Abstract

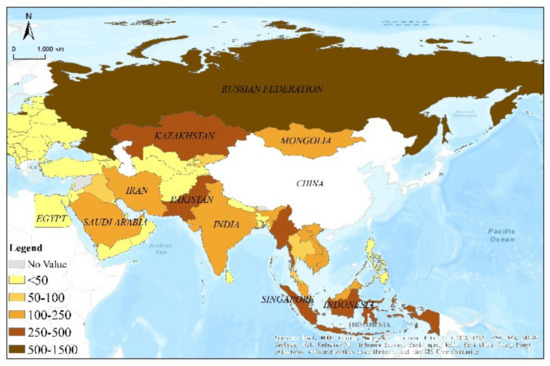

Under the Belt and Road concepts of mutual benefit and win–win cooperation, China is strengthening its energy cooperation with other countries. We used several econometric models and social network analysis models to study the impacts of China’s outward foreign direct investment (OFDI) on the host and home countries. We first examined China’s OFDI location preference and analysed the effects of OFDI on energy consumption in host countries. Meanwhile, we observed the impact of the reverse spillover effect of OFDI on China’s energy efficiency. The results indicate that (1) the impact of China’s OFDI on energy consumption in host countries has been lower than that on neighbouring countries, and increased significantly after 2014. (2) The space network of energy consumption in Belt and Road countries has a strict hierarchical structure. However, it was disbanded by the Belt and Road policy in 2014. The network centres are situated primarily in Middle Eastern and European countries, and the network’s periphery is mainly in South-East and West Asian countries. (3) The reverse spillover effects of OFDI, FDI, domestic R&D absorptive capacity, human capital, and financial development levels are conducive to improving China’s energy efficiency whereas regional professionalism does the opposite.

1. Introduction

As an emerging market country, China’s strong economic growth has driven its energy demand, leading to a continuous shift of the World’s energy centre to the Asian region. As the world’s largest developing country in terms energy production and consumption, China’s energy issues have attracted international attention [1]. China replaced the United States as the world’s largest energy consumer in 2010, and its total energy consumption accounted for 23.2% of the global total in 2017 [2]. Since China became an energy importer in 1992, the energy supply–demand gap has continued to expand, and energy imports have become an essential supplement to meet domestic energy demands. In 2015, dependence on external crude oil exceeded 60%. China’s coal production and consumption are relatively high, its natural oil supply is heavily dependent on imports, and domestic energy efficiency is not high. Additionally, the world’s energy situation is turbulent, and international crude oil prices are erratic. Many countries have strengthened their energy protection. The question of who will satisfy China’s energy demands is both a problem and a wake-up call.

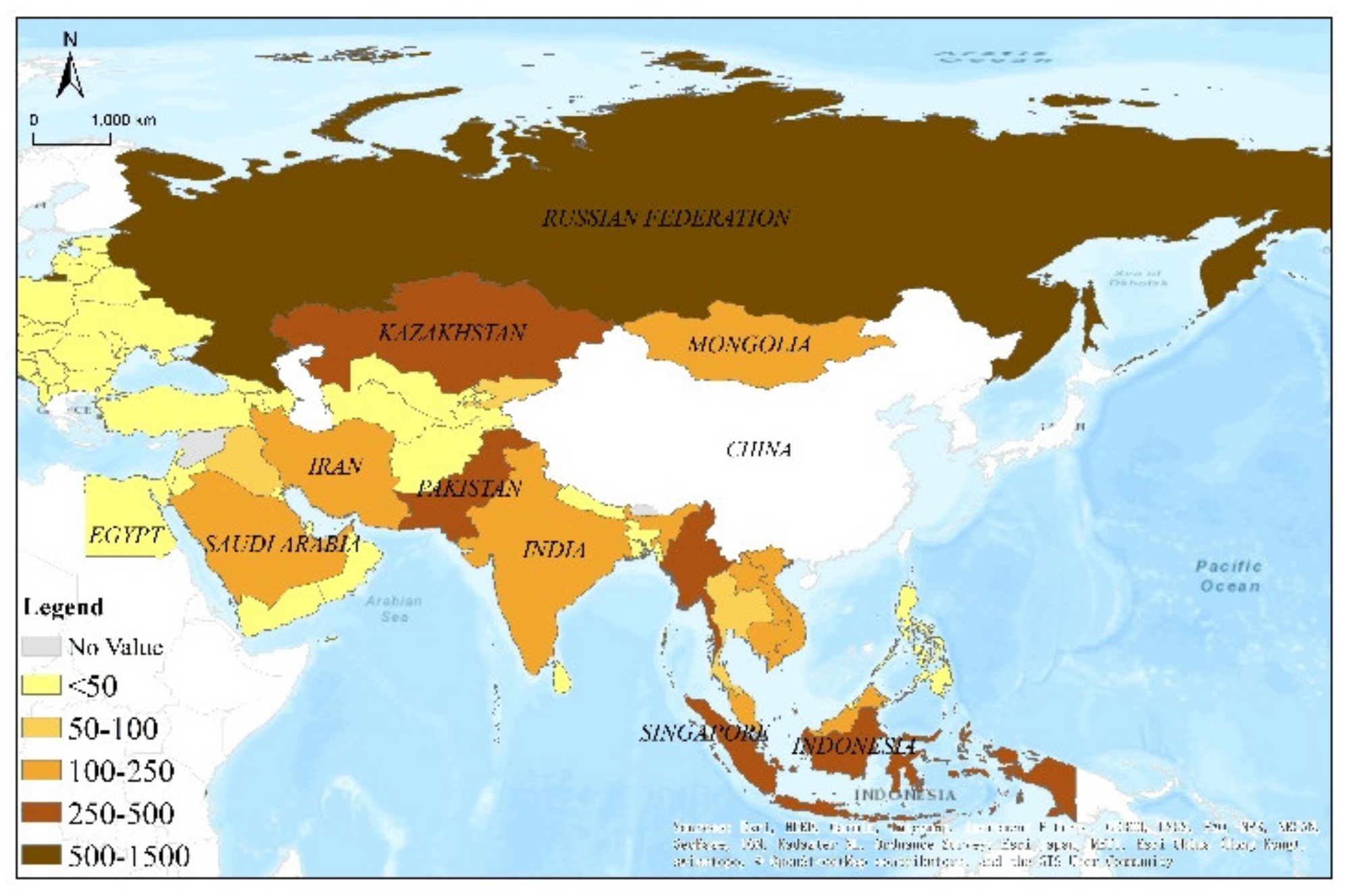

To address these challenges, the Belt and Road Initiative was launched in 2013 [3]. It has provided new economic growth targets for China and offered new development opportunities for neighbouring countries [4]. With the deepening of cooperation and exchanges between China and the countries involved in the Belt and Road Initiative, investment in China is increasing—from 1.317 billion U.S. dollars in 2003 to 14.53 billion U.S. dollars in 2016 [5], accounting for 8.5% of foreign investment. Based on resource endowment characteristics and the complementarity of economic individuals, Belt and Road countries have gradually become important areas for China’s foreign investment (Figure 1).

Figure 1.

China’s OFDI in the Belt and Road countries during 2003–2016.

With the deepening of cooperation, the energy consumption levels of various countries have steadily increased, and the growth trend is noticeable. In 2014, the countries along the Belt and Road consumed 39% of the world’s oil, 47% of its natural gas, and 60% of its coal. As the world’s largest carbon emitter, China has been in the spotlight. The pollution refuge hypothesis has been the focus of controversy, and some countries have even put forward the “environmental threat theory” of China’s Belt and Road policy. Based on these reservations, we discuss the causes and consequences of China’s OFDI from energy cooperation.

We have divided this study into three parts. (1) Is there a resource-seeking preference for Chinese OFDI to ease the demand for energy imports? (2) The Chinese government advocates win–win cooperation; does it drive the levels of energy consumption in host countries and thus change the overall spatial pattern of energy consumption? (3) Although most countries included in the initiative are developing countries, are there any advanced technologies and experiences in many areas of energy cooperation that are worth learning from and absorbing to improve China’s energy efficiency through reverse technology spillover effects?

2. Literature Review

2.1. Motivations for OFDI

We found that most scholars’ research on OFDI mainly focuses on the following two aspects: the choice of investment motivation and its correlation with influencing factors [6,7,8,9,10]. We classified the motivations for OFDI by examining the literature. (1) Resource seeking. Wang and Shao [11] discussed the motivations for China’s OFDI from 2001 to 2012. They argued that the location determinants of China’s OFDI vary among different industries, and resource seeking is the most important driving force. Developing countries that do not have sufficient resources for international cooperation will need to transfer resources from other partner countries to support new cooperation [12]. Yang et al. [13] used panel data on China’s foreign investment in 132 economies from 2003 to 2012 to confirm that Chinese multinational companies have, without exception, tended to invest in systems of high quality with abundant natural resources. Kang [14] studied China’s FDI in 62 countries and found that under the circumstances of high political risk, economic freedom, and low institutional distance, natural resource endowment is more attractive to the FDI of Chinese multinational companies. (2) Marketing seeking. Dunning [15] identified three main motivations for OFDI: the search for international marketing, efficiency, and resources. Li et al. [16] found that foreign investment in the tourism industry depends on the tourism flow of the host country and the tourism scale of the country. Zhang [17] studied the socioeconomic factors of OFDI in Latin America and found that China’s OFDI shifted from resource-oriented to market-oriented. (3) Stability seeking. Buckley et al. [7] collected China’s OFDI data. They found that China’s OFDI was related to the host country’s political risk, culture, and geographic distance from 1984 to 1991. Zhang et al. [18] suggested that the participation of local governments in the development of international sister cities can promote OFDI. Li et al. [19] found from 2003–2013 panel data on China’s OFDI that cultural distance and Chinese OFDI have a U-shaped curve relationship. It is not difficult to find significant differences in the motivations for OFDI across sectors. Natural resource endowment, economic freedom, market potential, political stability, cultural differences, and geographical distance are essential considerations for OFDI in most sectors.

2.2. Factors Influencing OFDI

We summarise the relationship between OFDI and the influencing factors in three main areas. (1) In environmental terms, more literature has focused on the home country when exploring the environmental impact of OFDI, but the research findings are not uniform. Hao et al. [2] found that China’s OFDI increases domestic environmental pollution through scale effects. Xin and Zhang [20] used a panel threshold model and data from 30 Chinese provinces from 2004 to 2015 to empirically examine the impacts of OFDI on provincial industrial wastewater emissions and SO2 emissions. The proposed policy recommends scaling up OFDI as a means to reduce domestic environmental pollution. Liu et al. [21] argued that the reverse green technology spillovers from OFDI could be amplified through good environmental regulation and the improved knowledge transfer capacity provided by OFDI. The pollution sanctuary hypothesis and the pollution halo hypothesis were discussed in studies focusing on some host country [22,23]. (2) In terms of economic development, most scholars have refined their research objectives to focus on the factors of production. There are significant impacts of OFDI on the labour force [24], technological innovation [25], and energy consumption. Meanwhile, the impact of factor distortions on OFDI is also of great concern [26]. (3) In energy terms, energy has been a hot topic of discussion regarding the correlation between OFDI and influencing factors [27,28,29]. Wang [30] used China’s interprovincial panel data from 2001 to 2013 to demonstrate that FDI can significantly improve energy efficiency. Adom et al. [31] studied the relationship between energy demand and FDI in Africa by using generalised moment estimation of the synchronous system and panel data, and believed that foreign direct investment had a significant adverse effect on energy consumption. Zhao et al. [32] found that China’s energy OFDI enhanced the energy security of the home country by increasing the host country’s oil imports and diversifying the home country’s import sources.

2.3. The Relevance of the Belt and Road Initiative to OFDI and Energy

In studying the relationship between energy and OFDI, many scholars have focused on the Belt and Road Initiative in recent years. (1) Regarding energy structure and energy efficiency, it is not difficult to find that the location choice of China’s OFDI remains a hot topic of research. The energy structure and energy efficiency of the host country have become important indicators to be examined. Liu et al. [33] found that Chinese companies tend to invest in green projects when the host countries have better political environments, natural resource endowments, and higher energy efficiencies, but lower carbon dioxide intensities and less developed energy structures, technologies, and infrastructures. Wang et al. [34] empirically proved the above point with 813 cases of OFDI in the energy sector. In addition, in studies on the correlation between OFDI and energy efficiency, some of the research focused on the host country [35] and found significant differences in energy efficiency among the Belt and Road countries [36], but the Belt and Road Initiative allows countries with low total factor energy efficiency to catch up more [37]. Another part of the study focused on the home country and found that reverse technology spillovers from OFDI significantly impact China’s total factor carbon productivity [38]. (2) Regarding energy consumption and carbon emission, there are two viewpoints on whether Chinese OFDI is beneficial to energy savings and emission reduction in countries along the Belt and Road. Some scholars believe that China’s OFDI has positive impacts on energy savings and emission reduction. By simulating different future scenarios of China’s OFDI, Li et al. [39] found that carbon emissions in Belt and Road countries would be reduced by 44.16 Gt and 79.48 Gt in the standard and enhanced investment scenarios compared to the no-investment scenario. Other scholars hold the opposite view. Mahadevan and Sun [40] believe that China may export carbon emissions to Belt and Road countries through OFDI. Razzaq et al. [41] used method of moments–quantile regression to find that China’s OFDI flows increased carbon emissions in medium to high-emitting countries, empirically confirming the pollution refuge hypothesis.

Through a literature review (Table 1), we found that in the context of Belt and Road energy cooperation, whether Chinese OFDI is resource-seeking oriented lacks in-depth exploration. In previous studies, the factors considered were not comprehensive. There is a lack of systematic thinking based on regional economic environment theory. A comprehensive measure of the investment environment should include natural, social, economic, and political factors.

Table 1.

The relevance the Belt and Road Initiative to China’s OFDI.

The impact of OFDI on energy consumption (energy consumption pattern) in the host country still leaves much room for research. Firstly, the effects of the Belt and Road Initiative need further empirical evidence. Secondly, the dynamic spatial pattern of energy consumption evolution in host countries under the Belt and Road Initiative remains a research gap.

As developing countries dominate the Belt and Road, the research on the reverse technology spillover effect of China’s OFDI has been neglected by most scholars. To address those shortcomings, we argue that the research should neither remain at the theoretical level, nor be detached from the actual situation of China’s pursuit of foreign energy cooperation. To highlight the innovative nature of this paper, it is necessary to explore in-depth the changes in energy consumption in the host country and energy efficiency in the home country.

3. Methodology and Data

We needed to build different models to solve the above three problems. First, the spatial econometric model analysed the spatial correlations and preferences of China’s OFDI. Second, we used a difference in difference (DID) model to discuss the impact of OFDI on the energy consumption of the Belt and Road countries. We observed the changes in spatial patterns of energy consumption in 57 countries using a social network analysis (SNA) model. Third, we established a dynamic panel model and used the system generalised moment method (SYS-GMM) model to estimate the impact of reverse technology spillover effects of OFDI on China’s energy efficiency.

3.1. Methodology

3.1.1. DID Model

The assessment of causal and policy effects is a central concern of economics, and the difficulty is in the endogeneity of economic and policy events. To overcome this problem, scholars have used various econometric models to assess the treatment effects of policies based on “quasi-experimental” opportunities. The standard methods include instrumental variable methods, breakpoint regression, propensity score matching, and DID models. The DID model was initially introduced by Ashenfelter and Card [48] in their study of the training benefits of the CETA program. As the joint propensity scoring method [49] and the DID model significantly improved the robustness of causal effect estimates in subsequent studies, more scholars began to focus on the PSM-DID model [50,51].

3.1.2. SNA Model

The SNA model uses a relationship as the basic unit of analysis [52,53]. Graph theory tools and algebraic models are often used to describe relational models to study the influences of these relationship models on members or the whole structure. The spatial correlation network of energy consumption reflects the interrelationship of energy in different countries. The gravity model takes into account factors such as geographical distance, economic development, and population size. Moreover, it is more advantageous to use cross-sectional data to describe spatially relevant spatially dynamic evolutionary trends. The gravity model’s formula is:

where subscripts i and j represent country i and country j; E represents energy consumption; P represents population size; and Gdp represents gross domestic product. Dij represents the distance between state i and country j. gi−gj represents the difference in GDP per capita between country i and country j.

Assuming that there are N network nodes in the space network, the maximum number of possible relationships in the system is N × (N−1). When the actual relationship coefficient of the spatial correlation matrix is M, the network density formula is:

When the number V of unreachable points exists in the network, the degree of network association is expressed as:

If the number of symmetrical reachable points in the network is S, then max(S) is the largest symmetrical reachable point. The network-grade formula is as follows:

Network efficiency is a portrayal indicator of the efficiency of communication among countries in a space-related network. There is excess relevance in the network when the network is inefficient. Suppose the extra number of bars is R, and the maximum number of possible additional lines is max(R). The network efficiency formula is:

The betweenness degree reflects the degree to which a node controls the relationships of other nodes.

The closeness centrality demonstrates the degree to which other nodes do not control a node.

3.1.3. SYS-GMM

Economic behaviour tends to be somewhat coherent and persistent. The introduction of the lagged term of the dependent variable to construct a dynamic panel model allows for the consideration of dynamic behaviour. Additionally, it facilitates the practical estimation of other coefficients in the model, enhancing the credibility of the regression results. However, the dynamic lagged terms of the dependent variable are correlated with the individual effects in the random disturbance terms within the model, which tends to create endogeneity problems. Scholars have commonly used the differential generalised method of moments (DIF-GMM) and SYS-GMM to estimate dynamic panel data models to address this problem [54,55]. There are two advantages of SYS-GMM estimation compared with DIF-GMM. (1) SYS-GMM estimation can provide good estimations when the sample period is small, especially when the sequence is close to random walks; (2) SYS-GMM estimation can effectively solve the weak instrumental variable problem [56]. A further breakdown shows that dynamic panel SYS-GMM estimation is divided into a one-step and a two-step approach. In the case of a limited sample, the asymptotic standard errors of the latter estimation are subject to severe downward bias [57]. Therefore, in this paper, we have chosen a one-step SYS-GMM estimation.

3.2. Data Sources

- (1)

- Considering data availability, only 57 countries along the Belt and Road were studied: Mongolia, Indonesia, Thailand, Malaysia, Vietnam, Singapore, Philippines, Myanmar, Cambodia, Laos, India, Pakistan, Bengal, Sri Lanka, Nepal, Saudi Arabia, United Arab Emirates, Oman, Iran, Turkey, Israel, Egypt, Kuwait, Iraq, Qatar, Jordan, Lebanon, Bahrain, Yemen, Georgia, Azerbaijan, Armenia, Russia, Poland, Romania, Czech, Slovakia, Bulgaria, Hungary, Latvia, Lithuania, Slovenia, Estonia, Croatia, Albania, Serbia, Ukraine, Belarus, Moldova, Macedonia, Bosnia and Herzegovina, Montenegro, Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan, and Tajikistan.

- (2)

- The primary data for the Belt and Road countries came from the World Bank. Market size and economic freedom indexes were from the UNCTAD database. Primary energy data were from the U.S. Energy Agency. The Government Governance Index was calculated from global governance indicators provided by Heritage, combined with the entropy method.

- (3)

- The data of China’s OFDI in 2003–2016 were from the Statistical Bulletin of China’s Foreign Direct Investment. The rest of China’s data were mainly from the China Statistical Yearbook; the China Energy Statistics Yearbook; the China Labor Statistics Yearbook; the China Science and Technology Statistics Yearbook; the China Population and Employment Statistics Yearbook; the China Foreign Economic Statistics Yearbook; the China Statistical Bulletin of Foreign Direct Investment; and the statistical yearbooks of the corresponding years in 30 provinces, municipalities, and autonomous regions. China’s foreign direct investment data came from the UNCTAD database, and R&D expenditures of various countries were from the OECD database.

4. Results and Analysis

4.1. Location Preferences for China’s OFDI

We used the spatial econometric models to study the factors that affect China’s foreign investment in the Belt and Road countries. The dependent variable was Chinese OFDI. The choices of independent variables needed to be combined with regional economic environment theory, which suggests that the factors influencing the investment environment include natural, social, economic, and political factors. We chose the primary energy output (e) to characterise natural resource endowment, and this variable was examined as the variable of interest. To examine other possible motivations for Chinese OFDI, the indicators of social and economic factors included market size (gdpp), labour capital (lab), trade dependence (tra), and openness (ope). Market size, labour capital, trade dependence, and openness were characterised by GDP per capita, population, trade as a share of GDP, and foreign investment as a share of GDP, respectively. Political factors were characterised by economic freedom (ef) and government governance level (gov).

The Moran’s I index is a standard indicator for interpreting spatial autocorrelation. Table 1 reports the Moran’s I index and p values of China’s OFDI in the Belt and Road countries from 2003 to 2016. As shown in Table 2, China’s OFDI in the Belt and Road countries has a significant spatial correlation. This shows that China’s foreign investment activities are not entirely random but are affected by regional activities in some host countries with similar spatial characteristics.

Table 2.

Moran’s I of the Belt and Road countries.

Before building a time series model, the stationarity and multicollinearity of the variables taken into the model needed to be tested. After passing the test, the Hausman test was used to select the standard panel data regression method. The Hausman test p-value was 0.0001, so the null hypothesis was rejected, and the fixed effect model was considered more suitable. As a standard approach to spatial econometric modelling, the spatial Durbin model is the standard framework for capturing all types of spatial spillover effects. It can be morphed into spatial lag models and spatial error models under different coefficient settings. We further used the L.M. test and the Wald test (Table 3), and by comparing the saliency of the variables, we finally chose the spatial Dubin model [58,59] with time-fixed effects (Table 4).

Table 3.

L.M. test, L.R. test, and Wald test results of the spatial panel model.

Table 4.

Time fixed effect results of the SDM model.

The estimated results in Table 4 show that W *dep. var was significantly negative at 1% and 10% levels in the geographic and economic distance models. This means that the third country’s OFDI will have a significant crowding-out effect on the home country’s OFDI. The influencing factors energy production, labour capital, trade dependence, and openness all passed the 1% significance test; and market size, economic freedom, and governance passed the 10% significance test (geographic distance model). The coefficients of China’s OFDI in relation to energy production, market size, labour capital, trade dependence, openness, economic freedom, and government governance level were 0.2314, 0.2018, 0.7230, 0.5114, 0.0534, −0.7543, and 0.3267, respectively. This shows that all variables have significant positive effects on China’s foreign investment except economic freedom. The coefficient of energy production was significantly positive, indicating that the more resources the host country has, the higher the Chinses OFDI in the host country will be. Our research conclusion is consistent with most literature: Chinese OFDI has an obvious motivation to seek resources [60], but unlike some studies, we found that resource seeking is not the most critical influence [61].

Based on the method proposed by Elhorst et al. [62], the results of the overall effect equations in Table 4 were evaluated for direct, indirect, and overall effects (Table 5). Labour capital, trade dependence, openness, and economic freedom are the main factors affecting China’s OFDI. For every 1% increase in foreign investment, they rose 0.67%, 0.51%, and 0.52%, respectively. Economic freedom, with each 1% change, correlated with a decline in OFDI of 0.95%. China’s comparative advantage is mainly concentrated in labour-intensive industries and the international division of labour at a relatively low-technology stage. Regarding China’s OFDI stock, manufacturing is also a critical for OFDI. Therefore, we believe that Chinese OFDI is a reclaiming of China’s advantage in the Belt and Road countries after losing the labour resource advantage. It is also a cross-border transfer of labour-intensive industries.

Table 5.

Direct and indirect effects of variables.

Natural resource endowment is not the most critical factor affecting Chinese OFDI. Every 1% change in energy output in the geographic weight matrix model increased the OFDI by 0.23%. This effect was slightly higher than that in the economic weight matrix model, which shows that geographic distance is also an essential consideration for Chinese enterprises’ foreign investment. It is worth noting that the indirect effect of energy production was significantly negative at the 10% level, indicating that the primary energy output of the host country has a dampening effect on Chinese OFDI to neighbouring countries.

4.2. The Impact of China’s OFDI on the Energy Consumption of Host Countries

4.2.1. Model Specification

We considered this study a natural experiment and divided the research objects into experimental and control groups. The 57 countries on the Belt and Road were the experimental group. Austria, Denmark, Germany, Finland, South Korea, Libya, Japan, Sweden, Cyprus, Sudan, Greece, Italy, and Australia, neighbours of the Belt and Road countries, were the control group. In 2014, economic and trade relations with the 12 Silk Road countries began, including Russia, Ukraine, and Belarus. Hence, we selected 2014 as the starting year of the policy. The formula is:

In the formula, subscripts i and t represent the country and year. Energyit represents energy consumption of country i in year t. Region and time represent regional dummy and time dummy variables, respectively. When the region is 1, it means the host country of the Belt and Road Initiative. When the region is 0, it means the 13 neighbouring states with no direct involvement to the policy. When time is 1, it means that the Belt and Road policy has been implemented; when time is 0, it means that the Belt and Road policy has not been implemented.

To observe the impact of China’s OFDI on the host country’s energy consumption, we had separately add the interaction term of the foreign investment multiplied by two dummy variables. At the same time, to ensure the validity of the model’s estimation, the level of economic development, urbanisation rate, trade dependence, industrialisation rate, and population were added as control variables:

where ofdiit × time and ofdiit × region are the interaction terms of foreign investment and dummy variables. To summarise scholars and foreign direct investment research results, we have selected other influencing factors related to energy consumption as control variables.

The level of economic development (gdpp) and the urbanisation rate (urb) are characterised by GDP per capita and the urban share of the population. Trade dependency (trade) and industrialisation rate (ind) are characterised by the share of total trade in GDP and the share of the secondary sector in GDP, and pop expresses population. The primary data were from the World Bank, and the research span was still 2003–2016.

4.2.2. Empirical Analysis

As shown in Table 6, model (1) and model (2) only used regional dummy variables and time dummy variables when the control variables were unchanged. Model (3) used the interaction term of region × time as a policy variable. Model (4) used the interaction terms of OFDI and two dummy variables based on model (3) to investigate the impact of OFDI on energy consumption in terms of region and time.

Table 6.

The impact of China’s OFDI on energy consumption of host countries during 2003–2016.

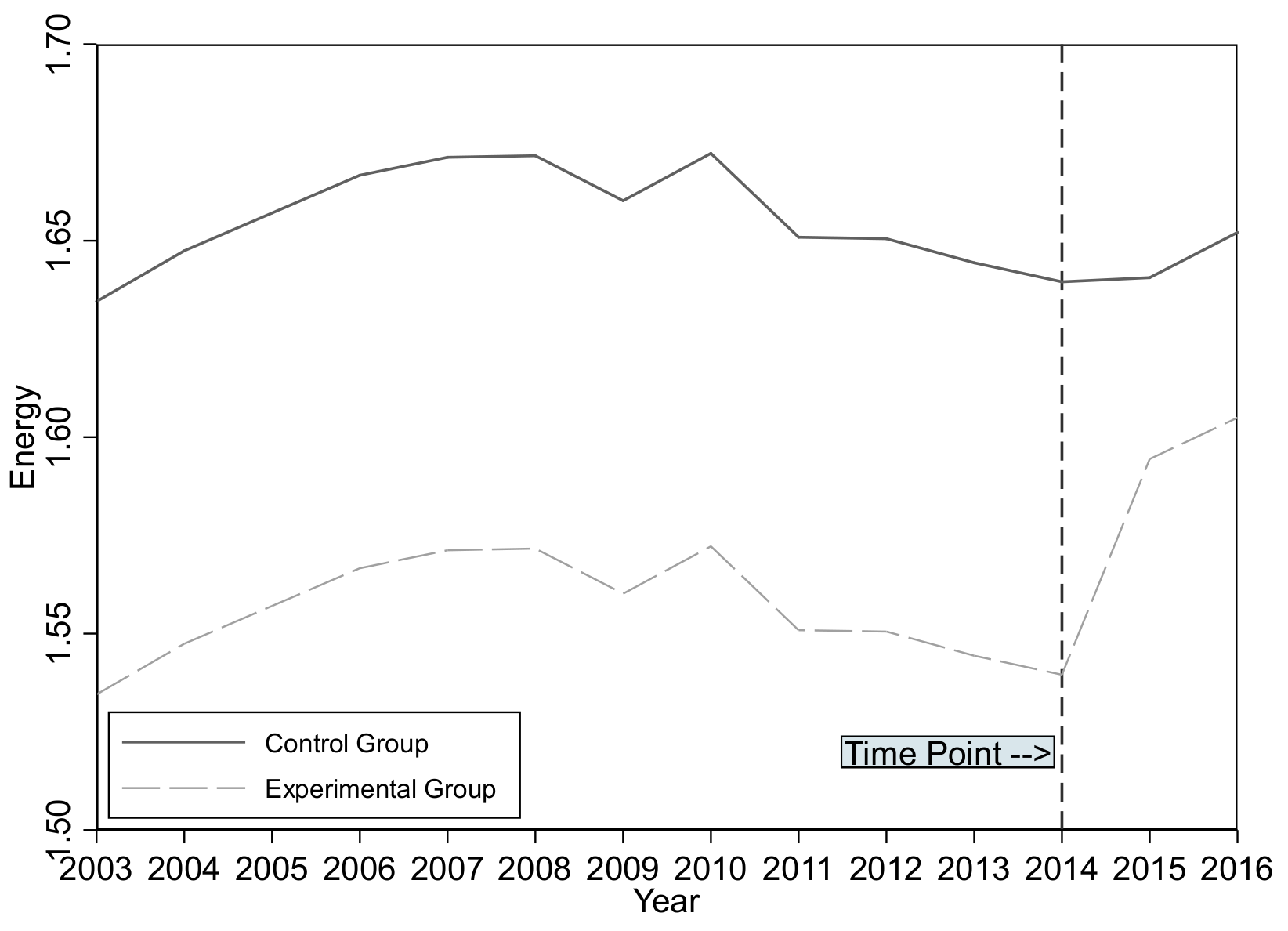

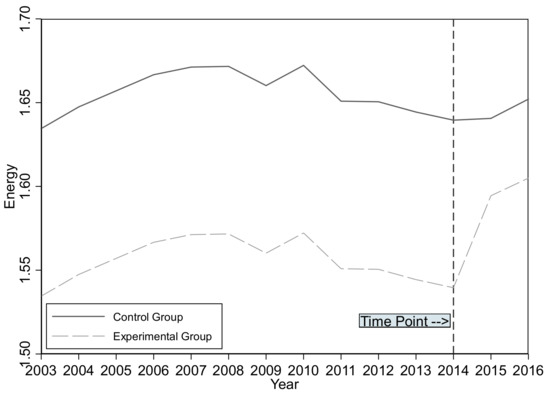

Bertrand pointed out that one of the prerequisites for the validity of DID estimation is that the experimental group and the control group have the same trend before receiving treatment. Therefore, to show the applicability of the DID model, this paper proves the same trend for the energy consumption of the experimental group and the control group. As shown in Figure 2, before the adjustment of the policy effect, the energy consumption of the control group and the experimental group maintained approximately the same growth trend, so the premise was satisfied. However, we found that after implementing the Belt and Road policy in 2014, there were still no significant changes. From observation models 3 and 4, it can be seen that no region × time passed the significance test, indicating that the Belt and Road policy implemented in 2014 had no significant impact on the energy consumption of the host country.

Figure 2.

Parallel trend in energy consumption.

Inter-individual differences and changes in time trends may interfere with policy effects. We controlled for time and individual fixed effects separately (Table 7). According to models 5–7, the Belt and Road policy’s effect was insignificant. We also used PSM to find a control group similar to the experimental group (countries) to avoid selectivity bias. The results were still not significant after accounting for the double fixed effect. We believe that the main reasons for this phenomenon may be the following: (1) Inadequate preparation in many aspects. After the policy was introduced, although China’s provinces hope to seize resources and seize opportunities to obtain new development opportunities and growth momentum, cross-regional and cross-sector national Belt and Road coordination agencies are not yet present. Meanwhile, international talent training is lagging, and overseas investments’ protection and insurance mechanisms are inadequate. (2) The political stability of some countries and regions is currently lacking. While facing state conflicts, party conflicts, ethnic conflicts, and religious conflicts, China is also facing provocations stemming from nationalism, isolationism, and trade and investments. Cultural differences, institutional differences, and geopolitical games make some economic corridors still have severe trust deficits, making it difficult to develop further development planning, policy coordination, standards compatibility, and investment [63]. (3) The time needed to resolve major projects. Energy consumption depends on infrastructure construction to a certain extent, and it is challenging to coordinate infrastructure construction. Such infrastructure expenses are far from what ordinary companies can afford, and commercial banks are generally risk-averse, so long delays are common. These issues need to be addressed one by one through top-level diplomacy, high-level dialogue, and bilateral or multilateral agreements [64].

Table 7.

The test for policy effects under fixed effects.

In model 4, the dummy variables region and time both passed the 1% significance test. This shows that the energy consumption of the Belt and Road countries is 0.1354% higher than that of the 13 neighbouring countries. Energy consumption has declined since 2014 compared to previous years. The main reason is that China’s clean energy technologies has continued to mature, and guided by Chinese technology and Chinese standards, green development has become an essential consideration in China’s international energy cooperation. On the supply side, China attaches importance to the collaboration with energy-producing countries and coordination with energy-consuming countries. On the demand side, China’s exporting of clean energy technology has been achieved with in-depth strategic energy cooperation. For example, vigorously developing clean energy projects such as biogas, distributed wind power, and photovoltaics in the African region can improve the energy structure of some developing countries and solves the problem of power shortages and energy access. It will promote local poverty reduction, employment, environmental protection, and sustainable economic development; and directly improve the lives of local people.

The interactive term ofdi × region passed the significance test at the 10% level, showing that the impact of OFDI on the energy consumption of the Belt and Road countries is 0.0225% lower than that of the 13 neighbouring countries. To shape the image of a “responsible country” and reduce the “anxiety” surrounding China’s large-scale OFDI, Chinese OFDI has become greener [34]. Compared to the control group, some countries along the route have signed Belt and Road-related agreements. At the heart of these agreements is a commitment to creating synergies between the 2030 Agenda for Sustainable Development and the Green Belt and Road. At the same time, it can be known through ofdi × time, the impact of OFDI on energy consumption increased by 0.0541% after 2014 compared to the previous period. The reason for this phenomenon is that with the development of trade integration and regional cooperation, the energy consumption of host countries has increased. In the process of energy cooperation, China’s OFDI technology spillover improves the energy efficiency of host countries, and the technology rebound effect may exacerbate the energy consumption.

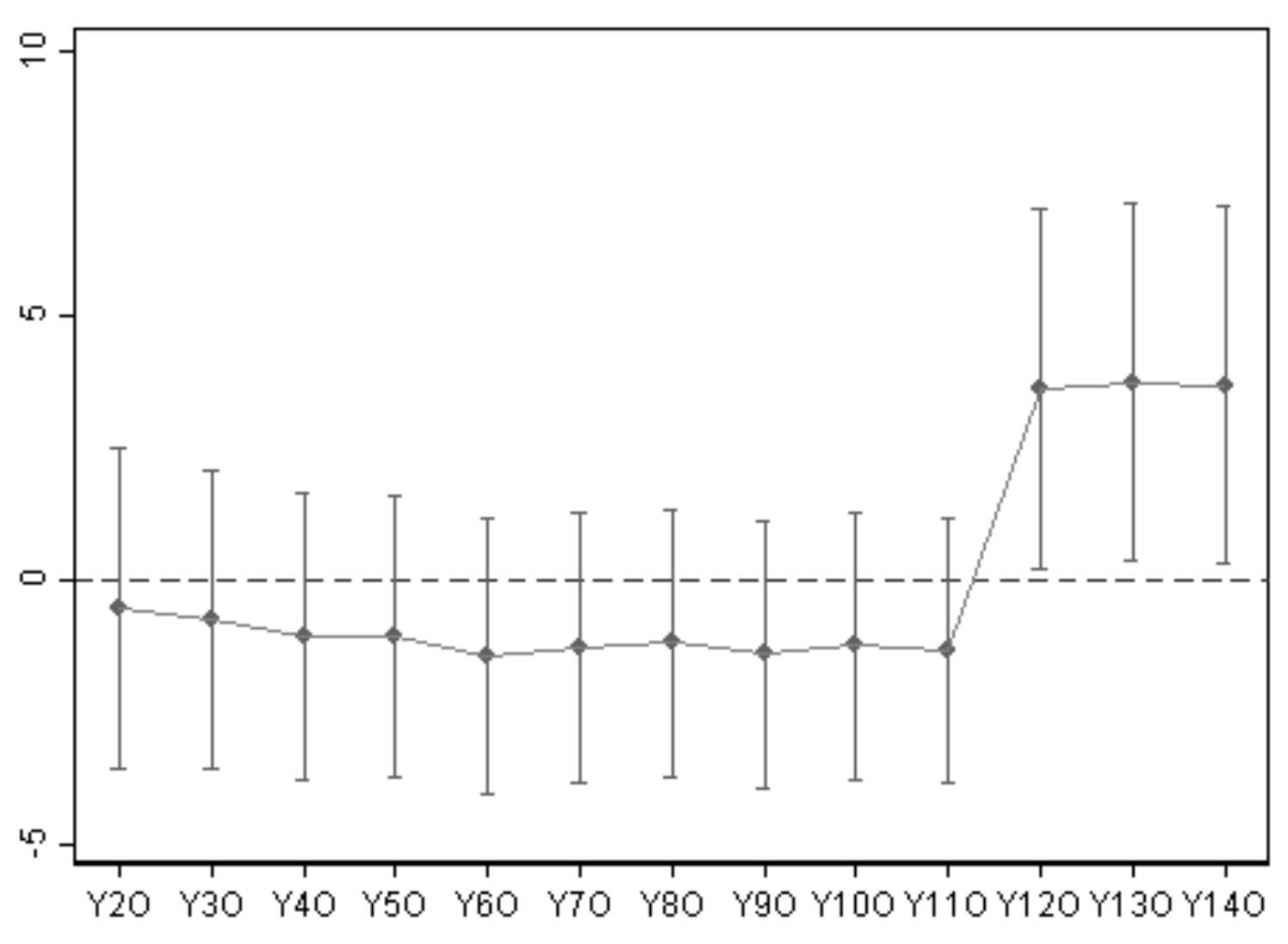

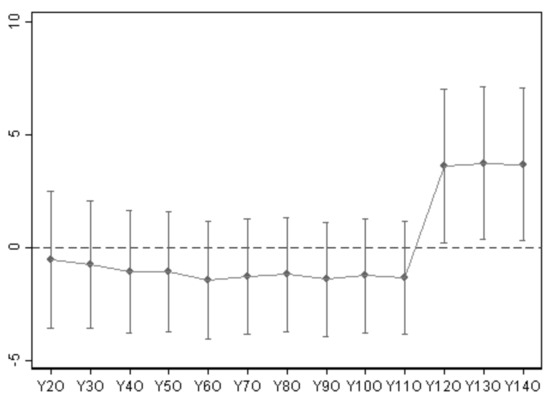

To further observe the impact of OFDI on energy consumption, we used the year as a dummy variable to form an interaction term ofdi × year with OFDI. We used 2003 as the base year to examine the change in the effects of foreign investment on energy consumption over the years. It can be seen in Table 8 and Figure 3 that the confidence interval of ofdi × year from 2004 to 2013 contains 0, and the significance test failed. This shows that there has been no significant change in the effect of OFDI on energy consumption in the past ten years. From 2014 to 2016, ofdi × year passed the significance test at the level of 10%, indicating that after implementing the Belt and Road policy, the marginal effect of OFDI on energy consumption increased. From 2014 to 2016, the impacts of OFDI on energy consumption were 0.0684%, 0.0685%, and 0.0693%, respectively.

Table 8.

Changes in the impact of China’s OFDI on energy consumption.

Figure 3.

Changes in the impact of China’s OFDI.

We found an exciting phenomenon: that energy consumption in Belt and Road countries decreased after 2014. However, the impact of Chinese OFDI on energy consumption increased compared to the period before 2014. The two findings are not in conflict, as reducing energy consumption may have resulted from other factors. Sun et al. [36] argued that the energy efficiency of the Belt and Road Initiative countries had been steadily increasing, primarily due to the effects of the Belt and Road Initiative on trade integration and regional cooperation. The current investment promotion effect of the Belt and Road Initiative is mainly an expansion of the intensive margin, with OFDI concentrated in infrastructure-related sectors such as energy, transport, and communications. This had a significant impact on energy consumption [65]. Nugent and Lu [22] argued that Chinese companies invested in the Belt and Road countries to alleviate China’s overcapacity and pollution problems. However, other scholars found that lower–middle-income countries along the route are the only groups adversely affected by OFDI [39].

4.3. Characteristics of the Spatial Network of Energy Consumption in the Belt and Road Countries

It can be seen from the above that the impact of China’s OFDI on the energy consumption of a host country is relevant. Energy consumption inequalities already exist in the Belt and Road countries [66], and with the increase in China’s OFDI, the spatial pattern of energy consumption in the Belt and Road countries has also quietly changed. We used the SNA model to solve the spatial correlation characteristics of energy consumption in the Belt and Road countries.

Table 9 can be obtained by Equations (4)−(7). The results show that the spatial correlation coefficients and spatial densities of the Belt and Road countries (including China) showed a “U-shaped” trend from 2003 to 2016. The number of spatial associations dropped from 534 in 2003 to 498 in 2011, and gradually increased to 529 (2016). The corresponding network density had the same trend. The causes of this phenomenon may have been geopolitical conflicts, wars, international sanctions, and natural disasters. Although the number of energy-related network relationships reached its peak of 529 in 2016, there was still a significant difference between it and the largest possible spatial correlation coefficient, so the potential for improving the spatial correlation of energy is enormous.

Table 9.

Overall characteristics of the space networks for the energy consumption of Belt and Road countries.

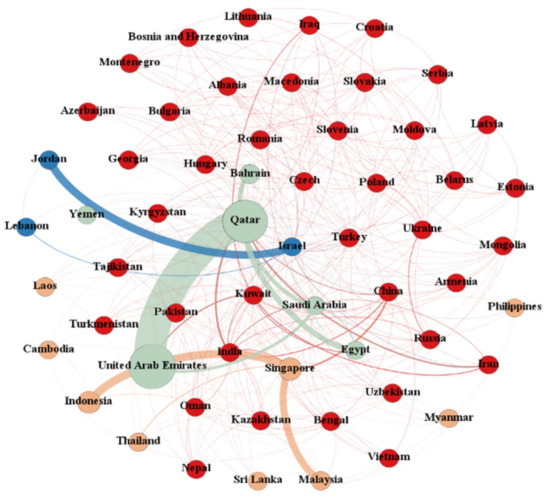

The measurement results of the network correlation degree show that the network correlations of the Belt and Road countries were one from 2003 to 2016, which indicates a close relationship between energy consumption in 58 countries (including China). It can be seen from the changes in the network level that there is a strictly hierarchical structure in the energy consumption’s spatial correlation among the Belt and Road countries, and such hierarchical structures are challenging to change. However, after 2014, the subordinate and marginal status of some states in the space network changed. The strict hierarchical structure of the spatial network of energy consumption was broken down.

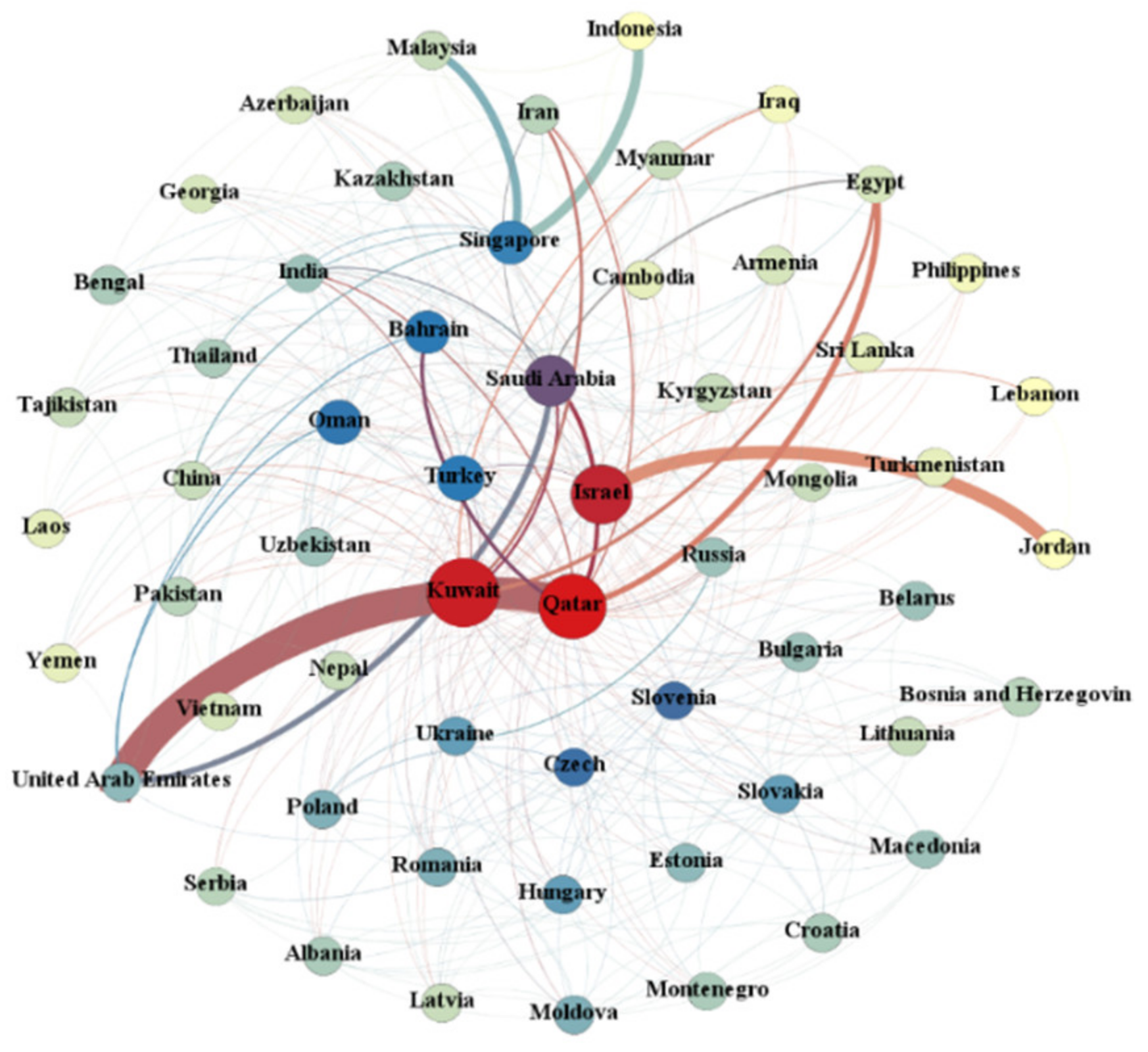

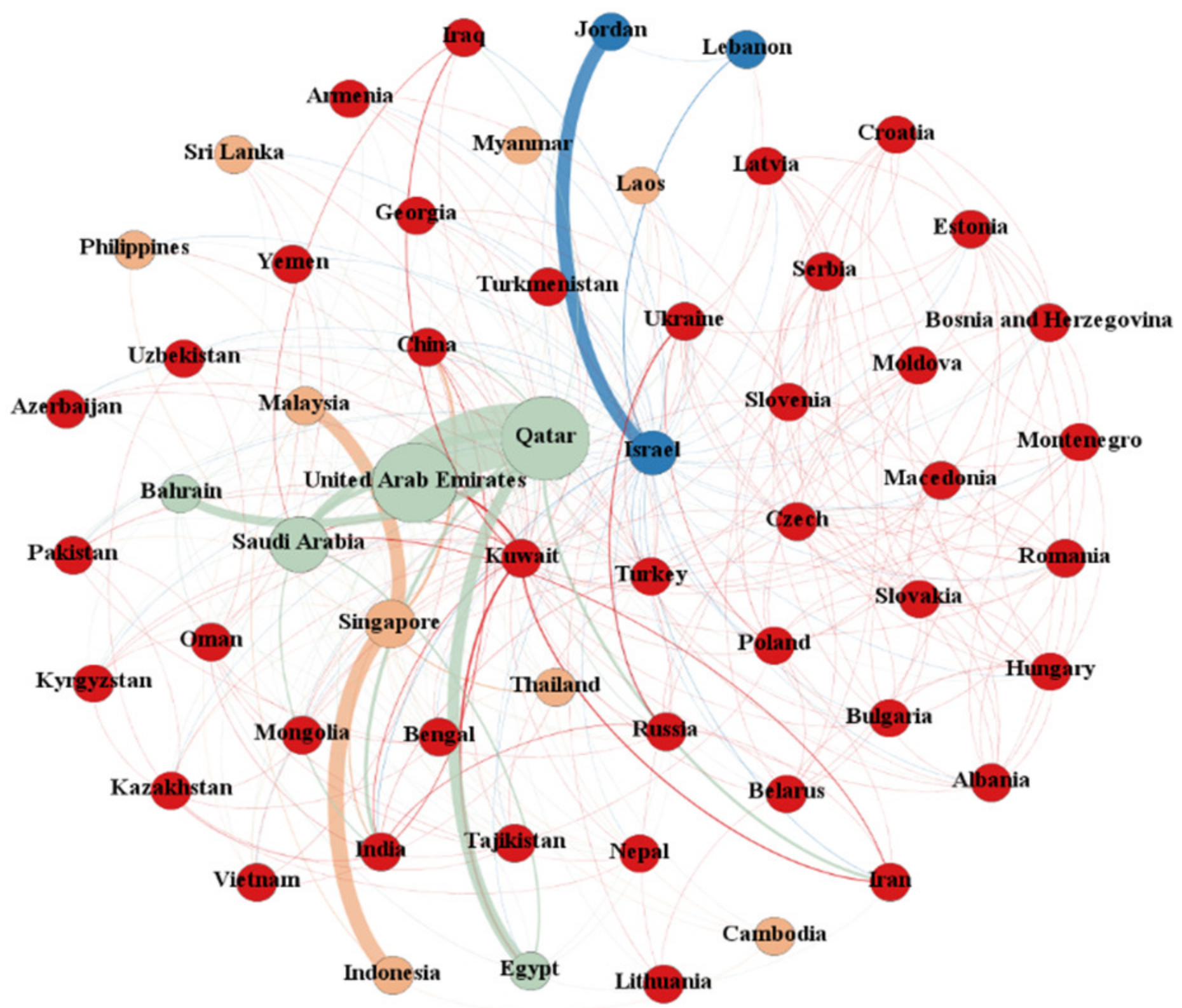

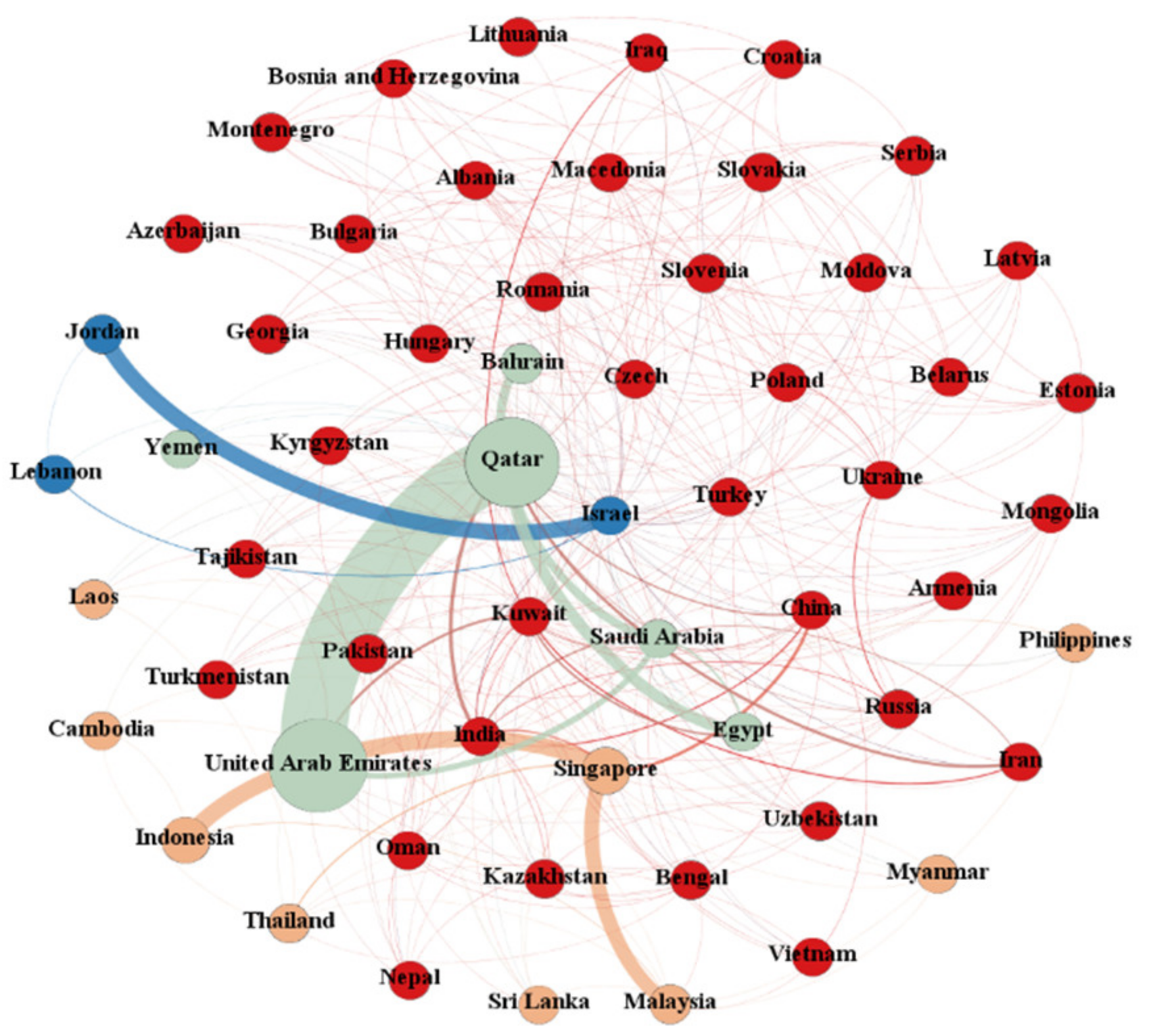

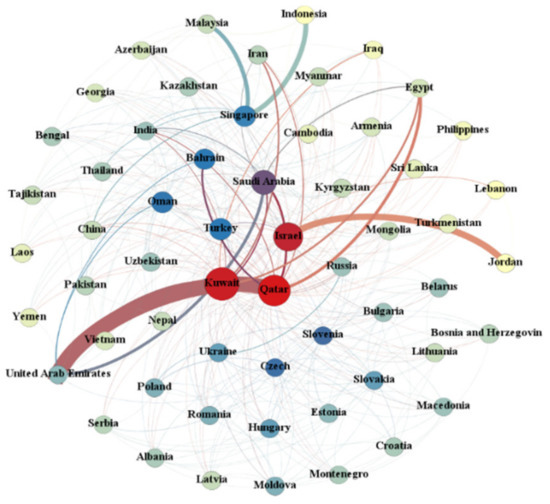

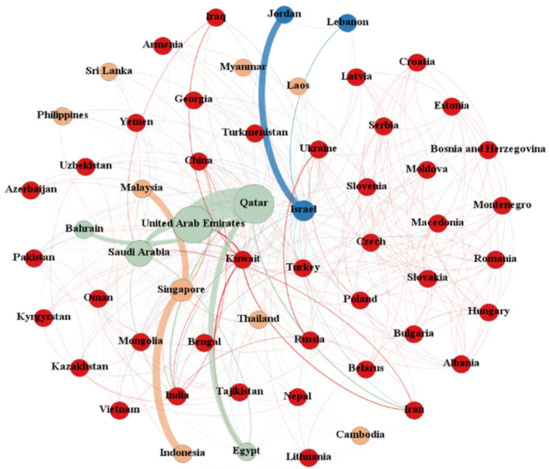

To further reveal the changes in the status and role of each country in the energy consumption spatial association network, we calculated the three indicators of degree of centrality, betweenness centrality, and closeness centrality for 2003, 2014, and 2016.

According to Table 10, the average degree of centrality of the Belt and Road countries in 2003 was 16.68, and only 19 countries were higher than this average. In 2016, there were 23 countries with higher than average degrees of centrality. From the perspective of dynamic changes (Figure 4, Figure 5 and Figure 6), the centrality of Oman, Bahrain, Estonia, Lithuania, Iran, and Myanmar in 2016 dropped significantly from 2003 and gradually deviated from the network’s centre. In 2016, Romania, Albania, Macedonia, Pakistan, Mongolia, China, and Sri Lanka slowly moved closer to the network’s centre. Among them, China’s centrality ranking increased from 42 to 34.

Table 10.

Overall characteristics of the energy consumption space network of Belt and Road countries.

Figure 4.

Energy space network of Belt and Road countries in 2003.

Figure 5.

Energy space network of Belt and Road countries in 2014.

Figure 6.

Energy space network of Belt and Road countries in 2016.

Betweenness centrality reflects the role of bridges. The average intermediary centrality in 2003 was 87.53, and there were 17 countries above the average. According to the centrality ranking, the total intermediary centrality of the top 10 countries accounted for 50.58%. In 2016, the proportion of betweenness centrality fell to 39.08% in these countries. This shows that these countries’ role in energy control and domination is gradually weakening. China’s intermediary centrality increased from 19.76 in 2003 to 182.62 in 2016, well above the average. This shows that as China’s Belt and Road Initiative promotes an interconnected energy cooperation model. The construction of bilateral and multilateral energy cooperation has helped China and some developing countries along the route to set prices.

Closeness centrality reflects the degree of control a country has over other countries. The 2016 average of closeness centrality was 0.3627, with 31 countries higher than the average. The top five countries included Russia, Mongolia, Uzbekistan, Tajikistan, and Kyrgyzstan. The high closeness centrality indicates that these five countries can more quickly establish intrinsic links with other countries in the energy-related network. In other words, the above five countries play the role of central actors in the spatial association network and are not controlled by other nodes. China’s closeness centrality was much higher than the average level in 2003, 2014, and 2016. Still, the closeness centrality rankings declined, mainly because some countries benefited from the continuous strengthening of the international energy cooperation of the Belt and Road Initiative. Their ability to control energy Gradually increased independently.

4.4. The Impact of the Reverse Technology Spillover of China’s OFDI on Energy Efficiency

4.4.1. Model Specification

Technology is an intangible and mobile element in the process of outward investment. Home country companies can achieve technology sharing with host country enterprises through transmission mechanisms such as human capital effects, technological synergies, and R&D feedback. Qi et al. [37] suggested that the Belt and Road low-income countries need to focus on attracting FDI and trade technology to reduce the technology gap.

We believe that energy efficiency at an early stage will impact energy efficiency later. A lagging term of the explanatory variable was introduced to construct a dynamic panel model. The form of the dynamic panel model is as follows:

where t is time and i is a cross-section unit. εit is a random error term consisting of the special effect μi and the heterogeneous shock term νit. The introduction of the dynamic lag term of the explained variable is related to the special effect in the random disturbance term in the model, which is likely to cause endogenous problems. We drew lessons from the STIRPAT environmental framework and used the L-P model to solve the endogenous problem. Using the SYS-GMM model proposed by Blundell and Bond [55], a model of the impact of outward direct investment based on reverse technology spillovers on energy efficiency was constructed.

where Ei represents energy efficiency; gdpp represents per capita GDP; urb represents urbanisation rate; is represents industrial structure; ofdi represents reverse spillover effect.

Considering that the characteristics of the geographical distribution of OFDI companies are apparent, they are also affected by the Belt and Road Initiative. We added region and time to represent the region dummy variable and the time dummy variable, respectively. When the region is 1, it indicates the provinces where foreign investment enterprises are mainly concentrated: Beijing, Fujian, Guangdong, Hainan, Hebei, Jiangsu, Liaoning, Shandong, Shanghai, Tianjin, and Zhejiang. When the region is 0, it means other provinces in China. When time is 1, that means after 2014, when the Belt and Road policy was implemented. When time is 0, that means before 2014, when the Belt and Road policy was not implemented. In order to observe the effect of the reverse spillover effect on foreign investment on energy efficiency, we have added the interaction term of the opposite spillover effect of foreign investment and two dummy variables. We added the level of economic development (gdp), energy structure (es), industrial structure (is), and urbanisation rate (urb) as control variables to strengthen the model’s explanatory power:

Based on formula 12, we increased the interaction terms between the factors that characterise the technology’s absorptive capacity and reverse technology spillovers. The purpose was to verify the impact of OFDI reverse technology on energy efficiency after considering the absorptive capacity.

The factors f that interact with reverse technology spillovers include foreign direct investment (fdi), regional specialisation (ds), human capital (hc), domestic R&D absorptive capacity (rd), and financial development (fin). We studied these indictors because the horizontal and backward linkage effects generated by FDI can increase the size of the market by producing more of the same or substitute products and consuming more intermediate products, resulting in higher total energy consumption and potentially lower energy efficiency. Increases in the levels of regional specialisation and balanced development are conducive to developing manufacturing advantages within the region. Therefore, the higher the level of regional specialisation, the greater the scope for improving energy efficiency. The effect of technology spillovers from the host country depends to a large extent on the technology absorption capacity of the home country. It is not only based on the absorptive capacity of human capital, but also on the level of technology. As the absorptive capacity of reverse technology spillovers begins to expand into more areas, financial development could provide financial support for international technology spillovers while also helping to improve the resource allocation capacity of enterprises.

The financial development level was expressed by the balance of various loans of financial institutions at the end of the year. Openness to the outside world was measured by the proportion of import and export trade in the GDP. The level of human capital was expressed by the ratio of college education or above. We characterised energy efficiency in terms of GDP per unit energy consumption. The energy structure was represented by the proportion of coal consumption in total energy consumption. The ratio of urban population to total population was used to express the urbanisation rate. The industrial structure was represented by the ratio of the tertiary industry to the secondary sector.

4.4.2. Empirical Analysis

Before building a time series model, the stationarity and multicollinearity of the variables taken into the model needed to be tested. After passing the test, we found that the Sargan test statistics were all standard, indicating that the instrumental variables were valid (Table 11). The p-value of Arellano–Bond AR (1) passed the 1% significance test, and the p-value of Arellano–Bond AR (2) was not significant. This shows that the second-order residual sequence after the first-order difference was uncorrelated and confirmed the null hypothesis of GMM estimation.

Table 11.

Impact of China’s OFDI reverse technology spillover effect on the energy efficiency of the home country.

As can be seen in Table 10, the energy efficiency lag terms were favourable in models 1–6, and passed the 1% significance test. This shows that there is a path-dependent characteristic of energy efficiency. Energy efficiency in the past positively affects the current value. Therefore, for each province in China, optimising energy efficiency is a gradual and cumulative process. Each province has to plan for the long term, consider its situation, and build a positive interactive cycle of energy efficiency.

First, GDP per capita, which characterises economic effects, had a significant positive impact on energy efficiency, indicating that economic growth drives technological progress and reduces energy consumption per unit output value beyond the increase in energy demand caused by economic expansion. In terms of energy consumption structure, models 1–6 were significantly positive. This shows that the in-depth development of industrialisation has led to a decline in demand for traditional energy sources; the importance of non-energy alternative elements, such as technology and capital, has become increasingly prominent. New energy and alternative energy sources have gradually increased, which has promoted energy conservation and emission reduction. Besides, the industrial structure was also significantly positive in models 1–6. The specific performance was that for each 1% increase in industrial architecture, GDP per unit of energy consumption increased by 0.1237–0.1999%. This shows that China’s industrial structure is shifting towards being intensive and efficient, and it is leaning from heavy to light, directly reducing energy consumption. With the elimination of backward production capacity, high-tech industries have driven technological progress, and unit energy production costs and prices have further decreased.

It can be seen from model 1 that time passed the 1% significance test, but region failed. This shows that Beijing, Fujian, Guangdong, Hainan, Hebei, Jiangsu, Liaoning, Shandong, Shanghai, Tianjin, and Zhejiang are not significantly different from other provinces. After 2014, China’s energy efficiency declined compared to the past. The interactive term ofdi × time passed the significance test under the condition of 10%, showing that the reverse technology spillover effect of OFDI increased by 0.1954% compared with that before 2014. The interactive term ofdi × region was not significant, indicating that the opposite technology spillover effect of OFDI between regions has no noticeable impact on energy efficiency. This phenomenon is because OFDI reverse technology spillover as an external technology shock requires sufficient technology accumulation and absorptive capacity to undertake it. However, most of China’s provinces are relatively backward regarding energy utilisation technology and have a relatively weak absorptive capacity for human capital and infrastructure development.

For each 1% increase in the reverse technology spillover effect of OFDI in model 1, energy efficiency increased by 0.0536%. This shows that China’s OFDI actively seeks advanced green technologies and low-carbon technologies in developed countries, which effectively improves domestic energy use. This is in line with the original intentions of the Belt and Road Initiative for energy partnerships. Models 2–6 examined the impacts of reverse technology spillovers on energy efficiency in the absorption capacity. The variables all passed the 1% significance test, but there are differences in the direction of energy efficiency. From a regional perspective, foreign direct investment, human capital, domestic research and development, and financial development positively impacted energy efficiency improvement, and have played roles in inhibiting energy efficiency in the regional specialisation.

For each 1% increase in reverse technology spillover effects of foreign direct investment in model 2, energy efficiency increased by 0.0033%. The horizontal correlation effect and backward correlation effect caused by the introduction of foreign capital directly expand the market size by producing more identical or alternative products and consuming more intermediate products, which will increase the total energy consumption and may reduce energy efficiency. The pollution paradise hypothesis holds that multinational companies use host country resources and transfer pollution to developing countries. On the other hand, foreign direct investment is also an essential carrier of technology globalisation and a meaningful way to introduce and absorb international technology spillovers. Investment companies from developed countries have advanced energy-saving technologies, and appropriate technology gaps in the host country can effectively capture technology spillovers. Changing production processes; investing in new equipment that matches them; enhancing the flow of advanced human capital; and increasing the effects of imitation, competition, and demonstration, effectively improve energy efficiency.

For each 1% increase in reverse technology spillover at the regional specialisation level in model 3, energy efficiency fell by 0.0034%. The suppression of energy efficiency mainly occurred due to: (1) Strengthening regional industrial specialisation. The government needs to actively mobilise the scale effect of small, medium, and micro-enterprises. However, this knowledge is currently not fully utilised at present. (2) China’s economic system is not complete, and regional industrial agglomeration is still immature. Therefore, appropriate economic intervention is needed. However, the government’s excessive attention to the growth of regional GDP and the sizes and number of enterprises has led to a decline in resource utilisation. (3) The international status of China’s manufacturing industry is not high. Fierce competition has caused enterprises to lose their motivation for innovation, which has hindered the sector’s development.

For each 1% increase in the reverse technology spillover effect of R&D absorption capacity in model 4, energy efficiency increased by 0.0031%. This shows that the acquisition of reverse technology spillover from the host country requires the home country to have good domestic R&D capabilities. A healthy local R&D level can quickly digest and absorb foreign advanced technology spillovers and achieve transformation. Suppose the technology gap between the home country and the host country is too large and exceeds the optimal technology gap. In that case, it is difficult for the home country to acquire advanced technology due to insufficient technology absorption capacity [67]. China’s multinational subsidiaries have established a follow-up mechanism for imitation. While imitating and learning advanced technology, Chinese companies do not encounter thresholds, and their absorption capacity is not limited. This means that China has more access to advanced technology than others.

For each 1% increase in the reverse technological spillover effect of human capital in model 5, energy efficiency improved by 0.0167%. Numerous studies have shown that the effect of international technology spillovers depends to no small extent on the technology absorption capacity of the host country. The critical element is human capital. In terms of technical talent reserves, multinational companies in China or host countries often employ local, high-quality research and development personnel, the fostering of exceptional talents, and internal talent training. These approaches can effectively promote the flow and overflow of energy technological information, improve the quality of trained technical personnel, and ultimately achieve technological progress. With the expansion of the scale of China’s technology-seeking outward investment, the ability of advanced human capital to absorb technology is gradually emerging.

For each 1% increase in the reverse spillover level of financial development in model 6, the energy efficiency increased by 0.0038%. High-tech enterprises have the characteristics of high investment and high risk. The perfect and efficient operation of the financial market can provide financing facilities for high-tech enterprises. Reasonable financing arrangements can ensure the long-term stability of the scale and structure of the venture capital market, expand financing channels, and reduce financing costs. At present, China’s financial market is gradually improving. The entire financial services industry is conducive to promoting multinational enterprises to invest in overseas markets, to enhance the study and absorption of advanced international technology and promote the growth and innovation of domestic enterprises [68].

5. Conclusions and Policy Implications

5.1. Conclusions

This paper is set in the context of Belt and Road energy cooperation. Taking Chinese OFDI as a starting point, the targets of OFDI and the impacts on each host country’s energy consumption (spatial pattern of energy consumption) and energy efficiency were studied in three parts. In contrast to previous studies, this paper revisited and uncovered the real drivers of OFDI through regional economic environment theory, and used the SNA model to delve into the dynamic evolution of the spatial pattern of energy consumption in the host country. At the same time, the impact of reverse technological spillover effects on energy efficiency in home countries was explored from various perspectives, including regional specialisation, R&D absorptive capacity, and human capital. The paper fills a research gap while providing a theoretical basis for the government to formulate outward investment policies. The main findings of the study were:

- As far as the Belt and Road Initiative’s effects are concerned, the current effect on host country energy consumption is not very significant. The possible reasons are (1) political instability in some countries or regions; (2) long lead times for resolving major cooperation projects; and (3) inadequate preparation in multiple areas, including lagging international talent development and inadequate overseas investment protection and insurance mechanisms.

- The energy consumption network density of the Belt and Road countries is only 0.16, and there is much room for improvement. Although a strict hierarchical structure exists in the entire energy consumption space network, some countries’ subordination and marginal status in the space network changed after 2014 [69]. The significant increase in intermediary centrality shows that China’s Belt and Road initiative promotes a connected energy cooperation model. Under the construction of bilateral and multilateral energy cooperation, some developing countries have increased their voice and pricing power.

- Due to the reverse technological spillover effect of OFDI, China’s energy efficiency improved significantly after 2014, but the regional differences were not significant. Regarding the interactive terms, the reverse technology spillover effects of FDI, OFDI, domestic R&D absorptive capacity, human capital, and financial development levels have contributed to China’s energy efficiency.

5.2. Policy Implications

5.2.1. The Macro-Level

Due to the above conclusions, the Chinese government should implement policy communication and strengthen the docking of policies, standards, and mechanisms for cooperation with key countries in the Belt and Road Initiative. Further the government should strengthen energy diplomacy, and establish and improve regular high-level exchange visits and multilateral consultation mechanisms. Including energy project cooperation in foreign cooperation agreements reduces the adverse impacts of resource country policy changes on cooperation projects and reduces investment risks.

5.2.2. The Micro-Level

Chinese outward investment enterprises should keep abreast of political, economic, legal, customary, and other aspects of the host country’s investment environment. The capital exports of energy cooperation projects drive China’s energy industry technology, production capacity, and industry to “go global”. The ability of overseas investment companies to absorb, learn, and imitate is related to the acquisition of reverse technology spillovers from foreign direct investment. Chinese enterprises should improve their scientific research quality, increase R&D investment, and accumulate technical elements. This will improve their ability to absorb advanced technologies and transform and re-innovate techniques to prevent technological disconnect caused by a lack of knowledge reserves. Being able to absorb, transform, and re-innovate the results of reverse technology spillovers is critical. Regional specialisation should be enhanced; industrial transformation should be actively carried out; the ability of concentrated industries to innovate should be actively enhanced; and their ability to absorb advanced technologies should be enhanced to improving their competitiveness.

There are, however, several limitations of this study. (1) We have only suggested possible reasons for the insignificant effect of the Belt and Road policy. As far as the data allow, we will further develop the theoretical hypothesis and empirical evidence in our subsequent work. (2) The SNA model shows the spatial evolution of energy consumption patterns in Belt and Road countries, but the study is too superficial. In the subsequent study, we need to explore further through social network analysis to find the main factors causing the spatially linked networks of energy consumption.

Author Contributions

Conceptualization, methodology, formal analysis, writing—original draft preparation, writing—review and editing, and visualization, X.Z.; investigation, validation, funding acquisition, Q.G.; supervision, M.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded under the program of the National Natural Science Foundation of China, grant number 72104093.Projuect number BS2109 has been implemented with the support provided from the doctoral promotion program of Suzhou Agricultural Vocational and Technical College.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, Y.Q.; Zhu, Z.W.; Zhu, Z.G.; Liu, Z.B. Analysis of China’s energy consumption changing using the Mean Rate of Change Index and logarithmic mean divisia index. Energy 2019, 167, 275–282. [Google Scholar] [CrossRef]

- Hao, Y.; Guo, Y.T.; Wu, H.T.; Ren, S.Y. Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Struct. Chang. Econ. Dyn. 2020, 52, 109–119. [Google Scholar] [CrossRef]

- Wang, C.; Wang, F. China can lead on climate change. Science 2017, 357, 64. [Google Scholar] [CrossRef]

- Chen, J.Z.; Qian, X.W. Measuring on-going changes in China’s capital controls: A De Jure and a hybrid index data set. China Econ. Rev. 2016, 38, 167–182. [Google Scholar] [CrossRef]

- Ministry Commerce of the People’s Republic of China. Statistical Bulletin of China’s Outward Foreign Direct Investment; Ministry Commerce of the People’s Republic of China: Beijing, China, 2017.

- Xu, W.X.; Sun, J.Q.; Liu, Y.X.; Xiao, Y.; Tian, Y.Z.; Zhao, B.X.; Zhang, X.Q. Spatiotemporal variation and socio-economic drivers of air pollution in China during 2005–2016. J. Environ. Manag. 2019, 245, 66–75. [Google Scholar] [CrossRef] [PubMed]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Zhang, X.; Daly, K. The determinants of China’s outward foreign direct investment. Emerg. Mark. Rev. 2011, 12, 389–398. [Google Scholar] [CrossRef]

- Deng, P. Chinese outward direct investment research: Theoretical integration and recommendations. Manag. Organ. Rev. 2013, 9, 513–539. [Google Scholar] [CrossRef] [Green Version]

- Robins, F. The uniqueness of Chinese outward foreign direct investment. Asian Bus. Manag. 2013, 12, 525–537. [Google Scholar] [CrossRef]

- Wang, Y.L.; Shao, Y.M. Motivations of Chinese outward direct investment: The sector perspective. J. Syst. Sci. Complex. 2016, 29, 688–721. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, W.; Yang, H.; Wu, Z. “Grouping” or “Ride One’s Coattails”?—How Developing Countries along the Belt and Road Satisfy Themselves. Energies 2021, 14, 3498. [Google Scholar]

- Yang, J.H.; Wang, W.; Wang, K.L.; Yeh, C.Y. Capital intensity, natural resources, and institutional risk preferences in Chinese Outward Foreign Direct Investment. Int. Rev. Econ. Financ. 2018, 55, 259–272. [Google Scholar] [CrossRef]

- Kang, Y.F. Regulatory institutions, natural resource endowment and location choice of emerging-market FDI: A dynamic panel data analysis. J. Multinatl. Financ. Manag. 2018, 45, 1–14. [Google Scholar] [CrossRef]

- Dunning, J.H. Trade, Location of Economic Activity and the Multinational Enterprise: A Search for an Eclectic Approach. In Theories and Paradigms of International Business Activity—The Selected Essays of John H. Dunning; Dunning, J.H., Ed.; Edward Elgar Publishing Limited: Cheltenham, UK, 2002; pp. 52–76. [Google Scholar]

- Li, X.J.; Huang, S.S.; Song, C.Y. China’s outward foreign direct investment in tourism. Tourism Manag. 2017, 59, 1–6. [Google Scholar] [CrossRef]

- Zhang, X. The socio-economic geography of Chinese outward foreign direct investment in Latin America. J. Int. Bus. Studies 2019, 38, 499–518. [Google Scholar]

- Zhang, Y.M.; Zhan, W.; Xu, Y.K.; Kumar, V. International friendship cities, regional government leaders, and outward foreign direct investment from China. J. Bus. Res. 2020, 108, 105–118. [Google Scholar] [CrossRef]

- Liu, Y.L.; Ge, Y.J.; Hu, Z.D.; Wang, S.F. Culture and capital flows—Exploring the spatial differentiation of China’s OFDI in the energy sector. Energy Policy 2017, 145, 111709. [Google Scholar] [CrossRef]

- Xin, D.L.; Zhang, Y.Y. Threshold effect of OFDI on China’s provincial environmental pollution. J. Clean. Prod. 2020, 258, 120608. [Google Scholar] [CrossRef]

- Liu, L.Y.; Zhao, Z.Z.; Zhang, M.M.; Zhou, C.X.; Zhou, D.Q. The effects of environmental regulation on outward foreign direct investment’s reverse green technology spillover: Crowding out or facilitation? J. Clean. Prod. 2021, 284, 124689. [Google Scholar] [CrossRef]

- Nugent, J.B.; Lu, J.X. China’s outward foreign direct investment in the belt and road initiative: What are the motives for Chinese firms to invest? China Econ. Rev. 2021, 68, 101628. [Google Scholar] [CrossRef]

- Jiao, Y.Q.; Ji, C.W.; Yang, S.Y.; Yang, G.G.; Su, M.R.; Fan, H.B. Home governments facilitate cleaner operations of outward foreign direct investment: A case study of a cleaner production partnership programme. J. Clean. Prod. 2020, 265, 121914. [Google Scholar] [CrossRef]

- Liao, H.W.; Yang, L.Q.; Dai, S.Q.; Assche, A.V. Outward FDI, industrial structure upgrading and domestic employment: Empirical evidence from the Chinese economy and the belt and road initiative. J. Asian Econ. 2021, 74, 101303. [Google Scholar] [CrossRef]

- Andreff, W.; Andreff, M. Multinational companies from transition economies and their outward foreign direct investment. Russ. J. Econ. 2017, 3, 445–474. [Google Scholar] [CrossRef]

- Kong, Q.X.; Tong, X.; Peng, D.; Wong, Z.; Chen, H. How factor market distortions affect OFDI: An explanation based on investment propensity and productivity effects. Int. Rev. Econ. Financ. 2021, 73, 459–472. [Google Scholar] [CrossRef]

- Lv, P.; Spigarelli, F. The integration of Chinese and European renewable energy markets: The role of Chinese foreign direct investments. Energy Policy 2015, 81, 14–26. [Google Scholar] [CrossRef]

- Reins, L. The European Union’s framework for FDI screening: Towards an ever more growing competence over energy policy? Energy Policy 2017, 128, 665–672. [Google Scholar] [CrossRef]

- Elheddad, M. Foreign direct investment and domestic investment: Do oil sectors matter? Evidence from oil-exporting Gulf Cooperation Council economies. J. Econ. Bus. 2019, 103, 1–12. [Google Scholar] [CrossRef]

- Wang, S.J. Impact of FDI on energy efficiency: An analysis of the regional discrepancies in China. Nat. Hazards 2017, 85, 1209–1222. [Google Scholar] [CrossRef]

- Adom, P.K.; Opoku, E.E.O.; Yan, I.K.M. Energy demand—FDI nexus in Africa: Do FDIs induce dichotomous paths? Energy Econ. 2019, 81, 928–941. [Google Scholar] [CrossRef]

- Zhao, Y.; Shi, X.P.; Song, F. Has Chinese outward foreign direct investment in energy enhanced China’s energy security? Energy Policy 2020, 146, 111803. [Google Scholar] [CrossRef]

- Liu, H.Y.; Wang, Y.L.; Jiang JWu, P. How green is the “Belt and Road Initiative”?—Evidence from Chinese OFDI in the energy sector. Energy Policy 2020, 145, 111709. [Google Scholar] [CrossRef]

- Wang, Y.L.; Zhang, Q.; Liu, J.S.; He, D.M. Determinants of Chinese Outward FDI in Energy Sector. In Proceedings of the Fourteenth International Conference on Management Science and Engineering Management; Springer: Cham, Switzerland, 2020; Volume 1190, pp. 157–170. [Google Scholar]

- Akbar, U.; Popp, J.; Khan, H.; Khan, M.A.; Oláh, J. Energy efficiency in transportation along with the belt and road countries. Energies 2020, 13, 2607. [Google Scholar] [CrossRef]

- Sun, H.; Edziah, B.K.; Song, X.; Kporsu, A.K.; Taghizadeh-Hesary, F. Estimating persistent and transient energy efficiency in belt and road countries: A stochastic frontier analysis. Energies 2020, 13, 3837. [Google Scholar] [CrossRef]

- Qi, S.Z.; Peng, H.R.; Zhang, X.L.; Tan, X.J. Is energy efficiency of Belt and Road Initiative countries catching up or falling behind? Evidence from a panel quantile regression approach. Appl. Energy 2019, 253, 113581. [Google Scholar] [CrossRef]

- Pan, X.F.; Li, M.N.; Wang, M.Y.; Chu, J.H.; Bo, H.G. The effects of outward foreign direct investment and reverse technology spillover on China’s carbon productivity. Energy Policy 2020, 145, 111730. [Google Scholar] [CrossRef]

- Li, X.X.; Liu, C.X.; Wang, F.; Ge, Q.S.; Hao, Z.X. The effect of Chinese investment on reducing CO2 emission for the Belt and Road countries. J. Clean. Prod. 2021, 288, 125125. [Google Scholar] [CrossRef]

- Mahadevan, R.; Sun, Y.Y. Effects of foreign direct investment on carbon emissions: Evidence from China and its Belt and Road countries. J. Environ. Manag. 2020, 276, 111321. [Google Scholar] [CrossRef]

- Razzaq, H.A.A.; Haseeb, M.; Mihardjo, L.W.W. The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: New evidence from Method of Moments Quantile Regression. Environ. Sci. Pollut. Res. 2021, 28, 5254–5270. [Google Scholar]

- Yu, S.; Qian, X.W.; Liu, T.X. Belt and road initiative and Chinese firms’ outward foreign direct investment. Emerg. Mark. Rev. 2019, 41, 100629. [Google Scholar] [CrossRef]

- Huang, Y.Y. Environmental risks and opportunities for countries along the Belt and Road: Location choice of China’s investment. J. Clean. Prod. 2019, 211, 14–26. [Google Scholar] [CrossRef]

- Yu, P.; Cai, Z.F.; Sun, Y.Q. Does the emissions trading system in developing countries accelerate carbon leakage through OFDI? Evidence from China. Energy Econ. 2021, 101, 105397. [Google Scholar] [CrossRef]

- Huang, M.X.; Li, S.Y. The analysis of the impact of the Belt and Road initiative on the green development of participating countries. Sci. Total Environ. 2020, 722, 137869. [Google Scholar] [CrossRef] [PubMed]

- Xie, F.M.; Zhang, B. Impact of China’s outward foreign direct investment on green total factor productivity in “Belt and Road” participating countries: A perspective of institutional distance. Environ. Sci. Pollut. Res. 2021, 28, 4704–4715. [Google Scholar] [CrossRef] [PubMed]

- Razzaq, A.; An, H.; Delpachitra, S. Does technology gap increase FDI spillovers on productivity growth? Evidence from Chinese outward FDI in Belt and Road host countries. Technol. Forecast. Soc. Chang. 2021, 172, 12050. [Google Scholar] [CrossRef]

- Ashenfelter, O.; Card, D. Using the Longitudinal Structure of Earnings to Estimate the Effect of Training Programs. Rev. Econ. Stat. 1985, 67, 648–660. [Google Scholar] [CrossRef]

- Villa, J. Diff: Simplifying the estimation of difference-in-differences treatment effects. Stata J. 2016, 16, 52–71. [Google Scholar] [CrossRef] [Green Version]

- Blundell, R.; Dias, M.C. Alternative approaches to evaluation in empirical microeconomics. Port. Econ. J. 2008, 44, 565–640. [Google Scholar]

- Dong, Z.X.; Miao, Z.; Zhang, Y. The impact of China’s outward foreign direct investment on domestic innovation. J. Asian Econ. 2021, 101307. [Google Scholar] [CrossRef]

- Ruzol, C.; Cabanilla, D.B.; Ancog, R.; Peralta, E. Understanding water pollution management: Evidence and insights from incorporating cultural theory in social network analysis. Glob. Environ. Chang. 2017, 45, 183–193. [Google Scholar] [CrossRef]

- Ciarapica, P.; Bevilacqua, M.; Antomarioni, S. An approach based on association rules and social network analysis for managing environmental risk: A case study from a process industry. Process Saf. Environ. Prot. 2019, 128, 50–64. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef] [Green Version]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel-data models. J. Econometr. 1998, 87, 115–143. [Google Scholar] [CrossRef] [Green Version]

- Sarafidis, V.; Robertson, D. On the impact of error cross-sectional dependence in short dynamic panel estimation. Econometr. J. 2009, 12, 62–81. [Google Scholar] [CrossRef]

- He, R.F.; Zhong, M.R.; Huang, J.B. The dynamic effects of renewable-energy and fossil-fuel technological progress on metal consumption in the electric power industry. Resour. Policy 2021, 71, 101985. [Google Scholar] [CrossRef]

- Li, J.Y.; Li, S.S. Energy investment, economic growth and carbon emissions in China—Empirical analysis based on spatial Durbin model. Energy Policy 2020, 140, 111425. [Google Scholar] [CrossRef]

- Li, L.; Hong, X.F.; Wang, J. Evaluating the impact of clean energy consumption and factor allocation on China’s air pollution: A spatial econometric approach. Energy 2020, 195, 116842. [Google Scholar] [CrossRef]

- Chang, S.C. The determinants and motivations of China’s outward foreign direct investment: A spatial gravity model approach. Glob. Econ. Rev. 2014, 43, 244–268. [Google Scholar] [CrossRef]

- Liu, H.Y.; Deseatnicov, I. Exchange rate and Chinese outward FDI. Appl. Econ. 2016, 48, 4961–4976. [Google Scholar] [CrossRef]

- Elhorst, P.; Piras, Q.; Arbia, G. Growth and convergence in a multiregional model with space-time dynamics. Geogr. Anal. 2010, 42, 338–355. [Google Scholar] [CrossRef]

- Huang, Y.P. Understanding China’s Belt & Road Initiative: Motivation, framework and assessment. China Econ. Rev. 2016, 40, 314–321. [Google Scholar]

- Shao, X. Chinese OFDI responses to the B & R initiative: Evidence from a quasi-natural experiment. China Econ. Rev. 2020, 61, 101435. [Google Scholar]

- Lv, Y.; Lu, Y.; Wu, S.B.; Wang, Y. The effect of the Belt and Road Initiative on Firms’ OFDI: Evidence from China’s Greenfield Investment. Econ. Res. J. 2019, 54, 187–202. [Google Scholar]

- Hafeez, M.; Yuan, C.; Khelfaoui, I.; Sultan Musaad, O.A.; Waqas Akbar, M.; Jie, L. Evaluating the energy consumption inequalities in the one belt and one road region: Implications for the environment. Energies 2019, 12, 1358. [Google Scholar] [CrossRef] [Green Version]

- Azman-Saini, W.N.W.; Law, S.H.; Ahmad, A.H. FDI and economic growth: New evidence on the role of financial markets. Econ. Lett. 2010, 107, 211–213. [Google Scholar] [CrossRef]

- Jiang, M.R.; Luo, S.M.; Zhou, G.Y. Financial development, OFDI spillovers and upgrading of industrial structure. Technol. Forecast Soc. Change 2020, 155, 119974. [Google Scholar] [CrossRef]

- Liu, Z.M.; Han, W.P.; Zhang, Y. Energy consumption and risk prevention along the “Belt and Road”. Coal Econ. Res. 2020, 40, 10–22. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).