Abstract

The disruptive impact of blockchain technologies can be felt across numerous industries as it threatens to disrupt existing business models and economic structures. To better understand this impact, academic researchers regularly apply well-established theories and methods. The vast majority of these approaches are based on multivariate methods that rely on average behavior and treat extreme cases as outliers. However, as recent history has shown, current developments in blockchain and cryptocurrencies are frequently characterized by aberrant behavior and unexpected events that shape individuals’ perceptions, market behavior, and public policymaking. In this paper, I apply various scenario tools to identify such extreme scenarios and illustrate their underlying structure as bundles of interdependent factors. Using the case of Bitcoin, I illustrate that the identification of extreme positive and negative scenarios is complex and heavily depends on underlying economic assumptions. I present three scenarios in which Bitcoin is characterized as a financial savior, as a severe threat to economic stability, or as a substitute to overcome several shortcomings of the existing financial system. The research questions that can be derived from these scenarios bridge behavioral and design science research and provide a fertile ground for impactful future research.

1. Introduction

Blockchain, which is the application of distributed ledgers to create immutable append-only ledgers that allow for decentralized decision making and shared data access [1], is predicted to substantially transform our economy and society [2,3]. This transformation includes organizational functions and industry sectors, as well as state functions, including governance [4,5], finance [6,7,8], supply chain management [9,10,11,12], marketing [13,14,15], tourism [16,17], agriculture [18,19], public sector management and smart cities [20,21,22], Internet of vehicles [23,24], healthcare [25,26], and nongovernmental organizations [27]. Furthermore, blockchain-based transformation can potentially reach into the spheres of central bank money (i.e., so-called central bank digital currencies (CBDCs)) [28]. The disruptive impact of blockchain-based cryptocurrencies can also be felt by individuals, who can now directly conduct transactions at lower transaction costs in a more confidential manner than was previously possible [29]. By buying and applying so-called tokens, they can transfer payments (payment tokens), consume companies’ services (utility tokens), become companies’ stakeholders or lend money to them (security tokens), or take part in governance decisions (governance tokens). Some authors even imply that the complexities of cryptocurrency markets are similar to those of foreign exchange markets [30]. In summary, blockchain-based applications facilitate the transition toward the so-called Web3, which is characterized by ubiquitous computing, a token-based economy, and decentralization [31], and which relies on the Internet as its infrastructural layer.

Quite obviously, these actual or envisioned changes are accompanied by severe criticism, mainly from the stakeholders and beneficiaries of existing systems, who regularly warn against making major changes to established existing structures. The higher the stakes of these stakeholders and the more severe the presumed impact of a blockchain-based alternative is, the more pronounced the criticism is. In this regard, Bitcoin can be seen as the ultimate menace to existing power structures since it threatens to interfere with national monetary autonomy by limiting the power of central and commercial banks [32]. Consequently, there is no shortage of sharp criticism, mostly pertaining to its lack of intrinsic value [33], environmental damage [34], or its potential use as a tool for terrorism financing [35]. In this regard, the website 99bitcoins has collected 447 so-called Bitcoin obituaries, statements that Bitcoin is or will be worthless by persons with a notable following. These obituaries were published between 2010 and 2022, with a strong peak in 2017 [36]. As of April 2022, Bitcoin has turned out to be a revenant and is the leading cryptocurrency with a market capitalization of more than 680 billion USD and a market dominance of 41.3% [37].

Being the most well-known, disruptive, and controversial cryptocurrency, Bitcoin poses an ideal case to create scenarios, juxtapose underlying assumptions, and derive research questions that can enlighten current and future discussions. In a previous paper published in Future Internet, Treiblmaier [38] suggested scenario analysis as a viable methodological approach to identify and assess research questions of practical importance while still pursuing a traceable and rigorous academic approach. Scenario analysis has a long history in academic research [39,40], yet it is underrepresented in many academic disciplines. This can be attributed to the fact that the method is poorly understood, and the description of published scenarios is often anecdotal, which makes it hard to reenact the research process. Applied correctly, scenario analysis not only poses a rigorous research approach but also provides a fertile ground for follow-up studies, which can be explorative, descriptive, explanatory, or even follow design science-based logic. In this paper, I illustrate the applicability of scenario analysis by investigating the following research questions:

- (1)

- Which factors determine the future development of Bitcoin?

- (2)

- What is the most positive scenario for Bitcoin’s future?

- (3)

- What is the most negative scenario for Bitcoin’s future?

- (4)

- How can Bitcoin complement existing currencies?

The remainder of this paper is structured as follows: in Section 2, I elaborate on previous research related to blockchain-based disruption and highlight some limitations of prevalent research approaches. In Section 3, I present the research design of this study and outline the methodological approach in some detail. In Section 4, I first describe the collected data and follow it with a discussion of the idiosyncrasies of Bitcoin development, as well as a presentation of three scenarios of future Bitcoin implications, two of which are extreme, while the third constitutes a trend prediction. A comprehensive research agenda can be directly derived from these scenarios. Lastly, in Section 5, I present implications for academia and the industry, and, in Section 6, I wrap up the findings, point out important limitations of this study, and offer concrete recommendations for future research.

2. Theoretical Background

Technological innovations shape our societies, economic structures, and individual lives in numerous ways. On the basis of the ideas of Karl Marx, Joseph Schumpeter [41] applied the notion of “creative destruction” to characterize the process of the constant renewal of economic structures. While it may be a trademark of modern industrialized societies, such destructive processes are more often than not controversial. The prevailing paradigm of steady economic growth coupled with technological progress regularly produces intended and unintended effects [42]. These effects can be investigated from the perspective of an individual (e.g., a citizen), an organization, or a nation. In this regard, Bitcoin or, more generally, cryptocurrencies and other technologies that are based on distributed ledgers provide prime examples for disruptive technologies whose adoption offers promising solutions to existing problems while also exhibiting potentially negative side-effects. To better understand the underlying decision processes that ultimately determine a technology’s success, numerous academic researchers have investigated the drivers or inhibitors of such adoption decisions [43,44]. It, therefore, makes sense to begin this research project with a brief look at previous rigorous (often labeled “theory-based”) adoption research on blockchain-based disruption and its limitations.

2.1. Research on Blockchain-Based Disruption

Several researchers have previously investigated how blockchain-based applications disrupt our economic and social systems and how this affects individuals. For example, Bonifazi et al. [45] studied user behavior on Ethereum during the speculative bubble of 2017/2018, and Bonifazi et al. [46] presented a social network-based model of Ethereum, as well as an innovative approach to classify new users. From a theoretical viewpoint, AlShamsi et al. [47] conducted a systematic review on blockchain adoption and thoroughly investigated 30 empirical studies related to blockchain adoption. They found that 14 studies were based on the technology acceptance model (TAM) and seven on its extended version, the unified theory of acceptance and use of technology (UTAUT), while eight used the technology–organization–environment framework (TOE), and five more were based on innovation diffusion theory. In general, existing research strategies mostly follow a well-established path, and any deviation might put a publication in danger of not being published in a top journal. Quite frequently, this path includes the identification of a relevant theory, the derivation of a research model based on said theory, and the subsequent testing of this model, which is frequently conducted using multivariate procedures. There is nothing inherently wrong with this approach, and it is well suited to identify average assessments and the presumed causal impacts of antecedents on dependent variables. However, there are also several limitations that are overshadowed by its focus on number crunching and the identification of significant p-values.

2.2. Limitations of Existing Approaches

Broadly speaking, there are two major shortcomings of existing quantitative multivariate approaches that are apparent in technology adoption research. The first is caused by the use of existing and pretested measurement scales that rarely take into account extreme events, many of which are hard to detect and predict by definition. Such measurement approaches regularly force the full range of opinions into a standardized scheme, often by using Likert-type items, in which (dis)agreements are frequently expressed on five-, six-, or seven-point scales. Furthermore, when it comes to statistical analysis, outliers often pose a nuisance that distort the main findings. They can either be eliminated (i.e., ignored) or avoided by using robust statistics. Moreover, the amount of complexity that can be simultaneously accounted for in a quantitative and theory-testing manner is limited, which is especially true in case a whole model is evaluated as such (“model fit”).

For example, the highly popular TAM unfolds its full tautological power in cases where decision-makers are asked about their perceived usability, usefulness, or intention to accept a technology in a cross-sectional survey. Quite obviously, those who perceive a technology to be useful and easy to use are likely to accept it (and vice versa), leading to those significant statistical relationships academic researchers crave. As of the time of writing this paper, I am not aware of any single study that has plausibly demonstrated an insignificant or even negative relationship between the two constructs of “ease of use” and “usefulness” and the intention to accept a technology. However, those outliers, extreme cases, and unlikely events that are never supposed to happen are swept under the carpet by this approach. Alas, they do happen, and they frequently lead to market turmoil, which can cause harm to individuals, organizations, and even nation states. Nicholas Taleb labels such extremely rare events as black swans and concludes that they are potentially unpredictable [48]. In the case of Bitcoin, numerous such events can be identified in the past, including a high volatility caused by events as diverse as Elon Musk’s Twitter posts [49], China’s crackdown on cryptocurrencies in general [50], or unforeseeable market actions of major Bitcoin investors, who are aptly titled “whales” [51]. Taleb suggests that we deal with such events through the creation of robustness, but scenario technique (which is used synonymously with scenario analysis in this paper) might be a proper tool to identify such rare occurrences since outliers are considered seriously and independent of majority mainstream opinions. Furthermore, it can be used to create bundles of factors and further develop them into elaborate descriptions of potential future states. In this regard, previous research has shown that the simultaneous consideration of the effects of numerous contingency factors can deliver some important insights into organizational behavior and performance from different managerial angles [52].

3. Methodology

To collect a wide range of opinions on Bitcoin and its perceived future impact, I designed a short questionnaire that can be found in Appendix A. After asking the respondents about their present or previous ownership of Bitcoin, as well as their knowledge of and general attitude toward Bitcoin, the main part of the questionnaire consisted of open-ended questions to collect numerous potential positive and negative effects of Bitcoin. Additionally, I asked about the most extreme positive and negative outcomes that can potentially emerge and collected information pertaining to several core attributes of Bitcoin (i.e., medium of exchange, store of value, trustworthiness, riskiness), as well as some demographic information.

Students from a blockchain course administered the questionnaire among their acquaintances in March 2022. In order to collect a broad range of opinions, each student had to interview one person, and there were no requirements in regard to the attitudes or prior knowledge of the survey participants. In a second step, the core factors (i.e., positive and negative effects of Bitcoin) were extracted and combined by means of a clustering process in which seven experts were asked to rate the mutual influence of the various factors and create cross-impact matrices.

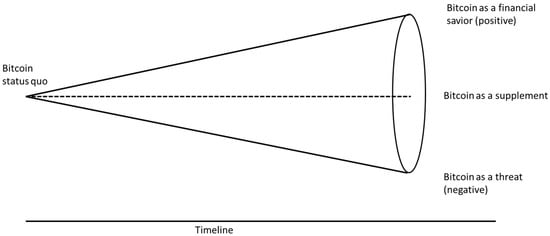

Following the suggested approach from Neuhofer [53], which is based on Fink et al. [54], the scenario creation process was structured into (1) scenario preparation, (2) scenario field analysis, (3) scenario prognostics, and (4) scenario development. The first step included the definition of the goals and the scope of the project. In this case, it was the future development of Bitcoin without the specification of a particular time frame. The scenario field analysis included the identification of relevant factors (including perceived positive and negative features of Bitcoin), which were then combined into consistent scenarios. Our analysis stops at the development of the scenarios and does not include the transfer process, which is beyond the scope of this research project. Figure 1 visualizes the research approach. Starting from the existing status quo of Bitcoin, the most positive and negative assessments were used to create two extreme scenarios. The focus was on the identification of those factors that can actually yield these outcomes. Additionally, based on Bitcoin’s previous development in combination with additional input from this study, a mainstream scenario was created that simultaneously considers positive and negative aspects of Bitcoin and projects them into the future.

Figure 1.

The scenario funnel for Bitcoin.

4. Findings

In the upcoming sections, I first outline several characteristics of the convenience sample and the respondents’ general attitudes toward Bitcoin. While this is not explicitly needed for the creation of the scenarios, it gives an impression of the diversity of opinions in the sample and confirms its suitability to yield a diverse range of opinions in an exploratory manner. Next, the factors that emerged from the interviews are bundled, and future predictions are made based on projections of individual factors or bundles thereof. Lastly, the three main scenarios are described in some detail followed by a suggestion for a comprehensive research agenda.

4.1. Sample Description

A total of 51 individuals participated in the interviews, which were conducted in March 2022. As can be seen in Table 1, the average age of the respondents was 25.08, and the majority (63%) of the respondents were male. Overall, 23% declared themselves to be current or previous Bitcoin holders, while the mean self-declared Bitcoin knowledge was 5.27 (0 “no knowledge at all” to 10 “expert”), and the mean general attitude was slightly positive with 6.62 (0 “I am totally against it” to 10 “I am totally in favor of it”). As is desirable in a scenario study, the full range of answers from 0 to 10 was present in the sample for every item.

Table 1.

Sample characteristics (n = 51).

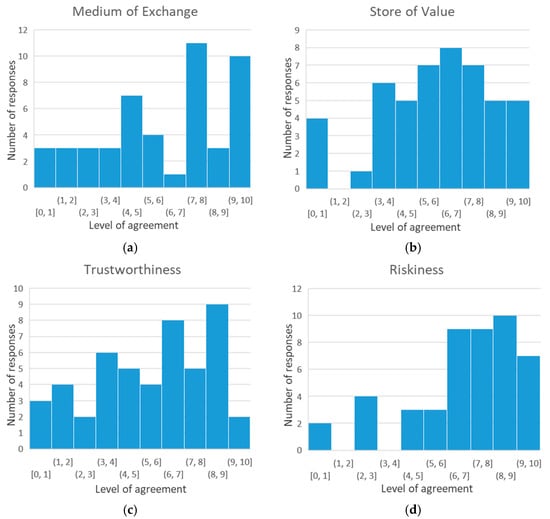

Figure 2 displays four histograms that visualize the respondents’ perceptions of two presumed functions of Bitcoin, namely, its role as a medium of exchange and a store of value, as well as two of its salient and frequently discussed features: privacy and trustworthiness. The level of agreement from 0 to 10 is shown on the x-axis, and the absolute number of responses is shown on the y-axis. Again, the range of responses covered the full spectrum. There was a slight positive tendency in the responses when it came to seeing Bitcoin as a medium of exchange, but its perceived function as a store of value was fairly evenly distributed. Moreover, there was a slightly positive perception of Bitcoin’s trustworthiness, while the majority of respondents saw Bitcoin as being risky.

Figure 2.

Histograms illustrating the evaluation of Bitcoin: (a) medium of exchange; (b) store of value; (c) trustworthiness; (d) riskiness (n = 51).

4.2. Scenario Field Analysis and Scenario Prognostics

The open questions resulted in a total of 90 positive and 91 negative effects. Overall, 46 of the study participants specified a “most extreme positive effect”, while 44 participants specified a “most extreme negative effect”. The outcomes were initially compiled into semantically identical factors (e.g., “quick payment” and “fast transactions” or “high energy use” and “huge energy consumption”) and further grouped into overarching categories. The most suitable first-layer categories turned out to be the stakeholders’ levels (individual, organization, and nation state), which were supplemented by one category for general issues. Within the first-layer categories, subcategories (S) were created according to the impact and/or perception of the respective effects. When it comes to individual perceptions, the emerging categories were related to transactions, security issues, and value. On an organizational level, the categories covered issues pertaining to transactions, security issues, and business aspects. On the national level, economic structures and environmental issues emerged as the main categories. The final results of this clustering and categorization process are shown in Table 2.

Table 2.

Influencing factors (properties) on different levels.

From these positive and negative effects, the reciprocal influences of the factors can be assessed using a scale ranging from 0 (“no impact”) to 3 (“strong impact”). This was mainly applied on the subcategory level (e.g., “How important are secure organizational structures for national economic structures?”); however, in some cases, a more fine-grained analysis was needed (e.g., “How can a proliferation of illicit activities impact organization Bitcoin acceptance?”). The goal of these analyses was to identify coherent bundles of factors, which can either foster or inhibit the future development of Bitcoin and the prediction of their future impact. A panel of seven experts with a substantial understanding of blockchain technology performed the analysis, and the results can be found in Table A1 (positive cross-impact matrix) and Table A2 (negative cross-impact matrix) in the Appendix B.

4.3. Idiosyncrasies and Scenario Development

The initial data analysis produced an interesting idiosyncrasy that can rarely be found in organizational settings of scenario applications, namely, that exactly the same feature and/or implication of Bitcoin can be perceived as either positive or negative. For example, the perceived anonymity of its transactions is simultaneously evaluated as extremely positive by respondents who value their privacy and negative by those who are afraid of the proliferation of illicit transactions. Another example is the destruction of the current monetary system, which is seen favorably by those who are suspicious of existing practices of central and commercial banking, whereas it is actually feared by those who are in favor of the current status quo. Furthermore, the level of analysis also plays an important role, such that the consequences of a specific factor can be seen as positive or negative on different levels. For example, the (unwanted) disintermediation on an organizational level may lead to cheaper prices at an individual level. The perception of blockchain, therefore, relies heavily on the position of the respective stakeholder and underlying political and economic assumptions. In general, the core ideas of Bitcoin predominantly appeal to Libertarians [32] but might also offer interesting perspectives for socialist or even Marxist thinkers [55]. Contrariwise, Bitcoin is mostly perceived with suspicion by those who are in favor of governmental interventions to prevent or alleviate economic downturns, most notably Keynesians [56].

Another idiosyncrasy emerged during the creation of the scenarios, which is related to underlying misconceptions regarding the basic functionality of Bitcoin. These misconceptions are often perpetuated in the public media, and they can substantially shape public opinion although they are objectively wrong. Examples of such statements include that Bitcoin is anonymous by default (instead of being pseudonymous) (debunked in [57]), that the amount of energy needed for mining new Bitcoin inevitably has to rise and might consume all the energy in the world [58], that Bitcoin needs to be “decrypted” [59], or that Bitcoin does not have any intrinsic value, while fiat currencies do (debunked in [60]). While such misconceptions might not directly contribute to future developments, they can shape individuals’ perceptions, which in turn might heavily influence the general adoption of Bitcoin.

Under consideration of the aforementioned idiosyncrasies, three scenarios were created. Two of them feature the most positive and negative evolutions of potential future Bitcoin development, as well as a scenario that considers Bitcoin as a supplement to existing monetary systems without causing any major disruptions. During the creation of the scenarios, attention was paid to differentiate between impacts that could cause a collapse of the entire system on their own (e.g., a worldwide regulatory ban) or such conditions that can be classified as an insufficient but necessary part of an unnecessary but sufficient condition (INUS) [61] (e.g., a particular solution to the scalability problem). For the sake of simplicity, the most positive (negative) outcomes were all considered simultaneously for the extreme scenarios in spite of the fact that some of the driving factors turned out to be hardly correlated (e.g., the future improvement of Bitcoin’s security features and Bitcoin’s positive impact on the environment).

4.4. Scenario 1: Bitcoin as a Financial Savior and a Destroyer of National Patronizing

The first scenario combines all positive features of Bitcoin on an individual, organizational, and national level, and its outcome will be the ultimate acceptance and use of Bitcoin. While it is not necessarily the case that all factors need to be present in their most positive manifestations, by and large, the study participants agreed that there is a considerable positive correlation among most relevant factors with the notable exception of Bitcoin’s environmental benefits.

Importantly, combing all positive Bitcoin evaluations and predicting ultimate adoption only works under the general assumption that a nation state is willing to give up parts of its centralized power (most notably, the control of the national currency) in favor of a decentralized peer-to-peer currency. Quite obviously, this might not be the most desired scenario for many politicians, central bankers, and also economists who favor a Keynesian approach that necessitates economic interventions. Therefore, the basic assumptions of this scenario only hold in cases where the underlying (Libertarian) assumptions pertaining to the benefits of a backed (i.e., limited) monetary supply and minimal public interventions also hold [32].

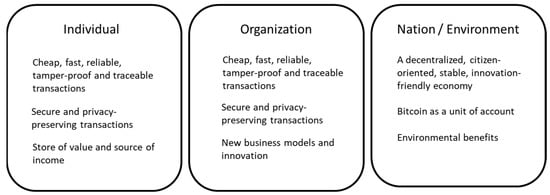

Figure 3 summarizes the bundles of the influencing factors on an individual, organizational, and national/environmental level. For individuals and organizations, this results in a cheap, fast, and reliable means of payment that also allows for traceability (which might facilitate auditing procedures for organizations). Individuals (and organizations to a lesser degree) can use Bitcoin as a store of value to hedge against inflation and apply it as an additional source of income. For organizations, numerous innovative opportunities arise to enrich and transform their existing business models and foster innovation. On a national level, Bitcoin, a currency that cannot be manipulated by intervention from governments and national banks, can help to stabilize economies and to create a fair and inclusive monetary system. Lastly, environmental benefits can be achieved since Bitcoin makes the process of producing and distributing paper money obsolete and can potentially create incentives to switch to more renewable energies [62]. The ultimate outcome of this scenario would be an efficient, inclusive, and fair monetary system with substantial positive economic and environmental benefits.

Figure 3.

The “best-case scenario” for Bitcoin.

4.5. Scenario 2: Bitcoin as a Stability Threat, Environmental Disaster, and a Menace to Existing National Structures

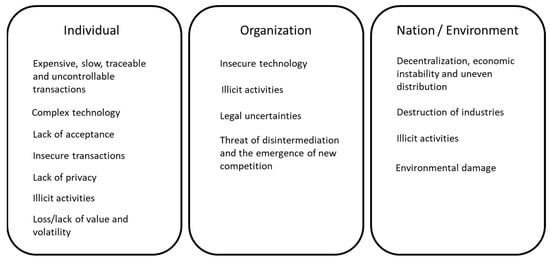

The second scenario basically presents the flipside of the previous one and showcases the most negative Bitcoin factors and their emerging consequences. Similar to the previous discussion, the most negative outcomes of the respective categories are listed, but care has to be taken to note that they are not necessarily contingent upon each other. Furthermore, several of the negative outcomes might not be perceived as such by everyone equally. For example, individuals can achieve speculative gains from Bitcoin’s volatility, and new market entrants might perceive the destruction of individual companies or industries to be positive.

In a nutshell, the second scenario, whose constituting factors are shown in Figure 4, more or less illustrates the demise of Bitcoin. From an individual’s perspective, Bitcoin transactions are slow and expensive. Their traceability allows authorities to pry around in individuals’ financial matters while some still find ways to conduct illicit transactions (e.g., by using technologies that can anonymize transactions). Individuals either have the choice of self-custody of their private keys, which is cumbersome and leads to lost keys, or they can use centralized exchanges that are prone to hacks and theft of money. Additionally, numerous illegal activities take place either directly on the Bitcoin network (e.g., money laundering) or are built upon it (e.g., Ponzi schemes that lure unsuspecting investors). The high volatility makes Bitcoin useless for day-to-day transactions and, for the most part, also as a store of value. Many of these detrimental effects also hold on an organizational level. Consequently, adoption by businesses will be low since Bitcoin can hardly be used as a means of payment due to legal uncertainties and lack of acceptance. Additionally, its reputation is further deteriorated by the fact that it is a popular payment means for extortionists that attack companies, for example, by using malware. On an industrial level, Bitcoin could pose a threat, especially to the financial industry, and might destabilize current structures. This negative effect might also be noticeable at the national level, such that a more widespread Bitcoin adoption could reduce the abilities of national and international financial institutions to stabilize economies through focused monetary measures. Lastly, the current amount of energy that is used to mine Bitcoin has a huge detrimental effect on the environment, which is especially true if nonrenewable energy sources are used.

Figure 4.

The “worst-case scenario” for Bitcoin.

4.6. Scenario 3: Bitcoin as a Supplement to Existing Financial Tools and a Provider of Additional Efficiency

The third scenario is just one out of many options in which several realistic trends are simultaneously taken into consideration. Given that Bitcoin is a worldwide phenomenon, it is reasonable to assume that the perceptions of individuals, organizations, and states will be divided. This is a likely scenario since widespread Bitcoin adoption will create winners and losers alike. The factors for this scenario, which are shown in Figure 5, are positive and hold for some members of the respective groups. It works under the assumption that there are no major legal restrictions in the jurisdictions in which Bitcoin gains more widespread acceptance, which also means that the main points of criticism in the public discussions (e.g., environmental concerns, volatility) can be solved satisfactorily.

Figure 5.

Bitcoin as an alternative payment system.

In this scenario, Bitcoin offers an alternative means of payment for individuals. While this might provide some additional conveniences for individual users and organizations in industrialized countries with a functioning monetary system, this can be of utmost importance for people living in countries with an unstable monetary system who frequently suffer from high inflation and strict monetary controls. Furthermore, Bitcoin transactions allow for a sufficient level of security and privacy in this scenario while ensuring that the number of illicit transactions can be minimized. One option to achieve this is to introduce reasonable know your customer (KYC) procedures for exchanges so that on- and off-ramps between fiat money and cryptocurrencies are monitored. Organizations can also benefit from Bitcoin’s monetary properties and can use it to enhance their current business models (e.g., by offering payments in cryptocurrencies). As opposed to the other two scenarios, the expected impact on a national level is limited in this scenario because Bitcoin is mainly used as a complementary means of payment within jurisdictions that do not see it as a competitor to its local currency.

5. Implications

Ever since its invention, Bitcoin has divided opinions. While diehard enthusiasts perceive it as a savior to the world’s most pending economic problems, skeptics see it as a useless exercise in cryptography that does more damage than good. Given this polarity in opinions and its overall economic importance, Bitcoin poses the ideal use case for a scenario analysis that uncovers the most positive and negative effects that can possibly emerge from a worldwide Bitcoin adoption. Therefore, the implications of this study are relevant for academics and practitioners.

5.1. Theoretical Implications

The major outcomes of this study include a structured listing of important factors for the future development of Bitcoin on an individual, organizational, and national level in combination with two extreme situations that can be caused by Bitcoin and one less disruptive scenario. Naturally, all of the scenarios can and should be used as starting points for more in-depth research. Table 3 lists a couple of generic research questions that follow from the creation of the scenarios along with some exemplary methods and tools. In addition, theories can easily be applied to build on an existing knowledge base and deepen our understanding regarding causal effects and nomological networks. Taking into account the idiosyncrasies of Bitcoin should refine these theories. For example, instead of asking respondents about how useful Bitcoin is in general (which might blur the difference between its perception as a medium of exchange, store of value, or object of speculation), it might make sense to investigate a specific use case, such as cross-border payments or hedge against inflation. Ideally, all important contingency factors are also provided in a specific research setting so that the respondents can accurately assess the usefulness of Bitcoin for a specific use case. Applied correctly, all popular theories (TAM, UTAUT, TOE, and diffusion theory, just to name a few) make sense and have the potential to foster our understanding regarding the development of Bitcoin and its future implications.

Table 3.

Research questions for future Bitcoin research based on [38].

5.2. Practical Implications

The acceptance of Bitcoin and the resulting implications is a topic that is not only of academic interest but also directly affects individuals, organizations, and nations. Given its potentially disruptive impact, it is no wonder that Bitcoin’s reception in the media is divided as even national policies range from its adoption as a legal tender (El Salvador) to the declaration of cryptocurrencies as illegal (e.g., China). Therefore, an objective and competent discussion of the features of Bitcoin, along with its implications on different levels, is needed to be able to contrast its positive and negative effects in addition to its ability to assist in making informed decisions. However, such informed discussions are rare, and the overall assessment of Bitcoin and its implications is often conducted on the basis of hearsay and widely publicized media stories. In this regard, it does not help that many powerful stakeholders feel personally threatened by Bitcoin (mostly in a negative way) and, therefore, help to propagate myths and half-truths. To overcome these problems, the public discussion will benefit by splitting up the expected effects of Bitcoin (e.g., on individual, organizational, and national levels as suggested in this study) and diving deeper into the consequences of future developments. A juxtaposition of Bitcoin’s positive and negative features in combination with an extrapolation of their effects will allow for a more informed and unbiased public discourse. In this regard, this study has outlined the overall complexity of the subject and provided an initial framework and starting point for future discussions.

6. Conclusions, Limitations, and Future Research

In this paper, I illustrated how scenario analysis can be applied to gain a better understanding regarding the future development of Bitcoin. On the basis of a survey among 51 end users and a subsequent analysis with an expert panel, positive and negative features of Bitcoin, as well as envisioned future opportunities and threats, were collected, bundled, and further developed into three consistent scenarios. The three scenarios showed different features of Bitcoin that shape its impact on an individual, organizational, and national level. These scenarios illustrate the potential future impacts of Bitcoin and can be used as a starting point for future research studies.

Several limitations exist in this study. First, the collection of positive and negative Bitcoin features, as well as their subsequent bundling, was based on a convenience sample of end users. More insights can be gained by incorporating experts’ opinions in future studies. Second, the bundling of the features and the creation of the scenarios revealed a substantial amount of complexity, which was caused by the fact that various stakeholder groups might perceive the exact same feature of Bitcoin differently. This complexity calls for future scenario studies that go into more detail and focus on more specific aspects of Bitcoin’s development (e.g., security features, governmental policies, environmental concerns).

Future research can benefit from this study in several ways. Importantly, several avenues for follow-up studies were already laid out in previous sections of this paper, including research questions and suggested methodologies. Naturally, other researchers should not feel constricted by these suggestions but are explicitly encouraged to find their own niche topics and explore methods other than those suggested in this paper. An extension to general cryptocurrency/blockchain/DLT/token research can be easily achieved. In many regards, other applications that are built on distributed ledgers might turn out to be highly impactful in specific sectors. For example, decentralized finance (DeFi) threatens to disrupt the existing financial systems, and CBDCs, which are currently highly popular among many central banks and can be built upon distributed ledgers, will substantially transform existing monetary systems. Lastly, the suggested research questions are also open to the application of a wide range of existing theories and methodologies, which will hopefully incite a stream of research that is rewarding for academics and fascinating for practitioners.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A. Questionnaire

- Question 1: Do you own Bitcoin or have you owned it in the past?

- Question 2: On a scale from 0 (“no knowledge at all”) to 10 (“expert”), how high would you rate your knowledge about Bitcoin?

- Question 3: What is your general attitude toward Bitcoin? (“0 I am totally against” it to “10 I am totally in favor of it”)?

- Question 4: Name any positive effects of Bitcoin (if any).

- Question 5: What is the most extreme positive effect that Bitcoin can have (if any)?

- Question 6: Name any negative effects of Bitcoin (if any).

- Question 7: What is the most extreme negative effect that Bitcoin can have (if any)?

- Question 8: Rate Bitcoin on the following attributes (from “0 not at all” to “10 excellent”):

- (a)

- Useful as a medium of exchange (i.e., a payment system),

- (b)

- Useful as a story of value,

- (c)

- Trustworthy,

- (d)

- Risky.

- Demographics

- Age:

- Gender:

- Occupation:

Appendix B. Cross-Impact Matrices

Table A1.

Positive cross-impact matrix.

Table A1.

Positive cross-impact matrix.

| I_S1 | I_S2 | I_S3 | O_S1 | O_S2 | O_S3 | N_S1 | N_S2 | |

|---|---|---|---|---|---|---|---|---|

| I_S1 | 2 | 3 | 3 | 2 | 3 | 1 | 0 | |

| I_S2 | 2 | 3 | 1 | 3 | 3 | 3 | 0 | |

| I_S3 | 2 | 1 | 1 | 1 | 2 | 2 | 0 | |

| O_S1 | 3 | 0 | 1 | 0 | 2 | 2 | 0 | |

| O_S2 | 1 | 3 | 2 | 1 | 2 | 2 | 0 | |

| O_S3 | 2 | 0 | 2 | 1 | 0 | 3 | 0 | |

| N_S1 | 0 | 0 | 2 | 0 | 0 | 2 | 0 | |

| N_S2 | 0 | 0 | 1 | 0 | 1 | 2 | 2 |

Table A2.

Negative cross-impact matrix.

Table A2.

Negative cross-impact matrix.

| I_S1 | I_S2 | I_S3 | O_S2 | O_S3 | N_S1 | N_S2 | |

|---|---|---|---|---|---|---|---|

| I_S1 | 2 | 2 | 1 | 2 | 2 | 1 | |

| I_S2 | 2 | 2 | 3 | 2 | 2 | 2 | |

| I_S3 | 2 | 2 | 1 | 3 | 3 | 0 | |

| O_S2 | 1 | 3 | 2 | 1 | 3 | 2 | |

| O_S3 | 0 | 0 | 0 | 0 | 3 | 0 | |

| N_S1 | 1 | 1 | 3 | 2 | 3 | 1 | |

| N_S2 | 1 | 1 | 1 | 2 | 0 | 2 |

0, no impact; 1, weak impact; 2, medium impact; 3, strong impact. I, individual; O, organizational; N, national; S, subcategory (as in Table 2). The matrices show the impact of the item in the row on the respective item in the column.

References

- Treiblmaier, H. Toward More Rigorous Blockchain Research: Recommendations for Writing Blockchain Case Studies. Front. Blockchain 2019, 2, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Tapscott, D.; Tapscott, A. Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World; Portfolio: New York, NY, USA, 2016; ISBN 978-0-399-56406-2. [Google Scholar]

- van Pelt, R.; Jansen, S.; Baars, D.; Overbeek, S. Defining Blockchain Governance: A Framework for Analysis and Comparison. Inf. Syst. Manag. 2021, 38, 21–41. [Google Scholar] [CrossRef]

- Beck, R.; Müller-Bloch, C.; King, J.L. Governance in the Blockchain Economy: A Framework and Research Agenda. J. Assoc. Inf. Syst. 2018, 19, 1020–1034. [Google Scholar] [CrossRef]

- Goldsby, C.; Hanisch, M. The Boon and Bane of Blockchain: Getting the Governance Right. Calif. Manag. Rev. 2022, 64, 141–168. [Google Scholar] [CrossRef]

- Cai, C.W. Disruption of Financial Intermediation by FinTech: A Review on Crowdfunding and Blockchain. Account. Financ. 2018, 58, 965–992. [Google Scholar] [CrossRef] [Green Version]

- Rajnak, V.; Puschmann, T. The Impact of Blockchain on Business Models in Banking. Inf. Syst. E-Bus. Manag. 2021, 19, 809–861. [Google Scholar] [CrossRef]

- Kherbouche, M.; Pisoni, G.; Molnár, B. Model to Program and Blockchain Approaches for Business Processes and Workflows in Finance. Appl. Syst. Innov. 2022, 5, 10. [Google Scholar] [CrossRef]

- Cocco, L.; Tonelli, R.; Marchesi, M. Blockchain and Self Sovereign Identity to Support Quality in the Food Supply Chain. Future Internet 2021, 13, 301. [Google Scholar] [CrossRef]

- Dobrovnik, M.; Herold, D.; Fürst, E.; Kummer, S. Blockchain for and in Logistics: What to Adopt and Where to Start. Logistics 2018, 2, 18. [Google Scholar] [CrossRef] [Green Version]

- Egwuonwu, A.; Mordi, C.; Egwuonwu, A.; Uadiale, O. The Influence of Blockchains and Internet of Things on Global Value Chain. Strateg. Change 2022, 31, 45–55. [Google Scholar] [CrossRef]

- Huang, L.; Zhen, L.; Wang, J.; Zhang, X. Blockchain Implementation for Circular Supply Chain Management: Evaluating Critical Success Factors. Ind. Mark. Manag. 2022, 102, 451–464. [Google Scholar] [CrossRef]

- Rejeb, A.; Keogh, J.G.; Treiblmaier, H. How Blockchain Technology Can Benefit Marketing: Six Pending Research Areas. Front. Blockchain 2020, 3, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Antoniadis, I.; Kontsas, S.; Spinthiropoulos, K. Blockchain and brand loyalty programs: A short review of applications and challenges. In Procedia of Economics and Business Administration; Spiru Haret University: Bucharest, Romania, 2019; Volume 5, pp. 8–16. [Google Scholar]

- Lemos, C.; Ramos, R.F.; Moro, S.; Oliveira, P.M. Stick or Twist—The Rise of Blockchain Applications in Marketing Management. Sustainability 2022, 14, 4172. [Google Scholar] [CrossRef]

- Acciarini, C.; Bolici, F.; Diana, G.; Marchegiani, L.; Pirolo, L. Blue ocean or dry desert? Blockchain and bitcoin impact on tourism industry. In Do Machines Dream of Electric Workers? Solari, L., Martinez, M., Braccini, A.M., Lazazzara, A., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 85–98. [Google Scholar]

- Kizildag, M.; Dogru, T.; Zhang, T.; Mody, M.A.; Altin, M.; Ozturk, A.B.; Ozdemir, O. Blockchain: A Paradigm Shift in Business Practices. Int. J. Contemp. Hosp. Manag. 2020, 32, 953–975. [Google Scholar] [CrossRef]

- Da Rocha, G.S.R.; de Oliveira, L.; Talamini, E. Blockchain Applications in Agribusiness: A Systematic Review. Future Internet 2021, 13, 95. [Google Scholar] [CrossRef]

- Griffin, T.W.; Harris, K.D.; Ward, J.K.; Goeringer, P.; Richard, J.A. Three Digital Agriculture Problems in Cotton Solved by Distributed Ledger Technology. Appl. Econ. Perspect. Policy 2022, 44, 237–252. [Google Scholar] [CrossRef]

- Treiblmaier, H.; Rejeb, A.; Strebinger, A. Blockchain as a Driver for Smart City Development: Application Fields and a Comprehensive Research Agenda. Smart Cities 2020, 3, 44. [Google Scholar] [CrossRef]

- Singh, P.; Nayyar, A.; Kaur, A.; Ghosh, U. Blockchain and Fog Based Architecture for Internet of Everything in Smart Cities. Future Internet 2020, 12, 61. [Google Scholar] [CrossRef] [Green Version]

- Karger, E.; Jagals, M.; Ahlemann, F. Blockchain for Smart Mobility—Literature Review and Future Research Agenda. Sustainability 2021, 13, 13268. [Google Scholar] [CrossRef]

- Kapassa, E.; Themistocleous, M.; Christodoulou, K.; Iosif, E. Blockchain Application in Internet of Vehicles: Challenges, Contributions and Current Limitations. Future Internet 2021, 13, 313. [Google Scholar] [CrossRef]

- Yi, H. A Secure Blockchain System for Internet of Vehicles Based on 6G-Enabled Network in Box. Comput. Commun. 2022, 186, 45–50. [Google Scholar] [CrossRef]

- Wang, B.; Li, Z. Healthchain: A Privacy Protection System for Medical Data Based on Blockchain. Future Internet 2021, 13, 247. [Google Scholar] [CrossRef]

- Júlio De Aguiar, E.; Faiçal, B.S.; Krishnamachari, B.; Ueyama, J. A Survey of Blockchain-Based Strategies for Healthcare. ACM Comput. Surv. 2020, 53, 1–27. [Google Scholar] [CrossRef] [Green Version]

- Baharmand, H.; Maghsoudi, A.; Coppi, G. Exploring the Application of Blockchain to Humanitarian Supply Chains: Insights from Humanitarian Supply Blockchain Pilot Project. Int. J. Oper. Prod. Manag. 2021, 41, 1522–1543. [Google Scholar] [CrossRef]

- Jung, H.; Jeong, D. Blockchain Implementation Method for Interoperability between CBDCs. Future Internet 2021, 13, 133. [Google Scholar] [CrossRef]

- Zhang, R.; Xue, R.; Liu, L. Security and Privacy on Blockchain. ACM Comput. Surv. 2019, 52, 1–34. [Google Scholar] [CrossRef] [Green Version]

- Wątorek, M.; Drożdż, S.; Kwapień, J.; Minati, L.; Oświęcimka, P.; Stanuszek, M. Multiscale Characteristics of the Emerging Global Cryptocurrency Market. Phys. Rep. 2021, 901, 1–82. [Google Scholar] [CrossRef]

- Gubbi, J.; Buyya, R.; Marusic, S.; Palaniswami, M. Internet of Things (IoT): A Vision, Architectural Elements, and Future Directions. Future Gener. Comput. Syst. 2013, 29, 1645–1660. [Google Scholar] [CrossRef] [Green Version]

- Ammous, S. The Bitcoin Standard: The Decentralized Alternative to Central Banking; Illustrated Ed.; John Wiley & Sons: Hoboken, NJ, USA, 2018; ISBN 978-1-119-47386-2. [Google Scholar]

- Helms, K. ECB Chief Lagarde: Cryptocurrencies Prone to Money Laundering, No Intrinsic Value, Buy If Prepared to Lose All Money—Featured Bitcoin News. Bitcoin News. 9 May 2021. Available online: https://news.bitcoin.com/ecb-chief-lagarde-cryptocurrencies-money-laundering-no-intrinsic-value-buy-prepared-to-lose-all-money/ (accessed on 25 April 2022).

- de Vries, A.; Gallersdörfer, U.; Klaaßen, L.; Stoll, C. Revisiting Bitcoin’s Carbon Footprint. Joule 2022, 6, 498–502. [Google Scholar] [CrossRef]

- Teichmann, F.M.J. Financing Terrorism through Cryptocurrencies—A Danger for Europe? J. Money Laund. Control 2018, 21, 513–519. [Google Scholar] [CrossRef]

- 99Bitcoins Bitcoin Obituaries—“Bitcoin Is Dead” Declared 400+ Times. Available online: https://99bitcoins.com/bitcoin-obituaries/ (accessed on 25 April 2022).

- CoinMarketCap Cryptocurrency Prices, Charts And Market Capitalizations. Available online: https://coinmarketcap.com/ (accessed on 25 April 2022).

- Treiblmaier, H. Exploring the Next Wave of Blockchain and Distributed Ledger Technology: The Overlooked Potential of Scenario Analysis. Future Internet 2021, 13, 183. [Google Scholar] [CrossRef]

- van der Heijden, K. Scenarios: The Art of Strategic Conversation, 2nd ed.; Wiley: Chichester, UK, 2005. [Google Scholar]

- Bradfield, R.; Wright, G.; Burt, G.; Cairns, G.; Heijden, K. The Origins and Evolution of Scenario Techniques in Long Range Business Planning. Futures 2005, 37, 795–812. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Capitalism, Socialism, and Democracy; Harper & Brothers: Manhattan, NY, USA, 1942. [Google Scholar]

- Kerschner, C. Economic De-Growth vs. Steady-State Economy. J. Clean. Prod. 2010, 18, 544–551. [Google Scholar] [CrossRef]

- Sanka, A.I.; Irfan, M.; Huang, I.; Cheung, R.C.C. A Survey of Breakthrough in Blockchain Technology: Adoptions, Applications, Challenges and Future Research. Comput. Commun. 2021, 169, 179–201. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Queiroz, M.M. Blockchain in the Operations and Supply Chain Management: Benefits, Challenges and Future Research Opportunities. Int. J. Inf. Manag. 2020, 52, 102064. [Google Scholar] [CrossRef]

- Bonifazi, G.; Corradini, E.; Ursino, D.; Virgili, L. A Social Network Analysis–Based Approach to Investigate User Behaviour during a Cryptocurrency Speculative Bubble. J. Inf. Sci. 2021, 01655515211047428. [Google Scholar] [CrossRef]

- Bonifazi, G.; Corradini, E.; Ursino, D.; Virgili, L. Defining User Spectra to Classify Ethereum Users Based on Their Behavior. J. Big Data 2022, 9, 37. [Google Scholar] [CrossRef]

- AlShamsi, M.; Al-Emran, M.; Shaalan, K. A Systematic Review on Blockchain Adoption. Appl. Sci. 2022, 12, 4245. [Google Scholar] [CrossRef]

- Taleb, N.N. The Black Swan; Random House: New York, NY, USA, 2009; ISBN 978-0-8129-7918-3. [Google Scholar]

- Molla, R. When Elon Musk Tweets, Crypto Prices Move. Available online: https://www.vox.com/recode/2021/5/18/22441831/elon-musk-bitcoin-dogecoin-crypto-prices-tesla (accessed on 28 April 2022).

- Alun, J.; Shen, S.; Wilson, T. China’s Top Regulators Ban Crypto Trading and Mining, Sending Bitcoin Tumbling; Reuters: London, UK, 2021. [Google Scholar]

- Lielacher, A.; Pickering, A. How Crypto Whales Affect the Bitcoin Price. Available online: https://bravenewcoin.com/insights/how-whales-influence-the-price-of-bitcoin (accessed on 28 April 2022).

- Strebinger, A.; Treiblmaier, H. E-Adequate Branding: Building Offline and Online Brand Structure within a Polygon of Interdependent Forces. Electron. Mark. 2004, 14, 153–164. [Google Scholar] [CrossRef]

- Neuhofer, B.; Magnus, B.; Celuch, K. The Impact of Artificial Intelligence on Event Experiences: A Scenario Technique Approach. Electron. Mark. 2021, 31, 601–617. [Google Scholar] [CrossRef]

- Fink, A.; Schlake, O. Scenario Management—An Approach for Strategic Foresight. Compet. Intell. Rev. 2000, 11, 37–45. [Google Scholar] [CrossRef]

- Huckle, S.; White, M. Socialism and the Blockchain. Future Internet 2016, 8, 49. [Google Scholar] [CrossRef] [Green Version]

- Pettifor, A. The Production of Money: How to Break the Power of Bankers; Illustrated Ed.; Verso: London, UK, 2017; ISBN 978-1-78663-134-3. [Google Scholar]

- Palmer, M.M.; Palmer, R.L. How Bitcoins Are Used to Conceal Assets and Launder Money. Available online: https://www.cachet-inter.com/articles/bitcoin.htm (accessed on 29 April 2022).

- Cuthbertson, A. Bitcoin’s Meteoric Rise Is Very Bad News for the Environment. Available online: https://www.newsweek.com/bitcoin-mining-track-consume-worlds-energy-2020-744036 (accessed on 29 April 2022).

- Urquhart, A.; Lucey, B. Crypto and Digital Currencies—Nine Research Priorities. Nature 2022, 604, 36–39. [Google Scholar] [CrossRef] [PubMed]

- Treiblmaier, H. Do Cryptocurrencies Really Have (No) Intrinsic Value? Electron. Mark. 2021, 1–10. [Google Scholar] [CrossRef]

- Mackie, J.L. Causes and Conditions. Am. Philos. Q. 1965, 2, 245–264. [Google Scholar]

- Sandner, P.; Wingen, D.; von Jan, S.; Straub, A. The Green Bitcoin Theory: How Are Bitcoin, Electricity Consumption and Green Energy Related? Medium. 2020. Available online: https://philippsandner.medium.com/the-green-bitcoin-theory-how-are-bitcoin-electricity-consumption-and-green-energy-related-b541b23424ab (accessed on 5 May 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).