Abstract

In many energy policies, including Poland’s, environmental priorities clash with the issue of energy security. With these contradictions in mind, the main objective of the article is a comparative analysis of domestic production and imports of hard coal in Poland and the formulation of conclusions for energy policy and competitiveness. The analysis covers the years 2018–2023 and concerns three issues: the volume and directions of coal imports to Poland, the qualitative and price competitiveness of coal, and the possibility of substituting imported coal with domestic coal. The research used statistical analysis. Indicators of structure and dynamics as well as comparative analysis were also used. The analysis shows that the structure of coal importers to Poland is quite diverse and includes many geographic directions. However, until 2021, it was dominated by Russia, followed by Colombia, indicating a fairly homogeneous supply market and a continuing tendency to depend on a single importer. Analysis of qualitative competitiveness confirms the existence of balance and industrial resources whose quality parameters (sulfur content, ash content, and calorific value) are comparable to and better than those of imported coal. Polish hard coal can also compete with imported coal in terms of price. From 2021 to 2023, it was clearly cheaper than foreign coal. In the above circumstances, it is quite difficult to unequivocally assess the reasons for importing coal to Poland and to justify dependence on external suppliers. This is especially relevant since domestic mining in 2020–2023 remains stable (periodically even increasing), which does not indicate a decisive shift away from coal as an energy resource.

1. Introduction

Modern energy policies are shaped by different, often competing and/or conflicting priorities [1,2,3]. Environmental goals clash with energy security and resource economics [4,5]. The availability of technology and innovation are also important determinants of energy source selection [6,7,8,9]. The political orientation of the ruling elite is also becoming increasingly important [10,11,12,13,14].

This multiplicity of determinants causes difficulties in both the formulation and implementation of energy policies. They can complicate the energy transition process, prolong its implementation time, and reduce its effectiveness. Such complications particularly and acutely affect emerging and developing economies, as they hold back energy development with not only negative environmental but also social consequences [15,16,17,18]. This materializes as dissatisfaction and lack of acceptance of the green transition [19,20,21,22]. In these economies, the green transformation is not effectively facilitated by the low level of technology, lack of innovations [23], and poor digitalization of the economy [24]. The transition away from fossil fuels may also be hindered by a lack of government support, which is key in the development of renewable energy sources [25].

One of the key elements of energy policy is the choice of energy sources, which is generally determined by their availability and cost of acquisition. With energy security concerns in mind, preference is given to those energy resources that are in the possession and control of a country [26,27,28,29]. Notably, in the last five years, the importance of energy security in the energy policy-making process has clearly increased due to the intensification of economic threats such as armed conflicts, financial crises, and pandemics [30,31,32,33,34,35]. In the above conditions, the import of energy resources and/or energy itself becomes an undesirable phenomenon, making the economy dependent on external suppliers of energy carriers. Therefore, the decision to import energy resources and/or energy should be preceded by a thorough analysis identifying its impact on the level of energy security and determining its broadly understood efficiency.

Meanwhile, relatively little attention has been paid to the issue of energy and energy resource imports in the literature, as will be documented in subsequent sections. Researchers currently focus on environmental issues [36,37,38,39], eco-innovation [40,41,42,43,44], renewable energy sources [45,46,47,48,49,50], and, more broadly, on the determinants of energy mixes. Thus, there is a gap in knowledge regarding the role of imports in contemporary energy policies.

The right choice of energy policy directions is particularly important in emerging and developing economies, because they usually have problems with effective implementation of environmental goals and energy transformation [51,52]. Poland, which is the subject of consideration of this article, is one such economy. Hard coal has dominated Poland’s energy mix for many decades. Deposits of hard coal with active mines are currently located in the Upper Silesian and Lublin Coal Basins.

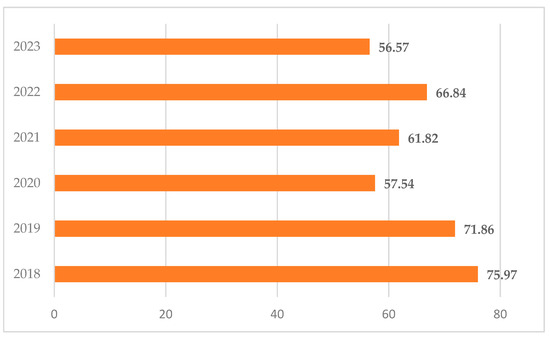

The pressure from the European Union to decarbonize has forced Poland to systematically reduce its coal consumption in the power industry [53,54]. Nevertheless, it remains a key source of energy, with consumption levels at around 55–75 million tons per year (Figure 1).

Figure 1.

Hard coal consumption in Poland in 2018–2023 [in million tonnes].

In connection with the above—despite changes in the EU’s approach to environmental issues—the main priority in Polish energy policy remains maintaining energy security. In principle, it is to be achieved through the use of coal extracted from domestic mines. The actual state of implementation of this priority will be assessed in this article.

As part of the characteristics of the Polish energy mix, it is also worth adding that, in addition to coal, Poland uses gas, and in recent years also oil, to meet its energy needs. The use of renewable resources is at a fairly low level and includes solar and wind energy as well as biomass. In such resource conditions, decarbonization and reduction in greenhouse gas emissions is an extremely difficult challenge [55,56].

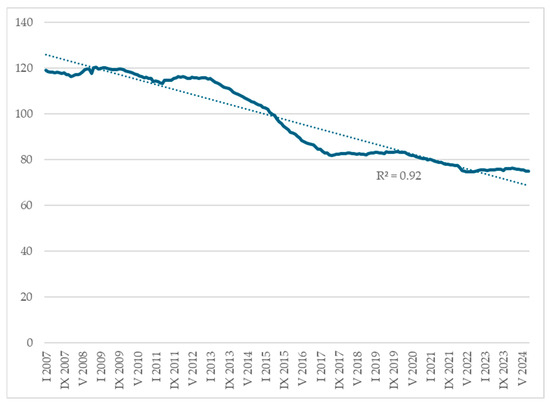

It is additionally complicated by the need to meet social expectations. Polish hard coal mining currently employs around eighty thousand people directly in mining companies (Figure 2). Additionally, the mining-related industry employs ninety to one hundred thousand workers. Reducing this employment raises concerns and opposition from the local community and may contribute to the pauperization of Upper Silesia. Therefore, social issues are still very important in the priorities of energy policy.

Figure 2.

Employment in Polish hard coal mining in 2008–2024 [in thousands]. Source: [https://polskirynekwegla.pl/raport-dynamiczny/stan-zatrudnienia]. [accessed on 1 July 2024].

Social pressure also has an impact on maintaining and increasing wages in Polish coal mining. This causes an increase in extraction costs and a decrease in the competitiveness of Polish coal, which is deepened by demanding mining conditions. This situation leads to a paradoxical choice between using domestic production (maintaining energy security) and importing hard coal (reducing energy independence).

With the above observations in mind, the main objective of this article is a comparative analysis of domestic hard coal production and imports in Poland and the formulation of conclusions for energy policy and competitiveness. To achieve such a goal, this paper examines the volume and structure of hard coal imports over the past five years, with a particular focus on geopolitical considerations. In addition, the qualitative and quantitative competitiveness of the Polish raw material over imported ones is assessed. Subsequently, based on the conclusions obtained, recommendations are developed for the Polish hard coal mining industry and energy policy.

In the context of assessing import competitiveness, the following questions were formulated:

- How do the volume and directions of coal imports to Poland change over time in comparison with domestic production?

- What parameters (quality, price) determine the advantage of imported hard coal over Polish coal?

Answers to the above questions provide information not only on the directions of Polish energy policy. They could also be used to identify progress in decarbonization. In addition, determining the sources of quality and price competitiveness of imported coal helps in establishing recommendations for improving domestic production.

Additionally, this research considers the possibility of import substitution by domestic production and identifies energy policy objectives in the context of decisions on coal imports. In this respect, the research questions are as follows:

- Does Poland have the resource potential to replace imported coal with its own production?

- What energy priorities shape the ratio of imported coal to domestic coal?

Increasing imports or maintaining them at a constant level may pose a threat to energy security. Such an approach is neither conducive to decarbonization nor to Poland’s energy security. It is therefore worth considering whether there are possibilities to meet the qualitative and quantitative requirements of the energy sector using domestic hard coal resources.

This research used analysis of structure, dynamics, and comparative analysis in terms of quality and price competitiveness.

The originality of the analyses undertaken is due to the following circumstances:

- embedding considerations in a narrow, currently less-recognized, research niche related to the import of non-renewable energy resources;

- conducting research from a micro-perspective relating to a selected energy policy of a developing economy (in addition to the prevailing considerations relating to international holistic analyses);

- characterizing imports in the context of their price and quality competitiveness and the potential of Poland’s hard coal reserves.

2. Literature Review

This subsection presents a review of the contemporary literature relating to the import of energy resources as an introduction to further analysis and as a starting point for the discussion contained in the final section of the paper. The review has been divided into two parts. It begins with a consideration of the role of imports in energy policy and the consequences of importing raw materials. It is followed by a description of the market determinants of energy resources imports. Both subsections conclude with the identification of the research gap resulting from the literature review.

2.1. Imports of Energy Resources and Their Consequences

The issue of energy resources imports and energy appears in the literature primarily in the context of energy security. This is where opinions seem to be quite consistent. Indeed, most studies link increasing imports with decreasing energy security.

Such a connection is also shown by Mišík (2022) [57] studying the impact of the Russia-Ukraine conflict on the energy security of European Union countries. His analysis shows that the conflict revealed a clear lack of resilience of European Union countries to shortages of natural gas imported from Russia. The long-standing dependence on external supplies of this commodity, coupled with insufficient development of RES, resulted in a significant reduction in the energy security of individual European countries and the EU as a region.

Similar dependencies in EU economies are seen by Carfora et al. (2022) [58], who state unequivocally that imports pose a threat to energy supply security. Furthermore, the authors emphasize that reducing energy dependence can be intensively strengthened by the use of renewable energy sources, which also allows for the simultaneous realization of the goals of sustainable development. The role of RES in enhancing energy security and reducing import dependence is also emphasized by Aslantürk and Kıprızlt (2020) [59].

However, Yadav and Mahalik [60], in a study of 16 emerging economies, no longer identify such a significant relationship between the use of renewable resources and reducing import dependence. The lack of a relationship between imports and RES use is also described by Purwanto et al. (2020) [61], using Indonesia as an example. So, in the case of emerging economies, the substitution effect is smaller. This may be due to the intensive growth of these countries strongly stimulating the demand for energy resources imports [62] and the slow development of RES in their energy mixes, which is not able to quickly and fully supplement the growing demand for energy.

Malik et al. (2020) [63], using Pakistan as an example, more broadly identify the adverse effects of importing non-renewable energy resources, including not only lowering energy security, but also straining foreign exchange reserves, exposing the economy to international energy price shocks, and increasing inflation. In addition, the authors note that rising inflation significantly worsens the competitiveness of Pakistan’s exports, further reducing the economy’s ability to bear the cost of energy imports.

The costliness of imports is also described by Brown and Huntington (2015) [64], using the example of the US economy and its dependence on oil supplies. The authors estimate the costs associated with importing this commodity and treat them as significant economic losses.

Similar conclusions were proposed by Murshed et al. (2020) [65], using the Sri Lankan economy as an example. Indeed, their study shows that increasing the share of imported energy in total energy consumption negatively affects economic growth, especially in the context of gross value added, industrial, and services.

Kong et al. (2019) [66] analyze the risk of losing energy independence in more detail, rightly noting that its nature is not always the same. Thus, they create a classification of risks associated with energy resources imports. This includes the risks of loss of independence, price volatility, resources, and purchasing power. The authors also suggest choosing import destinations depending on a country’s tolerance of particular risks.

On the other hand, the environmental impact of the use of non-renewable energy resources, using the example of Bangladesh, is highlighted by Islam et al. (2021) [67]. Bangladesh’s energy mix is based mainly on hard coal, with more than half of this resource imported. As demand for coal has increased due to the country’s intensive development, a number of import dependency problems have emerged. Among them, the most noticeable are problems with continuity of supply and the need to meet increasing environmental requirements, which involves ensuring raw material with certain quality parameters.

2.2. Market Determinants of Imports of Energy Resources

There are also publications in the literature describing market mechanisms related to the import of non-renewable resources and the increasing globalization of economies. Thus, Wang et al. (2021) [68] characterize such a mechanism in relation to the global hard coal market. The researchers note that competition for hard coal sourcing is particularly fierce in the Asia-Pacific region and primarily involves China and Japan. With the decarbonization of EU economies, imports to EU countries are no longer as important as they were in the 20th century. In addition, the network of hard coal importers has changed from a periphery structure to a reticular structure, which means multiple suppliers and theoretically increases supply flexibility.

The impact of imports on energy policy is also described at the local and regional levels. In their research, Yuan et al. (2020) [69] refer to oil imports in China and their impact on individual provinces. Their findings point to the need to strengthen supply chain resilience tailored to the geographic location of the region.

An interesting study on the price and income determinants of oil imports in Turkey was conducted by Ozturk and Arisoy (2016) [70]. Their results show a statistically significant relationship between oil consumption and income. With consumption of imported oil in Turkey growing faster than income, it can be concluded that it is a normal good and its buyers have a strong attachment to it. Thus, the identified relationship drives the demand for imports of this commodity.

With this observation in mind, it is worth noting that insufficient (or poorly planned) levels of domestic energy resources combined with the reduction or abandonment of imports can have disastrous economic consequences. This is illustrated by the case of Tanzania, as described by Jacob (2021) [71]. A hard coal import ban imposed there to strengthen the position of the local mining company caused prices to skyrocket and contributed to the collapse of many steel and cement producers. This, in turn, slowed down the construction sector and, as a result, the entire Tanzanian economy. The conclusions of the cited studies imply the need for careful and rational planning of energy policy, including decisions on the extent of imports of energy resources.

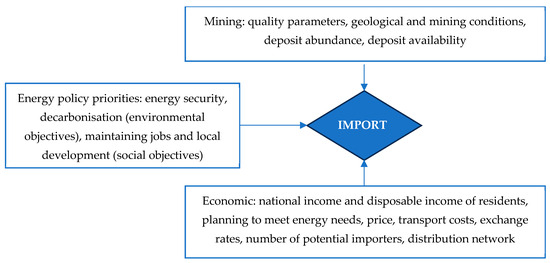

Figure 3 summarizes general considerations on the import of energy resources. It distinguishes three groups of conditions for import decisions. The first group refers to mining conditions, which have a defined character. These conditions are difficult to influence because they are shaped by nature. The second group includes a number of economic factors that must be taken into account when choosing imports. Decision-makers can predict and plan them and attempt to shape them. They therefore have a significant basis for making effective decisions. Additionally, decisions on imports are also influenced by energy policy priorities, which should be clearly and permanently declared.

Figure 3.

Determinants of energy resource imports: summary of the review.

As already mentioned, in Poland, energy security clashes with environmental issues (decarbonization pressure from the EU) and social issues (maintaining employment) in energy policy [72,73,74,75,76,77,78,79,80,81]. For these reasons, it is postulated to fulfill energy needs using hard coal extracted in domestic mines. Thus, energy and social security are prioritized. Unfortunately, the declining competitiveness of Polish coal is forcing energy producers to seek alternative methods of supply abroad. This leads to periodic increases in imports and (paradoxically) negates the key priority of energy policy, which is to maintain energy security. The conditions of this process will be the subject of detailed considerations in the research part of the article.

2.3. Identification of Research Gap

The literature review shows that issues related to the import of energy resources are present in the literature, but alongside mainstream considerations related primarily to the use of RES. Most often, they refer to energy security and the economic consequences of imports. In the subject aspect, they very often refer to emerging and developing economies, which are facing many energy policy problems. The European Union also appears in the analyses as a region exposed to the effects of dependence on natural gas imports from Russia.

However, despite the serious consequences caused by imports of energy resources and the relevance of decisions on the scale of these imports, the publications do not include threads on the details of import policy and price and quality competitiveness as the basis for decisions on external supplies of energy resources. Given these circumstances, the article decides to analyze the above issues using the example of the Polish economy.

Such an approach will detail the consideration of coal imports, which is particularly relevant in emerging and developing economies. In addition, it will provide conclusions on the rationality and circumstances of the decision to make the domestic energy industry dependent on external suppliers of energy resources.

3. Materials and Methods

The main objective of the article is a comparative analysis of domestic hard coal production and imports in Poland and the formulation of conclusions for energy policy and competitiveness. In order to achieve this goal, statistical data published on the Polish Coal Market portal [82] were used, including publications entitled: Imports and supplies (intra-EU purchases) of hard coal [83,84,85,86,87,88] and Information on coal resources [89,90,91,92].

Two research stages were completed during the analyses. The first stage refers to the volume of production and imports of hard coal in Poland from 2018 to 2023. In addition, the structure of the main directions of hard coal imports was determined, indicating individual countries. The research used statistical and comparative analysis. Using these methods, the main import directions and their changes over time were identified. Additionally, they enabled an assessment of the impact of crisis situations (the COVID-19 pandemic and the war in Ukraine) on decisions regarding the supply of thermal coal to Poland. These are valuable conclusions for both energy policy and crisis management.

The second stage presents the results of the analysis of the qualitative and price competitiveness of Polish hard coal, taking into account the following parameters:

- ash content expressed in %,

- sulfur content expressed in %,

- calorific value expressed in kJ/kg,

- price of imported and domestic coal expressed in PLN per 1 ton.

At this point, it should be added that the benchmark values for the qualitative parameters of thermal coal are most often defined on the basis of price indices such as: CIF ARA, FOB Newcastle, and FOB Richards Bay [93,94]. They take into account a calorific value of 25,000 kJ/kg, a sulfur content of less than 1%, and an ash content between 11 and 16% [95]. The higher the calorific value and lower the sulfur and ash content, the better the quality of hard coal.

Qualitative and price comparisons are rarely performed in the literature. Researchers most often focus on the volume of trade and the macroeconomic view. Meanwhile, the basis for making rational energy decisions is a multi-aspect assessment conducted from a microeconomic point of view, because ultimately the sum of individual decisions determines the effectiveness of energy policy. For these reasons, the authors of the article identified and compared the key quality and price parameters for domestic and imported coal.

Additionally, as part of the competitiveness assessment, the quality and price parameters of imported coal were compared with domestic resources. The results of this comparison are important in the context of the possibility of substituting imported coal with domestic coal, which would be beneficial economically and in the context of increasing energy security.

The analysis of the quality and price competitiveness of Polish hard coal allowed us to answer the following research questions:

- How do the volume and directions of coal imports to Poland change over time in comparison with domestic production?

- What parameters (quality, price) determine the advantage of imported hard coal over Polish coal?

- Does Poland have the resource potential to replace imported coal with its own production?

- What energy priorities shape the ratio of imported coal to domestic coal?

The main benefit of the methods used is the development of a microanalysis of competitiveness for domestic and imported coal. It can be the basis for selecting energy policy priorities. It can also be used to correct the rules for supplying coal to the energy sector. In the conditions of pressure towards decarbonization, the conclusions obtained are particularly valuable and important.

4. Results

4.1. Assessment of Changes and Directions of Coal Import to Poland

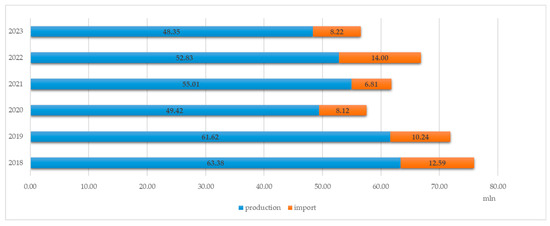

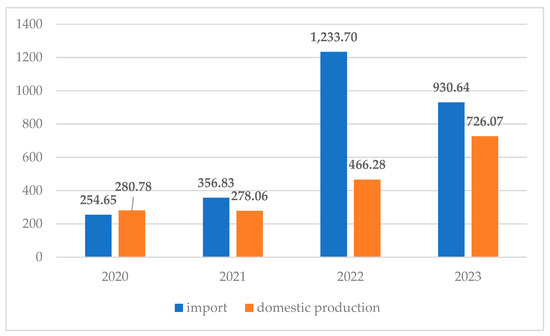

Given mining conditions, Poland should not import hard coal as an energy resource. This is because previous considerations show that it has the resource potential to meet the demand for thermal coal in at least a thirty-year perspective. Until 2018—when permanently unprofitable mines were closed—the growing volume of hard coal imports was explained by the unprofitability of mining and the possibility of acquiring cheaper raw material abroad. It is therefore worth looking at whether and how the situation has changed after the restructuring of Poland’s hard coal mining industry. Figure 4 shows the volume of coal mining in Poland and the volume of imports in 2018–2023.

Figure 4.

The size of hard coal import to Poland in 2018–2023 [in million tons]. Source: own work based on [83,84,85,86,87,88].

Figure 4 shows that both extraction and import changed quite irregularly during the period under review. By 2020, mining was being reduced. Import of hard coal to Poland also decreased. In 2021, extraction was again increased; in addition, in 2022 and 2023, imports of this raw material increased sharply. On the basis of these data, one can conclude that there is no consistent and permanent policy for the sourcing of the main energy resource. Indeed, it is difficult to say unequivocally whether the direction away from fossil fuels is being pursued, or whether the option that guarantees energy security is being continued, especially in periods when hard coal imports are growing significantly. It seems that neither of these goals is being pursued in a systematic and consistent manner.

It is worth mentioning in this context that the share of imports in the consumption of hard coal in Poland throughout the analyzed period has remained constant and quite high, ranging from 11% to over 20% (Table 1).

Table 1.

Share of imports in hard coal consumption in Poland in 2018–2023.

With these observations in mind, it is necessary to take a closer look at the directions of hard coal imports to Poland. This will allow us to assess the scale of dependence on individual suppliers and confirm or deny the thesis that there is no systematized policy for meeting the demand for hard coal, which is the main energy resource in Poland. Thus, Figure 5, Figure 6, Figure 7, Figure 8, Figure 9 and Figure 10 show the structure of hard coal importers to Poland in 2018–2023.

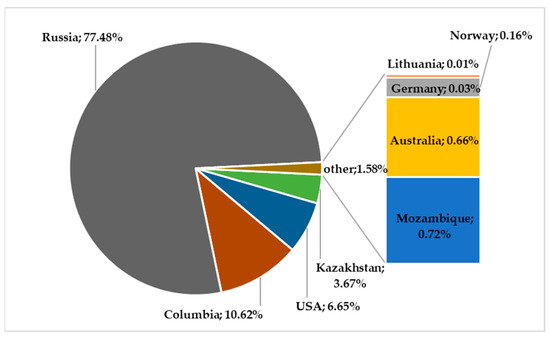

Figure 5.

Geographic structure of hard coal imports in Poland in 2018 [in %]. Source: own work based on [83,84,85,86,87,88].

Figure 6.

Geographic structure of hard coal imports in Poland in 2019 [in %]. Source: own work based on [83,84,85,86,87,88].

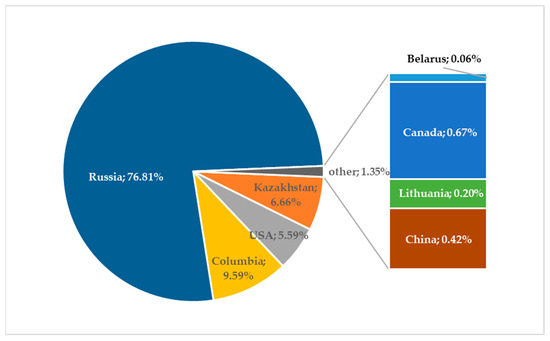

Figure 7.

Geographic structure of hard coal imports in Poland in 2020 [in %]. Source: own work based on [83,84,85,86,87,88].

Figure 8.

Geographic structure of hard coal imports in Poland in 2021 [in %]. Source: own work based on [83,84,85,86,87,88].

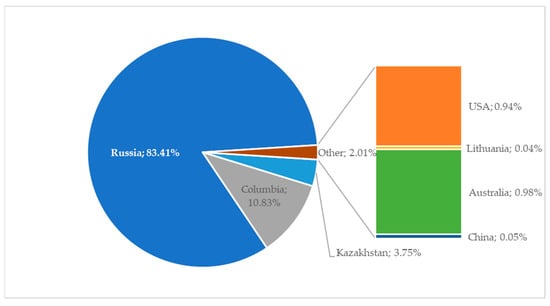

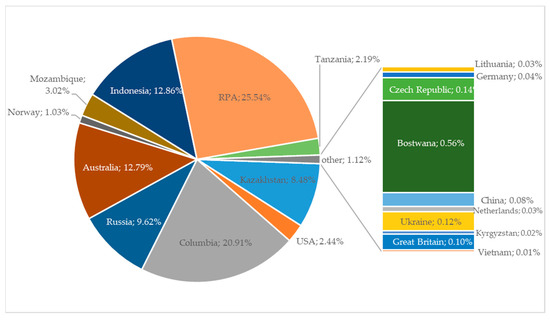

Figure 9.

Geographic structure of hard coal imports in Poland in 2022 [in %]. Source: own work based on [83,84,85,86,87,88].

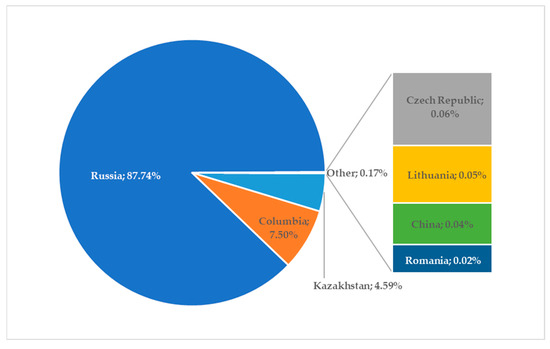

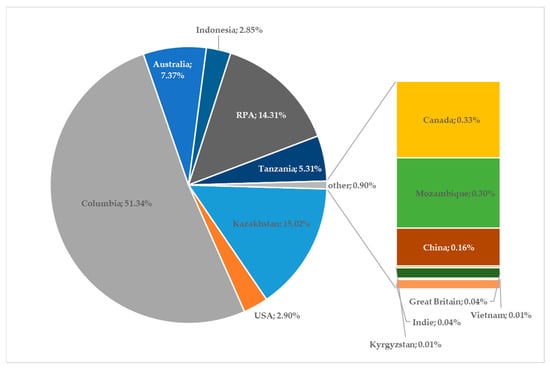

Figure 10.

Geographic structure of hard coal imports in Poland in 2023 [in %]. Source: own work based on [83,84,85,86,87,88].

Until 2021, the main importer of hard coal to Poland is Russia. Its share of total imports is steadily increasing from 77% to over 87%. Other, larger suppliers—with a share of no more than 10%—are Colombia and Kazakhstan. Most of Poland’s imports, therefore, come from the former states of the Union of Soviet Socialist Republics, located in fairly close geographical proximity. A few smaller importers also represent Eastern Bloc countries. These include Belarus, Lithuania, the Czech Republic, and Romania. More exotic supply regions include Mozambique, Australia, and China. Thus, for 2018–2021, the import structure is fairly stable, with a strong dependence on Russia, and the number of importers ranges from 6 to 9.

However, the armed conflict between Russia and Ukraine significantly changed the structure and directions of hard coal imports to Poland in 2022–2023, as illustrated in Figure 9 and Figure 10.

Thus, in 2021, Russia’s share of coal imports to Poland decreased to 9.62%, and in 2022, both Russia and Belarus ceased being Poland’s partners in hard coal trade. This forced the search for new suppliers, a rather difficult task due to the urgency of the situation and the significant influence of Russia on meeting Polish energy needs.

Nevertheless, a record amount of imported hard coal is being brought to Poland in 2022, accounting for more than one-fifth of the demand for this energy resource. It ultimately comes from 20 countries, with the emerging leaders among foreign suppliers, such as South Africa, Colombia, Indonesia, and Australia. The completely new import destinations that are emerging are Botswana, Vietnam, and Tanzania.

In 2023, the directions of foreign supplies stabilized somewhat. Indeed, imports are already coming from only 14 countries, and their structure shows a heavy reliance on Colombian suppliers. Kazakhstan and South Africa can also be considered significant importers.

In the context of the analysis carried out, it is worth considering why, when the continuity of supply from Russia was threatened, the existing demand for hard coal was not covered by domestic production. Moreover, the latter in 2022 decreased by more than 2 million tons compared to 2021, and imports reached the highest value in the analyzed period. Therefore, it can be presumed that the existing demand could not be covered by domestic production and the rapid search for new importers resulted in an unprecedented increase in the number of foreign suppliers and a record volume of imports.

The situation stabilized in 2023, but compared to 2020—apart from the directions of imports—not much has changed. Poland still consumes about 55–60 million tons of hard coal, which remains its main energy resource. The share of imports in covering this consumption is still around 14%, and the import structure is currently dominated by Colombia, as it was previously by Russia. This suggests a failure to both realize decarbonization and improve Poland’s energy security.

Given Poland’s continued dependence on hard coal importers (despite the abundance of its own hard coal deposits and pro-efficiency reforms being undertaken), the next section analyzes the quality and price parameters of imported hard coal.

4.2. Quality and Price of Imported Coal in the Context of Domestic Mining

Bearing in mind that Poland has significant hard coal resources, the sufficiency of which is estimated to last for a minimum of 30 years, it is worth asking about the reasons for importing this raw material during the analyzed period. One reason could be qualitative differences between domestic and imported coal regarding ash content, sulfur content, and calorific value. Therefore, a comparative analysis of these parameters is carried out in this subsection.

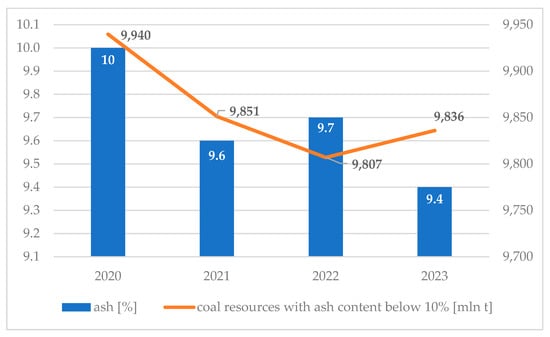

Figure 11 shows the ash content of imported coal, and the size of the balance coal reserves with an ash content of less than 10% in Poland in 2020–2023.

Figure 11.

Ash content of imported coal and the size of the balance coal reserves with ash content below 10% in Poland in 2020–2023 Source: own work based on data [82,89,90,91,92].

The ash content of imported coal is decreasing over time, indicating an improvement in the quality of this raw material in the analyzed context. Nevertheless, Poland has balance resources of over 9800 million tons, in which the ash content also does not exceed 10%. Therefore, it can be presumed that coal of comparable quality to imported coal could also be mined within domestic production capacity.

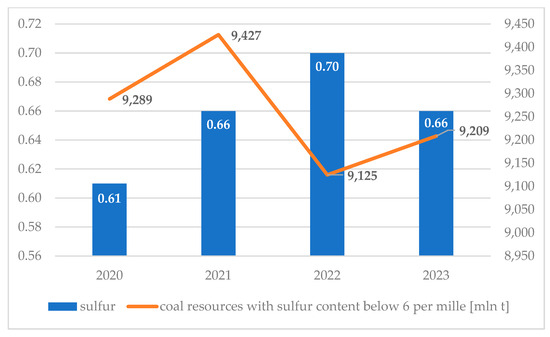

Figure 12, in turn, presents the sulfur content of imported coal and the size of the balance resources of coal with a sulfur content of less than 0.6% in Poland in 2020–2023. In imported coal, the sulfur content ranges from 0.61% to 0.67% and is characterized by an upward trend. Statistics also show that in more than 9000 million tons of Polish balance resources of this raw material, the sulfur content is lower than 0.6%. Thus, there are potential opportunities to extract coal with parameters similar to or better than those of imported coal.

Figure 12.

Sulfur content of imported coal and the size of the balance coal reserves with sulfur content below 0.6% in Poland in 2020–2023 Source: own work based on data [82,89,90,91,92].

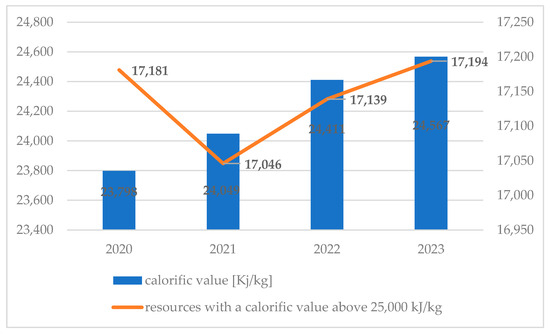

The last qualitative distinguishing feature of hard coal is calorific value, shown in Figure 13.

Figure 13.

Calorific value of imported coal and size of balance coal reserves with calorific value above 25,000 kJ/kg in Poland in 2020–2023. Source: own work based on data [82,89,90,91,92].

The calorific value for imported coal ranges from more than 23,700 kJ/kg to more than 24,500 kJ/kg and is characterized by an upward trend over time, which also reflects the increase in quality requirements from the industrial and commercial power industry. It is also worth noting that Poland has coal deposits with a calorific value of more than 25,000 kJ/kg, and they are far more abundant than those with the desired sulfur and ash content. They amount to about 17,000 million tons in balance resources and about 2800 in off-pillar industrial resources. Accordingly, Polish mines would also be able to supply coal of very good calorific quality.

Conclusions from the above analyses do not clearly indicate a lack of qualitative competitiveness on the part of Polish hard coal, since both balance and industrial resources of the raw material with desirable (better than imported coal) qualitative characteristics are quite significant and could satisfy domestic demand for thermal coal, as further illustrated by the data presented in Table 2.

Table 2.

Share of resources with the best quality parameters in the balance resources in Poland in 2020–2023.

These data show that more than 1/3 of the balance resources of Polish hard coal, i.e., more than 9000 million tons, meet the quality requirements in all three categories. Furthermore, more than 60% of the balance resources are characterized by a desirable and high calorific value. Nevertheless, it should be borne in mind that commercial coal must be characterized by simultaneous fulfillment of the described quality requirements, which can significantly reduce the described resource potential. It should be noted, however, that even if only 10% of the identified 9000 million tons ultimately represented the required quality, 900 million tons would remain available to the power industry, guaranteeing sufficiency for about 15 years.

It is therefore also worth looking at the price competitiveness of Polish hard coal. Data for this area of analysis are presented in Figure 14.

Figure 14.

Price of imported (free-at-frontier) and domestically produced (ex-mine) hard coal in 2020–2023 [PLN/ton] Source: own work based on data [82,89,90,91,92].

The price of imported coal was lower than the price of coal from domestic production only in 2020. At that time, the volume of production and imports was also the lowest in the analyzed period. The increase in demand in the next three years triggered an increase in the price of both domestic and imported coal. This increase intensified in 2022 as a result of the Russia-Ukraine armed conflict and the need for a sharp change in sourcing directions. In 2023, the price disparity between domestic and imported coal narrowed, but foreign coal was still more expensive than domestic coal.

Therefore, in light of the analyzed data, it is not possible to unequivocally conclude that imported hard coal was more profitable in price and quality than the use of domestic mining.

5. Discussion

The analysis shows that Poland imports about 11–20% of the coal used in its power industry. Together with domestic production, this yields consumption of 75 to 56 million tons per year. The decreasing volume of consumption indicates progress in decarbonization. However, this progress is quite slow and inconclusive, as periodically both imports and domestic output increase.

Importing hard coal could supplement domestic production when hard coal does not meet the quantity, quality, or price requirements. However, analyses show that Poland has resources with the desired quality and price parameters. The volume of available balance deposits, including industrial ones, is also significant and sufficient. Therefore, it can be concluded that importing hard coal has no clear, rational justification and adversely affects the country’s energy security, especially since foreign supplies are monopolized (the main share by Russia, followed by Colombia).

The above conclusions correspond with the results of the analysis by Carfora et al. (2022) [58] and Mišík (2022) [57] on the example of the European Union and point to the marginalization of energy security issues resulting from the EU’s relatively smooth cooperation with Russia in the run-up to the Russia-Ukraine armed conflict.

It should be added, however, that hard coal mining is a complex production process, in which a simple selection of only those deposits and seams with optimal quality and price parameters is not possible. It requires proper reconnaissance and assessment of the profitability of mining before deciding on mining. Meanwhile, in practice, very often the price and quality competitiveness of hard coal resources are not taken into account, and mining is carried out to maintain the continuity of production (including employment), keeping in mind mainly the availability of individual deposits. This results in the mismatch of quality parameters with the requirements of suppliers and generates the need to import hard coal. The above-mentioned consequences imply the need to rationalize import decisions, as pointed out by Jacob (2021) [71], among others, who also describes the long-term and disastrous consequences of ill-advised choices in this regard.

The Polish coal mining industry also lacks investments that would enable the extraction of coal with the best quality parameters and create an opportunity to minimize imports and dependence on foreign suppliers. Meanwhile, the rather slow pace of the transformation of the Polish energy sector implies a long-term dependence on hard coal, stimulating demand for imported coal. Thus, it can be predicted that without sufficient investment in mining (if the slow pace of the energy transition is maintained), energy security may diminish, despite having the quantitative and qualitative potential to meet energy demand [72,73,74,75,76].

The above observations reveal an inconsistency in the implementation of energy policy goals, as it is difficult to say whether decarbonization or energy security is the priority. This inconsistency and certain chaotic circumstances are also exposed by the armed conflict between Russia and Ukraine, during which there is a reorientation of import directions characterized by the number and exotic character of supply directions. It is worth adding at this point that such flexibility was made possible by the change to a more dispersed structure of coal importers, as described by Wang et al. (2021) [68].

These research findings illustrate the difficulties of meeting modern energy requirements in emerging and developing economies. On the one hand, they are due to objective circumstances, such as the long-standing use of cheaper and more available traditional non-renewable energy resources and lower technological efficiency, or an inferior level of economic development. On the other hand, they involve subjective causes characteristic of post-transformation economies. Among them are planning and management problems, political instability, and the volatility of energy policy directions.

6. Conclusions

6.1. Research Conclusions

This analysis shows that Poland still uses hard coal as its main energy resource. Despite having its own deposits, much of this raw material is imported. Such a situation indicates a lack of consistent implementation of energy policy. Indeed, it is difficult to determine whether the priority is decarbonization or maintaining energy security. The first goal is not supported by maintaining high levels of consumption. The realization of the second is contradicted by the periodically increasing volume of imports and the rather chaotic search for hard coal suppliers at the outbreak of the armed conflict between Russia and Ukraine.

The structure of coal importers to Poland is quite diverse and includes many geographic directions. However, until 2021, it was dominated by Russia, followed by Colombia, indicating a fairly homogeneous supply market and a continuing tendency to depend on a single importer. It also remains an open question why the demand for hard coal is not met using domestic hard coal deposits.

The qualitative competitiveness analysis carried out in this article indicates the existence of balance and industrial resources whose quality parameters (sulfur content, ash content, and calorific value) are comparable and better than those of imported coal. Polish hard coal can also compete with imported coal in terms of price. In 2021–2023, it was clearly cheaper than foreign coal.

6.2. Recommendations for Competitiveness and Energy Policy

This analysis provides two key observations. First, there is a possibility of supplying domestic coal to the energy sector with a quality comparable to or better than imported coal. Second, by increasing imports, Poland is not fulfilling either the priority of energy security or decarbonization. The recommendations described below are aimed at these two circumstances.

The substitution of imported coal with domestic coal requires answering the question of why coal from Polish mines is not used to meet the demand for energy resources. The reason is most likely the lack of effective and long-term mining planning, taking into account the quality and price requirements of the Polish energy sector. Therefore, it is necessary to:

- make mining decisions while considering the quality and price parameters of hard coal;

- plan mining production while taking into account the needs of the professional and industrial power industry, both in terms of quantity, quality, and price;

- harmonize long-term investment plans with Poland’s energy policy and the role of hard coal in meeting national energy needs.

The above activities allow for the synchronization of the needs of the energy sector and the possibilities of the Polish mining industry. In this way, they also contribute to increasing energy security by abandoning imports.

Nevertheless, this may turn out to be very fraught with consequences, especially in the current energy conditions dictated by the European Union. Reorientation of energy goals is very capital- and time-consuming. With the above in mind, it is recommended that Poland:

- unambiguously and consistently define energy priorities;

- take detailed planned and long-term measures for their implementation;

- plan to meet the demand for thermal coal, taking into account the entire economy and the quality and price parameters of mined and imported raw materials in order to strengthen the resilience of the energy supply chain [69];

- take into account investment plans in the coal mining industry aimed at ensuring the price and quality competitiveness of the Polish raw material even in the situation of a scenario of a complete shift away from coal (as it is not possible in the short term).

6.3. Originality of Research and Its Contribution to the Economics of Mining

The analyses presented in this article are conducted from a macro perspective, one rarely found in the literature, which is dominated by statistical research and comparative analyses of national economies and industries. Moreover, this research assesses not only the volume and directions of imports, but also its competitiveness in terms of quality and price. At the level of the Polish economy, such comparisons have not been carried out in the last few years. Therefore, the conclusions obtained can be a valuable source of knowledge supporting decision-making processes in the area of mining and energy policy. From a methodological point of view, the undertaken research can be easily replicated in other emerging and developing economies.

6.4. Research Limitations and Directions of Further Research

The research presented in the article has several research limitations. The first is methodological in nature and is related to the use of fairly simple analytical tools, which is largely due to the small volume of available data. Nevertheless, the use of an uncomplicated methodology facilitates its replication and allows for a broader understanding and use of the conclusions in economic practice.

The second research limitation relates to the geographic scope of the study covering only Poland. However, it is worth noting that this approach allows a closer look at selected aspects of energy policies. Analyses from a micro research perspective are far less frequent than holistic statistical studies of an international comparative nature.

Given the above circumstances, in the future, it would be advisable to expand the analyses conducted to other countries, including in particular those where energy security clashes with decarbonization. It would also be worthwhile to take a closer look at the managerial determinants of energy supply decisions, which could make a valuable and distinctive contribution to energy economics. In addition, it would also be useful to assess Poland’s balance resource potential in terms of meeting quality criteria in a concurrent manner and to estimate the market sufficiency of coal deposits parameterized in this way.

Author Contributions

Conceptualization, I.J.-K.; methodology, I.J.-K.; validation, I.J.-K.; formal analysis, W.G.; investigation, W.G.; resources, I.J.-K.; writing—original draft preparation, I.J.-K.; writing—review and editing, W.G.; funding acquisition, I.J.-K. All authors have read and agreed to the published version of the manuscript.

Funding

The research was financed from Statutory research No. BK-264/ROZ1/2024 (13/010/BK_24/0081) (Institute of Economics and Computer Science, Faculty of Organization and Management, Silesian University of Technology).

Data Availability Statement

Data are available on request from the author via email (izabela.jonek-kowalska@polsl.pl).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Primc, K.; Slabe-Erker, R. Social policy or energy policy? Time to reconsider energy poverty policies. Energy Sustain. Dev. 2020, 55, 32–36. [Google Scholar] [CrossRef]

- Hafner, M.; Raimondi, P.P. Priorities and challenges of the EU energy transition: From the European Green Package to the new Green Deal. Russ. J. Econ. 2020, 6, 374–389. [Google Scholar] [CrossRef]

- Bhardwaj, A.A.; McCormick, C.; Friedmann, J. Opportunities and Limits of CO2 Recycling in a Circular Carbon Economy: Techno-economics, Critical Infrastructure Needs, and Policy Priorities; Center on Global Energy Policy: New York, NY, USA, 2021. [Google Scholar]

- Axon, C.J.; Darton, R.C. Sustainability and risk—A review of energy security. Sustain. Prod. Consum. 2021, 27, 1195–1204. [Google Scholar] [CrossRef]

- Rabbi, M.F.; Popp, J.; Máté, D.; Kovács, S. Energy Security and Energy Transition to Achieve Carbon Neutrality. Energies 2022, 15, 8126. [Google Scholar] [CrossRef]

- Nevzorova, T.; Kutcherov, V. The Role of Advocacy Coalitions in Shaping the Technological Innovation Systems: The Case of the Russian Renewable Energy Policy. Energies 2021, 14, 6941. [Google Scholar] [CrossRef]

- Shantala, S.; Thakur-Wernz, P.; Hatfield, D.E. Does the focus of renewable energy policy impact the nature of innovation? Evidence from emerging economies. Energy Policy 2020, 137, 111119. [Google Scholar]

- Corsatea, T.D. Technological capabilities for innovation activities across Europe: Evidence from wind, solar and bioenergy technologies. Renew. Sustain. Energy Rev. 2014, 37, 469–479. [Google Scholar] [CrossRef]

- Li, D.; Ge, A. New energy technology innovation and sustainable economic development in the complex scientific environment. Energy Rep. 2023, 9, 4214–4223. [Google Scholar] [CrossRef]

- Borge-Diez, D. Energy Policy, Energy Research, and Energy Politics: An Analytical Review of the Current Situation. Energies 2022, 15, 8792. [Google Scholar] [CrossRef]

- Ohta, H.; Barrett, B.F.D. Politics of climate change and energy policy in Japan: Is green transformation likely? Earth Syst. Gov. 2023, 17, 100187. [Google Scholar] [CrossRef]

- Royston, S.; Foulds, C.; Pasqualino, R.; Royston, A.J. Masters of the machinery: The politics of economic modelling within European Union energy policy. Energy Policy 2023, 173, 113386. [Google Scholar] [CrossRef]

- Kuzemko, C.; Britton, J. Policy, politics and materiality across scales: A framework for understanding local government sustainable energy capacity applied in England. Energy Res. Soc. Sci. 2020, 62, 101367. [Google Scholar] [CrossRef]

- Xue, C.; Shahbaz, M.; Ahmed, Z.; Ahmad, M.; Sinha, A. Clean energy consumption, economic growth, and environmental sustainability: What is the role of economic policy uncertainty? Renew. Energy 2022, 184, 899–907. [Google Scholar] [CrossRef]

- Popkova, E.G.; Sergi, B.S. Energy efficiency in leading emerging and developed countries. Energy 2021, 221, 119730. [Google Scholar] [CrossRef]

- Wolde-Rufael, Y.; Mulat-Weldemeskel, E. Do environmental taxes and environmental stringency policies reduce CO2 emissions? Evidence from 7 emerging economies. Environ. Sci. Pollut. Res. 2021, 28, 22392–22408. [Google Scholar] [CrossRef]

- Alsagr, N.; Van Hemmen, S. The impact of financial development and geopolitical risk on renewable energy consumption: Evidence from emerging markets. Environ. Sci. Pollut. Res. 2021, 28, 25906–25919. [Google Scholar] [CrossRef]

- Yu, C.; Moslehpour, M.; Tran, T.K.; Trung, L.M.; Ou, J.P.; Tien, N.H. Impact of non-renewable energy and natural resources on economic recovery: Empirical evidence from selected developing economies. Resour. Policy 2023, 80, 103221. [Google Scholar] [CrossRef]

- Segreto, M.; Principe, L.; Desormeaux, A.; Torre, M.; Tomassetti, L.; Tratzi, P.; Paolini, V.; Petracchini, F. Trends in Social Acceptance of Renewable Energy Across Europe—A Literature Review. Int. J. Environ. Res. Public Health 2020, 17, 9161. [Google Scholar] [CrossRef]

- Batel, S. Research on the social acceptance of renewable energy technologies: Past, present and future. Energy Res. Soc. Sci. 2020, 68, 101544. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Hess, D.J.; Cantoni, R. Energy transitions from the cradle to the grave: A meta-theoretical framework integrating responsible innovation, social practices, and energy justice. Energy Res. Soc. Sci. 2021, 75, 102027. [Google Scholar] [CrossRef]

- Wahlund, M.; Palm, J. The role of energy democracy and energy citizenship for participatory energy transitions: A comprehensive review. Energy Res. Soc. Sci. 2022, 87, 102482. [Google Scholar] [CrossRef]

- Feng, Y. Life cycle cost analysis of power generation from underground coal gasification with carbon capture and storage (CCS) to measure the economic feasibility. Resour. Policy 2024, 92, 104996. [Google Scholar] [CrossRef]

- Hu, F.; Zhang, S.; Gao, J.; Tang, Z.; Chen, X.; Qiu, L.; Hu, H.; Jiang, L.; Wei, S.; Guo, B.; Zhou, H. Digitalization empowerment for green economic growth: The impact of green complexity. Environ. Eng. Manag. J. (EEMJ) 2024, 23, 519–536. [Google Scholar] [CrossRef]

- Hashemizadeh, A.; Ju, Y.; Abadi, F.Z.B. Policy design for renewable energy development based on government support: A system dynamics model. Appl. Energy 2024, 376, 124331. [Google Scholar] [CrossRef]

- Konopelko, A.; Kostecka-Tomaszewska, L.; Czerewacz-Filipowicz, K. Rethinking EU Countries’ Energy Security Policy Resulting from the Ongoing Energy Crisis: Polish and German Standpoints. Energies 2023, 16, 5132. [Google Scholar] [CrossRef]

- Gitelman, L.; Magaril, E.; Kozhevnikov, M. Energy Security: New Threats and Solutions. Energies 2023, 16, 2869. [Google Scholar] [CrossRef]

- Jonek-Kowalska, I. Assessing the energy security of European countries in the resource and economic context. Oeconomia Copernic. 2022, 13, 301–334. [Google Scholar] [CrossRef]

- Rajavuori, M.; Huhta, K. Investment screening: Implications for the energy sector and energy security. Energy Policy 2020, 144, 111646. [Google Scholar] [CrossRef]

- Hosseini, S.E. An outlook on the global development of renewable and sustainable energy at the time of COVID-19. Energy Res. Soc. Sci. 2020, 68, 101633. [Google Scholar] [CrossRef]

- Crnčec, D.; Penca, J.; Lovec, M. The COVID-19 pandemic and the EU: From a sustainable energy transition to a green transition? Energy Policy 2023, 175, 113453. [Google Scholar] [CrossRef]

- Żuk, P.; Żuk, P. National energy security or acceleration of transition? Energy policy after the war in Ukraine. Joule 2022, 6, 709–712. [Google Scholar] [CrossRef]

- Sturm, C. Between a rock and a hard place: European energy policy and complexity in the wake of the Ukraine war. J. Ind. Bus. Econ. 2022, 49, 835–878. [Google Scholar] [CrossRef]

- Bijańska, J.; Wodarski, K. Hard coal production in Poland in the aspect of climate and energy policy of the European Union and the war in Ukraine. Investment case study. Resour. Policy 2024, 88, 104390. [Google Scholar] [CrossRef]

- Bashir, M.F.; Sadiq, M.; Talbi, B.; Shahzad, L.; Bashir, M.A. An outlook on the development of renewable energy, policy measures to reshape the current energy mix, and how to achieve sustainable economic growth in the post COVID-19 era. Environ. Sci. Pollut. Res. 2022, 29, 43636–43647. [Google Scholar] [CrossRef]

- Liu, H.; Khan, I.; Zakari, A.; Alharthi, M. Roles of trilemma in the world energy sector and transition towards sustainable energy: A study of economic growth and the environment. Energy Policy 2022, 170, 113238. [Google Scholar] [CrossRef]

- Hager, C.; Hamagami, N. Local renewable energy initiatives in Germany and Japan in a changing national policy environment. Rev. Policy Res. 2020, 37, 386–411. [Google Scholar] [CrossRef]

- Lu, L.; Liu, Z.; Mohsin, M.; Zhang, C. Renewable energy, industrial upgradation, and import-export quality: Green finance and CO2 emission reduction nexus. Environ. Sci. Pollut. Res. 2023, 30, 13327–13341. [Google Scholar] [CrossRef]

- Nguyen, T.-D.; Ngo, Q.-T. The Impact of Corporate Social Responsibility, Energy Consumption, Energy Import and Usages and Carbon Emission on Sustainable Economic Development: Evidence from ASEAN countries. Contemp. Econ. 2022, 16, 241–256. [Google Scholar] [CrossRef]

- Khan, Z.; Malik, M.Y.; Latif, K.; Jiao, Z. Heterogeneous effect of eco-innovation and human capital on renewable & non-renewable energy consumption: Disaggregate analysis for G-7 countries. Energy 2020, 209, 118405. [Google Scholar] [CrossRef]

- Maaz, A.; Zhou, S.; Safi, A. The nexus between consumption-based carbon emissions, trade, eco-innovation, and energy productivity: Empirical evidence from N-11 economies. Environ. Sci. Pollut. Res. 2022, 29, 39239–39248. [Google Scholar] [CrossRef]

- Ding, Q.; Khattak, S.I.; Ahmad, M. Towards sustainable production and consumption: Assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustain. Prod. Consum. 2021, 27, 254–268. [Google Scholar] [CrossRef]

- Safi, A.; Chen, Y.; Zheng, L. The impact of energy productivity and eco-innovation on sustainable environment in emerging seven (E-7) countries: Does institutional quality matter? Front. Public Health 2022, 10, 878243. [Google Scholar] [CrossRef] [PubMed]

- Toha, M.A.; Johl, S.K. Does Proactive Eco Eco-Innovation Matter in the Energy Sector? In Proceedings of the European Conference on Management, Leadership & Governance, Online, 8–9 November 2021; Academic Conferences International Limited: Oxfordshire, UK, 2021. [Google Scholar] [CrossRef]

- Skjærseth, J.B. Towards a European Green Deal: The evolution of EU climate and energy policy mixes. Int. Environ. Agreem. 2021, 21, 25–41. [Google Scholar] [CrossRef]

- Fan, Z.; Yan, Z.; Wen, S. Deep Learning and Artificial Intelligence in Sustainability: A Review of SDGs, Renewable Energy, and Environmental Health. Sustainability 2023, 15, 13493. [Google Scholar] [CrossRef]

- Holechek, J.L.; Geli, H.M.E.; Sawalhah, M.N.; Valdez, R. A Global Assessment: Can Renewable Energy Replace Fossil Fuels by 2050? Sustainability 2022, 14, 4792. [Google Scholar] [CrossRef]

- Raihan, A.; Rashid, M.; Voumik, L.C.; Akter, S.; Esquivias, M.A. The Dynamic Impacts of Economic Growth, Financial Globalization, Fossil Fuel, Renewable Energy, and Urbanization on Load Capacity Factor in Mexico. Sustainability 2023, 15, 13462. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Aliyev, F.; Aliyev, J.; Ajayi, R. Renewable Energy Consumption and Carbon Emissions: Evidence from an Oil-Rich Economy. Sustainability 2023, 15, 134. [Google Scholar] [CrossRef]

- Benti, N.E.; Chaka, M.D.; Semie, A.G. Forecasting Renewable Energy Generation with Machine Learning and Deep Learning: Current Advances and Future Prospects. Sustainability 2023, 15, 7087. [Google Scholar] [CrossRef]

- Tobór-Osadnik, K.; Gajdzik, B.; Strzelec, G. Configurational Path of Decarbonisation Based on Coal Mine Methane (CMM): An Econometric Model for the Polish Mining Industry. Sustainability 2023, 15, 9980. [Google Scholar] [CrossRef]

- Zientara, P.; Zamojska, A.; Maciejewski, G.; Nikodemska-Wołowik, A.M. Environmentalism and Polish Coal Mining: A Multilevel Study. Sustainability 2019, 11, 3086. [Google Scholar] [CrossRef]

- Gajdzik, B.; Tobór-Osadnik, K.; Wolniak, R.; Grebski, W.W. European Climate Policy in the Context of the Problem of Methane Emissions from Coal Mines in Poland. Energies 2024, 17, 2396. [Google Scholar] [CrossRef]

- Magdziarczyk, M.; Chmiela, A.; Su, W.; Smolinski, A. Green Transformation of Mining towards Energy Self-Sufficiency in a Circular Economy—A Case Study. Energies 2024, 17, 3771. [Google Scholar] [CrossRef]

- Szewczyk-Świątek, A.; Ostręga, A.; Cała, M.; Beese-Vasbender, P. Utilizing Circular Economy Policies to Maintain and Transform Mining Facilities: A Case Study of Brzeszcze, Poland. Resources 2024, 13, 112. [Google Scholar] [CrossRef]

- Howaniec, N.; Kuna-Gwoździewicz, P.; Smoliński, A. Assessment of Emission of Selected Gaseous Components from Coal Processing Waste Storage Site. Sustainability 2018, 10, 744. [Google Scholar] [CrossRef]

- Mišík, M. The EU needs to improve its external energy security. Energy Policy 2022, 165, 112930. [Google Scholar] [CrossRef]

- Carfora, A.; Vega Pansini, R.; Scandurra, G. Energy dependence, renewable energy generation and import demand: Are EU countries resilient? Renew. Energy 2022, 195, 1262–1274. [Google Scholar] [CrossRef]

- Aslantürk, O.; Kıprızlt, G. The role of renewable energy in ensuring energy security of supply and reducing energy-related import. Int. J. Energy Econ. Policy 2020, 10, 354–359. [Google Scholar] [CrossRef]

- Yadav, A.; Mahalik, M.K. Does renewable energy development reduce energy import dependency in emerging economies? Evidence from CS-ARDL and panel causality approach. Energy Econ. 2024, 131, 107356. [Google Scholar] [CrossRef]

- Purwanto, S.K.; Sinaga, O.; Sidik, M.H.J. Ensuring renewable energy consumption through innovation, R&D and energy import in Indonesia: A time series analysis. Int. J. Energy Econ. Policy 2021, 11, 577–583. [Google Scholar] [CrossRef]

- Adewuyi, A.O. Determinants of import demand for non-renewable energy (petroleum) products: Empirical evidence from Nigeria. Energy Policy 2016, 95, 73–93. [Google Scholar] [CrossRef]

- Malik, S.; Qasim, M.; Saeed, H.; Chang, Y.; Taghizadeh-Hesary, H. Energy security in Pakistan: Perspectives and policy implications from a quantitative analysis. Energy Policy 2020, 144, 111552. [Google Scholar] [CrossRef]

- Brown, S.P.A.; Huntington, H.G. Evaluating US oil security and import reliance. Energy Policy 2015, 79, 9–22. [Google Scholar] [CrossRef]

- Murshed, M.; Mahmood, H.; Alkhateeb, T.T.Y.; Bassim, M. The Impacts of Energy Consumption, Energy Prices and Energy Import-Dependency on Gross and Sectoral Value-Added in Sri Lanka. Energies 2020, 13, 6565. [Google Scholar] [CrossRef]

- Kong, Z.; Lu, X.; Jiang, Q.; Dang, X.; Liu, G.; Elbot, N.; Zhang, Z.; Chen, S. Assessment of import risks for natural gas and its implication for optimal importing strategies: A case study of China. Energy Policy 2019, 127, 11–18. [Google Scholar] [CrossRef]

- Islam, A.; Tofayal, A.; Mondal, A.H.; Awual, M.R.; Monir, M.U.; Islam, K. A snapshot of coal-fired power generation in Bangladesh: A demand–supply outlook. NFR 2021, 45, 157–182. [Google Scholar] [CrossRef]

- Wang, W.; Fan, L.; Li, Z.; Zhou, P.; Chen, X. Measuring dynamic competitive relationship and intensity among the global coal importing trade. Appl. Energy 2021, 303, 117611. [Google Scholar] [CrossRef]

- Yuan, M.; Zhang, H.; Wang, B.; Huang, L.; Fang, K.; Liang, Y. Downstream oil supply security in China: Policy implications from quantifying the impact of oil import disruption. Energy Policy 2020, 136, 111077. [Google Scholar] [CrossRef]

- Ozturk, I.; Arisoy, I. Ozturk, Ilhan, and Ibrahim Arisoy. An estimation of crude oil import demand in Turkey: Evidence from time-varying parameters approach. Energy Policy 2016, 99, 174–179. [Google Scholar] [CrossRef]

- Jacob, T. When good intentions turn bad: The unintended consequences of the Tanzanian coal import ban. Extr. Ind. Soc. 2020, 7, 337–340. [Google Scholar] [CrossRef]

- Kozłowska-Woszczycka, A.; Pactwa, K. Social License for Closure—A Participatory Approach to the Management of the Mine Closure Process. Sustainability 2022, 14, 6610. [Google Scholar] [CrossRef]

- Kaczmarek, J.; Kolegowicz, K.; Szymla, W. Restructuring of the Coal Mining Industry and the Challenges of Energy Transition in Poland (1990–2020). Energies 2022, 15, 3518. [Google Scholar] [CrossRef]

- Pactwa, K.; Woźniak, J.; Dudek, M. Sustainable Social and Environmental Evaluation of Post-Industrial Facilities in a Closed Loop Perspective in Coal-Mining Areas in Poland. Sustainability 2021, 13, 167. [Google Scholar] [CrossRef]

- Kaczmarek, J. The Balance of Outlays and Effects of Restructuring Hard Coal Mining Companies in Terms of Energy Policy of Poland PEP 2040. Energies 2022, 15, 1853. [Google Scholar] [CrossRef]

- Jonek-Kowalska, I.; Turek, M. The Economic Situation of Polish Cities in Post-Mining Regions. Long-Term Analysis on the Example of the Upper Silesian Coal Basin. Energies 2022, 15, 3302. [Google Scholar] [CrossRef]

- Ober, J. Open Innovation in the ICT Industry: Substantiation from Poland. J. Open Innov. Technol. Mark. Complex. 2022, 8, 158. [Google Scholar] [CrossRef]

- Hysa, B.; Mularczyk, A. PESTEL Analysis of the Photovoltaic Market in Poland—A Systematic Review of Opportunities and Threats. Resources 2024, 13, 136. [Google Scholar] [CrossRef]

- Zdonek, I.; Mularczyk, A.; Turek, M.; Tokarski, S. Perception of Prosumer Photovoltaic Technology in Poland: Usability, Ease of Use, Attitudes, and Purchase Intentions. Energies 2023, 16, 4674. [Google Scholar] [CrossRef]

- Midor, K.; Ivanova, T.N.; Molenda, M.; Biały, W.; Zakharov, O.V. Aspects of Energy Saving of Oil-Producing Enterprises. Energies 2022, 15, 259. [Google Scholar] [CrossRef]

- Trzeciak, M. Factors and Areas of PgMO Supporting the Success of the Program Management in the Construction Sector. Buildings 2023, 13, 1336. [Google Scholar] [CrossRef]

- Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Krzykowska-Słomska, A. Import i Przywóz (Nabycie Wewnątrzunijne) Węgla Kamiennego. Agencja Rozwoju Przemysłu S.A., Katowice. 2023. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Krzykowska-Słomska, A. Import i Przywóz (Nabycie Wewnątrzunijne) Węgla Kamiennego. Agencja Rozwoju Przemysłu S.A., Katowice. 2022. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Import i Przywóz (Nabycie Wewnątrzunijne) Węgla Kamiennego. Agencja Rozwoju Przemysłu S.A., Katowice, 2021 ed. 2021. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Krzykowska-Słomska, A. Import i Przywóz (Nabycie Wewnątrzunijne) Węgla Kamiennego. Agencja Rozwoju Przemysłu S.A., Katowice, 2020 ed. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Krzykowska-Słomska, A. Import i Przywóz (Nabycie Wewnątrzunijne) Węgla Kamiennego. Agencja Rozwoju Przemysłu S.A., Katowice. 2019. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Krzykowska-Słomska, A. Import i Przywóz (Nabycie Wewnątrzunijne) Węgla Kamiennego. Agencja Rozwoju Przemysłu S.A., Katowice. 2018. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Kreja, T. nformacja o Zasobach Węgla Kamiennego. Publikacja w Ramach “Programu Badań Statystycznych Statystyki publicznej”—Badanie Statystyczne “Górnictwo Węgla Kamiennego i Brunatnego”. Stan na dzień 31.12.2023 Roku. ARP S.A. Oddział Katowice. 2023. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Kreja, T. Informacja o Zasobach Węgla Kamiennego. Publikacja w Ramach “Programu Badań Statystycznych Statystyki Publicznej”—Badanie Statystyczne “Górnictwo Węgla Kamiennego i Brunatnego”. Stan na dzień 31.12.2022 Roku. ARP S.A. Oddział Katowice. 2022. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Kreja, T. Informacja o Zasobach Węgla Kamiennego. Publikacja w Ramach “Programu Badań Statystycznych Statystyki Publicznej”—Badanie Statystyczne “Górnictwo Węgla Kamiennego i Brunatnego”. Stan na dzień 31.12.2021 Roku. ARP S.A. Oddział Katowice. 2021. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Informacja o Zasobach Węgla Kamiennego. Publikacja w Ramach “Programu badań Statystycznych Statystyki Publicznej"—Badanie Statystyczne “Górnictwo Węgla Kamiennego i Brunatnego”. Stan na dzień 31.12.2020 roku. ARP S.A. Oddział Katowice. 2020. Available online: https://polskirynekwegla.pl/ (accessed on 28 August 2024).

- Lorenz, U. Indeksy cen węgla energetycznego na rynkach spot—Możliwość wykorzystania doświadczeń w konstrukcji indeksu dla rynku krajowego. Polityka Energetyczna 2012, 15, 241–253. [Google Scholar]

- Lorenz, U. Ocena Oddziaływania Zmian cen Węgla Energetycznego na Rynkach Międzynarodowych na Krajowy Rynek Węgla; Studia Rozprawy Monografie Nr 188; Wyd. IGSMiE PAN: Kraków, Poland, 2014. [Google Scholar]

- Lorenz, U. Węgle energetyczne o obniżonej jakości w handlu Międzynarodowym. Polityka Energetyczna—Energy Policy J. 2016, 19, 19–34. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).