Simulation Analysis of Electricity Demand and Supply in Japanese Communities Focusing on Solar PV, Battery Storage, and Electricity Trading

Abstract

1. Introduction

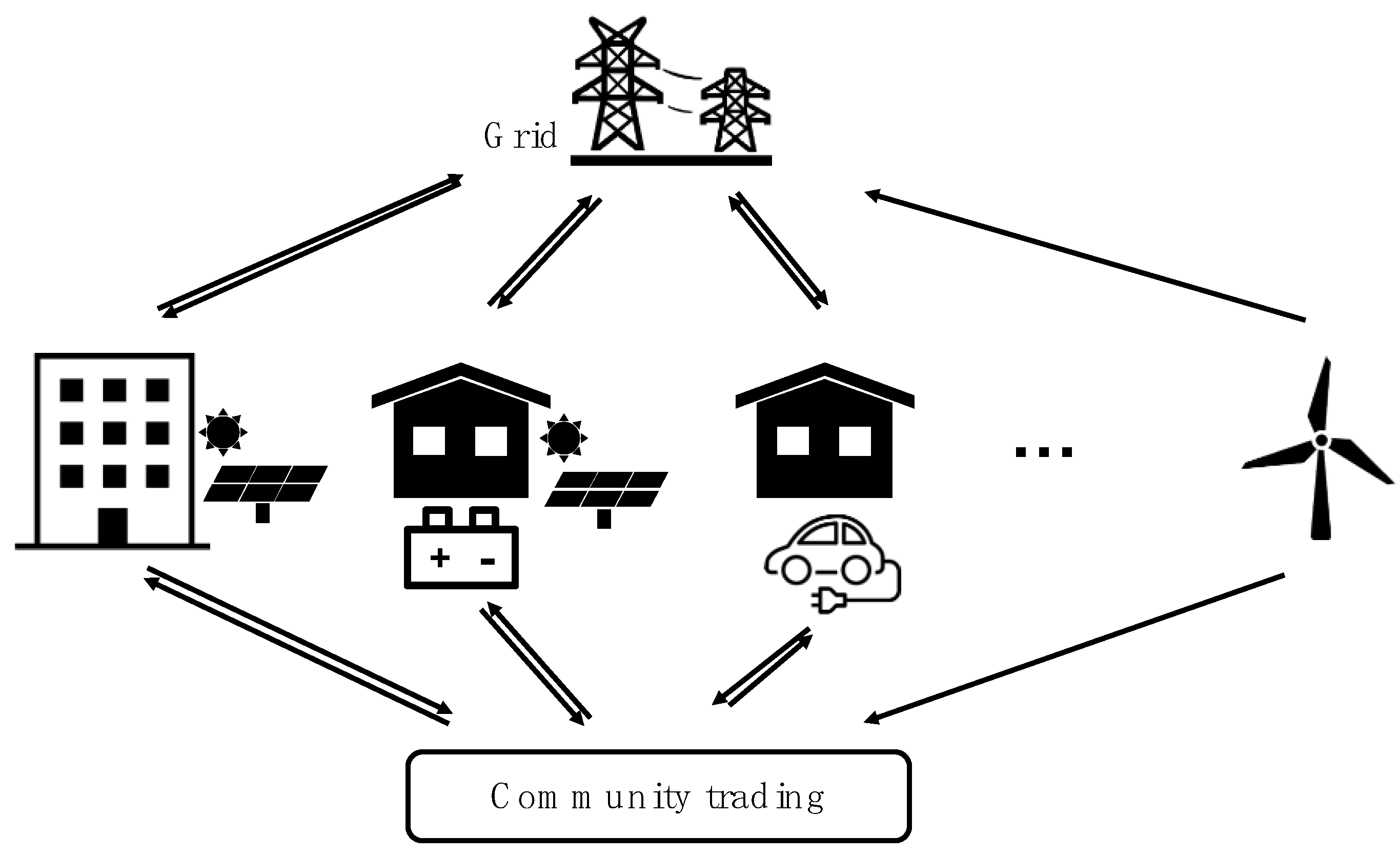

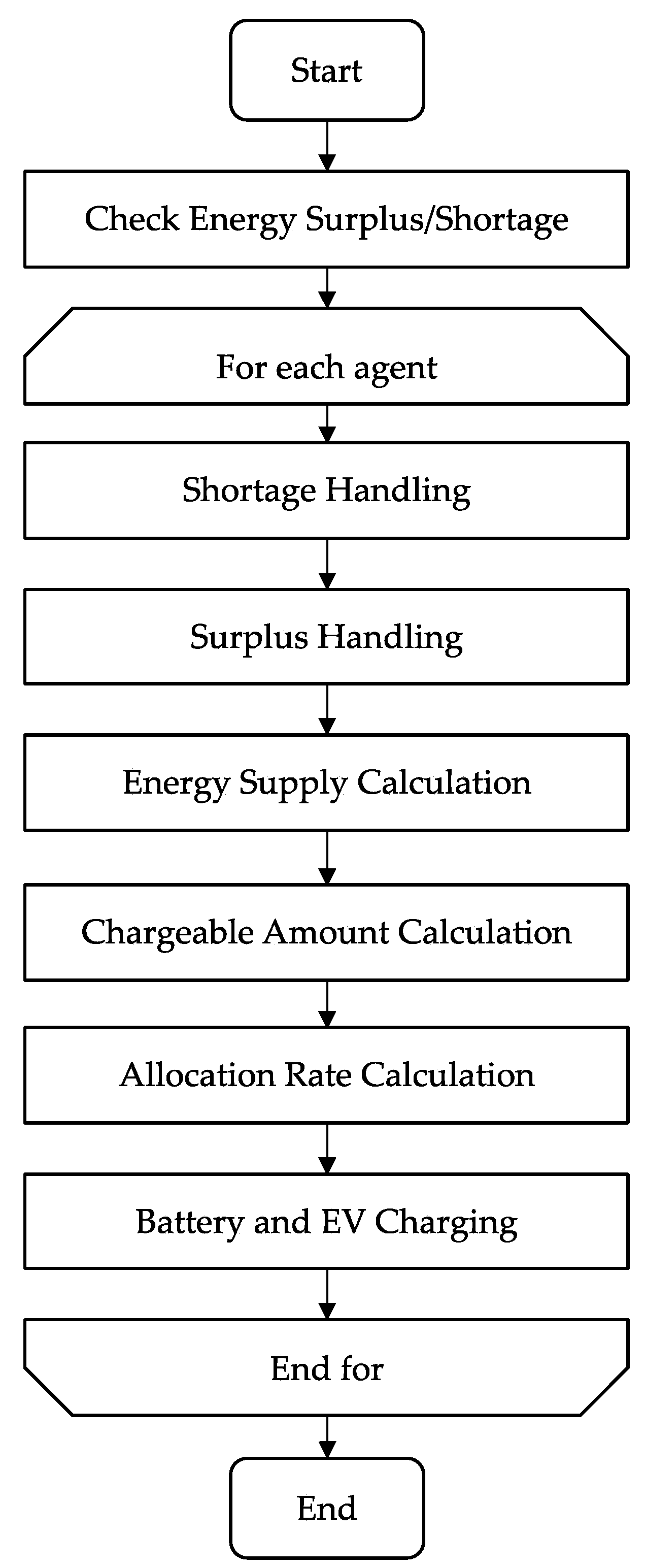

2. Framework of Simulation

2.1. Brief Description of Simulation

2.2. Community Generation

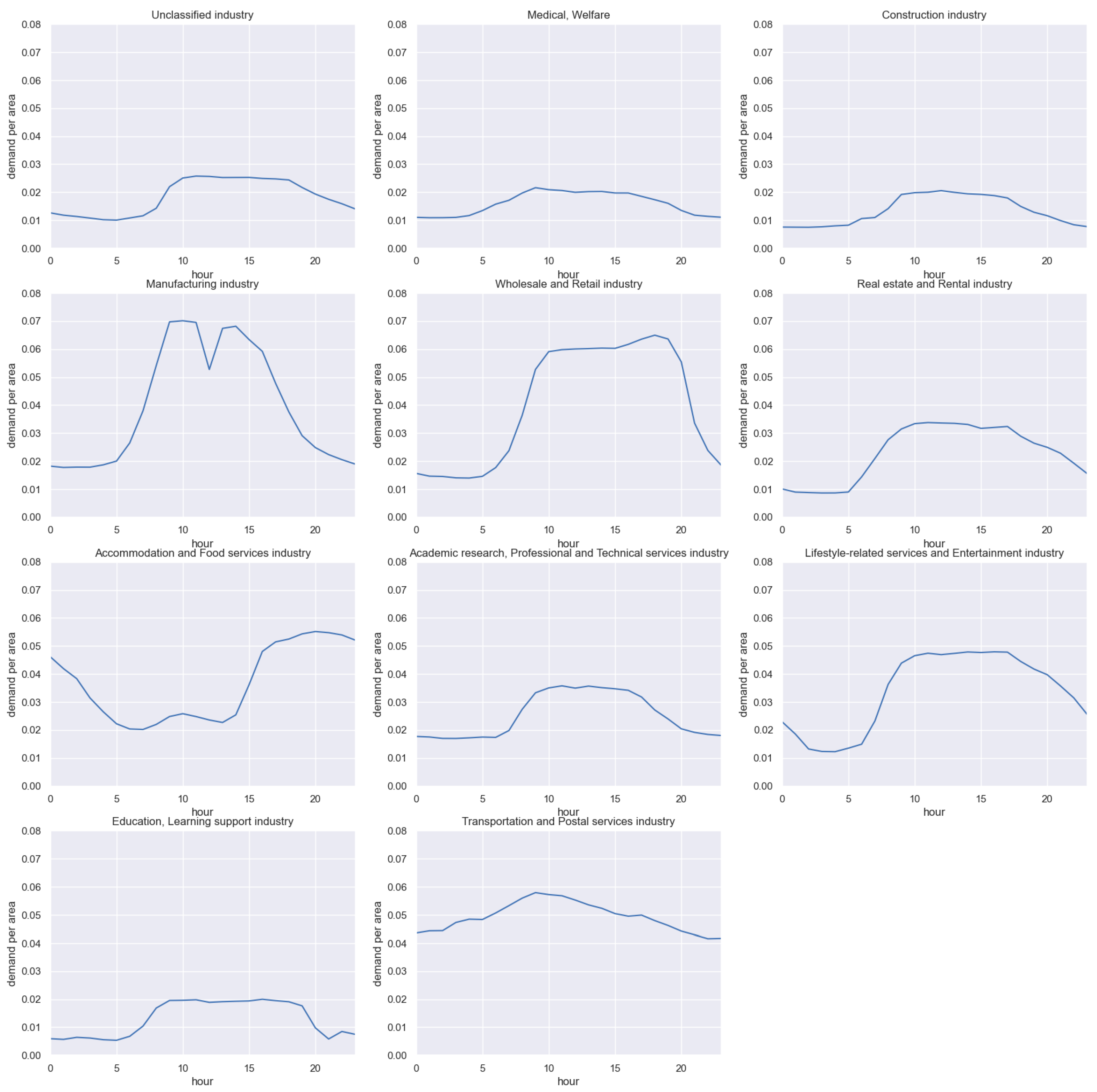

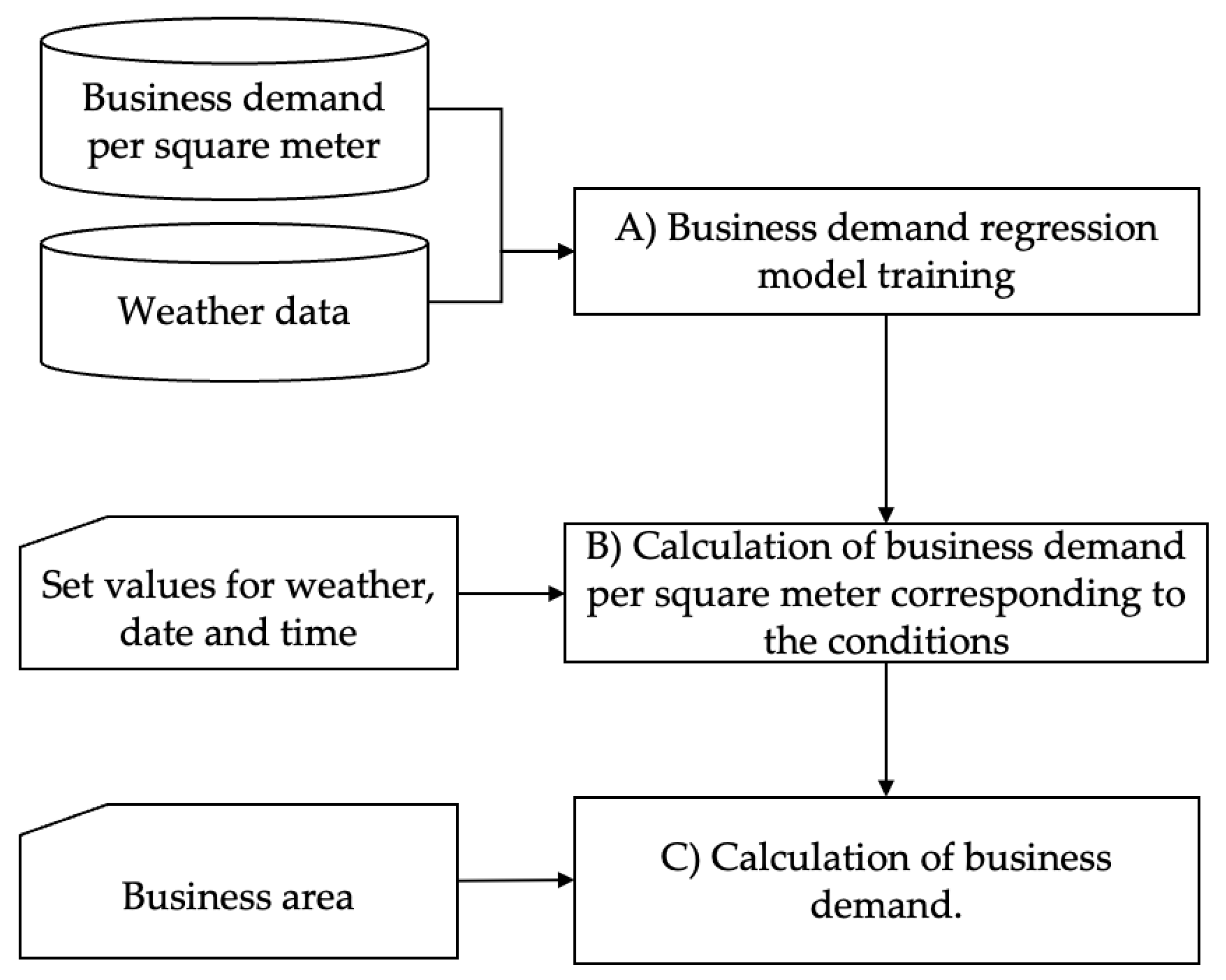

2.2.1. Business Demand Generation

- A model that reproduces the power consumption per square meter for each business type is trained by applying a random forest. The explanatory variables used in this study are as follows, from i to vii. The demand data are based on SII (sustainable open innovation initiative) data, and the model predicts the value of each business type per day.

- Business type;

- Day of the week;

- Time;

- Month;

- Precipitation;

- Temperature;

- Humidity.

- The trained model is provided with weather data corresponding to the simulation target date to calculate the power consumption per square meter for each business type, considering the weather conditions. We provide the trained model with the weather data for the simulation target period as an input, and then we obtain the basic load curve for each business type as an output.

- The power demand for each business is calculated by multiplying the basic load curve by the number of square meters of the business.

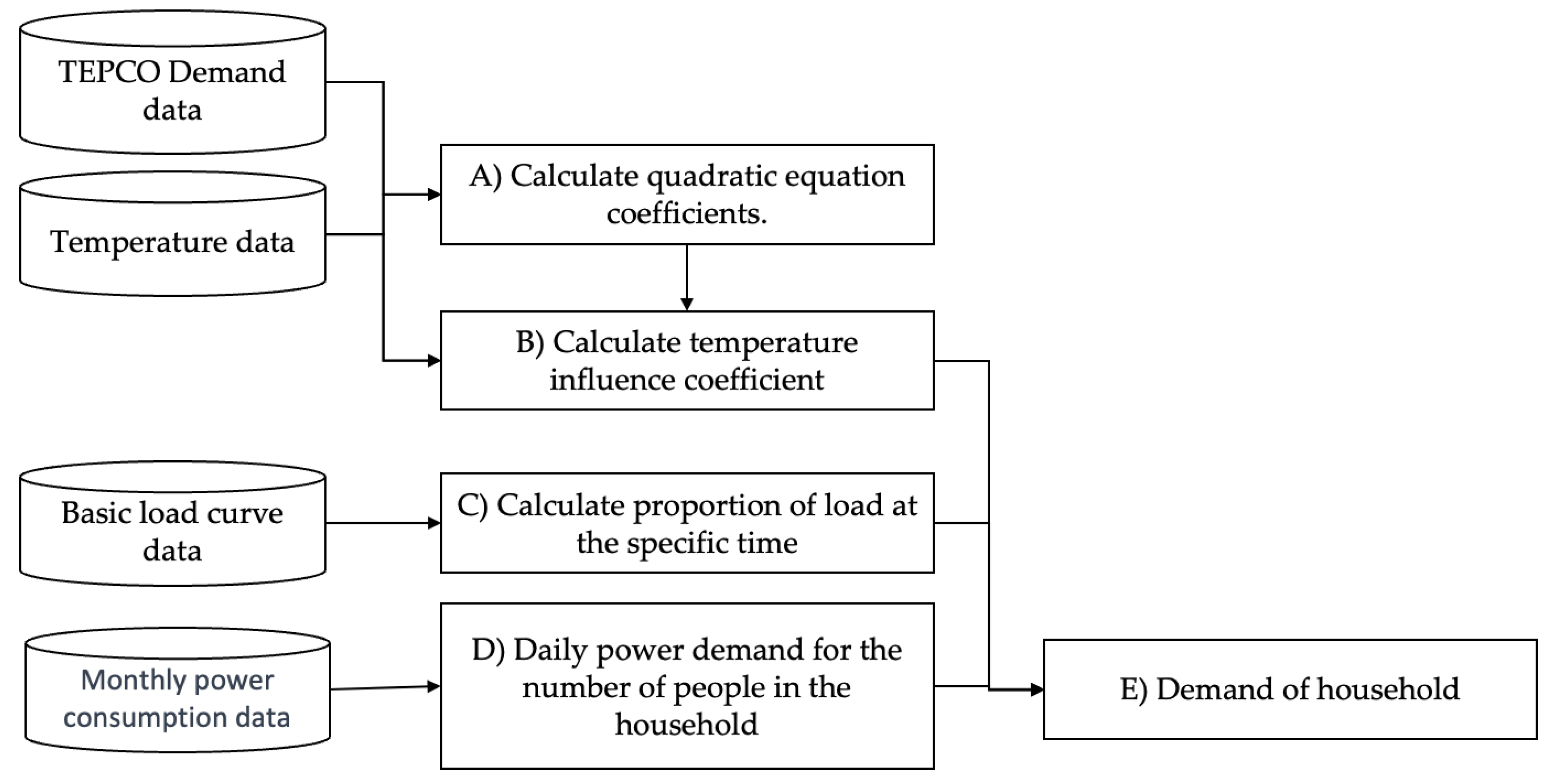

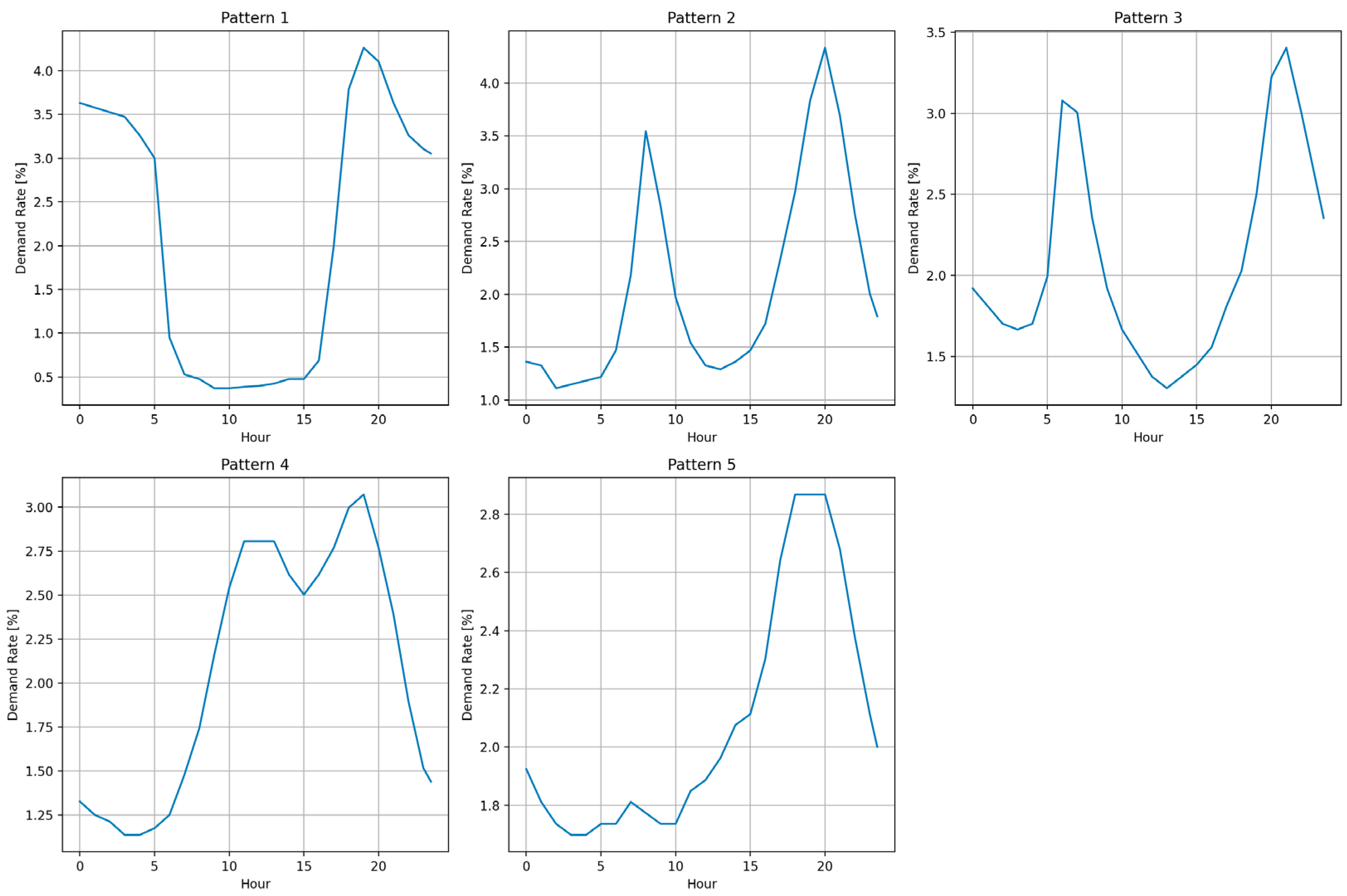

2.2.2. Household Demand Generation

- Quadratic Equation Coefficient

- Temperature Influence Coefficient

2.2.3. EV Travel Data Generation

2.2.4. Solar Power Generation Data Generation

2.2.5. Wind Power Generation Data Generation

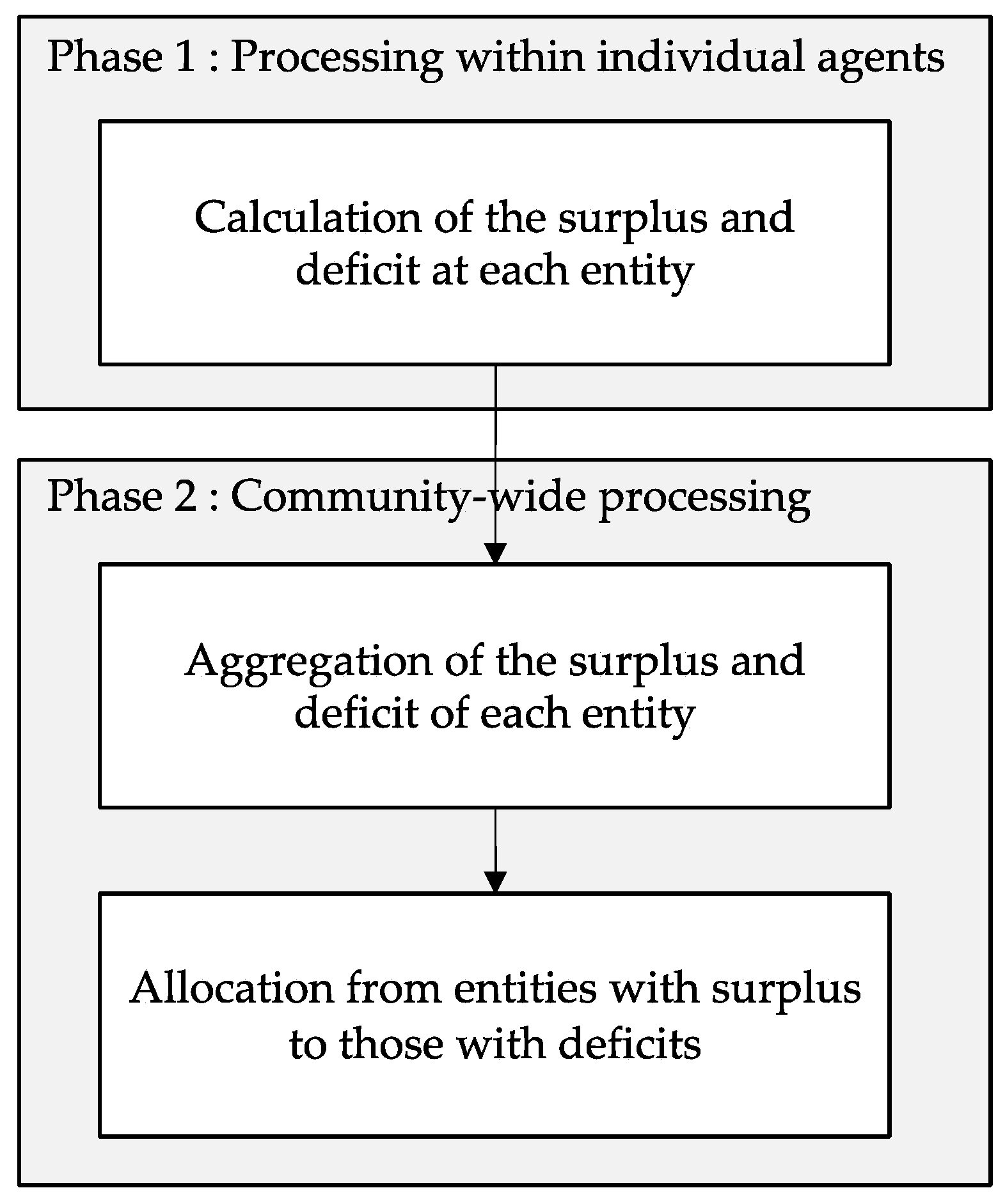

2.3. Power Trading

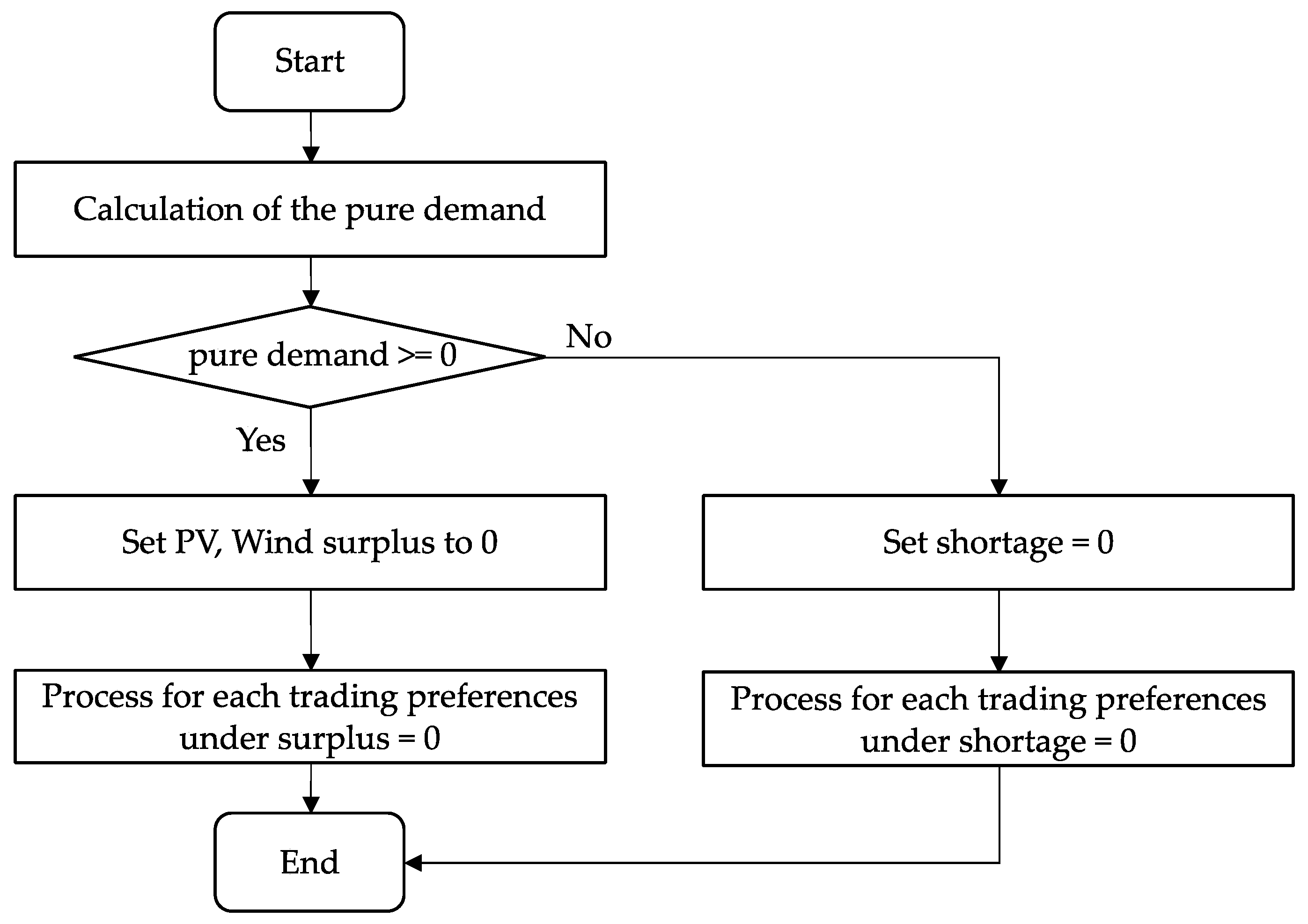

2.3.1. Phase 1: Processing within Individual Agents

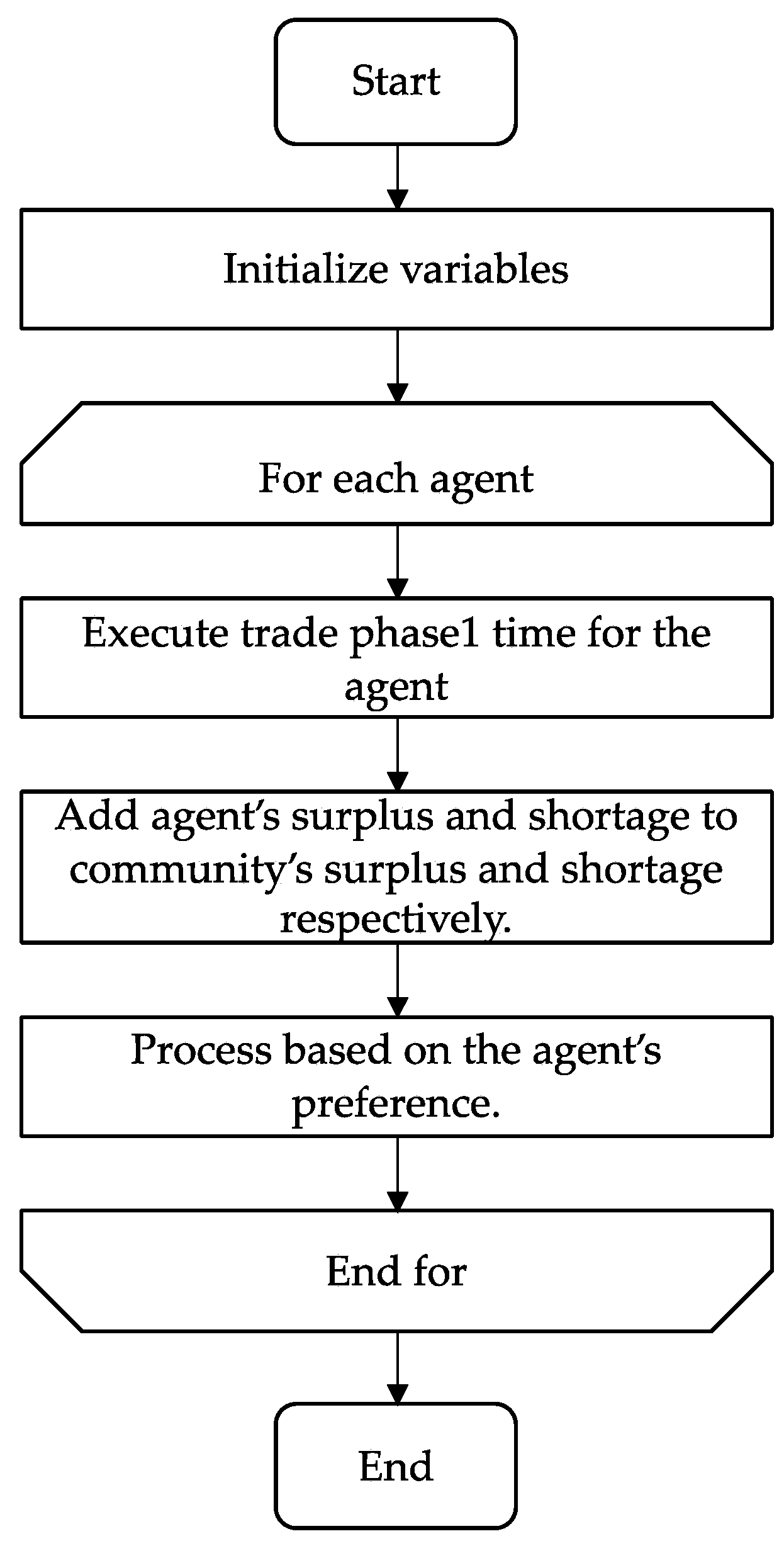

2.3.2. Phase 2: Community-Wide Processing

3. Simulation Cases and Results

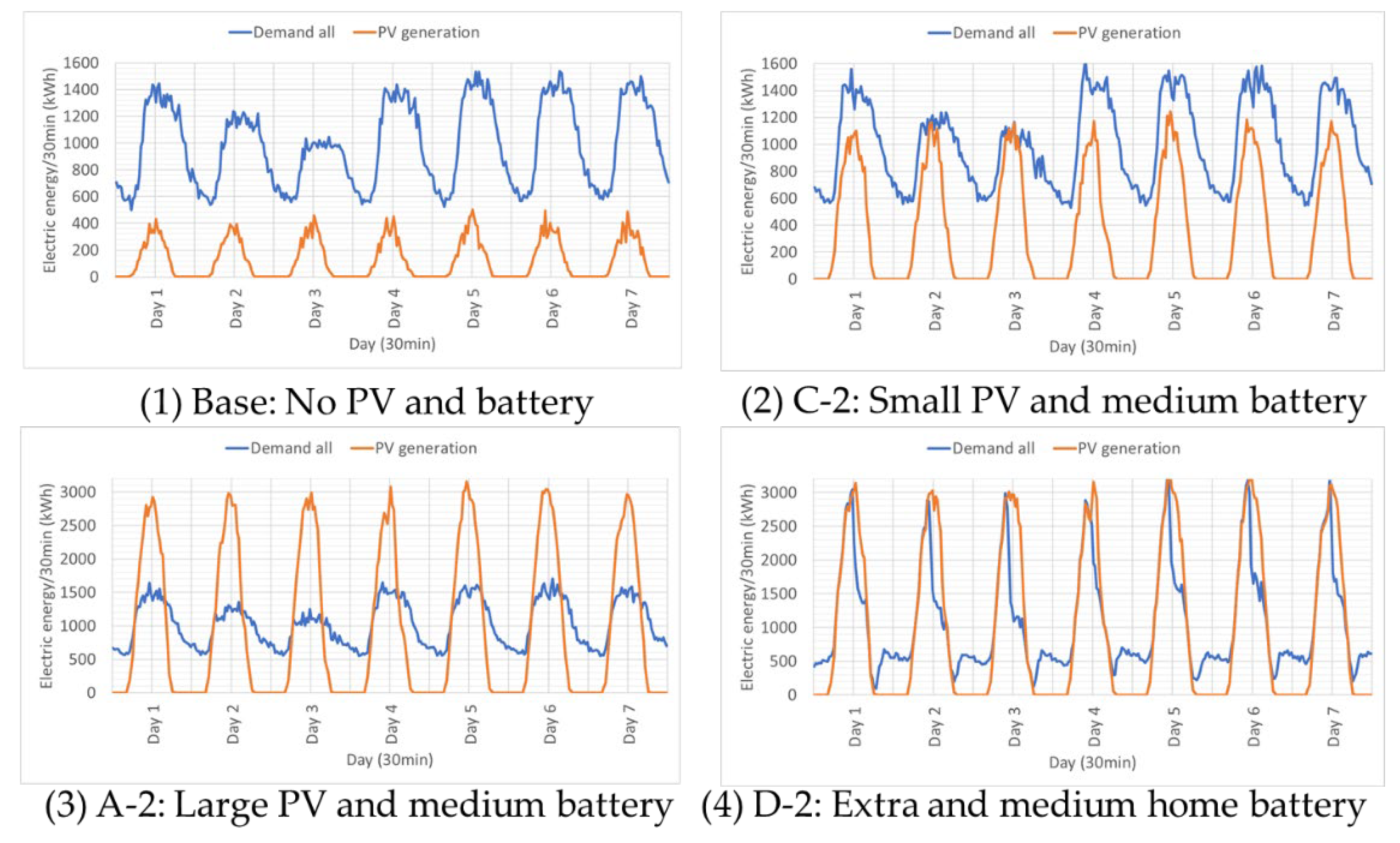

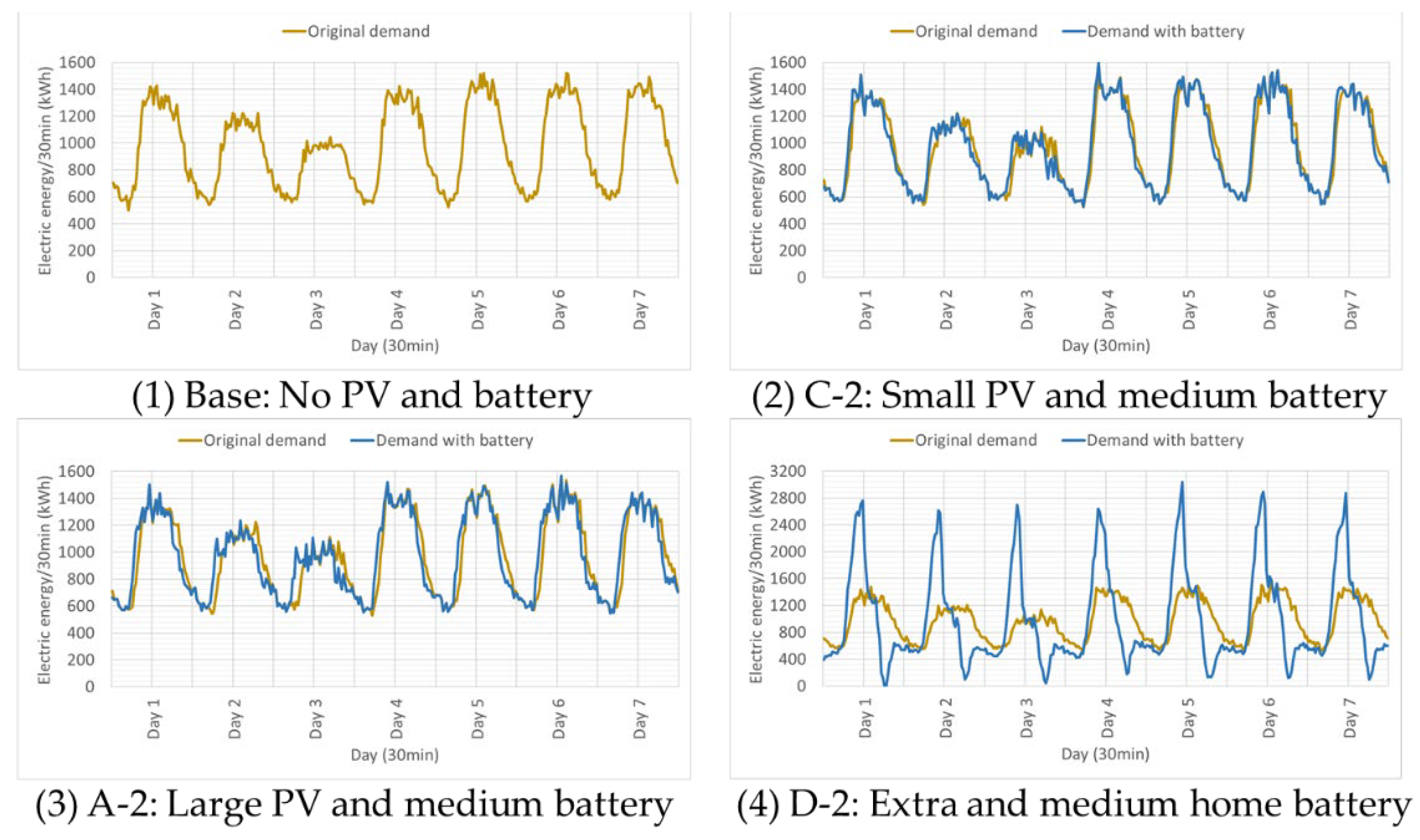

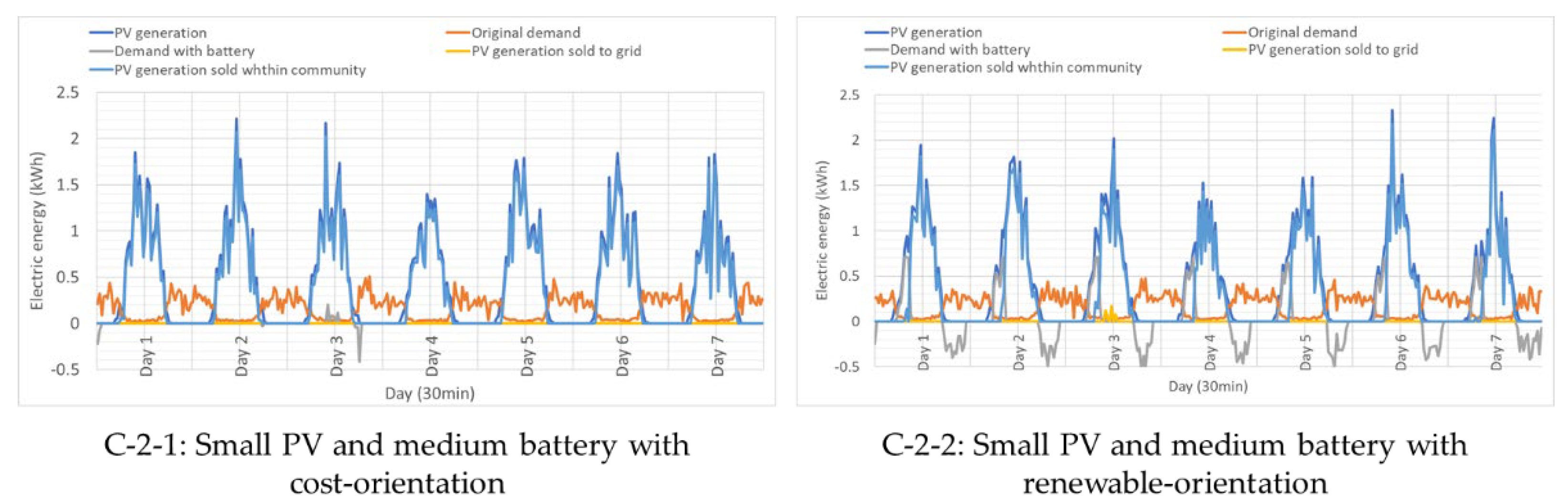

3.1. Simulation Cases

3.2. Results

- [Demand] is the total sum of consumed electricity by all homes and offices in the community (kWh).

- [PV generation] is the total generated electricity by all solar PV generation facilities (community-deployed solar PV plants and consumer-owned solar PV facilities) in the community (kWh).

- [Grid purchase amount] (kWh) is the total electricity that homes and offices purchase from the grid and use in the community.

- [Grid purchase cost] (JPY) is an expenditure for the purchased electricity from the grid, which is calculated from the system average price multiplied by the [Grid purchase amount].

- [Independence rate] (IndR) (%) is a ratio of community-deployed PV generation to community demand. It is calculated as {[Demand]–[Grid purchase amount] + battery net electricity storage}/{[Demand] + battery net electricity storage}. This is a focused core measure in this study because we consider that the higher the rate is, the higher the self-dependency on electricity in the community is achieved, which means being efficient in the use of renewable electricity in the community and also being resilient to critical events that would be caused by supply disruption of grid electricity.

- [PV sell amount to grid] (kWh) is the total amount of electricity sold to the grid that is produced by community-deployed PV facilities.

- [PV sell revenue to grid] (JPY) is revenue earned from electricity produced by community-deployed PVs and sold to the grid, which is calculated from the PV sell price multiplied by the [PV sell amount to grid].

- [Battery capacity] (kWh) is the total capacity installed in the community.

- [Battery loss] (kWh) is the total lost electricity due to the charge/discharge operation of the battery.

- [Community PV trading amount] (kWh) is the total amount of electricity traded (sell/buy) in the community.

- [Community PV trading revenue] (JPY) is revenue/cost earned/paid by electricity traded in the community.

- [Trade rate] (%) is the ratio of community PV power trading to demand, which is calculated by [Community PV trading amount]/[Demand].

- [Battery rate] (%) is the ratio of total battery charge amount to demand, which is calculated by total net electricity charge amount/[Demand].

- [Battery operation rate] is the ratio of total battery charge amount to battery capacity.

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IEA. Energy Technology Perspectives 2023. Available online: https://iea.blob.core.windows.net/assets/a86b480e-2b03-4e25-bae1-da1395e0b620/EnergyTechnologyPerspectives2023.pdf (accessed on 25 March 2023).

- Tokyo Metropolitan Government. Ordinance Revision to Halve Carbon Emissions (Carbon Half) 2022. Available online: https://www.kankyo.metro.tokyo.lg.jp/en/climate/solar_portal/document.files/ordinance_revision.pdf (accessed on 25 March 2023).

- Helm, C.; Mier, M. Steering the energy transition in a world of intermittent electricity supply: Optimal subsidies and taxes for renewables and storage. J. Environ. Econ. Manag. 2021, 109, 102497. [Google Scholar] [CrossRef]

- Asiaban, S.; Kayedpour, N.; Samani, A.E.; Bozalakov, D.; De Kooning, J.D.M.; Crevecoeur, G.; Vandevelde, L. Wind and solar intermittency and the associated integration challenges: A comprehensive review including the status in the Belgian power system. Energies 2021, 14, 2630. [Google Scholar] [CrossRef]

- Le, T.S.; Nguyen, T.N.; Bui, D.K.; Ngo, T.D. Optimal sizing of renewable energy storage: A techno-economic analysis of hydrogen, battery and hybrid systems considering degradation and seasonal storage. Appl. Energy 2023, 336, 120817. [Google Scholar] [CrossRef]

- Sagawa, D.; Tanaka, K.; Ishida, F.; Saito, H.; Takenaga, N.; Nakamura, S.; Aoki, N.; Nameki, M.; Saegusa, K. Bidding agents for PV and electric vehicle-owning uses in the electricity P2P trading market. Energies 2021, 14, 8309. [Google Scholar] [CrossRef]

- Sousa, T.; Soares, T.; Pinson, P.; Moret, F.; Baroche, T.; Sorin, E. Peer-to-peer and community-based markets: A comprehensive review. Renew. Sustain. Energy Rev. 2019, 104, 367–378. [Google Scholar] [CrossRef]

- Abdella, J.; Shuaib, K. Peer to Peer Distributed Energy Trading in Smart Grids: A Survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef]

- Morstyn, T.; Teytelboym, A.; McCulloch, M.D. Bilateral Contract Networks for Peer-to-Peer Energy Trading. IEEE Trans. Smart Grid 2019, 10, 2026–2035. [Google Scholar] [CrossRef]

- Sorin, E.; Bobo, L.; Pinson, P. Consensus-Based Approach to Peer-to-Peer Electricity Markets with Product Differentiation. IEEE Trans. Power Syst. 2019, 34, 994–1004. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Shrestha, A.; Bishwokarma, R.; Chapagain, A.; Banjara, S.; Aryal, S.; Mali, B.; Thapa, R.; Bista, D.; Hayes, B.P.; Papadakis, A.; et al. Peer-to-Peer Energy Trading in Micro/Mini-Grids for Local Energy Communities: A Review and Case Study of Nepal. IEEE Access 2019, 7, 131911–131928. [Google Scholar] [CrossRef]

- Liu, T.; Tan, X.; Sun, B.; Wu, Y.; Guan, X.; Tsang, D.H.K. Energy management of cooperative microgrids with P2P energy sharing in distribution networks. In Proceedings of the 2015 IEEE International Conference on Smart Grid Communications (SmartGridComm), Miami, FL, USA, 2–5 November 2015; pp. 410–415. [Google Scholar]

- Longo, A.; Markandya, A.; Petrucci, M. The internalization of externalities in the production of electricity: Willingness to pay for the attributes of a policy for renewable energy. Ecol. Econ. 2008, 67, 140–152. [Google Scholar] [CrossRef]

- Zori´c, J.; Hrovatin, N. Household willingness to pay for green electricity in Slovenia. Energy Policy 2012, 47, 180–187. [Google Scholar] [CrossRef]

- Tabi, A.; Hille, S.L.; Wüstenhagen, R. What makes people seal the green power deal?—Customer segmentation based on choice experiment in Germany. Ecol. Econ. 2014, 107, 206–215. [Google Scholar] [CrossRef]

- Dagher, L.; Harajli, H. Willingness to pay for green power in an unreliable electricity sector: Part 1. The case of the Lebanese residential sector. Renew. Sustain. Energy Rev. 2015, 50, 1634–1642. [Google Scholar] [CrossRef]

- Morstyn, T.; McCulloch, M.D. Multiclass Energy Management for Peer-to-Peer Energy Trading Driven by Prosumer Preferences. IEEE Trans. Power Syst. 2019, 34, 4005–4014. [Google Scholar] [CrossRef]

- Park, D.-H.; Park, J.-B.; Lee, K.Y.; Son, S.-Y.; Roh, J.H. A Bidding-Based Peer-to-Peer Energy Transaction Model Considering the Green Energy Preference in Virtual Energy Community. IEEE Access 2021, 9, 87410–87419. [Google Scholar] [CrossRef]

- Park, D.-H.; Park, Y.-G.; Roh, J.-H.; Lee, K.Y.; Park, J.-B. A Hierarchical Peer-to-Peer Energy Transaction Model Considering Prosumer’s Green Energy Preference. Int. J. Control. Autom. Syst. 2021, 19, 311–317. [Google Scholar] [CrossRef]

- Montakhabi, M.; Zobiri, F.; van der Graaf, S.; Deconinck, G.; Orlando, D.; Ballon, P.; Mustafa, M. An ecosystem view of peer-to-peer electricity trading: Scenario building by business model matrix to identify new roles. Energies 2021, 14, 4438. [Google Scholar] [CrossRef]

- Zepter, J.M.; Luth, A.; del Granado, P.C.; Egging, R. Prosumer integration in wholesale electricity markets: Synergies of peer-to-peer trade and residential storage. Energy Build. 2019, 184, 163–176. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F.; Matos, M. Optimal bidding strategy for an aggregator of prosumers in energy and secondary reserve markets. Appl. Energy 2019, 238, 1361–1372. [Google Scholar] [CrossRef]

- Lee, J.; Cho, Y. Estimation of the usage fee for peer-to-peer electricity trading platform: The case of South Korea. Energy Policy 2020, 136, 111050. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Bakirtzis, A. Optimal Bidding Strategy for Electric Vehicle Aggregators in Electricity Markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Capper, T.; Gorbatcheva, A.; Mustafa, M.; Bahloul, M.; Schwidtal, J.M.; Chitchyan, R.; Andoni, M.; Robu, V.; Montakhabi, M.; Scott, I.J.; et al. Peer-to-peer, community self-consumption, and transactive energy: A systematic literature review of local energy market models. Renew. Sustain. Energy Rev. 2022, 162, 112403. [Google Scholar] [CrossRef]

- Zhou, K.L.; Chong, J.; Lu, X.H.; Yang, S.L. Credit-based peer-to-peer electricity trading in energy blockchain environment. IEEE Trans. Smart Grid 2022, 13, 678–687. [Google Scholar] [CrossRef]

- Li, Z.G.; Chen, S.; Zhou, B.X. Electric vehicle peer-to-peer energy trading model based on SMES and blockchain. IEEE Trans. Appl. Supercond. 2021, 31, 5700804. [Google Scholar] [CrossRef]

- Reis, I.F.G.; Goncalves, I.; Lopes, M.A.R.; Antunes, C.H. Towards inclusive community-based energy markets: A multiagent framework. Appl. Energy 2022, 307, 118115. [Google Scholar] [CrossRef]

- Kim, S.J.; Chu, Y.O.; Kim, H.J.; Kim, H.T.; Moon, H.S.; Sung, J.H.; Yoon, Y.T.; Jin, Y.G. Analyzing various aspects of network losses in peer-to-peer electricity trading. Energies 2022, 15, 686. [Google Scholar] [CrossRef]

- Chung, M.H. Comparison of economic feasibility for efficient peer-to-peer electricity trading of PV-equipped residential house in Korea. Energies 2020, 13, 3568. [Google Scholar] [CrossRef]

- TEPCO Electricity Forecast. Available online: https://www.tepco.co.jp/forecast/html/download-j.html (accessed on 13 February 2023).

- Japan Meteorological Agency. Available online: https://www.data.jma.go.jp/gmd/risk/obsdl/index.php (accessed on 13 February 2023).

- Arpak Report. Available online: https://www.kankyo.metro.tokyo.lg.jp/climate/home/energy.files/syouhidoukouzittaityousa26honpen_3.pdf (accessed on 13 February 2023).

- Energy Management System Open Data. Available online: https://www.ems-opendata.jp/ (accessed on 13 February 2023).

- Kwac, J.; Flora, J.; Rajagopal, R. Household Energy Consumption Segmentation Using Hourly Data. IEEE Trans. Smart Grid 2014, 5, 420–430. [Google Scholar] [CrossRef]

- Gaete-Morales, C.; Kramer, H.; Schill, W.P. An open tool for creating battery-electric vehicle time series from empirical data, emobpy. Sci. Data 2021, 8, 152. [Google Scholar] [CrossRef]

| No. | Data Name | Description |

|---|---|---|

| 1 | Power Demand Data within Tokyo Electric Power Company Jurisdiction | Hourly power demand data of Tokyo Electric Power Company in the past (FY2013). http://www.tepco.co.jp/forecast/html/download-j.html [32], accessed on 25 March 2023 |

| 2 | Actual Meteorological Information in Tokyo Area | Past meteorological information from the Japan Meteorological Agency. Meteorological elements include temperature, precipitation, humidity, wind speed, wind direction, and solar radiation. http://www.data.jma.go.jp/gmd/risk/obsdl/index.php [33], accessed on 25 March 2023 |

| 3 | Monthly Electricity Consumption by Household Type | Tokyo Metropolitan Government, Report on the Actual Conditions of Energy Consumption Trends in Households (pp. 30–32). https://www.kankyo.metro.tokyo.lg.jp/climate/home/energy.files/syouhidoukouzittaityousa26honpen_3.pdf [34], accessed on 25 March 2023 |

| 4 | SII Power Demand Data of Businesses/Building Area and Attribute Data of Businesses | Obtained from EMS OPENDATA of The Environmental Co-creation Initiative. https://www.ems-opendata.jp/ [35], accessed on 25 March 2023 |

| Unclassified industry |

| Medical, welfare |

| Construction industry |

| Manufacturing industry |

| Wholesale and retail industry |

| Real estate and rental industry |

| Accommodation and food services industry |

| Academic research, professional and technical services industry |

| Lifestyle-related services and entertainment industry |

| Education, learning support industry |

| Transportation and postal services industry |

| Defined Variables (in Italics) | Description | Unit |

|---|---|---|

| demand | The total energy demand. | kWh |

| pv_generation | The energy generated from PV (photovoltaic) panels. | kWh |

| pure_demand | The demand remaining after accounting for PV and wind generation. | kWh |

| wind_generation | The energy generated from wind turbines. | kWh |

| pv_surplus | The surplus energy generated from PV panels. | kWh |

| wind_surplus | The surplus energy generated from wind turbines. | kWh |

| trading_preference | The preference for energy trading strategy: self-consumption, renewable-oriented, or cost-priority. | kWh |

| ev_dischargable_amount | The amount of energy that can be discharged from the EV. | kWh |

| ev_soc | The state of charge of the EV battery. | kWh |

| shortage | The energy deficit that needs to be met after considering generation, battery discharge, and EV charging. | kWh |

| ev_consumption | The energy consumed by the EV. | kWh |

| bat_dischargable_amount | The amount of energy that can be discharged from the battery. | kWh |

| ev_chargable_amount | The amount of energy that can be charged to the EV. | kWh |

| ev_soc_kwh | The state of charge of the EV battery in kilowatt-hours. | kWh |

| bat_soc_kwh | The state of charge of the battery in kilowatt-hours. | kWh |

| bat_chargable_amount | The amount of energy that can be charged to the battery. | kWh |

| surplus_pv_all | The total surplus energy generated from PV panels across all agents. | kWh |

| surplus_wind_all | The total surplus energy generated from wind turbines across all agents. | kWh |

| shortage_all | The total energy deficit across all agents. | kWh |

| shortage_all_re_preference | The total energy deficit for agents with a “Renewable-oriented” trading preference. | kWh |

| shortage_all_self_consuming | The total energy deficit for agents with a “Self-consumption” trading preference. | kWh |

| shortage_all_cost_priority | The total energy deficit for agents with a “Cost-priority” trading preference. | kWh |

| all_agent_list | The list of all agents participating in the energy trading system. | - |

| 1. Calculate pure_demand: pure_demand = demand-pv_generation-wind_generation 2. If pure_demand >= 0 (generation does not cover consumption): 2.1. Set pv_surplus = 0 and wind_surplus = 0 2.2. If trading_preference in [“Self-consumption”, “Renewable-oriented”]: 2.2.1. Discharge as much as possible from the battery 2.2.2. If EV is at home base (discharging only possible during this time): 2.2.2.1. If not owning an EV: set ev_dischargable_amount = 0 2.2.2.2. Else, if owning an EV: 2.2.2.2.1. Calculate EV state of charge 2.2.2.2.2. If ev_soc <= 0.5: charge the EV 2.2.2.2.3. Else, discharge the EV 2.2.2.3. Calculate shortage 2.2.3. Else, if EV is driving: 2.2.3.1. Calculate EV consumption 2.2.3.2. Calculate shortage (without considering ev_discharge_amount) 2.2.4. Update battery state of charge 2.2.5. Update EV state of charge 2.3. ElseIf trading_preference is “Cost-priority”: 2.3.1. Set bat_dischargable_amount = None (decide battery discharge in Phase 2 considering cost) 2.3.2. If EV is at home base: 2.3.2.1. If not owning an EV: set ev_soc = None and ev_chargable_amount = 0 2.3.2.2. Else, if owning an EV: 2.3.2.2.1. Calculate EV state of charge 2.3.2.2.2. If ev_soc <= 0.5: charge the EV as much as possible 2.3.2.2.3. Else: set ev_chargable_amount = None (decide EV discharge in Phase 2 considering cost) 2.3.2.3. If ev_chargable_amount is not None: update shortage and ev_soc_kwh 2.3.2.4. Else: set shortage = pure_demand 2.3.3. Else, if EV is in use (driving): 2.3.3.1. Calculate EV consumption 2.3.3.2. Set shortage = pure_demand 3. Else (if the demand is fully met by generation): 3.1. Set shortage = 0 3.2. If trading_preference is “Self-consumption” or “Renewable-oriented”: 3.2.1. Calculate battery charge amount 3.2.2. If EV is at home base: 3.2.2.1. Calculate EV charge amount 3.2.2.2. Calculate PV surplus 3.2.3. Else (if EV is in use): 3.2.3.1. Calculate EV consumption 3.2.3.2. Calculate PV surplus 3.2.4. Update battery and EV state of charge: 3.2.4.1. Update bat_soc_kwh 3.2.4.2. Update ev_soc_kwh (assuming PHEV and running on gasoline if below 0) 3.2.5. Set wind surplus: wind_surplus = wind_generation (all wind generation is surplus as it does not exist at household/business level) 3.3. ElseIf trading_preference is “Cost-priority”: 3.3.1. Calculate PV surplus 3.3.2. Set wind surplus: wind_surplus = wind_generation (all wind generation is surplus as it does not exist at household/business level) 3.3.3. Set bat_chargable_amount = None (decide to charge in Phase 2) 3.3.4. If EV is at home base: 3.3.4.1. If not owning an EV: set ev_soc = None and ev_chargable_amount = 0 3.3.4.2. Else, if owning an EV: 3.3.4.2.1. Calculate EV state of charge 3.3.4.2.2. If ev_soc <= 0.5: charge the EV as much as possible 3.3.4.2.3. Else: set ev_chargable_amount = None 3.3.5. Else (if EV is in use): 3.3.5.1. Calculate EV consumption 3.3.6. If ev_chargable_amount is not None: 3.3.6.1. Set shortage = max(ev_chargable_amount, 0) 3.3.6.2. Update ev_soc_kwh 3.3.7. Else: 3.3.7.1. Set shortage = 0 |

| Preferences | Type of Generations | Buying Prices |

|---|---|---|

| Cost-oriented | PV | 21 |

| Renewable-oriented | PV | 25 |

| Self-consumption | PV | 23 |

| Type | Prices |

|---|---|

| Grid power purchasing | 22 |

| PV sales to the grid | 15 |

|

| 1. If there is no surplus PV and wind generation in the community and there is an overall shortage: 1.1. For each agent in the community: 1.1.1. Determine the agent’s shortage 1.1.2. If the agent’s trading_preference is “Cost-oriented”: 1.1.2.1. If there is a shortage: 1.1.2.1.1. Discharge the battery up to its discharge speed or until the shortage is met 1.1.2.1.2. If the agent’s EV is at home, discharge the EV up to its discharge speed or until the remaining shortage is met 1.1.2.1.3. Update the agent’s battery and EV states of charge, and chargeable amounts 1.1.2.1.4. Update the agent’s grid purchase amount, shortage, and community PV and wind purchase amount to zero 1.1.2.2. If there is no shortage: 1.1.2.2.1. Do not discharge the battery or EV 1.1.2.2.2. Update the agent’s grid purchase amount, shortage, and community PV and wind purchase amount to zero 1.1.3. If the agent’s trading_preference is “Self-consumption” or “Renewable-oriented”: 1.1.3.1. Since these agents have already been discharged in phase 1, do not discharge them further 1.1.3.2. Update the agent’s grid purchase amount to meet the shortage, and set the shortage, community PV, and community wind purchase amounts to zero 2. If there is surplus PV and wind generation in the community, but it is not sufficient to cover the needs of all agents: 2.1. Calculate the pure_demand for all agents 2.2. Allocate surplus PV and wind generation to agents based on their trading preferences: 2.2.1. Calculate the amount of surplus PV and wind generation that can be allocated to each preference group (Renewable-oriented, Self-consumption, and Cost-oriented) 2.2.2. Calculate the allocation rates for each preference group based on their shortages and surplus PV and wind generation 2.2.3. For each agent in the community: 2.2.3.1. Assign the allocation rate based on the agent’s trading preference 2.2.3.2. Set the PV and wind prices based on the agent’s trading preference 2.2.3.3. Update the agent’s shortage based on the allocated energy 2.2.3.4. Determine the amount of energy supplied from PV and wind based on the surplus PV and wind generation 2.2.3.5. If the agent’s trading_preference is “Cost-oriented”: 2.2.3.5.1. Discharge the battery if it has not been discharged yet, and update the battery state of charge, shortage, and charge amount 2.2.3.5.2. If the agent’s EV is at home and has not been discharged yet, discharge the EV, and update the EV state of charge, shortage, and charge amount 2.2.3.5.3. Update the agent’s grid purchase amount to cover the remaining shortage, and set the shortage to zero. 3. If there is enough surplus PV and wind generation to cover the needs of all agents in the community: 3.1. Satisfy the energy demands of all agents 3.2. Calculate the amount of energy that can be absorbed by the batteries and EVs of all agents 3.3. Set the PV and wind prices to the standard price 3.4. Set the shortage to zero 3.5. For each agent in the community: 3.5.1. Calculate the supplied energy based on the agent’s shortage and surplus PV and wind generation 3.5.2. Assign the energy supplied from PV and wind based on the surplus PV and wind generation 3.5.3. Calculate the total chargeable amount for each agent’s battery and EV 3.5.4. Update the total chargeable amount for all agents’ batteries and EVs 3.6. Calculate the allocation rate for charging based on the total chargeable amount for all agents’ batteries and EVs and the remaining surplus energy 3.7. For each agent in the community: 3.7.1. Update the battery charged amount and calculate the chargeable amount for phase 2 3.7.2. Calculate the amount of energy charged in phase 2 based on the allocation rate 3.7.3. Update the battery state of charge (SOC) and total charge amount 3.7.4. If the agent’s EV is at home, perform the same calculations for the EV 3.7.4.1. Update the EV charged amount and calculate the chargeable amount for phase 2 3.7.4.2. Calculate the amount of energy charged in phase 2 based on the allocation rate 3.7.4.3. Update the EV state of charge (SOC) and total charge amount 3.7.5. If the agent’s EV is not at home, set the charged amount in phase 2 to zero 3.7.6. Allocate the energy charged in phase 2 to the community PV and wind generation based on the surplus PV and wind generation |

| Cases | Home/Office PV Capacity | Home/Office Battery Capacity | ||

|---|---|---|---|---|

| Base | None | None | ||

| A-1 | Large | Small | ||

| A-2 | Large | Medium | ||

| A-3 | Large | Large | ||

| B-1 | Medium | Small | ||

| B-2 | Medium | Medium | ||

| B-3 | Medium | Large | ||

| C-1 | Small | Small | ||

| C-2 | Small | Medium | ||

| C-3 | Small | Large | ||

| Home PV | Office PV | Home Battery | Office Battery | |

| D-1 | Extra-small | Extra-large | Small | Extra-large |

| D-2 | Extra-small | Extra-large | Medium | Extra-large |

| D-3 | Extra-small | Extra-large | Large | Extra-large |

| Cases | Demand | PV Generation | Grid Purchase Amount | Grid Purchase Cost | Independence Rate (IndR) | PV Sell Amount to Grid | PV Sell Revenue to Grid | Battery Capacity | Battery Loss | Community PV Trading Amount | Community PV Trading Revenue | Trade Rate | Battery Rate | Battery Operation Rate |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Base | 338,862 | 41,025 | 299,889 | 6,597,552 | 12% | 0 | 0 | 0 | 0 | 38,974 | 961,132 | 12% | 0% | - |

| A-1 | 338,258 | 326,796 | 151,640 | 3,336,086 | 55% | 123,354 | 1,850,308 | 1100 | 873 | 141,377 | 3,018,140 | 42% | 2% | 7.49 |

| A-1-1 | 338,236 | 325,007 | 149,900 | 3,297,796 | 56% | 119,761 | 1,796,415 | 1100 | 818 | 148,098 | 3,110,065 | 44% | 2% | 7.00 |

| A-1-2 | 338,511 | 325,007 | 152,549 | 3,356,076 | 55% | 122,379 | 1,835,680 | 1100 | 902 | 138,568 | 2,992,221 | 41% | 3% | 7.75 |

| A-1-3 | 338,258 | 325,007 | 152,996 | 3,365,914 | 55% | 123,077 | 1,846,153 | 1100 | 903 | 137,818 | 2,932,895 | 41% | 3% | 7.76 |

| A-2 | 338,035 | 326,796 | 148,914 | 3,276,108 | 56% | 120,633 | 1,809,502 | 1650 | 1292 | 141,677 | 3,026,465 | 42% | 4% | 7.38 |

| A-2-1 | 338,234 | 325,007 | 146145 | 3,215,200 | 57% | 115,679 | 1,735,184 | 1650 | 1227 | 152,180 | 3,195,786 | 45% | 3% | 7.00 |

| A-2-2 | 338,376 | 325,007 | 150,488 | 3,310,744 | 55% | 120,262 | 1,803,925 | 1650 | 1342 | 137,188 | 2,961,467 | 41% | 4% | 7.68 |

| A-2-3 | 338,201 | 325,007 | 150,868 | 3,319,096 | 55% | 120,815 | 1,812,226 | 1650 | 1343 | 136,583 | 2,908,509 | 40% | 4% | 7.69 |

| A-3 | 338,173 | 326,796 | 145,519 | 3,201,413 | 57% | 116,866 | 1,752,986 | 2200 | 1723 | 143,023 | 3,054,790 | 42% | 5% | 7.39 |

| A-3-1 | 338,248 | 325,007 | 142,449 | 3,133,870 | 58% | 111,638 | 1,674,570 | 2200 | 1636 | 156,223 | 3,280,678 | 46% | 5% | 7.00 |

| A-3-2 | 338,369 | 325,007 | 148,276 | 3,262,072 | 56% | 117867 | 1,768,009 | 2200 | 1780 | 136,097 | 2,939,624 | 40% | 5% | 7.64 |

| A-3-3 | 338,274 | 325,007 | 148,660 | 3,270,525 | 56% | 118,340 | 1,775,097 | 2200 | 1785 | 135,568 | 2,887,727 | 40% | 5% | 7.66 |

| B-1 | 338,183 | 245,077 | 161,515 | 3,553,333 | 52% | 55,702 | 835,537 | 1100 | 852 | 138,547 | 2,980,972 | 41% | 2% | 7.31 |

| B-1-1 | 338,214 | 243,485 | 158,811 | 3,493,851 | 53% | 51,248 | 768,722 | 1100 | 818 | 146,395 | 3,074,301 | 43% | 2% | 7.00 |

| B-1-2 | 338,375 | 243,485 | 162,831 | 3,582,292 | 52% | 55,390 | 830,854 | 1100 | 877 | 135,259 | 2,952,826 | 40% | 2% | 7.52 |

| B-1-3 | 338,266 | 243,485 | 163,213 | 3,590,694 | 52% | 55,879 | 838,190 | 1100 | 878 | 134,754 | 2,887,359 | 40% | 2% | 7.53 |

| B-2 | 337,923 | 245,077 | 158,736 | 3,492,197 | 53% | 52,966 | 794,493 | 1650 | 1273 | 138,856 | 2,989,854 | 41% | 4% | 7.28 |

| B-2-1 | 338,222 | 243,485 | 155,040 | 3,410,886 | 54% | 47,139 | 707,081 | 1650 | 1227 | 150,506 | 3,160,618 | 44% | 3% | 7.00 |

| B-2-2 | 338,366 | 243,485 | 161,411 | 3,551,050 | 52% | 53,806 | 807,085 | 1650 | 1305 | 133,312 | 2,929,506 | 39% | 4% | 7.46 |

| B-2-3 | 338,273 | 243,485 | 161,786 | 3,559,290 | 52% | 54,273 | 814,089 | 1650 | 1306 | 132,835 | 2,854,487 | 39% | 4% | 7.47 |

| B-3 | 338,097 | 245,077 | 156,886 | 3,451,499 | 53% | 50,733 | 760,996 | 2200 | 1687 | 138,594 | 2,989,651 | 41% | 5% | 7.23 |

| B-3-1 | 338,206 | 243,485 | 151,366 | 3,330,044 | 55% | 43,151 | 647,264 | 2200 | 1636 | 154,493 | 3,244,343 | 46% | 5% | 7.00 |

| B-3-2 | 338,407 | 243,485 | 160,253 | 3,525,573 | 52% | 52,445 | 786,673 | 2200 | 1727 | 131,136 | 2,879,279 | 39% | 5% | 7.41 |

| B-3-3 | 338,338 | 243,485 | 160,695 | 3,535,296 | 52% | 52,960 | 794,393 | 2200 | 1724 | 130,622 | 2,807,462 | 39% | 5% | 7.39 |

| C-1 | 338,012 | 122,498 | 221,788 | 4,879,327 | 34% | 112 | 1672 | 1100 | 572 | 89,718 | 2,096,405 | 27% | 2% | 4.82 |

| C-1-1 | 338,206 | 121,201 | 222,612 | 4,897,462 | 34% | 0 | 0 | 1100 | 57 | 93,615 | 1,965,907 | 28% | 0% | 0.26 |

| C-1-2 | 338,411 | 121,201 | 223,806 | 4,923,731 | 34% | 328 | 4918 | 1100 | 765 | 86,163 | 2,134,756 | 25% | 2% | 6.53 |

| C-1-3 | 338,214 | 121,201 | 223,556 | 4,918,237 | 34% | 275 | 4130 | 1100 | 765 | 86,223 | 1,969,624 | 25% | 2% | 6.53 |

| C-2 | 338,233 | 122,498 | 221,900 | 4,881,803 | 34% | 0 | 0 | 1650 | 845 | 87,391 | 2,045,261 | 26% | 2% | 4.75 |

| C-2-1 | 338,217 | 121,201 | 222,374 | 4,892,238 | 34% | 0 | 0 | 1650 | 71 | 93,615 | 1,965,907 | 28% | 0% | 0.18 |

| C-2-2 | 338,320 | 121,201 | 223,785 | 4,923,260 | 34% | 300 | 4504 | 1650 | 1141 | 82,691 | 2,047,948 | 24% | 3% | 6.49 |

| C-2-3 | 338,219 | 121,201 | 223,631 | 4,919,885 | 34% | 249 | 3732 | 1650 | 1140 | 82,750 | 1,889,751 | 24% | 3% | 6.49 |

| C-3 | 338,370 | 122,498 | 222,015 | 4,884,340 | 34% | 0 | 0 | 2200 | 1101 | 84,957 | 1,991,712 | 25% | 3% | 4.63 |

| C-3-1 | 338,199 | 121,201 | 222,108 | 4,886,385 | 34% | 0 | 0 | 2200 | 85 | 93,615 | 1,965,907 | 28% | 0% | 0.13 |

| C-3-2 | 338309 | 121,201 | 223,760 | 4,922,720 | 34% | 193 | 2902 | 2200 | 1514 | 79,308 | 1,963,318 | 23% | 4% | 6.46 |

| C-3-3 | 338,206 | 121,201 | 223,614 | 4,919,512 | 34% | 153 | 2301 | 2200 | 1512 | 79,350 | 1,813,432 | 23% | 4% | 6.45 |

| D-1 | 338,548 | 338,047 | 90,420 | 1,989,243 | 73% | 66,119 | 991,790 | 13,000 | 8542 | 73,657 | 1,554,804 | 22% | 24% | 6.24 |

| D-1-1 | 338278 | 336,849 | 84,061 | 1,849,348 | 75% | 58,148 | 872,225 | 13,000 | 8010 | 108,252 | 2,273,287 | 32% | 22% | 5.85 |

| D-1-2 | 338,371 | 336,849 | 96,584 | 2,124,849 | 71% | 71,798 | 1,076,967 | 13,000 | 8914 | 49,016 | 1,039,403 | 14% | 25% | 6.52 |

| D-1-3 | 338,306 | 336,849 | 96,484 | 2,122,640 | 71% | 71,731 | 1,075,971 | 13,000 | 8945 | 49,032 | 1,034,849 | 14% | 25% | 6.54 |

| D-2 | 338,455 | 338,047 | 87,122 | 1,916,675 | 74% | 62,739 | 941,082 | 13,500 | 8888 | 75,376 | 1,590,744 | 22% | 25% | 6.25 |

| D-2-1 | 338,262 | 336,849 | 80,676 | 1,774,872 | 76% | 54,480 | 817,201 | 13,500 | 8382 | 111,919 | 2,350,291 | 33% | 24% | 5.89 |

| D-2-2 | 338,371 | 336,849 | 93,364 | 2,054,006 | 72% | 68,455 | 1,026,828 | 13,500 | 9269 | 49,472 | 1,048,988 | 15% | 26% | 6.52 |

| D-2-3 | 338,276 | 336,849 | 93,195 | 2,050,297 | 72% | 68,385 | 1,025,775 | 13,500 | 9276 | 49,503 | 1,044,743 | 15% | 26% | 6.53 |

| D-3 | 338,494 | 338,047 | 83,944 | 1,846,769 | 75% | 59,332 | 889,985 | 14,000 | 9234 | 77,481 | 1,635,096 | 23% | 26% | 6.26 |

| D-3-1 | 338,328 | 336,849 | 77,374 | 1,702,232 | 77% | 50,811 | 762,164 | 14,000 | 8754 | 115,575 | 2,427,081 | 34% | 25% | 5.93 |

| D-3-2 | 338,447 | 336,849 | 89,871 | 1,977,155 | 73% | 64,730 | 970,946 | 14,000 | 9622 | 50,888 | 1,078,727 | 15% | 27% | 6.53 |

| D-3-3 | 338,288 | 336,849 | 90,074 | 1,981,637 | 73% | 65,122 | 976,830 | 14,000 | 9611 | 50,537 | 1,066,469 | 15% | 27% | 6.52 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Goto, M.; Kitamura, H.; Sagawa, D.; Obara, T.; Tanaka, K. Simulation Analysis of Electricity Demand and Supply in Japanese Communities Focusing on Solar PV, Battery Storage, and Electricity Trading. Energies 2023, 16, 5137. https://doi.org/10.3390/en16135137

Goto M, Kitamura H, Sagawa D, Obara T, Tanaka K. Simulation Analysis of Electricity Demand and Supply in Japanese Communities Focusing on Solar PV, Battery Storage, and Electricity Trading. Energies. 2023; 16(13):5137. https://doi.org/10.3390/en16135137

Chicago/Turabian StyleGoto, Mika, Hiroshi Kitamura, Daishi Sagawa, Taichi Obara, and Kenji Tanaka. 2023. "Simulation Analysis of Electricity Demand and Supply in Japanese Communities Focusing on Solar PV, Battery Storage, and Electricity Trading" Energies 16, no. 13: 5137. https://doi.org/10.3390/en16135137

APA StyleGoto, M., Kitamura, H., Sagawa, D., Obara, T., & Tanaka, K. (2023). Simulation Analysis of Electricity Demand and Supply in Japanese Communities Focusing on Solar PV, Battery Storage, and Electricity Trading. Energies, 16(13), 5137. https://doi.org/10.3390/en16135137