Abstract

Despite the positive dynamics of biogas and biomethane production in Poland, the country still lags behind Western European leaders per capita. With the ongoing phaseout of coal and the growing demand for power system flexibility, the importance of alternative solutions, with particular emphasis on renewable gases, is growing. Furthermore, capturing methane from manure and food waste offers a significant opportunity to significantly reduce the release of harmful gases into the atmosphere, as well as to recycle nutrients, which in turn translates into enhanced environmental performance (ESG). This places biogas production in Poland among the current and important issues of the energy transition. The available research relates to a limited extent to the conditions of biogas production and processes, particularly in the Polish market. With this in mind, the challenge was taken up to provide up-to-date knowledge on the management challenges of the biogas sector in Poland—today’s situation, conditions and development potential until 2030 and beyond. The analysis draws on regulatory reports, official records, EU policy documents, and industry data, offering practical insights for policymakers, investors, and researchers. The review’s methodology is based on economic analysis and evaluation techniques. The analysis revealed that management challenges in Poland’s biogas sector differ in severity and systemic impact. The priority ranking of barriers is as follows: policy and regulatory barriers, economic barriers, technological barriers, and social barriers. Moreover, the analysis confirms that feedstock price volatility and revenue instability are core components of the economic barrier category, directly affecting managerial decision-making, risk perception, and the overall investment climate in the Polish biogas industry.

1. Introduction

Converting organic matter into energy resources through anaerobic digestion is gaining popularity worldwide [,,,,,,]. Biogas produced through this process has emerged as an important solution for utilizing organic waste in light of ongoing environmental changes and the growing need for renewable energy [,,,]. The diversity of substrates used in anaerobic digestion and its high efficiency [,] provide an environmental and economic justification for biogas production compared to alternative green energy sources [,,,,,,]. Given this, biogas has become a strategically important pillar of Europe’s clean-energy transition [,], valued for its dispatchability, its circular economy benefits [,], and its potential to deliver pipeline-quality biomethane for the gas grid. The EU’s REPowerEU plan explicitly elevates biomethane, calling for 35 billion m3 per year by 2030, with associated investment needs on the order of €37 billion []. This target reframes biogas from a niche waste-to-energy option into a system-relevant, renewable gaseous fuel that supports decarbonization of electricity, heat, industry, and transport.

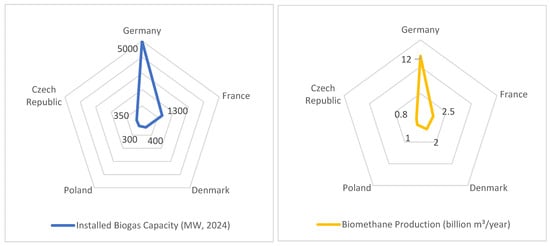

Compared with Western European leaders such as Germany [], Denmark, and France, Poland’s biogas sector remains at an earlier stage of maturity, yet it shows one of the fastest growth dynamics in the EU. While Germany operates over 9000 biogas plants and has surpassed 12 billion m3 of biogas production annually, Poland’s installed capacity remains below 1% of the national energy mix. However, the country’s recent acceleration aligns it with the trajectories observed in Central and Eastern European states such as the Czech Republic and Hungary, where agricultural biogas and wastewater co-digestion are key growth drivers. This convergence suggests that Poland’s experience can serve as a reference model for emerging EU markets transitioning from waste-based to circular, biomethane-oriented production systems (Table 1, Figure 1).

Table 1.

Comparative overview of biogas sector development in selected EU countries (2024) [,,].

Figure 1.

Comparative overview of biogas sector development in selected EU countries—visualization. Source: Own elaboration based on National Energy Agency data [], Eurostat [], and European Biogas Association Report [].

Poland is gradually developing its biogas sector, supported by national and EU climate policy instruments. In recent years, the market has transitioned from a green-certificate model to auctions and feed-in-tariff/feed-in-premium (FIT/FIP) schemes, complemented by programs such as Agroenergia and EU funding under the National Recovery and Resilience Plan []. These measures have encouraged new investment projects and modernization of existing plants, strengthening Poland’s contribution to the EU biomethane targets.

The current scale and structure of the biogas sector in Poland reflects the country’s energy policy. Poland’s biogas industry comprises agricultural plants, installations at wastewater treatment plants, and landfill gas units. Recent data indicate roughly 300 MW of installed electric capacity and about 400 biogas plants across all categories by 2024—still below 1% of the power system’s installed capacity but significantly larger than a decade ago [,]. Within this total, the agricultural segment—key for biomethane growth—has expanded steadily: the KOWR register listed 181 agricultural biogas installations as of March 2025 []. Agricultural substrates such as slurry, manure, food-processing residues, and silages dominate the feedstock mix, aligning with circular economy objectives. In this respect, this trend constitutes an important aspect of sustainable development of rural areas [].

The biogas production sector is a sector with potential. The next growth stage focuses on upgrading raw biogas to grid-quality biomethane and integrating it with national gas infrastructure and end-uses such as bio-CNG and bio-LNG. Studies estimate Poland’s realistic biomethane potential at 3–4 billion m3 per year by the early-to-mid 2030s, conditional on policy stability, investment incentives, and development of gas grid connections [,]. While no commercial biomethane injection projects were operating in 2024, investor interest is increasing, and several pilot projects are in preparation [].

Current formal, legal and market conditions create potential for the development of the biogas production sector [,]. The Polish support system for biogas includes RES auctions, FIT/FIP mechanisms, preferential loans and subsidies from public funds, and rising demand for renewable gases in the transport sector []. At EU level, the biomethane target is driving harmonization of guarantees-of-origin schemes and stimulating cross-border investment [].

Biogas production continues to pose a challenge for more intensive development and support for energy transition processes towards a responsible approach. This makes research into the biogas production sector a topical and important area of study. The literature on the subject provides insufficient insight into the conditions of biogas production and processes, particularly in relation to the Polish market. With this in mind, the authors of this review undertook a literature review, industry reports, and legal documents to provide structured, up-to-date knowledge on the management challenges facing the biogas sector in Poland—its current status, potential, and development prospects. The review’s objective determined its structure. The first section presents the state of the Polish biogas production sector (installations, production capacity, production, technologies, substrates). Next, the political and economic framework shaping the sector, the environmental impact, and the additional benefits of biogas production were analyzed, concluding with a summary section that outlined the barriers, potential, and prospects for the development of the biogas sector in Poland by 2030 and beyond. The study used current reports and literature from databases of indexed journals. Research material was searched based on keywords identified for this review. The methodology used for analysis and reasoning is based on the principles and techniques of economic analysis.

2. Current State of Biogas Production in Poland—Literature Review and Contextual Background

2.1. Justification for the Review

Recent studies on the biogas sector in Europe have predominantly focused on technical efficiency, feedstock optimization, and cost-effectiveness of production processes (e.g., [,]). While these analyses provide valuable insights into the technological and environmental dimensions of biogas production, they often neglect the institutional and market-related factors that shape the actual deployment of biogas technologies in national contexts. This imbalance creates a need for more integrative studies that combine technical, regulatory, and socio-economic perspectives, particularly in emerging EU markets such as Poland, the Czech Republic, or Hungary.

Moreover, existing literature remains fragmented in its treatment of policy and governance issues. Research from Western Europe—especially Germany, Denmark, and France—has extensively discussed the role of feed-in tariffs, biomethane grid integration, and national subsidy frameworks []. In contrast, studies concerning Central and Eastern Europe have primarily concentrated on production potential or investment costs, with limited consideration of institutional barriers, stakeholder behavior, or administrative challenges []. As a result, the biogas research agenda in post-transition economies lacks a holistic view of systemic barriers that constrain sectoral growth.

This study aims to address this gap by linking three critical analytical dimensions: (1) the regulatory environment, (2) financial and infrastructural limitations, and (3) stakeholder-level perceptions of biogas development. By integrating these perspectives, the article contributes to the broader European discourse on renewable energy governance and provides empirical evidence from a country undergoing a late but rapid phase of biogas sector expansion. In doing so, it responds to the European Commission’s call for comparative insights into renewable gas markets under the REPowerEU initiative.

Thus, the present analysis goes beyond a descriptive review of national trends. It offers a comparative and interpretative approach that situates Poland within the wider EU context, allowing the findings to inform both academic debate and practical policy formulation. By addressing the interdependencies between policy frameworks, economic incentives, and institutional maturity, this research extends current understanding of how biogas can function as a key component of the circular and low-carbon energy transition in Central and Eastern Europe.

With the above in mind, this review focuses on identifying and assessing the management challenges facing the Polish biogas sector, along with their prioritization in the following areas:

- -

- Political and regulatory;

- -

- Economic conditions;

- -

- Technological capacity;

- -

- Public opinion.

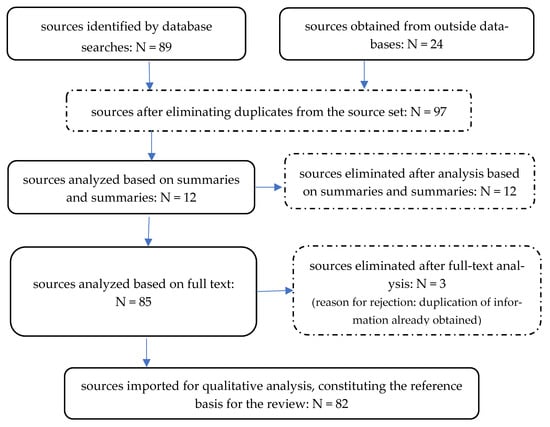

This review was conducted by analyzing peer-reviewed literature sources obtained from indexed databases such as Scopus, Google Scholar, Web of Science, etc., and other publicly available sources. The study also used regulations and industry reports related to the topic under investigation. The search for sources was based on keywords identified for this study. The process of searching and selecting sources was carried out in accordance with the steps specified in the model—Figure 2 [,]. The study of sources was qualitative in nature.

Figure 2.

A mechanism for identifying, evaluating and selecting sources for review. Source: Own elaboration based on guidelines specified in the literature [,].

In relation to the established concept, the authors analyzed a diversified revenue model to assess the impact of environmental conditions on the results of operations and management decisions in the biogas sector in the country under study in the current economic conditions.

2.2. Statistics: Number of Installations, Installed Capacity, and Energy Production

Poland’s biogas sector has experienced consistent growth over the past decade, evolving from a niche energy source into an increasingly important component of the national renewable energy mix. According to the Polish Energy Regulatory Office [], the total installed electric capacity of biogas plants reached approximately 300 MW by the end of 2024, representing around 1% of Poland’s renewable electricity generation capacity. The sector comprises approximately 400 installations across three main categories: agricultural biogas plants, wastewater treatment plant digesters, and landfill gas recovery systems [].

Agricultural biogas is the most dynamic and strategically significant segment of the market. The National Support Centre for Agriculture [] reports 181 agricultural biogas plants operated by 151 entities, with a combined annual production potential of over 640 million m3 of raw biogas. This marks a substantial increase compared with fewer than 100 such plants operating in 2018, reflecting the impact of targeted subsidy programs, legislative amendments to the Renewable Energy Sources Act, and improved investment conditions [].

Over the past decade, biogas-fired electricity output has increased to more than twice its earlier level, and the majority of installations now use combined heat and power (CHP) systems to make more efficient use of the generated energy. In 2024, biogas plants collectively generated approximately 1.25 TWh of electricity, equivalent to 0.7–0.9% of national electricity demand []. The heat produced in CHP systems is often utilized for district heating, greenhouse operations, or on-site industrial processes, providing additional economic and environmental benefits. To illustrate this development, Table 2 presents the dynamic growth of the Polish biogas sector over the period 2015–2024.

Table 2.

Dynamic development of the Polish biogas sector (2015–2024).

The data clearly demonstrate a rapid acceleration in sector development, especially between 2022 and 2024, which coincided with favorable energy market conditions and new funding instruments. While installed capacity growth was moderate, the sharp rise in the number of plants reflects an increasing participation of small and medium-sized installations, particularly in the agricultural segment.

Despite these positive trends, Poland still lags behind leading EU countries such as Germany or Denmark in per capita installed capacity and total biomethane production []. Nevertheless, the upward trajectory of plant numbers, capacity, and energy production suggests that biogas is becoming a more significant player in the renewable energy portfolio and is well positioned to support the achievement of EU biomethane targets under the REPowerEU plan [].

2.3. Types of Biogas Plants in Poland

The Polish biogas sector is composed of three principal categories of installations: agricultural biogas plants, wastewater treatment plant (WWTP) digesters, and landfill gas recovery systems. Each category differs in feedstock composition, technological configuration, economic profile, and environmental impact [].

2.3.1. Agricultural Biogas Plants

Agricultural biogas plants are the most rapidly expanding and strategically significant segment of the Polish biogas market. These facilities utilize a broad spectrum of feedstocks, including livestock manure, slurry, maize silage, cereal straw, agri-food industry by-products, and other biodegradable residues []. The share of agricultural plants in the total number of installations has been steadily increasing and reached nearly 45% of all biogas facilities in 2024, corresponding to more than half of the installed capacity [].

Technologically, most agricultural plants operate under mesophilic conditions (38–42 °C), which offer a balance between process stability and biogas yield. However, there is a growing trend toward thermophilic digestion (>50 °C), which shortens hydraulic retention time, increases methane production rates, and ensures better pathogen reduction—important in the context of EU biofertilizer standards. At this point, the importance of innovative investments should be emphasised []. Many operators are also investing in biogas upgrading technologies (pressure swing adsorption, water scrubbing, membrane separation) to produce grid-quality biomethane, enabling diversification of revenues through gas sales or bio-CNG fueling for transport [].

Agricultural biogas plants benefit from a multi-stream revenue model [].

- -

- Electricity and heat generation, supported by feed-in tariffs (FIT), feed-in premiums (FIP), or RES auctions.

- -

- Waste management fees for slurry and organic residues, which provide a stable income stream and help farmers meet environmental obligations.

- -

- Digestate utilization as an organic fertilizer, contributing to nutrient recycling and reducing dependence on synthetic fertilizers—an increasingly relevant factor given rising fertilizer prices and EU Farm-to-Fork goals [].

From a sustainability perspective, agricultural biogas mitigates methane emissions from manure storage, reduces odor nuisance, and contributes to local energy independence in rural areas. The sector is also a driver of sustainable job creation [] and technology transfer in rural regions, aligning with national objectives for balanced territorial development [].

2.3.2. Wastewater Treatment Plant Digesters

Biogas production at wastewater treatment plants (WWTPs) is the second-largest contributor to Poland’s biogas portfolio, accounting for approximately 30% of all biogas installations and 25–30% of installed capacity []. These facilities play a dual role:

- -

- They stabilize sewage sludge, reducing its volume and pathogen load before final disposal.

- -

- They enable energy recovery from otherwise problematic waste streams.

This aligns with EU directives on wastewater treatment and sludge management, which promote energy-efficient, resource-recovering treatment plants [].

Most WWTP digesters in Poland operate under mesophilic conditions in continuous stirred-tank reactors (CSTR). The biogas yield is typically between 15–25 m3 per person equivalent per year, depending on sludge quality and treatment technology. In large municipal WWTPs, biogas production can reach 2–5 million m3 annually, enough to cover a significant portion of the plant’s energy demand [] (Lima, Silva, Pereira, & Santos, 2025). Advanced facilities such as those in Warsaw or Kraków are able to cover 50–100% of their electricity and heat needs through combined heat and power (CHP) utilization of digester gas.

An important trend in this segment is co-digestion—the addition of external, high-energy substrates such as glycerin, food industry residues, or fats, oils, and greases (FOG) []. Studies show that co-digestion can increase methane yield by 20–50% without requiring major capital investment, as existing digesters often have unused capacity []. This approach supports circular economy objectives by diverting organic waste from landfills or incineration, reducing sludge disposal costs, and enhancing resource efficiency.

From a technological perspective, innovation focuses on [].

- -

- Thermal hydrolysis pre-treatment, which breaks down sludge cell walls, increasing biogas yield by 30–50% and improving dewaterability of digestate.

- -

- Advanced process monitoring and control, including online measurement of volatile fatty acids (VFA) and real-time biogas composition [].

- -

- Post-digestion and polishing steps, such as second-stage anaerobic digestion or upgrading biogas to biomethane for grid injection.

Although the sector’s absolute growth potential is limited by the fixed number of WWTPs, there remains significant untapped potential in process optimization. Retrofitting existing plants, integrating co-digestion, and upgrading CHP units could raise biogas production substantially. Moreover, as Poland implements the revised Urban Waste Water Treatment Directive (2023), energy self-sufficiency targets for WWTPs may drive further investments in biogas technology.

2.3.3. Landfill Gas Recovery Systems

Landfill gas (LFG) recovery systems are designed to capture and utilize methane generated by the anaerobic decomposition of biodegradable municipal waste [,]. In Poland, LFG systems account for approximately one-quarter of all biogas installations but contribute a smaller share of capacity (15–20%) due to relatively low energy content and declining gas yields as landfill volumes stabilize or decline [].

The role of landfill gas recovery is changing under the influence of EU waste policy, particularly the Landfill Directive (1999/31/EC) and Circular Economy Package, which set ambitious targets for waste diversion and recycling. As a result, the quantity of biodegradable waste landfilled in Poland has decreased, leading to a gradual decline in LFG production. For example, between 2015 and 2023, the total volume of recovered landfill gas dropped by more than 20%, according to national waste statistics [].

Despite this downward trend, LFG capture remains critical for climate protection because methane’s global warming potential is 28–34 times higher than CO2 over a 100-year horizon. Captured gas is either flared (to convert methane to CO2) or used for electricity generation in gas engines, supplying power to the grid and sometimes heat for local facilities. Electricity production from LFG in Poland is still significant, though declining, contributing several hundred GWh annually to the RES mix.

Key challenges in this segment include:

- -

- Economic viability as gas production declines, reducing revenues while fixed operating costs remain.

- -

- Collection efficiency, which must be optimized to minimize fugitive emissions, often requiring better wellfield design and monitoring.

- -

- Integration with other renewable sources to maintain profitability, e.g., hybrid projects combining solar PV with LFG generation to share infrastructure [].

In the medium term, as landfilling rates decrease further, the contribution of landfill gas to Poland’s biogas mix will continue to shrink. However, its role in methane mitigation and compliance with EU climate goals will remain relevant until legacy sites are fully stabilized.

2.3.4. Comparative Significance and Future Outlook

The data reveal not only the structural composition of the sector but also its development priorities and future trajectory. Agricultural biogas plants, which now constitute nearly half of all installations, have become the driving force of the market []. This growth reflects Poland’s strong agricultural base and the availability of feedstocks such as manure, slurry, and silage, which provide a reliable substrate supply throughout the year. Their rapid development is further supported by EU and national incentives, including dedicated auction baskets for agricultural biogas and programs encouraging biomethane production. This makes the segment strategically relevant not only for energy policy but also for rural development, job creation, and manure management, helping to address challenges of nutrient runoff and greenhouse gas emissions from livestock farming.

Wastewater treatment plants, despite a slower growth rate, continue to play an essential role by ensuring energy neutrality of municipal infrastructure and improving sludge management. Their contribution remains relatively stable because the number of WWTPs is determined by population and municipal infrastructure, but optimization initiatives—such as thermal hydrolysis, co-digestion, and advanced process control—allow for incremental increases in biogas yield. These facilities represent a highly predictable and resilient component of the biogas sector, since their operation is not dependent on market prices of biomass or on agricultural seasonality [].

Landfill gas recovery, while declining in absolute terms due to the progressive reduction in waste landfilling, remains an important climate mitigation measure. Capturing methane from legacy landfills helps to reduce the sector’s overall greenhouse gas footprint and supports compliance with EU landfill and methane regulations. The decreasing energy contribution of this segment signals a structural transformation: the Polish biogas sector is shifting from waste-end-of-pipe solutions toward circular and proactive models, where energy recovery is coupled with resource recycling and emission prevention [,].

In this context, the data from Table 3 should be interpreted as more than a snapshot—they represent a pivot point in Poland’s biogas market development. Agricultural biogas is positioned to dominate future capacity additions, wastewater treatment plants will become even more efficient and energy self-sufficient, and landfill gas will gradually transition into a niche activity focused primarily on emission control rather than electricity generation. This shift underscores the importance of integrating biogas into broader decarbonization strategies, linking it with biomethane injection into the gas grid, the production of renewable transport fuels, and hybrid renewable energy systems combining biogas with solar PV, wind, and energy storage.

Table 3.

Estimated share of biogas plant types in Poland (2024).

Looking ahead, agricultural biogas and biomethane upgrading projects are projected to dominate capacity additions, supported by REPowerEU and national biomethane targets, which envision several billion cubic meters of biomethane production annually by 2030. Unlocking this potential will require streamlined permitting procedures, improved access to the gas grid, and stable long-term support mechanisms to attract private investment. Wastewater treatment plant digesters will likely see efficiency improvements rather than significant capacity growth, driven by requirements of the revised Urban Waste Water Treatment Directive aiming for energy neutrality of WWTPs. Landfill gas recovery, meanwhile, will gradually decline as waste landfilling is phased out, shifting its role from energy generation toward climate compliance and methane emission mitigation [].

Strategic integration of biogas into Poland’s broader energy system will be essential. This includes connecting CHP units to district heating networks, using biomethane for low-carbon transport fuels (bio-CNG/LNG), and combining biogas facilities with hybrid renewable energy systems (solar PV, wind, energy storage) to provide flexibility to the power grid. If these steps are taken, the Polish biogas sector could double its installed capacity by 2030 and become a significant contributor to both national energy security [,] and the EU’s decarbonization goals [].

The main factors and barriers to the development of the biogas sector in Poland presented in Table 4 create a system of management challenges for the biogas production sector in Poland, consistent with the challenges of climate protection.

Table 4.

Key Drivers and Barriers for Biogas Sector Development in Poland.

2.4. Technological Innovation, Digitalization, and Benchmarking in the EU Context

The Technological development and innovation are becoming crucial drivers of efficiency and competitiveness in the Polish biogas sector. In recent years, several key advancements have been implemented or piloted:

- -

- Biogas upgrading technologies—Increasing numbers of plants are installing upgrading units such as pressure swing adsorption (PSA), membrane separation, and water and amine scrubbing systems. These solutions allow the production of grid-quality biomethane, which can be injected into the gas grid or used as bio-CNG/LNG for transport, supporting Poland’s compliance with EU decarbonization targets [].

- -

- Thermal hydrolysis and advanced pre-treatment—Particularly in WWTP digesters, thermal hydrolysis systems improve the biodegradability of sludge and other feedstocks, boosting methane yield by up to 50% and enhancing digestate dewaterability.

- -

- Digitalization and smart monitoring—The integration of IoT-based sensors and AI-supported process control systems enables real-time monitoring and optimization of key parameters (pH, temperature, organic loading rate, gas composition). Predictive maintenance tools and data-driven analytics improve operational reliability and reduce downtime, which translates into lower production costs and higher plant profitability [].

- -

- Hybrid renewable energy systems—Biogas CHP units are increasingly connected with solar PV and wind installations to create hybrid microgrids, ensuring a more stable supply of electricity and heat while balancing intermittent renewables [].

Together, these innovations support the transition from traditional, single-purpose biogas plants toward flexible, digitally optimized, and grid-integrated energy hubs. Wider deployment of upgrading and digital technologies will be crucial to achieving Poland’s biomethane production potential and contributing to the REPowerEU target of 35 bcm biomethane by 2030.

Benchmarking against the EU shows that Poland is still at an early-to-mid stage of biogas market maturity. Germany alone accounts for nearly 60% of EU biogas capacity, with over 9000 plants and more than 5 GW of installed power []. France and Italy also surpass Poland in both installed capacity and biomethane output. Nonetheless, Poland has one of the fastest growth rates in the EU, particularly in agricultural biogas, and an estimated technical potential of 7–8 billion m3 of biomethane annually []. This positions the country as an emerging key player capable of making a meaningful contribution to EU decarbonization and energy security targets, provided that permitting procedures, grid access, and financial instruments are further streamlined.

An overview of the main biogas upgrading technologies, their key advantages, limitations, and cost ranges is presented in Table 5.

Table 5.

Overview of Biogas Upgrading Technologies.

Table 5 highlights the technological diversity of biogas upgrading options available to Polish operators. PSA and membrane separation are currently the most common technologies in Poland, owing to their modular design, relatively low operating costs, and suitability for small- and medium-scale agricultural biogas plants. Water scrubbing remains popular in older installations due to its simplicity, though it requires careful water management to minimize consumption and methane slip.

For larger projects and biomethane grid injection hubs, amine scrubbing offers superior methane purity and is attractive where waste heat from other processes is available for solvent regeneration. Cryogenic separation, while expensive, is emerging as a preferred option for projects targeting bio-LNG production, particularly those serving the transport sector [].

From a policy and investment perspective, promoting a technology-neutral but performance-based approach will allow operators to select the most cost-effective solutions depending on plant size, substrate type, and proximity to the gas grid. Future developments in AI-driven process control and hybrid systems (e.g., combining PSA with membrane polishing) may further reduce costs and improve efficiency, accelerating the transition toward large-scale biomethane deployment in Poland.

3. Analysis and Discussion: Management Challenges of the Biogas Production Sector in Poland—Economic and Environmental Aspects

3.1. Investment and Operating Costs, Financing Sources

Biogas projects in Poland typically involve CAPEX ranging between €3000–5000 per installed kW of electric capacity, depending on plant size, feedstock type, and technology complexity (membrane upgrading, co-digestion). Operating expenditures (OPEX) are mainly driven by feedstock costs, labor, maintenance, and electricity consumption for mixing and pumping, typically representing 5–8% of CAPEX per year [].

Key financing sources include:

- -

- NFOŚiGW programs such as Agroenergia, offering grants and preferential loans covering up to 50% of eligible costs.

- -

- National Recovery and Resilience Plan (KPO) funds for biomethane grid connections and digitalization projects.

- -

- EU cohesion funds and the Modernisation Fund, which prioritize renewable heat and gas infrastructure.

- -

- Private equity and bank loans, which are becoming more available as biomethane projects gain bankability.

The transition toward biomethane projects may require higher CAPEX due to upgrading units and grid connections, but is supported by growing demand for renewable gases in transport and industry, improving long-term investment attractiveness [].

3.2. Revenue Model and Market Economics

The revenue model of biogas plants in Poland is increasingly diversified, reflecting both the maturation of the sector and the evolving policy environment. The three primary revenue streams remain electricity sales, heat sales, and waste treatment fees, but their relative importance has been shifting as policy frameworks and market drivers evolve [].

Electricity sales still form the backbone of the sector’s income. Plants participating in the auction system or benefitting from Feed-in Tariffs (FIT) and Feed-in Premiums (FIP) receive guaranteed remuneration for 15 years, which reduces exposure to wholesale market volatility and improves project bankability []. The FIT mechanism is particularly attractive for smaller plants (<1 MW), while larger installations tend to participate in RES auctions. Recent electricity price spikes on the wholesale market have improved the competitiveness of unsubsidized generation, opening the door for merchant projects in the longer term.

Heat sales are becoming increasingly relevant, especially in plants located near district heating systems or industrial consumers. The utilization rate of thermal energy is a key determinant of overall project efficiency. Combined heat and power (CHP) operation with >70% total efficiency can significantly increase revenue streams and improve the greenhouse gas (GHG) balance of the plant. Some operators have begun exploring contracts for heat offtake with municipalities and greenhouse operators, providing stable, indexed revenue.

Waste treatment fees represent a unique feature of the biogas business model, turning a cost (waste management) into a revenue source. Plants can charge gate fees for slurry, manure, food waste, or by-products from agri-food processing industries. This revenue stream is particularly valuable because it is largely uncorrelated with energy market prices, offering a natural hedge against electricity price fluctuations.

Beyond these three pillars, emerging revenue opportunities are becoming more important:

Guarantees of origin (GoO):

- -

- Harmonized GoO systems for biomethane and renewable electricity under the EU RED III directive are creating a tradable market for green attributes, allowing operators to capture additional value and sell “green gas” premiums to industry or energy suppliers.

- -

- Transport sector incentives: The implementation of bio-CNG and bio-LNG as advanced renewable fuels generates compliance value under the EU Renewable Energy Directive (RED III) and Poland’s National Indicative Target (NIT). This creates an additional market for upgraded biomethane, particularly attractive for heavy transport and municipal fleets.

- -

- Digestate utilization: As mineral fertilizer prices remain volatile, digestate is increasingly valued as a locally available, nutrient-rich soil amendment. The monetization of digestate, whether via direct sales or nutrient credit schemes, contributes both to farm economics and circular economy objectives [].

- -

- Carbon credits: Although still nascent in Poland, voluntary carbon markets are beginning to recognize methane avoidance from manure management as a tradable credit. Future integration with the EU ETS for non-CO2 agricultural emissions could further enhance revenue streams.

A diversified revenue structure significantly reduces project risk and improves debt financing conditions, as lenders favor projects with multiple predictable income sources. Sensitivity analyses show that projects with high thermal energy utilization and waste treatment fees are more resilient to power price fluctuations and policy changes, which strengthens their long-term viability [,].

The diversified revenue mix of Polish biogas plants is presented in Table 6, highlighting the relative shares of electricity, heat, waste treatment fees, and emerging income sources such as guarantees of origin and digestate valorization.

Table 6.

Revenue Structure of a Typical Agricultural Biogas Plant in Poland (CHP Mode).

Table 6 illustrates the multi-stream nature of revenue generation in Polish biogas plants. While electricity sales remain the dominant income source, waste treatment fees and heat sales can represent up to 40% of total revenues, significantly improving financial stability. The growing importance of guarantees of origin and digestate valorization reflects the sector’s alignment with circular economy objectives and EU climate policy. A diversified revenue mix mitigates market and regulatory risks, making biogas projects more attractive to investors and financial institutions.

In comparison with leading EU markets, Polish biogas plants still monetize heat to a lesser extent. In Germany, heat sales frequently account for 20–25% of total revenues, driven by a highly developed district heating infrastructure, whereas Denmark applies guaranteed heat tariffs that ensure attractive margins and incentivize nearly full thermal energy utilization []. This illustrates the untapped potential of heat valorization in Poland, which could further improve the profitability and environmental performance of CHP units.

Regulatory risk remains a significant factor for investors. As current support schemes (FIT/FIP) expire after 15 years, operators will need to develop new business models, including long-term power purchase agreements (PPAs) for biomethane or renewable electricity, merchant electricity sales, and participation in capacity markets to ensure revenue stability in a post-subsidy environment [].

Real-world experience confirms these dynamics. A recent case study of a 0.5 MW agricultural biogas plant in Greater Poland demonstrated that upgrading to biomethane and selling bio-CNG increased annual revenues by approximately 25%, primarily due to access to transport-sector incentives and higher unit margins compared with electricity sales []. This evidence suggests that upgrading investments may become a key lever for improving the financial viability of the sector and achieving EU biomethane targets under REPowerEU.

3.3. Environmental Benefits and Circular Economy Contribution

Biogas production provides significant environmental co-benefits, making it one of the most sustainable forms of renewable energy when designed and operated correctly. The primary contribution is methane emission reduction: anaerobic digestion captures methane that would otherwise be released from manure storage, landfills, and unmanaged organic waste streams. According to IEA Bioenergy [], each cubic meter of biogas generated from livestock manure can mitigate up to 2.7 kg CO2-eq of greenhouse gas emissions. For Poland, where agriculture accounts for over 8% of total GHG emissions, widespread deployment of agricultural biogas plants could reduce annual methane emissions by several million tonnes CO2-eq by 2030.

Combined heat and power (CHP) operation enhances the overall energy efficiency of biogas plants, often exceeding 70%, which helps displace fossil fuel consumption in both the power and heat sectors. This dual energy use improves the carbon intensity of local energy systems and contributes to national climate targets under the EU Effort Sharing Regulation.

Biogas plants also play a crucial role in waste management and nutrient recycling []. Anaerobic digestion stabilizes sewage sludge and organic waste, reducing odor, pathogen content, and disposal volumes. The resulting digestate is a nutrient-rich by-product that can substitute for mineral fertilizers, contributing to the EU Farm-to-Fork strategy’s goal of reducing synthetic fertilizer use by 20% by 2030 []. This is particularly relevant in Poland, where nutrient runoff from agriculture is a major contributor to water eutrophication.

Furthermore, biogas contributes to energy resilience and rural development by decentralizing energy production and providing new revenue streams for farmers and municipalities. Studies show that local biogas plants can create 5–7 permanent jobs per MW installed, supporting regional employment and knowledge transfer [].

From a life-cycle perspective, the carbon footprint of electricity from biogas can be as low as 50–80 g CO2-eq/kWh, substantially below the EU grid average []. When co-benefits from avoided methane emissions and nutrient recycling are included, the net climate impact can even become negative, making biogas a key enabler of a carbon-neutral and circular economy.

The main environmental benefits of biogas production are summarized in Table 6, which provides indicative quantitative ranges for GHG mitigation, nutrient recycling, and waste management impacts [].

Environmental benefits were quantified using a simplified life-cycle assessment (LCA) approach adapted to the Polish biogas sector. Three main impact categories were considered:

- (1)

- Reduction in greenhouse gas emissions (CO2 eq), calculated according to the RED II methodology based on avoided methane emissions and substitution of fossil fuels;

- (2)

- Energy recovery efficiency, measured as the ratio of usable biogas energy to total feedstock energy potential;

- (3)

- Nutrient recycling efficiency, based on digestate utilization rates in agricultural applications.

The composite environmental index (E_env) was calculated as:

where each component was normalized to a 0–1 scale.

Eenv = 0.5 × GHGred + 0.3 × Erec + 0.2 × NrecE_{env}

= 0.5 \times GHG_{red} + 0.3 \times E_{rec} + 0.2 \times N_{rec}Eenv

= 0.5 × GHGred + 0.3 × Erec + 0.2 × Nrec

= 0.5 \times GHG_{red} + 0.3 \times E_{rec} + 0.2 \times N_{rec}Eenv

= 0.5 × GHGred + 0.3 × Erec + 0.2 × Nrec

This model provides a comparative basis for evaluating the environmental performance of biogas installations.

Table 7 illustrates that biogas production delivers measurable environmental gains beyond renewable energy generation. The capture of methane from manure and landfills provides one of the most cost-effective GHG mitigation strategies available in the agricultural and waste sectors, while nutrient recycling through digestate use directly supports EU Farm-to-Fork and circular economy objectives. These combined effects position biogas as a cornerstone of Poland’s low-carbon transition, contributing simultaneously to climate policy, sustainable agriculture, and rural development.

Table 7.

Key Environmental Benefits of Biogas Production.

The analysis of economic and environmental aspects demonstrates that the Polish biogas sector has reached a level of maturity where its contribution to the national energy mix, GHG mitigation, and circular economy objectives is significant and measurable. The sector exhibits a diversified revenue structure, robust policy support mechanisms, and growing interest in biomethane upgrading, all of which improve its resilience and attractiveness for private investment []. At the same time, biogas production delivers tangible environmental co-benefits, including methane emission reduction, nutrient recycling, and rural development, positioning it as a cornerstone of Poland’s low-carbon transition [].

However, the continued expansion of the sector will depend on overcoming several systemic and market barriers. These include complex and time-consuming permitting procedures, limited availability of grid connection points, high capital intensity of upgrading projects, and competition for sustainable feedstock []. Moreover, the approaching end of the 15-year FIT/FIP support period for early projects raises questions about post-subsidy business models and long-term revenue stability.

Therefore, a comprehensive examination of barriers and enablers is essential to identify the most effective policy instruments and investment strategies for the 2030 horizon and beyond. The following section explores these challenges in detail, highlighting regulatory, economic, technological, and social dimensions, and outlining potential pathways to unlock Poland’s full biomethane potential in line with EU REPowerEU targets.

4. Conclusions: Potential and Future Perspectives for the Biogas Production Sector in Poland

4.1. Theoretical and Technical Potential of Biogas and Biomethane

Poland possesses one of the largest untapped biogas potentials in Central and Eastern Europe, making the sector strategically relevant for both energy security and climate objectives. According to the European Biogas Association [], the country’s theoretical biogas potential is estimated at 7–8 billion m3 of biomethane equivalent per year, derived from a combination of sources:

- -

- Agricultural residues—livestock manure and slurry represent more than 50% of the potential, offering a dual benefit of energy generation and methane emission mitigation.

- -

- Crop residues and catch crops—maize silage, straw, and other energy crops grown on marginal land could contribute another 20–30% of the potential, with careful management to avoid competition with food production [].

- -

- Agri-food industry waste—by-products from dairies, breweries, distilleries, and sugar refineries are highly suitable substrates due to their high methane yield, providing an opportunity for industrial symbiosis.

- -

- Municipal and sewage sludge streams—although smaller in absolute volume, they contribute a steady year-round feedstock base and support circular economy objectives [].

The technical potential, meaning the portion that is economically and technologically feasible under present market and regulatory conditions, is currently estimated at 3–4 billion m3 of biomethane per year, equivalent to 10–12% of Poland’s natural gas consumption in 2024 []. Achieving even this technical potential would have a transformative impact: displacing imported fossil gas, reducing national GHG emissions by several million tons of CO2-equivalent annually, and strengthening rural economies.

Realizing this potential would require:

- -

- Capacity expansion—scaling up from the current 300 MW installed capacity to at least 700–800 MW by 2030, implying a near tripling of current output [].

- -

- Biogas upgrading deployment—widespread installation of PSA, membrane, water and amine scrubbing units to produce grid-quality biomethane, enabling gas grid injection and use in transport as bio-CNG and bio-LNG [].

- -

- Grid integration and infrastructure—building new biomethane injection points, especially in rural areas, and introducing standardized quality and metering requirements [].

- -

- Technological optimization—implementing high-rate anaerobic digestion, thermal hydrolysis, and AI/IoT-driven process control to increase methane yield and reduce operational costs [].

Benchmarking against the EU highlights the size of this opportunity. Germany, the European leader, operates over 9000 biogas plants with more than 5 GW of installed capacity and produces more than 12 billion m3 of biogas annually []. Even reaching half of Germany’s per capita capacity would require Poland to double its current output and install several hundred new facilities.

From a strategic perspective, the development of Poland’s biogas potential aligns with multiple policy objectives []:

- -

- Energy security—reducing dependence on imported natural gas, especially in the context of geopolitical instability.

- -

- Climate action—contributing to Fit for 55 and the Methane Strategy by avoiding fugitive methane emissions from agriculture and landfills.

- -

- Circular economy—enabling nutrient recycling and waste management solutions that reduce environmental burdens.

Table 8 highlights that while Poland’s theoretical biomethane potential is substantial—estimated at 7–8 billion m3 annually—only about half of this volume is currently technically and economically feasible under prevailing conditions, mainly due to logistical constraints in feedstock collection, insufficient gas grid injection capacity, and relatively high capital costs of upgrading units. Achieving the technical potential of 3.3–4.0 billion m3 per year could cover approximately 10–12% of Poland’s natural gas demand, significantly displacing imported fossil gas and thereby strengthening energy security, improving price resilience, and reducing greenhouse gas emissions.

Table 8.

Theoretical and Technical Potential of Biogas and Biomethane in Poland.

In the European context, Poland’s biogas sector remains underdeveloped relative to leaders such as Germany (over 9000 biogas plants and >5 GW installed capacity) and France (rapidly expanding biomethane injection projects). Nevertheless, Poland exhibits one of the fastest growth rates in Central and Eastern Europe. Bridging the gap with Western Europe will require coordinated action:

- -

- Accelerating permitting and standardizing biomethane grid injection rules;

- -

- Expanding rural gas grid infrastructure and injection hubs;

- -

- Creating long-term market signals through power purchase agreements (PPAs) and guarantees of origin;

- -

- Fostering innovation in modular and cost-efficient upgrading technologies.

If these measures are implemented, Poland could unlock its full biogas potential by 2030–2035, positioning itself as a regional leader in renewable gas production and a critical contributor to EU decarbonization targets under REPowerEU and Fit for 55. This strategic perspective provides the foundation for the next section, which explores the role of biogas in Poland’s energy transition and its integration into future low-carbon energy systems.

4.2. The Role of Biogas in Poland’s Energy Transition

Biogas and biomethane are uniquely positioned to play a systemic role in Poland’s energy transition, complementing intermittent renewables and supporting the country’s climate and energy security objectives. Unlike solar and wind power, which are variable by nature, biogas provides dispatchable, storable energy that can stabilize the electricity grid and offer flexibility services []. This is particularly important in Poland, where coal still accounted for nearly 70% of power generation in 2023 and where balancing capacity will be needed as coal-fired units are phased out under the National Energy and Climate Plan (NECP) and the EU’s Fit for 55 package.

From a policy perspective, the EU’s REPowerEU plan sets a target of 35 billion m3 of biomethane annually by 2030, effectively mainstreaming biomethane as a pillar of European energy security []. For Poland, achieving its proportional share-estimated at 2.5–3.0 billion m3 per year—would require nearly tripling current production levels and deploying widespread upgrading and grid injection infrastructure []. This would contribute to reducing Poland’s dependence on imported natural gas, particularly LNG and pipeline supplies, which remain subject to price volatility and geopolitical risks.

Biogas also supports the decarbonization of hard-to-abate sectors. In transport, biomethane can be used as bio-CNG or bio-LNG, providing a near drop-in solution for heavy-duty trucks, municipal bus fleets, and maritime applications []. In industry, biomethane offers a renewable substitute for natural gas in high-temperature processes where electrification is not yet cost-competitive. Moreover, the combined heat and power (CHP) operation of biogas plants can supply low-carbon heat to district heating networks, which are still largely coal-dependent in many Polish cities.

Integration with other renewables further enhances the systemic value of biogas. Hybrid projects combining biogas CHP with solar PV, wind, and battery storage can create local microgrids capable of providing frequency regulation, peak shaving, and black-start capabilities. This aligns with Poland’s strategy to develop distributed energy resources (DER) and smart grids, as outlined in the Polish Energy Policy 2040 [].

In summary, biogas is more than just a waste-to-energy solution—it is a strategic enabler of Poland’s low-carbon transformation. By providing dispatchable renewable energy, replacing fossil gas, and integrating with other renewables, it can simultaneously advance multiple policy priorities: greenhouse gas reduction, energy system resilience, circular economy development, and rural economic revitalization.

Table 9 illustrates that biogas plays a multi-dimensional role in Poland’s energy transition. Beyond electricity generation, its systemic value [] lies in decarbonizing heat and transport, stabilizing the power grid, and providing local solutions for waste management and nutrient recycling. This broad applicability strengthens its position as a cornerstone of Poland’s pathway to meet Fit for 55 and REPowerEU targets.

Table 9.

Key Contributions of Biogas to Poland’s Energy Transition.

4.3. Future Development Pathways and Scenarios

The future trajectory of Poland’s biogas and biomethane sector will be shaped by a combination of regulatory stability, market signals, infrastructure development, and technological innovation. Scenario analysis provides a valuable framework for understanding how different levels of policy ambition and investment could influence sector growth, helping policymakers and investors make informed decisions in line with the EU’s 2030 and 2050 decarbonization objective [].

Three indicative scenarios—Optimistic, Baseline (Moderate), and Constrained—are presented to illustrate possible development pathways [].

In the Optimistic Scenario, Poland fully aligns with the REPowerEU biomethane target, achieving 3.5–4.0 billion m3 of biomethane production annually by 2030. This outcome would be driven by streamlined permitting procedures, expanded biomethane grid injection infrastructure, and stable long-term support mechanisms such as power purchase agreements (PPAs) and harmonized guarantees of origin (GoO). The number of biogas plants would exceed 700 by 2030, with agricultural biomethane hubs and hybrid projects integrating CHP, solar PV, and energy storage becoming the norm. By 2050, Poland could reach near-technical potential, covering 15–20% of its gas demand and making a major contribution to national and EU climate neutrality goals.

The Baseline Scenario assumes moderate but steady growth under the current policy environment, with gradual grid investments and incremental deployment of upgrading technologies. Biomethane production would rise to 2.0–2.5 billion m3 by 2030—equivalent to 6–8% of gas demand—and would continue expanding toward 70–80% of technical potential by 2050. Growth would be led by agricultural biogas and wastewater co-digestion projects, but progress would be constrained by administrative barriers, financing limitations, and slower development of injection points in rural areas [,].

Finally, the Constrained Scenario depicts a future in which regulatory uncertainty and the expiration of FIT/FIP schemes after 15 years result in a slowdown of investment. Biomethane production would reach only 1.2–1.5 billion m3 by 2030, leaving most of the technical potential untapped. Many operators would face challenges transitioning to merchant markets or securing new offtake contracts, and Poland would remain heavily dependent on imported fossil gas, exposing the economy to energy price shocks and geopolitical risks.

Table 10 highlights that achieving the optimistic scenario would nearly triple Poland’s biomethane production by 2030, positioning the country as a regional leader and aligning its output with its proportional share of the REPowerEU target. The baseline trajectory reflects steady progress but risks leaving a significant portion of available feedstock resources unexploited. The constrained scenario underlines the risk of underinvestment and regulatory inertia, potentially delaying Poland’s ability to meet EU climate goals and exposing the energy system to external supply shocks.

Table 10.

Scenarios for Biogas and Biomethane Development in Poland (2030 and 2050).

4.4. Barriers to Development and Recommendations

Despite the promising potential of biogas and biomethane in Poland, several barriers still hinder the full-scale deployment of the sector. These obstacles can be grouped into regulatory, economic, technological, infrastructural, and social dimensions.

- -

- Regulatory and Administrative Barriers.

Lengthy and complex permitting procedures remain one of the key challenges for investors. According to industry surveys, obtaining all necessary permits for a new agricultural biogas plant can take up to 18–24 months, significantly delaying project implementation []. Moreover, the lack of standardized biomethane quality and metering rules across distribution system operators (DSOs) creates additional uncertainty for investors planning grid injection. Another challenge is the absence of long-term, predictable support beyond the 15-year FIT/FIP period, raising concerns about the viability of projects after the support scheme expires.

- -

- Economic and Financial Barriers.

The high capital intensity of biogas projects, particularly for upgrading and grid connection, poses a financing challenge for small and medium-sized farms. CAPEX for biomethane plants typically ranges from €4000–6000 per kW of installed capacity, which limits participation to well-capitalized investors or consortia []. Limited access to low-interest loans and risk-sharing instruments further constrains sector development. In addition, substrate competition (e.g., maize silage prices) and volatility in gate fees can undermine project profitability.

- -

- Technological and Infrastructure Barriers.

Although mature technologies for anaerobic digestion and CHP exist, biogas upgrading and grid injection infrastructure remain underdeveloped. Only a few pilot biomethane injection points were operational in Poland as of 2024, limiting market access for producers []. Moreover, a lack of seasonal biomethane storage and limited interconnection capacity between local distribution networks impede the integration of higher volumes of renewable gas.

- -

- Social and Environmental Barriers.

Local opposition (NIMBY effect) to large-scale biogas plants is observed in some regions, driven by concerns about odor, increased traffic, and landscape changes. There are also environmental concerns about potential monocultures for energy crops (e.g., maize silage), which may affect biodiversity and soil health if not properly managed [].

- -

- Recommendations for Policy and Practice

To overcome these barriers and unlock Poland’s biogas potential, several measures are recommended:

- Regulatory Streamlining: Introduce a one-stop-shop permitting system and harmonize biomethane quality and metering rules across DSOs to reduce administrative burden and investor risk.

- Stable Support Framework: Extend support schemes or introduce market-based instruments such as long-term PPAs for biomethane and renewable electricity to provide post-FIT/FIP revenue stability.

- Infrastructure Investment: Expand rural gas grid connections, create regional biomethane hubs, and invest in seasonal gas storage solutions.

- Financial Support: Increase access to preferential loans, guarantees, and EU funds targeting small- and medium-sized farms. Consider CAPEX subsidies for upgrading units to accelerate biomethane deployment.

- Technological Innovation: Promote digitalization, predictive maintenance, and modular upgrading systems to lower OPEX and CAPEX.

- Social Engagement: Develop community-benefit schemes and transparent communication strategies to improve local acceptance and highlight co-benefits such as job creation and odor reduction.

- Environmental Safeguards: Encourage sustainable feedstock sourcing, crop rotation practices, and digestate management plans to prevent negative environmental impacts.

Table 10 summarizes the main regulatory, economic, technological, and social barriers to biogas sector development in Poland, together with recommended solutions to accelerate market growth and align with EU biomethane targets

Table 11 shows that the most critical barriers remain regulatory—especially lengthy permitting procedures and fragmented grid connection rules—and financial, as high CAPEX and limited access to affordable financing constrain new investments. Addressing these challenges through streamlined permitting, standardized biomethane injection regulations, and targeted financial instruments should be the priority for policymakers. Technological innovation and public engagement can then amplify these efforts, enabling faster deployment of biogas plants and supporting Poland’s contribution to REPowerEU and Fit for 55 targets.

Table 11.

Barriers and Recommended Solutions for Biogas Sector Development in Poland.

4.5. Key Findings of the Review

The analysis revealed that management challenges in Poland’s biogas sector differ in severity and systemic impact. The priority ranking of barriers is as follows:

- (1)

- Policy and regulatory barriers—due to unstable support mechanisms, lengthy permitting procedures, and frequent legislative changes;

- (2)

- Economic barriers—related to feedstock price volatility, limited access to long-term financing, and low profitability of small-scale plants;

- (3)

- Technological barriers—concerning upgrading technology costs and grid interconnection constraints; and

- (4)

- Social barriers—primarily low public awareness and limited stakeholder cooperation.

Moreover, the analysis of the diversified revenue model (Section 3) confirms that feedstock price volatility and revenue instability are core components of the economic barrier category, directly affecting managerial decision-making, risk perception, and the overall investment climate in the Polish biogas industry.

Author Contributions

Conceptualization, S.Z., E.C.-P., K.Ć. and P.B.; methodology, S.Z. and E.C.-P.; validation, K.Ć. and P.B.; formal analysis, S.Z. and K.Ć.; resources, S.Z. and K.Ć.; data curation, P.B.; writing—original draft preparation, S.Z. and E.C.-P.; writing—review and editing, E.C.-P. and P.B.; supervision, E.C.-P. and P.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Wang, Y.; Li, Y.; Yao, L.; Fu, L.; Liu, Z. The Biogas Production Potential and Community Structure Characteristics of the Co-Digestion of Dairy Manure and Tomato Residues. Agronomy 2024, 14, 881. [Google Scholar] [CrossRef]

- Jin, W.Y.; Xu, X.C.; Yang, F.L.; Li, C.L.; Zhou, M. Performance enhancement by rumen cultures in anaerobic co-digestion of corn straw with pig manure. Biomass Bioenergy 2018, 115, 120–129. [Google Scholar] [CrossRef]

- Korberg, A.D.; Skov, I.R.; Mathiesen, B.V. The role of biogas and biogas-derived fuels in a 100% renewable energy system in Denmark. Energy 2020, 199, 117426. [Google Scholar] [CrossRef]

- Li, Y.Y.; Manandhar, A.; Li, G.X.; Shah, A. Life cycle assessment of integrated solid state anaerobic digestion and composting for on-farm organic residues treatment. Waste Manag. 2018, 76, 294–305. [Google Scholar] [CrossRef]

- Li, C.X.; Champagne, P.; Anderson, B.C. Evaluating and modeling biogas production from municipal fat, oil, and grease and synthetic kitchen waste in anaerobic co-digestions. Bioresour. Technol. 2011, 102, 9471–9480. [Google Scholar] [CrossRef]

- Bond, T.; Templeton, M.R. History and future of domestic biogas plants in the developing world. Energy Sustain. Dev. 2011, 15, 347–354. [Google Scholar] [CrossRef]

- Bhat, P.R.; Chanakya, H.N.; Ravindranath, N.H. Biogas plant dissemination: Success story of Sirsi, India. Energy Sustain. Dev. 2001, 5, 39–46. [Google Scholar] [CrossRef]

- Uranga-Valencia, L.P.; Pérez-Álvarez, S.; Gabriel-Parra, R.; Chávez-Medina, J.A.; Magallanes-Tapia, M.A.; Sánchez-Chávez, E.; Muñoz-Márquez, E.; García-García, S.A.; Rascón-Solano, J.; Castruita-Esparza, L.U. Biogas Production from Organic Waste in the Forestry and Agricultural Context: Challenges and Solutions for a Sustainable Future. Energies 2025, 18, 3174. [Google Scholar] [CrossRef]

- Wang, Z.; Sanusi, I.A.; Wang, J.; Ye, X.; Kana, E.B.G.; Olaniran, A.O.; Shao, H. Developments and Prospects of Farmland Application of Biogas Slurry in China—A Review. Microorganisms 2023, 11, 2675. [Google Scholar] [CrossRef]

- Perea-Moreno, M.A.; Samerón-Manzano, E.; Perea-Moreno, A.J. Biomass as renewable energy: Worldwide research trends. Sustainability 2019, 11, 863. [Google Scholar] [CrossRef]

- Mmusi, K.; Mudiwa, J.; Rakgati, E.; Vishwanathan, V. Biogas a Sustainable Source of Clean Energy in Sub Saharan Africa: Challenges and Opportunities. J. Appl. Mater. Sci. Eng. Res. 2021, 5, 7–12. [Google Scholar]

- Bai, D.; Jain, V.; Tripathi, M.; Ali, S.A.; Shabbir, M.S.; Mohamed, M.A.; Ramos-Meza, C.S. Performance of biogas plant analysis and policy implications: Evidence from the commercial sources. Energy Policy 2022, 169, 113173. [Google Scholar] [CrossRef]

- Bhatt, A.H.; Tao, L. Economic perspectives of biogas production via AD. Bioengineering 2020, 7, 74. [Google Scholar] [CrossRef]

- Velásquez-Piñas, J.A.; Calle-Roalcaba, O.D.; Miramontes-Martínez, L.R.; Alonso-Gómez, L.A. Economic and environmental assessment of biogas utilization technologies and perspectives of multicriteria analysis. ION J. 2023, 36, 29–47. [Google Scholar]

- Cervi, R.G.; Esperancini, M.S.; Bueno, O.D.C. Economic Viability of using Biogas for Electrical Power Generation. Inf. Technol. 2011, 22, 3–14. [Google Scholar]

- Yu, X.; Yan, L.; Wang, H.; Bi, S.; Zhang, F.; Huang, S.; Wang, Y.; Wang, Y. Anaerobic co-digestion of cabbage waste and cattle manure: Effect of mixing ratio and hydraulic retention time. Renew. Energy 2024, 221, 119743. [Google Scholar] [CrossRef]

- Saracevic, E.; Frühauf, S.; Miltner, A.; Karnpakdee, K.; Munk, B.; Lebuhn, M.; Wlcek, B.; Leber, J.; Lizasoain, J.; Friedl, A.; et al. Utilization of food and agricultural residues for a flexible biogas production: Process stability and effects on needed biogas storage capacities. Energies 2019, 12, 2678. [Google Scholar] [CrossRef]

- Abbas, Y.; Yun, S.; Mehmood, A.; Shah, F.A.; Wang, K.; Eldin, E.T.; Al-Qahtani, W.H.; Ali, S.; Bocchetta, P. Co-digestion of cow manure and food waste for biogas enhancement and nutrients revival in bio-circular economy. Chemosphere 2023, 311, 137018. [Google Scholar] [CrossRef]

- Mlaik, N.; Sayadi, S.; Masmoudi, M.A.; Yaacoubi, D.; Loukil, S.; Khoufi, S. Optimization of anaerobic co-digestion of fruit and vegetable waste with animal manure feedstocks using mixture design. Biomass Convers. Biorefinery 2024, 14, 4007–4016. [Google Scholar] [CrossRef]

- Nevzorova, T.; Kutcherov, V. Barriers to the wider implementation of biogas as a source of energy: A state-of-the-art review. Energy Strategy Rev. 2019, 26, 100414. [Google Scholar] [CrossRef]

- Scarlat, N.; Dallemand, J.F.; Fahl, F. Biogas: Developments and perspectives in Europe. Renew. Energy 2018, 129, 457–472. [Google Scholar] [CrossRef]

- Capodaglio, A.G.; Callegari, A.; Lope, M.V. European framework for the diffusion of biogas uses: Emerging technologies, acceptance, incentive strategies, and institutional–regulatory support. Sustainability 2016, 8, 298. [Google Scholar] [CrossRef]

- Alayi, R.; Shamel, A.; Kasaeian, A.; Harasii, H.; Topchlar, M.A. The role of biogas to sustainable development (aspects environmental, security and economic). J. Chem. Pharm. Res. 2016, 8, 112–118. [Google Scholar]

- Kiselev, A.; Magaril, E.; Magaril, R.; Panepinto, D.; Ravina, M.; Zanetti, M.C. Towards circular economy: Evaluation of sewage sludge biogas solutions. Resources 2019, 8, 91. [Google Scholar] [CrossRef]

- REPowerEU Plan; European Commission: Brussels, Belgium, 2022. Available online: https://commission.europa.eu/topics/energy/repowereu_en (accessed on 1 October 2025).

- Thrän, D.; Deprie, K.; Dotzauer, M.; Kornatz, P.; Nelles, M.; Radtke, K.S.; Schindler, H. The potential contribution of biogas to the security of gas supply in Germany. Energy Sustain. Soc. 2023, 13, 12. [Google Scholar] [CrossRef]

- Energy Regulatory Office (URE). National Energy Market Report 2024; URE: Warsaw, Poland, 2024. Available online: https://www.ure.gov.pl/en/about-us/reports/67,Reports.html (accessed on 29 September 2025).

- Eurostat. Renewable Energy Statistics–2024 Edition; Publications Office of the European Union: Luxembourg, 2024; Available online: https://ec.europa.eu/eurostat/web/interactive-publications/energy-2024 (accessed on 4 October 2025).

- European Biogas Association. EBA Statistical Report 2024; EBA: Brussels, Belgium, 2024; Available online: https://www.europeanbiogas.eu/wp-content/uploads/2024/12/EBA_stats_report_complete_241204_preview.pdf (accessed on 3 October 2025).

- National Fund for Environmental Protection and Water Management (NFOŚiGW). Annual Report 2023; NFOŚiGW: Warsaw, Poland, 2023. Available online: https://www.gov.pl/web/nfosigw/sprawozdanie-z-dzialalnosci-nfosigw-w-roku-2023 (accessed on 29 September 2025).

- National Support Centre for Agriculture (KOWR). Bioenergy Market Report 2025; National Support Centre for Agriculture (KOWR): Warsaw, Poland, 2025. Available online: https://www.gov.pl/web/kowr/odnawialne-zrodla-energii (accessed on 30 September 2025).

- Kowalska, M.; Chomać-Pierzecka, E. Sustainable Development Through the Lens of Climate Change: A Diagnosis of Attitudes in Southeastern Rural Poland. Sustainability 2025, 17, 5568. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Renewable Capacity Statistics 2023; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2023; Available online: https://www.irena.org/Publications/2023/Mar/Renewable-capacity-statistics-2023 (accessed on 4 October 2025).

- Polish Biogas Association. Biogas Market in Poland 2024; Polish Biogas Association: Warsaw, Poland, 2024; Available online: https://bioch4.org/en/forum-en-copy/ (accessed on 1 October 2025).

- PwC. Energy Transformation in Poland 2024; PwC: Warsaw, Poland, 2024; Available online: https://www.pwc.pl/pl/o-nas/raport-zrownowazonego-rozwoju-pwc-polska-2024.html (accessed on 4 October 2025).

- Szymańska, D.; Lewandowska, A. Biogas power plants in Poland—Structure, capacity, and spatial distribution. Sustainability 2015, 7, 16801–16819. [Google Scholar] [CrossRef]

- Bednarek, A.; Klepacka, A.M.; Siudek, A. Development barriers of agricultural biogas plants in Poland. Econ. Environ. 2023, 1, 229–258. [Google Scholar] [CrossRef]

- Scarlat, N.; Fahl, F.; Dallemand, J.-F.; Monforti, F.; Motola, V. A spatial analysis of biogas potential from manure in Europe. Renew. Sustain. Energy Rev. 2018, 94, 915–930. [Google Scholar] [CrossRef]

- IEA Bioenergy. Task 37: Country Reports Summary 2023. Available online: https://task37.ieabioenergy.com/country-reports/ (accessed on 3 October 2025).

- D’Adamo, I.; Ribichini, M.; Tsagarakis, K.P. Biomethane as an energy resource for achieving sustainable production: Economic assessments and policy implications. Sustain. Prod. Consum. 2023, 35, 13–27. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; The PRISMA Group. Preferred Reporting Items for Systematic Reviews and Meta Analyses: The PRISMA Statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef]

- Bała, M.M.; Leśniak, W.; Jaeschke, R. Process of developing systematic reviews, including Cochrane reviews. Pol. Arch. Med. Wewn. 2015, 125, 16–25. Available online: https://bm.cm.uj.edu.pl/cm/uploads/2021/04/Proces-przygotowywania-przegladow-systematycznych-z-uwzglednieniem-przegladow-Cochrane.pdf (accessed on 11 November 2025). [CrossRef] [PubMed]

- Central Statistical Office of Poland (GUS). Statistical Yearbook of the Republic of Poland 2024; Central Statistical Office of Poland (GUS): Warsaw, Poland, 2024. Available online: https://stat.gov.pl/en/topics/statistical-yearbooks/statistical-yearbooks/statistical-yearbook-of-the-republic-of-poland-2024,2,26.html (accessed on 30 September 2025).

- Biogas and biomethane in Poland 2024 Report. Available online: https://magazynbiomasa.pl/pobierz-raport-biogaz-i-biometan-w-polsce-2024/ (accessed on 30 September 2025).

- Zupok, S.; Chomać-Pierzecka, E.; Dmowski, A.; Dyrka, S.; Hordyj, A. A Review of Key Factors Shaping the Development of the U.S. Wind Energy Market in the Context of Contemporary Challenges. Energies 2025, 18, 4224. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E. Innovation as an Attribute of the Sustainable Development of Pharmaceutical Companies. Sustainability 2025, 17, 2417. [Google Scholar] [CrossRef]

- Mertins, A.; Wawer, T. How to use biogas?: A systematic review of biogas utilization pathways and business models. Bioresour. Bioprocess. 2022, 9, 59. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E.; Dyrka, S.; Kokiel, A.; Urbańczyk, E. Sustainable HR and Employee Psychological Well-Being in Shaping the Performance of a Business. Sustainability 2024, 16, 10913. [Google Scholar] [CrossRef]

- Brahmi, M.; Bruno, B.; Dhayal, K.S.; Esposito, L.; Parziale, A. From manure to megawatts: Navigating the sustainable innovation solution through biogas production from livestock waste for harnessing green energy for green economy. Heliyon 2024, 10, e34504. [Google Scholar] [CrossRef]

- European Commission. EU Energy Outlook 2023; European Commission: Brussels, Belgium, 2023. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ac_22_7677 (accessed on 30 September 2025).

- Lima, D.; Li, L.; Appleby, G. Biogas Production Modelling Based on a Semi-Continuous Feeding Operation in a Municipal Wastewater Treatment Plant. Energies 2025, 18, 1065. [Google Scholar] [CrossRef]

- Miranzadeh, M.B.; Jafarsalehi, M.; Akram, J.; Ebrahimi, M.; Mazaheri, A.; Mashayekh, M. Boosting biogas production in wastewater treatment plants: A narrative review on co-digestion of sewage sludge with internal and external organic waste. Bioresour. Technol. Rep. 2024, 26, 101856, ISSN 2589-014X. [Google Scholar] [CrossRef]

- López-Herrada, E.; Gallardo-Rodríguez, J.J.; López-Rosales, L.; Cerón-García, M.C.; Sánchez-Mirón, A.; García-Camacho, F. Life-cycle assessment of a microalgae-based fungicide under a biorefinery approach. Bioresour. Technol. 2023, 383, 129244. [Google Scholar] [CrossRef]

- Mukundan, S.; Xuan, J.; Dann, S.E.; Wagner, J.L. Highly active and magnetically recoverable heterogeneous catalyst for hydrothermal liquefaction of biomass into high quality bio-oil. Bioresour. Technol. 2023, 369, 128479. [Google Scholar] [CrossRef]

- Thaysen, E.M.; McMahon, S.; Strobel, G.J.; Butler, I.B.; Ngwenya, B.T.; Heinemann, N.; Wilkinson, M.; Hassanpouryouzband, A.; McDermott, C.I.; Edlmann, K. Estimating microbial growth and hydrogen consumption in hydrogen storage in porous media. Renew. Sustain. Energy Rev. 2021, 151, 111481. [Google Scholar] [CrossRef]

- Deublein, D.; Steinhauser, A. Biogas from Waste and Renewable Resources: An Introduction, 2nd ed.; Wiley-VCH: Weinheim, Germany, 2011. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook 2023; OECD/IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/world-energy-outlook-2023 (accessed on 1 October 2025).

- Kim, J.-C.; Huh, J.-H.; Ko, J.-S. Optimization Design and Test Bed of Fuzzy Control Rule Base for PV System MPPT in Micro Grid. Sustainability 2020, 12, 3763. [Google Scholar] [CrossRef]

- Hamman, P.; Dziebowski, A. Building an Agricultural Biogas Supply Chain in Europe: Organizational Models and Social Challenges. Sustainability 2025, 17, 5806. [Google Scholar] [CrossRef]

- Wellinger, A.; Murphy, J.; Baxter, D. (Eds.) The Biogas Handbook: Science, Production and Applications; Woodhead Publishing: London, UK, 2013. [Google Scholar] [CrossRef]

- Igliński, B.; Piechota, G.; Iwański, P.; Skarzatek, M.; Pilarski, G. 15 Years of the Polish Agricultural Biogas Plants: Their History, Current Status, Biogas Potential and Perspectives. Clean Technol. Environ. Pol. 2020, 22, 281–307. [Google Scholar] [CrossRef]

- Zupok, S. Innowacje jako element budowy wartości dla klienta–studium przypadku RCGW S.A. w Tychach. Zarz. Finans. 2017, 15, 375–387. [Google Scholar]

- Hosseini, M.; Leonenko, Y. A reliable model to predict the methane-hydrate equilibrium: An updated database and machine learning approach. Renew. Sustain. Energy Rev. 2023, 173, 113103. [Google Scholar] [CrossRef]

- Kęsy, I.; Godawa, S.; Błaszczak, B.; Chomać-Pierzecka, E. Human Safety in Light of the Economic, Social and Environmental Aspects of Sustainable Development—Determination of the Awareness of the Young Generation in Poland. Sustainability 2025, 17, 6190. [Google Scholar] [CrossRef]

- Chomać-Pierzecka, E. Economic, Environmental and Social Security in accordance with the Concept of Sustainable Development. Stud. Adm. Bezpiecz. 2025, 18, 257–272. [Google Scholar] [CrossRef]

- Baredar, P.; Khare, V.; Nema, S. Design and Optimization of Biogas Energy Systems; Academic Press: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Akash, M.A.H.; Hossain, M.S.; Islam, M.; Islam, K.S.; Islam, M.N.; Sony, S.Y. Optimization of methane production in anaerobic digestion: A hybrid approach using experimental analysis, process simulation and machine learning. Results Eng. 2025, 28, 107464. [Google Scholar] [CrossRef]