Abstract

One of the most important problems in economic development is the supply of stable amounts of renewable energy sources, including biomass. The production of biomass in Poland is not satisfactory; thus, this country has to import this product. As with other products, the trade of stable biomass includes both imports and exports and depends on the price and other characteristics of the market. This research aimed to assess the biomass trade in terms of energy and evaluate changes and trends in the import and export of biomass in Poland and its characteristics. Moreover, the export specialization index (SI index), Grubel–Lloyd index (IITk index) and foreign trade coverage index (CRK index) were evaluated. The considerations were based on the biomass trade in the context of environmental economics. This research found that the neighboring countries of Poland are the most important partners in both imports and exports. Germany and Lithuania are the most important countries in the trade of woody biomass. The export specialization index (SI index), in 2005–2008, was positive and growing, which means that exports exceeded imports; then, in 2009, there was a decline; from 2010 to 2013, the balance increased again, reaching significant positive values until 2019; and, in 2020, there was a decline. The Grubel–Lloyd index for the Polish wood and forestry industry showed a dynamic evolution in the analyzed period of 2005–2020, which reflects the industry’s adaptive strategies in the face of global changes. Raw wood and veneer sheets are more volatile, which may indicate periodic shifts in the structure of foreign trade and the flexibility of producers to respond to international trends and demands. The CRK index in the years 2005–2020 presents an astonishing picture of changes in competitiveness and the ability to maintain the balance of imports and exports. The significant increase in the ratio of firewood and raw wood may reflect an increase in interest in renewable energy sources and the expansion of the industry into new markets.

1. Introduction

According to an International Energy Association (IEA) report [1], all major markets are set to move away from electricity based on fossil fuels, as renewable energy, nuclear power, hydrogen, and CO2 capture technologies are expanding. Notably, other renewable energy sources include bioenergy and renewable waste, as well as concentrated solar and marine energy. In the European Union (EU), the emphasis on energy security and reducing the dependence on imported natural gas is accelerating the development of renewable energy. The expansion of solar photovoltaics (PV) and wind power can provide consumers with a degree of protection against fuel price volatility in the market, such as that being currently experienced [1]. Forecasts for the increase in investment in the field of renewable energy sources in the coming years are very optimistic. In fact, it is estimated that the renewable energy market will be one of the fastest-growing in the world, and its impact will be cross-sectoral [2].

The type of renewable energy source that has the largest share is biomass [3]. A unique role is played by biomass, especially woody biomass. The demand for woody biomass is increasing because it is replacing coal [4]. Biomass can be achieved from almost all organic matter, including forests, agricultural waste, and municipal waste. Biomass can be delivered by forests, which are the most important source of wood. Moreover, biomass can be used from agricultural residues from major crops that are produced globally [5]. For this reason, biomass has a positive impact on the economic situations of farmers and forest owners [6].

The development of the biomass trade can be seen throughout the world. The most important forms include stable biomass, wood, wood pellets, and others. Imported biomass can be processed into different refined products, which can be used as fuels or exported onwards [7].

Biomass is a resource for the production of biofuels. The most typical biofuels are bioethanol and biodiesel. Bioethanol is mostly produced from grains, and biodiesel is produced from rapeseed oil in the European Union (EU) [8,9,10]. However, such a situation leads to a price increase for rapeseed and grains because they are also used in food, fodder, and the petrochemical industry. Moreover, there is a relationship between crude oil prices and agricultural commodity prices [11]. The global biofuel industry is interested in the vegetable oil market in the European Union (EU) and the United States (US), where fuel security and environmental goals are promoted [12].

The biomass resources are different in each country and, therefore, can be traded to satisfy needs. Biomass can be traded in a stable form as well as liquid form. This form of exchange of biomass can be widely observed and is increasingly important in expanding the market for process forms such as raw wood, logs, pulpwood, chips, wood pellets, biodiesel, and bioethanol [13]. The usage of biomass may decrease emissions because biomass is environmentally friendly and each plant, before it is burned, uses carbon dioxide (CO2). The amount of carbon dioxide that is emitted to the atmosphere is equal to those emissions used by plants to produce oxygen (O2). Moreover, biomass helped to reach the 2020 targets promised by each EU Member State [14]. According to Directive 2009/28/EC [15] on the promotion of the use of energy from renewable sources (RED I), the increase in renewable energy sources used in the gross energy consumption should be 20% by 2020, and the reduction in CO2 should reach 20% compared to the levels in 1990. RED I (2009/28/EC) created national targets, contributing to an EU-wide target of 20% renewable energy among the total energy consumption by 2020 [16]. This level has been achieved (22.1%). The leaders were Sweden (55.8%), Finland (42.7%), and Latvia (40.9%). Such countries as Luxembourg (7.0%), Malta (8.2%), and the Netherlands (8.9%) achieved the lowest shares of energy from renewable sources. The largest share in 2020 was achieved by biomass in such countries as Estonia (94%), Latvia (92.4%), and Lithuania (91.1%). The smallest share of biomass was seen in such countries as Malta (9.3%), Cyprus (15.2%), and Ireland (23.5%) [17,18,19]. In the European Union, the share of biomass is large and it accounts for 60% of all renewable energy sources and 10% of all energy sources [20,21,22].

However, the EU has established a new goal of a 55% greenhouse gas (GHG) emissions reduction by 2030, as envisaged in the Climate Target Plan [23] under the European Green Deal [24]. By 2050, the European Union seeks to achieve the deep decarbonization of all sectors of the economy [25].

This research aims to examine the woody biomass trade in terms of energy and evaluate changes and trends in the import and export of biomass in Poland and its characteristics.

The detailed aims include the following:

- An evaluation of the scope of the trade of woody biomass in Poland;

- The determination of the SI, CRK, and Grubel–Lloyd index of woody biomass in Poland.

The following questions are given to help to achieve and verify the aims:

- What is the balance of the woody biomass trade?

- What are the values of the SI, CRK, and Grubel–Lloyd index for the woody biomass trade?

Hypothesis 1 (H1).

The woody biomass trade is Poland is extending according to the increasing demand and the European Union’s requirements concerning renewable energy sources.

This paper is organized as follows. First, we present the problems in the development of the stable biomass trade around the world and in the context of environmental economics. Second, we present the environmental economics theory. Then, we present the imports, exports, and trade balance of wood and woody products. Moreover, we present the SI index, CRK index, and IITK index for wood and woody products. We also support the analysis with a discussion. The final part is the conclusions, in which we review the aims of the work.

1.1. Background of the Research

The main aims of the European Union’s (EU) policy concerning renewable energy sources (RES) are an increase in supply security and environmental protection [26]. The European Union (EU) is moving towards a carbon-free economy, which is described as a green economy defined as ’low-carbon, resource efficient, and socially inclusive’ [27]. This green economy is focused on the reduction of environmental risks and improving human well-being and equality [28].

The development of the biomass trade can be observed in many countries and includes different products. Thailand, Vietnam, South Korea, and Japan are well known for their wood pellet trade, Malaysia for palm oil, and Asian markets for wood pellets. EU and Baltic countries such as Estonia, Latvia, and Poland are also contributing to the wood pellet trade. Divergent policy regulations and large price differentials have led to complex wood pellet trade streams within the EU [29].

Since 2015, only forest biomass can be used for bioenergy production, which can reduce greenhouse gas emissions by at least 60% compared to the average fossil-fuel-generated electricity in the EU, and proof of sustainable forest management is required [30].

Wood pellets, waste wood, and roundwood are imported from origin countries to neighboring countries, and wood pellets are traded across long distances from North America and Russia. The imports reached around 3.2 Mtons, including over 1 Mton from Russia and Eastern Europe, in 2012 [31,32]. The trade of biomass is increasing around the world. In 2004, the value of the international trade of biomass reached 200 PJ, whereas, in 2015, it reached 600 PJ [33].

Biomass is a highly important product in the European Union (EU). The demand for biomass is increasing, which is why it is transported across long distances, even from other continents. The energy needs in the European Union (EU) are based on biomass that is imported, and the plants in many countries regarding biomass imports and processing for energy purposes are large [34].

Research on solid biomass has been widely conducted. Stolarski et al. [35] analyzed the characteristics of solid biomass as a fuel. They found that solid biomass is mainly derived from forestry, agriculture, and industrial processing. More land is used for perennial industrial crops (PICs), providing a lignocellulosic biomass source. Willow, poplar wood, and other plants are grown to obtain solid biomass in Poland and other countries.

Research on straw as a solid biofuel has also been conducted. Solid biomass (biofuel) is also derived from other agricultural products. Straw is characterized by different properties because of the different types of species from which it is derived and the harvest period. The share of cereals and rapeseed in the sown area is increasing, which results in a larger supply of straw that can be used for energy purposes [36].

The largest share of solid biomass is derived from wood. The quality of wood chips depends on the species of the tree. Stolarski et al. [37] analyzed three types of forest tree branches and found that Scots pine, Norway spruce, and European larch had similar characteristics in terms of the C, ash, N, S, and Cl content [37].

Other research has focused on biomass and its characteristics. Biomass, compared to coal, delivers clean energy. Its characteristics include the possibility to achieve zero carbon emissions in the utilization process and a reduction in the emissions of SO2 and NO2, thus reducing the pollution to the environment [38].

Biomass has been analyzed in relation to the economy too. Agriculture delivers large amounts of biomass—for instance, grasslands for dairy production and carbon sequestration. Biomass is important in the process of innovation in the renewable energy industry, enhancing sustainability and pollution control, as well as having other advantages [39].

A product that is traded internationally is wood pellets. An increasing demand in the industrial sector and other sectors has been observed. Many international enterprises are engaged in the wood trade. Such countries as the Netherlands, the United Kingdom, and Denmark are becoming more dependent on wood consumption, including imports. Other products of wood that are traded are pulp and paper [40].

A particular role in the wood pellet trade and production is played by Ukraine. This country has great resources of wood and can be a major provider of woody biomass, including pellets. This product can be imported to the European Union (EU) from Ukraine because of its low costs of transportation. The import potential can be evaluated at the level of 30 to 150 million tons of pellets or the output from 50 to 300 large-scale pellet mills [41,42].

The development of the woody biomass market and trade depends on the costs. There are different types of costs in relation to biomass. They include harvest costs, which range from 5 to 30 USD/m3 and vary according to the region and the steepness of the terrain [43]. The second group of costs includes transport. They vary from USD 5 to 15 depending on the region [44].

China is also an important woody biomass producer. In 2010, China’s forest biomass energy resources amounted to 169 million tons [45]. The United States (US) is also an important country for wood delivery, and it is expected to deliver 35–129 million dry tons of woody biomass for energy purposes by 2030. Woody products can include conventional pulpwood, forest residues, mill residues, and urban wood waste [46].

The European Union (EU) has great potential due to forests, which was estimated at the level of 744 million m3 in 2010. The EU’s potential could increase to 895 million m3 by 2030 [47]. Poland is also an important producer of woody biomass. Wieruszewski et al. [48] pointed out that the total amount of woody biomass harvested in Poland was over 24 million m3 between 2018 and 2021. The average energy resource represented by forest biomass in Poland increased from 351.8 TJ to 498.4 TJ between 2018 and 2021 [48]. Woody biomass plays a very important role in the development of the bioenergy sector. Woody biomass is a key fuel, estimated at the level of 65% in 2019.

Southeast Asia is an important part of the world as a source of timber and other forest products. The production of woody biomass between 1990 and 2020 in this region was estimated at 563.4 million tons per year. Forest plantations can deliver 16.2 million tons per year [49].

1.2. Environmental Economics and Foreign Trade Theory

In economics, the first aspect of the environment that began to interest economists was the question of land and the associated ground rent. In the seventeenth century, W. Petty drew attention to this issue, emphasizing the close relationship between the use of the environment, the valuation of its elements, and the value of goods [50]. On the other hand, economists began to pay attention to issues related to the use and pollution of the environment in the mid-twentieth century. The beginnings of environmental economics can be associated with the founding of the American organization named Resources for the Future (RFF) in 1952, which sought to solve environmental problems economically. Two reports of the Club of Rome, “The Limits to Growth” (1972) and “Humanity at a Turning Point” (1974) [51,52], represented a breakthrough in the hitherto carefree approach to the use of the environment. Both reports addressed issues of both the depletion of natural resources and environmental pollution [53].

According to Sameulson and Nordhaus, climate change is a serious threat, although it is not the greatest problem affecting the environment. The repurposing of the Earth and the poisoning of the planet could pose an even greater risk [54].

Growing social awareness and economic practices have led to increasing awareness of the need to respect the restrictions regarding the protection of the natural environment. Such a change is mainly due to the awareness of the threats posed by human activity to the natural environment. In addition, the growing understanding of the finiteness of the Earth’s natural resources has also contributed to this heightened awareness [55]. Thus far, the consumption of fossil fuels has mostly been connected with global development and the increase in the number of people. The decreased use of fossil fuels may adversely impact the global economy and political stability, which is why there is a strong need to increase renewable energy sources’ utilization [56]. Both renewable and non-renewable energy sources correspond to economic development. However, only renewable energy is useful in controlling carbon emissions in developed countries [57].

The natural environment, such as air, water, forests, and other unique landscapes, has value, both immeasurable, non-material, and measurable, which can be determined by prices [58]. The valuation of the natural environment plays an important role in the economy and environmental protection, as well as in the pursuit of sustainable development. This has led to the concept of a bioeconomy, which decreases the dependence on fossil fuels and increases the use of biomass, which will be used to produce renewable energy sources, including biofuels [59]. The use of biomass increases the use of renewable energy that may be used as a base load technology, contributing to a reduction in greenhouse gas (GHG) emissions [60].

The use of environmental valuation is necessary in the case of investment projects, the assessment of benefits from pro-ecological investments, the estimation of external costs of production and consumption activities, and the analysis of legal conditions related to the assessment of the impact of planned investments on the environment [61,62]. Ecological threats result from increasing environmental pollution, which affects not only individual countries but also regions [63].

The problems concerning the environment, pollution, and economic growth have been of serious concern worldwide. Economists have elaborated on the Environmental Kuznets Curve (EKC), which shows the relationship between economic, social, and environmental outcomes [64].

Effective environmental protection requires an understanding of natural phenomena and the relationships between organisms. It is also important to take into account the human influence on the environment. Knowledge from different fields, such as the natural, political, and social sciences, is crucial in this context. Examples of such sciences include geography, geophysics, geology, hydrology, climatology, anthropology, ecology, law, engineering, and economics [65]. Even in resource-rich areas, the environment has its limits. Nowadays, people are becoming more aware of the problem of the depletion of non-renewable resources. The problems of constraint also apply to the use of renewable resources such as water and wood. This is caused by the excessive rates of exploitation and contamination of these raw materials. Environmental economics aims to consider the effective management of tangible and intangible resources. The long-term goal is to maximize the benefits for humanity [66]. Agriculture plays an important role in greenhouse gas (GHG) emissions, carbon sequestration, bioenergy, biodiversity, and other landscape goods; therefore, strategies including these actions should be implemented on a global scale [67]. This could lead to progress towards sustainable development, which stresses economic, social, and environmental goals. We should also evaluate eco-efficiency, which stresses the possibility of achieving economic goals in coherence with the environment. Agriculture should be environmentally friendly [68,69].

Economics seeks to present means of managing environmental resources, both tangible and intangible, in order to maximize the benefits for humanity in the long term. Nevertheless, few economic theories take environmental issues into account. As a result, many economic decisions are made without taking these aspects into account. This phenomenon highlights the need for a greater focus on environmental economics [70]. The growing interest in economic changes caused by the dynamic development of industry has led to the underestimation of research on the relationship between humans and the environment. The lack of reliable valuation of the costs of using the environment, resulting from the treatment of its resources (except for those traded, such as coal or land) as worthless, has led to the free exploitation of natural resources, which has far-reaching consequences. It is difficult to change this approach, but, as K.W. Kapp has pointed out, for traditional economics, environmental destruction is more dangerous than any other factor [71]. J.S. Mill, based on the works of D. Ricardo and T. Malthus, formulated the universal law of production, which assumes that the limitations of natural resources lead to an increase in the expenditure of labor and capital per unit of production. Mill pointed out that technical progress will counteract declining revenues. He also noted the importance of such aspects of the environment in terms of their recreational, psychological, and aesthetic value for the proper functioning of humans [72]. A. Marshall (1842–1924) also, although to a lesser extent, dealt with the problem of the scarcity of natural resources [73].

As a result of this research, the concepts of externalities and external costs and benefits were created. However, widespread interest in the issue of the scarcity of raw materials did not emerge until the 1960s, when the problems of scarcity became noticeable in many countries. Therefore, the works of A. Marshall can already be included in the neoclassical approaches to economics. Because of this work and other pioneering research, the paradigm shift in economics has become more evident, and it has become the basis for the further development of environmental economics and environmental science [74].

Nature is the basis of life on Earth, where it provides essential resources such as air, water, minerals, and energy. In order to exist, people must use these resources in a reasonable way, ensuring the protection of the environment. In fact, nature conservation is the protection of the foundations of life on our planet. The destruction of the environment and natural resources is one of the most important problems of the modern world [75]. For a long time, the environment and its resources were considered to be both data-free and unlimited, as well as meaningless in terms of human labor [76].

The control of environmental pollution is in line with the maxims of Abraham Lincoln, who stated that the government should do for the people what needs to be done and what they, by their own efforts, cannot do for themselves or cannot do well enough [77].

The problem of competitiveness has been analyzed in the international literature too. This theory dominated in the 15th–16th centuries and was associated with Mercantilism. Trade should be protected by policies against foreign countries. Another theory, called the physiocratic period theory, pointed out that protectionism should be partially softened. Adam Smith, the father of Classical Liberalism, pointed out that countries should specialize in product exports in which they achieve the lowest costs and import products in which they incur high costs of production [78]. The international trade theory is also related to biomass supply chains, which can support countries with less developed biomass markets [79].

2. Materials and Methods

2.1. Data Sources

To achieve the goals of this study, the authors used different sources of information. Eurostat was the main source of information. Thanks to this resource, we analyzed the imports, exports, and trade balance. We also determined the coefficients of the international competitiveness of stable biomass. These data enabled us to conduct many analyses, such as analyses of the changes in imports, exports, and the foreign trade of biomass. Moreover, we calculated ratios for the foreign trade of biomass. The time range included the period of 2010–2021.

2.2. Methods

The authors used different sources of information to analyze the changes in imports, exports, the trade balance, and the coefficients of stable biomass. A very useful tool in analyzing the international competitiveness of biomass is the export specialization index (SI index), as well as the foreign trade coverage index (CRK index) and Grubel–Lloyd intra-industry trade index (IITk index). These measures were used to analyze the competitiveness of different products and markets and have never been used in stable biomass analysis [80].

In the first step of the analysis, the export specialization index (SI index), which measures a product’s share in the exports of country k to this product’s share in the global or regional exports, was measured. The higher the ratio is, the better the outcome [80]. The export specialization index shows that a country’s product achieves competitiveness on a global scale [81]. The formula for this ratio is the following:

where: SI—the export specialization index; Xik—the share of product I in the exports of country k; Xiw—the share of product I in the exports in the European single market.

SI = Xik/SI Xiw

In the second step of the analysis, the foreign trade coverage index (CRK index), which is used to measure the exports to imports, was calculated. Values higher than 100 are needed because they indicate that a country acquires an advantage over its trade partners and specializes in a given product. When the value is below 100, it indicates higher imports over exports and a lack of specialization [82].

where: CRK—foreign trade coverage index; Xk—exports of country k; Mk—imports of country k.

CRK = Xk/Mk

In the third step, the Grubel–Lloyd intra-industry trade index (IITk index), which is used to analyze intra-industry trade, was calculated. High values of the IITk index (approximating 100) point to intra-industry trade. Changes in the IITk index are also considered in the Grubel–Lloyd index [83]. The value can be evaluated in terms of points or percentages (0–1 point or 0–100%). High values of the IITk index indicate that most trade takes place within the same industrial branch [83]. Moreover, values close to 100% indicate that the exports and imports of products in the same industry overlap to a large extent on one side. Meanwhile, an IIT index close to zero points to the existence of inter-industry trade [84,85].

where: IITk—Grubel–Lloyd intra-industry trade index of country k; EXik—export of product i in country k; IMik—import of product i in country k.

Finally, the descriptive statistics of woody biomass imports (tons), woody biomass exports (tons), the woody biomass balance (tons), the national use of stable biomass (TJ), and stable biomass acquisition (TJ) were calculated. Such variables as the minimum, maximum, coefficient of variation, skewness, and kurtosis were analyzed.

The coefficient of variation informs us about the dispersion of the data. Skewness and kurtosis are measures of asymmetry. Skewness measures a random variable about the mean. When it is negative, the left tail of the data is longer [86].

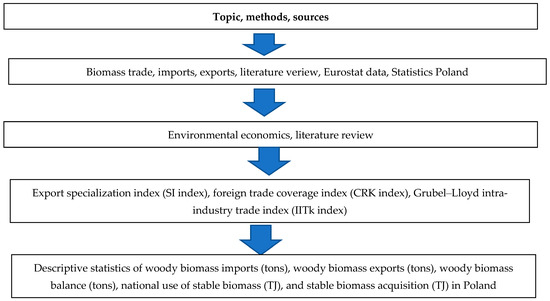

The layout of the research is presented in Figure 1.

Figure 1.

Layout diagram of biomass research. Source: own elaborations.

3. Results

3.1. Imports of Woody Biomass in Poland Compared to the European Union

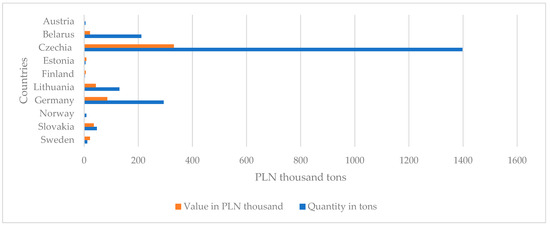

The data on raw wood imports to Poland in 2020 show that the largest amount of wood (in tons) is imported from Czechia—amounting to 1,000,397 tons, worth PLN 331,264 thousand. Germany is in second place in terms of quantity, from which 293,493 tons of wood worth PLN 85,246 thousand were imported.

Poland also imports significant amounts of wood from Lithuania and Slovakia. Imports from Lithuania amounted to 130,266 tons, worth PLN 43,160 thousand, and those from Slovakia amounted to 46,835 tons, worth PLN 35,691 thousand [87].

Regarding Belarus, despite the fact that it supplies a smaller amount of wood (211,278 tons), its value is PLN 21,258 thousand. On the other hand, the imports from Finland and Sweden are much smaller, amounting to 2600 tons (with value of PLN 5611 thousand) and 11,658 tons (with value of PLN 21,433 thousand), respectively. Other countries from which Poland imports wood are Austria, Estonia, Norway, and Ukraine, but the quantities are much smaller. Analyzing the data, it can be seen that Poland imports wood from many countries, but the largest share is held by Czechia, Germany, and Lithuania (Figure 2).

Figure 2.

Imports of raw and rough wood (2020). Source: own work based on [88].

An analysis of the information in Figure 2 shows that the geographical proximity determines the import of woody biomass. The countries located closest to Poland provide the most wood biomass. In addition to geographical proximity, historical ties and the level of potential in neighboring countries may be factors. In most cases, cheaper raw materials are brought to Poland by neighboring countries belonging to the EU and Belarus.

Pellets are a product that is traded internationally. The reason for this is their attractive technical characteristics, which are useful in logistics. Another product that can be traded is torrefied biomass, which involves the mild pre-treatment of biomass at a temperature between 200 and 300 °C. Such a process improves the biomass quality for combustion and gasification and it can be traded from the USA to the European Union (EU). Pressing torrefied biomass into pellets and briquets improves its quality and its content, so that it can produce more energy during combustion [87].

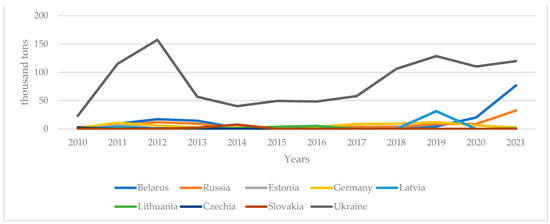

Polish imports of biomass are also important. Imports of pellets to Poland in recent years have shown significant variability, both in terms of the quantity and the countries of origin. Belarus, starting from a modest 2071 tons in 2010, has significantly increased its exports to Poland, peaking at 77,005 tons in 2021.

Russia, like Belarus, increased its supplies, albeit to a lesser extent, from 3165 tons in 2010 to 32,660 tons in 2021. However, Ukraine was an unrivaled leader in pellet exports to Poland, increasing the level of shipments from 23,255 tons in 2010 to 119,827 tons in 2021. Even despite the decline in 2014, Ukraine quickly regained its position.

Regarding Germany, although it supplied small quantities of raw material, it showed some volatility in its exports, which peaked at 12,037 tons in 2019 but fell to 2346 tons in 2021. Estonia and Latvia were minor players, with a few sporadic deliveries, while Lithuania, Czechia, and Slovakia maintained a small but steady stream of exports to Poland. In conclusion, pellet imports to Poland are dominated by Ukraine, with a growing share from Belarus and Russia. Other countries supply relatively small quantities, but this picture may change depending on developments in the commodity markets (Figure 3).

Figure 3.

Polish imports of wood pellets. Source: own work based on [89].

The largest imports of pellets come from Ukraine. The large imports from this country are due to the low costs. The economic crises in 2009–2010 caused the imports from Ukraine to increase. The subsequent crisis related to the COVID-19 pandemic then caused an increase in imports from Ukraine. The collapse of the supply chain from other countries provided an opportunity to increase the import of wood pellets from Ukraine to Poland.

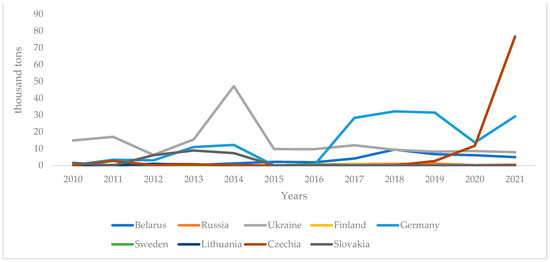

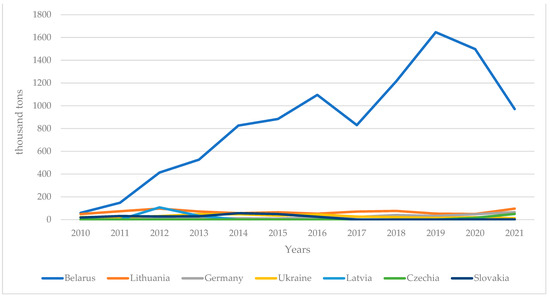

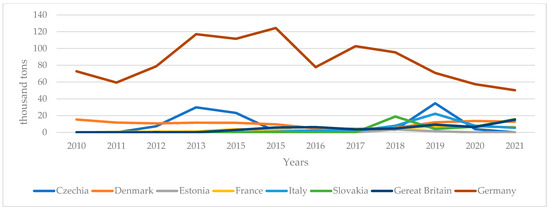

Analyzing the imports of wood fuel to Poland in the years 2010–2021 in Figure 4, we can see significant changes in both the quantities and directions of imports.

Figure 4.

Imports of fuel wood. Source: own work based on [89].

The largest supplier of wood fuel to Poland in 2021 was Czechia, which delivered 76,695 tons. This was a significant increase compared to previous years, when the imports from Czechia were relatively small or non-existent. Another significant supplier is Germany, with 29,175 tons of wood fuel imported to Poland in 2021. Germany was a steady supplier in this period, although the amount of imported wood fuel fluctuated year by year. Ukraine, despite a reduction in the amount of wood fuel exported in recent years, is still one of the main suppliers to Poland, with 7896 tons in 2021. Although it had the highest level of imports in 2018 (9462 tons), in 2021, Belarus delivered less—4932 tons. This is still a significant amount, making Belarus one of the leading suppliers of wood fuel to Poland.

Russia, despite its small initial exports, managed to increase its supply to 531 tons in 2021. Other countries, such as Sweden, Lithuania, Finland, and Slovakia, supplied less significant amounts of wood fuel to Poland during the period under review. However, it is worth noting that this situation may change depending on global trends in the commodity markets and changes in energy policies.

Fuel wood was imported to Poland from the Czech Republic, Germany, and Ukraine to the greatest extent. Fuel wood is medium- or small-sized wood with minimal quality requirements, intended for heating purposes. The production of fuel wood defined in this way amounted to approximately 4.7 million m3 in Poland in 2020 and was then reduced by 7%. Imports amounted to approximately 1% of domestic production and exports amounted to approximately 4%. This was possible thanks to international companies operating in the EU market. Fuel wood can be easily transported in pieces on pallets, which significantly facilitates transport. Imports from the nearest neighboring countries indicate the internationalization of the sector and foreign cooperation.

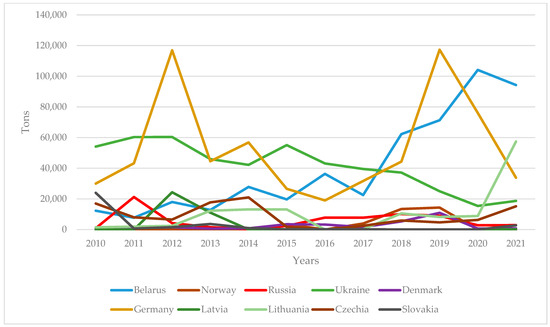

Looking at the data on wood chip imports to Poland in 2010–2021 in Figure 5, it can be seen that Belarus has consistently dominated in this area. Belarus delivered 971,439 tons of wood chips to Poland in 2021.

Figure 5.

Imports of wood chips. Source: own work based on [89].

Despite a slight decrease compared to the previous year, when 1 million 497 thousand tons were delivered, Belarus remained the undisputed leader in supplying this raw material to Poland. Then, surprisingly, Germany became a significant supplier in 2021, with 65,076 tons. Germany has steadily increased its wood chip deliveries since 2010, when they amounted to only 949 tons. Lithuania also plays an important role in supplying wood chips to Poland, with 95,865 tons delivered in 2021. This amount is higher compared to previous years, when the deliveries oscillated between 48,734 and 72,973 tons. Czechia, which did not export wood chips to Poland until 2019, delivered as much as 50,118 tons in 2021. This is a significant increase, especially considering that, in 2020, their exports amounted to 15,632 tons.

Ukraine, once a reliable supplier of wood chips, delivered 12,641 tons in 2021, a decrease compared to previous years. The sawdust imports from Latvia and Slovakia were relatively small in 2021, amounting to 261 and 1524 tons, respectively.

Belarus, Lithuania, Germany, and the Czech Republic imported the most wood chips to Poland in the period under review. Chips are commonly used in the wood industry, including for the production of chipboard. The wide use of chipboard creates a large demand, which can only be satisfied by cheap imports.

Analyzing the import of wood waste to Poland in 2010–2021 in Figure 6, we can see that Belarus and Germany were the main suppliers. Belarus tops the ranking of suppliers with the largest exports of wood waste to Poland.

Figure 6.

Imports of wood waste. Source: own work based on [89].

Although Lithuania supplied relatively small quantities of wood waste at the beginning of the period under review, in 2021, it significantly increased its deliveries, reaching 57,420 tons. Ukraine, despite initially leading the import of wood waste, saw a drop in deliveries to 18,687 tons in 2021. The Czech Republic delivered 15,165 tons of wood waste to Poland in 2021, and Slovakia ended the year with 2683 tons. Among other countries, such as Norway, Denmark, and Latvia, the deliveries were much smaller, and Norway recorded no deliveries in 2021.

The imports of wood waste were characterized by major changes, especially from Germany. Increased imports in 2011–2013 resulted from the financial crisis, while, in 2018–2020, they were due to the COVID-19 pandemic. Germany’s position in 2021 was taken by wood waste from Belarus and Lithuania, which indicates a search for cheaper suppliers. The COVID-19 pandemic, especially recently, has resulted in an increase in fuel prices, which has translated into an increase in transport costs.

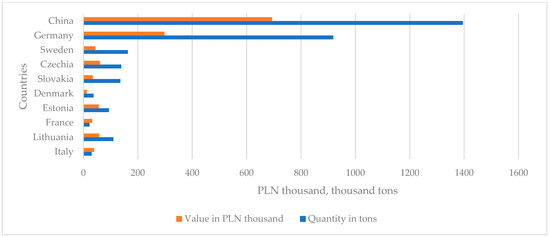

3.2. Exports of Wood and Woody Products

Exports of raw wood, including rough wood, from Poland in 2020, as shown in Figure 7, varied depending on the destination country. The most, as much as 1 million 395 thousand tons of wood, went to China, generating revenue at the level of PLN 693,540 thousand. On the other hand, 138,877 tons of wood, worth PLN 60,799 thousand, were sent to Czechia. Germany imported 918,574 tons of wood from Poland, generating revenues of PLN 298,173 thousand.

Figure 7.

Exports of raw and rough wood (2020). Source: own work based on [87].

Estonia received 93,776 tons of raw material from Poland, for which it paid PLN 56,609 thousand. Slovakia and Sweden received 135,711 tons and 163,056 tons of wood, respectively, and the value of these transactions amounted to PLN 34,526 thousand and PLN 43,690 thousand, respectively.

Italy received 30,401 tons of wood from Poland, worth PLN 39,006 thousand, and Finland imported 131,871 tons of wood for PLN 48,050 thousand.

In summary, the export of raw wood from Poland in 2020 showed large differences between the recipient countries, both in terms of the amount of raw material shipped and the value generated from it.

A different situation is observed for 2021, when wood exports from Poland to China decreased, with approximately 16% delivered to this country. The cost of transport to China increased. Moreover, the Russian invasion of Ukraine created transport problems. Germany dominates the geographical structure of exports, with a share close to 40%. A total of 24% of wood exported from Poland went to the Czech Republic and Slovakia.

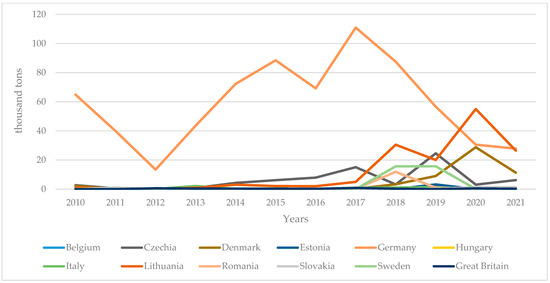

An analysis of the wood pellet export data from Poland in 2010–2021 in Figure 8 below shows that the main recipients are Germany, Italy, and Denmark. Italy is the largest recipient of pellets from Poland, with 183,573 tons in 2021.

Figure 8.

Wood pellet exports. Source: own work based on [89].

Throughout the entire period under review, they presented a strong upward trend, reaching a peak in 2018, when imports amounted to as much as 194,980 tons. Germany is the second-largest recipient of pellets from Poland, with 132,560 tons in 2021. Despite a slight decrease compared to 2020, when the figure was 133,660 tons, Germany still remains in the lead.

Denmark is the third-largest importer of pellets from Poland. This is a slight increase compared to 2020, when the figure was 94,266 tons. Although in fourth place, France significantly increased its pellet imports during the period under review, reaching 17,477 tons in 2021. Czechia and Belgium also show a stable pace of imports, with 6198 tons and 4583 tons in 2021, respectively. Other countries, such as Slovenia, Slovakia, Sweden, the Netherlands, and Hungary, import much smaller amounts of pellets from Poland.

The increase in the consumption of wood pellets in the European Union is primarily attributed to the increased use of fuel in new buildings and single-family farms. The growth of the housing market, mainly in Germany and France, which can benefit from support programs for the installation of biomass boilers, and high coal prices are the main reasons for the increased exports from Poland. Polish wood pellets are cheaper compared to those of other countries because of the lower costs of transport and wood processing.

In the case of data on the export of fuel wood waste from Poland from 2010 to 2021, presented in Figure 9, it can be seen that the main recipient is Germany.

Figure 9.

Exports of fuel wood waste. Source: own work based on [89].

Germany is the largest export market for Polish wood waste. Exports to Germany started with 72,797 tons in 2010 and peaked in 2015 with 124,376 tons. After 2015, however, the exports began to decline, reaching 50,276 tons in 2021. The UK, although it imported small amounts of wood waste from Poland at the beginning of the period (77 tons in 2010), has significantly increased these volumes in recent years, reaching 15,153 tons in 2021.

The proper use of wood waste can have a positive impact on the environment and can be cheaper compared to other renewable energy sources and coal. The European Union’s policy seeks to increase the share of renewable energy sources in the total amount of energy consumed. Lower transport costs were the reason for the increase in exports to Germany, Great Britain, and Denmark.

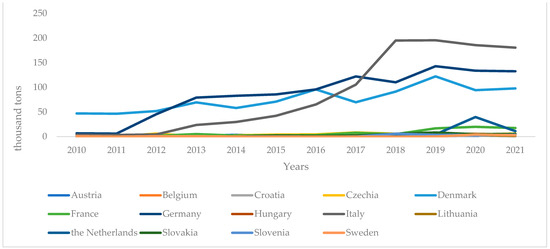

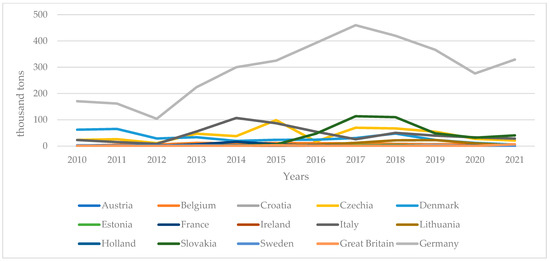

The exports of wood chips from Poland, shown in Figure 10, included various countries between 2010 and 2021, but the dominant recipients were Germany, Lithuania, and the Czech Republic. Over the years, there have been clear fluctuations in the amounts of wood chips exported to individual countries.

Figure 10.

Exports of wood chips. Source: own work based on [89].

In Germany, which was the main recipient, the exports peaked in 2017 but generally showed a downward trend. Lithuania, being the second-largest recipient, experienced a significant increase in exports during this period, with a peak in 2020, but they then declined. Czechia, the third-largest importer, showed some irregularity in the amount of imported wood chips, with two peaks in 2016 and 2018. Other countries, such as Denmark, Sweden, Romania, Estonia, Hungary, Belgium, Italy, and the United Kingdom, showed different patterns of wood chip imports. Denmark imported small amounts of wood chips.

The exports of wood chips to Germany, Lithuania, and Denmark changed the most. The reasons for these changes could be problems in trade with Ukraine. Poland imports wood chips from Ukraine and sells them further to Germany and other countries.

The wood fuel exports from Poland in 2010–2021, shown in Figure 11 below, had many recipients, but the largest was and remains Germany.

Figure 11.

Wood fuel exports. Source: own work based on [89].

Germany is by far the largest recipient of wood fuel from Poland in this period, with a peak in 2017 but a noticeable decline in 2018–2020. In 2021, the exports to Germany increased to 329,156 tons, despite the previous downward trend. Czechia and Slovakia were also significant recipients, although their imports were much smaller than those of Germany. In the case of Czechia, the imports peaked in 2015 at 98,896 tons and have generally declined since then. Other countries, such as Slovakia, Italy, Denmark, Belgium, Austria, and Lithuania, also imported wood fuel from Poland, but in much smaller quantities. For these countries, the imports showed different patterns, with some countries peaking in the middle of the period and others maintaining a fairly constant level of imports. These findings point to a diversified and dynamic market for wood fuel exports from Poland, which is shaped by various factors, such as energy policies, environmental and environmental requirements, and market tendencies.

There are many reasons that wood fuel is mainly exported to Germany, Czechia, Slovakia, and other European Union countries. Restrictions imposed on trade with Russia and Belarus have resulted in increased interest in wood fuel from Poland. Moreover, the European Union (EU) market is characterized by a lack of tariffs between Member States. Changes in the exports of wood fuel resulted from global changes and problems such as financial crises, which decreased the exports. Then, COVID-19 also had a negative impact on wood fuel exports.

3.3. Balance of Imports and Exports of Wood and Wood Products

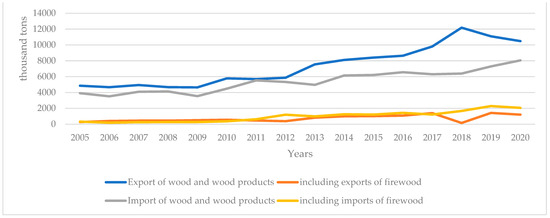

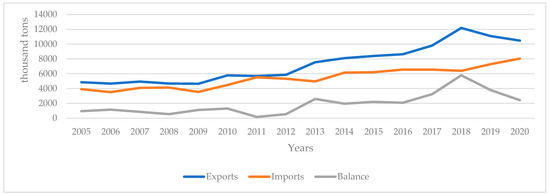

The balance of the imports and exports of wood and wood products and firewood in Poland shows that this country is a net exporter of both wood and wood products, as well as firewood.

The exports of wood and wood products from Poland have consistently exceeded their imports since 2005. Despite some fluctuations, the trend generally shows growth, with the exception of a slight decrease in 2006–2008 and 2019–2020. A particularly large jump in exports can be seen in the years 2013–2018. Imports, despite some fluctuations, also generally increased, although at a slower pace than exports.

Similarly, Poland was a net exporter of firewood throughout this period. Here, however, in contrast to wood and wood products, the exports did not increase so rapidly. In fact, after 2010, firewood exports tended to stabilize or even decline slightly, while firewood imports increased sharply, especially between 2012 and 2019. Overall, these figures show that Poland is a significant player in the timber and wood product market, both as an exporter and importer.

Looking at the data in Figure 12, we can see that both the exports and imports of wood and wood products have increased significantly in recent years. Exports in 2005 amounted to 4,856,560 tons, while, in 2020, they already amounted to 10,477,893 tons, which means that they increased by over 115%. Similarly, imports increased from 3,913,902 tons in 2005 to 8,051,492 tons in 2020, an increase of about 106%.

Figure 12.

Balance of imports and exports of wood and wood products and firewood (tons). Source: own work based on [89].

As for firewood, the exports in 2005 totaled 270,549 tons, and, in 2020, they totaled 1,201,615 tons, an increase of about 344%. Firewood imports also increased during this period, from 232,111 tons in 2005 to 2,057,052 tons in 2020, an increase of almost 787%. It is therefore evident that both the exports and imports of both types of wood products have increased over the past 15 years. However, the growth rate was higher for firewood imports, which may indicate the growing demand for these products in this country. Despite this, the exports of both types of wood products still exceed the imports, which means that Poland remains a net exporter.

The data on the import and export of woody biomass in 2020 are presented in Table 1. They show that different countries dominate in different categories.

Table 1.

Percentage and quantitative representation of imports and exports of woody biomass for energy purposes (2020).

Ukraine is the main supplier of pellets (75.6% of imports) and charcoal (51.1% in 2017), Belarus provides the most wood chips (91.7% of imports) and wood waste (48.4% of imports), and Germany is the main source of firewood (33.8% of imports). In terms of exports, Italy leads the pellet category (36.5%), Germany dominates in terms of firewood (54.8%) and wood waste (66.7%), and Lithuania is the largest exporter of wood chips (45.8%). In 2017, Germany was also the largest exporter of charcoal (52.2%). These findings show that Poland is involved in international trade in woody biomass with different countries that specialize in different types of products.

The data on the imports and exports of woody biomass for energy purposes presented in Table 2 indicate that Belarus is the main trading partner of Poland in terms of imports of woody biomass. Poland imported as much as 78.0% of the total from Belarus, which translates into 1 million 622 thousand tons of biomass. Ukraine is the second-largest supplier with a 10.3% share, which equates to 211,624 tons.

Table 2.

Volume of imports and exports of woody biomass for energy purposes.

In terms of exports, Germany is the largest recipient of Polish woody biomass, receiving 49.0% of its exports, which translates into 588,905 tons. Italy is the second-largest recipient, with an 18.9% share, receiving 226,811 tons of biomass. This indicates the significant role of Poland in the trade of woody biomass in the European market, especially in relation to Germany and Italy.

The following data in Table 3 represent the percentage distribution of the imports and exports of various types of biomass and wood products for Poland in 2020. For example, the largest suppliers of rough raw wood to Poland are Czechia (65.9%), Germany (13.8%), and Belarus (10%). The same goods are mainly exported to China (44.7%), Germany (29.4%), and Sweden (5.2%). Similarly, sawn or longitudinally planed timber is most often imported from Belarus (35.9%), Sweden (13.9%), Germany (13.7%), and Sweden (5.2%).

Table 3.

Import and export of biomass and wood products—percentage representation (2020).

The largest recipients of this type of wood from Poland are Germany (22.5%), China (17.4%), and Italy (11.4%). In the case of carpentry and carpentry products for the construction industry, the main sources of imports are Ukraine (27.4%), Russia (8.5%), and Germany (8%). On the other hand, the main export destinations are Germany (25.6%), the United Kingdom (15.2%), and France (9.4%). Overall, Germany is one of Poland’s main trading partners in terms of both imports and exports.

The data in Table 4 represent the volume of the imports and exports of biomass and wood products for Poland in 2020. Among the countries from which Poland imports the most of these goods, Czechia is the leader, with 26% of the total imports, which translates into 1 million 521 thousand tons. Belarus is in second place, with 18.6% (1,087,942 tons), and Germany is third, with 13.8% (809,330 tons). On the other hand, Germany is the main recipient of Polish exports of biomass and wood products, accounting for 27.8% of the total value, which equates to 2 million 580 thousand tons. China is the second-largest recipient, with a share of 16.3% and a volume of 1 million 512 thousand tons. It is noticeable that Germany is a key trading partner for Poland, both in terms of imports and exports of these goods.

Table 4.

Volume of imports and exports of biomass and wood products.

3.4. Ratio Analysis of Imports and Exports

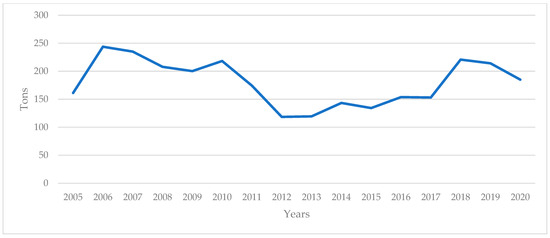

Figure 13 presents the dynamics of the imports and exports of wood and wood articles (in tons) to Poland over the years 2005–2020. The trade balance, which is the difference between the value of exports and imports, is referred to as the SI index. The chart shows that timber exports grew steadily throughout the analyzed period, with the exception of a slight decline in 2009.

Figure 13.

SI ratio for woody biomass (tons). Source: own calculations based on [89].

From 2009 to 2020, we can observe steady export growth, peaking in 2018 with over 12 million tons of wood exported. Timber imports also show an upward trend, albeit with smaller fluctuations than exports. It is worth noting that, in 2015–2017, the imports remained at a relatively stable level; they then increased in 2018 and then showed a decrease in 2020. The trading balance (SI ratio) shows a diverse trend. In 2005–2008, the balance was positive and growing, meaning that exports exceeded imports.

This was followed by a decline in the balance in 2009, which may have been the result of the global economic crisis, affecting international trade. From 2010 to 2013, the balance increased again, reaching significant positive values in the following years until 2019. In 2020, we observe a clear decline in the balance.

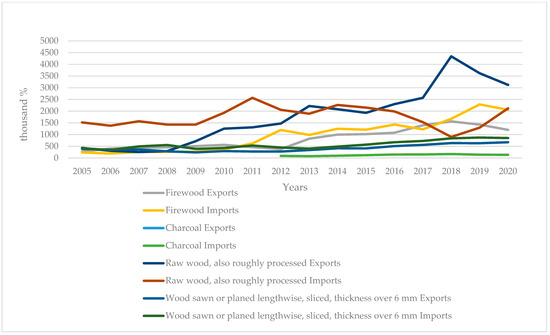

Figure 14 below shows the dynamics of the exports and imports of wood and wood products for Poland in the years 2005–2020, broken down into raw material categories. It is evident that firewood exports exhibit an upward trend, especially in recent years, where they peaked in 2019.

Figure 14.

Dynamics of exports and imports (%). Source: own calculations based on [89].

The imports of this raw material remain at a stable level, with slight fluctuations throughout the analyzed period. In the case of charcoal, exports have remained fairly stable, while imports have shown a gradual increase, especially after 2010. Exports of raw wood, including rough wood, increased until 2019 and then declined in 2020.

Imports of this product category are volatile, with marked increases and decreases over the years. In the category of sawn or longitudinally planed, cut wood, with a thickness of more than 6 mm, we observe increased exports in 2017–2019, followed by a decrease. Imports of this category remain at a relatively stable level, with a slight increase in 2020. These data indicate dynamic changes in the trade of raw wood materials, emphasizing their importance for the Polish economy.

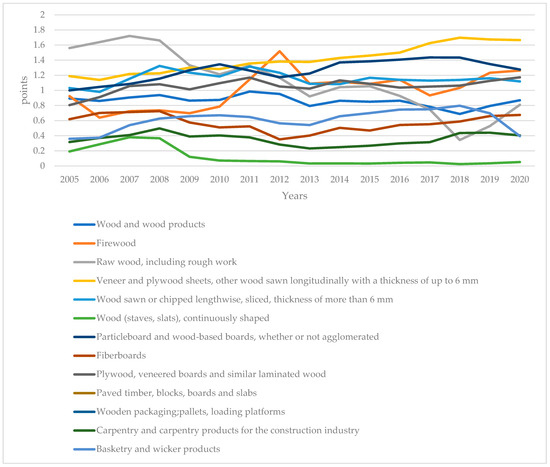

The Grubel–Lloyd index (IITk index) for the Polish wood and forestry sector in Figure 15 shows a dynamic evolution in the analyzed period of 2005–2020, which reflects the industry’s adaptive strategies in the face of global changes.

Figure 15.

Grubel–Lloyd index. Source: own calculations based on [89].

The analysis shows that some categories of goods, such as raw wood and veneer sheets, are more volatile, which may indicate periodic shifts in the structure of foreign trade and the flexibility of producers to respond to international trends and demands. The stability in the category of carpentry products indicates the continuing specialization and competitiveness of Poland in these segments.

It is also worth noting the gradual increase in the rate for firewood, which may reflect the growing role of biomass in the country’s energy mix. On the other hand, basketry and wicker products present a lower value in the index, which suggests that the market is dominated by imports and the possibility of the further development of the domestic production sector. Overall, the analysis of the Grubel–Lloyd Index provides a valuable contribution to our understanding of the specificities of the trade in forest and wood products, highlighting both the challenges and the possibilities of the Polish economy in terms of international relations.

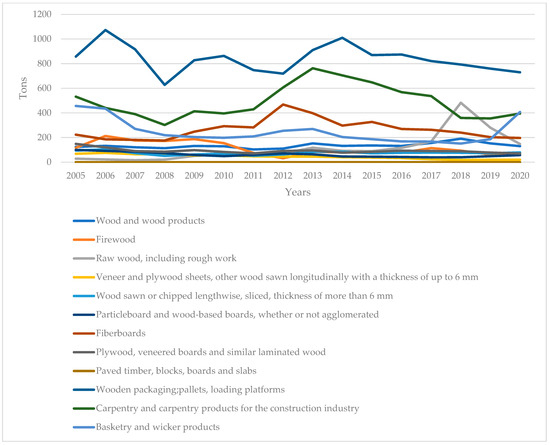

The foreign trade coverage index (CRK index), shown Figure 16 and Figure 17 for the Polish timber and forestry sector in the years 2005–2020, presents an astonishing picture of changes in competitiveness and the ability to maintain the balance of exports, imports, and exports.

Figure 16.

Foreign trade coverage index (CRK index) (1/2). Source: own calculations based on [89].

Figure 17.

Foreign trade coverage index (CRK index) (2/2) for the wood category (staves, slats). Source: own calculations based on [89].

The significant increase in the index of firewood and raw wood may reflect an increase in interest in renewable energy sources and the expansion of the industry into new markets. Veneer and plywood sheets, representing processed products, also indicate dynamic development and possible investments in production technologies.

Interestingly, the category of wood (staves, slats) shaped in a continuous manner shows a clear increase in the index, which may signal effective promotional activities and the positioning of Poland as a supplier of high-quality semi-finished products. In the category of carpentry and carpentry products for the construction industry, the stabilization of the index indicates the solid position of Poland in the European market, which may be the result of investments in modern technologies and trained staff.

On the other hand, basketry and wicker products, although characteristic of Polish craftsmanship, show lower values in the index, which may suggest the need for greater support for these traditional industries. The overall upward trend in the CRK index, especially in recent years, can be interpreted as the result of consistent industry efforts to innovate and adapt to the changing global market conditions.

To better illustrate the individual carriers of the wood and forestry sector, the CRK index for the wood category (staves, slats) is presented in Figure 17.

3.5. Statistical Analysis of Exports and Imports of Woody Biomass in Poland

Finally, the changes in the international trade of biomass in Poland were evaluated. The minimal and maximal coefficients of variation, skewness, and kurtosis were calculated.

In 2005–2020, the biomass exports reached the minimal level of 4,664,096 tons and the maximal level of 12,180,163 tons. This led to a positive trade balance for woody biomass (170,751 tons).

The second variable was the coefficient of variation. The highest coefficient of variation was observed in the biomass balance (tons) and biomass exports (tons). The lowest coefficient of variation was found in stable biomass acquisition (TJ) and biomass imports (tons).

The ranks were also evaluated using skewness and kurtosis, which are measures of asymmetry (Table 5). The skewness was positive in the analysis of all variables. The kurtosis was negative in biomass exports (tons), biomass imports (tons), the national use of stable biomass (TJ), and stable biomass acquisition (TJ), which means that the data are left-handed. Only the kurtosis for the biomass balance was positive, which means that the data are right-handed.

Table 5.

Descriptive statistics of woody biomass in Poland.

4. Discussion

In summary, Central and Eastern European countries such as Czechia, Belarus, and Germany are the largest importers of woody biomass for industrial purposes, accounting for almost 60% of all imports. On the other hand, Germany and China are the largest exporters of this raw material, generating 44% of all exports. With regard to woody biomass for energy, Belarus and Ukraine are the largest importers, covering almost 90% of the global demand, while Germany and Italy account for about 68% of the global exports.

The import of raw wood is diversified regionally. The largest amount was imported to Poland from Czechia, Germany, Lithuania, and Slovakia. These European Union countries deliver the largest shares of raw wood to Poland. These findings suggest that the lower cost of transport is the decisive factor.

The next product that is imported to Poland is pellets. The largest deliveries in 2005–2021 were found for Belarus, Russia, Ukraine, Germany, Lithuania, Czechia, and Slovakia. These results demonstrate that the imports depend mostly on low transport costs. Wood fuel was mostly imported to Poland from Czechia, Germany, Ukraine, and Belarus. Poland is an important recipient of wood fuel from these countries.

The side exports of wood from Poland were dominated by deliveries to China, Czechia, Germany, Estonia, Slovakia, Sweden, Italy, and Finland. These data demonstrate that China is preparing for the decarbonization of the economy by replacing fossil fuels. The domination of other countries from the European Union (EU) shows the importance of lower transport costs.

Exports of wood pellets were observed from Poland to Germany, Italy, Denmark, Czechia, Belgium, Slovakia, Slovenia, and other EU countries.

Polish exports of fuel wood waste were dominated by Germany and the United Kingdom (UK). The largest purchaser of wood fuel from Poland was also Germany, followed by Czechia, Slovakia, Italy, Denmark, and Belgium.

The authors of this paper evaluated the trading balance (SI ratio), which changed in the analyzed period. The changes are due to the global economic situation. The accession of Poland to the EU increased the balance. In 2009, the global financial crisis started, which decreased the balance. Later, the improvement in the economic situation increased the balance from 2010 to 2019. Then, the COVID-19 crisis caused the balance to decline.

An entirely different situation was observed for the Grubel–Lloyd index (IITk index) for the Polish wood and forestry sector. In 2005–2020, there was a dynamic increase in this index. This means that the sector undertook strategies to adapt to the new situation and reflects the effect of opening the market for Polish products. Some products, such as raw wood and veneer sheets, are more volatile. This is the result of the increasing demand for different goods and products and the development of the sector. The EU’s strong requirements for renewable energy sources have caused greater interest in biomass. Forests occupy more than 31% of the land in Poland; however, the increasing demand for biomass caused an increase in trade.

The foreign trade coverage index (CRK index) of the Polish timber and forestry sector in the years 2005–2020 increased, which suggests increasing competitiveness and an increasing trade balance. A particular increase was observed for firewood and raw wood, which suggests the increasing potential of this market. This sector has developed in the last few years due to investments resulting from the higher demand for wood and woody products for energy purposes. An increase has been observed in the category of wood (staves, slats) shaped in a continuous manner. Poland has increased its competitiveness in the wood and processed product markets. Wood, which is a basic product for the construction industry, is gaining more attention in the energy sector. This would not have been possible without investments in modern technologies and logistics.

Wood biomass, including pellets, has great potential for the future. This is because of the worldwide access to wood and the cheap costs of transport. Woody biomass could even satisfy 2–18% of the world’s primary energy consumption by 2050. A very large role is played by forests, and, if we exclude forests, the potential may decrease by up to 25% [90].

Woody biomass’ potential will increase in the future by 0.5–1.3% in the gross regional product. In particular, it will lead to an increase in income by USD 17.32 to USD 51.31 million each year. The woody biomass sector will play an important role in employment, providing an increase of 218.1–1127.8 jobs worldwide [91].

5. Conclusions

The world is undergoing important processes such as urbanization, industrialization, and globalization, which are associated with energy transformation, the development of renewable energy sources, and the decreasing use of fossil fuels. This transformation has brought challenges, such as climate change and changes in living conditions. The necessity to deliver a sufficient amount of renewable energy requires changes in logistics and trade [92].

Poland mainly imports raw wood and firewood, which account for about 57% of its imports, and it exports mainly raw wood and wood packaging, which account for about 45% of its exports. It is worth noting that the territorial size and degree of afforestation of a given country do not have to play a significant role in the import of woody biomass. The conflict in Ukraine and the sanctions imposed on Belarus in 2022 are likely to result in a significant decline in the share of these countries in the woody biomass market in Poland.

The Polish wood sector generates about 2.5% of the national gross domestic product (GDP) and employs about 350,000 people directly, according to the data of the Polish Chamber of Commerce of the Wood Industry. Despite the huge economic potential of forestry, Poland still needs significant amounts of this raw material. The current conflict in Ukraine and the sanctions imposed on Belarus may significantly affect the wood industry in Poland in 2022.

The authors of this paper analyzed three indexes, the SI index, Grubel–Lloyd index, and CRK index, to check the changes in the trade of biomass after the Polish accession to the EU. The first ratio was the trading balance (SI index), whose value in the years 2005–2008 was positive and growing, which means that exports exceeded imports and reflected the development of the trade of biomass. In 2009, there was a financial crisis worldwide, and it caused a decline in the balance; later, from 2010 to 2019, it started to grow. The COVID-19 pandemic also had a negative impact on trade, causing it to decrease.

The second ratio, called the Grubel–Lloyd index, showed a dynamic increase in the Polish wood trade from 2005 to 2020. According to Kraciuk [93], high values point out the presence of intra-industry trade, where the export and import flows of goods from the same industry significantly overlap. The increasing sector has an impact on the strategies adopted in the economy. Our research found that raw wood and veneer sheets are more volatile, which led to changes in demand and supply in the market.

The third ratio was the foreign trade coverage index (CRK index). According to Pawlak and Smutka [76], the enlargement of the European Union (EU) has contributed to a slight increase in the comparative advantages gained by the EU agri-food industry [94]. An increased value for the CRK index was found for the Polish timber and forestry sector in the years 2005–2020. The competitiveness of the biomass sector is increasing, which is reflected in the changes in the balance of exports, imports, and exports.

The ratio of firewood and raw wood is increasing, which may reflect the expansion of the industry into new markets. Other products, such as veneer and plywood sheets, representing processed products, also showed development. Staves and slats increased, reflecting the development of the sector.

Based on our research, we have positively verified Hypothesis 1 (H1), positing that the woody biomass trade in Poland is extending according to the increasing demand and the European Union’s requirements concerning renewable energy sources. The development of the biomass sector depends on trade, which shows a significant increase. The biomass sector, as well as other sectors, is vulnerable to global changes, such as the financial crises in 2008–2009 and the COVID-19 pandemic. The current economy in Poland is shaped by various factors, including access to the common market of the European Union (EU).

Policy Implications

The development of a stable biomass trade is determined by the European Union’s (EU) energy policy, and it will change in the coming years.

The biomass trade has been affected by the financial crises and COVID-19, which suggests that actions should be taken to prevent such problems.

Financial stimuli should be implemented in line with the increasing demand if the European Union wishes to become a clean and carbon-free area. Moreover, the trade of biomass prevents an increase in prices.

This research could be useful for policymakers, stakeholders in biomass supply chains, and other market participants [94]. Countries such as Poland, which are using biomass to a wide extent, should look for foreign trade partners in neighboring countries, particularly in the European Union (EU). This is because the costs of transport, production, and processing have a great impact on the woody biomass trade. The lowest costs of transport should be the decisive factor in choosing wood trade partners.

The quality of biomass is also important. This is why only high-quality woody biomass delivering high calorific value should be imported [95].

The members of the supply chain of woody biomass should be checked and controlled. When biomass is exported and imported overseas, the port investors should be controlled. Scandinavian countries, which have great resources of woody biomass, could be potential trade partners for woody biomass. However, sea-based biomass supply chains require better integration [95,96].

Policymakers should not reduce the share of biomass in the renewable energy source mix. Fossil fuels should be replaced with an increased share of stable biomass production. Biomass even emits carbon dioxide (CO2) during burning, which is attractive during growth. For this reason, society should be more broadly educated about the proper burning and utilization of energy from biomass [97,98].

Stable biomass will play a key role in the transformation of the energy sector in the future and will undoubtedly lead to a temperature decrease of 2 ◦C above preindustrial temperatures [99]. The reduction of carbon dioxide (CO2) and other greenhouse gases (GHG) requires the transformation of the energy sector, which suffers from a lack of stable and cheap energy. Stable biomass and nuclear energy will help to overcome these problems [100].

Author Contributions

Conceptualization, R.W., P.B., A.B.-B. and T.R.; methodology, R.W. and P.B.; validation, R.W. and P.B.; formal analysis, R.W. and P.B.; investigation, R.W. and P.B.; resources, R.W., A.B.-B. and P.B.; data curation, R.W., A.B.-B. and P.B.; writing—original draft preparation, R.W., A.B.-B., P.B., T.R., A.P. and L.H.; writing—review and editing, R.W., A.B.-B., P.B., T.R., A.P. and L.H.; visualization, R.W., A.B.-B. and P.B.; supervision, R.W., A.B.-B. and P.B.; project administration, A.B.-B. and P.B.; funding acquisition, A.B.-B. and P.B. All authors have read and agreed to the published version of the manuscript.

Funding

The results presented in this paper were obtained as part of a comprehensive study funded by the Minister of Science under “the Regional Initiative of Excellence Program”, University of Warmia and Mazury in Olsztyn, Faculty of Agriculture and Forestry, Department of Agrotechnology and Agribusiness (Grant No. 30.610.012-110).

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Nomenclature

| C | Carbon |

| Cl | Chlorine |

| CO2 | Carbon dioxide |

| CAP | Common agricultural policy |

| CRK | Foreign trade coverage ratio |

| GDP | Gross domestic product |

| EU | European Union |

| EKC | Environmental Kuznets curve |

| GHG | Greenhouse gases |

| GDP | Gross domestic product |

| IEA | International Energy Association |

| IITk | Grubel–Lloyd intra-industry trade index |

| N | Nitrogen |

| PLN | Polish Zloty |

| PV | Photovoltaics |

| RFF | Resources for the Future |

| S | Sulfur |

| SI | Ratio export specialization index |

| TJ | Terejaco joules |

| UK | United Kingdom |

| USA | United States of America |

References

- World Energy Outlook. Available online: https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf (accessed on 17 July 2024).

- Nawrot, Ł.; Bednarska, M.; Zamyślony, P. Odnawialne Źródła Energii w Gospodarce Turystycznej Jako Obszar Badań Naukowych; Wydawnictwo Uniwersytetu Łódzkiego: Lodz, Poland, 2014. [Google Scholar]

- Bełdycka-Bórawska, A.; Bórawski, P.; Borychowski, M.; Wyszomierski, R.; Bórawski, M.B.; Rokicki, T.; Ochnio, L.; Jankowski, K.; Mickiewicz, B.; Dunn, J.W. Development of Solid Biomass Production in Poland, Especially Pellet, in the Context of the World’s and the European Union’s Climate and Energy Policies. Energies 2021, 14, 3587. [Google Scholar] [CrossRef]

- Ratajczak, E.; Szostak, A.; Bidzinska, G.; Herbeć, M. Demand for wood biomass for energy purposes in Poland by 2015. Drewno. Pr. Nauk. Donies. Komunik. 2012, 55, 187. [Google Scholar]

- Bentsen, N.S.; Felby, C.; Thorsen, B.J. Agricultural residue production and potentials for energy and materials services. Prog. Energy Combust. Sci. 2014, 40, 59–73. [Google Scholar] [CrossRef]

- Stolarski, M.; Warmiński, K.; Krzyżaniak, M.; Olba-Zięty, E.; Akincza, M. Bioenergy technologies and biomass potential vary in Northern European countries. Renew. Sustain. Energy Rev. 2020, 133, 110238. [Google Scholar] [CrossRef]

- Heinimo, J.; Junginger, M. Production and trading of biomass for energy—An overview of the global status. Biomass Bioenergy 2009, 33, 1310–1320. [Google Scholar] [CrossRef]

- Azad, A.K.; Rasul, M.G.; Khan, M.M.K.; Sharma, S.C.; Hazrat, M.A. Prospect of biofuels as an alternative transport fuel in Australia. Renew. Sustain. Energ. Rev. 2015, 43, 331–351. [Google Scholar] [CrossRef]

- Shavkatovich Hasanov, A.; Xuan Do, H.; Shaiban, M.S. Fossil fuel price uncertainty and feedstock edible oil prices: Evidence from MGARCH-M and VIRF analysis. Energy Econ. 2016, 57, 16–27. [Google Scholar] [CrossRef]

- Janda, K.; Kristoufek, L.; Zilberman, D. Biofuels: Policies and Impacts. Agric. Econ.-Czech. 2012, 58, 372–386. [Google Scholar] [CrossRef]

- Gardebroek, C.; Hernandez, M.A. Do energy prices stimulate food price volatility? Examining volatility transmission between US oil, ethanol and corn markets. Energy Econ. 2013, 40, 119–129. [Google Scholar] [CrossRef]

- Gaetano Santeramo, F.; Di Gioia, L.; Lamonaca, E. Price responsiveness of supply and acreage in the EU vegetable oil markets: Policy implications. Land Use Policy 2021, 101, 105102. [Google Scholar] [CrossRef]

- Proskurina, S.; Junginger, M.; Heinimö, J.; Vakkilainen, E. Global biomass trade for energy—Part 1: Statistical and methodological considerations. Biofuels Bioprod. Bioref. 2019, 13, 358–370. [Google Scholar] [CrossRef]

- Sikkema, R.; Junginger, W.; Pichler, W.; Hayes, S.; Faaij, A.P.C. The international logistics of wood pellets for heating and power production in Europe: Costs, energy-input and greenhouse gas balances of pellet consumption in Italy, Sweden and The Netherlands. Biofuels Bioprod. Bioref. 2010, 4, 132–153. [Google Scholar] [CrossRef]

- Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources OJL. Off. J. Eur. Union 2009, 140, 16.

- Renewable Energy in Europe—2020 Recent Growth and Knock-on Effects. Eionet Report—ETC/CME 7/2020—December 2020. Available online: https://www.researchgate.net/publication/349522371_Renewable_energy_in_Europe_2020_-_Recent_growth_and_knock-on_effects (accessed on 1 July 2024).

- Janiszewska, D.; Ossowska, L. The Role of Agricultural Biomass as a Renewable Energy Source in European Union Countries. Energies 2022, 15, 6756. [Google Scholar] [CrossRef]

- Tenchea, A.I.; Tokar, D.M.; Foris, D. The use of biomass as a renewable energy source in a fluidized bed combustion plant. Bull. Transilv. Univ. Bra¸sov Ser. II For. Wood Ind. Agric. Food Eng. 2019, 12, 117–126. [Google Scholar]

- European Comission. Energy, Transport and Environment Statistics, 2020th ed.; Publication Office of the European Union: Luxembourg, 2020; pp. 10–40. Available online: https://ec.europa.eu/eurostat/web/products-statistical-books/-/ks-dk-20-001 (accessed on 30 November 2021).

- Rokicki, T.; Bórawski, P.; Szeberényi, A. The Impact of the 2020–2022 Crises on EU Countries’ Independence from Energy Imports, particularly from Russia. Energies 2023, 16, 6629. [Google Scholar] [CrossRef]

- Janiszewska, D.; Ossowska, L. Biomass as the Most Popular Renewable Energy Source in EU. Eur. Res. Stud. J. 2020, 23, 315–326. [Google Scholar] [CrossRef]

- Raport: Bioenergy Landscape. Brussels 2019. Available online: https://www.ieabioenergy.com/wp-content/uploads/2020/05/IEA-Bioenergy-Annual-Report-2019.pdf (accessed on 29 July 2024).

- COM(2020) 562 Final. Available online: https://knowledge4policy.ec.europa.eu/publication/communication-com2020562-stepping-europe%E2%80%99s-2030-climate-ambition-investing-climate_en (accessed on 28 July 2024).

- COM(2019) 640 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2019%3A640%3AFIN (accessed on 28 July 2024).

- COM(2020) 952 Final Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee of the Regions. Renewable Energy Progress Report. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2020:952:FIN (accessed on 28 July 2024).

- deLlano-Paz, F.; Anxo Calvo-Silvosa, A. Susana Iglesias Antelo a,2, Isabel Soares. Renew. Sustain. Energy Rev. 2015, 48, 49–61. [Google Scholar] [CrossRef]

- UNEP. 2014 Green Economy Initiative. Available online: http://www.unep.org/greeneconomy/ (accessed on 28 July 2024).

- Scarlat, N.; Dallemand, J.-F.; Monforti-Ferrario, F.; Nita, V. The role of biomass and bioenergy in a future bioeconomy: Policies and facts. Environ. Dev. 2015, 15, 3–34. [Google Scholar] [CrossRef]

- Proskurina, S.; Junginger, M.; Heinimö, J.; Tekinel, B.; Vakkilainen, E. Global biomass trade for energy—Part 2: Production and trade streams of wood pellets, liquid biofuels, charcoal, industrial roundwood and emerging energy biomass. Biofuels Bioprod. Bioref. 2019, 13, 371–387. [Google Scholar] [CrossRef]

- Lamers, P.; Mai-Moulin, T.; Junginger, M. Challenges and Opportunities for International Trade in Forest Biomass. In Mobilisation of Forest Bioenergy in the Boreal and Temperate Biomes; Elsevier: Amsterdam, The Netherlands, 2016; pp. 127–164. ISBN 978-0-12-804514-5. [Google Scholar]

- Lamers, P.; Marchal, D.; Heinimo, J.; Steierer, F. Woody biomass trade for energy. In International Bioenergy Trade: History, Status & Outlook on Securing Sustainable Bioenergy Supply, Demand and Markets; Junginger, M., Goh, C.S., Faaij, A., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 41–64. [Google Scholar]

- Lamers, P.; Hoefnagels, R.; Junginger, M.; Hamelinck, C.; Faaij, A. Global solid biomass trade for energy by 2020: An assessment of potential import streams and supply costs to North-West Europe under different sustainability constraints. GCB Bioenergy 2015, 7, 618–634. [Google Scholar] [CrossRef]

- Proskurina, S. Proskurina, S. International Trade in Biomass for Energy Production: The Local and Global Contex. Acta Universitatis Lappeenrantaensis 2018. Available online: https://lutpub.lut.fi/bitstream/handle/10024/158444/Svetlana%20Proskurina%20A4_ei_artik.pdf?sequence=1&isAllowed=y (accessed on 19 July 2024).

- Heinimö, J.; Lamers, P.; Tapio, R. International trade of energy biomass—An overview of the past development. In Proceedings of the 21st European Biomass Conference, Copenhagen, Denmark, 3–7 June 2013. Presentation 5CV.2.38. [Google Scholar]

- Stolarski, M.J.; Gil, Ł.; Krzyzaniak, M.; Olba-Ziety, E.; Wu, A.-M. Willow, Poplar, and Black Locust Debarked Wood as Feedstock for Energy and Other Purposes. Energies 2024, 17, 1535. [Google Scholar] [CrossRef]

- Stolarski, M.J.; Welenc, M.; Krzyzaniak, M.; Olba-Zi˛ety, E.; Stolarski, J.; Wierzbicki, S. Characteristics and Changes in the Properties of Cereal and Rapeseed Straw Used as Energy Feedstock. Energies 2024, 17, 1243. [Google Scholar] [CrossRef]

- Stolarski, M.J.; Wojciechowska, N.; Seliwiak, M.; Dobrzański, T.K. Properties of Forest Tree Branches as an Energy Feedstock in North-Eastern Poland. Energies 2024, 17, 1975. [Google Scholar] [CrossRef]