Abstract

The energy crisis in Europe in 2022 and its consequences have brought changes to approaches towards the issue of energy security, energy policy, and the ability to react to crisis phenomena in the energy market in a short period of time. European countries that are dependent on Russian fossil fuels have faced numerous dilemmas and challenges in 2022. This paper aims to analyse the instruments and energy policies introduced as the reactions of European countries, specifically with the examples of Poland and Germany, to the ongoing fossil fuel crisis in the context of a short period. Due to the specificity of the energy market, the countries’ energy policies mainly concern long- and medium-term goals. In 2022, there was an unprecedented situation in which many European countries had to make significant changes to their fossil fuel imports quickly. We analyse and evaluate how two European countries that are heavily reliant on imported energy resources responded in a short time to the necessity of modifying their patterns of fossil fuel supply and demand. The results of our research are models that illustrate both countries’ reactions to the disturbances in the energy market during the initial months of the energy crisis. As part of the research, we conducted an analysis of the energy mix of Poland and Germany, their import energy dependency, and self-sufficiency. We then compared them with the short-term energy policies of both countries. As a result, we elaborate on a comparative analysis of the models of Poland’s and Germany’s responses to the crisis. The research also assesses the similarities and differences in the response models in Poland’s and Germany’s short-term energy security policies. The results of our research may help, in the future, to choose the available short-term instruments in the energy policy of countries in the face of a sudden need resulting from disruptions in supply chains. The article contributes to the future discussion on renewed national and regional energy security, as well as efficiency concepts. Our research findings could be valuable in selecting appropriate short-term energy policy tools for countries during supply chain disruptions. This article provides significant input for future deliberations on enhancing national and regional energy security, and also efficiency strategies.

1. Introduction

As the Russian Federation is one of the world’s most important exporters of crude oil and natural gas, the Russian invasion of Ukraine and the subsequent sanctions against Russia and Russia’s own retaliatory sanctions have left their mark on the international energy market. The energy security policy in the countries importing oil and natural gas from Russia has become a particularly important problem. The European Union faced the challenge of shaping its further relations with the Russian Federation in the area of energy resources [1]. Due to their geographic location, many EU countries depend on Russian gas and oil, as well as transmission infrastructure.

In response to the Russian invasion of Ukraine, the European Commission (EC) published, on 8 March 2022, a communication on the REPowerEU strategy to reduce dependence on Russian fossil fuels (oil and coal) before 2030 [2]. On 15 May 2022, the President of the European Commission announced that the Commission would allocate 300 billion euros to reduce EU dependence on Russian fossil fuels and increase the energy efficiency goal in 2030 from 9% to 13% [3]. In June 2022, the European Parliament and the Council adopted gas storage regulation to improve the EU’s security of supply [4]. The regulation aimed to ensure European gas storage capacities can be shared between member states in the name of solidarity. The national situation on gas storage depends on individual conditions of particular EU countries; nevertheless, the gas storage in territories should be filled to at least 80% capacity before the winter of 2022, and 90% before the following winter periods. Moreover, on 26 July 2022, the Council of the European Union (EU) energy ministers agreed to reduce natural gas demand by 15% between 1 August 2022 and 31 March 2023 (voluntary demand reduction) [5]. A new EU external energy strategy, delivered on 18 May 2022, provided a direction on a green energy transition, stronger energy security, the diversification of energy supplies, as well as common support and solidarity with Ukraine and the other countries affected by the crisis. What seems to be the most essential is the replacement of Russian gas with the gas from non-Russian sources (e.g., Canada, Egypt, Israel, Azerbaijan, Algeria, and Sub-Saharan Africa), and also with renewable hydrogen (from the North Sea region, the Southern Mediterranean, and Ukraine) [6].

The significant role of crude oil and natural gas in the energy mix of EU Member States is essential in the context of the energy security of the entire grouping. Additionally, these are energy resources that, for the most part, have to be imported by European countries. At the same time, it should be emphasised that a radical change in the energy mix of the EU countries is not possible in the short term [1].

As a result of the war in Ukraine and the severe sanctions that have been imposed on Russia, the majority of European countries have been forced to rethink their reliance on Russian energy resources supplies, to diversify their suppliers, and to introduce changes to their energy policy. The ongoing global energy crisis has prompted EU countries to intensify their efforts to become independent of Russian energy supplies. However, the solutions introduced in the energy policy of individual countries are very diverse. Different responses result from the other structures of the energy mix and the sources of supply of individual EU member states. The dependence on energy imports is a powerful geoeconomic vulnerability of the EU [7,8], and it has weakened its position regarding supplier countries such as Russia.

This research uses the examples of Poland and Germany to assess the impact of the energy crisis on the European Union’s countries’ energy security strategy in the short term. The main purpose of the research is to analyse and evaluate how two European countries that are heavily reliant on imported energy resources responded in a short time to the necessity of modifying their patterns of fossil fuel supplies and demand. The results of the research are models that illustrate both countries’ reactions to the disturbances in the energy market during the initial months of the energy crisis.

It is not our goal to evaluate long- and medium-term energy policy. First of all, we want to show how countries can modify their energy policy in a short period of time and what the effects of this are. To this end, we formulated the following research questions:

What instruments in energy policy can be used by countries in the face of a sudden disruption of the fossil fuels supply chain?

How did the differences in the energy mix of the surveyed countries affect the instruments used by them to influence the market?

How did both countries cope with the negative consequences of the destabilisation of energy markets?

What are the EU states’ response models under high risk and uncertainty conditions?

The results of our research may, in the future, help to choose the available short-term instruments in the energy policy of countries in the face of a sudden need resulting from disruptions in supply chains. This article contributes to the future discussion on renewed national and regional energy security, as well as efficiency concepts.

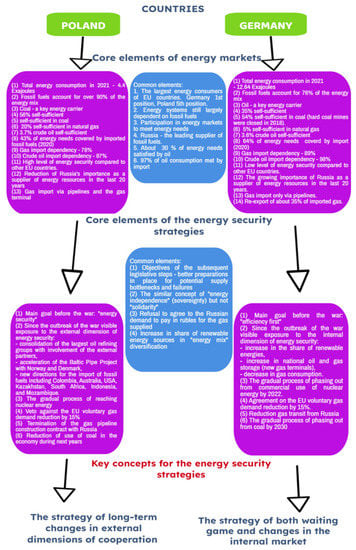

The research process requires applying a set of indicators that compare the energy mix, self-sufficiency, import energy dependency, and the directions of the fossil fuel supplies of both countries. Then, based on the analysis of legal acts, the direction of changes in the field of the energy security policy of Poland and Germany can be evaluated. As a result of the conducted research, a model of the response to the crisis and destabilisation of energy markets for Poland and Germany was developed (Scheme 1).

Scheme 1.

Stages of the research process.

The dynamics of changes related to the issue examined are very significant due to their importance. For this reason, it should be emphasised that our research on the model of the response covers the period from 24 February 2022 until July 2022.

2. European Union Energy Security Challenges: Theoretical Framework

The concept of energy security can be defined in various ways: from narrow issues of physical supply disruption to broader ones involving the economic, environmental, and political consequences of changes to energy markets [9]. The United Nations defines energy security simply as “the continuous availability of energy in varied forms, in sufficient quantities and at affordable prices” [10]. A similar definition is used by the International Energy Agency (IEA) [11], which defines it “as the uninterrupted availability of energy sources at an affordable price”. However, in its broad sense, energy security is an interdisciplinary concept and is associated with such aspects as climate change, globalization, as well as the uncertain future of fossil fuels, sustainability, energy efficiency, mitigation of greenhouse gas emissions, accessibility of energy services, and energy poverty [12].

In the context of state security, energy security is one of the key elements of economic security [13,14,15] and national security [16,17]. It is also a key parameter defining the current position and orientation of the development of a country [17].

Exporters and importers of energy resources differ when it comes to the perception of energy security [18]. Institutions, states, international organizations, entrepreneurs, or individuals/households also perceive it differently.

Energy security policy impacts both internal and external economic policy [19,20]. Depending on the international situation, various aspects related to energy security come to the fore [21]. In the literature on the subject, the intensification of research on energy security took place in the 1970s, during the oil crises [12,18]. The international situation resulting from the current global energy crisis is causing another wave of intensive research on energy security. Russia is one of the most important exporters of energy resources and energy in the world. Many European countries depend on Russian gas, oil, and coal supplies. Russian fossil fuels were attractive to European countries because they were relatively cheaper and easily available. Moreover, in the case of Poland, the fossil fuel transmission infrastructure was established in the socialist era. Energy links between Poland and Russia were inherited from the period when the Eastern Bloc was still functioning. On the other hand, in the case of Germany, energy cooperation between Germany and Russia has been tightening over the last twenty years. The large resources of Russian fossil fuels, low prices, and a mutual will to cooperate in the field of energy led to the construction of Nord Stream 1 and Nord Stream 2. In response to the energy crisis, most European countries have been striving to become independent from Russian fossil fuel supplies and to change their import portfolio at the earliest opportunity [22].

The issue of energy management by states is the subject of numerous studies and publications. Bauer et al. [23] addressed the topic of energy policy and the energy security of states mainly in the context of supporting basic human needs, development, and well-being. Bogachov et al. [24] compared the economic policy of Eastern European countries in the field of energy in the context of European integration.

For several years, an increasingly important issue related to energy security has been the need to increase the share of renewable energy sources in the energy mix of countries and the need of decarbonization. Green energy not only prevents the further devastation of the natural environment, but it also reduces countries’ energy dependency imports and contributes to their more stable economic development [25,26].

The literature on energy security often focuses on delineating its dimensions [27,28] and indicators [29]. When planning a long-term strategy, taking into account the numerous dimensions of energy security makes it possible to assess the various internal and external risks, as well as the likelihood of their occurrence.

In our article, we analyse a situation in which a sudden event forced a rapid change in the strategy of two countries. Therefore, we are not dealing with a comprehensive development of a long-term strategy, but with a reaction to a sudden event, which—to its greatest extent—concerns geopolitical issues and securing supplies of fossil fuels.

For the above reasons in our research, from among the energy security key areas—energy availability, infrastructure, markets and prices, environment, social aspects, geopolitical aspects, and information [20] (Table 1)—we considered energy availability and geopolitical factors to be the most important in the short period of time during the ongoing energy crisis for Poland and Germany. Poland and Germany as EU members are covered by the European Energy Security Strategy, according to which the grouping’s prosperity and security are supposed to hinge on stable and abundant energy supplies [30].

Table 1.

Energy security key areas.

Several economic, political, and historical reasons were considered when selecting Poland and Germany for the analysis. Firstly, they are countries that have largely used energy resources from Russia. This also they belong to the group of countries that wish to eliminate economic contact with Russia, and consequently they will experience negative economic consequences. Secondly, both countries partly use the same transmission infrastructure. In the case of the Druzhba pipeline, it runs through Poland to Germany, and both countries buy gas from Russia. Meanwhile, in the case of the Nord Stream, the gas pipeline runs through the Baltic Sea to Germany, and Poland buys Russian gas from Germany. This does not change the fact that, due to their geographic location, both countries are interconnected in the area of infrastructure for the transmission of energy resources from Russia. As a result, the decision of one of the surveyed countries to eliminate imports from Russia is going to have consequences for the other country.

The reasons why we have chosen the two countries for the research are also political and historical. Germany, as one of the founding countries of the European Community, is currently the largest economy in the European Union and has a strong influence on its policies. Germany, despite the adoption of sanction packages, has had difficulties in eliminating Russian fossil fuels from its market. Poland was a socialist country until 1989 and was strongly dependent on the USSR. Since its systemic transformation, it has become the largest economy in Central and Eastern Europe, and it strongly supports Ukraine to the greatest possible extent. Poland endorses the imposition of sanctions on the Russian energy sector.

3. The Energy (In)security of Poland and Germany

3.1. Primary Energy Consumption and Energy Mix

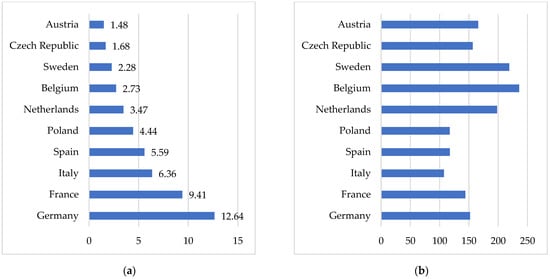

Poland and Germany are among Europe’s largest energy consumers. In 2021, Germany was the largest energy consumer in the EU, with its total primary energy consumption standing at 12.64 exajoules (EJ), followed by France (9.41 EJ), Italy (6.36 EJ), Spain (5.59 EJ), and Poland (4.44 EJ) (Figure 1). The per capita primary energy consumption in both countries is similar to the per capita consumption of the European Union, which is 135 gigajoules. In Poland, the per capita primary energy consumption is 117 gigajoules, while in Germany it is slightly higher at 152 gigajoules [31]. Given that the energy systems of both examined countries largely depend on fossil fuels, which account for 92% of the energy mix in Poland and 76% in the case of Germany (Figure 2 and Figure 3), energy security remains an issue of special importance for them.

Figure 1.

(a) The primary energy consumption of the largest energy consumers in the EU in 2021 (in exajoules); (b) the primary energy consumption of selected EU countries in 2021 (in gigajoules per capita). Source: own elaboration based on the BP Statistical Review of World Energy 1965–2021 [31].

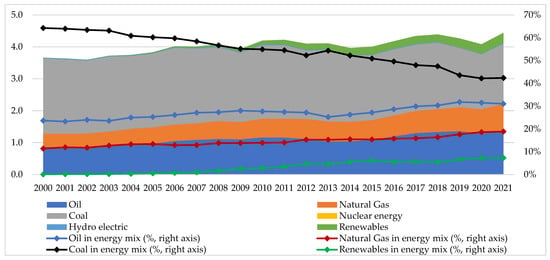

Figure 2.

The primary energy consumption structure in Poland during 2000–2021 (in exajoules). Source: own elaboration based on the BP Statistical Review of World Energy 1965–2021 [31].

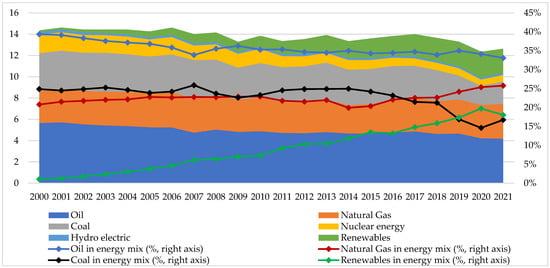

Figure 3.

Primary energy consumption structure in Germany during 2000–2021 (in exajoules). Source: own elaboration based on the BP Statistical Review of World Energy 1965–2021 [31].

For many years, fossil fuels—such as coal, oil, and natural gas—have satisfied most of Poland’s energy needs. However, this split hides the shift away from coal to oil and natural gas over the last few decades. Although coal is still a key energy carrier for Poland, its importance is declining in favour of the remaining energy sources (Figure 2). In 2021, coal with its share of 42% remains the country’s dominant fossil energy source (down from 76% in 1991), followed by oil with a share of 31% (up from 15%), and natural gas with a share of 19% (up from 8%). In turn, renewable energy sources (RES) and hydroelectric energy covered, respectively, 7% and 0.5% of Poland’s primary energy use in 2021 [31].

By contrast, the importance of coal in Germany’s energy mix is much lower than in Poland due to energy transition efforts and the availability of nuclear energy. In 2021, coal covered 17% of Germany’s primary energy consumption (Figure 3). Although coal still remains a significant energy source, renewables are of greater importance in Germany (18% of the energy mix in 2021). The role of coal decreased between 2000 and 2021, mainly due to the growing importance of renewable energy sources (RES) and natural gas.

Moreover, the analysis of the energy mixes of Poland and Germany revealed that oil remains a significant energy source in both countries, satisfying approximately 31% and 33% of their energy needs in 2021, respectively. In the case of Germany, oil remains the country’s dominant energy carrier (Figure 2 and Figure 3).

As for the role of natural gas, its consumption in Poland is rising both in absolute terms and as a share of the total country’s energy consumption, whereas in Germany its share in the energy mix has been slightly falling of late (Figure 2 and Figure 3).

Over the analysed period, the share of renewables has significantly increased from 1% to 18%, whereas the role of coal and oil decreased from 25% to 17% and from 39% to 33%, respectively (Figure 3). As a result, the share of oil in 2021 accounted for 33% of the primary energy consumption in Germany, followed by natural gas (26%), renewable energy (18%), solid fossil fuels (17%), nuclear energy (5%), and hydroelectric energy (1%) [31].

3.2. Energy Self-Sufficiency and Energy Import Dependency

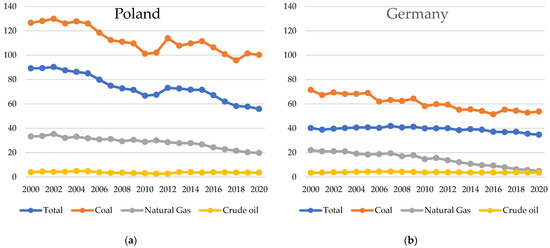

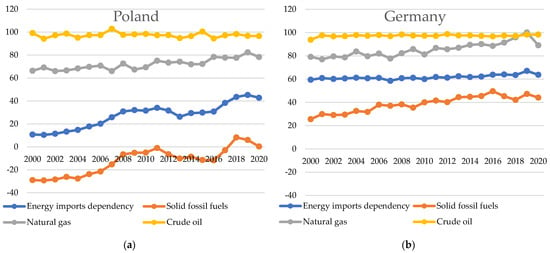

All member states of the EU import energy resources to meet their energy needs, and all are net importers of energy [32]. As a result of the growing demand for fossil fuels, neither Poland nor Germany is self-sufficient enough to cover all their resource requirements (Figure 4).

Figure 4.

(a) Poland: energy self-sufficiency (%); (b) Germany: energy self-sufficiency (%). Source: own elaboration based on data from the International Energy Agency [33].

In Poland, coal is by far the nation’s most abundant energy source, which translates into the country’s self-sufficiency in this respect. As of 2020, Poland had proven coal reserves of 28 billion tonnes, constituting 2.6% of the global reserves of this fossil fuel [31]. Considering remaining fossil fuels, domestic natural gas production was sufficient enough to cover nearly 20% of the country’s yearly consumption in 2020, while almost all consumed crude oil came from abroad (Figure 4 and Figure 5). Therefore, the growing demand for these fossil fuels is the main challenge for Poland’s energy security.

Figure 5.

(a) Poland: energy import dependency during 2000–2020 (%); (b) Germany: energy import dependency during 2000–2020 (%). Source: own elaboration based on data from Eurostat [32].

In Germany, the issue of energy self-sufficiency is more challenging as domestic natural gas and oil production capacity covered only 5% and 3.6% of their consumption in 2020, respectively (Figure 4).

Given limited domestic oil and natural gas resources, Poland and Germany are highly dependent on imports in this respect (Figure 5). In the case of Poland, the growing requirements for foreign oil and natural gas supplies over the past few decades has translated to the overall energy security score of the country. In 2021, around 43% of its energy consumption was covered by imports, whereas the energy import dependency ratio in 2000 amounted to 11%. Although Poland’s reliance on imported energy resources is increasing, the country still remains one of the least dependent countries on fossil fuel imports in the EU. As of 2020, only Estonia (10.5%), Romania (28.2%), Sweden (33.5%), Bulgaria (38%), Czechia (39%), and Finland (42%) have lower energy dependency rates [30]. Poland’s relatively low energy dependence level results from its abundance of hard coal and lignite resources. Moreover, coal has a large share in the Polish energy mix. A negative solid fossil fuel energy import dependency ratio over the period of 2000–2017 means that Poland was, at that time, a net exporter of solid fossil fuel resources (Figure 5).

Germany is more dependent on fossil fuel imports to meet its energy requirements than Poland. Its import dependency degree stands at almost 64%, which is above the EU average of 57% [32]. Germany imports more than 44% of the solid fossil fuels it uses, which is more than 98% of its crude oil and almost 90% of its natural gas (Figure 5).

In 2020, Poland and Germany were almost totally dependent on imported crude oil (Figure 5). Both countries are also increasingly reliant on imported gas. However, dependence on foreign natural gas supplies is slightly lower than in the case of crude oil (78% in Poland and 80% in Germany, respectively). In turn, in the case of coal, dependence is much lower in the case of Germany (44%). However, Germany’s reliance on foreign supplies of hard coal will grow in years to come as the country has decided to close all its hard coal mines. On the other hand, Poland is self-sufficient in this respect. In addition, until 2017, Poland was a net exporter of solid fossil fuels.

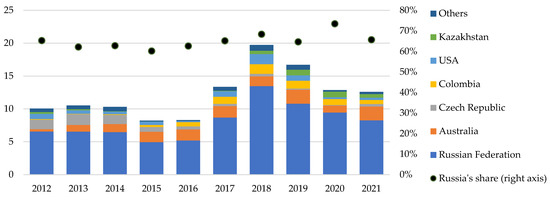

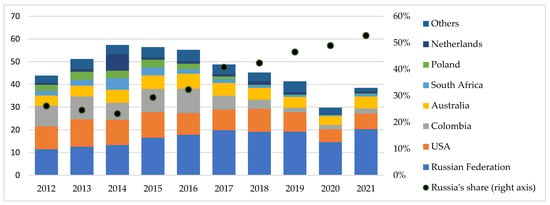

3.3. Reliance of Poland and Germany on Fossil Fuels Imports from Russia

Poland and Germany participate in international energy markets to meet their energy needs. Both countries are entangled in a web of interdependent energy relationships. For many years, the Russian Federation has been the leading supplier of fossil fuels for both countries (Figure 6, Figure 7, Figure 8, Figure 9, Figure 10 and Figure 11). Russia plays a leading role as an energy supplier not only to Poland and Germany, but also to many other members of the EU. According to the official data collected by Eurostat, 49% of hard coal, 26% of crude oil, and 38% of natural gas supplied to the EU in 2020 came from Russia [32].

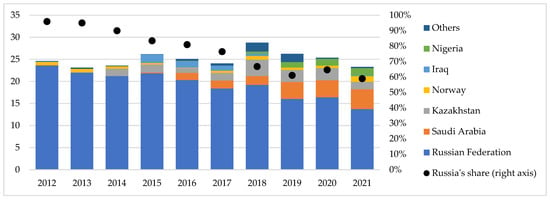

Figure 6.

Trends in Poland’s imports of coal during 2012–2021 (in million tons). Source: own elaboration based on data from the International Trade Centre [34].

Figure 7.

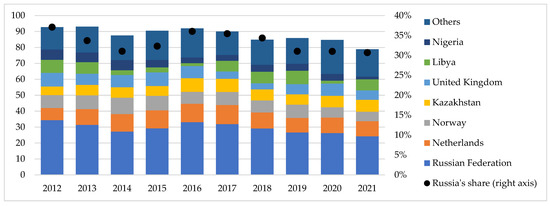

Trends in Germany’s imports of coal during 2012–2021 (in million tons). Source: own elaboration based on data from the International Trade Centre [34].

Figure 8.

Trends in Poland’s imports of crude oil during 2012–2021 (in million tons). Source: own elaboration based on data from the International Trade Centre [34].

Figure 9.

Trends in German crude oil imports during 2012–2021 (in million tons). Source: own elaboration based on data from the International Trade Centre [34].

Over the period 2012–2021, Russia provided 66% of Poland’s total hard coal imports (Figure 6). The high reliance on Russian coal is the result of economic reasons, and—due to geological conditions—the coal extraction in Polish domestic mines is more expensive than importing. In 2021, supplies from Russia accounted for almost 66% of the total coal imports, followed by imports from Australia (17%), Colombia (5%), Kazakhstan (4%), Czechia (3%), the USA (3%), and other directions (3%) (Figure 5).

Unlike Poland, Germany imports coal from numerous countries. As in previous years, Russia was the largest supplier in 2021, representing 53% of all imported coal. Russia’s share of German imports of coal between 2012 and 2021 increased from 26% to 53% (Figure 7).

Over the recent decade (2012–2021), Russia has provided 77% of Poland’s total crude oil imports (Figure 8). For many years, Poland has been making efforts to lessen the risk of overreliance on a single source of crude oil supply by reducing imports from Russia and by diversifying its supplier portfolio. As a result, Russia’s importance as a supplier of crude oil has gradually decreased. In 2021, Russian supplies covered 59% of Polish crude oil imports, while in 2012, this share was 96% (Figure 8).

In the case of the German crude oil trade, the structure of supply sources is quite well diversified, although Russia has been the main supplier for many years (Figure 9). In 2021, the crude oil imported to Germany originated from 26 suppliers. Imports from Russia amounted to 31% of the country’s total crude oil imports, and the remainder came from the Netherlands (12%), USA (10%), Kazakhstan (10%), Libya (9%), the United Kingdom (8%), Norway (7%), and other directions (14%) [34].

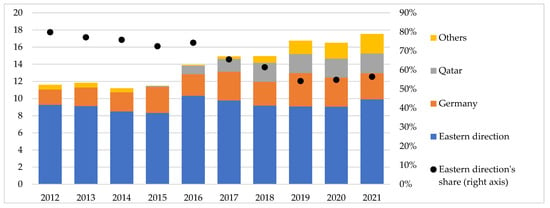

Russia has been the main natural gas supplier to Poland for many years. However, Poland has been diversifying its sources of origin and gas delivery methods to reduce its energy vulnerability and to prevent overdependence on a particular gas supplier [35]. Poland imports gas via pipelines and through a liquefied natural gas (LNG) terminal in Świnoujście. By eliminating existing technical constraints, the LNG terminal extends Poland’s ability to import liquefied natural gas from various places of origin and reduces its dependence on pipeline gas suppliers. The commissioning of the LNG terminal resulted in a significant increase in gas imports from Qatar, which has become one of Poland’s main natural gas suppliers. As a result, Russia’s importance as a natural gas supplier decreased from 80% in 2012 to 56% in 2020 [33]. In 2021, the highest amount of gas was imported from the eastern direction (56%) (Figure 10), i.e., mainly Russia, followed by Germany (21%), Qatar (13%), and the USA (6%) (Figure 10).

Figure 10.

Trends in Poland’s imports of natural gas during 2012–2021 (in billion cubic meters). Source: own elaboration based on data from the Ministry of Climate and Environment and ARE [36,37].

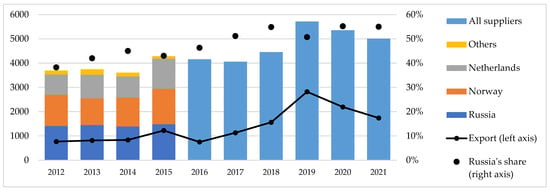

By contrast, Germany relied only on gas supplies by cross-border pipelines until November 2022, which translated into a higher degree of geoeconomic vulnerability compared to Poland. Germany is relatively highly reliant on Russian gas (55% of total imports in 2021). Over the period of 2012–2021, the import share of Russian natural gas increased gradually from about 38% to 55%. In 2020, Russia was the leading supplier of natural gas to Germany, providing 56.3 billion cubic meters of pipelined natural gas. In the same year, Germany imported 31.2 bcm of natural gas from Norway (31% of German’s total imports are by pipeline), and 13 bcm of this fossil fuel was from the Netherlands (13%) [31].

Germany is one of the world’s major natural gas consumers [23] and an important transit country for Russian natural gas in Europe [38]. Germany exports a large part of its imported gas (Figure 11). In 2021, Germany re-exported about 35% of the imported gas [38].

Figure 11.

Trends in the German imports and exports of natural gas during 2012–2021 (in petajoules). Source: own elaboration based on data from BP Statistical Review of World Energy 1965–2021, Federal Office for Economic Affairs and Export Control and World Economic Forum [31,38,39].

The presented data reveals that a significant portion of Poland’s and Germany’s imports of required fossil fuels come from Russia. Dependence on energy resource imports from a single supplier is the main geoeconomic vulnerability of both countries. Moreover, such reliance on Russian fossil fuel imports means that both countries have been affected by international bans on imports from Russia and the curtailment of Russian pipeline gas supplies to Europe. This requires taking extensive action to reduce dependence on Russian fossil fuels and to diversify their energy resource suppliers. However, given that Russia is a leading supplier of energy resources to the European Union as a whole [32], introducing any changes to the network of fossil fuel suppliers of both examined countries seems even more complicated. The ongoing energy crisis has mobilised both countries to intensify their efforts to reduce their energy import dependence on Russia’s fossil fuels. However, reliance on Russia remains challenging to Polish and German energy policy.

As a result of the ongoing energy crisis and problems with supplies of fossil fuels from Russia, an increasing role of renewable energy in the energy mix of both Poland and Germany can be expected. In turn, substituting coal with gas will be more difficult for the foreseeable future because finding new suppliers and building transmission infrastructure requires time. In response to the global energy crisis, the phasing out of Russian fossil fuels from the energy mix of EU countries has gained greater importance and has significantly accelerated. Consequently, the priority of the energy policies of Poland and Germany is to ensure energy security through renewable energy development. However, transitioning from coal to renewable energy is a long-term process, and it can be extremely difficult in times of energy crisis. Moreover, in the short term, reducing energy dependence on Russia may result in the increasing role of coal in meeting the energy needs of both countries. Moving away from coal and other fossil fuels will be possible only if renewables become the dominant energy source. However, it should be noted that Poland and Germany have not withdrawn from their plans to phase out coal, but the current energy crisis has slowed this process down.

4. Energy Security Policies Analysis

The national energy security strategies and policies of the EU member states are being affected by the European Union’s energy policy and current decisions. Nevertheless, in times of crisis, each country, when making decisions and launching various actions, must, first of all, take into account its energy security. Since 2010, the European Union has adopted five complex strategic documents on the governance of the EU energy union. Apart from the green factor and EU commitments to long-term energy and climate goals [40], the key area of interest in all the above documents was the problem of EU energy security and safety, especially in the context of the progressive energy dependence on external energy supplies [41]. By 2014, the EU concentrated on issues of energy efficiency at all stages of the energy chain, starting with production, transmission, distribution, storage, and consumption, as well as the improvement of energy infrastructure and transport (smart technologies, smart grids, and low-cost technologies) [42]. EU leaders have also underlined a necessity for the diversification of energy production capabilities, such as diversified new technologies, diversified sources of energy, and decarbonisation (substitution of coal with gas, nuclear energy, and renewable energy sources). The external dimension of the EU’s energy security policy has provided the member countries with an integration of energy markets and systems, as well as the creation of a pan-European integrated energy market, including external supplies, distribution, new transport corridors, and new import directions (such as to Norway, Russia, Ukraine, Turkey, North Africa, the Middle East, etc.) [43]. In 2014, new geopolitical factors (namely the Russian annexation of Crimea) affected the subsequent EU energy strategy documents. In addition to the previous priorities, the European Union emphasised the improvement of energy security in the long term by adopting a better, deeper cooperation at the European level and through a coordination of national energy policies to achieve a fully integrated internal market. It specified a need for increasing energy production in the EU and reducing dependency on particular fuels and external energy suppliers and routes (especially Russia) [44].

According to the EU Regulation of the European Parliament and of the Council of 11 December 2018 on the Governance of the Energy Union and Climate Action, by 31 December 2019 (and subsequently by 1 January 2029 and every ten years thereafter), each member state should notify the Commission of an integrated national energy and climate plan (NECP) [45]. Furthermore, by 1 January 2020 (and subsequently by 1 January 2029 and every 10 years thereafter), each member state should prepare and submit to the Commission its long-term strategy (NLTS) with a perspective of at least 30 years [45]. Poland has adopted a national energy and climate plan, but it has not published a long-term strategy, whereas Germany has prepared both documents.

Poland’s National Energy and Climate Plan for the years 2021–2030 [46] was submitted to the European Commission in December 2019. The document presents the objectives, policies, and actions for the implementation of the five dimensions of the Energy Union: security, solidarity, and trust; a fully integrated internal energy market; energy efficiency; climate action, decarbonising the economy and research; and innovation and competitiveness [47]. The priority objective is the energy security of Poland, which is understood in mainly two areas: electricity production and gas and oil supplies. Therefore, it is necessary to increase electricity generation capacity and energy consumption that are based on renewable energy sources (to 21–23% in 2030). The share of coal in electricity generation will be systematically reduced to 56–60% in 2030. The first nuclear power plant’s first nuclear power unit (with a capacity of about 1–1.5 GW) is planned to start in 2033. In the next few years, it is planned to launch another five such units every 2–3 years (with a total capacity of approx. 6–9 GW) [46].

The European Commission, in its individual assessment of Poland’s NECP, stated that the proposed plan and its goals (especially in the area of contribution for renewable energy) were not ambitious enough and were below the EC’s expectations. The document did not outline the plan for reducing the country’s dependence on coal [48]. It should be admitted that the recent destabilisation of energy markets has proved the need for a rapid diversification of the structure of Poland’s energy mix.

Energy security is defined, by the Polish government, as the continuity of electricity supply, ensuring the customers’ current and future demand for fuels and energy, accessibility and possibility of purchasing energy at reasonable prices, as well as the resistance of the energy system to exceptional and unpredictable challenges. [49]. The key factors of Poland’s energy security include diversification of production capacities, prices, a required level of investment in production and transmission lines, transport, the concentration of suppliers, accessibility of infrastructure and expert knowledge, a network of the interconnection of energy systems, interchangeability of fuels (diversification), and political threats [50].

Poland’s current energy security policy is based on a strategic document: the Energy Policy of Poland until 2040 (EPP2040). This document was adopted on 2 February 2021 by the Council of Ministers [51]. The EPP2040 corresponds to EU regulations and Poland’s National Energy and Climate Plan; however, it also includes new goals regarding, in particular, the limitation of coal use in the residential sector and aiming to improve air quality [52].

The strategy outlines the three major pillars of the energy transition: just transition, a zero-emission energy system, and good air quality. The most important goal, i.e., energy security, derives directly from the Energy Law [48]. Based on the three pillars, eight specific objectives were indicated: the optimal use of the country’s own energy resources; the expansion of electricity generation and grid infrastructure; the diversification of supply and the development of network infrastructure for natural gas, crude oil, and liquid fuels; the development of energy markets; the implementation of nuclear power; the development of renewable energy sources; and the development of district heating and the cogeneration and improvement of energy efficiency. The document assumes the following: an increase in the share of the RES in all sectors and technologies (at least a 23% share of RES in gross final energy consumption); an increase in the installed capacity of the offshore wind energy at approx. 5.9 GW in 2030 up to approx. 11 GW in 2040; an increase in the installed capacity in photovoltaics of approx. 5–7 GW in 2030 and approx. 10–16 GW in 2040; the share of coal in electricity generation not being higher than 56%; a reduction in the use of coal in the economy; an increase in energy efficiency (reduction in primary energy consumption by 23%); the construction of six nuclear power units (first nuclear power plant to be completed in 2033); natural gas as a bridge fuel in the energy transition; expansion of the natural gas, crude oil, and liquid fuel infrastructure; and diversification of supply directions. In 2021, the government estimated that the energy transition in Poland would cost around PLN 1.6 billion during 2021–2040 [51].

The ongoing energy crisis has made EU leaders and decision-makers rethink and reorientate their current actions and mid-term strategies. Most of the common goals and actions were set at the European level [52]. In its REPowerEU document, the European Commission recommends lowering gas consumption by 30% by 2023, cutting fossil fuel power generation by 31%, diversifying gas supplies, increasing the RES from 30% to 45%, and reducing energy consumption to 13%.

The Russian invasion of Ukraine made the Polish government accelerate its actions in strengthening Poland’s energy security. On 29 March 2022, the Council of Ministers adopted the Principles for the Update of Poland’s Energy Policy until 2040, which is aimed at strengthening energy security and independence in the context of a new crisis [53,54]. The existing three pillars were supplemented with energy sovereignty and its specific component of a quick decoupling of the national economy from imported fossil fuels and their derivatives from Russia, as well as from other economically sanctioned countries. The updated energy strategy emphasises increasing technological diversification and the extension of capacity based on national resources; the further development of RES as one of the components of energy mix diversification; improved energy efficiency; a further diversification of supplies and providing alternatives for hydrocarbons; adjustment of investment decisions related to gas production capacity to fuel availability; maintaining the readiness of coal units to operate by their technical lifetime; and the implementation of nuclear energy development, as well as grid and energy storage development [52].

Following Gazprom’s decision of 27 April 2022 to suspend gas supplies to Poland, the Polish Government adopted, on 13 May 2022, a resolution on the termination of the agreement (which was signed in Warsaw on 25 August 1993) on the construction of a gas pipeline system for the transit of Russian gas, as well as the supply of Russian gas to Poland, through the territory of the Republic of Poland. In April 2022, Poland (like Germany) refused to agree to the Russian demand to pay in RUB for the gas supplied as this was in breach of the terms of a binding contract [53].

During the bilateral meeting of Polish and Norwegian ministers for energy on 6 July 2022, both sides confirmed the great importance of the Baltic Pipe Project for energy security and stability in Europe. This strategic infrastructure international project of Poland, Denmark, and Norway will start transmitting gas in October 2022 [54].

In turn, on 29 July 2022, the Polish oil refining company ORLEN Group finalised its merger with LOTOS Group to strengthen its leading role in the fuel and energy industry in Central and Eastern Europe. According to the President of the Management Board of PKN ORLEN, the resilience of the new group (and soon the PGNiG Group) will be significantly enhanced amid a difficult and extremely volatile environment, and it will strengthen independence from external suppliers [55]. The former president of the PGNiG Group and former minister of economy, Piotr Woźniak, points out a certain threat: namely that two companies, which are selected as partners in the transaction (Hungarian MOL and Saudi Aramco), declared to be and have been cooperating with Russian companies for many years [56].

On July 26, 2022, the energy ministers of the Council of the European Union (EU) agreed to reduce natural gas demand by 15% between 1 August 2022 and 31 March 2023, (voluntary demand reduction). The Regulation was finally adopted on 5 August 2022. The purpose of this regulation is to make savings in the case of possible disruptions of gas supplies from Russia [5]. Hungarian and Polish delegations voted against the adoption of the Council Regulation. In its statement, the Polish government argued that the decisions influencing the energy mix, limitation of the consumption of energy resources, and the energy security of EU member states should be adopted unanimously. Furthermore, none of the countries should decide on other energy policies because policy energy and energy security are the exclusive policies and responsibilities of member states [57].

The German Energy Concept (“Energiewende”) adopted on 28 September 2010, which was supplemented with the nuclear energy package on 6 June 2011, outlines the long-term energy policy of Germany for the period leading up to the year 2050 [58]. The document provides detail on the expansion of energy mix. Thus, it shows the following: an increase in the share of renewable energies (diversification of energy sources); the extension of wind energy power capacities; lowering primary energy consumption by 50% (energy efficiency target); the expansion of energy and electricity storage capacities; and the diversification of supplier countries and import routes (integration into European energy policy and new cross-border energy infrastructure).

In the aftermath of the 2011 nuclear disaster at the Japanese Fukushima power plant, the German Government decided to review Germany’s nuclear energy safety. Based on the Atomic Energy Act and its subsequent amendments all nuclear power plants for commercial use are to be closed by the end of 2022 [59].

Following the EU Regulation of 2018, the German National Energy and Climate Plan for the years 2021–2030 was submitted to the European Commission in 2019. The national long-term strategy (Climate Action Plan 2050) was adopted two years earlier in 2016.

The key objective of the Climate Action Plan 2050 [60] is to achieve extensive greenhouse gas neutrality (in line with the EU’s goal of reducing greenhouse gases by 80 to 95% by 2050). According to this document, renewable energies were supposed to become the principal source of energy in the future. Based on the “efficiency first” principle, the German Government is to permanently seek ways in which to reduce the energy demand.

The German Integrated National Energy and Climate Plan (and likewise Poland’s strategy), introduced in October 2019 [61], was related to five dimensions of the EU Energy Union. In the framework of the energy security unit, the document sets out four central objectives: the coverage of Germany’s energy demand at all times; a continued resilience to supply crises; further reduction in the likelihood of supply crises; and preparedness for a potential deterioration in the supply situation. By 2030, the Federal Government aimed to achieve a 30% share of renewables in gross final energy consumption and 65% in electricity consumption, whereas a national energy efficiency goal was set at less than 30% of the primary energy consumption [61].

Following the outbreak of the conflict in Ukraine, the German federal government launched several activities and instruments to ensure German energy security and to reduce its dependence on Russian energy. The German government conducting the following: supplemented the previous energy purchases with a new programme to buy at least 700 million m3 of gas; released approx. 3.2 million barrels of oil from the national oil reserves; signed a Memorandum on a joint project to build a terminal for the import of liquefied natural gas; adopted the Act on the National Gas Reserve; and took out options on three floating LNG terminals (floating storage and regasification units) [62].

On 30 March 2022, the Ministry for Economic Affairs and Climate Action announced the early warning level of the so-called Emergency Plan for Gas (“Notfallplan Gas”) [63]. This precautionary measure as the first of three defined safety levels (early warning level, alert level, and emergency level) obliges gas suppliers and the gas grid operators to make regular assessments of the situation and to undertake market-based measures to maintain the gas supply. Robert Habeck, the Federal Minister for Economic Affairs and Climate Action, stated “Security of supply continues to be ensured. There are no supply bottlenecks at present. Nevertheless, we need to step up our preventive measures in order to be ready to cope with any escalation by Russia” [63].

On 6 April 2022, the Ministry for Economic Affairs and Climate Action submitted the “Easter Package” to the German government, which is a draft of a legislative package of immediate energy action [64]. This German energy policy revision is the greatest revision by the government and it emphasises the expansion of renewable energy as a matter of national security, as well as proposes amendments to the Renewable Energy Sources Act (i.e., promotes a share of the RES in electricity consumption to increase to 80% by 2030), the Offshore Wind Energy Act, the Energy Industry Act, the Federal Requirements Plan Act, the Grid Expansion Acceleration Act, and further laws and ordinances in the field of energy legislation.

Based on the Gas Storage Act, which entered into force on 30 April 2022, all operators are required to gradually fill their storage facilities at the beginning of the heating season. This act imposes the following goals for gas storage: 80% by 1st October, 90% by 1st November, and 40% by 1 February 2023 [65].

To reduce the consumption of gas used to generate electricity in the event of an impending gas shortage, the German government adopted, on 8 June 2022, the Act on the Maintenance of Substitute Power Stations [66]. In particular, a gas replacement reserve will be created to increase the reserves. The bill provides for the modernisation of coal or oil power plants. The urgent target to end the phaseout of coal in Germany by 2030 remains unchanged.

As a consequence of the 60% reduction in gas transit through Russia via the Nord Stream 1 pipeline, the federal government declared, on 23 June 2022, the alert level, which is the second level of the Emergency Plan for Gas [67]. Germany decided to take further measures to reduce gas consumption, particularly in the electricity sector, such as the quick deployment of coal-fired power plants if needed and an auction mechanism encouraging industrial gas consumers to save gas. At the same time, the federal government granted a credit line—initially of EUR 15 billion—to fill storage facilities, and this was backed by a federal guarantee [67].

5. Discussion and Conclusions

The conducted research provided insights into the differences and similarities in the scope of Poland’s and Germany’s energy mixes and energy security strategies. Both countries are member states of the European Union and share a border, which causes certain dependencies between them in the area of the energy market. Both countries must comply with the principles of the common EU energy policy; however, as members, they can also influence the shaping of these principles.

Germany is the largest energy consumer in Europe and in the EU. Poland is the fifth largest energy consumer in the EU.

Both Poland and Germany participate in the international energy market to meet their energy needs. Both countries do not have significant resources of fossil fuels, although their energy systems still depend to a large extent on them. For many years, Russia was the most important and largest supplier of fossil fuels for both countries.

The dependence of Poland on the import of fossil fuels is much lower than in the case of Germany, and also lower than the EU average. In the case of coal, Poland is self-sufficient, and coal is a key energy carrier for Poland. However, Polish coal is expensive to extract and of poor quality, which is why Polish supplies are supplemented by imports. In addition, Poland declared a further reduction in coal in its energy mix as part of its CO2 reduction policy and due to the pursuit of a more ecological energy policy. If the decarbonization process was faster in Poland, its economy would have been more resistant to the energy crisis in 2022. A greater share of renewable sources in Poland’s energy mix would have a positive impact on its energy self-sufficiency. In the case of Germany, dependence on the importation of fossil fuel is higher than the EU average. The key German energy carrier is imported oil. In the case of imports, 95% of this fossil fuel comes from imports. It should be noted, however, that almost a third of the gas imported by Germany is then exported to other countries and thus brings financial benefits to Germany. In the German energy policy, it is visible that they are striving for the elimination of coal, for reducing the use of nuclear energy, and striving to increase the participation of renewables. This much greater involvement in the development of renewable energy worked to the advantage of the German energy market in the face of the crisis (Scheme 2).

Scheme 2.

Model of the response to the destabilisation of energy markets for Poland and Germany.

Gas supplies to Poland are diversified geographically and in terms of delivery methods. Since launching a gas terminal in Świnoujście, Poland can import liquefied natural gas from any place of origin. In turn, the Germans did not have LNG terminals in February 2022; thus, they relied solely on gas supplies via pipelines. In Germany, natural gas was imported only through cross-border pipelines until November 2022. However, it should be noted that, although this element was not included in this study, at the end of 2022 when Germany faced the need to give up Russian gas, it quickly started building and launching the LNG receiving terminals and the charter of FSRU vessels.

Energy policy in both countries is an important element of economic security policy. It should be noted, however, that before the ongoing energy crisis, both countries had different priorities in this area. In Poland, the priority was “energy security” and the search for alternative partners in the energy market instead of Russia. The diversification of fossil fuels suppliers in Polish energy policy has been widely discussed for many years and is seen as a key element of the country’s economic security.

Meanwhile, the German energy policy has been guided by the idea of “efficiency first” for many years. German policy focuses on the cheapest purchases of oil and gas, and the best use of transmission infrastructure. Additionally, Germany has earned money from re-exporting gas. An important element of German energy policy is the pursuit of using more ecological fossil fuels, the elimination of coal, and limiting the use of nuclear energy. All these factors have, for years, increased Russia’s participation as a supplier of energy fossil fuels to Germany.

In the case of Poland, limiting Russia’s participation in the energy market has become a priority. The tendency to diversify in fossil fuel suppliers, which was dominated before the outbreak of ongoing crisis, has changed into activities aimed at completely replacing Russia with other suppliers. Poland’s government strives to introduce long-term and durable changes. The subject of diversification is to be not only the geographical directions of imports, but also the ways through which to import energy resources and of obtaining energy (Scheme 2). At the same time, in the EU forum, Poland is striving to permanently limit energy cooperation with Russia. In addition, the situation has accelerated the activities aimed at increasing the share of renewable electricity and decarbonisation in Poland [65].

When analysing the actions taken, as a reaction to the energy crisis, on the energy market in Germany, changes in the internal market come to the fore. The Germans took steps to reduce gas consumption and, unlike Poland, voted for such a solution in the EU. They also decided to extend the working time of the last three nuclear power plants and to postpone their final closing date. The indicated steps, however, are short-term and do not lead to permanent changes in Germany’s energy policy. Rather, these are options that are to allow for survival in difficult times (Scheme 2).

The destabilisation of world energy markets in 2022 and its consequences requires a new approach to the energy security strategy of many countries. Poland and Germany, as countries with strong energy ties with Russia, are good research areas to study the changes and consequences of the situation. The conducted research provided insights into the short-time response to the energy crisis models and its consequences in the energy security policies of Poland and Germany. The main determinants of the energy markets of both countries were identified to result from their energy mix and energy import dependency. The sequence of actions taken by both the studied countries allowed the authors to build two models that illustrated the changes adopted in the two countries’ energy strategies.

Globalization processes increase the degree of dependence and interdependence of countries in the area of energy. In the future, countries must take into account the need for increasingly rapid reactions on the energy market and they must increase their flexibility in response to these new phenomena. The presented research shows how states can react in a short period of time and what consequences their actions can lead to. The conclusions from the research can be used in the creation of medium- and long-term strategies for countries. As part of the research, the characteristics of the markets of both countries were identified, which became the biggest problem for both in the face of the crisis—namely excessive dependence on one external supplier of fossil fuels. An important conclusion from the research is that the use of renewable energy sources increases the flexibility of the energy market, as well as its security and stability. Countries that are leaders in green energy are vulnerable to the energy crises and disruptions in global supply chains. This research is another argument for tightening the common energy policy of the EU and for further increasing efforts related to decarbonisation and renewable energy.

Due to this research, it will be possible to outline various scenarios regarding the future directions of the energy security strategies of European countries. The authors plan to conduct further research using foresight methods, including STEEPVL and SWOT analyses, on the basis of which the scenarios of the state of energy security in Poland and Germany will be developed.

Author Contributions

Conceptualization, A.K., L.K.-T. and K.C.-F.; methodology, A.K., L.K.-T. and K.C.-F.; investigation, A.K., L.K.-T. and K.C.-F.; resources, A.K., L.K.-T. and K.C.-F.; writing—original draft preparation, A.K., L.K.-T. and K.C.-F.; writing—review and editing, A.K., L.K.-T. and K.C.-F.; visualization, A.K., L.K.-T. and K.C.-F. All authors have read and agreed to the published version of the manuscript.

Funding

This research was financed by a subsidy granted to the Faculty of Engineering Management of the Bialystok University of Technology (WZ/WIZ-INZ/1/2020 and WZ/WIZ-INZ/2/2022) and the Faculty of Economics and Finance of the University of Bialystok by the Ministry of Education and Science of the Republic of Poland.

Data Availability Statement

The data used in the paper are extracted from the following databases: ITC, IEA, Eurostat, BP, Ministry of Climate and Environment of Poland, ARE and BAFA. The detailed sources of the data are cited below each figure.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Ejdys, J.; Czerewacz-Filipowicz, K.; Halicka, K.; Kononiuk, A.; Magruk, A.; Siderska, J.; Szpilko, D. A Preparedness Plan for Europe: Addressing Food, Energy, and Technological Security, European Parliamentary Research Service Scientific Foresight Unit (STOA), European Parliament 2023. Available online: https://www.europarl.europa.eu/stoa/en/document/EPRS_STU(2023)740232?fbclid=IwAR0n_0IzOvcZIUXpZ_mcqFq6pvPPeTw5PnjJNM5BspB4tV3V_diZ5-asrow (accessed on 25 May 2023).

- REPowerEU: Joint European Action for more affordable, secure and sustainable energy. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions, Strasbourg, 8 March 2022 COM (2022) 108 final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52022DC0108 (accessed on 26 May 2023).

- REPowerEU: A Plan to Rapidly Reduce Dependence on Russian Fossil Fuels and Fast Forward the Green Transition, European Commission. Press Releases. 18 May 2022. Brussels. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131 (accessed on 26 May 2023).

- Regulation of the European Parliament and of the Council amending Regulations (EU) 2017/1938 and (EC) No 715/2009 with regard to gas storage, Brussels, 24 June 2022, PE-CONS 24/22. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32017R1938&qid=1688117152865 (accessed on 3 June 2023).

- European Council. Council of the European Union. Available online: https://www.consilium.europa.eu/en/press/press-releases/2022/07/26/member-states-commit-to-reducing-gas-demand-by-15-next-winter/30.07.2022 (accessed on 26 May 2023).

- EU external energy engagement in a changing world. European Commission. High Representative of the Union for Foreign Affairs and Security Policy. Joint Communication to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Brussels, 18 May 2022 JOIN (2022) 23 final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52022JC0023 (accessed on 1 June 2023).

- Proedrou, F. Sensitivity and Vulnerability Shifts and the Energy Pattern in the EU-Russia Gas Trade: Prospects for the Near Future. Stud. Dipl. 2010, 63, 85–104. [Google Scholar]

- Kostecka-Tomaszewska, L.; Krukowska, M. Europe between China and the United States: Geoeconomic Implications of the Belt and Road Initiative. Eur. Res. Stud. J. 2020, 23, 286–291. [Google Scholar] [CrossRef] [PubMed]

- Dreyer, I.; Stang, G. What energy security for the EU. Brief Issue 2013, 39, 1–4. Available online: https://www.iss.europa.eu/sites/default/files/EUISSFiles/Brief_39_Energy_security.pdf (accessed on 15 March 2022).

- World Coal Institute. Available online: https://www.worldcoal.org/ (accessed on 15 March 2022).

- World Energy Outlook 2020, International Energy Agency. Available online: https://iea.blob.core.windows.net/assets/a72d8abf-de08-4385-8711-b8a062d6124a/WEO2020.pdf (accessed on 15 June 2022).

- Jakstas, T. What does energy security mean? In Energy Transformation Towards Sustainability, 1st ed.; Tvaronaviciene, M., Slusarczyk, B., Eds.; Elsevier: Amsterdam, The Netherlands, 2020; pp. 99–112. [Google Scholar] [CrossRef]

- Kostecka-Tomaszewska, L. Economic security of China: The implications of the Belt and Road Initiative. Optim. Econ. Stud. 2018, 4, 166–182. [Google Scholar] [CrossRef]

- Księżopolski, K.M. Bezpieczeństwo Ekonomiczne; Elipsa: Warsaw, Poland, 2011; pp. 1–204. [Google Scholar]

- Azzuni, A.; Breyer, C. Global Energy Security Index and Its Application on National Level. Energies 2020, 13, 2502. [Google Scholar] [CrossRef]

- Czerewacz-Filipowicz, K.; Konopelko, A. Regional Integration Processes in the Commonwealth of Independent States, 1st ed.; Springer International Publishing: Cham, Switzerland, 2017; pp. 94–95+267. [Google Scholar] [CrossRef]

- Radovanović, M.; Filipović, S.; Pavlović, D. Energy security measurement—A sustainable approach. Renew. Sustain. Energy Rev. 2017, 68, 1020–1032. [Google Scholar] [CrossRef]

- Willrich, M. International Energy Issues and Options. Annu. Rev. Energy 1976, 1, 743–772. [Google Scholar] [CrossRef]

- Konopelko, A.; Czerewacz-Filipowicz, K. The Strategy of the Eurasian Economic Union Extra-Regional Integration. WSEAS Trans. Bus. Econ. 2021, 18, 67–75. [Google Scholar] [CrossRef]

- Mattia De Rosa, M.; Gainsford, K.; Pallonetto, F.; Finn, D.P. Diversification, concentration and renewability of the energy supply in the European Union. Energy 2022, 253, 124097. [Google Scholar] [CrossRef]

- Ang, B.W.; Choong, W.L.; Ng, T.S. Energy security: Definitions, dimensions and indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Halser, C.; Paraschiv, F. Pathways to Overcoming Natural Gas Dependency on Russia-The German Case. Energies 2022, 15, 4939. [Google Scholar] [CrossRef]

- Bauer, N.; Calvin, K.; Emmerling, J.; Fricko, O.; Fujimori, S.; Hilaire, J.; Eom, J.; Krey, V.; Kriegler, E.; Mouratiadou, J.; et al. Shared Socio-Economic Pathways of the Energy Sector—Quantifying the Narratives. Glob. Environ. Change 2017, 42, 316–330. [Google Scholar] [CrossRef]

- Bogachov, S.; Kirizleyeva, A.; Mandroshchenko, O.; Shahoian, S.; Vlasenko, Y. Economic policy of Eastern European countries in the field of energy in the context of global challenges. Glob. J. Environ. Sci. Manag. 2022, 8, 1–16. [Google Scholar] [CrossRef]

- Ayres, R.U.; Turton, H.; Casten, T. Energy Efficiency, Sustainability and Economic Growth. Energy 2007, 32, 634–648. [Google Scholar] [CrossRef]

- Ayres, R.U.; Warr, B. Energy Efficiency and Economic Growth: The ‘Rebound Effect’ as a Driver. In Energy Efficiency and Sustainable Consumption. Energy, Climate and the Environment Series; Herring, H., Sorrell, S., Eds.; Palgrave Macmillan: London, UK, 2009. [Google Scholar] [CrossRef]

- Sovacool, B.; Brown, M.A. Competing dimensions of energy security: An international perspective. Annu. Rev. Environ. Resour. 2010, 35, 77–108. [Google Scholar] [CrossRef]

- Cherp, A.; Jewell, J. The three perspectives on energy security: Intellectual history, disciplinary roots and the potential for integration. Current Opinion in Environmental. Sustainability 2011, 3, 202–212. [Google Scholar]

- Cherp, A.; Jewell, J. Measuring energy security: From universal indicators to contextualised frameworks. In The Routledge Handbook to Energy Security; Sovacool, B., Ed.; Routledge: London, UK, 2010. [Google Scholar]

- European Commission, European Energy Security Strategy, COM 2014, 330 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A52014DC0330 (accessed on 15 July 2022).

- BP Statistical Review of World Energy 1965–2021. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/xlsx/energy-economics/statistical-review/bp-stats-review-2022-all-data.xlsx (accessed on 23 August 2022).

- Eurostat. Database. Available online: https://ec.europa.eu/eurostat/data/database (accessed on 23 August 2022).

- International Energy Agency (IEA). Data and Statistics. Available online: https://www.iea.org/data-and-statistics (accessed on 23 August 2022).

- International Trade Centre (ITC). Trade Map. Available online: https://www.trademap.org/ (accessed on 23 August 2022).

- Ministry of Climate and Environment. Sprawozdanie z Wyników Monitorowania Bezpieczeństwa Dostaw Paliw Gazowych za 2021 r. Available online: https://bip.mos.gov.pl/fileadmin/user_upload/bip/Energetyka/Sprawozdania_z_wynikow_monitorowania_bezpieczenstwa_dostaw_paliw_gazowych/2021_Sprawozdanie_z_wynikow_monitorowania_bezpieczenstwa_dostaw_paliw_gazowych_za_2021_r..pdf (accessed on 5 September 2022).

- Ministry of Climate and Environment, Sprawozdania z Wyników Monitorowania Bezpieczeństwa Dostaw Paliw Gazowych, 2012–2021. Available online: https://bip.mos.gov.pl/energetyka/sprawozdania-z-wynikow-monitorowania-bezpieczenstwa-dostaw-paliw-gazowych/ (accessed on 5 September 2022).

- Ministry of Climate and Environment; Agencja Rynku Energii S.A. (ARE). Bilans Energii Pierwotnej w Latach 2006–2021. Warsaw: 2022. Available online: https://www.are.waw.pl/component/phocadownload/category/44-bilans-energii-pierwotnej?download=201:bilans-energii-pierwotnej-w-latach-2006-2021 (accessed on 14 December 2022).

- World Economic Forum (WEF). Germany Takes New Steps to Tackle the Energy Crisis. Available online: https://www.weforum.org/agenda/2022/08/energy-crisis-germany-europe/ (accessed on 7 August 2022).

- United Nations, Kyoto Protocol to the United Nations Framework Convention on Climate Change, FCCC/CP/1997/L. 7/Add.1 10 December 1997. In Paris Agreement; United Nations: New York, NY, USA, 2015. [Google Scholar]

- Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Brussels, 26 October 2021 COM (2021) 950 final. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:67d54e0f-363d-11ec-bd8e-01aa75ed71a1.0001.02/DOC_1&format=PDF (accessed on 5 June 2022).

- Energy 2020. A strategy for competitive, sustainable and secure Energy, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, Brussels, 10 November 2010, COM (2010) 639 final. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2010:0639:FIN:En:PDF (accessed on 5 June 2022).

- Energy Roadmap 2050. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Brussels, 15 December 2011. COM (2011) 885 final. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2011:0885:FIN:EN:PDF (accessed on 5 June 2022).

- European Energy Security Strategy. Communication from the Commission to the European Parliament and The Council, Brussels, 28 May 2014, COM (2014) 330 final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014DC0330& (accessed on 5 June 2022).

- Regulation (EU) 2018/1999 of the European Parliament and of the Council of 11 December 2018 on the Governance of the Energy Union and Climate Action, Official Journal of the European Union, L 328/1, 21 December 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018R1999&from=EN (accessed on 5 June 2022).

- Ministry of Climate and Environment. National Energy and Climate Plan for the years 2021–2030. Available online: https://www.gov.pl/web/klimat/national-energy-and-climate-plan-for-the-years-2021-2030 (accessed on 2 August 2022).

- European Commission. Commission Staff Working Document. Assessment of the final national energy and climate plan of Poland. Brussels, 14 October 2020 SWD (2020) 920 final. Available online: https://energy.ec.europa.eu/system/files/2021-01/staff_working_document_assessment_necp_belgium_en_0.pdf (accessed on 7 June 2022).

- Ustawa z, dn.; 10.04.1997 Prawo energetyczne (The Energy Law), Dz. U. z 2022 r. poz. 1385. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20220001385/U/D20221385Lj.pdf (accessed on 2 June 2023).

- European Commission. Energy Union. Available online: https://energy.ec.europa.eu/topics/energy-strategy/energy-union_en (accessed on 2 August 2022).

- Official Service of the Republic of Poland. Energy Security as the Basis for the Development of Society. Available online: https://www.gov.pl/web/polski-atom/bezpieczenstwo-energetyczne-podstawa-rozwoju-spoleczenstwa (accessed on 2 August 2022).

- Obwieszczenie Ministra Klimatu i Środowiska z dnia 2 marca 2021 r. w sprawie polityki energetycznej państwa do 2040 r., Monitor Polski z dn. 10.03.2021, poz. 264. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WMP20210000264/O/M20210264.pdf (accessed on 7 June 2022).

- Ministry of Climate and Environment. Energy Policy of Poland until 2040. Available online: https://www.gov.pl/web/climate/energy-policy-of-poland-until-2040-epp2040 (accessed on 2 August 2022).

- Ministry of Climate and Environment. Poland Terminated the Gas Agreement on the Yamal Gas Pipeline. Available online: https://www.gov.pl/web/climate/poland-terminated-the-gas-agreement-on-the-yamal-gas-pipeline (accessed on 3 August 2022).

- Website of the Republic of Poland. Polish-Norwegian Energy Cooperation. Available online: https://www.gov.pl/web/norge/polish-norwegian-energy-cooperation (accessed on 3 August 2022).

- Orlen. ORLEN-LOTOS Merger Completed. Available online: https://www.orlen.pl/en/about-the-company/media/press-releases/2022/august-2022/ORLEN-LOTOS-merger-completed (accessed on 3 August 2022).

- Portal Money.pl. Fuzja Lotosu z Orlenem. Były minister gospodarki nie kryje obaw. Chodzi o Rosję, 1 August 2022. Available online: https://www.money.pl/gospodarka/fuzja-lotosu-z-orlenem-byly-minister-gospodarki-nie-kryje-obaw-chodzi-o-rosje-6796792094308864a.html (accessed on 3 August 2022).

- Council of the European Union. General Secretariat. Communication, CM 4101/22, Brussels, 5 August 2022. Available online: https://data.consilium.europa.eu/doc/document/CM-4101-2022-INIT/x/pdf (accessed on 7 August 2022).

- Federal Ministry for the Environment, Nature Conservation and Nuclear Safety. The Federal Government’s Energy Concept of 2010 and the Transformation of the Energy System of 2011, 28 September 2010. Available online: https://cleanenergyaction.files.wordpress.com/2012/10/german-federal-governments-energy-concept1.pdf (accessed on 4 August 2022).

- Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection. Amendments to the Atomic Energy Act. Available online: https://www.bmuv.de/en/topics/nuclear-safety-radiological-protection/nuclear-safety/amendments-to-the-atomic-energy-act (accessed on 4 August 2022).

- Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety Climate Action Plan 2050. Principles and goals of the German government’s climate policy, November 2016. Available online: https://www.bmuv.de/fileadmin/Daten_BMU/Pools/Broschueren/klimaschutzplan_2050_en_bf.pdf (accessed on 5 August 2022).

- European Commission. Integrated National Energy and Climate Plan, 9 October 2019. Available online: https://energy.ec.europa.eu/system/files/2020-07/de_final_necp_main_en_0.pdf (accessed on 5 August 2022).

- Federal Ministry for Economic Affairs and Climate Action. Energy Security Progress Report. 25 March 2022. Available online: https://www.bmwk.de/Redaktion/EN/Downloads/Energy/0325_fortschrittsbericht_energiesicherheit_EN.pdf?__blob=publicationFile&v=3 (accessed on 5 August 2022).

- Federal Ministry for Economic Affairs and Climate Action. Federal Ministry for Economic Affairs and Climate Action Announces Early Warning Level of the Emergency Plan for Gas—Security of Supply Still Ensured. Available online: https://www.bmwk.de/Redaktion/EN/FAQ/Emergency-Plan-for-Gas/emergency-plan-for-gas.html (accessed on 5 August 2022).

- Federal Ministry for Economic Affairs and Climate Action. Overview of the Easter Package. 6 April 2022. Available online: https://www.bmwk.de/Redaktion/EN/Downloads/Energy/0406_ueberblickspapier_osterpaket_en.pdf?__blob=publicationFile&v=5 (accessed on 5 August 2022).

- Federal Ministry for Economic Affairs and Climate Action. Second Energy Security Progress Report. 1 May 2022. Available online: https://www.bmwk.de/Redaktion/EN/Downloads/Energy/0501_zweiter-fortschrittsbericht_energiesicherheit_EN.pdf?blob=publicationFile&v=2 (accessed on 6 August 2022).

- Federal Ministry for Economic Affairs and Climate Action. Further Steps on the Path to Creating Independence from Russian Gas Imports—Federal Cabinet Adopts Precautionary Measures for the Event of an Impending Gas Shortage. 8 June 2022. Available online: https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2022/06/20220608-further-steps-on-the-path-to-creating-independence-from-russian-gas-imports-federal-cabinet-adopts-precautionary-measures-for-the-event-of-an-impending-gas-shortage.html (accessed on 6 August 2022).

- Federal Ministry for Economic Affairs and Climate Action. Bundesministerium für Wirtschaft und Klimaschutz ruft Alarmstufe des Notfallplans Gas aus—Versorgungssicherheit Weiterhin Gewährleistet. 23 June 2022. Available online: https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2022/06/20220623-federal-ministry-for-economic-affairs-and-climate-action-announces-alert-level-of-the-emergency-plan-for-gas.html (accessed on 6 August 2022).

- Czyżak, P.; Uusivuori, E.; Ilas, A.; Candlin, A.; Shocked into Action. CREA EMBER. Available online: https://ember-climate.org/app/uploads/2022/06/Ember-EU-national-plans-slash-fossil-fuels.pdf (accessed on 15 December 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).