Abstract

The sustainable energy consumption in northeast Asia has a huge impact on regional stability and economic growth, which gives price volatility research in the energy market both theoretical value and practical application. We select China’s fuel oil futures market as a research subject and use recurrence interval analysis to investigate the price volatility pattern in different thresholds. We utilize the stretched exponential function to fit the pattern of the recurrence intervals of price fluctuations and find that the probability density functions of the recurrence intervals in different thresholds do not show the scaling behavior. Then the conditional probability density function and detrended fluctuation analysis prove that there is short-term and long-term correlation. Last, we use a hazard function to introduce the recurrence intervals into the (value at risk) VaR calculation and establish a functional relationship between the mean recurrence interval and the threshold. Following this result, we also shed light on policy discussion for hedgers and government.

1. Introduction

With regard to sustainable development in northeast Asia, the utilization and depletion of energy is always a problem for each country [1]. With the rapid development of emerging nations such as China, energy will increasingly become an important factor affecting regional stability and economic growth. Among many energy sources, fuel oil occupies a prominent position and maintains a country’s economic lifeline and livelihood development [2]. However, for a long time, the fuel market in a country like China has mainly been built by agreement pricing, which lacks a buffer mechanism to maintain the endogenous stability of this system [3,4]. The long-term contract pricing of these agreements will make China and entire northeast Asia suffer losses in the international fuel price fluctuations. In 2004, China followed the example of West Texas Intermediate (WTI) and Brent and set up its energy futures market [5], hoping to stabilize the market price and futures expectation of domestic primary fuel consumers and to achieve a more balanced and sustainable development.

Fuel oil is a downstream product of oil and China is a significant fuel oil importing country in the world as well as the largest consumer of fuel oil in northeast Asia considering its Gross Domestic Product (GDP) scale. Although China’s enormous oil demand has had a significant impact on the international oil market supply and demand pattern, its role in the global oil price has been negligible owing to lack of impactful oil futures [6]. Therefore, in case of sharp fluctuations in international oil prices, China needs an oil futures market to reflect the supply and demand to determine the “Chinese oil price” in line with China’s interests and thus ensure oil security and economic stability. Hence, research of the fuel oil futures market is of necessity, not only allowing regulators to efficiently judge and understand the market capitalization in time and adopt reasonable and adequate control measures but also allowing market participants to make use of the two primary functions—price discovery and hedging—of fuel oil futures for decision-making.

To sum up, the study of the fuel oil futures market has theoretical value and practical implications. From a macro perspective, the participants’ behaviors directly determine a resource allocation of the fuel oil futures and spot markets. If the market fails, then the resources mismatch and efficiency decline in the futures and spot markets will directly affect the normal operation of the macroeconomy. From a micro perspective, the normal process of the futures market directly affects the hedging performance of market participants. Though the fuel oil futures market also has some speculative behaviors, its primary function is to preserve value as a financial hedging instrument. If the futures market fails, it will make enterprises or investors suffer massive losses, and then the price volatility will have become a source of economic and financial fluctuations in China. This paper, by using recurrence interval analysis (RIA), will investigate the price volatility pattern of fuel oil futures and estimate the risk.

The remaining sections of this paper are arranged as follows: Section 2 reviews current research. Section 3 briefly describes the approach and gives the basic statistics of the data set. Section 4 conducts empirical research, including probability distribution function, scaling properties, memory effect and risk estimation. Section 5 discusses implications of the study and Section 6 concludes.

2. Literature Review

2.1. Energy Futures Market

For studies about energy futures market, researchers mainly focus on the price discovery mechanism between the prices of futures and spot [7,8,9]. For example, Bekiros and Disks [10] used a cointegration method to confirm that there may be an asymmetric GARCH (Generalized Autoregressive Conditional Heteroscedasticity) effect between WTI futures and spot. If asymmetric effects are taken into account, the lead-lag relationship between futures and spot markets will change over time. Chen et al. [11] investigated the impact of structural breaks on the relationship between WTI futures and New York Mercantile Exchange (NYMEX) crude oil spot by a cointegration test. The results show that the lead–lag relationship between WTI futures and NYMEX crude oil spot will change with time across both regimes. The situation in China was complicated. China’s earliest energy futures appeared in 1993 when the Shanghai Petroleum Exchange launched an oil futures contract, followed by several futures exchanges listing oil futures contracts. However, as a result of the change in national policies, the initially implemented “two-track system” of crude oil and refined oil price was halted and the mechanism in which price was formed automatically by market supply and demand no longer existed. Oil futures with only one-year life were forced to stop trading. For an extended period, the domestic oil futures market was kept under vacuum. Ten years later, on 25 August 2004, another energy futures—fuel oil futures—was listed on the Shanghai Futures Exchange, and domestic scholars have begun to study the issues regarding the Chinese oil market. For example, Li et al. [12] examined the relationship between fuel oil spot, fuel oil futures, and energy stock market in China and pointed out that the correlations are weaker than those in U.S. market due to China’s oil price regulation and control policy. Ji and Fan [13] found that China’s oil markets were related to domestic and international commodity markets. Additionally, the impact of China’s fuel oil futures market on other local commodity markets was high (small) when the oil price was high (low).

Since the early emergence of the energy futures market outside China, a lot of research has been done on the function of price discovery. China’s research in this area mainly focuses on the impact of price discovery on the domestic and international futures markets. Also, the current study on oil futures still put different oil markets or related petroleum and related industries together. In the context of financialization in the international oil market, the capital market plays an increasingly important role in the oil futures market with an increasingly significant influence on the oil futures market, especially on the price discovery function of the oil futures market. Hence, the research in this area should be strengthened.

2.2. Recurrence Interval Analysis

Recurrence interval is a measurement to estimate extreme events—events that do not occur frequently but do so with a high magnitude. In the natural environment, extreme events include earthquakes, tsunamis, hurricanes, floods, etc, while in the social environment extreme events include violent conflicts, acts of terrorism, industrial accidents, financial and commodity market crashes, etc. In the long run, extreme events are presumed to be spontaneous. In other words, they are mutually uncorrelated. However, studies have shown that the occurrence of extreme events is not independent, but instead, they congregate together, occurring in relatively short periods of time [14,15,16]. Therefore, recurrence interval can be applied to estimate the magnitude of price volatility of China’s fuel oil futures here.

Recurrence interval analysis (RIA) is a time series method for volatility forecast with high-frequency data, which is widely used in many areas [17,18,19] including stock and exchange rate markets [20,21,22,23,24]. RIA is frequently applied to risk analysis, assuming that the probability of future volatility is constant and independent of the volatility of the past. Also, the problem of insufficient data can also be solved by finding the scaling behavior of different scale events [25]. At present, the recurrence interval between volatility in the energy market has been widely studied [26,27,28,29]. For example, Xie et al. [30] used RIA to investigate four NYMEX energy futures and showed that the long-term correlations have resulted in clusters of recurrence intervals. Suo et al. [31] compared the CSI 300 spot and futures market with RIA and found that futures market has a lower (higher) risk than that in the spot market during volatile (regular) periods. However, to the best of our knowledge, there are insufficient studies on price volatility of China’s fuel oil futures by RIA with current high-frequency data.

Therefore, our research has made the following contributions. First, we investigate the price volatility of China’s fuel oil futures from a new perspective by using RIA. So far, this is one of the few articles on China’s fuel oil futures with RIA. Second, different from previous research using the daily data of China fuel oil futures, we use one-minute high-frequency data that can reveal more price information, providing a new perspective for the study of China’s energy derivatives market in the view of high-frequency trading. Third, we focused on the price volatility of fuel oil futures instead of the relationship between fuel oil futures market and other markets.

3. Materials and Methods

We here select fuel oil futures as research subject which was listed on Shanghai Futures Exchange, and Table 1 shows the contract specifications. The data here is obtained from Tongdaxin Database and the sample period covers from 1 January 2015 to 30 December 2016. We have collected 70,635 price observations after removing the days without trading. The return of time series is measured by the logarithmic difference of the price:

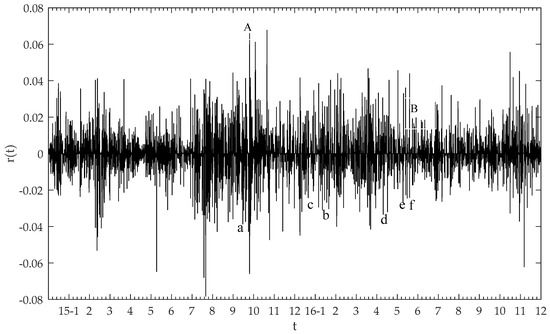

where due to the data being 1-min frequent and is the closing price of the th time. By taking logarithm difference, the data magnitude is reduced for subsequent calculations. The logarithmic returns of fuel oil futures are shown in Figure 1 and, the statistics is summarized in Table 2.

Table 1.

Contract specifications of the fuel oil futures.

Figure 1.

Logarithmic returns of fuel oil futures.

Table 2.

Statistics of the logarithmic returns of fuel oil futures.

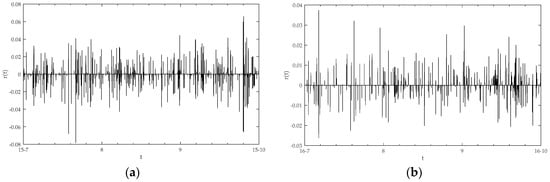

From Figure 1, we can see that the fluctuations in the different periods have different magnitudes. For example, a massive volatility like A has a much larger scale than that of a small fluctuation like B. Furthermore, volatilities with similar level tend to cluster with each other. It can be seen in Figure 1 that a large fluctuation tends to follow significant volatility while a small one tends to follow a small one, which indicates the long-term memory effect [32,33]. Also, the X-axis in Figure 1 is from 5 January 2015 to 30 December 2016, hence the more significant fluctuations are approximately concentrated in the second half of 2015 and the first half of 2016. Such fluctuation periods may be related to the events occurring in the international oil market during that period, like Russia bombing Syria, four oil-producing nations reaching cut consensus, the lifting of Iran’s oil ban, the Canadian wildfires leading to disruption of oil sands, Nigeria cutting off supply, and the British Brexit vote (see a–f in Figure 1, respectively). We can also find that a volatile period when large volatilities cluster is accompanied with short and dense recurrence intervals. In contrast, the recurrence intervals during the less volatile period are long, few and far between. In Figure 2, we magnify two sections in Figure 1 to represent the period of large and small volatilities, respectively, to present these characteristics. Figure 2a shows the volatility from June 2015 to October 2015, and Figure 2b shows the fluctuations from June 2016 to October 2016. We can see that for a given , assuming 0.02, the properties of recurrence are in accordance with our discussion above.

Figure 2.

Logarithmic returns of fuel oil futures in different periods. (a) Large volatilities; (b) small volatilities.

In Table 2, the statistics of the logarithmic returns are not normally distributed but the skewness is near symmetrical, and the kurtosis is leptokurtic, which is also consistent with the findings in most studies on the probability distribution of returns in stock and futures markets [34,35,36,37]. Therefore, by using RIA, we hope to promote the risk estimation in the energy futures market by describing the volatility of the fuel oil futures and estimating the time intervals between fluctuations, e.g., what is the probability of the next significant volatility after a larger one?

Considering the recurrence interval at the threshold , the mathematical expression of recurrence interval could be derived as follows:

Most studies [38,39,40,41] have pointed that stretched exponential distribution can better fit the recurrence intervals of fluctuations:

Equation (3) means that is the probability distribution of recurrence interval at the threshold , where is the average recurrence interval and will change when threshold is different, and , , are the parameters.

4. Results

4.1. Probability Density Function

Before applying RIA, we need to normalize the time series by dividing the standard deviation as follows:

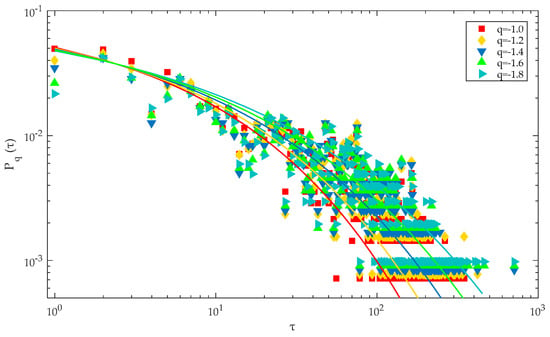

where is the standard deviation of . For a threshold , we can get the coresponding set of recurrence interval , then calculate the occurance probability of each . In this paper, the threshold is set to a negative value () because a slump tends to attract more interest to the market participants than a surge. In Figure 3, we draw the empirical (color symbols) and theoritical values (color curves) of the probability distribution function (PDF) of recurrence intervals between returns at different threshold . In addition, Table 3 shows the parameters for theoritical PDFs of each threshold .

Figure 3.

Empirical and theoretical probability distribution of recurrence intervals with different thresholds of fuel oil futures.

Table 3.

Estimates of the coefficients of stretched exponential functions.

We can see from Figure 3 that when rises, in the whole period, for the same probablility, larger volatilities tend to have larger interval, while for the same interval, larger volatilities will occur more likely than small volatilities, which also means that for large volatilities the time interval between two consecutive events has a higher probability to increase than decline. Combining the observation from Table 3 and Figure 3, it is found that all the curves are in similar shape which leads us to investigate the scaling behavior between these PDFs.

With this question, after observing the behavior of PDFs in Figure 3 and how they may depend on the threshold , we can see that for different , the corresponding PDF is not the same and cannot be described by a single distribution as for irrelevant data. To understand the dependence, the method in Yamasaki et al. [42] is introduced:

where is scaled PDF and is scaled recurrence interval. With an increasing threshold , will change in the same direction, i.e., , indicating that as the volatility increases, the average length of recurrence interval increases, too. If there exists scaling behavior, will be independent of the threshold . Namely, the discrepancy between PDFs of recurrence invervals at different threshold can be eliminated by calculating . Additionally, the scaling behavior can be demonstrated if converges to a single curve , which is given by: . Figure 4 displays the scatter diagram with x-ray as and y-ray as . We can see clearly that do not converge into one curve when threshold is different. This suggests that the scaling behavior does not exist here, that is, when data is insufficient, we are unable to derive the behavior of large fluctuations from the behavior of small ones.

Figure 4.

Scaled probability distributions of recurrence intervals with different thresholds of fuel oil futures.

4.2. Memory Effect

In this part, we want to know if there exists a memory effect between recurrence intervals. Short-term memory refers the correlation between two consecutive recurrence intervals, and long-term memory means current volatility was affected by fluctuations not only in the recent past but also from a long time ago, which would cause volatility clusters.

4.2.1. Short-Term Correlation

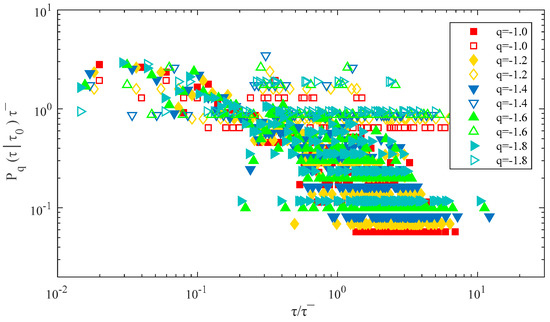

For recurrence intervals, the short-term correlation will affect the length of one interval after another interval. In this part, we will calculate the conditional probability density function to study the short-term correlation within the recurrence intervals [42]. refers to the probability of a recurrence interval to occur immediately following the last recurrence interval . When short-term correlation does not exist, will be independent of . However, a certain value may result in insufficient data, to avoid that, we have selected a range for to calculate rather than a fixed value .

Each threshold q corresponds to a series of recurrence intervals and the set of all the recurrence intervals at threshold q is . We then divide into four subsets without overlapping, , where . In this dividing procedure, the whole recurrence intervals in are sorted in an ascending order and then is turned into subsets with the same size. Hence, the 1/4 smallest recurrence intervals are selected to the first subset and largest quarter goes to the last subset . Therefore, the conditional probability density function is derived as , and if short-term correlation does not exist, it could be found that .

Figure 5 shows that is the function of for . Filled symbols indicate and open symbols mean . It is obvious that from the smallest subset does not equal to from the largest subset : . On the left side of Figure 5, is bigger than for small , while on the right side, is smaller than when increases. This suggests that short is more likely to follow short , and long tends to follow long , indicating that short-term correlations do exist in the recurrence intervals, i.e., the probability of a short (long) interval existing after a small (long) one is higher than the probability of a short (long) interval after a long (short) one for the volatility with a certain magnitude.

Figure 5.

Conditional probability density functions with (filled symbols) and (open symbols) for fuel oil futures.

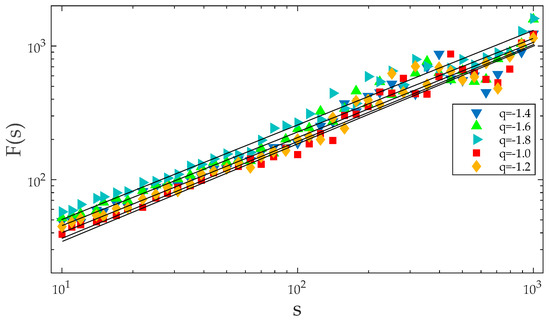

4.2.2. Long-Term Correlation

The volatility clusters in Figure 1 indicate that long-term correlation exists in the time series. To verify this we employ detrended fluctuation analysis (DFA) method, and the results are shown in Figure 6. DFA was invented by Peng [43] for determining the statistical self-affinity of a signal. In addition, DFA has become one robust method for analyzing time series that appear to be long-memory processes [44,45,46]. DFA will compute the root-mean-square deviation from the trend, where is the length of time windows. After repeatedly calculating the for a range of different , a log–log figure of against is constructed in accord to the form . H is the Hurst exponent to determine whether there is long-term correlation in the time series. H greater than 0.5 suggests that long-term correlations do exist in the time series while H equals to 0.5 means the time sequence is un-correlated. The results are depicted in Figure 6 and the parameters are in Table 4. As can be seen, each line has a Hurst exponent more than 0.5, which indicates the long-term correlation within the recurrence intervals. This is consistent with previous studies on the recurrence interval and demonstrates the existence of a long-term memory on the recurrence interval in fuel oil futures [47,48], indicating that the fuel oil futures market in China is an inefficient market and the market shows strong trend behavior. This means that in one cycle, the former price volatility and historical information will affect the price fluctuations in the future.

Figure 6.

Detrended fluctuation function of the recurrence intervals.

Table 4.

Estimates of exponent H.

4.3. Risk Estimation

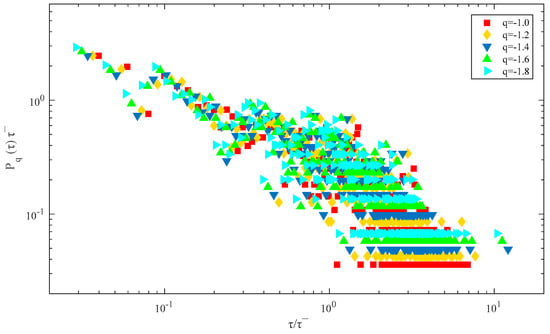

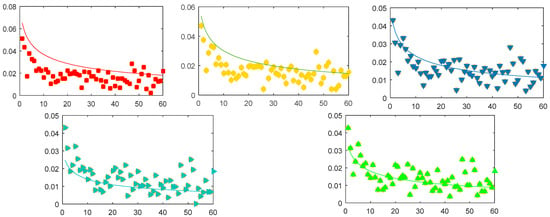

For a specific , we want to know the probability of an interval after another interval. The hazard probability function is used here to estimate risk of RIA. Assuming that the last big fluctuations greater than have passed t units of time, then what is the chance that the next large fluctuations greater than will happen within units of time? Based on this, the hazard probability can be written as:

Equation (6) calculates the theoretical value of hazard probability. As we know, each has a corresponding stretched exponential function and the value of parameters can be found in Table 3. Furthermore, in order to compare the theoretical and empirical values of , we shall rewrite as:

For each threshold , “” counts the number of recurrence intervals greater than units of time and “” is the number of recurrence intervals between and units of time.

The calculation results of Equations (6) and (7) are shown in Figure 7, represented by color symbols and curves, respectively. In Figure 7, it can be observed that when is relatively small, the curve is above the scatter symbols, which means that the theoretical value will overestimate the risk in the short term, while with the increase of the difference between the theoretical and empirical value will gradually decrease. In addition, decreases when increases, indicating that the longer the time interval between the two volatilities, the less likely the next fluctuation will happen instantly, which confirms that long-term correlations and clustering behavior exist within the recurrence intervals between volatilities. Additionally, we can calculate the recurrence probability of an extreme event for each threshold .

Figure 7.

Theoretical (curves) and empirical (color symbols) value of (x-rays are t (unit: 1 min), y-rays are values of for from left to right, top to bottom).

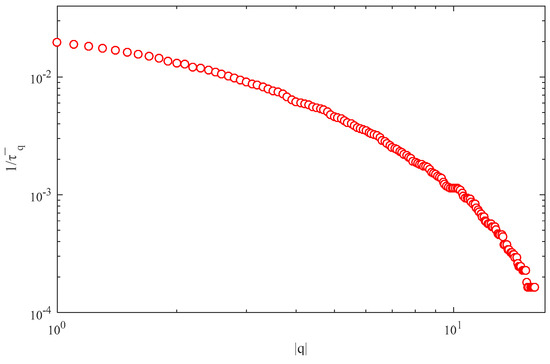

We here utilize value at risk (VaR) to estimate the risk. To construct a functional relationship between recurrence interval and VaR, we first define the loss probability at volatility level :

where defines the loss probability, is the normalized time series given by Equation (4) and is the PDF of . For a given threshold , the mean recurrence interval is the average value of total intervals: , where is the recurrence interval and is the number of . Hence we can derive that is approximately equal to the total number of returns and is the number of returns below threshold . Then we can construct a relationship between mean recurrence interval and VaR:

where is the function of threshold as shown in Figure 8. The loss probability in the Y-axis corresponds to the fluctuation degree in X-axis, for example, if the market participants hope to control the risk level of loss at two percent, the fluctuation degree—i.e., the threshold— meets is what they should be aware of. We can also see from Figure 8 that the mean recurrence interval increases with an increasing , suggesting that the larger the fluctuation, the greater the interval.

Figure 8.

The reciprocal of mean recurrence interval as a function of absolute threshold ().

5. Discussion

From the above analysis, it can be seen that there is long-term memory, abnormality, and autocorrelation in the recurrence intervals of China’s fuel oil futures market, which shows that this market is mostly a complicated nonlinear system. Therefore, efficient market hypothesis adopting “linear and normal” as the hypothetical premise can no longer efficiently describe and analyze the price volatility of the futures markets [49,50,51]. This conclusion makes it necessary to alter the linear traditional research paradigm in the futures research when analyzing the energy futures market and introduce nonlinear theory and methods. It also has significant theoretical and practical significance by changing from the linear analysis, equilibrium analysis, and static analysis to nonlinear analysis, evolutionary analysis, and dynamics analysis. Also, long-term memory indicates that the impact of price volatility of the energy futures market does not disappear immediately. Instead, it can have long-term effects. Therefore, based on sufficient historical information and within a specific long-term memory length, it is possible to measure and predict the price volatility of the energy futures market.

Probability density function analysis shows that the occurrence probability of significant and minor fluctuations and the degree of risk are different. When new information appears, some market participants do not respond to the information in time but try to verify the authenticity of the information and identify the impact of the information by analyzing the relevant information. For example, when a new policy is promulgated, the participants cannot understand the purpose of the policymaker in a short period and accordingly decide after some trend is identified after a period. Such information understanding lag means that the information cannot be digested immediately by the participants; on the contrary, it will have some degree of cumulative effect. Participants may react suddenly when some new information arrives continually, or when policymakers’ intentions are apparent, which will result in sudden and drastic market volatility, resulting in a flock effect and herd behavior.

At present, China’s fuel oil futures market has been established for more than a decade. As a big consuming country, it is necessary to establish an oil pricing mechanism with an international influence to better predict the price and risk. Specifically, the authority can improve the futures market laws and regulations, increase the futures trading volume, continuously develop new varieties of futures, and strengthen the domestic oil market. Furthermore, China’s oil futures market should be integrated into the international oil market, accelerating the pace of oil price adjustment, to reflect the real-time domestic oil price.

6. Conclusions

The paper utilized RIA to investigate the properties of recurrence intervals of price fluctuations for different thresholds and to understand the behaviors of large volatilities of fuel oil futures in China with the mass data collected at one-minute high-frequency.

First, we used the stretched exponential function to fit the probability density distribution of recurrence intervals at different thresholds and found that the PDFs do not have scaling behavior at different thresholds. Subsequently, the conditional PDF and DFA respectively confirmed that there is a short-term and long-term relationship between the recurrence intervals, which indicates that the intervals are not only affected by the near-term, but also by the long-term effect. Finally, RIA was used to evaluate the risk for fuel oil futures, which provides a relatively accurate risk estimation and constructs a relationship between loss possibility and volatility scale.

For those hedgers who want to achieve sustainable development, attention should be paid in the short term to significant price fluctuations in the energy futures market, and in the long run, they should make judgments based on specific market conditions to more effectively prevent and mitigate the risk of price volatility. Also, because the energy futures market in China is relatively short and not yet mature compared to Western countries, we can consider cultivating domestic institutional investors and lowering transaction costs. At the same time, we could speed up the opening up of the market to attract foreign institutional investors and mitigate the risks caused by the fluctuations through the connection with the international energy market. The government should improve energy futures market construction and promote risk control to enhance the global influence of China’s energy futures market. Through strengthening the pricing power of energy pricing, China could contribute to the sustainable development in China and northeast Asia in the future.

Acknowledgments

This research is supported by the China Social Science Fund (fund number 15AJL004, 15CJL048), the Fundamental Research Funds for the Central Universities (fund number 3214007103) and the Elementary Research Fund of Southeast University (fund number 2242017S10008).

Author Contributions

Chi Zhang conceived and designed the experiments; Zhengning Pu and Qin Zhou performed the experiments; Chi Zhang and Qin Zhou analyzed the data; Zhengning Pu contributed analysis tools; Chi Zhang wrote the paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Shen, Y.; Li, X.S.; Guo, X.L. Logistic analysis of energy security cooperation of northeast Asia. Adv. Mater. Res. 2012, 524–527, 2950–2953. [Google Scholar] [CrossRef]

- Qu, X. China’s Energy Economy from Low-Carbon Perspective; Springer: Berlin/Heidelberg, Germany, 2013; pp. 435–441. [Google Scholar]

- Zhang, J.; Xie, M. China’s oil product pricing mechanism: What role does it play in China’s macroeconomy? China Econo. Rev. 2016, 38, 209–221. [Google Scholar] [CrossRef]

- Bouri, E.; Chen, Q.; Lien, D.; Lv, X. Causality between oil prices and the stock market in China: The relevance of the reformed oil product pricing mechanism. Int. Rev. Econ. Financ. 2016, 48, 34–48. [Google Scholar] [CrossRef]

- Chu, J.A.; Zhang, H.; Exchange, S.F. Review at 3rd anniversary of the listing of Shanghai fuel oil futures and prospect of China’s petroleum futures market. Int. Pet. Econ. 2007, 8, 009. [Google Scholar]

- Gao, X.W.; Ma, H.X. International petroleum pricer risk early-warning based on grey theory. J. Grey Syst. 2011, 14, 9–19. [Google Scholar]

- Bjursell, J.; Wang, G.H.K.; Zheng, H. VPIN, jump dynamics and inventory announcements in energy futures markets. J. Futures Markets 2017, 37, 542–577. [Google Scholar] [CrossRef]

- Byun, S.J. Speculation in commodity futures markets, inventories and the price of crude oil. Energy J. 2017, 38, 1–36. [Google Scholar]

- Ma, F.; Wahab, M.I.M.; Huang, D.; Xu, W. Forecasting the realized volatility of the oil futures market: A regime switching approach. Energy Econ. 2017, 67, 136–145. [Google Scholar] [CrossRef]

- Bekiros, S.D.; Diks, C.G.H. The relationship between crude oil spot and futures prices: Cointegration, linear and nonlinear causality. Energy Econ. 2008, 30, 2673–2685. [Google Scholar] [CrossRef]

- Chen, P.F.; Lee, C.C.; Zeng, J.H. The relationship between spot and futures oil prices: Do structural breaks matter? Energy Econ. 2014, 43, 206–217. [Google Scholar] [CrossRef]

- Li, P.; Zhang, Z.Y.; Yang, T.N.; Zeng, Q.C. The relationship among China’s fuel oil spot, futures and stock markets. Financ. Res. Lett. 2017, in press. [Google Scholar]

- Ji, Q.; Fan, Y. How do China’s oil markets affect other commodity markets both domestically and internationally? Financ. Res. Lett. 2016, 19, 247–254. [Google Scholar] [CrossRef]

- Franzke, C.L. Persistent regimes and extreme events of the North Atlantic atmospheric circulation. Philos. Trans. 2013, 371, 20110471. [Google Scholar] [CrossRef] [PubMed]

- Gregersen, I.B.; Madsen, H.; Dan, R.; Arnbjerg-Nielsen, K. Long term variations of extreme rainfall in Denmark and southern Sweden. Clim. Dyn. 2015, 44, 1–15. [Google Scholar] [CrossRef]

- Scarabino, A.; Sterling, M.; Baker, C.J.; Richards, P.J.; Hoxey, R.P. An investigation of the structure of ensemble averaged extreme wind events. Wind Struct. Int. J. 2007, 10, 135–151. [Google Scholar] [CrossRef]

- Bunde, A.; Eichner, J.F.; Kantelhardt, J.W.; Havlin, S. Long-term memory: A natural mechanism for the clustering of extreme events and anomalous residual times in climate records. Phys. Rev. Lett. 2005, 94, 048701. [Google Scholar] [CrossRef] [PubMed]

- Bogachev, M.I.; Kireenkov, I.S.; Nifontov, E.M.; Bunde, A. Statistics of return intervals between long heartbeat intervals and their usability for online prediction of disorders. New J. Phys. 2009, 11, 063036. [Google Scholar] [CrossRef]

- Lin, A.; Yan, B.; Rao, G. Millennium recurrence interval of morphogenic earthquakes on the Qingchuan fault, northeastern segment of the Longmen Shan Thrust Belt, China. J. Seismol. 2016, 20, 535–553. [Google Scholar] [CrossRef]

- Duong, D.; Swanson, N.R. Empirical evidence on the importance of aggregation, asymmetry, and jumps for volatility prediction. J. Econom. 2013, 187, 606–621. [Google Scholar] [CrossRef]

- Bekaert, G.; Hoerova, M. The VIX, the variance premium and stock market volatility. J. Econom. 2014, 183, 181–192. [Google Scholar] [CrossRef]

- Bollerslev, T.; Osterrieder, D.; Sizova, N.; Tauchen, G. Risk and return: Long-run relationships, fractional cointegration, and return predictability. J. Financ. Econ. 2013, 108, 409–424. [Google Scholar] [CrossRef]

- Zhang, C. Stock Market Volatility, Recurrence Interval and Memory Effect. Int. J. Bus. Adm. Manag. Res. 2017, 3, 14. [Google Scholar]

- Billio, M.; Casarin, R.; Osuntuyi, A. Markov switching GARCH models for Bayesian hedging on energy futures markets. Energy Econ. 2017, in press. [Google Scholar]

- Chattopadhyay, A.K.; Burroughs, N.J. Close contact fluctuations: The seeding of signalling domains in the immunological synapse. EPL 2006, 77, 48003. [Google Scholar] [CrossRef]

- Kaizoji, T.; Kaizoji, M. Power law for the calm-time interval of price changes. Phys. A Stat. Mech. Appl. 2004, 336, 563–570. [Google Scholar] [CrossRef]

- Qiu, T.; Guo, L.; Chen, G. Scaling and Memory Effect in Volatility Return Interval of the Chinese Stock Market. Phys. A Stat. Mech. Appl. 2008, 387, 6812–6818. [Google Scholar] [CrossRef]

- Ren, F.; Zhou, W.X. Recurrence interval analysis of high-frequency financial returns and its application to risk estimation. New J. Phys. 2009, 12, 1653–1655. [Google Scholar] [CrossRef]

- Zhang, C.; Pu, Z.N.; Fu, J.S. The Recurrence Interval Difference of Power Load in Heavy/Light Industries of China. Energies 2018, 11, 106. [Google Scholar] [CrossRef]

- Xie, W.J.; Jiang, Z.Q.; Zhou, W.X. Extreme value statistics and recurrence intervals of NYMEX energy futures volatility. Econ. Model. 2014, 36, 8–17. [Google Scholar] [CrossRef]

- Suo, Y.Y.; Wang, D.H.; Li, S.P. Risk estimation of CSI 300 index spot and futures in China from a new perspective. Econ. Model. 2015, 49, 344–353. [Google Scholar] [CrossRef]

- Tabak, B.M.; Cajueiro, D.O. Are the crude oil markets becoming weakly efficient over time? A test for time-varying long-range dependence in prices and volatility. Energy Econ. 2007, 29, 28–36. [Google Scholar] [CrossRef]

- Elder, J.; Serletis, A. Long memory in energy futures prices. Rev. Financ. Econ. 2008, 17, 146–155. [Google Scholar] [CrossRef]

- Premaratne, G.; Bera, A. A test for symmetry with leptokurtic financial data. J. Financ. Econom. 2001, 3, 169–187. [Google Scholar] [CrossRef]

- Choi, P.; Nam, K. Asymmetric and leptokurtic distribution for heteroscedastic asset returns: The U-normal distribution. J. Empir. Financ. 2008, 15, 41–63. [Google Scholar] [CrossRef]

- Bhattacharyya, M.; Siddarth, M.R. A Comparison of VaR estimation procedures for leptokurtic equity Index returns. J. Math. Financ. 2012, 2, 13–30. [Google Scholar] [CrossRef]

- Solomon, S.; Levy, M. Market Ecology, Pareto Wealth Distribution and Leptokurtic Returns in Microscopic Simulation of the LLS Stock Market Model. arXiv, 2012; arXiv:cond-mat/0005416. [Google Scholar]

- Wang, F.; Weber, P.; Yamasaki, K.; Havlin, S.; Stanley, H.E. Statistical regularities in the return intervals of volatility. Eur. Phys. J. B 2006, 55, 123–133. [Google Scholar] [CrossRef]

- Wang, F.; Yamasaki, K.; Havlin, S.; Stanley, H.E. Scaling and memory of intraday volatility return intervals in stock markets. Phys. Rev. E Stat. Nonlin. Soft Matter Phys. 2006, 73, 026117. [Google Scholar] [CrossRef] [PubMed]

- Wang, F.; Wang, J. Statistical analysis and forecasting of return interval for SSE and model by lattice percolation system and neural network. Comput. Ind. Eng. 2012, 62, 198–205. [Google Scholar] [CrossRef]

- Jung, W. Return intervals analysis of the Korean stock market. J. Korean Phys. Soc. 2010, 56, 67–95. [Google Scholar] [CrossRef]

- Yamasaki, K.; Muchnik, L.; Havlin, S.; Bunde, A.; Stanley, H.E. Scaling and memory in volatility return intervals in financial markets. Proc. Natl. Acad. Sci. USA 2005, 102, 9424–9428. [Google Scholar] [CrossRef] [PubMed]

- Peng, C.K.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685. [Google Scholar] [CrossRef]

- Chen, Z.; Pch, I.; Hu, K.; Stanley, H.E. Effect of nonstationarities on detrended fluctuation analysis. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2002, 65, 041107. [Google Scholar] [CrossRef] [PubMed]

- Hu, K.; Ivanov, P.C.; Chen, Z.; Carpena, P.; Stanley, H.E. Effect of trends on detrended fluctuation analysis. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2001, 64, 011114. [Google Scholar] [CrossRef] [PubMed]

- Ma, Q.D.; Bartsch, R.P.; Bernaola-Galván, P.; Yoneyama, M.; Pch, I. Effect of extreme data loss on long-range correlated and anticorrelated signals quantified by detrended fluctuation analysis. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2010, 81, 031101. [Google Scholar] [CrossRef] [PubMed]

- Shang, P.; Lin, A.; Liu, L. Chaotic SVD method for minimizing the effect of exponential trends in detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2009, 388, 720–726. [Google Scholar] [CrossRef]

- Bogachev, M.I.; Eichner, J.F.; Bunde, A. Effect of nonlinear correlations on the statistics of return intervals in multifractal data sets. Phys. Rev. Lett. 2007, 99, 240601. [Google Scholar] [CrossRef] [PubMed]

- Lee, C.-C.; Lee, J.-D. Energy prices, multiple structural breaks, and efficient market hypothesis. Appl. Energy 2009, 86, 466–479. [Google Scholar] [CrossRef]

- Manahov, V.; Hudson, R. A note on the relationship between market efficiency and adaptability—New evidence from artificial stock markets. Expert Syst. Appl. 2014, 41, 7436–7454. [Google Scholar] [CrossRef]

- Kleinnijenhuis, J.; Schultz, F.; Oegema, D.; Atteveldt, W.V. Financial news and market panics in the age of high-frequency sentiment trading algorithms. Journalism 2013, 14, 271–291. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).