Abstract

The accounting principles prevalent in Hollywood are seemingly crafted to mislead creators and investors. Film studios and streaming platforms have been found to use complex strategies to annually divert millions in net profits. Many contracts include audit clauses, but the cost of auditing a billion-dollar system is prohibitive for most creatives with “net profit” deals. However, a resourceful minority have recovered billions in profits and damages. We suggest using Bitcoin’s transparent, immutable ledger to eliminate fraudulent accounting and build trust among profit-seeking filmmakers willing to trade maximum income for maximum profit per share. This trust can be spread globally utilizing the Bitcoin network as a transparent and immutable triple-entry accounting system. Our research shows that distributing this decentralized trust is achievable by configuring an ecosystem of existing Bitcoin wallets, applications, and recorded contracts to create a universal source of truth for all parties assisting in the creation of valuable content in the form of movies. This network can form the foundation on which to build a legal blockchain infrastructure that can eventually facilitate the sale of tokenized securities, discretely disseminate recorded financial data, and transparently distribute revenue to a collective of filmmakers indefinitely.

1. Introduction

Hollywood Accounting is a term that refers to the opaque or creative set of accounting methods used by the film, television, and music industry to budget and record profits for creative projects (Ahmed 2023). These methods involve inflating expenditures, charging fees from one sub-entity to another, and cross-collateralizing losses from different projects to reduce or eliminate the net profits owed to content creators, investors, and other profit participants (Zinn 2020). As a result, many films that are commercially successful and generate millions of dollars in revenue are reported as losses in the financial statements of the studios (Ahmed 2023). This practice is widely acknowledged as a reality within the industry, and has been challenged in court by several actors, writers, and producers who have recovered hundreds of millions of dollars in profits and damages in the past (Stelter and Barnes 2010). Despite the existence of agents, lawyers, and managers who are supposed to protect the interests of the artists, many of them still fall prey to the most generally accepted and fraudulent accounting practices in the world (Thompson 2011).

Mel Gibson, a writer, producer, director, actor, and Academy Award winner, recounts his experience of his first deals in Hollywood and being informed that his contractual losses were a type of “School Fees”. He has come to realize that there is a tacit agreement in Hollywood where everyone exploits everyone else, and they all persist in doing business, because they concur that “you just can’t get mad (Gibson 1998)”.

One can seek justice, but justice requires resources. Emily Deschanel and David Boreanaz are prominent actors and producers who had the resources to conduct a forensic audit and were awarded USD 178 million when an arbitrator found that Fox Studio had engaged in self-dealing by selling the series to themselves at below market rates. They did this to evade paying the producers their share of the profits (Faughnder 2019).

Hollywood Talent Agencies are aware of this and the price of highly marketable A-List talent has increased dramatically over the years. These A-list creatives constitute a small fraction of the total workforce in an industry where only 12.7 percent of all 170,000 Screen Actors Guild Members earn the minimum USD 26,000 per year to be eligible for union-sponsored health care benefits (MIRA 2023).

Music Accounting in the digital streaming era poses a challenge for Artists and Label Executives, who are also perplexed by the calculation of artist’s revenue (Dimont 2018). Silicon Valley and the new internet streaming giants have exploited new technologies and old creative accounting methods to generate billions of dollars in revenue at the cost of everyone involved (Garder 2015).

These artists are essential contributors to one of the most profitable industries in the world. Yet, they struggle to earn a living wage while studios and streaming giants generate billions of dollars indefinitely for studio executives and shareholders alike. Movie producers also have a reputation for offering net-revenue points to actors and crew instead of paying prevailing wages only to sell off the rights to the picture or sign disadvantageous distribution deals that render those points valueless in the end (Cones 1997). These artists recognize that they are ultimately responsible for the demand for the movies they produce but rely entirely on studio or independent financing sources to excel at their craft. This has resulted in the necessity for multiple filmmaking unions who now bargain for these artists in a perpetual struggle for higher wages and better profit sharing in the form of residual pay.

The Directors Guild of America, The Writers Guild of America, and The Screen Actors Guild are the most influential of the several unions employed by Hollywood movie studios. These three unions have a certain degree of bargaining power as their members contribute most to the market value of the final product. The Producers Guild membership and the studios that constitute the Alliance of Motion Picture and Television Producers (AMPTP), the business people, use contracts that are designed to acquire artists’ copyrights and redistribute profits back to the artists in the form of residuals (Pederson 2023). After the producer or production company has obtained the copyright ownership, they have an incentive to retain as much revenue as possible for their executives and shareholders.

The tragedy of the commons is relevant here in that as long as they act as individual filmmakers seeking maximum pay, they will never be as powerful as the same group forming a cooperative around the same valuable copyrights demanded by studios. In theory, they could form a business entity, pay each other union minimum wages, and jointly pursue maximum profit indefinitely together. But that requires trust.

Many filmmakers in Hollywood are trustworthy, ranked, and categorized by abilities and past successes in the industry using an online filmmaking metric and data catalogue called the Internet Movie Database Pro (IMDbPro). IMDb Pro enables paying professionals to assess each other’s verifiable body of work and contact one another with offers for employment either directly or through their representatives. The movie credits on a person’s profile are verifiable and the sortable economic data associated with each title help rank these professionals by the performance of their movies in the marketplace (Yayla et al. 2023). These numbers are reliable to the extent that investors can also estimate the probability of a successful production cycle based on the past success of those involved in producing the new movie. At the core, they are all storytellers who aspire to tell their stories in this costly, risky, and profitable industry. These creatives often have to relinquish their valuable intellectual property rights to make movies for the same fans who ultimately fund their future projects at the box office. The irony here is that they would not require the studio’s money if there was a way to organize themselves and manage the financial data generated while producing a movie. This proposed solution is one of the potential benefits of the distributed ledger technology called blockchain (Gupta 2017).

A public blockchain-based financial system of accounting and revenue distribution would likely be rejected by a studio system that depends on secrecy to deprive artists of their profits. However, a blockchain could be implemented by a collective of artists, enabling them to trust each other and compete with the same studios that have exploited artists and investors in the past.

As Ostrom proposes, one possible solution to this fraudulent system of accounting is to form a cooperative of filmmakers and tokenize their individual trust around a communally owned work of intellectual property and conduct their business jointly (Ostrom 2009). We have identified recent technological developments that will enable them to regulate business activity, issue shares of ownership, and distribute transparent revenue streams using a publicly available blockchain. True disruption of this predatory industry is now feasible once filmmakers comprehend how triple-entry accounting could help them to foster trust, allowing them to compete in a multibillion-dollar industry where many have a propensity to cheat (Escandon 2020). The goal of Hollywood Accounting is a reduction in or the avoidance of sharing profits with creatives and stakeholders other than the studios (Ahmed 2023). The aim of triple-entry accounting is to transparently record and precisely distribute all rightful profits to those whom a fiduciary is contractually bound to deliver.

The inception of triple-entry accounting systems can be traced back to the innovative work of contemporaries Todd Boyle and Ian Grigg. Boyle’s Shared Transaction Repository (STR) marked the initial endeavor to post a duplicate of an XML document payload or any digitally recorded transaction between two parties (Boyle 2001). Grigg, involved in Bitcoin early on, was developing a technical framework for accounting using financial cryptography (Grigg 2000).

Building upon the foundational work of Ian Grigg, this study aims to further explore and expand the concept of triple-entry accounting to Hollywood Accounting. Grigg’s seminal paper introduced a revolutionary concept in financial record keeping by producing a digitally signed receipt (Grigg 2005). This innovative system utilizes financial cryptography and challenges traditional double-entry book-keeping systems as it proposes a system that extends accounting into the world of hashed transactions and digital cash (Grigg 2005). Grigg’s vision for triple-entry accounting reduces costs and enables stronger governance to meet the needs small business as well as the ability to scale to accommodate more complex forms of corporate accounting. Grigg’s paper represents a significant milestone in the evolution of accounting practices and sets the foundation for further research by the next generation of financial cryptographers.

One paper to stand out discusses a future where triple-entry accounting uses individual entries to create “signed indexes” or “fingerprints” to better structure scalable distributed ledgers. This third entry acts as published notarized index of financial transaction recorded to any public blockchain (Sunde and Wright 2023). While many theoretical applications make their way to the forefront, this research stands out in that it is a real-world use case with the ability to challenge Hollywood Accounting and deliver a simple and cost-effective solution for filmmakers desiring ownership of their content.

The application of Occam’s Razor here suggests that a simple, transparent, and comprehensible solution is preferable to something as complex and obscure as Hollywood Accounting. We propose that blockchain, as a simple triple-entry accounting system, can be implemented by a collective of filmmakers and investors to reduce fraud in the industry and enhance efficiency in the way accounting data are shared and audited.

Our research indicates that a recent version of the Bitcoin blockchain can offer filmmakers a cost effective technical and financial infrastructure that can disrupt the Hollywood studio system today (Fujihara 2022). We will demonstrate how these filmmakers can use a system of digital identities and signatures to establish a network of contracts to legally finance, produce, and distribute a Hollywood Movie with fans, and transparently share all profits with the collective indefinitely using a publicly distributed ledger.

2. Materials and Methods

The aim of the following experiment is to construct an entertainment ecosystem of trust using Bitcoin to legally crowdfund a Hollywood Movie and share revenue and production data with a movie’s cast, crew, and investors, indefinitely. A Manager of a company can deploy several tools that will enable a collective to exchange peer-to-peer cash, generate digital tokens, and transmit all financial accounting data to a Bitcoin blockchain. The use of distributed ledger technology as an accounting system is legal until an unregistered sale of securities or a promise to profit is made by those who control the entity raising funds (Hazen 2023). Code is not law. Law is law (Wu 2003). For this exercise, we opted to legally register and structure companies, tokens, and securities to operate under the jurisdiction of Wyoming and U.S. law. The aim is to create a collective of filmmakers using a series of digital contracts hashed to a publicly distributed ledger by which they can ascertain a transparent, verifiable truth about all financial aspects of a Hollywood movie production.

2.1. Property

The Intellectual Property (IP) is a 90-Page Screenplay Registration Number issued by The United States Library of Congress (The Movie). The Screenplay will serve as the blueprint from which a collective of filmmakers will produce a low-budget Hollywood Movie for less than USD 1.2 million. The Copyright is a government-issued title of ownership. The Company plans to fractionalize ownership of the property in a series of digital agreements dividing the Manager Points among the cast, crew, and musical acts contributing to the production value of The Movie.

2.2. Law

Wyld West Film Ventures LLC (Sheridan, Wyoming) desires to issue securities via a public offering. They have future plans to create a tokenized version of the securities to sell in the secondary market after one year from the sale date.

- The Wyoming Commercial Code includes groundbreaking legislation to record company data, generate utility tokens, and issue digital securities using a blockchain (Andhov 2021).

- The United States’ law will also allow a U.S. Company to sell unregistered movie company shares to the public using an easily obtainable and affordable Securities and Exchange Commission (SEC) Regulation “CF” Crowdfund Exemption (Krause 2023).

2.3. Entities

The cooperation of several business entities is required for this real-world experiment in triple-entry accounting. Wyld West Film Ventures LLC, The Company, is a Wyoming Limited Liability Company that will sell shares to the general public using SEC Regulation CF Crowdfunding.

- A Licensed Certified Public Accountant (CPA) has reviewed The Company’s accounting history and methods.

- A Licensed Attorney has filed SEC Crowdfund Exemption Form “C”.

- A Wyoming CPA with blockchain experience has been retained for tax purposes.

- The SEC has accepted The Company’s Form C.

- Silicon Prairie Portal & Exchange (SPPX) is a Licensed Brokerage/Online Regulation Crowdfund Portal used to establish investor identity and sell shares of The Movie (https://sppx.io). Accessed on 12 November 2023.

- MyMovies is a data-sharing website where Investors and Fans will gain tokenized access to all financial and movie-production-related data (mymovies.us). Accessed on 22 August 2023.

- MyMusic is a music streaming, crowdfunding, and synchronization rights platform where Filmmakers will partner with Artists to license their music for movies, web, and television projects (mymusic.global). Accessed on 12 November 2023.

- Tiatro is a Web 3 video player that instantly splits, records, and sends user payments to thousands of Investors with a transparent record of events (Tiatro.app). Accessed on 12 November 2023.

- Vimeo Pro is a website that will cost effectively store and distribute 4K Video on Demand (VOD) to Tiatro users (https://vimeo.com). Accessed on 13 November 2023.

- Bitcoin: Satoshi Vision (BSV) is a cost-effective and competitive public blockchain network of commercially operated Bitcoin miners (Nodes). This network will allow a group of interested parties to maintain a decentralized collection of all financial data generated by The Company.

- Moneystream is a digital wallet used to manage blockchain tokens, split Bitcoin revenues, and grant user access to various levels of data (https://github.com/moneystreamdev). Accessed on 2 December 2023.

- Handcash is a digital wallet and credit card on-ramp for Users wishing to purchase BSV on the open market and top off capabilities for Moneystream. A public media gallery (https://handcash.io/). Accessed on 21 October 2023.

- Rock Wallet is a digital wallet provider used to legally offramp user funds in the United States and its territories (https://www.rockwallet.com/). Accessed on 20 December 2023.

- Sign-On-Chain is a website that enables The Company to review, sign, and distribute the cryptographically generated BSV hash of any document stored on the Interplanetary File Sharing System (IPFS) (https://sign.signonchain.id/authentication/sign-in). Accessed on 16 September 2023.

- Magic Dapp (Decentralized Application) is a website used to write The Company’s accounting data into transactions designated for publication to the BSV blockchain ledger of time stamped events (https://magicdapp.io/). Accessed on 21 October 2023.

- IMDbPro is a website used to establish Identity and contact credible professionals in the motion picture industry with a legal offer for work (https://pro.imdb.com/). Accessed on 8 December 2023.

- Mark Litwak’s: Contracts for Film and Television Production CD contains the Actor Deal Memo used as a template for a tokenized transfer of ownership.

- The Writers Guild of America (WGA) is a Union with a trustworthy low-budget contract The Company can use to establish an arm’s length value for the contribution of the Writer of The Movie (WGA 2020a). At the time of this research, they were negotiating an end to an ongoing strike with the AMPTP.

- The Directors Guild of America (DGA) is a Union with a trustworthy low-budget contract The Company can use to establish an arm’s length value for the contribution of the Director of The Movie (DGA 2020).

- The Screen Actors Guild (SAG) is a Union with a trustworthy low-budget contract The Company can use to establish an arm’s length value for the contribution of the Actors of The Movie (SAG 2023b).

- The Producers Guild of America (PGA) is a Union that provides The Company an Employment Guide to establish low-budget compensation rates for the Producers of The Movie (PGA 2020).

- The BING AI tool was used to grammatically and syntactically correct the manuscript to meet the academic publication standards where necessary (Microsoft 2023).

2.4. The Wyld West Collective

The aim of this experiment is to demonstrate that a cohesive group of filmmakers can use blockchain technology to foster trust and equitably distribute all revenue according to a network of agreements that constitute their collective ownership of The Screenplay. The Manager of Wyld West Film Ventures LLC, the Co-Producer of Roger Corman’s DINOCROC, comprehends every aspect of Low-Budget Filmmaking and is dedicated to sharing a transparent revenue stream with all cast and crew of The Movie (Corman and Jerome 1998). The Manager will also store and distribute all required company records using a blockchain in accordance with Wyoming Law (Lyndholm 2020). The aim of Wyld West Film Ventures LLC is to:

- Submit a Screen Actors Guild Signatory Application (SAG 2023c). At the time of this research, The Company is not a Screen Actors Guild Signatory as The Union has authorized a Strike with the AMTPT. For this exercise, The Company will use standardized Union Writer, Director, and Actor Contract nomenclature to establish an arm’s length pricing for Cast and Crew deals.

- Create digital independent contracts with net profit clauses and establish a collective trust by encrypting, hashing, and sharing a third-party record with all Independent Contractors joining The Movie’s cast and crew.

- Define net profit for this exercise as a function of the Investors’ required rate of return and debt, if any. No complex private maze of expenses, depreciation, or marketing fees will be used to divert funds from the investors and other equity participants without their consent. A simple net profit calculation for this exercise is a function of Gross Profit as derived in Equation (1).Gross Profit = Revenue − (Debt + 1.2 (Original Investment))Revenue, as used above, is defined in this use case as any Bitcoin or U.S. dollars received in exchange for the sale, licensing, or streaming of The Movie. Debt used here would be any production loans from movie financiers who loan to partially funded projects. Original Investment for this exercise is defined as the total amount deposited into The Company’s escrow account with Silicon Prairie. Therefore, the Net Profit calculation for this exercise is derived using Equation (2).Net Profit = Gross Profit ≥ 1.2 (Original Investment)

The Company’s Operating Agreement filed with the SEC stipulates that after the repayment of any debt incurred during the production of The Movie, the Investors will receive 100% of all revenue until 120% of their initial investment has been recovered; thereafter, all revenue will be equally distributed among the investors, cast, and crew of The Movie according to their percentage of ownership, indefinitely (SEC 2023a).

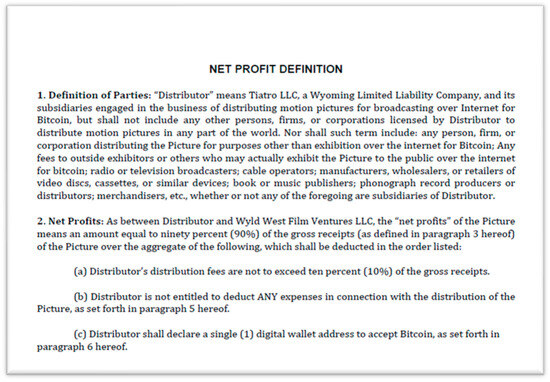

The Manager will specify these terms and figures used to ascertain the break-even point for investors in a Declaration of a “Net Profit Definition”, as shown in Figure 1. The Declaration will be time-stamped and its hash will then be recorded to the BSV Blockchain. The Hash of the original document will then be accessible to all equity participants of The Movie. If there is any doubt about the order of the distribution of funds, a reliable third-party record is available and accessible by the principles for comparison with the actual data.

Figure 1.

A sample net-profit definition declaration.

2.5. Screenplay Valuation

The arm’s length price of the screenplay in terms of total percentage of Ownership is a function of the Writers Guild Union Screenplay Price of USD 81,220 for a movie produced for less than USD 2,000,000. The low-budget price of USD 81,220 is stated in the WGA Schedule of Minimums (WGA 2020b). The speculative investment maximum budget for The Movie, per Regulation CF Guidelines, is USD 1,235,000 (CFR 2023). The screenplay’s value is a percentage of the total budget and is calculated using Equation (3). The Arm’s Length Price (P) for screenplay is a function of the budget level as calculated in Equation (4).

WGA Min. Price/WGA Low Budget Max. = Value as Percentage of Total Budget

USD 81,220/USD 2,000,000 = 0.04061

USD 81,220/USD 2,000,000 = 0.04061

P = 0.04061% × USD 1,235,000 = USD 50,153.35

In accordance with the stipulations of the digitally encoded Writers Agreement, which is securely hashed to the BSV blockchain, a transaction will be executed resulting in the transfer of ownership. Specifically, 0.04061% of The Company Manager Points will be reassigned to the Writer. This transfer is contingent upon the receipt of funding and is executed in exchange for the copyright of the screenplay. This process exemplifies the innovative use of blockchain technology in the realm of intellectual property rights management.

2.6. Manager Points

The Manager Points, representing fractional ownership of The Company, are available to the cast and crew. This collective endeavor aims to bypass the traditional system, with all participants investing their labor to secure a portion of the film’s continuous revenue stream. The investors supply the necessary resources and base salaries for the cast and crew. In exchange for a living wage and a share of all profits, the cast and crew agree to accept wages below the industry standard.

Fifty Manager Points are allocated to those who provide the creative and administrative inputs required to successfully complete the film. The Company will implement various pricing strategies to ensure that all contributors receive a fair ownership percentage, commensurate with the discounted professional services each contributes to the collective effort and their impact on the net income.

The figures provided herein are illustrative and may be subject to change in the actual production of the film. The objective of this exercise is to examine equity in relation to contribution to the collective. The manager plans to distribute all fifty Manager Points to the collective cast, musicians, and crew of the film. The writer has been promised 0.04061% of the fifty Manager Points as calculated in Equation (5).

Writer’s Points = 0.04061% × 50 Manager Points = 2.0305 Points

The Director, accredited by Roger Corman as a Producer, comprehends the challenges associated with filmmaking on a constrained budget. This understanding was demonstrated through the successful delivery of the Sci-Fi Channel’s DINOCROC, which was completed both within the allotted time frame and allocated budget (Lambie 2012). The Director will renounce remuneration in favor of Manager Points, which are valued at the Level II Low Budget Rate of USD 75,000, as stipulated by the Director’s Guild. This valuation corresponds to 13 weeks of work (DGA 2020). The methodology employed for the computation of the Director’s Points is delineated in Equation (6) as follows:

Director’s Points = (USD 75,000/USD 1,235,000) × 50 = 3.0364 Points

In accordance with the stipulated remuneration structure, the actors shall receive a fundamental compensation amounting to USD 212 per day, in addition to Manager Points. A principle of equitable treatment, referred to as “Favored Nations”, shall be adhered to on-set. It is imperative to note that no actor shall be accorded preferential treatment in terms of accommodations, sustenance, or transportation services (SAG 2023a, 2023b). Under the provisions of the Screen Actors Guild Low Budget Agreement, a daily remuneration of USD 812 is allocated. Consequently, each actor will accrue equity for the differential amount of USD 600 per day, which will be directed towards the valuation of their Manager Points (SAG 2023b). In the context of lower-budget allocations, the recompense is constituted by proprietorship. Conversely, at elevated budget levels, the reward encompasses both proprietorship and the prevailing wage rates. It is noteworthy that an actor engaged for a duration of 10 days will be entitled to base pay in addition to the 0.02429 points calculated in Equation (7).

(USD 6000/USD 1,235,000) × 50 = 0.2429 Points

A financial provision amounting to USD 200,000 has been earmarked for the remuneration of A-List or principal cast members within the budgetary framework of USD 1,235,000. Actors, whose artistic contributions are deemed to significantly enhance the quality of the final product, will also engage in negotiations for a proportionate share from the Lead Actor Point Pool calculated in Equation (8).

Lead Actor Point Pool = (USD 200,000/USD 1,235,000) × 50 = 8.0971 Points

This methodology will be uniformly applied throughout the process of crew recruitment. Members of the cast and crew will be solicited to relinquish standard market wage rates in exchange for accepting diminished rates, supplemented by a share of the Manager Points, with the objective of augmenting the collective wealth of the group. Wage rates stipulated by the industry and union for all crew positions will be subjected to a similar evaluation. Crew members who consent to discounted wage rates will be recompensed with a percentage of The Company’s ownership. The percentage allocated to the crew is contingent upon the total cost of the above-the-line talent. The above-the-line talent are the lead and supporting actors, the director, the writer, and the producers who add to the marquee value of The Movie.

Once all the above-the-line agreements are finalized, the residual points will be equitably distributed among the below-the-line crew. The aggregate Manager points offered must not exceed 50. The aforementioned calculations are approximations and can be modulated to accommodate real-world scenarios wherein certain artists may negotiate for higher compensation rates that are justifiable.

2.7. Establishing Trust

It is incumbent upon all individuals to place the economic requirements of the collective above any personal aspirations for maximized remuneration. The Company comprehends the Hollywood interpretation of the tragedy of the commons. This refers to the phenomenon where rational individual actions, such as agents, managers, and attorneys negotiating contracts in the best interest of their clients, culminate in a scenario where everyone is detrimentally affected compared to a situation where they were granted collective ownership of the content they created. The Company posits that they will collaborate effectively if they can place their trust in the accounting system employed to report and distribute all revenue. The Company asserts its trustworthiness, substantiated by the degree of transparency in accounting offered to the collective. The Company pledges to perpetually share all financial records with the members of the collective in order to sustain an exceptionally high level of trust.

Attaining such a degree of trust presents a formidable challenge in the context of Hollywood Accounting. The propensity to engage in deceitful practices will persist if individuals harbor the belief that they can conceal their actions behind a costly and loyal cadre of accountants, attorneys, and studio executives. The culture of secrecy emerges as the most significant contributor to fraudulent activities in Hollywood. The industry is currently bereft of a moral compass, particularly in relation to honoring their contractual obligations with content creators. However, this issue is not a novel phenomenon. In the second book of Plato’s Republic, Glaucon proffers a philosophical discourse on justice, morality, and the inherent nature of individuals when they operate under the assumption that they can act without fear of repercussions (Adam 2011). The narrative revolves around an individual who possesses a ring that bestows upon them the power of invisibility, a privilege that is subsequently exploited for fraudulent advantage. Plato’s allegory of “The Ring of Gyges” underscores the paramount importance of transparency and accountability in fiscal affairs, and elucidates how the veil of secrecy and the lack of accountability can profoundly influence behavior and ethical standards. The Company acknowledges that this milieu is inherently resistant to transformation; hence, their optimism is vested in a trust that can be established, transferred, and fortified through the application of blockchain technology (Lidsky 2023).

2.8. Establishing Identity

The concept of identity holds significant importance to the collective. In the context of Hollywood, identity is intrinsically linked to one’s reputation. A majority of producers and directors exhibit a preference for collaborating with individuals with whom they share a sense of familiarity. This element of familiarity, coupled with a demonstrated level of trust, is challenging to quantify in individuals from outside certain circles. The Internet Movie Database (IMDb) plays a pivotal role in facilitating the establishment of an individual’s identity within the industry. An individual’s body of work serves as a testament to their capabilities. The IMDb is instrumental in promoting and maintaining an exhaustive and searchable database of films, inclusive of their cast and crew (IMDb 2023).

A work reference is provided on behalf of a certain “Bob Sanchez” by an associate who is a producer. The ambiguity lies in the identification of the correct Bob Sanchez. Is it the individual known for his work as a Camera Operator, the one recognized for his contributions as a Set Designer, or an uncredited individual who claims to have been associated with Steven Spielberg in the past? The congruence of an individual’s identity with the cinematic credits they purport to hold is of paramount importance.

IMDb Pro, a subscription-based service, empowers creative professionals by providing access to critical data such as work history, movie budgets, and box office revenue reports (IMDb Pro 2023). The credits enumerated on the IMDb Pro website are furnished by the producers of the respective content and can be contested or supplemented solely with their consent. It is a robust and global consortium of professionals from diverse disciplines within the motion picture industry who are capable of assessing each other’s competencies based on their identifiable body of work (Grigg 2021).

2.9. A Simple Bitcoin Agreement

A digital “Copyright Option Agreement”, as delineated by Mark Litwak, is formulated between the Manager of The Company and The Writer, with the objective of encapsulating the mutually agreed-upon stipulations (Litwak 2012). All contractual agreements will be meticulously drafted and subsequently uploaded for the acquisition of signatures, utilizing Sign-on-Chain, a platform that functions as a document hash recorder and file storage system, underpinned by Bitcoin technology.

2.10. A Blockchain Hash Recorder

The Sign-On-Chain platform allows the user to sign and hash any document, store it on their server network, and distribute the hash of the document in a blockchain transaction. The Manager uses Sign-On-Chain’s BSV smart contracts to provide The Manager with the ability to organize and control the messaging of events and the execution of actions regarding all legal, financial, and production related documents generated by The Company (Grigg 2015). Through the insertion of The Company’s data on a public ledger, The Manager can assure that there is a lasting and dominating record of all agreements and financial documents generated by The Company (Grigg 2005).

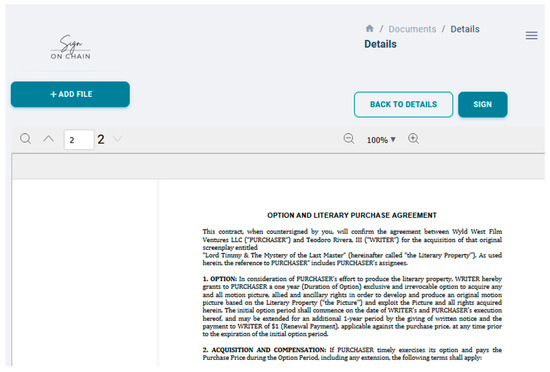

The Manager and Screenwriter agree to terms and a contract is drafted and uploaded to Sign-on-Chain’s platform as in Figure 2. The contract contains metadata that include the Sign-on-Chain public key associated with The Manager’s account. This signature is cryptographic proof that The Manager has the proper authority to spend the Bitcoin sent to the network (Grigg 2005). The Manager previews the document and, when satisfied, clicks the sign button. This action broadcasts the transaction to the Bitcoin network where miners compete to record the transaction into a mined block (Nakamoto 2008).

Figure 2.

The Sign-on-Chain detail preview and signing window.

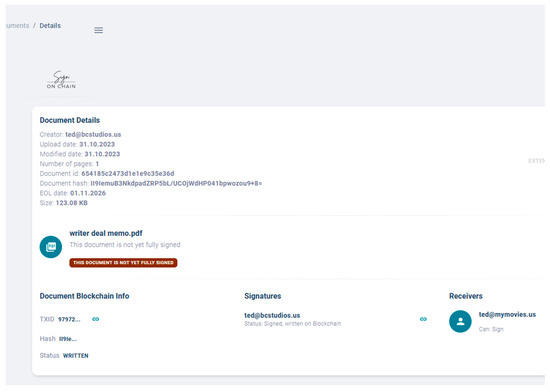

The Sign-on-Chain program generates a document ID and hash for recording to the Blockchain. These data will forever be associated with the mutually signed contract. Figure 3 shows the document detail viewer displaying the relative information and data associated with the hash of the document.

Figure 3.

Transaction ID and the associated hash of the contract.

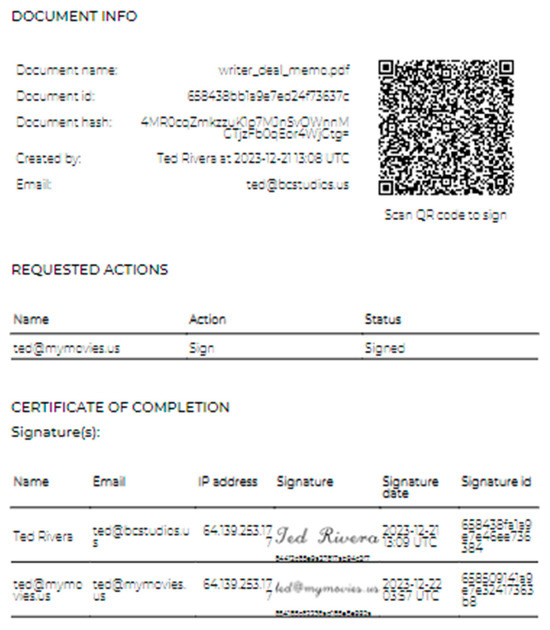

The TxID also identifies The Screenwriter, assigning them a pseudonymous Signature ID which can be associated with the signed agreement on file (see Figure 4). The resulting Transaction ID is the location of the transaction hash on the BSV Blockchain.

Figure 4.

The signing party’s Signature IDs are forever associated with the hash.

In the event of any future dispute between The Company and The Writer, the unique transaction ID generated through this hashing process will serve as an immutable record of their agreement, accessible to all relevant parties possessing the necessary keys for verification (see Figure 5).

Figure 5.

A public block explorer.

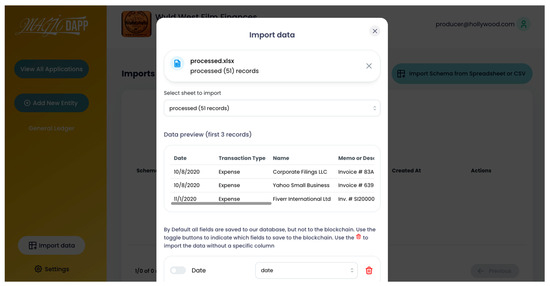

2.11. A Blockchain Writer

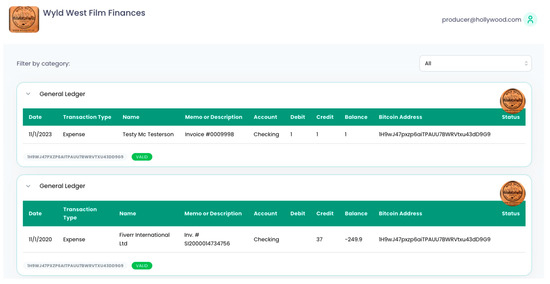

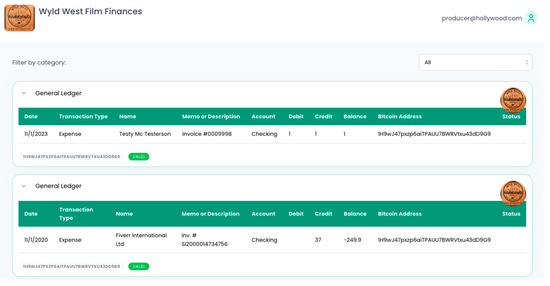

The Magic Dapp platform allows the User to insert alpha-numerical data into a block of the BSV Blockchain. The Manager will use Magic Dapp to regularly upload a Quick-books™ Excel™ export file into an actual time-stamped block of the BSV blockchain in order to fulfill the promise of providing the collective with a transparent and accessible record of current accounting line items, debits, credits, and balances (Lyndholm 2018). In the near future, investors, cast, and crew can use private keys to access all accounting records to instantly audit the financial state of the company, on any given moment and at their own personal convenience (Pan et al. 2023). For this exercise, we are allowing unrestricted access by providing everyone with the same URL from which they can view all of The Company’s financial and accounting records.

The Manager has now successfully implemented software mechanisms enabling The Company to transition from traditional double-entry accounting to a more efficient and cost-effective triple-entry accounting system. This third entry, displayed in Figure 6, is a testimony that cannot be rewritten as the data exist as a permanent record of events on a publicly distributed ledger (Lewis 2021). The regular reporting of the current state of the bookkeeping record to a blockchain ensures that the Company can be held accountable for any discrepancies in the transparent revenue stream.

Figure 6.

Blockchain data presentation.

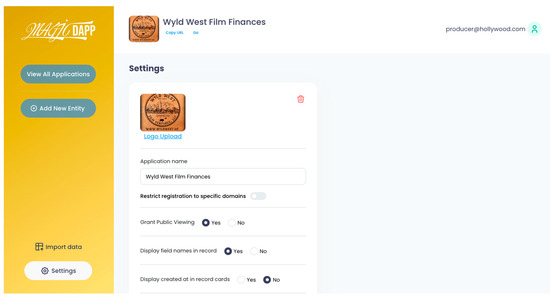

To grant public viewing of the data, the Manager simply selects yes before uploading the file, as shown in Figure 7.

Figure 7.

Magic Dapp permissions and controls.

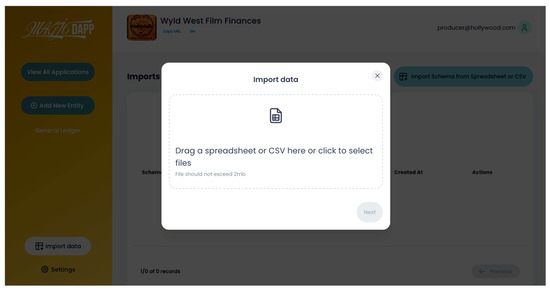

The spreadsheet is then uploaded and renamed for presentation by the Magic Dapp software using a drag-and-drop upload mechanism, as seen in Figure 8.

Figure 8.

Drag-and-drop file loader.

Once uploaded (see Figure 9), the Magic Dapp platform generates a preview of all entries in the spreadsheet, confirming that the application has organized the data as we expect to view them when called.

Figure 9.

The uploaded file preview window.

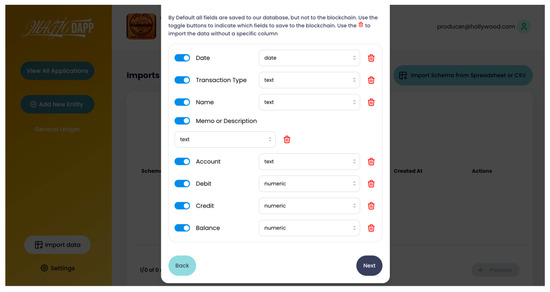

The Manager also has the ability to arrange the presentation of the data to the public using the controls in the Magic Dapp User Interface shown in Figure 10. This action instructs Magic Dapp as to how the data are to be stored on the blockchain. The data are now staged and ready for publication to the blockchain. A Bookkeeper or a Manager’s Assistant can organize and arrange the data prior to publication.

Figure 10.

Magic Dapp settings and controls.

The person publishing the data to the blockchain is ultimately responsible for the validity of the information. The Manager’s public key signature stands as a witness that they have approved the figures being presented to the public as authentic and accurate (see Figure 11).

Figure 11.

The public data-publishing page.

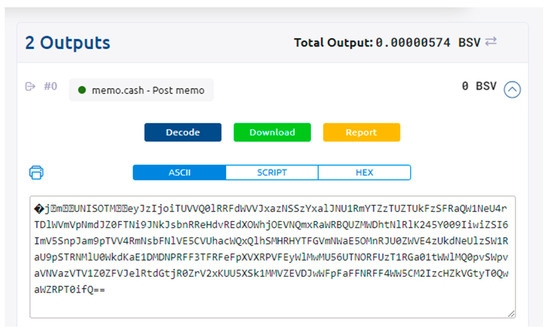

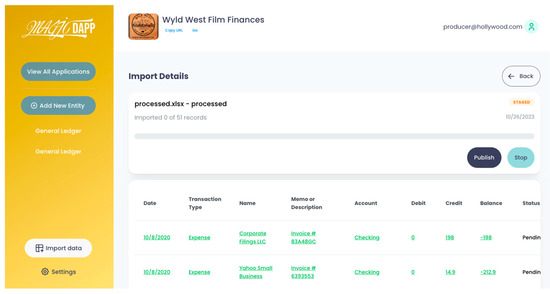

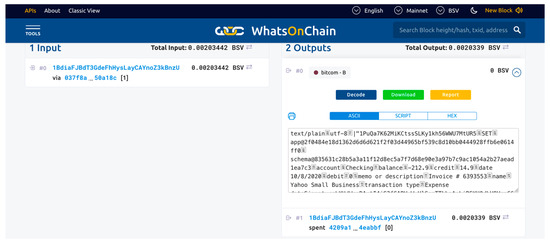

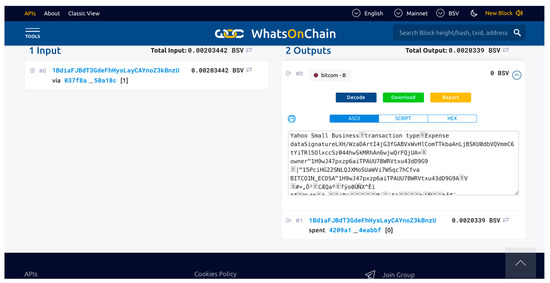

Once recorded, the resulting transaction is available using the public block explorer, Whats on Chain (see Figure 12). The Whats on Chain Explorer is used to analyze transactions posted to the BSV blockchain. There, one can view the transaction record containing the associated application along with the Signer’s details. It shows that the entire record has been inserted in the Op_Return of a standard Bitcoin transaction. The Op_Return is script code used to write arbitrary data to a mined block in the Bitcoin blockchain. The data are immutable and serve our purpose for establishing a truly public display of The Company’s immutable and transparent accounting records.

Figure 12.

The public blockchain transaction report.

Anyone with the TxID has the ability to locate and verify that the data have been submitted to the blockchain (see Figure 13). The Op_Return data contain all of the accounts and figures associated with The Company’s books and create a time-stamped declaration of The State of The Company’s finances at any given moment in time (Nakamoto 2008).

Figure 13.

The accounting record transaction report.

The data are now available for review on the Magic Dapp platform to anyone with the web page link (see Figure 14). These data are further verification that The Company’s records are in the blockchain as required by Wyoming Law (Lyndholm 2018). If an audit is desired, any member of the collective can retrieve the accounting data instantly by accessing a public index of the blockchain. The public index for BSV is b.map.sv (BMAP 2023). The b.map.sv index of the published data can be accessed using a query produced by the Magic Dapp Application ID and executed against a public indexer that allows outside auditors to access the relevant data without the permission of The Company. Thus, this stands as a truly dependable and transparent triple-entry accounting system as defined by the visionaries in this field (Grigg 2005).

Figure 14.

Recalling the list of accounting records from the blockchain.

2.12. A Collective of Filmmakers

MyMovies functions as a web-based directory for the independent filmmaking community, serving to identify, connect, and engage with filmmaking professionals who are in pursuit of work-for-equity positions. This digital platform is designed to catalog, disseminate, and monetize all pre-production data generated from a multitude of daily activities, and present them to the digital cash transacting public. Activities such as script rewrites, budget breakdowns, director storyboards, casting, make-up, and wardrobe sessions are merely a few instances of content-generating activities that are shared with fans and potential investors. These individuals remit micropayments, denominated in USD BSV, to access these engaging movie data on a daily basis. These micropayments can be directly transferred to the production wallet and could be utilized to reimburse investors, remunerate principles, or defray other necessary pre-production expenses outlined in the production budget (Wright 2018). Investors will also employ MyMovies as a virtual repository to access all financial data generated by The Company. Here, they can peruse invoices and receipts and cross-reference any document back to the most recent accounting data situated in the most current and extensive chain of Bitcoin blocks. This serves as a testament to the transparency and accountability of The Company’s financial operations (Nakamoto 2008).

2.13. A Collective of Musicians

The MyMusic platform also functions as a crowdfund accountability platform that, for the purposes of this exercise, will be utilized to recruit and contract a composer and several musical Acts for the soundtracks of The Movie. The Manager will enter into synchronization rights contracts with the Artist permitting the use of several seconds of each song during specific moments in The Movie. These contracts are also hashed to the BSV Blockchain where they serve as a trusted third-party witness of their contractual terms.

Artists from MyMusic who contribute music to MyMovies projects will partake in the defined net-revenue stream alongside the cast and crew. Four percent of the Manager Points will be apportioned among the Artists contributing original music to The Movie soundtrack. These Artists will also receive USD BSV in accordance with their agreements each time The Movie is streamed. The initial estimated breakdown is for 16 songs to share 4 Manager Points, or 0.0025 Manager’s Points per song.

These musical compositions can also be streamed for USD BSV in the form of music videos. The Artist is entitled to 90% of the revenue, with the remaining 10% allocated to the platform to cover the costs associated with hosting and payment processing. This arrangement ensures a fair distribution of revenue, rewarding the Artist for their creative contributions while also supporting the operational costs of the platform.

2.14. Securities and Exchange Commission Exemption

The Company is absolved from the obligation of registering the sale of Company shares to the general public. This is feasible due to the retention of a licensed broker, a lawyer well-versed in the SEC Exemption process, and a licensed CPA tasked with the review of The Company’s accounting system. This arrangement ensures compliance with regulatory requirements and maintains the integrity of The Company’s financial operations (CFR 2023). The Lawyer, in a straightforward procedure, attaches the CPA review to The Company’s Operating Agreement. The Lawyer then files the Company’s Form C using the Edgar Online filing system. This process ensures The Company’s compliance with regulatory requirements and maintains the integrity of its financial operations (SEC 2023b). Upon acceptance, The Company is empowered to utilize SEC Regulation CF Crowdfunding rules to amass up to USD 1,235,000 by selling 50% of The Company online to fans and investors in the form of Company shares. The United States Code permits The Company to sell unregistered securities, and the State of Wyoming sanctions the tokenization of this share on a public blockchain. This arrangement ensures The Company’s compliance with regulatory requirements and maintains the integrity of its financial operations (Lyndholm 2018).

The exemption allows The Company to sell shares on the Silicon Prairie Portal and Exchange (SPPX). These shares symbolize the financial contribution of the Investors towards the production of The Movie (Duccini 2020). As Investors, they anticipate a return on their investment. The Operating Agreement, which is officially filed with the SEC, stipulates that they are entitled to receive one hundred and twenty percent (120%) of their initial investment prior to the distribution of any revenue with the cast and crew. This figure represents The Company’s Break-Even Point. This point signifies the juncture at which all cast and crew commence the perpetual division of all Gross Revenue with the cash contributing investors.

2.15. Debt

The Corporation neither requires nor foresees the accrual of debt for this exercise. For a variety of plausible debt scenarios deemed acceptable, one may refer to Section 4.1, titled ‘Project Management and Governance’. This section elucidates the Corporation’s approach to debt management, thereby ensuring its financial stability and sustainability.

2.16. A Bitcoin Distribution Model

A significant proportion of fraudulent activities transpire within the realm of accounting practices employed in the distribution of content. A film that has been adeptly marketed possesses the potential to yield revenue in the magnitude of millions of dollars, a stream of revenue that could potentially occur indefinitely (Kay 2023). The entity that governs the distribution process wields control over the dissemination of information and revenue accrued from territorial sales and licensing rights. The Manager’s obligation is to generate revenue that yields a profit for investors.

Foreign Distribution is not deemed a viable option. Any individual soliciting foreign pre-sales or promissory notes is essentially relinquishing investor profit to mitigate their own investment risk. A foreign distribution pre-sale is not legally enforceable. Once it has been procured, it is irrevocably lost. Major Studios possess the financial resources to operate at this level. International laws, coupled with straightforward deception, pose challenges for independent filmmakers attempting to audit or recover any misappropriated revenue on an international scale. Contemporary technology simplifies the process of self-distribution in foreign markets, an option that The Manager intends to explore.

The Manager acknowledges that any significant foreign or domestic distribution deal will be laden with clauses intended to construct a complex network of accounting activity designed to misappropriate filmmaker revenue. Distribution clauses such as “Marketing Expenses”, “Cross-Collateralization”, and “Single Contract Packaging for Several Films” are sophisticated terminologies, all contrived to divert revenue away from filmmakers and investors:

- Distributors frequent numerous film markets and festivals globally, and the expenditures associated with this lifestyle are not borne by them if they can be offset against the filmmakers’ revenue stream. This practice underscores the financial dynamics of the film distribution industry, where the costs of business operations are often defrayed against the revenue generated from film sales. Cross-collateralization allows them to spread their costs and expenses over a slate of film titles.

- Single-Contract Packaging Clauses empower distributors to sell an assortment of low-budget films at a singular, reduced price. This price significantly surpasses their incurred costs and typically encompasses a substantial profit margin. However, the cumulative returns accrued by each individual filmmaker fall considerably short of their anticipated returns based on available sales figures. This discrepancy underscores the financial dynamics of the film distribution industry, where the profitability of distributors often comes at the expense of individual filmmakers (Zaidi 2010).

- The necessity for foreign pre-sales as a safeguard for a movie’s production budget has become obsolete. The collective, far from being risk-averse, exists with the primary objective of generating profit and is willing to undertake risks to ensure the security of their funds. Minimum guarantees have lost their allure given the history of fraudulent activities associated with independent foreign distributors. The advent of the internet has facilitated self-distribution on a global scale, and contemporary tools such as audio translation and subtitling are cost effective and readily accessible with a simple mouse click. There is no longer a compelling reason to permit foreign distributors to monopolize those territories. The Tiatro player, discussed in Section 2.17, is embeddable, and The Manager intends to distribute these players to foreign movie fans who can promote a translated movie to their social media networks, thereby earning a distribution fee at the point of sales with a transparent record of the events.

The sole strategy to disrupt the existing distribution model is to disseminate the risk across The Company and self-distribute content to movie fans and investors who possess such a profound belief in the subject matter that both crew and investors are prepared to risk their time and resources to enjoy a fraud-free return on their investments. Presently, the United States is home to approximately 331 million individuals. If a movie is viewed by 5,000,000 individuals in a theater on its opening night, it is deemed an international blockbuster. Box Office figures reaching USD 100,000,000 are only achievable when the Print and Advertising (P&A) costs for these films surpass tens of millions of dollars. Most recently, several Hollywood producers were caught exploiting spurious “projected” P&A Revenue to misappropriate funds from the venture capital giant, Blackrock (SEC 2023c).

The definition of a blockbuster movie is a moving target (Stringer 2003). The cinematic landscape is replete with variables, and if a film exhibits the potential to become a blockbuster, studios will acquire it and invest the requisite resources to generate the necessary public awareness for substantial audience turnout. An examination of historical data reveals that a film is deemed successful if it yields a return of at least 110% of its budget. This benchmark serves as a reliable indicator of a film’s financial success (Cook et al. 2016).

There exist only two scenarios deemed preferable wherein a distribution deal would assure investors of a profit upon the completion of The Movie. These scenarios encompass a bidding situation or a lucrative proposition to acquire The Movie’s “Pay One” Video-on-Demand rights. These constitute the sole justifiable reasons for The Manager to enter into a distribution agreement in this exercise. This approach ensures the financial viability of the project and safeguards the interests of the investors (Adalian 2023).

All alternative arrangements have been empirically demonstrated to obscure financial resources from investors. The primary objective of this exercise is to ensure the initial reimbursement of all funds to investors, followed by the perpetual distribution of profits to the cast and crew as pledged. The Company aims to offer investors returns derived from ‘gross’ revenues and possesses the capability to modify open-source computer code to remunerate everyone their rightful percentage in accordance with agreements hashed to a public blockchain. The most secure method to facilitate this is to self-distribute using a blockchain content delivery system.

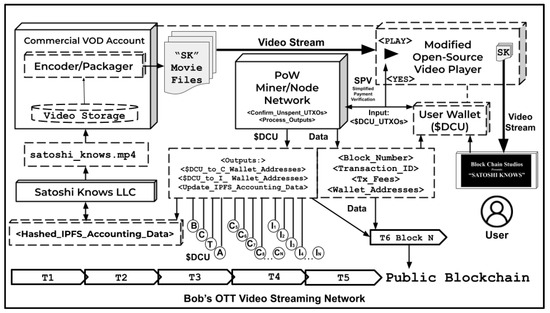

2.17. Blockchain Content and Payment Delivery

Tiatro.app is a streaming platform that possesses the capability to stream video content in exchange for digital currency. It provides a platform for The Manager to distribute The Movie in return for Bitcoin SV (BSV). The Manager comprehends that the underlying wallet infrastructure, Moneystream, employed by Tiatro.app has the capacity to instantaneously disburse gross revenue to a multitude of wallets at the point of transaction. This distribution can potentially reach thousands of wallets, demonstrating the scalability and efficiency of the system (Nakamoto 2008). The feasibility of this system is attributed to the Bitcoin protocol’s capacity to instantaneously divide Unspent Transaction Outputs (UTXOs) among thousands of addresses via the BSV Ledger. This mechanism provides the sole assurance for investors and artists that they are directly receiving every streaming payment directly from the audience.

The system’s security and close monitoring are paramount. Any deviation from the expected outcomes will be revealed by the transparent record of events recorded on a public blockchain. Continuous work in Hollywood is reputation-based, and any discovered malfeasance can lead to the termination of one’s career. This system imposes honesty on all parties involved. The discovery, apprehension, and sentencing of violators would only underscore the necessity of the system and the importance of an immutable and transparent record of their crimes. This serves as a deterrent and reinforces the integrity of the system (Wright 2023). The Manager has successfully tested a Bitcoin Over-the-Top (OTT) video streaming platform. This has been achieved through the integration of various existing service providers and technologies. The Company uses Vimeo Pro, a commercial video delivery platform. This platform possesses the capability to store and distribute a cinematic file on a global scale. This arrangement also ensures the efficient dissemination of the movie file to a worldwide audience (Mulgrum 2022). Tiatro employs a modified open-source media player to synchronize the existing Over-the-Top (OTT) payment infrastructure with the Bitcoin blockchain. The system operates via a user wallet interface, which levies a charge in BSV on viewers each time they stream The Movie. The modified play button functions akin to a binary gate within the ‘call to play’ code, effectively serving as a ‘yes’ or ‘no’ video gate. This code broadcasts the transactions to commercial data centers that are competitively mining BitcoinSV Protocol (see Figure 15).

Figure 15.

A simplified over the top Tiatro video distribution system.

The video streams when the user presses play (see Figure 15). The code in the play button verifies the balance in their Moneystream wallet and, if sufficient, code in the play button calls for the link provided by Vimeo Pro. The payment is an Input to a transaction and the Moneystream wallet distributes the Outputs to the wallets identified in the Play Button code. The Tiatro player uses BSV protocol to facilitate near-instant payments using Simplified Payment Verification (SPV), a mechanism discussed in Chapter 8 of The Bitcoin Whitepaper (Nakamoto 2008). The utilization of SPV ensures a seamless and efficient transaction process for the users. The video player possesses the capability to instantaneously distribute gross revenue payments in the form of UTXO’s to thousands of wallets simultaneously, providing each recipient with a permanent and transparent record of every transaction. This obviates the necessity for substantial retainers typically paid to attorneys and forensic accountants to enforce the audit clauses of Hollywood distribution contracts. The utilization of a blockchain-based ecosystem could finally safeguard creative individuals from exploitative accounting strategies. This system would enable them to directly engage with the fans who are essentially de-facto investors after the fact, thereby fostering a more transparent and equitable environment for all parties financially contributing to the production of The Movie (Morrow 2023).

The Tiatro Platform employs Moneystream and Handcash proprietary wallets to facilitate user payments denominated in BSV. These payments are made in exchange for the rights to stream the movie’s video file as seen in Figure 1. The computer code that constitutes the “Play” button directs competitive miners operating on the network to process the UTXOs into thousands of individual outputs if necessary. These outputs are instantaneously recorded and dispatched to individual cast members, crew, and their community of investors. Consequently, all parties involved are aware of the number of streams purchased and the corresponding amount they are owed. The Tiatro revenue distribution system ensures transparency and accountability in the dissemination of revenues to all eligible parties.

2.18. Replication of the Ostrom’s Razor Process

To emulate Ostrom’s Razor Collective and Financial Management system for a non-union movie, one merely needs to adhere to the subsequent sequence of events:

- Purchase, option, or write a Hollywood feature length screenplay.

- Confirm or obtain Copyright from The Library of Congress.

- Form a limited liability company or corporation in Wyoming.

- Retain a securities attorney, a licensed certified public accountant, and a FINRA approved online brokerage portal.

- C.P.A. reviews and certifies accounting methods.

- Attorney files Securities & Exchange Commission “Form C”.

- Broker lists exempt public offering.

- Market movie investment opportunity online or in public.

- Execute equity employment contracts with cast, crew, and musicians.

- Use Sign-on-Chain to sign, hash and record contracts to the BSV Blockchain.

- Distribute access to Sign-on-Chain documents to all parties.

- Regularly export Quickbooks Excel files to Magic Dapp. Upload accounting data to the BSV Blockchain.

- Distribute access to Sign-on-Chain documents to all investors, cast, musicians, and crew.

- Create account to You Tube, Facebook, or MyMovies to share day-to-day activity with fans and investors.

- Post all data generated to the platform of choice.

- Produce The Movie.

- Sell, license, or stream The Movie on Amazon Prime, Netflix, or other digital streaming platform.

- Stream Movie on Tiatro.app for transparent, direct revenue sharing.

3. Results

The Company has proven it has the ability to:

- Monetize The Movie’s pre-production data, which is the proof of work.

- Document all legally binding contracts and upload all accounting records to a time-stamped publicly distributed ledger.

- Distribute gross revenue to investors instantaneously while maintaining a transparent record of all financial data.

- Ensure the accessibility of the accounting data to any individual possessing the link to the reports.

4. Discussion

The results obtained align with the principles and objectives of a robust triple-entry accounting system. The legal storage of a company’s financial records on a public ledger establishes a foundation for the development of a more secure and scalable version with minimal investment. It has been demonstrated that accounting data, when stored in a block of the Bitcoin Satoshi Vision (BSV) Blockchain, are immutable, transparent, and accessible to anyone possessing a link and a transaction ID. It has been established that individuals can download these data and conduct audits without requiring the company’s permission. It has been proven that payments can be split instantaneously at the point of sale. It has been shown that hashed agreements can be signed and stored to create a system of wallets for receiving revenue at the point of sale. Furthermore, it has been determined that the Bitcoin Satoshi Vision Blockchain is the most accurate embodiment of the technology outlined in Satoshi Nakamoto’s Bitcoin Whitepaper (Nakamoto 2008).

We shall persist in utilizing the Bitcoin Satoshi Vision (BSV) ecosystem to devise solutions in the realms of project management, governance, and accounting until a more apt substitute is made accessible to the public. Presently, no other protocol matches the cost effectiveness and efficiency of BSV based on our experience with development on Ethereum, BTC, or any Ethereum-based cryptocurrencies. These alternatives have proven to be costly, time consuming, and lacking in scalability. In contrast, BSV exhibits a promising capacity for scaling (Jutel 2021).

Block Chain Studios is dedicated to pioneering the path towards the worldwide adoption of blockchain technology. This is achieved by offering innovative, economically viable distributed ledger solutions to stakeholders and investors who aspire to instill trust in their financial reporting and fund distribution mechanisms. The scope for future research encompasses, but is not limited to, subjects discussed in Section 4.

4.1. Project Management and Governance

The MyMovies ecosystem presently serves as a repository of movie data. Our objective is to integrate conventional project management tools, enabling producers and company managers to gather, systematize, and disseminate data related to movie production. We posit that A-list actors can leverage Regulation CF crowdfund financing rules to produce movies at the USD 15 million level. Producers can utilize MyMovies to raise USD 5,000,000 and employ ‘mezzanine’ debt financing to attract the standard 200% of equity loan structure. It is observed that individuals in Hollywood prefer not to hold equity in another’s movie; they would rather possess the content outright or be prioritized for payment through high-interest mezzanine debt (Shelton 2017). A successful fundraising effort under Regulation A, amounting to up to USD 50 million, will enable projects featuring A-list actors to attain a budget level of USD 150 million. This would position them to compete with major movie studios by capitalizing on the support of their fan base and investors who are keen to see them succeed. This can be securely accomplished by employing the same completion bond companies utilized by the studios. An affordable and ‘Bondable Line Producer’ is requisite for this insurance product given that they provide the enhanced level of oversight necessary for qualification. This ensures the financial stability and risk management of the project (Litwak 2022). Completion bonds serve to mitigate overall risk by ensuring monetary compensation for the production in the event of a depletion of funds prior to completion. This assurance bolsters investor confidence in the completion of the movie. The Bond Company assumes a primary position, preceding any debtors and investors. This is a standard operating procedure at higher budget levels. We posit that a scalable version of MyMovies can engage a global audience of movie enthusiasts and investors who are interested in observing day-to-day operations and collectively making decisions regarding their movie.

We envisage the MyMovies platform as a governance system that will significantly augment the producers’ capacity to effectively evaluate, measure, and implement the business model using a consensus mechanism, such as tokenized votes on a blockchain. We believe that investor input, and, in most instances, complete control of all financial decisions related to the production of higher-budgeted movies, is crucial to maintaining trust at every budget level.

We are currently collaborating with Magic Dapp to test their new project management platform, which offers producers a more suitable interface for communication and data exchange with investors, cast, and crew. We anticipate commencing testing of their Minimum Viable Product (MVP) in the second quarter of 2024.

4.2. Private Channel Mining Agreement

The organization posits that competitive Bitcoin miners will engage in negotiations to establish private mining channels with high-volume transaction processors. The agreed-upon fee could be ‘fixed’ above the minimum acceptable price threshold. The adoption of the compact block protocol, which utilizes short TxID numbers, can expedite the propagation of transactions between nodes.

To alleviate concerns regarding fees, a fixed fee rate in a fiat structure can be instituted, with the provision for service providers to absorb the fees on behalf of users. By forecasting transaction volumes and determining total fee caps, providers can hedge fees by procuring Bitcoin in advance, effectively offering a prepaid package for users. This strategy enables efficient and cost-effective transaction processing while preserving incentives for miners.

4.3. Administrative Nodes

We posit that it will be imperative for parties expressing interest to operate their personal computational systems, referred to as ‘nodes’, within the Bitcoin network. This approach ensures a higher degree of control and active participation in the network’s operations (Nakamoto 2008). In an ideal scenario characterized by complete transparency, entities such as unions, studios, agencies, and management firms could all operate nodes. This would enable them to cost-effectively ensure their access to the most recent and extensive chain of events at any given instance. This approach fosters a sense of autonomy and real-time awareness of the network’s operations (Nakamoto 2008). This information can subsequently be utilized to resolve disputes or serve as evidence of fraudulent or wasteful practices within the system. In the event of a fork or systemic outage, each entity can maintain a record of all financial events, which can be used for reconciliation or to proceed as planned.

It will be crucial to educate the general public about the power efficiency of Bitcoin in order to dispel misconceptions propagated by legacy industries and to foster an understanding of Bitcoin’s impact in a competitive marketplace. In the foreseeable future, mining is expected to occur in large data centers as competition for Bitcoin fees intensifies. The notion that Bitcoin squanders energy is a classic straw man argument, as Wright elucidates that the real issue lies in Bitcoin’s relative efficiency. All data centers that power the World Wide Web consume electricity, and this energy allocation is paid for in a competitive environment. It is anticipated that market forces will eliminate unnecessary consumption (Wright 2019).

4.4. Multi-Currency Digital Wallets

Presently, we are conducting experiments with wallets capable of holding and transacting in Bitcoin (BTC), Ethereum (ETH), and Bitcoin Satoshi Vision (BSV) concurrently. We posit that, in their current state, neither BTC nor ETH constitute cost-effective solutions for development. However, as legal tender, they warrant consideration in the drive towards the global adoption of the MyMovies ecosystem.

4.5. The Mark Litwak Law Library Mint

At present, we are in the process of developing a minting technology capable of formulating legal digital contracts. This technology is predicated on the principles outlined in the best-selling book “Contracts for Film and Television” by the renowned Hollywood legal expert, Mark Litwak. This endeavor aims to integrate the legal frameworks of the entertainment industry with the capabilities of modern technology.

For numerous decades, Mark Litwak has been a resource for independent Hollywood producers, offering a legally robust library of contract templates that facilitate the production and distribution of content. A drop-down menu provides access to these contract templates, complete with form fields for the input of relevant information such as the parties involved, the timeline, and the financial terms. Users select the appropriate contract, input the contractual terms, and remit a fee in Bitcoin. This process generates a contract token that symbolizes the agreement between all parties. This token is encrypted and recorded on the Bitcoin public ledger, ensuring transparency and security.

4.6. Access Tokens

We have conducted experiments with static Access Tokens and possess the capability to transmit an electronic message to new participants. This message facilitates the ‘air drop’ or delivery of these tokens to the public wallet address of the recipients. This process ensures the efficient and secure distribution of Access Tokens to new participants in the system (Colicev 2023). Control over access to various levels of data can be exerted in this manner as we investigate diverse token configurations tailored for crew members, fans, and investors. These Access Tokens can also be employed in governance mechanisms, enabling the casting of votes, responding to polls, and aiding in decisions related to production. This approach ensures a democratic and participatory decision-making process within the system.

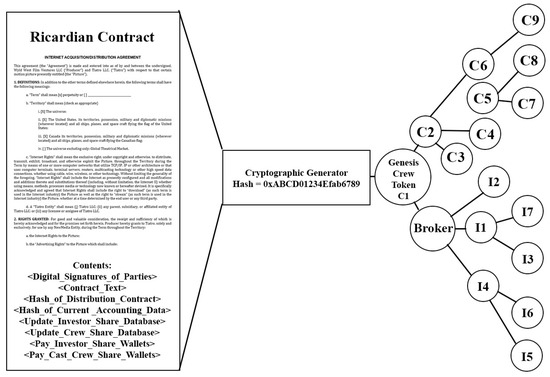

4.7. Ricardian Security Tokens

Bitcoin technology empowers corporations to tokenize a system of immediate cash flows. This system is comprehensible to both humans and a decentralized competitive network of machines. This dual accessibility ensures transparency and efficiency in financial transactions (Grigg 2004). The jurisdiction of Wyoming permits the implementation of tokenization for corporate shares. This legislative provision facilitates the digital representation of share ownership, thereby enhancing the efficiency and transparency of corporate transactions (Lyndholm 2019). We are in the process of developing a Ricardian security token that possesses the qualities of immutability and amenability. The brokered online sale of this token necessitates the capability to eventually activate Unspent Transaction Outputs (UTXOs) to remunerate the network for updating the blockchain token registry in accordance with the instructions embedded in the metadata. A hash of the updated owner database and the revised ownership data could subsequently be traced back to the broker’s database of the current owners. A broker licensed by the Federal Investment Regulatory Administration (FINRA) could then sell tokenized shares via the online secondary marketplace. Upon the broker conducting the requisite Know Your Customer (KYC) procedures mandated by the FINRA, a new investor opening an account can purchase the share with a simple tap. The FINRA stipulates that this personal information must be collected and retained by both the company and the broker (FINRA 2012).

This methodology facilitates the establishment of each investor’s identity and seamlessly extends the collective’s trust to the new investor, as displayed in Figure 16. We have now obtained the requisite authorization to encode a cryptographic mint for the registration, issuance, and distribution of blockchain tokens within the jurisdiction of Wyoming. This process ensures the secure and efficient management of digital assets (Lyndholm 2018).

Figure 16.

A Ricardian Bow Tie distribution of information and revenue.

Our objective is to ultimately facilitate the sale of tokenized shares to the general public, a process that will be governed by both the legal frameworks of Wyoming and the broader United States and its territories. This approach ensures compliance with regional and national regulations while democratizing access to the digital asset realm. At present, numerous enterprises are employing the BSV Protocol. Our team is in the process of conducting a comprehensive evaluation of the various BSV token protocols currently in development. The objective of this assessment is to ascertain a dependable and economically efficient pathway for investors to easily engage with the secondary market for SEC registered securities.

Furthermore, an illustrative instance of this concept can be found in performance-based contracts. In such agreements, specific percentages within a smart contract are triggered and subsequently updated upon the attainment of predetermined milestones or “issues”. These issues typically encompass stages such as pre-production, production, and post-production. This mechanism ensures a systematic and transparent progression of any contract containing performance clauses.

4.8. Alternative Blockchains

In the realm of digital currencies, the Bitcoin protocol stands as a paragon of integrity, with scant few alternatives offering a comparable level of trustworthiness and cost effectiveness. Our research has led us to the conclusion that the notion of decentralization in Blockchains is, in fact, a misnomer. The developers responsible for the creation of the code, as well as the entities funding the enhancement of the infrastructure, are all subject to the jurisdiction of their local authorities and the financial services regulators in their respective countries.

Moreover, our findings indicate a significant trust deficit in proof-of-stake blockchains. The recent debacle involving FTX has shed light on the vulnerabilities of Solana and other similar proof-of-stake chains, which can be exploited by malicious actors wielding influence. This incident underscores the need for rigorous security measures and robust governance mechanisms in the realm of digital currencies (Flitter and Yaffe-Bellany 2023). Our conviction lies in the trustworthiness of Proof-of-Work Blockchains, and we posit that the BSV blockchain offers a cost-efficient and credible immutable and transparent record of events.

Furthermore, the legal case for the ownership of Bitcoin between Crypto Open Patent Alliance and Craig Steven Wright will commence in January 2024. The crux of the lawsuit is the verification of the identity of Satoshi Nakamoto (RCJ 2023). COPA is seeking judicial declaration that Mr. Wright has failed to prove he is Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

Bitcoin is an open-source protocol and is competitively mined. We do not envision a situation where miners would not compete for transaction fees generated by a vibrant ecosystem. We intend to continue our operations in this domain until a superior alternative emerges, although the prospect appears unlikely considering the unfortunate proliferation of illicit activities in the crypto sphere (Low 2020). Our commitment is to persist in the empirical examination of our hypotheses using the BSV blockchain, contingent upon its sustained compliance with the legal stipulations detailed in the blockchain laws in Wyoming. This approach ensures that our operations remain within the bounds of the legal framework, thereby upholding the integrity of our research and development efforts (Lyndholm 2020).

4.9. Blockchain Industry Statistics

Worldwide spending on blockchain solutions is expected to surpass USD 20 billion in 2024. Over 300 million people, or approximately 4 percent of the global population, use blockchain technology or cryptocurrency (McCain 2022). The global blockchain market is estimated to boost global GDP by USD 1.76 trillion by 2030 (Carter 2023). Blockchain applications in manufacturing are expected to grow at a rate of 73% between 2023 and 2026 and 90% of U.S., Canadian, and European banks are currently exploring blockchain technology (McCain 2022).

As of November 2023, there are over 8000 active blockchains and cryptocurrencies in existence (Investing.com 2023). There are currently hundreds of Bitcoin forks. The most popular forms of Bitcoin are BTC, BCH, and BSV. Bitcoin BTC, the first iteration, remains the most valuable in terms of price and market capitalization (cap), with a current price of approximately USD 52,000 and a market cap of approximately USD 1 trillion. It has a maximum circulating supply of 21,000,000 BTC coins and processes about 300,335 transactions per day. The average transaction value is BTC 1.32 (USD 69,219), and the median transaction fee is BTC 0.000047 or USD 2.43 (BitInfoCharts 2023).

Bitcoin Cash BCH, a fork of BTC protocol, has a lower price and market cap, with a current price of approximately USD 273.63 and a market cap of around USD 5.3 billion. It has a similar circulating supply to BTC, with 19.6 million BCH coins. BCH processes fewer transactions per day, with about 230,000 transactions. The average transaction value is BCH 2.55 (USD 697.13), and the median transaction fee is BCH 0.0000053 or USD 0.0014 (BitInfoCharts 2023).

Bitcoin Satoshi Vision BSV, the fork that is most resemblant of the Satoshi Nakamoto Bitcoin Whitepaper, has a current price of approximately USD 79.52 and a market cap of around USD 1.5 trillion. It has a circulating supply of 19,633,950 BSVB coins and processes the highest number of daily transactions at 379,784. The average transaction fee is also the lowest at BSV 0.000004 or USD 0.00031 (BitInfoCharts 2023).

4.10. Applicational Aspects

Triple-entry accounting is a revolutionary approach to financial record keeping that is poised to transform the accounting industry with its many applicational aspects. A blockchain-based triple-entry accounting system enhances transparency and trust by recording each transaction executed by both parties with a verifiable time-stamped record that is instantly available to both parties. This complete transparency, coupled with the immutable nature of blockchain, offers robust fraud prevention by making it economically unfeasible to alter any past records. Furthermore, real-time recording and verification of transactions improve efficiency by reducing the time and costs associated with auditing.

Expanding the use of accounting to activity between firms, triple-entry accounting facilitates more accurate and reliable inter-firm financial data. This feature, along with the provision of real-time updates, improves the speed and efficiency of financial operations. Given these benefits, triple-entry accounting holds immense potential for disruption in the accounting industry. However, while the theory and potential benefits are promising, its practical application is still in the early stages, necessitating ongoing research and development.