Abstract

Vulnerability theory is a fundamental scientific knowledge system in sustainable development, and vulnerability assessment is important in vulnerability studies. Economic vulnerability affects economic growth sustainability. Comprehensive assessment of economic vulnerability in the process of economic growth under the theoretical framework of vulnerability will provide a new perspective for vulnerability studies. Based on a vulnerability scoping diagram assessment model, this study selected 22 economic sensitivity indexes and 25 economic adaptability indexes from the economic, social, and nature–resource–environmental subsystems to comprehensively assess and spatially analyse the vulnerability of China’s provincial economies since the year 2000, while applying the entropy method, multilevel extension assessment, spatial measurement method, and geographic information system technology. The results showed the following: (1) There are great differences in the vulnerability of China’s provincial economies. Western China’s vulnerability is higher and the fluctuation range of economic vulnerability is larger. The vulnerability increased significantly based on spatial differential features; (2) Regional differences in economic vulnerability, mainly caused by differences within a region, increased gradually. Eastern and Western China showed the spatial pattern characteristics of prominent and reinforcing regional imbalance, while Central and Northeast China showed declining regional imbalance. The spatial structure evolution of economic vulnerability is characterized by a volatility curve, and regional separation and divergence are strengthened; (3) Growth of China’s provincial economies and economic vulnerability are related negatively. In Eastern, Central, and Northeast China, vulnerability of the provincial economies has a negative spillover effect on neighbouring provinces’ economic growth, while in Western China it has a slight positive spillover effect.

1. Introduction

Vulnerability studies are mainly confined to geosciences. As vulnerability research is constantly being enriched, its scope has expanded to include natural disaster vulnerability, ecosystem vulnerability, groundwater system vulnerability, regional development system vulnerability, social vulnerability, and poverty vulnerability [1]. Multiple academic disciplines, such as geography, economics, ecology, sociology, management science, engineering science, and political science, have become the top concerns of vulnerability studies [2]. In 2001, Science listed vulnerability studies as one of seven core issues in sustainability science [3]. Vulnerability studies have become an important scientific approach to probe into the human–earth interaction mechanism in contemporary geography and relevant disciplines, as well as major cutting-edge scientific problems [4]. Vulnerability studies are now considered a fundamental system of scientific knowledge aiming to analyse the degree, mechanism, and process of human–earth interaction, as well as regional sustainable development [5]. The initial objective of vulnerability studies was examining the natural ecological environment system, but now it has expanded to include human system studies [6,7]. The concept connotations of vulnerability have expanded from the study of endogenous risk factors—which was based on natural vulnerability in the earlier days—into a multidimensional comprehensive category that integrates natural, economic, social, human, environmental, organizational, and institutional characteristics. The concept of vulnerability initially began as a dual structure of sensitivity and coping capability, but it has expanded into a multi-structured, conceptual collection of multiple elements, including sensitivity, coping capability, degree of exposure, and adaptability [8].

As the main content of vulnerability studies, economic vulnerability involves the expansion and utilization of vulnerability in the economic field. In 1990, the concept of economic vulnerability was first proposed at the United Nations Conference on Trade and Development held in Malta [9]. Economic vulnerability—first seen as an issue of sustainable economic development in least developed countries in the political–economic context—generally refers to uncontrollable exposure of an economic force due to its reliance on export, resulting from a shortage of natural resources, economic notarisation, and enclosed economic geography, which may cause difficulties in diversifying economic development, resulting in economic crises or economic risks [10]. In 1999, the United Nations Development Program officially defined economic vulnerability as tolerance of an economy towards damage caused by unexpected shocks in the process of economic development [11]. Briguglio believes that economic vulnerability is as an essential attribute of an internal system, and the economic vulnerability of countries with higher gross domestic product per capita is accordingly higher; the author thus came up with the “Singapore Paradox” regarding economic vulnerability [12]. Some scholars hold that economic vulnerability is similar to risk [13], and economic risk is closely related to economic vulnerability and economic resilience. Economic risk may cause direct economic losses, while economic vulnerability, as an essential attribute of the system, will magnify such impact and response in times of external shocks. Economic resilience denotes the competence scope within which the welfare loss is reduced in times of external shocks, and it sometimes signifies the recovery capability of an economy after its exposure to external risk. Briguglio et al., summarizes economic risk, economic vulnerability, and economic resilience with an equation; economic risk is the result when economic resilience is subtracted from economic vulnerability [12,14,15,16,17,18,19].Yet, most scholars define economic vulnerability from the perspective of an economic system, and maintain that the vulnerability of an economic system refers to its essential attribute that may expose the system to harm due to the economic system’s sensitivity during internal and external disturbances and lack of capability to deal with unfavorable disturbances [12,14,20,21,22]. Some scholars think of economic vulnerability as uncertainty in the macro-economic or regional economic system [23,24]. From the perspective of economic growth and existing research literature, this study suggests that economic vulnerability is an essential attribute of the system in the process of economic growth and that it may cause potential loss of economic growth, thus affecting sustainable economic growth. Economic vulnerability manifests as two aspects—economic sensitivity and economic adaptability—which can be presented as measurable functional relationships [25,26].

Economic vulnerability has an impact on the sustainability of economic growth. In the 1990s, after China reformed the economic system based on the market economy, the system was prone to external shocks and disturbances caused by economic globalization. This led to vulnerability that affected the macro-economic growth, such as the Asian financial crisis (1997) and global financial crisis (2008). There are some “black swans” lurking in many aspects of China’s economic growth, such as real estate investment, industrial transformation and development, financial venture, urbanization, resident income, social security, environmental investment, and governance [27]. Each black swan is a “window of opportunity” in China’s economic growth, although it may simultaneously bring a potential negative effect to economic growth, which will cause loss of economic growth, leading to downward or stagnant economic growth and thus higher economic vulnerability. After 2010, a significant slowdown in China’s economic growth indicates that China entered an era of the “three periods superimposed”, which consists of the three periods of change of pace in economic growth, economic structural adjustment, and digestion of economic stimulus policy. Thus, China’s economic growth faced more uncertainty [28]. In 2015, the vulnerability of China’s economy became one of two main themes of the world economy [29], causing great worldwide concern for the sustainability of China’s economic development. As for economic vulnerability studies, Chinese scholars pay more attention to the urban-type (resources-based city [20,22,30,31,32], coastal city [24,33,34,35,36], tourist city [37,38], etc.) economic vulnerability and sustainable development issues in urban areas, and there are few studies that deal with economic vulnerability in the process of economic growth. The economic growth of different provinces in China is characterized by difference and imbalance. The economic aggregate of Eastern China takes up a larger share and Western China needs to catch up with Eastern China in terms of economic speed. Yet if there is some blind pursuit of speed of economic growth on the part of Western China, the system of economic growth is bound to be disturbed by external shocks and impacts. Thus a lack of adaptability in some areas will inevitably cause greater economic vulnerability and even uncertain economic risk. In the process of market-oriented reforms, the economic growth in different provinces in China is confronted with various shocks and impacts, and some structural conflicts are difficult to solve in a short period of time, therefore distinctive characteristic of vulnerability can see in economic growth [21,24,26,39,40].

Currently, economic vulnerability studies are generally carried out under the framework of vulnerability studies, and there are few studies dedicated to constructing a theoretical framework for economic vulnerability studies. Due to different research perspectives of economic vulnerability, scholars find it difficult to reach a consensus regarding the concept of economic vulnerability. Adger believes that the concept of vulnerability is difficult to define accurately, but it can be measured [41], and the assessment and measurement of vulnerability is an important part and main direction of vulnerability studies. Current economic vulnerability studies are mainly focused on state assessment and counter measures, with an emphasis on the summarization of vulnerability in a general sense, while the study of rules and processes of the spatial evolution of vulnerability is inadequate and economic vulnerability studies in different geospatial scales are scarce. The assessment index system and assessment methods in current literature do not fully apply to the economic vulnerability assessment of China’s economic growth, due to the lack of a scientific assessment from the perspective of a multi-scale system, and the neglect of economic growth as a substantive characteristic of interrelated systems in terms of assessment method [2,12,13,14,30,31,32,42,43]. This article makes further endeavours on the research index and assessment method, and takes sustainable economic growth as its research perspective. It is believed that economic growth is a compound system that consists of economic subsystems, social subsystems, and nature–resource–environmental subsystems. With the establishment of a vulnerability assessment index system, a comprehensive assessment will be conducted using the multilevel extension assessment method. Therefore, from the perspective of economic growth sustainability, the aim of this article is to contribute to constructing a comprehensive assessment index system for economic vulnerability; conduct a comprehensive assessment of economic vulnerability at the provincial level; clarify the basic situation of vulnerability of China’s provincial economies and the evolution patterns of its spatial structure; and explore the spatially interactive relations between economic vulnerability and economic growth, with the aim of providing a scientific decision-making basis for ordering the transformation of national and provincial promotion of economic growth in the spatial structure, as well as proving a path and direction of space governance to help reduce and cope with economic vulnerability to achieve sustainable economic growth.

2. Methodology

2.1. Assessment Model of Economic Vulnerability

Based on existing literature about vulnerability [44,45,46,47,48], there are mainly three function models of vulnerability: respectively, the VSD Model (Vulnerability Scoping Diagram) [44,45,46], VSR Model (V-vulnerability, S-exposure-sensitivity, R-response capacity) [38], and PSE Model (P-pressure, S-sensitivity, E-elasticity) [47,48]. The VSD Model is a basic functional form that can better illustrate the essential attributes of vulnerability studies. Therefore, this study uses a VSD model for assessing economic vulnerability. Its functional form is as follows:

Here, is the economic vulnerability of a system (or region) ; is the economic sensitivity of system (or region) ; is the economic adaptability of system(or region) .

Previous literature interprets the VSD model as a positive functional relation between economic vulnerability and economic sensitivity: the greater is the sensitivity caused by the disturbance, the greater is the vulnerability. Moreover, there is a negative functional relation between adaptability and vulnerability: the greater the adaptability, the smaller the vulnerability [44,45,46]. After reviewing the related literature, this paper argues that economic sensitivity is the mechanism of interactions among economic subsystems, social subsystems, and nature–resource–environmental subsystems in the process of sustainable economic development, which is characterized by the degree of impact and response of each subsystem to internal and external factor changes; thus, it is a function of economic vulnerability [8,9,49,50,51]. Economic adaptability is the self-adaptive process of each subsystem when internal and external environment changes take place in the process of sustainable economic development, which is manifested as an adaptive capacity that forms a certain functional relation with economic vulnerability and an effective decision-making system that can adjust, manage, and plan sustainable economic development [12,14,15,16,17,18,19,42,51,52]. The VSD model of economic vulnerability can be interpreted as follows: there is a functional relationship between economic vulnerability, economic sensitivity, and economic adaptability. Economic vulnerability is determined by economic sensitivity, which is generated when the system is affected by disturbances and economic adaptability of the system’s self-organization. When economic sensitivity is strong and economic adaptability of the system’s self-organization is weak, economic vulnerability will increase. On the contrary, when economic sensitivity is weak and economic adaptability of the system self-organization is strong, economic vulnerability will decrease [21,22,23,44,45,46].

2.2. Comprehensive Assessment Index System of Economic Vulnerability

According to the VSD Model, the construction of the index system of economic vulnerability involves economic sensitivity indexes and economic adaptability indexes. With regard to indicator selection, this paper observes the principles of scientificity, systematization, dynamicity, dominance, universality, and operability. As for data information obtainment, this paper takes into full account the accessibility and reliability of indicator data and tries its best to avoid the impact of human factors to deliver quantification and spatialization expressions to ensure the accuracy, scientificity, and objectivity of vulnerability assessment results. There is some related literature [2,12,14,21,22,23,25,26,44,45,46,47,48,49,50,51,52,53,54,55,56,57]. A multi-dimensional perspective involving the economic subsystems, social subsystems, and nature–resource–environmental subsystems will be conducive to the establishment of economic vulnerability index systems. There are different levels and indexes for each subsystem, each of which is not only correlated with in-system indexes, but also correlated with various levels and indexes of other systems to some extent. There are 17 third-class indexes and 22 four-class indexes of economic sensitivity, including 11 four-class indexes of the economic subsystem, 6 four-class indexes of the social subsystem, and 5 four-class indexes of the nature–resource–environmental subsystem (Table 1). There are 9 third-class indexes and 25 four-class indexes of economic adaptability, including 12 four-class of the economic subsystem, 6 four-class of the social subsystem, and 7 four-class of the nature–resource–environmental subsystem (Table 2).

Table 1.

Index system for economic sensitivity.

Table 2.

Index system for economic adaptability.

Most index data are collected as statistical data from yearbooks, while some calculation data are acquired in strict accordance with the theoretical equations in index descriptions (See Appendix A and Appendix B). Due to insufficient data about economic vulnerability of the Hong Kong Special Administrative Region, Macao Special Administrative Region, and Taiwan province, these three regions are not included in this study. The entropy method uses the utility value of information of indexes to determine the weight of an index, which avoids the impact of subjective factors on index weights [58,59].

2.3. Assessment Method of Economic Vulnerability

2.3.1. Multilevel Extension Assessment Method

This study adopts the multilevel extension assessment method to conduct a comprehensive assessment of economic vulnerability. Introduced by Cai in 1983, the extenics theory adopts formalised models to assess the applicability of extenics as well as the laws and methods of innovation. Extenics theory describes three elements, which are the matter, character, and corresponding character value. These elements are assumed to solve contradictory and incompatible problems qualitatively and quantitatively [60,61,62,63,64]. The multilevel extension assessment is the expression of matter-element with triple . If matter U has n characteristics , m matter-element to be assessed has the same characteristic C, then matter-element R with the same characteristic can be expressed as

In this equation, —matter-element to be assessed; —the whole body of matter-element to be assessed ; —value of the th characteristic of the th matter-element to be assessed, ; .

Suppose there is m matter-element to be assessed (or category of assessment) , using to indicate the range of characteristic value of matter-element (or category) to be assessed, then matter-element with the same characteristic can be expressed as

In this equation, —the th matter-element (or category) to be assessed; —the th evaluation index; —the value range of defined by defined by , that is, the classical domain.

Based on this, the Multilevel Extension Assessment Method will be established. By identifying matter-elements with the same characteristics, determining the value range of every characteristic, describing the characteristic values of matter-element to be assessed and calculating correlation degrees, the category to which the matter-element to be assessed belongs will be finally concluded [60,61,62,63,64].

The extenics method has been applied in the literature as an assessment tool [63,64]. As this method not only qualitatively analyses the state of being of the system during the market-oriented process but also quantitatively analyses the adaptation capacity of the system and the changes that occur at different stages, this research adopts the extenics method to assess economic growth adaptation for the first time.

The multilevel extension assessment method is divided into the following steps [60,61,62,63,64]:

Step one: Identify grade theory domain U and assessment factor set C. First, set the domain name as follows:

of which the grade theory domain is divided into assessment grades. Then, set assessment index factor set as follows:

of which is the number of assessment indexes.

Step two: Identify classical domain and joint domain. Suppose,

In this equation, is the classical domain of , which serves as the range value in the assessment index set C chosen according to grade . represents the matrix of lower limit of classical domain, and represents the matrix of upper limit of the classical domain.

Suppose,

In this equation, is the joint domain, which serves as the range value in the assessment index set C chosen according to grade U. is the matrix of lower limit of joint domain, and is the matrix of upper limit of joint domain.

Step three: Identify the assessment matter-element. The formula of the matter-element assessment is

In this equation, N is the assessment object; is the value of associated with assessment object N; , is the number of secondary index.

Step four: Calculate the correlation degree of index. The degree of correlation of second-class index is

is the degree of correlation of grade j in second-class index K in order within the first-class index. The correlation coefficient is in the formula i

Multiplying the weight vector of the second-class index by the correlation degree matrix of different grades of second-class index, we calculate the correlation degree matrix of first-class index as follows:

Multiplying the weight vector of the first-class index by first-class correlation coefficient, we calculate the correlation coefficient matrix of assessment object as follows:

Step five: Assessment results. Determine assessment grade as follows: if , then the assessment object N belongs to grade .

The assessment coefficient is

of which , and is the grading coefficient.

2.3.2. Explanations about the Multilevel Extension Assessment Method of Economic Vulnerability

Set grade theory domain. The grade theory domain of economic sensitivity is as follows: = {weak sensitivity, medium sensitivity, and strong sensitivity}. When the disturbance and impact on economic growth are not strong, weak sensitivity occurs; when they are apparent and the system is within a reasonable threshold, medium sensitivity occurs; when they are huge and the system is unstable, strong sensitivity occurs. The stronger the sensitivity, the higher the vulnerability.

Grade theory domain of economic adaptability is as follows: = {low adaptability, medium adaptability, and high adaptability}. Low adaptability occurs when the adaptive capacity hinders or restricts sustainable economic development; medium adaptability indicates that demand of sustainable growth is basically met. High adaptability indicates that the current demand of economic growth is met, and economic growth will be promoted for some time in the future. Higher adaptability is conducive to economic sustainable growth, and vulnerability will be reduced in the meantime.

Set assessment factor set. The assessment factor set of economic sensitivity is as follows:

of which is the four-class index of economic sensitivity and is the number of indexes. The assessment factor set of economic adaptability is thus as follows:

of which is the four-class index of economic adaptability, and n is the number of indexes.

Identify classical domain and joint domain. Classical domain and joint domain are mainly identified according to the corresponding range value of index data. There are three different levels of standard-setting principles for economic sensitivity and economic adaptability: national standards, theoretical perspectives, and expert opinions. The standard-setting principles are as follows: for data that meet international standards, international warning line is the minimum standard; standards found in relevant literature will be seen as theoretical perspectives; for data that are not related to any international warning line or theoretical perspective, expert opinions will be taken into account.

Determine the weight of indexes. This paper applies the entropy method in Shannon C E and Weaver W (1947) to determine the Weight of indexes [58,59].

Type classification of economic vulnerability. Based on classification standards of grade theory domain in the process of economic sensitivity and economic adaptability assessments, economic vulnerability is divided into nine different types as seen in Table 3.

Table 3.

Types for the comprehensive assessment of economic vulnerability.

2.4. Analysis Method of Regional Differences

This study uses the Theil index to conduct the spatial structure analysis of regional differences of economic vulnerability. The formula of the Theil index is as follows [65]:

of which is the overall difference in vulnerability between China’s provincial economies; is the intraregional economic vulnerability difference; is the economic region (according to the classification standards established by the National Bureau of Statistics of China, there are four economic regions: Eastern, Central, Western, and Northeast.); is the proportion of the economic vulnerability of a province in economic region in the economic vulnerability of 31 provinces in China; is the proportion of GDP of all provinces in economic region in China’s economic aggregate; is the proportion of economic vulnerability of province in economic region in the total sum of economic vulnerability of all provinces in economic region ; is the proportion of economic aggregate of province in economic region in the total sum of economic aggregate of all provinces in economic region .

A greater indicates greater difference in the economic vulnerability of different provinces in China. A greater indicates greater difference in economic vulnerability of different economic regions. A greater indicates greater difference in economic vulnerability of different provinces in an economic region.

When interregional and intraregional economic vulnerability affect the regional difference in overall economic vulnerability, this study uses the contribution rate for analysis. The formula of the contribution rate for interregional economic vulnerability is as follows:

The formula of the contribution rate for intraregional economic vulnerability is as follows:

In their study of the Theil index, O’Kelly and Pakes consider the manifestations of regional difference in different time periods and use the regional separation index to uncover the variability characteristics of regional spatial difference patterns [66]. The formula of the regional separation index is as follows:

of which is the regional separation index of the economic vulnerability of a province in China; is the total sum of economic aggregate of all provinces in China; is the economic aggregate of the province with the lowest economic aggregate in China.

2.5. Enactment of Spatial Econometric Model

Drawing on previous experience of experts who introduced some variables into the Cobb-Douglas (C-D) production function model, this study attempts to apply economic vulnerability as an independent factor to the production function model [67,68,69]. A correlation analysis of economic vulnerability and economic growth of different provinces in China from 2000 to 2014 indicates that the correlation coefficient R-square is 0.964, which is “highly correlated”, thus economic vulnerability has an obvious impact on economic growth and can be included in the C-D Model. The production function expression with the introduction of economic vulnerability model is as follows:

in which is the economic aggregate (GDP), is capital, is labour, is total factor productivity (technological level), is the output elasticity of capital stock, is the output elasticity of labour stock, is the influence coefficient of economic vulnerability on economic growth, and is economic vulnerability. Taking the log of both sides of Formula (21), and we get the linear transformation form that includes economic vulnerability:

The implications of this model are as follows: with the introduction of economic vulnerability, we can inquire into the change of technological levels, production factors input, and impact of economic vulnerability on economic growth.

Enactment of the spatial lag model (SLM). After the introduction of spatial independent variables, the SLM is as follows [42]:

in which − () is the error term vector of order normal distribution, and is the spatial autoregressive coefficient. and W is the spatial weight. Since geographic proximity is easier to measure than geographical distance and economic distance, this paper mainly analyzes provincial spillover effect, and spatial econometrics of different provinces in China adopting proximal spatial weight matrix will be more appropriate [67,68,69].

Enactment of the spatial error model (SEM). After the introduction of spatial independent variables, the SEM is as follows [70]:

in which is the vector coefficient of the correlation intensity of regression residual space, which can be used to measure the direction and degree of influence imposed by the economic growth of neighbouring regions on that of this region.

Enactment of the spatial durbin model (SDM). After introduction of the spatial independent variables, the SDM is as follows [71]:

in which is the explanatory variable matrix of , and is the parameter vector of , which can be used to measure the border effect of the economic growth of neighbouring provinces on this province. is the spatial lag explanatory variable of average observed value of neighbouring provinces.

2.6. Data Sources

In this article, data are obtained from China Statistical Yearbook for Regional Economy (2000–2015), Statistics Database of China’s Economic and Social Development, statistical yearbooks of 31 provinces and regions in China from 1999 to 2015, statistical data of China Yearbooks Full-text Database, of which some data are acquired in strict accordance with theoretical equations (see Appendix A and Appendix B). A spatial econometric analysis has been conducted according to panel data estimation from 2000 to 2014. With regard to spatial weight, we use the proximal spatial weight matrix to spatially measure every province in China. In this model, the data come from statistical yearbooks of different provinces from 2000 to 2014 in China. In the calculation formula in Appendix B, Y indicates GDP, L indicates employment, variable capital K indicates capital stock and total factor productivity (A), and economic vulnerability (V) is the calculation result of a comprehensive assessment of the vulnerability of China’s provincial economies from 2000 to 2014. Matlab10.0 is used to conduct calculations.

3. Overall Analysis of Assessment results of Economic Vulnerability

3.1. Economic Vulnerability and Ranking of China’s Provinces in Different Periods

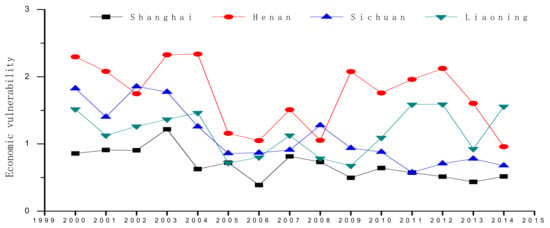

In 2014, economic vulnerability was lowest in Guangdong (0.4354) and highest in Guangxi (1.8851). The economic vulnerability of Guangxi is 4.3 times as high as that of Guangdong. Provinces with higher economic vulnerability are mainly located in Western China, such as Guizhou, Qinghai, Ningxia, Inner Mongolia, Yunnan, and Guangxi, as well as Henan in Central China. Provinces with lower economic vulnerability are mainly located in Eastern China, including Shanghai, Beijing, Guangdong, Jiangsu, Zhejiang, and Tianjin, as well as Heilongjiang and Liaoning in Northeast China and Jiangxi in Central China. Significant variations can be seen in the vulnerability of China’s provincial economies (see Appendix C and Table 4). There are obvious fluctuations in terms of economic vulnerability of different provinces from 2000 to 2014. Shanghai in Eastern China and Sichuan in Western China show the fluctuation tendency of gradual decrease, while the fluctuation tendency of economic vulnerability of Henan in Central China and Liaoning in Northeast China is not distinctive, and the fluctuation range is relatively large (Figure 1).

Table 4.

The top and last five Chinese provinces based on economic vulnerability.

Figure 1.

Fluctuation map of the economic vulnerability of several provinces in China from 2000 to 2014.

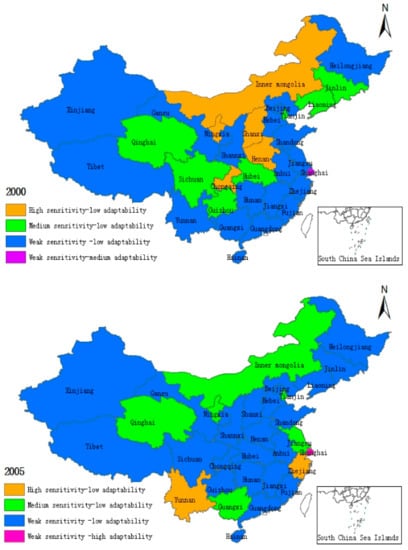

3.2. Vulnerability Types of Provincial Economies

Based on the changing spatial distribution of vulnerability types of provincial economies, economic vulnerability is characterized by the obvious spatial differentiation features, and economic vulnerability of the same type is in a state of aggregation (Figure 2). There are five types of economic vulnerability from 2000 to 2005, seven types in 2010, and eight types in 2014. Only the medium sensitivity–low adaptability type is absent. From 2000 to 2014, an apparent increase in economic vulnerability types and a diversified tendency can be seen. According to the change of economic vulnerability types, in 2000, most provinces in China belonged to the weak sensitivity–low adaptability type. Only five provinces belonged to the high sensitivity–low adaptability type: Chongqing, Henan, Shanxi, Inner Mongolia, and Ningxia. In 2014, nine provinces belonged to the high sensitivity–low adaptability type: Hainan, Guizhou, Guangxi, Xinjiang, Qinghai, Gansu, Inner Mongolia, Jilin, and Liaoning. High economic sensitivity and lack of higher economic adaptability lead to an increase in economic vulnerability, which will greatly affect the economic growth of these provinces. After 2010, there is a significant increase in the weak sensitivity–high adaptability type that only Jiangsu and Shanghai belonged to in 2010, but more provinces—that is, Guangdong, Shanghai, Beijing, Jiangsu, Anhui, Shandong, and Shaanxi—belonged to this type in 2014. The economic adaptability of some provinces has been observed to have improved, and, in the meantime, increased intervention and control imposed on economic sensitivity will lead to lower economic sensitivity. Overall, every province is characterized by the localization features of different economic sensitivity types during different time periods, which is a reflection of the complexity introduced by the economic vulnerability of a province.

Figure 2.

Spatial distribution map of economic vulnerability types of China’s provinces (2000, 2005, 2010, and 2014).

4. Spatial Analysis of Economic Vulnerability

4.1. Analysis of Regional Differences of Economic Vulnerability

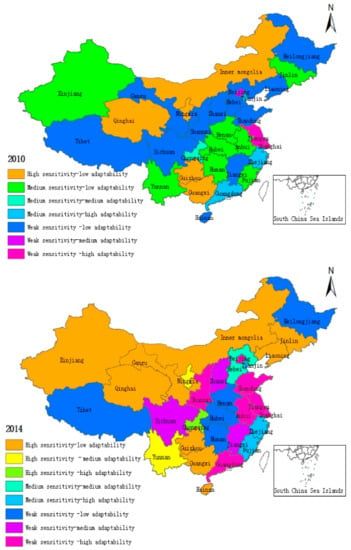

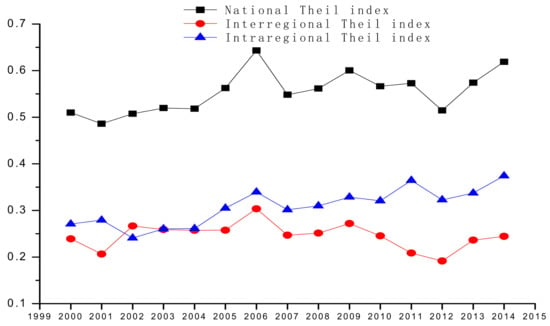

4.1.1. Interregional Difference in Economic Vulnerability

The regional difference in economic vulnerability shows an overall increasing trend, although regional differences vary in terms of range and tendency in different periods (Figure 3). From 2000 to 2006, the regional difference in economic vulnerability in China saw an obvious rising trend, especially from 2004 to 2006 when the rising range was significant, and the difference was maximum (0.6431) in 2006. The regional difference in economic vulnerability in China saw mild fluctuations from 2007 to 2012 and an obvious rising trend from 2012 to 2014.

Figure 3.

Trend change of the Theil Index of economic vulnerability from 2000 to 2014.

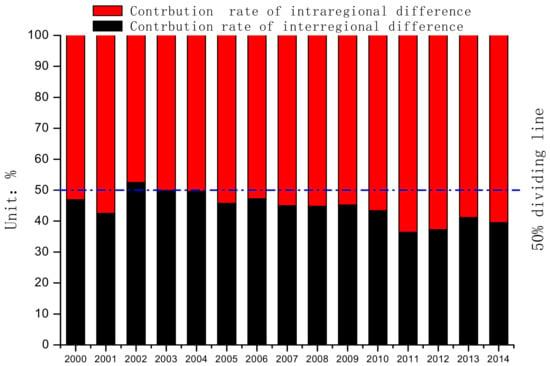

The difference in intraregional economic vulnerability saw an obvious rising trend, while the interregional difference in economic vulnerability saw a slightly decreasing trend (Figure 4). After 2002, the difference in intraregional economic vulnerability gradually expanded, and in 2003 the difference value of intraregional economic vulnerability began to exceed the interregional difference value. After 2006, the interregional difference in economic vulnerability began to weaken significantly. From 2006 to 2014, the differences in economic vulnerability within and outside the region saw a significant rising trend.

Figure 4.

Contribution rates of intraregional and interregional differences of economic vulnerability from 2000 to 2014.

After 2003, the contribution rates of the difference in intraregional economic vulnerability are constantly higher than those within the region. The difference values within the region are also constantly higher than those among regions, indicating that the difference in intraregional economic vulnerability is the primary cause for the generation of difference. Overall, the regional difference in economic vulnerability has gradually increased, especially from 2012 to 2014. The national Theil index has expanded and so has the intraregional difference, which is the main reason for the expansion of economic vulnerability difference.

4.1.2. Characteristics of Regional Difference

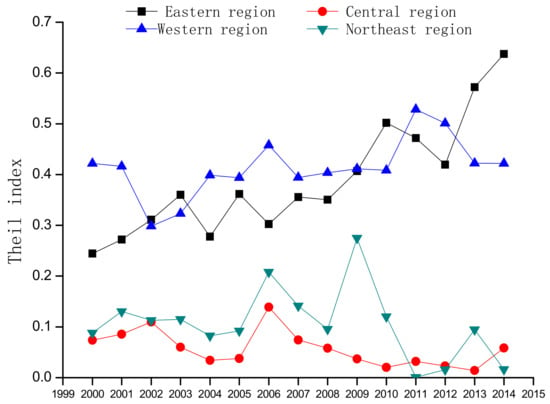

According to the value and trend change of the Theil index of interregional differences in economic vulnerability of the four economic regions in China (Figure 5) from 2000 to 2014, the Theil indexes of the regional difference in economic vulnerability between the Eastern and Western regions are higher, and an overall trend of increasing differences through fluctuations can be seen. The Theil indexes of the regional difference in economic vulnerability between the Central and Northeast regions in China are lower, and an overall trend of decreasing differences through fluctuations can be seen. Different economic regions are characterized by different spatial structure features, even though there is some similarity between the Eastern and Western regions as well as between the Central and Northeast regions. Because different economic regions involve the economic growth of different provinces, the difference in economic vulnerability has shown regional characteristics of imbalance as follows: (1) In the Eastern region, from 2000 to 2003, a gradual expansion of difference can be seen; from 2004 to 2010, there is an overall trend of expanding difference through fluctuations; from 2011 to 2012, a slight decrease in the difference can be seen as well; from 2012 to 2014, the regional difference witnesses rapid expansion. Overall, the Theil index in the Eastern region is higher and the difference is larger. After 2012, the regional difference rapidly expanded, indicating that the spatial distribution pattern of 10 provinces in the eastern region is unbalanced and the provincial difference is huge; (2) In the Central region, from 2000 to 2005, a trend of steady decrease can be seen; the difference is maximum in 2006; after 2006, the regional difference gradually decreases. Taken as a whole, the Theil index in the central region is relatively smaller and the regional difference is little, indicating that economic vulnerability of the six provinces in this area is spatially characterized by a relative balance; (3) In the Western region, from 2000 to 2002, a trend of gradual decrease can be seen; from 2003 to 2006, there is a trend of gradual expansion; from 2007 to 2010, the difference is relatively stable; from 2011 to 2014, an obvious trend of decrease can be seen. Taken as whole, the Theil index in the Western region is relatively larger, which indicates that the regional difference is larger and characteristics of spatial distribution imbalance are prominent; after 2011, the regional imbalance shows a decreasing trend; (4) In the Northeastern region, from 2000 to 2005, a trend of steady decrease can be seen; the difference is maximum in 2006; in 2007 and 2008, the regional difference decreases; the difference value is maximum in 2009; in 2010 and 2011, it decreases to its minimum value; after 2011, the fluctuation is slight and the difference is little. Taken as whole, the Theil index in the Northeastern region is relatively smaller and the regional difference is little, which indicates that the economic vulnerability of the three provinces in this area is spatially characterized by a relative balance.

Figure 5.

Trend of the Theil Index of the regional difference in economic vulnerability between the four regions from 2000 to 2014.

4.1.3. Complexity and Spatial Heterogeneity

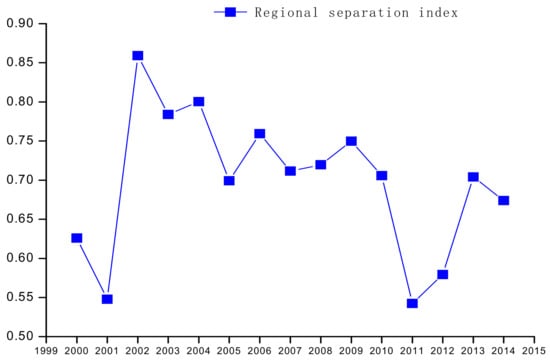

Considering that economic regions are spatially separate from each other, the regional separation index will reflect the trend of the spatial structure evolvement of economic vulnerability differences. According to the formula of regional separation index, we take Tibet—whose economic aggregate is the lowest in China—as an example and calculate the regional separation index among the four economic regions in China from 2000 to 2014 (Figure 6). From 2001 to 2014, the regional separation index of economic vulnerability is characterized by a volatility curve; that is, a significant increase is followed by a gradual decrease, which indicates that economic vulnerability has gone through divergence and finally evolved towards convergence in terms of spatial structure in this period. In 2011, the regional separation index saw a significant change in inflection points, and the divergence of regional separation was strengthened, indicating that economic vulnerability has shown apparent complexity and spatial heterogeneity in terms of spatial structure.

Figure 6.

Trend of regional separation index of economic vulnerability from 2000 to 2014.

4.2. Spatial Econometric Analysis of Eeconomic Growth and Economic Vulnerability

4.2.1. Taken as a Whole, Economic Growth and Economic Vulnerability Have a Negative Effect on Each Other, and Economic Vulnerability Has an Obvious Negative Spillover Effect on the Economic Growth of Neighbouring Provinces

The spatial econometric models, SLM, SEM, and SDM, all pass relevant tests and meet the requirements of the Akaike information criterion (AIC) and Schwarz information Criterion (SIC) for optimized model variables (AIC < SC). Based on the maximum log likelihood, the heightened SDM is an optimized model. The R-squared of the models are, respectively, 0.9926, 0.9910, and 0.9995, indicating that R-squared is higher, and the enactment of spatial econometric models basically meets the conditions for variable estimation.

The three models, SLM, SEM and SDM, show that production factors and technological levels have obvious positive effects on provincial economic growth, while economic vulnerability has obvious negative effects on provincial economic growth (Table 5). SLM shows that the spatial lagged variable is 0.065 under a significance level of 5%, indicating that economic growth has a positive spillover effect on the economic growth of neighbouring provinces. SEM shows that the spatial disturbance variable is 0.1347 under a significance level of 10%, indicating that production factors, technological levels, and economic vulnerability have obvious disturbing effects on economic growth. SDM shows that the spatial disturbance variable is 0.590 under a significance level of 10%, indicating that the disturbing effect of production factors, technological levels, and economic vulnerability on economic growth has become stronger, and production factors and technological levels have a positive spillover effect on the economic growth of neighbouring provinces. The spatial interaction variable of economic vulnerability is −0.2605, which indicates that economic vulnerability has an obvious negative spillover effect on the economic growth of neighbouring provinces. Economic vulnerability not only hinders provincial economic growth but also greatly hinders the economic growth of neighbouring provinces.

Table 5.

Results of the spatial econometric models of economic growth and economic vulnerability.

4.2.2. Vulnerability and Spillover Effect on Neighbouring Provinces’ Economic Growth

Based on the spatial econometrics results of the Eastern, Central, Western, and Northeastern regions, the spatial econometric models, SLM, SEM, and SDM, all pass the relevant tests, and the R-squared is relatively high. The SLM, SEM, and SDM models of the Eastern, Central, and Northeastern regions all indicate that the economic vulnerability of these three regions has an obvious negative effect on economic growth, which in turn has a positive spillover effect on the economic growth of neighbouring provinces (Table 6). Economic vulnerability has an obvious disturbing effect on economic growth, and it also has an obvious negative spillover effect on the economic growth of neighbouring provinces. Thus, within these three regions, economic vulnerability not only hinders provincial economic growth, but also greatly hinders the economic growth of neighbouring provinces. The SLM and SEM of the Western region show that economic vulnerability has an obvious negative effect on economic growth, which in turn has a positive spillover effect on the economic growth of neighbouring provinces. The SDM model of the Western region shows that the spatial interaction variable of economic vulnerability is 0.052, indicating that economic vulnerability has a slight positive spillover effect on the economic growth of neighbouring provinces. Therefore, while the economic vulnerability of provinces in the Western region has a disturbing effect on provincial economic growth, it somehow facilitates the economic growth of neighbouring provinces. The reason is that the economic vulnerability of some provinces in the Western region is higher, and the strength of their economic growth is weaker than that of other places; moreover, to realize economic growth targets, the Chinese government provides financial and policy support, which benefits neighbouring provinces in similar situations and promotes their economic growth as well.

Table 6.

Results of the spatial econometric models of economic growth and economic vulnerability in the Eastern, Central, Western, and Northeastern regions of China.

5. Conclusions and Discussion

5.1. Conclusions

There are great differences in the economic vulnerability among provinces. The economic vulnerability of the Western provinces of China is higher, and the fluctuation range is large. The provincial economic vulnerability is characterized by obvious spatial difference, and economic vulnerability of the same type is spatially aggregated. The types of economic vulnerability have significantly increased, and their characteristics of localization are evident. Thus, a complicated state of economic vulnerability can be seen.

Interregional economic vulnerability has gradually increased, and intraregional difference is the main cause of economic vulnerability differences. The difference in economic vulnerability between Eastern and Western China is higher, showing spatial pattern characteristics of prominent and reinforcing regional imbalance. The difference in economic vulnerability between Central and Northeast China is lower, showing spatial pattern characteristics of declining regional imbalance. The trend of spatial structure evolution of economic vulnerability is characterized by a volatility curve. Regional separation and divergence have been strengthened, and complexity and spatial heterogeneity can be seen in terms of spatial structure.

The growth of China’s provincial economies and economic vulnerability are negatively related. In Eastern, Central, and Northeast China, the vulnerability of provincial economies has an obvious negative spillover effect on the economic growth of neighbouring provinces. In Western China, the vulnerability of provincial economies has a slight positive spillover effect on the economic growth of neighbouring provinces.

5.2. Discussion

The vulnerability of China’s provincial economies is essentially a consequence of the combined effects of sensitivity and adaptability in economic subsystems, social subsystems, and nature–resource–environmental subsystems. Economic growth at a provincial spatial scale is characterized by different localization features in terms of economic growth factors, such as population, geographic location, environment, resource endowment, economic development level, and economic stage; thus, economic vulnerability at different regional spatial scales show different representations and there is significant regional difference in spatial distribution. It is an urgent need for us to adopt regulatory measures according to localization features of the vulnerability of China’s provincial economies to further promote sustainable growth of China’s provincial economies.

With regard to the vulnerability of China’s provincial economies, a clear sense of regulation direction and regulation measures of economic vulnerability will contribute to the reduction of economic vulnerability. The main measures taken to reduce the vulnerability of China’s provincial economies include the establishment of an industry security prewarning system, the establishment and implemention of a scientific industrial security development plan, and finance-based supply-side structural reforms aiming to serve the real economy and strengthen financial regulation. Furthermore, we should also intensify our efforts to fight poverty and redouble our efforts to build a healthy China. We should adopt diversified methods of environmental governance, increase investment in environmental governance, and strengthen the construction of an environmental legal system. We should change the mode of urbanization development, promote city agglomeration construction with a focus on the construction of characteristic towns, and put economic vulnerability in the context of the implementation of urban planning and construction to build a new type of urbanization. We should aim to set up a good institutional environment for scientific and technological innovations, and implement a system construction that promotes development through innovation to make China an innovative nation. We should also aim to form the factor -price -oriented market mechanism, encourage supply-side structural reforms, and allocate resources according to market prices. In addition, economic vulnerability should be seen in the context of regional economic planning.

Current studies of regional economic growth have been mostly carried out in terms of the theory, model, and structure of economic growth from a positive perspective, and there are few economic vulnerability studies that examine the potential negative effects on sustainable economic growth. Using the VSD model, this study adopts the multilevel extension assessment method to conduct a comprehensive assessment of provincial economic vulnerability in China. Although previous research on the essential attributes of economic vulnerability is adequate, economic vulnerability theory needs further attention.

Economic vulnerability assessment is an important part of economic vulnerability studies. There are many quantitative assessment methods, and abundant research results have been achieved. Due to the complexity of the economic system and different perspectives for interpreting the concept of economic vulnerability, there is some controversy about the assessment model, assessment index, and assessment result of economic vulnerability. Therefore, this study uses a multilevel extension assessment method to conduct a comprehensive assessment of provincial economic vulnerability in China, and scientific conclusions have been drawn. However, comprehensive assessments from the perspective of economic growth are few, thus there is lack of result comparisons using different assessment methods. In further research, we will compare this with other assessment methods to optimize and adjust the multilevel extension assessment method, while a contrasting quantitative with qualitative case-study research will be included.

Nevertheless, the multilevel extension assessment method has its limitations. In the assessment process, the setting of grade theory domains has a certain degree of subjectivity. Index selection of an assessment factor set should be more scientific, and classical domains and joint domains should be determined by strict standards. Moreover, this assessment method only focuses on the degree and trend of economic vulnerability, and does not pay enough attention to the early warning assessment of economic vulnerability in the future.

This article analyses the interactive relation between economic growth and economic vulnerability from a spatial perspective. In the future, study of the spatial generation mechanism, influence factor, and spatial evolution process will help clarify the spatiotemporal pattern change of economic vulnerability and determine vulnerability factors in economic growth so that we can exert effective regulation and forewarning, and reduce economic vulnerability to achieve economic growth sustainability.

Acknowledgments

This study is supported by Humanities and Social Sciences of the Ministry of Education Planning Fund of China, NO. 17YJAZH066 and major training projects for basic scientific research services in central colleges and Universities, NO. 31920170103.

Author Contributions

Guofang Zhai and Chongqiang Ren developed the original idea and contributed to the conceptual framework, Guofang Zhai and Chongqiang Ren wrote the paper and were responsible for data collection, process, and analysis. Shasha Li, Wei Chen, and Shutian Zhou provided suggestions for improvements. All authors have read and approved the final manuscript.

Conflicts of Interest

The authors declare no conflict of interest. The founding sponsors had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, and in the decision to publish the results.

Appendix A. Index System for Economic Sensitivity

Appendix A.1. Third-Class Index

1. economic fluctuation

Due to large and frequent fluctuations in the growth of China’s provincial economies, a high sensitivity under the impact of uncertainty factors from multiple disturbances both internal and external will cause the instability within the economic growth system, which will further lead to the occurrence of vulnerability of the economic growth system.

2. industrial disturbance

Among provinces in China, economic growth shows diversified sensitivity characteristics under the impact of changing industrial disturbances.

3. vinvestment disturbance

4. consumption change

5. trade pressure

Investment, consumption, and import and export trade are three major forces in China’s economic growth, based on which China’s provincial economies have made great achievements, whereas high sensitivity has been found under the great impact of various factors in the meanwhile.

6. financial risk

China was hit by financial crises in the 1997 Asian financial crisis and the 2008 American subprime mortgage crisis, which indicates that the financial system is highly unstable, vulnerable to impacts, and highly sensitive to engender financial vulnerability.

7. fiscal risk

A high risk in some of China’s provincial finances has a great impact on economic growth, which signifies high sensitivity.

8. price fluctuation

Price fluctuation is a major factor that affects economic growth. Large fluctuations and high sensitivity will enhance the sensitivity to changes for the currency in economic growth.

9. rural-urban divide

China’s fast urbanization has shown structural characteristics of dualization. Seen as two growth situations of polarization, the urban and the rural, when taken as a whole, can be counted as a sensitivity factor in economic growth.

10. gap between the rich and the poor

The over-high Gini coefficient in China has risen above the international warning line for a long time. The wide gap between the rich and the poor as well as the inadequate and unfair income distribution mechanism may easily lead to income stratification and increased social instability, which will affect the sustainable and stable growth of economy.

11. employment influence

Changes in employment, a major factor in economic growth, highlight the sensitivity of economic growth, which will make an impact, especially on social stability and harmony.

12. poverty pressure

A country with a large population, China’s high cost of and high difficulty in poverty reduction for a larger segment of the poverty-stricken population has increased economic vulnerability, thus poverty is seen as a sensitivity factor in China’s economic growth.

13. educational influence

Key to sustainable economic development, education is considered as one of factors in economic sensitivity.

14. resident health

Faced with reforms of the medical and health sectors, China’s national medical security system is unsound and unbalanced at present, thus it can be seen as one of the sensitivity factors.

15. natural disasters

China is a country with frequent occurrence of natural disasters, which will impact economic growth to engender high sensitivity.

16. energy consumption

Resource shortage has been an important unfavorable factor in China’s economic growth. The single structure of energy and resource use and its low efficiency indicate that energy cannot be completely converted into productivity to promote economic growth. Therefore, the secure and adequate resource supply and supply constraints are two typical vulnerability characteristics in economic growth.

17. environmental pollution

Still confronted with enormous environmental stress at present, China has not completely grown out of extensive economic growth, which takes a heavy toll on resources and the environment, to engender high sensitivity.

Appendix A.2. Fourth-Class Index

- Fluctuation range of economic growth (S1). The calculation formula is as follows: fluctuation coefficient of economic growth = |economic growth rate of the current period-economic growth rate of the prior period|/economic growth rate of the prior period. Under normal circumstances, a larger fluctuation range of economic growth indicates a more unstable economic growth system, higher sensitivity and higher vulnerability.

- Disturbance degree of industry (S2, S3, S4). The calculation formula is:I is the disturbance degree of the sub-industry, i is the year, n is the number of years in the calculation period, is the output value of the sub-industry in the ith year, and is the annual average output value of the sub-industry in the calculation period. A larger disturbance degree of the industry indicates unstable industrial development, higher economic sensitivity, and higher economic vulnerability.

- Disturbance degree of investment (S5). The calculation formula is:F is the disturbance degree of fixed assets investment, i is the year, n is the number of years in the calculation period, is the total value of fixed assets investment in the i th year, is the average annual investment value of fixed assets investment in the calculation period. A larger disturbance degree indicates a larger impact on economic growth, higher sensitivity and higher vulnerability.

- Urban–rural consumption ratio (S6). The calculation formula is as follows: urban–rural consumption ratio = per capital annual expenditure on consumption of urban residents/per capita annual living expenditure of rural residents. A larger urban–rural consumption ratio indicates higher sensitivity and higher vulnerability. It is a positive index.

- Foreign trade dependence degree (S7). The calculation formula is: foreign trade dependence degree = (total volume of foreign trade of the year/GDP of the year) × 100%. A larger foreign trade dependence degree indicates a higher exposure to the impact of international markets, higher sensitivity and higher vulnerability.

- Fluctuation range of exchange rate (S8). Exchange rate uses direct quotation, involving how much RMB 1 US dollar could be converted into. The fluctuation range of exchange rate = |average exchange rate of the year—average exchange rate of the last year |/average exchange rate of the last year.

- Loan–deposit ratio (S9). The calculation formula is as follows: loan–deposit ratio = loan balance of financial institutions at the end of the year/deposit balance of financial institutions at the end of the year. A larger loan–deposit ratio indicates more bank loans, greater risk for the bank, and higher sensitivity.

- Financial deficit ratio (S10). The calculation formula is: financial deficit ratio = (financial expenditure—financial revenue)/GDP × 100%. An increased fiscal deficit reflects greater financial risk, low efficiency of government administration and operation, and higher sensitivity.

- Absolute value of inflation rate (S11). This study takes the consumer price index as the price level. The calculation formula is: inflation rate = |consumer price index of the year|/consumer price index of the last year × 100%. An increased absolute value of inflation rate indicates a larger impact of price inflation and higher sensitivity.

- Urban–rural income ratio (S12). The calculation formula is: urban–rural income ratio = per capita disposable income of urban residents/ rural per capita net income. A larger urban–rural income ratio indicates a larger urban–rural income gap, a more serious situation of city–countryside dualization, and higher sensitivity.

- Gini coefficient (S13). The calculation of Gini coefficient adopts a trapezoidal rule and its calculation formula is:The population is divided into different groups according to urban and rural income levels, that is, low-income groups and high income groups. In this equation, is the serial number of income level, n is total number of groups of population, is the corresponding population index of the th group, is the income level of the th group, is the proportion of population of the th group in regional population, is the proportion of the income of the th group in regional total income, is the proportion of accumulated population, is the proportion of accumulated income. is the trapezoidal area, is the Gini coefficient. A larger Gini coefficient indicates a larger gap between the rich and the poor, more unequal distribution of income, and higher sensitivity.

- Registered urban unemployment rate (S14). Registered urban unemployment rate is the proportion of registered unemployed population in the total number of employees in urban units (deducting employed rural labor force, reemployed retirees, employees from Hong Kong, Macau, and Taiwan and foreign countries), off-duty employees in urban units, urban private business owners, the self-employed, urban private businesses, individual employees and registered urban unemployment. A higher registered urban unemployment rate indicates higher sensitivity.

- Poverty incidence in rural areas (S15). Due to the change of poverty standards in rural areas, this paper selects poverty incidence according to the standards in China Statistical Yearbook, mainly the standards from 1978. Under this standard, the period 1978–1999 is the rural poverty standard, the period 2000–2007 is the absolute rural poverty standard. Under the standards from 2008, the period 2008–2010 is the rural poverty standard. The standards from 2010 is the newly determined rural poverty alleviation standard. A higher poverty incidence in rural areas indicates higher sensitivity. It is a positive index.

- Dropout rate of school-age children (S16). The calculation formula is: dropout rate of school-age children = 100-enrollment rate of school-age children. This index reflects education equity degree and educational rights. A higher dropout rate indicates higher sensitivity.

- Annual hospitalization rate of residents (S17). The calculation formula is: annual hospitalization rate of residents = (annual hospitalized population/total population) × 100%. A higher hospitalization rate of residents indicates a larger threat that diseases pose to health and higher sensitivity.

- Growth rate of direct economic loss caused by natural disasters (S18). The calculation formula is as follows: the proportion of direct economic loss caused by natural disasters in GDP = (direct economic loss caused by natural disasters of the year—direct economic loss caused by natural disasters of the last year)/direct economic loss caused by natural disasters of the last year × 100%. This index indicates the impact of natural disasters on economic growth. A larger proportion implies higher sensitivity.

- Elastic coefficient of energy consumption (S19). The calculation formula is as follows: elastic coefficient of energy consumption = annual average growth rate of energy consumption/annual average growth rate of national economy. This index reflects the pressure that energy consumption exerts on economic growth. A larger elastic coefficient of energy consumption indicates higher sensitivity.

- Three industrial wastes (S20, S21, S22). These three indexes reflect the pressure that the environment exerts on economic growth. A larger number of them indicates more environmental pressure and higher sensitivity.

Appendix B. Index System for Economic Adaptability

Appendix B.1. Third-Class Index

1. economic efficiency

The increase of economic efficiency is both an effective measure and impetus for the promotion of economic growth and the basis for economic sustainable growth, which will reflect the increase of adaptability as well.

2. economic institution

The economic institution has made an important contribution to China’s economic growth. Under the push of economic institution reforms, marketized resource distribution reforms have been completed to increase efficiency in resource distribution and to enhance economic adaptability so as to promote economic growth.

3. economic development

The increase in welfare benefits for the people, industrial development, and the increase in the service capability of the tertiary industry and consumption level are the basis for the comprehensive development of economy and the foundation of sustainable economic growth.

4. social development

In the process of a comprehensive development of society in a country, the comprehensive development of society is the cornerstone of economic growth. China’s social development reforms are mainly reflected in its rapid development of urbanization.

5. social security

As the basis for the stability of people’s livelihood, social security is also a reflection of China’s coping capacity in dealing with problems in employment, annuity, and socialized services.

6. social investment

The social investment in education and health is a key measure to strengthen social functions and raise human capital to further promote economic growth.

7. prevention of natural disasters

Preventing and mitigating natural disasters is very important for China. Effective prevention and mitigation of natural disasters is the embodiment of adaptability.

8. energy production

Energy production is both an important indicator of economic growth and a major measure to cope with energy shortage, which is also a reflection of the technological and management levels of energy production.

9. environmental improvement

The environmental improvement is currently a key measure to harness environmental pollution, adjust economic structure, and promote industry transformation and upgrading. It is key to sustainable economic development in China.

Appendix B.2. Fourth-Class Index

- Capital productivity (D1). Capital productivity mainly refers to the material capital input of the year and in the past, that is, capital stock input. The calculation formula is as follows: capital productivity = GDP/fixed assets investment stock. A higher capital productivity indicates a higher rate of capital return and a stronger coping capacity. The fixed assets investment stock needs to be measured; the measurement formula isis the actual capital stock in the year t. is the actual capital stock in the year t − 1, is the fixed assets investment price index, is the nominal investment in the year t, is the depreciation rate of fixed assets in the year t. This paper takes in 1978 as the base period for fixed assets price index. Since the deflator of investment sequences have not been officially released, the price index deflator of GDP in China will be adopted. As for the capital stock of a base period, Young’s (2000) approach will be adopted, which takes 10 times the fixed assets amount invested in a base period as the initial capital stock, and 6% as the depreciation rate, the same as Jones Jones & Hall (1998). A higher capital productivity indicates higher adaptability.

- Labor productivity (D2). The calculation formula is as follows: labor productivity = GDP/quantity of employment. A higher labor productivity indicates a higher level of techniques and labor skills, and higher proficiency.

- Total factor productivity (D3). The calculation of total factor productivity uses the C-D production function that includes two input factors, that is, capital and labor:is the output level, is the capital input, is the labor input, α and β are respectively the average capital output share and the average labor output share. Assume the scale return is invariable, that is, α + β = 1.First, take the natural logarithms of both sides of the production function:is the error term. Put β = 1 − α into this function, and we will get the following equation form:The OLS regression method can be adopted to calculate the data of α, for which the capital stock needs to be measured; the measurement formula is the same as the calculation of capital stock in capital productivity. The calculation formula of total factor productivity is:A higher total factor productivity indicates a faster pace of technological progresses and reforms, which will greatly improve production efficiency, production capacity, and adaptability.

- Non-fiscal expenditure in GDP (D4). Non-fiscal expenditure in GDP = 100 − (fiscal revenue/GDP) × 100%. This index reflects the changes brought about by marketization in terms of economic resources distribution. Under normal circumstances, areas where the marketization degree is higher will see a lower degree to which the government allocates economic resources. A higher index indicates a higher degree to which the government allocates economic resources, a higher degree of marketization, stronger institutional reforms, and higher adaptability.

- Percentage of non-state-owned economy in total industrial output value (D5). The calculation formula is: percentage of non-state-owned economy in total industrial output value = 100 − (total industrial output value of state-owned industrial enterprises/total industrial output value) × 100%. Since 2008, due to differences in statistical caliber, the sales revenue of industrial products has been taken as the total industrial output value. These two indexes are found to be similar by comparison. The development of non-state-owned economic sectors is the main means of market regulation, which reflects the market-oriented property right system reforms in the process of marketization reforms. A larger number of this index indicates higher adaptability.

- Percentage of foreign investment in actual use in GDP (D6). The calculation formula is: percentage of foreign investment in actual use in GDP = (foreign investment in actual use/GDP) × 100%. A higher degree of foreign capital investment indicates more favorable market circumstances and more developed factor markets.

- Patent authorizations per 10,000 persons (D7). The calculation formula is: patent authorizations per 10,000 persons = number of patent authorizations/total population. This index reflects the degree of technological innovation in the market. A higher index indicates a higher degree of innovation and stronger adaptability.

- Percentage of R&D expenditure in GDP (D8). Percentage of R&D expenditure in GDP = (R&D expenditure/GDP) × 100%. This index reflects the degree of investment of R&D. A higher percentage indicates a higher investment intensity of R&D and stronger adaptability.

- GDP per person (D9). It is a reflection of the economic development status. A higher GDP per person indicates better economic welfares for the people and stronger adaptability.

- Percentage of industrial added value in GDP (D10). Percentage of industrial added value in GDP = (industrial added value/GDP) × 100%. It is a reflection of the development degree of industrialization. A higher degree of industrialization indicates faster economic growth and higher adaptability.

- Percentage of added value of tertiary industry in GDP (D11). Percentage of added value of tertiary industry in GDP = (added value of tertiary industry/GDP) × 100%. The tertiary industry is generally seen as the service industry, thus a higher percentage of tertiary industry in GDP indicates a higher degree of servitization.

- Percentage of household consumption expenditure in GDP (D12). Percentage of household consumption expenditure in GDP = (final consumption expenditure of households/GDP) × 100%. This index reflects the household consumption level. A larger percentage indicates higher adaptability.

- Urbanization rate (D13). Urbanization rate = (urban population/total population) × 100%. This index reflects the state of urban and rural development in the context of social development. A higher urbanization rate indicates higher adaptability.

- Percentage of people with unemployment insurance in people in employment (D14). Percentage of people with unemployment insurance in people in employment = people covered by unemployment insurance/total employment × 100%. This index mainly reflects the safeguard level for unemployment. A larger percentage indicates higher adaptability.

- Percentage of people with basic endowment insurance in total population (D15). Percentage of people with basic endowment insurance in total population = people covered by basic endowment insurance/total population × 100%. This index mainly reflects the level of basic safeguard for the society. A larger percentage indicates higher adaptability.

- Coverage of community service institutions (D16). This index is a reflection of the construction of social service system. A higher coverage indicates higher adaptability.

- Percentage of educational expenditure in GDP (D17). This index reflects the degree of education development. A greater investment indicates higher adaptability.

- Percentage of total health expenditure in GDP (D18). This index reflects the degree of healthcare development. A larger percentage indicates higher adaptability.

- Natural disaster relief per 10,000 persons (D19). Natural disaster relief per 10,000 persons = natural disaster relief expenditure/people affected by natural disasters. This index reflects the degree of economic aid for affected population. A larger number indicates a stronger capability to withstand natural disasters.

- Elastic coefficient of energy production (D20). The elastic coefficient of energy production is an index to be used to study the relations between the growth rate of energy production and the growth rate of the national economy. The calculation formula is: elastic coefficient of energy production = average annual growth rate of total energy production/average annual growth rate of GDP. A higher index indicates a stronger capability of energy production to meet the demand of economic growth.

- Overall efficiency of energy processing and transforming (D21). The calculation formula is as follows: efficiency of energy processing and transforming = (output of energy processing and transforming/input of energy processing and transforming) × 100%. This index reflects the level of technology and management of energy production. A higher index indicates higher adaptability.

- Percentage of investment in treatment of industrial pollution in total industrial output value (D22). The calculation formula is as follows: (amount of investment in industrial pollution sources treatment/total industrial output value) × 100%. A larger percentage indicates tighter control of industrial pollution and higher adaptability.

- Standard-meeting rate of industrial waste water discharge (D23), standard-meeting rate of industrial sulphur dioxide (D24), and overall utilization of industrial solid wastes (25). These three indexes can reflect the effectiveness of environmental governance. A higher rate indicates higher effectiveness and higher adaptability.

Appendix C

Table A1.

Average economic vulnerability and ranking of China’s provinces in different periods.

Table A1.

Average economic vulnerability and ranking of China’s provinces in different periods.

| Province | 2000–2004 | 2005–2009 | 2010–2014 | 2000–2014 | ||||

|---|---|---|---|---|---|---|---|---|

| Average Value | Ranking | Average Value | Ranking | Average Value | Ranking | Average Value | Ranking | |

| Beijing | 0.9878 | 30 | 0.7312 | 30 | 0.5192 | 31 | 0.7461 | 30 |

| Tianjin | 1.4316 | 18 | 0.8572 | 27 | 0.8744 | 23 | 1.0544 | 25 |

| Hebei | 1.5274 | 15 | 0.9034 | 25 | 0.9422 | 20 | 1.1244 | 22 |

| Shanxi | 1.8074 | 7 | 1.0745 | 20 | 0.9084 | 21 | 1.2634 | 12 |

| Inner Mongolia | 1.9953 | 4 | 1.6870 | 5 | 1.6001 | 6 | 1.7608 | 4 |

| Liaoning | 1.3465 | 25 | 0.8205 | 28 | 1.3507 | 10 | 1.1726 | 18 |

| Jilin | 1.7670 | 8 | 1.3973 | 7 | 1.2618 | 12 | 1.4754 | 8 |

| Heilongjiang | 1.5002 | 16 | 0.7474 | 29 | 0.9580 | 18 | 1.0685 | 24 |

| Shanghai | 0.9036 | 31 | 0.6301 | 31 | 0.5356 | 30 | 0.6898 | 31 |

| Jiangsu | 1.3638 | 22 | 0.9570 | 22 | 0.6297 | 28 | 0.9835 | 28 |

| Zhejiang | 1.0544 | 28 | 1.1487 | 16 | 0.8773 | 22 | 1.0268 | 26 |

| Anhui | 1.3538 | 23 | 1.3835 | 8 | 0.9448 | 19 | 1.2274 | 14 |

| Fujian | 1.0932 | 27 | 1.3602 | 10 | 1.1287 | 13 | 1.194 | 16 |

| Jiangxi | 1.4749 | 17 | 0.9177 | 24 | 0.6851 | 27 | 1.0259 | 27 |

| Shandong | 1.4204 | 19 | 1.2100 | 13 | 0.8041 | 24 | 1.1448 | 20 |

| Henan | 2.1572 | 1 | 1.3690 | 9 | 1.6804 | 3 | 1.7355 | 5 |

| Hubei | 1.4172 | 20 | 0.8628 | 26 | 1.0998 | 14 | 1.1266 | 21 |

| Hunan | 1.6003 | 10 | 1.0943 | 19 | 1.4550 | 7 | 1.3832 | 10 |

| Guangdong | 1.0151 | 29 | 0.9305 | 23 | 0.5782 | 29 | 0.8413 | 29 |

| Guangxi | 1.5842 | 13 | 1.6370 | 6 | 1.7902 | 1 | 1.6705 | 7 |

| Hainan | 1.1288 | 26 | 1.1942 | 14 | 1.4001 | 8 | 1.241 | 13 |

| Chongqing | 1.5987 | 11 | 1.2879 | 12 | 1.0512 | 16 | 1.3126 | 11 |

| Sichuan | 1.6230 | 9 | 0.9702 | 21 | 0.7241 | 26 | 1.1058 | 23 |

| Guizhou | 2.0072 | 3 | 1.9171 | 1 | 1.7324 | 2 | 1.8856 | 1 |

| Yunnan | 1.8813 | 6 | 1.9026 | 2 | 1.2768 | 11 | 1.6869 | 6 |

| Tibet | 1.3528 | 24 | 1.1482 | 17 | 1.0330 | 17 | 1.178 | 17 |

| Shaanxi | 1.5924 | 12 | 1.1836 | 15 | 0.7397 | 25 | 1.1719 | 19 |

| Gansu | 1.3673 | 21 | 1.1394 | 18 | 1.0823 | 15 | 1.1963 | 15 |

| Qinghai | 2.0401 | 2 | 1.8423 | 3 | 1.6462 | 5 | 1.8428 | 2 |

| Ningxia | 1.9384 | 5 | 1.7715 | 4 | 1.6475 | 4 | 1.7858 | 3 |

| Xinjiang | 1.5691 | 14 | 1.3376 | 11 | 1.3918 | 9 | 1.4329 | 9 |

References