Abstract

The article explores the interplay between policy, technological innovation and market dynamics. It highlights the challenges of combining biofuel policies for ‘greening’ transport with reviving the Nordic forestry industry. We find that strong policy initiatives have triggered a transition to biofuel in the three Nordic countries but have so far given little stimulus to forest-industrial revival. Instead, biofuel has created dynamic change in the petroleum sector, where retailers and refineries have adopted cheap imported biofuel to diversify out of an exclusive reliance on petroleum, leaving forest-based biofuel unable to compete. However, this does not mean that the forestry industry has remained stagnant. We find that parts of the Nordic forestry industry have staged an impressive revival, though one based predominantly on high value products, such as hygiene products and labels, and not on biofuel. We conclude that, while public policy may influence commercial conditions, it does not—in a market economy—dictate the industrial strategy, which is hard to predict, especially when it moves beyond existing sector-boundaries. However, the recent adjustment in biofuel policy, in part a response to ecological critique, may represent a more promising opportunity for forest-industrial participation in the future.

1. Introduction

A number of studies on Nordic biofuel and renewable energy have been conducted over the last four or five years. The focus has been on innovation, and variants of the ‘systems of innovation’ (SI) perspective have provided the conceptual framework.

A study of failed biofuel development in Norway [1] investigated the effects of the Norwegian petroleum economy on the biofuel industry, finding that while the petroleum sector exerted a certain drain on risk capital, it did not monopolize technological expertise in a way that hampered the emergence of Norwegian biofuel production. Instead, the study argues, policy failure mattered most. The lack of adequate incentives and support measures to stimulate the development and production of advanced biofuels was of much greater significance than the petroleum economy.

A broader study of Nordic road transport [2] highlighted how lock-in mechanisms have benefitted biofuel refining and sales in Finland. The authors show how the network externalities of the dominant fossil transport regime are favourable to bio-ethanol and biodiesel, and can be integrated into existing supply and distribution systems. However, the dominant feedstock has been imported palm oil, with the Finnish petroleum refiner as the major player, while the forestry industry has largely been sidelined. The study also shows how Swedish biofuel policy has traditionally been closely aligned with the car industry and the production of engines specialized in biofuel. In contrast to Finland, Swedish biofuel policy has thereby come to rely in part on specialized engines, with a specialized E85 ethanol pump infrastructure integrated with conventional fueling.

Another study of road transport in the Nordic countries [3] focused on path creation, highlighting how the ambitious biofuel policy in Finland represents a classic path-creating experiment. However, the authors show that most of the Finnish biofuel production comes from non-forest resources. The study portrays Sweden as having a weaker policy, but one ending up with a similar import-based biofuel supply.

A common feature in these studies has been to see the Nordic biofuel development in relation to forest feedstock and the advancement of the domestic forestry industry. In this article, we take a somewhat broader perspective, exploring biofuel as much for its potential in sparking a strategic reorientation of the midstream and downstream petroleum industry, as for any role it might have in stimulating a forest industrial revival. Furthermore, we take a cross-national perspective across the three Nordic countries with vast forest resources: Finland, Norway and Sweden.

Our argument for this expanded perspective is that:

- the public policy goal of green transition in transport may be fulfilled in various ways. Forest-based feedstock and forest industrial processing are only one method among many others, also including imported alternatives.

- the downstream part of the petroleum value chain is bound to have a dominant position in supplying biofuel to end users through its control of the existing infrastructure.

- to the extent that the forestry industry engages supplying biofuel, there are attractive options for joint ventures with petroleum refineries, and across national boundaries.

- Finally, the downstream—and partly also the midstream—petroleum industry may have a strategic interest in finding new ‘green’ alternatives in a climate-constrained world. Their recent de-coupling from the upstream petroleum business has given them new freedoms in this respect.

1.1. A Sectoral Innovation Perspective

Our analysis draws on what has come to be called a ‘systems of innovations’ conceptual framework [4], which includes “important economic, social, political, organizational, institutional and other factors that influence the development, diffusion and use of innovations” [5]. The SI approach emphasizes the role of institutions in innovation, and is based on the understanding that firms normally do not innovate in isolation but interact with other organizations through complex relations often characterized by reciprocity and feedback mechanisms in several loops.

Within this framework, it has become customary to distinguish between national (OECD), sectoral [6] and regional [7] systems, which may be seen as variants of a generic ‘system of innovation’ approach [5]. Our analysis falls within the sectoral approach [6] focusing on a group of firms that develop and manufacture the products of a specific sector, and generate and utilize the technologies of that sector. However, as previously noted, we have expanded the analysis to incorporate a dual sector perspective, in order to reflect the cross-sectoral scope of biofuel policies and business strategies.

More specifically, our analysis of biofuel and industrial transition draws on the work of Malerba and his associates regarding sectoral innovation systems and ‘catch-up cycles’ [8,9,10,11].

This approach brings the systems of innovation perspective to bear on the industrial development at the sectoral level. It draws attention to the interplay between technological innovation, market dynamics and institutions, and highlights their co-evolution in industrial transformation.

In a nutshell, Lee and Malerba [11] (hereafter L&M) argue that it is the combination of the opening of a window of opportunity (either driven by technology, demand or institutional/policy), the presence of capabilities and the appropriateness of responses/strategies by the actors that determine the changes in industrial leadership.

L&M focus on three windows of opportunity that open up for industrial transformation: technology, demand and policy. While recognizing the importance of technology, this article focuses primarily on the two other windows: policy and demand conditions:

With respect to public policy or institutional changes, L&M point out that the government may intervene in a variety of ways: R&D programmes, subsidies, tax reduction, export support, regulations and public standards. All of these bias markets and business strategies toward compelling societal goals. The case for public policy intervention is, as argued by Mazzucato [12], particularly strong as the public interest calls for a response to major social, environmental and economic challenges, such as climate change.

With respect to demand conditions, L&M argue that a new demand may open an opportunity for new entrants, as leading firms may be slow to enter because they successfully serve existing markets and customers.

The Dynamics of Industrial Transformation

While public policy may influence commercial conditions, it does not generally dictate the industrial strategy in a market-based economy. Implementing policies for industrial transformation, therefore, raises challenges with respect to foreseeing market outcomes, particularly when they may involve a cross-sectoral industrial re-configuration.

As L&M point out, there are many trajectories for industrial adaptation. These range from path-following incremental adjustment strategies where actors move along conventional technical trajectories, to path-creating strategies where the innovating firm explores new paths of commercial and technological development. In the latter case, new actors can create their own path, which diverges from those taken by its forerunners [13] and which may be difficult for policy-makers to foresee.

However, while Malerba’s sectoral perspective establishes a focal point of departure, the industrial response across sectors, we argue, calls for a broader focus capable of capturing the cross-sectoral co-evolution. The Nordic biofuel industry is a case in point. While policy makers—at least in Norway—envisaged that the policy-induced biofuel demand that would provide a basis for a forest-industrial revival, the main industrial transformation appeared in the down- and midstream petroleum industry.

2. Materials and Methods

Our study maps biofuel policies, industrial strategies and market dynamics across the forestry and petroleum refining sectors in Norway, Sweden and Finland, and follows core companies from the turn of the millennium up to 2016/2017. In line with the systems of innovation perspective, this analysis is interdisciplinary and draws on a financial analysis, combined with a structural analysis of product-portfolios and a scrutiny of companies’ strategic orientation. Public policy is factored in as a major framework condition.

On the forest industry side, the study includes the largest Nordic companies—six of them listed on the stock exchange and two privately owned ones not listed so—and follows these companies from the turn of the century up to 2016. The quantitative variables are the share prices and product portfolios. The first is acquired from the Financial Times database [14]. Our analysis of the forest industry’s often complex product strategy is based on the companies’ sales figures from the financial sections of their annual reports. The evolution of each company’s strategic product portfolio is calculated in terms of the company’s external sales in each product category as a percentage of its total sales. We distinguished between nine major product types: pulp, printing papers, forest and wood, hygiene, bio-products, energy, labels and specialty, packaging and others. To document their strategic transition, the analysis of each company’s product mix was conducted both for 2000 and 2016.

Relating the product portfolio data to the share price development allows us to discuss the possible relations between the product mix and economic performance. In addition, the juxtaposition of the quantitative and qualitative data allows us to explore how the companies interpreted and made sense of their evolving strategic configuration.

Our analysis of the petroleum companies is less complex when it comes to the product portfolios, and focuses on their production or distribution of biofuels compared to fossil fuels, based on information in their annual reports. The volume of respective fuels is registered and related to the revenue and profit, also taken from the company reports. The corporate information is then related to the market data from the petroleum business associations and national statistics authorities. As with the forestry industry, we also include the development of the petroleum companies’ share value based on data from the Financial Times.

For both the forestry and petroleum sectors, we have combined the quantitative analysis with a qualitative inquiry, based on the strategic information in the annual reports. We have undertaken a pragmatic textual study of the annual reports for all the companies throughout the period 2000–2016/17. The information from the annual reports has been supplemented by interviews with selected companies, and comments and statements on industrial strategy from industry leaders and influential stakeholders. The juxtaposition of the quantitative and qualitative data has allowed us to explore how the companies interpreted and made sense of their evolving strategic configuration.

To include public policy, which in our analysis constitutes a central framework condition, we have relied on data gathered from national and European bodies. Both the EU and the Nordic countries have transparent and easily available online information about biofuel policy and regulation.

Although the use of information from multiple sources, and the mixture of quantitative and qualitative data, prevents unified econometric modelling, we argue that this somewhat eclectic approach, in line with many studies in political economy and systems of innovation analysis, has its merits when it comes to gaining institutional and strategic insights.

3. Results

While the initial assumption was that Nordic biofuel policy would stimulate industrial catch-up in the forestry industry following the downturn in paper markets, its dominant effect has been to stimulate transition in the petroleum refining and retailing industry. More recently, however, there has also been an emerging industrial engagement in the forestry industry in response to the biofuel policy reform. The following two sections present the industrial development in the respective sectors.

3.1. Biofuel in the Strategic Reorientation of Nordic Petroleum Industry

Seen from a market perspective, the policy for promoting biofuel for road vehicles has been an apparent success. To take Norway as an example, the mandatory sales requirements, directed at fuel vendors, have not only been fulfilled but have in fact been massively surpassed by a voluntary biofuel acquisition. As indicated by Midttun & Myrum Næss [15], the total volume of biofuel sold in Norway—at almost 700 million litres in 2017—was more than twice as high as that demanded by the government. It amounted to around 16% of the total fuel sales to road transport, against a requirement of 8%.

Seen from an industrial perspective, the increasing biofuel requirements have created a dynamic commercial development in the Nordic petroleum sector. Biofuel supply has been promoted through a supportive engagement from fuel vendors, who are moving into multi-energy services, where biofuel constitutes one ingredient. This strategic reorientation comes as retailers have largely divested from the upstream petroleum industry, and have thus become free to seek complementary feedstocks. The fact that biofuel helps build positive climate-branding is also an important selling point.

The refinery industry’s engagement has been more mixed, and ranges from pioneering initiatives like that of Neste (which has become a world leader with its HVO technology) to Esso and Equinor (which have engaged in a minimal way). They have done so by including externally refined biofuel in their distribution to retailers, but have not undertaken bio-refining themselves.

3.1.1. Retailers

In Norway, the three dominant retailers Circle K (26%), St1 (24%) and UnoX (24%), all decoupled from upstream petroleum companies, and have earmarked a substantive part of their business beyond petroleum. Circle K (13.1%) is also among the largest retailers in Sweden; the others are OK-Q8 (24.5%) and Preem (12.6%). In Finland, ABC Chain (24.1%), Neste (24.9%), and Teboil (17.7%) are the three biggest petroleum retailers. Like their Norwegian counterparts, both the Swedish and Finnish retailers, with one exception, are without organizational ties to the upstream industry.

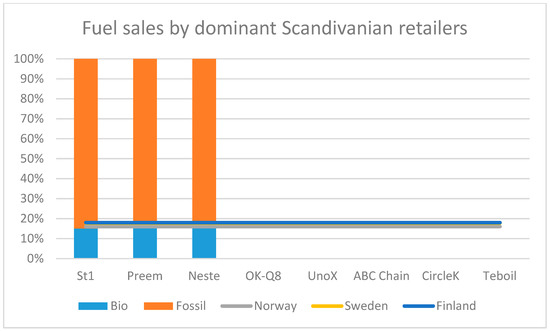

Due to the strong policy push from the Nordic authorities, the major retailers developed substantive biofuel sales. As illustrated in Figure 1, the three companies that report on the biofuel share of their sales all have a considerable biofuel engagement, ranging from 15 to 17% of the total fuel sales (For Norway and Sweden, data is readily available from the National Institutes for Petroleum and Biofuels (respectively Drivkraft Norge and ‘Svenska Petroleum & Biodrivmedel Institutet’ SPBI). Their Finnish counterpart does not publish biofuel statistics. According to Statistics Finland, the biofuel consumption for 2016 (latest data available) was almost 66% lower in 2016 than in 2015, at less than 5% of the total road consumption. For 2017, Eurostat reports a renewables proportion in Finnish transport (including rail transport) of 18.83%, most of which is biofuels. We use the Eurostat number in this report). The other large Nordic retailers do not report their biofuel shares, but are likely to lie in the same range, in compliance with the respective national sales requirements represented by the lines below.

Figure 1.

Fuel sales in Scandinavia. Source: [16,17,18,19,20,21,22,23,24,25].

The strategic reorientation from petroleum vendors to multi-energy stations has taken different forms from company to company. Firms also vary in how, and to what extent, they have used their fuel-shift to profile a ‘green’ transition.

St1, Preem, and ABC are among the most profiled ‘green’ retailers:

St1’s programmatic statement, “Our goal is to gradually substitute fossil energy with renewable solutions,” illustrates the fundamental shift in attitude away from fossil fuels [26].

Preem also puts its biofuel engagement in a larger context and flags a vision of leading the transformation to a sustainable society [27].

Finland’s second largest retailer, ABC, flags an extensive green engagement, and argues that “[I]t decreases motoring fossil carbon dioxide emissions by up to 80%” [28].

Neste, UnoX, Circle K and OK-Q8 then follow with a more modest ‘green’ rebranding:

Neste flags a “Collaboration for a cleaner future” centrally on its homepage [29].

The biofuel message from Uno X is rather subdued. There is no reference to biofuel or greening on its homepage at the first and second levels. Only at the third level there appears the following assurance that they are not selling palm oil: “We engage for a sustainable and advanced biofuel which is an efficient climate solution towards a low emission society. We guarantee that the biofuel bought by us is free of palm oil and remains of palm oil production” [30].

Circle K profiles itself relatively conventionally: “Circle K adds the maximum permitted quantity of biofuels in our transport fuels” [31].

OK-Q8 also figures in the middle range when it comes to its green aspirations. It points out that OK-Q8 was the first Swedish fuel company to mix five per cent ethanol in 95-octane gasoline for environmental reasons [32].

Finally, Teboil Ab hardly has any mention of biofuel or green branding aspirations. In its presentation of its product range, it lists petrol and diesel, light and heavy fuel oil, LP gas, lubricants and automotive chemicals. It ownership by PJSC LUKOIL, an upstream petroleum company, may explain this biofuel reluctance [33].

The Nordic market also includes smaller actors, such as Eco1, that specialize exclusively in biofuels. Through a focus on quality, both in terms of sustainability and technical characteristics at a premium cost, they market their fuels to companies under public contracts that have a requirement for biofuels, as well as to private companies and consumers who are willing to pay.

3.1.2. Refiners

The active policy-induced biofuel engagement by many retailers has triggered a considerable biofuel commitment by refineries, immediately before them in the value chain. However, this engagement has been quite selective, reflecting both diverse engagements in upstream petroleum extraction, technological capabilities and strategic orientation.

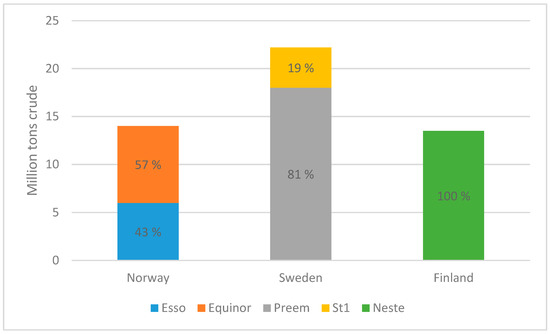

As indicated in Figure 2, the Nordic refinery industry consists of a relatively small number of companies, with dominant market positions in their home market—Neste with a 100% market share in Finland, Preem with a 78% market share in Sweden and Equinor with a 64% market share in Norway.

Figure 2.

Nordic crude oil refining capacity. Source: [27,34,35,36,37].

Finnish Neste stands out with strong strategic commitments to the development of a biofuel product line. Swedish Preem and Finnish St1 have more modest engagements. Because these are companies without an upstream petroleum business, biofuel provides a diversification of the feedstock and of strategic dependencies, as well as a green transition in climate-focused markets. Refiners like Equinor and Esso, both with strong ties to upstream petroleum extraction, have stayed out of biofuel. However, they have had to provide a biofuel admixture in order to supply market demand.

Neste

Neste is clearly the pioneer among the Nordic refiners, both as an early entrant and in terms of quantity. As early as 2006, when the policy debate surrounding biofuels began picking up in the EU and the Nordics, Neste created Biodiesel as a separate business area, alongside oil refining, oil retail and shipping.

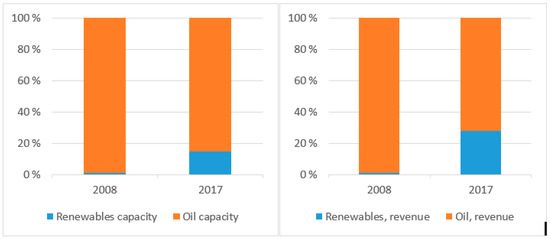

In the course of less than a decade, Neste has built up a considerable biofuel refining business, which now stands at 15% of the total fuel refining (Figure 3). Because biofuel has a substantially higher profit margin, this level of revenue is even more impressive, with around 28% of the company’s 2017 revenue stream from production coming from biofuel.

Figure 3.

Neste production volume and revenue. Source: [16].

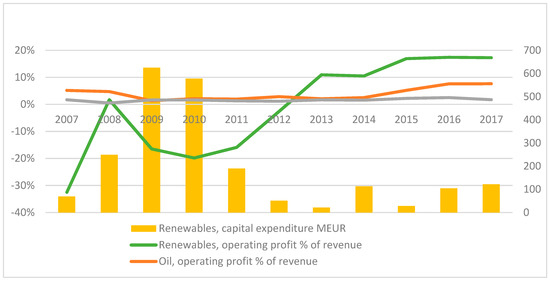

This development reflects a major strategic commitment. As indicated in Figure 4, Neste spent more than €2 billion in the decade after 2007. The investments (yellow columns) were especially concentrated between 2005 and 2011, with a total of more than €1.8 billion invested.

Figure 4.

Neste Biofuel investments and operating profits. Source: [16].

As of 2018, the total production capacity stands at 2.7 million tons per year with production in Finland and Singapore. Neste uses a variety of feedstocks including palm oil, used cooking oil and other waste products. Neste Oil and Lufthansa announced an initiative to use renewable fuels in air transport in 2010. In December 2018, the company announced their decision to invest an additional €1.4 million in their Singapore refinery, increasing the capacity from 1 million to 2.3 million tons per year, and their total global production capacity to around 4 million tons per year [38].

By 2009, the business had been consolidated into three segments: oil products, renewable fuels and oil retail. As capital expenditure dropped off at the beginning of the 2010s, operating profits for renewable fuels started increasing. It was still negative for a couple of years before picking up in 2012 (green line). Since then it has been a crucial area for the company. In 2016 and 2017, the operating profit from renewable fuels has approached 20% of the revenue, more than twice as high as the same numbers for the oil segment (red line) and 8 times as high as marketing and services (grey line).

Neste’s engagement in biofuel-retailing has thus functioned as a marketing outlet for the company’s own branded renewable products, including Neste MY Renewable Diesel consisting of 100% HVO, and Neste MY Renewable Gasoline. However, Neste’s biofuel engagement goes way beyond this, as the company has become the dominant global biodiesel producer standing for around half of global production capacity.

Preem

As of 2017, Preem accounts for around 80% of Sweden’s refining capacity. The Supply & Refining segment owns and operates two refineries, Preemraff Lysekil and Preemraff Gothenburg. Approximately 62 per cent of production is exported, mainly to the North European market. The proportion of production that is sold in Sweden is sold through the Group’s own market channels as well as through other oil companies [17].

While renewable fuels constitute a significant proportion of sales through the company’s marketing segment, in-house production in Preem is modest. Having started out much later than Neste and with much smaller investments, Preem is still in a catchup phase. In 2015, Preem reported to have invested SEK 1bn in renewable fuels over a ten-year period. In 2017, this investment had given the company a total production of about 160,000 million litres of renewable diesel. Given a total refining capacity of around 18 billion litres, this accounts for less than 1% of Preem’s total production.

In contrast to Neste, renewable fuels have not been a separate business segment for Preem. Rather, renewables are integrated into the company’s existing divisions: the modest refining of forest-based biofuel is part of Preem’s supply and refining business, and its larger-scale sale of renewable fuel is part of its marketing segment discussed above.

In their 2017 annual report, Preem announced plans to add an additional renewable fuel production capacity of up to 1 billion litres by 2022. Should five planned biozin plants be built in Norway (see below), this would account for around 600 million litres. The company aims to produce at least 3 billion litres of renewable fuel by 2030. Unlike Neste, Preem excludes palm oil from its renewable products [39].

St1

St1 has a broad offering of renewable energy, with business in refining, oil trade, biofuels, wind and geothermal heat. Their biofuel production is concentrated in bioethanol and is part of St1 Renewable Energy Oy, alongside wind power and geothermal heat. As of 2017, St1 owns and operates eight biorefinery facilities, categorized according to the technologies Etanolix, Bionolix and Cellulonix. Etanolix produces bioethanol from fermentable waste and process residues from bakeries, breweries and beverage production. Bionolix produces bioethanol from municipal and commercial biowaste. Cellulonix produces bioethanol from sawmill side products such as chips and sawdust.

As with Preem, biofuel production constitutes a modest business area for St1, whereas biofuel sales are more significant. For 2017, the net sales for the renewable energy business segment were 45.6 MEUR, compared with total net sales for St1 Nordic Oy of 6540 MEUR.

ST 1 has announced biofuel projects in Columbia, Thailand, Norway and Sweden. In Columbia, they will produce renewable fuels from afforesting land with palm plantations, used to capture atmospheric CO2 before being harvested to produce renewable fuels [40]. In Thailand, they plan to produce biofuel from Cassava starch waste [18]. ST 1 is, in other words, following Neste in utilizing palm oil, but seeking to delimit production to avoid climate-related criticism.

Equinor and Esso

Equinor (formerly Statoil) stands out in three ways. First, its chief focus is exploration and production, second it has no biofuel production or refining capacity, and third it has divested from fuel retail—selling its service stations to the company Circle K.

Like Equinor, Esso has divested from the Nordic retail market in a strategy that concentrates on upstream and midstream petroleum. Its service stations in Finland have been taken over by St1, and its service stations in Norway by the Irish conglomerate DCC. It maintains an oil refinery and wholesale outlet in Norway, with no Nordic biofuel production initiatives in the pipeline.

3.1.3. Summing Up Petroleum

To sum up, the dynamic uptake of biofuel in fuel retailing and the refining industry illustrates the importance of expanding the analysis of biofuel uptake beyond just the forestry industry. As previously mentioned, our study has therefore deliberately widened its scope to include both the forestry and the petroleum sectors.

As a consequence of the petroleum majors’ divestment of retailing, the strong allegiance to fossil fuel has been broken, and many fuel retailers have found biofuel to be an attractive option. Following the public policy demand for mandatory renewable sales, they have therefore added a sizeable voluntary market.

Petroleum refiners without upstream exploration and production have also engaged strongly in biofuel. Neste, in particular, has found biofuel to be a highly attractive new field of development, with higher profit margins than fossil fuel. In this respect Finnish Neste’s and Swedish Preem’s strategies differ from Equinor’s and Esso’s in that the latter two have not engaged in bio-refining but have remained loyally committed to their upstream petroleum resources.

3.2. The Strategic Reorientation of Nordic Forest-Industrial Companies

The Nordic forestry industry’s engagement in biofuel has been far less forceful than that of petroleum refining and retailing. All forestry companies have some level of involvement in bioenergy through the use of chips, sawdust and other low value residue. Some have also made investments in liquid biofuels, but at modest levels compared with their core business areas.

As of 2018, Swedish BillerudKorsnäs, Swedish-Finnish Stora Enso and Norwegian Norske skog and Holmen produced only solid biofuels. Norske skog had short-lived plans for a forest-based biofuel production plant in 2009 when Norwegian regulatory support was stronger because of a tax exemption for all biodiesel. However, these plans were cancelled as the project became unprofitable due to the introduction of tax on biodiesel [41].

Finnish Metsä has made considerable investments in solid bioenergy, both for the production of heat and electricity for their own plants and adjacent areas, and for the production and sale of pellets. They have also been moving into biochemicals, with side streams of tall oil and turpentine from pulp mills [42]. Tall oil may go into the production of biodiesel.

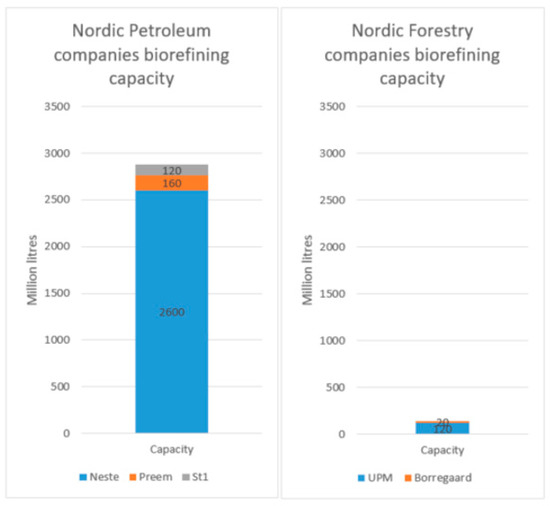

Norwegian Borregaard, Swedish Södra and Finnish UPM have so far been the only forest-industrial companies with investments in liquid biofuels. As of 2018, Borregaard had a production capacity of 20 million litres of bioethanol. Södra had a 25% stake in the company Sunpine, which produces 110 million litres of tall oil per year for further refining by Preem. UPM has invested 179 million euros in its UPM Lappeenranta Biorefinery, which produces UPM BioVerno diesel from crude tall oil, a residue of UPM’s own pulp production. Production started in 2015, and as of 2018 it stood at 120 million litres per year [43,44].

In terms of revenue, biofuel has been a marginal part of these companies’ catchup strategies. While the decline in demand for printing paper in particular pushed the Nordic forestry industry into a major structural transformation, industrial progress has been sought in products such as tissue and hygiene products, labelling and packaging, or in a return to more balanced forest-industrial production.

In the companies’ catchup approaches, following the failing paper market, two general strategies have emerged. One group has met the commercial challenges through specialization. It has concentrated on a limited product spectrum to pursue cost-efficient scale and scope production, often together with internationalization. A second group has instead met the structural changes by product differentiation. They have reduced their activities in declining markets and sought to rebalance their portfolios in several product domains. As mentioned previously, neither of the two groups was, by the end of 2018, sufficiently engaged in biofuel to make it a central factor in their strategic reorientation.

3.2.1. Focused, Specialist Approaches

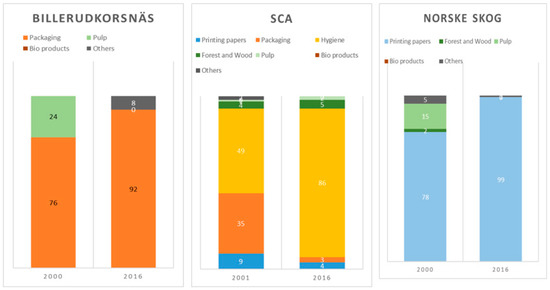

The specialist group comprises BillerudKorsnäs, SCA and Norske Skog. As indicated in Figure 5, BillerudKorsnäs has—over the first one and a half decades of the 21st century—consolidated its position in packaging (up from 76% to 92% of sales), while reducing its external sales of pulp and utilizing it for packaging products.

Figure 5.

Product portfolio for ‘specialists’. Source: [45,46,47].

SCA has also moved decisively into specialization, by scaling up its hygiene production from 49% in 2000 to 86% in 2016. In the same period, the company moved decisively out of packaging (from 35% to 3%)—thus, in this product category, going in the opposite direction of BillerudKorsnäs.

Norske Skog has responded to the challenges in the newsprint and communication paper market with an even stronger specialization in paper. From 2000 to 2016, the company has moved from 78% to 99% of its sales in this product area.

3.2.2. Generalist Approaches

The generalist group comprising Holmen, StoraEnso and UPM all adapted to the 21st century structural challenges by balancing their positions (Figure 6).

Figure 6.

Product portfolios of the generalists. Source: [42,44,48,49,50].

As indicated in Figure 6, Holmen diversified moderately out of paper over the 2000–2016 period (down from 50% to 38%). On the other hand, the company increased packaging sales from 28% to 33% and the production of forestry and wood products from 20% to 25%. Therefore, it has moved toward a balanced position across its three dominant product domains.

Figure 6 also indicates how StoraEnso has likewise moved toward a balanced position. Stora has reduced its paper production from 53% to 33% of total sales, while increasing the sales of packaging paper/board from 19% to 35%, and undertaking a moderate increase of its forestry and wood products—up from 10% to 15%. In addition, the company also sells pulp (up from 12% to 14%).

StoraEnso has strongly reduced its engagement in paper. Since 2006, its share of paper sales has declined dramatically, and the market has gone through large structural changes. While reducing its overall engagement in paper, StoraEnso has sought to retain the high-end paper market. StoraEnso has, like Holmen, also moved toward a balanced position and has largely followed the same pattern as Holmen in scaling up packaging while scaling down paper. The company has also scaled up forestry and wood products, while still being a major player in pulp.

As Figure 9 shows, UPM has similarly moved toward a balance. The company has reduced its engagement in paper from 60% to 49% from 2000–2016. This has happened in parallel with an upgrading of its labels and specialty paper from 18% to 25%. It has retained a more modest position in forestry and wood products, though down from 17% to 12%. In addition, the company has increased its sale of pulp from 3% to 8%.

Recognizing, like Holmen, that the demand for graphic papers has been declining and that the decline is expected to continue, UPM Paper ENA has reduced its graphic paper capacity and optimized operations to increase competitiveness.

Metsä Group has transitioned out of paper and has reduced forest and wood, increasing its positions in packaging, hygiene, pulp and bio products.

Finally, Södra is Sweden’s largest forest-owner association, and a forest-industrial group with operations in forestry, wood, cellulose and bioenergy. It has diversified somewhat while still keeping 90% of its business in forest, wood and pulp.

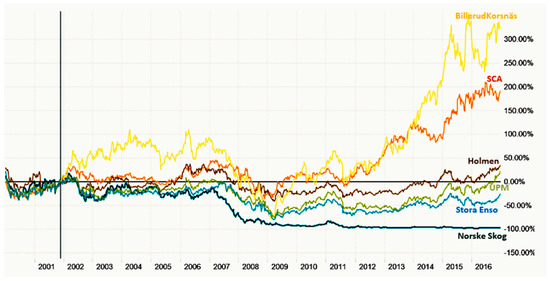

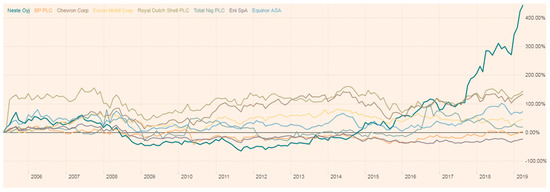

As measured by share value, parts of the Nordic forestry industry have managed a spectacular recovery, mainly based on products other than biofuel (Figure 7).

Figure 7.

Share price development of six Nordic companies in the forestry, paper & packaging industry, 2000–2016. Source: [14].

3.2.3. Summing Up the Forest Industry

To sum up, contrary to policy expectations, the forestry industry has been far less engaged in biofuel than the petroleum industry, given its limited capability to deliver forest-based biofuel at competitive prices. As previously shown, there were other attractive options available. Most of the Nordic forestry industry’s responses to the ‘paper-crisis’ were therefore not biofuel-focused, but aimed at strengthening the engagement in higher margin products such as hygiene, labelling and packaging. As Hansen et al. noted in their Nordic biofuel study [3], faced with a choice between producing low volume high value products, such as cosmetics, and high-volume low-value products, such as biofuels, the former was often more appealing.

4. Discussion

In their theory of catchup-cycles, Lee and Malerba [11] argue that it is the combination of the opening of a window of opportunity (driven by technology, demand or institutional/policy), the presence of capabilities and the appropriateness of responses/strategies by actors, that determine the changes in industrial leadership.

The Nordic biofuel policies that emerged in the first decade of the 21st century created a window of opportunity for industrial reorientation. Many policy-makers saw this as a chance to combine the greening of transport with new business opportunities for a challenged Nordic forest industry facing a shrinking market for printing paper.

4.1. 1st Generation Policy and its Green Stimulus to Petroleum Refining and Retail

However, as previously mentioned, the industrial responses to biofuel policy in the first round came mainly from the petroleum industry. Policy triggered an industrial response in the down and midstream petroleum industry more directly and dynamically than in the forestry industry. Fuel retailers directly targeted by sales requirements imposed on them, and/or by tax exemptions in the case of Sweden and Norway, came to see this as an opportunity to diversify their feedstock and simultaneously shift toward green brands. This again created a pressure on refiners and their logistical systems to deliver fuel in compliance with the public regulation, along with supplying an emerging market for voluntary ‘green fuel’.

Some petroleum refiners saw the political demand for biofuel as an opportunity for new product development, building on their petro-refining capabilities. But the feedstock from the forestry industry was too costly. The competitive fuel market has led both refiners and retailers to neglect costly forest-based biofuel and predominantly search for low cost feedstock and supplies from international markets—for example palm oil and rape seed. Early movers like Neste seized this opportunity to create a new product line in refining, while others limited their engagement to retailing.

The forestry industry was, by contrast, far less engaged during this first wave. First, it lacked the petroleum refiners’ and retailers’ direct connection to the fuel market. Second, it did not have the capability to deliver forest-based biofuel at competitive prices, given early biofuel policy’s wide acceptance of biofuel feedstock. It therefore remained largely sidelined under the first ‘biofuel-wave’. Furthermore, as previously shown, there were other attractive options available. Most of the Nordic forestry industry’s responses to the ‘paper-crisis’ were therefore not biofuel-focused, but aimed at strengthening the engagement in higher margin products such as hygiene, labelling and packaging.

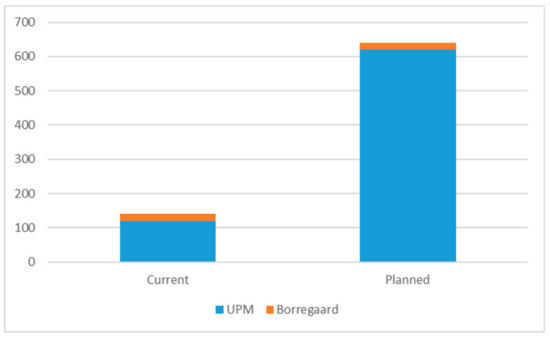

In this way, the first-generation biofuel policy stimulated petroleum refineries to engage in biofuel, with Neste in the lead based on its HVO technology, which allowed the company to take a world-scale position in biofuel. The result was that, in stark contrast to the forestry industry, petroleum refiners took a completely dominant position in biofuel (Figure 8).

Figure 8.

Biorefinery capacity 2018 [16,17,18,44].

4.2. Will the 2nd Generation Policy Trigger Forest-Based Biofuel?

Following criticism of the use of palm oil and food crops for fuel, European and Nordic biofuel policy has been revised. In line with EU policy, the Nordics have begun to move away from food-based biofuels and feedstocks which risk deforestation, and toward waste-based biofuels. The approaches differ somewhat between countries:

- Norway and Finland practice a mandatory sales requirement in the percentage of total fuel sales. So-called advanced fuels are double-counted. In addition, biofuels sold under the mandatory sales requirement must lead to a reduction in fossil fuel CO2 emissions equal to at least 50% in Norway and 60% in Finland. Norway has also adopted a practice whereby any biofuels sold on top of the mandatory sales requirement are exempted from the so-called ‘road tax’.

- Sweden has opted for a different model: there is no mandatory biofuel sales requirement, but only a CO2 reduction requirement per litre of fuel sold (including petroleum). The current annual improvement requirement (February 2019) is 2.6% for petrol and 19.3% for diesel. With clearly defined principles for calculating CO2 savings, this means that a fuel retailer has the option either to sell a comparatively smaller amount of more sustainable biofuel or a greater amount of less sustainable biofuel. Sweden has also continued its tax exemption regime, whereby the proportion of energy tax levied on biofuels is dependent on the feedstock used for production.

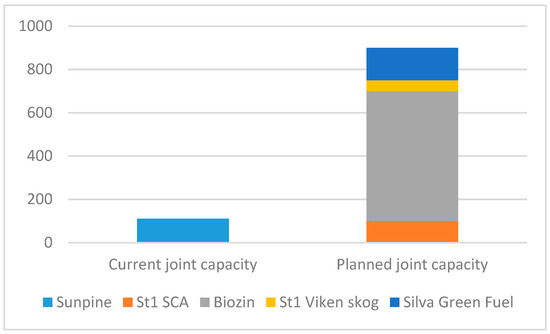

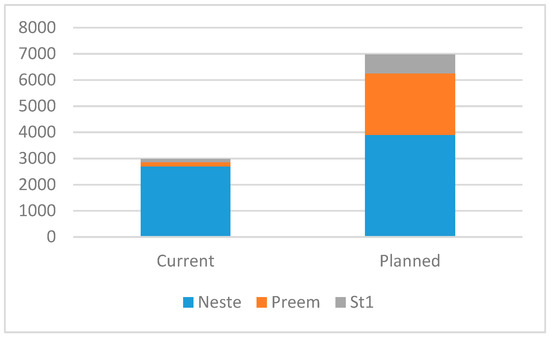

The second-generation biofuel policy has thus created a new and expanded window of opportunity for forest-based supplies. These opportunities are largely set to be exploited through collaborative projects across borders and industrial divides. Crossover engagements between the two sectors appear to have stimulated a dynamic coupling between consumption and production, as well as a complementary mobilization of joint refining capabilities (Figure 9).

Figure 9.

Collaborative projects. Source: [51,52,53,54,55].

Some of the collaborative projects on the [ as of 2019 are:

- Biozin (Bergene Holm and Södra) plans to build five plants for the production of biocrude in Norway, based on forest residue.

- St1, Viken Skog SA and Treklyngen Holding AS’s intention to build a factory for the production of advanced bioethanol at Follum.

- Statkraft and Södra’s joint venture, Silva Green Fuels, plans to construct a demonstration plant at Tofte to produce biocrude, with a flexible feedstock input.

- St1 is investing in a biofuel plant in Gothenburg in collaboration with SCA. The intended feedstock is tall oil from SCA.

However, individual forest-industrial initiatives to scale up biofuel refining such as UPM’s, have also emerged. For UPM, biofuel is an integrated part of a broader strategy of “innovating for a future beyond fossils,” by replacing fossil-based products with forest-based products over a large range of applications. The company’s planned upscaling of biofuel is massive and represents more than five times its 2018 biofuel production (Figure 10). Nevertheless, in anticipation of competitive challenges for forest-based feedstock, UPM Kotka and Silva Green Fuels were preparing for multiple feedstocks.

Figure 10.

Forest industry projects. Source: [43,56,57].

However, the forest-industrial biofuel initiatives—as well as the new collaborative partnerships—are challenged by petroleum refiners. Neste, which has already established itself as a leading global biofuel player, has proven that, for the midstream petroleum industry, biofuel can be a valuable business segment. The company is, therefore envisaging a considerable expansion of its Singapore refinery capacity (Figure 11).

Figure 11.

Petroleum industry projects: Source: [8,9,10,30,32].

In addition to Neste, Swedish Preem has presented as yet unspecified plans for a massive upscaling in biofuel, and Finnish St1 is following suit with projects in Finland, Sweden, Columbia and Thailand.

The plans of all three companies are based on flexible feedstock so that they can optimize on various market opportunities. Neste has proven the advantage of a broad pluralistic approach to biofuel, such that the product can serve various markets according to diverse criteria for each market. The company’s soaring share price (Figure 12), even beating that of conventional oil companies like Equinor, bears witness to its success. As previously noted, Neste’s biofuel segment delivers a higher value creation than conventional petroleum refining.

Figure 12.

Share price development of Neste and oil super majors. Source: [44].

In terms of percentages, the plans for the biofuel expansion of the petroleum refineries may represent a less impressive upscaling than the ambitious projects for increased biofuel refining in collaborative and forest-industrial projects. However, they still outnumber the other two groups by a factor of close to 10. Petroleum refiners will therefore surely remain dominant players for the foreseeable future.

As previously noted, besides the immediate commercial interest, the mid- and downstream petroleum industry also gleans major branding advantages from biofuel engagement. As combined refiners and retailers, Neste, Preem and St1 all benefit from this effect.

For the forestry industry, biofuel is likely to be focused on waste products. This is in fact inscribed in the definition of double counting, which specifies that the feedstock must be based on waste from other production processes [58] This makes biofuel an important element in, but not the core of, industrial catchup. None of the large Nordic forestry companies have therefore yet defined biofuel as a separate business area. Collaborative projects may enhance the forestry industry’s connection to fuel markets, as well as contributing valuable expertise in refining, but they are unlikely to transform forestry players into dominant primary energy suppliers.

5. Conclusions

To sum up, the following core factors stand out:

First, the question of the success or failure of biofuel policy depends on the sector in focus: In stark contrast to the forestry industry, petroleum refiners took a completely dominant position in biofuel. The rapid expansion in the first phase (until 2018) was largely based on feedstock importation. This is in line with Fevolden and Klitkou’s [1] finding, but was interpreted as a policy failure by them because of the strong focus on the forestry industry. From a petroleum retailing and refining perspective, however, it could well be seen as a success. Our finding is that much of the downstream petroleum sector—particularly after its divestment from upstream extraction—has been more open to feedstock diversification than the lock-in literature would lead us to expect [2]. Industry, while being required by legislation to provide increasing quantities of renewable fuels, has also found that biofuel could be an important part of its future strategy, as a new green add-on to the transformation into multi-energy stations. In this way, the companies are scoring a double bonus: diversifying feedstock while going green, as they gradually de-couple from their role as monolithic petroleum vendors.

Second, our finding is that for the forestry industry, biofuel is likely to be a side-stream from higher-value creating products. A basic assumption underlying some of the analyses of the Nordic forestry industry has been that biofuel is an attractive option because it can compensate for the failing paper market (see e.g., Trømborg 2015 [59]). However, our analysis of forestry industry product portfolios indicates that this assumption may not be justified. Many of the companies have successfully ventured into higher value products, confirming similar observations by Hansen et al. [3]. Third, in response to the new biofuel policy, which includes so-called double counting, there has been a stronger forest-industrial engagement in biofuel, but often in collaboration with the petroleum industry. Crossover engagements between the two sectors appear to have stimulated a dynamic coupling between consumption and production, as well as a complementary mobilization of joint refining capabilities. The plans are often based on flexible feedstock so that they can optimize on various market opportunities, following Neste’s successful biofuel strategy. Nevertheless, the petroleum industry is still the dominant biorefinery player.

Last, the success of forest-based biofuel is highly contingent on its ecological and social sustainability. The attack on biofuel for displacing food crops, and the discussion about biofuel’s possible negative impact on CO2 absorption from forests, has led to policy setbacks. Any successful boost to forest-based biofuel production is dependent on the industry convincingly documenting its sustainability in competition with other green alternatives.

Theoretically, our study indicates the need for an extension of Malerba’s sectoral system of innovation into a broader cross-sectoral perspective, as industrial dynamics play out in new commercial configurations. Our study indicates that under conditions of commercial innovation sectoral boundaries may evolve, and this evolution needs to be part of the analysis itself. Nevertheless, we have found that the core elements of Lee and Malerba’s catchup perspective still hold, and that they represent a useful framework for studying sector-level industrial transformation.

Author Contributions

A.M.: Conceptualization, formal analysis, funding acquisition, investigation, methodology, project administration, writing - original draft; K.M.N.: Data curation, formal analysis, investigation, methodology, project administration, writing - original draft; P.B.P.: Data curation, formal analysis, investigation, methodology, project administration, writing - original draft.

Funding

This research was funded by THE RESEARCH COUNCIL OF NORWAY, under the Grant for the BIOnext project in collaboration with the following industrial partners: Avinor, Glommen Skog, Moelven Industrier and Statkraft.

Acknowledgments

We are grateful for valuable comments from professors Torjus Bolkesjø and Erik Trømborg at the Norwegian University of Life Sciences, as well as research scientists Judit Sandquist and Gonzalo del Alamo Serrano at SINTEF Energy Research. We also wish to thank our industry partners Olav Mosvold Larsen, Avinor, Morten Fossum, Statkraft, Berit Rødseth, Moelven and Gudmund Nortun, Glommen Skog for valuable comments.

Conflicts of Interest

The authors declare no conflict of interest. The funders provided valuable factual comments and materials, but had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Fevolden, A.M.; Klitkou, A. A fuel too far? Technology, innovation, and transition in failed biofuel development in Norway. Energy Res. Soc. Sci. 2017, 23, 125–135. [Google Scholar] [CrossRef]

- Klitkou, A.; Bolwig, S.; Hansen, T.; Wessberg, N. The role of lock-in mechanisms in transition processes: The case of energy for road transport. Environ. Innov. Soc. Trans. 2015, 16, 22–37. [Google Scholar] [CrossRef]

- Hansen, T.; Klitkou, A.; Borup, M.; Scordato, L.; Wessberg, N. Path creation in Nordic energy and road transport systems–The role of technological characteristics. Renew. Sustain. Energy Rev. 2017, 70, 551–562. [Google Scholar] [CrossRef]

- Edquist, C. Systems of Innovation: Technologies, Institutions and Organizations; Routledge: London, UK, 2013. [Google Scholar]

- Fagerberg, J.; Mowery, D.C.; Nelson, R.R. The Oxford Handbook of Innovation; Oxford University Press: Oxford, UK, 2005. [Google Scholar]

- Breschi, S.; Malerba, F. Sectoral innovation systems: Technological regimes, Schumpeterian dynamics, and spatial boundaries. Syst. Innov. Technol. Inst. Organ. 1997, 130–156. [Google Scholar]

- Asheim, B.T.; Isaksen, A. Regional innovation systems: The integration of local ‘sticky’and global ‘ubiquitous’ knowledge. J. Technol. Transf. 2002, 27, 77–86. [Google Scholar] [CrossRef]

- Malerba, F. Sectoral systems of innovation and production. Res. Policy 2002, 31, 247–264. [Google Scholar] [CrossRef]

- Malerba, F. Sectoral Systems of Innovation: Concepts, Issues and Analyses of Six Major Sectors in Europe; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Malerba, F.; Nelson, R.R. Economic Development as a Learning Process: Variation across Sectoral Systems; Edward Elgar Publishing: Cheltenham, UK, 2012. [Google Scholar]

- Lee, K.; Malerba, F. Changes in Industry Leadership and Catch-up by the Latecomers: Toward a Theory of Catch-up Cycles; Working Paper Seoul National University Seoul, Korea and CRIOS - Bocconi University: Milan, Italy, 2014; Available online: http://policydialogue.org/files/events/Keun_Kee_Paper_2.pdf (accessed on 16 July 2019).

- Mazzucato, M. The Entrepreneurial State: Debunking Public vs. Private Sector Myths; Penguin Books Limited: London, UK, 2018. [Google Scholar]

- Perez, C.; Soete, L.; Dosi, G. Technical Change and Economic Theory; Laboratory of Economics and Management (LEM), Sant’Anna School of Advanced Studies: Pisa, Italy, 1988. [Google Scholar]

- Financial Times. Markets Data. Available online: https://markets.ft.com/data (accessed on 27 March 2019).

- Midttun, A.N.; Myrum, K. Markets for Biofuel: Norway in a Nordic Context; Report to the Biofuel Project. Center for Energy. BI Norwegian Business School: Oslo, Norway, 2019. [Google Scholar]

- Neste. Neste Annual Reports. Available online: https://www.neste.com/corporate-info/news-inspiration/material-uploads/annual-reports (accessed on 29 March 2019).

- Preem. Preem Annual Reports. Available online: https://www.preem.com/in-english/investors/corral/financials/financial-reports-preem-ab/ (accessed on 27 March 2019).

- St1. Annual Reports. Available online: https://www.st1.eu/about-st1/company-information/company-information (accessed on 27 March 2019).

- OK-Q8. OK-Q8 Annual Report. 2017. Available online: https://www.okq8.se/om-okq8/verksamhet/ (accessed on 17 July 2019).

- UnoX. UnoX Annual Report. 2017. Available online: https://unoxenergi.no/om-unoxenergi/verdiskapning/last-ned-arsrapportene (accessed on 17 July 2019).

- ABC. S Group Annual Report. 2017. Available online: https://s-ryhma.fi/en/finance-and-administration/reports (accessed on 17 July 2019).

- Teboil. Lukoil Annual Report. 2017. Available online: http://www.lukoil.com/InvestorAndShareholderCenter/ReportsAndPresentations/AnnualReports/ArchiveAnnualReports1999-2009?wid=wid4Tgn652RYke-bUzKSTJocw (accessed on 17 July 2019).

- SPBI. Svenska Petroleum & Biodrivmedel Institutet. Available online: https://spbi.se/ (accessed on 27 March 2019).

- Drivkraft Norge. Drivkraft Norge. Available online: https://www.drivkraftnorge.no/ (accessed on 27 March 2019).

- EUROSTAT. SHARES (Renewables). Available online: https://ec.europa.eu/eurostat/web/energy/data/shares (accessed on 27 March 2019).

- St1. Fornybar Energi. Available online: https://www.st1.no/fornybarenergi (accessed on 9 April 2019).

- Preem. Sustainable Products. Available online: https://www.preem.com/in-english/investors/corral/sustainability-report-2017/focus-areas/sustainable-products/ (accessed on 27 March 2019).

- ABC. Eko E85. Available online: https://www.abcasemat.fi/en/fuel/eko-e85 (accessed on 9 April 2019).

- Neste. About Neste. Available online: https://www.neste.us/about-neste (accessed on 27 March 2019).

- UnoX. UnoX Forsyning. Available online: https://unoxenergi.no/unoxforsyning (accessed on 9 April 2019).

- CircleK. Drivstoff. Available online: https://m.circlek.no/m/no_NO/pg1334074723366/circlek_Privat/Drivstoff.html (accessed on 9 April 2019).

- OKQ8. Om OKQ8. Available online: https://www.okq8.se/om-okq8/ (accessed on 27 March 2019).

- Teboil. Teboil Company. Available online: https://www.teboil.fi/en/company/ (accessed on 27 March 2019).

- Equinor. Terminals and Refineries. Available online: https://www.equinor.com/en/what-we-do/terminals-and-refineries.html (accessed on 27 March 2019).

- ExxonMobil. Raffinering og Logistikk. Available online: https://www.exxonmobil.no/nn-no/company/operations/downstream-operations/refining-and-supply (accessed on 27 March 2019).

- St1. Refinery. Available online: https://www.st1.eu/about-st1/company-information/areas-operations/st1-refinery (accessed on 27 March 2019).

- Neste. Finnish Refineries. Available online: https://www.neste.com/corporate-info/who-we-are/production/finnish-refineries (accessed on 27 March 2019).

- Neste. Neste Strengthens Its Global Leading Position in Renewable Products with a Major Investment in Singapore. Available online: https://www.neste.sg/releases-and-news/neste-strengthens-its-global-leading-position-renewable-products-major-investment-singapore (accessed on 27 March 2019).

- Preem. Förnybara Råvaror. Available online: https://www.preem.se/om-preem/hallbarhet/fornybara-ravaror/ (accessed on 27 March 2019).

- Voegele, E. St1 Announces Biofuel Projects in Sweden, Columbia. Available online: http://www.biomassmagazine.com/articles/15338/st1-announces-biofuel-projects-in-sweden-columbia (accessed on 27 March 2019).

- Hovland, K.M. Norske Skog Dropper Biodiesel. Available online: https://www.tu.no/artikler/norske-skog-dropper-biodiesel/240650 (accessed on 27 March 2019).

- Metsähallitus. Annual Reports. Available online: http://www.metsa.fi/web/en/annual-reports (accessed on 27 March 2019).

- UPMBiofuels. UPM Lappeenranta Biorefinery. Available online: https://www.upmbiofuels.com/about-upm-biofuels/production/upm-lappeenranta-biorefinery/ (accessed on 27 March 2019).

- UPM. Annual Reports. Available online: https://www.upm.com/Investors/ (accessed on 27 March 2019).

- BillerudKorsnäs. Financial Reports. Available online: https://www.billerudkorsnas.com/investors/financial-reports (accessed on 27 March 2019).

- SCA. Annual and Sustainability Reports. Available online: https://www.sca.com/en/about-us/Investors/financial-archive/annual--and-sustainability-reports/ (accessed on 27 March 2019).

- Norske skog. Reports. Available online: http://www.norskeskog.com/Investors/Reports.aspx (accessed on 27 March 2019).

- Holmen. Reports and Presentations. Available online: https://www.holmen.com/en/investors/financial-information/reports-and-presentations/ (accessed on 27 March 2019).

- Stora Enso. Reports and Presentations. Available online: https://www.storaenso.com/en/investors/reports-and-presentations (accessed on 27 March 2019).

- Södra. Financial Reports. Available online: https://www.sodra.com/en/about-sodra/this-is-sodra/financial-information/financial-reports/ (accessed on 27 March 2019).

- St1; SCA. St1 and SCA form Partnership to Produce Renewable Fuels. Available online: https://www.st1.eu/st1-and-sca-form-partnership-to-produce-renewable-fuels (accessed on 27 March 2019).

- Biozin. Om Oss. Available online: http://biozin.no/#omoss (accessed on 27 March 2019).

- Sunpine. Tall Diesel. Available online: https://www.sunpine.se/en/produkter/talldiesel/ (accessed on 27 March 2019).

- St1. Drivstoff Fra Avfall. Available online: https://www.st1.no/fornybarenergi/drivstoff-fra-avfall (accessed on 27 March 2019).

- Statkraft. Silva Green Fuel. Available online: https://www.statkraft.com/about-statkraft/Projects/norway/silva-green-fuel/ (accessed on 27 March 2019).

- UPM Biofuels. Environmental Impact Assessment for UPM’s Possible Kotka Biorefinery is Ready. Available online: https://www.upmbiofuels.com/whats-new/news/2018/10/environmental-impact-assessment-for-upms-possible-kotka-biorefinery-is-ready/ (accessed on 27 March 2019).

- Martiniussen, E. Borregaard Blir Størst i Verden Lpå Bioetanol Fra Trevirke. Available online: https://www.tu.no/artikler/borregaard-blir-storst-i-verden-pa-bioetanol-fra-trevirke-br/457068 (accessed on 27 March 2019).

- The European Parliament and of the Council. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources; The European Parliament and of the Council: Brussels, Belgium, 2018. [Google Scholar]

- Trømborg, E. IEA Bionergy Task 40-Country Report 2013 for Norway. 2015. Available online: https://www.researchgate.net/profile/Erik_Tromborg/publication/228450505_IEA_Bioenergy_task_40-Country_report_2011_for_Norway/links/0deec524d20fe05d71000000/IEA-Bioenergy-task-40-Country-report-2011-for-Norway.pdf (accessed on 11 July 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).