Abstract

Background: Working capital management plays a critical role in ensuring business liquidity and financial sustainability. However, few studies in developing economies have employed multivariate statistical techniques to optimize working capital decisions. This study addresses this gap by applying discriminant analysis to classify Ecuadorian manufacturing firms according to their financial sustainability and business continuity. Methods: A quantitative approach was applied to a sample of 112 manufacturing companies located in Zone 3 of Ecuador, covering the 2017–2020 period. The model incorporated working capital indicators and the Z-Score index as independent variables, while company size served as the categorical dependent variable. Results: The discriminant function retained two significant predictors—Working Capital (2019) and Z-Score (2017)—with an eigenvalue of 0.191, a canonical correlation of 0.400, and an overall classification accuracy of 71.4%. Box’s M test (p = 0.000) indicated unequal covariance matrices, suggesting cautious interpretation but acceptable robustness of the model. Conclusions: This study concludes that working capital and Z-Score are effective indicators for assessing financial sustainability and predicting firm continuity. The findings provide practical insights for managers and policymakers to enhance financial efficiency and resource allocation. The originality of this work lies in the application of discriminant analysis to model financial sustainability in Ecuador’s manufacturing sector, offering a statistical foundation for future optimization models.

1. Introduction

Working capital is a key component of corporate financial management, determining a company’s capacity to meet short-term obligations and sustain operational continuity. In manufacturing industries, optimizing working capital is fundamental to maintaining a balance between liquidity and profitability, given their intensive investment in inventories, raw materials, and accounts receivable (Ortega et al., 2023). Poor management of current assets and liabilities can lead to liquidity shortages, excessive indebtedness, and, ultimately, financial distress (Benítez Gaibor et al., 2022).

In recent decades, Latin America and the Caribbean have experienced a persistent decline in industrial competitiveness, with manufacturing value added reaching historically low levels. Globalization and the relocation of production processes to Asia have intensified competition, leaving the region with limited integration into global value chains (Masera, 2022). Consequently, Latin American manufacturing firms face structural challenges such as low productivity, insufficient investment in innovation, and a strong dependence on imported intermediate goods. As highlighted by Jolly et al. (2025) the lack of productivity-oriented investment constrains regional economic growth and limits industrial transformation.

Recent global evidence also shows that working capital plays a central role in strengthening firms’ resilience and long-term sustainability. Efficient liquidity management enables companies to maintain operational continuity during periods of uncertainty, supply chain disruptions, or financial stress (Baños-Caballero et al., 2011). Studies conducted after the COVID-19 crisis demonstrate that firms with stronger working capital positions were more capable of absorbing shocks, preserving employment, and avoiding liquidity-driven insolvency (Chang & Yang, 2022; Enqvist et al., 2013). These findings align with recent OECD (2023) and Toro (2025) reports, which emphasize that effective working capital strategies—particularly maintaining adequate liquidity buffers—are critical for ensuring financial sustainability in manufacturing sectors worldwide.

Within this context, manufacturing firms in emerging economies—such as Ecuador—require efficient working capital management strategies to ensure liquidity, improve profitability, and sustain operations over time. Previous studies have confirmed the relationship between working capital efficiency and firm profitability (Guamán et al., 2021; Armenta et al., 2022). A clear research gap persists: few studies have employed predictive multivariate models capable of classifying firms according to their financial sustainability or identifying which financial indicators best discriminate between firms with stronger or weaker continuity prospects. Moreover, little empirical evidence exists on how these relationships differ by firm size within emerging economies.

This study addresses that gap by applying multivariate discriminant analysis (MDA) to evaluate whether working capital and financial solvency indicators can effectively distinguish between small and medium-sized manufacturing firms in Ecuador and classify their financial sustainability. Compared with prior descriptive research, discriminant analysis adds predictive value and allows the identification of key discriminating variables.

Therefore, the present study seeks to fill this research gap by applying a multivariate discriminant analysis to evaluate the relationship between working capital management and financial sustainability in Ecuadorian manufacturing companies. Specifically, it aims to identify the financial indicators that best distinguish firms by size and stability, offering empirical evidence and methodological innovation within the Latin American context. This research contributes to both academic and managerial perspectives by proposing a statistical framework capable of supporting financial decision-making and optimizing working capital management for long-term sustainability.

1.1. Research Background

Ortega et al. (2023) investigated the effect of working capital management on the financial profitability of companies in the clay sector in Colombia. Using a sample of 40 companies during the period 2017–2021, they found that proper working capital management has a positive influence on financial profitability, highlighting the importance of financial strategies that optimize working capital management to improve decision-making and achieve business sustainability.

In Ecuador, Benítez Gaibor et al. (2022) analyzed the relationship between working capital and profitability in footwear manufacturing companies. Through 130 observations of 29 companies between 2013 and 2017, they concluded that a reduction in the average period of finished product inventory and payment, together with an increase in the cash conversion cycle, has a positive effect on profitability. These findings highlight the relevance of efficient working capital management in the financial administration of organizations.

In addition, Guamán et al. (2021) evaluated the impact of working capital management on the profitability of manufacturing companies in Ecuador. Through an analysis of financial data, they identified that efficient working capital management contributes significantly to business profitability, emphasizing the need for appropriate financial strategies in the manufacturing sector.

In contrast, Armenta et al. (2022) studied the relationship between working capital management and profitability in manufacturing companies in Mexico. Their results indicate that efficient working capital management improves profitability, suggesting the implementation of financial policies that optimize working capital management to achieve greater profitability in the manufacturing sector.

Despite the existing evidence on the importance of working capital management in business profitability, there is a gap in the application of advanced statistical models that allow for the optimization of this management in manufacturing companies. Most studies focus on descriptive or correlational analyses, without delving into predictive models that can anticipate the impact of different working capital management strategies on profitability and financial sustainability. This study seeks to fill this gap by proposing a statistical model that contributes to the optimization of working capital, strengthening the financial sustainability and competitiveness of manufacturing companies.

1.2. Theoretical Foundations

1.2.1. Working Capital

Working capital refers to the net investment in current assets and liabilities and represents a firm’s capacity to meet short-term obligations while maintaining operational stability (Saucedo Venegas, 2020). In manufacturing firms, working capital management is critical due to the need to balance inventory levels, procurement cycles, and production continuity (Gutiérrez Garza, 2012). Studies in Latin America and other regions consistently show that efficient management of accounts receivable, accounts payable, and inventory cycles improves profitability and operational resilience (Ortega et al., 2023; Guamán et al., 2021).

1.2.2. Financial Sustainability

Financial sustainability refers to a company’s ability to generate sufficient income to enable it to operate in the long term without relying on external financing. Tapia Hermida (2021) emphasizes that efficient management of financial resources and an appropriate investment strategy are essential for achieving economic stability. Financial sustainability involves strategic planning that optimizes the use of working capital and minimizes financial risks.

Pacha (2012) emphasizes that, in the context of manufacturing companies, financial sustainability is closely linked to the ability to innovate and adapt to changes in market demand. Factors such as access to credit, operational efficiency, and cost management play a crucial role in the economic viability of these companies.

Financial sustainability refers to the firm’s ability to operate continuously over the long term while maintaining adequate profitability and solvency. Recent literature links sustainability with financial resilience—defined as a firm’s capacity to absorb shocks and protect its operational continuity (Chang & Yang, 2022; OECD, 2023). Resilience depends on liquidity buffers, balanced capital structures, and efficient working capital strategies, particularly for firms in volatile markets or emerging economies (Rahi et al., 2024). Consequently, working capital management is not only a short-term financial decision but also a strategic element of long-term business continuity.

1.2.3. Manufacturing Sector Dynamics

Manufacturing companies play a key role in the global economy, contributing to GDP growth and generating employment. However, they face significant challenges related to globalization and international competition. Maldonado Guzmán and Pinzón Castro (2023) analyze the transformation of the manufacturing industry in Mexico and point out that the adoption of Industry 4.0 technologies has improved production efficiency and reduced operating costs.

In this context, Cadena (2009) argues that financial sustainability in manufacturing depends not only on working capital management, but also on the capacity for innovation and adaptation to new production and distribution models. Public policies and regulations also play a decisive role in the competitiveness of this sector.

1.2.4. Financial Sustainability and Resilience

Financial sustainability refers to the firm’s ability to operate continuously over the long term while maintaining adequate profitability and solvency. The recent literature links sustainability with financial resilience—defined as a firm’s capacity to absorb shocks and protect its operational continuity (Chang & Yang, 2022; OECD, 2023). Resilience depends on liquidity buffers, balanced capital structures, and efficient working capital strategies, particularly for firms in volatile markets or emerging economies.

1.2.5. Predictive Models in Finance

Predictive statistical models such as multivariate discriminant analysis (MDA) have been widely used to classify firms based on financial characteristics and predict business failure or continuity (Altman, 1968; de Jesús Rahmer, 2023). Compared to descriptive methods, MDA provides a linear function that optimally separates predefined groups and identifies the most relevant predictors. Despite its advantages, few studies in Latin America apply MDA to working capital and sustainability, creating a methodological gap this study seeks to address.

1.3. Empirical Evidence on Working Capital and Profitability

Several empirical studies have analyzed the relationship between working capital management and firm profitability in different manufacturing contexts. Ortega et al. (2023), in their analysis of 40 Colombian clay-sector firms between 2017 and 2021, found that effective working capital management positively influences financial profitability, reinforcing the need for financial strategies that optimize liquidity and operational efficiency.

In Ecuador, Benítez Gaibor et al. (2022) and Guamán et al. (2021) demonstrated that reducing inventory and payment periods, while maintaining adequate cash conversion cycles, improves profitability in manufacturing firms. Similarly, Armenta et al. (2022) identified that Mexican manufacturing firms with efficient working capital policies achieve greater profitability, confirming the link between liquidity management and financial performance.

Furthermore, the Consejo Mexicano de Normas de Información Financiera y de Sostenibilidad (2025) asserts that efficient working capital management enhances profitability by minimizing financing costs and freeing up funds for productive investments. Conversely, Bialakowsky et al. (2005) note that Latin American firms often face structural barriers and limited access to credit, which hinder effective working capital management and, consequently, reduce their competitiveness.

Despite this evidence, a methodological gap persists in the literature. Most studies rely on descriptive or correlational approaches, lacking predictive statistical models capable of classifying firms by financial sustainability or identifying key discriminating variables. This research addresses that gap by applying multivariate discriminant analysis, a technique that allows the identification of the most relevant financial indicators for distinguishing firms according to their size, profitability, and continuity. By introducing this methodological innovation, the study contributes both theoretically and empirically to understanding how working capital management supports the financial sustainability of manufacturing firms in emerging economies.

1.4. Bibliometric Analysis

Bibliometric analysis is a quantitative methodology that allows scientific output in a given area of knowledge to be examined. Through techniques such as publication counting, keyword co-occurrence analysis, and citation networks, research patterns, key contributors, evolving interest in a topic, and emerging trends can be identified (Duque et al., 2021).

For this study, the following search code was used:

(financial management OR financial management) AND (working capital OR working capital) AND (manufacturing OR manufacturing)

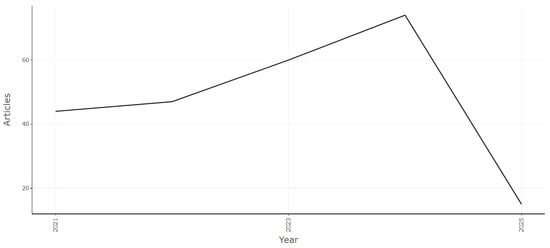

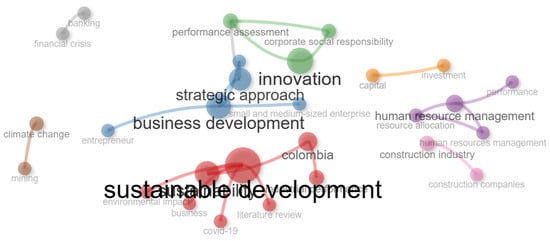

A total of 953 publications were retrieved in the fields of business, management, accounting, and economics, of which 240 were analyzed in detail using the Bibliometrix package in R. The results indicate a steady increase in scientific output in recent years, reflecting growing academic and professional interest in optimizing working capital as a determinant of financial sustainability.

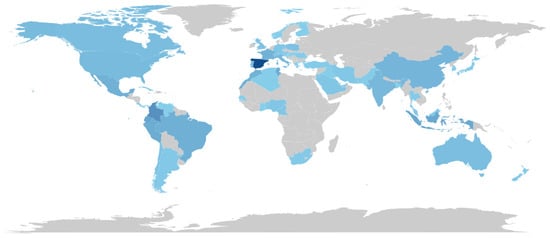

Spain, Colombia, and Ecuador stood out as the most active countries in terms of publication volume, demonstrating the consolidation of Latin America as a relevant region in research on financial management and sustainability. The co-occurrence network revealed that “sustainable development”, “financial performance”, and “manufacturing industry” are central concepts that connect various research clusters, indicating an emerging intersection between sustainability and corporate finance.

Figures illustrating annual publication trends, keyword co-occurrence networks, and country productivity are included in the Appendix A (Figure A1, Figure A2 and Figure A3).

1.5. Objective

This research aims to analyze the connection between working capital management and financial sustainability in manufacturing companies, assessing its influence on profitability and operational efficiency. Through a bibliometric study, the most relevant research trends, significant authors, and outstanding sources in the academic literature will be identified. Likewise, tactics for maximizing working capital will be investigated, with the aim of strengthening the economic stability and competitiveness of the company in a context of globalized and changing markets.

2. Materials and Methods

Discriminant analysis is appropriate when the goal is to classify observations into predefined categories based on quantitative predictors and to identify variables that maximize group separation (Hair et al., 2019; Tabachnick & Fidell, 2019). It is widely used in financial research for bankruptcy prediction and firm classification due to its interpretability and robustness (de Jesús Rahmer, 2023; Terreno et al., 2024).

2.1. Research Design and Data Source

This study followed a quantitative, explanatory, and cross-sectional design, aimed at examining how working capital management influences the financial sustainability of manufacturing firms. The analysis used a secondary database obtained from the Superintendency of Companies, Securities, and Insurance of Ecuador (SUPERCIAS), which compiles official financial statements from all registered entities.

The sample consisted of 112 manufacturing companies located in Zone 3 of Ecuador, encompassing the provinces of Cotopaxi, Tungurahua, and Chimborazo. The selected period (2017–2020) allowed the observation of financial performance before and during the pandemic period, facilitating a comprehensive assessment of business continuity and resilience.

All data were processed using IBM SPSS Statistics version 28, ensuring statistical consistency and accuracy in the estimation of the discriminant model.

2.2. Variables and Measurement

The study employed one categorical dependent variable and several quantitative independent variables, summarized in Table 1.

Table 1.

Variables used in the discriminant analysis by year and category.

Dependent variable:

Company size (COD_TAMAÑO), classified according to the official Ecuadorian criteria established by the Superintendencia de Compañías, based on the number of employees and annual sales:

Small companies: up to 49 employees and annual sales below USD 1,000,000;

Medium companies: between 50 and 199 employees and annual sales between USD 1,000,000 and USD 5,000,000.

Independent variables:

Working Capital (2017–2020)

Z-Score Index (2017–2020)

Sustainability indicator (binary variable: 1 = sustainable, 0 = non-sustainable)

These financial indicators were chosen for their relevance in evaluating liquidity, solvency, and overall financial health in manufacturing firms.

The study employed multivariate discriminant analysis (MDA) because it enables the classification of firms into predefined groups based on quantitative predictors. This method is particularly appropriate when the dependent variable is categorical and the goal is to determine which independent variables best discriminate between groups (Fisher, 1936; Torrado Fonseca & Berlanga, 2012).

Unlike logistic regression, which estimates probabilities of group membership, discriminant analysis provides a linear function that maximizes separation between groups and identifies the most influential predictors. This technique is therefore suitable for distinguishing between small and medium-sized firms based on financial indicators, helping to interpret the variables most associated with sustainability and continuity.

The choice of MDA over alternative classification methods (such as decision trees or clustering) was due to its interpretability and statistical rigor, making it a well-established tool in financial analysis for company classification and bankruptcy prediction (de Jesús Rahmer, 2023; Terreno et al., 2024).

2.3. Statistical Model and Estimation Procedure

The sustainability indicator is a binary variable representing whether the firm exhibited a positive financial performance trend over the 2017–2020 period. A value of 1 = sustainable was assigned to firms with positive liquidity trends, stable solvency indicators, and no signs of deterioration in continuity metrics. Firms failing to meet these criteria were classified as 0 = not sustainable.

The discriminant analysis seeks a linear combination of independent variables that best separates the predefined groups. The selection of variables was performed using the stepwise method, which identifies the predictors that provide the greatest discriminatory power based on partial F-values. The entry and removal criteria followed the established thresholds (F-to-enter = 3.84; F-to-remove = 2.71), ensuring that only statistically significant variables were retained. To assess robustness, results from the final stepwise model were compared with those from the full model containing all predictors, yielding consistent classification patterns. Additionally, a leave-one-out cross-validation procedure was performed, confirming the stability of the classification accuracy. These robustness checks support the reliability of the estimated discriminant function.

The general form of the discriminant function is

where Di is the discriminant score for company i, a is the constant, bj are the standardized coefficients, and Xj are the predictor variables.

Di = a + b1X1 + b2X2 + … + bnXn

In this study, the final discriminant function obtained was

D1 = −1.166 + 0.000 Working Capital 2019 + 0.128 Z Score 2017

This equation represents the classification rule that distinguishes small and medium-sized firms based on the two most significant financial indicators identified through the stepwise method.

Before estimating the function, the following assumptions were verified:

- Multivariate normality of the independent variables.

- Homogeneity of covariance matrices (tested through Box’s M test).

- Independence of observations.

Although Box’s M test (p = 0.000) indicated heterogeneity of covariance matrices, the model remains acceptable for exploratory purposes, as discriminant analysis demonstrates reasonable robustness to moderate violations when sample sizes are balanced (Chávez et al., 2017; Terreno et al., 2024).

The model’s quality was evaluated using three complementary indicators:

Wilks’ Lambda (λ): measures the discriminatory power of the model.

Canonical correlation (R): evaluates the relationship between discriminant scores and group membership.

Eigenvalue: indicates the proportion of variance explained by the discriminant function.

Finally, the model’s predictive ability was validated by analyzing the classification matrix (confusion matrix), which measures how accurately companies are assigned to their correct group. The model achieved an overall classification accuracy of 71.4%, with greater precision for small firms (85%) than for medium-sized firms (55.8%), demonstrating moderate but meaningful predictive capacity.

3. Results

Table 2 show the Box’s M test revealed significant heterogeneity across covariance matrices (p = 0.000). Although this violates a formal assumption of discriminant analysis, prior research demonstrates that MDA is robust to such violations when sample sizes are similar across groups and variables are moderately correlated (Chávez et al., 2017; Hair et al., 2019). Therefore, results should be interpreted with caution but remain valid for exploratory and predictive purposes. Future analyses may consider alternative classifiers such as quadratic discriminant analysis (QDA), logistic regression, or machine-learning methods.

Table 2.

Box’s M test.

The discriminant analysis showed an eigenvalue of 0.191, shown in Table 3, indicating that the function has a moderate ability to distinguish between the groups established in the study applied to Ecuadorian companies based on their financial and organizational characteristics. This result suggests that the intergroup variability explained is not high but is relevant for continuing the research. The canonical correlation recorded was 0.400, reflecting an acceptable relationship between the selected predictor variables and each company’s membership in the identified groups without reaching a strong association. This value provides evidence that the function allows for a certain degree of classification between groups.

Table 3.

Eigenvalue.

For its part, in Table 4, Wilks’ lambda test yielded a value of 0.840 with a chi-square statistic of 19.042 and a significance level of less than 0.001, which implies that there are significant differences between the groups defined based on the variables used and, therefore, the discriminant function is useful in classifying cases. The relatively high value of Wilks’ lambda suggests that these differences, although statistically significant, are not particularly marked, so there may be variables within the model that do not contribute substantially to the analysis.

Table 4.

Wilks’ lambda.

The model should be refined using a stepwise procedure to retain only those variables that significantly influence the classification, thus achieving a more efficient model in terms of interpretation and prediction.

The discriminant analysis performed using the stepwise method identified that only two independent variables were significant for the construction of the model, indicating that the other variables analyzed did not reach the statistical threshold required for their incorporation. This is reflected in Table 5, where it can be seen that in the first step, the variable Working Capital 2019 was included, presenting a Wilks’ lambda of 0.923 and a significance of 0.003, which demonstrates its discriminating power within the model that seeks to classify companies according to their permanence or exit from the market. In the second step, the 2017 Z Score variable was added with a Wilks’ lambda of 0.840 and a significance of 0.000, indicating a better fit of the model and a greater ability to discriminate between the groups analyzed in the Ecuadorian business context during the period evaluated.

Table 5.

Input variables.

The eigenvalue obtained was 0.191, in Table 5, explaining 100% of the variance of the single discriminant function. The canonical correlation (R = 0.400) indicates a moderate relationship between the discriminant scores and the predefined groups. The Wilks’ Lambda, in Table 6, (λ = 0.840, χ2 = 19.042, p < 0.001) confirms that significant differences exist between the groups of small and medium-sized companies.

Table 6.

Variables included in the final discriminant model.

Table 7 shows the centroid values for each group according to company size, which allows us to observe that the discriminant function adequately differentiates between small and medium-sized companies. The group of medium-sized companies has a positive value of 0.465, while the group of small companies has a negative value of −0.403, which shows a clear separation between the two groups according to the calculated function. This difference reflects that the variables used in the model have discriminant capacity, as they allow observations to be grouped effectively according to their financial characteristics.

Table 7.

Functions in group centroids.

In this case, companies with higher values in the selected variables tend to be grouped in the medium-sized group, while those with lower values tend to be classified as small, indicating that the model is useful for categorizing companies based on their economic behavior. The presence of differentiated values in the centroids reaffirms that there is a significant relationship between the variables and company size.

The standardized discriminant coefficients indicate that both predictors have similar contributions to the discriminant function:

D1 = −1.166 + 0.000 Working Capital 2019 + 0.128 Z Score 2017

The centroid values for each group were 0.465 for medium-sized firms and −0.403 for small firms, evidencing a clear separation between the two categories, this can be seen in Table 8. This distinction shows that firms with higher Z-Scores and greater working capital levels are more likely to belong to the medium-sized group.

Table 8.

Coefficients of the canonical discriminant function.

From a business perspective, this result suggests that strong liquidity and solvency positions are key determinants of firm growth and stability. The Z-Score variable, widely used to predict financial distress, reinforces the idea that firms with higher financial resilience tend to maintain continuity and expand their operations.

The discriminant function correctly classified 71.4% of the cases, shown in Table 9. Accuracy was higher for small companies (85%) compared to medium-sized companies (55.8%), a pattern consistent with previous studies (Wieprow & Gawlik, 2021). This difference suggests that small firms have more homogeneous financial structures, which facilitates their classification, while medium-sized companies exhibit greater financial variability.

Table 9.

Classification results.

To complement the interpretation, Figure A1 (see Appendix A) illustrates the classification results graphically, highlighting the distribution of correctly and incorrectly classified cases by company size.

The results demonstrate that both Working Capital 2019 and Z-Score 2017 play a decisive role in differentiating firms by size and sustainability. The inclusion of a lagged indicator (Z-Score 2017) indicates that earlier financial solvency has lasting effects on future business performance, supporting the hypothesis that stable financial structures contribute to sustained growth.

The moderate canonical correlation (0.400) and classification rate (71.4%) confirm that while the model provides a meaningful classification, it should be interpreted as exploratory rather than deterministic. These findings align with Terreno et al. (2024), who emphasize that discriminant models benefit from including additional qualitative and macroeconomic variables to enhance predictive accuracy.

In practical terms, the results imply that manufacturing firms capable of maintaining adequate working capital levels and financial stability are more likely to remain competitive and sustain operations over time. Conversely, insufficient liquidity management may increase vulnerability to market fluctuations and external shocks.

4. Discussion

This study responds directly to the identified research gap by applying a predictive multivariate model to evaluate financial sustainability in Ecuadorian manufacturing firms. The findings highlight two key variables—Working Capital 2019 and Z-Score 2017—as significant determinants of firm classification and continuity. These results reinforce the argument that liquidity management and early financial solvency are fundamental components of firm resilience in emerging economies.

The moderate discriminant power (canonical correlation of 0.400) suggests that including additional variables—such as qualitative indicators, managerial capabilities, or macroeconomic shocks—may enhance predictive accuracy. This aligns with international evidence indicating that sustainability outcomes depend not only on financial ratios but also on external stressors and organizational factors.

From a theoretical standpoint, the study extends the existing literature by demonstrating that discriminant analysis offers predictive value beyond descriptive or correlational approaches commonly used in Latin American financial research.

This study applied a discriminant analysis to identify the financial variables that allow Ecuadorian manufacturing companies to be classified according to their size and to evaluate their continuity in the market. Among the variables analyzed, only Working Capital 2019 and Z-Score 2017 were statistically significant. This finding coincides with that of Wieprow and Gawlik (2021), who highlight that these indicators are critical for assessing a company’s financial health and predicting bankruptcy risk. The convergence between both studies reinforces the validity of these indicators as reliable business diagnostic tools, even in different economic and geographic contexts.

The prominence of Working Capital (2019) as a discriminating variable indicates that liquidity management remains a central determinant of firm stability in volatile contexts. This finding supports theoretical perspectives that associate liquidity sufficiency with reduced vulnerability to financial shocks and improved operational efficiency. The inclusion of Z-Score (2017) as a significant predictor reflects the long-term influence of solvency and financial structure on firms’ survival capacity. Higher Z-Scores in earlier periods suggest stronger balance-sheet fundamentals that contribute to sustained growth and improved resilience, consistent with the theoretical frameworks proposed by Altman (1968) and recent empirical studies on financial fragility in emerging economies.

The discriminant function obtained an eigenvalue of 0.191 and a canonical correlation of 0.400, indicating a moderate capacity of the model to distinguish between small and medium-sized enterprises. The Wilks’ Lambda test (0.840, p < 0.001) confirmed the existence of statistically significant, though not very strong, differences between the groups. These results are consistent with those reported in the previous literature, which suggest that discriminant models can significantly benefit from the inclusion of additional financial and non-financial variables to enhance their predictive power (Ramírez, 2014). This finding opens a clear avenue for future research: expanding the set of variables could contribute to more precise classification, particularly in emerging economies such as Ecuador.

Regarding model accuracy, 71.4% of cases were correctly classified, with greater precision in identifying small companies (85%) than medium-sized ones (55.8%). This difference in classification performance is also observed in the study by Wieprow and Gawlik (2021), which reported similar discrepancies when applying discriminant analysis in other sectors. Such results suggest that the internal and operational structures of small firms tend to be more homogeneous, which facilitates their classification compared to medium-sized firms, whose financial behavior is more diverse.

Nevertheless, Box’s M test indicated a violation of the homogeneity of covariance matrices (p = 0.000), which limits the strict statistical validity of the model. Even so, following the methodological recommendations of Terreno et al. (2024), it is possible to interpret the results with caution, since discriminant analysis maintains a certain robustness to this type of violation when sample sizes are sufficiently balanced. Recognizing this limitation ensures transparency and strengthens the methodological rigor of the study.

From a practical perspective, the findings have relevant implications for both business managers and public policymakers in Ecuador. Early identification of key financial variables can serve as a warning and planning tool for strategic decision-making, resource optimization, and the formulation of targeted support policies. As Altman (1968) emphasized, models based on financial ratios make it possible to anticipate insolvency risks and improve financial planning, an essential factor for business sustainability in volatile economic contexts such as Ecuador’s.

In summary, this study provides empirical evidence of the usefulness of Working Capital and Z-Score as key variables for classifying company size and assessing business continuity. Despite the methodological limitations identified, the results represent a relevant contribution to financial analysis in the Ecuadorian manufacturing sector. They also establish a foundation for future research aimed at strengthening the stability and long-term sustainability of firms operating in similar emerging economies.

5. Conclusions

This study concludes that working capital and the Z-Score index are decisive financial indicators for classifying Ecuadorian manufacturing companies according to their size and for evaluating their continuity in the market. The results obtained through discriminant analysis demonstrate that these two variables explain, to a moderate extent, the financial behavior of firms and their level of sustainability. The model achieved an eigenvalue of 0.191, a canonical correlation of 0.400, and a classification accuracy of 71.4%, evidencing its capacity to differentiate small from medium-sized firms based on their liquidity and solvency levels.

From a theoretical perspective, this research contributes to the literature on financial sustainability and working capital management by empirically validating the use of multivariate discriminant analysis as a diagnostic tool for company classification in emerging economies. The findings support the theoretical assumption that liquidity and solvency—captured by working capital and the Z-Score—are fundamental dimensions of financial health and long-term business sustainability. This approach also expands the methodological scope of financial research by applying predictive statistical models that go beyond traditional correlation or descriptive analyses.

Despite its contributions, this study acknowledges certain methodological limitations. The violation of covariance homogeneity suggests the need for caution when interpreting the model; incorporating larger and more diverse datasets could improve statistical consistency. Likewise, future research should validate the present model in other regions of Ecuador and across different manufacturing subsectors. Integrating macroeconomic shocks—such as inflation, interest rate fluctuations, or supply chain disruptions—would also strengthen the understanding of how external factors influence financial sustainability. These considerations open avenues for constructing more comprehensive models that integrate financial, operational, and contextual dimensions.

From a practical standpoint, the results offer valuable insights for both managers and policymakers. Business decision-makers can use these indicators to anticipate liquidity problems, strengthen financial planning, and improve operational efficiency. For policymakers, the findings highlight the importance of designing public programs that facilitate access to financial management tools and promote training in efficient capital utilization. Although the model presents methodological limitations related to covariance homogeneity, it provides a valid foundation for future research that incorporates additional financial, qualitative, and macroeconomic variables to enhance the robustness and predictive accuracy of business sustainability assessments.

Limitations and Future Research

Although the discriminant model provides meaningful insights, several limitations must be acknowledged. First, Box’s M test indicated heterogeneity of covariance matrices, which may reduce the strict robustness of the discriminant function, although sample balance mitigates this issue. Second, the analysis focused exclusively on financial variables, excluding qualitative aspects such as managerial capacity, innovation capability or access to financing, which may further influence financial sustainability. Third, the study is restricted to manufacturing firms in Zone 3 of Ecuador, limiting the generalizability of the results. Future research should incorporate macroeconomic indicators, qualitative variables, and alternative predictive models—such as logistic regression, random forests, or support vector machines—to enhance classification accuracy and provide broader insights into firm sustainability.

Future research should incorporate broader datasets, macroeconomic shocks, qualitative characteristics, and alternative predictive techniques such as logistic regression, random forests, or support vector machines. Such extensions could improve classification accuracy and provide deeper insights into the financial sustainability of manufacturing firms in emerging economies.

Author Contributions

Conceptualization, K.E.M. and E.R.V.-N.; methodology, K.E.M.; software, F.A.-A.; validation, K.E.M., E.R.V.-N. and J.P.-L.; formal analysis, J.P.-L.; investigation, K.E.M.; resources, E.R.V.-N.; data curation, J.P.-L.; writing—original draft preparation, J.P.-L.; writing—review and editing, E.R.V.-N.; visualization, F.A.-A.; supervision, E.R.V.-N.; project administration, K.E.M.; funding acquisition, E.R.V.-N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used were obtained from the official website of the Superintendency of Companies, Securities, and Insurance (SUPERCIAS), specifically from the “Corporate Sector” section. This platform contains the financial statements needed to calculate the indicators for each variable, based on the information in Form 101. The statistical basis covers the period 2017–2020 and includes all manufacturing companies in Zone 3 of Ecuador, registered and supervised by SUPERCIAS. The information used is publicly available and can be found on the institution’s website: https://mercadodevalores.supercias.gob.ec/reportes/directorioCompanias.jsf (19 September 2025).

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Figure A1.

Annual scientific output. Note. Prepared internally using data obtained from Bibliometrix software (V. 5.2.0).

Figure A2.

Co-occurrence network. Note. Prepared internally using data obtained from Bibliometrix software.

Figure A3.

Scientific production by country. Note. Prepared internally using data obtained from Bibliometrix software.

References

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. [Google Scholar] [CrossRef]

- Armenta, J. F., Miranda, L. F., & Aceviz, L. C. P. (2022). La productividad total de los factores en las manufacturas de la región centro de México: 1993–2018. Telos: Revista de Estudios Interdisciplinarios en Ciencias Sociales, 24(3), 3. [Google Scholar] [CrossRef]

- Baños-Caballero, S., García Teruel, P. J., & Martínez Solano, P. (2011). Working capital management, corporate performance, and financial constraints. Notas Técnicas: [Continuación de Documentos de Trabajo FUNCAS], 627, 1. Available online: https://dialnet.unirioja.es/servlet/articulo?codigo=4960762 (accessed on 5 May 2025). [CrossRef]

- Benítez Gaibor, M., Margalina, V. M., & Taboada Valle, D. E. (2022). Incidencia del capital de trabajo en la rentabilidad de las empresas productoras de calzado ecuatoriano. Revista UNIANDES Episteme, 9(1), 16–27. [Google Scholar]

- Bialakowsky, A. L., Partida Rocha, R. E., & Antunes, R. (2005). Trabajo y capitalismo entre siglos en Latinoamérica: El trabajo entre la perennidad y la superfluidad. Universidad de Guadalajara. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/74242?fs_q=capital__de__trabajo&prev=fs (accessed on 5 May 2025).

- Cadena, F. C. (2009). Los principios de progresividad en la cobertura y de sostenibilidad financiera de la seguridad social en el derecho constitucional: Una perspectiva desde el análisis económico. Red Vniversitas. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/32736?fs_q=sostenibilidad__financiera&prev=fs (accessed on 8 May 2025).

- Chang, C.-C., & Yang, H. (2022). The role of cash holdings during financial crises. Pacific-Basin Finance Journal, 72(C). Available online: https://ideas.repec.org//a/eee/pacfin/v72y2022ics0927538x22000282.html (accessed on 8 May 2025). [CrossRef]

- Chávez, N., Córdova, C., & Alvarado, P. (2017). Medición del riesgo de la gestión financiera de las compañías con la utilización del análisis discriminante: El caso de las industrias de la región 7 del Ecuador. Revista Publicando, 4(13), 90–107. [Google Scholar]

- Consejo Mexicano de Normas de Información Financiera y de Sostenibilidad. (2025). Normas de información Financiera 2025. Instituto Mexicano de Contadores Públicos. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/280490?fs_q=sostenibilidad__financiera&prev=fs (accessed on 12 May 2025).

- de Jesús Rahmer, B. (2023). Factores endógenos de la fragilidad financiera en unidades económicas colombianas. Aplicación de un modelo de análisis discriminante. Revista de Estudios Empresariales. Segunda Época, 85–118. [Google Scholar] [CrossRef]

- Duque, P., Trejos, D., Hoyos, O., & Chica Mesa, J. C. (2021). Finanzas corporativas y sostenibilidad: Un análisis bibliométrico e identificación de tendencias. Semestre Económico, 24(56), 25–51. [Google Scholar] [CrossRef]

- Enqvist, J., Graham, M., & Nikkinen, J. (2013). The impact of working capital management on firm profitability in different business cycles: Evidence from Finland (SSRN Scholarly Paper No. 1794802). Social Science Research Network. [Google Scholar] [CrossRef]

- Fisher, R. A. (1936). The use of multiple measurements in taxonomic problems. Annals of Eugenics, 7, 179–188. [Google Scholar] [CrossRef]

- Guamán, C. A. V., Jiménez, K. V. S., Peñate, M. U., García, Á. R. S., & Peñate, A. V. (2021). Gestión de capital de trabajo y su efecto en la rentabilidad para el grupo de empresas del sector manufacturero Ecuatoriano: Working capital management and its effect on profitability for a group of companies in the Ecuadorian manufacturing sector. South Florida Journal of Development, 2(2), 2082–2101. [Google Scholar] [CrossRef]

- Gutiérrez Garza, E. (2012). Capital, trabajo y nueva organización obrera. Editorial Miguel Ángel Porrúa. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/38643?fs_q=capital__de__trabajo&prev=fs (accessed on 12 May 2025).

- Hair, J. F., Jr., Black, W. C., Babin, B. J., & Anderson, R. E. (2019). Multivariate data analysis (8th ed.). Cengage Learning. [Google Scholar]

- Jolly, S., Asheim, B., Benner, M., Calignano, G., Eadson, W., Gong, H., & Nilse, T. (2025). Future-oriented green and just regional industrial path: Evidence on investment, productivity, and structural change. Journal of Regional Development and Planning, 3(2), 123–145. Available online: https://www.sciencedirect.com/science/article/abs/pii/S2949694225000148 (accessed on 5 May 2025).

- Maldonado Guzmán, G., & Pinzón Castro, S. Y. (2023). La industria 4.0 en las empresas manufactureras de México. Academia Mexicana de Investigación y Docencia en Innovación (AMIDI). Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/281069?fs_q=empresas__manufactureras&prev=fs (accessed on 5 May 2025).

- Masera, D. (2022, April 21). La industrialización en América Latina y el Caribe: Retos y oportunidades. Industrial Analytics Platform. Available online: https://iap.unido.org/es/articles/la-industrializacion-en-america-latina-y-el-caribe-retos-y-oportunidades (accessed on 13 May 2025).

- OECD. (2023, June 28). Strengthening SMEs and entrepreneurs key to a strong, resilient economy. OECD. Available online: https://www.oecd.org/en/about/news/press-releases/2023/06/strengthening-smes-and-entrepreneurs-key-to-a-strong-resilient-economy.html (accessed on 13 May 2025).

- Ortega, N. I. D., Eslava Zapata, R., & Ortiz, E. J. G. (2023). Gestión del capital de trabajo y rentabilidad en empresas del sector manufactura colombiano. International Journal of Professional Business Review, 8(9), 20. [Google Scholar] [CrossRef]

- Pacha, M. J. (2012). Sostenibilidad financiera para áreas protegidas en América Latina: Fortalecimiento del manejo sostenible de los recursos naturales en las áreas protegidas de América Latina. FAO. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/66081?fs_q=sostenibilidad__financiera&prev=fs (accessed on 13 May 2025).

- Rahi, A. F., Johansson, J., Blomkvist, M., & Hartwig, F. (2024). Corporate sustainability and financial performance: A hybrid literature review. Corporate Social Responsibility and Environmental Management, 31(2), 801–815. [Google Scholar] [CrossRef]

- Ramírez, M. H. (2014). Modelo financiero para la detección de quiebras con el uso de análisis discriminante múltiple. InterSedes, 15(32), 32. [Google Scholar] [CrossRef]

- Saucedo Venegas, H. (2020). Capital del trabajo. Instituto Mexicano de Contadores Públicos. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/130923?fs_q=capital__de__trabajo&prev=fs (accessed on 16 May 2025).

- Tabachnick, B. G., & Fidell, L. S. (2019). Using multivariate statistics (7th ed.). Pearson. [Google Scholar]

- Tapia Hermida, A. J. (2021). Sostenibilidad financiera. Available online: https://elibro-net.uta.lookproxy.com/es/ereader/uta/269347?fs_q=sostenibilidad__financiera&prev=fs (accessed on 22 May 2025).

- Terreno, D. D., Pérez, J. O., & Sattler, S. A. (2024). Un modelo jerárquico para la predicción de insolvencia empresarial. Aplicación de análisis discriminante y árboles de clasificación. Cuadernos de economía (Santafé de Bogotá), 43(91), 51–76. [Google Scholar]

- Toro, L. C. (2025). Comparative analysis of the financial performance of SANFREMED CIA. LTDA. Using the Dupont model: Implications for business management (2018–2023). Revista de Investigación, Formación y Desarrollo: Generando Productividad Institucional, 13(1), 145–154. [Google Scholar] [CrossRef]

- Torrado Fonseca, M., & Berlanga, V. (2012). Análisis discriminante mediante SPSS. Articles publicats en revistes (Mètodes d’investigació i diagnòstic en educació). Available online: https://diposit.ub.edu/dspace/handle/2445/45344 (accessed on 22 May 2025).

- Wieprow, J., & Gawlik, A. (2021). The use of discriminant analysis to assess the risk of bankruptcy of enterprises in crisis conditions using the example of the tourism sector in poland. Risks, 9(4), 78. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.