2% | 4.7% | 10.5% | 3.5% | 8.1% | 12.8% | 8.1% | 0.0% | 1.2% | 0.0% | 100.0% | ||

| % within sector | 9.9% | 16.7% | 12.5% | 0.0% | 9.1% | 0.0% | 5.6% | 0.0% | 0.0% | 10.8% | 13.0% | 10.1% | 5.6% | 2.0% | 4.4% | 4.4% | 4.1% | 5.2% | 3.5% | 3.5% | 0.0% | 5.9% | 0.0% | 5.3% | ||

| % of Total | 0.7% | 0.1% | 0.1% | 0.0% | 0.1% | 0.0% | 0.1% | 0.0% | 0.0% | 0.4% | 0.2% | 0.9% | 0.1% | 0.1% | 0.2% | 0.6% | 0.2% | 0.4% | 0.7% | 0.4% | 0.0% | 0.1% | 0.0% | 5.3% | ||

| ChungCheongnam | Count | 14 | 2 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 5 | 2 | 9 | 3 | 1 | 3 | 12 | 5 | 6 | 24 | 22 | 0 | 0 | 0 | 110 | |

| Expected Count | 7.6 | .4 | 1.1 | 2.5 | .7 | 1.2 | 2.5 | .5 | .2 | 4.4 | 1.6 | 9.5 | 2.5 | 3.3 | 6.1 | 14.0 | 5.0 | 9.1 | 21.3 | 13.6 | 1.4 | 1.2 | .3 | 110.0 | ||

| % within region | 12.7% | 1.8% | 0.0% | 0.0% | 0.0% | 0.0% | 1.8% | 0.0% | 0.0% | 4.5% | 1.8% | 8.2% | 2.7% | 0.9% | 2.7% | 10.9% | 4.5% | 5.5% | 21.8% | 20.0% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 12.6% | 33.3% | 0.0% | 0.0% | 0.0% | 0.0% | 5.6% | 0.0% | 0.0% | 7.7% | 8.7% | 6.5% | 8.3% | 2.0% | 3.3% | 5.8% | 6.8% | 4.5% | 7.7% | 11.0% | 0.0% | 0.0% | 0.0% | 6.8% | ||

| % of Total | 0.9% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.3% | 0.1% | 0.6% | 0.2% | 0.1% | 0.2% | 0.7% | 0.3% | 0.4% | 1.5% | 1.4% | 0.0% | 0.0% | 0.0% | 6.8% | ||

| Daegu | Count | 4 | 0 | 2 | 0 | 0 | 1 | 2 | 3 | 0 | 2 | 0 | 8 | 0 | 1 | 17 | 13 | 7 | 4 | 24 | 22 | 0 | 1 | 0 | 111 | |

| Expected Count | 7.6 | .4 | 1.1 | 2.5 | .8 | 1.2 | 2.5 | .5 | .2 | 4.5 | 1.6 | 9.5 | 2.5 | 3.4 | 6.2 | 14.1 | 5.0 | 9.2 | 21.5 | 13.7 | 1.4 | 1.2 | .3 | 111.0 | ||

| % within region | 3.6% | 0.0% | 1.8% | 0.0% | 0.0% | 0.9% | 1.8% | 2.7% | 0.0% | 1.8% | 0.0% | 7.2% | 0.0% | 0.9% | 15.3% | 11.7% | 6.3% | 3.6% | 21.6% | 19.8% | 0.0% | 0.9% | 0.0% | 100.0% | ||

| % within sector | 3.6% | 0.0% | 12.5% | 0.0% | 0.0% | 5.9% | 5.6% | 37.5% | 0.0% | 3.1% | 0.0% | 5.8% | 0.0% | 2.0% | 18.9% | 6.3% | 9.6% | 3.0% | 7.7% | 11.0% | 0.0% | 5.9% | 0.0% | 6.9% | ||

| % of Total | 0.2% | 0.0% | 0.1% | 0.0% | 0.0% | 0.1% | 0.1% | 0.2% | 0.0% | 0.1% | 0.0% | 0.5% | 0.0% | 0.1% | 1.1% | 0.8% | 0.4% | 0.2% | 1.5% | 1.4% | 0.0% | 0.1% | 0.0% | 6.9% | ||

| Daejeon | Count | 2 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 3 | 2 | 3 | 2 | 3 | 2 | 8 | 10 | 2 | 5 | 2 | 0 | 0 | 0 | 45 | |

| Expected Count | 3.1 | .2 | .4 | 1.0 | .3 | .5 | 1.0 | .2 | .1 | 1.8 | .6 | 3.9 | 1.0 | 1.4 | 2.5 | 5.7 | 2.0 | 3.7 | 8.7 | 5.6 | .6 | .5 | .1 | 45.0 | ||

| % within region | 4.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.2% | 0.0% | 0.0% | 6.7% | 4.4% | 6.7% | 4.4% | 6.7% | 4.4% | 17.8% | 22.2% | 4.4% | 11.1% | 4.4% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 1.8% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.8% | 0.0% | 0.0% | 4.6% | 8.7% | 2.2% | 5.6% | 6.1% | 2.2% | 3.9% | 13.7% | 1.5% | 1.6% | 1.0% | 0.0% | 0.0% | 0.0% | 2.8% | ||

| % of Total | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.2% | 0.1% | 0.2% | 0.1% | 0.2% | 0.1% | 0.5% | 0.6% | 0.1% | 0.3% | 0.1% | 0.0% | 0.0% | 0.0% | 2.8% | ||

| Ganwon | Count | 2 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 2 | 1 | 0 | 0 | 0 | 3 | 3 | 1 | 1 | 0 | 0 | 0 | 16 | |

| Expected Count | 1.1 | .1 | .2 | .4 | .1 | .2 | .4 | .1 | .0 | .6 | .2 | 1.4 | .4 | .5 | .9 | 2.0 | .7 | 1.3 | 3.1 | 2.0 | .2 | .2 | .0 | 16.0 | ||

| % within region | 12.5% | 6.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 6.3% | 6.3% | 12.5% | 6.3% | 0.0% | 0.0% | 0.0% | 18.8% | 18.8% | 6.3% | 6.3% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 1.8% | 16.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.5% | 4.3% | 1.4% | 2.8% | 0.0% | 0.0% | 0.0% | 4.1% | 2.2% | 0.3% | 0.5% | 0.0% | 0.0% | 0.0% | 1.0% | ||

| % of Total | 0.1% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.1% | 0.1% | 0.1% | 0.0% | 0.0% | 0.0% | 0.2% | 0.2% | 0.1% | 0.1% | 0.0% | 0.0% | 0.0% | 1.0% | ||

| Gwangju | Count | 2 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 2 | 0 | 1 | 2 | 3 | 2 | 2 | 7 | 11 | 0 | 0 | 1 | 35 | |

| Expected Count | 2.4 | .1 | .3 | .8 | .2 | .4 | .8 | .2 | .1 | 1.4 | .5 | 3.0 | .8 | 1.1 | 1.9 | 4.5 | 1.6 | 2.9 | 6.8 | 4.3 | .5 | .4 | .1 | 35.0 | ||

| % within region | 5.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.9% | 0.0% | 0.0% | 0.0% | 2.9% | 5.7% | 0.0% | 2.9% | 5.7% | 8.6% | 5.7% | 5.7% | 20.0% | 31.4% | 0.0% | 0.0% | 2.9% | 100.0% | ||

| % within sector | 1.8% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.8% | 0.0% | 0.0% | 0.0% | 4.3% | 1.4% | 0.0% | 2.0% | 2.2% | 1.5% | 2.7% | 1.5% | 2.2% | 5.5% | 0.0% | 0.0% | 20.0% | 2.2% | ||

| % of Total | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.1% | 0.1% | 0.2% | 0.1% | 0.1% | 0.4% | 0.7% | 0.0% | 0.0% | 0.1% | 2.2% | ||

| Gyeongbuk | Count | 4 | 1 | 5 | 0 | 0 | 1 | 2 | 0 | 0 | 3 | 0 | 10 | 2 | 6 | 9 | 11 | 4 | 7 | 25 | 25 | 0 | 3 | 0 | 118 | |

| Expected Count | 8.1 | .4 | 1.2 | 2.7 | .8 | 1.2 | 2.6 | .6 | .2 | 4.7 | 1.7 | 10.1 | 2.6 | 3.6 | 6.6 | 15.0 | 5.3 | 9.8 | 22.9 | 14.6 | 1.5 | 1.2 | .4 | 118.0 | ||

| % within region | 3.4% | 0.8% | 4.2% | 0.0% | 0.0% | 0.8% | 1.7% | 0.0% | 0.0% | 2.5% | 0.0% | 8.5% | 1.7% | 5.1% | 7.6% | 9.3% | 3.4% | 5.9% | 21.2% | 21.2% | 0.0% | 2.5% | 0.0% | 100.0% | ||

| % within sector | 3.6% | 16.7% | 31.3% | 0.0% | 0.0% | 5.9% | 5.6% | 0.0% | 0.0% | 4.6% | 0.0% | 7.2% | 5.6% | 12.2% | 10.0% | 5.3% | 5.5% | 5.2% | 8.0% | 12.5% | 0.0% | 17.6% | 0.0% | 7.3% | ||

| % of Total | 0.2% | 0.1% | 0.3% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.0% | 0.2% | 0.0% | 0.6% | 0.1% | 0.4% | 0.6% | 0.7% | 0.2% | 0.4% | 1.5% | 1.5% | 0.0% | 0.2% | 0.0% | 7.3% | ||

| Gyeonggi | Count | 19 | 0 | 3 | 1 | 1 | 2 | 15 | 2 | 0 | 20 | 7 | 34 | 13 | 12 | 17 | 69 | 23 | 49 | 84 | 25 | 2 | 5 | 3 | 406 | |

| Expected Count | 27.9 | 1.5 | 4.0 | 9.3 | 2.8 | 4.3 | 9.0 | 2.0 | .8 | 16.3 | 5.8 | 34.9 | 9.0 | 12.3 | 22.6 | 51.8 | 18.3 | 33.7 | 78.6 | 50.2 | 5.3 | 4.3 | 1.3 | 406.0 | ||

| % within region | 4.7% | 0.0% | 0.7% | 0.2% | 0.2% | 0.5% | 3.7% | 0.5% | 0.0% | 4.9% | 1.7% | 8.4% | 3.2% | 3.0% | 4.2% | 17.0% | 5.7% | 12.1% | 20.7% | 6.2% | 0.5% | 1.2% | 0.7% | 100.0% | ||

| % within sector | 17.1% | 0.0% | 18.8% | 2.7% | 9.1% | 11.8% | 41.7% | 25.0% | 0.0% | 30.8% | 30.4% | 24.5% | 36.1% | 24.5% | 18.9% | 33.5% | 31.5% | 36.6% | 26.8% | 12.5% | 9.5% | 29.4% | 60.0% | 25.1% | ||

| % of Total | 1.2% | 0.0% | 0.2% | 0.1% | 0.1% | 0.1% | 0.9% | 0.1% | 0.0% | 1.2% | 0.4% | 2.1% | 0.8% | 0.7% | 1.1% | 4.3% | 1.4% | 3.0% | 5.2% | 1.5% | 0.1% | 0.3% | 0.2% | 25.1% | ||

| Gyeonnam | Count | 14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 | 0 | 13 | 2 | 1 | 8 | 6 | 4 | 8 | 35 | 33 | 9 | 0 | 0 | 136 | |

| Expected Count | 9.3 | .5 | 1.3 | 3.1 | .9 | 1.4 | 3.0 | .7 | .3 | 5.5 | 1.9 | 11.7 | 3.0 | 4.1 | 7.6 | 17.3 | 6.1 | 11.3 | 26.3 | 16.8 | 1.8 | 1.4 | .4 | 136.0 | ||

| % within region | 10.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.7% | 1.5% | 0.0% | 9.6% | 1.5% | 0.7% | 5.9% | 4.4% | 2.9% | 5.9% | 25.7% | 24.3% | 6.6% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 12.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 33.3% | 3.1% | 0.0% | 9.4% | 5.6% | 2.0% | 8.9% | 2.9% | 5.5% | 6.0% | 11.2% | 16.5% | 42.9% | 0.0% | 0.0% | 8.4% | ||

| % of Total | 0.9% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.8% | 0.1% | 0.1% | 0.5% | 0.4% | 0.2% | 0.5% | 2.2% | 2.0% | 0.6% | 0.0% | 0.0% | 8.4% | ||

| Incheon | Count | 7 | 0 | 1 | 0 | 0 | 9 | 0 | 0 | 0 | 6 | 2 | 20 | 3 | 7 | 11 | 32 | 2 | 15 | 40 | 17 | 0 | 4 | 0 | 176 | |

| Expected Count | 12.1 | .7 | 1.7 | 4.0 | 1.2 | 1.9 | 3.9 | .9 | .3 | 7.1 | 2.5 | 15.1 | 3.9 | 5.3 | 9.8 | 22.4 | 8.0 | 14.6 | 34.1 | 21.8 | 2.3 | 1.9 | .5 | 176.0 | ||

| % within region | 4.0% | 0.0% | 0.6% | 0.0% | 0.0% | 5.1% | 0.0% | 0.0% | 0.0% | 3.4% | 1.1% | 11.4% | 1.7% | 4.0% | 6.3% | 18.2% | 1.1% | 8.5% | 22.7% | 9.7% | 0.0% | 2.3% | 0.0% | 100.0% | ||

| % within sector | 6.3% | 0.0% | 6.3% | 0.0% | 0.0% | 52.9% | 0.0% | 0.0% | 0.0% | 9.2% | 8.7% | 14.4% | 8.3% | 14.3% | 12.2% | 15.5% | 2.7% | 11.2% | 12.8% | 8.5% | 0.0% | 23.5% | 0.0% | 10.9% | ||

| % of Total | 0.4% | 0.0% | 0.1% | 0.0% | 0.0% | 0.6% | 0.0% | 0.0% | 0.0% | 0.4% | 0.1% | 1.2% | 0.2% | 0.4% | 0.7% | 2.0% | 0.1% | 0.9% | 2.5% | 1.1% | 0.0% | 0.2% | 0.0% | 10.9% | ||

| Jeju | Count | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | |

| Expected Count | .1 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .0 | .1 | .0 | .2 | .0 | .1 | .1 | .3 | .1 | .2 | .4 | .2 | .0 | .0 | .0 | 2.0 | ||

| % within region | 50.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 50.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 0.9% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.8% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | ||

| % of Total | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | ||

| Jeollabuk | Count | 8 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 2 | 5 | 8 | 2 | 0 | 0 | 29 | |

| Expected Count | 2.0 | .1 | .3 | .7 | .2 | .3 | .6 | .1 | .1 | 1.2 | .4 | 2.5 | .6 | .9 | 1.6 | 3.7 | 1.3 | 2.4 | 5.6 | 3.6 | .4 | .3 | .1 | 29.0 | ||

| % within region | 27.6% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 3.4% | 0.0% | 0.0% | 0.0% | 0.0% | 3.4% | 0.0% | 0.0% | 3.4% | 3.4% | 0.0% | 6.9% | 17.2% | 27.6% | 6.9% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 7.2% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.8% | 0.0% | 0.0% | 0.0% | 0.0% | 0.7% | 0.0% | 0.0% | 1.1% | 0.5% | 0.0% | 1.5% | 1.6% | 4.0% | 9.5% | 0.0% | 0.0% | 1.8% | ||

| % of Total | 0.5% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.1% | 0.3% | 0.5% | 0.1% | 0.0% | 0.0% | 1.8% | ||

| Jeollnam | Count | 5 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 3 | 1 | 2 | 0 | 2 | 2 | 1 | 0 | 3 | 5 | 1 | 2 | 1 | 0 | 29 | |

| Expected Count | 2.0 | .1 | .3 | .7 | .2 | .3 | .6 | .1 | .1 | 1.2 | .4 | 2.5 | .6 | .9 | 1.6 | 3.7 | 1.3 | 2.4 | 5.6 | 3.6 | .4 | .3 | .1 | 29.0 | ||

| % within region | 17.2% | 0.0% | 0.0% | 0.0% | 0.0% | 3.4% | 0.0% | 0.0% | 0.0% | 10.3% | 3.4% | 6.9% | 0.0% | 6.9% | 6.9% | 3.4% | 0.0% | 10.3% | 17.2% | 3.4% | 6.9% | 3.4% | 0.0% | 100.0% | ||

| % within sector | 4.5% | 0.0% | 0.0% | 0.0% | 0.0% | 5.9% | 0.0% | 0.0% | 0.0% | 4.6% | 4.3% | 1.4% | 0.0% | 4.1% | 2.2% | 0.5% | 0.0% | 2.2% | 1.6% | 0.5% | 9.5% | 5.9% | 0.0% | 1.8% | ||

| % of Total | 0.3% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.2% | 0.1% | 0.1% | 0.0% | 0.1% | 0.1% | 0.1% | 0.0% | 0.2% | 0.3% | 0.1% | 0.1% | 0.1% | 0.0% | 1.8% | ||

| Sejong | Count | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 1 | 1 | 0 | 3 | 0 | 0 | 2 | 1 | 2 | 0 | 2 | 0 | 0 | 0 | 14 | |

| Expected Count | 1.0 | .1 | .1 | .3 | .1 | .1 | .3 | .1 | .0 | .6 | .2 | 1.2 | .3 | .4 | .8 | 1.8 | .6 | 1.2 | 2.7 | 1.7 | .2 | .1 | .0 | 14.0 | ||

| % within region | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 14.3% | 0.0% | 0.0% | 7.1% | 7.1% | 0.0% | 21.4% | 0.0% | 0.0% | 14.3% | 7.1% | 14.3% | 0.0% | 14.3% | 0.0% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 5.6% | 0.0% | 0.0% | 1.5% | 4.3% | 0.0% | 8.3% | 0.0% | 0.0% | 1.0% | 1.4% | 1.5% | 0.0% | 1.0% | 0.0% | 0.0% | 0.0% | 0.9% | ||

| % of Total | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.2% | 0.0% | 0.0% | 0.1% | 0.1% | 0.1% | 0.0% | 0.1% | 0.0% | 0.0% | 0.0% | 0.9% | ||

| Seoul | Count | 6 | 0 | 2 | 36 | 6 | 1 | 6 | 3 | 0 | 5 | 2 | 4 | 2 | 1 | 4 | 33 | 6 | 10 | 12 | 1 | 0 | 0 | 1 | 141 | |

| Expected Count | 9.7 | .5 | 1.4 | 3.2 | 1.0 | 1.5 | 3.1 | .7 | .3 | 5.7 | 2.0 | 12.1 | 3.1 | 4.3 | 7.9 | 18.0 | 6.4 | 11.7 | 27.3 | 17.5 | 1.8 | 1.5 | .4 | 141.0 | ||

| % within region | 4.3% | 0.0% | 1.4% | 25.5% | 4.3% | 0.7% | 4.3% | 2.1% | 0.0% | 3.5% | 1.4% | 2.8% | 1.4% | 0.7% | 2.8% | 23.4% | 4.3% | 7.1% | 8.5% | 0.7% | 0.0% | 0.0% | 0.7% | 100.0% | ||

| % within sector | 5.4% | 0.0% | 12.5% | 97.3% | 54.5% | 5.9% | 16.7% | 37.5% | 0.0% | 7.7% | 8.7% | 2.9% | 5.6% | 2.0% | 4.4% | 16.0% | 8.2% | 7.5% | 3.8% | 0.5% | 0.0% | 0.0% | 20.0% | 8.7% | ||

| % of Total | 0.4% | 0.0% | 0.1% | 2.2% | 0.4% | 0.1% | 0.4% | 0.2% | 0.0% | 0.3% | 0.1% | 0.2% | 0.1% | 0.1% | 0.2% | 2.0% | 0.4% | 0.6% | 0.7% | 0.1% | 0.0% | 0.0% | 0.1% | 8.7% | ||

| Ulsan | Count | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 4 | 1 | 6 | 3 | 1 | 2 | 1 | 5 | 13 | 3 | 0 | 0 | 42 | |

| Expected Count | 2.9 | .2 | .4 | 1.0 | .3 | .4 | .9 | .2 | .1 | 1.7 | .6 | 3.6 | .9 | 1.3 | 2.3 | 5.4 | 1.9 | 3.5 | 8.1 | 5.2 | .5 | .4 | .1 | 42.0 | ||

| % within region | 2.4% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 2.4% | 2.4% | 0.0% | 9.5% | 2.4% | 14.3% | 7.1% | 2.4% | 4.8% | 2.4% | 11.9% | 31.0% | 7.1% | 0.0% | 0.0% | 100.0% | ||

| % within sector | 0.9% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 33.3% | 1.5% | 0.0% | 2.9% | 2.8% | 12.2% | 3.3% | 0.5% | 2.7% | 0.7% | 1.6% | 6.5% | 14.3% | 0.0% | 0.0% | 2.6% | ||

| % of Total | 0.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.1% | 0.1% | 0.0% | 0.2% | 0.1% | 0.4% | 0.2% | 0.1% | 0.1% | 0.1% | 0.3% | 0.8% | 0.2% | 0.0% | 0.0% | 2.6% | ||

| Total | Count | 111 | 6 | 16 | 37 | 11 | 17 | 36 | 8 | 3 | 65 | 23 | 139 | 36 | 49 | 90 | 206 | 73 | 134 | 313 | 200 | 21 | 17 | 5 | 1616 | |

| Expected Count | 111.0 | 6.0 | 16.0 | 37.0 | 11.0 | 17.0 | 36.0 | 8.0 | 3.0 | 65.0 | 23.0 | 139.0 | 36.0 | 49.0 | 90.0 | 206.0 | 73.0 | 134.0 | 313.0 | 200.0 | 21.0 | 17.0 | 5.0 | 1616.0 | ||

| % within region | 6.9% | 0.4% | 1.0% | 2.3% | 0.7% | 1.1% | 2.2% | 0.5% | 0.2% | 4.0% | 1.4% | 8.6% | 2.2% | 3.0% | 5.6% | 12.7% | 4.5% | 8.3% | 19.4% | 12.4% | 1.3% | 1.1% | 0.3% | 100.0% | ||

| % within sector | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | ||

| % of Total | 6.9% | 0.4% | 1.0% | 2.3% | 0.7% | 1.1% | 2.2% | 0.5% | 0.2% | 4.0% | 1.4% | 8.6% | 2.2% | 3.0% | 5.6% | 12.7% | 4.5% | 8.3% | 19.4% | 12.4% | 1.3% | 1.1% | 0.3% | 100.0% | ||

References

- Cho, C.; Park, S.Y.; Son, J.K.; Lee, S. R&D support services for small and medium-sized enterprises: The different perspectives of clients and service providers, and the roles of intermediaries. Sci. Public Policy 2016, 43, 859–871. [Google Scholar]

- Cho, C.; Park, S.Y.; Son, J.K.; Lee, S. Comparative analysis of R&D-based innovation capabilities in SMEs to design innovation policy. Sci. Public Policy 2017, 44, 403–416. [Google Scholar]

- Radas, S.; Božić, L. The antecedents of SME innovativeness in an emerging transition economy. Technovation 2009, 29, 438–450. [Google Scholar] [CrossRef]

- Zhang, Y.; Khan, U.; Lee, S.; Salik, M. The Influence of Management Innovation and Technological Innovation on Organization Performance. A Mediating Role of Sustainability. Sustainability 2019, 11, 495. [Google Scholar] [CrossRef]

- Michelino, F.; Cammarano, A.; Celone, A.; Caputo, M. The Linkage between Sustainability and Innovation Performance in IT Hardware Sector. Sustainability 2019, 11, 4275. [Google Scholar] [CrossRef]

- Wehnert, P.; Kollwitz, C.; Daiberl, C.; Dinter, B.; Beckmann, M. Capturing the Bigger Picture? Applying Text Analytics to Foster Open Innovation Processes for Sustainability-Oriented Innovation. Sustainability 2018, 10, 3710. [Google Scholar] [CrossRef]

- Shin, J.; Kim, C.; Yang, H. The Effect of Sustainability as Innovation Objectives on Innovation Efficiency. Sustainability 2018, 10, 1966. [Google Scholar] [CrossRef]

- Bessant, J.; Lamming, R.; Noke, H.; Phillips, W. Managing innovation beyond the steady state. Technovation 2005, 25, 1366–1376. [Google Scholar] [CrossRef]

- Hall, L.A.; Bagchi-Sen, S. An analysis of firm-level innovation strategies in the US biotechnology industry. Technovation 2007, 27, 4–14. [Google Scholar] [CrossRef]

- Kapsali, M. How to implement innovation policies through projects successfully. Technovation 2011, 31, 615–626. [Google Scholar] [CrossRef]

- Hobday, M.; Boddington, A.; Grantham, A. Policies for design and policies for innovation: Contrasting perspectives and remaining challenges. Technovation 2012, 32, 272–281. [Google Scholar] [CrossRef]

- Samara, E.; Georgiadis, P.; Bakouros, I. The impact of innovation policies on the performance of national innovation systems: A system dynamics analysis. Technovation 2012, 32, 624–638. [Google Scholar] [CrossRef]

- Aubert, B.A.; Kishore, R.; Iriyama, A. Exploring and managing the “innovation through outsourcing” paradox. J. Strateg. Inf. Syst. 2015, 24, 255–269. [Google Scholar] [CrossRef]

- Soetanto, D.; Jack, S. The impact of university-based incubation support on the innovation strategy of academic spin-offs. Technovation 2016, 50, 25–40. [Google Scholar] [CrossRef]

- Curnow, R.C.; Moring, G.G. ‘Project sappho’: A study in industrial innovation. Futures 1968, 1, 82–90. [Google Scholar] [CrossRef]

- Rothwell, R.; Freeman, C.; Horlsey, A.; Jervis, V.T.P.; Robertson, A.B.; Townsend, J. SAPPHO updated-project SAPPHO phase II. Res. Policy 1974, 3, 258–291. [Google Scholar] [CrossRef]

- Freeman, C.; Soete, L. Success and Failure in Industrial Innovation. In The Economics of Industrial Innovation, 3rd ed.; MIT Press: Boston, MA, USA, 1997; pp. 197–226. [Google Scholar]

- Dziallas, M.; Blind, K. Innovation indicators throughout the innovation process: An extensive literature analysis. Technovation 2019, 80, 3–29. [Google Scholar] [CrossRef]

- Becheikh, N.; Landry, R.; Amara, N. Lessons from innovation empirical studies in the manufacturing sector: A systematic review of the literature from 1993–2003. Technovation 2006, 26, 644–664. [Google Scholar] [CrossRef]

- Rothwell, R. Successful industrial innovation: Critical factors for the 1990s. R D Manag. 1992, 22, 221–240. [Google Scholar] [CrossRef]

- Coombs, R.; Narandren, P.; Richards, A. A literature-based innovation output indicator. Res. Policy 1996, 25, 403–413. [Google Scholar] [CrossRef]

- Souitaris, V. External communication determinants of innovation in the context of a newly industrialised country: A comparison of objective and perceptual results from Greece. Technovation 2001, 21, 25–34. [Google Scholar] [CrossRef]

- Wolfe, R.A. Organizational innovation: Review, critique and suggested research directions. J. Manag. Stud. 1994, 31, 405–431. [Google Scholar] [CrossRef]

- Asheim, B.T.; Isaksen, A. Location, agglomeration and innovation: Towards regional innovation systems in Norway? Eur. Plan. Stud. 1997, 5, 299–330. [Google Scholar] [CrossRef]

- Michie, J. Introduction. The Internationalisation of the Innovation Process. Int. J. Econ. Bus. 1998, 5, 261–277. [Google Scholar] [CrossRef]

- Amitrano, C.C.; Tregua, M.; Russo Spena, T.; Bifulco, F. On Technology in Innovation Systems and Innovation-Ecosystem Perspectives: A Cross-Linking Analysis. Sustainability 2018, 10, 3744. [Google Scholar] [CrossRef]

- Wang, C.-H.; Chin, Y.-C.; Tzeng, G.-H. Mining the R&D innovation performance processes for high-tech firms based on rough set theory. Technovation 2010, 30, 447–458. [Google Scholar]

- Bastı, E.; Kuzey, C.; Delen, D. Analyzing initial public offerings’ short-term performance using decision trees and SVMs. Decis. Support Syst. 2015, 73, 15–27. [Google Scholar] [CrossRef]

- Evangelista, R.; Perani, G.; Rapiti, F.; Archibugi, D. Nature and impact of innovation in manufacturing industry: Some evidence from the Italian innovation survey. Res. Policy 1997, 26, 521–536. [Google Scholar] [CrossRef]

- Roberts, E.B. Managing Invention and Innovation. Res. Technol. Manag. 2007, 50, 35–54. [Google Scholar] [CrossRef]

- Dewangan, V.; Godse, M. Towards a holistic enterprise innovation performance measurement system. Technovation 2014, 34, 536–545. [Google Scholar] [CrossRef]

- Freeman, C.; Soete, L. Developing science, technology and innovation indicators: What we can learn from the past. Res. Policy 2009, 38, 583–589. [Google Scholar] [CrossRef]

- Evanschitzky, H.; Eisend, M.; Calantone, R.J.; Jiang, Y. Success factors of product innovation: An updated meta-analysis. J. Prod. Innov. Manag. 2012, 29, 21–37. [Google Scholar] [CrossRef]

- Archibugi, D.; Planta, M. Measuring technological change through patents and innovation surveys. Technovation 1996, 16, 451–519. [Google Scholar] [CrossRef]

- Adams, R.; Bessant, J.; Phelps, R. Innovation management measurement: A review. Int. J. Manag. Rev. 2006, 8, 21–47. [Google Scholar] [CrossRef]

- Cruz-Cázares, C.; Bayona-Sáez, C.; García-Marco, T. You can’t manage right what you can’t measure well: Technological innovation efficiency. Res. Policy 2013, 42, 1239–1250. [Google Scholar] [CrossRef]

- Dodgson, M.; Hinze, S. Indicators used to measure the innovation process: Defects and possible remedies. Res. Eval. 2000, 9, 101–114. [Google Scholar] [CrossRef]

- OECD. Oslo Manual: The Measurement of Scientific and Technological Activities: Proposed Guidelines for Collecting and Interpreting Technological Innovation Data, 3rd ed.; OECD: Paris, France, 2005; p. 46. [Google Scholar]

- Kalantaridis, C. Processes of innovation among manufacturing SMEs: The experience of Bedfordshire. Entrep. Reg. Dev. 1999, 11, 57–78. [Google Scholar] [CrossRef]

- Kam, W.P.; Kiese, M.; Singh, A.; Wong, F. The pattern of innovation in Singapore’s manufacturing sector. Singap. Manag. Rev. 2003, 25, 1–34. [Google Scholar]

- Quadros, R.; Furtado, A.; Bernardes, R.; Franco, E. Technological innovation in Brazilian industry: An assessment based on the São Paulo innovation survey. Technol. Forecast. Soc. Chang. 2001, 67, 203–219. [Google Scholar] [CrossRef]

- Uzun, A. Technological innovation activities in Turkey: The case of manufacturing industry, 1995–1997. Technovation 2001, 21, 189–196. [Google Scholar] [CrossRef]

- Baptista, R.; Swann, P. Do firms in clusters innovate more? Res. Policy 1998, 27, 525–540. [Google Scholar] [CrossRef]

- Michie, J.; Sheehan, M. Labour market deregulation,‘flexibility’and innovation. Camb. J. Econ. 2003, 27, 123–143. [Google Scholar] [CrossRef]

- Zahra, S.A. Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. J. Bus. Ventur. 1993, 8, 319–340. [Google Scholar] [CrossRef]

- Blundell, R.; Griffith, R.; Van Reenen, J. Market share, market value and innovation in a panel of British manufacturing firms. Rev. Econ. Stud. 1999, 66, 529–554. [Google Scholar] [CrossRef]

- Koeller, C.T. Innovation, market structure and firm size: A simultaneous equations model. Manag. Decis. Econ. 1995, 16, 259–269. [Google Scholar] [CrossRef]

- Nielsen, A.O. Patenting, R&D and market structure: Manufacturing firms in Denmark. Technol. Forecast. Soc. Chang. 2001, 66, 47–58. [Google Scholar]

- Smolny, W. Determinants of innovation behaviour and investment estimates for West-German manufacturing firms. Econ. Innov. New Technol. 2003, 12, 449–463. [Google Scholar] [CrossRef]

- Debackere, K.; Clarysse, B.; Rappa, M.A. Dismantling the ivory tower: The influence of networks on innovative output in emerging technologies. Technol. Forecast. Soc. Chang. 1996, 53, 139–154. [Google Scholar] [CrossRef]

- Beneito, P. Choosing among alternative technological strategies: An empirical analysis of formal sources of innovation. Res. Policy 2003, 32, 693–713. [Google Scholar] [CrossRef]

- Love, J.H.; Ashcroft, B. Market versus corporate structure in plant-level innovation performance. Small Bus. Econ. 1999, 13, 97–109. [Google Scholar] [CrossRef]

- González-Blanco, J.; Coca-Pérez, J.; Guisado-González, M. The Contribution of Technological and Non-Technological Innovation to Environmental Performance. An Analysis with a Complementary Approach. Sustainability 2018, 10, 4014. [Google Scholar] [CrossRef]

- Brouwer, E.; Budil-Nadvornikova, H.; Kleinknecht, A. Are urban agglomerations a better breeding place for product innovation? An analysis of new product announcements. Reg. Stud. 2010, 33, 541–549. [Google Scholar] [CrossRef]

- Kaufmann, A.; Tödtling, F. Science–industry interaction in the process of innovation: The importance of boundary-crossing between systems. Res. Policy 2001, 30, 791–804. [Google Scholar] [CrossRef]

- Wang, L. A study on innovation performance measurement of college students’ venture enterprise based on SFA model. J. Comput. 2012, 7, 1974–1981. [Google Scholar] [CrossRef]

- De Fuentes, C.; Dutrenit, G.; Santiago, F.; Gras, N. Determinants of innovation and productivity in the service sector in Mexico. Emerg. Mark. Financ. Trade 2015, 51, 578–592. [Google Scholar] [CrossRef]

- Kamasak, R. Determinants of innovation performance: A resource-based study. Procedia-Soc. Behav. Sci. 2015, 195, 1330–1337. [Google Scholar] [CrossRef]

- Frey, M.; Iraldo, F.; Testa, F. The determinants of innovation in green supply chains: Evidence from an Italian sectoral study. R D Manag. 2013, 43, 352–364. [Google Scholar] [CrossRef]

- MacPherson, A.D. Academic-industry linkages and small firm innovation: Evidence from the scientific instruments sector. Entrep. Reg. Dev. 1998, 10, 261–276. [Google Scholar] [CrossRef]

- Romijn, H.; Albaladejo, M. Determinants of innovation capability in small electronics and software firms in southeast England. Res. Policy 2002, 31, 1053–1067. [Google Scholar] [CrossRef]

- Keizer, J.A.; Dijkstra, L.; Halman, J.I. Explaining innovative efforts of SMEs. An exploratory survey among SMEs in the mechanical and electrical engineering sector in The Netherlands. Technovation 2002, 22, 1–13. [Google Scholar] [CrossRef]

- Trąpczyński, P.; Puślecki, Ł.; Staszków, M. Determinants of Innovation Cooperation Performance: What Do We Know and What Should We Know? Sustainability 2018, 10, 4517. [Google Scholar] [CrossRef]

- Cooke, P.; Uranga, M.G.; Etxebarria, G. Regional innovation systems: Institutional and organisational dimensions. Res. Policy 1997, 26, 475–491. [Google Scholar] [CrossRef]

- Storper, M.; Harrison, B. Flexibility, hierarchy and regional development: The changing structure of industrial production systems and their forms of governance in the 1990s. Res. Policy 1991, 20, 407–422. [Google Scholar] [CrossRef]

- Dicken, P.; Forsgren, M.; Malmberg, A. The local embeddness of transnational corporations. In Globalization, Institutions, and Regional Development in Europe; Amin, A., Thrift, N., Eds.; Oxford University Press: New York, NY, USA, 1995; pp. 23–45. [Google Scholar]

- Landry, R.; Amara, N.; Lamari, M. Does social capital determine innovation? To what extent? Technol. Forecast. Soc. Chang. 2002, 69, 681–701. [Google Scholar] [CrossRef]

- Ritter, T.; Gemünden, H.G. Network competence: Its impact on innovation success and its antecedents. J. Bus. Res. 2003, 56, 745–755. [Google Scholar] [CrossRef]

- Souitaris, V. Technological trajectories as moderators of firm-level determinants of innovation. Res. Policy 2002, 31, 877–898. [Google Scholar] [CrossRef]

- Beugelsdijk, S.; Cornet, M. ‘A far friend is worth more than a good neighbour’: Proximity and innovation in a small country. J. Manag. Gov. 2002, 6, 169–188. [Google Scholar] [CrossRef]

- Coombs, R.; Tomlinson, M. Patterns in UK company innovation styles: New evidence from the CBI innovation trends survey. Technol. Anal. Strateg. Manag. 1998, 10, 295–310. [Google Scholar] [CrossRef]

- Love, J.H.; Roper, S. Location and network effects on innovation success: Evidence for UK, German and Irish manufacturing plants. Res. Policy 2001, 30, 643–661. [Google Scholar] [CrossRef]

- Avermaete, T.; Viaene, J.; Morgan, E.J.; Pitts, E.; Crawford, N.; Mahon, D. Determinants of product and process innovation in small food manufacturing firms. Trends Food Sci. Technol. 2004, 15, 474–483. [Google Scholar] [CrossRef]

- Åstebro, T.; Michela, J.L. Predictors of the survival of innovations. J. Prod. Innov. Manag. 2005, 22, 322–335. [Google Scholar] [CrossRef]

- Bullinger, H.-J.; Bannert, M.; Brunswicker, S. Managing innovation capability in SMEs. The Fraunhofer three-stage approach. Tech Monit. 2007, 24, 17–27. [Google Scholar]

- Freeman, C. The economics of technical change. Camb. J. Econ. 1994, 18, 463–514. [Google Scholar] [CrossRef]

- Griffin, A.; Page, A.L. An interim report on measuring product development success and failure. J. Prod. Innov. Manag. 1993, 10, 291–308. [Google Scholar] [CrossRef]

- Hollenstein, H. Innovation modes in the Swiss service sector: A cluster analysis based on firm-level data. Res. Policy 2003, 32, 845–863. [Google Scholar] [CrossRef]

- Thongsri, N.; Chang, A. Interactions Among Factors Influencing Product Innovation and Innovation Behaviour: Market Orientation, Managerial Ties, and Government Support. Sustainability 2019, 11, 2793. [Google Scholar] [CrossRef]

- Darroch, J.; McNaughton, R. Examining the link between knowledge management practices and types of innovation. J. Intell. Cap. 2002, 3, 210–222. [Google Scholar] [CrossRef]

- Koberg, C.S.; Uhlenbruck, N.; Sarason, Y. Facilitators of organizational innovation: The role of life-cycle stage. J. Bus. Ventur. 1996, 11, 133–149. [Google Scholar] [CrossRef]

- Koschatzky, K.; Bross, U.; Stanovnik, P. Development and innovation potential in the Slovene manufacturing industry: Analysis of an industrial innovation survey. Technovation 2001, 21, 311–324. [Google Scholar] [CrossRef]

- Koeller, C.T. Union membership, market structure, and the innovation output of large and small firms. J. Labor Res. 1996, 17, 683–699. [Google Scholar] [CrossRef]

- Baldwin, J.R.; Johnson, J. Business strategies in more-and less-innovative firms in Canada. Res. Policy 1996, 25, 785–804. [Google Scholar] [CrossRef]

- Bughin, J.; Jacques, J.-M. Managerial efficiency and the Schumpeterian link between size, market structure and innovation revisited. Res. Policy 1994, 23, 653–659. [Google Scholar] [CrossRef]

- Damanpour, F. Organizational size and innovation. Organ. Stud. 1992, 13, 375–402. [Google Scholar] [CrossRef]

- Majumdar, S.K. The determinants of investment in new technology: An examination of alternative hypotheses. Technol. Forecast. Soc. Chang. 1995, 50, 235–247. [Google Scholar] [CrossRef]

- Tsai, W. Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar]

- González-Benito, Ó.; Muñoz-Gallego, P.A.; García-Zamora, E. Entrepreneurship and market orientation as determinants of innovation: The role of business size. Int. J. Innov. Manag. 2015, 19, 1550035. [Google Scholar] [CrossRef]

- Aldieri, L.; Vinci, C. Firm Size and Sustainable Innovation: A Theoretical and Empirical Analysis. Sustainability 2019, 11, 2775. [Google Scholar] [CrossRef]

- Andries, P.; Stephan, U. Environmental Innovation and Firm Performance: How Firm Size and Motives Matter. Sustainability 2019, 11, 3585. [Google Scholar] [CrossRef]

- Bertschek, I.; Entorf, H. On nonparametric estimation of the Schumpeterian link between innovation and firm size: Evidence from Belgium, France, and Germany. Empir. Econ. 1996, 21, 401–426. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Schumpeter, J.A. Socialism, Capitalism and Democracy; Harper and Brothers: New York, NY, USA, 1942. [Google Scholar]

- Sørensen, J.B.; Stuart, T.E. Aging, obsolescence, and organizational innovation. Adm. Sci. Q. 2000, 45, 81–112. [Google Scholar] [CrossRef]

- Krasniqi, B.A.; Kutllovci, E.A. Determinants of innovation: Evidence from Czech Republic, Poland and Hungary. Int. J. Technoentrep. 2008, 1, 378–404. [Google Scholar] [CrossRef]

- Freel, M. External linkages and product innovation in small manufacturing firms. Entrep. Reg. Dev. 2000, 12, 245–266. [Google Scholar] [CrossRef]

- Love, J.H.; Ashcroft, B.; Dunlop, S. Corporate structure, ownership and the likelihood of innovation. Appl. Econ. 1996, 28, 737–746. [Google Scholar] [CrossRef]

- Martinez-Ros, E. Explaining the decisions to carry out product and process innovations: The Spanish case. J. High Technol. Manag. Res. 1999, 10, 223–242. [Google Scholar] [CrossRef]

- Bishop, P.; Wiseman, N. External ownership and innovation in the United Kingdom. Appl. Econ. 1999, 31, 443–450. [Google Scholar] [CrossRef]

- Propris, L.D. Innovation and inter-firm co-operation: The case of the West Midlands. Econ. Innov. New Technol. 2000, 9, 421–446. [Google Scholar] [CrossRef]

- Song, C.; Oh, W. Determinants of innovation in energy intensive industry and implications for energy policy. Energy Policy 2015, 81, 122–130. [Google Scholar] [CrossRef]

- Arvanitis, S.; Sydow, N.; Woerter, M. Is there any impact of university–industry knowledge transfer on innovation and productivity? An empirical analysis based on Swiss firm data. Rev. Ind. Organ. 2008, 32, 77–94. [Google Scholar] [CrossRef]

- Jacobsson, S.; Oskarsson, C.; Philipson, J. Indicators of technological activities-comparing educational, patent and R&D statistics in the case of Sweden. Res. Policy 1996, 25, 573–585. [Google Scholar]

- Flor, M.L.; Oltra, M.J. Identification of innovating firms through technological innovation indicators: An application to the Spanish ceramic tile industry. Res. Policy 2004, 33, 323–336. [Google Scholar] [CrossRef]

- Sosnowski, J. Precipitating innovations by academia and industry feedback. Procedia-Soc. Behav. Sci. 2014, 109, 113–119. [Google Scholar] [CrossRef][Green Version]

- Kleinknecht, A. Why do we need new innovation output indicators? An introduction. In New Concepts in Innovation Output Measurement; Kleinknecht, A., Bain, D., Eds.; Palgrave Macmillan: London, UK, 1993; pp. 1–9. [Google Scholar]

- Cavdar, S.C.; Aydin, A.D. An empirical analysis about technological development and innovation indicators. Procedia-Soc. Behav. Sci. 2015, 195, 1486–1495. [Google Scholar] [CrossRef]

- Raymond, L.; St-Pierre, J. R&D as a determinant of innovation in manufacturing SMEs: An attempt at empirical clarification. Technovation 2010, 30, 48–56. [Google Scholar]

- Sternberg, R.; Arndt, O. The firm or the region: What determines the innovation behavior of European firms? Econ. Geogr. 2001, 77, 364–382. [Google Scholar] [CrossRef]

- Pekovic, S.; Lojpur, A.; Pejic-Bach, M. Determinants of innovation intensity in developed and in developing economies: The case of France and Croatia. Int. J. Innov. Manag. 2015, 19, 1550049. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and learning: The two faces of R&D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Graves, S.B.; Langowitz, N.S. R&D productivity: A global multi-industry comparison. Technol. Forecast. Soc. Chang. 1996, 53, 125–137. [Google Scholar]

- Kim, C.Y.; Lim, M.S.; Yoo, J.W. Ambidexterity in External Knowledge Search Strategies and Innovation Performance: Mediating Role of Balanced Innovation and Moderating Role of Absorptive Capacity. Sustainability 2019, 11, 5111. [Google Scholar] [CrossRef]

- Loredo, E.; Mielgo, N.; Pineiro-Villaverde, G.; García-Álvarez, M.T. Utilities: Innovation and Sustainability. Sustainability 2019, 11, 1085. [Google Scholar] [CrossRef]

- Hastuti, W.; Mardani, A.; Streimikiene, D.; Sharifara, A.; Cavallaro, F. The Role of Process Innovation between Firm-Specific Capabilities and Sustainable Innovation in SMEs: Empirical Evidence from Indonesia. Sustainability 2018, 10, 2244. [Google Scholar] [CrossRef]

- Pisano, G.P.; Shan, W.; Teece, D.J. Joint ventures and collaboration in the biotechnology industry. In International Collaborative Ventures in US Manufacturing; Mowery, D., Ed.; Ballinger Publishing Company: Cambridge, MA, USA, 1988. [Google Scholar]

- Mohnen, P.; Hoareau, C. What type of enterprise forges close links with universities and government labs? Evidence from CIS 2. Manag. Decis. Econ. 2003, 24, 133–145. [Google Scholar] [CrossRef]

- Miotti, L.; Sachwald, F. Co-operative R&D: Why and with whom?: An integrated framework of analysis. Res. Policy 2003, 32, 1481–1499. [Google Scholar]

- Becker, W.; Dietz, J. R&D cooperation and innovation activities of firms-evidence for the German manufacturing industry. Res. Policy 2004, 33, 209–223. [Google Scholar]

- Sampson, R.C. R&D alliances and firm performance: The impact of technological diversity and alliance organization on innovation. Acad. Manag. J. 2007, 50, 364–386. [Google Scholar]

- Abramovsky, L.; Kremp, E.; López, A.; Schmidt, T.; Simpson, H. Understanding co-operative innovative activity: Evidence from four European countries. Econ. Innov. New Technol. 2009, 18, 243–265. [Google Scholar] [CrossRef]

- Freel, M.S.; Harrison, R.T. Innovation and cooperation in the small firm sector: Evidence from ‘Northern Britain’. Reg. Stud. 2006, 40, 289–305. [Google Scholar] [CrossRef]

- Harrigan, K.R. Joint ventures and competitive strategy. Strateg. Manag. J. 1988, 9, 141–158. [Google Scholar] [CrossRef]

- Kogut, B. Joint ventures: Theoretical and empirical perspectives. Strateg. Manag. J. 1988, 9, 319–332. [Google Scholar] [CrossRef]

- Kesteloot, K.; Veugelers, R. Stable R&D cooperation with spillovers. J. Econ. Manag. Strategy 1995, 4, 651–672. [Google Scholar]

- Barkema, H.G.; Vermeulen, F. What differences in the cultural backgrounds of partners are detrimental for international joint ventures? J. Int. Bus. Stud. 1997, 28, 845–864. [Google Scholar] [CrossRef]

- Mora-Valentin, E.M.; Montoro-Sanchez, A.; Guerras-Martin, L.A. Determining factors in the success of R&D cooperative agreements between firms and research organizations. Res. Policy 2004, 33, 17–40. [Google Scholar]

- Lhuillery, S.; Pfister, E. R&D cooperation and failures in innovation projects: Empirical evidence from French CIS data. Res. Policy 2009, 38, 45–57. [Google Scholar]

- Mata, J.; Woerter, M. Risky innovation: The impact of internal and external R&D strategies upon the distribution of returns. Res. Policy 2013, 42, 495–501. [Google Scholar]

- Ozman, M. Inter-firm networks and innovation: A survey of literature. Econ. Innov. New Technol. 2009, 18, 39–67. [Google Scholar] [CrossRef]

- Oliver, C. Determinants of interorganizational relationships: Integration and future directions. Acad. Manag. Rev. 1990, 15, 241–265. [Google Scholar] [CrossRef]

- Okamuro, H. Determinants of successful R&D cooperation in Japanese small businesses: The impact of organizational and contractual characteristics. Res. Policy 2007, 36, 1529–1544. [Google Scholar]

- Cassiman, B.; Veugelers, R. In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar]

- Beneito, P. The innovative performance of in-house and contracted R&D in terms of patents and utility models. Res. Policy 2006, 35, 502–517. [Google Scholar]