Abstract

The sharing economy is treated as an alternative consumption model. Its aim is to increase the efficiency of the resources used and create a new value for society. In order to create a new value for business, attempts are being made to implement a shared economy model in the B2B (business-to-business) sector. While this model is effectively implemented in the case of B2C (business-to-consumer) relations, sharing resources is still a problem in the business environment. In the case of B2B relationships, the use of the sharing economy has a number of unresolved issues concerning legal regulations, responsibility, and security. The research presented in this article includes the analysis and assessment of the sharing economy between enterprises in order to identify whether, and in what way, the exchange of material resources between them is implemented. In order to indicate what factors motivate enterprises for sharing and using the resources of other companies, the selected methods of statistical testing were applied. The empirical research was preceded by the literature analysis in which the basic concepts and aspects of the concept of the sharing economy was referred to against the background of the fourth industrial revolution. The obtained results showed that enterprises which have fixed assets are willing to exchange them with other entities. At the same time, the lack of formal and technological solutions is the most important barrier in implementing the economy of sharing in B2B.

1. Introduction

The rapidity and quality of the transmitted information and the related increasing pace of the spread of new information and communication technologies caused various changes in the economy. Deep social change and the accompanying digital revolution have meant that owned goods cease to be treated as the most important value [1,2]. As a result, a new business model based on the exchange of resources was created. The previous research shows that cooperation in interorganizational networks allows for generating benefits through sharing resources, knowledge, competence, which leads to the achievement of common goals and benefits [3,4,5,6].

Modern technologies and solutions available in the new industrial revolution allow for the implementation of a new business model based on the exchange of all the available assets and their optimal use [7,8,9]. Connection of the network of entities and innovative information technology allow for an increase in the productivity of the company’s resources, as well as an increase in the efficiency of business processes [10,11]. This means the readiness to implement tasks associated with streamlining the flow of physical resources and exchange of information [12], at the same time, expecting the increased production but with the same resources [13,14]. The exchange of resources is reasonably justified in the change in the production paradigm (Table 1), i.e. the transition from mass production to individual production.

Table 1.

The evolution of production methods [20].

As far as mass production does not engage the customer at all, in the case of mass customization, it is the customer that decides on the final product. This stage corresponds with new goals and directions associated with a flexible market activity and assumes that no entity has all the resources necessary to achieve the indicated objectives of the market [15,16,17,18]. As a result, both in the vertical and horizontal value chain, an important part of the current functioning of the entity on the market is the effective management of assets [19].

The paper is organized as follows. Section 2 presents the objectives and challenges of the sharing economy in the contemporary economy, which are presented to the society and entrepreneurs. Section 3 presents the results of the research into the implementation of the concept of sharing between enterprises. The discussion on the obtained results is held in Section 4. Section 5 includes the final conclusions and the directions of future research.

2. Literature Review

2.1. The Concept of the Sharing Economy

Economy sharing is a socioeconomic model which is based on sharing unutilized resources with other market participants. Intelligent technological and communication solutions are to facilitate sharing resources or products which are not fully used within the framework of the sharing economy [21]. The sharing economy is the opposite of the classical economy consisting in possession. It allows for using goods and commodities with no need to possess them; therefore, its main idea is based on the change in the approach to possession and, consequently, cost reduction [22,23,24,25].

A significant impact on the development of the concept of the sharing economy is exerted by the mass spread of new technologies. They reduced the distance between different market participants, creating entirely new prospects for cooperation. Mainly due to the role of the Internet, the model of sharing resources has been the most common among households and local communities so far. It involves a whole range of behavior based on the temporary use of goods and services [26,27]. Most frequently, this applies to services of renting an apartment, a car, or equipment. So far, the sharing economy has contributed to benefits for numerous companies, particularly from the transport, hospitality, or tourism sectors [28]. Companies such as Uber, Blablacar, or Lyft, by linking drivers having free time and a car with people who need transport, have become serious competitors for classic transport companies. Another example of the use of the idea of the sharing economy refers to the Airbnb service, which links tourists seeking accommodation with landlords and efficiently competes with the hospitality industry.

The research carried out by PWC (PricewaterhouseCoopers indicates that the way of thinking changes by the value which comes with ownership. The vast majority of the respondents (81%) prefer using the goods and services of others rather than possessing them, which is most frequently regarded as an unnecessary burden on the budget. More than half (57%) perceive the idea of access to resources as an attractive alternative to ownership [29,30]. According to the report by the French Institute for Sustainable Development and International Relations, the households practicing the idea of common consumption are able to reduce their expenditure even up to 7% while simultaneously also reducing the level of waste to 20% [31]. At the same time, the idea of the sharing economy also has its opponents. Numerous doubts primarily relate to the rights and obligations of people providing services and the nature of responsibility. An important problem in terms of future regulations is also to determine the form of employment of such a service provider. The advantages and disadvantages of the concept of the sharing economy are presented in Table 2.

Table 2.

Advantages and disadvantages of the concept of the sharing economy [32,33].

In spite of uncertainty, the companies and people providing services in the sharing economy model have an opportunity to make money. It is predicted that the income from the sharing economy will be about $335 billion by 2015, which indicates more than a 200% increase in relation to 2015 [34].

The concept of sharing is also used among enterprises. As a result of changing technologies, cooperation between many sectors of the economy is intensifying. This, in turn, significantly reduces transaction costs and opens up new opportunities for alternative forms of business relationships [35,36]. Their functioning is conditioned by certain factors [32,37,38]:

- releasing redundant or not fully used resources;

- creating the mission based on transparency, authenticity, and trust;

- support and mutual respect in relation to suppliers and customers in the supply chain;

- improving benefits resulting from access to goods and services for customers;

- networking nature of the company.

As a result of sharing resources between enterprises, there is a new market model known as coopetition. In the era of Industry 4.0, it means the cooperation between market competitors in order to reduce own operating costs. This model takes the form of partnership, the ultimate goal of which is to operate for the benefit of consumers [39].

2.2. Sharing Economy in the Activities of Contemporary Enterprises

The basis for the operation of each company is to collect the right amount and quality of resources among which an important place is occupied by material resources, i.e. real estate, equipment, machinery, raw materials, tools, means of transport, materials, or products. Some material resources (e.g., specialized equipment) are expensive and not all companies can afford them. In such situations, it is worth using the resources belonging to other companies based on the concept of the sharing economy. Thus, enterprises can acquire necessary material resources cheaper and operate more flexibly. Moreover, the cost of the ownership of the resource is usually much higher than the cost of the use or access to the service. Additionally, the possessed resources usually remain unused for most of the time [40,41]. The use of sharing resources is fully justified in such a case [22,42].

The sharing economy is an intelligent solution for resource management in the fourth industrial revolution [43,44]. The application of the sharing economy in the activities of enterprises allows for changing the approach to the management and use of assets, translating into an increase in savings and efficiency based on mutual cooperation [45]. This cooperation can be based on various principles; however, there is one objective, i.e. the effective use of production resources which are not used in the production process continuously.

The use of the sharing economy among enterprises, compliant with the conditions of Industry 4.0, is possible among those related to each other via networking. Therefore, it can be assumed that the contemporary enterprise operates as a network organization, provided that there are efficient information links, the result of which is the implemented concept of flexible and effective management of assets [46,47]. Therefore, the sharing economy means something more than focusing on the efficiency of a single company. The concept allows for sustainable development in the era of Industry 4.0 for many companies at the same time.

The exchange of resources in cooperation networks is particularly important for the sector of small and medium enterprises which, due to the complexity of products and processes, most often have limited resources [48]. Within the framework of cooperation, the market risk is balanced and the combined resources may increase the potential of market opportunities previously unnoticed with no need for further investments [49,50]. As a result of the network organization based on modern communication technologies and further resource exchange, the companies remaining in cooperation may easily adapt to changing market conditions and shortened product life cycle [51,52].

The implementation of the concept of the sharing economy at the level of business relationships allows for [33,53,54]:

- reducing production costs;

- responding flexibly to the needs and expectations of customers;

- rebranding the company faster through effective liquidation of assets;

- making more flexible and fulfilling more complex orders cheaper than before;

- including suppliers and customers in the production process, sales, and distribution.

In order to build a competitive advantage of the company, it is necessary to use the solutions compliant with the standard of Industry 4.0 since, only in this way, is it possible to implement the combination resulting from reduction in costs of mass production and far-advanced product customization. According to Z. Bentyn, the management of the flow of resources will be easier due to the reflection of the movement of products in the virtual supply chain [55]. Taking into account the fear of companies associated with Industry 4.0, including a) uncertainties related to the return-on-investment; b) security concerns; and, c) lack of trust in the maturity of new technologies, the effective and continuous exchange of resources can also be handicapped [56].

It is certain that management aspects associated with the exchange of assets will constitute new challenges for organizations operating in the era of Industry 4.0. M. Brkljač and T. Sudarević [57] claim that one should not exclude the emergence of a business model in which the concepts of the sharing economy and Industry 4.0 will be inseparable. A lot of enterprises possess spare capacities which can be shared with other companies on the basis of cooperation networks and exchange of information [58]. Since the concept of the sharing economy indicates similarities with the objectives of Industry 4.0 at different levels, the results obtained from the research into the approach of different enterprises to the exchange of resources can provide an understanding of their attitudes towards flexible innovative business models created in Industry 4.0 [59,60].

3. Research Methodology

Literature studies indicated that management of resources is an important part of the social and environmental policy. However, the limited research in this area does not indicate clearly what this phenomenon looks like in the economic practice and what its range is. As a result of the conducted research, the information on the use of resource exchange among the surveyed enterprises was collected. The primary objective of the empirical part was to respond to the question: Do companies possess redundant or unused assets? And if so, are they able to benefit from this? In order to search for the responses to these questions, in the first quarter of 2019, the nationwide survey was conducted, concerning the level and type of the redundant assets owned and the ways of their management in enterprises with a different type of activity.

The size of the research sample was 352 entities, among which the number of enterprises, broken down by the number of employees, was distributed evenly. In the research, broken down by the number of employees, a similar number of entities participated (26% of micro-enterprises; 25% of small ones; 24% of medium ones; and 25% of large ones). The data collection was carried out randomly using the CATI method (Computer Assisted Telephone Interviews). This method allowed for the rapid collection of necessary data and, simultaneously, the reduction in the number of possible errors committed by the respondents. During the ongoing telephone session, the questions are displayed on the interviewer’s computer screen, which enables the control of the accuracy of the record of responses. Consequently, the reliability of the responses obtained from the respondents increased [61,62].

The main hypothesis assumes:

The main hypothesis: Enterprises use the sharing economy in their activities depending on the assets possessed and fixed costs generated.

The verification of the main hypothesis consisted of a few stages:

- Firstly, the assessment of the potential for resource exchange between enterprises ought to be made;

- Secondly, it should be verified whether the surveyed enterprises exchange resources with each other;

- Groups of enterprises broken down by the applied model of resource exchange should be identified;

- Subsequently, it is necessary to examine the impact of the level of the resources possessed on the occurrence of the motivation to exchange them with other entities.

4. Results

4.1. The Assessment of the Potential for Resource Exchange Between Enterprises

Here, the exchange potential is understood as the level of assets which can be partially subject to exchange between different entities (Table 3).

Table 3.

Assets structure of the surveyed entities.

The preliminary research indicated that the vast majority of enterprises have less than 60% of fixed assets in total assets. In most cases, less than 20% of these assets are used seasonally or temporarily. The vast majority of these enterprises possess material resources which they use continuously in their activities. Fixed costs invariably remain at the same level per annum and, among others, they depend on the costs of maintenance of assets; therefore, the willingness to reduce fixed costs should also result from the disposal of redundant assets in the company. In the surveyed entities, the share of fixed costs per annum in total costs is most frequently at the level of not more than 60%. This means the possibilities of exchanging resources which are involved temporarily, which are redundant or unused. At the same time, 96% of the surveyed enterprises declared they had ever possessed redundant assets. The structure of material resources which remain unused most frequently in the company’s activity during the year is the following:

- Machinery and equipment (40.1%);

- Stocks of raw materials, materials, and intermediate goods (35.5%);

- Ancillary and buffer stocks (21%).

Therefore, it can be observed that enterprises possess the potential to use the concept of the sharing economy, particularly in the area of machinery and equipment as well as stocks. As far as stocks constituting a part of current assets that can be efficiently liquidated and the related funds can be recovered, it is much harder to get rid of the equipment which is needed in the activity of the entity only in selected periods.

The preliminary analyses indicated that enterprises possess the physical potential to use the concept of the sharing economy since they own the assets, in particular, machinery and equipment, which are not fully used. Moreover, these enterprises indicate the possession of redundant assets which they most frequently sell (62%) or lend for fee or donate (36%). However, it should be assumed that this is only the assets which are not used in the enterprise at all. The remaining redundant assets are most often lent and they are unnecessary only temporarily.

4.2. The Level of Resource Exchange Between Enterprises

The exchange of resources between enterprises was considered in the category of the form and direction of their flow. The one-way and two-way flow, as well as the form of partial or temporary exchange, were taken into account. It was assumed that enterprises may exchange resources:

- partially—to transmit only this part of the resources which they do not need at all; in this case, the most frequent form of transmission is sales;

- temporarily—to transmit only this part of the resources which they do not need at a specific time; in this case, the most common form of transmission is lend for fee or donation;

- one-way—only to share their resources or exclusively to use the resources of other companies;

- two-way—to share their resources and use the resources of other companies simultaneously.

The possibility that enterprises do not show the willingness to exchange resources was also taken into consideration. Table 4 presents habits concerning sharing resources in the surveyed enterprises.

Table 4.

The sharing of resources with the environment

Every third company does not decide on sharing its resources; however, they are already less reluctant to reach for the resources of other companies. In turn, every third company uses the external resources temporarily and shares them in this form slightly more often. Taking into account the possibility of partial transmission, enterprises more frequently reach for their own resources than those of others. The obtained indications are comparable with each other. At the same time, it can be observed that sharing resources based on the existing outsourcing relationship occurs only in few cases.

In the case of most enterprises, the flow of assets based on temporary or partial exchange can be observed. For the significant share of entities (every third one) there is no need to exchange resources in their activities.

The overwhelming number of companies which decide on the mutual transmission of assets allows the positive verification of the first part of the main hypothesis, which assumes that enterprises use the concept of the sharing economy in their activities.

4.3. The Identification of Groups of Enterprises Broken Down by the Applied Model of Resource Exchange

For the purpose of the assessment of the impact of the assets possessed and costs generated on the approach towards sharing resources, first of all, the groups of enterprises were isolated, broken down by the applied model of exchange of resources. In order to present some significant relationships between the possible ways of resource exchange (see: Table 4), the Chi-square correlation analysis was carried out (Table 5).

Table 5.

A correlation matrix for model of exchange of resources.

The results allowed for identification of the following significant pairs of variables, where:

- a)

- χ2 (1, N = 352) = 0.389, p < 0.001 means that the entity which indicated P8_1, equally often indicated P8_2;

- b)

- χ2 (1, N = 352) = −0.459, p < 0.001 and for χ2 (1, N = 352) = −0.325, p < 0.001 means that the company which indicated P8_1 simultaneously did not indicate P8_3 and P8_4;

- c)

- χ2 (1, N = 352) = −0.458, p < 0.001 and for χ2 (1, N = 352) = −0.427, p < 0.001 means that the company which indicated P8_2 simultaneously did not indicate P8_3 and P8_4;

- d)

- χ2 (1, N = 352) = 0.312, p < 0.001, means that the company which indicated P8_3, equally often indicated P8_4;

- e)

- χ2 (1, N = 352) = 0.595, p < 0.001, means that the company which indicated P8_5 equally often indicated P8_6;

- f)

- χ2 (1, N = 352) = −0.116, p < 0,001 and for χ2 (1, N = 352) = −0.115, p < 0.001 means that the company which indicated P8_5 simultaneously did not indicate P8_3 and P8_4;

- g)

- χ2 (1, N = 352) = −0.199, p < 0,001 means that the company which indicated P8_6 simultaneously did not indicate P8_3 and P8_4.

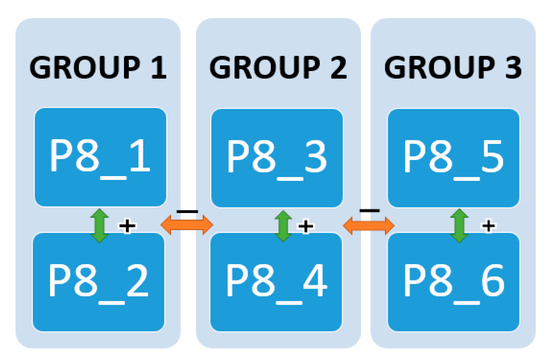

Significant correlations between the selected pairs of variables allowed the isolation of specific groups of enterprises broken down by the practiced approach to the concept of sharing. The graphical illustration of the combinations is presented in Figure 1.

Figure 1.

Graphical relationships between groups of enterprises.

- Group 1. The enterprises which share resources temporarily:A. share their resources B. use the resources of others C. simultaneously share and use

- Group 2. The enterprises which share resources partially:A. share their resources B. use the resources of others C. simultaneously share and use

- Group 3. The enterprises which do not share resources:A. do not share their resources B. do not use the resources of others C. simultaneously do not share and use

Subsequently, the results of indications based on new groups of the application of the concept of the sharing economy were examined. The results of these groups were presented as a percentage in Table 6.

Table 6.

The number of enterprises broken down by the model of use of resource exchange.

The most frequently practiced model in the case of entities which apply the concept of the sharing economy is the two-way resource exchange. In a situation where enterprises do not decide on exchange, they most often do not share their resources. This allows for the conclusion that, if enterprises implement the concept of the sharing economy, this is most frequently realized through mutual exchange of assets.

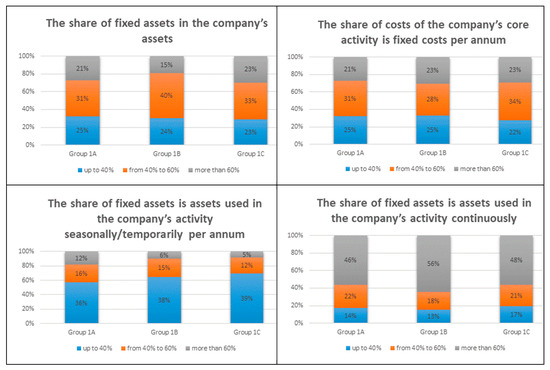

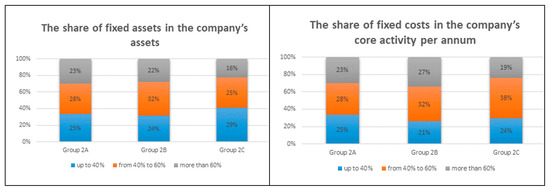

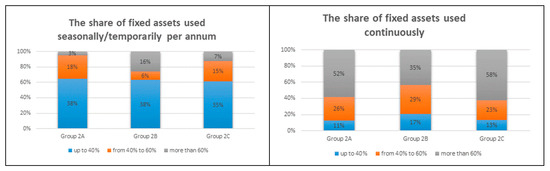

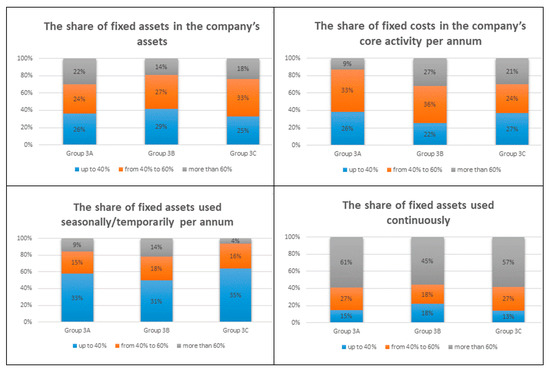

Subsequently, the detailed analysis of the structure of assets and fixed costs was conducted in relation to the applied model of resource exchange in the surveyed companies. The results were presented graphically for the three previously isolated groups (Figure 2, Figure 3 and Figure 4).

Figure 2.

The characteristics of management of fixed assets in Group 1.

Figure 3.

The characteristics of management of fixed assets in Group 2.

Figure 4.

The characteristics of management of fixed assets in Group 3.

When comparing the conditions for the company’s asset management for Group 1, the same trends are observed between the three subgroups. In each of the groups, the share of fixed assets in the company’s assets most often ranges from 40% to 60%; fixed costs are at the same level. The group of these enterprises has up to 40% of fixed assets which are used seasonally/temporarily; on the other hand, the majority of them have more than 80% of assets used in the company continuously.

Also, in Group 2, the same trends for the share of assets and fixed costs are observed. In each of the subgroups, the share of fixed assets in the company’s assets most frequently ranges from 40% to 60%, fixed costs are at the same level. The share of fixed assets most often amounts up to 40% of fixed assets which are used seasonally/temporarily and more than 80% of assets used continuously.

In Group 3, it can be observed that the share of fixed assets amounts to up to 40% for enterprises which operate following the two-way exchange. In turn, enterprises which share resources one-way possess from 40% to 60% of fixed assets. Fixed costs most commonly range from 40% to 60% of total costs. The differences due to the seasonal use of assets are not observed, where most frequently their share amounts to up to 40%. The group of these companies has more than 60% of fixed assets which are used continuously.

The graphical characterization of individual groups of enterprises broken down by the assets possessed and fixed costs generated indicated the lack of significant differences between the subgroups. Both the direction of exchange and its form do not result from the level of fixed assets and fixed costs. Therefore, in the subsequent part of the research, only the fact of resource exchange or its lack due to the assets possessed was verified.

4.4. Types of the Resources Possessed and the Willingness to Share Resources

In order to verify the second part of the main hypothesis, it was subsequently tested whether sharing resources in the surveyed entities is determined by the structure of the assets possessed and the share of fixed costs. For this purpose, the fact of resource exchange was coded using the binary system, where:

- 1 means that the company does not exchange resources;

- 2 means that the company exchanges resources in any way.

The relationship was verified using the Spearman’s rho nonparametric test. The results are presented in Table 7.

Table 7.

The significance of the relationship between the structure of assets and costs and the general approach of the company to resource exchange.

It is observed that there is a relationship between the share of fixed assets in the company’s total assets and the willingness to exchange resources between the surveyed entities. The other variables do not significantly affect the approach to resource exchange. In order to verify the differences between the surveyed groups of enterprises which exchange resources and the companies which do not implement this approach and the share of fixed assets in total assets, the ANOVA test was subsequently carried out for the means of these groups(Table 8).

Table 8.

A one-way ANOVA for the approach to the sharing economy broken down by the share of fixed assets in the company’s total assets.

The results of the obtained test F (2.338) = 2,427; p < 0.049 means that it is statistically significant. This means that it should be assumed that there are significant differences between the means in the groups compared. In order to assess how these means differ from each other, the data of the descriptive statistics were generated (Table 9).

Table 9.

Descriptive statistics for the groups compared.

It is observed that, the larger the share of fixed assets in total assets, the greater the motivation indicated by enterprises to share and exchange the resources possessed. Based on this, it should be noted that the main hypothesis was verified positively only partially. This means that enterprises use the sharing economy in their activities more willingly if the share of fixed assets in total assets is higher. At the same time, it was not indicated that the use of assets in time (seasonally or continuously) and fixed costs generated were of great significance in the process of exchange.

The summary of the results of the four research stages is presented in Table 10.

Table 10.

The summary of the results of the survey.

The collected results allow for the final conclusion that enterprises use the sharing economy in their activities depending on the level of the assets owned, regardless of their type and generated fixed costs.

5. Discussion

The conducted research in the field of the sharing economy among enterprises allowed for making a number of important observations. The vast majority of companies have material resources which they use in their activities continuously. Fixed costs remain stable per annum. At the same time, almost all the surveyed enterprises declared they had ever possessed some redundant assets, which are most frequently lent and which are redundant in their nature only temporarily or partially [63]. According to the research by MarketplaceHUB, among tangible assets the most frequently exchanged between companies, there are primarily unused materials and raw materials [64]. In order to manage the assets more effectively, P.N. Umoh [65] and J. Pfeffer [66] suggest conducting their systematic registry, the task of which is their proper use or release if they are not necessary any longer.

In the case of the majority of enterprises, the flow of assets was observed based on their temporary or partial exchange. The most frequently practiced model in the case of entities using the concept of the sharing economy is a two-way exchange of resources. This means that, most often, companies indicate the willingness to simultaneously exchange resources. According to S. Siitonen [67] and D. Slagen [68], the sharing economy between enterprises transmits the mentality of companies from possession to access. The research into individual groups of enterprises, broken down by the assets possessed and fixed costs generated, indicated the lack of significant differences between the subgroups identified in the research. Both the direction of exchange and its form do not result from the characteristics of fixed assets and fixed costs generated in enterprises. It was not indicated that the seasonality or continuity of the use of an asset influenced the willingness to share. This is confirmed by the research by D. Slagen [68], according to which, it is the process of sharing resources that plays the main role in resource exchange and improves the operation of enterprises, which translates into faster operations and rapid responses to market changes. At the same time, the fact that there is a relationship between the share of fixed assets in total assets and the willingness to exchange resources between the surveyed entities was verified positively in the research. The larger the share of fixed assets in total assets, the greater the motivation indicated by enterprises to share and exchange the possessed resources [69]. This means that the ownership of the excessive or temporarily or partially redundant assets itself is only one of the determinants of sharing one’s own resources with other forms. S.M. Ekayanti et al. [70] supplement that the basis for the effective management of assets is the proper information system, which is simultaneously an important part of the fourth industrial revolution. B. Cohen [71] confirms that, for the sharing economy in business, it is more important to select the transaction model and manage the flow of information than to possess common resources and technologies. C. Lemmens and C. Luebkeman [72], as the most important role in the implementation of the sharing economy in business, also list the exchange of information. Modern IT solutions induces cost reduction and revenue growth, resulting in a real competitive advantage for the whole chain [73,74].

6. Conclusions and Recommendations

The sharing economy gives new meaning to the concept of consumption which, along with the technological and social progress, more and more frequently includes sharing, exchange, and lend of resources based on mutual cooperation. The “possession” loses its value, whereas sharing and sharing unused resources gains value. The task of such an approach is to develop a range of benefits associated with generating higher profits, cost reduction by limiting unnecessary investments, and overall improvement in business performance.

The research indicated that the possession of excessive material resources is only one of the reasons for resource exchange. The larger the share of fixed assets in total assets motivates the enterprises to share and exchange the resources possessed. However, after more thorough consideration, neither the type of resources nor the willingness to reduce costs constitute the motivation of the entity for conducting the sharing economy if there are no formal and technological solutions enabling its implementation. The surveyed companies do not differ from each other due to their assets and generated fixed costs, which means that the direction of exchange as well as its form do not result from the level of fixed assets and fixed costs.

The conducted research has some constraints, though. If the level and type of fixed assets do not constitute the main motivation for resource exchange, the main source of such behavior should be sought in the lack of appropriate technologies and information platforms, which enable the exchange of information in this field. Therefore, further research should include the analysis of opportunities and the level of technological development of companies. Moreover, there is a need to repeat the research including a larger number of samples in a few countries, in order to also take into consideration companies operating in a global network. Such extended research can also serve as the basis for responding to the question as to how the concept of Industry 4.0 is implemented in these enterprises. This should be another research step; therefore, the presented research in the field of the sharing economy in the era of the fourth industrial revolution can be found as the preliminary effort made towards this direction.

Funding

This research received no external funding.

Conflicts of Interest

The author declares no conflict of interest.

References

- Belk, R. extended self in a digital world. J. Consum. Res. 2013, 40, 477–500. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The circular economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Zaheer, A.; Gözübüyük, R.; Milanov, H. It’s the connections: The network perspective in interorganizational research. Acad. Manag. Perspect. 2010, 24, 62–77. [Google Scholar] [CrossRef]

- Varda, D.; Shoup, J.A.; Miller, S. A systematic review of collaboration and network research in the public affairs literature: Implications for public health practice and research. Am. J. Public Health 2012, 102, 564–571. [Google Scholar] [CrossRef] [PubMed]

- Kenis, P.; Provan, K.G. Towards an exogenous theory of public network performance. Public Adm. 2009, 87, 440–456. [Google Scholar] [CrossRef]

- Baggio, R.; Scott, N.; Cooper, C. Network science. A review focused on tourism. Ann. Tour. Res. 2010, 37, 802–827. [Google Scholar] [CrossRef]

- Nagy, J.; Oláh, J.; Erdei, E.; Máté, D.; Popp, J. The Role and impact of industry 4.0 and the internet of things on the business strategy of the value chain-the case of hungary. Sustainability 2018, 10, 3491. [Google Scholar] [CrossRef]

- Ciesielski, M.; Wieczerzycki, W. Logistyka w Gospodarce Elektronicznej, w: Wieczerzycki, W. (red), E-logistyka; PWE: Warszawa, Poland, 2012.

- Zhong, R.Y.; Xu, X.; Klotz, E.; Newman, S.T. Intelligent manufacturing in the context of industry 4.0: A review. J. Eng. 2017, 3, 616–630. [Google Scholar] [CrossRef]

- Goksoy, A.; Ozsoy, B.; Vayvay, O. Business process reengineering: strategic tool for managing organizational change an application in a multinational company. Int. J. Bus. Manag. 2012, 7, 89–112. [Google Scholar] [CrossRef][Green Version]

- Builes, A.P. Tendencias tecnológicas que influyen en el aumento de la productividad empresarial. Inge Cuc 2015, 11, 84–96. [Google Scholar] [CrossRef]

- Ślusarczyk, B. Industry 4.0–Are we ready? Pol. J. Manag. Stud. 2018, 17, 232–248. [Google Scholar] [CrossRef]

- Alcácer, P.; Cruz-Machado, V. Scanning the industry 4.0: A literature review on technologies for manufacturing systems. Eng. Sci. Technol. 2019, 22, 899–919. [Google Scholar] [CrossRef]

- Bentyn, Z. Aadaptacja łańcuchów dosatw do potrzeb przemysłu 4.0. Autobusy 2017, 6, 1317–1321. [Google Scholar]

- Ford, D. Understanding Business Markets, 2nd ed.; The Dryden Press: London, UK, 1997. [Google Scholar]

- Håkansson, H. Industrial Technological Development: A Network Approach; Croom Helm: London, UK, 1987. [Google Scholar]

- Davies, W.; Brush, K.E. High-tech. industry marketing: The elements of a sophisticated global strategy. Ind. Mark. Manag. 1997, 26, 1–13. [Google Scholar] [CrossRef]

- Czinkota, M.R.; Ronkainen, I.A. International Marketing, 4th ed.; Dryden Press: New York, NY, USA, 1995. [Google Scholar]

- Lee, M.; Yun, J.J.; Pyka, A.; Won, D.; Kodama, F.; Schiuma, G.; Park, H.; Jeon, J.; Park, K.; Jung, K.; et al. How to respond to the fourth industrial revolution, or the second information technology revolution? Dynamic new combinations between technology, market, and society through open innovation. J. Open Innov. Technol. Mark. Complex. 2018, 4, 1–24. [Google Scholar] [CrossRef]

- Gownder, J.P.; Epps, S.R.; Corbett, A.E.; Doty, C.A.; Schadler, T.; McQuivey, J.L. Mass Customization Is (Finally) The Future of Products Apply the CURA Framework to Build a Winning Customized Product Strategy; Forrester: Cambridge, MA, USA, 2011. [Google Scholar]

- Anbumozhi, V.; Kimura, F. Industry 4.0: Empowering ASEAN for the Circular Economy; Economic Research Institute for ASEAN and East Asia: Senayan Jakarta Pusat, Indonesia, 2018; pp. 106–127. [Google Scholar]

- Ranjbari, M.; Morales-Alonso, G.; Carrasco-Gallego, R. Conceptualizing the sharing economy through presenting a comprehensive framework. Sustainability 2018, 10, 2336. [Google Scholar] [CrossRef]

- Möhlmann, M. Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. J. Consum. Behav. 2015, 14, 193–207. [Google Scholar] [CrossRef]

- Kauf, S. Ekonomia współdzielenia (sharing economy) jako narzędzie kreowania smart city, zeszyty naukowe politechniki śląskiej. Organ. Manag. 2018, 120, 141–151. [Google Scholar]

- Heinrichs, H. Sharing economy: A potential new pathway to sustainability. Gaia 2013, 22, 228–231. [Google Scholar] [CrossRef]

- Akbar, P.; Mai, R.; Hoffmann, S. When do materialistic consumers join commercial sharing systems. J. Bus. Res. 2016, 69, 4215–4224. [Google Scholar] [CrossRef]

- Pekarskaya, M. Sharing Economy and Socio-Economic Transitions: An Application of the Multi-Level Perspective on a Case Study of Carpooling in the USA (1970–2010); Lund University: Lund, Sweden, 2015. [Google Scholar]

- Ślusarczyk, B. Prospects for the shared services centers development in Poland in the context of human resources availability. Pol. J. Manag. Stud. 2017, 15, 218–231. [Google Scholar] [CrossRef]

- Report PWC, Współdziel i rządź! Twój Nowy Model Biznesowy Jeszcze Nie Istnieje. Available online: https://www.pwc. pl/pl/pdf/ekonomia-wspoldzielenia-1-raport-pwc.pdf (accessed on 15 May 2019).

- PricewaterhouseCoopers LLP. The Sharing Economy: Consumer Intelligence Series; PricewaterhouseCoopers LLP: New York, NY, USA, 2015; Available online: https://www.pwc.com/us/en/industry/entertainment-media/publications/consumerintelligence-series/assets/pwc-cis-sharing-economy.pdf (accessed on 23 May 2019).

- Piselli, D.; Pavoni, R. The sustainable development goals and international environmental law: Normative Value and challenges for implementation. Veredas Direito 2016, 13, 13–60. [Google Scholar] [CrossRef]

- Ziobrowska, J. Sharing economy as a new consumer trend. In Własność w Prawie i Gospodarce pod Red; Kalina-Prasznic, U., Ed.; E-Wydawnictwo, Prawnicza i Ekonomiczna Biblioteka Cyfrowa, Wydział Prawa, Administracji i Ekonomii Uniwersytetu Wrocławskiego: Wrocław, Poland, 2017; p. 264. [Google Scholar]

- Frenkena, K.; Schor, J. Putting the sharing economy into perspective. Environ. Innov. Soc. Transit. 2017, 23, 3–10. [Google Scholar] [CrossRef]

- Olalla, D.M.; Crespo, E. Does the Sharing Economy Truly Know How to Share? Global Agenda Digital Economy and Society. Available online: https://www.weforum.org/agenda/2019/01/does-the-sharing-economy-truly-know-how-to-share (accessed on 12 June 2019).

- Allen, D.; Berg, C. The Sharing Economy. How Over-Regulation Could Destroy an Economic Revolution; Institute of Public Affairs: New York, NY, USA, 2014. [Google Scholar]

- Ślusarczyk, B. Shared services centres in central and eastern Europe: The examples of Poland and Slovakia. Econ. Sociol. 2017, 10, 46–58. [Google Scholar] [CrossRef] [PubMed]

- Szmelter, A. Communication in global supply chains in automotive industry. Inf. Sys. Manag. 2015, 4, 205–218. [Google Scholar]

- Xueguang, C. The formation of network organization and its practice. China Ind. Econ. 2013, 2, 52–58. [Google Scholar]

- Cygler, J.; Sroka, W.; Solesvik, M.; Debkowska, K. Benefits and drawbacks of coopetition: The roles of scope and durability in coopetitive relationships. Sustainability 2018, 10, 2688. [Google Scholar] [CrossRef]

- Bajdor, P.; Brzeziński, A. The role of it solutions in reverse logistics management support. J. Fundam. Appl. Sci. 2018, 10, 211–216. [Google Scholar] [CrossRef]

- Starostka-Patyk, M. Management of Waste-Defective Products as the Element of Company Strategy. In Projet & Logistique (Red.); Benzidia, S., Bentahar, O., Eds.; MA Editions-ESKA: Paris, France, 2017. [Google Scholar]

- Roh, T. The sharing economy: Business cases of social enterprises using collaborative networks. Procedia Comput. Sci. 2016, 91, 502–511. [Google Scholar] [CrossRef]

- Öberg, C. Social and economic ties in the freelance and sharing economies. J. Small Bus. Entrep. 2017, 30, 77–96. [Google Scholar] [CrossRef]

- Grybaite, V.; Stankevicien, J. Motives for participation in the sharing economy-Evidence from Lithuania. Econ. Manag. 2016, 8, 7–17. [Google Scholar] [CrossRef]

- Becker, T.; Stern, H. Impact of resource sharing in manufacturing on logistical key figures. In Proceedings of the 48th CIRP Conference on Manufacturing Systems-CIRP CMS 2015, Procedia CIRP, Naples, Italy, 12–14 June 2016; pp. 579–584. [Google Scholar]

- Singh, A.K.; Garg, A. Impact of information integration on decision-making in a supply chain network. Prod. Plan. Control 2015, 26, 994–1010. [Google Scholar] [CrossRef]

- Vanini, P. Asset Management; University of Basel: Basel, Sweden, 2019. [Google Scholar]

- Brettel, M.; Friederichsen, N.; Keller, M.; Rosenberg, M. How virtualization, decentralization and network building change the manufacturing landscape: an industry 4.0 perspective. Int. J. Inf. Commun. Eng. 2014, 8, 1. [Google Scholar]

- Chien, C.F.; Kuo, R.T. Beyond make-or-buy: Cross-company short-term capacity backup in semiconductor industry ecosystem. Flex. Serv. Manuf. J. 2013, 13, 310–342. [Google Scholar] [CrossRef]

- Lin, H.W.; Nagalingam, S.V.; Kuik, S.S.; Murata, T. Design of a global decision support system for a manufacturing SME: Towards participating in collaborative manufacturing. Int. J. Prod. Econ. 2012, 136, 1–12. [Google Scholar] [CrossRef]

- Jaehne, D.M.; Li, M.; Riedel, R.; Mueller, E. Configuring and operating global production networks. Int. J. Prod. Res. 2009, 47, 2013–2030. [Google Scholar] [CrossRef]

- Goldman, A. Short product life cycles: Implications for the marketing activities of small high-technology companies. RD Manag. 2007, 12, 81–90. [Google Scholar] [CrossRef]

- PWC. Opportunities and challenges of the industrial internet, Industry 4.0; PricewaterhouseCoopers LLP: London, UK, 2014. [Google Scholar]

- Ritter, M. The sharing economy: A comprehensive business model framework. J. Clean. Prod. 2018, 213. [Google Scholar] [CrossRef]

- Bentyn, Z. E-logistyka narzędziem rozwoju globalnych sieci dostaw. Gospod. Mater. Logistyka 2015, 5, 16–27. [Google Scholar]

- Darnley, R.; DiPlacido, M.; Kerns, M.; Kim, A. Industry 4.0: Digitization in Danish Industry; Worcester Polytechnic Institute and Copenhagen School of Entrepreneurship: Worcester, MA, USA, 2018. [Google Scholar]

- Brkljač, M.; Sudarević, T. Sharing economy and Industry 4.0 as the business environment of milleninial generation—A marketing perspective. In Proceedings of the 29th Daaam International Symposium on Intelligent Manufacturing and Automation 2018, Zadar, Croatia, 21–28 October 2018; pp. 1092–1101. [Google Scholar]

- Wang, L.; Liu, G. Research on Information Sharing Mechanism of Network Organization Based on Evolutionary Game. IOP Conf. Ser. Earth Environ. Sci. 2017, 113, 2–6. [Google Scholar] [CrossRef]

- Richardson, L. Performing the sharing economy. Geoforum 2015, 67, 121–129. [Google Scholar] [CrossRef]

- Kosintceva, A. Business Models of Sharing Economy Companies: Exploring Features Responsible for Sharing Economy Companies’ Internationalization. Master’s Thesis, Norwegian School of Economics, Bergen, Norway, 2016. [Google Scholar]

- Blumberg, S.J.; Luke, J.V. Wireless Substitution: Early Release of Estimates from the National Health Interview Survey; Centers for Disease Control and Prevention: Atlanta, GA, USA, 2011.

- Malhotra, N.; Krosnick, J.A.; Thomas, R.K. optimal design of branching questions to measure bipolar constructs. Public Opin. Q. 2009, 73, 304–324. [Google Scholar] [CrossRef]

- Agwor, T.C. Assests safeguard and business performance in quotaed manufacturing companies in Nigeria. Eur. J. Account. Audit. Financ. Res. 2017, 5, 58–65. [Google Scholar]

- Paajanen, S. Business-to-Business Resource Sharing; VTT Technical Research Centre of Finland Business, Innovation and Foresight: Espoo, Finland, 2019. [Google Scholar]

- Umoh, P.N. Bank customer protection through deposit insurance. NDIC Q. Rep. 1994, 4, 280–282. [Google Scholar]

- Pfeffer, J. Organization Theory Mansfields; Pitman Publishing: London, UK, 1982. [Google Scholar]

- Siitonen, S. Take a Leap into Circular Economy! Together Towards New Growth; Confederation of Finnish Industries EK: Helsinki, Finland, 2016. [Google Scholar]

- Slagen, D. From P2P to B2B: The next phase of the sharing economy VentureBeat Business by John Koetsier 2014. Available online: https://venturebeat.com/2014/09/08/from-p2p-to-b2bthe-next-phase-of-the-sharing-economy/ (accessed on 26 June 2019).

- Hvolkova, L.; Klement, L.; Klementova, V.; Kovalova, M. Barriers hindering innovations in small and medium-sized enterprises. J. Compet. 2019, 11, 51–67. [Google Scholar] [CrossRef]

- Ekayanti, S.; Rifa’i, A.; Irwan, M. Determinants effectiveness fixed asset management of district government on the Island of Lombok. Int. J. Bus. Manag. Econ. Res. 2018, 9, 1219–1229. [Google Scholar]

- Cohen, B. Making Sense of the Many Business Models in the Sharing Economy. Fast Company 2016. Available online: https://www.fastcompany.com/3058203/making-sense-of-the-manybusiness-models-in-the-sharing-economy (accessed on 1 May 2019).

- Lemmens, C.; Luebkeman, C. The Circular Economy in the Built Environment; ARUP: London, UK, 2016. [Google Scholar]

- Pelikánová, R.M.; MacGregor, R. The impact of the new EU trademark regime on entrepreneurial competitiveness. Forum Sci. Oeconomia 2019, 7, 53–70. [Google Scholar]

- Krykavskyy, Y.; Pokhylchenko, O.; Hayvanovych, N. Supply chain development drivers in Industry 4.0 in Ukrainian enterprises. Oeconomia Copernic. 2019, 10, 273–290. [Google Scholar] [CrossRef]

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).