Abstract

The echelon utilization of electric vehicle batteries is regarded as an effective method for treating waste batteries, enabling the recycling and reuse of retired electric vehicle batteries. However, the efficiency of battery disassembly is a crucial factor that impacts the potential for battery recycling. When manufacturers take disassembly efficiency into account during the design phase of new electric vehicle batteries, they can significantly reduce disassembly costs at the time of decommissioning. This, in turn, incentivizes recycling and echelon utilization of waste batteries. Our research aims to promote the echelon use of waste batteries and analyze how market competition intensity and profits from battery echelon utilization influence decision-making within the battery recycling supply chain. This paper explores the effect of market competition on battery recycling and echelon utilization, while developing a supply chain model that includes a battery manufacturer responsible for determining the level of battery disassembly design and recycling waste batteries from the market, as well as a new energy vehicle manufacturer that focuses solely on recycling waste batteries. The findings indicate that as market competition increases, the battery manufacturer tends to lower both the level of battery disassembly design and the recycling price for waste batteries. Additionally, the recycling price for waste batteries offered by new energy vehicle manufacturers is also influenced by the intensity of market competition. In scenarios with low competition intensity, the recycling price tends to rise as competition intensifies. Conversely, in highly competitive markets, the recycling price decreases with increased competition. Furthermore, the overall volume of battery recycling is impacted by the intensity of market competition; in highly competitive markets, waste battery recycling is hindered. To enhance the echelon utilization of battery recycling, relevant government agencies should strive to maintain market competition at lower levels while also encouraging the recycling of batteries that do not meet usage standards. This dual approach will improve the benefits associated with the echelon utilization of waste batteries, thereby fostering greater enthusiasm for recycling among the involved enterprises.

1. Introduction

According to the China Association of Automobile Manufacturers (CAAM), the ownership of new energy vehicles in China was 1.09 million in 2016. Following years of rapid technological advancements and strong government support through preferential car purchasing policies, this number rose to 20.41 million by 2023. This rapid growth indicates a thriving new energy automobile industry in China, and the CAAM projects that future sales of new energy vehicles will continue to increase at a fast pace. However, this prosperity is overshadowed by the impending wave of battery retirements. It is estimated that by 2025, the cumulative volume of retired power batteries in China will reach 780,000 metric tons. The proper handling of these batteries presents a pressing challenge, as the current formal recycling rate remains below 25%, with a significant portion flowing into informal channels, posing serious environmental and safety risks [1]. As per national regulations, the vast majority of new energy vehicle manufacturers in China offer consumers a warranty service lasting eight years or up to 120,000 km. When the battery capacity of a new energy vehicle falls below 80%, it is deemed no longer suitable for use. Consequently, the upcoming period will see a significant uptick in the decommissioning of new energy vehicle batteries. To promote standardized development in the battery recycling and echelon utilization sector, China has established the “Administrative Measures for the Ladder Utilization of Power Batteries for New Energy Vehicles.” This initiative encourages manufacturers to design batteries that are easy to disassemble, facilitating their repurposing after decommissioning. In response to state directives, battery manufacturers are expected to increase their investments in disassembly design, which is also likely to lower the overall costs associated with battery recycling.

In light of these developments, the “Administrative Measures for Comprehensive Utilization of Power Batteries for New Energy Vehicles (Draft for Public Opinion)” issued by the Ministry of Industry and Information Technology on 15 December 2023, further clarifies regulations surrounding battery recycling and processing. These guidelines place the primary responsibility for recycling and processing used batteries on new energy vehicle manufacturers. As a result, we can anticipate a surge of battery recyclers entering the battery recycling industry, including battery manufacturers, third-party recyclers, and echelon utilization companies. For instance, Contemporary Amperex, which supplies batteries for Tesla, BMW, and other automobile companies, has established Guangdong Brunp Recycling to handle the recycling of used batteries. By 20 November 2023, 88 enterprises had been shortlisted in the first four batches of battery recycling companies announced by the Ministry of Industry and Information Technology of the People’s Republic of China. With the recent release of the “List of Standard Enterprises for Comprehensive Utilization of Waste Steel, Waste Paper, Waste Plastics, Waste Tires, New Energy Vehicles, and Waste Power Batteries,” issued by the Department of Energy Conservation and Comprehensive Utilization within the Ministry, an additional 68 enterprises have been added to this list. Looking ahead, it is clear that more and more companies will join the battery recycling and echelon utilization industry. An increasing number of companies are entering the battery recycling industry, which is heightening competition in both battery recycling and echelon utilization and exposing some core unresolved contradictions. While Extended Producer Responsibility (EPR) policies designate new energy vehicle manufacturers as the primary responsible entities, battery producers who possess core technologies and design capabilities are also critical participants. The absence of a clear game-theoretic framework to characterize their interactive decision-making often leads to market fragmentation and duplicative investment. Furthermore, in the context of battery recycling, intense competition does not necessarily translate into higher overall recovery rates. On the contrary, it may lead to speculative price wars and deter investment in eco-design, for example, design for battery disassembly, as companies prioritize short-term cost savings over long-term system efficiency. Consequently, the relationship between competition intensity and recycling efficiency is inherently nonlinear—a critical aspect that existing models fail to capture.

This paper considers competition intensity as a significant factor influencing the recycling behaviors of battery recycling companies. When market competition is low, the quantity of batteries recycled by these companies is less affected by their competitors’ actions. In other words, at the same recycling price, recycling companies can acquire and process more retired batteries from the market. Conversely, in a high-competition environment, the number of batteries recycled by companies is significantly influenced by their competitors. In such scenarios, even at the same recycling price, companies struggle to recycle as many retired batteries. Consequently, businesses operating within the battery recycling and echelon utilization sectors must carefully analyze the effects of market competition intensity. This assessment will enable them to make informed decisions aimed at maximizing their profits based on varying market conditions. Beyond assessing market competition intensity, another critical factor for companies in the battery recycling echelon utilization industry to consider is the profitability derived from recycled waste battery utilization. This profitability largely depends on the average quality of the batteries available for recycling; higher quality generally leads to greater profitability from echelon utilization. As battery recyclers recognize the potential profit associated with higher-quality batteries, they are likely to increase their recycling efforts to gather more waste batteries from the market. However, the actions of battery recycling companies are not straightforward when market intensity is taken into account. The competitive landscape makes it uncertain whether increased recycling efforts will indeed yield higher profits for the companies involved. Therefore, when evaluating these two key influencing factors, battery recycling enterprises must carefully balance their strategies to make optimal decisions.

To assist relevant recycling companies in making informed decisions that ensure their profitability, battery recycling companies should take into account the intensity of market competition within the battery recycling industry and the profit derived from the echelon utilization of unit waste batteries. In this paper, we establish a closed-loop supply chain that includes battery manufacturers, new energy vehicle manufacturers, precious metal recycling stations, and consumers. Each member of the supply chain aims to maximize profits while fulfilling the requirements of EPR.

The primary research questions addressed in this paper are as follows

- If a battery manufacturer opts for a disassembly design, should they join the battery recycling echelon utilization industry, and what impact will this choice have on their profits before and after joining?

- How will the intensity of market competition in the battery recycling sector and the profit from the echelon utilization of unit waste batteries influence the decision-making processes of battery manufacturers and new energy vehicle producers?

- What distinctions exist between the battery manufacturing and recycling decisions made by new energy vehicle manufacturers, and how do these choices affect the volume of batteries recycled in each scenario?

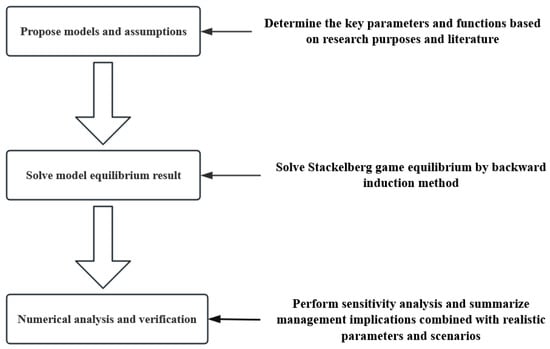

The rest of this paper is organized as follows. Section 2 reviews the existing literature relevant to the research in this paper. Section 3 introduces the model, symbols, and assumptions, and then analyzes the equilibrium decision. Section 4 verifies the research results through numerical analysis. Section 5 summarizes the research results and management significance, and outlines the potential future research directions. As is shown in Figure 1.

Figure 1.

Sequence of research.

2. Literature Review

This section reviews previous research in three primary categories: competition, government subsidies in closed-loop supply chains, and the management of new energy battery recycling and echelon utilization.

2.1. Battery Recycling and Echelon Utilization

With the growth of the electric vehicle industry, battery recycling has become an increasingly critical issue. Chen et al. [2] assessed the current state of new energy vehicle battery recycling in China and offered management recommendations for battery manufacturers, new energy vehicle manufacturers, and third-party recyclers in light of the challenges faced during the recycling and reuse processes. Zhang et al. [3] investigated the battery recycling dilemma across various channels, establishing decision-making models to analyze the equilibrium decisions in these channels. They highlighted the advantages and disadvantages associated with each channel and provided management insights on selecting optimal recycling channels based on differing conditions. Xu et al. [4] examined environmental and resource wastage issues in battery recycling and the echelon utilization of new energy vehicles under the extended producer responsibility framework, proposing management suggestions aimed at promoting sustainability within the electric vehicle sector. Feng et al. [5] analyzed the technical, policy, social, and economic contexts of the current battery recycling echelon and concluded that the existing recycling system is chaotic and costly; they offered several suggestions for improvement. Heydari et al. [6] simulated residential energy distribution, exploring the feasibility of reusing electric vehicle batteries for energy storage systems, and determined that this approach can reduce costs and alleviate pressure on the electrical grid. Further, Zhang et al. [7] reviewed central and local policies in China regarding the echelon utilization of waste batteries, noting that central policies emphasize echelon utilization and testing, while local policies focus on the collection stage. Similarly, Xu et al. [8] investigated the residual capacity and performance of retired batteries, finding that most retired power batteries retain around 77% capacity, making them suitable for applications such as energy storage. Zhang et al. [9] analyzed recycling channels for battery echelon utilization, concluding that collaboration among retailers, third-party recyclers, and echelon utilization companies results in the highest recycling rates. Xiao et al. [10] indicated that echelon utilization promotes effective resource usage and reviewed various echelon utilization methods for used batteries, particularly through a hierarchical analysis based on various battery indicators. Jiang et al. [11] recommended that electric vehicle batteries, which are retired due to diminished charging capacity, could be repurposed in low-demand areas. They proposed different regression methods to enhance the accuracy of remaining capacity assessments. Lai et al. [12] summarized the current state and challenges in waste battery management while offering relevant suggestions for addressing the technical challenges of waste battery classification. Additionally, Lai et al. [13] introduced a method utilizing machine learning algorithms for the rapid sequencing and recombination of waste batteries, demonstrating its effectiveness through simulation and experiments.

The aforementioned literature primarily illustrates the feasibility and benefits of battery echelon utilization. However, studies specifically addressing echelon utilization within a defined supply chain remain scarce. One notable study by Gu et al. [14] examined government subsidies in closed-loop supply chain models for battery recycling, concluding that subsidies should be contemplated primarily when battery capacity is significant or the remanufacturing rate is low. Yu et al. [15] explored decision-making in a closed-loop supply chain comprising battery manufacturers, recycling firms, and echelons, leveraging cost-sharing contracts to achieve better coordination in the recycling of decommissioned batteries. Zhao et al. [16] further investigated how the external environment influences the equilibrium decisions of waste battery echelons within a closed-loop supply chain, employing cost-sharing and profit-sharing contracts to enhance coordination.

However, most of these studies consider only a single recycling model, failing to adequately explore the endogenous decision-making interactions among different recycling entities within a competitive market environment.

2.2. Battery Disassembly Design

In recent years, the literature surrounding disassembly design has expanded to encompass battery disassembly. For instance, Lander et al. [17] conducted a comprehensive analysis of the battery disassembly process, offering design optimization recommendations to reduce time and costs. Chung et al. [18] explored how design decisions impact disassembly costs, particularly emphasizing that green product design significantly affects future disassembly expenses. Thompson et al. [19] investigated the recycling of lithium-ion batteries, concluding that modifications in battery design can enhance recycling effectiveness. Rosenberg et al. [20] employed hybrid battery disassembly experiments, integrating fuzzy logic methods to evaluate disassembly times and costs under uncertain conditions. Meng et al. [21] found that incorporating artificial intelligence in the disassembly design of electric batteries can lower disassembly costs, boost efficiency, and improve recycling profits. Lander et al. [17] further studied the effects of automatic battery disassembly, asserting that optimizing battery pack design during the battery disassembly phase is essential to fully harness the benefits of automatic disassembly and achieve a more streamlined workflow. Talens Peiro et al. [22] analyzed the relationship between battery design, battery longevity, and potential reuse, arguing that creating easily separable batteries facilitates repair, remanufacturing, and reuse. Da Silva et al. [23] contended that the overall market development influences stakeholder decisions, including considerations related to material benefits, raw material prices, recycling costs, availability, and overall material demand.

Numerous studies have demonstrated that effective battery disassembly design can enhance disassembly efficiency, lower associated costs, and boost the profits of recyclers. While these studies fully acknowledge the value of design for disassembly, they predominantly conceptualize it as a matter of technological or process optimization. A significant research gap lies in the failure to model the level of design for disassembly as an endogenous strategic decision variable for firms and to analyze how it is determined within the dynamic game of market competition.

2.3. Research on Market Competition Intensity

With the increasing number of decommissioned new energy vehicle batteries and the national support for waste battery echelon utilization development, the battery recycling industry is expected to become more standardized, leading to greater profits for recycling enterprises. Consequently, more battery manufacturers and echelon utilization companies are likely to engage in battery recycling activities. As this occurs, the intensity of market competition will continuously shift, becoming a critical factor influencing decision-making among related enterprises. Therefore, this paper summarizes the existing research on market competition intensity in this section.

He et al. [24] examined a supply chain consisting of multiple manufacturers and retailers, constructing both centralized and decentralized decision-making models to analyze how market competition intensity and demand fluctuations affect the decisions of manufacturers and retailers. Their findings indicate that robust market competition can motivate manufacturers and retailers to actively compete for market share, ultimately enhancing the overall profit of the supply chain. Deng et al. [25] explored decision-making behavior within two competing supply chains in a competitive environment, investigating how competition impacts product sustainability and profit strategies. They concluded that horizontal competition encourages enterprises to improve product sustainability and enhance supply chain profits, whereas vertical competition can hinder these advancements under certain conditions. Liu [26] studied how top management characteristics influence green supply chain management across a sample of 251 manufacturing firms in China, the United States, and Vietnam. The research also incorporated competition intensity to determine its moderating role in the relationship between green supply chain management and enterprise performance. Adida et al. [27] investigated quantity competition among multiple manufacturers in a supply chain, providing products to several risk-averse retailers competing based on uncertain consumer demand. Their results showed that increased manufacturer competition can enhance product differentiation to better meet consumer needs and improve profits. Mahapatra et al. [28] analyzed the impact of competition intensity on supplier development and relationship initiatives, considering the product life cycle as a moderating factor influencing the interplay between competition intensity, supplier development, relationship initiatives, and supplier capability. Anderson et al. [29] looked at the effects of price competition on the supply chain, comparing centralized and decentralized decision-making scenarios among distribution channels. They explored how varying levels of price competition affect the profits of industry participants and highlighted the critical role of market share allocation, demonstrating that the sharing coefficient of market shares dictates whether a decentralized supply chain outperforms its centralized counterpart at suitable competition levels. Bian et al. [30] focused on manufacturer-retailer bilateral information sharing in competing supply chains, where both parties provided partial information on demand. Their findings revealed that, within a competitive market environment, voluntary sharing of demand forecasts benefits manufacturers while disadvantaging retailers, with the overall profit of the supply chain dependent on competition intensity and prediction accuracy.

Nevertheless, existing research on competitive intensity has still not systematically incorporated this variable into the decision-making models of the battery recycling supply chain.

By reviewing relevant literature and aligning it with practical realities, Section 4 investigates how market competition intensity affects the battery recycling supply chain. To visually demonstrate the innovations and breakthroughs of this study compared to existing literature, Table 1 systematically compares the key aspects between prior research and this work.

Table 1.

A brief literature review.

3. Model Description and Construction

3.1. Problem Description

This paper examines a supply chain comprising a battery manufacturer and a new energy vehicle manufacturer. Within the battery recycling supply chain, the new energy vehicle manufacturer is tasked with recycling used batteries from electric vehicles to fulfill its EPR obligations. The battery manufacturer designs and produces the batteries, selling them to the new energy vehicle manufacturer, which in turn uses these batteries for electric vehicle production and sells the finished vehicles to consumers.

In addition to producing batteries, battery manufacturers also engage in recycling used batteries from consumers, allowing them to create more value. The intensity of market competition is primarily driven by the recycling prices set by both battery manufacturers and new energy vehicle manufacturers. Beyond the factor of recycling prices, competition is also influenced by other elements such as recycling advertising and convenience. To enable a calculable model and simplify the calculation process, this paper primarily incorporates these factors into the market competitive intensity coefficient.

Recycled waste batteries are categorized into three distinct types. The first type consists of used batteries that meet the standards for echelon usage and can be reused by the battery manufacturer. The second type includes batteries that do not meet these standards; new energy vehicle manufacturers will sell these to battery manufacturers after the second type of batteries has undergone echelon utilization. The third type encompasses both used batteries that have been through echelon utilization and those that do not meet echelon utilization standards, which will be processed and sold to battery manufacturers by the electric vehicle manufacturers.

We employ a Stackelberg game theoretic approach to model the decision-making process, with the battery manufacturer acting as the leader and the new energy vehicle manufacturer as the follower. Utilizing the traditional complete information dynamic game approach, we derive the decision-making outcomes for each party under equilibrium conditions and analyze how various parameters influence supply chain decisions using control variables.

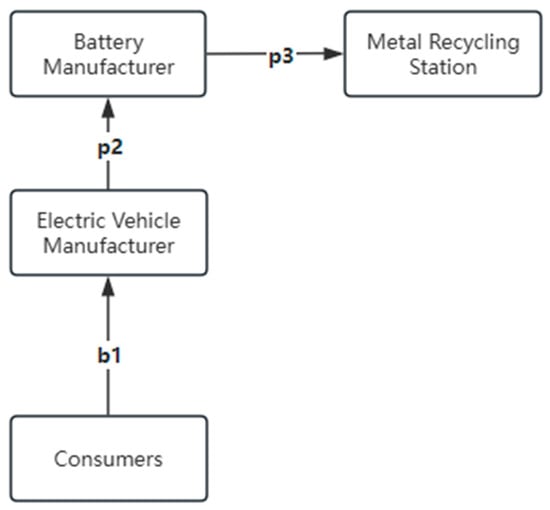

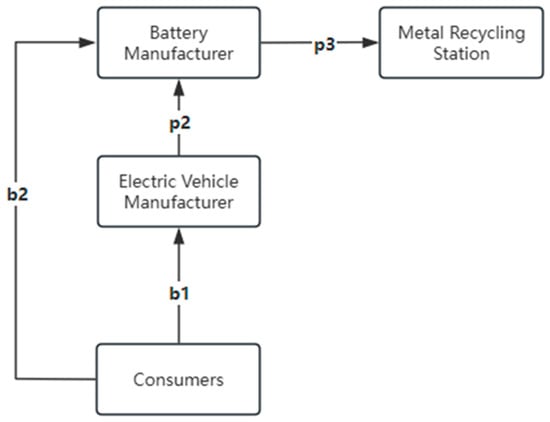

The innovation of this study lies in integrating market competition intensity, battery disassembly design, and the profit from the echelon utilization of unit waste batteries into the battery recycling echelon utilization supply chain. Two models are developed in this paper: the first model describes a scenario where battery manufacturers do not partake in the battery recycling business, while the second model illustrates the situation when the battery manufacturer gets involved in the recycling process. The decision flowcharts for both companies are presented in Figure 2 and Figure 3.

Figure 2.

Decision diagram of the first model, where means unit price of waste battery recycling of new energy vehicle manufacturers, means battery manufacturer repurchase price and means unit retail price of the third type of old battery.

Figure 3.

Decision diagram of the second model, where means unit price of waste battery recycling of new energy vehicle manufacturers, means battery manufacturer waste battery recycling unit price, means battery manufacturer repurchase price and means unit retail price of the third type of old battery.

As illustrated in the decentralized decision model in Figure 2, the battery recycling segment is indicated by a dotted line. There are two primary reasons for excluding the production and sales of batteries from consideration. First, when new energy vehicles are sold to consumers, the ownership of the batteries also transfers to the consumers. In turn, these consumers are generally more inclined to sell the batteries to recycling companies that offer higher recycling prices for waste batteries. This behavior does not impact battery sales. Consequently, the wholesale price, retail price, sales volume of new energy vehicles, and profits for both parties under the two models remain unchanged, allowing us to simplify the calculation process by excluding the production and sales of batteries altogether.

In the battery recycling process, the battery manufacturer first determines that the new energy vehicle manufacturer will recycle the waste battery after its echelon utilization from the new energy vehicle manufacturer at the recycling price . Following this, the new energy vehicle manufacturer decides to recycle waste batteries from the consumer at the recycling price b. The flow of the batteries specifically involves the new energy vehicle manufacturer recycling waste batteries at the recycling price b for echelon utilization. The waste batteries, after echelon utilization, will be sold to the battery manufacturer at the recycling price . The battery manufacturer will then process all the waste batteries for metal recovery and subsequently sell them to the metal recycling station at the price of .

In the decentralized decision-making model shown in Figure 3, the dotted line represents the battery recycling process. Unlike the first model, the battery manufacturer also participates in the waste battery recycling process to maximize profits. Here, the battery manufacturer first decides that the new energy vehicle manufacturer will recycle the secondary used batteries from their fleet at the recycling price , and also recycle retired batteries from consumers at the recycling price . Subsequently, the new energy vehicle manufacturer will decide to recover batteries from consumers at the recycling price . The overall battery flow process forms part of the market dynamics. Decommissioned waste batteries are echelon utilized by new energy vehicle manufacturers who recycle the waste batteries at a recycling price . The used batteries are then sold to the battery manufacturers at price . Additionally, some retired used batteries are recycled by consumers at a recycling price , facilitated by battery manufacturing. Finally, the battery manufacturer will process all used batteries for metal recovery and then sell them to the metal recycling station at a price of .

The relevant symbols and their definitions are shown in Table 2.

Table 2.

Symbols and Decision Variables.

To make the model more convenient for calculation and confirm the actual situation, this paper consults the relevant references and makes the following assumptions.

Assumption 1:

The actual number of waste batteries recycled by new energy vehicle manufacturers is affected by the unit recycling price of their waste batteries and the unit recycling price of the battery manufacturer . The quantity of waste batteries recycled by battery manufacturers from the market is also affected by the unit recycling price of their waste batteries and the unit recycling price of the new energy vehicle manufacturer and the unit recycling price of used batteries recovered by new energy vehicle manufacturers . By referring to the relevant literature, we conceptualize primarily as a price elasticity of substitution between recycling channels. Specifically, it quantifies how the quantity of batteries recycled by one enterprise decreases when its competitor increases its recycling price. A higher λ indicates a more competitive market where consumers are highly sensitive to price differences, and recycling volumes are easily contested between manufacturers. This paper obtains the following demand function [16].

Assumption 2:

The disassembly design of the battery manufacturer will not affect the cost of the battery production process, but it will increase the investment cost of the battery design, and it will also affect the disassembly cost in the waste battery recycling process. The cost of a new battery design is in the form of design investment and cost function , where is the product design level and is the product design investment cost coefficient [35].

Assumption 3:

It is assumed that the proportion of waste batteries that meet the echelon use standard is , and the waste batteries that meet the echelon use standard can obtain unit profit . This paper further assumes that the recycling range of batteries is limited, so the first type of waste batteries and the second type of waste batteries can coexist in the recycling process. For new energy vehicle manufacturers, the expected unit net income from the use of batteries is [9].

Assumption 4:

To ensure that the benefits obtained by new energy vehicle manufacturers in recycling waste batteries can be greater than the costs paid and that battery manufacturers can obtain benefits from the disposal of waste batteries, this paper makes the following assumptions.

3.2. Modeling

The first case is when the battery manufacturer does not recycle retired batteries from the consumer, the profit on battery manufacturers is:

The first item is the total cost of the battery disassembly design, and the second item is the profit from the repurchasing of waste batteries from new energy vehicle manufacturers and the disposal and sale to metal recycling stations.

The profit on new energy vehicle manufacturers is:

Since the sales segment of new energy vehicles is not considered, the total profit of new energy vehicle manufacturers is the profit made from recycling waste batteries from consumers and re-selling them to battery manufacturers.

The second case is when the battery manufacturer recycles the retired batteries of new energy vehicles from consumers, the profit on battery manufacturers is:

The first and second items of the profit model for the battery manufacturer are the same as in the first case. The difference is that the third item is the profit obtained by recycling the retired batteries of new energy vehicles from consumers and selling them to metal recycling stations for echelon utilization and processing by the battery manufacturer.

The profit of new energy vehicle manufacturers is the same as in the first case, both of which are:

3.3. Model Results and Analysis

In this subsection, the above models are solved by using the reverse induction method in game theory to obtain the equilibrium decisions under each decision model.

3.3.1. The Equilibriums When Battery Manufacturers Do Not Participate in Battery Recycling

Proposition 1.

The equilibrium decision of battery manufacturers, when they do not recycle retired batteries of new energy vehicles from consumers, is:

Meanwhile, Proposition 1 is presented in Table 3. Related proof is shown in Appendix A.

Table 3.

The equilibriums in different scenarios.

By analyzing the equilibrium decision of Proposition 1, Corollaries 1 and 2 are obtained. Related proof is shown in Appendix A.

Corollary 1.

When battery manufacturers do not recycle retired batteries from consumers of new energy vehicles, the repurchase price that these manufacturers offer to new energy vehicle manufacturers will decrease as the income from the utilization of unit waste batteries increases, i.e., . However, the level of battery disassembly design among battery manufacturers will improve with the increase in income from unit waste battery echelon utilization, i.e., .

Corollary 1 indicates that higher revenue per unit of waste battery echelon utilization is associated with a lower battery repurchase price following the repurchase of echelon utilization from new energy vehicle manufacturers, while simultaneously correlating with a higher level of battery disassembly design. As the profit from the echelon utilization of unit waste batteries rises, the profits that battery manufacturers gain from selling waste batteries to metal recycling stations also increase with the growing volume of batteries. To incentivize new energy vehicle manufacturers to recycle more waste batteries, battery manufacturers will enhance their battery disassembly design and reduce disassembly costs. Furthermore, battery manufacturers selling at lower repurchase prices after acquiring echelon utilization from new energy vehicle manufacturers do so because the increased expenses from higher disassembly design levels place additional burdens on these manufacturers, prompting them to lower repurchase prices to safeguard their profits.

Corollary 2.

When battery manufacturers do not recycle retired batteries from consumers, the unit recycling price that new energy vehicle recyclers offer for collecting these retired batteries will rise as the income from unit waste battery echelon utilization increases, i.e., .

Corollary 2 suggests that with higher income from unit waste battery echelon utilization, the unit recycling price that new energy vehicle recyclers set for recovering retired batteries from consumers will also increase. On one hand, as the income from echelon utilization rises, new energy vehicle recyclers can attain greater unit profits from the business of recycling waste batteries. To secure a larger quantity of waste batteries from consumers, recyclers will elevate the unit recycling price. On the other hand, battery manufacturers, having improved their battery disassembly design levels to motivate new energy vehicle manufacturers to recycle more waste batteries, contribute to this dynamic. Consequently, under reduced battery recycling costs, new energy vehicle manufacturers are likely to raise their unit recycling price for waste batteries.

3.3.2. The Equilibria When Battery Manufacturers Participate in Battery Recycling

Proposition 2.

The equilibrium decision of battery manufacturers when they recycle retired batteries of new energy vehicles from consumers is:

Also, Proposition 2 is presented in Table 3. Related proof is shown in Appendix A.

By analyzing the equilibrium decision of Proposition 2, Corollaries 3 and 4 are obtained. Related proof is shown in Appendix A.

Corollary 3.

When battery manufacturers recycle retired batteries from consumers of new energy vehicles, the price they pay for recycling these waste batteries increases with the profitability of the unit waste battery echelon utilization, i.e., . Conversely, the price of recycled batteries tends to decrease as competition in the battery recycling industry intensifies, i.e., .

Corollary 3 suggests that as the profit from unit waste battery echelon utilization rises, battery manufacturers are more likely to offer higher recycling prices for retired batteries collected from consumers. On the other hand, increased competition in the battery recycling sector leads to lower unit recycling prices for manufacturers recovering retired batteries from new energy vehicle consumers. The rationale behind this is straightforward: higher profits from unit waste battery recycling boost battery manufacturers’ enthusiasm to participate in recycling, making them more willing to pay higher prices to obtain waste batteries from consumers in pursuit of greater profits.

One reason for the decline in recycling prices as competition intensifies is that a more competitive market condition results in the price of recycled batteries being significantly influenced by the recycling costs set by other companies. This competitive environment raises the marginal costs associated with increasing battery recycling in manufacturing. Additionally, waste batteries collected from new energy vehicle manufacturers are processed and sold to metal recycling stations, which can also generate profits for battery manufacturers. Consequently, these manufacturers may not be inclined to pay exorbitant recycling prices to source waste batteries from the market.

Corollary 4.

When battery manufacturers recycle retired batteries from consumers of new energy vehicles, the cost of repurchasing waste batteries after each echelon utilization from new energy vehicle manufacturers will rise with the profitability of that unit waste battery echelon utilization, i.e., . However, the price of waste batteries purchased by battery manufacturers from new energy vehicle manufacturers after echelon utilization does not change in a straightforward manner with variations in competition intensity within the battery recycling industry. Specifically, when , the quantity of used batteries repurchased by battery manufacturers from new energy vehicle manufacturers will decrease as competition in the battery recycling industry escalates, i.e., . When , the situation is opposite, i.e.,. The parameter is more complex and will be discussed in Section 4.

Corollary 4 suggests that when , the competition in the battery recycling industry is low; higher profits from the unit utilization of waste batteries lead to an increased unit recycling price of waste batteries. This pricing occurs after battery manufacturers repurchase these utilized batteries from new energy vehicle manufacturers. Battery manufacturers derive their income from recycling waste batteries collected from consumers for reuse and selling the remaining batteries to metal recycling stations. Two main reasons explain this situation. Firstly, battery manufacturers encourage new energy vehicle recyclers to gather more waste batteries from the market, which allows them to process and sell a larger volume, ultimately increasing their profits and enabling them to raise the prices they offer for recycling. Secondly, during periods of low market competition, the recycling operations of battery manufacturers remain robust and largely unaffected by new energy vehicle recyclers, ensuring that their profits from recycling are secure, thus enabling them to raise the repurchase prices for utilized waste batteries.

Conversely, when competition intensity in the battery recycling industry increases , the unit recycling price that battery manufacturers are willing to pay for repurchased waste batteries diminishes. The first explanation for this trend is that battery manufacturers have implemented disassembly designs for their batteries, which reduces recycling costs but also elevates their investments. To maintain profitability, manufacturers might opt to lower the repurchase price for waste batteries, aligning with what we referred to in corollary 1. Secondly, as competitive pressure in the battery recycling market escalates, manufacturers may reduce the repurchase prices to encourage greater collection of waste batteries from consumers, thereby increasing their volume of usable materials. However, this strategy can adversely affect the overall profits of new energy vehicle manufacturers involved in recycling, diminishing their incentive to participate in the recycling process.

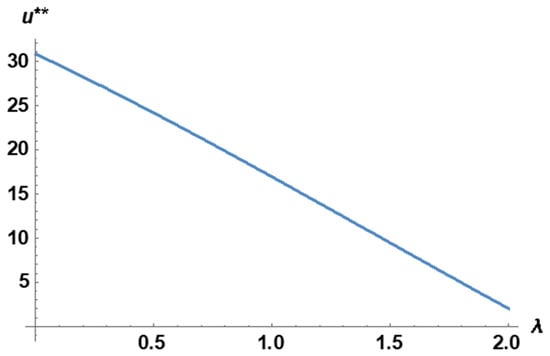

Corollary 5.

When battery manufacturers recycle retired batteries from consumers of new energy vehicles, the level of battery disassembly design improves as the revenue per unit of waste battery echelon utilization increases, i.e., . Conversely, this design level tends to decrease with greater market competition intensity in the battery recycling industry, i.e., .

Corollary 5 (related proof is shown in Appendix A) indicates that as the profit per unit of waste battery echelon utilization increases, so does the battery disassembly design level of these manufacturers. Battery manufacturers enhance their level of battery disassembly design primarily to support their recycling operations and reduce the disassembly costs associated with recycling waste batteries from consumers. Additionally, improving this design encourages new energy vehicle manufacturers to recycle more waste batteries, thus increasing the total volume of batteries processed and enhancing overall profitability in their recycling business.

However, when market competition intensity rises, the battery disassembly design level of manufacturers tends to decrease. This decline occurs because increased competition significantly impacts the recycling efforts of electric vehicle manufacturers, making the collection of waste batteries from the market more challenging. To boost their profits and mitigate the recycling enthusiasm of new energy vehicle manufacturers, battery manufacturers may opt to lower their battery disassembly design standards.

Corollary 6.

As battery manufacturers recycle retired batteries from consumers, recycling prices for new energy vehicle manufacturers will rise along with the revenue per unit of waste battery echelon utilization, i.e., . However, the recycling decisions of new energy vehicle manufacturers do not uniformly respond to increasing market competition intensity. When , the recycling price of waste batteries may actually rise as market competition intensifies, i.e., . When , the situation is opposite, i.e., . The parameter is more complex and will be shown in Section 4.

Corollary 6 (related proof is shown in Appendix A) suggests that when , that is, when the market competition intensity is low, higher profits from unit waste battery echelon utilization and increased competition intensity correspond to higher recycling prices set by new energy vehicle manufacturers. Under these conditions, driven by the dual influences of elevated echelon utilization income and increased repurchase prices from battery manufacturers, new energy vehicle manufacturers are incentivized to raise battery recycling prices to recover more waste batteries from the market and maximize their profits.

Conversely, when market competition intensity is high, , the recycling price of waste batteries tends to decline as competition intensity increases. New energy vehicle manufacturers may reduce recycling prices for two primary reasons: first, lower disassembly design levels and repurchase prices from battery manufacturers directly diminish recycling willingness among new energy vehicle manufacturers; second, heightened competition significantly impacts the recycling operations of these manufacturers, further reducing their motivation to recycle.

This dynamic differs from that of battery manufacturers, where recycling prices decrease with the rising intensity of competition in the battery recycling sector. In contrast, changes in the recycling prices set by new energy vehicle manufacturers are influenced by the extent of competition in the market.

Corollary 7.

When , that is when the battery manufacturer participates in battery recycling, the total amount of battery recycling when the battery manufacturer does not participate in battery recycling, i.e., > . When , the total amount of battery recycling is less than the total amount of battery recycling when the battery manufacturer does not participate in battery recycling, i.e., < , where .

Corollary 7 suggests that lower competition intensity in the battery recycling industry can lead to an increase in the overall amount of battery recycling. This shift would facilitate the full utilization of waste batteries and help reduce environmental pollution and resource wastage. The primary reason for this increase is that both parties are more willing to raise their battery recycling prices in a market with lower competition intensity. This willingness can incentivize both sides to recycle a greater number of waste batteries from the market. Conversely, higher market competition intensity does not support the growth of battery recycling. In such scenarios, the total amount of battery recycling tends to be lower compared to situations where battery manufacturers are not engaged in the recycling business. This situation indicates that some waste batteries from new energy vehicles may not be adequately collected or processed by third-party recycling companies, leading to underutilization of battery resources and potential environmental harm. To promote standardized development in the battery recycling industry and ensure that more waste batteries are effectively managed, the government should gradually implement supportive measures for battery recycling enterprises. By maintaining an appropriate level of market competition intensity within the battery recycling sector, it will be possible to fully utilize more waste batteries while simultaneously reducing the environmental pollution associated with battery disposal.

4. Numerical Experiments

This section uses numerical analysis to illustrate the results of this paper based on the above analysis. Considering the constraints of the model and referring to the relevant literature, the initial parameter values are established as follows: , , , , , , , [16,35], and we can have the thresholds and . Additionally, Table 4 illustrates the sources of these key initial parameter values.

Table 4.

The sources of key initial parameter values.

To calibrate the value of λ for our numerical analysis, we refer to the base value of used in the closely related work of Zhao et al. [16]. This value implies a moderate level of competition. To comprehensively analyze the impact of competition intensity, we further vary λ within a reasonable range of [0, 2] in our sensitivity analysis. This range allows us to examine scenarios from weak competition () to intense competition (), providing insights into how different market structures affect the equilibrium outcomes.

The numerical analysis consists of three main parts. Firstly, this paper analyzes the impacts of unit waste battery echelon utilization income and battery recycling industry market competition intensity on the equilibrium decision-making of battery manufacturers and new energy vehicle manufacturers. In Section 2, this paper analyzes the impact of market competition intensity on the number of waste batteries recycled by battery manufacturers and new energy vehicle manufacturers. Thirdly, this paper analyzes the impact of unit waste battery echelon utilization income and battery recycling industry market competition intensity on the total profit of battery manufacturers and new energy vehicle manufacturers.

4.1. Numerical Analysis of Equilibrium Decision

Firstly, this paper analyzes the situation when battery manufacturers participate in the battery business, that is, when battery manufacturers also recycle waste batteries directly from the market. In the following, this paper will analyze the impact of unit waste battery echelon utilization income and battery recycling industry market competition intensity on equilibrium decision-making.

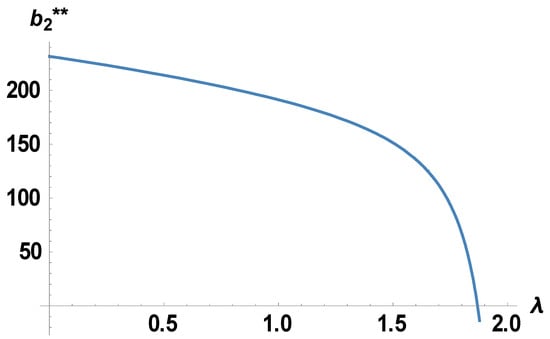

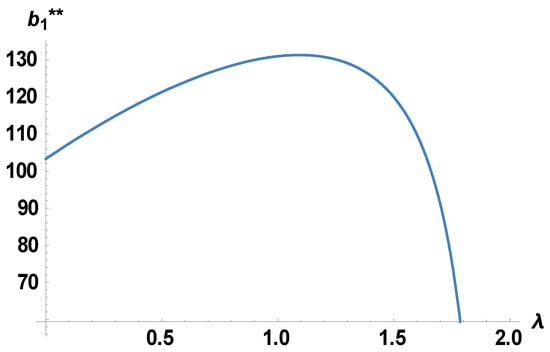

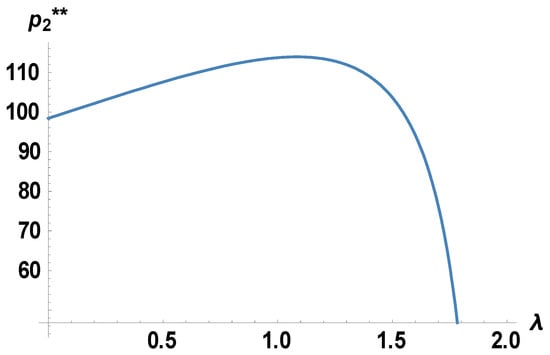

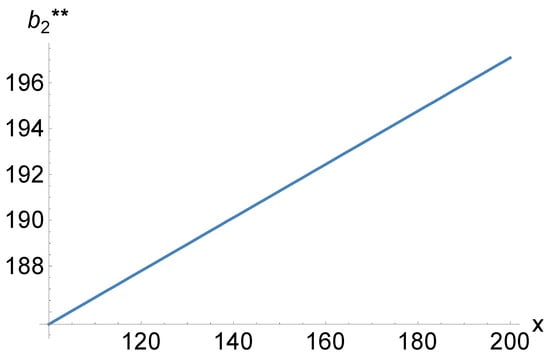

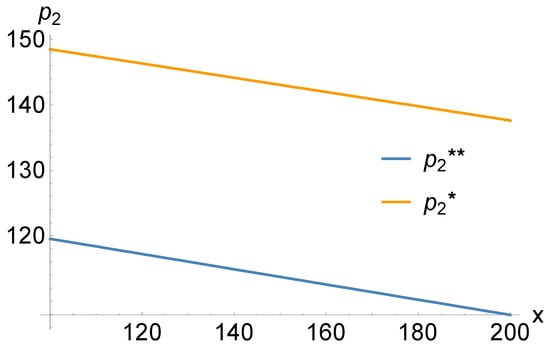

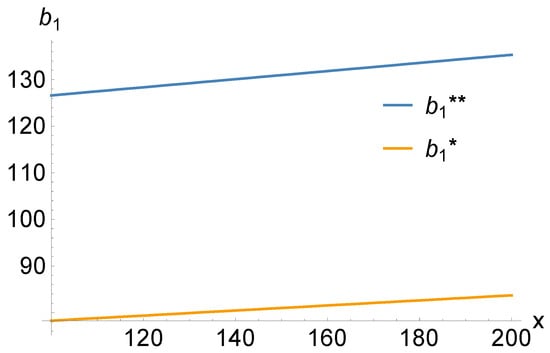

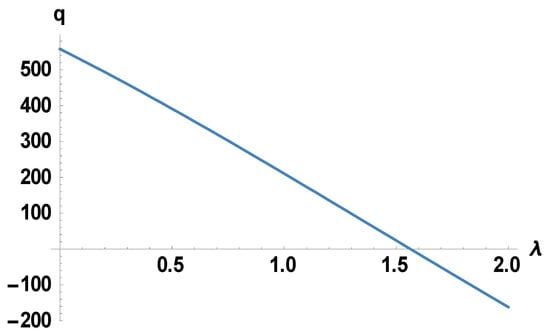

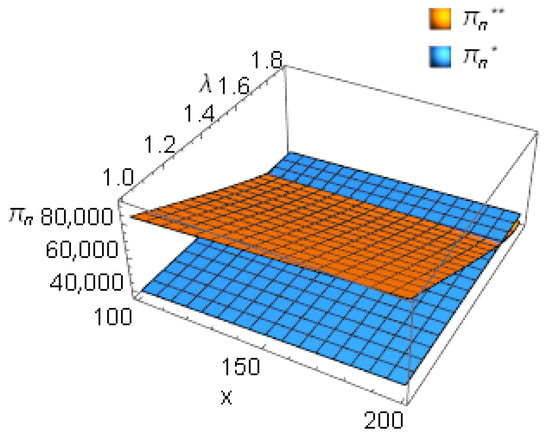

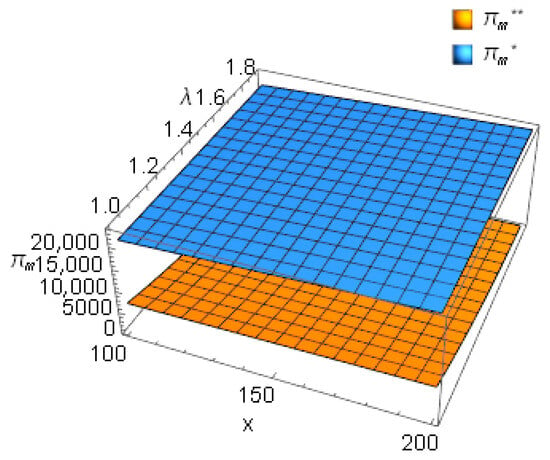

From Figure 4 and Figure 5, we can see that when the market competition intensity of the battery recycling industry increases, battery manufacturers will reduce the design level of battery disassembly and the recycling price of waste batteries from the market. From Figure 6 and Figure 7, we know that when the intensity of market competition increases, the repurchase price of waste batteries recovered by battery manufacturers from new energy vehicle manufacturers and the recycling price of waste batteries by new energy vehicle manufacturers from the market will not change monotonically. When battery manufacturers participate in the battery recycling business and the market competition intensity of the battery recycling industry is small, the price of used batteries that battery manufacturers repurchase from new energy vehicle recyclers and the recycling price of used batteries that new energy vehicle manufacturers recycle from the market will increase with the increase in market competition intensity in the battery recycling industry. However, when the market competition intensity of the battery recycling industry is relatively strong, the price of the used batteries repurchased by the battery manufacturers from the new energy vehicle recyclers and the recycling price of the used batteries recycled by the new energy vehicle manufacturers from the market will decrease with the increase in the market competition intensity of the battery recycling industry.

Figure 4.

Impact of market competition intensity on battery disassembly design.

Figure 5.

Impact of Market Competition Intensity on Recycling Prices of Battery Manufacturers.

Figure 6.

Impact of Market Competition Intensity on Recovery Prices of New Energy Vehicle Manufacturers.

Figure 7.

Impact of Market Competition Intensity on Battery Repurchase Price.

The numerical analysis leads to Corollary 8.

Corollary 8.

(1) Battery manufacturers will reduce the level of battery disassembly design and the recycling price of waste batteries from marketers in response to increased competition in the battery recycling industry, as theoretically predicted in Corollaries 3 and 5. However, battery manufacturers should change the price of repurchasing used batteries from new energy vehicle manufacturers according to the change in competition intensity and the size of the competition, which aligns with the threshold effect described in Corollary 4. Specifically, when the market competition intensity of the battery recycling industry is small, the repurchase price of waste batteries after echelon utilization should be increased. When the market competition intensity of the battery recycling industry is large, the repurchase price of waste batteries after echelon utilization should be reduced. (2) New energy vehicle manufacturers to recycle waste batteries from the market price should also give full consideration to the change of market competition intensity and the influence of the size of the competition, and the battery manufacturer’s battery repurchase price change decision is the same when the battery recycling industry market competition intensity is small should raise the price of recycling waste batteries, when the battery recycling industry market competition intensity is bigger, should reduce the price of recycling waste batteries, which is anticipated by Corollary 6.

In practice, when battery manufacturers observe that the market competition intensity of the battery recycling industry becomes larger, they need to reduce the strength of battery disassembly design. This method aims to reduce its cost reduction in the battery recycling and dismantling process, thereby reducing the willingness of new energy vehicle manufacturers to recycle waste batteries and ultimately increasing the number of used batteries that they can recycle in the market, thereby increasing the total profit of the battery manufacturers. In addition, it is worth noting that battery manufacturers will not increase the recycling price of waste batteries from the market at any time. The total profit of the battery manufacturer consists of two parts: the sale of waste batteries after treatment to metal recycling stations and the recycling of waste batteries from the market for echelon utilization. After the battery manufacturer has the first part of the profit guarantee, considering the market competition factor and its impact on reducing the level of battery disassembly, it should not increase the recycling price of the batteries to reduce the business risk of the enterprise. In addition, the repurchase price of the batteries after the battery manufacturer repurchases the echelon utilization from the new energy vehicle manufacturer should be adjusted in time according to the change in market competition intensity. When the market competition intensity is small, the battery manufacturer can increase the repurchase price of waste batteries after echelon utilization to encourage new energy vehicle manufacturers to recycle more waste batteries from the market. However, when the market competition intensity is large, the marginal cost for new energy vehicle manufacturers to increase battery recycling is high, and the recycling willingness of new energy vehicle manufacturers will decline. The battery manufacturer must reduce the repurchase price of waste batteries after echelon utilization. Only in this way can they ensure their profits.

For new energy vehicle manufacturers, the price of recycling waste batteries should be adjusted in time according to changes in market competition intensity. When the market competition intensity is small, because the battery manufacturer reduces the battery disassembly design level is smaller, the battery manufacturer can repurchase the price of the waste battery after the echelon utilization is higher, and the marginal cost of increasing the amount of waste battery recovery is lower. At this time, the price of recycling waste batteries should be increased with the increase in market competition intensity to recover more waste batteries from the market to improve their profits. On the contrary, when the market competition intensity of the battery recycling industry is high, the battery manufacturer will reduce the battery disassembly design level, the battery manufacturer will reduce the repurchase price of waste batteries after the echelon utilization, and the marginal cost of increasing the battery recycling volume will become higher. At this time, the battery manufacturer should reduce the recycling of the recycled waste batteries in time with the increase in market competition intensity to ensure their profits. The above is an analysis of the impact of market competition intensity on equilibrium decision-making and puts forward relevant management suggestions for battery manufacturers and new energy vehicle manufacturers to help them make reasonable decision-making changes in response to changes in market competition intensity. The following will analyze the impact of unit waste battery echelon utilization on equilibrium decision-making.

From Figure 8 and Figure 9, we can see that when the average quality of used batteries is higher, that is, when the revenue of battery echelon utilization increases, battery manufacturers will improve the level of battery disassembly design and the recycling price of waste batteries from the market. When the battery manufacturer recycles batteries directly from the market, the battery disassembly design level is higher than the battery disassembly design level when the battery is not recycled from the market. However, from Figure 10, we can see that when the revenue from the echelon utilization of waste batteries increases, the battery manufacturer will reduce the price of repurchased waste batteries from new energy vehicle manufacturers. When the battery manufacturer recycles the battery directly from the market, the repurchase price of the waste battery after echelon utilization is lower than the repurchase price of the waste battery after echelon utilization when the battery manufacturer does not recycle the battery from the market. From Figure 11, we know that the price of used battery recycling from the market by the new energy vehicle manufacturer will increase when the profit of the gradient utilization of used batteries increases. When the battery manufacturer directly carries out battery recycling from the market, the new energy vehicle manufacturer’s price of recycling used batteries from the market is higher than the new energy vehicle manufacturer’s recycling price when the battery manufacturer does not carry out battery recycling from the market.

Figure 8.

Impact of Echelon Utilization Profit on Battery Disassembly Design.

Figure 9.

Impact of Echelon Utilization Profit on Recycling Price of Battery Manufacturers.

Figure 10.

Impact of Echelon Utilization Profit on Battery Repurchasing Price.

Figure 11.

Impact of Echelon Utilization Profit on Recycling Price of New Energy Vehicle Manufacturers.

The numerical analysis leads to Corollary 9.

Corollary 9.

(1) When the profit of echelon utilization of unit waste batteries increases, battery manufacturers should improve the battery disassembly design level and the price of recycling waste batteries from the market, which is consistent with Corollaries 3 and 5. However, the price of repurchasing used batteries from new energy vehicle manufacturers should be reduced, a strategy supported by the findings in Corollaries 1 and 4. (2) When the echelon utilization income of unit waste batteries increases, new energy vehicle manufacturers should increase the price of recycling waste batteries in the market, a behavior that aligns with the theoretical outcome of Corollaries 2 and 6.

In practice, when battery manufacturers observe that the echelon utilization income of unit waste batteries becomes larger, they need to increase the level of battery disassembly design and the price of recycling waste batteries. On the one hand, this method reduces cost reduction in the process of battery recycling and disassembling, thereby reducing the willingness of new energy vehicle manufacturers to recycle waste batteries, and ultimately increasing the number of waste batteries that they can recycle in the market, thereby increasing the total profit of battery manufacturers. On the other hand, because battery manufacturers are also involved in the battery recycling business at this time, that is, recycling waste batteries directly from the market, higher battery disassembly levels and battery recycling prices can also help battery manufacturers reduce the disassembly cost of recycling waste batteries and increase the total number of waste batteries recycled from the market. In addition, it is worth noting that the disassembly design level of battery manufacturers not participating in battery recycling is greater than that of battery manufacturers not participating in battery recycling at any time, which will be beneficial to battery manufacturers and new energy vehicle recyclers. Battery manufacturers should reduce the price of recycling waste batteries from new energy vehicle manufacturers as the profit of unit waste battery echelon utilization increases. The main reason is that the total cost of battery manufacturers is composed of three parts: the cost of battery repurchasing after echelon utilization, the cost of battery disassembly design, and the cost of waste battery recycling. After improving the level of battery disassembly design and increasing the price of battery recycling, battery manufacturers will not increase the price of repurchasing used batteries from new energy vehicle manufacturers, considering the impact of new energy vehicle manufacturers and the benefits from a higher level of battery disassembly design, to reduce the cost of enterprises to protect their profits.

For new energy vehicle manufacturers, the price of recycling waste batteries from the market should be increased with the increase in the echelon utilization income of unit waste batteries. The first reason is that battery manufacturers will improve the level of battery disassembly design with the increase in the echelon utilization income of unit waste batteries, which helps new energy vehicle manufacturers reduce the disassembly cost of recycling waste batteries. The second reason is that battery manufacturers will also directly recycle waste batteries from the market, which will affect the recycling business of new energy vehicle manufacturers. To recycle more waste batteries from the market to protect their profits, new energy vehicle manufacturers will increase the recycling price of waste batteries. In addition, it is worth noting that when battery manufacturers participate in battery recycling, the battery recycling price of new energy vehicle manufacturers will be greater than the battery recycling price of new energy vehicle manufacturers when battery manufacturers do not participate in battery recycling.

The above is an analysis of the impact of the echelon utilization income of unit waste batteries on the equilibrium decision-making and puts forward relevant management suggestions for battery manufacturers and new energy vehicle manufacturers to help them make reasonable decision changes in response to changes in market competition intensity. The following will analyze the impact of the income of unit waste battery echelon utilization and the intensity of market competition on the total number of battery recycling.

4.2. Numerical Analysis of the Number of Battery Recycling

To simplify the expression, will be used to represent the total amount of batteries recycled when the battery manufacturer directly participates in the battery recycling minus the total amount of batteries recycled when the battery manufacturer does not participate in battery recycling, i.e., − . In this section, the relevant parameters are updated as , , , , , , , [16,35].

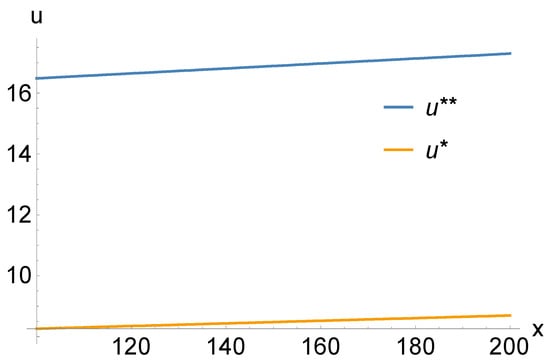

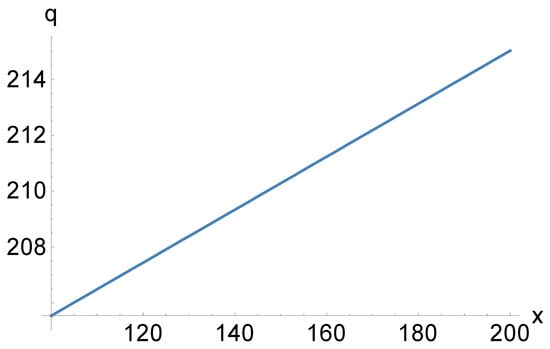

As can be seen from Figure 12, when battery manufacturers are directly involved in battery recycling, the total number of battery recycling is always greater than the total number of battery recycling when battery manufacturers are not involved in battery recycling, and when the unit waste battery echelon utilization income increases, the total number of battery recycling will also increase. As can be seen from Figure 13, when the market competition intensity of the battery recycling industry is small, the total recycling amount of battery manufacturers participating in battery recycling is greater than the total recycling amount of battery manufacturers not participating in battery recycling. However, when the market competition intensity of the battery recycling industry is large, the recycling amount of battery manufacturers participating in battery recycling is less than the total recycling amount of battery manufacturers not participating in battery recycling. The difference in the total number of battery recycling is reduced with the increase in the market competition intensity of battery recycling.

Figure 12.

Impact of Echelon Utilization Profit on the Number of Batteries Recycling.

Figure 13.

Impact of Market Competition Intensity on the Number of Batteries Recycling.

As introduced in the research background, whether the waste batteries retired from new energy vehicles can be reasonably recovered and properly reused is crucial for environmental protection and resource utilization. In the next period, China will face more and more new energy vehicle battery retirements. These batteries can only be used by professional and technical enterprises, such as battery manufacturers and new energy vehicle manufacturers, to make them fully effective and ensure less pollution to the environment. So, for the relevant government departments, on the one hand, they should actively promote the decommissioning of batteries with a residual capacity of less than 80% by improving market regulations and laws, and then be recycled by enterprises with the ability to echelon use waste batteries. This can not only ensure the driving safety of new energy vehicles and the personal safety of vehicle owners but also increase the profit of secondary utilization of waste batteries, so that battery manufacturers and new energy vehicle manufacturers can actively improve the design level of battery disassembly and the price of battery recycling so that waste batteries can be reasonably recycled and properly reused. On the other hand, the relevant government departments need to ensure that the waste battery recycling industry always maintains a smaller market competition environment. Just as the current government is based on the number of waste batteries to be retired in the market, more enterprises are allowed to enter the battery recycling industry in batches. In the future, it is also necessary to analyze and predict the number of waste batteries to be retired, and gradually increase the number of enterprises entering the battery recycling industry in batches to ensure that the battery recycling industry always maintains a small market competition intensity. As the conclusion of Corollary 8 above, when the market competition intensity is small, battery manufacturers will not reduce too much battery disassembly design level and maintain a high battery repurchase price and battery recycling prices after echelon utilization. New energy vehicle manufacturers will also increase the recycling price of batteries, which can help both parties recycle more waste batteries from the market, which will make more waste batteries reasonably recycled and properly handled.

The above is an analysis of the impact of the two factors of the echelon utilization income of the unit waste battery and the market competition intensity of the battery recycling industry on the total number of waste batteries recycled. Based on the analysis results and the current development status of battery recycling, relevant government management suggestions are proposed to help more retired waste batteries of new energy vehicles be reasonably recycled and properly utilized. The following will analyze the impact of the revenue per unit of waste battery echelon utilization and the impact of market competition intensity on the profits of new energy vehicle manufacturers and battery manufacturers.

4.3. Numerical Analysis of Profit

Next, the impact of the income from the echelon utilization of unit waste batteries and the intensity of market competition on the profits of new energy vehicle manufacturers and battery manufacturers will be analyzed. In this section, the relevant parameters are updated as follows , , , , , , (Zhao et al., 2022; Wu, 2013) [16,35].

In practice, for new energy vehicle manufacturers, the profit of new energy vehicle manufacturers when battery manufacturers participate in battery recycling is lower than that of new energy vehicle manufacturers when battery manufacturers do not participate in battery recycling. The main reason is that the participation of battery manufacturers in battery recycling will increase the difficulty of recycling waste batteries by new energy vehicle manufacturers, and battery manufacturers will reduce the level of battery disassembly design and reduce the price of repurchasing waste batteries after echelon utilization from new energy vehicle manufacturers when the market competition intensity of battery recycling and reuse is high, which will not be conducive to the recycling business of new energy vehicle manufacturers. Therefore, the direct participation of battery manufacturers in battery recycling will be detrimental to new energy vehicle manufacturers.

For battery manufacturers, when the market competition intensity of the battery recycling industry is low, the total profit when participating in battery recycling will be higher than the total profit when not participating in battery recycling. There are two main reasons for this. Firstly, when battery manufacturers participate in battery recycling, the level of battery disassembly design will be reduced, which will reduce the total cost of battery manufacturers in disassembly design. Secondly, when battery manufacturers are directly involved in the battery recycling business, battery manufacturers have more revenue sources, and it can be seen in Figure 14 and Figure 15 that the total number of battery recycling will increase when the battery manufacturers are involved in battery recycling, so battery manufacturers can also handle more waste batteries after echelon utilization, which will help battery manufacturers to increase the total revenue. The profit of battery manufacturers with higher market competition intensity in the battery recycling industry will be lower than the total profits of battery manufacturers when they do not participate in battery recycling. The reason for this situation is that the total battery recycling of battery manufacturers and new energy vehicle manufacturers will be low, which will directly affect the total amount of waste batteries that can be processed by battery manufacturers and sold to metal recycling stations, which will reduce the total profit of battery manufacturers.

Figure 14.

Profit Analysis of Battery Manufacturers.

Figure 15.

Profit Analysis of New Energy Vehicle Manufacturers.

5. Conclusions

5.1. Research Conclusions

This paper addresses a significant operation management problem within a supply chain that includes a battery manufacturer, a new energy vehicle recycler, a precious metal recycling station, and consumers. The study employs a Stackelberg game model led by battery manufacturers to examine the equilibrium decisions of supply chain members under two scenarios: when battery manufacturers participate in the battery recycling business and when they do not.

The theoretical contributions of this study are below. First, it incorporates battery manufacturers’ design for disassembly as an endogenous strategic decision variable within the electric vehicle battery recycling supply chain to enhance profitability for relevant entities, while also assessing the impact of both the unit waste battery echelon utilization and the intensity of market competition in battery recycling on the decision-making of supply chain members. Furthermore, through theoretical derivation and numerical validation, it reveals the non-monotonic and complex influence of market competition intensity on recycling prices and the level of design for disassembly.

Specifically, the disassembly design level of battery manufacturers consistently exhibits a positive correlation with the revenue generated from the cascaded utilization of per-unit retired batteries, reflecting how economic returns drive investments in green technology. Furthermore, both the recycling price and disassembly design level set by battery manufacturers decrease as market competition intensity increases. In contrast, the repurchase price offered by battery manufacturers to new energy vehicle producers and the recycling price set by new energy vehicle manufacturers demonstrate a non-monotonic relationship with market competition intensity—first increasing and then decreasing. Additionally, while the participation of battery manufacturers in recycling activities can boost the total recycling volume, this effect is moderated by the intensity of market competition. When competition is relatively low, their involvement enhances system efficiency; however, once competition exceeds a certain threshold, it may lead to “excessive competition,” which ultimately undermines overall recycling performance.

5.2. Management Suggestions

The main conclusions of this study provide both practical and theoretical guidance for battery manufacturers and new energy vehicle producers, helping them to make strategic decisions that are commercially competitive and environmentally sustainable.

For battery manufacturers, they must also consider the intensity of market competition, as this may necessitate adjustments in battery disassembly design and repurchase pricing. Therefore, battery manufacturers should regularly monitor key competitors’ recycling prices, new production capacity, and market share fluctuations to assess the current level of market competition and activate pre-established response plans accordingly. When market competition is relatively weak, they should increase the repurchase price offered to new energy vehicle manufacturers for retired batteries to incentivize greater collection. Conversely, in highly competitive environments, they should reduce investments in battery disassembly design and lower repurchase prices, reallocating resources toward improving operational efficiency and cost control within their own recycling channels. Furthermore, disassembly design should be regarded as a strategic investment aimed at enhancing long-term recycling profitability and building core competitiveness. This transforms green design from a conceptual ideal into a strategic initiative that directly shapes a company’s technological edge. A notable example is CATL, which integrated its subsidiary Brunp Recycling to engage directly and deeply in battery recycling operations. This strategic move provided CATL with strong incentives to invest in disassembly-oriented design, while leveraging its scale and cost advantages to implement flexible and highly competitive pricing strategies in the recycling market.

New energy vehicle manufacturers must consider the implications of recycling prices for waste batteries on battery manufacturers. When market competition in battery recycling is minimal, there is potential to raise the recycling prices of waste batteries to capture market share through cost advantages. Conversely, in a highly competitive market, it may be necessary for them to reduce the recycling price to control recovery costs and avoid being drawn into loss-inducing price wars. Under such conditions, it becomes essential to adopt strategies such as “free door-to-door battery collection,” “accurate residual value assessment,” and “trade-in discounts.” By enhancing service convenience and building brand trust, New energy vehicle manufacturers can attract consumers and establish non-price competitive advantages.

On one hand, relevant government departments should dynamically adjust and publish the quantity and geographical distribution of the “Compliant Recycler Whitelist” based on regional forecasts of new energy vehicle ownership and battery retirement data. This aims to regulate market competition density from the supply side, maintaining competition intensity at an appropriately low level to maximize total social recycling benefits and avoid the systemic efficiency losses caused by “excessive competition.” On the other hand, regulations should mandate that batteries with a capacity below 80% must enter formal recycling channels. Furthermore, rather than providing universal subsidies, support should be reallocated towards targeted incentives for battery designs that prioritize disassembly and recyclability, or offer credit advantages to vehicle manufacturers that procure such green batteries. This approach enhances the economic returns from cascaded utilization at the source and stimulates innovation in green technology.

5.3. Research Prospect

In this paper, we have focused on the competition between two battery recycling companies. Future research could explore scenarios with three or more recycling companies, incorporating third-party recyclers as well, to address the competition-related issues that arise in a more complex market. Another potential research direction involves examining the impact of advertisements for battery recycling and the related behaviors of recycling enterprises on the competitive intensity within the battery recycling sector. These investigations will address existing research gaps and provide valuable theoretical insights for the advancement of the battery recycling industry.

Author Contributions

S.Z.: conceptualization, methodology, software, writing—original draft preparation, writing—review and editing, supervision, funding acquisition; X.W.: formal analysis, methodology, investigation; H.L.: validation, investigation, resources, data curation, writing—original draft preparation, visualization. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China [grant numbers 72472142, 72072111, 72472096].

Data Availability Statement

Data is contained within the article. The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

Appendix A

- Proof of Proposition 1

Firstly, we can obtain by Equation (2). Then plugging into Equation (1), and the profit function, i.e., Equation (1) can be re-written as follows:

The Hessian matrix according to the is as follows:

Due to , the profit function is concave. So we can find unique equilibrium solution and .

Then plugging and into , we can get that . Substituting into , we can get that . Substituting , , and into and , we can get that and .

To summarize, Proposition 1 is proved. □

- Proof of Corollary 1

Based on Proposition 1, we analyze the sensitivity of the and .

Due to and , we can have . So and . Corollary 1 is proved. □

- Proof of Corollary 2

Based on Proposition 1, we analyze the sensitivity of the .

Due to and , we can have . So . Corollary 2 is proved. □

- Proof of Proposition 2

Firstly, we can obtain by Equation (4). Then plugging into Equation (3), and the profit function, i.e., Equation (3) can be re-written as follows:

The Hessian matrix according to the is as follows:

Due to and , the profit function is concave. So we can find unique equilibrium solution , and .

Then plugging , and into , we can get that . Substituting and into and , we can get that and . Substituting , , , , and into and , we can get that and .

To summarize, Proposition 2 is proved. □

- Proof of Corollary 3

Based on Proposition 2, we analyze the sensitivity of the .

Due to and , we can have . So and . Corollary 3 is proved. □

- Proof of Corollary 4

Based on Proposition 2, we analyze the sensitivity of the .

Due to and , we can have . So . Also we can get . Thus, we can ensure that when and when . Corollary 4 is proved. □

- Proof of Corollary 5

Based on Proposition 2, we analyze the sensitivity of the .

Due to and , we can have . So and . Corollary 5 is proved. □

- Proof of Corollary 6

Based on Proposition 2, we analyze the sensitivity of the .