Abstract

One of the major challenges regarding energy transition is to create active support towards renewable energy installations on a local level. The CROWDTHERMAL project presents practical approaches for involving local stakeholders in different measures in order to develop acceptable solutions. Based on technical evidence and data from concrete case studies, the project shows ways how community funding can increase social acceptance towards geothermal energy installations. The presented solutions are based on alternative financial schemes studies and risk mitigation analysis in geothermal projects.

1. Introduction

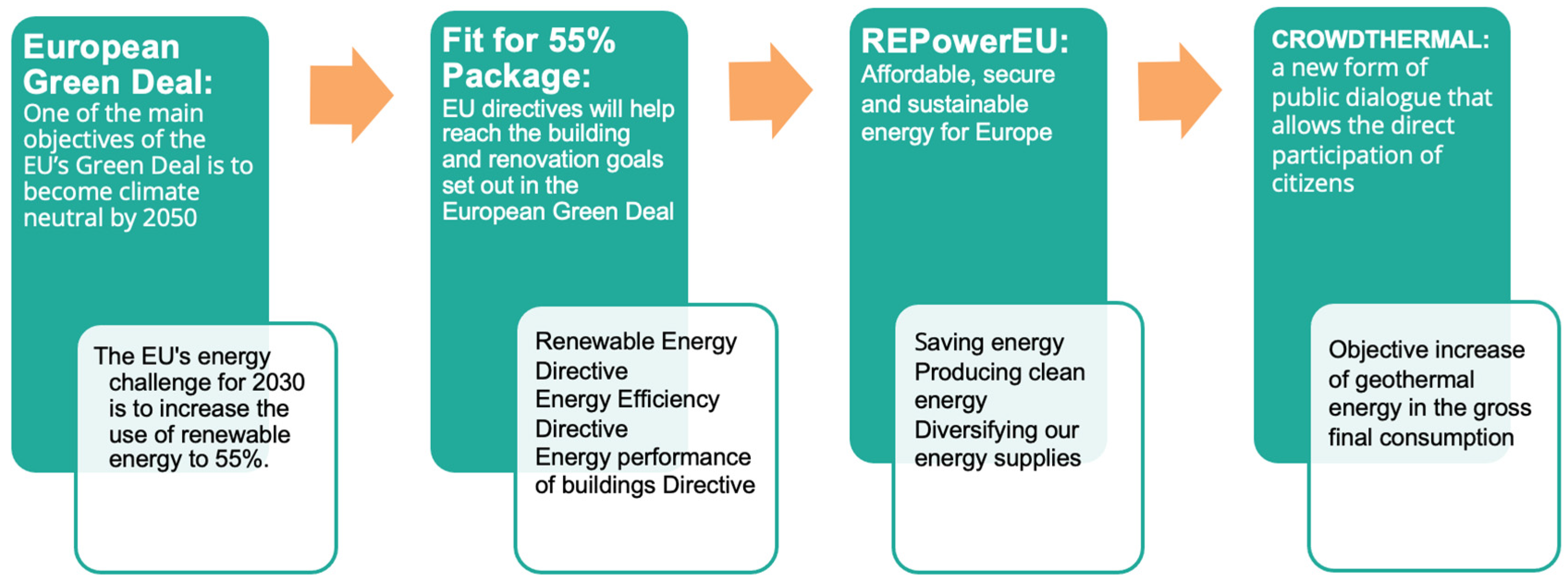

EU policy is on the forefront of driving a systemic shift in the energy field, addressing both supply and demand of energy while transitioning towards sustainable and renewable resources. In December 2019, the European Commission launched the European Green Deal [1], a comprehensive policy to accelerate energy transition in the EU to ensure a climate-neutral EU by 2050. Investment, regulations and reforms are mobilized in parallel to create the right framework conditions for industry to consumers. More recently, responding to the geostrategic energy dependency from Russia, the EU launched the Repower EU policy [2], which includes an ambition to double the deployment of geothermal energy in the EU.

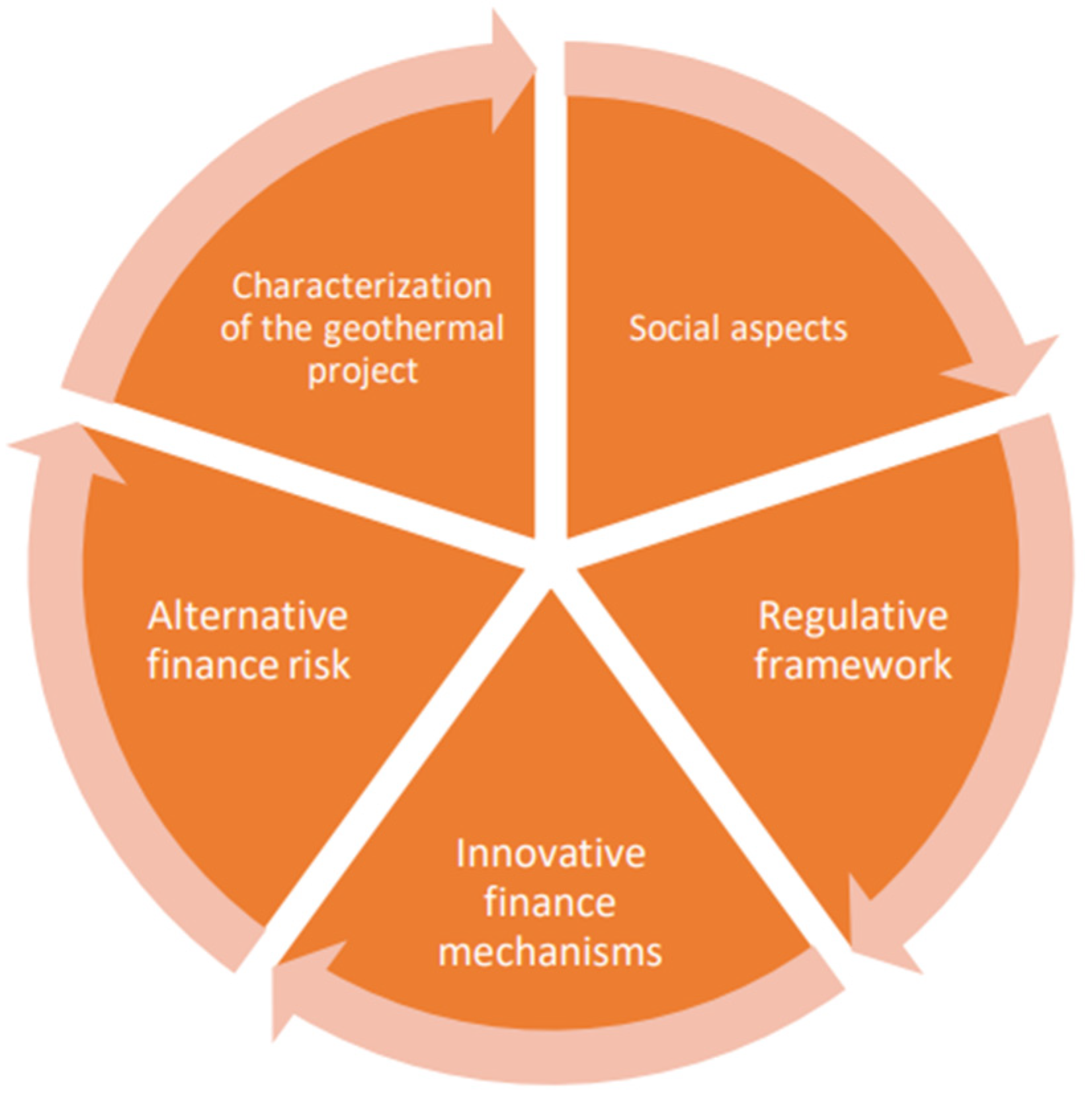

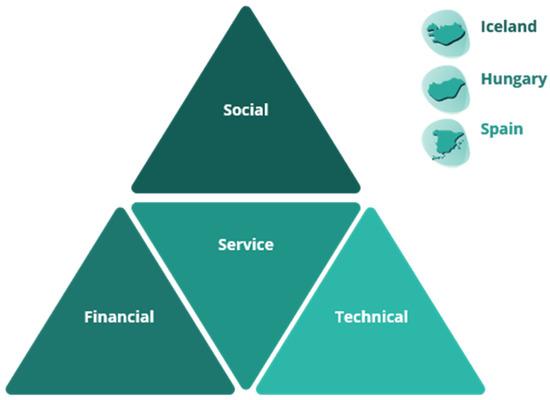

This has been the context and motivation for the CROWDTHERMAL project (Figure 1). There is a clear need to learn more on public engagement and social acceptance of renewable energy, focusing here on geothermal energy in its different forms. With the right framework conditions, citizens do not only accept renewable energy but actively promote them, engaging as co-investors. Community funding and innovative use of crowdfunding require both increased public engagement and trust.

Figure 1.

Political background for CROWDTHERMAL.

The CROWDTHERMAL project is based on multidisciplinary research, combining engineering and technical knowledge on geothermal energy with social science, psychology, innovative finance engineering and social innovation. This is possible thanks to a multidisciplinary consortium team, where relevant institutions from several European countries have joined up:

- European Federation of Geologists, EFG: Project coordinator, European professional NGO;

- Institute for Future Energy and Material Flow Systems, IZES GmbH, Department Environmental Psychology: Germany, research institute;

- University of Glasgow, UoG: UK, research institute;

- GeoThermal Engineering GmbH, GEOT, Germany, SME;

- La Palma Research Centre, LPRC, Spain, SME;

- CrowdFundingHub BV, CFH, Netherlands, SME;

- Szegedi Tavfuto Kft, SZDH, Hungary, Energy Company;

- Spanish Geothermal Technology Platform, GEOPLAT, Spain, NGO;

- Geothermal Research Cluster, GEORG, Iceland, NGO;

- EIMUR, Iceland, NGO.

This team includes geology associations, research centers on social and technical aspects of geothermal energy, geothermal industry and SMEs specialising in financial engineering. The geographical spread is further enhanced by so called “linked third parties”, i.e., collaborating geological associations from 17 European countries. Finally, the project is supported by an Advisory Board with 10 members representing the societal, technical and financial sector.

CROWDTHERMAL is a project funded under the European Union’s Research and Innovation programme Horizon 2020—Grant Agreement n° 857830. It is a 40-month project led by the European Federation of Geologists (EFG), with a consortium of 10 partners from 7 different European countries. The project started 1 September 2019 and will finish the 31 December 2022. The topic for the call of the project was market uptake support, with the focus on the area of building a low carbon (LC), climate resilient future.

2. The Target Groups Are

- Communities of citizens keen to become actors in the energy transition process. The benefits for these communities could be economical or environmental;

- Geothermal project developers interested in involving the community to increase commitment and/or fundraising;

- Local authorities interested in involving the community to develop a Sustainable Energy (and Climate) Action Plan 2030.

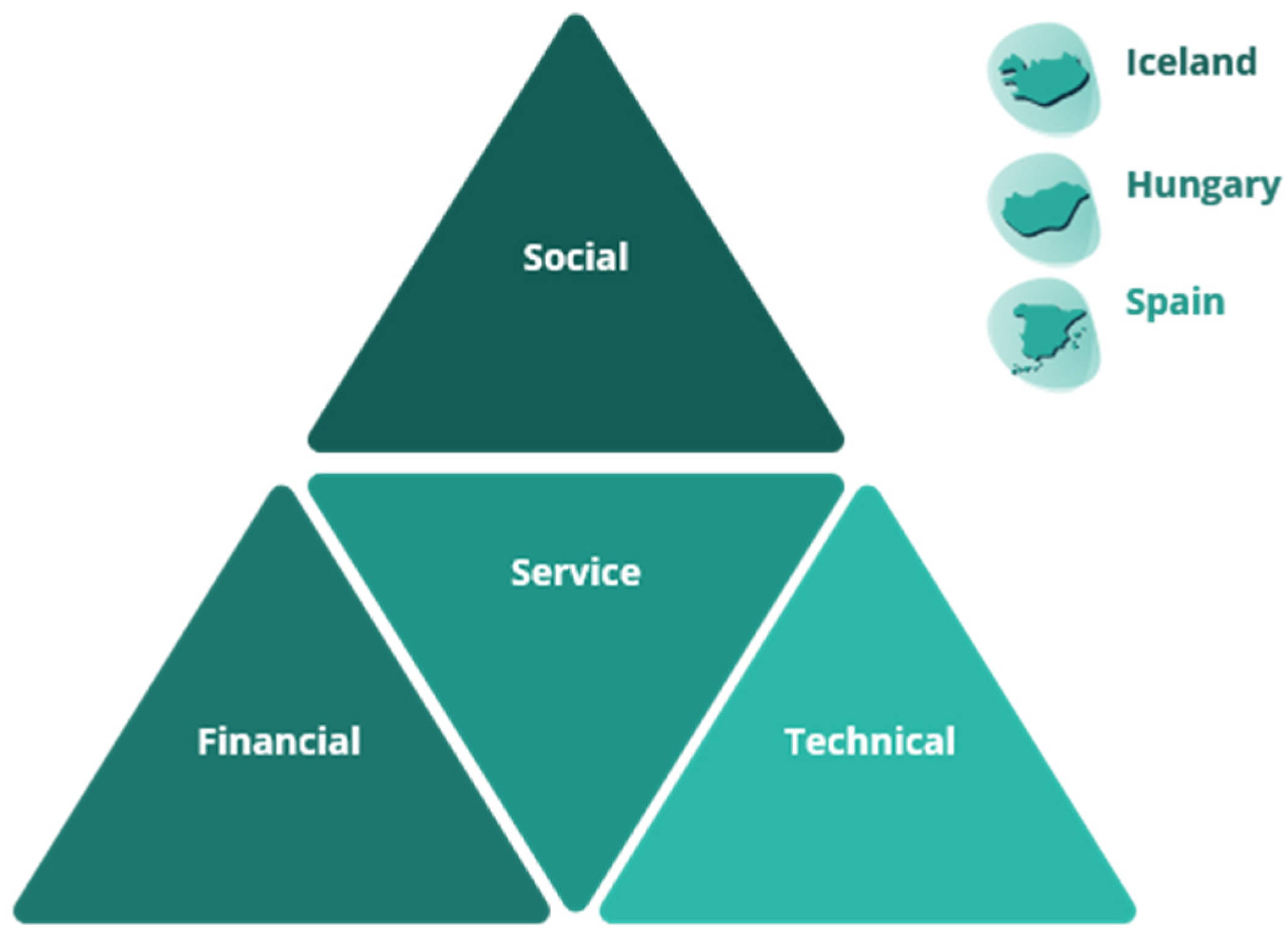

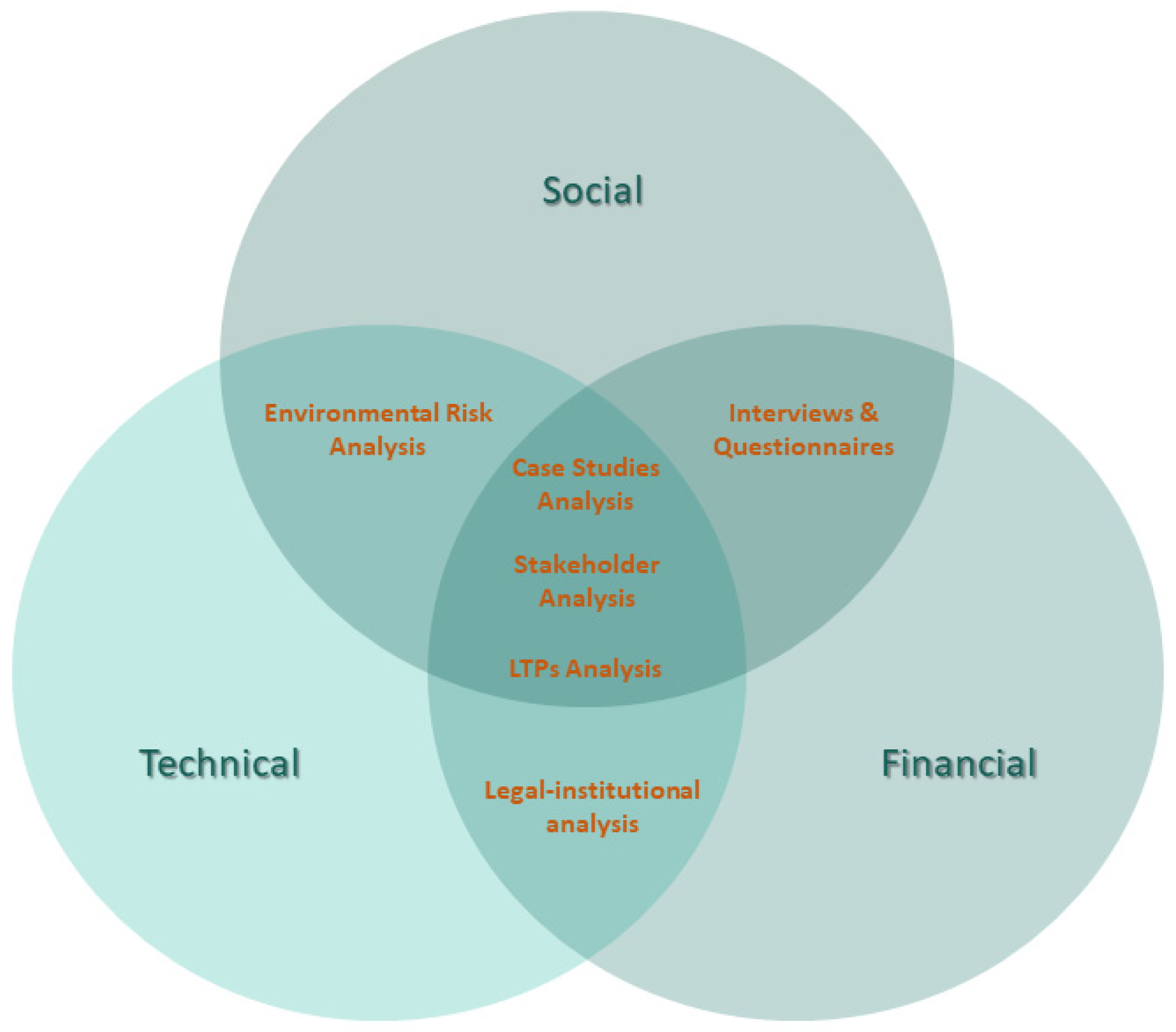

One key outcome of the project is to develop core services for social media-based promotion and alternative financing of geothermal projects, working closely with existing structures and conventional players. Figure 2 shows the schematic development of core services based on three angles: social, financial and technical, and CROWDTHERMAL case studies. Understanding:

Figure 2.

Schematic development of CROWDTHERMAL core services.

- Social: new forms of public dialogue to tackle concerns and increase interest in geothermal energy;

- Financial: empowering citizens to directly participate in the development of geothermal projects with the help of alternative financing, such as crowdfunding;

- Technical: techniques to gain public trust, risk mitigation and transparency of geothermal projects;

- Operational tools and services will be delivered to facilitate access to new financial instruments for the developers of geothermal projects and regulators/authorities.

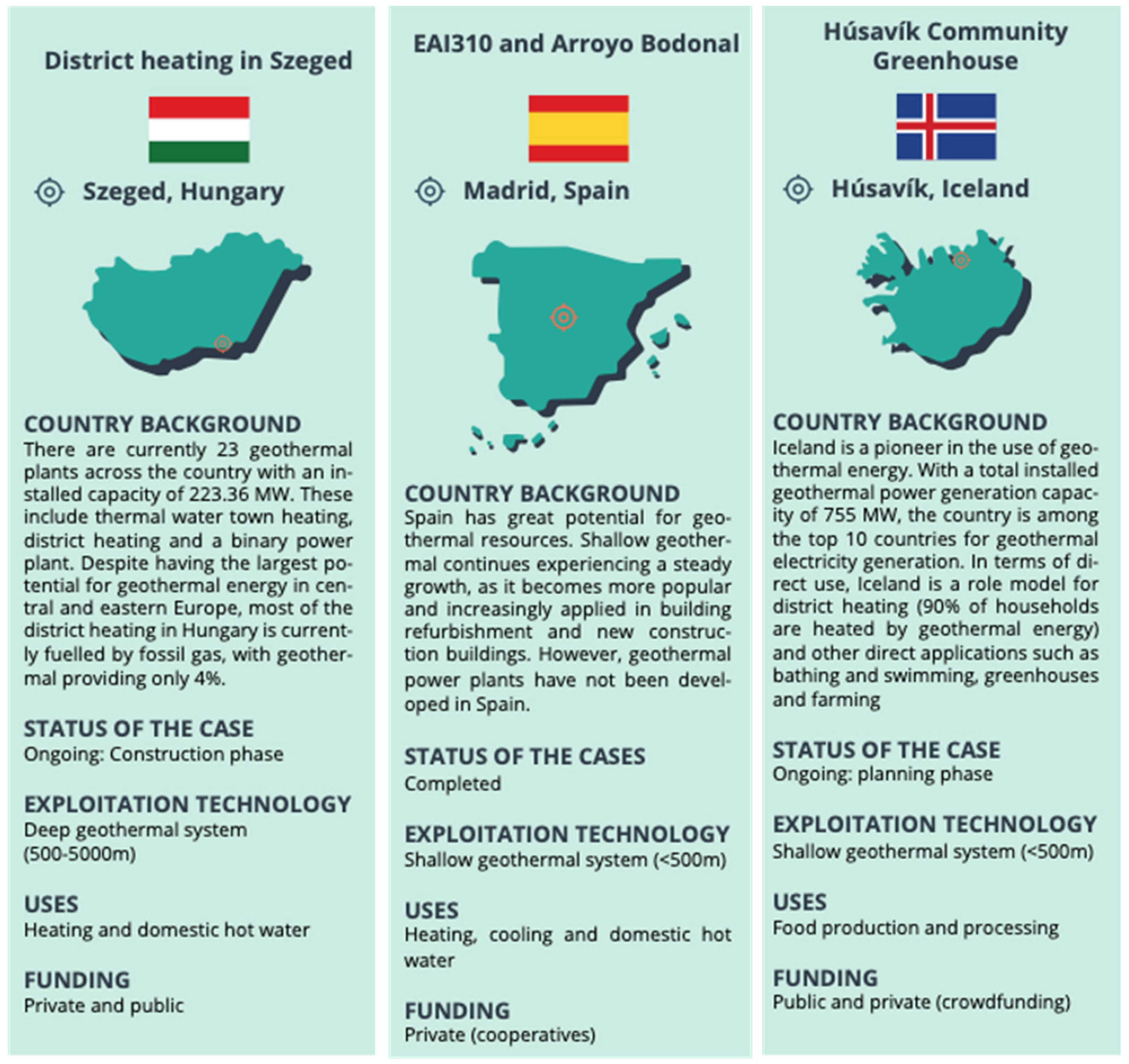

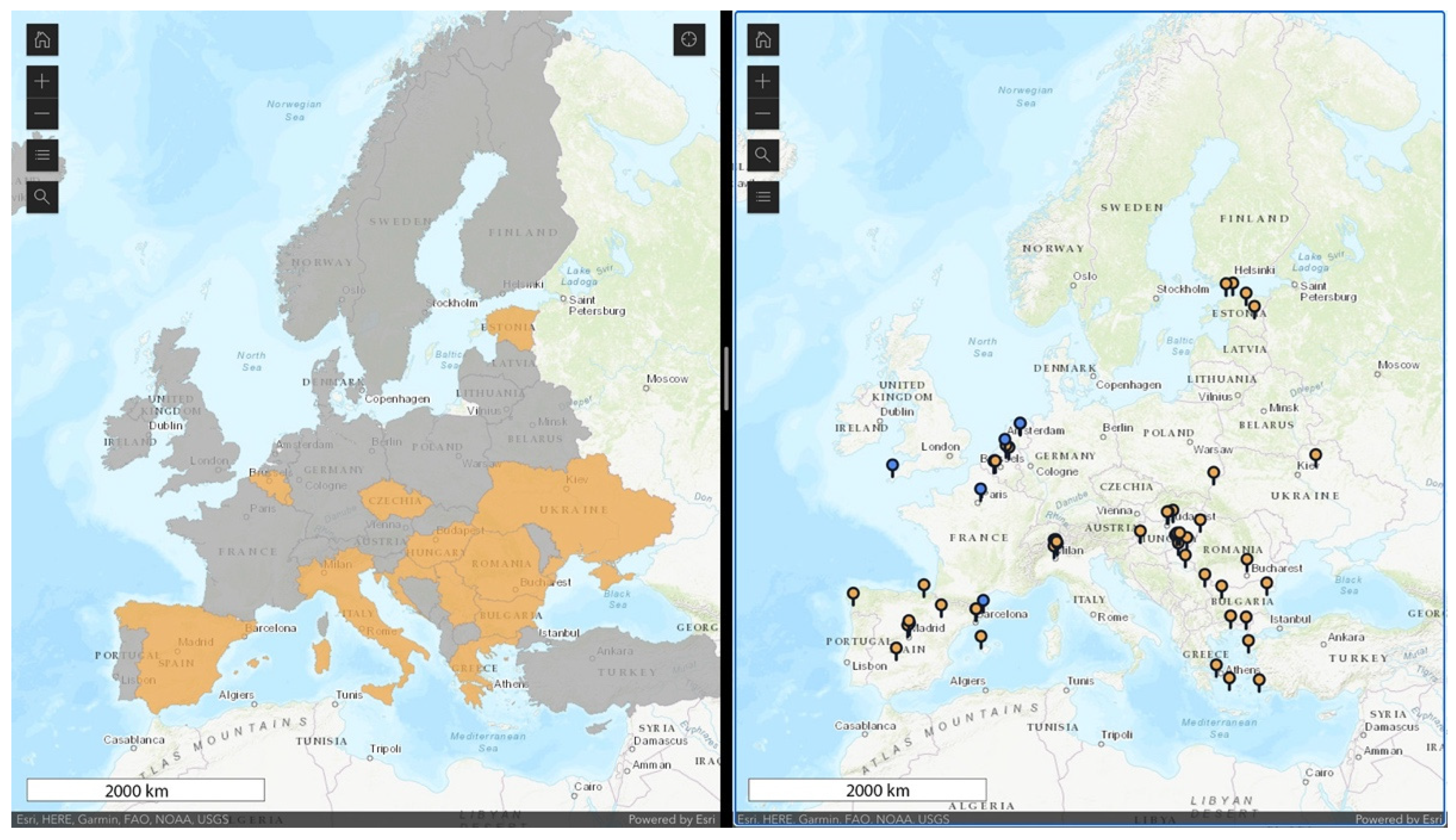

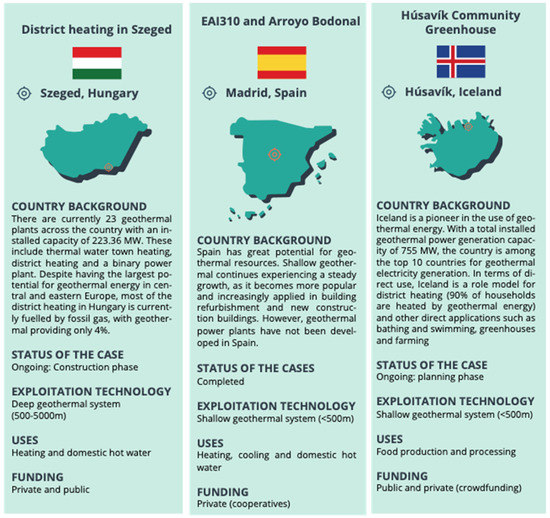

The CROWDTHERMAL project validates its findings with the help of three case studies located in Iceland, Hungary and Spain (Figure 3).

Figure 3.

CROWDTHERMAL case studies countries.

3. Methodology

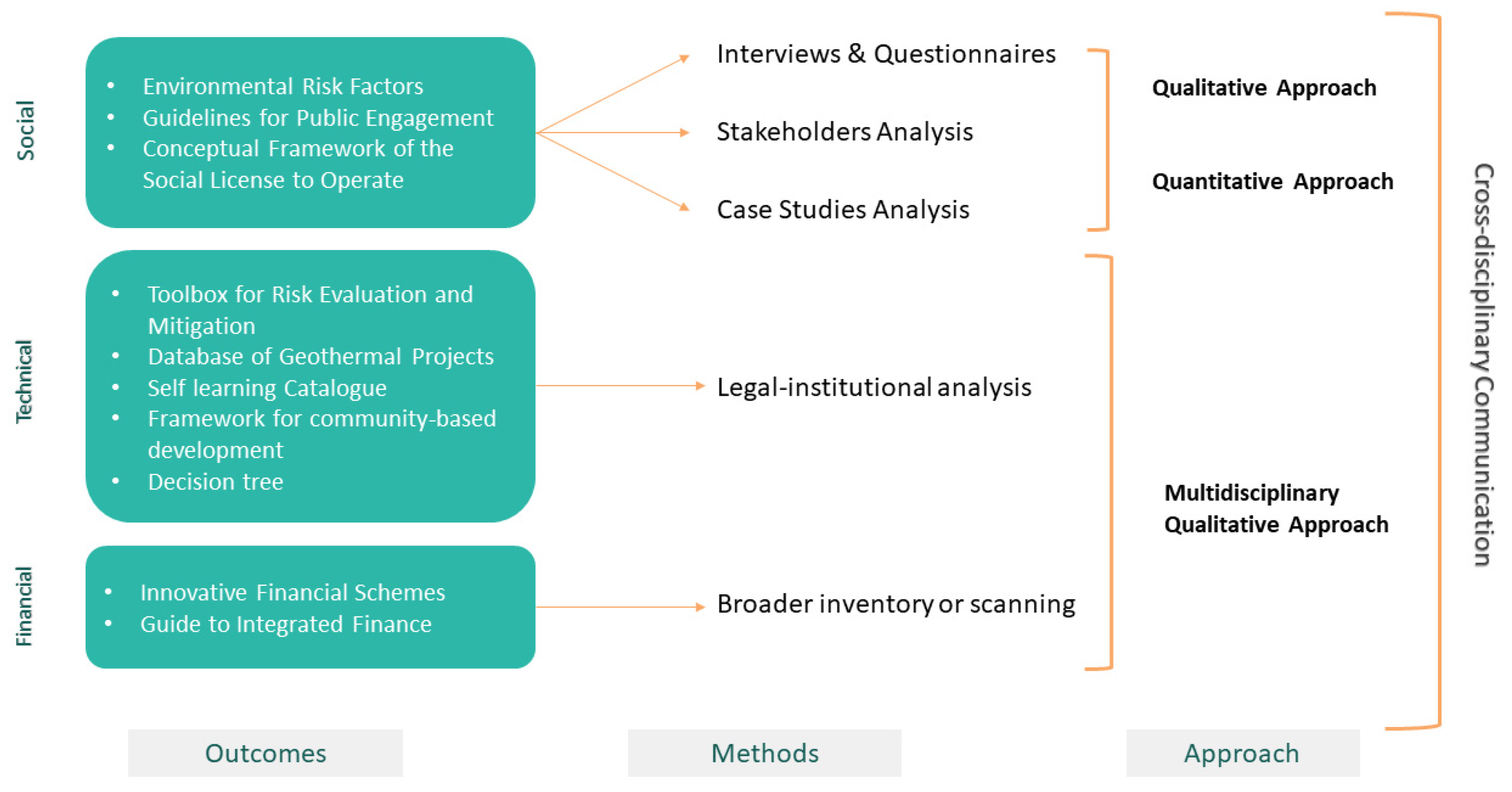

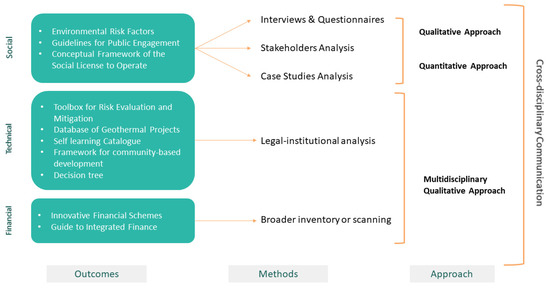

The findings of the CROWDTHERMAL project are based on a broad range of empirical sources and methodological approaches (Figure 4). The most common methods used were case study analyses, qualitative interviews, consultations with experts and the Advisory Board of the project, questionnaires, literature reviews, inventories of best practice, theoretical constructs and economic assessment of specific scenarios. The methods used were adapted to the specific target of each element of the project. There were also important learnings coming from comparative analysis across the findings in each of the reports of the project.

Figure 4.

CROWDTHERMAL project methodology approach.

To ensure a common understanding of the project’s scope and ensure a successful cross-disciplinary communication, a harmonization of the relevant terminology was performed at the beginning of the project: Geothermal Resource Classification [3] and Geothermal Project Phases [4].

A fundamental empirical base in the project has been the three case studies of geothermal energy in Spain, Hungary and Iceland. Data from these concrete, real-life experiments have for instance been utilized in the psychological, behavioural science analysis of social acceptance and engagement and in the demand analysis for risk mitigation.

CROWDTHERMAL has performed a stakeholder and case study analysis of each of the three case studies including qualitative interviews and context analyses in Hungary, Iceland and Spain [5]. The three cases differ in their technological approaches and regional contexts, as well as in terms of their temporal dimension. The comparison of the cases allows to draw conclusions regarding relevant stakeholder settings as well as social dynamics and the importance of psychological variables. Methodological approaches involved a questionnaire as an entry in order to collect information about general data, which were then put together to characteristics of the respective cases.

Stakeholder interview is the chosen method to relocate the social dynamics while retracing the history of the project. We carried out a stakeholder analysis for each case, providing an overview of the framing conditions and social dynamics between the different groups [6]. The stakeholder analysis is an approach or set of tools for retrieving knowledge about involved stakeholders as a matter of understanding their interests and intentions as well as their behavior and interrelations [6,7]. The meaning of a stakeholder includes all actors who are interested in or affected by the matter as well as those actors with a predictable active or passive effect on particular actions and aims of a project, an organization or a policy direction and, more generally, on decision-making and implementation processes [8,9]. To give examples, individuals, organizations and networks such as alliance groups are included in the concept of a stakeholder.

An interview guideline was constructed based on a summary of theoretical background regarding the exploration of stakeholders’ perspectives. Furthermore, the interview guideline constitutes the attempt to measure crucial acceptance factors for geothermal energy by means of the perception of relevant stakeholders, such as risk perception, procedural justice, the possibility for financial participation or trust.

The interviews were planned and organised together with project partners that were in direct contact with the respective case study representatives. As the selection of appropriate interview partners was based on theoretical knowledge about who has an influence on the process of project development and implementation, the local project partners served both as a link to the case study and also performed the interviews in the representatives’ native language to avoid barriers in communication and facilitate the exchange. Interview procedures were adapted and customized for each case study. Amidst the Corona Virus pandemic, the interviews took place via web meeting platforms. All in all, in the three case studies, 5 stakeholders were interviewed in Spain, 3 in Hungary and 3 in Iceland. The interview persons were residents, users and representatives from the companies or the municipality.

The three real-life geothermal cases also serve as an empirical basis for the legal-institutional analysis of the regulatory frameworks for community funding.

In the three case studies and countries, the infrastructure formed by ownership structures, energy production, distribution legislation and financial legislation were quite different. Different government instruments increase these differences. This means that the countries can learn from each other concerning the possibilities and obstacles created by the regulative framework. The differences are too many to summarize here but they have been included in summary tables in [10], (e.g., on governance and ownership structures; legislation on the generation and supply of electricity and heating; and financial legislation). Each table contains the main best practices we have found in the three case study countries.

The three case studies have also been the base for multidisciplinary approaches and analysis across project outcomes. This was the case for the broader analysis of public perception and acceptance of renewable energy sources and geothermal energy. It took into account several decisive factors of various nature including social, economic, environmental, technological and scientific ones. A brief sheet was prepared to gather general aspects of the project as people and entities involved in the project or the timeline of events.

The case study protocol served to integrate the results obtained and complete the information with aspects not mentioned but considered relevant for the development of the project. The protocol was composed of several stages, enabling both the characterization and the assessment of the perception of the project by the involved public in each case study. One first stage consisted of the general characterization of the project. It included geographical, technical, socioeconomic (including finance) and environmental aspects. The second and third stages consisted of two different surveys, which tackled public awareness (knowledge) and perception of geothermal projects. These methods were carried out separately and benefitted from the knowledge of stakeholders and experts (e.g., Advisory Board).

Furthermore, a questionnaire for collecting information on the risk aspects of the case studies was prepared. This questionnaire included a brief description of the case study and covered subjects such as risk owners, types of risks and mitigation ways. This work was part of a broader demand analysis for geothermal risk mitigation identifying the most important issues currently not fully mitigated by existing geothermal de-risking schemes.

The empirical base for the CROWDTHERMAL project also extended beyond the three case studies. For instance, to deepen the understanding of innovative financing schemes, a broader inventory or scanning was performed. The objective was to identify and describe new and innovative finance models which could be used to realize financing for geothermal projects, including what advantages these new finance schemes could bring. New finance schemes are all alternative finance methods or solutions offered by other financing parties than regular banks. A particular focus was put on new financing schemes to involve the community in future geothermal projects. The scanning looked at several European sustainable energy projects where forms of community funding were used. Some interesting cases were added globally, for example from Kenya, where actors have used new ways of funding. These are all relevant cases from which we can learn. The methods used in these projects were analysed to reach an overall view of possibilities. For instance, the fintech world is in constant development. New financing schemes are being developed as we speak. Interesting new examples are smart contracts using block chain technology, new guarantee schemes, steward ownership and sale and lease back schemes. The finance schemes described can be useful to increase the success of community funding in geothermal projects. For success, the compatibility with legal infrastructure is essential. That is why the new finance schemes were related to the usability in the three case study countries using the information about the legal framework and energy market infrastructure in these countries.

In order to give some guidance on the usability of these models in other member states, the project used the information from the CROWDTHERMAL questionnaire that was filled in by different Linked Third Parties (LTP’s) of the CROWDTHERMAL project. The aim was to classify these countries to see which of the three case study countries is closest to their situation. Using this, each EU member state can see which schemes could be interesting to use in their country.

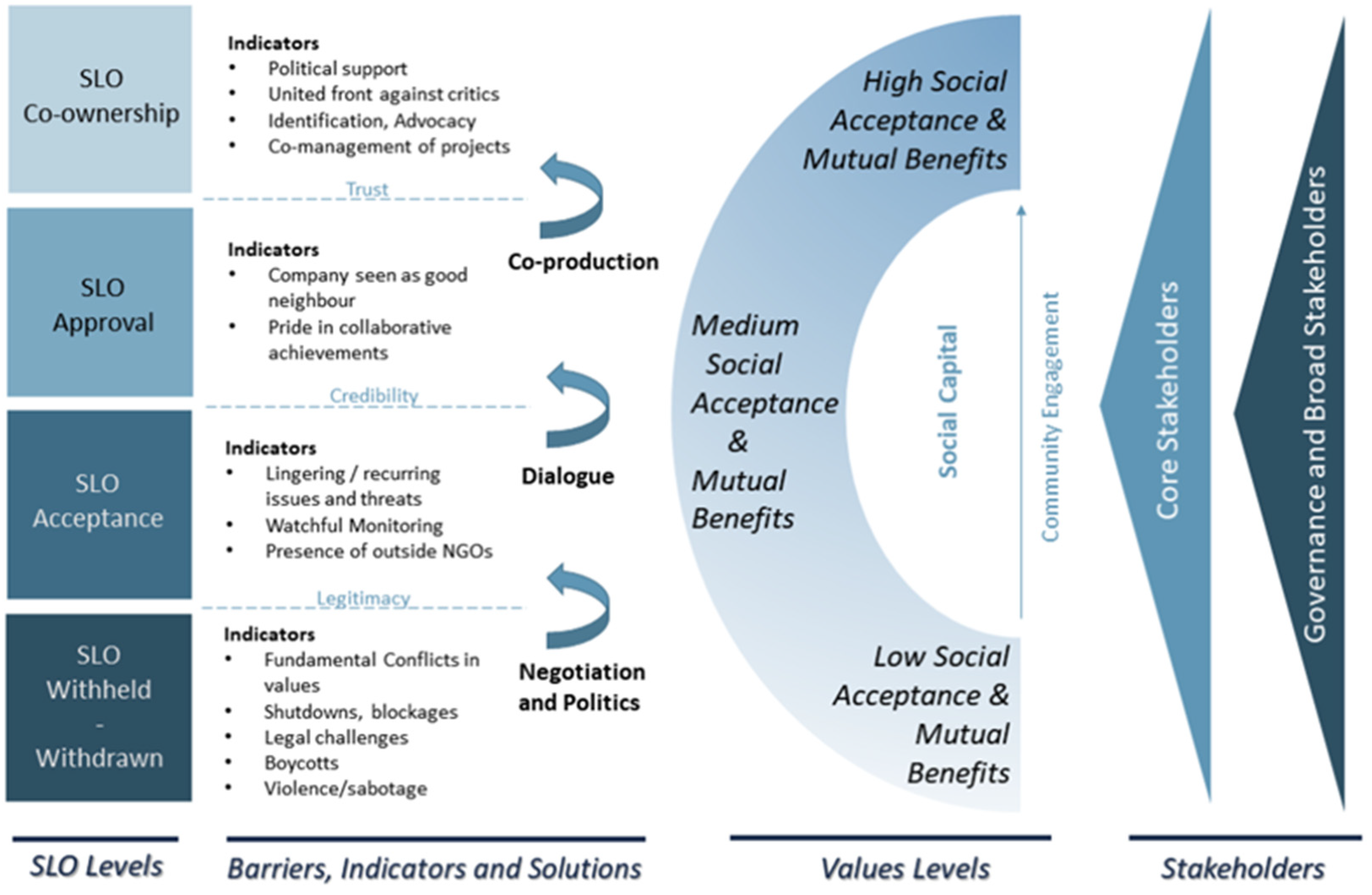

Complementing the empirical methods, the project has also developed theoretical constructs such as the Social Licence to Operate, derived from Corporate Social Responsibility concept. A Social License to Operate (SLO) is a theoretical construct representing the degree to which a corporation and its activities meet the expectations of local communities, the wider society, and various constituent groups. CROWDTHERMAL has delivered, for the first time, a conceptual framework for the Social License to Operate (SLO) in the geothermal energy sector.

This work was triggered from the stakeholder analysis of the CROWDTHERMAL case studies and social acceptance work, which identified different steps to plan and implement public engagement, and the necessity to define a framework to manage the dynamics between the stakeholders/public and geothermal projects operators.

A state-of-the art critical literature review (based on academic literature, ongoing and previous projects and industry and innovation reports) was also conducted to identify environmental risk factors of both deep and shallow geothermal energy systems. The aim of the critical review is to synthesise and analyse evidence from diverse sources, critically evaluating their quality and finally present outputs in a coherent and consistent way [11]. The critical reading searched for the weight/criticality of each factor in terms of its influence on public perception and approval.

Lessons learned from best practices were also used as a method to analyse community finance [12]. Important lessons learned were, e.g., the need to focus on the impact of the project (sustainable energy) and not on the financial return, as this will increase the commitment of the community, or it is advised to build a community first, as this can make the financing more successful. Start with a small, involved community and if that is successful, increase the target group for investment. The analysis of best practices revealed that there are several forms of community finance that can be interesting for a geothermal project. Which form of community finance is the best to use depends on social, environmental, risk and financial aspects of a specific project. It contained some of the best practices of community finance used in other sustainable energy projects in Europe. For each best practice, there is a description of what the lessons learned in this specific project actually are and what bottlenecks were encountered in the project. Bottlenecks are equally important as they can make or break the success of the community financing.

Within the task of exploration risk, mitigation clusters and dialogues, numerous networking activities were conducted. All partners in the CROWDTHERMAL project were asked to get involved in the dialogues on geothermal risk mitigation. Following up on a first brainstorming at the kick-off meeting, a log spreadsheet was sent to all consortium partners, asking for contribution from the partners’ networks. In total, more than 30 cluster dialogues were established with geothermal project developers, investors, co-operatives, past and ongoing exploration risk mitigation schemes and initiatives, the insurance market, geothermal and institutional experts, research projects, geothermal energy policy initiatives and public authorities. All contributions to the log sheet from the consortium were compiled in a master spreadsheet and distributed to the consortium partners for their reference.

The networking activities were supplemented by desktop research on past projects and initiatives with the focus of geothermal risk mitigation. In addition to the first contacts of the cluster dialogues, more in-depth interviews were held with risk mitigation experts from several organisations and programmes dealing with geothermal risk mitigation (namely the World Bank Group, GRMF, ARGeo, KfW and BGR GEOTHERM-Programme). The dedicated interviews focused on lessons learned from previous geothermal risk mitigation schemes and so far, unaddressed issues in risk mitigation. A questionnaire was used as a basis for these interviews. Interview protocols were prepared and finalised in co-operation with the interviewees.

Furthermore, a questionnaire regarding risk assessment and risk mitigation demand analysis of the CROWDTHERMAL case studies was prepared and sent to the case study partners. The questionnaire on the case studies’ demand analysis for risk mitigation was filled in by partners SZDH (Szeged, Hungary), Geoplat (Madrid, Spain, 2 cases) and Eimur (Húsavík, Iceland). Finally, additional interviews were held with project developers who experienced project failures.

A further methodological approach was an economic analysis of the proposed new CROWDTHERMAL risk mitigation scheme. The action tasks that were performed included software adaptation and economic calculations for different scenarios. It capitalized on content-specific knowledge of the project partners in the area of economic modelling for geothermal projects using the in-house software Renewalyzer to generate Profit and Loss, Cash-Flow and Balance Sheet statements to calculate different economic benchmark parameters.

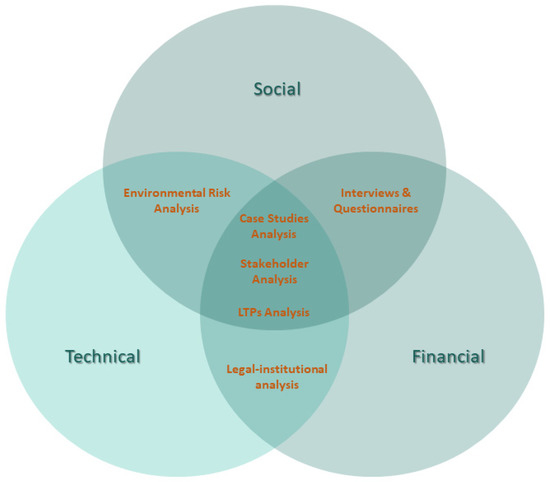

The Figure 5 presents the interrelation between the methodological elements.

Figure 5.

CROWDTHERMAL methodological interrelationships.

4. Social Acceptance of Geothermal Energy

4.1. Environmental Risk Factors

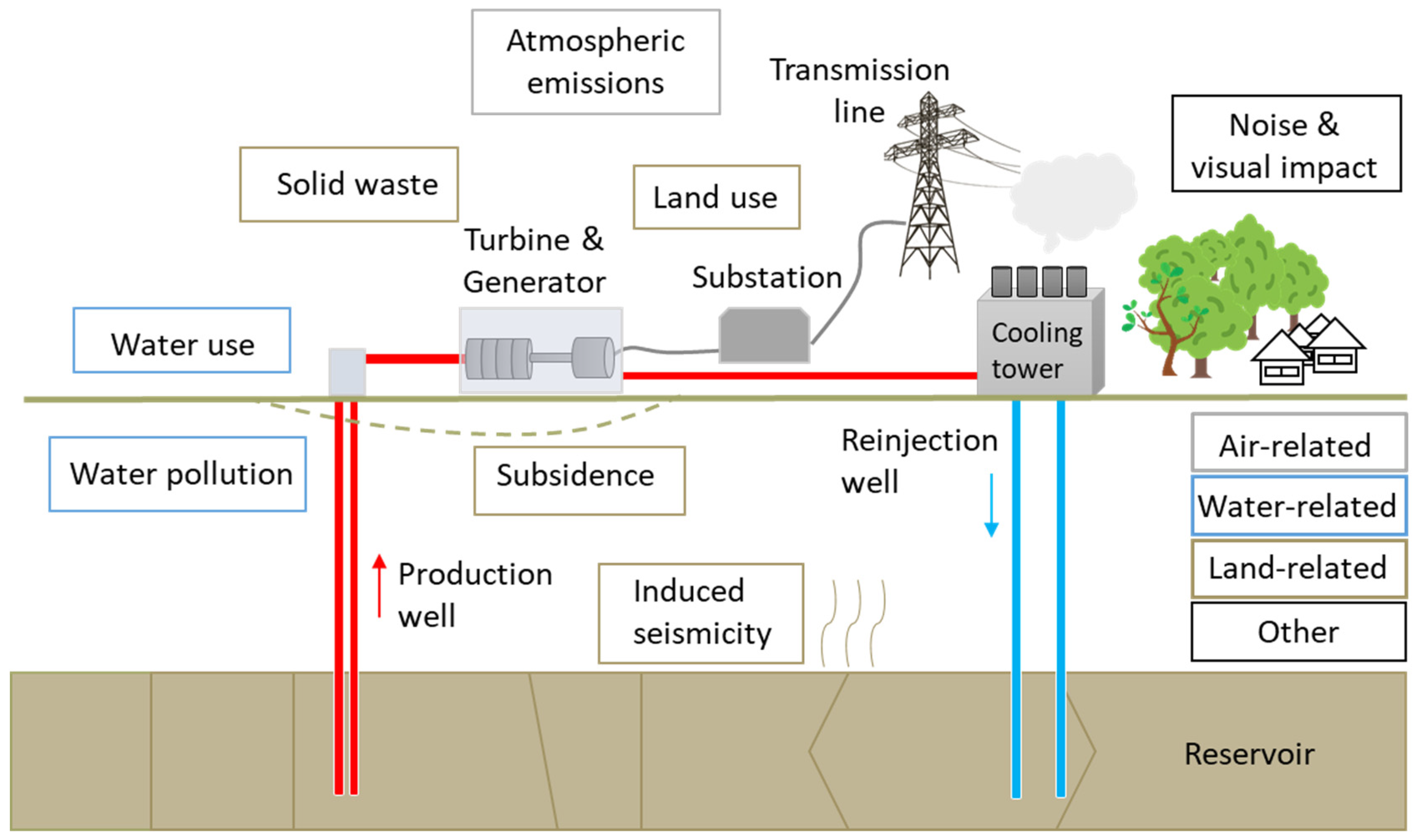

Geothermal energy is an environmentally friendly and sustainable form of energy, yet a major obstacle to geothermal development is social acceptability, with perceived environmental factors being a cause for public concern. A state-of-the-art literature review of environmental risks was carried out to investigate the influence on public support for the development and deployment of the technology (Figure 6). It was concluded that some environmental issues are based on facts, whilst others are perceptions, which operate as socio-environmental and psychological processes.

Figure 6.

Environmental risks of geothermal energy projects (Source: [3], based on [13]).

The review study classifies environmental risks in terms of environmental matrices covering:

- Potential air impacts. The emissions of pollutants, including non-condensable gases (NCGs), to the atmosphere from geothermal energy plants are much lower than conventional fossil fuel-based energy plants [14], but still need to be monitored and reduced [15];

- Potential water impacts. The pollution and consumption of water depend on the size, the technology type, the working temperatures, and the cooling mechanism of the geothermal energy plant. In high-enthalpy projects, losses of geo-fluid and steam during operations mean make-up water is required. Environmental risks of shallow geothermal energy include groundwater contamination due to leakages of contaminants in vertical closed loop systems, connection of different aquifers or connecting aquifers to the surface and thermal changes of soil and groundwater causing variations in the concentration of microbes, among others [16];

- Potential land impacts. As geothermal operations are concentrated in seismic active zones, energy production by extraction or circulation of geofluids can lead to induced seismicity [17,18]. Land subsidence can occur from the extraction of fluid and steam from geothermal reservoirs. Land use during the different project phases of a geothermal power plant can be temporal (construction and reclamation) or permanent (operation) and includes changes to landscape and to natural features. Solid waste is created during drilling and operation phases and waste from geothermal energy production includes activated carbon from abatement systems and chemical deposition in pipes, vessels and in cooling towers;

- Potential noise and visual pollution and radioactivity impacts. Throughout the life of a geothermal energy system, noise is created during plant operations [19,20]. Visual disturbances caused by geothermal plants include deforestation, land occupation and increased road traffic and dust emissions. Radioactivity from leached uranium and thorium can reach the surface in geothermal fluid and radioactive tracers have been used in doublet well testing.

The review covers the environmental risks of both deep and shallow geothermal systems and considers each factor’s criticality in terms of its influence on public perception and approval [3]. The assessment considers not only the risk of the selected technology used to exploit geothermal energy but also its temporal nature, as environmental factors can change at different stages of geothermal development.

4.2. Public Acceptance and Public Engagement

There is broad literature on the different acceptance factors towards geothermal energy and experiences from participation processes (e.g., [21,22,23]), as there is for other energy infrastructures such as transmission lines or renewables energies [24].

Looking at this pool of knowledge, public engagement is a central factor for successful energy projects beside others. In this contact, it is obvious that participation is neither a silver bullet nor does it provide a guarantee that everybody does accept the project; there are examples where participation procedures were misleading or failing. Still, it opens the space for exchange, provides the chance to integrate local knowledge, and has relevant correlation with perceived procedural justice [25].

When it comes to public engagement, it is relevant to reflect that there are different engagement levels such as formal participation regulated through legal frameworks, and informal participation and communication measures conducted voluntarily by the project owner. The quality of both levels has proved to be crucial for the success of a project all along the line. The involvement of the public starts with information. Information is the basis for any further level of participation and should therefore be carefully and continuously pursued. It is an essential prerequisite for consultation, where opinions are exchanged between involving persons or institutions. “Real” participation starts with the level of cooperation, where the involved people are not just consulted but play and active role in the project’s outcome [24]. Even if the participation process is designed to be as open-ended as possible, there are limits to what can be negotiated. These limits should be transparently discussed right from the beginning in a sense of realistic expectation management [25].

When planning public engagement, it is essential to consider the existing (contextual) preconditions of a project when deciding on public engagement strategies. Consequently, the participation instrument itself is not the most important determiner for success, but rather the analysis of the context of the system, into which it is planned to integrate a certain technology or with whom there is the desire to jointly develop a certain technological solution. The analysis should be conducted before choosing the instrument for public engagement and can be conducted via media analyses, surveys, interviews and literature research.

The context analyses can involve factors such as place, meaning it should be brought into experience whether there are protected spaces, nature reserves, national parks or whether there exist directives protecting flora and fauna, whether the project would affect the landscape negatively and what consequences would result from this circumstance. It can be relevant to understand how residents are attached to an area in order to act appropriately. Furthermore, information about the community is crucial for planning public engagement. It is important to know the groups of people and the stakeholders that need to be represented in the engagement process of a geothermal energy project, what the socio-demographic characteristics of a community are, as well as which political attitudes are dominant in the area.

When assessing the community, stakeholders that are of relevance should be considered [6]. Examples for relevant stakeholders are citizens, project initiators, administration and politics, companies, associations, experts and the media. Identifying the relevant stakeholders and their relation to each other is essential when tailoring the different participation measures to the existing target groups. Therefore, stakeholder maps provide a good overview. Furthermore, it should be researched whether there were any events in the history of the area that could influence the residents’ reactions towards following energy projects, and whether there already exist specific visions in terms of energy solutions, which is closely connected to the political context and should also be taken into account. What should also be taken into account is that citizens´ knowledge about geothermal energy or energy topics in general determines how engagement strategies are designed.

4.3. Social Licence to Operate

One of the main goals of the CROWDTHERMAL project is to comprehend social licensing requirements and develop a Social License to Operate (SLO) framework for geothermal projects.

A Social License to Operate is a theoretical construct that represents the level of acceptance by local communities and stakeholders of an organization or company’s activities in their territories. It is an implied consent, independent from legal or statutory requirements.

The SLO concept originated from the mining sector and became an integrated part of the discourse on natural resource management in recent decades, especially since the inception of the United Nations declaration on the Rights of Indigenous People (UNDRIP) for Free, Prior and Informed Consent (FPIC), which allows them to give or withhold consent to a project that may affect them or their territories [26]. With rising criticism and opposition to mining projects, SLO became a tool to ensure sustainable mining and work towards legitimacy to proceed with mining projects (refs. [27,28,29]).

Literature on SLO is so far dominated by research related to extractive industries, however, the application of this paradigm in other sectors such as renewable energy is increasing (refs. [30,31,32]).

The general aim for a geothermal SLO is to further reduce the risks of public criticism and social conflicts, and, in general, provide a universally accepted social acceptance framework for the different types of geothermal investment projects. This will result in 1. More transparency, 2. Reduced investment risk and 3. More versatile and easier engagement for crowdfunding.

The SLO framework developed through the CROWDTHERMAL project is a first of a kind model in the geothermal energy industry which considers contemporary discussions concerning all stages of geothermal development from exploration to planning and building, and from operations to closure [33] and [34].

Considering the various levels of strength in social license ‘contracts’, the framework is based on the SLO Pyramid Model [27], which allows for a clear measurability of the SLO. At the lowest level of SLO, the lack of legitimacy reflects a state of absence or withdrawal of the social license by the community or a network of stakeholders. A higher level of SLO is represented by a state of legitimacy and credibility, where the stakeholder accepts, approves of and encourages the continuation of the operation. The highest level is achieved when the operation is perceived by local stakeholders are an integral part to their values and identity, feeling therefore invested in the outcomes of the project and advocating towards its completion and success (psychological identification).

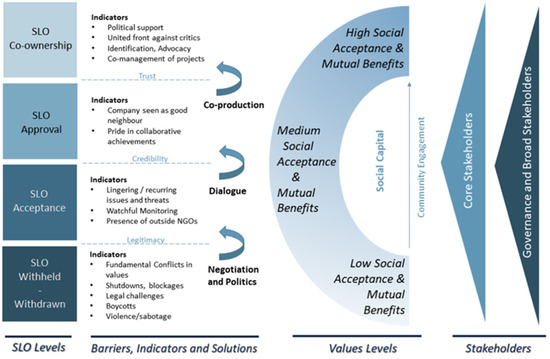

The components of the conceptual model are SLO Levels, Barriers, Indicators and Symptoms, Social Acceptance & Mutual Benefits Levels and Stakeholders (Figure 6). The model shows that the different levels of SLO are positively correlated with levels of social acceptance and mutual benefits (Figure 7). Given the dynamic and multiscale nature of the SLO, it is important to consider a continuous effort in building the social capital through dialogue and community engagement, through actively seeking an inclusive approach in order to reach the highest levels of social acceptance, and an optimal mutual benefit. When SLO is absent or withdrawn, it reflects a lack of legitimacy to proceed with the project and a great conflict of interest and in values between the stakeholders and project developers. If the community resistance persists, it can result in legal challenges and a possible withdrawal of the legal license. It is therefore important to initiate processes of mediation and negotiation with local regulators and communities of practice in order to align values and aspire to reach trust, the ultimate boundary to the highest SLO. It is therefore fundamental to maintain good quality dialogue at all stages.

Figure 7.

SLO Model for Geothermal Energy [33,34].

From a practical point of view, given that SLO is context-specific, a more comprehensive approach would be to include a “Factors” element to the framework, refs. [29,30]. These would consider:

- Needs of the stakeholders (especially the local communities and the relevance of the proposed projects to those communities);

- Relevance of geothermal development projects is intrinsically linked to the national (as well as regional and international) strategic energy utilization;

- Legal and economic licenses;

- Environmental and financial risks;

- Competition and industry perception.

Key results:

|

5. New Finance Schemes for Geothermal Energy

5.1. Innovative Finance Mechanisms for Geothermal Energy

Community funding (or community financing) is a tool to financially involve stakeholders around a geothermal project [7]. By making them a part of the project through funding, they can:

- Be more directly involved in the decision-making around the project;

- Be actively involved in the realization of the project and its sustainability goals;

- Be better informed about the project;

- Receive some of the financial or other benefits (cleaner or cheaper energy) of the project.

There are different alternative finance instruments that can be used to attain community funding for geothermal projects [35]. Alternative finance in general can be defined as all finance methods that are not through traditional channels (like commercial banks). These instruments can be combined with risk mitigation instruments to obtain the right mix of risk and return for both the project owner [36]. The involved community and other stakeholders would comprise local governments or other investors. The right mix of instruments depends on the risk appetite of the community and the project owner and on the project phase in which the community funding will be used [37].

It is important to realise that the specific circumstances of an individual project determine which combination of instruments fits best. It is not a one size fits all [38].

The following alternative finance instruments can be used for community finance [39,40]:

- Donations;

- Reward- or output-based funding (can be done through crowdfunding): With reward-based funding, the investors choose an individual project or company. The reward they receive is a non-monetary one. Investors can receive certain products, be invited to certain events or receive products at discount prices. In the case of output-based funding, investors only receive a reward based on the quantity of output. This reward can be financial or non-financial;

- Social impact bonds/green bonds (can be done through crowdfunding): Social impact bonds and green bonds are debt instruments specifically designed to achieve certain non-financial objectives. They are a new development in finance and although look similar to regular bonds, they are very different in nature. A social impact bond goes beyond its financial component. It is a “pay for success” financing instrument for projects that will create better social outcomes whereby the payment to investors is flexible, based on the achieved results or savings. A green bond is a bond that is specifically earmarked to raise money for climate and environmental projects. It can be realized in the form of a social impact bond;

- Equity investments (can be done through crowdfunding): With equity investments, the investors also choose the project or company to invest into but receive shares in return. While they are entitled to the financial benefits, they also share any loss incurred by the project or company;

- Revenue-based funding (can be done through crowdfunding);

- Output-based funding (can be done through crowdfunding);

- Direct lending is a form of lending where a financial intermediary gives out bonds or other debt (fixed income) instruments to investors and uses the incoming funds to finance a certain project or a certain company, without going through a bank;

- Leasing: It is a form of financing by which a firm can obtain and directly use an asset in exchange of a periodic fee. It is a contract between the funder (lessor) and the end-user (lessee) for the acquisition and use of the asset. The asset in this case could be a production plant for geothermal energy.

- Match funding with grants or donations: Match funding is when a governmental organization (or funding body) grants financial support as a part of a contribution to an already existing funding generated by other investors to finance a given project or company.

Most of these instruments can be used through crowdfunding [41]. Crowdfunding is a form of funding where funds are raised directly from the community. The community invests into a project or company directly, often through an online platform [40,41].

Crowdfunding and community funding do overlap but are not the same thing. Crowdfunding is usually also community funding, although institutional parties or (local) governments, who are not part of the crowd, can also invest. On the other hand, community funding can also take other forms, e.g., social or green bonds and direct lending.

Another interesting supporting instrument to achieve the involvement of the community and other stakeholders is steward ownership. This is a form of ownership where all stakeholders involved, including personnel, can be owners of the company. This implies that the company is not driven by share value only but is more centered on its products and its overall purpose. Steward ownership can be combined with all alternative finance instruments.

The alternative finance methods can also all be combined with different risk mitigation instruments such as guarantee instruments, fiscal instruments or smart contracts.

The different alternative finance options have different risk consequences for parties involved. Table 1 gives a general indication of the risks involved for different involved parties.

Table 1.

Alternative finance instrument risks for community and project developers.

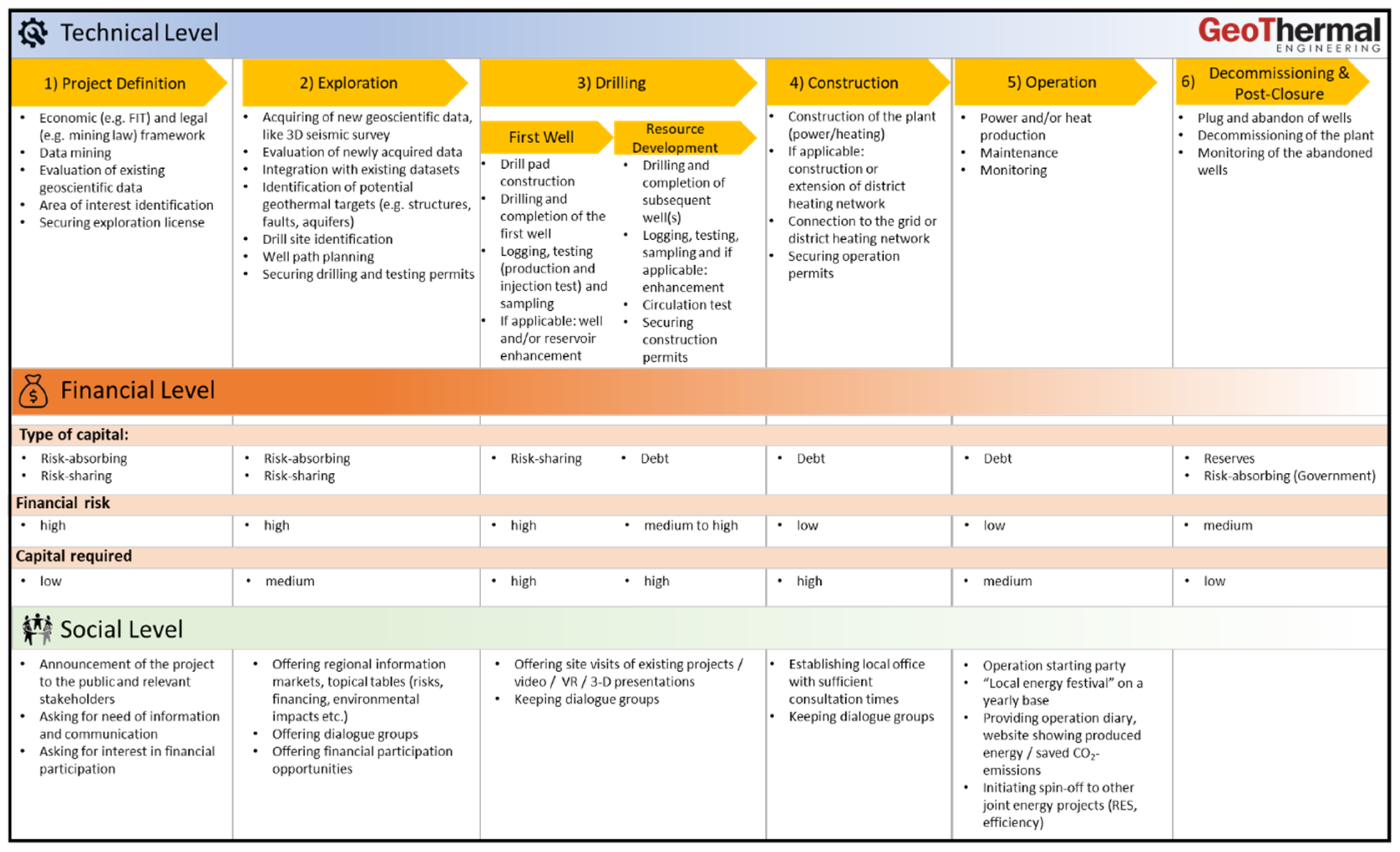

When looking at the phase the geothermal project is in, and the amount of capital and the kind of capital that are needed, a general mapping of possible alternative finance mechanisms can be made (keeping in mind that project-specific circumstances will determine the actual possibilities), as seen in Table 2, [42].

Table 2.

Relationship between geothermal project phase and the capital required.

Table 2 shows which alternative finance methods could suit a given geothermal project phase. The choice of method depends on several factors specific to that project.

The first factor is the phase the project is in when the financing is required.

The second factor is the type of capital that would suit this particular phase. The type of capital can be: (a) risk absorbing (when the capital takes risk away from the project owner or other investors); (b) risk sharing (when the capital shares in the risk with the project owner or other investors); (c) debt (which always has to be repaid thus possibly increasing the risk for the project owner or other investors); or (d) retained profits (which are generated by the project itself).

The third factor is the financial risk. This is mainly determined by the project phase but can also be influenced by other characteristics particular to each project.

The fourth factor is the amount of capital required. Typically, the amount of capital required in the definition phase is low, while the one required in the drilling phase is higher. This can, however, vary from project to project.

These factors altogether can give a general indication regarding which alternative finance methods are suitable for a given project. Additionally, it is important to take into consideration the specificities of each project and to determine all related factors prior to choosing a suitable alternative finance method. The conceptual framework CROWDTHERMAL (in Section 6.3) is a good start to identify which method is suited to the needs of all the stakeholders.

5.2. Crowdfunding and Risk Mitigation for Deep Geothermal

Alternative finance methods can be vital elements to the funding plan for geothermal projects. Moreover, community funding can achieve public engagement and increase acceptance. New approaches to finance, however, also bring about new types of risks. This is especially relevant with regard to the sector-specific exploration risk (also known as geological, resource, or discovery risk), as the risk of not finding an economically viable amount of energy is defined by temperature and productivity of a geothermal reservoir [43].

Against this background, one of the objectives of CROWDTHERMAL is the compilation of alternative finance risks and associated mitigation options for geothermal projects.

For this purpose, we analysed nine geothermal case studies where different types of community funding had already been applied [44]. The case studies comprise geothermal heat and power projects in France, the UK, the Netherlands (2), Spain, Iceland, Germany, Kenya, and Romania (Table 3). They include one negative example of financial fraud to demonstrate what could happen if the risk occurred and to avoid future repetition. Besides eight deep geothermal projects, the CROWDTHERMAL case study from Madrid serves as a positive example for crowdfunding for shallow geothermal developments. The case studies demonstrate that alternative finance can successfully be used for different geothermal project and technology types as well as various investment sizes.

Table 3.

Case studies type/project phase of geothermal community funding [44].

The case studies provided the basis to derive an inventory of the key advantages, potential risks, and possible risk mitigation measures for different alternative finance solutions, each from a project developer’s and from a community investor’s perspective [45]. The alternative finance methods included in this assessment are crowdfunding (general), crowdfunding (loans), crowdfunding (shares/equity), crowdfunding (reward-based), direct lending, and leasing. The overview of advantages, risks, and mitigation tools allows project developers and community investors to systematically improve their risk management and decision-making processes when choosing a specific alternative finance instrument for fundraising or as an investment.

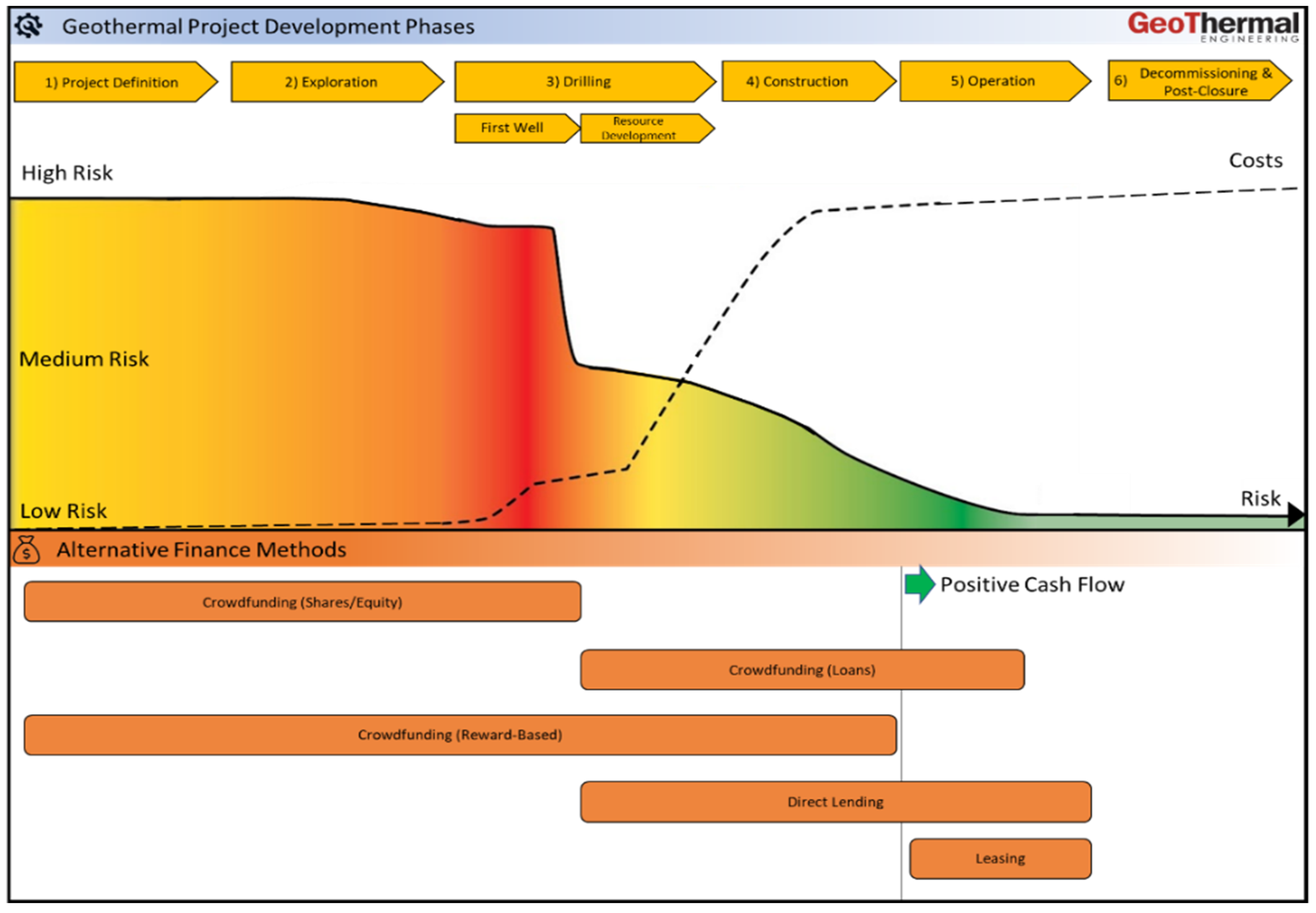

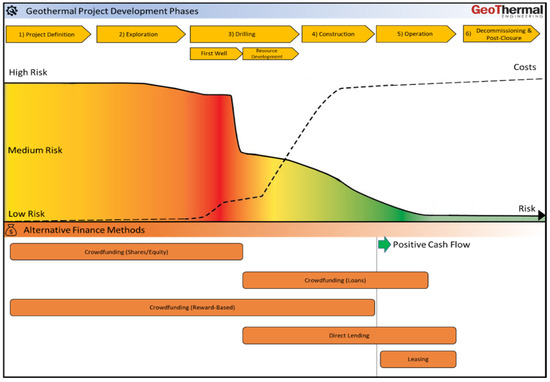

The risk inventory also helped to derive a guideline on which alternative finance methods are best suited for which project development phase, taking into consideration the technical workflow of a deep geothermal project as well as its associated costs and resource-related risks (Figure 8).

Figure 8.

Technical geothermal project development phases, associated resource risks, costs, and most appropriate alternative finance methods. Source: [44], modified after [46,47].

Despite all its advantages, community funding for geothermal projects also involves several challenges [45]. Due to the high-risk profiles of deep geothermal projects, applying crowdfunding usually means having to pay high interest rates to investors. It is thus a relatively expensive option for project developers.

Community investors in geothermal projects on the other hand need to be aware of the high resource risk in the early project development phases as well as the long project development periods. To a certain degree, crowd investors must accept these risks in exchange for a chance of high returns. Transparent communication of opportunities and risks however is a key aspect and needs to be sought.

We stress the importance of risk mitigation strategies such as trust funds, guarantees, or earmarked insurance mechanisms. Within CROWDTHERMAL’s work, recommendations for a tailored exploration risk mitigation framework for community-funded deep geothermal projects were formulated [48]. Generally, sufficient knowledge of the legal framework of national and EU fundraising regulations is crucial to decide on the most appropriate form of business model, alternative finance method, and overall financial mix. Project developers choosing to apply crowdfunding should partner with a trusted and experienced crowdfunding platform.

For sustainable community funding, it is deemed most promising to focus on impact investors aiming at supporting the energy transition and/or local projects. Project developers need to be aware that involving people requires time and energy. It is recommended to involve the community early and to clearly communicate the goals, benefits, and the potential risks of a project and investment upfront. Following best practice strategies to build and keep trust is a prerequisite for successful and sustainable financial community engagement. Examples are the personal relationship with local stakeholders and the involvement of well-known experts or reputable institutions, for example through match funding.

Understanding and developing a project in a holistic way, taking into consideration technical, financial, and social dimensions as well as their interdependency is another important risk mitigation measure for project developers (Figure 9). It reduces the risk of interface problems and increases the chances for a Social License to Operate and for both technical and economic project success.

Figure 9.

Integration of technical, financial, and social project levels [44].

5.3. Regulatory Framework for Community Funding

A community finance campaign is a project in itself. To be able to implement it successfully, the legal and financial infrastructure under which the community finance is set up must be considered. As these infrastructures vary between member states of the European Union, the possible steps and choices to be made to realise a successful community finance project can be different in different member states [42].

The CROWDTHERMAL “Regulative Framework for community funding” studies the effect of the legal and financial infrastructure on the possibilities for community finance for geothermal projects. It focuses on the three case study countries that have been selected for the CROWDTHERMAL project: Iceland, Spain and Hungary.

The study describes the three main areas of infrastructure that affect the choices and possibilities of community finance:

- Governance and ownership structures

Who can own a geothermal site, well or a power plant? This can be a determining factor when developing a geothermal project, especially for the ways the community can be involved. In some countries, all sites or power plants are government owned. This may hamper the development of new and/or local small projects. It can also make it more difficult to find a way to involve the local community and give them a sense of commitment or ownership;

- 2.

- Legislation around the generation and supply of electricity and heating

Another factor which determines if and how the community can be involved is the general regulative framework for electricity and heating. This regulation specifies how the process of generation and supply of electricity and heating is organized in a country. Who owns the distribution network and what prices are used for the buying and selling of the energy and/or heat? Are prices fixed? Or can the involved community receive the product at a flexible/better price? To determine how the community can be involved and which form of community funding can be used in a certain country, these factors have to be considered.

- 3.

- Financial legislation

Financial regulation is also essential to be able to choose the most suited form and method of community finance. In some countries, money can only be raised from natural persons by intermediaries who have a banking license. This means only banks and their traditional forms of finance could be used to involve the community through community finance. In other countries, there are several licenses available to raise money from natural persons, which implies that more methods of community finance are applicable.

The new European Crowdfunding Service Provider (ECSP) regime will create more opportunities for raising funds from a local community.

The report analyses if these regulatory frameworks form possible restrictions for the use of community finance in geothermal projects and presents recommendations for developers and regulatory bodies to deal with this.

In the three case study countries, the infrastructure formed by ownership structures, energy production and distribution, legislation and financial legislation are quite different. Different government instruments increase these differences. This means that the countries can learn from each other concerning the possibilities and obstacles created by the regulative framework.

Based on the case studies and the analysed regulatory frameworks, we can make the following recommendations for project developers and governments (Table 4):

Key results:

|

Table 4.

Regulatory frameworks recommendations for project developers and governments.

6. Core Services for Community Investors, Project Developers and Local Authorities in the Development of Geothermal Projects

6.1. Introduction

The final months of CROWDTHERMAL are being dedicated to the integration and deployment of a set of added-value core services into the project’s website. These core services consist of key outputs from the CROWDTHERMAL project related to public engagement, alternative finance and risk mitigation, which were transformed into webtools and applications. These tools are designed to be a starting point for community investors, project developers and local authorities in the development of geothermal projects. They range from educational articles, parameters to perform an economic modelling of a geothermal project, meta-database of geothermal projects in Europe as well as a self-assessment and guidelines to achieve your objectives based on your current situation on community involvement, project phase, environmental factors, finance and risk mitigation.

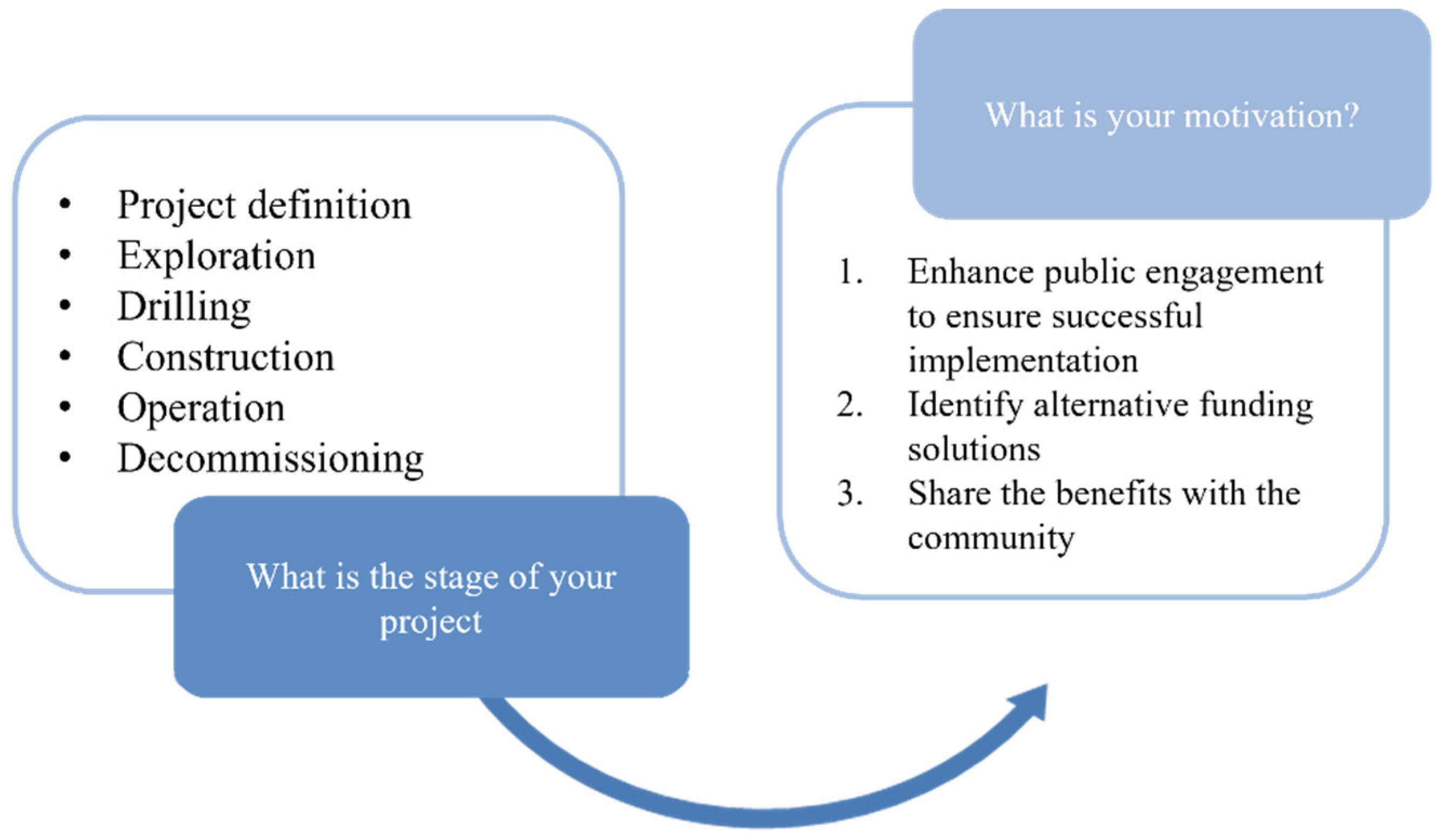

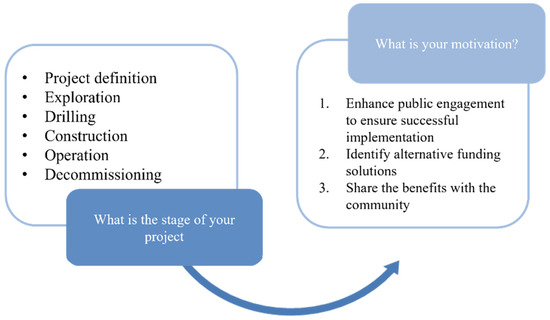

6.2. Online Decision Tree

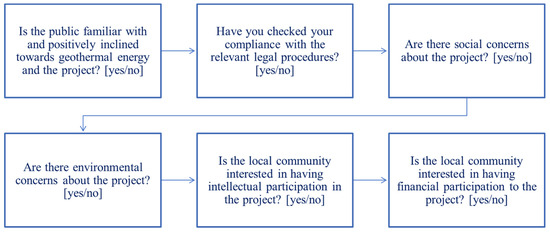

The online decision tree aims to provide guidelines for developers and promoters of geothermal energy by asking questions they need to ask themselves when deciding on appropriate social engagement, financial and risk mitigation instruments [49]. The tool integrates environmental, social, resource risk, legal and financial aspects of geothermal projects and is designed to assist those engaged in developing and promoting geothermal energy projects to:

- Enhance public engagement to ensure successful implementation;

- Identify alternative funding solutions;

- Share the benefits with the community.

The decision tree involves a graphical representation which facilitates decision making along with a transparent approach to how those decisions have been made. The tool acknowledges that each phase of a geothermal energy project is characterised by different risks, requirements and opportunities, and accordingly, the risk will determine what type of capital should ideally be used (Figure 10). For example, resource risk is likely to be high during the early stages, so raising capital via bank loans may prove difficult and alternative sources of finance should be considered. Risk mitigation options are provided to address potential public environmental concerns associated with geothermal exploration and exploitation and their corresponding financial measures are reported.

Figure 10.

Decision tree’s first two questions.

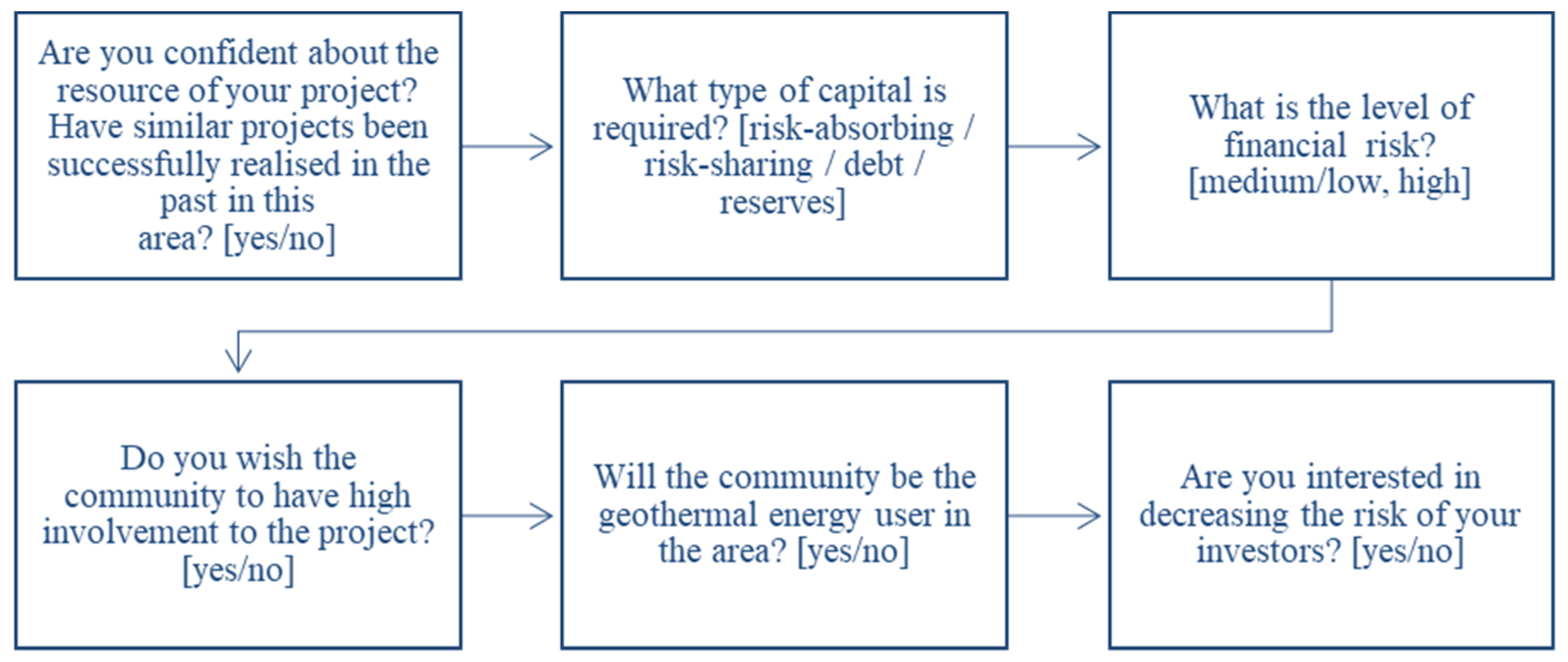

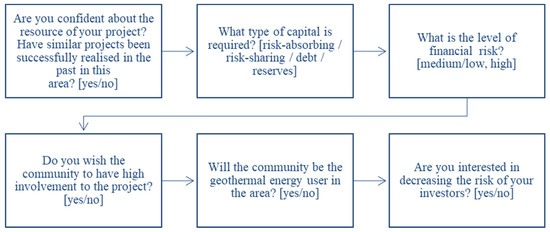

As such, the selection of the most appropriate finance option depends on the development phase of the project, the type and amount of capital required, the level of risk and the desired level of community involvement and interest in financial participation (Figure 11). In the case of community interest in financial participation by means of risk-sharing capital, crowdfunding (equity) and direct lending combined with governmental guarantees can be used. If the community is also the geothermal energy user in the area, reward-based funding solutions including crowdfunding (reward), which promotes local project ownership and public engagement, would be appropriate. For debt capital, crowdfunding loan and direct lending (with guarantees) in the early stages of the projects, together with green bonds, regular loans and regular bonds during later stages of the project may be used for financing the project.

Figure 11.

Decision tree’s sequence of questions to identify appropriate funding solutions.

Risk mitigation strategies typically include insurance or/and guarantee schemes to protect against financial losses, reducing investors’ risk.

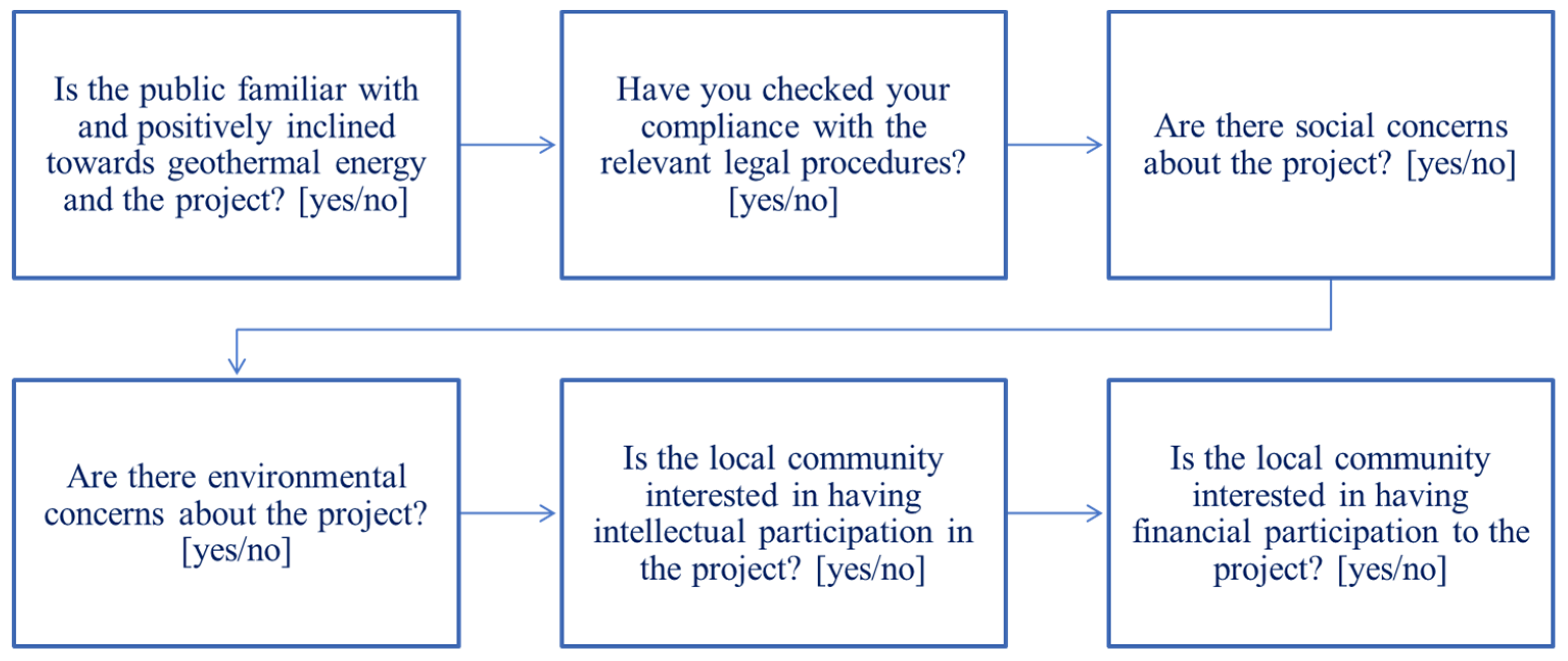

In addition to identifying appropriate funding solutions, a developer/promoter of geothermal projects may need to enhance public engagement to ensure successful implementation, as the risk posed by lack of public acceptance of the renewable energy technology may hinder development of a renewable energy project (Figure 12). The necessary risk mitigation to public opposition entails effective planning of a communication and engagement strategy to enhance the social acceptance of a project and ensure conflict prevention. Following the checks about legal compliance, social concerns and environmental concerns about the project, the user is asked whether there is interest for financial participation of the society. If there is no interest in the community’s involvement through financial participation, enabling society’s intellectual participation can be realized through communication of the yielded renewable energy production (e.g., how many kilowatt hours or megawatt hours of energy were produced per day) and carbon emission savings to enhance the perceived added value of the project, along with early and comprehensive provision of information about the implementation plans, access to hearings and transparent communication on topics such as noise, steam or odor annoyance, among others. In the same way, addressing stakeholders’ environmental and social concerns helps remove barriers and local objections to successful implementation of the project.

Figure 12.

Decision tree’s sequence of questions to enhance public engagement.

The tool is not intended to give quantitative answers, rather it provides a logical and auditable workflow via a sequence of questions on social, environmental, resource risk and financial influencing factors, to screen which strategies would be most appropriate for a specific setting.

The decision tree was built based on the review of a project’s reports on social engagement and financial and risk mitigation options as well as on expert elicitation from project partners who provided a significant source of knowledge about the specifics of financial, resource-risk and social aspects of geothermal energy developments. The Table 5 presents a summary of the online decision tree tool.

Table 5.

Online Decision Tree.

6.3. Guide to Integrated Finance

The guide to integrated finance guide is an online tool helping project developers and communities to fill in the alternative finance framework. This framework contains the questions that should be answered to find the right community finance and risk mitigation instruments for a specific geothermal project.

The main items of the framework are the following steps:

- Define involvement goals.

Why does the project developer want to involve the community, what does he want to achieve by involving them?

- 2.

- Define and select community.

Which community fits this goal, who are they?

- 3.

- Define community (risk) profile.

What is the social and financial situation of this community?

- 4.

- Define appropriate risk level.

What risk can the community absorb and how does this risk potentially influence the goals?

- 5.

- Define finance and risk mitigation options.

Which combinations of financial instruments and risk mitigation instruments fit the goal and community of a specific project (developer)?

- 6.

- Score different options against the project’s criteria and select top options.

- 7.

- Are possible alternative finance and risk mitigation instruments combinable with national regulation?

- 8.

- Contact possible providers of selected financial instruments.

The steps have been defined to help a project developer determine why he wants to involve the community, what results he is hoping to achieve, what risk levels fit these goal and what finance and risk mitigation instruments can be used to achieve this.

After all the steps have been followed and the relevant information has been gathered, possible alternative finance and risk mitigation combinations can be selected.

The conclusions and recommendations of the report can be found at the end. In short, they are the following:

- Many different factors are involved when choosing the right alternative finance and risk mitigation instruments;

- The research should follow the steps mentioned above for optimal results;

- A case-to-case approach is important as many different combinations of individual factors are possible;

- The risk of certain instruments is usually inversely related for the project owner and community investors;

- The risk absorbing capacity and risk appetite for both project developer and community are very important when choosing the best combinations of alternative finance and risk mitigation;

- The wishes of the community are also very important;

- Not all combinations of risk mitigation instruments and alternative finance instruments result in the desired decrease of risk for community investors.

Risk mitigation can change the possible use of alternative finance instruments and increase the possibility of realizing the wishes of both community and project developer. The Table 6 presents a summary of the guide to integrated finance tool.

Table 6.

Guide to integrated finance.

6.4. Toolbox for Risk Evaluation and Mitigation

The toolbox for risk evaluation and mitigation is a further CROWDTHERMAL Core Service that is primarily targeted at project developers. The heart of this service is an extensive excel questionnaire earmarked for easy input of the project and financial data necessary to perform an economic analysis for deep geothermal projects. It is advertised with the slogan: “Perform a thorough economic modelling of your geothermal project—with or without community funding!“

The questionnaire was developed within the scope of an analysis of the economic implications of the proposed CROWDTHERMAL Risk Mitigation Framework [50]. It is set up in the form of an excel spreadsheet with entry masks for all parameters necessary to perform economic efficiency calculations for deep geothermal projects. The compilation is meant as a guideline for the information that is needed to create a robust financial model and to perform a full economic analysis of an individual project.

The questionnaire consists of seven individual sheets:

- Instruction—Explanations on input data priorities;

- Project Description—General information on the project;

- Geology and Heat and Power Plant—Target depths, expected reservoir parameters (e.g., temperature, flow rate), planned plant capacities, etc.;

- CAPEX—Costs for subsurface and surface installations, e.g., drilling, infrastructure, pumps or heat plant;

- OPEX—Operation and maintenance expenditure;

- Financing Plan—Details on the project-specific financing scheme, including both alternative and conventional financing sources as well as existing support schemes;

- AltFin definition—Definition of the alternative finance methods mentioned in the spreadsheet.

Users of the toolbox for risk evaluation and mitigation are first directed to an introductory page explaining the concept and purpose of this Core Service. After registration, they can access and download the spreadsheet in which they may enter their individual project details, geological parameters, plant specifications, CAPEX, OPEX, and financing plan. Throughout the process, users can find additional help from the CROWDTHERMAL consortium via a contact button.

The completed individual spreadsheet can provide the basis for a full, project-specific economic assessment. It can be used for financial scenarios and sensitivity analyses as well as for the preparation of a bankable feasibility study. It can also be consulted to check the applicability of projects for the proposed CROWDTHERMAL Risk Mitigation Framework and to assess the economic implications of this risk mitigation mechanism for a specific project. The CROWDTHERMAL toolbox for risk evaluation and mitigation can thus help to assess, reduce, and mitigate the financial risks associated with geothermal project developments. Table 7 presents a summary of the toolbox for risk evaluation and mitigation.

Table 7.

Toolbox for risk evaluation and mitigation.

6.5. Framework for Community-Based Development

CROWDTHERMAL has built a framework for the implementation of a potential community-based geothermal project, proposing a set of best practices and recommendations to be considered in a variety of locations that present similar boundary conditions, i.e.: geographical, geological, economic, social and political settings.

To identify relevant key elements and help validate our findings, three case studies were selected: A district heating system of Szeged (Hungary), powered by 1–20 MW boilers and total energy output of 224 MW; Húsavík Community Greenhouse (Iceland), which aims to decrease the carbon footprint in local food production, and two housing cooperatives in Madrid (Spain), using a shallow geothermal system for heating and cooling (GSHP).

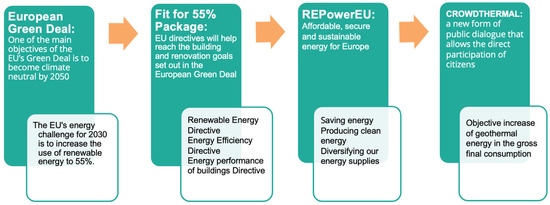

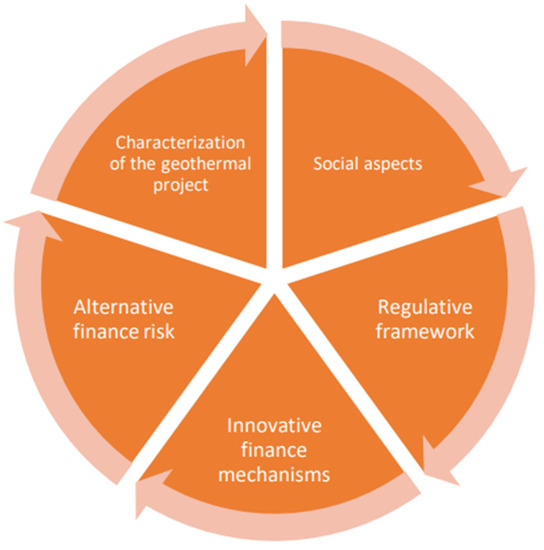

Our analysis revealed five core elements to be considered for the implementation framework in a community-based geothermal project to be built in Europe (Figure 13).

Figure 13.

Elements in a community-based geothermal project to be built in Europe.

- Characterization of the geothermal project

To find the right funding system, the main features of the geothermal project should be explicitly stated, since, although the technology is assimilable, other local factors will make each venture unique, e.g., the nature of the geothermal sources and their location, local climatic and weather conditions and the type of technology used.

- 2.

- Social aspects

In addition to the technical elements of a geothermal project, there are social dynamics on-site that must be considered, since public acceptance plays a key role in the final success of the project. Therefore, it will be useful to design models to assess the local acceptance of geothermal energy. Those will help clarify public perceptions and potential social barriers related to the initiative.

- 3.

- Regulative Framework

Community finance can be useful to involve communities in new geothermal projects. It can solve part of the funding needed, as well as create a sense of commitment toward the project, which can be a critical success factor for other investors.

A community finance campaign is a project itself. To make the right choices and be able to take it to term, legal and financial frameworks within the country or region must be considered. These legal and financial infrastructures may vary between member states.

- 4.

- Innovative finance mechanisms

New finance schemes are alternative funding methods or solutions offered by other financing parties than traditional banks.

Some interesting new examples are smart contracts using blockchain technology, new guarantee schemes, steward ownership and sale and leaseback schemes.

Some of these new and innovative finance models are especially interesting for community-based geothermal projects and have potential advantages.

- 5.

- Alternative finance risk

Geothermal projects can be different depending on two main factors: the type of produced energy (thermal or electrical) and the depth they have to reach to obtain geothermal resources.

Deep geothermal projects involve geological risks (typically present in the early stages of their development) that make it difficult to mobilize the required capital for funding early exploration surveys and first drillings through traditional bank finance.

Before choosing a specific form of alternative finance, it is recommended that project developers and community investors evaluate all possible options, along with the associated opportunities and risks in the individual context of a geothermal project. The Table 8 presents a summary of the framework for community-based development tool.

Table 8.

Framework for community-based development.

6.6. Database of Geothermal Projects

Among the core services, the CROWDTHERMAL project has delivered a meta-database of geothermal projects with the potential for alternative finance. This database informs visitors about the national framework of European countries about geothermal, about existing geothermal projects and provides the opportunity for project to self-register in the database.

The main objective of the meta database is to identify with geothermal projects via the other core services, and connect them with alternative finance, risk mitigation or social engagement strategies.

The geothermal projects were first identified by the European Federation of Geologists’ National Associations. In total, 78 projects were collected, using a data collection template. The template is based on the first stage of the CROWDTHERMAL case study assessment protocol [3]. The document is an excel table with two types of sheets. The first sheet describes a country overview, which is unique per country.

The second sheets contain the geothermal project description, which is unique per project. The project description, which is also available online, includes information about:

- General characteristics (name, location, proximity for direct use, project phase);

- Geothermal characteristics and associated environmental and technical risks;

- Community characteristics and associated socio-economic risks;

- Financing characteristics and associated financial risks;

- Alternative financing models, e.g., involvement choices;

- Preference to alternative financing methods:

The generated project profile provides an overview of the projects, which is required for the recommendation of social engagement strategies or alternative financing (using the decision tree tool), selection of most suitable Core Service, or the inquire additional advice from the AltFinator Hubs.

There are two maps created (Figure 14) using the data from the country overview and the geothermal projects, and as a map-based search engine using ArcGIS maps.

Figure 14.

Country overview (left) and geothermal projects maps (right).

Data collection is still ongoing and the meta database is open for new registrations. As the database is already populated with the first set of geothermal projects, after the roll out of the Core Services, the next main objective is to establish direct contact with the geothermal projects and connect them with CROWDTHERMAL’s Core Services. The Table 9 presents a summary of the database of geothermal projects.

Table 9.

Database of geothermal projects.

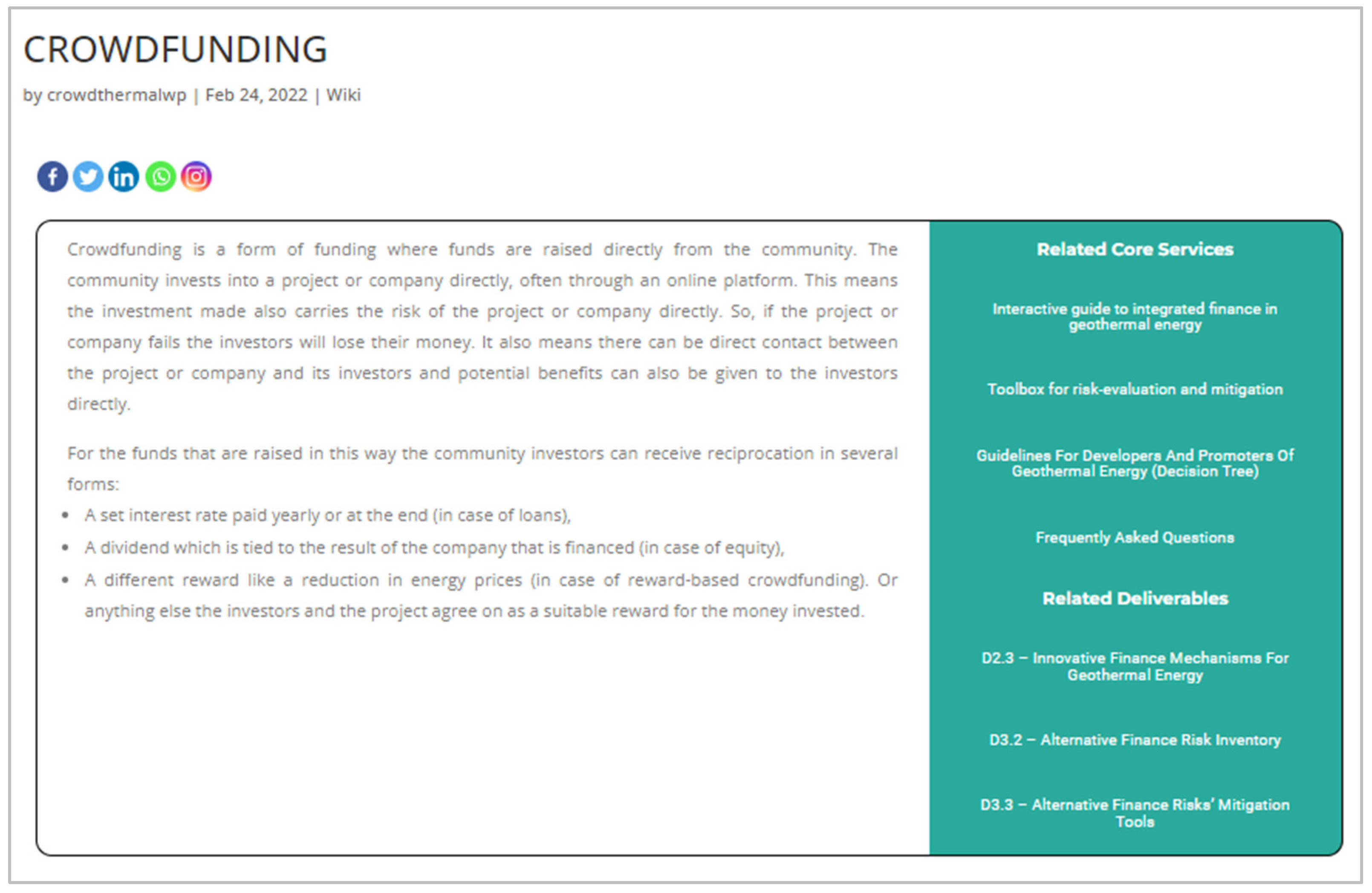

6.7. Self-Learning Catalogue

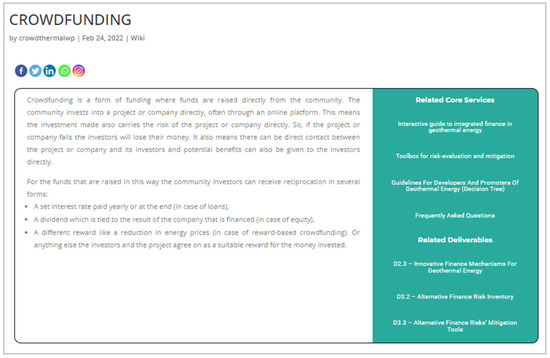

In terms of educational tools, end users will be able to consult both the Information Catalogue for Self-Learning, and the Frequently Asked Question tabs. The first is a compilation of definitions of common subjects related to CROWDTHERMAL pillars, represented as wiki articles. These articles are extracted pieces from project deliverables covering topics about geothermal energy, social acceptance, alternative finance and risk mitigation. In addition, users will be able to consult the other Core Services related to the article of their interest, associated deliverables as well as external references—if applicable (Figure 15 and Table 10).

Figure 15.

Wiki article about crowdfunding.

Table 10.

Self-learning catalogue.

The Frequently Asked Questions (FAQ) section has a similar approach as the Information Catalogue for Self-Learning; however, it is designed in a Q&A format, with shorter and straight-forward answers to common questions related to CROWDTHERMAL topics. Both tools contain social media icons for users to easily share the wiki articles and Q&A entries on social media, which not only help in proliferating knowledge, but also help in attracting future users of CROWDTHERMAL Core Services and expertise (Figure 16 and Table 11).

Figure 16.

Frequently Asked Questions menu.

Table 11.

Frequently Asked Questions.

7. Conclusions

- The analysis in this project confirms that co-financing, co-ownership and shared responsibility all support the energy transition, as they extend the possibilities of social acceptance.

- The test-labs in the three case studies refine this analysis by introducing diversity of geographical locations, cultural dynamics and technical characteristics of geo-thermal solutions/installations. This diversity affected the three key variables explored in the project, namely the financial solutions, geothermal risk mitigation options and social acceptance. As a project limitation, due to limited case studies, we have not explicitly differentiated between deep or shallow geothermal sources. More studies are needed to better compare their social implications and perception and formulate more detailed SLO and social engagement strategies for shallow and deep geothermal projects.

- The concrete outcomes of the project are guidelines for how to achieve greater social acceptance and for elaborating the contracts of Social Licence to Operate (SLO) as well as an alternative finance risk inventory including mitigation tools. These concrete tools can support future project development and avoid the most common barriers to social acceptance.

- The implementation of the techniques of alternative finance requires an analysis of the attitudes and preferences of the local community. The project described in this article presents guidelines for this type of analysis.

- The specific financial risks inherent to geothermal installations also raise barriers for investors. Part of these risks are related to resource uncertainties; others are related to the probability to achieve social acceptance. The project has explored mechanisms to mitigate these risks and even revert them into opportunities by applying alternative financial mechanisms.

- Geothermal energy remains a largely underused power source in the overall energy mix in Europe. Therefore, the project presents tools to support the communication and dissemination of geothermal energy. These are core services offered by the project with a view of implementing the results of the financial, social, risk and technical analysis.

- The next steps are closely related to the mobilization of geothermal energy regarding the urgent need of energy transition in the EU, as defined in the RepowerEU communication of the European Commission. The CROWDTHERMAL project contributes to this larger mission by offering core services online for geothermal project developers, local authorities and local communities.

Author Contributions

Conceptualization: I.F.F.; Methodology: I.F.F. and A.B.; Environmental risks analysis: A.I. and G.F. (Gioia Falcone); Social engagement strategies: J.H.; SLO conceptualisation: A.B.; Risk mitigation: C.B.; Case studies analysis: M.d.G., T.M. (Tamas Medgyes), O.E. and P.P.; Financial schemes: G.F. (Georgie Friederichs); Core services: M.T.P., T.M. (Tamas Miklovicz) and I.F.F.; writing—original draft preparation, all authors; writing—review and editing, I.F.F. and A.B.; project coordination, I.F.F.; funding acquisition, I.F.F. and B.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by EU Horizon 2020 Programme, grant number 857830.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

Nomenclature

| EU | European Union |

| SMEs | Small- and Medium-sized Enterprises |

| LC | Low Carbon |

| GRMF | Geothermal Risk Mitigation Facility |

| ARGeo | African Rift Geothermal Development Facility |

| BGR | Bundesanstalt für Geowissenschaften und Rohstoffe |

| SLO | Social License to Operate |

| UNDRIP | United Nations Declaration of the Rights of Indigenous Peoples |

| FPIC | Free, Informed and Prior Consent |

| FIT | Formation Integrity Test |

| RES | Renewable Energy Systems |

| CAPEX | Capital Expenditure |

| OPEX | Operational Expenditure |

| AltFin | Alternative Finance |

| ECSP | European Crowdfunding Service Provider |

| Q&A | Question and Answer |

| FAQ | Frequently Asked Questions |

| GSHP | Ground Source Heat Pump |

References

- A European Green Deal, Striving to Be the First Climate-Neutral Continent. 2019. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 7 August 2022).

- REPowerEU: A Plan to Rapidly Reduce Dependence on Russian Fossil Fuels and Fast forward the Green Transition. 2022. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131 (accessed on 7 August 2022).

- De Gregorio, M.; Perez, P.; Casillas, A. Case Study Assessment Protocol, CROWDTHERMAL Deliverable 5.1; CROWDTHERMAL: Brussels, Belgium, 2020. [Google Scholar]

- Ioannou, A.; Falcone, G. Synthesis of Environmental Factors, CROWDTHERMAL Deliverable 1.2; CROWDTHERMAL: Brussels, Belgium, 2020. [Google Scholar]

- Bogner, A.; Menz, W. The theory-generating expert interview: Epistemological interest, forms of knowledge, interaction. In Interviewing Experts; Bogner, A., Littig, B., Menz, W., Eds.; Palgrave Macmillan: London, UK, 2009; pp. 43–80. [Google Scholar]

- Reed, M.S.; Graves, A.; Dandy, N.; Posthumus, H.; Hubacek, K.; Morris, J.; Prell, C.; Quinn, C.H.; Stringer, L.C. Who’s in and why? A typology of stakeholder analysis methods for natural resource management. J. Environ. Manag. 2009, 90, 1933–1949. [Google Scholar] [CrossRef] [PubMed]

- Varvasovszky, Z.; Brugha, R. A stakeholder analysis. Health Policy Plan 2000, 15, 338–345. [Google Scholar] [CrossRef] [PubMed]

- Crosby, B. Stakeholder Analysis: A Vital Tool for Strategic Managers; USAID: Washington, DC, USA, 1992.

- Walt, G.; Gilson, L. Reforming the health sector in developing countries: The central role of policy analysis. Health Policy Plan 1994, 9, 353–370. [Google Scholar] [CrossRef] [PubMed]

- Friederichs, G.; Kleverlaan, R. Community for Renewable Energy, Best Practices, CROWDTHERMAL Deliverable 2.1; CROWDTHERMAL: Brussels, Belgium, 2021. [Google Scholar]

- Grant, M.J.; Booth, A. A typology of reviews: An analysis of 14 review types and associated methodologies. Health Inf. Libr. J. 2009, 26, 91–108. [Google Scholar] [CrossRef] [PubMed]

- Friederichs, G.; Kleverlaan, R. Regulative Framework for Community Funding, CROWDTHERMAL Deliverable 2.2; CROWDTHERMAL: Brussels, Belgium, 2021. [Google Scholar]

- Bayer, P.; Rybach, L.; Blumb, P.; Brauchler, R. Review on Life Cycle Environmental Effects of Geothermal Power Generation. Renew. Sustain. Energy Rev. 2013, 26, 446–463. [Google Scholar] [CrossRef]

- McCay, A.T.; Feliks, M.E.J.; Roberts, J.J. Life Cycle Assessment of the Carbon Intensity of Deep Geothermal Heat Systems: A Case Study from Scotland. Sci. Total Environ. 2019, 685, 208–219. [Google Scholar] [CrossRef]

- DiPippo, R. Environmental impact of geothermal power plants. In Geotherm Power Plants, 4th ed.; DiPippo, R., Ed.; Butterworth Heinemann: Oxford, UK, 2016; pp. 657–684. [Google Scholar]

- Zhu, K.; Fang, L.; Diao, N.; Fang, Z. Potential Underground Environmental Risk Caused by GSHP Systems. Procedia Eng. 2017, 205, 1477–1483. [Google Scholar] [CrossRef]

- Majer, E.L.; Baria, R.; Stark, M.; Oates, S.; Bommer, J.; Smith, B.; Asanuma, H. Induced Seismicity Associated with Enhanced Geothermal Systems. Geothermics 2007, 36, 185–222. [Google Scholar] [CrossRef]

- Rathnaweera, T.D.; Wu, W.; Ji, Y.; Gamage, R.P. Understanding injection-induced seismicity in enhanced geothermal systems: From the coupled thermo-hydro-mechanical-chemical process to anthropogenic earthquake prediction. Earth Sci. Rev. 2020, 205, 103182. [Google Scholar] [CrossRef]

- Mannvit, H.F. Environmental Study on Geothermal Power GEOELEC Project-WP4 D4.2; GEOELEC: Brussels, Belgium, 2013. [Google Scholar]

- Kristmannsdóttir, H.; Ármannsson, H. Environmental Aspects of Geothermal Energy Utilization. Geothermics 2003, 32, 451–461. [Google Scholar] [CrossRef]

- Zaunbrecher, B.S.; Kluge, J.; Ziefle, M. Exploring Mental Models of Geothermal Energy among Laypeople in Germany as Hidden Drivers for Acceptance. J. Sustain. Dev. Energy Water Environ. Syst. 2018, 6, 446–463. [Google Scholar] [CrossRef]

- Stauffacher, M.; Muggli, N.; Scolobig, A.; Moser, C. Framing deep geothermal energy in mass media: The case of Switzerland. Technol. Forecast. Soc. Change 2015, 98, 60–70. [Google Scholar] [CrossRef]

- Wallquist, L.; Holenstein, M. Engaging the Public on Geothermal Energy. In Risk Dialouge Foundation; World Geothermal Congress: Melbourne, Australia, 2015. [Google Scholar]

- Rau, I.; Schweizer-Ries, P.; Hildebrand, J. Participation: The silver bullet for the acceptance of renewable energies. In Vulnerability, Risk and Complexity: Impacts of Global Change on Human Habitats; Hogrefe: Leipzip, Germany, 2017; pp. 177–191. [Google Scholar]

- Hildebrand, J.; Klein, K.; Wagner, M.; Alena, J. Guidelines for Public Engagement, CROWDTHERMAL Deliverable 1.4; CROWDTHERMAL: Brussels, Belgium, 2020. [Google Scholar]

- United Nations. Declaration on the Rights of Indigenous Peoples; United Nations: Geneva, Switzerland, 2008.

- Thomson, I.; Boutilier, R. The social license to operate. In SME Mining Engineering Handbook, 3rd ed.; Darling, P., Ed.; Society for Mining, Metallurgy, and Exploration: Englewood, CO, USA, 2011; pp. 1779–1796. [Google Scholar]

- Prno, J.; Slocombe, D. A systems-based conceptual framework for assessing the determinants of a social license to operate in the mining industry. Environ. Manag. 2014, 53, 672–689. [Google Scholar] [CrossRef] [PubMed]

- Owen, J.R.; Kemp, D. Social licence and mining: A critical perspective. Resour. Policy 2013, 38, 29–35. [Google Scholar] [CrossRef]