Improving the Sustainable Competitiveness of Service Quality within Air Cargo Terminals

Abstract

:1. Introduction

2. Literature Review

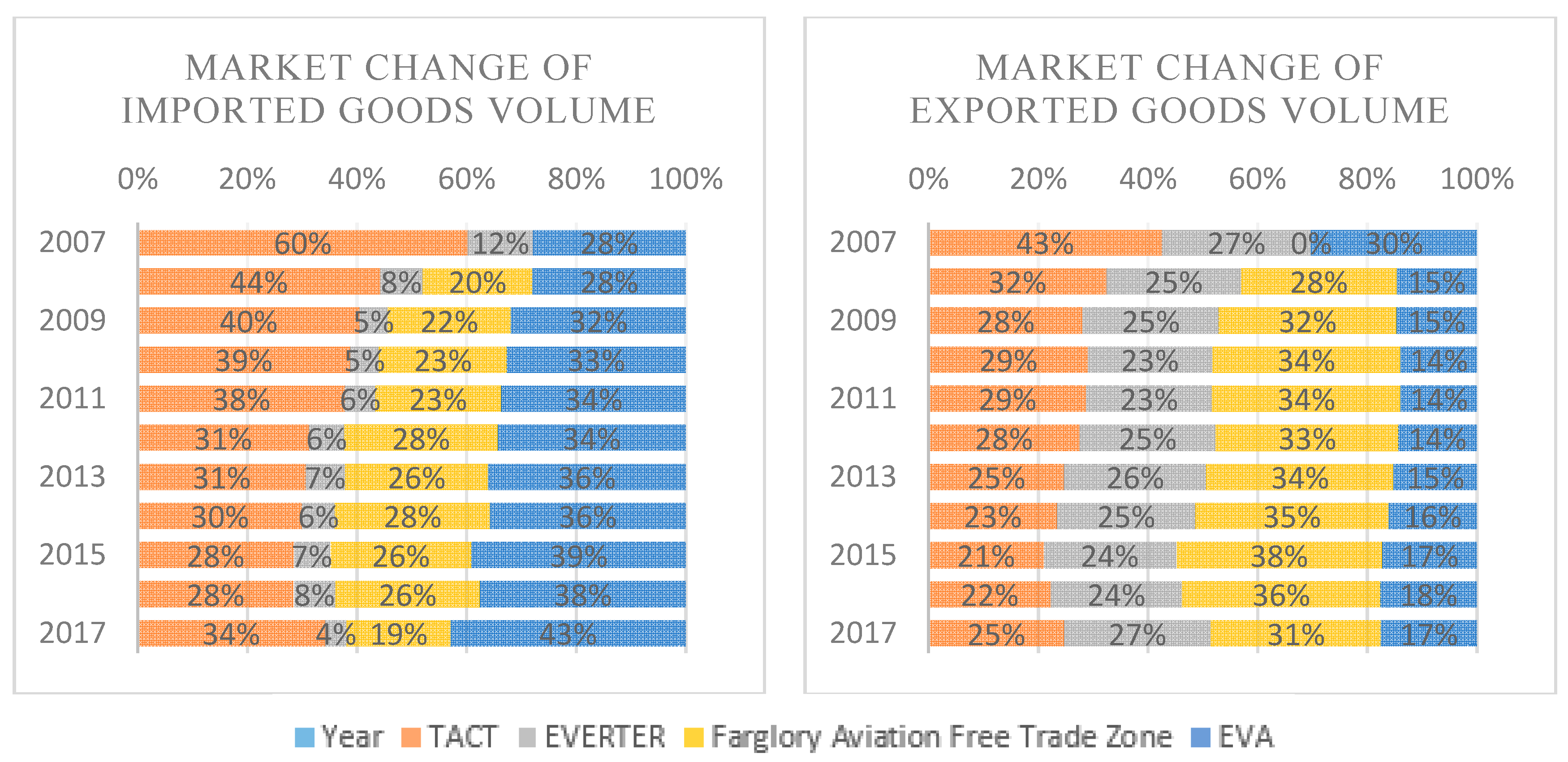

2.1. Air Cargo Forwarder Industry in Taiwan

2.2. Service Quality

3. Research Methods

3.1. Delphi Method

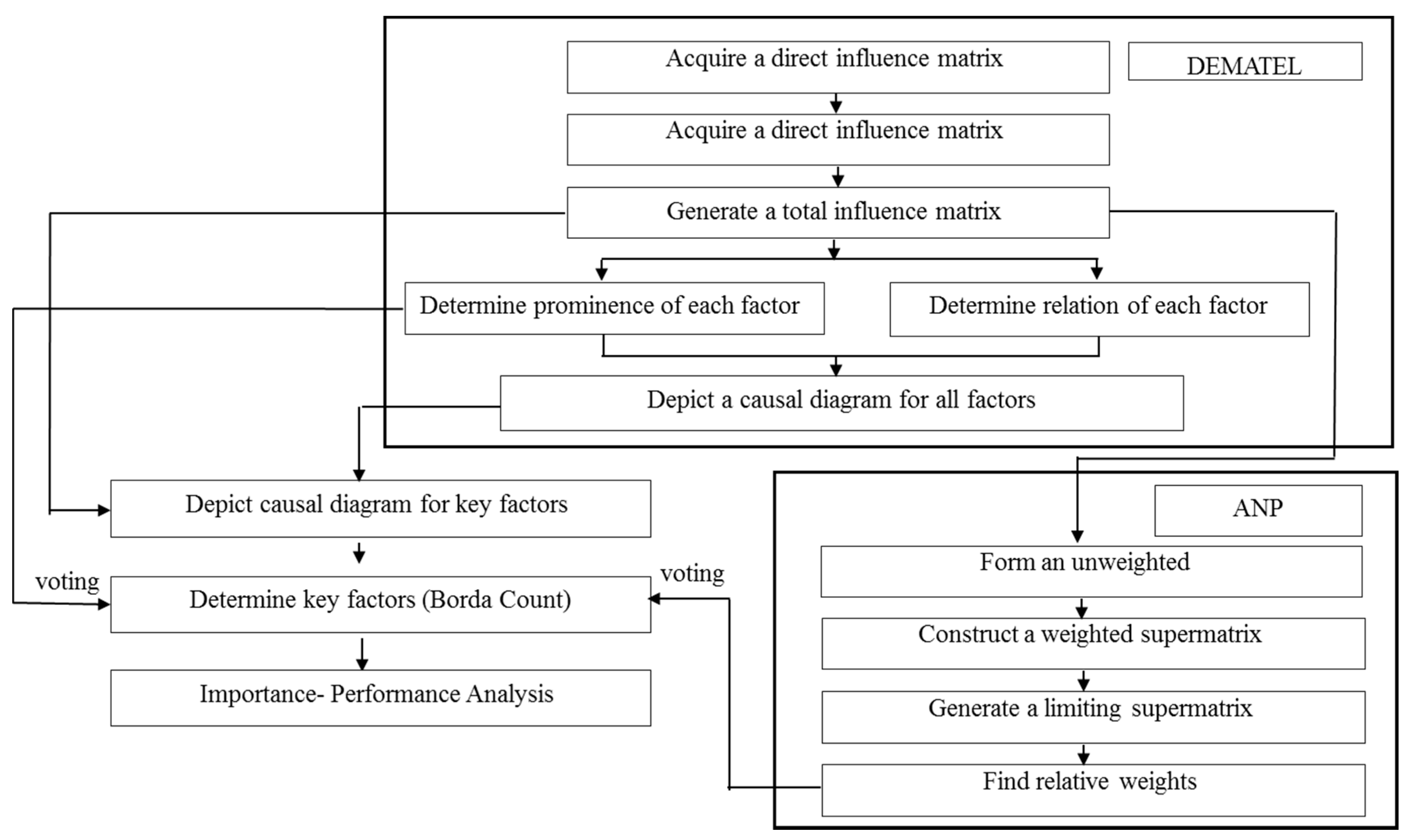

3.2. DEMATEL-Based ANP (DANP)

- Determining the Total Influence Matrix.

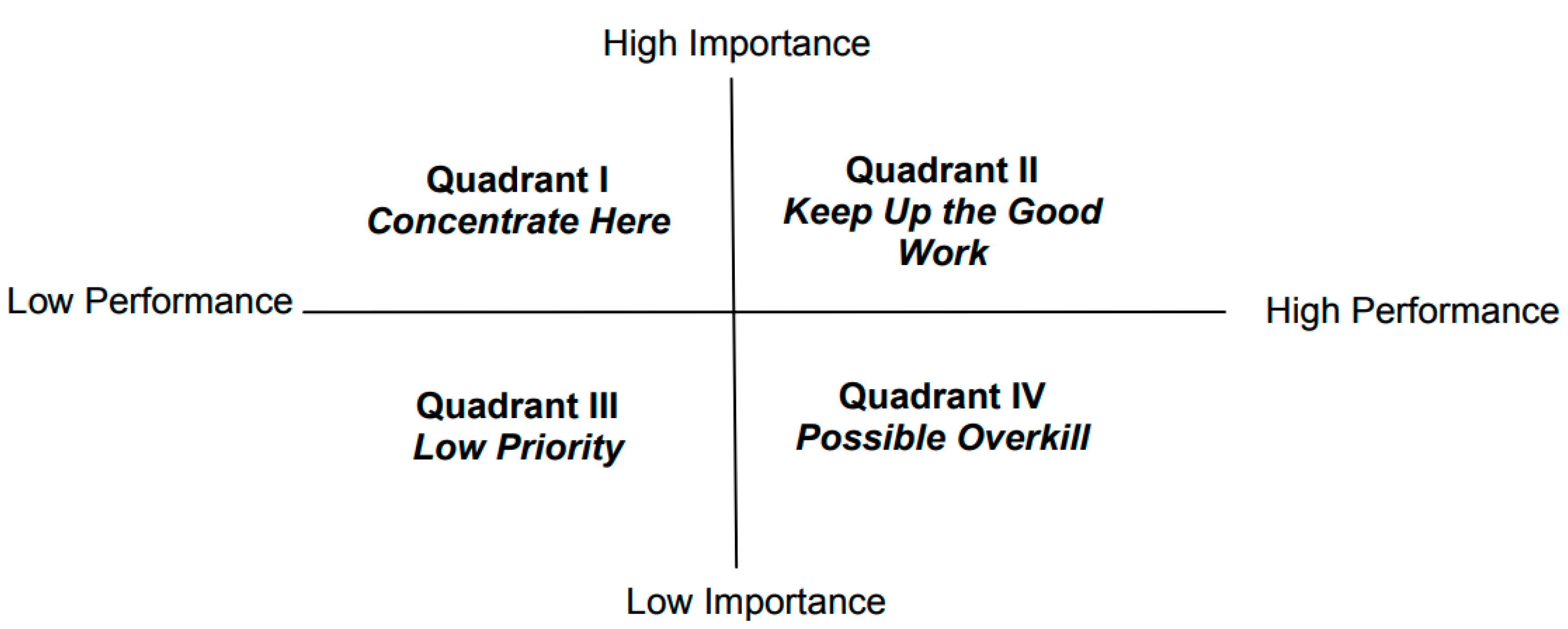

3.3. Importance-Performance Analysis

4. Empirical Study

4.1. Establish an Evaluation Hierarchy

4.2. Delphi Method Questionnaire Results and Expert Suggestions

4.3. Criteria Importance Analysis

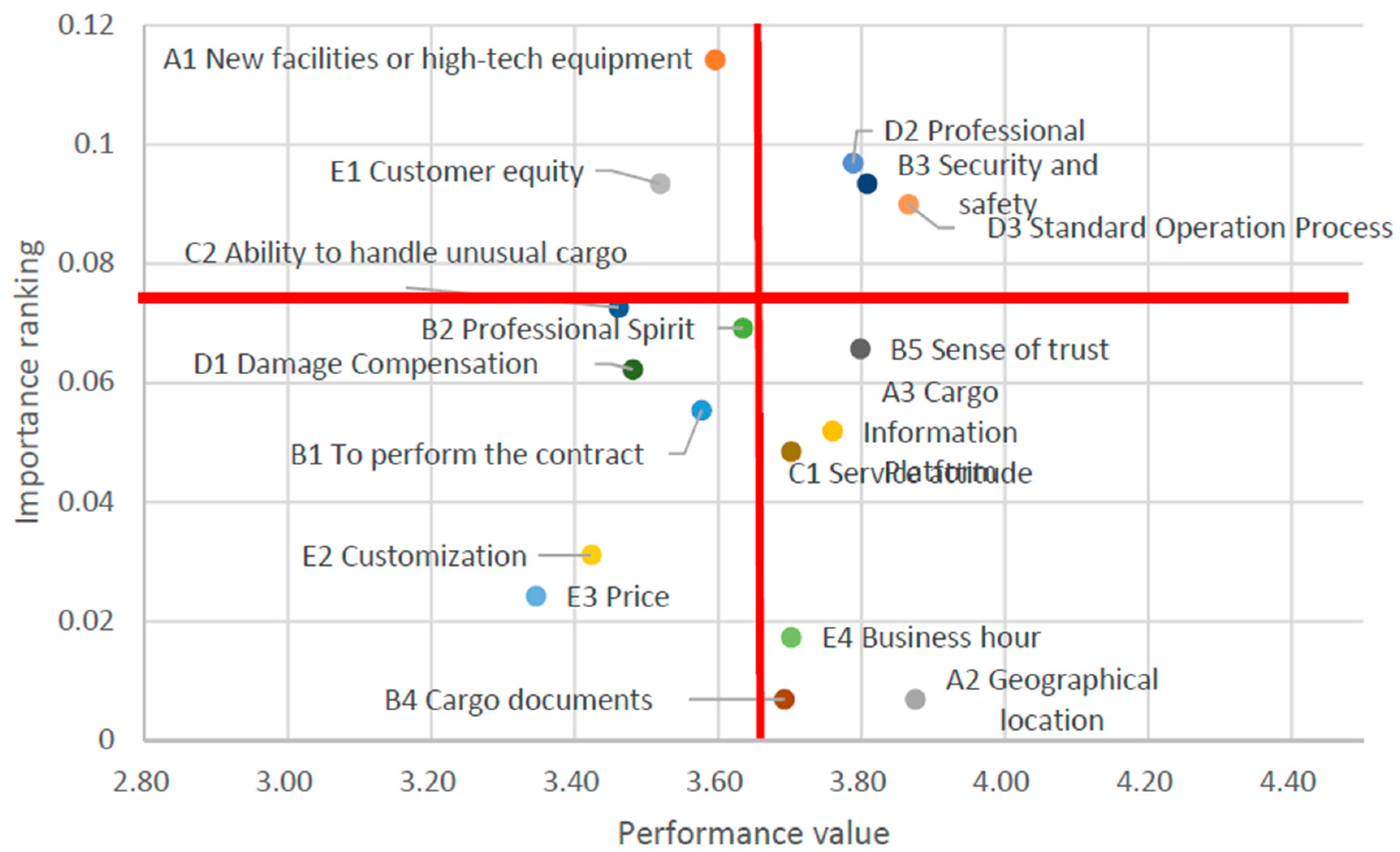

4.4. Importance-Performance Analysis

4.5. SWOT Analysis

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Boeing. World Air Cargo Forecast 2016–2017. Available online: http://www.boeing.com/resources/boeingdotcom/commercial/about-our-market/cargo-market-detail-wacf/download-report/assets/pdfs/wacf.pdf (accessed on 3 July 2018).

- IATA. Another Strong Year for Airline Profits in 2017; IATA: Montreal, QC, Canada, 2016. [Google Scholar]

- Taiwan Industry Economics Services. Air Cargo Industry Basic Information. Available online: https://tie.tier.org.tw/db/article/list.asp?code=IND30-14&ind_type=midind (accessed on 3 July 2018).

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. Servqual: A multiple-item scale for measuring consumer perceptions of service quality. Retail. Crit. Concepts 1988, 64, 12–40. [Google Scholar]

- Taiwan. Clause 16, article 2 of the civil aviation law of Taiwan. 2018. [Google Scholar]

- Hu, K.-C.; Lu, L.M.; Huang, M.-C. The effects of service quality, innovation capability, and corporate image of air cargo terminals on customer satisfaction and loyalty. Int. J. Oper. Res. 2010, 2, 037–054. [Google Scholar]

- Chao, C.-C.; Huang, C.-C.; Yeh, T.-L. Market segmentation of air cargo terminal in taiwan. Marit. Q. 2012, 21, 45–70. [Google Scholar]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L.L. A conceptual model of service quality and its implications for future research. J. Mark. 1985, 49, 41–50. [Google Scholar] [CrossRef]

- Park, Y.; Choi, J.K.; Zhang, A. Evaluating competitiveness of air cargo express services. Transp. Res. Part E Logist. Transp. Rev. 2009, 45, 321–334. [Google Scholar] [CrossRef]

- Chu, H.-C. Exploring preference heterogeneity of air freight forwarders in the choices of carriers and routes. J. Air Transp. Manag. 2014, 37, 45–52. [Google Scholar] [CrossRef]

- Chang, S.-C. The effects of air cargo warehouses’ service quality on trust, commitment and behavioral intentions. Logist. Res. Rev. 2007, 6, 41–55. [Google Scholar]

- Wang, R.-T. Improving service quality using quality function deployment: The air cargo sector of china airlines. J. Air Transp. Manag. 2007, 13, 221–228. [Google Scholar] [CrossRef]

- Huang, S.-H.S.; Tseng, W.-J.; Hsu, W.-K.K. An assessment of knowledge gap in service quality for air freight carriers. Transp. Policy 2016, 50, 87–94. [Google Scholar] [CrossRef]

- Meng, S.-M.; Liang, G.-S.; Lin, K.; Chen, S.-Y. Criteria for services of air cargo logistics providers: How do they relate to client satisfaction? J. Air Transp. Manag. 2010, 16, 284–286. [Google Scholar] [CrossRef]

- Lin, J.-F. The Service Quality of Airline Cargo Transportation—A Case Study of Eva Air; National Taiwan Ocean University: Kaohsiung City, Taiwan, 2010. [Google Scholar]

- Hsu, W.-K.K. A gap analysis in service quality for air freight forwarders. J. Chin. Inst. Transp. 2011, 23, 515–540. [Google Scholar] [CrossRef]

- Yoon, S.-H.; Park, J.-W. A study of the competitiveness of airline cargo services departing from korea: Focusing on the main export routes. J. Air Transp. Manag. 2015, 42, 232–238. [Google Scholar] [CrossRef]

- Pill, J. The delphi method: Substance, context, a critique and an annotated bibliography. Socio-Econ. Plan. Sci. 1971, 5, 57–71. [Google Scholar] [CrossRef]

- Dalkey, N.; Helmer, O. An experimental application of the delphi method to the use of experts. Manag. Sci. 1963, 9, 458–467. [Google Scholar] [CrossRef]

- Saaty, T.L. The analytic hierarchy and analytic network measurement processes: Applications to decisions under risk. Eur. J. Pure Appl. Math. 2008, 1, 122–196. [Google Scholar]

- Hu, Y.-C.; Chiu, Y.-J.; Hsu, C.-S.; Chang, Y.-Y. Identifying key factors for introducing gps-based fleet management systems to the logistics industry. Math. Probl. Eng. 2015, 2015, 1–14. [Google Scholar] [CrossRef]

- McLean, I. Condorcet: Foundations of Social Choice and Political Theory; Edward Elgar Publishing: Cheltenham, UK, 1994. [Google Scholar]

- Martilla, J.A.; James, J.C. Importance-performance analysis. J. Mark. 1977, 41, 77–79. [Google Scholar] [CrossRef]

- Aguilar, F.J. Scanning the Business Environment; Macmillan: New York, NY, USA, 1967. [Google Scholar]

| Aspects | Criteria | References |

|---|---|---|

| Tangibles | New facilities or high-tech equipment | [6,9,10,11] |

| Geographical location | [6,7,9,12,13] | |

| Cargo tracking | [7,11,12,13,14] | |

| Customer service area | [12] | |

| Website | [12,13] | |

| Reliability | To perform the contract | [6,7,9,11,14,15,16] |

| Professional attitude | [6,9,11,12,13,14,17,18] | |

| Security and safety | [7,11,12,14,16,17,18] | |

| Cargo documents | [7,15,17] | |

| Reputation and corporate image | [7,11,12,19,20] | |

| Sense of trust | [6,9,12,20] | |

| Responsiveness | Service attitude | [6,9,13,14] |

| Ability to handle unusual cargo | [9,10,13,15] | |

| Assurance | Compensation | [9,10,13,15] |

| Professional | [6,7,9,11,14,15,16,17] | |

| Standard Operation Process | [7,14] | |

| Empathy | Convenience | [6,9,13,19] |

| Customer equity | [6,9] | |

| Customization | [13,14,17,18] | |

| Price elasticity | [11,13,14,16,18,19,20] | |

| Business hours | [7,13,18,19] |

| Expert Code | Service Unit | Title | Years of Experience |

|---|---|---|---|

| Expert A | Air cargo terminal distribution industry | Manager | 15–25 years |

| Expert B | Air cargo terminal distribution industry | Manager | 15–25 years |

| Expert C | Air cargo terminal distribution industry | Manager | 15–25 years |

| Expert D | Air cargo terminal distribution industry | Manager | 15–25 years |

| Expert E | Air cargo terminal distribution industry | Manager | 15–25 years |

| Expert F | Air cargo terminal distribution industry | Manager | 15–25 years |

| Expert G | Airline Freight Dept. | Manager | 15–25 years |

| Expert H | Qualified senior manager of forwarders who is presently a scholar in relevant areas | Teacher | 15–25 years |

| Expert I | Qualified senior manager of forwarders who is presently a scholar in relevant areas | Teacher | 20–30 years |

| Aspects | Criteria | Descriptions |

|---|---|---|

| Tangibles (A) | New facilities or high-tech equipment (A1) | The company has a modern air cargo terminals fully equipped with the hardware, software, cold chain and other ancillary equipment needed to handle the goods. |

| Geographical location (A2) | The operating space is of an adequate size. The location of the warehouse, the transportation network near the warehouse and the line layout of the air cargo terminals are sufficient to meet demands. | |

| Cargo information platform (A3) | Cargo checking, equipment completeness and cargo tracking systems at the terminals are sufficient to meet demands. | |

| Reliability (B) | Ability to fulfil contracts (B1) | Terminals can fulfil promises and goods on time. |

| Professional spirit (B2) | The service personnel are professional, devoted, passionate, exertive, with professional ethics, professional conduct and dedication. | |

| Security and safety (B3) | The company has in place suitable safety and security procedures, resulting in low rates of damage and loss. | |

| Cargo documents (B4) | EDI (Electronic Data Interchange) transmits correctly and correctly handles various transportation documents. | |

| Sense of trust (B5) | Service personnel give customers a sense of trust and clearly explain services. | |

| Responsiveness (C) | Service attitude (C1) | Service personnel provide customers with the information they need. Smooth and real-time communication channels are open. Customer inquiries (such as trade inquiry) are answered in real time. Documents are rapid processed and warehousing operators inform customers of the expected delivery time after completing the deconsolidation of goods. The customer is notified when the goods have been delivered. Service staff are willing to help the customer to solve problems. |

| Ability to handle unusual cargo (C2) | Issues with respect to unusual cargoes are handled quickly, with good responsiveness and reasonableness. | |

| Assurance (D) | Damage compensation (D1) | Processing of cargo damage compensation is efficient. |

| Professional (D2) | Air cargo terminal SGS, BV and ISO standards are used, to ensure air cargo is handled safely. The company works to achieve staff resilience, improve professional knowledge, provide professional air cargo terminals management staff and improve storage-related consulting capabilities. | |

| Standard operation processes (D3) | The loading and unloading of goods is performed in accordance with standard operating procedures, operations within the air cargo terminals are efficient and goods are properly handled. | |

| Empathy (E) | Customer equity (E1) | Air cargo terminal staff value customer rights. |

| Customization (E2) | Provide customized services, logistics processing services (such as labeling, carton packaging), logistics value-added services and consolidation services. | |

| Price (E3) | Complete operating fee schedules and flexible payment options are available to customers. | |

| Business hours (E4) | Provide extra overtime services and flexible booking times. |

| Criteria | d | r | d + r | d − r |

|---|---|---|---|---|

| A1 | 10.9230 | 10.7194 | 21.6424 | 0.2036 |

| A2 | 8.2980 | 7.1679 | 15.4660 | 1.1301 |

| A3 | 10.3368 | 10.2416 | 20.5783 | 0.0952 |

| B1 | 10.2471 | 10.5118 | 20.7589 | −0.2647 |

| B2 | 10.6197 | 9.8995 | 20.5192 | 0.7202 |

| B3 | 10.4727 | 10.8878 | 21.3605 | −0.4150 |

| B4 | 6.5309 | 9.0400 | 15.5708 | −2.5091 |

| B5 | 10.2157 | 11.0237 | 21.2394 | −0.8080 |

| C1 | 10.3426 | 10.1752 | 20.5178 | 0.1674 |

| C2 | 10.4182 | 10.5737 | 20.9919 | −0.1555 |

| D1 | 10.3464 | 10.2485 | 20.5950 | 0.0979 |

| D2 | 10.8462 | 10.3364 | 21.1825 | 0.5098 |

| D3 | 10.6969 | 10.4072 | 21.1040 | 0.2897 |

| E1 | 10.5840 | 10.6599 | 21.2439 | −0.0759 |

| E2 | 9.9858 | 9.5785 | 19.5643 | 0.4073 |

| E3 | 9.6711 | 9.2127 | 18.8838 | 0.4584 |

| E4 | 9.1855 | 9.0369 | 18.2223 | 0.1486 |

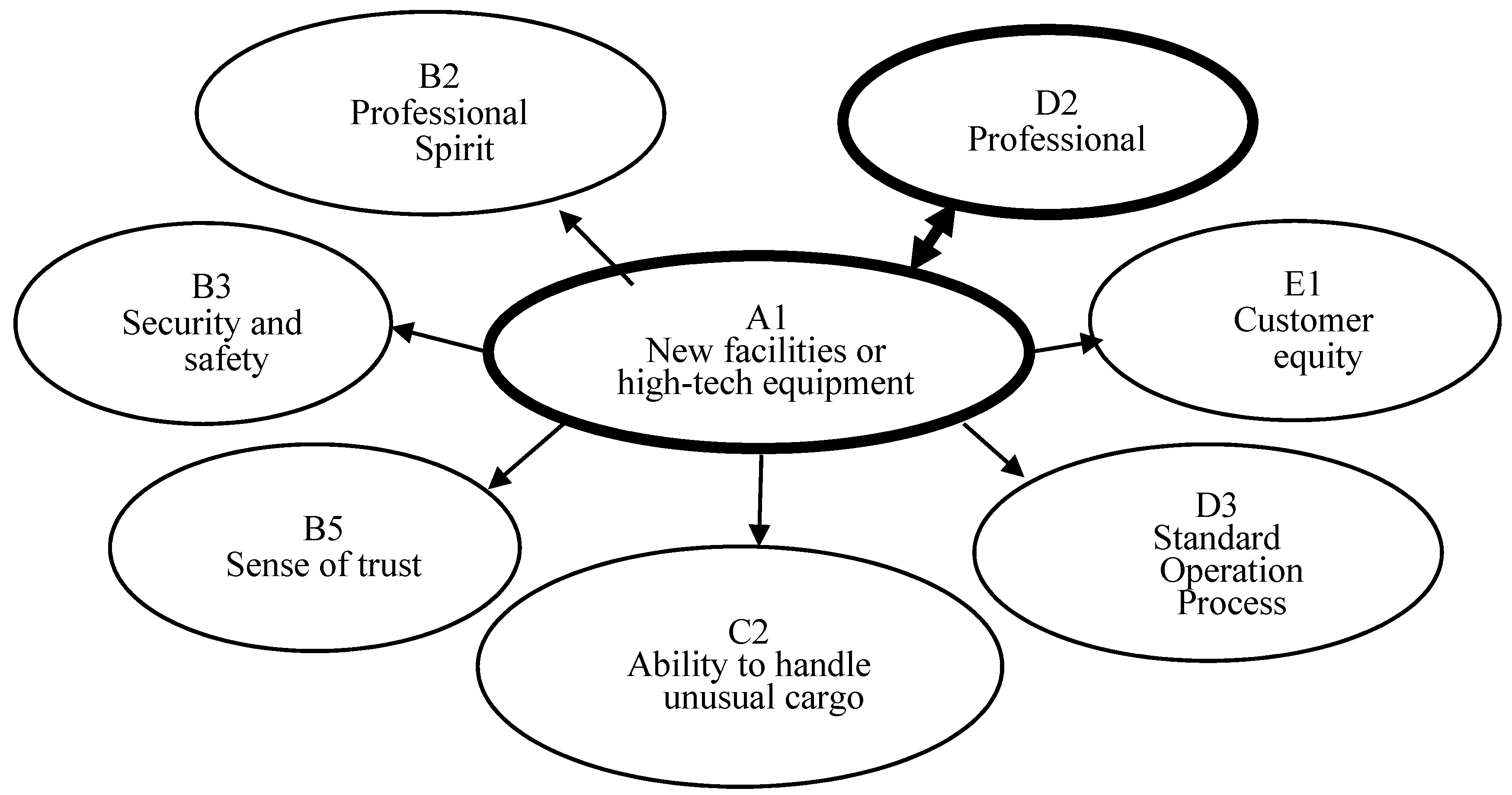

| Cause/Effect | Criteria |

|---|---|

| Cause | New facilities or high-tech equipment (A1), Professional (D2), Standard operation processes (D3) |

| Effect | Professional spirit (B2), Security and safety (B3), Sense of trust (B5), Ability to handle unusual cargo (C2), Customer equity (E1) |

| Criteria | DEMATEL | DANP | Sum of Rankings | Overall Rankings |

|---|---|---|---|---|

| A1 | 1 | 1 | 2 | 1 |

| A2 | 17 | 16 | 33 | 16 |

| A3 | 10 | 10 | 20 | 11 |

| B1 | 8 | 11 | 19 | 10 |

| B2 | 11 | 4 | 15 | 7 |

| B3 | 2 | 6 | 8 | 3 |

| B4 | 16 | 17 | 33 | 16 |

| B5 | 4 | 12 | 16 | 8 |

| C1 | 12 | 9 | 21 | 12 |

| C2 | 7 | 7 | 14 | 6 |

| D1 | 9 | 8 | 17 | 9 |

| D2 | 5 | 2 | 7 | 2 |

| D3 | 6 | 3 | 9 | 5 |

| E1 | 3 | 5 | 8 | 3 |

| E2 | 13 | 13 | 26 | 13 |

| E3 | 14 | 14 | 28 | 14 |

| E4 | 15 | 15 | 30 | 15 |

| Rating | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Performance | Very dissatisfied | Dissatisfied | Ordinary | Satisfied | Very satisfied |

| Criteria | Air Cargo Terminal 1 | Air Cargo Terminal 2 | Air Cargo Terminal 3 | Air Cargo Terminal 4 | Average |

|---|---|---|---|---|---|

| A1 | 3.3077 | 3.3462 | 3.7308 | 4.0000 | 3.5962 |

| A2 | 4.6154 | 2.8462 | 4.4615 | 3.5769 | 3.8750 |

| A3 | 3.6538 | 3.6538 | 3.9615 | 3.7692 | 3.7596 |

| B1 | 3.5385 | 3.6154 | 3.6154 | 3.5385 | 3.5769 |

| B2 | 3.5769 | 3.8077 | 3.5769 | 3.5769 | 3.6346 |

| B3 | 3.5769 | 3.8846 | 3.9615 | 3.8077 | 3.8077 |

| B4 | 3.6154 | 3.8077 | 3.8077 | 3.5385 | 3.6923 |

| B5 | 3.5385 | 4.1154 | 3.8462 | 3.6923 | 3.7981 |

| C1 | 3.4615 | 4.0769 | 3.5000 | 3.7692 | 3.7019 |

| C2 | 3.2692 | 3.6154 | 3.4615 | 3.5000 | 3.4615 |

| D1 | 3.3462 | 3.6923 | 3.4231 | 3.4615 | 3.4808 |

| D2 | 3.6923 | 3.9615 | 3.8077 | 3.6923 | 3.7885 |

| D3 | 3.8077 | 3.8846 | 3.7692 | 4.0000 | 3.8654 |

| E1 | 3.3462 | 3.6154 | 3.5769 | 3.5385 | 3.5192 |

| E2 | 3.1538 | 3.8077 | 3.3077 | 3.4231 | 3.4231 |

| E3 | 2.9615 | 3.7692 | 3.2692 | 3.3846 | 3.3462 |

| E4 | 3.6923 | 3.8077 | 3.6538 | 3.6538 | 3.7019 |

| PEST Factors | External Environment |

|---|---|

| Politics | Political influence on trade—China (including Hong Kong and Macao) is the largest area that receives freight transport from Taoyuan Airport, accounting for 1/3 of the total cargo volume transported via the airport. Political relations between Taiwan and China has the greatest influence on bilateral trade. Promotion of the Free Trade Port Policy—The “Challenge 2008 National Development Priority Plan” was put forward in 2002 by the Executive Yuan, which includes one of the subprograms, “Planning for Free Trade Port Area,” in order to tie in with changes to the global operational model of the industry and to use domestic and foreign customs. To attract multinational corporations and Taiwanese business people to perform value-added operations or various business activities in the port area. New South-Oriented Policy—The “New South-Oriented Policy” adopted in the “Foreign Economic and Trade Strategic Talks” in 2016 will promote the establishment of regional “economic community awareness” by establishing mutually beneficial economic and trade relations with Southeast Asian and South Asian neighboring countries. Taoyuan Aerotropolis Plan—“International Airport Park Development Ordinance” was published in January 23, 2009. In 2014, the government launched the “Maritime and Air Transport Talent Training Fund,” which aimed to support talent training, as well as development within the shipping and aviation industries, in order to expand the talent pool and support the long-term sustainable development of both industries. |

| Economy | The growth of the global pharmaceutical market—There has been an increase in air demand for medical supplies and airlifting of biotechnological and medical supplies, which will reach USD1.12 trillion by 2022. Change of order and delivery mode—In the past, the exportation of key components from Taiwan adopted a model whereby shipping took place from Taiwan, manufacturing was carried out in Mainland China and goods were exported from Taiwan, thus boosting Taiwan’s import/export business. Today, with the relocation of Taiwanese manufacturers, increasingly more products are shipped and exported directly from China or overseas. The pattern of delivery orders as seen in Taiwan in the past has disappeared. Instead, more and more orders are placed in Taiwan and goods are exported overseas. |

| Society | The rise of cross-border e-commerce—With the improvement of consumer consumption habits, online shoppers hope to receive goods faster, which urges cross-border e-commerce to change access patterns. Goods that were once shipped by cargo ships, trains and trucks have been increasingly transported by air. Consumer acceptance of higher prices has increased and basic daily necessities such as dog food and pasta sauce have now begun to be transported by air. |

| Technology | Progress in packaging and planting technology for agricultural flowers—Developments in packaging and planting technology for highly priced agri-flowers and so forth, has effectively reduced marine transportation losses and diminished the dependency on air transport. |

| Internal Environment | Strengths (S) | Weaknesses (W) | |

|---|---|---|---|

| Strategy | S1: Professional (D2) S2: Security and Safety (B3) S3: Standard Operation Processes (D3) S4: Sense of Trust (B5) | W1: New Facilities or High-Tech Equipment (A1) W2: Customer Equity (E1) W3: Ability to Handle Unusual Cargo (C2) W4: Professional Spirit (B2) | |

| External Environment | |||

| Opportunities (O) | SO Strategy | WO Strategy | |

| O1: Government’s development of the New South-Oriented Policy O2: Rise of cross-border e-commerce O3: Taoyuan aviation city plan O4: Promotion of the Free Trade Port Policy O5: Global pharmaceutical market growth O6: Maritime and air transport talent training fund | (SO1)—Utilize the government’s development of the New South-Oriented Policy to enhance overall operating performance. (SO2)—Use geographical advantage to occupy the cross-border e-commerce market. (SO3)—Cooperate to promote the Sea–Air Transport Plan to compete in the cross-border e-commerce market (SO4)—Compete in the cold-chain market | (WO1)—Make use of the Taoyuan aviation city plan to improve air cargo terminals facilities. (WO2)—Enhance the quality of talent using the “Maritime and Aviation Training Fund” | |

| Threats (T) | ST Strategy | WT Strategy | |

| T1: Political impact on trade T2: Changes in exporters’ order-delivery mode T3: Improvement in agricultural flower packaging and planting technology | (ST1)—Reduce operating costs through professional and standard operating procedures. (ST2)—Use the airline alliance to increase the volume of re-exports. (ST3)—Collaborate with business partners to integrate more international air cargo. | (WT1)—Enhance employees’ professional service spirit for higher customer satisfaction. (WT2)—Build an automated delivery system to increase customer equity | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, Y.-C.; Lee, P.-C.; Chuang, Y.-S.; Chiu, Y.-J. Improving the Sustainable Competitiveness of Service Quality within Air Cargo Terminals. Sustainability 2018, 10, 2319. https://doi.org/10.3390/su10072319

Hu Y-C, Lee P-C, Chuang Y-S, Chiu Y-J. Improving the Sustainable Competitiveness of Service Quality within Air Cargo Terminals. Sustainability. 2018; 10(7):2319. https://doi.org/10.3390/su10072319

Chicago/Turabian StyleHu, Yi-Chung, Ping-Chuan Lee, Yuh-Shy Chuang, and Yu-Jing Chiu. 2018. "Improving the Sustainable Competitiveness of Service Quality within Air Cargo Terminals" Sustainability 10, no. 7: 2319. https://doi.org/10.3390/su10072319

APA StyleHu, Y.-C., Lee, P.-C., Chuang, Y.-S., & Chiu, Y.-J. (2018). Improving the Sustainable Competitiveness of Service Quality within Air Cargo Terminals. Sustainability, 10(7), 2319. https://doi.org/10.3390/su10072319