Abstract

Hydrogen production via water electrolysis and renewable electricity is expected to play a pivotal role as an energy carrier in the energy transition. This fuel emerges as the most environmentally sustainable energy vector for non-electric applications and is devoid of CO2 emissions. However, an electrolyzer’s infrastructure relies on scarce and energy-intensive metals such as platinum, palladium, iridium (PGM), silicon, rare earth elements, and silver. Under this context, this paper explores the exergy cost, i.e., the exergy destroyed to obtain one kW of hydrogen. We disaggregated it into non-renewable and renewable contributions to assess its renewability. We analyzed four types of electrolyzers, alkaline water electrolysis (AWE), proton exchange membrane (PEM), solid oxide electrolysis cells (SOEC), and anion exchange membrane (AEM), in several exergy cost electricity scenarios based on different technologies, namely hydro (HYD), wind (WIND), and solar photovoltaic (PV), as well as the different International Energy Agency projections up to 2050. Electricity sources account for the largest share of the exergy cost. Between 2025 and 2050, for each kW of hydrogen generated, between and 1.22 kW will be required for the SOEC-hydro combination, while between and 1.4 kW will be required for the PV-PEM combination. A Grassmann diagram describes how non-renewable and renewable exergy costs are split up between all processes. Although the hybridization between renewables and the electricity grid allows for stable hydrogen production, there are higher non-renewable exergy costs from fossil fuel contributions to the grid. This paper highlights the importance of non-renewable exergy cost in infrastructure, which is required for hydrogen production via electrolysis and the necessity for cleaner production methods and material recycling to increase the renewability of this crucial fuel in the energy transition.

1. Introduction

Hydrogen production via water electrolysis is gaining interest due to the possibility of performing electrolysis with renewable electricity. In this case, the hydrogen produced is the so-called green hydrogen. This chemical and fuel represents an essential low-carbon chemical feedstock and energy vector essential for the success of the energy transition, especially in challenging-to-electrify applications [1,2]. Together with lithium batteries and air compression energy storage systems (CAES), hydrogen has been projected as a possible solution (as an energy vector, e.g., ammonia and methanol) for dealing with the renewable energy production intermittency [3,4] and curtailment issues [5,6] in the current energy transition scenario [7]. Hydrogen use is very flexible and possesses a very diverse range of applications, which are involved in, for example, energy storage (Power-to-gas, Power-to-fuel, or Power-to-power) [8], chemical industries (for the production of ammonia, methanol, and polymers) [9,10], fuel (for industrial high-temperature processes and the transport sector) [11], the reducing agents in the metallurgical industry (e.g., iron and steel, copper, aluminum) [12], etc. Therefore, hydrogen production via water electrolysis is expected to meet increasing hydrogen demands throughout the world.

Some regions of the world are already producing green hydrogen from renewable energy sources via water electrolysis [13]. Four electrolyzer technologies, alkaline water electrolysis (AWE), proton exchange membrane (PEM) electrolysis, solid oxide electrolysis cells (SOECs), and anion exchange membrane (AEM) electrolysis, are approached in this study. Their degrees of technology readiness levels (TRLs) significantly differ [14]. AWE is a mature and commercial technology used since the 1920s, particularly for hydrogen production in the fertilizer and chlorine industries. However, most of these electrolyzers were decommissioned when natural gas and steam methane reforming for hydrogen production took off in the 1970s [7]. This technology uses nickel in the electrodes and zirconium in the separator [12,15]; therefore, it features precious material independence in its construction and operation. However, its operation is not very flexible and usually produces a low purity hydrogen [16]. PEM electrolyzer systems were first introduced in the 1960s by General Electric to overcome some of these operational drawbacks of AWE systems. They offer a very flexible operation, but they require expensive electrodes made of platinum group metals (PGMs), and their lifetime is currently shorter than AWE [7,17]. SOEC and AEM are the most novel electrolysis technology systems among the four, and they have not yet been commercialized, although individual companies are now aiming to bring them to market. SOEC use ceramics as electrolytes, have lower material costs, are capable of operating at high temperatures, and have a high degree of Faradaic/Coulombic efficiency [7]. This technology uses zirconium (Zr) in the electrolyte, rare earth elements (REE) (e.g., lanthanum, La) in the cathode, yttrium (Y) in the interconnections, and nickel (Ni) in the anode [17]. Unfortunately, it also depends on critical metals to operate efficiently. On the other hand, AEM is freer from noble metals than PEM and uses a low-concentrated liquid electrolyte (1 M KOH) [18], although it currently presents limited stability and is still in research and development stages. In summary, AWE systems yield hydrogen with lower purity (99.9%), but except for nickel, they do not depend on rare metals. On the other hand, PEM systems generate high-purity hydrogen with great flexibility, are suitable for integration with renewable sources, but rely on PGMs. And even though SOEC and AEM systems avoid the use of some noble metals, they are still in the development phases [14,16,18,19].

Thus, the increasing need for green hydrogen [10] has already triggered the production of electrolyzers and, consequently, increased the demand for the metals required for their manufacturing. However, in 2022, we only produced around 100 kt of hydrogen via this pathway (35% growth), with material costs presented as a major factor for increasing installed infrastructure costs [20]. Under this context, some elements stand out in infrastructure costs: Ni and Zr for AWE, Pt, Pd, and Ir (PGM) for PEM, Ni, Zr, La, and Y for SOEC, and Ni and Pt for AEM. Complementarily, stainless steel (SS), aluminum (Al), or copper (Cu) is also necessary for the electrolyzer structure and conduction of electricity [21]. Therefore, based on this uncertain scenario, this investigation focused on the study of the applications of 14 different metals, including Al, Cu, Fe, Ir, La, Ni, Pd, Pt, Sn, Y, Zr, and stainless steel, as well as glass, and graphite (utilized on AWE and PEM systems), on the current and future electrolysis demand scenarios and how they affect the cost of obtaining green hydrogen.

Apart from electrolyzers, there are two more resources essential for hydrogen production via water electrolysis: water and electricity. Although this paper does not focus on the use of water in electrolysis, we are aware of this particularly critical problem in arid regions [22]. Regarding electricity, its origin is key. For instance, if electricity has a renewable origin, hydrogen is called green. Furthermore, several studies indicate that the supply of renewable electricity is the main environmental concern of green hydrogen production [1,19,23,24]. On the other hand, using the electrical grid for hydrogen production via water electrolysis could be more polluting than producing it directly from fossil fuels [1]. Thus, this study uses several scenarios that depend on the electricity source. We consider the three most diffused renewable technologies, hydro, wind and photovoltaic, combined with the three different grid projections based on IEA scenarios, namely NZE, APC, and STEPS (Net Zero Emissions, Announced Pledges, and Stated Policies), from most to least optimistic in terms of decarbonization [7]. Therefore, scenarios using only renewable technologies produce green hydrogen, while scenarios using grid electricity do not (yellow hydrogen). Furthermore, all these electricity production technologies are also intensive in the use of metals, the most important being steel, Al, Cu, Pb, Zn, Si, REE, Ag, and other materials such as concrete [25], and these should be included in the cost of green hydrogen production.

The exergy cost theory (ECT) is fundamentally associated with Thermoeconomics [26] and other exergy-based analysis theories. Its main output, unit exergy cost, represents one of the main exergy-based ecological indicators adopted in the specific literature [27]. It indicates how many physical units of fuel exergy (consumed resources in an energy production system) are consumed to produce or yield 1 unit of product exergy (the main product of this system), and it can be represented by . Consequently, the process of exergy cost formation is fundamentally associated with the unavoidable process of natural resources (and energy) degradation. Currently, ECT also allows proper physical waste cost allocation [28]. In parallel, other physical-environmental cost theories, such as the Thermo-ecological Cost (TEC) [29], combine exergy, non-renewable natural resources, cumulative exergy consumption, and effluent treatment or remediation exergy costs with economic principles [30] to evaluate the overall physical cost of a product. Recently, the avoided thermo-ecological cost method has been applied to carbonaceous and renewable-energy hydrogen production technologies [31] and highlighted the non-renewable exergy cost contribution. However, they did not include the importance of critical raw materials in the electrolyzer’s construction. This work intends to address this gap by shedding a light on its importance in overall exergy consumption and how it affects the physical costs of producing water-splitting in hydrogen production.

Therefore, this study focuses on the renewability of hydrogen production via water electrolysis from an exergy perspective with regard to industrial usage. Exergy represents the maximum amount of useful work that a system can deliver when interacting with its surroundings. Therefore, this property represents the energy quality of a flow. However, the material dimension is not properly assessed by exergy [32]. In these cases, it is more appropriate to use exergy costs. This concept represents the exergy destroyed for manufacturing a product [33]. Therefore, this study considers exergy for assessing fuels and exergy cost for assessing materials, combining energy and material perspectives into a single property: exergy. As previously stated, the material dimension, represented by all metals and materials, is key in hydrogen production via electrolysis. The exergy perspective also allows us to split up the exergy or exergy costs, depending on their origin and whether they are non-renewable or renewable. This disaggregation allows us to assess the physical renewability of such a product. The higher the renewable exergy contribution to the exergy cost is, the more renewable the hydrogen will be.

This study builds on the previous work on the energy footprint of materials [34] and the exergy cost of the electricity [35] by evaluating the exergy costs of each electrolysis technology and electricity sources in hydrogen production via water electrolysis. Our goal in this work is to first evaluate the physical-based costs of obtaining hydrogen from such a technology, which is devoid of the economic effects on our product. It is common knowledge that the exergy cost of electricity, and consequently, hydrogen, changes over time in a dynamic process for these reasons: (1) technological advancements reduce the amount of materials required for production; (2) shifts in the electricity mix toward renewables decrease the contribution of fossil exergy costs, which is particularly significant in metal production; (3) the operating hours and conversion efficiency of electrolyzers increase. Thus, this study approaches the problem of exergy cost, which is differentiated between renewable and non-renewable exergy, as well as analyze the interaction between energy and materials, through exergy.

2. Methodology

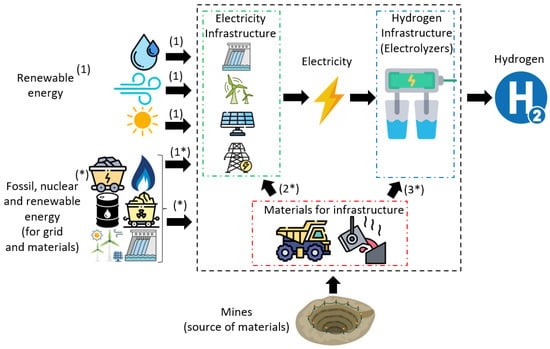

Figure 1 shows a diagram of the production phases of hydrogen via water electrolysis using the electricity grid and three consolidated renewable energy sources: hydro, wind, and PV. Three cost classifications are taken into consideration: (1) primary renewable energy or () primary energy for grid electricity production; (2) energy embedded in the electricity infrastructure; (3) energy embedded in the hydrogen generation infrastructure, i.e., electrolyzers. In addition, embedded energy ( and ) is classified by differentiating its origin, whether fossil (natural gas, oil, or coal), nuclear, or renewable (hydro, biomass, wind, or solar PV).

Figure 1.

Simplified diagram of the non-renewable and renewable exergy cost of H2 via water electrolysis. The asterisk symbol * refers to the exergy costs related to non-renewable sources usage (electricity production and materials extraction).

First, we briefly discuss and summarize some current and projected key parameter indicators (KPIs) of all four water electrolysis technologies involved in our study (AWE, PEM, SOEC, and AEM). Next, we describe the adopted methodology for obtaining the evolution of the exergy cost of electricity (i.e., numbers 1 and 2 in Figure 1) from the renewable sources and the materials for the infrastructure. Then, we proceed further to elaborate on the exergy costs of producing green hydrogen (number 3 of Figure 1) from the materials constituting the infrastructure. Next, we clarify our model hypotheses and assumed limitations. Finally, we present an illustrative example of how to apply the presented methodology to evaluate the renewable and non-renewable exergy cost of water electrolysis H2 production.

2.1. Water Electrolyzer Technologies

Table 1 presents a summary of the current and projected state-of-the-art KPIs for the water electrolysis technologies included in this study.

Table 1.

Summary of some current and future (2050) water electrolysis technology KPIs, industrial demonstration sizes, and degradation rates. All data refer to current days, except when explicitly described otherwise. References: [7,14,18,36,37].

The authors used specific literature-supported data from recent days (2021) up to future estimations (2050) for the lifetime-averaged electrolyzers efficiency and lifetime [7,14,36,37] to represent their performance without going under the complexities of each electrolyzer mathematical modeling. We used a constant cell degradation rate to evaluate these efficiencies by evaluating how the electrical potential increased throughout the electrolyzers’ lifetimes, thus representing a conservative scenario for our model. Since our electrolyzer models are inherently simple, naturally we did not simulate their dynamical behavior, including membrane degradation, gas crossover, scaling and economical costs, etc. However, this simplicity allows us to project initial projections on overall exergy costs from distinct energy sources and scenarios in a simpler way. It also allows us to estimate the effects of critical raw materials and the material and energy intensities on the electrolyzer’s infrastructures and, therefore, on the physical cost of hydrogen.

Table 2 shows the lifetime-averaged efficiency and lifetimes of these values, where we assumed a linear interpolation between 2021 and 2050 to represent their yearly evolution rate, that is, for each electrolyzer technology installed in a specific year, it will have an increase in their average performance in comparison to the previous year.

Table 2.

Water electrolyzer technology operation parameters (average efficiency and lifetime) adopted in this study. References: [7,14,36,37]. Reproduced with permission from [38], Copyright [Elsevier], 2025.

A comparative LCA of water electrolysis technologies presented by [37] was adopted together with available data from both IEA and IRENA [7,36] to estimate the material intensities (kgMaterial/MW) of each material accounted for in this study. Table 3 presents the infrastructure material intensity estimations for each technology. In this work, we did not include fundamental, but auxiliary electrical components (e.g., transformer, cables, etc.). A comprehensive analysis should naturally include all these aspects; however, these would run out of the scope of this work, which is highlighting the importance of an extended, yet simple physical/exergy cost analysis on estimating representative values for water electrolysis hydrogen production.

Table 3.

Estimations on material intensities of the infrastructure of each water electrolysis technology (). Unit in kgMaterial/MW. References: [7,36,37]. Reproduced with permission from [38], Copyright [Elsevier], 2025.

2.2. Electricity Exergy Cost

Calculating the exergy cost of electricity is more challenging compared to hydrogen. The reason is that electricity itself is an indispensable resource for the production of the infrastructure that generates electricity. Thus, the study of the cost of electricity is a dynamic process. This process has been studied previously [35], considering the chemical exergy of minerals, the ore grade declining of major metals for producing the electricity infrastructure, and the decrease in material intensity as a result of technological development. Thus, the electricity produced in a selected year is used to produce the following year’s infrastructure. Therefore, the more renewable energy is installed, the more renewable electricity is used in the manufacturing of the new infrastructure, accelerating decarbonization. Table 4 shows the results of the exergy cost of the electricity considering this aforementioned dynamic process by assuming different scenarios. We consider three different projections based on the IEA Scenarios, NZE, APC, and STEPS [39,40], which are evaluated for 2025 (current), 2030 (short term), and 2050 (long term). Furthermore, as stated in the introduction, we consider combinations of four different technologies: hydro (HYD), wind (WIND), photovoltaic (PV), and the electrical grid (GRID).

Table 4.

Exergy costs of electricity (ExCOE) under the IEA NZE, APC, and STEPS scenarios; based on the methodology presented in [35]. (Unit: kW/kW).

The values of Table 4 show the average exergy cost of hydro (), wind (), PV (), and the grid (). The exergy cost of these technologies can be disaggregated into the following: (1) exergy cost of fuel; (2) exergy cost of infrastructure. The latter is further divided into the following: (i) non-renewable (fossil fuels and nuclear); (ii) renewable energy. While fossil fuels can be used directly in the manufacture of materials, nuclear and renewable energy can only be embedded in the infrastructure through the electricity used in manufacturing. This disaggregation was calculated following the methodology of previous work [35].

Table 4 shows the declining exergy cost of electricity over time. This decline can be attributed primarily to two factors for the studied renewable technologies (HYD, WIND, PV). First, there is the amortization of infrastructure: renewable infrastructure incurs high energy consumption during installation in the initial year but generates electricity over its lifetime. Consequently, the need for investing in new infrastructure decreases in subsequent years, gradually lowering costs. Second, technological advancements play a crucial role in reducing the exergy costs of renewable technologies. The PV technology is a particularly noteworthy case that experiences faster cost reductions than any other technology due to its expected rapid improvement, marked by significant decreases in the usage of silicon and silver [41]. Regarding the decrease in the grid exergy cost, it is higher in NZE, APC and STEPS, respectively, depending on the degree of deployment of renewable technologies over time.

In summary, we classify the primary energy sources (PESs) of electricity as the average cost electricity , split up between fossil fuels, nuclear and renewable exergy. This classification includes both direct use (burning coal in a power plant for electricity production) and indirect use (fuel needed to manufacture required infrastructures).

2.3. Hydrogen Exergy Cost

In this section, and based on the exergy costs of renewables and average electricity (numbers 1 and 2* from Figure 1), we estimate the amount of electricity needed for hydrogen production (Section 2.3.1) and the exergy cost of the PESs and electrolyzer infrastructures (Section 2.3.2).

2.3.1. Electricity for Hydrogen Production

Hydrogen produced via water electricity requires electricity. However, part of this electricity is not converted into hydrogen due to the electrolyzer conversion inefficiencies.

The exergy cost of hydrogen due to electricity generation is calculated dividing the exergy cost of electricity for each electricity scenario by the efficiencies of each electrolyzer technology (), as shown by Equation (1). It is important to remember that already contains all the information regarding the life cycle of each renewable energy source (e.g., the capacity factor, the lifetime, and the cost of the infrastructure). has 3 components: (1) fuel (it is renewable when electricity is produced from a renewable technology, sunlight, potential energy of water, or wind, whereas it is non-renewable when electricity is produced from a non-renewable source, such as fossil fuels or nuclear energy); (2) non-renewable exergy cost of the infrastructure; (3) renewable exergy cost of the infrastructure. Therefore, is also disaggregated into these 3 components.

This equation is repeated for each studied electrolyzer technology, AWE, PEM, SOEC, and AEM, and each of the studied electricity sources. In this study, we chose to evaluate different electricity production scenarios by combining HYD, WIND, PV and electricity grid of Table 4: the first group involves individual fully renewable sources (either HYD, WIND, or PV), whereas the second group considers hybridization of renewable sources (e.g., HYD + WIND, WIND + PV, etc.); and the third group assumes hybridization between renewable sources with electricity grid (e.g., HYD + GRID, WIND + PV + GRID, etc.). And by comparing these possibilities with a scenario where only the electricity grid is used to produce hydrogen, we obtain a total of 14 evaluated energy source scenarios. In each of these cases, hydrogen is produced from a different electrolyzer technology and under different IEA energy projections up to 2050, thus resulting in 14 × 4 × 3 × 3 = 504 different combinations.

2.3.2. Hydrogen Infrastructure

We need to calculate the exergy cost of all required materials from each electrolyzer technology infrastructure to obtain a-1 electrolyzer (). But first, we need to evaluate the energy intensity of each material required by the electrolyzer infrastructures. Equation (2) relates the material intensity of each electrolyzer ( measured in kgMaterial/MW) Table 3 and the energy intensity of each material from their sources (, measured in MJMaterial/kgMaterial) [34]. Iridium energy footprint was not presented, but we had estimated it following the same methodology: MJ/kgIr]. can be split into two groups: one that accounts for fossil fuels usage during its extraction or production () and another for electricity usage (). The latter is multiplied by the electrical energy required to produce a material (), and for that we adopted the instantaneous exergy cost of electricity (ExCOE), [35]. This approach allows us to classify the material exergy cost due to electricity into non-renewable and renewable sources, as we did before with .

In total, we evaluated the contribution of 14 different materials for the electrolyzers: aluminum, copper, iron, iridium, lanthanum, nickel, palladium, platinum, tin, yttrium, zirconium, stainless steel, glass, and graphite Table 3.

Once (measured in MJMaterials/MJ) is obtained, it is possible to calculate the exergy cost due to the infrastructure for each technology and electricity scenario () measured in (MJ/MJ) (Equation (3)). is divided by (measured in hours), which represents the operating time of each technology. For transforming the units to (MJ/MJ), it is necessary to multiply the number of hours by 3600.

As Table 2 and Table 3 show, each electrolyzer technology had their operation and infrastructure material intensity evaluated based on diverse references [7,37,42]. A yearly operation working time of 8760 h was assumed in our analysis. Thus, represents the exergy invested on the infrastructure for producing H2 throughout its lifetime.

Although is calculated for all electrolyzer technologies and several electricity renewable sources scenarios, () Equation (3) is only calculated for the four electrolyzer technologies since the electricity scenarios only affect the production of hydrogen, but not the electrolyzers.

Thus, the main results of this work are the and arrays.

2.4. Model Assumptions

We adopted some simplifications for both water electrolyzer operation and hydrogen production in order to shed a light on the importance of the infrastructure, required materials, and the electricity origin of the overall exergy cost. For example, these include electrolyzer cell degradation rate, water source (groundwater, seawater, or wastewater), oxygen co-production, renewable energy variability and electricity curtailment, SOEC demanded heat input and heat co-production, H2 thermodynamic conditions (temperature and pressure), auxiliary electrical components (transformers, rectifiers, cables, etc.), pipelines and storage tanks, and so on. Naturally, we expect higher physical costs due to all these aspects, but these do not restrict this analysis of reaching its previously mentioned main goal. Table 5 presents and summarizes each of our model’s assumptions adopted in this study. These aspects will be further addressed in future works related to our research.

Table 5.

Model assumptions adopted in this study.

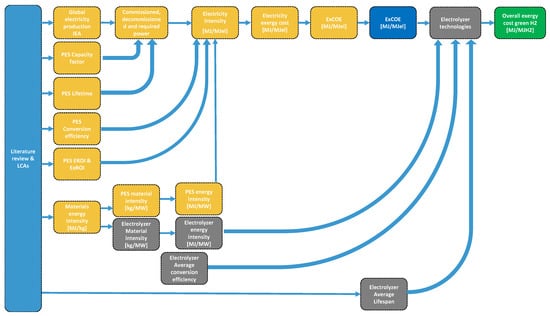

Based on our assumptions, Figure 2 summarizes the algorithm adopted in this study. We evaluated the ExCOE values from 2025 to 2050 as evaluated in [35]. We split up the 14 materials’ energy intensities required for each primary energy source (PES) infrastructure, and we used LCAs to evaluate fossil fuel, nuclear energy, and renewables usages on each material extraction, refining, and manufacture [34]. These values, together with each PES capacity factor, average lifetime, conversion efficiency, EROI, and ExROI data used to model them, were used to project the electricity intensity. The IEA energy transition scenarios provided us the required, commissioned, and decommissioned power, and installed capacity from each PES for the future, whereas [44] provided us the electricity data (from 1900 to 2017) to estimate past ExCOEs (dark blue icon). Then, we collected representative data from each water electrolysis technology (material intensity, conversion efficiency and lifetime) [7,14,36,37] to represent their average behavior for each studied year and by applying the ExCOE, we were able to estimate overall exergy costs of hydrogen under such circumstances, as is detailed in the subsequent sections.

Figure 2.

Adopted algorithm for evaluating the non-renewable and renewable exergy cost of H2 via water electrolysis. The dark blue icon refers to the ExCOE function [34,35,44], whereas the gray ones refer to the electrolysis functions [7,14,36,37] and the green to the overall exergy cost of hydrogen.

2.5. Example of Hydrogen Renewable and Non-Renewable Exergy Costs in 2025

As an illustrative example, we chose an alkaline water electrolysis (AWE) solar-PV-fed system in 2025 under the NZE scenario as an illustrative example of how to evaluate the green hydrogen overall exergy cost in this work. The first step involves evaluating the electrolysis (process) requirement to produce 1 MJ of hydrogen (unit: MJ/MJH2) via Equation (1). In this case, however, the electricity power (assuming electrical energy as pure exergy) not only includes meeting electricity demand but also the exergy costs required to build the primary energy source (PES) infrastructures that provide the electricity grid [35]. While fossil fuel sources and infrastructure do not present a significant contribution to their electricity production costs (via their EROI and ExROI), this is not the case for renewable energy sources. These demand materials that have very energy-intensive origins (e.g., refined silicon for PV) or require significantly large amounts (e.g., stainless steel and concrete for wind and hydro, respectively).

Under this context, we adopted the exergy cost of electricity ExCOE to represent . The overall ExCOE values are available on Table 4 and were evaluated as shown in [35]. For this example, the ExCOE vector and are, respectively,

The elements represent the process exergy demand (first value) and the cumulative exergy costs from PES infrastructures (values for natural gas, oil, coal, hydro, nuclear, biomass, wind, and solar PV, respectively) to produce 1 MJ of hydrogen. A linear interpolation on the estimated AWE’s average efficiency (Table 2) provided us a value of 0.594 for this year and was used on Equation (1).

The next step is to estimate the electrolyzer infrastructure exergy costs and how they affect overall H2 production exergy cost (Equations (2) and (3)). Based on the material energy intensities (Table 3) and material energy intensities [34], one can obtain the following:

By interpolating the expected AWE electrolyzer lifetime for 2025 (66,666.7 h), Equation (3) gives :

and consequently Equation (4) provides us the disaggregated overall exergy cost of hydrogen production, :

This is a vector with 9 elements, where the first term represents the direct process exergy cost, whereas the rest represent the indirect infrastructure costs. Their sum (2.81 kW/kWH2) represents the overall exergy cost of producing H2 by this configuration in 2025. Another viewpoint from this vector is by filtering the exergy costs associated with each PES: 1.007 kW/kWH2 is related to fossil fuel and nuclear energy usages throughout the production chain process, 1.777 kW/kWH2 to renewables (solar-PV + electrolysis process and renewables infrastructures). Therefore, this approach allows checking how non-renewable natural resources (fossil fuels and raw materials) affect even renewable electricity production and its sub-sequential products.

3. Results and Discussion

In this section, we present how the overall exergy costs of producing hydrogen range for each evaluated water electrolysis technology between 2025 and 2050 (under projected IEA scenarios). A Grassmann diagram illustrates the non-renewable and renewable exergy cost contributions in 2025 to show how the costs can be split from natural resources. Current, short-term, and long-term hydrogen costs of different energy source cases, including hybrid sources for PEM electrolysis, are compared. Then, we assess the evolution of the non-renewable and renewable exergy cost of green hydrogen and finish by discussing our model’s current advantages and shortcomings and future pathways that our research can proceed to address the renewability of hydrogen production.

3.1. Grassmann Diagram of Hydrogen Production from AWE Electrolyzers Under IEA NZE Projection

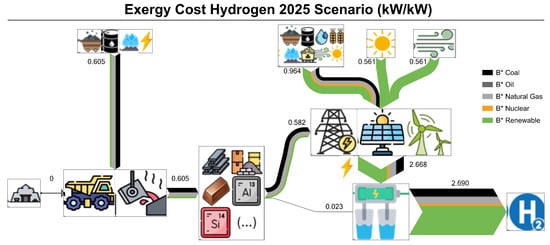

Figure 3 presents a Grassmann diagram of the projected hydrogen exergy costs (in kW/kWH2) for the AWE + Wind + PV + electricity grid combination under the IEA NZE scenario in 2025. The idea here is to show how we disaggregated hydrogen exergy cost in this study: between production stages and between non-renewable or renewable exergy costs.

Figure 3.

Grassmann diagram of the projected hydrogen production exergy cost for the AWE + Wind + PV + electricity grid combination under IEA NZE scenario (2025) (kW/kWH2). refers to the overall exergy costs related to each primary energy source type: coal, oil, and natural gas (black, dark gray and light grey); nuclear (yellow); renewable (green).

Regarding the production stages, the exergy cost of hydrogen (2.690 kW/kW) is first split into the exergy cost of electricity (2.668 kW/kW) and the exergy cost of the electrolyzer infrastructure (0.023 kW/kW). This corroborates that the higher exergy cost contribution of hydrogen from water electrolysis comes from the exergy cost of the electricity, as affirmed by other studies [1,19,23,24]. In this case, from the electricity production sources (wind, PV, and electricity grid). The exergy cost of fossil fuels for the grid (0.964 kW/kW) is higher than the renewable’s (0.561 kW/kW). This happens because part of the non-renewable fuel’s exergy is destroyed during its transformation into electricity. For instance, a combined-cycle plant that uses natural gas as fuel usually has an exergy yield of 50%, i.e., 50% of the exergy of the natural gas is destroyed. On the other hand, we consider that renewable technologies have an exergy yield of 100% following the physical content method (PCM), wherein primary energy is defined as the first commercially available form of energy. And this method is more appropriate when a study focuses on the energy sector [35]. As for the primary energy source infrastructures, Figure 3 also shows that their exergy costs (0.582 kW/kW) are not negligible, since they account for approximately 22% the total exergy cost.

Hydrogen exergy costs can also be disaggregated between non-renewable and renewable sources. The non-renewable contribution is composed of coal, oil, natural gas, and nuclear, and the renewable contribution is composed of sunlight, wind, water, and biomass [35]. Sunlight and wind exergy are both utilized in the grid and for PV and wind turbines, respectively. However, water and biomass are only used in the grid in the example of Figure 3. Considering this disaggregation, the electricity grid’s non-renewable exergy cost constitutes 0.996 kW/kW of the total cost (2.690 kW/kW), i.e., 37%. Therefore, this figure graphically reflects the renewability of the hydrogen produced via electrolysis. Furthermore, we can identify which stage contributes more to the non-renewable exergy cost. The exergy cost of fuels contributed with 0.500 non-renewable kW/kW and the exergy cost of infrastructure with 0.496 non-renewable kW/kW. Although the overall exergy cost contribution in the infrastructure is around 22%, the contribution of the infrastructure increases significantly when we consider the non-renewable exergy cost. Another important concept shown in this diagram is the investment of non-renewable exergy in the infrastructure required for the capture of renewable exergy. Therefore, to capture 1.585 kW/kW of renewable exergy (0.561 kW/kW from both wind and PV and 0.463 kW/kW from the grid), it is required to invest 0.4757 kW/kW of non-renewable exergy in the infrastructure. This concept, the so-called Renewable Exergy Return On Investment (RExROI) or Renewation Index (RI) [25], is key for understanding the renewability of the electricity and hydrogen produced via electrolysis. Renewable technologies always depend on the materials and, in turn, the material’s dependency on non-renewable exergy. Therefore, to increase renewability (measured with RExROI), it is necessary to decrease the investment in non-renewable exergy, usually used in the material production stage.

The disaggregation of non-renewable and renewable exergy is key for long-term production sustainability. Non-renewable exergy relies on finite reserves such as oil wells or coal mines. However, renewable exergy can be considered as infinite since it ultimately comes from the Sun. Therefore, long-term sustainability of the commodity production (such as hydrogen) that relies on non-renewable exergy will be limited. Given this importance, the next section analyses more cases regarding this context.

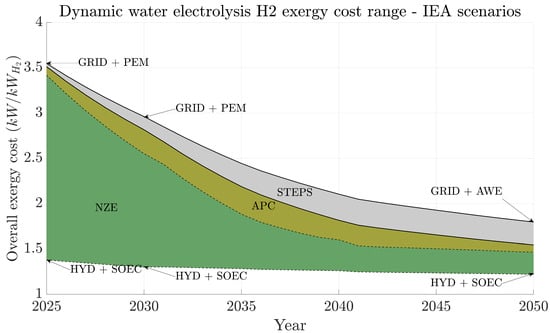

3.2. Evolution of Non-Renewable and Renewable Exergy Costs Range Under IEA Scenarios

Figure 4 summarizes the overall exergy cost of producing H2 under three IEA projections from 2025 up to 2050, fourteen electricity production scenarios and four water electrolysis technologies. We compacted all possible results in surface areas for each IEA projection. For example, the green area represents all possible exergy cost values that all studied technologies provide throughout the years. The same interpretation can be given to APC (dark yellow) and STEPS scenarios; what occurs is simply area overlap (the green area overlapping the dark yellow one, which overlaps the gray one). Therefore, the NZE scenario presents the lowest exergy cost range throughout the studied period. Moreover, 2025’s overall exergy costs range between (for the HYD + SOEC combination) and 3.41 kW/kWH2 (for the GRID + PEM combination), whereas in 2050, they will depend on the energy transition scenario. The NZE case presents the highest exergy cost reduction (smallest area), which ranges between and 1.47 kW/kWH2, while the APC and STEPS maximum values are and 1.79 kW/kWH2, respectively. The bottom part of all three areas is covered by fully renewable production systems (hydro presents the lowest exergy costs). Therefore, depending on how the energy transition scenario takes place, there might be at least a 17.8% overall exergy cost difference (between maximum cost values). This finding indicates that the energy transition rate will dictate the amount of wasted exergy to produce hydrogen and, therefore, how renewable and sustainable this production might become over the years (without even including proper recycling of end-of-life electrolyzer materials).

Figure 4.

Range of projected hydrogen production exergy costs (unit: kW/kWH2) under IEA projected scenarios (2025–2050). Green represents NZE, dark yellow represents APC, and gray represents STEPS. The arrows indicate the electricity source–electrolyzer technology combination that represents the minimum and maximum values in 2025, 2030, and 2050. NZE exergy cost range in 2025: [1.38; 3.41] and in 2050: [1.22; 1.47]. APC exergy cost range in 2025: [1.38; 3.51] and in 2050: [1.22; 1.54]. STEPS exergy cost range in 2025: [1.38; 3.55] and in 2050: [1.22; 1.79].

Other important factors suggested by Figure 4 are the lower and upper limiting cases, that is, the best and worst exergy costs over time. The combination hydro + SOEC presents the lowest exergy costs [1.38; 1.22] kW/kWH2, showing the benefits of hydro’s long lifetime and low energy-intensive materials dependency with SOEC’s high energy efficiency. However, SOEC is still under research and development; thus, some uncertainty arises from its current usage to produce green hydrogen. On the other hand, the highest exergy costs belong to using the electricity grid together with PEM or AWE [3.54; 1.79] kW/kWH2. This result is not surprising since other authors found that using the electrical grid for hydrogen production via water electrolysis could be more polluting than producing it directly from fossil fuels [1]. Regarding electrolyzer technologies, PEM initially presents higher exergy costs due to the weight of PGMs on the infrastructure exergy cost, but newer versions are expected to decrease this material dependency up to 2050 [14]. AWE, on the other hand, is already a consolidated technology and it is close to its optimal point. Environmentally speaking, Krishnan [15] stated that there is no clear winner between AWE and PEMs. When AEM is included in the discussion, both PEM and AEM’s efficiencies overcome AWE’s performance over time with higher lifetime and efficiencies, so they will likely become interesting options over the next years. In summary, AWE is viable for immediate implementation but its performance will be limited over time.

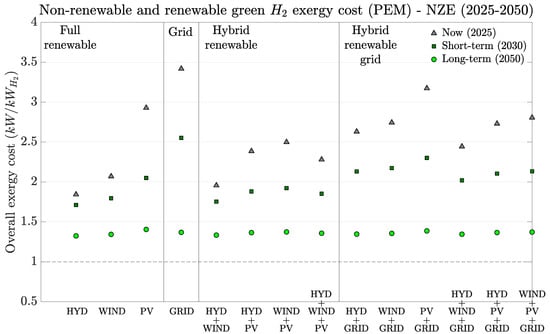

3.3. Hybridization of Electricity Origin for Hydrogen Production

Having discussed the range of hydrogen production exergy costs up to 2050, we note that Figure 5 details the exergy cost of H2 production via PEM electrolysis for the IEA NZE projection between 2025 and 2050. This figure covers four different regions of different energy technology sources: fully renewable (hydro, wind, and PV-green hydrogen), electricity grid (yellow hydrogen), hybrid renewable (also green), and hybrid renewable grid (mix between green and yellow). The idea is to explore the effect of distinct electricity scenarios on the hydrogen exergy cost.

Figure 5.

Current, short-term, and long-term projected green or yellow hydrogen production unit costs for PEM water electrolysis under the IEA-NZE scenario (2025–2050). The dashed line shows the theoretical exergy cost limit that represents a reversible process.

For green hydrogen production scenarios, it is noteworthy how they evolve over time. All three renewables show cost reductions up to 2050, especially since manufacturing processes are affected by the increase in the renewables’ contribution on the electricity grid and throughout the materials chain production. Hydro presents the lowest exergy costs among all studied renewables (between and 1.3 kW/kWH2) at all times. This technology does not significantly depend on energy-intensive materials (highest contribution is concrete). Projections on PEM’s efficiency improvement naturally contributed to hydrogen’s exergy cost reduction, as expected. Additionally, its high lifetime (60–100 years) mitigates its infrastructure cost, thus showing how overall exergy costs are low throughout the studied period.

Wind presents intermediate exergy costs, but it is very close to those for hydro. This indicates how the increase in renewable energies on the electrical grid benefits future new generations of renewables, therefore reducing their infrastructure exergy cost (from to 1.35 kW/kWH2). An additional factor that supports this trend is the reduction of fossil fuel consumption on the electricity grid assumed by the NZE projection. PV, on the other hand, presents significantly higher exergy costs than the other two, mostly because its required infrastructure is very energy intensive (e.g., refined silicon, 1200 MJ/kg). However, as it happened to wind, infrastructure exergy costs from newer generations are expected to decrease due to the renewable energy contribution from previously commissioned PV cells. Actually, PV presents the highest exergy cost reduction rate. Therefore, hydrogen exergy cost from PVs is likely to significantly decrease up to 2050 (from to 1.4 kW/kWH2).

Hybrid renewable scenarios are included in this study due to their growing importance as alternatives to stabilize renewable electricity production (power and curtailment). Under the four evaluated conditions, hydrogen exergy costs present intermediate results between the individual contributions among all three (from 2.5 kW/kWH2 in 2025 to 1.4 kW/kWH2 in 2050). The hybrid scenarios assume an equivalent ExCOE contribution from each renewable source. This means 50% power from each source for pairs and 33.33% for trios. An additional assumption is that the hybrid electric system capacity factor [35] is not affected by the mix between the renewable sources. Thus, the presented exergy costs can be somehow conservative, although even their combinations have limits on how much the overall capacity factor can increase. Following the same reasoning, hybridization between renewables and the grid can be used to cover the lack of renewable electricity in order to keep hydrogen production stable for specific industrial processes that cannot stop (e.g., ammonia industries to avoid catalyst damage). Under this context, the hybrid renewable grid combinations (last six) show higher exergy costs due to the non-renewable exergy cost contribution from the electricity grid. In 2050, these costs will be comparable to fully renewable plants because the electricity grid is mostly dominated by renewables (NZE projection). Nevertheless, these results show how it is more expensive to use grid electricity to cover yellow hydrogen production, which naturally affects the degree of sustainability of such a system and, therefore, its renewability.

3.4. Evolution of Non-Renewables, Renewables, and Hydrogen Exergy Costs

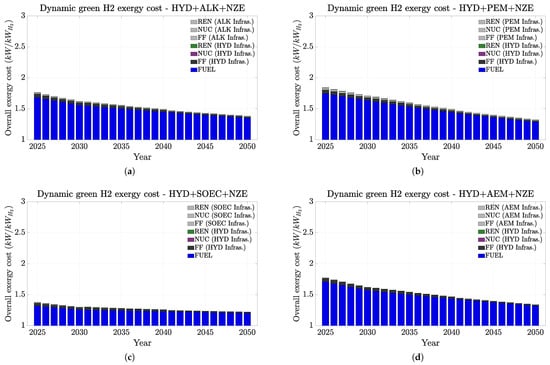

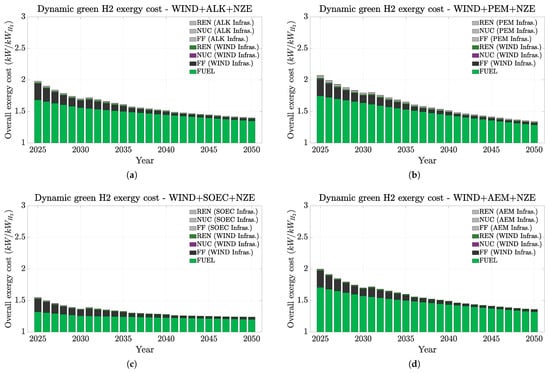

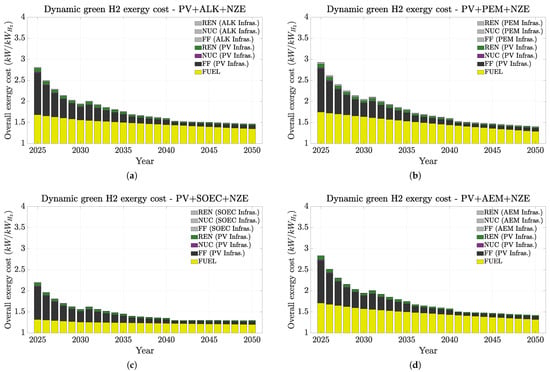

The Grassmann diagram illustrated how hydrogen exergy costs can be tracked from the natural sources’ origins, thereby emphasizing the non-renewable cost aspect of either green or yellow hydrogen production. In this section, we show how infrastructure exergy cost evolves for all three renewables and four electrolyzers under the IEA NZE projection.

Figure 6, Figure 7 and Figure 8 present a summary of how H2 exergy costs evolve in each scenario and highlight the weight of infrastructures and of non-renewable on the overall cost. In this study, the non-renewable exergy cost basically shows the contribution of non-renewable sources throughout the whole hydrogen production chain (fossil fuels and mining), encompassing all exergy sources not originating from water (hydro), wind, or sun (PV). Figure 6, Figure 7 and Figure 8 indicate that all hydrogen infrastructure exergy costs are mainly from the energy sources rather than from the electrolyzers. Therefore, this finding emphasizes how renewable infrastructure weighs more on the overall exergy cost. Additionally, it is the fossil fuel consumption on the infrastructure manufacturing that most contributes to hydrogen’s exergy cost. This trend is even more emphasized in the PV case (Figure 8), especially in the short term. These trends mean that if we could replace the fossil fuel contribution on the material origins for renewable electricity, the overall exergy costs would naturally significantly drop, and thus, the overall H2 chain production would become more renewable and sustainable.

Figure 6.

Dynamic non-renewable and renewable H2 exergy costs up to 2050 under the IEA NZE scenario (HYD + electrolyzers). Exergy costs are split up between the electrolyzer efficiency, the energy source used on the PES, and electrolyzer infrastructures. (a) AWE. (b) PEM. (c) SOEC. (d) AEM.

Figure 7.

Dynamic non-renewable and renewable H2 exergy costs up to 2050 under the IEA NZE scenario (WIND + electrolyzers). Exergy costs split up between the electrolyzer efficiency, and the energy source used on the PES and electrolyzer infrastructures. (a) AWE. (b) PEM. (c) SOEC. (d) AEM.

Figure 8.

Dynamic non-renewable and renewable H2 exergy costs up to 2050 under the IEA NZE scenario (PV + electrolyzers). Exergy costs split up between the electrolyzer efficiency, and energy source used on the PES and electrolyzer infrastructures. (a) AWE. (b) PEM. (c) SOEC. (d) AEM.

Figure 7 shows how competitive the exergy cost of wind can be in comparison to that for hydro. Their overall cost ranges between approximately 2 and 1.3 kW/kWH2 and presents viable results even for low-temperature electrolyzers (AWE, PEM, and AEM). Additionally, its availability is higher than that for hydro around the world (very concentrated in countries such as China, Brazil, Canada, and the US). Therefore, it will keep assisting with the energy transition scenario if proper end-of-life recycling of older versions of wind turbines takes place.

In summary, infrastructurally speaking, renewables demand higher exergy costs than electrolyzers, but the electrolyzers’ performance affects more of the overall exergy costs for hydrogen. Additionally, our results suggest that the most favorable renewable sources are likely hydro, wind, and photovoltaic, in this order. Other studies [23,24] reached the same conclusions. Complementarily, the environmental footprint of hydrogen production is directly influenced by the electricity source utilized. Other studies have similarly highlighted this point [19,23]. For instance, [23] pointed out that only 4% of the carbon footprint (which shows similar trends with exergy cost) corresponds to an electrolyzer.

3.5. Discussion on Model Limitations and Future Steps

The mathematical model adopted in this study, although simple, showed great potential to first attempt to indicate how renewable hydrogen can be. Depending on the overall infrastructure, the materials adopted, their energy footprint, and exergy conversion efficiencies, hydrogen (or any other product) can have its renewability evaluated. However, our model can be improved to encompass more aspects and intricacies of the studied process (e.g., electrolyzer modeling, storage, plant auxiliary component infrastructures) and any specifics of local production. Next, we address some aspects that will be improved as our research advances and then comment on some future aspects to be added to our model.

The method used to calculate LExCOE and ExCOE in this paper has some limitations. First, the study [35] did not take into account the exergy cost of assembling renewable energy technologies such as wind turbines or photovoltaic panels. Additionally, the exergy cost associated with their installation, maintenance, and decommissioning was not considered. Regarding the electrical infrastructure, transmission lines play a crucial role and require large amounts of metals such as copper, steel, and aluminum. However, these were also excluded from the calculation due to a lack of information on their future global deployment. Another limitation concerns the calculation method itself, as the global LExCOE of electricity used in this paper is not fully leveled since it does not account for the exergy cost of electricity from previous years. Due to all these factors, the exergy cost of electricity used in this study could be higher than estimated. Therefore, the results presented here should be interpreted as an estimation of the minimum exergy cost of hydrogen production via electrolysis.

In terms of raw materials, we decided to address the Iridium (Ir) issue. Ir is a very rare metal and a co-product of platinum group metals (PGMs). To the best of the authors’ knowledge, there are no available data on the energy consumption or carbon footprint of this metal. Therefore, as previously mentioned, this article proposes some hypotheses for its estimation. First, we start with the energy cost of platinum, which is 76,135 MJ/kg [34], and which has a concentration in the Earth’s crust of . Second, we assume that the energy cost of extracting iridium is inversely proportional to its concentration in the Earth’s crust. Based on this assumption, by knowing the energy cost of platinum, its concentration in the Earth’s crust, and the concentration of iridium, which is , we can estimate the energy cost of iridium extraction as presented in Section 2.4.

Another limitation of this study is the assumption that the energy cost of metals remains constant over time. This assumption was made due to the challenge of estimating how metal exergy costs will change in the future. The difficulty lies in the fact that three main factors influence the exergy cost: (1) the ore grade of the mines; (2) the extraction and refining technology; (3) the type of energy used for extraction and refining. The first factor means that the exergy cost increases as mines become depleted since a decline in ore grade leads to an exponential increase in the energy required for mineral extraction. However, this is difficult to measure on a global scale. The second factor relates to technological advancements. As larger quantities and a greater variety of metals are extracted from previously unexploited ores, extraction technologies are expected to improve, leading to a reduction in exergy costs. Once again, it is a significant challenge to predict which ores will be mined in the future and what technologies will be used for their extraction and refinement. The third factor concerns the energy transition. Renewable technologies require fewer primary resources than fossil fuels in terms of exergy consumption; however, integrating them into mining and metallurgical processes may be complex. Therefore, there is considerable uncertainty regarding the adoption of renewable technologies in metal production and the resulting decrease in exergy costs.

In summary, our model is already capable of providing useful findings about the renewability of certain products but naturally can become more refined by adding newer features to the overall process. Therefore, future studies will focus on refining the assumptions previously presented, evaluating ExCOE and hydrogen’s under local distinct natural resources availability (groundwater or seawater availability, natural H2, soil exergy, renewables, and weather variation), electrolyzers model refinement, electricity curtailment management and control, and inclusion of the non-renewable exergy costs of electrolyzers manufacturing [37], industrial auxiliary components (electrical, storage, etc.) or overall infrastructure [45] on the overall exergy cost and, finally, a physical-based degree of recyclability of critical raw materials of renewables origins (end-of-life cycles).

4. Conclusions

Hydrogen production via water electrolysis is key for the energy transition. This study examines the renewability of green hydrogen production by analyzing the exergy costs of hydrogen infrastructure, encompassing electrolyzers and renewable energies, with a particular focus on their metallic composition. The ExCOE concept [35] is adopted here to evaluate how materials required in primary energy sources and in electrolyzer infrastructures affect the overall exergy cost over time. Several energy scenarios were evaluated under distinct IEA energy transition projections and for the most discussed water electrolyzer technologies.

Despite the rise in the exergy cost of metal extraction due to declining ore grades, the exergy cost diminishes over time for all cases thanks to technological advancements such as lower material intensity in both renewables and electrolyzers, enhanced efficiency, and prolonged electrolyzer operation time. SOEC presented the lowest hydrogen exergy costs among the electrolyzers, although its current TRL emphasizes it is still under research and development. AEM and PEM showed significant exergy cost reduction over time, mostly due to prolonged operation time and to a projected lower dependency on noble metals. AWE presented better results for the current application; however, in the long run, it is surpassed by AEM and PEM’s better performance.

Hydro presented the lowest exergy costs among all renewables, but it is less available throughout the world. On the other hand, wind and PV are becoming more diffused, and their hydrogen exergy costs are expected to significantly decrease due to the increase in renewable energy on the electricity grid and to the reduction of fossil fuel usage on the material production chain.

In conclusion, while green hydrogen production is predominantly renewable, the materials required for its production entail a non-renewable exergy cost. Although this exergy cost is expected to decrease over time due to technological advancements, it will persist mainly for steel, concrete, silicon, and PGMs. Therefore, reducing the reliance on non-renewable energies in their manufacturing processes and promoting recycling will be pivotal in achieving more renewable green hydrogen production. In addition, there are other challenges related to the hydrogen economy. These issues concern the economic costs of production, transportation, storage, and safety, which will also have to be overcome to be successfully implemented as an energy carrier in the energy transition context. Finally, this study provides a basis for assessing the exergy costs of any industry that uses green hydrogen to reduce its environmental impact, including the fertilizer or metallurgical industries.

Author Contributions

Conceptualization, A.L. and J.T.; methodology, A.L. and J.T.; software, A.L. and J.T.; investigation, A.L. and J.T.; writing—original draft preparation, A.L. and J.T.; writing—review and editing, A.L., J.T., A.V. (Alicia Valero), and A.V. (Antonio Valero); supervision, A.V. (Alicia Valero) and A.V. (Antonio Valero); funding acquisition, A.V. (Alicia Valero). All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by MICIU/AEI/10.13039/501100011033, and FEDER (EU) under grant agreement PID2023-148401OB-100 (Project RESTORE) and MICIU/AEI/10.13039/501100011033 (NextGeneration EU under the Renewable Energy and Hydrogen Complementary Plan) GA no. 2022/4/0042, Order PRI/1762/2022, of 27 October, 425.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries about the model are welcome and can be directed to the corresponding authors.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| AWE | alkaline water electrolysis |

| Ag | silver |

| Al | aluminum |

| Cu | copper |

| H2 | hydrogen |

| IEA | International Energy Agency |

| Ir | iridium |

| La | lanthanum |

| Ni | nickel |

| NZE | IEA’s Net-zero emission scenario |

| O2 | oxygen |

| Pb | lead |

| Pd | palladium |

| PEM | Proton-exchange membrane electrolysis |

| PGM | Platinum group materials |

| Pt | platinum |

| PV | photovoltaic |

| RE | renewable energy sources (Hydro, wind, or PV) |

| REE | rare earth elements |

| Si | silicon |

| SOEC | solid oxide electrolysis cell |

| TEC | electrolysis technology |

| Average electrolyzer efficiency | |

| Average electrolyzer lifetime [h] | |

| ExCOE | exergy cost of electricity [MJ/MJelectricity] |

| Fossil fuel contribution on the exergy cost of electrolyzer materials [MJ/MJ] | |

| Electricity contribution on the exergy cost of electrolyzer materials [MJ/MJ] | |

| Exergy cost of electrolyzer materials [MJMaterials/MJ] | |

| Exergy cost of electrolyzer infrastructure [MJ/MJ] |

| Fuel exergy cost of hydrogen from water electrolysis [MJ/MJ] | |

| Average exergy cost of electricity from hydro sources [MJ/MJelectricity] | |

| Average exergy cost of electricity from the electricity grid [MJ/MJelectricity] | |

| Average exergy cost of electricity [MJ/MJelectricity] | |

| Average exergy cost of electricity from solar PV sources [MJ/MJelectricity] | |

| Average exergy cost of electricity from wind sources [MJ/MJelectricity] | |

| Y | yttrium |

| Zn | zinc |

| Zr | zirconium |

References

- Busch, P.; Kendall, A.; Lipman, T. A systematic review of life cycle greenhouse gas intensity values for hydrogen production pathways. Renew. Sustain. Energy Rev. 2023, 184, 113588. [Google Scholar] [CrossRef]

- Tabrizi, M.; Famiglietti, J.; Bonalumi, D.; Campanari, S. The carbon footprint of hydrogen produced with state-of-the-art photovoltaic electricity using life-cycle assessment methodology. Energies 2023, 16, 5190. [Google Scholar] [CrossRef]

- Peng, J.; Vijayshankar, S.; King, J.; Mathieu, J. Trade-offs between Battery Energy Storage and Hydrogen Storage in Off-Grid Green Hydrogen Systems. In Proceedings of the 58th Hawaii International Conference on System Sciences, Waikoloa, HI, USA, 7–10 January 2025; Available online: https://hdl.handle.net/10125/109215 (accessed on 6 March 2025). [CrossRef]

- Smith, C.; Torrente-Murciano, L. The importance of dynamic operation and renewable energy source on the economic feasibility of green ammonia. Joule 2024, 8, 157–174. [Google Scholar] [CrossRef]

- Laimon, M.; Goh, S. Unlocking potential in renewable energy curtailment for green ammonia production. Int. J. Hydrogen Energy 2024, 71, 964–971. [Google Scholar] [CrossRef]

- Dufo-López, R.; Lujano-Rojas, J.M.; Bernal-Agustín, J.L. Optimisation of size and control strategy in utility-scale green hydrogen production systems. Int. J. Hydrogen Energy 2024, 50, 292–309. [Google Scholar] [CrossRef]

- International Energy Agency. The Future of Hydrogen; IEA-International Energy Agency: Paris, France, 2019. [Google Scholar]

- Luo, X.; Wang, J.; Dooner, M.; Clarke, J. Overview of current development in electrical energy storage technologies and the application potential in power system operation. Appl. Energy 2015, 137, 511–536. [Google Scholar] [CrossRef]

- Ishaq, H.; Crawford, C. Review of ammonia production and utilization: Enabling clean energy transition and net-zero climate targets. Energy Convers. Manag. 2024, 300, 117869. [Google Scholar] [CrossRef]

- Vitta, S. Sustainability of hydrogen manufacturing: A review. RSC Sustain. 2024, 2, 3202–3221. [Google Scholar] [CrossRef]

- Hu, T.; Song, Y.; Zhang, X.; Lin, S.; Liu, P.; Zheng, C.; Gao, X. A mini review for hydrogen production routes toward carbon neutrality. Propuls. Energy 2025, 1, 1. [Google Scholar] [CrossRef]

- Vidas, L.; Castro, R. Recent developments on hydrogen production technologies: State-of-the-art review with a focus on green-electrolysis. Appl. Sci. 2021, 11, 11363. [Google Scholar] [CrossRef]

- Panchenko, V.A.; Daus, Y.V.; Kovalev, A.A.; Yudaev, I.V.; Litti, Y.V. Prospects for the production of green hydrogen: Review of countries with high potential. Int. J. Hydrogen Energy 2023, 48, 4551–4571. [Google Scholar] [CrossRef]

- Chatenet, M.; Pollet, B.G.; Dekel, D.R.; Dionigi, F.; Deseure, J.; Millet, P.; Braatz, R.D.; Bazant, M.Z.; Eikerling, M.; Staffell, I.; et al. Water electrolysis: From textbook knowledge to the latest scientific strategies and industrial developments. Chem. Soc. Rev. 2022, 51, 4583–4762. [Google Scholar] [CrossRef]

- Krishnan, S.; Corona, B.; Kramer, G.J.; Junginger, M.; Koning, V. Prospective LCA of alkaline and PEM electrolyser systems. Int. J. Hydrogen Energy 2024, 55, 26–41. [Google Scholar] [CrossRef]

- Rashid, M.M.; Al Mesfer, M.K.; Naseem, H.; Danish, M. Hydrogen production by water electrolysis: A review of alkaline water electrolysis, PEM water electrolysis and high temperature water electrolysis. Int. J. Eng. Adv. Technol 2015, 4, 2249–8958. [Google Scholar]

- Jolaoso, L.A.; Duan, C.; Kazempoor, P. Life cycle analysis of a hydrogen production system based on solid oxide electrolysis cells integrated with different energy and wastewater sources. Int. J. Hydrogen Energy 2024, 52, 485–501. [Google Scholar] [CrossRef]

- Shiva Kumar, S.; Lim, H. An overview of water electrolysis technologies for green hydrogen production. Energy Rep. 2022, 8, 13793–13813. [Google Scholar] [CrossRef]

- Bareiß, K.; de la Rua, C.; Möckl, M.; Hamacher, T. Life cycle assessment of hydrogen from proton exchange membrane water electrolysis in future energy systems. Appl. Energy 2019, 237, 862–872. [Google Scholar] [CrossRef]

- International Energy Agency. Energy Technology Perspectives 2023; International Energy Agency: Paris, France, 2023. [Google Scholar]

- International Energy Agency. The Role of Critical World Energy Outlook Special Report Minerals in Clean Energy Transitions; International Energy Agency: Paris, France, 2021. [Google Scholar]

- Juárez-Casildo, V.; Cervantes, I.; Cervantes-Ortiz, C.A.; González-Huerta, R.d.G. Key aspects in quantifying massive solar hydrogen production: Energy intermittence, water availability and electrolyzer technology. J. Clean. Prod. 2022, 371, 133550. [Google Scholar] [CrossRef]

- Bhandari, R.; Trudewind, C.A.; Zapp, P. Life cycle assessment of hydrogen production via electrolysis—A review. J. Clean. Prod. 2014, 85, 151–163. [Google Scholar] [CrossRef]

- Palmer, G.; Roberts, A.; Hoadley, A.; Dargaville, R.; Honnery, D. Life-cycle greenhouse gas emissions and net energy assessment of large-scale hydrogen production via electrolysis and solar PV. Energy Environ. Sci. 2021, 14, 5113–5131. [Google Scholar] [CrossRef]

- Torrubia, J.; Valero, A.; Valero, A. Renewable exergy return on investment (RExROI) in energy systems. The case of silicon photovoltaic panels. Energy 2024, 304, 131961. [Google Scholar] [CrossRef]

- Lozano, M.A.; Valero, A. Theory of the exergetic cost. Energy 1993, 18, 939–960. [Google Scholar] [CrossRef]

- Sciubba, E. Exergy-based ecological indicators: From Thermo-Economics to cumulative exergy consumption to Thermo-Ecological Cost and Extended Exergy Accounting. Energy 2019, 168, 462–476. [Google Scholar] [CrossRef]

- Torres, C.; Valero, A. The Exergy Cost Theory Revisited. Energies 2023, 14, 1594. [Google Scholar] [CrossRef]

- Stanek, W.; Czarnowska, L.; Gazda, W.; Simla, T. Thermo-ecological cost of electricity from renewable energy sources. Renew. Energy 2018, 115, 87–96. [Google Scholar] [CrossRef]

- Sciubba, E. A possible reconciliation between Exergy Analysis, Thermo-Economics and the resource cost of Externalities. Energy 2024, 310, 132731. [Google Scholar] [CrossRef]

- Mendrela, P.; Stanek, W.; Simla, T. Thermo-ecological cost—System evaluation of energy-ecological efficiency of hydrogen production from renewable and non-renewable energy resources. Int. J. Hydrogen Energy 2024, 50, 1–14. [Google Scholar] [CrossRef]

- Torrubia, J.; Torres, C.; Valero, A.; Valero, A.; Parvez, A.M.; Sajjad, M.; García Paz, F. Applying Circular Thermoeconomics for Sustainable Metal Recovery in PCB Recycling. Energies 2024, 17, 4973. [Google Scholar] [CrossRef]

- Valero, A.; Lozano, M.A.; Muñoz, M. A general theory of exergy saving. I. On the exergetic cost. Comput.-Aided Eng. Energy Syst. Second Law Anal. Model. 1986, 3, 1–8. [Google Scholar]

- Torrubia, J.; Valero, A.; Valero, A. Energy and carbon footprint of metals through physical allocation. Implications for energy transition. Resour. Conserv. Recycl. 2023, 199, 107281. [Google Scholar] [CrossRef]

- Torrubia, J.; Valero, A.; Valero, A. Non-renewable and renewable levelized exergy cost of electricity (LExCOE) with focus on its infrastructure: 1900–2050. Energy 2024, 313, 133987. [Google Scholar] [CrossRef]

- International Renewable Energy Agency. Green Hydrogen Cost Reduction Scaling Up Electrolysers to Meet the 1.5 °C Climate Goal; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Wei, X.; Sharma, S.; Waeber, A.; Wen, D.; Sampathkumar, S.N.; Margni, M.; Maréchal, F.; van herle, J. Comparative life cycle analysis of electrolyzer technologies for hydrogen production: Manufacturing and operations. Joule 2024, 12, 3347–3372. [Google Scholar] [CrossRef]

- Lima, A.; Torrubia, J.; Torres, C.; Valero, A.; Valero, A. Dynamic Small-Scale Green Ammonia Non-Renewable and Renewable Exergy costs up to 2050: Short and Long-Term Projections under IEA Energy Transition Scenarios. Renew. Energy, 2025; under review. [Google Scholar]

- International Energy Agency. Net Zero by 2050—A Roadmap for the Global Energy Sector; International Energy Agency: Paris, France, 2021. [Google Scholar]

- International Energy Agency. Energy Technology Perspectives 2024; International Energy Agency: Paris, France, 2024. [Google Scholar]

- Carrara, S.; Alves Dias, P.; Plazzotta, B.; Pavel, C. Raw Materials Demand for Wind and Solar PV Technologies in the Transition Towards a Decarbonised Energy System; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar] [CrossRef]

- International Renewable Energy Agency; World Trade Organization Agency. International Trade and Green Hydrogen: Supporting the Global Transition to a Low-Carbon Economy; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2023. [Google Scholar]

- Granovskii, M.; Dincer, I.; Rosen, M. Life cycle assessment of hydrogen fuel cell and gasoline vehicles. Int. J. Hydrogen Energy 2006, 31, 337–352. [Google Scholar] [CrossRef]

- Pinto, R.; Henriques, S.T.; Brockway, P.E.; Heun, M.K.; Sousa, T. The rise and stall of world electricity efficiency:1900–2017, results and insights for the renewables transition. Energy 2023, 269, 126775. [Google Scholar] [CrossRef]

- Arrigoni, A.; Dolci, F.; Ortiz Cebolla, R.; Weidner, E.; D’Agostini, T.; Eynard, U.; Santucci, V.; Mathieux, F. Environmental Life Cycle Assessment (LCA) Comparison of Hydrogen Delivery Options Within Europe; Publications Office of the European Union: Luxembourg, 2024. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).