Abstract

The increasing utilisation of the distribution grid caused by the ramp-up of electromobility and additional electrification can be eased with flexibility through smart and bidirectional charging use cases. Implementing market-oriented, grid-, and system-serving use cases must be tailored to the different national framework conditions, both in technical and regulatory terms. This paper sets out an evaluation methodology for assessing the implementation of smart and bidirectional charging use cases in different countries. Nine use cases are considered, and influencing factors are identified. The evaluation methodology and detailed analysis are applied to Austria, the Czech Republic, Denmark, Finland, France, Germany, Italy, the Netherlands, Spain, and Sweden. In every country, the implementation of vehicle-to-home use cases is possible. Realising market-oriented use cases is feasible in countries with a completed smart meter rollout and availability of tariffs with real-time pricing. Grid-serving and ancillary service use cases depend most on country-specific regulation, which is why no clear trend can be identified. Use cases that require direct remote controllability are the most distant from implementation. The overarching analysis provides orientation for the design of transnational products and research and can serve as a basis for a harmonisation process in regulation.

1. Introduction

The current transformation of the transport sector towards electromobility is bridging the gap between the transport and energy sectors. The transport sector electrification presents new challenges for grid operators, car manufacturers, and marketers. Distribution system operators (DSOs) must adapt to increasing grid utilisation and develop strategies for integrating electric vehicles (EVs). Car manufacturers must implement new standards and communication protocols such as ISO 15118 [1] while the competition for international market dominance has yet to be decided. Marketers must offer customers new business models that are economically profitable and technically feasible for all players.

For the first time, the internationally active automotive sector encounters nationally different and historically evolved framework conditions and regulations for electrical energy supply. Both the grid-side requirements and the strategies for the respective energy supply system of the future differ—not only at the national level but often even at the DSO level.

Although the implementation and the revenue opportunities of smart and bidirectional charging use cases are significantly influenced by national regulation [2] and framework conditions, evaluating these has taken place at the national level. The common minimum functional requirements for smart meters have been proposed by the EU Commission [3], but the implementation and technical possibilities of smart meters still differ significantly between countries. Germany, for example, is developing its own control system. Consequently, a grid-serving use case that works in Germany cannot be implemented similarly in other countries.

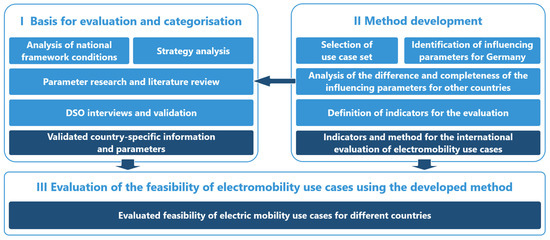

The main objective is to analyse the framework conditions for nine different use cases: (photovoltaics (PV)-self-optimisation, peak-shaving, market-oriented flexibility via price incentives or marketing success, emergency power supply, grid-serving flexibility via variable grid fees, grid-serving flexibility by regulation, ancillary services like redispatch and Frequency Containment Reserve (FCR)) for several European countries (Austria, the Czech Republic, Denmark, Finland, France, Germany, Italy, the Netherlands, Spain, and Sweden). The considered vehicle-to-home (V2H) and vehicle-to-grid (V2G) use cases are identified, described, and implemented in the research project unIT-e2 [4]. The most important factors influencing the implementation of the use cases are identified, researched, validated, and supplemented by interviews with DSOs as shown in Figure 1. Central aspects like the smart meter rollout in the countries, the different technical capabilities of those, the available electricity tariffs, the standard deviation of electricity prices, and the grid fee design significantly influence whether a use case can be sensibly implemented in a country.

Figure 1.

Procedure of the investigation (light blue: work package, dark blue: outcome).

An evaluation methodology is drawn up based on the relevant parameters for implementing the use cases. In a final synthesis, the implementation possibilities of the use cases in Europe are analysed comprehensively, summarized in an overview, and trends are identified.

2. Methodology

The following sections describe the methodology of the present paper. The first section lays out the use cases and the evaluation parameters, while the second one details the evaluation itself.

2.1. Use Cases and Evaluation Parameters

The smart and bidirectional charging use cases are defined in the research project unIT-e2 [4]. In this paper, the term smart and bidirectional charging use cases covers both smart unidirectional use cases, often also called V1G, and smart bidirectional use cases, like V2H and V2G. Even though V1G and V2G differ in terms of technical implementation, both can be described collectively here, as use cases are being evaluated and not the technical implementation of components. The use cases considered for this paper are PV-self-consumption optimisation, peak-shaving, market-oriented flexibility via price incentives, market-oriented flexibility via marketing success, emergency power supply, grid-serving flexibility via variable grid fees, grid-serving flexibility by regulation, and ancillary services like redispatch and FCR.

The use cases market-oriented flexibility via price incentives and market-oriented flexibility via marketing success differ in terms of incentives. The former is based on price signals provided by the energy supplier, for example. The latter works the other way around. The aggregator or marketer transmits the flexibility potential and the energy supplier then informs it about the traded energy. The use cases grid-serving flexibility via variable grid fees and grid-serving flexibility by regulation represent two different approaches to leveraging grid-serving flexibility. The first is based on a monetary incentive through variable grid fees set by the DSO. The second is based on a regulatory obligation of the connectee to be controlled by the DSO and to receive a corresponding remuneration in return. This use case corresponds to the implementation of §14a in Germany.

The most relevant influencing factors are identified to evaluate the considered use cases. The influencing factors can be divided into technical and market parameters and regulatory parameters.

2.1.1. Technical and Market Parameters: The Following Section Describes and Defines the Technical and Market Parameters Considered

- Smart meter rollout: The status quo of the smart meter rollout in each country investigated in 2023 [5] represents a central parameter to realise most of the considered use cases. The progress of the smart meter rollout is subdivided into three groups: level three (80–100%), level two (20–80%), and level one (0–20%);

- Control: This parameter specifies whether the grid connection point and/or the assets behind the meter can be remote controlled or not;

- Electricity tariffs: To evaluate the feasibility and the economic viability of the abovementioned smart and bidirectional charging use cases, the available types of tariffs for electricity procurement in a country are crucial. Four types of tariffs are distinguished and defined as follows. The static electricity tariff consists of one fixed price for the whole year without any time variability. Critical peak pricing (CPP) sets a higher price during critical time slots of a day considering the grid capacity, mainly due to high demand. The time slot can be several hours. Often, the price is set the day before. The static time-of-use (TOU) pricing defines beforehand different time slots. In each time slot, the price remains the same for the whole time slot, e.g., peak and off-peak hour prices. The duration of a time slot can vary between seasons, days, or periods. The pricing can be volumetric (price per energy), capacity-based (price per power), or a mix of both. Real-time pricing (RTP) provides electricity prices based on real-time or day-ahead market data. In most cases the resolution is hourly. In some countries, a 15-min resolution could be available. The resolution of the RTP is not considered for the evaluation of the applicability of the use cases. Tariffs using TOU pricing or RTP are called variable;

- Average daily standard deviation of day-ahead electricity prices: For evaluating the use case market-oriented flexibility via marketing success, the average daily standard deviation of the day-ahead electricity prices is considered. Due to the major influence of various crises on price trends and price spreads in the energy market, the average daily standard deviation of day-ahead electricity prices from the pre-crisis year 2019 is chosen as a reference. The average daily standard deviation of the day-ahead electricity prices in 2019 [6] ranges for the considered countries from EUR 2.3/MWh to EUR 10.1/MWh. For the evaluation, three levels are defined: high (>EUR 8/MWh), medium (EUR 6/MWh–8/MWh), and low (EUR <6/MWh). As this assessment aims to illustrate differences between countries, a pragmatic approach for setting the intervals is chosen;

- Installed rooftop PV capacity: The PV revenue potential is considered crucial for the evaluation of the PV-self-consumption optimisation use case. This paper assumes that the installed capacity of rooftop PV per country can be interpreted as an indicator of the demand and economic benefit of rooftop PV as a distributed renewable energy (RE) resource;

- Projectable production and baseload RE resources: Additional indicator for the country’s need for an additional provision of flexibility for redispatch or ancillary services.

- Reliable power supply (SAIDI): Indicates the relevance of emergency power supply in a country;

- Redispatch and price zones: Additional indication for assessing the relevance of the redispatch and FCR use case.

2.1.2. Regulatory Parameters: The Following Section Describes and Defines the Regulatory Parameters Considered

- Grid fee design: Since regulation has a high influence on the economic viability of V2G use cases [2], the grid fee design is a central component. Six different grid fee designs are considered in this paper and defined as follows: A volumetric grid fee design represents a fixed price per kWh consumed. A fixed price for the connection power is defined as a capacity-based grid fee design. Time-variable grid fees have different prices for different time slots, e.g., for peak and off-peak hours. In this paper, predefined time slots for a whole year or month are also considered as time-variable. If the price of the grid fee changes depending on the remaining grid capacity in (near to) real-time it is considered as a dynamic grid fee design. Furthermore, grid fee designs exist that contain a fixed price component per connection point, a volumetric-, and a capacity-based price component. In this case, we call it a mixed grid fee design. In some countries, the grid fees are composed of a capacity and a consumption component, and sometimes, an additional fee is charged depending on the contracted fuse size. The price component for capacity is usually determined based on the monthly average of the three highest power peaks, which is why this case is called the monthly average in this paper;

- Pooling: The essential requirement for many electromobility use cases is that an aggregator can pool the capacity. This enables participation with large capacities in markets for balancing power or ancillary services, for instance. However, as pooling is not permitted in all countries, this is an essential criterion for assessing the feasibility of some use cases.

2.2. Use Case Evaluation

First, relevant use cases are identified that enable the provision of flexibility by EVs and thus partially increase the hosting capacity of distribution grids. Based on the use cases of the project unIT-e2, a set of use cases is selected for further analysis, representing V1G, V2H, and V2G use cases. The use cases represent market-oriented, grid-, and system-serving use cases.

The influencing factors necessary and favourable for the implementation of the use cases are collected and reduced to the most necessary as shown in Figure 1. The relevance of the factors is assessed and validated by experts in the respective field.

To obtain a precise assessment basis and an understanding of the market conditions and the regulatory framework for each country, literature research is first carried out. The identified abovementioned influencing factors are researched, as well as the political objectives, the available electricity tariffs, and, if possible, an indication of the extent to which these are used, as well as the prequalification for ancillary services.

Since it is often hard to assess the extent to which researched information corresponds to actual practice, expert interviews are conducted with DSOs from Austria, the Czech Republic, Denmark, Finland, France, Italy, the Netherlands, Spain, and Sweden. For the other countries initially included in the analysis (Belgium, Norway, Poland, Portugal, and the UK), no interview partners were found, which is why they are not discussed in this paper. The interviews focus in particular on details of the smart meter rollout, the technical features of the smart meters, the capabilities of the smart meters used by DSOs, the general degree of digitalisation of the distribution grid, the extent to which remote control of assets or household connections is possible, the current situation about the hosting capacity of the distribution grids, the grid fee design, the current use of grid-serving flexibility as well as the strategy of the DSOs for integrating and utilising decentralised consumers and producers.

Five categories, illustrated by five colours, are defined for the evaluation and are shown in Table 1. Green means that the use case is feasible in terms of the technical and regulatory aspects. Yellow indicates that the use case is technically feasible, but the regulatory framework is not fully developed, even though a roll-out could start. Orange signifies that the use case is technically feasible, but the regulatory framework or the level of digitalisation prevents the implementation of the use case and/or that a market does not exist or is not fully developed. Red means that the use case cannot be implemented under the currently prevailing framework conditions and/or that it is unlikely that a functioning market will develop. Grey indicates that the use case is not or less relevant for the country.

Table 1.

Colour scheme of the evaluation.

The evaluation method then defines for each use case which requirements must be met for which evaluation level (colour). The use case PV-self-consumption optimisation is feasible in all countries, given that it is a V2H use case. Based on country-specific information influencing the revenue potential of the use case, like the already installed PV capacity as well as the amount of hydro energy, it is evaluated if the use case is relevant or not for a country. The use case emergency power supply is a V2H use case, too, and thus basically possible in every country. There is no regulatory framework for this use case in any country, though, and so far, there is no “plug-and-play” solution on the market. The relevance of the UC is assessed based on the country’s system average interruption duration index (SAIDI) [7] and the availability of very rural areas or islands. Peak shaving is generally feasible if this is already being used or if the electricity price contains a capacity charge, whether for residential or commercial customers. If no capacity charge exists, neither for residential nor for commercial customers, it depends on the grid capacity. If the grid capacity is sufficient so far, then the use case is rated as not relevant. If the grid capacity is reaching its limits or if this is foreseeable the use case is rated as not feasible.

The first requirement for market-oriented flexibility via price incentives is the existence of variable electricity tariffs. If they do not exist, the use case is rated as not feasible. If variable electricity tariffs exist, but the smart meter rollout is at the first level (<20%), there is no market for the use case. If the smart meter rollout is at level two (>20%) or three (>80%), the evaluation distinguishes between the sort of variable electricity tariffs available. If there is not even a TOU tariff, there is no market. If there are TOU and/or CPP tariffs but no RTP tariff, there is no framework because a RTP tariff is a basic requirement for the use case. If RTP tariffs exist, the country is rated as feasible. Related to this evaluation is the evaluation method for the use case market-oriented flexibility via marketing success. Like the former use case, it is not feasible if no variable electricity tariffs exist. If they exist, there is no market if the smart meter level is at level one (<20%). For higher levels of the smart meter rollout, the existence of RTP electricity tariffs is mandatory for the use case to be rated feasible. If no RTP tariffs exist, it depends on the average daily standard deviation of the day-ahead electricity prices if there is no framework for the use case, stating that the use case could be rolled out, or that there is no market. An average daily standard deviation of the day-ahead electricity prices higher than EUR 8/MWh leads to the rating “no framework”, and below this limit, it leads to the rating “no market”. However, it is a pragmatic approach to evaluate the higher revenue potential of the use case with a high average daily standard deviation of the day-ahead electricity prices.

To assess whether the use case grid-serving flexibility via variable grid fees is relevant for a country, the availability of base load-capable renewable energy resources is considered. If the country has a high capacity in this area, the use case is categorised as irrelevant. Otherwise, it is assessed whether variable grid fees already exist in any form, and the status of the smart meter rollout is analysed. If there are already variable grid fees and the smart meter rollout has been completed, the use case is consequently assessed as feasible. In the case of a smart meter rollout at level two (>20%), no complete framework exists yet. In the case of a smart meter rollout at level one (<20%), the market is not fully developed due to the level of digitalisation. If there are no variable grid fees, the rating is shifted down one level. This means that there is no framework with a completed smart meter rollout, no market for level two (>20%), and the use case is not feasible for level one (<20%). For the use case of grid-serving flexibility by regulation, it is crucial that the control of assets via the smart meter is made possible. If this is not possible, the use case is rated as not feasible. Another decisive factor is whether the regulator also permits the control of assets via the smart meter. If this is not the case, there is no market, even if it were theoretically possible. If it is permitted, the use case is categorised as feasible if the smart meter rollout is at level two (>20%) or three (>80%). There is no framework for the use case for a smart meter rollout at level one (<20%), as the framework conditions are not sufficient, but the rollout could start.

Regarding ancillary services, a distinction is made between two use cases, the redispatch use case and the FCR use case. The evaluation of both use cases is similar, but the level of the smart meter rollout is rated as less important for the FCR use case, as a lower number of EVs is required for implementation and the spatial distribution is less relevant. For the redispatch use case, the first consideration is whether the country has easily plannable electricity production. If this is the case, the need to perform redispatch via EVs is low, and the use case is therefore irrelevant. If redispatching is already being performed or if there are several price zones, the use case is categorised as relevant. If this is the case, the first decisive factor is whether pooling is permitted. If it is not permitted, the use case is not feasible. If permitted, it is assessed whether the provision of redispatch by EVs is already being implemented. If not, no market exists. If yes, the level of the smart meter rollout determines whether there is still no market for a smart meter rollout at level one (<20%), whether a rollout would be possible at level two (>20%), or whether the use case is feasible at level three (>80%). The evaluation of the FCR use case also initially assesses the extent to which there is a need for additional provision of ancillary services. As with the redispatch use case, this depends largely on the national power plant fleet. If there is no need, as the internal need for FCR providers is already covered, the use case is categorised as irrelevant. If there is a need, the pooling of EVs is also the first decision variable in this use case. If pooling is not possible, the use case is not possible. If pooling is possible, but the smart meter rollout is at level one (<20%), then there is no market. If the smart meter rollout is at level two (>20%) or three (>80%), it depends on whether the provision of balancing power by EVs is already enabled or already being practiced. If so, the use case is feasible. If not, the necessary framework conditions are still missing, even if the basic requirements are already in place. In comparing the assessments of the FCR and the redispatch use case, the status of the smart meter rollout is weighted less heavily for the FCR use case. This is due to the fact that regional distribution is less relevant, and the market is also more limited. A total of 220,000 connected EVs are sufficient to cover the FCR provision [8].

3. Results and Discussion

Due to the amount of information needed to evaluate nine use cases for 15 countries, the detailed discussion for each country and each use case would go beyond the scope of this paper. Therefore, only the countries for which an interview could be carried out are selected.

The results of the analyses using the established evaluation method are summarised in Table 2.

The reasons for the evaluation per use case are described for each country separately in detail below.

Table 2.

Evaluation overview (green (1) = feasible, yellow (2) = no framework, orange (3) = no market, red (4) = not feasible, grey (0) = not relevant).

Table 2.

Evaluation overview (green (1) = feasible, yellow (2) = no framework, orange (3) = no market, red (4) = not feasible, grey (0) = not relevant).

| Use Case | AT | CZ | DE | DK | ES | FI | FR | IT | NL | SE |

|---|---|---|---|---|---|---|---|---|---|---|

| PV-self-consumption optimisation | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Emergency power supply | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 2 |

| Peak shaving | 1 | 1 | 1 | 4 | 1 | 0 | 1 | 1 | 1 | 1 |

| Market-oriented flexibility via price incentives | 2 | 3 | 3 | 1 | 1 | 1 | 2 | 1 | 1 | 1 |

| Market-oriented flexibility via marketing success | 2 | 3 | 3 | 1 | 1 | 1 | 2 | 1 | 1 | 1 |

| Grid-serving flexibility via variable grid fees | 2 | 3 | 4 | 1 | 1 | 1 | 1 | 2 | 2 | 1 |

| Grid-serving flexibility by regulation | 4 | 2 | 2 | 4 | 4 | 1 | 1 | 4 | 4 | 4 |

| Ancillary services: Redispatch | 3 | 4 | 3 | 3 | 4 | 1 | 0 | 4 | 3 | 3 |

| Ancillary services: FCR | 2 | 4 | 3 | 2 | 4 | 1 | 2 | 4 | 2 | 2 |

3.1. Austria

The status of the smart meter rollout in Austria depends on the DSO and varies between 50% and 90%. Communication takes place via powerline communication (PLC) or mobile radio. The smart meters are used for metering. The first generation of smart meters does not offer the option of controlling behind-the-meter assets. Customers can gain access to their data on a minute-by-minute basis via a HAN bus, for example, to support self-optimisation. With regard to the digitalisation of the distribution grid, some substations are equipped with meters and provide data at an aggregated level. Based on these data, load profiles and time slots are determined so that certain assets have reduced power available at certain times. These load profiles and time slots are then applied to other substations that are not measured but have similar characteristics. The DSO can switch water boilers off and on between 10 p.m. and 5 a.m. if the customer has a corresponding tariff. However, the proportion of so-called interruptible tariffs is decreasing. The customer can give the DSO access to his data at a 10 min resolution. The data are transmitted once a day. To date, there is no legal framework for controlling heat pumps or EVs behind the meter. However, it is technically possible to use the 0/1 relay to reduce the charging power of an electric vehicle supply equipment (EVSE) to a fixed, pre-installed value, e.g., from 100% to 60%.

Grid capacity is reaching its limits in Austria. The expansion of the low-voltage grid is being driven in particular by PV. However, it has been possible to connect every asset so far. In medium voltage, the connection of charging parks also plays a role and leads to waiting times of one to two years, depending on the region. As the share of EVs currently amounts to around 2%, further grid expansion is expected. Apart from the interruptible tariffs of the water boilers, grid flexibility is not utilised. To date, there is no legal framework for utilising other forms of flexibility. In the future, the utilisation of flexibility should play a greater role, but the focus is currently still on grid expansion. The use of price-based concepts is considered unlikely in the near future. Grid fees are fixed except for the interruptible tariffs. They consist of a consumption and capacity component. The latter is a fixed flat rate that is the same for every private customer in Austria. (The previous sections mainly refer to the DSO interview).

Based on this information, the PV-self-consumption optimisation use case is classified as feasible and the emergency power supply use case is irrelevant. As the electricity price has a capacitive component, the peak shaving use case is also categorised as feasible. Variable tariffs are available, and the smart meter rollout is at level two (>20%). In addition, TOU tariffs exist, which is why the use case market-oriented flexibility via price incentives is categorised as not yet having a framework. The assessment of the use case market-oriented flexibility via marketing success concludes that there is not yet a framework for this use case. This is because although variable tariffs exist and the smart meter rollout is at level two (>20%), there is no widespread availability of RTP tariffs. However, since the average daily standard deviation is greater than EUR 8/MWh, a market exists, and only the framework conditions are missing.

Time-variable grid fees exist (in the form of predefined time slots with a price per time slot), and the smart meter rollout is at level two (>20%). Both criteria together, but in particular the incomplete smart meter rollout, lead to the assessment for the use case grid-serving flexibility via variable grid fees that no framework exists to date. The use case of grid-serving flexibility by regulation is assessed as not feasible. Although a relay exists for switching water boilers on and off, which from a purely technical point of view could also be used to limit EVSEs to a fixed value, dynamic control is not possible, and there is no legal framework for this. No market yet exists for the redispatch use case. Although there is a need for redispatch and the pooling of EVs is permitted, redispatch by EVs has not yet been practised. As with redispatch, whether pooling is permitted is relevant for the provision of FCR. As this is the case and the smart meter rollout is at level two (>20%), but the provision of balancing power by EVs is not yet carried out, there is no framework for the use case according to the evaluation methodology.

3.2. The Czech Republic

The realisation of the smart meter rollout in the Czech Republic is scheduled to take place between 2024 and 2026. Each DSO can define its own strategy for the rollout. Certain minimum requirements that the smart meters must fulfil are defined for the whole Czech Republic. The DSOs may adapt and upgrade these to meet local requirements. The smartest version offers 15-min load profiles, two 0/1 relays to control assets behind the meter, a digital data interface, a control box for EVs, and a limiter. The distribution network has not yet been digitised, but the DSOs are already using processes to control the heating systems and water boilers. Via a frequency signal, 0/1 relays can control both. So far, there are no plans to control EVs using this technology; this is to be realised with the smart meter rollout.

Until now, the network capacity is sufficient. From 2030, it is expected that more grid capacity or more precise load management will be required. Grid-serving flexibility is already used. TOU tariffs are specially designed for the widely used electric heating and water boilers and harness the user‘s flexibility already. Depending on the assets connected behind the meter, customers can be offered different time windows with high and low tariffs. The high tariff can vary from 2 h/day to 8 h/day. The low tariff is usually applied between 2 a.m. and 6 a.m. The already widespread implementation is seen as favourable for the smart meter rollout, as customers are already familiar with variable tariffs. The grid fees are time-variable and regulated but may vary from DSO to DSO. In principle, they consist of a capacitive and a consumption price component. High and low tariffs are used for the consumption price component and can differ depending on the connected asset. The time slots can also vary seasonally. High and low tariffs can differ by a factor of ten. (The previous sections mainly refer to the DSO interview).

As in most countries, the use case of PV-self-consumption optimisation is possible, and the use case of emergency power supply is irrelevant due to reliable supply. As the electricity price already has a capacitive price component, the use case of peak shaving is also feasible. No markets exist for the use cases of market-oriented flexibility via price incentives, market-oriented flexibility via marketing success, and grid-serving flexibility via variable grid fees according to the evaluation methodology. Although both variable electricity tariffs and variable grid fees already exist and therefore provide good preconditions for implementing the use cases, all use cases are hindered by the smart meter rollout of less than 20%. The smart meter rollout is also an obstacle to implementing the use case grid-serving control by regulation. As the control of assets behind the meter is already permitted and practiced, only the fact that the smart meter rollout is not advanced means that there is still no framework for the use case. Since the pooling of assets is not permitted, it is not possible to implement the redispatch or FCR use cases for EVs.

3.3. Denmark

Denmark has installed almost 100% of the required smart meters. The smart meters are owned and operated by the DSO. A special feature in Denmark is that the DSO must send the data to a national data hub where electricity suppliers can access them for billing purposes. The smart meters are mainly used to measure consumption at hourly resolution. Work is being carried out to implement a quarter-hourly resolution. The DSO also records other measured values via the smart meter, although it is not authorised to pass these on. The digitalisation of the distribution grid is based on smart meters, which provide hourly or quarter-hourly customer data. The data can be used for simulations, load flow calculations, and forecasts. However, few DSOs produce forecasts for the low-voltage grid. The 10 kV feeder is measured at the larger 15 kV/10 kV substations. Out of a total of approx. 75,000 substations, a few hundred strategically selected ones are measured. Customers are not controlled, which has not been necessary to date. In general, it is possible to disconnect or limit large consumers based on a bilateral agreement between the DSO and the customer.

The grid capacity has been sufficient to date. Overvoltages occurred due to a high penetration of residential PV systems. These have been resolved by stepping down the transformer. The afternoon charging peak of EVs is already higher than the historical peak in the evening hours. Grid supply in Denmark is not regulated or limited. This means that customers can use as much as they want. Grid-serving flexibility is not considered likely on low voltage levels, and there is a preference for grid reinforcement measures. The DSOs would be more interested in providing reactive power than active power through flexible assets. On medium and high voltage levels, the flexibility of active power is of interest. The grid fee design varies from DSO to DSO. Some time-variable tariffs have a higher price from 5 p.m. to 9 p.m., for example. However, the volumetric standard tariff is mainly used. Overall, the grid fees represent approx. 15% of the electricity price is due to the relatively high electricity tax of approx. 10 ct/kWh. (The previous sections mainly refer to the DSO interview).

Nothing hinders the implementation of the use case of PV-self-consumption optimisation, and due to the reliable power supply, the use case emergency power supply is irrelevant. The use case peak shaving is not feasible, as there is no capacity price component so far. However, a new grid fee design, including a capacity price component, is being worked on. Thus, the use case may be possible in the future [9]. Both market-oriented use cases (market-oriented flexibility via price incentives, and market-oriented flexibility via marketing success) are equally feasible. This is because variable electricity tariffs are available in the form of RTP tariffs, and the smart meter rollout is completed.

As variable grid fees are available, there are no obstacles to the use case of grid-serving flexibility via variable grid fees. Despite the completed smart meter rollout, it is impossible to control households or assets via the smart meters. As a result, the use case grid-serving flexibility by regulation is not feasible. According to the assessment methodology, there is no market for the redispatch use case. Although different price zones exist and pooling is permitted, redispatch is not provided by EVs. For a similar reason, there is no framework for the FCR use case. The possibility of pooling and the completed smart meter rollout favours the use case. However, the provision of FCR has not yet been performed with EVs, except in field tests.

3.4. Finland

In Finland, the smart meter rollout has been completed since 2014, and the second generation is currently being rolled out. The smart meters measure electricity consumption and production at hourly or quarter-hourly resolution. Apart from the smart meters, the distribution grid is not yet digitalised. The data from the smart meters are used to optimise grid planning and asset management. All smart meters of the DSO interviewed can be controlled remotely (1/0), and some are also equipped with remote switches for large consumers, such as electric heaters, EV charging points, or saunas. However, this control option is not available to the same extent for all DSOs. The smart meters are also used for fault detection and to check whether the power supply works.

The grid capacity is considered sufficient. The integration of EVs is also estimated to be feasible without major problems. The need for grid reinforcements in rural areas is expected, but electromobility, in general, is considered a minor addition to power and energy demand. However, demand charges for peak power demands are being discussed. Grid-serving flexibility is utilised in the form that the DSO can control larger loads if the customer wants it to do so. The customer can also set the switching times for these assets themselves. Larger loads, such as electric water heaters, are switched on at night by default. The DSO can limit large public charging stations via ADR protocol. Operators of public charging stations also participate in flexibility markets. Customers can also sell their flexibility (boilers, EVs), which is used to provide ancillary services via a virtual battery, in a first project. However, grid expansion is preferred in general. Grid fees are divided into day and night tariffs. Also, seasonal prices exist. Dynamic grid fees are discussed but still on a theoretical level. The first pilot projects with flexible customers receiving a cheaper grid fee have been carried out. (The previous sections mainly refer to the DSO interview).

As in the other Scandinavian countries, the use case PV-self-consumption optimisation is feasible but is classified as less relevant for the above reasons. The emergency power supply use case is categorised as relevant due to the many rural areas with low meshing of the electricity grid, but no framework exists for it to date. The use case of peak shaving is not feasible as there is usually no capacitive price component in the electricity price. However, some DSOs calculate a capacitive price based on the highest annual peak. The use cases market-oriented flexibility via price incentives and market-oriented flexibility via marketing success are both feasible. Implementation is favoured by the widespread availability of RTP tariffs and the completed smart meter rollout. Due to the availability of RTP tariffs, the criterion of the average daily standard deviation of the day-ahead prices is not relevant for evaluating the use case market-oriented flexibility via marketing success.

The use case grid-serving flexibility via variable grid fees is feasible, but due to the high level of base load-capable renewable energy resources and a well-plannable power plant portfolio, the use case is also rated as not relevant. The use case grid-serving flexibility by regulation is feasible, given the completed smart meter rollout and the fact that it is already possible to control assets behind the meter. This enables sufficient consumers to be controlled if necessary. Both ancillary services use cases, redispatch and FCR, are feasible. Both use cases benefit from the fact that pooling is possible and that the provision of ancillary services by EVs is already being practiced—albeit only to a limited extent. Of course, the completed smart meter rollout also favours both use cases. Both use cases are also categorised as less relevant due to Finland’s well-plannable power plant portfolio.

3.5. France

France is at nearly 100% of the smart meter rollout. The smart meter can host different sorts of electricity tariffs, but the critical peak price tariff with prices for peak and off-peak hours is the most widespread. The level of grid digitalisation provides data at the transformer level retrospectively. The smart meters transmit information—such as the maximum power consumed and the meter reading per tariff level and time slot [10]—once a day (at night) to the intelligence of the transformer. The data are bundled and transmitted to the DSO and the cloud [11]. The DSO is allowed to analyse the data sets statistically. Customers can be given access to their data via the cloud. The DSO can already control decentralised loads such as water boilers to a certain extent. However, the regulatory design for control is not precisely defined here. Usually, the heating intervals of the boilers (with around 2 kW) are organised in groups so that the heating intervals are staggered, and the hosting capacity of the distribution grid is used efficiently as a result. The simultaneous start-up of a large number of boilers can thus be prevented. In addition, an explicit restart during off-peak hours can help to utilise the nuclear surplus. It is just possible to switch it on or off, not to throttle the output. So far, controlling EV charging processes via the smart meter is not possible.

In terms of grid capacity, no grid expansion has been necessary to date. The largest DSO had to equip all motorways with charging stations of up to 2 MW, which was possible without major additional grid expansion. Due to the increasing number of residential charging stations, the DSO regularly conducts a survey on users’ charging behaviour. According to this survey, most people charge their EVs overnight using the standard 2 kW household plug. Therefore, a strong need for grid expansion is considered unlikely so far. Apart from the above-mentioned control of the water boilers, no grid-serving flexibility is utilised at the low voltage level. The likelihood of the DSO purchasing flexibility in a corresponding market is considered to be very low. The grid fees are variable and differ between peak and off-peak hours. Although the contracted capacity is the central price component, all taxes relate to consumption. In the electricity bill, the variable grid fees lead to a difference of 25% to 30% between peak and off-peak hours. (The previous sections mainly refer to the DSO interview).

Based on the information described, the V2H use cases PV-self-consumption optimisation and emergency power supply are possible. The latter is not classified as relevant due to the SAIDI of France and because the overseas departments are not taken into account. Since the capacity charge is the central electricity price component and critical peak pricing already exists, the use case of peak shaving is assessed as feasible. The two market-oriented use cases market-oriented flexibility via price incentives and market-oriented flexibility via marketing successes cannot be implemented directly as no RTP exists. However, as the smart meter rollout is complete and variable electricity pricing has already been implemented, a rollout is generally within reach. The framework conditions for this have not yet been finalised. In addition, there is an average daily standard deviation of the day-ahead electricity prices of over EUR 8/MWh, which favours the use case of market-oriented flexibility via marketing success. As a result of the above-mentioned criteria, both use cases do not have a framework.

The use case of grid-serving flexibility via variable grid fees is assessed as feasible, as a framework for variable grid fees is already in place due to the peak and off-peak grid fees. In addition, the level of digitalisation through the completed smart meter rollout supports the use case. Although France has a well-plannable power plant fleet and base-load capable renewable energy resources, the use case is categorised as relevant. Due to the high proportion of nuclear generation in particular, shifting load from the high load times to the low load times is interesting to harmonise the power consumption as well as the utilisation of the grid as much as possible and thus make efficient use of the grid’s hosting capacity. The use case grid-serving flexibility by regulation is categorised as feasible, as it is generally possible to control assets via the smart meter; this is already being practiced, and the smart meter rollout is sufficiently advanced. Due to the aforementioned easily plannable power plant portfolio and the sufficient hydropower supply, the redispatch use case is classified as irrelevant. The prerequisites for the FCR use case are met, as pooling is permitted and the smart meter rollout is advanced accordingly. However, as FCR provision by EVs is not yet practiced, there is no framework.

3.6. Germany

In Germany, the smart meter rollout is still in its infancy, with very few smart meters being installed so far (below 1%) [12]. The German smart meter is a special case, as Germany has set up its own control system. A so-called smart meter gateway has been developed to send and receive data with a high level of security and, if necessary, a high time resolution. The data are sent to the metering point operator, who can distribute them to different registered parties, e.g., the DSO or the energy supplier [13]. In terms of tariffs, only a few providers offer variable tariffs today, even though such tariffs are possible from a regulatory perspective. From 2025 onwards, electricity providers must offer at least one variable electricity tariff [14]. RTP tariffs are virtually non-existent. In terms of digitalisation, electric grids are not yet digitalised, such that especially DSOs can only estimate the status of their grid and cannot compute it with real data. Controlling flexible assets behind the meter is generally possible, particularly if a smart meter gateway is installed. The metering operator can receive signals from third parties to be sent to the smart meter gateway, which in turn forwards the signal to a local energy management system or directly to flexible assets. The gateway is mandatory for specific customers and required for the use case grid-serving flexibility by regulation [15]. For other use cases, a digital connection without a smart meter gateway is possible.

The grid expansion in Germany is progressing slowly and grid capacities could become scarce in the future [16], especially as the installed power of PV systems has rapidly increased within the last year [17]. For PV systems, a fixed remuneration system applies for systems no larger than 30 kW peak power. The remuneration rate is staggered by system size and fixed for 20 years, depending on the installation date [18]. Today, only static grid fees apply. Most electricity consumers pay a constant grid fee per kWh based on the region and the local DSO. For end consumers with more than 100,000 kWh of electricity demand per year, a CPP applies based on the peak power demanded over one year [19,20]. Variable grid fees are not permitted under the current regulatory grid fee system in Germany.

The optimisation of PV-self-consumption is feasible today. The use case is implemented behind the meter, and the slow smart meter rollout does not impede its implementation. Since most PV systems are remunerated with a fixed remuneration fee and the installed power of PV systems is constantly increasing, this use case becomes more and more relevant. In addition, the remuneration fee decreases every year, and the costs of energy from the grid increase. As a result, self-consumption becomes more economically attractive [21]. As for the use case emergency power supply, the electricity supply in Germany is reliable, and few to no very rural areas exist, such that the use case is rated as not relevant. In contrast, peak shaving is a highly relevant use case, as the electricity grid might reach its capacity limit in some areas in the foreseeable future [16]. The use case is already feasible and potentially highly profitable for commercial consumers in Germany who pay a CPP based on the annual peak power demand. Variable tariffs are theoretically possible regarding regulation, even though only a few providers offer such tariffs today. The main obstacle hindering the use case is the very slow rollout of smart meters in Germany. As a consequence, no real basis can be established for such market-oriented flexibility via price incentives. The same reasoning holds true for real-time trading in electricity spot markets. As no competitive market exists so far in Germany, the use case market-oriented flexibility via marketing success is not yet established on a larger scale today.

The use case grid-serving flexibility via variable grid fees is not feasible, as variable grid fees are not possible in Germany as of now and the smart meter rollout is still in its infancy. Grid-serving flexibility by regulation is theoretically possible, as control of assets via smart meters is allowed and possible [15]. However, the small number of installed smart meter gateways limits this use case, as no sufficient framework exists. The lack of digitalisation in Germany concerning the electricity grid is a general hurdle for many use cases, especially those that should stabilize the grids and the energy system. The use case redispatch is theoretically possible today, as a pooling of EVs is generally allowed. However, in reality, the case is not yet implemented, as no market for flexible small-scale assets exists. The ancillary service of FCR is theoretically possible (pooling of EVs is feasible) but not yet implementable on a larger scale due to a lack of digitalisation, i.e., slow smart meter rollout. Hence, there is no market.

3.7. Italy

In Italy, the smart meter rollout is completed and the second generation is being rolled out. The smart meter controls the contracted power, and the second generation offers the possibility of smart charging for EVs. Considering the electricity tariffs, residential customers are increasingly switching from an electricity tariff in the protected market (“maggior tutela”) to an electricity tariff in the free market. Furthermore, the number of customers switching from a tariff with a fixed electricity price to a tariff with a variable electricity price is increasing. In 2022, around 90% of customers who switched from the regulated to the free market opted for a fixed tariff. In 2023, this figure was only 10%, meaning that 90% of customers who left the regulated market switched to a variable contract. This is due to the low number of fixed tariffs on offer and the prices on the regulated market, which exceed those on the free market [22]. This development promotes the utilisation of flexibility from EVs and the implementation of market-oriented use cases. So far, direct control of assets behind the meter is not possible via the current version of the smart meter.

A technological-neutral control of distributed assets in emergencies is possible as distribution grid capacity is reaching its limits [23]. Also, the usage of grid-serving flexibility to increase the hosting capacity of the distribution grid is tested in pilot projects [24,25] or in a trial of the regulator ARERA described in [26], to analyse the technical possibilities and future market designs. Both grid expansion and flexibility of decentralised assets will likely be used in the future. Grid fees are composed of a fixed fee per connection point, a capacity charge, and a volumetric charge. The volumetric charge represents just a small part of the final electricity bill. Private customers pay a quota for the contracted power (around EUR 23/kW/year plus taxes). An extra quota for each additional contracted kW is paid. So far, there is no time variability in the grid fee design. The possibility of additional power for private EV chargers in the low voltage grid during the night and on holidays is tested in the above-mentioned trial of ARERA. The contracted power from 2 to 4.5 kW of connection points is increased free of charge during off-peak hours to 6 kW. This is only for customers providing two-way communication with a third party (e.g., aggregators) [26]. (The previous sections mainly refer to the DSO interview).

Given the circumstances described, the V2H use cases like PV-self-consumption optimisation and emergency power supply are feasible. The latter is given the SAIDI of Italy in most regions, which is not relevant, though. As Italy provides a high capacity charge in the current electricity pricing, the peak shaving use case is feasible. The use case market-oriented flexibility via price incentives is feasible because the smart meter rollout is completed, and variable electricity tariffs with real-time pricing are available. For the same reasons the use case, market-oriented flexibility via marketing success is feasible. Due to the availability of real-time pricing tariffs, the criteria of the standard deviation of day-ahead prices are not applicable.

For grid-serving flexibility via variable grid fees, it still lacks the regulatory framework. However, an implementation would be possible as the smart meter rollout is completed. The regulatory-defined grid-serving control is not feasible, given that control of assets with the current version of the smart meter is not possible. The participation of decentralised assets at ancillary services like redispatch or FCR is not feasible because aggregation and prequalification are so far not allowed.

3.8. The Netherlands

The smart meter rollout is 90% complete. The smart meters communicate via 5G and offer RTP electricity tariffs based on day-ahead electricity prices. The low-voltage grid is digitalised in the sense that the transformers are measured, e.g., the current, and household data are therefore available at an aggregated level. The DSO cannot control assets behind the meter or collect data at the household level. Neither is permitted by law. Everything that happens behind the meter must be carried out by an energy contractor.

Grid capacity is reaching its limits in the Netherlands. In some regions, such as Amsterdam, connecting new customers is currently impossible. As a result, the waiting time for new grid connections at low-voltage levels (EVSEs in particular) is between 25 and 100 weeks, depending on the necessary grid reinforcement. However, grid congestion is more likely to occur at medium and high voltages due to PV and wind feed-in. Grid-serving flexibility is only considered at medium-voltage level and from an installed capacity of over 96 kW. As part of the so-called “capaciteitsbeperkingscontract”, i.e., capacity-limiting contracts, operators of PV parks are compensated for reducing feed-in during peak times [27]. At the low-voltage level, there is a strong preference for grid expansion measures. Grid-serving flexibility on low voltage levels is neither used nor planned to be used in the future. The grid fees are mostly fixed capacity-based tariffs. (The previous sections mainly refer to the DSO interview).

The V2H use cases of PV-self-consumption optimisation and emergency power supply are feasible in the Netherlands. The emergency power supply use case is classified as irrelevant, though. The peak shaving use case is also feasible as the electricity price has a capacitive price component. The two use cases of market-oriented flexibility via price incentives and market-oriented flexibility via marketing success are feasible. Since both the smart meter rollout is more than 80% complete and RTP tariffs exist, the criterion of the average daily standard deviation of the day-ahead prices is not applicable for the marketing success use case. Thus, the same assessment is made for both use cases.

Implementing the grid-serving flexibility use case via variable grid fees is not feasible due to the lack of time variability in the grid fee design. Despite the widespread use of smart meters, the framework for the use case is therefore lacking. As the smart meters are not designed for remote control and the control of behind-the-meter assets by the DSO is not legally possible, the use case grid-serving flexibility by regulation is not feasible. According to the evaluation method, there is not yet a market for the redispatch use case. Although the pooling of EVs is permitted, no redispatching with EVs yet takes place. The implementation of the FCR use case is favoured both by the possibility of pooling and by the advanced smart meter rollout. However, as FCR is not yet provided by EVs, the framework conditions for the use case are still lacking.

3.9. Spain

In Spain, the smart meter rollout is completed. The smart meter is mainly used to communicate hourly electricity prices. In addition, the customer is provided with measurement data such as consumption, active and reactive power, and voltage via the national platform datadis.es, which is used by all DSOs. Communication takes place via PLC. Apart from the smart meters, the digitalisation of the distribution grid consists of advanced measuring of more than half of the substations, more precisely, their low voltage feeder. Control is not possible via the Spanish smart meter. The DSO can neither control assets nor the grid connection point.

In terms of grid capacity, there is currently no need to expand the grid due to the increasing number of EVs. However, this is expected in the future. The current need for grid expansion at a low-voltage level is driven by the expansion of rooftop PV. With an installed capacity of up to 100 kW, the DSO must pay for the reinforcement. Above 100 kW, the customer must pay for the reinforcement themselves. In addition, up to an installed capacity of 15 kW, no approval from the DSO is required. Grid flexibility has not yet been utilised. However, it is being tested in pilot projects. The role of the aggregator is currently being discussed for future applications. The already implemented and regulated electricity tariffs, like the Precio Voluntario al Pequeño Consumidor (PVPC), may already harness the customer‘s flexibility. Every day at 08:15 p.m., the hourly PVPC prices for the following day are published. Other concepts, such as automatic load reduction, only exist for customers with more than 1 MW on the transmission system operator side. The grid fees are time-variable and depend on the hour of the day and the month. The grid fees are regulated and uniform for the entire country. Customers pay for the contracted power and the energy consumed. (The previous sections mainly refer to the DSO interview).

The use case of PV-self-consumption optimisation is feasible and promises to be very attractive in Spain due to the comparatively high number of hours of sunshine. The emergency power supply use case is also feasible as a V2H use case but is categorised as irrelevant, as in most other countries. Whenever any capacity-based charge exists, peak shaving becomes relevant. The grid fees have a fixed, capacitive price component. However, this is currently the same for all consumers below 15 kW and, therefore, has no steering effect. Nevertheless, the use case is feasible. As the smart meter rollout is completed and RTP tariffs with hourly prices are widely available, the assessment of the use cases of market-oriented flexibility via price incentives and market-oriented flexibility via marketing success is the same. Both use cases are feasible.

The use case grid-serving flexibility via variable grid fees is also feasible, as variable grid fees are already applied as static TOU tariffs and as the smart meter rollout is at the necessary level. The two system service use cases redispatch and FCR are not possible. Both use cases fail because the pooling of EVs is currently not permitted in Spain. In addition, control via the smart meter is not possible.

3.10. Sweden

The roll-out of smart meters in Sweden is completed. The smart meters must fulfil seven mandatory requirements: Measurement at 15 min intervals, 3 min outage registration (start/stop), remote mains switch (on/off, only at a power plant or transformer for congestion management), firmware upgrade capability, 15 min interval active and reactive power measurement, local customer information report: customer information in real-time (via third-party provider). The smart meter does not have a gateway. The data are sent to a database four times daily and analysed for forecasts. Communication takes place via long-term evolution (LTE). Due to the advanced digitalisation of the grid, local voltage monitoring and the flow at low-voltage levels are provided at the substation level. There is no information about the power flow in each line at a low voltage level. The smart meter only provides the DSO with information as to whether the customer has electricity or not. The DSO has no authorisation to control assets behind the meter or the customer’s house connection point. Technically, however, it would be possible to control the asset behind the meter via a smart meter [28].

Concerning grid capacity, there is currently no need for grid expansion or congestion management. If necessary, the DSO can limit the consumption of larger grid areas across the board. As is usually the case, private customers’ grid connection is obligatory. Grid-serving flexibility is currently only utilised to a very limited extent in pilot projects and bilateral long-term contracts. Apart from this, there is no market for flexibility. The design of grid fees varies from DSO to DSO in Sweden. Different tariffs based on the fuse size, the power, and/or the consumption are available. Usually, three price components represent the fuse size, the monthly average of the three highest power peaks, and the consumption. With regard to the pricing of power peaks, an hourly average can also be selected, although this is less common. There are also tariffs for net metering. (The previous sections mainly refer to the DSO interview).

Based on the information described, the V2H use case PV-self-consumption optimisation is classified as feasible. Due to the lower number of hours of sunshine, the resulting lower revenue potential, and the generally low installed PV capacity compared to other countries in Central Europe, the use case is classified as less relevant for Sweden. The use case emergency power supply is categorised as relevant due to the existence of very rural areas or islands with a low meshing of the power grid and the additional relevance due to force majeure. However, the technical feasibility of providing power for a whole household (not just vehicle-to-load) depends on the given electrical infrastructure and the EV. The use case of peak shaving is also feasible, as the electricity price already contains a capacitive price component. As electricity tariffs with RTP are available and can also be realised thanks to the completed smart meter rollout, the market-oriented use cases, market-oriented flexibility via price incentives and via marketing success, are both equally possible.

Grid-serving flexibility via variable grid fees is categorised as possible, as according to [29] both the volumetric and capacitive components can be implemented as TOU. Nevertheless, the use case is categorised as less relevant due to the high availability of base load-capable RE resources. As the DSO is not authorised to control customers’ assets, the use case grid-serving flexibility by regulation is classified as not feasible. The redispatch use case is categorised as relevant, as several price zones exist. Although pooling is generally permitted, pooled assets currently do not participate in redispatch. Therefore, no market exists. A regulatory framework is still lacking for the FCR use case. The basic conditions (pooling permitted and completed smart meter rollout) are met. However, EVs still do not provide FCR.

4. Conclusions

The established methodology enables a targeted evaluation and a contextual, country-specific categorisation of electric mobility use cases.

The implementation of V2H use cases is feasible in every country as displayed in Table 2. As no electricity is fed into the grid, no regulatory obstacles exist. The PV self-optimisation use case can already be implemented today without any obstacles. The implementation of the emergency power supply use case depends on the technical capabilities of EVs and EVSEs, which is why the evaluation method presented here focuses on assessing the relevance and usefulness of the use case for a country. For different reasons, the other smart and bidirectional charging use cases have hardly been implemented to date, even if it is generally possible.

Regarding the market-oriented use cases, the implementation via price signals is feasible and the most obvious option for countries with a completed smart meter rollout. Even if the offer of corresponding tariffs is small or if they are not yet widespread, this will likely continue to increase significantly in the coming years.

Concerning the grid-serving and ancillary service use cases, the countries can be divided into three groups: For one group of countries, both the technical and regulatory framework conditions are currently still lacking, such as a necessary proportion of customers with smart meters and EVs or the regulatory framework for V1G and V2G applications. This applies to Austria, the Czech Republic, and Germany. For the second group of countries, the technical framework conditions are fulfilled or are at an advanced stage. However, there is significantly less demand for grid-serving or ancillary service use cases. Regulation or the technical features of smart meters are often not geared towards leveraging the potential. This applies in particular to the Nordic countries and France. They have power plants that are easy to control and sufficient grid capacity. Therefore, these countries are not necessarily reliant on small-scale solutions. Large-scale implementations of these use cases are not expected in the short to medium term. Nevertheless, as displayed in Table 2, the use case grid-serving flexibility by regulation could be implemented in France, for example. Italy, Spain, and the Netherlands form the third group. These countries are well advanced in terms of smart meter rollout. Especially in the Netherlands and Italy, there is a need to increase the grid’s hosting capacity. Although the potential for grid usage reduction could be leveraged, grid-serving flexibility or ancillary services have so far only been implemented to a limited extent or in pilot projects, if at all. Implementation of grid-serving flexibility use cases in the Netherlands is not expected in the short to medium term, as the DSO’s strategy here focuses on grid expansion.

More precisely, with regard to variable grid fees, no cross-national trend can be identified. The implementation is feasible provided a completed smart meter rollout. Implementing grid-serving flexibility by regulation is not legally possible in many countries, and many smart meters are not designed for remote control. Currently, only indirect control via price signals or complete switch-off is possible in most cases. Actively switching assets on and off by the DSO is currently possible in France and the Czech Republic. Direct control of assets by the DSO is possible in Finland. The implementation of ancillary services use cases is being trialled and discussed, but currently faces high barriers to market entry in many countries: The technical and regulatory framework conditions and the limited need for additional provision of ancillary services by small-scale assets in some countries. Added to this are the complex prequalification processes that are not yet adapted for (aggregated) EVs and the lack of definition of the role of the aggregator, as well as the different country-specific restrictions on the pooling of assets, meaning that consumers and generators may not always be combined [5].

Concerning the methodological approach, the reduced complexity of the evaluation method established in this paper means that it can be used even with limited data. This is also the limitation of the methodology. For example, a precise analysis of the technical interfaces of the country-specific smart meters is not carried out as part of this paper. As a result, it is impossible to derive a detailed statement on technical implementation options. In particular, there are still obstacles to the implementation of V1G and, in particular, of V2G applications at a technical level [30,31], which are not analysed in this paper and are therefore not included in the evaluation methodology. The complex certification of EVSE according to the grid codes of various DSOs or countries and the lack of availability of bidirectional EVs and EVSE are current obstacles for V2G applications [31], but these are considered to be solved in the medium to long term. In the overall context, it is of great relevance for manufacturers and service providers in the field of smart and bidirectional charging to consider the framework conditions and requirements as well as the resulting hurdles to the implementation of EV use cases at an international level. As the conditions and needs vary greatly from country to country, there is a risk that national and proprietary individual solutions will prevail. From both a systemic and customer perspective, cross-national applications and solutions are to be favoured. It is of high importance to drive forward the standardisation and harmonisation process at the European level.

Author Contributions

Conceptualization, J.Z., P.V. and A.O.; methodology, J.Z.; validation, J.Z.; investigation, J.Z.; resources, J.Z.; data curation, J.Z.; writing—original draft preparation, J.Z.; writing—review and editing, J.Z., P.V. and A.O.; visualization, J.Z.; project administration, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was conducted as part of the activities of FfE in the project “unIT-e2—Living Lab for Integrated E Mobility”. The project is funded by the Federal Ministry for Economic Affairs and Climate Action (BMWK) (funding code: 01MV21UN11 (FfE e. V.)).

Data Availability Statement

The data are not publicly available due to privacy reasons.

Acknowledgments

We would like to thank all the DSOs who agreed to be interviewed.

Conflicts of Interest

Authors Jakob Zahler, Adrian Ostermann and Patrick Vollmuth were employed by the company FfE. They declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- ISO 15118-20; Road Vehicles—Vehicle to Grid Communication Interface—Part 20: 2nd Generation Network Layer and Application Layer Requirements. International Organization for Standardization—ISO: Geneva, Switzerland, 2022.

- Kern, T.; Dossow, P.; von Roon, S. Integrating Bidirectionally Chargeable Electric Vehicles into the Electricity Markets. Energies 2020, 13, 5812. [Google Scholar] [CrossRef]

- 2012/148/EU; Commission Recommendation of 9 March 2012 on Preparations for the Roll-Out of Smart Metering Systems. Official Journal of the European Union: Brussels, Belgium, 2012.

- Köppl, S.; Hinterstocker, M.; Springmann, E.; Ostermann, A. unIT-e2—Reallabor für verNETZe E-Mobilität; Forschungsstelle für Energiewirtschaft e. V.: Munich, Germany, 2021; Available online: https://www.ffe.de/projekte/unit-e2-reallabor-fuer-vernetze-e-mobilitaet/ (accessed on 19 March 2024).

- EU Agency for the Cooperation of Energy Regulators. Demand Response and Other Distributed Energy Resources: What Barriers Are Holding Them Back?—2023 Market Monitoring Report; ACER: Ljubljana, Slovenia, 2023. [Google Scholar]

- Kern, T. European Day-Ahead Electricity Prices in 2020; Forschungsstelle für Energiewirtschaft e. V.: Munich, Germany, 2021; Available online: https://www.ffe.de/veroeffentlichungen/european-day-ahead-electricity-prices-in-2020/ (accessed on 19 March 2024).

- Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen. Kennzahlen der Versorgungsunterbrechungen Strom; Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen (BNetzA): Bonn, Germany, 2023; Available online: https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/Versorgungssicherheit/Versorgungsunterbrechungen/Auswertung_Strom/start.html (accessed on 26 March 2024).

- Vollmuth, P.; Ganz, K.; Kern, T. Smart e-Mobility: User Potential in Germany Today and in the Future; Forschungsstelle für Energiewirtschaft e. V.: Munich, Germany, 2023. [Google Scholar]

- Energinet. Status of Energinet’s Tariff Design 2023; Energinet: Fredericia, Denmark, 2023. [Google Scholar]

- Sorties de Télé-Information Client des Appareils de Comptage Linky Utilisés en Généralisation par Enedis (Enedis-NOI-CPT_54E); Enedis: Paris, France, 2018.

- ERDF. Le Compteur Linky et la Communication par CPL; ERDF: Paris, France, 2016. [Google Scholar]

- Bundesnetzagentur. Monitoringbericht 2023; Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen: Bonn, Germany, 2023. [Google Scholar]

- Sylla, S. The Smart Meter Rollout in Germany and Europe; Forschungsstelle für Energiewirtschaft e. V.: Munich, Germany, 2023; Available online: https://www.ffe.de/en/publications/the-smart-meter-rollout-in-germany-and-europe/ (accessed on 19 March 2024).

- Gesetz über die Elektrizitäts- und Gasversorgung (Energiewirtschaftsgesetz—EnWG) § 41 Energielieferverträge mit Letztverbrauchern (§ 41 EnWG); Issued on 2006-12-17, Version of 2022-5-28; Bundesministerium der Justiz und für Verbraucherschutz: Berlin, Germany, 2022.

- Wulff, F. Moderne Messeinrichtungen und Intelligente Messsysteme; Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen: Bonn, Germany, 2018; Available online: http://www.webcitation.org/6xmhO7MAV (accessed on 19 March 2024).

- Agora Energiewende und Forschungsstelle für Energiewirtschaft e. V. Haushaltsnahe Flexibilitäten Nutzen. Wie Elektrofahrzeuge, Wärmepumpen und Co. die Stromkosten für alle Senken Können; Agora Energiewende and Forschungsstelle für Energiewirtschaft e. V.: Berlin, Germany, 2023. [Google Scholar]

- Bundesnetzagentur (BNetzA). Zubau Erneuerbarer Energien 2023. Bundesnetzagentur für Elektrizität, Gas, Telekommunikation, Post und Eisenbahnen: Bonn, Germany. 2024. Available online: https://www.bundesnetzagentur.de/SharedDocs/Pressemitteilungen/DE/2024/20240105_EEGZubau.html (accessed on 13 March 2024).

- Wirth, H. Recent Facts about Photovoltaic in Germany; Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE): Freiburg, Germany, 2024. [Google Scholar]

- Netze, B.W. Stromzähler Registrierende Lastgangmessung—Für Stromverbräuche ab 100.000 kWh; Netze BW: Stuttgart, Germany, 2024; Available online: https://www.netze-bw.de/zaehler/stromzaehler/registrierende-lastgangmessung (accessed on 13 March 2024).

- Netztransparenz.de: Grid Fees. Berlin, Dortmund, Bayreuth, Stuttgart: 50Hertz Transmission GmbH, Amprion GmbH, TransnetBW GmbH, TenneT TSO GmbH. 2024. Available online: https://www.netztransparenz.de/en/About-us/Grid-fees (accessed on 13 March 2024).

- Kern, T.; Dossow, P.; Morlock, E. Revenue opportunities by integrating combined vehicle-to-home and vehicle-to-grid applications in smart homes. Appl. Energy 2021, 307, 118187. [Google Scholar] [CrossRef]

- Memoria dell’Autorità di Regolazione per Energia Reti e Ambiente in Merito allo Stato dei Mercati Elettrico e del gas Naturale e All’andamento dei Prezzi, Sia in Regime di Maggior Tutela sia di Libero Mercato (544/2023/I/com); ARERA: Rome, Italy, 2023.

- e-Distribuzione: Verifica L’idoneità alla Connessione Nella tua Zona; e-Distribuzione: Rome, Italy. 2024. Available online: https://www.e-distribuzione.it/a-chi-ci-rivolgiamo/produttori/aree-critiche.html?idMappa=6965287c83ac49cfb77781c8f54a14b3 (accessed on 19 March 2024).

- Field, K. New V2G Pilot in Genoa Aims to Define Operating Standard for V2G in Italy; Cleantechnica.com: El Cerrito, CA, USA, 2017; Available online: https://cleantechnica.com/2017/05/18/v2g-pilot-in-italy-hopes-to-define-operating-standard/ (accessed on 19 March 2024).

- Terna. The Vehicle-to-Grid Pilot Project Has Been Inaugurated at Mirafiori—Innovative Services for the Electricity Grid, Supporting the Energy Transition; FCA, Engie Eps and Terna Working Together to Develop the World’s Largest Sustainable Mobility Hub; Terna: Rome, Italy, 2024; Available online: https://www.terna.it/en/media/press-releases/detail/The-Vehicle-to-Grid-pilot-project-has-been-inaugurated-at-Mirafiori (accessed on 19 March 2024).

- 541/2020/R/EEL; Ricarica dei Veicoli Elettrici in Luoghi non Accessibili al Pubblico: Avvio di una Sperimentazione Finalizzata a Facilitare la Ricarica Nelle Fasce Orarie Notturne e Festive. ARERA: Rome, Italy, 2020.

- Bellini, E. Netherlands Combats Grid Overcapacity with Flexible Contracts for PV Owners; PV-Magazine: Berlin, Germany, 2023; Available online: https://www.pv-magazine.com/2023/11/21/netherlands-combats-grid-overcapacity-with-flexible-contracts-for-pv-owners/ (accessed on 20 March 2024).

- Shortall, U.; Esser, C. Annual Report on the Results of Monitoring the Internal Electricity and Natural Gas Markets in 2021; ACER: Ljubljana, Slovenia; CEER: Brussels, Belgium, 2022. [Google Scholar]

- ACER. Report on Electricity Transmission and Distribution Tariff Methodologies in Europe; ACER: Ljubljana, Slovenia, 2023. [Google Scholar]

- Vollmuth, P.; Hawran, J.; Ostermann, A.; Krug, F.; Boldt, M.; Abromeit, A.; Behringer, C. Interoperabilität im Energiesystem der Zukunft—Erkenntnisse aus dem unIT-e2 Plugfest; Forschungsstelle für Energiewirtschaft e. V.: Munich, Germany, 2024; Available online: https://unit-e2.de/media/unIT-e%C2%B2-Plugfest-Whitepaper-Ergebnisse-Handlungsempfehlungen.pdf (accessed on 19 July 2024).

- Hecht, C.; Figgener, J.; Sauer, D.U. Vehicle-to-Grid Market Readiness in Europe with a Special Focus on Germany. Vehicles 2023, 5, 1452–1466. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).