Abstract

The tourism industry has become a new growth engine that closely coordinates with the financial industry and contributes to the sustainable development of local economies. This study establishes a comprehensive index system and evaluates the coupling coordination based on an integrated approach, and the dynamic relationship between tourism and finance through applying coupling coordination degree modeling, the Granger causality test, and an impulse response function based on the regional coordination theory and system theory. Using data from 2000 to 2016 of three tourism-based cities in China, the findings reveal heterogeneous results among the cities. Specifically, the following: (1) The coupling coordination degree between finance and tourism in Zhangjiajie increased with strong fluctuations. A one-way causality relationship existed between two subsystems, and finance continuously contributed to the growth of tourism with serious lags; (2) The coupling coordination degree between finance and tourism in Huang Shan presented a ladder-type and continuous rise. A two-way causality relationship existed between the two subsystems mentioned above, and finance influenced the growth of tourism with continuously positive or negative effects, while tourism continuously contributed to the development of finance. (3) The coupling coordination degree between finance and tourism in Sanya grew with a frequent, tiny, and fluctuating trend. A two-way causality relationship existed between the two subsystems mentioned above, and finance influenced the growth of tourism with continuously positive or negative effects, while tourism influenced the development of finance with temporary positive or negative effects.

1. Introduction

Developmental problems, including resource exhaustion, environmental deterioration, cultural destruction, and social turbulence are attributed to the overconsumption of natural resources and unbalanced development of the economy, the ecological system, and society [1,2]. Barbier (1987) asserted that these problems could be avoided if the economy developed sustainably [3]. Coordinating the development of the subsystems of the economy is believed to be a preferable way to control and adjust unsustainable issues [1].

As two important subsystems of the economy, the finance and tourism industries are considered to contribute to the development of regions and economic growth [4,5]. Finance is regarded as the driver of modern economic development [6] and as contributing to the coordinating developments of other industries (e.g., [7,8,9]). With the help of finance, the pillar industries and related industries boot [8]. As a kind of sunrise industry with high consistency, tourism is related to finance [10,11], motivating the development of regional industries and economic growth. Rural tourism, in particular, can help an entire society develop sustainably, thanks to its large employment capacity, low resource consumption, and many benefits [12,13]. In tourism cities, the sustainable development of the society and the economy is totally determined by the influences of finance and tourism. If finance and tourism interact with each other healthily, then the economy may develop in a more sustainable way.

At present, the development of the tourism industry places a high demand on financial development with the need for more diversified financial products and financing means to meet the needs of different consumers and tourism enterprises [11]. Additionally, Yang and Li (2013) found that the effects of finance on tourism are different in the different regions of China [14]. In their study, the direct financing in the eastern and central regions had an obvious influence on the improvement of the investment efficiency of the tourism industry, while bank credit financing was considered to be the main way to promote tourism in the western region. Some scholars explore the specific effect between finance and tourism. Yang and Shi (2014) supported that there was a continuously hysteretic effect of finance on tourism [15]. Katircioglu and Altinay (2017) found that the development of tourism has a continuously interactive relationship with financial growth in Turkey [16]. Shi (2011) believed that only by forming a reasonable matching relationship between financial development and the growth of the tourism industry can the tourism industry and the economy maintain sustainable growth [17]. However, few papers focus on the specific mechanism of how finance influences tourism and the interactive relationship between the two. Therefore, this research contributes to the literature by studying the dynamic relationship between finance and tourism.

A coupling is defined as a situation in which a few systems influence each other interactively by changing the conditions of components in the systems simultaneously [18,19]. At present, more scholars are applying coupling to study sustainable development through measuring interactive relationships in a wide range of areas, including economy, society [18,20,21,22], and tourism [23,24,25,26].

In terms of indigenous research, although past literature has proposed a series of indicators for measuring sustainability, the categories of most sustainability indices are too homogeneous and there are too few of them point out the coordination relationship among the subsystems in an urbanization context.

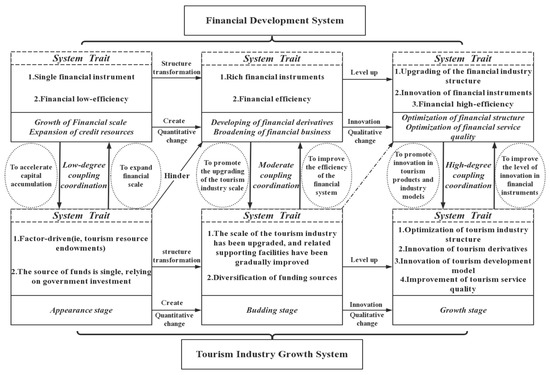

To some extent, coupling coordination can be regarded as a process of finance and tourism interactively influencing each other (Figure 1), through which the fictitious economy and the substantial economy affect each other and blend together [13]. According to the demand compliance theory proposed by Patrick (1966), industries will require more financing resources to accelerate the expansion of the financial system, through which the industrial structure will upgrade because of capital accumulation in this process [27]. At the same time, a new way of financing is urgently needed to make financial structures and derivatives more diversified to expand the scales as well as promote efficiency [28]. The growth of the tourism industry, in essence, is a dynamic process that is supported by financial systems and consists of appearance, production, and development [29]. Thus, this study analyzes the coupling coordination between finance and tourism step-by-step from the perspective of the three stages of tourism growth (Figure 1).

Figure 1.

Coupling and coordinative mechanism of financial development levels and tourism industry growth in tourism destinations.

In the appearance stage of the tourism industry, the government’s investment plays the main role. In this stage, a lot of capital investments are needed to improve the supportive the infrastructure. The increasing demand of the tourism industry for credit resources promotes the expansion of the financial system, indirectly accelerating the capital accumulation and the development of both finance and tourism.

In the production stage, the gradually refined tourism industry-related infrastructure allows the tourism industry more diversified capital source channels, followed by a surge in related service industries and the rapid development of the tourism industrial structure. Meanwhile, the escalation of tourism promotes the development of the financial system. To be specific, firstly, in order to satisfy more customers’ demands in this Internet era, an increasing number of tourism enterprises and governments launch the usage of electronic tickets, online banking services, electronic payments, travel cards, tourism credit, and insurance, which expands the scope of financial services. Secondly, the development of tourism will drive the diversification of financial derivative products. At present, there are two kinds of financial derivatives related to tourism, including product type, which can help enterprises to repatriates and solve the problem of a shortage of funds, and invest in the type that helps the buyers of financial products to manage their money better (e.g., Xie Cheng Bao, Cheng Zhang Bao, and Tuniu Bao).

The development stage of tourism has a series of features, including the optimization of the tourism industrial structure, improvement of the quality of services, and innovation of the development model. Many popular tourist places will propose creative marketing patterns based on present resources, and develop new products to attract more tourists. The above-mentioned development of tourism products and the innovation of marketing models will set higher requirements for financial instruments and financial structure, indirectly promoting the innovation of financial instruments and the optimization of the financial structure. Meanwhile, the optimization of the financial structure and innovation of the tools will not only bring more money to local places for developing tourism products and advertising, but can also improve the allocation efficiency of financial capital in the real economy.

Until now, few studies (e.g., [26]) have proposed persuasive coordination models to predict the reciprocal relationship between finance and tourism. Therefore, this research contributes to the literature by elucidating the coordinating effect and the dynamic relationship between finance and tourism, based on coupling theory and impulse response function. This study also aims to provide references and share some suggestions to governments in the promotion and policy-making around the finance–tourism system. This paper firstly gives a brief introduction of the study areas, three tourism cities (Zhangjiajie, Huangshan and Sanya). Then, we propose the evaluation of the index system and establish the system evaluation model for coordinated development. Subsequently, we present the data analysis and results and discuss our findings. The paper ends with implications, limitations, and conclusions.

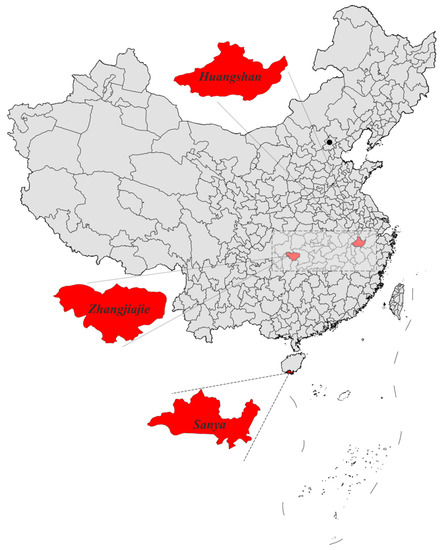

2. Study Areas

We selected three cities as our study cases (Figure 2), including Zhangjiajie, Huangshan, and Sanya. Zhangjiajie, located in the northwestern part of Hunan Province, with rich tourism resources, was approved by the central state of China around 1988 to 1990 to set up as a city called Da Yong, and it changed the name to Zhangjiajie in 1994, because of the rapid development of the tourism industry. The tourism revenue of Zhangjiajie increased from 1.941 billion yuan in 2000 to 44.31 billion yuan in 2016, accounting for 89.05% of the gross domestic product (GDP) of the city. In terms of financial savings and loans, the financial institutions’ deposits and loans of Zhangjiajie were 68.25 billion yuan and 41.75 billion yuan, respectively, in 2016, with an average annual growth rate of 19.82% and 15.13%, respectively.

Figure 2.

Locations of three cities in China.

Huangshan (named after a mountain called Huangshan), located in the southern part of Anhui Province was approved by the central state in 1987–1988, to cultivate the tourism industry. The tourism revenue of Huangshan increased from 1.772 billion yuan in 2000 to 45.01 billion yuan in 2016, accounting for 78.03% of the GDP of the city. In terms of financial savings and loans, the financial institutions’ deposits and loans of Huangshan were 102.58 billion yuan and 60.91 billion yuan, respectively, in 2016, with an average annual growth rate of 16.76% and 17.56%, respectively.

Sanya, known as ‘Eastern Hawaii’, is located in the most southern part of Hainan Province, and it is a famous as international tourist city with tropical seaside scenery. In order to develop the tourism, the central state approved Sanya to be set as a county-level city in 1984, and changed it to a provincial-level city in 1987. The tourism revenue of Sanya increased from 2.141 billion yuan in 2000 to 32.24 billion yuan in 2016, accounting for 67.79% of the GDP of the city. In terms of financial savings and loans, the financial institutions’ deposits and loans of Sanya were 149.383 billion yuan and 107.923 billion yuan, respectively, in 2016, with an average annual growth rate of 24.72% and 26.07%, respectively.

These three cities can all be categorized as tourism cities, and they are famous for their unique natural scenery. Additionally, the tourism industries appeared in the 1980s and 1990s. Although their tourism industries appeared in a similar era, there are some differences. The different locations, in the western, central, and eastern part of China, respectively, determine that they are not the same. Therefore, this study choses these regions as the research object, discussing the coordinated development of the financial industry and tourism industry to clarify the coordination mechanism for theoretical and practical usages.

3. Methods

3.1. Index System

The process of how finance influences tourism is complex. The development of a tourism industry will require more abundant services offered by finance institutions to satisfy the demands of consumers, and the growth of finance will ensure that the tourism industries have more capital to expand and promote. A coupling system consisting of tourism and finance can help tourism realize sustainable development. Thus, an index system is proposed based on coupling coordination to evaluate the development of finance and tourism, and the interactive relationships between them [30]. In this study, we establish a series of index systems for measuring the degree of development of finance and tourism. The data of all of the indicators are generated from ‘China City Statistical Yearbook’, ‘China Tourism Statistical Yearbook’, ‘China Regional Statistical Yearbook’, and ‘Official Statistical Bulletin’ of the three regions. Some missing data are estimated by an interpolation method, based on the average annual growth rate.

The indicators are explained as follows (The details can be checked in Appendix A). The scale of the financial industry is an indicator of the overall financial development level of a region and the strength of the regional financial system. A series of factors are selected to measure the institutional form of finance, including financial interrelations ratio, insurance penetration, financial agglomeration degree, investment scale, etc. (Table 1). The scale of the tourism industry reflects the degree of tourism growth. In this study, the total income from domestic tourism, number of domestic tourists, number of international tourists, number of travel agencies, and the number of hotels have been selected to measure the degree of the tourism market and tourism incomes.

Table 1.

Coupling and coordinated evaluation index system of tourism industry growth and financial development level. GDP—gross domestic product;

The theory of financial development believes that the nature of financial development is a change of structure [6], continuously optimizing the financial tools and structures, and establishing better financial order and mechanisms in a dynamic process of change [31,32]. Financial structure, a combination of financial instruments, institutions, intermediaries, and markets, reflects the degree of financial development and its importance in the national economy [33]. In addition, some scholars believe that the financial environment, including economic basis, legal environment, and political system, should be considered in the measurement of the level of regional financial development [34]. The China Development Institute put forward a concept named the China Financial Center Index in 2009 and it believes that Chinese financial competitiveness is determined by the performance of the financial industry, the strength of the financial institutions, the scale of the financial market, and the financial environment [35].

Therefore, the total financial quantity (i.e., the scale of the financial industry), quality (i.e., industrial development efficiency of the financial industry), and the contribution of the financial industry structure and the external environment should be considered, when the levels of development of the regional financial system are measured. In this study, 15 indicators, divided into the scale of the financial industry, financial structure, and the development efficiency of finance, are set to comprehensively, accurately, and systematically measure the level of financial development. The specific index system is shown in Table 1.

According to the theory of industry development, the tourism industry growth system is a complex system and its industrial development is motivated by many factors [36]. Lu (2002) also supports that, as the industry is a subsystem of the social–economic system, it should be put in the social–economic system and analyzed from the perspective of the relationships among various elements to find the real motivations of industrial evolution [37]. Ma and Sun (2015) argue that tourism industry growth can be mainly divided into self-growth (i.e., tourism market and tourism resources) and exogenous growth (the growth of other factors related to the tourism industry, e.g., tourism transportation and government support) [38]. To sum up, this study believes that 16 indicators and 4 dimensions (the scale of industrial development, industrial structure, industrial element investment, and industrial development efficiency), can be used to measure tourism industry growth. The specific index system is shown in Table 1.

3.2. Coupling Coordination Model and the Division of Characteristic Level

Formulas (1)–(5) show the way to establish the comprehensive evaluation model of financial development and tourism growth.

In Formula (1), U is set as the level of development of financial development system (UF) or tourism development system (UT). The standardized values (range method is used to realize standardization) of the indexes of the financial industry and tourism industrial growth system are labeled as uij, and wij is calculated through an entropy method and labeled as the weight of the indexes of both systems.

The calculation steps can be checked as follows:

Firstly, we standardize the original data matrix, as follows:

Positive index, namely:

Negative index, namely:

The yij in Formulas (2) and (3) are the data generated from the standardized process; xij means the original value of index j of sample i. To be specific, i = 1,2,…,m; j = 1,2,…,n. max(xij) and min(xij) indicate the maximum and minimum value of xij.

Then, we define the entropy of each index. The entropy of index j is as follows:

pij indicates the weight of sample i of index j.

Finally, the weight of index j is as follows:

According to the definition of coupling coordination mentioned in the literature review, we define the degree to which the financial development system and tourism growth system interactively influence each other through coupling elements as coupling degree with the degree of interaction and coordination. In this study, we deduce the coupling model between the financial industry and tourism industry based on the concept of capacity coupling and the capacity coupling coefficient model in physics, as follows:

In Formula (6), C indicates the coupling degree of the system, also satisfying . It means that the closer C gets to 1, the better and the more orderly the elements of the two systems interact, coordinate, and develop. Although the coupling model can reflect the consistency of the development of finance and tourism, the result cannot accurately reveal the real level and situation between them. For example, the degree of coupling may be high, even if both finance and tourism stay in at a low level, with a similar development situation. Therefore, we propose a coupling coordinate model to predict the degree of coupling between finance and tourism, based on past literature, as follows:

Formulas (7)–(9) show the coupling coordinate model. To be specific, D indicates the degree of coupling and coordination; C indicates the degree of coupling; and T indicates the comprehensive evaluation index that reflects the level of coordination between finance and tourism. RDD indicates the degree of relative development of finance and tourism; α and β indicate undetermined coefficients and α + β = 1.

As the financial industry and the tourism industry are both tertiary industries (service industries), and both of them make contributions to the regional economic growth. The values of α and β in this paper are set as 0.5.

In order to reflect the situation of the coupling coordination and relative development between the financial development system (UF) and tourism development system (UT), this study refers to the studies of Fan and Lui et al., (2012) in applying a uniform function method to divide the degree of coupling coordination and the degree of relative development into 10 grades and 9 stage features (Table 2) [18].

Table 2.

Coupling and coordinated evaluation standards for financial industry development system and tourism industry growth system. RDD—relevant development level.

4. Result

4.1. Comparative Analysis of Time and Space Characteristics

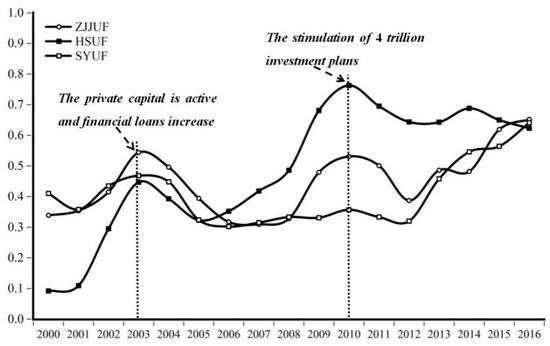

Figure 3 shows that the financial systems of Zhangjiajie, Huangshan, and Sanya had an increasing tendency towards fluctuations from 2000 to 2016. To be specific, the trends of financial development in Zhangjiajie and Huangshan in 2010 were similar, while they were different after 2010. However, the financial development of Sanya displays a ‘W’ curve and less fluctuation compared with the performance of Zhangjiajie and Huangshan between 2010 and 2016.

Figure 3.

A comparative analysis of the comprehensive development level of the financial development in Zhangjiajie, Huangshan, and Sanya. Note: The x and y axis is the year and the level of financial development respectively.

From the perspective of annual change, the financial industries in Zhangjiajie and Huangshan were boosted rapidly by 20.5% compared with 2000, and 35.5% compared with 2003, attributed to the development of private capital in 2003. The expansion of the total amount of financial loans, the actual utilization of foreign capital, and the increase of the total investment in fixed assets results in the optimization of the financial development scale, industrial structure, and the overall efficiency of the financial development. The increase of finance for Sanya reached 0.468 in 2003 from 0.41 in 2000, while it experienced a drop in 2002 (0.358). This phenomenon can be attributed to the decrease in the total amount of financial loans at the end of 2002, with 14.01%.

Between 2003 and 2010, the finance of Zhangjiajie and Huangshan experienced a ‘decrease to increase’ fluctuation, while their intervals of fluctuation were different. The figure for Zhangjiajie decreased from 0.544 in 2003 to 0.309 in 2007, which can be attributed to the decrease of the financial interrelations ratio, insurance industry structure, external financing capacity, deposit and loan ratio, and savings and investment conversion. The finance of Zhangjiajie then increased to 0.531 between 2007 and 2010.

By contrast, the figures for Huangshan dropped from 0.447 in 2003 to 0.332 in 2005, attributed to the decline of the financial interrelations ratio, insurance depth, and the deposit and loan ratio. The figures increased to 0.763 between 2005 and 2010. Sanya experienced a series of fluctuations between 2003 and 2010, with ‘decrease, increase, decrease, and increase’ changes. Separately, the figures decreased in two periods (0.302 in 2003–2005 and 0.331 in 2008–2009) and increased in two intervals (0.333 in 2005–2008 and 0.357 in 2009–2010) as well.

In 2008, the financial crisis in the United States, evolving into a global economic crisis, not only impacted the Chinese financial industry, but also influenced the tourism industry. Four trillion yuan was distributed by the central government and stimulated a rise of the regional financial system in 2010. After 2011, China’s financial system began to suffer from money shortages, challenges from Internet finance, and other factors, and the regional financial development level system declined significantly.

To sum it up, firstly, the developments of finance in Zhangjiajie and Huangshan have been similar, with strong fluctuations before 2010. By contrast, the figures of Sanya experienced less fluctuation in the same period. Secondly, all of the three cities experienced two fluctuations in 2003 and 2010, with Sanya suffering less than the other two.

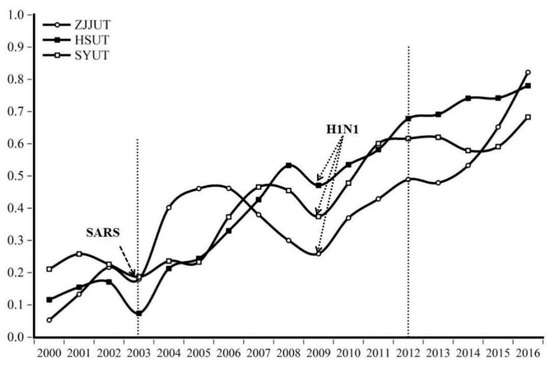

Figure 4 shows that the development level of tourism in Zhangjiajie, Huangshan, and Sanya has maintained an increasing trend, while they experienced drops in 2003 and 2009, due to negative effects of the spread of influenza and the Severe Acute Respiratory Syndrome (SARS). The change of development can be divided into three stages.

Figure 4.

A comparative analysis of the comprehensive development level of tourism industry in Zhangjiajie, Huangshan, and Sanya. Note: The x and y axis is the year and the level of tourism industry respectively.

In the first stage (2000–2003), tourism decreased because of the low level of development of the scale of the tourism industry, industrial structure, the input of industrial factors, and the traffic network. The horizontal comparison shows that tourism in Sanya grew the fastest, because of the comparative advantage of a high degree of international foreign exchange income, the tourism industry labor factor input, the number of public cars, the tourism contribution degree, the tourism aggregation degree, and the traffic network density. However, the comparative advantage of Sanya was caught up by Zhangjiajie and Huangshan.

In the second stage (2004–2012), tourism in the three regions increased with fluctuations in 2004 and 2009, and continuously increased between 2010 and 2012. Thanks to the large number of domestic and foreign tourists and currency income, the average level of development of tourism in Zhangjiajie (0.442) was higher than in Huangshan (0.262) and Sanya (0.281) in the period of 2004–2006. The number of domestic and foreign tourists and the currency income of Zhangjiajie during 2004–2006 were 1.4 times and 3.5 times of Huangshan, respectively, and 2.6 times and 2.3 times that of Sanya, respectively.

However, the average level of the development of tourism in Zhangjiajie was less than in Huangshan and Sanya in the period of 2007–2009, decreasing by 0.203%. The development of tourism in Huangshan increased in the period 2004–2008 (0.533), but it suffered from the negative effect of the spread of H1N1. The figure for Sanya increased (0.466) in the period from 2005–2007 and decreased (0.233) in the period of 2004–2009, because of the global economic crisis and H1N1. After 2009, the figures for the three regions all rose, followed by the increase of the index of the tourism growth systems.

In the third stage (2013–2016), the development of tourism in the three regions slowed down because of the lag effects of the economic crisis and the challenges of new economies. The indexes of the subsystem of growth of the tourism industry development scale and the industrial structure become slow, and some indexes such as the number of domestic tourism, international currency income, star hotels, and tourism labor inputs presented negative growth in 2013 and 2014. From the perspective of the region, the development of tourism in Zhangjiajie and Sanya decreased during two periods (2013–2014 and 2014–2015), and then increased annually by 20% and 8.82% to 0.822 and 0.683 in 2016, respectively. In contrast, the figure for Huangshan continuously increased annually by 3.6% from 2013 to 2016 (0.78).

4.2. Comparison Analysis of Coupling Coordination on Time and Space Characteristics between the Development of Finance and Tourism Growth

In order to further explore the degree of coordination and the relative development between the financial development and tourism industry growth, we used the above Formulas (1)–(9) to calculate the coupling coordination degree and the relative development degree in three areas.

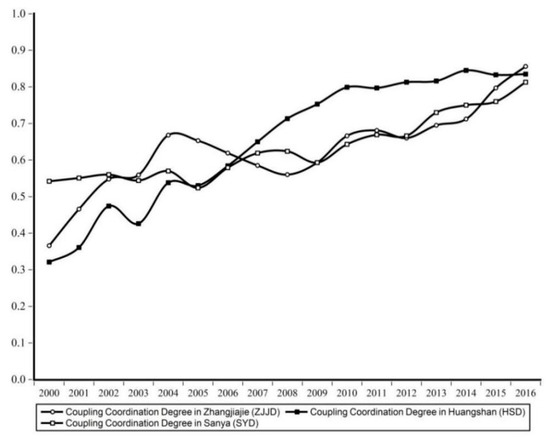

Table 3 and Figure 5 show that the coupling coordination degree of the regional financial development level and the growth of the tourism industry were the lowest (0.321) in 2000 in Huangshan. The characteristic of this period was mild disorder, suggesting that the financial industry lagged behind the development of the tourism industry and restricted the coordinated development of both.

Table 3.

The coordinated effect evaluation results of the tourism industry growth and financial industry development in the three tourism destinations (2000–2016).

Figure 5.

The coordinated development trend of tourism industry growth and financial industry development. Note: The x and y axis is the year and the coupling coordination degree respectively.

From the perspective of the general trend, the average level of coupling coordination in Huangshan was the highest of the three regions, and this state maintained general stability, except for fluctuations in 2002–2003 (0.474–0.426) and 2004–2005 (0.538–0.530).

The coordination level in Huangshan was one of mild disorder (2000–2001), endangered disorder (2002–2003), force coordination (2004–2006), primary coordination (2007), the intermediate coordination (2008–2011), and good coordination (2012–2016). This suggests that the coupling coordination development in Huangshan had a stepwise rising trend.

From 2000 to 2016, the relative development degree of the financial and tourism industries in Huangshan was between 0.703 and 6.041 (the overall mean value was 1.408), suggesting the relative development was highly matched (V) with the mean value of 1.119 after eliminating the extreme value (6.041). This means that the financial industry and the tourism industry promoted each other well and coordinated with each other.

The coupling coordination degree of the financial development and tourism industry growth in Zhangjiajie increased with fluctuations. The degree changed several times in the period 2000–2004 (0.366–0.668, increasing by 82.51%), and in the period 2008–2011–2012 (0.56–0.681–0.66). Additionally, the coupling coordination degree reached 0.825 in 2016 and the coordination level also increased from intermediate coordination (0.797) in 2015 to good coordination in 2016. This shows that in the period of 2000–2015, the coupling coordination level of the financial development level and the tourism industry growth in Zhangjiajie was between mild disorder and intermediate coordination, as well as grudging coordination and primary coordination, for a long time. From 2000 to 2016, the relative development degree of the finance and tourism industries was in a low gear (VI), between 0.686 and 6.396 (the overall mean value was 1.622). This means that the development of finance was ahead of the tourism industry in Zhangjiajie, and the tourism industry’s contribution to the financial industry was weak.

Although the coupling coordination degree of the regional financial development and growth of the tourism industry in Sanya was higher than that of the other two regions, the degree was low (0.542) in 2000. Generally speaking, the coupling coordination degree in Sanya showed a frequent, but, small fluctuation trend. The coordination level changed from grudging coordinated (2000–2006 and 2009) to primary coordinated (2007–2008 and 2010–2012), and then to the intermediate coordinated (2013–2015), and finally to well-coordinated (2016). From 2000 to 2016, the relative development degree was high, between 0.676 and 2.503 (the overall mean value was 1.15). This means that the financial industry and the tourism industry promoted each other and coordinated with each other well.

4.3. Dynamic Relationship between the Development of Finance and Tourism Growth

In order to test the dynamic effects of the financial system’s development on the growth of the tourism industry, this study applies the Granger causality test, impulse response function, and variance decomposition technology to examine the short-term dynamic relationship. Before making the above analyses, the unit root test and co-integration test of each indicator should be carried out. The specific test results are as follows.

As Table 4 shows, the level of financial development and tourism industry growth in Zhangjiajie and Huangshan passed the test at the significance level of 1%, 5%, or 10%, suggesting that the original data was stable. The raw data of the growth level of the tourism industry in Sanya was tested at the 10% significance level, while the original data of the level of financial development is unstable because it failed to pass the test. After applying first-order difference, the level of financial development and tourism industry growth in Sanya passed the test at a 1% significance level, which suggests that the level of regional financial development and tourism growth was integrated of order (i.e., I), Formula (1). From the above analysis, it can be determined that the time series of the financial development and the growth level of the tourism industry is a stationary sequence or integrated in an order, which can be further tested by co-integration.

Table 4.

Unit root test.

The results of the co-integration and the largest eigenvalue test in the three regions reject the null hypothesis at the 5% significance level (Table 5). This means that there exists co-integration relationships between financial development and the tourism industry.

Table 5.

Co-integration test.

Although there is a long-term equilibrium relationship between the financial developments (UF) and the growth of the tourism industry level (UT), the Granger causality test should be used to determine the causal relationship. This study sets the order of the maximum number of the test values as the cut-off point to determine the causal relationship (Table 6). The results of testing show that finance contributes s to tourism at the 5% level in Zhangjiajie, rejecting the null hypothesis (UT is not the Granger cause of UF). This means that finance development will improve tourism growth, but the tourism cannot contribute to the financial system in Zhangjiajie. For Zhangjiajie, financial institutions should support the development of tourism as the tourism industry needs a large amount of investment in the growing process. However, the high proportion of loans (81.3%) in the medium- and long-term leads to slow capital recollection and a lagging effect of tourism on financial development. The results of testing show that finance and tourism can positively influence each other at the 5% level in Huangshan and Sanya, suggesting that the relationship of finance and tourism is one of reciprocal causation.

Table 6.

Granger causality test of financial developments (UF) and growth of the tourism industry level (UT).

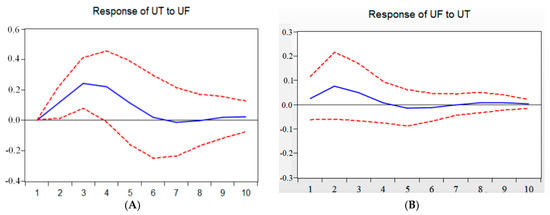

In order to explore the short-term interaction between finance and tourism in the three cities, impulse response function was applied (Figure 6, Figure 7 and Figure 8). Figure 6 shows that after the first lagging period, tourism positively influenced finance in Zhangjiajie. This positive effect reached a peak in the third period and then increased and remained stable after the ninth period Figure 6A. Meanwhile, after the first lagging period, finance positively influenced tourism and reached a peak in the second period, and then decreased and remained stable in the ninth period Figure 6B.

Figure 6.

The impulse–response curve between financial development level and tourism industry growth in Zhangjiajie.

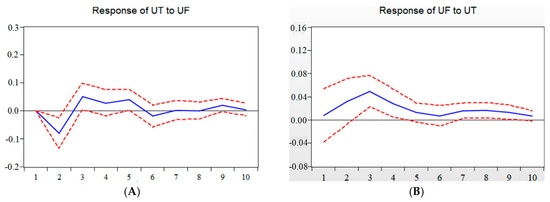

Figure 7.

The impulse–response curve between the financial development level and tourism industry growth in Huangshan.

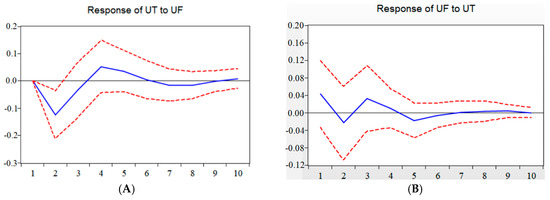

Figure 8.

The impulse–response curve between the financial development level and tourism industry growth in Sanya.

Figure 7 shows that tourism negatively influenced finance in Huangshan and that the development of tourism reached the lowest point in the second period. After that, the development of tourism decreased Figure 7A. The finance positively influenced tourism in the lagging period and maintained an increasing trend. This influence reached a peak in the second period and then dropped and remained stable in the ninth period Figure 7B. This indicated that finance positively influenced tourism with positive–negative effects, while tourism positively influenced finance over the long-term. Figure 8 shows that tourism negatively influenced finance and this effect decreased to the lowest point in the second period in Sanya. During this process, a positive–negative effect existed and remained stable in the ninth period. Finance positively influenced tourism in the first period and negatively influenced tourism in the second period. This negative effect persisted until the second period, and then turned to fluctuation and reached stability in the seventh period. This indicated that finance had a long-term and positive–negative effect on tourism, while tourism had a short-term and positive–negative effect on finance.

Variance decomposition can help us understand the degree of interaction between financial development and tourism industry growth (Table 7). Table 7 shows that the tourism industry growth was fully affected by the fluctuation in the first period. The effect of the financial development on the tourism industry growth appeared in the second period (the effect in Sanya was the most, to 38.865%). After the second period, the effect decreased slowly and remained stable at around 45% in the seventh period. This means that the financial development had a great contribution to the improvement of the tourism industry’s growth in the short term.

Table 7.

Variance decomposition of the financial development level and tourism industry growth in the three tourist cities.

The effects of finance on tourism showed an increasing trend and then a decreasing trend and finally a stable trend in Zhangjiajie. The biggest contribution was in the fourth period, reaching 62.555%. The effects of finance on tourism became strong in the second period and maintained stability in the fifth period (62%). This indicated that the effect of finance on tourism was strong in Zhangjiajie. Compared with the other the two regions, the effects of finance on tourism in Huangshan were the weakest. In the eighth period, the effect remained stable, at around 30%. This indicated that finance was not the main driver of development of the tourism in Huangshan.

The results of the variance decomposition show that the development of finance was influenced by tourism in the first period. To be specific, the finance of Sanya was influenced by 8.638%, the finance of Zhangjiajie was influenced by 2.318%, and the finance of Huangshan was influenced by 0.789%. However, since the second period, tourism was influenced by finance in Huangshan by 25.271%, with increasing fluctuation in the short-term and a stable increasing trend after the sixth period. In the third period, finance was influenced by tourism in Zhangjiajie, remaining stable at 13%. Additionally, the influence of tourism on finance in Sanya remained stable, increasing at around 14%.

5. Discussion

5.1. Findings

This study had some significant findings. Firstly, the development of finance was readily influenced by economic factors and political influence. The results show that the development of finance dropped following the 2008 global financial crisis, which revealed the influence of economic factors. Song and Lin (2010) proposed a similar conclusion that the inbound and outbound tourism were significantly influenced by the financial crisis [39]. The figure for finance rose after the Chinese central government invested four trillion yuan to boost the economy, which reflects the effect of policy on finance. Moreover, the influences of outside factors are continuous, cyclic, and lagging. These findings support the conclusions of Yu (1997), and Ferraz and Coutinho (2017), and extend to a more specific degree [40,41].

Secondly, the development of tourism is influenced by policy, infrastructure, transportation, natural disasters, and tourists’ attitudes. The results show that the time from being approved as a city by the central state to becoming a county-level city to develop tourism and the regional economy was quicker in Sanya than in Zhangjiejie and Huangshan. Thanks to the support of the government, Sanya utilized lots of capital and resources to build abundant infrastructure, and to promote public transportation to attract tourists from all over the world, which made the development of tourism in Sanya faster than in the other two cities at the initial stages. This conclusion verifies the findings of Martínez, Galván, and Lafuente (2014) about the effect of public policy on tourism [42]. The development of tourism is also affected by natural disasters, plagues, and people’s perception of safety. The results show that the number of tourist decreased during the period of SARS, H1NI, and the post-earthquake period, and people were not willing to travel in similar areas with natural disasters and plagues, out of consideration of personal safety. Thus, the perceptions of tourists will influence the development of tourism. Wijaya and Furqan (2018) also pointed out that the perceptions of people were definitely influenced by weather-related disasters, so the numbers of tourists can then decline [43].

Thirdly, the relationship between tourism and finance can be described as an interaction, which has also been observed in previous literature (e.g., [44]). The growth of tourism needs more capital support from financial institutions. At the same time, financial institutions will expand in scale and structure because of the development of tourism. The coordination between tourism and finance will lead to a win–win situation [45]. The healthy development of finance and tourism will contribute to the sustainable development of regional economies [46]. On the one hand, as the growth of tourism is negatively impacted by natural disasters, finance may help tourism pull through the disasters and recover more quickly, as finance is negligibly influenced by disasters. On the other hand, tourism can retard the overheating of the development of the economy as it is less influenced by economic factors [47,48]. Therefore, tourism cities can enjoy the benefits from coordination between the development of finance and the growth of the tourism industry, to avoid the negative effects from outside shocks and maintain sustainability [49,50,51,52,53,54,55,56,57,58,59,60].

5.2. Financial Development, Sustainable Tourism, and Sustainability

It is believed that financial development contributes to economic growth through increasing the productivity of investments, reducing transaction costs, and changing savings [61]. Additionally, Rajan and Zingales (1998) reported that firms could get more support from cheaper external funding if finance developed more quickly [62]. The support of funding will indirectly increase the expansion of firms and the development of industry. For tourism, financial development will offer more chances for tourism companies to gain funding support and develop more products and services, which indirectly maintains the sustainable development of the tourism industry and the sustainable development of society as a whole. The development of tourism is considered to increase people’s incomes, create job opportunities, increase the level of consumption, and enhance social welfare [63]. Furthermore, Yalcin and Mehmet (2011) believe that the development of tourism increases the amount of investments in fixed assets, which contributes to the development of related industries (e.g., culture industry and media industry [64]), the employment rate, and the economy [65]. The development of tourism is considered to contribute to the urbanization of regions [66], the development of public transportation [67], and to shape and spread urban culture [68].

5.3. Implications

This study contributes to theory and practice. From the perspective of theory, this study establishes a new index system that can be used to measure the relationship between the finance and tourism industries. Additionally, this study fills a research gap through explaining the mechanisms of the development of finance and tourism, and the coordination between them, which inspires more study to examine the findings in different contexts. Finally, this study summarizes a series of influential factors of coordination, which may inspire more scholars to explore the degree of the effects.

In terms of practice, this study makes the following suggestions.

Firstly, financial institutions should diversify their financial instruments and financing instruments to improve the allocation efficiency of financial capital in the growth of the tourism industry. As the investment cycle of the tourism industry is long, money collecting is slow; but the income is steady in the late period, and the financial sectors need to develop financial products to improve financial capital allocation efficiency in the tourism industry. Also, financial sectors should balance the coordinated development of the indirect financing and direct financing so that they can constantly optimize the financing structure, accelerate the construction of multi-level capital market, increase the proportion of direct financing, and create good financing conditions for the tourism industry growth.

Secondly, the tourism industry should expand and diversify financing channels to meet the multi-level financial needs of structural upgrading. The industry should also encourage social capital to participate in the development of the tourism industry, strengthen the support from bond markets, establish and perfect the guarantee mechanism of enterprises’ direct financing, standardize the development of Internet finance, promote the diversification of financial supply structure, and effectively meet the multi-level financial needs of the industrial structure upgrade.

5.4. Limitation and Further Research

Although this study establishes an index system and explores the dynamic process of how finance interactively influences tourism, there are several limitations in this study. Firstly, the study chooses just three Chinese cities as cases, and draws some conclusions based on the results of quantitative analysis. Further study may try to reexamine the findings from this study in a wider context. Secondly, this study just focuses on the data from 2000 to 2016, which may be insufficient in terms of reliability and validity. For further study, more longitudinal research can be carried out based on longer time series data. Thirdly, this article does not study tourism from the perspective of different industry growth stages, therefore, future research can divide tourism industry growth into different periods to better analyze the dynamic relationship between the finance and tourism industry development.

6. Conclusions

The harmonious development of the finance and tourism industries can be considered as a dynamic process and it will contribute to the sustainable growth of both industries as well as the wider economy. This study evaluates the coupling coordination and dynamic relationship between finance and tourism, based on the data from 2000 to 2016 of three tourism cities in China, as well as testing the effects of coordination on the development of the regions’ economies. The findings fill the gap in research about coordinating the development between finance and tourism, and the sustainable development of the economy, with an index system that can be used for further research in similar emerging economies. Additionally, the findings can be regarded as a reference for policy-making and investments. The study appeals to further research to examine the findings in a broader context based on a larger sample and to take different perspectives in terms of the industries’ growth stages.

Author Contributions

K.-C.L. made contributions to the study design and data analysis; S.-W.S. and W.L. wrote the draft of paper; M.-Y.Y. polished the manuscript; and H.-B.X., J.-T.W., and S.-B.T. gave a series of suggestions for this paper.

Funding

This research is supported by the National Social Science Foundation of China (Grant No. 17CGJ002), the Natural and Cultural Heritage Research Base Open Fund Project of Hunan Province in 2016 (Grant No. 16jdzb071), and the Natural and Cultural Heritage Research Base Open Fund Project of Hunan Province in 2015(Grant No. 15jdzb071).

Acknowledgments

We would like to thank the governments and institutes who offer the funds for this research, and the students and colleagues who gave support for the data collection. Furthermore, we also would like to thank the anonymous reviewers and editors for commenting on this paper.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

| Definitions of Subsystem Indexes | |

| Subsystem | Definition |

| Financial industry development scale | The index reflects the level of comprehensive financial development in a region. It is also an important index measuring the strength of the regional financial system. From the perspective of the form of regional financial system, the financial correlation ratio, the depth of insurance, the degree of financial agglomeration, and the scale input of financial factors are measured. |

| Financial industry structure | The financial industrial structure reflects the degree of diversification of the financial industry. It includes the proportion of loan structure of the financial industry, the proportion of financial industry structure, and the proportion of the insurance industry structure. |

| Financial industry development efficiency | This index is the quality index of the development of the financial system, and it is also an important index measuring the allocation efficiency of financial resources, the efficiency of financial development, and the health of the development of the financial industry. The conversion rate of savings, savings rate, the ratios of loan and deposit, financial development efficiency, insurance compensation rate, foreign financing capacity, insurance density, and the difference between deposit and loan are measured. |

| Tourism industry scale | The scale of tourism industry development is the dominant indicator of the growth of tourism industry. It is an important symbol measuring the growth scale of regional tourism industry, including the growth of tourism market and tourism income. |

| Tourism industry structure and factor investment in tourism industry | Tourism industry structure and tourism industry factor input are internal and external environmental indicators, respectively, of the growth of the tourism industry, which mainly reflect the regional reception capacity, service quality, infrastructure, and attractiveness. Therefore, the number of travel agencies, the number of star hotels, the input of the elements of the labor force of the tourism industry, the rental cars in the end of the year, and the number of the public operating cars per 10,000 population are selected to measure regional reception capacity, service quality, and infrastructure investment. |

| Tourism industry development efficiency | This index measures the quality of the growth of the tourism industry. It mainly includes tourism contribution degree, tourism agglomeration degree, passenger volume, traffic network density, and the international development efficiency of tourism industry. |

References

- Qing, Y.; Yang, D.; Vries, B.D.; Qi, H.; Huimin, M. Assessing Regional Sustainability Using a Model of Coordinated Development Index: A Case Study of Mainland China. Sustainability 2014, 6, 9282–9304. [Google Scholar]

- United Nations Environment Programme (UNEP). Towards a Green Economy: Pathways to Sustainability Development and Poverty Eradication; UNEP: Nairobi, Kenya, 2011. [Google Scholar]

- Barbier, E.B. The concept of sustainable economic development. Enviorn. Conserv. 1987, 14, 101–110. [Google Scholar] [CrossRef]

- Ohlan, R. The relationship between tourism, financial development and economic growth in India. Future Bus. J. 2017, 3, 9–22. [Google Scholar] [CrossRef]

- Parida, Y.; Bhardwaj, P.; Chowdhury, J.R. Impact of terrorism on tourism in India. Econ. Bull. 2015, 35, 2543–2557. [Google Scholar]

- Goldsmith, R.W. Financial Structure and Development; Yale University Press: New Heaven, CT, USA, 1969; pp. 378–412. [Google Scholar]

- Kletzer, K.; Bardhan, P. Credit markets and patterns of international trade. J. Dev. Econ. 1986, 27, 57–70. [Google Scholar] [CrossRef]

- Basen, T.; Martin, C.D. Financial development and international trade: Is there a link? J. Int. Econ. 2002, 57, 107–131. [Google Scholar]

- Livesay, H.C.; Porter, G. The financial role of merchants in the development of U.S. manufacturing, 1815–1860. Explor. Econ. Hist. 1971, 9, 63–87. [Google Scholar] [CrossRef]

- Perić, J. International financial institution investments in tourism and hospitality. J. Int. Bus. Cult. Stud. 2011, 4, 1–17. [Google Scholar]

- Eagles, P.F.J. Fiscal implications of moving to tourism finance for parks: Ontario Provincial Parks. Manag. Leis. 2014, 19, 1–17. [Google Scholar] [CrossRef]

- Badulescu, D.; Giurgiu, A.; Istudor, N.; Badulescu, A. Rural tourism development and financing in Romania: A supply-side analysis. Agric. Econ. 2015, 61, 72–80. [Google Scholar] [CrossRef]

- Chen, J.; Lu, L.; Zhu, F.B. On the Study Progress of Tourism Industrial Merging and Its Enlightenment. Tour. Trib. 2011, 26, 13–19. (In Chinese) [Google Scholar]

- Yang, R.H.; Li, Y.B. The Empirical Analysis of Regional Differences in Financial Support to the Development of Chinese Tourism Industry—On the Basis of the Panel Data of the Eastern, Central and Western. Econ. Manag. 2013, 7, 86–91. (In Chinese) [Google Scholar]

- Yang, J.C.; Shi, R. Comparison of Dynamic Effects of Financial Support for Tourism Industry Development: A Case Study of Guizhou and Zhejiang Provinces. Soc. Sci. 2014, 6, 88–92. (In Chinese) [Google Scholar]

- Katircioglu, S.; Katircioğlu, S.; Altinay, M. Interactions between tourism and financial sector development: Evidence from Turkey. Serv. Ind. J. 2017, 4, 1–24. [Google Scholar] [CrossRef]

- Shi, E.Y. Research on the Internal Mechanism of Financial Growth and Industrial Growth; Harbin Institute of Technology Press: Harbin, China, 2011. (In Chinese) [Google Scholar]

- Li, Y.F.; Li, Y.; Zhou, Y.; Shi, Y.L.; Zhu, X.D. Investigation of a coupling model of coordination between urbanization and the environment. J. Environ. Manag. 2012, 98, 127–133. [Google Scholar] [CrossRef] [PubMed]

- Guan, D.J.; Gao, W.J.; Su, W.C.; Li, H.F.; Hokao, K. Modeling and dynamic assessment of urban economy-resource-environment system with a coupled system dynamics-geographic information system model. Ecol. Indic. 2011, 11, 1333–1344. [Google Scholar] [CrossRef]

- Tang, Z. An integrated approach to evaluating the coupling coordination between tourism and the environment. Tour. Manag. 2015, 46, 11–19. [Google Scholar] [CrossRef]

- Wang, S.J.; Ma, H.T.; Zhao, Y.B. Exploring the relationship between urbanization and the eco-environment—A case study of Beijing–Tianjin–Hebei region. Ecol. Indic. 2014, 45, 171–183. [Google Scholar] [CrossRef]

- Liu, W.; Shi, H.B.; Zhang, Z.; Tsai, S.B.; Zhai, Y.; Chen, Q.; Wang, J. The Development Evaluation of Economic Zones in China. Int. J. Environ. Res. Public Health 2018, 15, 56. [Google Scholar] [CrossRef] [PubMed]

- Castellani, V.; Sala, S. Sustainable performance index for tourism policy development. Tour. Manag. 2010, 31, 871–880. [Google Scholar] [CrossRef]

- Choi, H.; Sirakaya, E. Sustainability indicators for managing community tourism. Tour. Manag. 2006, 27, 1274–1289. [Google Scholar] [CrossRef]

- Hunter, C.; Shaw, J. Research article: The ecological footprint as a key indicator of sustainable tourism. Tour. Manag. 2007, 28, 46–57. [Google Scholar] [CrossRef]

- Guo, Y.; Guo, Z.R. Empirical Analysis of Coupled Coordination Development between Tourism and Finance: A Case Study of Jiangsu Province. Tour. Trib. 2017, 3, 74–84. (In Chinese) [Google Scholar]

- Patrick, H.T. Financial Development and Economic Growth in Undeveloped Countries. Econ. Dev. Cult. Chang. 1966, 14, 174–189. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. Financial systems, industrial structure, and growth. Oxf. Rev. Econ. Policy 2001, 17, 467–482. [Google Scholar] [CrossRef]

- Ma, X.F.; Cui, P.P. On the Copling Development of Tourism Growth and Urbanization from the Perspective of Industry Generation: A Case Study of Zhang Jiajie. J. Southwest Univ. 2017, 12, 90–97. (In Chinese) [Google Scholar]

- Liu, Y.B.; Yao, C.S.; Wang, G.X.; Bao, S.M. An integrated sustainable development approach to modeling the eco-environmental effects from urbanization. Ecol. Indic. 2011, 11, 1599–1608. [Google Scholar] [CrossRef]

- Mckinnon, R.I. Money and Capital in Economic Development; Brookings Institution: Washington, DC, USA, 1973. [Google Scholar]

- Shaw, E. Financial Deepening in Economic Development; Oxford University Press: New York, NY, USA, 1973. [Google Scholar]

- Demirgüç-Kunt, A.; Levine, R. Bank Based and Market Based Financial Systems: Cross Country Comparison Mimeo; World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Han, T.C.; Lei, Y.J. The Influence of Financial Ecological Environment on the Development of Financial Subjects. World Econ. 2008, 3, 71–79. (In Chinese) [Google Scholar]

- Fan, G.; Guo, W.D.; Zhang, J.S. CDI China Financial Center Index Report (Phase 1st); China Economy Press: Beijing, China, 2009. (In Chinese) [Google Scholar]

- Zhen, L. Industrial Economics; Henan People Publish House: Zhengzhou, China, 1992; pp. 34–40. (In Chinese) [Google Scholar]

- Lu, G.Q. On the System Dynamic Mechanism of Industrial Evolution. Jianghan Tribune 2002, 4, 15–18. (In Chinese) [Google Scholar]

- Ma, X.F.; Sun, B. A Study on the Growth of Zhangjiajie Tourism Industry Based on Natural Trend Cure Theory and TOPSIS Method. J. Xi’an Univ. Financ. Econ. 2015, 28, 63–70. (In Chinese) [Google Scholar]

- Song, H.; Lin, S. Impacts of the financial and economic crisis on tourism in Asia. J. Travel Res. 2010, 49, 16–30. [Google Scholar] [CrossRef]

- Yu, Q. Economic Fluctuation, Macro Control, and Monetary Policy in the Transitional Chinese Economy. J. Comp. Econ. 1997, 2, 180–195. [Google Scholar] [CrossRef]

- Ferraz, J.; Coutinho, L. Investment policies, development finance and economic transformation: Lessons from BNDES. Struct. Chang. Econ. Dyn. 2017, in press. [Google Scholar] [CrossRef]

- Martínez, R.M.; Galván, M.O.; Lafuente, A.M.G. Public Policies and Tourism Marketing. An Analysis of the Competitiveness on Tourism in Morelia, Mexico and Alcala de Henares, Spain. Procedia 2014, 148, 146–152. [Google Scholar] [CrossRef]

- Wijaya, N.; Furqan, A. Coastal Tourism and Climate-Related Disasters in an Archipelago Country of Indonesia: Tourists’ Perspective. Proc. Eng. 2018, 212, 535–542. [Google Scholar] [CrossRef]

- Kumar, R.R.; Kumar, R. Exploring the developments in urbanization, aid dependency, sectorial shifts and services sector expansion in Fiji: A modern growth perspective. Glob. Bus. Econ. Rev. 2013, 15, 371–395. [Google Scholar] [CrossRef]

- Işik, C.; Kasımatı, E.; Ongan, S. Analyzing the causalities between economic growth, financial development, international trade, tourism expenditure and/on the CO2 emissions in Greece. Energy Source Part B 2017, 12, 665–673. [Google Scholar] [CrossRef]

- López, M.F.B.; Virto, N.R.; Manzano, J.A.; Miranda, J.G.M. Residents’ attitude as determinant of tourism sustainability: The case of Trujillo. J. Hosp. Tour. Manag. 2018, 35, 36–45. [Google Scholar] [CrossRef]

- Liu, W.; Wei, Q.; Huang, S.Q.; Tsai, S.B. Doing Good Again? A Multilevel Institutional Perspective on Corporate Environmental Responsibility and Philanthropic Strategy. Int. J. Environ. Res. Public Health 2017, 14, 1283. [Google Scholar] [CrossRef] [PubMed]

- Lin, F.H.; Tsai, S.B.; Lee, Y.C.; Hsiao, C.F.; Zhou, J.; Wang, J.; Shang, Z. Empirical research on Kano’s model and customer satisfaction. PLoS ONE 2017, 12, e0183888. [Google Scholar] [CrossRef] [PubMed]

- Peng, C.F.; Ho, L.H.; Tsai, S.B.; Hsiao, Y.C.; Zhai, Y.; Chen, Q.; Chang, L.C.; Shang, Z. Applying the Mahalanobis–Taguchi System to Improve Tablet PC Production Processes. Sustainability 2017, 9, 1557. [Google Scholar] [CrossRef]

- Li, H.; Zhang, H.; Tsai, S.B.; Qiu, A. China’s Insurance Regulatory Reform, Corporate Governance Behavior and Insurers’ Governance Effectiveness. Int. J. Environ. Res. Public Health 2017, 14, 1238. [Google Scholar] [CrossRef] [PubMed]

- Yuan, Y.H.; Tsai, S.B.; Dai, C.Y.; Chen, H.M.; Chen, W.F.; Wu, C.H.; Li, G.; Wang, J. An Empirical Research on Relationships between Subjective Judgement, Technology Acceptance Tendency and Knowledge Transfer. PLoS ONE 2017, 12, e0183994. [Google Scholar] [CrossRef] [PubMed]

- Chang, S.F.; Chang, J.C.; Lin, K.H.; Yu, B.; Lee, Y.C.; Tsai, S.B.; Zhou, J.; Wu, C.; Yan, Z.C. Measuring the service quality of e-commerce and competitive strategies. Int. J. Web Serv. Res. 2014, 11, 96–115. [Google Scholar] [CrossRef]

- Gao, Y.; Tsai, S.B.; Xue, X.; Ren, T.; Du, X.; Chen, Q.; Wang, J. An Empirical Study on Green Innovation Efficiency in the Green Institutional Environment. Sustainability 2018, 10, 724. [Google Scholar] [CrossRef]

- Chou, C.C.; Shen, C.W.; Gao, D.; Gao, Y.; Wang, K.; Tsai, S.B. Modelling the Dynamic Impacts of High Speed Rail Operation on Regional Public Transport—From the Perspective of Energy Economy. Energies 2018, 11, 1151. [Google Scholar] [CrossRef]

- Chen, Q.; Wang, J.; Yu, J.; Tsai, S.B. An Empirical Research on Marketing Strategies of Different Risk Preference Merchant. Math. Probl. Eng. 2018, 2018, 7947894. [Google Scholar] [CrossRef]

- Chen, Y.; Yu, J.; Li, L.; Li, L.; Li, L.; Zhou, J.; Tsai, S.B.; Chen, Q. An Empirical Study of the Impact of the Air Transportation Industry Energy Conservation and Emission Reduction Projects on the Local Economy in China. Int. J. Environ. Res. Public Health 2018, 15, 812. [Google Scholar] [CrossRef] [PubMed]

- Tsai, S.B.; Chien, M.F.; Xue, Y.; Li, L.; Jiang, X.; Chen, Q.; Zhou, J.; Wang, L. Using the fuzzy DEMATEL to determine environmental performance: a case of printed circuit board industry in Taiwan. PLoS ONE 2015, 10, e0129153. [Google Scholar] [CrossRef] [PubMed]

- Wu, W.; Huang, X.; Li, Y.; Chu, C.C. Optimal Quality Strategy and Matching Service on Crowdfunding Platforms. Sustainability 2018, 10, 1053. [Google Scholar] [CrossRef]

- Su, J.; Li, C.; Tsai, S.B.; Lu, H.; Liu, A.; Chen, Q. A sustainable closed-loop supply chain decision mechanism in the electronic sector. Sustainability 2018, 10, 1295. [Google Scholar] [CrossRef]

- Chu, C.C.; Tsai, S.B.; Chen, Y.; Li, X.; Zhai, Y.; Chen, Q.; Jing, Z.; Ju, Z.Z.; Li, B. An Empirical Study on the Relationship between Investor Protection, Government Behavior, and Financial Development. Sustainability 2017, 9, 2199. [Google Scholar] [CrossRef]

- Pagano, M. Financial markets and growth: An overview. Eur. Econ. Rev. 1993, 37, 613–622. [Google Scholar] [CrossRef]

- Rajan, R.; Zingales, L. Financial dependence and growth. Am. Econ. Rev. 1998, 88, 559–586. [Google Scholar]

- Mayer, M.; Müller, M.; Woltering, M.; Arnegger, J.; Job, H. The economic impact of tourism in six German national parks. Landsc. Urban Plan. 2010, 97, 73–82. [Google Scholar] [CrossRef]

- Cheng, X.L.; Zhu, Y.W. The Integration of Tourism Industry and Culture Industry in Anhui Province. Econ. Geogr. 2012, 32, 161–165. (In Chinese) [Google Scholar]

- Yalcin, A.; Mehmet, B. Time-varying linkages between tourism receipts and economic growth in a small open economy. Econ. Model. 2011, 28, 664–671. [Google Scholar]

- Mullins, P. Tourism Urbanization. Int. J. Urban Reg. Res. 1991, 15, 326–342. [Google Scholar] [CrossRef]

- Wang, Y.M.; Ma, Y.F. Analysis of Coupling Coordination between Urban Tourism Economy and Transport System Development: A Case Study of Xi’an City. J. Shaanxi Normal Univ. 2011, 39, 86–90. (In Chinese) [Google Scholar]

- Wang, D.Y.; Xia, Y.L.; Li, R.M. A Study on the Coordinate Development between City Tourism and City Culture. Econ. Geogr. 2007, 27, 1059–1062. (In Chinese) [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).