Incentive Mechanism of Prefabrication in Mega Projects with Reputational Concerns

Abstract

1. Introduction

2. Literature Review

2.1. Sustainability in Project Management

2.2. Incentive Mechanism in Project Management

2.3. Reputation Incentives

3. Model Description, Solution and Analysis

- :

- The productive effort of the supplier, implies the equipment, labors and other resources which are invested by the supplier.

- :

- The observed reputation of the supplier in production process, represents the aptitude and capacity of the supplier, where higher reputation means faster implementation and optimization of natural resources, reducing waste and minimizing risks for the worker, etc.

- :

- The observable variable of supplier’s effort, which could be observed by duration and quality of the product.

- :

- The effort coefficient of the supplier, .

- :

- The reputation coefficient of the supplier, .

- :

- An exogenous random variable which influences the output, such as the uncertainty of the market, technology and environment, i.e., .

- :

- An external random variable which influences the observable variable of the effort, .

- :

- The initial market evaluation value of the supplier’s reputation, represents the aptitude and capacity of the supplier that evaluated by the project owner in the bidding stage.

- :

- The basic standard value of productive effort.

- :

- The effort coefficient of the reputation, .

- :

- An external random variable which influences reputation function, .

- :

- The cost coefficient of the supplier, .

- :

- The fixed pay in the contract.

- :

- The marginal incentive intensity of the effort.

- :

- The marginal incentive intensity of the reputation.

- :

- The reservation utility of the supplier.

- :

- The total output of the production.

- :

- The supplier’s production cost, which can be expressed as , the cost function conform to properties of increasing cost and increasing marginal cost, which is , .

- :

- The expected payoff of the owner.

- :

- The expected payoff of the supplier.

3.1. Incentive Mechanism without Reputational Concerns

3.2. Incentive Mechanism with Reputational Concerns

3.3. Incentive Mechanism with Constant Total Incentive Intensity

4. Numerical Analysis

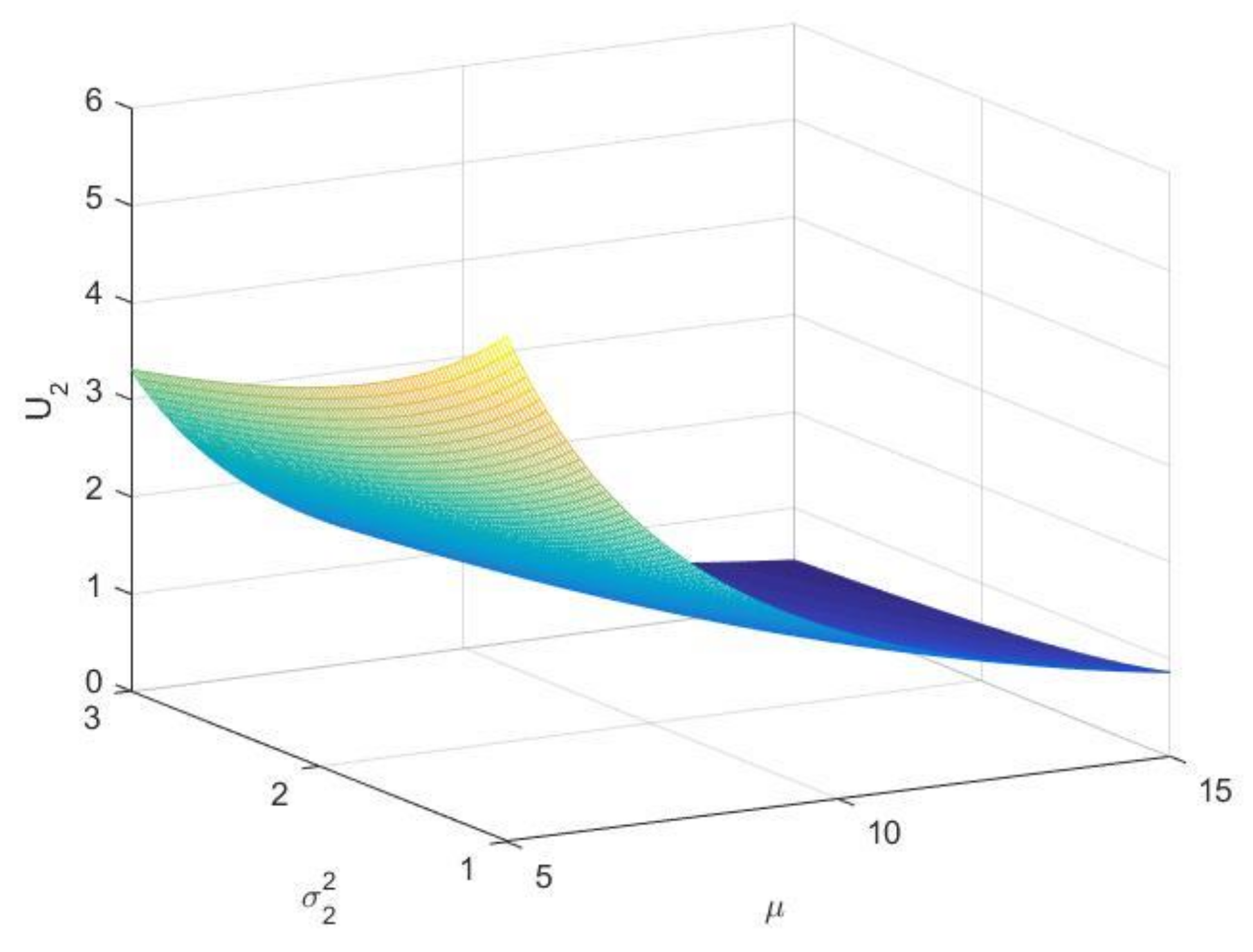

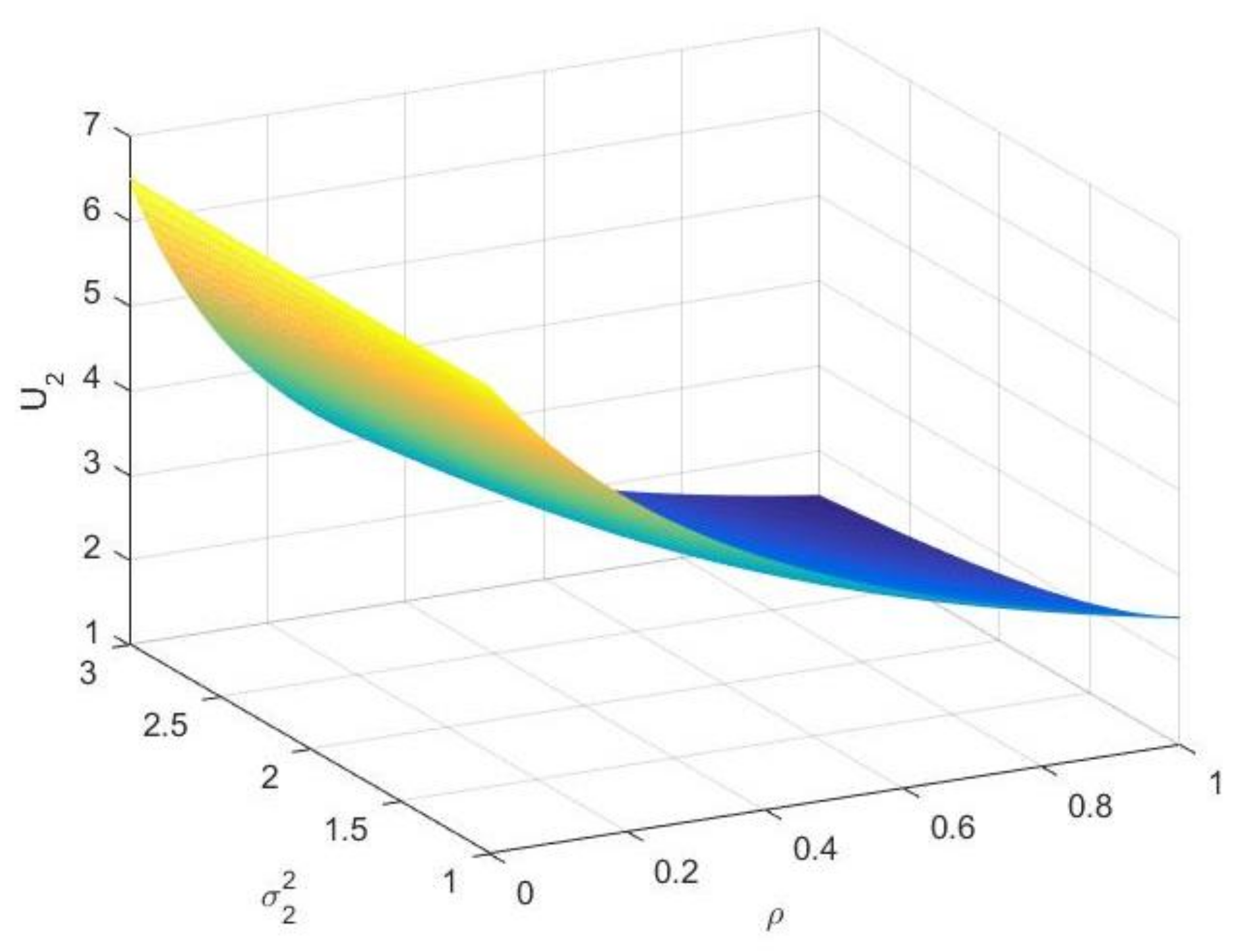

4.1. Numerical Analysis of Incentive Mechanism with Reputational Concerns

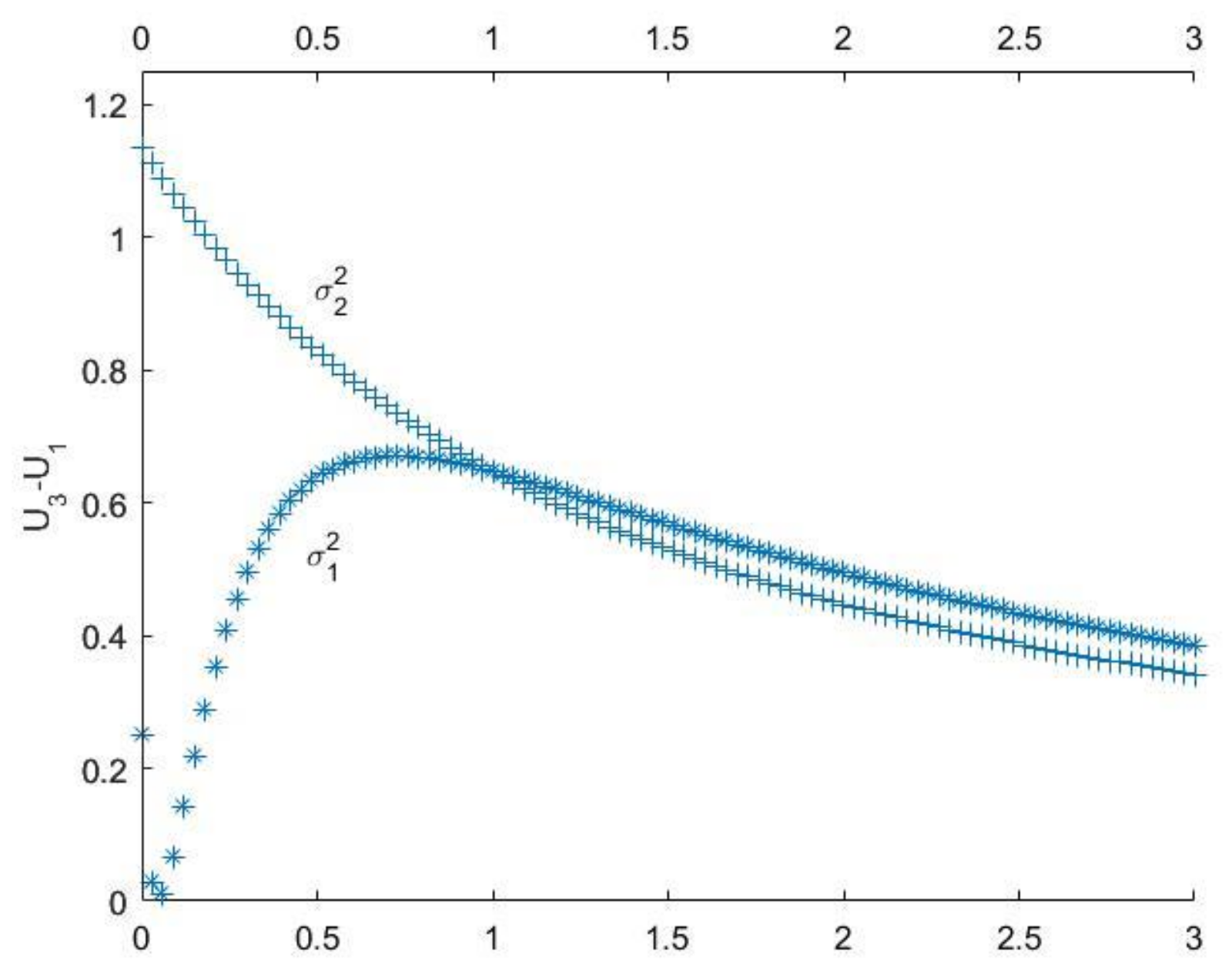

4.2. Numerical Analysis of Comparison of Incentive Mechanisms

4.3. Management Insights

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- He, Q.; Luo, L.; Hu, Y.; Chan, A.P. Measuring the complexity of mega construction projects in china—A fuzzy analytic network process analysis. Int. J. Proj. Manag. 2015, 33, 549–563. [Google Scholar] [CrossRef]

- Lu, Y.; Luo, L.; Wang, H.; Le, Y.; Shi, Q. Measurement model of project complexity for large-scale projects from task and organization perspective. Int. J. Proj. Manag. 2015, 33, 610–622. [Google Scholar] [CrossRef]

- Hertogh, M.; Westerveld, E. Playing with Complexity. Management and Organisation of Large Infrastructure Projects; Erasmus University Rotterdam: Rotterdam, The Netherlands, 2010. [Google Scholar]

- Kivilä, J.; Martinsuo, M.; Vuorinen, L. Sustainable project management through project control in infrastructure projects. Int. J. Proj. Manag. 2017, 35, 1167–1183. [Google Scholar] [CrossRef]

- Jaillon, L.; Poon, C.-S. Sustainable construction aspects of using prefabrication in dense urban environment: A Hong Kong case study. Constr. Manag. Econ. 2008, 26, 953–966. [Google Scholar] [CrossRef]

- Aarseth, W.; Ahola, T.; Aaltonen, K.; Økland, A.; Andersen, B. Project sustainability strategies: A systematic literature review. Int. J. Proj. Manag. 2017, 35, 1071–1083. [Google Scholar] [CrossRef]

- Said, H. Prefabrication best practices and improvement opportunities for electrical construction. J. Constr. Eng. Manag. 2015, 141, 04015045. [Google Scholar] [CrossRef]

- Chen, Y.; Okudan, G.E.; Riley, D.R. Sustainable performance criteria for construction method selection in concrete buildings. Autom. Constr. 2010, 19, 235–244. [Google Scholar] [CrossRef]

- Tam, C.; Tam, V.W.; Chan, J.K.; Ng, W.C. Use of prefabrication to minimize construction waste-a case study approach. Int. J. Constr. Manag. 2005, 5, 91–101. [Google Scholar] [CrossRef]

- Blismas, N.; Pasquire, C.; Gibb, A. Benefit evaluation for off-site production in construction. Constr. Manag. Econ. 2006, 24, 121–130. [Google Scholar] [CrossRef]

- Rahman, M.M. Barriers of implementing modern methods of construction. J. Manag. Eng. 2013, 30, 69–77. [Google Scholar] [CrossRef]

- Mao, C.; Shen, Q.; Pan, W.; Ye, K. Major barriers to off-site construction: The developer’s perspective in china. J. Manag. Eng. 2015, 31. [Google Scholar] [CrossRef]

- Hong, J.; Shen, G.Q.; Li, Z.; Zhang, B.; Zhang, W. Barriers to promoting prefabricated construction in china: A cost–benefit analysis. J. Clean. Prod. 2018, 172, 649–660. [Google Scholar] [CrossRef]

- Tam, W.Y.V.; Fung, W.H.; Sing, C.P.; Ogunlana, S.O. Best practice of prefabrication implementation in the Hong Kong private and public sector. J. Clean. Prod. 2015, 109, 216–231. [Google Scholar] [CrossRef]

- Mao, C.; Xie, F.; Hou, L.; Wu, P.; Wang, J.; Wang, X. Cost analysis for sustainable off-site construction based on a multiple-case study in china. Habitat Int. 2016, 57, 215–222. [Google Scholar] [CrossRef]

- Khalili, A.; Chua, D. Integrated prefabrication configuration and component grouping for resource optimization of precast production. J. Constr. Eng. Manag. 2013, 140, 04013052. [Google Scholar] [CrossRef]

- Isaac, S.; Bock, T.; Stoliar, Y. A methodology for the optimal modularization of building design. Autom. Constr. 2016, 65, 116–124. [Google Scholar] [CrossRef]

- Xue, H.; Zhang, S.J.; Su, Y.K.; Wu, Z.Z. Factors affecting the capital cost of prefabrication-a case study of china. Sustainability 2017, 9, 22. [Google Scholar] [CrossRef]

- Zhang, W.; Zhang, J.; Wang, H.; Zhou, H. Supplier development and its incentives in infrastructure mega-projects: A case study on Hong Kong-zhuhai-macao bridge project. Front. Eng. 2018, 5, 88–97. [Google Scholar]

- Dowling, G.R. Defining and measuring corporate reputations. Eur. Manag. Rev. 2016, 13, 207–223. [Google Scholar] [CrossRef]

- Fombrun, C.; Shanley, M. What’s in a name? Reputation building and corporate strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar] [CrossRef]

- Marnewick, C. Information system project’s sustainability capabality levels. Int. J. Proj. Manag. 2017, 35, 1151–1166. [Google Scholar] [CrossRef]

- Robichaud, L.B.; Anantatmula, V.S. Greening project management practices for sustainable construction. J. Manag. Eng. 2010, 27, 48–57. [Google Scholar] [CrossRef]

- Wang, T.; Wang, J.; Wu, P.; Wang, J.; He, Q.; Wang, X. Estimating the environmental costs and benefits of demolition waste using life cycle assessment and willingness-to-pay: A case study in shenzhen. J. Clean. Prod. 2018, 172, 14–26. [Google Scholar] [CrossRef]

- Song, Y.; Tan, Y.; Song, Y.; Wu, P.; Cheng, J.C.P.; Kim, M.J.; Wang, X. Spatial and temporal variations of spatial population accessibility to public hospitals: A case study of rural–urban comparison. GISci. Remote Sens. 2018, 55, 1–27. [Google Scholar] [CrossRef]

- Silvius, A.; Schipper, R.P. Sustainability in project management: A literature review and impact analysis. Soc. Bus. 2014, 4, 63–96. [Google Scholar] [CrossRef]

- Silvius, A.G.; Kampinga, M.; Paniagua, S.; Mooi, H. Considering sustainability in project management decision making; an investigation using q-methodology. Int. J. Proj. Manag. 2017, 35, 1133–1150. [Google Scholar] [CrossRef]

- Martens, M.L.; Carvalho, M.M. Key factors of sustainability in project management context: A survey exploring the project managers’ perspective. Int. J. Proj. Manag. 2017, 35, 1084–1102. [Google Scholar] [CrossRef]

- Marcelino-Sádaba, S.; González-Jaen, L.F.; Pérez-Ezcurdia, A. Using project management as a way to sustainability. From a comprehensive review to a framework definition. J. Clean. Prod. 2015, 99, 1–16. [Google Scholar] [CrossRef]

- Verrier, B.; Rose, B.; Caillaud, E. Lean and green strategy: The lean and green house and maturity deployment model. J. Clean. Prod. 2016, 116, 150–156. [Google Scholar] [CrossRef]

- Jaillon, L.; Poon, C. Life cycle design and prefabrication in buildings: A review and case studies in Hong Kong. Autom. Constr. 2014, 39, 195–202. [Google Scholar] [CrossRef]

- Jaillon, L.; Poon, C.S. Design issues of using prefabrication in Hong Kong building construction. Constr. Manag. Econ. 2010, 28, 1025–1042. [Google Scholar] [CrossRef]

- Jeong, J.G.; Hastak, M.; Syal, M.; Hong, T. Internal relationship modeling and production planning optimization for the manufactured housing. Autom. Constr. 2011, 20, 864–873. [Google Scholar] [CrossRef]

- Altaf, M.S.; Bouferguene, A.; Liu, H.; Al-Hussein, M.; Yu, H. Integrated production planning and control system for a panelized home prefabrication facility using simulation and rfid. Autom. Constr. 2018, 85, 369–383. [Google Scholar] [CrossRef]

- Shi, Q.; Zhu, J.; Li, Q. Cooperative evolutionary game and applications in construction supplier tendency. Complexity 2018, 2018, 8401813. [Google Scholar] [CrossRef]

- Feng, T.; Tai, S.; Sun, C.; Man, Q. Study on cooperative mechanism of prefabricated producers based on evolutionary game theory. Math. Probl. Eng. 2017, 2017, 1676045. [Google Scholar] [CrossRef]

- Wu, G.; Zuo, J.; Zhao, X. Incentive model based on cooperative relationship in sustainable construction projects. Sustainability 2017, 9, 1191. [Google Scholar] [CrossRef]

- Meng, X.; Gallagher, B. The impact of incentive mechanisms on project performance. Int. J. Proj. Manag. 2012, 30, 352–362. [Google Scholar] [CrossRef]

- Suprapto, M.; Bakker, H.L.; Mooi, H.G.; Hertogh, M.J. How do contract types and incentives matter to project performance? Int. J. Proj. Manag. 2016, 34, 1071–1087. [Google Scholar] [CrossRef]

- Kerkhove, L.-P.; Vanhoucke, M. Incentive contract design for projects: The owner’s perspective. Omega 2016, 62, 93–114. [Google Scholar] [CrossRef]

- Rose, T.; Manley, K. Motivation toward financial incentive goals on construction projects. J. Bus. Res. 2011, 64, 765–773. [Google Scholar] [CrossRef]

- Love, P.E.; Davis, P.R.; Chevis, R.; Edwards, D.J. Risk/reward compensation model for civil engineering infrastructure alliance projects. J. Constr. Eng. Manag. 2010, 137, 127–136. [Google Scholar] [CrossRef]

- Kwon, H.D.; Lippman, S.A.; Tang, C.S. Sourcing decisions of project tasks with exponential completion times: Impact on operating profits. Int. J. Prod. Econ. 2011, 134, 138–150. [Google Scholar] [CrossRef]

- Chan, D.W.; Lam, P.T.; Chan, A.P.; Wong, J.M. Achieving better performance through target cost contracts: The tale of an underground railway station modification project. Facilities 2010, 28, 261–277. [Google Scholar] [CrossRef]

- Karle, H.; Schumacher, H.; Staat, C. Signaling quality with increased incentives. Eur. Econ. Rev. 2016, 85, 8–21. [Google Scholar] [CrossRef]

- Hosseinian, S.M.; Carmichael, D.G. Optimal incentive contract with risk-neutral contractor. J. Constr. Eng. Manag. 2012, 139, 899–909. [Google Scholar] [CrossRef]

- Bubshait, A.A. Incentive/disincentive contracts and its effects on industrial projects. Int. J. Proj. Manag. 2003, 21, 63–70. [Google Scholar] [CrossRef]

- Rose, T.M.; Manley, K. Financial incentives and advanced construction procurement systems. Proj. Manag. J. 2010, 41, 40–50. [Google Scholar] [CrossRef]

- Fu, R.; Subramanian, A.; Venkateswaran, A. Project characteristics, incentives, and team production. Manag. Sci. 2015, 62, 785–801. [Google Scholar] [CrossRef]

- Sommer, S.C.; Loch, C.H. Incentive contracts in projects with unforeseeable uncertainty. Prod. Oper. Manag. 2009, 18, 185–196. [Google Scholar] [CrossRef]

- Tang, C.S.; Zhang, K.; Zhou, S.X. Incentive contracts for managing a project with uncertain completion time. Prod. Oper. Manag. 2015, 24, 1945–1954. [Google Scholar] [CrossRef]

- Yang, K.; Zhao, R.; Lan, Y. Impacts of uncertain project duration and asymmetric risk sensitivity information in project management. Int. Trans. Oper. Res. 2016, 23, 749–774. [Google Scholar] [CrossRef]

- Fama, E.F. Agency problems and the theory of the firm. J. Political Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- Kreps, D.M.; Wilson, R. Sequential equilibria. Econ. J. Econ. Soc. 1982, 50, 863–894. [Google Scholar] [CrossRef]

- Kreps, D.M.; Milgrom, P.; Roberts, J.; Wilson, R. Rational cooperation in the finitely repeated prisoners’ dilemma. J. Econ. Theory 1982, 27, 245–252. [Google Scholar] [CrossRef]

- Milgrom, P.; Roberts, J. Limit pricing and entry under incomplete information: An equilibrium analysis. Econometrica 1982, 50, 443–459. [Google Scholar] [CrossRef]

- Healy, P.J. Group reputations, stereotypes, and cooperation in a repeated labor market. Am. Econ. Rev. 2007, 97, 1751–1773. [Google Scholar] [CrossRef]

- Chi, H.; Hou, J. Study on logistics project team member’s incentive mechanism based on reputation. In Iclem 2010: Logistics for Sustained Economic Development: Infrastructure, Information, Integration; American Society of Civil Engineers: Reston, VA, USA, 2010; pp. 423–430. [Google Scholar]

- Huang, C.; Zhang, Y.; Lai, C. A mathematical model of communication with reputational concerns. Discret. Dyn. Nat. Soc. 2016, 2016, 6507104. [Google Scholar] [CrossRef][Green Version]

- Wagner, S.M.; Coley, L.S.; Lindemann, E. Effects of suppliers’reputation on the future of buyer–supplier relationships: The mediating roles of outcome fairness and trust. J. Supply Chain Manag. 2011, 47, 29–48. [Google Scholar] [CrossRef]

- Lu, W.; Zhang, L.; Pan, J. Identification and analyses of hidden transaction costs in project dispute resolutions. Int. J. Proj. Manag. 2015, 33, 711–718. [Google Scholar] [CrossRef]

- Chen, J.-H.; Ma, S.-H. A dynamic reputation incentive model in construction supply chain. In Proceedings of the ICMSE 2008 15th Annual International Conference on Management Science and Engineering, Long Beach, CA, USA, 10–12 September 2008; pp. 385–392. [Google Scholar]

- Lai, X.; Wu, G.; Shi, J.; Wang, H.; Kong, Q. Project value-adding optimization of project-based supply chain under dynamic reputation incentives. Int. J. Simul. Model. 2015, 14, 121–133. [Google Scholar] [CrossRef]

| Incentive Mechanism | Incentive Mechanism without Reputational Concerns | Incentive Mechanism with Reputational Concerns | Incentive Mechanism with Constant Total Incentive Intensity |

|---|---|---|---|

| 1.111 | |||

| 0.139 | 0.490 | 0.232 | |

| 0.694 | 2.500 | 1.966 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shi, Q.; Zhu, J.; Hertogh, M.; Sheng, Z. Incentive Mechanism of Prefabrication in Mega Projects with Reputational Concerns. Sustainability 2018, 10, 1260. https://doi.org/10.3390/su10041260

Shi Q, Zhu J, Hertogh M, Sheng Z. Incentive Mechanism of Prefabrication in Mega Projects with Reputational Concerns. Sustainability. 2018; 10(4):1260. https://doi.org/10.3390/su10041260

Chicago/Turabian StyleShi, Qianqian, Jianbo Zhu, Marcel Hertogh, and Zhaohan Sheng. 2018. "Incentive Mechanism of Prefabrication in Mega Projects with Reputational Concerns" Sustainability 10, no. 4: 1260. https://doi.org/10.3390/su10041260

APA StyleShi, Q., Zhu, J., Hertogh, M., & Sheng, Z. (2018). Incentive Mechanism of Prefabrication in Mega Projects with Reputational Concerns. Sustainability, 10(4), 1260. https://doi.org/10.3390/su10041260