Abstract

Nowadays decarbonisation of the energy system is one of the main concerns for most governments. Renewable energy technologies, such as rooftop photovoltaic systems and home battery storage systems, are changing the energy system to be more decentralised. As a consequence, new ways of energy business models are emerging, e.g., peer-to-peer energy trading. This new concept provides an online marketplace where direct energy exchange can occur between its participants. The purpose of this study is to conduct a content analysis of the existing literature, ongoing research projects, and companies related to peer-to-peer energy trading. From this review, a summary of the most important aspects and journal papers is assessed, discussed, and classified. It was found that the different energy market types were named in various ways and a proposal for standard language for the several peer-to-peer market types and the different actors involved is suggested. Additionally, by grouping the most important attributes from peer-to-peer energy trading projects, an assessment of the entry barrier and scalability potential is performed by using a characterisation matrix.

1. Introduction

Decarbonisation of the energy sector is one of the main objectives on which governments around the globe have been working. The German government decided recently to re-adapt its climate objectives for achieving climate neutrality in the year 2045 [1]. The expansion of renewable energy systems is a key measure to accomplish this objective. In Germany, renewable energy is distributed with a share of more than 30% owned by private actors [2], converting them into prosumers and enabling them to participate more actively in the energy market [3]. Among photovoltaics and wind turbines, other technologies such as battery storage systems (BSSs), electric vehicles, heat pumps, and (mini) combined heat and power units (CHP), are forming a network of distributed energy resources (DER) [4]. The increasing power capacity of DER is changing energy generation from a centralised scheme to a more decentralised and flexible one. The agglomeration of DER contributes to a significant energy generation capacity in the energy system [5]. Moreover, the networking and centralised operation of this group of DER can be depicted as a virtual power plant (VPP) [6].

Power grids traditionally operate in a unidirectional way and the electricity fed into the system comes mostly from conventional power plants. However, awareness of climate change, government incentives, and improvements in the efficiency of renewable energy technologies and flexibility options are accelerating the installation of DER [4] and consequently, the adaptation of the current operational mode of the power grid is required. Microgrids (MGs), defined as the group of DER and loads with the ability to disconnect and re-connect with an upstream grid [7], are usually located in a defined geographical zone and able to increase the security of supply in case of system failures, such as the controlled shutdown of the power supply in given areas and even a blackout situation [8,9]. With the development and adoption of information and communication technologies (ICT), the concept of a smart grid (SG) is emerging. The employment of ICT devices enables the transformation of the current grid into an SG, allowing the bidirectional flow of both electricity and real-time data in the current electrical grid [10]. Together, ICT and SGs enable the interconnection of several MGs physically or virtually to create Cells, considered as a group of MGs that can exchange energy and data [11] (p. 3). Similarly, other new terms such as Internet of Energy and Industrial Internet of Things (IIoT), which derive from IoT technology, refer to the communication and efficient flow of energy and data between generation and demand via energy management systems [12,13].

As a consequence of the above technologies, innovative networking of assets and enabling technologies such as Distributed Ledger Technologies (DLTs) (e.g., Blockchain), original and novel business models for the energy systems are also emerging, including the market and trading infrastructures [14]. In this context, peer-to-peer energy trading (P2P-ET) provides an online marketplace where direct energy exchange can occur between its participants, namely, prosumers and consumers [15]. P2P-ET offers techno-economical benefits to its participants and brings savings to them [16]. Due to the aggregated load profiles, generation, and flexibility technologies, P2P-ET can provide ancillary services, such as frequency control or congestion management, by controlling thousands of decentralized BSSs as in the case of the German demonstrator Sonnen [17]. In addition, it can improve the efficiency of local distributed generation and demand balance as well as improve grid flexibility [18]. Moreover, prosumers and consumers are empowered as they gain active participation in energy procurement by setting their electricity prices according to their personal preferences and objectives [11] (p. 3).

Due to all the changes that the current energy system will suffer in the future, our paper wants to expand the knowledge of P2P-ET by collecting and classifying journal papers, research projects, and companies related to the topic. Moreover, definitions of the main aspects concerning P2P-ET are formulated always based on different sources. Within our research, an interchangeable use of several terms that can often lead to confusion concerning P2P-ET has been identified. For example, terms such as administrator, coordinator, and manager, are sometimes used differently depending on which P2P-ET market is being referenced. From our knowledge, a distinct definition of types of P2P-ET is necessary since many times these concepts are used with different meanings. Last but not less important, a techno-economic characterisation matrix to assess the entry barrier and the scalability potential is done to classify and evaluate projects depending on their characteristics. Although several papers [19,20,21,22] list projects and demonstrators around the world showing its main aspects and some others perform evaluation performance indicators on models [23,24,25], a techno-economic characterisation matrix from the end-customer point of view of P2P-ET projects was not found yet. While the main aspects of P2P-ET projects focus on general information such as year of operation and country, on the other hand, a techno-economic characterisation matrix aims to provide additional information such as entry barriers and scalability potential for P2P-ET concepts.

This paper presents a profound overview and classification of the existing literature related to peer-to-peer energy trading, a standard language for different market types and actors, and a techno-economic characterization matrix to evaluate the entry barrier and scalability potential of P2P-ET projects. The questions to be addressed by this study include:

- What is the current state-of-the-art of peer-to-peer for energy trading?

- How many market types exist? What are their characteristics? Which names are used?

- How can we evaluate projects depending on their entry barrier and scalability potential?

The contributions pursued with this research are summarized as follows:

- Literature overview with classification and grouping of literature sources according to the main aspects of research in P2P-ET.

- Main classification and sub-classification scheme of different market structures of P2P-ET.

- Standard terms language for energy markets and actor roles for each market structure of P2P-ET.

- Techno-economic characterisation matrix of P2P-ET projects and demonstrators in the form of a table with a focus on entry barrier and scalability potential.

2. Literature Review

This section is divided into four segments: overview and general information of P2P-ET, market designs, distributed ledger technology, and pricing mechanisms in P2P-ET. Section 2.1 presents a summary of the literature that overviews the general situation of P2P-ET, research projects, companies, and demonstrators. Additionally, a cluster of literature with the key aspects and research focus involved in P2P-ET is depicted. Section 2.2 provides a thorough review of the three main sub-categories of market designs in P2P-ET with their respective advantages and disadvantages. Section 2.3 defines distributed ledger technology and presents the literature researched. Finally, Section 2.4 presents different price mechanisms used in the literature for P2P-ET markets.

2.1. Overview and General Information about P2P-ET

The existing literature on P2P-ET is extensive and it has enabled the conception of innovative solutions combining key aspects, technologies, and different interaction layers present in P2P-ET. Information about the energy evolution and explanation of P2P-ET models from a theoretical point of view is analysed by Giotitsas et al. [26], providing three different types of P2P-ET networks. Moreover, a design of an ideal P2P-ET model within a social context is developed backed up on the principle of commons-based peer production. Abdella et al. [27] presented a comprehensive survey of existing demand response optimization models, power routing devices, and power routing algorithms from the perspective of MGs. It provides furthermore a listing of challenges and enabling technologies for future P2P-ET. A clear definition of P2P-ET with its potential impacts on the actual power system, key factors for deployment, and a worldwide list of project trials is presented in [18], contributing also a checklist that resumes the most important requirements for implementation of P2P-ET, namely: technical requirements, policies needed, regulatory requirements and stakeholder roles and responsibilities. A complete overview of P2P-ET can be found in the literature review paper [28], displaying a summary and classification of journal papers, research projects, industrial projects, and a thorough review of key aspects concerning P2P-ET. The authors provided also a scheme with the possible market structures in which P2P-ET can be installed. Tushar et al. in [29] provided an overview of the use of game-theory approaches for different P2P-ET structures as a feasible and effective means of energy management, providing a classification of literature that applies game-theoretic approaches.

Table 1 resumes a grouping of the literature researched with a focus on the theoretical aspects and test case studies of P2P-ET. The aspects considered for the classification of literature are based on sources [20,28] and are the following: P2P-ET market design, P2P/P2G (Peer-to-grid) market design, P2P-ET sector coupling design, Physical and Virtual Layer, social, policy, and legal perspectives. Specifically, the P2P/P2G market design and P2P-ET on sector coupling categories have not been considered as classification categories in the researched literature, to the best of our knowledge. P2G is defined in this context as the ability to exchange electricity between interconnected MGs and, additionally, with an upper grid if the interconnection exists. Additionally, research papers on political and legal aspects are considered, although it is not deeply discussed in this paper, as it widely differs for each country. Note that several studies may cover more than one aspect.

Table 1.

Cluster of papers with a focus on theoretical perspectives.

Table 1.

Cluster of papers with a focus on theoretical perspectives.

| Focus/Approach/Area | Sources |

|---|---|

| P2P market design | [3,8,9,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56] |

| P2P/P2G market design | [9,11,16,42,46,57,58,59,60] |

| P2P design on sector coupling | [61,62,63,64] |

| Physical and virtual Layer | [3,13,25,34,40,51,56,65,66,67,68,69,70,71,72,73,74,75,76] |

| Social perspectives | [66,71,77,78,79,80,81,82,83,84,85,86] |

| Policy perspectives | [66,77,83,84,86,87] |

| Legal perspectives | [66,88,89,90] |

Besides providing an overview of P2P-ET market designs, several papers provide test case studies to evaluate results more accurately. Indeed, Ref. [37] proposed a reference test case on an Institute of Electrical and Electronics Engineers (IEEE) 14 bus-network to present realistic results of three P2P-ET market designs (Full, Community and Hybrid). In [41] the authors presented a theoretical review of two centralised P2P-ET designs: bilateral contract-based and auction-based trading mechanisms. It also provided an evaluation of direct trading market designs and possible new actors. In [32] a novel concept bringing together P2P-ET transactions and VPPs is presented. This new system is called Federated Power Plants and aims to encourage prosumers to participate in the upstream electricity market. Ref. [45] proposes a scalable option for a P2P-ET market applying bilateral contracts between prosumers, suppliers (intermediary), and generators (fuel-based), introducing forward and real-time markets. Ref. [44] proposes a multi-class energy management P2P-ET platform, which considered three energy classes (green, subsidized, and grid) along with three different types of prosumers (green, philanthropic, and low-income household), that can trade energy with each other and with the wholesale electricity market. Ref. [54] presents a distributed system operator (DSO) pricing strategy based on locational marginal pricing for a distribution network of 57 prosumers divided consequently into two P2P-ET platforms. Finally and in line with previous papers, Ref. [53] showed an overview of different business models that P2P-ET can support and reviews the mathematical frameworks that have been proposed for designing P2P-ET and other prosumer-centric energy markets. Ref. [34], the authors considered a distribution network with a central generator and prosumers employing a canonical coalition game to study the prosumers’ behaviour. Ref. [47], they extended their previous work by applying a cooperative Stackelberg game to the same network scheme doubling the number of players and implementing an auction-based price mechanism.

A series of innovative market designs and optimization mathematical frameworks have been proposed. The authors from [30] proposed an algorithm to cluster prosumers that can balance their energy needs into the new concept of virtual MGs. A localized event-driven market, i.e., due to seasonality and hours with maximum solar energy generation, with a not-so-common reinforcement learning technique is presented in [39]. As an extension of previous work, a deep reinforcement learning technique denominating deep Q-networks is used to model automatic P2P energy trading using an adapted algorithm from the stock exchange and a Long Short-Term Delayed Reward system [52]. Under the topic of DLTs applied to the energy field, a novel proposal of Blockchain ET under demurrage and “Enertoks” as a cryptocurrency utilizing Mixed Complementary Problems and game theory for the simulation is presented in [40]. Additionally, in line with past work, an incentive mechanism based on the usage of a virtual currency “NRG-X-Change”, a game-theory model under a Nash Equilibrium is presented in [50]. A two-layer multi-agent system-based model with Blockchain for test case study modelling 50 to 300 participants is modelled with the Matlab optimization tool in [43]. A Stackelberg game and power flow analysis in a community-based case study, furthermore, with the estimation of a distribution system usage fee charged for P2P-ET transactions is presented in [51]. In the network of California, USA, an algorithm for clustering prosumers and consumers based on the flocking behaviour of birds, so they trade electricity in a direct trading market design, as proposed in [55].

On the other hand, there are proposals with an emphasis on how the flexibility of BSSs can improve a P2P-ET market design. Lüth et al. assess two different market designs to encourage P2P-ET and BSS as flexibilities, either owned privately or by a community. Moreover evaluates the possible market outcome in two different cases [31]. Nguyen et al. demonstrate, through a mixed integer linear programming method, how peers can gain higher economic savings by optimizing photovoltaic (PV) generation with BSS [33]. Guerrero et al. present two P2P trading scenarios for an SG system applied to a low-voltage radial distribution network that considers prosumers with private BSS as well as a bigger community BSS. It demonstrates that, in general, there is an overall market benefit for both scenarios [36]. Bjarghov et al., propose a market design for trading capacity in a P2P-ET way for a small test case sample for Norway, composed of four prosumers with two of them owning a BSS [49]. Zepter et al., introduce and modelled a proposed trading platform, namely, “Smart elecTricity Exchange Platform (STEP)”, that integrates a group of residential buildings equipped with BSSs, i.e., sonnenBatterie, into the wholesale market [48].

In line with the MG concept, P2P-ET enables peer-to-grid energy trading models, in which a prosumer’s MG can trade electricity with an upstream main grid or another MG [60]. Paper [11] proposed a clarifying four-system layer design for P2P-ET within a grid-connected low voltage MG using the virtual platform “Elecbay”. An energy-sharing market proposal for an interconnected MG of PV prosumers through an intermediary can be found in [58]. Another P2P—P2G market structure is presented by Paudel A. et al. [46] in a prosumer MG interconnected with bidirectional communication and power lines between its participants. Papers [16,42] present a game theoretic constrained non-linear programming approach respectively analyzing and comparing several price mechanisms and size of community for an interconnected MG performing P2P and P2G transactions. A Korean test case study for three different MGs performing P2P—P2G transactions using the market clearing price signal is analyzed in [59]. Dudkina E. et al. in [57] presented a pure P2G power flow optimization problem for two remote villages physically interconnected between each other.

A few papers that addressed P2P-ET market designs on sector coupling were also clustered within this study. The cooperation between residential and commercial peers in Germany, with more than 18,000 participants, is analysed by Wanapinit and Thomsen in [61], employing cooperative games theory in a mixed integer linear programming model, they evaluated the effects of total reduced costs, electricity imports, and total emissions. Similar to the previous paper, [64] studied a P2P-ET network composed of 2000 residential prosumers and a commercial prosumer business area in Shangai, who can trade electrical energy as well as heating energy. The network is modelled under a Nash non-cooperative game and mixed integer linear programming method model. In [62], the impact of P2P-ET in the transport sector and the electrical grid is evaluated in Belgium using a predictive model and quadratic problem formulation, classifying drivers based on their daily driving activity. P2P-ET between charging and discharging plug-in hybrid EVs in the USA is studied in [63], proposing a consortium blockchain based on aggregators, that allow electricity trading, and an iterative double auction price mechanism.

More papers focusing on the physical and virtual layer of P2P-ET can be found in the literature since these are key aspects of its implementation. A classification of the current literature that assesses the different challenges encountered in the virtual and physical layer of P2P-ET structures with its respective discussion is conveyed in [3]. Ref. [71] overviews the blockchain applicability in the energy sector looking at its opportunities and risks of it and assessing socio-technical aspects. Ref. [65] develops a home energy management systems communication scheme to exchange information and trace possible energy mismatch information. Ref. [66] focuses on the physical layer and summarized studies that assess probable avoidable grid costs in different voltage levels through local electricity markets (LEMs). A proposed energy blockchain trading framework with a payment scheme and optimal pricing strategy utilizing game theory is found in [13]. An integration and prototype implementation of blockchain technology for a decentralised P2P-ET system that enables anonymity in price negotiation and security in transactions is proposed in [67]. A detailed discussion and performance analysis of the structured and unstructured P2P-ET architectural models for energy trading is carried out in [68]. A proposal of a secure and private energy trading based on blockchain and IIoT system considered for nodes with the ability of energy storage is made in [69]. Power flow modelling is employed for different nodes in a distribution network in [70], consequently, a framework for allocating losses is proposed to balance physical energy trades and financial transactions. Based on the Smart Grid Architecture Model (SGAM) [91], a proposed blockchain-based mathematical model for the P2P-ET considering physical network constraints in SG is presented in [73]. The creation of a business model consisting of a P2P electricity trading platform, a marketplace for PV equipment and related services, and a platform for funding solar energy investments are done by [75].

A series of papers overviewing and evaluating social aspects such as the general willingness to pay and to participate in P2P-ET were also clustered. Reuter and Look [77] conveyed a survey in four different European countries with a total sample of 830, in which 78% of participants are in favour of participating in P2P-ET concepts. Participants also stated that, overall, the environment and economic aspects are the main motivations for jumping into P2P-ET. In papers [78,79], survey-based studies are employed in a total sample of 400 participants. The studies depicted several autarkies and P2P-ET scenarios for household, neighbourhood, and small-town situations. A positive indication of the participation rate in P2P-ET is concluded from the results, as selling and buying prices for P2P-ET electricity indicated by surveyees are below the average market price of 28 ct€/kWh (Stand 2017). Mengelkamp, E. presented a series of papers that evaluate several social aspects regarding LEM. Ref. [81] an agent-based model is employed in which a cluster of prosumers and consumers are modelled and evaluated on how much electricity is traded from the grid and the LEM. Ref. [80] develops a structural equation model tested via the partial least squares method for analyzing a survey and determined the most important factors that participants consider for going into P2P-ET. Finally, in [83], an adaptative choice-based conjoint analysis is used for a regional (Allgäu, Germany) and a country-wide (whole Germany) survey to quantify the willingness to participate in LEMs. Hackbarth and Loebbe in their study [85] evaluated consumer and prosumer preferences related to P2P-ET through hierarchical multiple regression analysis of a survey from 4148 participants. Ref. [86] employs a multilevel model for clustering different types of prosumers who own a PV-system combined with BSS and determined the probability of entering into P2P-ET as a function of the BSS’s state of charge and possible LEM prices. Ref. [84] evaluates the behaviour of participants in the “Quartierstrom” pilot project collecting quantitative and qualitative data and analyzing them via third-party tools, such as Google analytics and Inspectlet. Singh et al. in [82] presented a multi-method ethnographic study to analyze energy exchanges within remote rural villages located in India, where all the data was collected via participant observation, interviews, and field notes by an ethnographer.

As mentioned before, although the political and legal aspects related to P2P-ET are out of the scope of this study, a cluster of papers for both categories is carried out. Several of the addressed studies for social aspects (e.g., [77,83,84,86]) give insights into political strategies for implementing and disseminating P2P-ET. Concerning legal aspects, the studies [66,88,89,90] address the current legal framework and how it may affect P2P-ET implementation and market penetration.

Table 2 resumes the researched literature that focuses on demonstrators, actual companies, research, and pilot projects worldwide that work already (or enable) P2P-ET in every aspect. As in Table 1, it is noted that a study can board more than one type of P2P-ET demonstrator.

Table 2.

Cluster of literature focused on P2P-ET demonstrators.

Table 2.

Cluster of literature focused on P2P-ET demonstrators.

| Type of P2P-ET Demonstrator | Sources |

|---|---|

| Start-up and Industrial Company | [19,20,21,22,56,72] |

| Physical and Virtual Layer | [9,19,37] |

| Research and Development pilot projects | [8,9,20,37,72,84,89,92] |

An extended collection of research projects is presented in [20]. The study [22] compares some of the major P2P-ET cases being promoted worldwide, reviewing, and analysing the potential development, future challenges, and the profit structure of each company. In source [21], a more extended list of P2P-ET projects with their respective comparison is presented as well, providing a possible future scenario of P2P-ET. A complete detailed list of P2P-ET platforms enabling local trades and specified for the following regions: Germany, Europe, and the rest of the world are presented and discussed in [19]. Source [37] provides an overview of P2P-ET-related research and development projects worldwide, as well as, a list of start-ups that emerged from research projects and that cover the physical and virtual layer of P2P-ET. The design of a seven-component MG market is presented in [9] and applied to evaluate the famous Brooklyn MG project [93]. Applying the SGAM [91], the case study Landau Microgrid Project (LAMP) [94] is designed and evaluated in [8]. Defined in the framework of the NEMoGrid [95] project, different types of P2P-ET business models and other important factors such as new actors in the market and the formulation of the objective function in a proposed business model are described by Barbara Antonioli in [92].

A group of literature proposing evaluation methods for P2P-ET aspects, structures, price mechanisms, and pilot projects has been also summarized as part of our research. Abdela, Tari et al. In [25], authors evaluate the effectiveness of blockchain in P2P energy trading systems by defining some performance metrics. They integrated three different types of energy markets in one unified energy trading model and one single payment model. Zhou, Wu, et al. in [23,24] present an evaluation method employing agent-based simulation to compare the performance of different P2P-ET models under different pricing mechanisms. The evaluation indexes are divided into economic and technical.

2.2. Market Design

Several authors [3,8,9,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56] have defined three different types of markets in the P2P-ET, the main difference between them being the degree of decentralization. A more detailed description of each type of market will be discussed in the following sections.

2.2.1. Centralised Energy Market

An energy market can be composed of consumers, producers or prosumers, and a third entity. In the so-called centralised energy market, there is a third entity which has an active role. It coordinates and controls the energy trading and fixes the price. In this market, the architecture relies on the presence of a central entity that acts as a supervisor, coordinating electricity trading between agents involved in the negotiations [92]. There is no direct connection between the production and the consumption block, meaning that buyers and sellers remain anonymous. Literature review shows that in most cases consumers do not have the option to choose the technology, the price, or the producer by themselves, but is the third entity that makes these decisions. The main advantage of this market type is that the overall economy can be maximised due to centralised control [96]. The coordinator distributes the revenues depending on predefined contracts [28].

Several studies are reported in the literature to address this type of market. In [16], authors proposed a fully centralized P2P-ET market under a supply-demand ratio pricing mechanism, where an energy-sharing coordinator controls the participants’ DER and performs contracts with each participant. Ref. [30] presents a centralised energy market where prosumers are clustered into virtual microgrids (VMGs) to participate in the market as a single entity and optimize the benefits of all participants. With the idea that VMGs participate in an organized manner with the upper electricity market, the introduction of the virtual MG aggregator role is proposed. The results of the case study show a cost reduction. Denysiuk, et al. In [50], authors developed a market mechanism designed to incentivize the production and self-consumption of renewable energies produced locally. The main characteristic of this project is the assumption that the agents act in their self-interest when optimizing energy usage.

Another research project is LAMP [94], which currently runs on a centralized basis operated by the local energy utility company. Here a merit order market mechanism is employed to allocate PV and CHP generation within a small neighbourhood. In this case, consumers and prosumers can use an app that allows them to set their price expectations. Energy trading on the local trading platform is made through automatic agents. Furthermore, the project assesses the suitability of a blockchain-based local energy market [8,94].

Other significant projects from companies are Sonnen [97], Badische-Energie-Servicegesellschaft [98], and LichtBlick Swarm Energy [99]. Sonnen provides the SonnenFlat electricity tariff, which is only for customers who own the sonnenBaterie, which is digitally networked in the sonnenCommunity to form a VPP. Thus, it helps in a completely new way to keep the power grid stable. It is considered a closed community since only prosumers with batteries from Sonnen can participate in it. Furthermore, the company has full control of the energy devices and is then responsible for setting the price.

The advantages and disadvantages of the centralised energy market are listed in Table 3.

Table 3.

Advantages and disadvantages—Centralised P2P-ET market. Table based on own interpretation from Section 2.2.1.

2.2.2. Direct Trading Energy Market

In this market configuration, third entities are not directly involved in the control or management of the energy flow, meaning that they cannot control DER. A third entity could be optional for peers, would that be the case, then it has a passive role as a service provider, for example, for billing or invoicing. Peers interact directly between them performing an optimal multi-bilateral transaction to sell or purchase electricity without centralised supervision [50]. The main advantage of this market structure is that prosumers can fully control their devices and privacy is not an issue because the participants decide which information to share. However, the efficiency is lower due to the lack of centralised coordination and the overall economy is not maximised. Most case studies use blockchain-based smart contracts for tracing the quantity of electricity traded and the financial transactions. A token-based transaction mechanism could be further established for realizing financial transactions.

There is a wide choice of direct trading study cases available in the literature. Ref. [35] formulatesa P2P-ET electricity market based on Multi-Bilateral trading and product differentiation, for example, based on consumer preferences. This model structure does not need a central agent and there is only a limited exchange of information. Ref. [38] employs a decentralized approach based on the alternating direction method of multipliers to attribute the costs through exogenous network charges in different ways: uniformly, based on the electrical grid distances, and by zones. In this variety of ways, the main grid physical and regulatory configurations are covered. Ref. [56] develops a decentralised energy trading platform that consists of two layers, namely market, and blockchain. The market layer provides privacy and a near-optimally efficient market solution for the participants. On the other hand, blockchain guarantees a high level of automation, security, and smart contracts. Ref. [74] develops a decentralised P2P-ET model using blockchain. This model allows the market members to interact with each other and trade energy without involving any third party and proposed three different smart contracts: the main smart contract, the P2P-ET smart contract, and the P2G smart contract. The first one proves the participant’s status, stores the important data, and allows him to take part in the LEM. The second one is responsible for the local trading of the market and the last contract is responsible for the electricity exchange between the prosumers and the grid in the case of electricity shortage in LEM. Ref. [76] presents a model for a decentralised P2P-ET marketplace for energy trading between autonomous agents using DLT. The model combines different emerging technologies, which allow for the provision of a dynamic, scalable, and sustainable Multi-Agent System. This protects the security of peers during data collection, trading, and billing.

The Brooklyn MG [93] is a successful pilot project that follows the decentralised market approach. As mentioned before, Ref. [9] established seven components for the efficient design and operation of blockchain-based MG energy markets to locally trade distributed generation. Thus, a construct to evaluate the case study of Brooklyn MG is developed, concluding that this project fulfils three components (MG Setup, grid connection, and the information system), partially fulfils three components (energy management trading system, market, and pricing mechanism) and does not yet fulfil the legal environment component [9].

There are already some companies that try to follow the approach of the direct trading P2P-ET market. Enyway, which, at the beginning of the year 2022 ceased operations [100] and Lition, which ceased operations in 2021 [101] in Germany were two examples. Enyway offered a platform that prosumers could use for posting their ads to sell their self-produced energy. Hence, producers could freely set the price for their energy. At the same time, consumers had the opportunity to choose the producer. However, as a consumer, a monthly fee had to be paid. In the case that the producer chosen could not supply the required energy, the producer bought certified electricity. The platform also took responsibility for the electricity invoice and customer service. Lition runs on the open-source Ethereum blockchain via smart contracts. This company gives the option of choosing the producer and the price is set by the producer itself too. Nevertheless, Lition earns half of the price that the producers offer. One special condition of this company is that all producers must sell in direct marketing and have at least an output of 100kWp.

The advantages and disadvantages of the direct trading P2P-ET market are listed in Table 4.

Table 4.

Advantages and disadvantages—direct trading P2P-ET market. Table based on own interpretation from Section 2.2.2.

2.2.3. Distributed Energy Market

The distributed energy market is the combination of the two energy market concepts explained above. In this energy market model, the third entity influences peers indirectly by sending pricing signals [28]. However, unlike the centralized market, the third entity is not able to control the energy systems. In other words, the platform or third entity cannot directly control the export and import of energy from the different prosumers within the market [96]. Thus, in a distributed energy market model, the information is normally shared with the third entity and only a limited amount of information is needed. Subsequently, privacy is not a big issue in this model.

As well as the other described market structures, it can be found several proposals of theoretical case studies. Ref. [39] proposesa market mechanism that provides additional options for peers who have the willingness to occasionally participate in the retail electricity market. This trading mechanism will introduce the figure of an energy broker, whose goal is to facilitate the market operation. Ref. [44] introduces an intermediary agent that allows electricity trading between the prosumers and the wholesale market. It is considered that the intermediary agent adapts the price considering the prosumer electricity demand and the wholesale market price, seeking social welfare and satisfying network constraints and privacy constraints of LEM participants.

Currently, some companies offer this service. PowerPeers [102], Talmarkt [103], and RegionalStrom Soest [104] are examples in Europe. Powerpeers promises the highest remuneration for PV electricity in the Netherlands, including electricity from wind farms in their energy mix. Consumers can select different sources to create their energy mix in this case. PowerPeers offers two options: a platform service for consumers and one for businesses. The electricity from prosumers is rather bought by the platform than the consumer directly. Talmarkt [103] offers a platform where you can create your energy mix and every 15 minutes you are allowed to change it. The mix is based on solar, wind, and hydropower energy and the consumer can choose which producer or producers will deliver to them the energy, as well as, the price. In a similar way to previous options, the municipal utility company RegionalStrom Soest [104] offers an online marketplace in which the end customer can choose its energy mix. Energy carriers offered in the platform are based on solar PV, wind farms, biogas facilities, and CHP, and residual electricity needs are covered by hydro-power plants.

The advantages and disadvantages of the distributed energy market are listed in Table 5.

Table 5.

Advantages and disadvantages—Distributed P2P-ET market. Table based on own interpretation from Section 2.2.3.

2.3. Distributed Ledger Technology

Keeping transaction records is an integral part of electricity trading, as with any kind of trading. Distributed ledger technologies (DLT), which include Blockchain, resonate well with peer-to-peer trading due to their distributed and bilateral natures. In general, DLT refers to shared and distributed databases that digitally store transactions without a central authority [105]. Given that records are kept by multiple nodes, e.g., participants, DLT can be more secure than the conventional central ledger system [8]. Via the integration of smart contracts, DLT can evolve into a comprehensive interface between metering systems, appliances, and transactions [71]. Many research projects and start-ups in the energy sector place their focus on combining the DLT with the P2P-ET concepts [9,19,84,89,92]. Furthermore, several authors propose different architectures of DLT that can be implemented successfully in energy trading [25,56,63,74,76].

By providing decentralised interfaces and systems, blockchains can play an important role in this transition, offering an alternative to the current form of energy market organisation [71].

It should be noted that the application of distributed ledgers in energy trading is unproven. That is, while applications in localized parts may exist, the scalability and viability of system-wide applications are subject to further investigations. Existing regulations may also hinder the adoption of DLT, which needs to be revised [106]. Concretely, it is to be investigated if a distributed ledger in energy trading applications would be superior to a conventional centralized ledger in terms of transaction efficiency, transparency, and security. To most (grid-connected) customers, production and consumption are monitored by other market actors, e.g., grid operators or balancing responsible parties. This also raises the question of it additionally distributed record-keeping is necessary.

2.4. Pricing Mechanisms

P2P-ET has encouraged research on novel price mechanisms since feed-in tariffs (FiTs) schemes are already expiring in several countries [28,85].

In the context of local energy trading, pricing mechanisms refer to means of allocating costs and benefits among the participants. Under this definition, payments may be based on pre-determined per kWh prices, a share of the total costs at the end of payment periods, or a fixed payment regardless of the volume of consumption, i.e., the energy as a service tariff model. Depending on the market setup, the allocation of costs may be determined before or after the delivery.

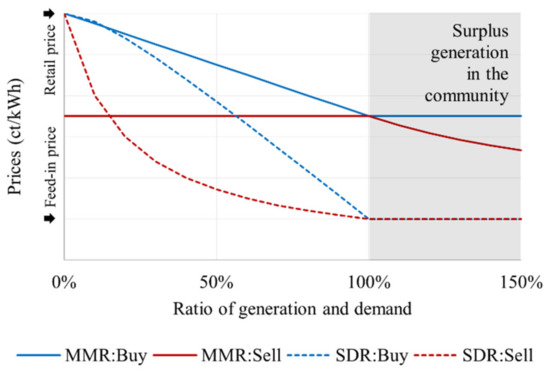

In the literature, existing pricing mechanisms designed for cooperative energy sharing include bill sharing, mid-market-rate (MMR) [107], and supply-demand-ratio (SDR) [58]. These mechanisms are originally proposed for the cost allocation in microgrids with variable renewable electricity generation. The principle of bill sharing is that all participants are on equal terms, and therefore should bear the same costs or prices for their consumption or generation. Figure 1 depicts the MMR and SDR prices. Under MMR, the common price is the average of the feed-in price and the electricity retail price, i.e., the minimum revenues of selling to the utility and the maximum purchasing price of buying from the utility, respectively. However, this mechanism does not consider the scarcity of supply within the local systems; therefore, they fail to signal if additional investments are needed (For example, one of the functions of the wholesale electricity prices is to incentive new investments. This is achieved as high market prices also signify the supply scarcity [108]). The SDR is set to resolve this by dynamically adjusting the prices between these two price points. That is, during periods of high local generation, the prices are closer to the feed-in price. Both mechanisms are relatively simple to comprehend and implement; however, they have some notable drawbacks, namely, they assume that participants are similar in terms of technical potentials and behaviours, and they do not consider the flexibility, nor individual preferences of participants.

Figure 1.

Electricity buying and selling prices within a microgrid according to the MMR and SDR pricing mechanisms.

In market-based mechanisms, in which transactions are regulated by a market, prices may be determined directly by the participants, e.g., pay-as-bid, or indirectly via a common price set by an agreed-upon algorithm, e.g., merit order. These market-based mechanisms imply that participants compete with each other to increase their benefits. Theoretically, this competitive behaviour should maximize the total welfare. In reality, certain participants may exercise their market power to manipulate the prices, which results in sub-optimal outcomes. Ultimately, the choice of price mechanisms must balance various aspects, e.g., economic efficiency, transparency, and social acceptance including the principle of the local energy community.

3. Key Aspects of P2P-ET Markets

Derived from Section 2, qualitative content analysis is performed to propose the following: an own subdivision of P2P-ET, a standard language overviewing for the different market types that involved actors and possibly new ones for each market structure, and different sketches for defining the actor roles in the different energy market types.

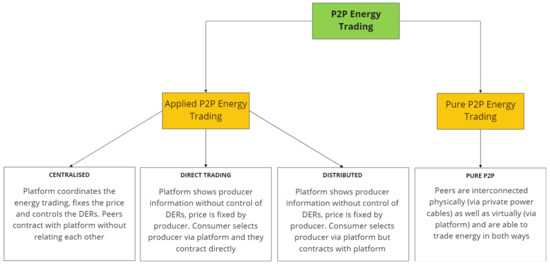

Figure 2 depicts the main divisions from the different forms of P2P-ET concepts that were summarized in the literature review. Pure P2P-ET refers to the possibility of virtual and physical energy trading between peers, meaning that peers are interconnected by private power lines and by an online platform as well. Pure P2P-ET is usually limited by local geographic areas and is usually employed for the different combinations of MGs interconnection, such as islanded MGs, Grid-connected MGs, and networked MGs. The Applied P2P-ET refers solely to the virtual energy trading concept and can by nature aggregate more participants even on a supraregional scale. It is important to note, that DLTs can be employed for each subdivision to deploy smart contracts that define the energy transactions between peers, and also whenever a mismatch between generation and demand occurs, the necessity of residual electricity is fulfilled by additional operators such as energy utility companies, distribution and transmission system operators, balance responsible parties, or third party entities (in Figure 2 named as the platform). Additionally, different price mechanisms can be utilized to clear the P2P-ET market price. Applied P2P-ET is further subdivided into three main markets: centralised, direct trading, and distributed; in the next section, the terminology used in literature to refer to them will be discussed.

Figure 2.

Division of P2P-ET derived from Section 2—Literature review.

3.1. Standard Language

In literature about P2P-ET, a wide range of different names are given to describe the same concept. The main motivation behind this section is to create a standard language to define the confusing concepts of P2P-ET energy markets and actors. Three different types of energy markets can be distinguished, which have been already discussed above. In Table 6 a list of different names for the different P2P-ET markets found in the literature is presented and later discussed.

Table 6.

P2P-ET market names in different literature sources.

- Centralised energy market: In this study, the word “centralized” has been chosen because the main characteristic of this type of market is to be controlled by one main system or authority. In other publications, “community-based” has also been used, along with “coordinated” and “structured”. However, these terms can be misleading. A community-based market refers to the centralised energy market according to [37,92], but [96] used this same word to refer to the distributed energy market. On the other hand, the words “structured network” can also create confusion because all energy markets have their structure even though it is not controlled by one main system or authority. Concerning the coordinated market, this term can also create confusion because coordinate means, according to the Cambridge dictionary, that all parts are effectively organised so that they can work well together. This definition would be valid for all three markets because they are all capable of working successfully, although they have differences.

- Distributed energy market: The word “distributed” means “to divide something among several people”. If this definition from the Cambridge dictionary is adapted to the energy market, it can be understood that the responsibilities are shared between different actors, specifically the platform and prosumers. In this case, the platform is responsible for some tasks but the prosumers still have responsibilities. Another word often seen in the literature is a hybrid market, which means that something is a mixture of very different things. In the P2P-ET market case, it will be a mix of centralised and direct trading.

- Direct trading energy market: The phrase “direct trading” has been chosen because it is self-explanatory and will avoid confusion. The trading in this case is without anyone or anything else being involved. Other words such as “pure,” “fully decentralized,” or “unstructured” can be found in the literature. Pure or full P2P markets have been rejected because they are not self-explanatory words. On the other hand, the decentralised market has been rejected to avoid conflicts with the similarity of the centralised energy market. Lastly, the unstructured has been discarded due to the same reason as the structured energy market. All energy markets have a structure even though they do not have a main system or authority controlling everything.

Together with different expressions for P2P-ET market types, several terms for actors in P2P-ET have been found in the literature as well. Table 7 shows a group of actors with a respective proposed term for each one, while Table 8 displays the definition of the terminology used in the literature.

Table 7.

Terms used in literature for referring to proposed actors in P2P-ET markets.

Table 8.

Definition of actor roles in P2P-ET markets from the literature.

The most repeated terms are “coordinator,” “agent,” “administrator,” and “aggregator”. A definition of our proposed standard terms for actors in P2P-ET is presented below.

- Manager: Usually defined as the person who controls or organises something. In the context of P2P-ET, this would be defined as the responsibility for controlling the energy trading in a defined group of peers, i.e., the manager has the highest authority in the hierarchy and could control eventually the DERs of peers to balance, for example, a local energy community. This actor would be present in a centralised P2P market due to the role that he performs

- Administrator: Defined as the person whose job is to control the operation of a business, organization, or plan. As a proposed term in P2P-ET, it is defined as the responsibility to coordinate and administrate the electricity trading within a P2P market; nevertheless, without the ability to control the DERs of the participants within a P2P market, i.e., this actor would be present in the distributed and direct trading variant of a P2P market. Furthermore, the responsibility of providing energy-related services must be performed.

- Supervisor: Defined as the person whose job is to supervise someone or something. Related to P2P-ET, this would be the entity responsible to oversee a P2P-ET market, to authorise transactions, and to confirm that no violations to physical constraints of the distribution grid are being committed by the operation of, e.g., a LEM in a defined geographical area. The supervisor must be in constant communication with the administrator or manager and his role should be performed by a representantive from a DSO, TSO, BRP, or energy utility company.

- Broker: Defined as an independent person or company that organises and executes a financial transaction on behalf of another party. Usually also depicted as an intermediator or middleman. We define this actor as optional in a P2P-ET market and he could be responsible for communication between peers or negotiators between the end-customer and a manager or administrator. Additionally, he could provide billing services.

The different terms in Table 8 refer to new actors (or already existing ones) that provide related energy services such as billing, invoice system, balancing, and communication between different participating peers. The coordinator usually has an active and invasive role in centralized P2P markets, since he can control even prosumer’s DERs [28]. The administrator is proposed as a service provider and authorizing entity and can be confused with the term “coordinator” or “manager” [109]. The term “agent” is defined with diverse roles depending on the P2P concept and has different responsibilities depending on the source. The role of aggregator, as its name suggests, adds prosumer’s DERs to have an active role in the wholesale energy market. Specifically, in novel decentralized P2P concepts, new actors are sometimes even depicted as virtual platforms in the from of computing centres or machine learning algorithms that can clear an LEM automatically [13]. As for the central-based P2P structures (centralized and distributed), these actors are usually from entities, such as energy utility companies, DSOs, or BRPs [30,109].

3.2. Actor Roles in the Energy System Market

In this section, the roles of the different actors in the energy market will be discussed depending on whether they are centralised, distributed, or direct trading. The roles considered in this study are:

- Digital platform

- Production group

- Consumption group

For the sake of simplicity, the role of a prosumer is not depicted in the sketches although the production group can be at the same time a prosumer and vice versa. The production group represents all prosumers or producers who generate energy with their energy system, while the consumption group is representative of the consumers or prosumers who receive that energy.

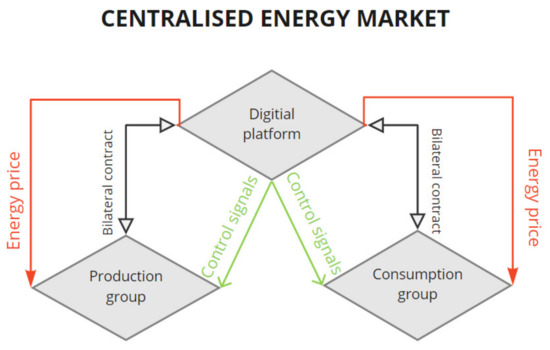

3.2.1. Sketch Centralised Energy Market

Figure 3 shows the relationship between the digital platform, the production group, and the consumption group in the centralised energy market. In this type of energy market, the platform is always in the middle between the production and consumption groups, these two groups will never interact between them. The digital platform is responsible for making a contract on one side with the production group and on the other side with the consumption group. The digital platform is operated in this case by the coordinator. At the same time, it is the digital platform that controls the energy system of the production group and if the consumers own an energy storage system, it could also be controlled by them. Regarding the energy price, the digital platform fixes the amount that the producers will receive and at the same time fixes the price that consumers will need to pay. Moreover, if not enough energy can be generated from the production group, the digital platform takes the responsibility of providing it. All this information is summarised in Table 9.

Figure 3.

Actor roles sketch—centralised P2P-ET market. Sketch-based on own interpretation from Section 2.2.1.

Table 9.

Characteristics of the actors’ roles for the centralised P2P -ET market. Table based on own interpretation from Section 2.2.1.

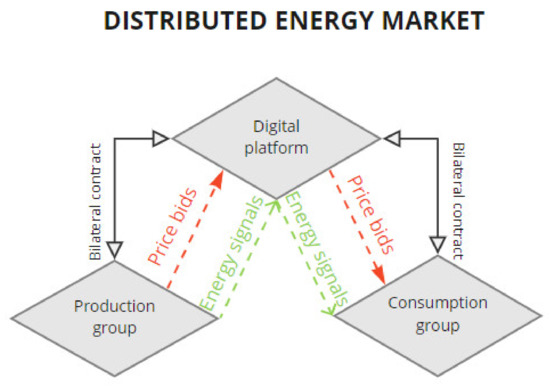

3.2.2. Sketch Distributed Energy Market

Figure 4 shows the interaction of participating entities for the distributed P2P-ET architecture and Table 10 summarises all the characteristics of this market. For this market, the platform still has an active role. The digital platform has a contract with the production group and with the consumption group. However, the platform has a more passive role when it comes to the energy price and the energy produced. Price bids are sent from the production group to the digital platform, where consumers can use the platform to see the offer. Nonetheless, it could be the case where the platform fixes the price for both groups or just for one. In parallel, producers send to the digital platform the amount of energy they have available and once again, this information arrives at the consumer through the platform. If not enough energy is provided by the energy system from the production group, it is the platform that is responsible for providing the rest of the energy.

Figure 4.

Actor roles sketch—distributed P2P-ET market. Sketch-based on own interpretation from Section 2.2.3.

Table 10.

Characteristics of the actors’ roles for the distributed P2P-ET market. Table based on own interpretation from Section 2.2.3.

3.2.3. Sketch Direct Trading Energy Market

In this case, in the direct trading energy market, the digital platform has a passive role. The platform only has a contract with the production group, all the other interactions are between the production and consumption groups. It is the same producer who makes a contract with the consumption group. Meanwhile, the production group sends the price bids directly to the consumption group, as well as, the energy signals. If there is not enough energy produced, it is the same production group that is responsible for solving this problem. However, it could also be the case where the digital platform takes the responsibility of providing the residual energy. Table 11 shows a summary of the main characteristics and Figure 5 the relationship between the optional digital platform, the production group, and the consumption group in the direct trading energy market.

Table 11.

Characteristics of the actors’ roles for the direct trading P2P-ET market. Table based on own interpretation from Section 2.2.2.

Figure 5.

Actors role sketch—direct trading P2P-ET market. Sketch-based on own interpretation from Section 2.2.2.

4. Methodology for a Techno-Economic Characterisation Matrix for the Entry Barrier and Scalability Potential

For this section, a qualitative analysis methodology assessing different P2P-ET projects based on the most significant attributes is presented. The focus of all the attributes is from the final consumer point of view considering the techno-economical characteristics and leaving the social aspects and the regulatory hurdles surrounding P2P-ET out of the scope of this paper. All attributes are defined and evaluated considering the current situation of the energy system. Moreover, it has the aim to create a matrix in which the entry barrier and the scalability potential can be both evaluated. In this study, an attribute is considered to be a quality or characteristic that a peer-to-peer project has.

The process to evaluate the entry barrier and the scalability potential involves:

- Establishing a set of attributes that affect P2P-ET;

- Determining a scheme for scoring projects against the evaluation criteria;

- Setting threshold values;

- Computing the overall score for each concept;

When grouping different attributes the entry barrier and the scalability potential can be evaluated.

The entry barrier was defined in 1979 by Franklin M. Fisher as “anything that prevents entry when entry is socially beneficial” [110]. By adapting this definition to the energy market, it is considered an entry barrier as the difficulty that a consumer or producer can have to join a P2P-ET project. A difficulty is understood as a condition or conditions that must be fulfilled and can imply an extra investment or limit the possibilities to enter.

For the entry barrier the following concepts are considered to be unfavourable:

- Smart meter;

- Fee;

- Maximum distance between generation and consumption;

- Participants limit;

- A minimum capacity of the energy system;

- Specific technology;

- Invoice system: Uniform price;

- Market type: Centralised;

On the other hand, scalability potential refers to the capability of a P2P-ET project to cope and perform well under an increase of participants. A project that scales well will be able to maintain or even increase its level of performance. In other words, if the project has one or more of the following attributes, it will be more difficult to scale it, for example, at a national level.

Therefore attributes that directly affect the expansion of P2P-ET projects are examined:

- Maximum distance between generation and consumption

- Participants limit

- Specific technology

- Market Type: Centralised

Different attributes which can characterise a P2P-ET project are described in detail in the following section. A matrix to classify projects and define the entry barrier and scalability potential will be also discussed in the last section. To create the classification of the projects, some threshold values are defined. The entry barrier will be classified as low if the total number of concepts affecting is lower or equal to two and it will be considered as high if the total score is higher than two. On the other hand, the scalability potential will only be considered as national (big potential) if there is a maximum of one concept affecting the project and regional if there are two or more concepts.

4.1. Attributes Definition

This section defines the attributes used in the entry barrier and the scalability potential.

- Smart meter: An electronic device that can measure and communicate information. The consumption data is transferred directly to the interested actor. Transmission of data can occur at least every 15min [111,112].

- Smart meters play a major role in the P2P energy trading scenario. It is needed to participate actively in the market providing electricity consumption values and trends. Moreover, the device should provide information about the current demand and prices [113].

- Fee: A monthly or annual fee must be paid in some cases, to be able to participate in P2P energy trading. Producers and consumers may pay a fee to use the services of a specific company or platform provider.

- Maximum distance: A maximum distance between the generation and consumption point is defined.

- Participants’ limitation: A maximum or a minimum number of participants is set.

- A minimum capacity of technology: A minimum capacity of the energy system is required to enter the P2P energy trading group.

- Specific technology: A specific type or brand of energy generation system is required to enter the P2P-ET project, meaning no freedom of choice on the equipment’s brand.

- Price definition system: Refers to the system of setting the final energy price for the prosumer. The options considered to are to pay as a bid, where the producer sets the price and they are not paid more than requested, or to use a uniform price where the price is fixed by the platform. Producers or consumers cannot decide the price, they all receive the same fixed price.

- Market type: The market design on which the P2P-ET project is based. Three different types of markets are considered: centralised, distributed, and direct trading.

4.2. Characterisation Matrix

In this section, two different matrices will be considered, one for the entry barrier and another one for the scalability potential. The goal of this section is to be able to classify a project depending on the difficulty to enter a P2P-ET community project and the potential to scale it at a national level, respectively. Reasons for considering the attributes disadvantageous are discussed, and three concepts are shown as an example of classification. These three concepts belong to different market types and have different characteristics that are based on real projects. A brief description of the main characteristics of these concepts is done:

Concept 1: This concept belongs to the direct market energy market type. A monthly fee must be paid and the pricing mechanism for the invoice is Pay-as-bid and it is the producer who fixes the price. Moreover, a smart meter is needed to participate in this community. The platform is responsible for the electricity invoice and offers an online platform where the consumer can choose which producer will deliver the energy.

Concept 2: This concept belongs to the centralised energy market type. To participate in this energy market, a battery from a specific company must be bought and it is mandatory to have a smart meter installed. The platform is fully responsible for controlling the battery and setting the prices. The batteries are digitally networked in the community to form a virtual power plant.

Concept 3: This concept belongs to the distributed trading energy market. Only producers that own an energy system of at least 30kW can participate. Consumers can choose their electricity mix by selecting the providers.

4.2.1. Entry Barrier Matrix

This subsection is divided into three parts. Firstly, attributes that have a direct influence on the main actors (consumer and producer) will be discussed and classification will be done resulting in a first partial score (see Table 12). Secondly, attributes that affect the invoice system and the market type will be analysed and each concept will end up with a second partial score (see Table 13). Lastly, the final score will be calculated (see Table 14) and the results will be discussed.

Table 12.

Entry barrier—first partial score. Attributes affecting the main actors in the P2P-ET.

Table 13.

Entry barrier—second partial score. Price mechanism and market type attributes.

Table 14.

Entry barrier. Final score.

To create a classification of the entry barrier, all attributes selected are equally weighted. To be specific, all attributes are equally important. Previously, two threshold values have been set for classifying the projects.

To determine a scheme for scoring the projects, zero is added to the counter if the project does not meet the attribute and one if the project meets that attribute. The addition of them results in a score, the higher the score is, the more difficult it is to enter the P2P-ET community. In other words, if an attribute is considered as “Yes” in the table, one is added to the counter.

The attributes affecting directly the main actors: consumer, producer, or both parts and the reasons when an attribute is unfavourable for the entry barrier are shown next.

- Smart meter: This concept negatively affects the entry barrier for the consumer and producer. Both actors should have a smart meter, although there are some pilot projects or research projects in which it is not (yet) necessary. It is considered to be negative because the end-consumer will need to make the extra investment to be able to participate in P2P-ET. Nevertheless, based on § 30 MsbG [114], a law from Germany, by the year 2032 all consumers will have one installed. Consequently, this attribute in the future in Germany will not affect the entry barrier anymore.

- Fee: If the fee is high, it can negatively affect the entry barrier for consumers and/or producers.

- Maximum distance between generation and consumption: This characteristic is unfavourable for the entry barrier. It will limit the number of consumers and producers that are allowed to participate in that P2P-ET market.

- Participants limit: If there is a limit of participants, it could be a situation where the number of participants willing to join is not enough or is too high for that specific project. As a consequence, people would not be able to join that project.

- A minimum capacity of the energy system: This aspect negatively affects the entry barrier. It could be a situation where the producer cannot fulfil this condition and is not allowed to participate, although it can produce energy.

- Specific technology: This aspect is unfavourable for the entry barrier because it limits the number of producers to enter the community to just those who have a specific technology or brand. For example, only those who own a photovoltaic system can join the project.

Concept 1: Consumers do not need to own a smart meter, however, a monthly fee must be paid. This last characteristic penalizes the entry barrier, so one is added to the counter. Moreover, producers do need to install a smart meter, which is also unfavourable for the entry barrier, and one is added to the counter. All the other attributes, such as participants’ limitations or price mechanisms are favourable to letting people enter the project. Therefore, they add zero to the counter. In this case, concept 1 would have a partial score of two.

Concept 2: In this case, actors, consumers, and producers need to own a smart meter. In addition, a specific technology from a particular brand and characteristics, in this case, a battery system is required from the platform. All the other attributes are not needed, which means that no fee needs to be paid or that there is no minimum capacity to enter the project. Consequently, the partial score is 3.

Concept 3: This last concept has a partial score of 1. Unlike the two other concepts, a smart meter is not strictly necessary for joining the community. However, the energy system must meet a minimum capacity.

Next, the attributes that affect the invoice system and the market type will be analysed and the second partial score will be obtained.

- Price definition system (Uniform price): If just the economical aspect of the uniform price is contemplated, it is considered less advantageous for the producer and consumer. From the perspective of the producer, if the price is given by the platform, they will not have the opportunity to be competitive. In parallel, if consumers belong to that community and the price is modified (for example annually) and they do not agree, they will either accept the price or leave the community.

- Market type (Centralised): If the market design is centralised, it is unfavourable for the entry barrier and scalability characteristics. The drawbacks of this type of market cannot let it expand at a national level, such as the advanced need for technology for a big number of participants or privacy issues. As a consequence, the entry barrier will also be high, because there might be a maximum number of participants.

Concept 1: This concept has a pay-as-bid invoice system. This means that producers are free to set the price. As discussed before, these attributes are considered convenient for the project. Regarding the market type, it is direct trading which will also not affect negatively. So the partial score for this concept in this table is 0.

Concept 2: In this case, this concept uses a uniform price which is considered a bad attribute. This will add one to the counter. In addition, the market types are centralised which will also add to the counter. The partial score for this table is 2.

Concept 3: Concept 3 has a partial score of 0 considering these attributes. The invoice system is Pay as Bid and the market type is distributed, both attributes do not influence in a bad way the entry barrier.

Finally, the total score can be calculated by adding both partial scores (see Table 14).

As described before a project is considered to have a low entry barrier when the final score is equal to or lower than 2. In this particular case, two of the concepts discussed have a low entry barrier. This means that more people will be able to join the community and they can have a better impact on the energy market. On the other hand, Concept 2 has a high entry barrier, which means that only some particular prosumers meet the conditions to enter the community and the entry barrier is higher.

4.2.2. Scalability Potential Matrix

To classify a project depending on its scalability potential, all attributes considered before affecting this characteristic are equally weighted. The addition of them results in a score, the higher the score is the less expandable the project will be.

Firstly, the three different attributes that affect the scalability potential are presented in Table 15 together with the three different concepts and the first partial score is obtained. Afterward, the market type is discussed and the three concepts are analysed again in Table 16, where the second partial score is obtained. Additionally, lastly, the final score is calculated and the result of Table 17 is examined.

Table 15.

Scalability potential—first partial score. Attributes affecting the scalability potential.

Table 16.

Scalability potential—second partial score. Market type attributes.

Table 17.

Scalability potential. Final score.

Reasons, when 1 is added to the counter for each attribute, are the following:

- Maximum distance between generation and consumption: This characteristic is unfavourable for the scalability classification if the distance is small. If the distance between production and consumption is short the scalability of the market is small. The project could never be expanded at a national.

- Participants limit: If there is a limit of participants, it could be a situation where the number of participants willing to join is not enough or is too high for that specific project. In the case, where the maximum number of participants is low, that project will not be able to expand at a national level.

- Specific technology: This attribute limits the expansion of the project because not all producers will have the same type of technology. As a consequence, the project will not be able to reach a national level of expansion.

Concept 1: In this case concept 1 has a partial score of 0 which means it could be positive to scale this project. There is no maximum distance needed, neither a limit of participants nor a specific technology required.

Concept 2: A specific technology is required for entering this concept, specifically, a battery from a certain brand and characteristics. This attribute is considered to affect negatively, therefore the partial score is 1.

Concept 3: Concept 3 has the same characteristics as concept 1. In these first three attributes, no drawback can be found, which will imply that for the moment the project characteristics are favourable to scale the project.

Now the second partial score is going to be calculated. Depending on the market type that the project has can influence the scalability potential. This attribute is discussed.

- Market Type (Centralised): If the market design is centralised, it is unfavourable for the scalability characteristics. The drawbacks of this type of market cannot let it expand at a national level, such as the advanced need for technology for a big number of participants or privacy issues.

Concept 1: Direct trading is used as a market type and it is considered to not affect the expansion of the project. The partial score of this project is 0.

Concept 2: The market type used is centralised. As discussed before it can affect the scalability of the project. Therefore, the partial score is 1.

Concept 3: The partial score for this concept is 0 due to the distributed market type.

Finally, the final score can be calculated and discussed.

As already mentioned, if a project has one or fewer attributes, it is considered that it has the potential to expand the project on a major scale. On the other side, if a project meets two or more attributes, the potential of scalability is low. In this particular case, concept 1 and concept 3 have a high potential to scale their project. This means that the project characteristics are favourable when the number of participants increases in a significant way. In contrast, concept 2 has low potential scalability due to the market type and the specific technology requirement. With these two attributes, it will be more difficult or not even possible to expand this project at a national level with a lot of participants.

5. Conclusions and Future Work

This study presents a profound overview of the current P2P-ET literature, proposes a standard language for the energy market types and actors participating in them, and formulates a methodology to evaluate the entry barrier and the scalability potential of P2P-ET projects.

P2P energy trading is a new concept that has been developing since the last recent years, therefore, many research studies only have theoretical models and only a few have implemented the project in real life. Moreover, it was also found that only a few companies apply this new concept.

In this study and many other publications [3,8,9,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56] three different market types were identified: centralised, distributed, and direct trading markets. However, the names used to define the same or similar concepts differ from paper to paper. From our point of view, one gap found in the literature was the standardisation of the different terms used to refer to the same market type, hence a standard language for those terms is proposed in this study as centralised energy market, direct trading energy market, and distributed energy market. Additionally, four different actor terms are proposed and defined, namely, manager, administrator, supervisor, and broker. Sometimes differentiation between the centralised and distributed market is hard to assess because they do not fulfil all concepts. In this sense, the actor roles of the three different markets are defined together with a sketch to provide more differentiative characteristics. Each market is formed by a producer, consumer, and platform role, and depending on the market types, they receive different roles and responsibilities. The platform provider role depicted in our sketches may be composed of one or a combination of our proposed standard actors depending on the case. Last but not least, Sorin et al. [35] analyse the scalability of P2P-ET markets but from a computational point of view, in this study, it is analysed and evaluated based on the actual characteristics that define the project. When analysing different P2P-ET concepts, some important attributes were identified and used to develop a method for evaluating the entry barrier of a project and the scalability potential. It was found that projects which have a smart meter, a fee, a maximum distance between the generation and consumption, a minimum capacity for the energy system, and a uniform price, belong to the centralised market, and that those that ask for a specific technology present more difficulties for prosumers to enter the community. On the other hand, projects which have a maximum distance between generator and consumption, participants limit, ask for specific technology, and belong to the centralised market show more difficulties to scale the project into bigger communities. In this regard, incentivization of smart meter rollout must be deployed by the government or Transmission System Operator (TSOs), so end-consumer does not pay for it and the entry barrier and scalability potential would benefit from it.

Within this context, the research questions formulated in the introduction could be all successfully answered.

This study mainly focuses on the different types of P2P-ET markets and identifies the gaps in the literature, however, this research is subject to limitations and needs more research on the following points:

- The feasibility of distributed ledger technologies applied to energy trading would need to be further investigated because they could be a key factor in the development of P2P-ET markets.

- The regulative aspect should also be considered in future projects and be analysed in more detail.

- The pricing mechanism will provide an incentive to the prosumers to adopt the P2P-ET market and should be modelled and analysed in more detail. On this basis, flexibilization of grid usage tariff will incentivize participation in P2P-ET, especially for those concepts that are local/community-focused.

- Social acceptance

Author Contributions