Abstract

It is generally argued that Islamic banks are safer than conventional banks. The prime reason is that their product structure is essentially asset-backed financing, while conventional banks rely heavily on leveraging, which was considered one of the main causes of the 2008 global financial crisis. This paper examines the riskiness of Islamic and conventional banks during the 2008 global crisis by measuring overleveraging, defined as the difference between actual and optimal debt. This research conducted empirical analysis on the overleveraging of 20 banks (10 conventional and 10 Islamic banks) from five different countries, namely, Bahrain, Kuwait, Malaysia, the United States, and the United Kingdom. The analysis is double-folded: on the one hand, the results in this paper suggest that excess debt, rather than the mere holding of debt, was the reason behind the severe financial meltdown in 2007–2009; on the other hand, this paper shows that Islamic banks, in most of the countries in context, performed better during the recent crisis, but were subject to the second-round effect of the global crisis around the years of 2011–2013.

1. Introduction

Over the last decade, Islamic banks’ annual growth rate reached 15%, and Islamic banks are currently present in over 51 countries (Juan Sole 2007). This constant growth was due to the fact that competition among banks has pushed towards innovation accompanied by the stability that Islamic banks offer in a way. Many banks opened an Islamic banking window where they adopted some Islamic banking operations or established full-fledged Islamic banking (Turk-Ariss 2009).

This expansion of Islamic banking has attracted many researchers to conduct comparison studies between Islamic and conventional banks. Prior attempts on Islamic banks focused primarily on their conceptual issues, and issues of liquidity, capital adequacy, and operations. Most research studies on Islamic and conventional banks used neither statistical techniques to assess the leveraging of banks, nor made cross-country intertemporal comparisons of debt levels. Research on the leverage level of banks in general and especially of Islamic banks is scarce. A literature review revealed that there is no empirical evidence of excess leverage in the case of Islamic banks in the countries examined in this paper. This paper contributes to recent academic research on the topic of the overleveraging of banks in general and specifically of Islamic banks, and compares Islamic banks and their conventional counterparts.

To undertake the empirical study on those issues, I introduced a new measure of overleveraging. If borrowing exceeds debt capacity, this can be called excess leveraging. Debt capacity is measured as sustainable or optimal debt. In other words, the measure of overleveraging is defined as the difference between actual and optimal debt. I followed the literature presented by Stein (2012b) and Schleer and Semmler (2016), and focused on the solution of the dynamic version of the Stein model that allows us to use time-series data on banks in order to calculate the excess debt of twenty banks in five countries, namely, Bahrain, Kuwait, Malaysia, the United States, and the United Kingdom.

When we speak about overleveraging, we are actually referring to lending booms. It is well known that lending booms may precede banking-system instability because they imply increased risk taking in the financial system. This has the potential to result in financial turmoil if the economy is hit by a negative adverse shock in asset prices, as what occurred during the crisis of 2008. Banks have continued to leverage after 2012, and there are expectations of another financial crisis affecting the banking sector following the COVID-19 crisis. Many studies investigated issues related to asset-price channels through which the banking system’s instability is triggered. Some of these important academic contributions include Brunnermeier and Sannikov (2014); Mittnik and Semmler (2012, 2013); Stein (2012a, 2012b); and Gross et al. (2017).

This paper addresses if and how excess debt defined by Stein (2012a) can be considered as an early warning signal for banks, and takes an additional dimension by comparing the excess leverage between Islamic and conventional banks before and during the recent global financial crisis. Results showed that all banks became vulnerable to the banking crisis in 2007–2009, while credit build-up, in other terms, overleveraging, started in 2005. However, for most of the countries in the sample, Islamic banks performed better and leveraged less during the crisis, which affected these banks less by the crisis and more resilient to a financial crisis. Nevertheless, Islamic banks still in some cases relied on leveraging, and were subject to the second-round effect of the global crisis around the years of 2011–2013, when higher excess-debt values were found for Islamic banks. That could also be due to the fact the financial crisis hit the real economy after 2009, and since most Islamic bank investments and contracts were backed by real estate and property as collateral.

This paper is organized as follows: Following the introduction and rationale of this study in Section 1, Section 2 gives the literature review about Islamic bank performance, and a comparison with their conventional counterparts in the examined countries. Section 3 provides the theoretical model. Section 4 presents empirical and graphical analysis of the results. The policy implications are presented in Section 5 and Section 6 concludes the paper. The appendices provide the technical background and calculations of excess debt.

2. Literature Review

Over the past decade, Islamic banks’ annual growth rate reached between 15% and 20%, and the world’s 100 largest Islamic banks reached an annual asset growth rate of 26.7%. Moreover, there are globally over 300 Islamic financial institutions operating in 75 countries according to the Asian Banker Research Group. This constant growth occurred because competition among banks has moved towards innovation accompanied by stability, which Islamic banks offer in a sense. Many banks opened an Islamic banking window and adopted some Islamic banking operations or established a full-fledged Islamic banking system (Turk-Ariss 2009).

This expansion of Islamic banking has motivated several researchers to assess Islamic banks’ performance. For instance, Kusuma and Ayumardani (2016) examined the performance of Islamic banks in Indonesia. The authors investigated the relationship of bank performance with its corporate governance. The authors selected a sample of 11 Islamic banks for the years 2010 to 2014 and performed regression analysis on the data extracted from bank balance sheets. Findings showed that the efficiency level of corporate governance of Indonesian Islamic banks improved during the research period. In addition, corporate-governance efficiency was significantly corelated to Islamic bank performance.

Sufian (2014) conducted empirical analysis using a regression model aiming to investigate the impact of economic freedom on Islamic bank performance during the period of 2000–2008. The author found that the larger the size of the Islamic bank, the higher its profitability. This is consistent with most of the found literature. Moreover, the author stated that credit risk yielded negative impact on performance, while greater financial freedom positively influenced the profitability of Islamic banks operating in Middle East and North Africa (MENA) banking sectors.

Similar to this study, Hidayat and Abduh (2012) studied the impact of the global financial crisis towards the financial performance of the Islamic banking industry in Bahrain. The authors used panel regression on a sample of fourteen conventional banks and eight Islamic banks, and found that the independent variables, namely, GDP, equity, and debt variables, were good predictors for return on equity (ROE) but not for return on assets (ROA). Moreover, Islamic banks were not immune to the financial crisis, but were usually affected at a later stage. This is consistent with this paper’s findings, where we see that Islamic banks were subject to the second-round effect of the crisis.

Febianto (2012) researched the risk management for the profit-and-loss-sharing financing of Islamic banks. Results showed that risk management can give Islamic banks guidance on how to manage the risk attributed to profit-and-loss-sharing arrangements that can motivate Islamic banks to increasingly use their assets for those kinds of contracts.

Pratomo and Ismail (2006) examined the optimal capital structure of a bank while assessing the performance of Islamic banks. This is in context with this paper, as the authors analyzed the agency-cost hypothesis in a profitability framework for Islamic banks in Malaysia. They stated that high leverage proxied by ratio equity reduces the agency costs of outside equity, and increases firm value and, eventually, higher profit efficiency. This paper takes a different approach in examining leverage as a measure of stability and not of profitability; however, both papers agree that Islamic banks do leverage, and that periods of overleveraging are accompanied by periods of higher profitability.

Abdel-Hameed Bashir (2001) studied the determinants of Islamic bank performance from a sample of 14 banks across eight Middle Eastern countries for the time span of 1993–1998. The main variables used in this paper are capital ratios, leverage, overhead, loan and liquidity ratios, foreign ownership, and some macroeconomic variables to control for cyclical factors that might affect bank performance. The author stated that a high leverage level is associated with higher profitability. Results also indicated that foreign-owned banks are more profitable than their domestic counterparts. This seems logical since foreign-owned banks are larger in size that, as per most of the literature, is positively correlated with higher performance and profitability.

Comparative studies between Islamic and conventional banks has been an ongoing and interesting research for several decades. For example, Fayed (2013) compared the performance of Islamic and conventional banks in Egypt for a sample of three Islamic banks and six conventional banks for the time span of 2008–2010 using financial-ratio analysis. The results depicted the outperformance of conventional banks in all areas, specifically in profitability, liquidity, credit-risk management, and solvency.

Parashar and Venkatesh (2012) conducted research that compared the difference between Islamic and conventional banks’ reactions to the crisis. Their study showed that the two differed in the ways in which they were affected. For instance, Islamic banks experienced a crisis in the areas of capital ratio, leverage, and return on average equity. Meanwhile, conventional banks underwent greater challenges in returns on average assets and in liquidity.

Another paper by Abdullah et al. (2007) examined the differences in terms of performance between Islamic and conventional mutual funds in the context of the Malaysian capital market. It concluded that Islamic funds outperform conventional funds in a “bearish” economy, while conventional funds surpass Islamic funds in a “bullish” economy. In addition, it found that, while conventional funds fared slightly better during market diversification, neither fund reached the 50% mark in this area.

Samad and Hassan (2006) focused on the performance of Malaysian Islamic banks. The authors applied financial-ratio analysis over the period of 1984–1992 and found that, in general, bankers’ lack of knowledge was the main reason for the slow growth of loans under profit loss sharing. However, in terms of liquidity and risk management, Malaysian Islamic banks are quite efficient, and even more efficient than conventional banks.

Similarly, Samad (2004) addresses the issue of credit and risk taking. The author examined the performance of Islamic versus conventional banks during the post-Gulf War period (1999–2001). The paper found that credit was the major difference between both types of banks as opposed to performance, and this is in line with this study. The author concluded that, while both types of banks perform equally well, Islamic banks experience less credit risk taking. Likewise, Osborn et al. (2007) conducted research on British Islamic banks, and found that Islamic banks had a better reaction to the 2008 crisis. The authors attributed this to Islamic banks’ higher capitalization and higher liquidity reserves, which efficiently enhanced their risk undertakings.

On the other hand, Chapra (2008) argued that adherence to Islamic banking does not necessarily provide more banking stability because Islamic banks still rely on high leveraging. The author stated that Islamic banks were not resistant to the 2008 crisis. He stated that, given that Islamic banks can pass a substantial part of investment losses on to depositors, these banks are tempted to undertake riskier projects than if they had to guarantee all deposits, such as in conventional banks.

Moreover, a World Bank paper by Beck et al. (2010) compared Islamic and conventional banks in the United Kingdom in terms of business model, efficiency, and stability. The paper stated that Islamic banks’ products are being applied in a similar way to that of conventional banks, and that most Islamic banks are being introduced under conventional banks’ umbrellas. Still, the authors found that Islamic banks are more cost-effective and stable than conventional banks. The rise in hybrid financial products, for which aspects of conventional banks are mixed with those of Islamic banks, is increasing the risk profile of Islamic banks, and requires additional financial standards and regulations.

A recent International Monetary Fund (IMF) working paper by Bitar et al. (2017) examined the effect of Basel core principle (BCP) compliance on the stability of conventional and Islamic banks. The authors used a sample of 761 banks in 19 countries for the years of 1999–2013. Their findings suggested that the BCP index is positively associated with the stability of conventional banks, while the effect is less noticeable for Islamic banks.

Another IMF paper by Shabsigh et al. (2017) showed that the complexity of Islamic banks exposes them to additional risks that should be addressed by supervisory authorities and central banks. Islamic banks’ hybrid products expose them not only to additional returns, but also to added risks that make them volatile. The authors argued that there is a need to establish a clear framework for troubled Islamic banks to ensure the stability of the financial system.

3. Empirical Approach and Definition of Variables

3.1. Background

According to Stein (2012b), the United States financial crisis in 2008 was caused by excessive financial obligations/mortgages of private households (i.e., bubbles in the mortgage market defined as unsustainable debt/income ratios), while in the 1980s, the financial crisis was related to the business sector. Essentially, Stein argued that, although debt problems may have originated in either the public or private sectors in different nations, the result was still declining asset values, and the mechanisms at work resulted in a contagion effect either from the United States to Europe and/or from one European nation to another depending on the debtor-to-debtee relationship under examination. Of course, in each scenario, Stein made it clear that the primary source of the problem was not the presence of debt but excess debt within the country/countries under analysis.

Stein derived an optimal-debt ratio and built on it to identify an early warning signal (EWS) of a debt crisis, which is defined as the excess debt of households (actual-debt ratio less than the optimal-debt ratio). As the excess-debt level rises, the probability of a debt crisis increases. It has been shown that rising house prices since the late 1990s led to above-average capital gains for households, thereby increasing owner equity. The supply of mortgages increased, and consequently, financial obligations as a percentage of disposable income increased for private households. At the same time, the quality of loans declined (subprime mortgages). Of course, this process was not sustainable. As capital gains1 dropped below the interest rate, debtors could not service their debts any longer, and foreclosures led to a collapse in the value of financial derivatives.

Before delving into the theoretical model and empirical analysis presented in this paper, it is important to briefly provide background information regarding Islamic banks’ mortgage-loan operations. As mentioned, their operations do not involve interest rates; rather, they have a proprietary program called the LARIBA (interest-free) model, and they use equity-participation systems or profit loss sharing. They offer two types of mortgage loans. First, profit sharing (murabaha) is offered in which the bank does not loan money to the buyer to purchase the home or other property; rather, the bank buys the home itself and then resells it to the buyer at a profit. The buyer typically pays a fairly large down payment, and the price at which the bank buys the property is disclosed to the end buyer. The second method is decreasing rent (ijara). The bank purchases the home and resells it to the buyer; however, unlike the first method, in this case, the home remains in the bank’s name until the total price is paid. The buyer takes up residence immediately and makes payments to the bank on the purchase price, but in addition to the payments, the buyer also pays a fair market rent. This method is preferred in countries such as the United Kingdom to avoid double payments of taxes (Khan 2010).

Dr. Abdul-Rahman, Chairman and CEO of the Bank of Whittier, said during an interview that they had few nonperforming mortgages in 2008, and this was due to their riba-free (RF) discipline2 He explained that the bank tracks home prices in US dollars relative to more stable commodities, such as gold, silver, wheat, or rice, thereby allowing for the discovery of real-estate bubbles. He added that, on the basis of the used strategy, the bank had an early warning signal of a macro-bubble forming in the real-estate sector. In addition, they marked the property to the market, meaning that they researched the rental value of a similar property in the same neighborhood. He stated that the inputs of their model are the amount to be invested (financed), the number of years of financing, and the rent. The unknown is the rate of return on investment3. Their internal business model allowed them to survive the recent financial crisis.

3.2. Theoretical Model

I introduce a model of optimal leverage that helps us to define overleveraging. The model sketched here is a low-dimensional stochastic variant of a model of banking leveraging, and it follows Stein (2008, 2012a) and Brunnermeier and Sannikov (2014).

Overall, my model is very similar to those of Brunnermeier and Sannikov (2014) and Stein (2012a). Both models have leveraging and payouts as choice variables, and net worth as a state variable. Moreover, both models are stochastic. Similar to this study, Brunnermeier and Sannikov (2014) specifically focused on the banking sector; however, the setting is more general compared to the one used in this paper. There are households that save, and financial experts representing financial intermediaries that invest in capital assets owned by households and financial intermediaries. Both have different discount rates. I focus solely on the behavior of financial intermediaries.

In this model, I use preferences in the objective function and Brownian motions as state variables similar to both studies. The Stein (2012a) model, assuming certain restrictions, uses log utility and allows to exactly compute excess leveraging. Capital return is also stochastic due to capital gains, and the interest rate is stochastic as well, similar to my model and in contrast with that of Brunnermeier and Sannikov (2014); where only the capital return is stochastic, and the interest rate is taken as constant. Both Brunnermeier and Sannikov (2014) and Stein (2012a) employed a continuous time version, but the problem in this paper is formulated as a discrete time variant with a discounted instantaneous payout and an optimal leveraging function.

Moreover, both Brunnermeier and Sannikov (2014) and Stein (2012a) stated that a shock to asset prices creates a vicious cycle through the balance sheets of banks. In other words, risk taking and excessive borrowing occur when asset prices are volatile. They defined what they referred to as the volatility paradox as the shock to asset prices that negatively affects the banks’ balance sheets and subsequently disrupts the real sector. Thus, when the prices of banks’ assets decrease, and thus their equity value and net worth decrease, margin-loan requirements increase. For financial intermediaries to remain liquid, they take haircuts and deleverage. Consequently, a fire sale of assets begins, further decreasing the asset price, and net worth declines, thus triggering an endogenous jump in volatility and a risk for all, which generates a downward spiral. This is in accordance with the findings of this paper.

The asset-price channel through which the banking system’s instability is triggered was also studied by Mittnik and Semmler (2012, 2013). In this model, the unconstrained growth of capital assets through excessive borrowing, facilitated by the lack of regulations imposed on financial intermediaries, is considered the main cause for banking-sector instability4. On the other hand, large payouts with no “skin in the game” affect banks’ risk-taking behaviors, equity development, and leveraging. The higher the payout is, the more leveraged the bank becomes, which increases the aggregate risk and risk premia for all. In summary, the increased risk spreads, and risk premia, especially at a time when defaults begin, expose banks to vulnerabilities and financial stress triggered by security-price movements.

To derive an optimal-debt ratio, Stein used stochastic optimal control (SOC). A hypothetical investor selects an optimal-debt ratio, , to maximize the expectation of a concave function of net worth, , where T is the terminal date. The model assumes that the optimal-debt/net-worth ratio significantly depends on the stochastic process concerning the capital-gain variable. The expected growth of net worth is also maximal when the debt ratio is at the optimal level.

Optimal leverage is given by:

such that

where is the bank’s capital gain/loss; is the credit cost of banks; is the productivity of capital; is the deviation of capital gain from its trend; σ2 is the variance; and represents the negative-correlation coefficient between interest rate and capital gain5. Through the presented model, Stein could determine excess debt and an early warning signal of a potential crisis. As mentioned, it is this mechanism that played a role in the decreasing net worth of individuals, households, and institutions in the United States, and that was amplified by the increased leverage and pricing volatility of complex securities.

To measure the excess leveraging of banks, the introduced and defined Stein model was followed with a focus on the solution of the dynamic version of the model, which allowed for using time-series data on banks. One difference from Stein is that, in this case, each bank’s productivity of capital was not assumed to be deterministic or constant as in the Stein model; rather, it was calculated for the years of 2000–2016.

The optimal-debt level was calculated for the years 2000 until 2016; thus, excess debt, which is the measure of overleveraging in this paper, was estimated. To calculate the banks’ optimal-debt ratios, data on the banks’ capital gain/loss, market interest rates, and the productivity of capital were collected. Using these variables, the risk and return components of the model were then calculated. Using the abovementioned variables, the optimal-and actual-debt ratios were calculated for a sample of twenty banks, 10 Islamic and 10 conventional banks, in five different countries6. The full calculations are presented in 20 tables7 with 18 columns each. Data were derived from the banks’ annual reports, balance sheets, and financial statements, in addition to some data received directly from bank managers. The calculations are summarized below.

Column 1 consists of capital gain/loss that represents the return in percentage to the investors of the bank from capital appreciation or loss in a particular year. This capital gain/loss is calculated by dividing the change in each bank’s stock-market cap by the beginning market cap at each period. The market caps were Hodrick–Prescott (HP)-filtered to eliminate the effects of daily stock-market swings. HP Filter is a data-smoothing technique frequently applied on time series data to remove short-term fluctuations associated with the business cycle. For example, to calculate the National Bank of Bahrain capital gain of 0.05% during 2006 shown in Table A3, I divided the change in the bank’s market cap from 31 December 2005 to 31 December 2006 by the market cap on 31 December 2005.

Column 2 represents the market interest rate. The 10-year treasury yield was used to represent the market interest rate, and is therefore presented in percentage8.

In Column 3, beta (β) represents the productivity of capital. The beta is calculated as the bank’s annual gross revenue divided by total capital. The total capital here is calculated as the shareholder equity plus half of both short-term and total long-term debt9. To determine shareholder equity, I obtained the annual value of each bank’s shareholder equity from the balance sheet. Short-term debt comprises all the banks’ current liabilities that are usually due within 12 months. Long-term debts, on the other hand, are calculated as the combinations of long-term liabilities and other liabilities in banks’ balance sheets. These are basically all bank liabilities due in more than a year’s time. Therefore, each bank’s productivity of capital is calculated for the years of 2000–2016, and not constant as in Stein (2012b).

Columns 4 through 9 are the risk elements in the model (Stein 2012a). Column 4 represents beta variance that calculated as the difference between each year’s beta from the mean beta for the years 2000 and 2016, representing the deviation of each period’s beta from the mean. Column 5 is also a component of the risk element. This is calculated as one-half of the square of the capital-gain variable. Column 6 is the statistical correlation between interest-rate and capital-gain variables over the period from 2000 to 201610. Columns 7 and 8 are the variance for the interest-rate and capital-gain variables, respectively. Each period’s variance is calculated as the deviation of that period’s value from the mean. Therefore, interest-rate variance is the difference between each year’s 10-year treasury yield and the mean interest rate from 2000 to 2016. Similarly, capital-gain variance is the difference between each year’s capital gain/loss and the mean capital gain from 2000 to 2016.

Column 9, which is the product of the correlation between the stochastic variables (interest rate and capital gain), and interest-rate and capital-gain variance, represents an additional component of the risk element. It is calculated as the product of the correlation factor of the stochastic variables (Column 6), interest-rate variance (Column 7), and capital-gain variance (Column 8)11. Columns 10–12 are used to determine the risk-investors bear when they decide to hold equity in the bank, and this is a key issue for the investors’ decision making.

Columns 10 and 11 represent the standard deviations of the interest rate and capital gains, respectively. Therefore, Column 10 is the standard deviation of values in Column 2, while Column 11 is the standard deviation of values in Column 1. Here, standard deviations are constant over the periods, as in the Stein model.

Column 12, on the other hand, is calculated as twice the value of variances of the two stochastic variables and their correlation. This is, therefore, calculated as 2 multiplied by Column 9.

Column 13 is, hence, the risk of an investor holding the equity of the bank at each time period as in Equation (A2). The risk is calculated using Columns 10–12. The risk is calculated by adding the standard deviations of the interest rate (Column 10) plus the standard deviation of capital gain (Column 11) minus the risk component in Column 12.

In the model, the optimal-debt ratio maximizes the difference between net return and risk term. Therefore, only if the net return exceeds the risk premium does the optimal-debt ratio become positive. The optimal-debt ratio, therefore, is not a constant, as Stein also noted Stein (2012a), but rather varies directly with net return and risk.

In Column 14, I then calculated, using all the above-mentioned variables, Stein optimal-debt ratio, f*(t). Debt ratios were normalized to remove the effects of seasonality. Therefore, normalized f*(t) measures the deviation of the optimal-debt ratio away from the mean. Negative values in Column 14 represent lower optimal-debt ratios away from the mean ratio during the applicable periods. The components of the optimal-debt ratio are, therefore, primarily the capital gains for equity holders of the bank’s stock, the market interest rate, and the risk term. The optimal-debt ratio maximizes the difference between mean return and risk term. The formula for calculating optimal-debt ratio using the above column numbers is: ((Column 1 − Column 2) + Column 3 − Column 4 − Column 5 + Column 9)/Column 13 (Ebisike 2014). This reiterates what was mentioned above that optimal-debt ratio is positive only if the net return is greater than the risk premium, and this can intuitively be seen.

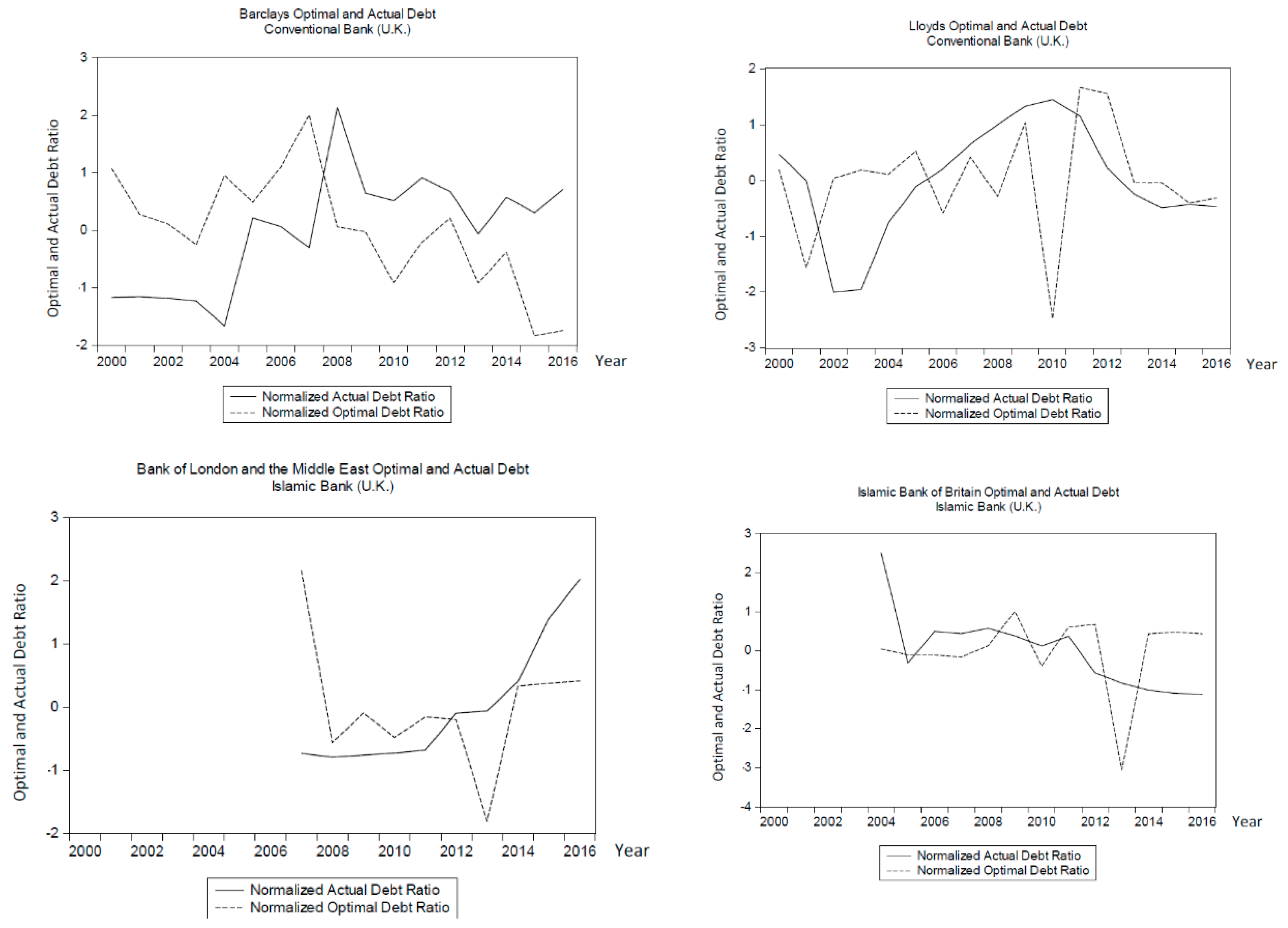

In Column 15, I calculated normalized optimal-debt ratios using Column 14, the mean and standard deviation of the optimal-debt values12. In addition to calculating the optimal-debt ratio, I calculated the banks’ actual-debt ratio in order to calculate the excess-debt ratio. The actual-debt ratio of the banks was equal to long-term debt divided by total assets, which are given in the banks’ annual reports as well. Actual-debt ratios are also normalized in the same way as optimal-debt ratios are, and are presented in Column 16. After optimal- and actual-debt ratios are calculated as discussed above, excess debt is calculated in the last columns as normalized actual minus optimal debt. The graphs of the two ratios, namely, actual- and optimal-debt ratios, are presented in Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5 below, followed by empirical analysis.

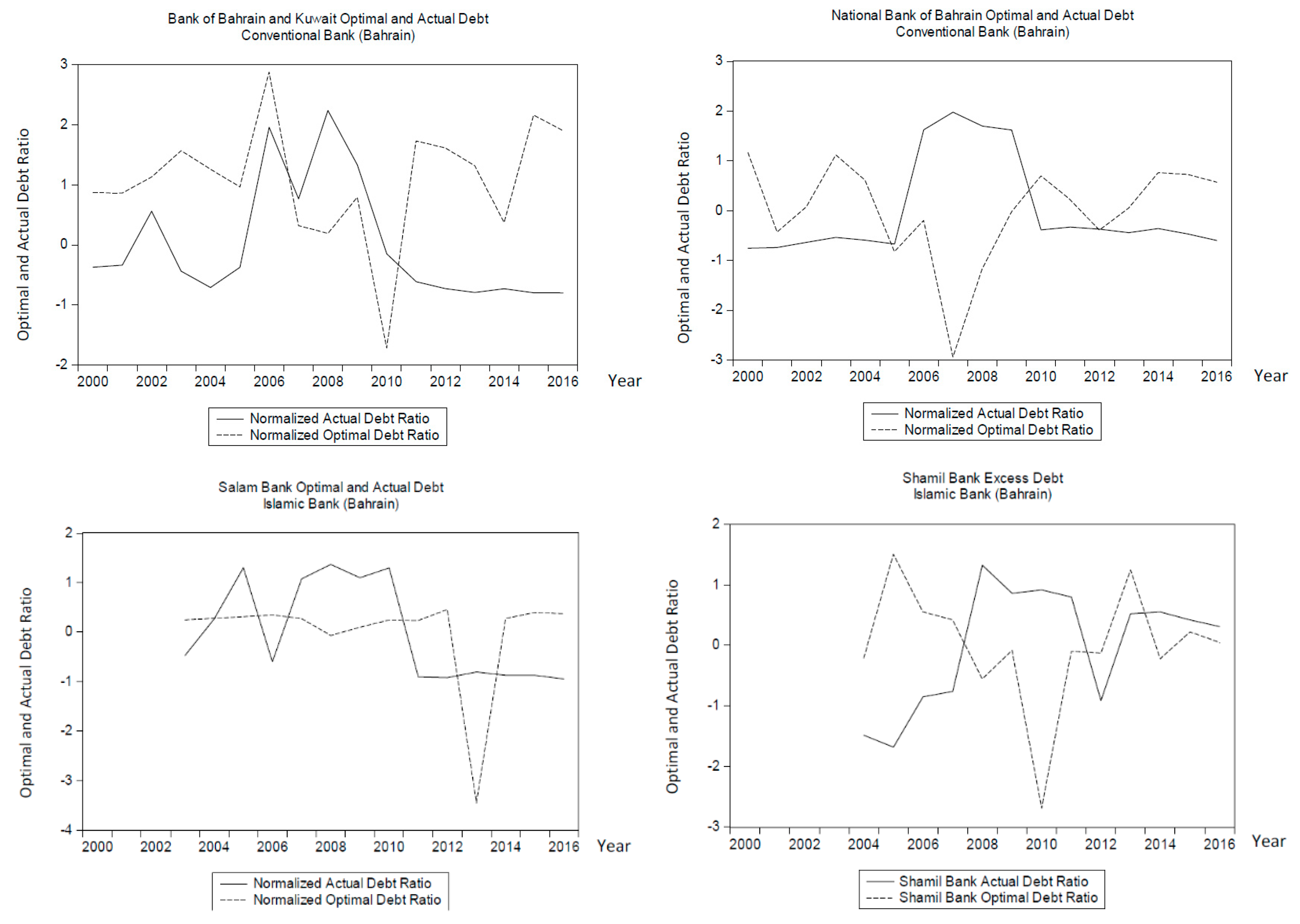

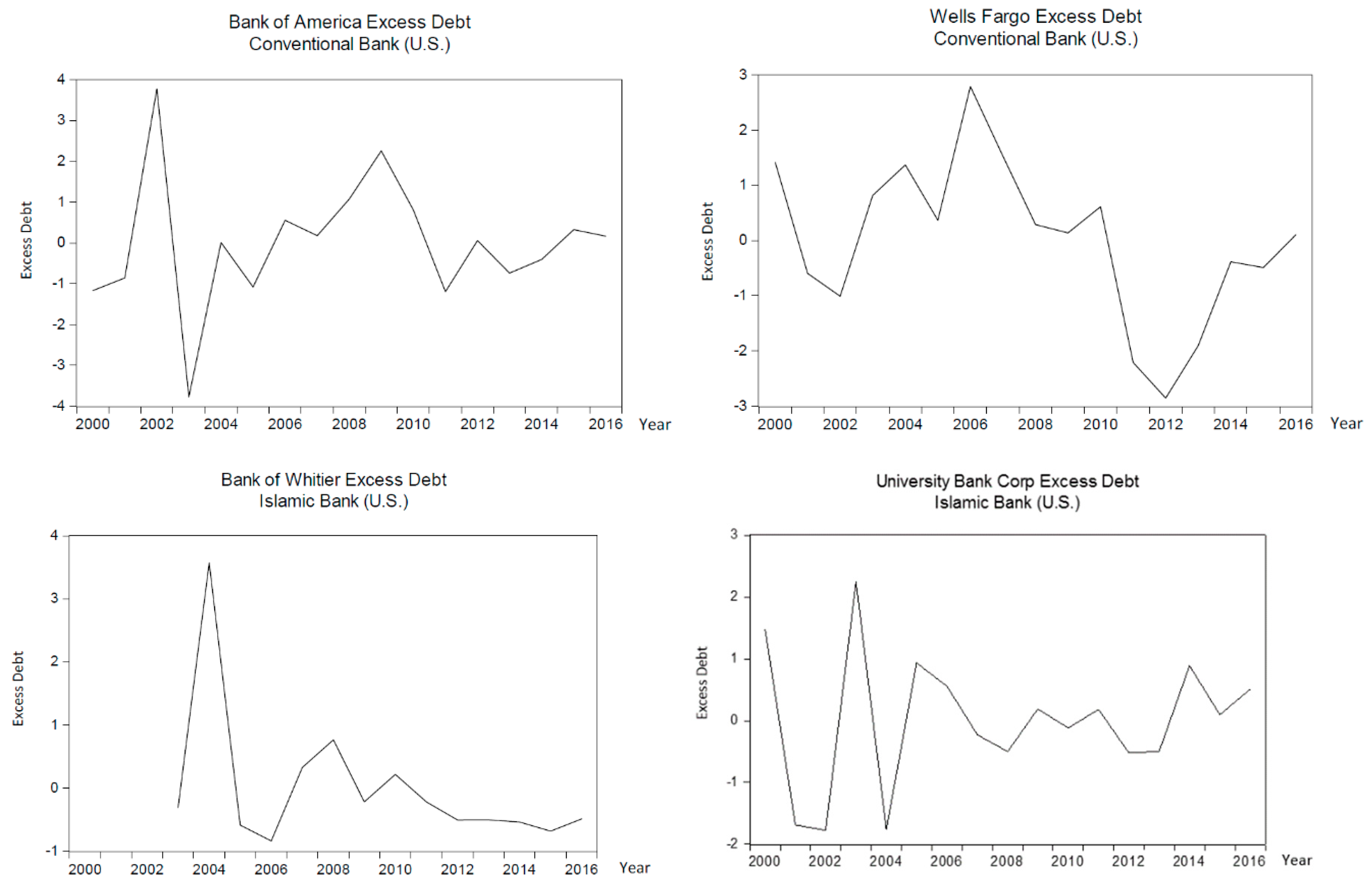

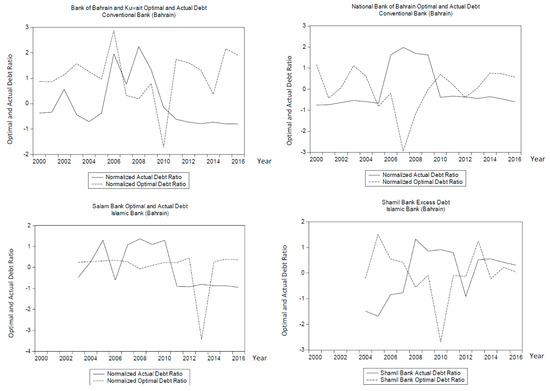

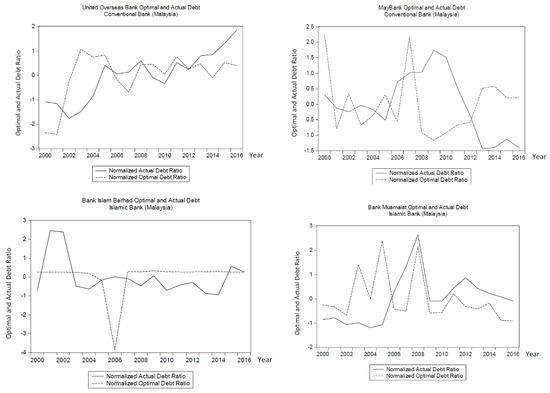

Figure 1.

Bahrain optimal- versus actual-debt ratio. Source: Author’s calculations.

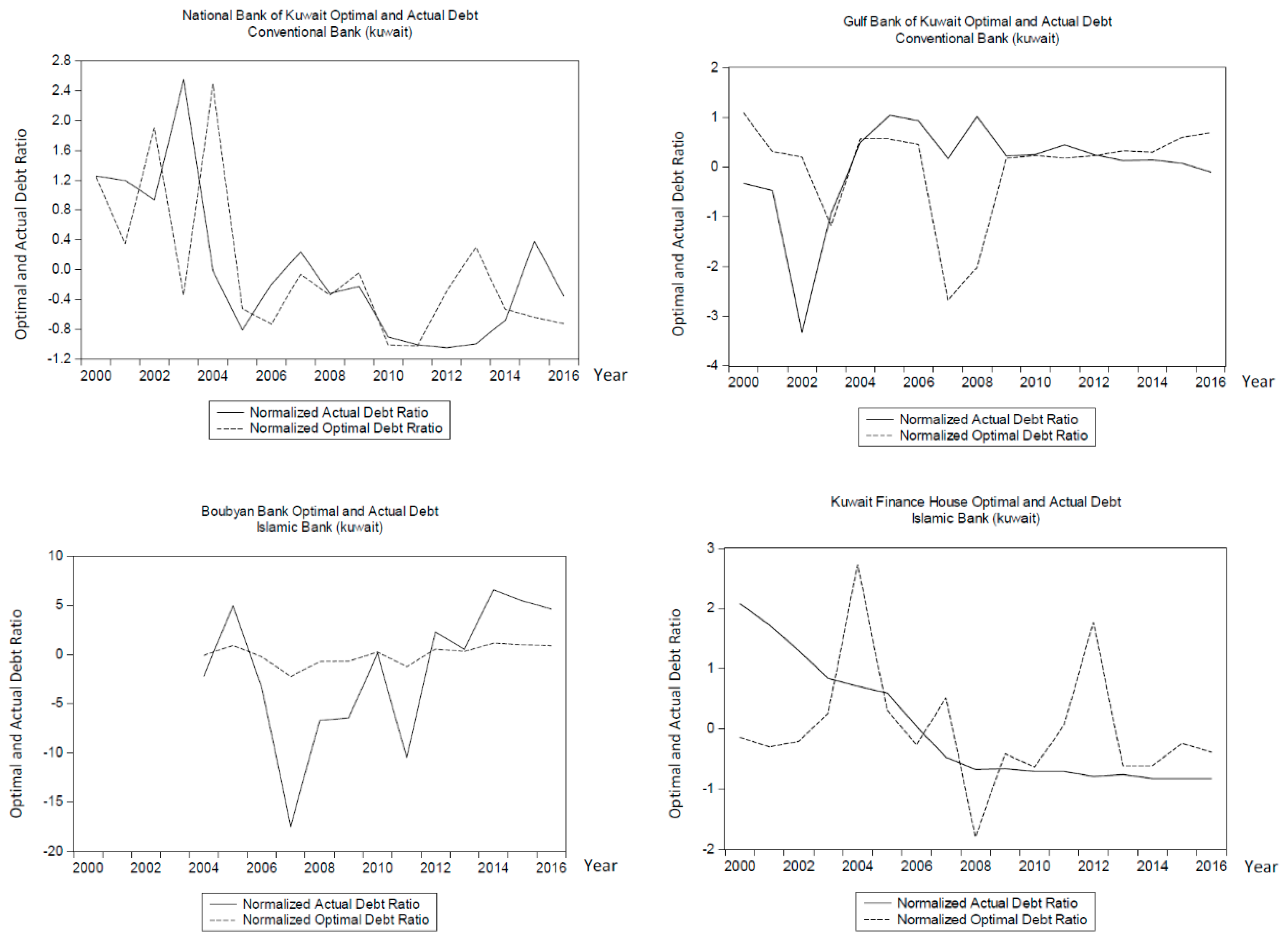

Figure 2.

Kuwait optimal- versus actual-debt ratio. Source: Author’s calculations.

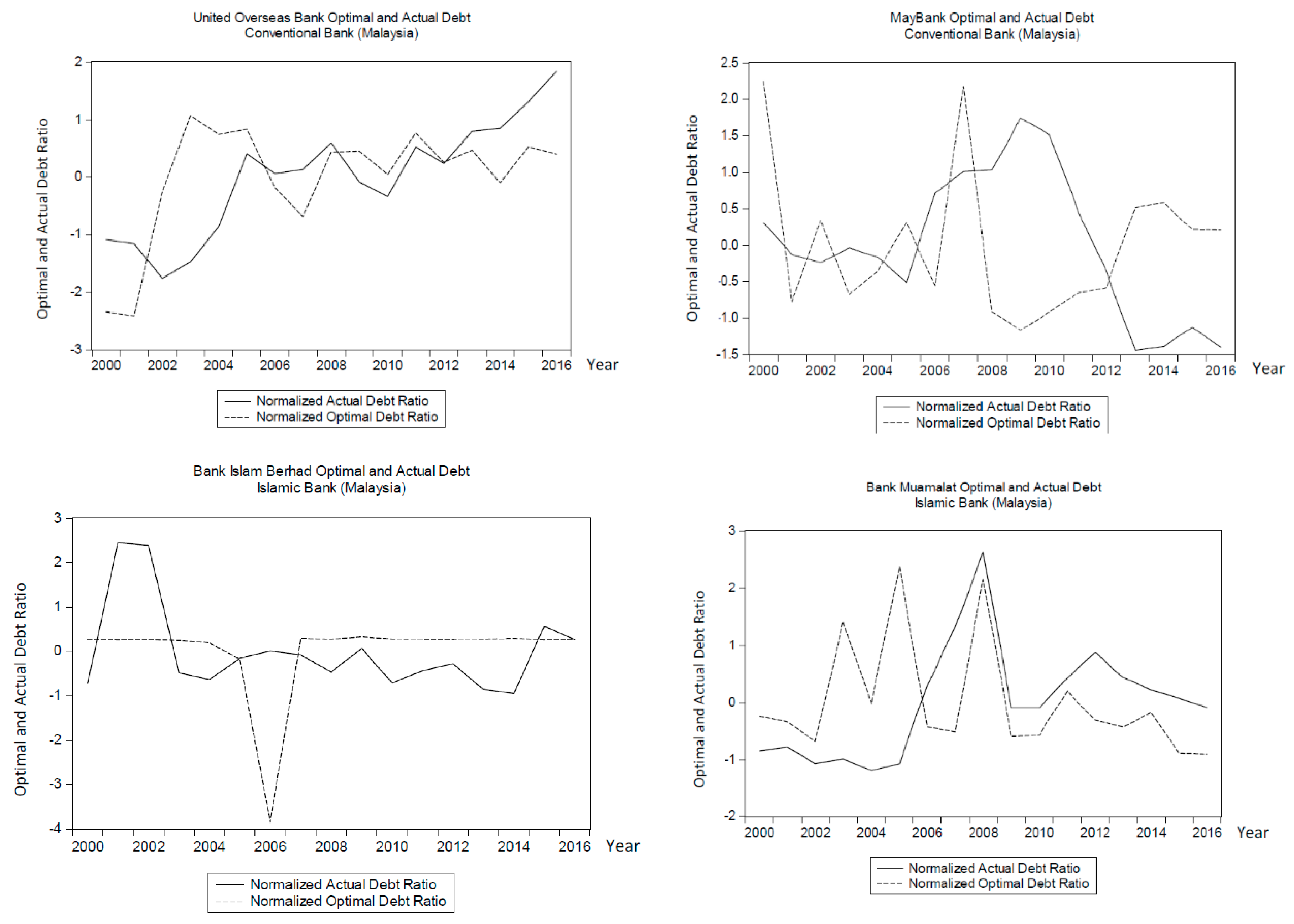

Figure 3.

Malaysia optimal- versus actual-debt ratio. Source: Author’s calculations.

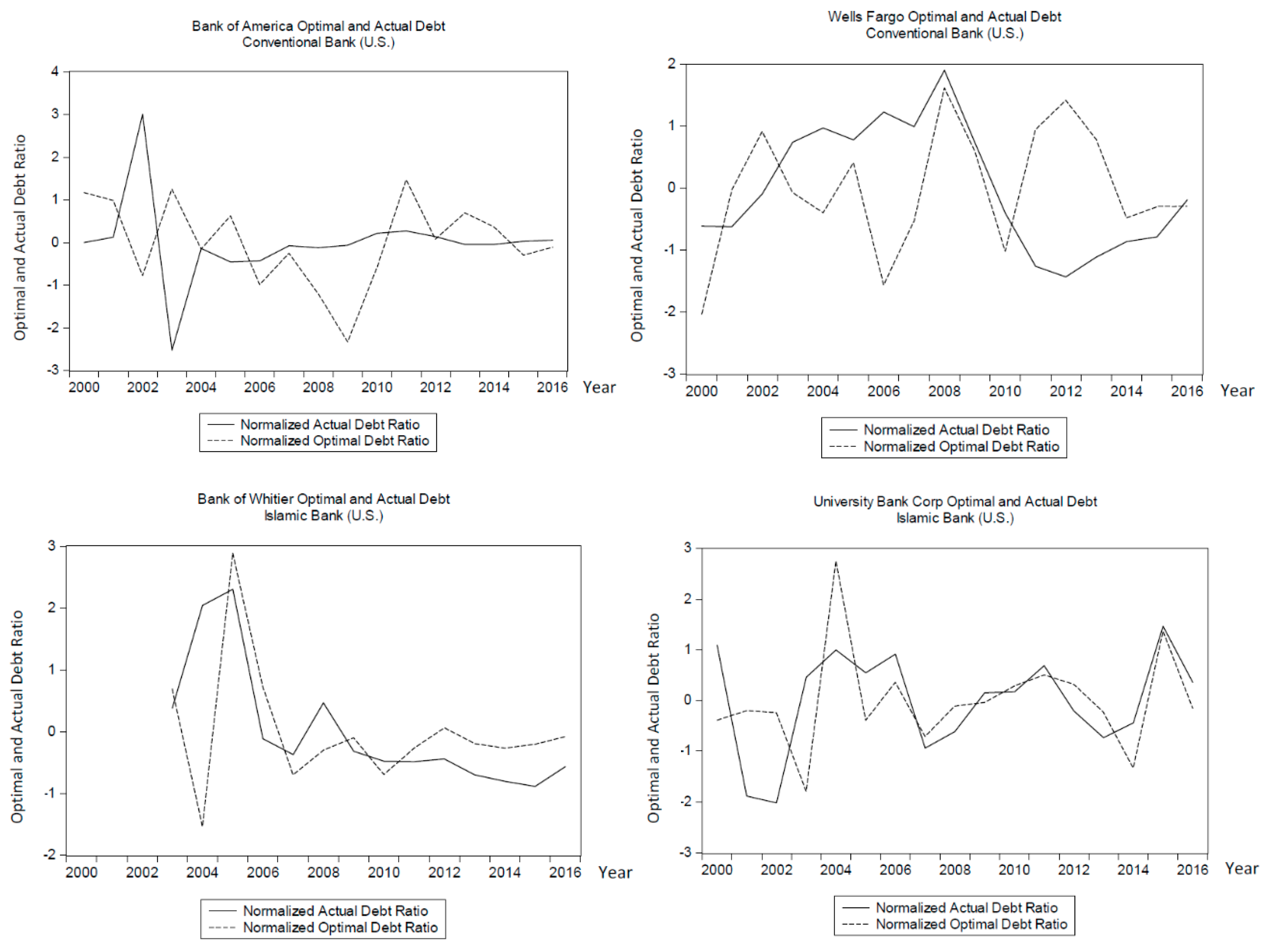

Figure 4.

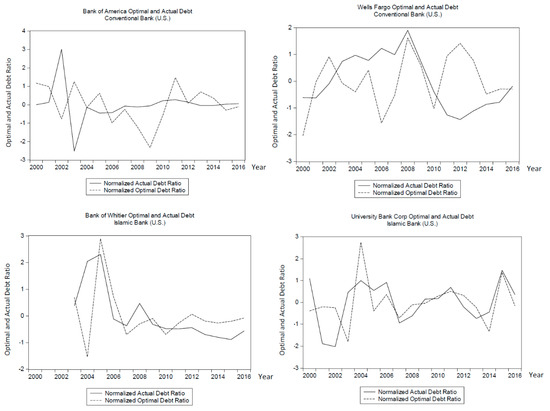

United States optimal- versus actual-debt ratio. Source: Author’s calculations.

Figure 5.

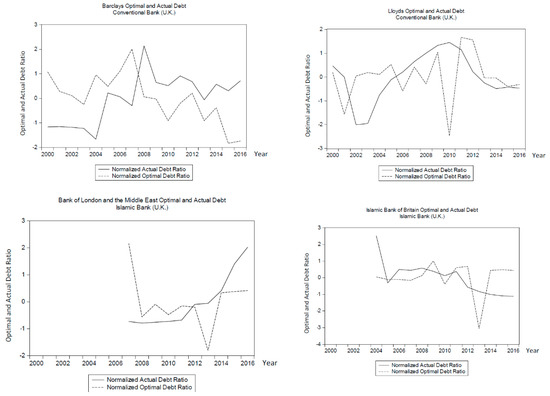

United Kingdom optimal- versus actual-debt ratio. Source: Author’s calculations.

4. Empirical Analysis

4.1. Graphical Results and Analysis: Actual vs. Optimal Debt

Next, applying the methodology presented in the previous section, optimal leverage was calculated for a sample of 20 banks in fives economies, namely, Bahrain, Kuwait, Malaysia, the United States, and the United Kingdom. For the banks under study, this analysis was performed using the banks’ total long-term debts and total assets. As noted, total long-term debt represents a bank’s total debt with a maturity date of more than one year from the balance-sheet date. Total asset represents the value of a bank’s total assets13.

The vertical axes of Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5 represent the debt ratios, while horizontal axes represent the years. First, Figure 1 shows the optimal debt against actual-debt ratios for the four banks under study in Bahrain. Similarly, Figure 1 shows optimal debt against the actual-debt ratios for the four banks under study in Kuwait. Then, Figure 3, Figure 4 and Figure 5 present the results for optimal debt against the actual-debt ratios for Malaysia, the United States, and the United Kingdom, respectively.

The graphs show the optimal- against the actual-debt ratio for a sample of four banks under study in each of the five countries. The optimal-debt ratios for most of the banks exhibited similar trends, although the trends were more pronounced for conventional than for Islamic banks. For a number of years preceding the 2007–2009 financial crisis, these banks had high optimal-debt ratios. For most of the banks, about a year or two prior to 2007, optimal-debt ratios began to drop, and the decrease was severe in most cases. Overall, optimal debt for most Islamic banks was not as high as optimal debt for conventional banks in this context. On the other hand, the drastic drop in optimal debt right before the crisis for both types of banks exhibited the same behavior. Another interesting observation is that optimal debt for Islamic banks was more stable during the years immediately following the crisis when compared with that of conventional banks, with the exception of a couple of conventional banks. Moreover, the trend of actual debt exceeding optimal debt clearly reversed post-crisis for most banks in the sample.

Each of the banks’ actual-debt ratio was also calculated. As Figure 1, Figure 2, Figure 3, Figure 4 and Figure 5 show, most of the banks exhibited an increase in actual-debt ratio over the years prior to the crisis, with a smoother and less severe increase in the debt ratio of the Islamic banks. In the next paragraphs, each country is separately discussed.

First, on the basis of graphs of banks in Bahrain, the same trend as mentioned earlier can be seen, but only for conventional banks. For example, at the banks of Bahrain and in Kuwait, the optimal-debt ratio was high between 2004 and 2005, and began to decrease in 2006 year after year. The first graph in Figure 1 clearly shows evidence of deterioration, and as the graph shows, it worsened during the year preceding the recent financial crisis; however, the bank clearly began to show an improvement in the optimal-debt ratio since late 2009 on the basis of the graph. On the other hand, when both Islamic banks under study in Bahrain, namely, Salam Bank and Shamil Bank, are examined, debt appears to have been well-managed in general. For Salam Bank, the optimal-debt ratio was smooth throughout the years preceding the crisis and remained so during the crisis. A drop in optimal-debt ratios in 2013 can be observed, which was a result of the bank’s merger with BMI Bank in 2013 that dramatically increased its market cap. For Shamil Bank, optimal debt was relatively higher before the crisis, and began to drop in late 2005 or 2006. In addition, the strong drop in optimal debt for Shamil Bank in 2010 can be attributed to the bank’s acquisition of a significant majority stake in Bahraini Saudi Bank. In general, Bahrain is the leading center for Islamic finance in the Middle East region, with Islamic banks in operation for almost forty years. They managed to better withstand the financial crisis. Moreover, the progress of landmark developments, such as the Bahrain financial harbor and the World Trade Centre, helped enhance the kingdom’s status as a leading financial and business center in the MENA region.

Next, the behavior of Kuwait banks is discussed. The graphs in Figure 2 exhibit the trends of the four banks in Kuwait. Optimal-debt ratio exhibited a trend similar to that of Bahraini banks, except for Boubyan Bank, where the optimal-debt ratio remained almost constant and close to zero throughout the years, while actual debt decreased over the years with some swings from one year to another. This constancy in optimal debt can be attributed to the astronomical increase in the gross revenue of the bank, which was equal to 80% in 2007, as well as the huge increase in total assets growth, equaling 48%, as per the bank’s balance sheets and financial statements. For the National Bank of Bahrain, up until 2005, optimal debt was high, dropped dramatically in 2006, and remained at this low level until 2011, when optimal debt increased again but at a moderate level. The Gulf Bank of Kuwait behaved slightly differently, as there was a decrease in optimal debt from 2000 until 2003, and then another increase until 2007, followed by a steep drop in late 2007. In 2009, optimal debt settled to an acceptable level until 2016. Kuwait Finance House had more frequent swings in optimal-debt ratio, while actual-debt ratio exhibited a smooth decreasing trend from 2000 until 2007, when the debt became well-managed and almost persistent. In general, Islamic banks in Kuwait managed their debts better than conventional banks did before, during, and after the financial crisis. Kuwait experienced a rapid expansion of the Islamic banking segment over the course of the past decade, in addition to Kuwait’s reputation as a center for Islamic banking and policies.

Third, Malaysian banks’ behavior is discussed. Again, high optimal-debt ratio was found for the years prior to 2005, followed by a drop and then another increase after the crisis beginning in 2009. For both conventional banks, actual debt increased. For the United Overseas Bank, actual and optimal debt moved together to a certain extent, but actual debt displayed an increasing trend versus a smoother constant trend for optimal debt. For MayBank, actual debt began to continuously increase from 2005 to 2011, when there was a sharp decline. Optimal debt, on the other hand, was high only between 2005 and 2008. For Bank Islam Berhad, optimal debt was smooth except for a strong decrease in optimal debt in 2006, which was then followed by an immediate increase in 2007. Actual debt for the bank was well-managed, which helped the bank perform well during the crisis with almost no nonperforming loans. Bank Muamalat, which is also an Islamic bank, was similar in behavior to conventional banks during the crisis, exhibiting high actual-debt ratio. It is singled out for its long commitment to Islamic finance, spanning over 30 years, and it has pioneered many of the areas where Islamic banking has most fruitfully developed.

Fourth, United States banks are discussed. Similar to previous countries, optimal-debt ratio was high during the years prior to the crisis and then decreased around 2006 for both types of banks; however, for Islamic banks, optimal-debt ratio remained low after the crisis compared to conventional banks. As shown in Figure 4, Bank of America had high optimal-debt ratio before the crisis; however, the ratio began to drop, and dropped more dramatically in the years immediately preceding the financial crisis. Between 2002 and early 2005, there were high optimal-debt ratios, but a decrease began in mid-2005. The decrease in Bank of America’s actual debt around 2002 can be explained by several bank-specific actions. First, in 2001, revenue increased by 68%, and market stock price increased by 37%. In 2002, Bank of America purchased a 24.9% stake in Grupo Financiero Santander Serfin (GFSS), the subsidiary of Santander Central Hispano in Mexico, for $1.6 billion. GFSS is the third-largest and most profitable banking organization in Mexico14. In 2008, there was a strong decline in the optimal debt of the bank. This is strongly correlated with the bank’s acquisitions of both Merrill Lynch and Countrywide Financial in 2008. The bank’s financial statements clearly showed a strong effect of these acquisitions, which continued over the following several years. This was expected because the acquired firms held significant amounts of risky mortgages and mortgage-backed securities that significantly increased the bank’s debt.

On the other hand, as shown in Figure 4, Wells Fargo improved significantly after the crisis on the basis of the bank’s optimal- and actual-debt ratios. Further, optimal-debt ratio decreased. More importantly, actual-debt ratio remained very low, and debt was well-managed compared to previous years, as well as with other banks. Bank of America’s asset prices began to rise at the end of 2010, thus improving the bank’s actual-debt ratio. Wells Fargo’s actual-debt ratio declined, which could be related to the constant swings in asset prices (Ebisike 2014).

Before discussing Islamic banks in the United States, it should be mentioned that the size of these banks is by far smaller than that of conventional banks, and the comparison is not appropriate in the United States. In the future, it might be useful to include smaller American banks and credit unions in the sample because smaller banks are also less indebted than larger lenders are. While the gap has somewhat closed since the crisis, it is still substantial and can be used for a better comparison with Islamic banks.

Bank of Whittier, one of the Islamic banks in the sample, exhibited a well-managed debt level. This resulted in an extremely low number of nonperforming loans. In his book, Chairman and CEO of Bank of Whittier, Dr. Yahia Abdul-Rahman (2010), provided some case studies of how Islamic banks, particularly Bank of Whittier, handled unstable and nonperforming loans in 2008 and 2009. The approach mainly depended on a close relationship with customers. He stated that, because mortgage payments represent profit generated from assets invested in (financed) for Islamic banks, the responsibility for finding a solution to avoid a bailout during financial instabilities is of both the customer and the banker. Graphs show that Bank of Whittier had a parallel movement of optimal and actual debt between 2004 and 2008, which then remained low until 2016. University Bank Corp was no exception to the trend of optimal-debt ratio being high beginning in 2004 and beginning to drop after 2006. The actual-debt level seemed to be well-managed. The bank faced some legal issues in 2014 and 2015 that negatively affected its balance sheet.

Lastly, for the United Kingdom, the strong conclusion can be made that Islamic banks leveraged less than conventional banks did prior to, during, and after the financial crisis. For Barclays, optimal debt was high between 2004 and 2007, while actual debt was high between 2007 and 2009. For Lloyds, optimal debt was not high, but had frequent swings of ups and downs between 2003 and 2009, when there was a sharp decrease, followed by an increase in 2010. Its actual-debt ratio was highest between 2005 and 2010, although it is not considered that high. Generally speaking, Barclays’ optimal debt decreased over time, while that of Lloyds remained approximately at the same level except for a strike in 2012. Lloyds, following its merger with the Trustee Savings Bank (TSB), took the market lead, which increased the bank’s efficiency, performance, and, consequently, the bank’s debt ratio (Wilson 1999).

On the other hand, both Islamic banks exhibited better debt management. Bank of London and The Middle East had low actual and optimal debt between 2007 and 2013, and the same behavior was observed at the Islamic Bank of Britain. Moreover, graphs posit a decrease in optimal-debt level in 2013 and a striking rise beginning at the end of 2013 and continuing until 2014 for both banks. Amin et al. (2013) stated that 2013 was the year that the shadows of the global financial crisis began to lift both in the United Kingdom in general and in the British Islamic finance industry, with an increase in deposits and investments.

4.2. Graphical Results and Analysis: Excess Debt

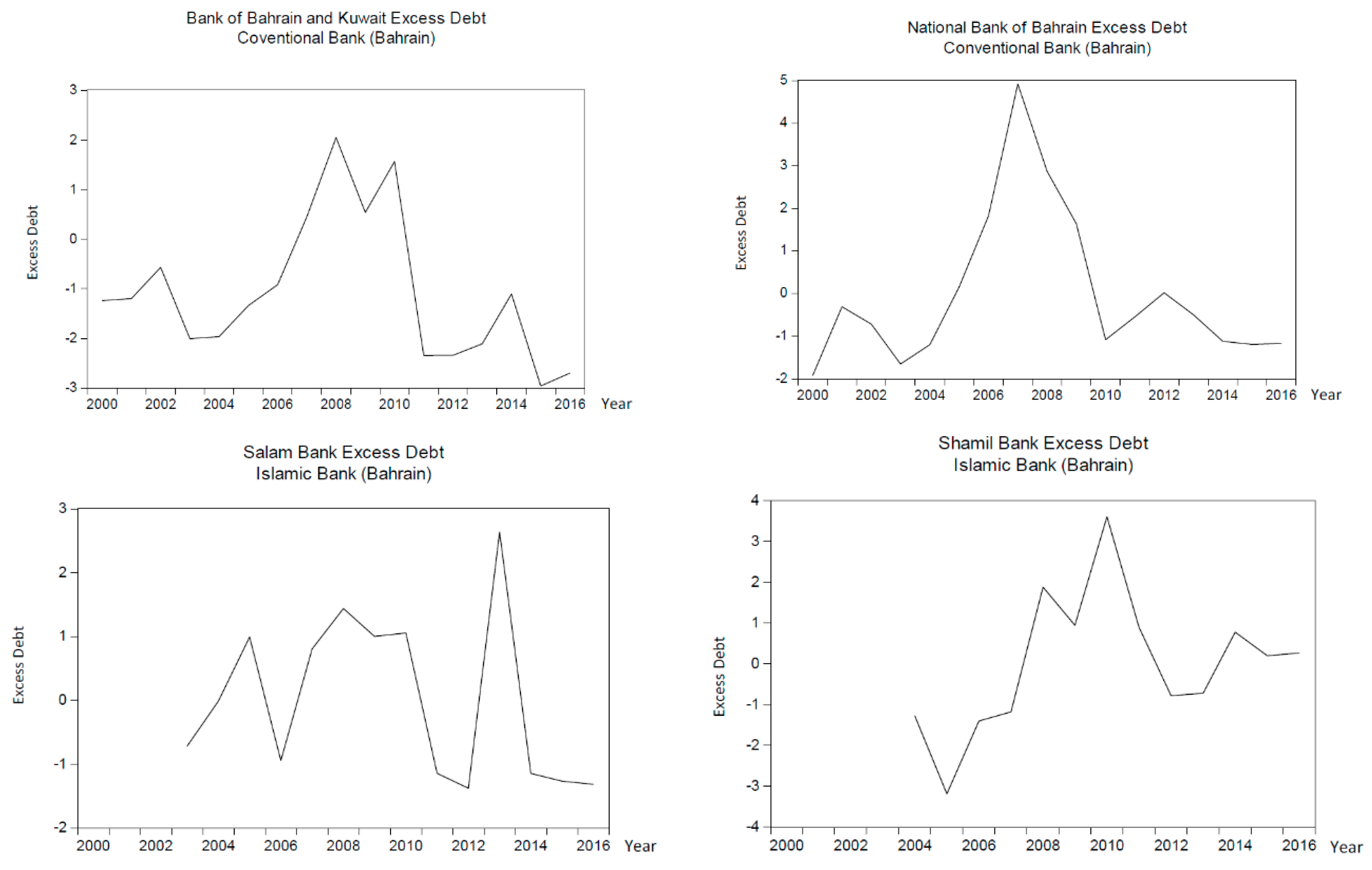

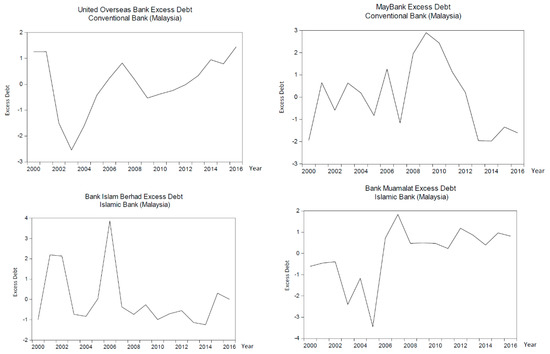

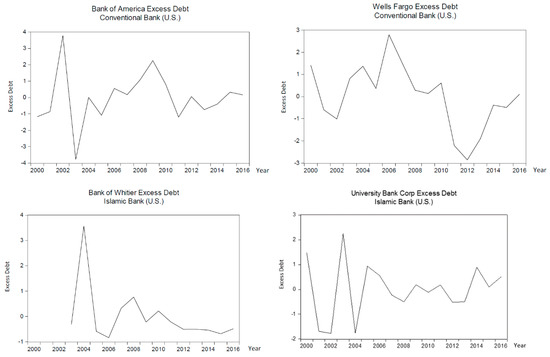

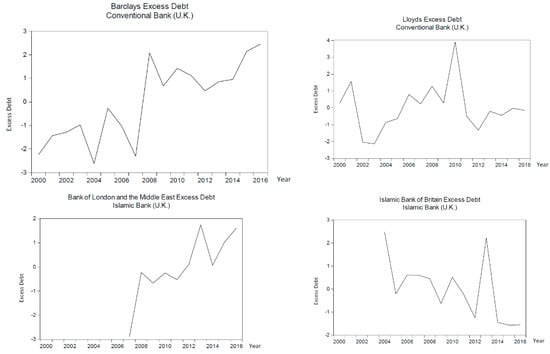

For further analysis, the deviation of the banks’ actual-debt ratios from the mean over the period from 2000 to 2016 was calculated as an alternative proxy for excess-debt ratio. Excess-debt ratios were calculated for the 20 above-mentioned banks. For this calculation, each bank’s total assets and long-term debts were used to calculate debt ratios, as previously noted. Total assets represent the bank’s total balance-sheet assets at the end of the period. Long-term debts are the balance of each bank’s debts that are more than one year due at the end of each period. On the basis of the presented calculation method, the excess debts of the respective banks were calculated15, and graphs of the excess-debt ratios are exhibited in Figure 6, Figure 7, Figure 8, Figure 9 and Figure 10.

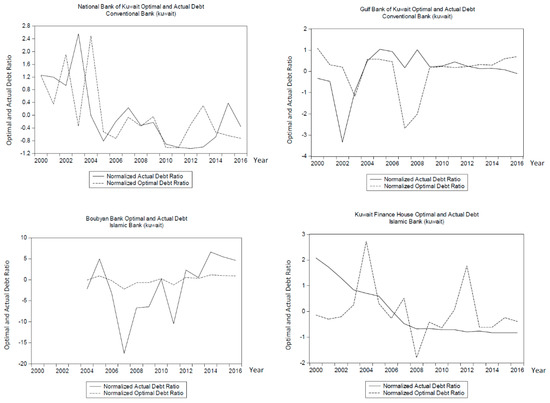

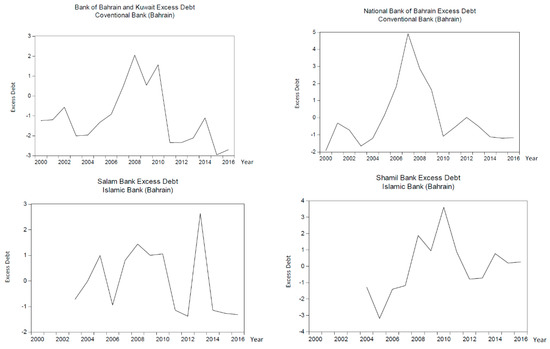

Figure 6.

Bahrain excess debt. Source: Author’s calculations.

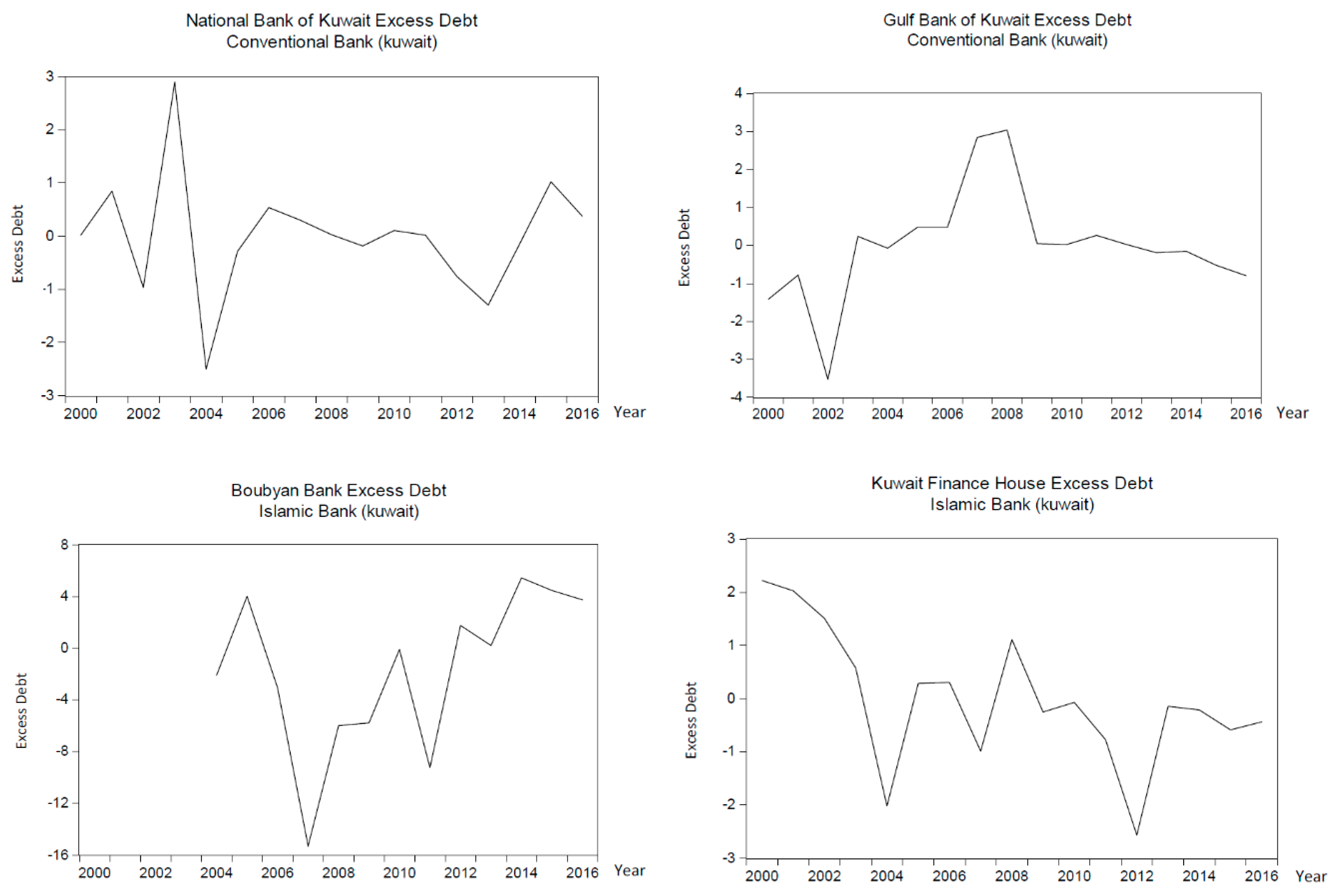

Figure 7.

Kuwait excess debt. Source: Author’s calculations.

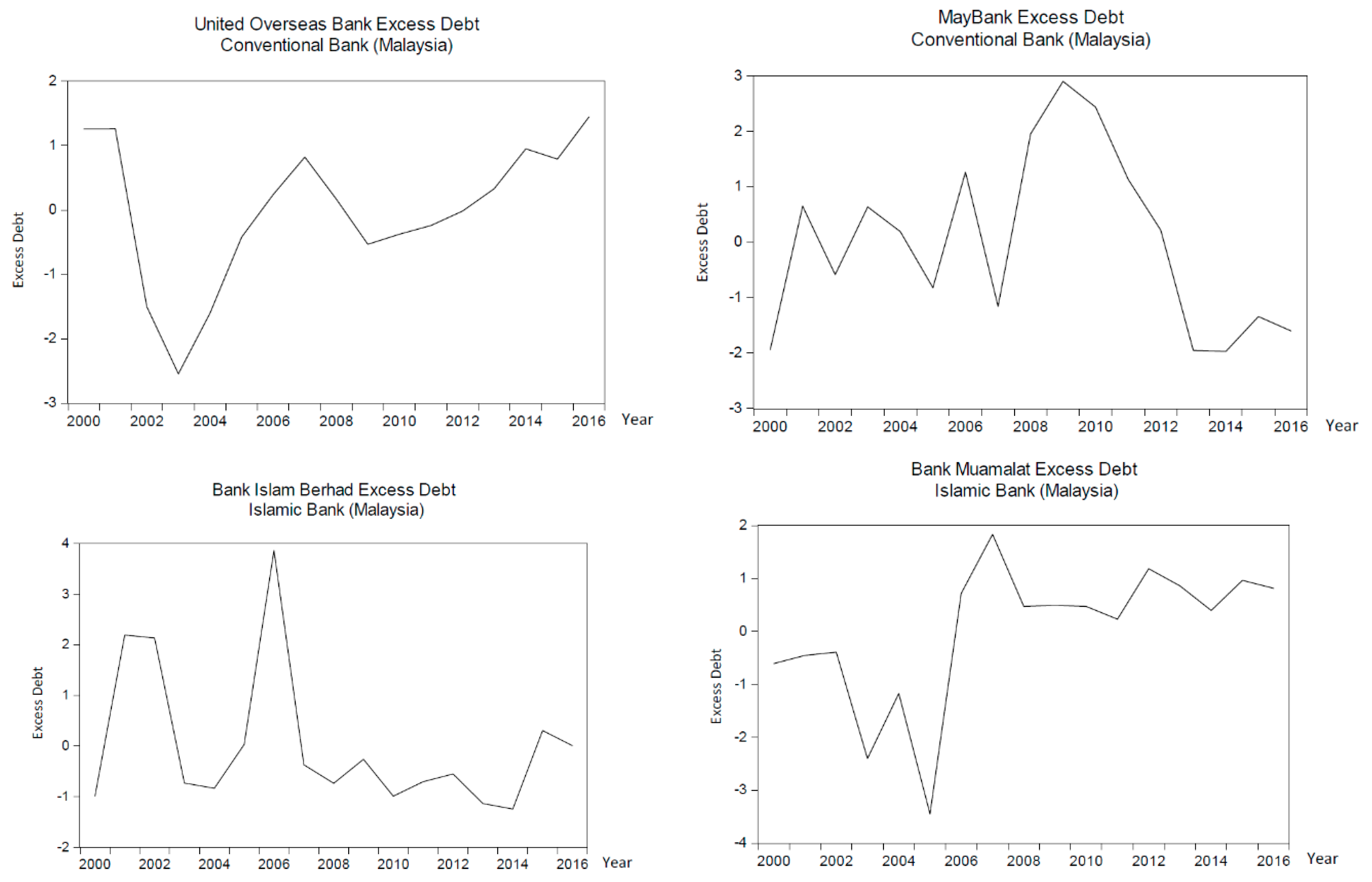

Figure 8.

Malaysia excess debt. Source: Author’s calculations.

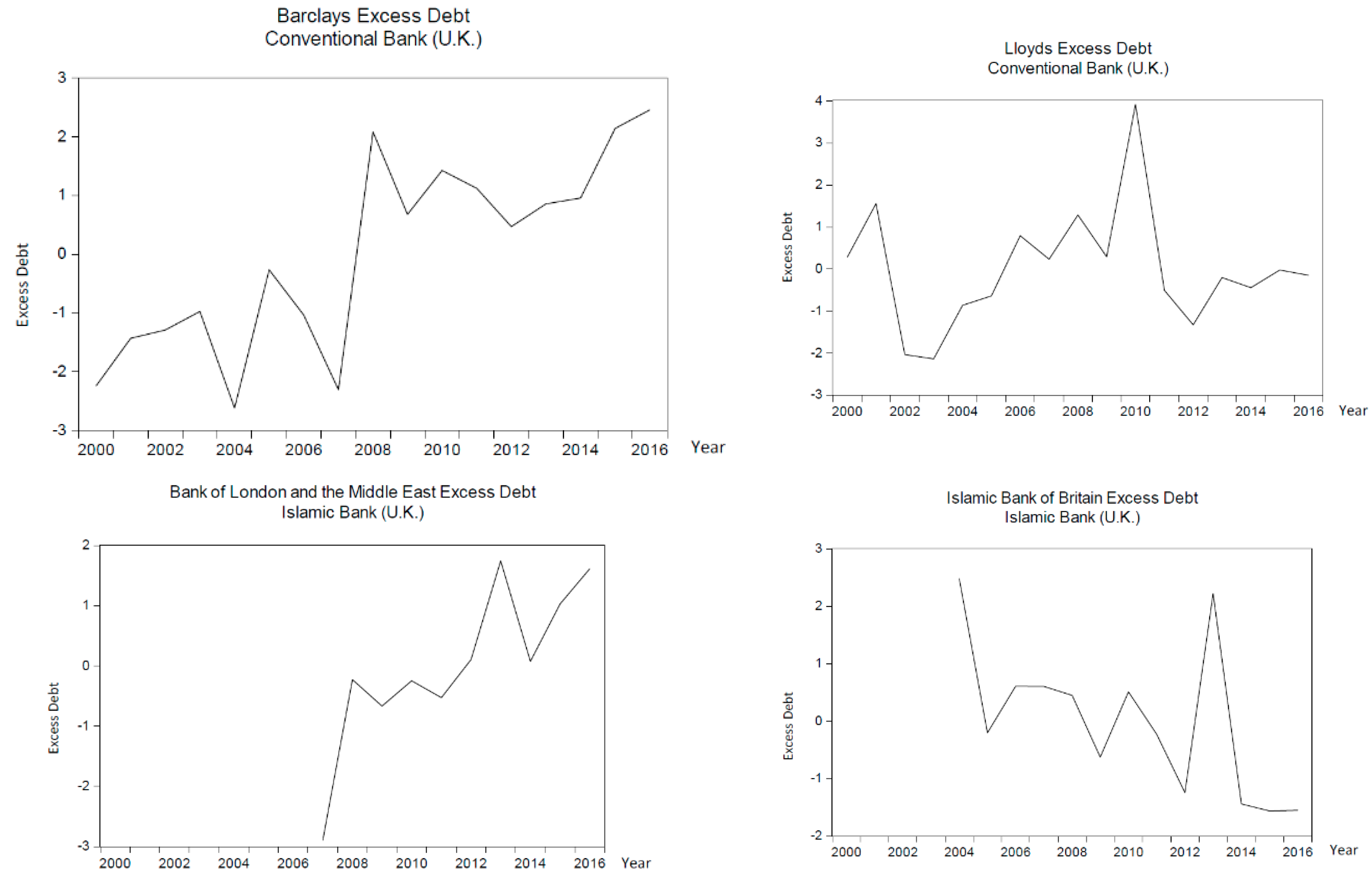

Figure 9.

United States excess debt. Source: Author’s calculations.

Figure 10.

United Kingdom excess debt. Source: Author’s calculations.

In the graphs in Figure 6, Figure 7, Figure 8, Figure 9 and Figure 10, vertical axes are the deviation of debt ratios, namely, excess-debt ratio, while horizontal axes represent years. Graphs show that all banks in this study exhibited a similar movement in debt ratio for most of the period with excess debt between 2007 and 2009 during the financial crisis.

All banks in Bahrain, including Islamic banks, had excess debt in the years preceding and during the financial crisis, with excess debt higher for Islamic banks after the crisis. This occurred because Bahraini Islamic banks also highly relied on leverage, especially after the global crisis, which made them vulnerable to the second-round effect of the global crisis (Hasan and Dridi 2010). Most of the banks exhibited a rise in excess debt between 2010 and 2012, overlapping weak economic growth due to the global economy, with the sovereign-debt crisis in Europe and policy uncertainties in the United States impacting investments and companies. At times of low economic growth, companies begin to face liquidity issues and therefore request more loans, which increases the leverage of banks. Gulf Cooperation Council (GCC) economies were not immune to the effects of the global slowdown, but performed reasonably well as a result of government-sponsored infrastructure projects.

According to the graphs, the Bank of Bahrain and Kuwait had the lowest level of excess debt compared to other Bahraini banks in the sample, placing the bank in a solid position during that period. The capacity of the bank to manage debt and avoid the crisis was because the bank made provisions of BD 44.7 million for the impairment of certain investments, and developed a strategy to reduce the cost-to-income ratio. Because the impairment provision was set against earnings for the years of the crisis, the bank’s balance sheet seemed unaffected, and maintained a strong base of assets, shareholder equity, and liquidity.

Kuwaiti banks showed a similar trend, in addition to a high excess-debt level, during 2000–2002. Overall, Islamic banks in Kuwait performed better during the financial crisis, as illustrated by the graphs, where excess debt was close to zero and not exceeding one, while it reached three for Gulf Bank, which is a conventional bank. The post-crisis effect was observed in Kuwait as well, but it was small except for Boubyan Bank.

For Malaysia, the findings are somewhat different. Conventional banks showed high excess debt before and during the crisis, while Islamic banks maintained a low excess-debt level during and after the crisis. This is due to their lower leverage and higher solvency, which allowed them to meet relatively stronger demand for credit; however, for both types of banks, an increase in excess debt a couple of years preceding the crisis and/or during the crisis was observed, while the level of increase differed from one bank to another. Islamic banks in Bahrain, Kuwait, and Malaysia were not highly exposed to the real-estate sector, which limited the effect of the global crisis on them (Hasan and Dridi 2010).

When examining the Western world, for both the United States and the United Kingdom, Islamic banks clearly leveraged less than conventional banks. Figure 9 and Figure 10 show that conventional banks in both countries had higher excess debt prior to and during the financial crisis. Islamic banks in the United States had few nonperforming mortgages in 2008, and they maintained excess debt at a reasonable level. This was a result of management’s decision to focus on improving debt management at the bank due to the recent crisis. Before the crisis, American Islamic banks funded American corporations, some of which had risky profiles and low credit ratings (Wilson 1999). This resulted in the high excess debt shown in graphs from 2000–2004. Wilson (1999) argued that these funded companies would have been reasonable for conventional banks, but not for Islamic banks that claim a high need for diligence. Few American institutions are involved in Islamic banking thus far mainly due to the steep learning curve, because it is not sufficient to simply understand the technicalities and legal concepts underlying Islamic financing instruments.

Overall, Islamic banks leveraged less than conventional banks in the United States, especially as both Bank of America and Wells Fargo had high excess debt, which made the banks vulnerable during the crisis. To maintain high profits, American banks relied on loans, especially loans with high risks, such as commercial real-estate loans. This made the banks even more vulnerable due to the real-estate boom. In addition, banks increased lending for corporate takeovers and leveraged buyouts, which are highly leveraged transaction loans. The decline in the profitability of banks’ traditional business contributed to the recent crisis (Mishkin 2007). Nevertheless, as mentioned, the comparison between Islamic and conventional banks in the United States is not highly accurate due to the large difference in size.

In general, British banks outperformed American banks during the period preceding and during the crisis. Islamic banks’ products in the United Kingdom, especially Bank of London and the Middle East, highly limit excessive leverage and disruptive financial innovation, which contributes to financial and macroeconomic stability (Hibbs 1977). For the sample of banks in the United Kingdom, Islamic banks had much smaller excess-debt ratio compared to that of conventional banks. For Barclays, excess debt began to increase in 2004, dropped in 2007, and then followed an increasing trend from 2008 onward. For Lloyds, the increasing trend began in 2002, with a spike in 2009, and then the bank had a more stable level of excess debt after 2010. For both Islamic banks, excess-debt ratio was low except for a sharp increase between 2011 and 2013.

The Economist (2009), and El Said and Ziemba (2009) agree that Islamic banks were able to escape subprime exposure, but they remained susceptible to the second-round effect of the global crisis. This can be intuitively concluded because Islamic finance is based on a close link between financial and productive flows; however, Islamic banks were affected by the long duration of the crisis because they operate using asset-backed transactions, but not because of any direct exposure to derivative instruments. Property markets declined in several countries with a substantial Islamic banking presence due to the global recession. These banks were negatively affected because real-estate backed many of their contracts as collateral (Hasan and Dridi 2010).

In general, the results in this paper are in accordance with most of the literature, whether in terms of the reasons behind the financial crisis or when it comes to comparing Islamic and conventional-bank riskiness and performance. The overall picture is very clear regarding debt. Before 2002, overleveraging was not a serious problem, and leveraging was on a sustainable/optimal level for banks; however, leveraging increased after that, leading to instability in the overall banking sector. The measure of overleveraging presented in this paper sheds light on the vulnerability of the banking sector in the countries in context (see Brunnermeier 2009; Brunnermeier and Sannikov 2014; Mittnik and Semmler 2012, 2013; Stein 2011, 2012b; and Gross et al. 2017).

Similarly, the results of the comparison between Islamic and conventional banks are in accordance with most of the literature. Islamic banks leveraged prior to the 2008 financial crisis, which made these banks less vulnerable and more resilient to the financial crisis (see Hidayat and Abduh 2012; Samad 2004; Osborn et al. 2007). Nevertheless, Islamic banks still relied on leveraging in some cases, and were subject to the second-round effect of the global crisis around 2011–2013, where higher excess-debt values were found for Islamic banks. Moreover, the complexity of Islamic banks exposed them to additional risks that lower profitability (see Bitar et al. 2017; Beck et al. 2010).

5. Policy Implication

With respect to our main endeavor, empirical analysis showed that leverage is lower in general at Islamic banks compared with their conventional counterparts. How should policymakers think about Islamic banks? Are these interest-free banks safer than interest-based conventional banks? Are Islamic banks safer than conventional banks and yet profitable enough to survive in the competitive financial world?

A better understanding of these policy questions requires specific knowledge about the riskiness of the banks and the leverage level undertaken by Islamic banks, as well as the profitability of Islamic banks. Indeed, the performance evaluation of Islamic banks and the stability of these types of banks are especially important today since, in the aftermath of all that is going on, we can probably anticipate a rise in nonconventional banking/leveraging activities. It would seem logical that, as conventional funds are leaving some countries, especially in emerging markets, these economies have to rely on their specific advantages to draw additional funds, hence the rise of Islamic banking activity.

Although Islamic banks exhibit a lower level of leverage, its operations are yet characterized by a high degree of financial risks. The reason is that Islamic banks undertake risky operations in order to be able to generate a return that can attract customers when they cannot be guaranteed a return on deposits. What might make Islamic banks unique and attractive in the coming years is the short-term funding and noninterest-earning assets that might be in high need and are considered the main aspects of Islamic banks’ profits.

This paper’s results draw some implications for policy that helps to improve the performance of the banking sector as well. The main policy implication for all countries is to reduce overall risky debt, and develop an optimal-debt structure that needs to be followed in order to avoid the risk of financial instability and default. The first challenge in designing an effective policy to make optimal debt a fixed ratio on the basis of the net worth of a financial corporation is a regulatory one. High risk implies high return; therefore, decreasing the risk by providing secured lending such as in Islamic banks is a challenging task.

This paper tried to distinguish between the optimal and actual leveraging of financial institutions. A further policy challenge is to introduce and strengthen risk-weighted capital buffers and the use of collaterals that can quickly turn into liquidity. Collaterals are a powerful tool of stability despite the repossession cost that they impose on the banks. Policy makers should impose higher collaterals on riskier borrowers, and also for financial institutions exposed to shocks such as oil-price shocks or the COVID-19 pandemic crisis. Finally, when banks see that they are suffering from excess debt, stability instead of high profit should be the driving force. Banks can take a corrective measure by keeping cash flowing, increasing capital requirements and limiting lending to high risk borrowers.

6. Conclusions

This study presented a model that helps to identify the early warning signs of banking crises on the basis of the presence of excess debt or what is called overleveraging. Here, I presented a measure of overleveraging defined as the difference of actual and sustainable debt. Furthermore, I conducted an empirical study on overleveraging for 16 banks in five different countries, and studied the vulnerabilities of banks, and credit and output contractions that could subsequently arise when hit by a crisis.

As results showed, all banks in the sample exhibited high excess-debt levels preceding the crisis. It is argued that excess debt, rather than actual debt, can serve as an early indicator of crises because the presence of excess debt is actually the reason why banks collapse. In other words, it is not sufficient to examine current capital gains and interest rates alone. Drift and trend parameters must be considered as well. This paper presents methodologies that can be used to estimate optimal-debt ratios in the banking sector. Excess debt is, hence, determined by the difference between actual and optimal debt. Empirical results presented in this paper showed that, although banks have different debt ratios, a significant rise in excess-debt ratios often precedes and/or overlaps a banking crisis.

Moreover, this paper provides evidence that Islamic banks managed debt better prior to and during the 2008 financial crisis, but were subject to the second-round effect of the crisis beginning in 2011; however, in theory, the unique feature of Islamic banking, which is its profit-and-loss sharing, is not that different from conventional banking in practice. Therefore, Islamic banks should revisit their strategies to provide higher returns while maintaining banking stability.

This paper has some limitations. For instance, the size of the sample was relatively small. This issue will be addressed in the future by soliciting additional banks and countries, such as Qatar, which would constitute an interesting research study. Moreover, the calculated optimal debt showed some swings; hence, there is a need to smooth the capital-gain variable. Some techniques, such as the HP filter, were applied for some of the banks; however, this did not show any difference, and some irregular and random fluctuations in results of optimal debt were still observed. The moving-average technique could not be applied because it was only available for quarterly or monthly data, and the data used for this paper were annual. Converting annual into quarterly data was attempted, but results were the same. Thus, more advanced approaches should be investigated and applied to provide a smoothed series16. Moreover, Bitar et al. (2017) argued that countries in which the two types of banks operate are more stable. It could be interesting for future research to analyze a sample of banks in countries where only conventional banks operate to measure their excess debt and to compare the results with a similar sample from countries where both types of banks operate.

In conclusion, in the aftermath of all that is currently happening, we can probably anticipate a rise in non-Western-conventional banking/leveraging activities. Current questions are: Can conventional banks withstand the impact of COVID-19? Will the capital and liquidity buffers that they built be sufficient to overcome their borrowing costs and survive the most dramatic economic disaster in history? Would there be a rise in non-Western-conventional or specifically Islamic banking, especially in emerging markets? It would be interesting for future research to look into a concrete indication through data; however, it would seem logical that, as conventional funds are leaving emerging markets, these economies have to rely on their specific advantages to draw additional funds—here, the focus on Islamic banking would be ratified.

Funding

This research received no external funding.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A

Appendix A.1. Mathematical Derivation of Stein’s Optimal Debt

Here Stein shows how the optimal debt ratio is derived in the logarithm case.

The stochastic differential equation is (A1)

where the Debt Ratio is Capital Gain or Loss is ; Productivity of Capital is Interest Rate is ; ; Ratio of Consumption is: and is taken as given.

Let the price evolve as:

where represents the asset’s drift component and the interest rate is represented by the sum of i and a Brownian Motion term as follows:

Substitute (A2) and (A3) in (A1) and derive (A4)

contains the deterministic terms and contains the stochastic terms. To solve for consider the change in in (A5). This is based upon Ito equation of the stochastic calculus. A great virtue of using logarithm criterion is that one does not need to use dynamic programming. The expectation of is (A6).

The correlation is negative, which increases risk. .

The optimal debt ratio maximises the difference between the Mean and Risk.

s.t.

Appendix A.1.1. Model I

Model I assumes that the price has a trend and a deviation from it (A8). The deviation follows an Ornstein-Uhlenbeck ergodic mean reverting process (A9). Coefficient is positive and finite. The interest rate is the same as in model II.

The deviation from the trend is demonstrated through:

The mean reversion aspect characterized by a convergence of is defined as:

In this model, Stein defines E(dw) = 0;

Stein constrains the solution such that r and calls this the “No free lunch constraint.” Therefore, using the stochastic calculus in model I is the first term in (A10):

where represents the asset’s drift component and the interest rate is represented by the sum of i and a Brownian Motion term as follows:

Substituting (A10) in (A7) and derive (A11), the optimal debt ratio in model I is as follows:

Consider as deterministic.

Appendix A.1.2. Model II

In model II, the price equation is (12). The drift is πdt and the diffusion is

The optimal debt ratio is (13). Consider as deterministic.

s.t.

In terms of a maximization portfolio decision we have:

Appendix B

Table A1.

List of Banks

Table A1.

List of Banks

| Bank Name | Type | Country |

|---|---|---|

| Bank of Bahrain and Kuwait | Conventional Bank | Bahrain |

| National Bank of Bahrain | Conventional Bank | Bahrain |

| Salam Bank | Islamic Bank | Bahrain |

| Shamil Bank | Islamic Bank | Bahrain |

| National Bank of Kuwait | Conventional Bank | Kuwait |

| Gulf Bank of Kuwait | Conventional Bank | Kuwait |

| Boubyan Bank | Islamic Bank | Kuwait |

| Kuwait Finance House | Islamic Bank | Kuwait |

| United Overseas Bank | Conventional Bank | Malaysia |

| MayBank | Conventional Bank | Malaysia |

| Bank Islam Berhad | Islamic Bank | Malaysia |

| Bank Muamalat | Islamic Bank | Malaysia |

| Bank of America | Conventional Bank | United States |

| Wells Fargo | Conventional Bank | United States |

| Bank of Whittier | Islamic Bank | United States |

| University Bank Corp | Islamic Bank | United States |

| Barclays | Conventional Bank | United Kingdom |

| Lloyds | Conventional Bank | United Kingdom |

| Bank of London and the Middle East | Islamic Bank | United Kingdom |

| Islamic Bank of Britain | Islamic Bank | United Kingdom |

Appendix C

Table A2.

Calculations of Optimal and Excess Debt: Bank of Bahrain and Kuwait.

Table A2.

Calculations of Optimal and Excess Debt: Bank of Bahrain and Kuwait.

| Bank | Year | Capital Gains/ (losses), (r ) | Interest Rate (i) | Beta (Productivity of Capital, β) | Beta variance (αy(t)) | Half Square of Capital Gain Variance | Correlation of Interest and Capital Gain Variables | Interest Rate Variance | Capital Gain Variance | Correlation and Variances of Interest and Capital Gain | Std. Deviation of Interest Rate | Std. Deviation of Capital Gain | 2 x (Correlation and Variances of Interest and Capital Gain) | Risk | Optimal Debt Ratio, ƒ*(t) | Normalized Optimal Debt Ratio | Actual Debt Ratio | Normalized Actual Debt Ratio | Excess Debt |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bank of Bahrain and Kuwait | 2000 | 0.035948 | 0.0209 | 0.025349 | (0.009) | 0.001 | 0.33 | 0.0001 | (0.0416) | (0.0000) | 0.0112 | 0.1543 | (0.0000) | 0.166 | 0.29 | 0.87 | 0.236872 | (0.37) | (1.24) |

| 2001 | 0.041504 | 0.0267 | 0.032331 | (0.002) | 0.001 | 0.33 | 0.0059 | (0.0360) | (0.0001) | 0.0112 | 0.1543 | (0.0001) | 0.166 | 0.29 | 0.86 | 0.254565 | (0.34) | (1.20) | |

| 2002 | 0.073967 | 0.018 | 0.003159 | (0.031) | 0.003 | 0.34 | (0.0028) | (0.0035) | 0.0000 | 0.0112 | 0.1543 | 0.0000 | 0.165 | 0.53 | 1.13 | 0.69835 | 0.56 | (0.57) | |

| 2003 | 0.138663 | 0.011 | 0.033255 | (0.001) | 0.010 | 0.34 | (0.0098) | 0.0611 | (0.0002) | 0.0112 | 0.1543 | (0.0004) | 0.166 | 0.92 | 1.57 | 0.205046 | (0.44) | (2.01) | |

| 2004 | 0.088788 | 0.013 | 0.037132 | 0.003 | 0.004 | 0.37 | (0.0078) | 0.0113 | (0.0000) | 0.0112 | 0.1543 | (0.0001) | 0.166 | 0.64 | 1.26 | 0.070744 | (0.71) | (1.97) | |

| 2005 | 0.063932 | 0.033 | 0.031825 | (0.002) | 0.002 | 0.39 | 0.0122 | (0.0136) | (0.0001) | 0.0112 | 0.1543 | (0.0001) | 0.166 | 0.38 | 0.96 | 0.235672 | (0.38) | (1.34) | |

| 2006 | 0.430349 | 0.049 | 0.034116 | (0.000) | 0.093 | 0.41 | 0.0282 | 0.3528 | 0.0041 | 0.0112 | 0.1543 | 0.0081 | 0.157 | 2.08 | 2.88 | 1.387948 | 1.96 | (0.92) | |

| 2007 | −0.0284 | 0.037 | 0.036741 | 0.003 | 0.000 | (0.04) | 0.0162 | (0.1059) | 0.0001 | 0.0112 | 0.1543 | 0.0002 | 0.165 | (0.19) | 0.32 | 0.8 | 0.77 | 0.45 | |

| 2008 | −0.05395 | 0.0295 | 0.052763 | 0.019 | 0.001 | 0.09 | 0.0087 | (0.1315) | (0.0001) | 0.0112 | 0.1543 | (0.0002) | 0.166 | (0.31) | 0.19 | 1.52585 | 2.24 | 2.05 | |

| 2009 | 0.019355 | 0.0159 | 0.039745 | 0.006 | 0.000 | 0.37 | (0.0049) | (0.0582) | 0.0001 | 0.0112 | 0.1543 | 0.0002 | 0.165 | 0.23 | 0.79 | 1.078156 | 1.33 | 0.54 | |

| 2010 | −0.30252 | 0.0133 | 0.045063 | 0.011 | 0.046 | 0.38 | (0.0075) | (0.3800) | 0.0011 | 0.0112 | 0.1543 | 0.0022 | 0.163 | (2.00) | (1.72) | 0.346702 | (0.15) | 1.57 | |

| 2011 | 0.17931 | 0.0225 | 0.044219 | 0.010 | 0.016 | 0.65 | 0.0017 | 0.1018 | 0.0001 | 0.0112 | 0.1543 | 0.0002 | 0.165 | 1.06 | 1.73 | 0.117191 | (0.62) | (2.35) | |

| 2012 | 0.152295 | 0.0159 | 0.03695 | 0.003 | 0.012 | 0.67 | (0.0049) | 0.0748 | (0.0002) | 0.0112 | 0.1543 | (0.0005) | 0.166 | 0.96 | 1.61 | 0.061531 | (0.73) | (2.34) | |

| 2013 | 0.093535 | 0.0082 | 0.033621 | (0.001) | 0.004 | 0.67 | (0.0126) | 0.0160 | (0.0001) | 0.0112 | 0.1543 | (0.0003) | 0.166 | 0.69 | 1.32 | 0.029262 | (0.79) | (2.11) | |

| 2014 | −0.05067 | 0.007 | 0.032519 | (0.002) | 0.001 | 0.68 | (0.0138) | (0.1282) | 0.0012 | 0.0112 | 0.1543 | 0.0024 | 0.163 | (0.14) | 0.37 | 0.059426 | (0.73) | (1.11) | |

| 2015 | 0.239627 | 0.012 | 0.033432 | (0.001) | 0.029 | (1.00) | (0.0088) | 0.1621 | 0.0014 | 0.0112 | 0.1543 | 0.0029 | 0.163 | 1.44 | 2.16 | 0.027358 | (0.80) | (2.96) | |

| 2016 | 0.196 | 0.0209 | 0.028069 | (0.006) | 0.019 | (1.00) | 0.0001 | 0.1185 | (0.0000) | 0.0112 | 0.1543 | (0.0000) | 0.003 | 1.21 | 1.90 | 0.025771 | (0.80) | (2.70) |

Table A3.

Calculations of Optimal and Excess Debt: National Bank of Bahrain.

Table A3.

Calculations of Optimal and Excess Debt: National Bank of Bahrain.

| Bank | Year | Capital Gains/(Losses), (r ) | Interest Rate (i) | Beta (Productivity of Capital, β) | Beta Variance (αy(t)) | Half Square of Capital Gain Variance | Correlation of Interest and Capital Gain Variables | Interest Rate Variance | Capital Gain Variance | Correlation and Variances of Interest and Capital Gain | Std. Deviation of Interest Rate | Std. Deviation of Capital Gain | 2 x (Correlation and Variances of Interest and Capital Gain) | Risk | Optimal Debt Ratio, ƒ*(t) | Normalized Optimal Debt Ratio | Actual Debt Ratio | Normalized Actual Debt Ratio | Excess Debt |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| National Bank of Bahrain | 2000 | 0.166589 | 0.0209 | 0.0531 | (0.007) | 0.014 | (0.51) | 0.0001 | 0.0951 | (0.0000) | 0.0112 | 0.0682 | (0.0000) | 0.079 | 2.41 | 1.16 | 0.194007 | (0.76) | (1.92) |

| 2001 | 0.041728 | 0.0267 | 0.057698 | (0.002) | 0.001 | (0.51) | 0.0059 | (0.0298) | 0.0001 | 0.0112 | 0.0682 | 0.0002 | 0.079 | 0.93 | (0.43) | 0.195552 | (0.74) | (0.31) | |

| 2002 | 0.072756 | 0.018 | 0.054797 | (0.005) | 0.003 | (0.51) | (0.0028) | 0.0012 | 0.0000 | 0.0112 | 0.0682 | 0.0000 | 0.079 | 1.41 | 0.08 | 0.206507 | (0.64) | (0.72) | |

| 2003 | 0.14795 | 0.011 | 0.056187 | (0.004) | 0.011 | (0.51) | (0.0098) | 0.0764 | 0.0004 | 0.0112 | 0.0682 | 0.0008 | 0.079 | 2.37 | 1.12 | 0.217089 | (0.54) | (1.66) | |

| 2004 | 0.108767 | 0.013 | 0.058259 | (0.002) | 0.006 | (0.51) | (0.0078) | 0.0372 | 0.0001 | 0.0112 | 0.0682 | 0.0003 | 0.079 | 1.89 | 0.60 | 0.211194 | (0.60) | (1.20) | |

| 2005 | 0.017907 | 0.033 | 0.057255 | (0.003) | 0.000 | (0.51) | 0.0122 | (0.0536) | 0.0003 | 0.0112 | 0.0682 | 0.0007 | 0.079 | 0.57 | (0.83) | 0.203157 | (0.67) | 0.15 | |

| 2006 | 0.084808 | 0.049 | 0.048394 | (0.011) | 0.004 | (0.51) | 0.0282 | 0.0133 | (0.0002) | 0.0112 | 0.0682 | (0.0004) | 0.080 | 1.15 | (0.20) | 0.447588 | 1.62 | 1.82 | |

| 2007 | −0.12275 | 0.037 | 0.048615 | (0.011) | 0.008 | (0.51) | 0.0162 | (0.1943) | 0.0016 | 0.0112 | 0.0682 | 0.0032 | 0.076 | (1.39) | (2.94) | 0.48535 | 1.98 | 4.92 | |

| 2008 | −0.01062 | 0.0295 | 0.043831 | (0.016) | 0.000 | (0.51) | 0.0087 | (0.0822) | 0.0004 | 0.0112 | 0.0682 | 0.0007 | 0.079 | 0.25 | (1.17) | 0.455625 | 1.70 | 2.87 | |

| 2009 | 0.062447 | 0.0159 | 0.033267 | (0.027) | 0.002 | (0.51) | (0.0049) | (0.0091) | (0.0000) | 0.0112 | 0.0682 | (0.0000) | 0.079 | 1.31 | (0.02) | 0.447103 | 1.62 | 1.64 | |

| 2010 | 0.116453 | 0.0133 | 0.039456 | (0.020) | 0.007 | (0.51) | (0.0075) | 0.0449 | 0.0002 | 0.0112 | 0.0682 | 0.0003 | 0.079 | 1.98 | 0.69 | 0.233302 | (0.39) | (1.08) | |

| 2011 | 0.088381 | 0.0225 | 0.028235 | (0.032) | 0.004 | (0.51) | 0.0017 | 0.0168 | (0.0000) | 0.0112 | 0.0682 | (0.0000) | 0.079 | 1.53 | 0.21 | 0.239318 | (0.33) | (0.55) | |

| 2012 | 0.034268 | 0.0159 | 0.047863 | (0.012) | 0.001 | (0.51) | (0.0049) | (0.0373) | (0.0001) | 0.0112 | 0.0682 | (0.0002) | 0.080 | 0.97 | (0.39) | 0.23483 | (0.37) | 0.02 | |

| 2013 | 0.060448 | 0.0082 | 0.042752 | (0.017) | 0.002 | (0.51) | (0.0126) | (0.0111) | (0.0001) | 0.0112 | 0.0682 | (0.0001) | 0.080 | 1.38 | 0.05 | 0.227359 | (0.44) | (0.50) | |

| 2014 | 0.113977 | 0.007 | 0.242594 | 0.183 | 0.006 | (0.51) | (0.0138) | 0.0424 | 0.0003 | 0.0112 | 0.0682 | 0.0006 | 0.079 | 2.04 | 0.76 | 0.236065 | (0.36) | (1.12) | |

| 2015 | 0.117358 | 0.012 | 0.059611 | (0.000) | 0.007 | (0.51) | (0.0088) | 0.0458 | 0.0002 | 0.0112 | 0.0682 | 0.0004 | 0.079 | 2.01 | 0.72 | 0.224724 | (0.47) | (1.19) | |

| 2016 | 0.115698 | 0.0209 | 0.044737 | (0.015) | 0.007 | (0.51) | 0.0001 | 0.0442 | (0.0000) | 0.0112 | 0.0682 | (0.0000) | 0.079 | 1.86 | 0.57 | 0.210441 | (0.60) | (1.17) |

Table A4.

Calculations of Optimal and Excess Debt: Salam.

Table A4.

Calculations of Optimal and Excess Debt: Salam.

| Bank | Year | Capital Gains/ (Losses), (r ) | Interest Rate (i) | Beta (Productivity of Capital, β) | Beta Variance (αy(t)) | Half Square of Capital Gain Variance | Correlation of Interest and Capital Gain Variables | Interest Rate Variance | Capital Gain Variance | Correlation and Variances of Interest and Capital Gain | Std. Deviation of Interest Rate | Std. Deviation of Capital Gain | 2 x (Correlation and Variances of Interest and Capital Gain) | Risk | Optimal Debt Ratio, ƒ*(t) | Normalized Optimal Debt Ratio | Actual Debt Ratio | Normalized Actual Debt Ratio | Excess Debt |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Salam | 2006 | 0.28948 | 0.049 | 0.090492 | (0.549) | 0.042 | 0.29 | 0.0280 | 0.4546 | 0.0037 | 0.0129 | 0.9810 | 0.0073 | 0.987 | 0.85 | 0.37 | 0.037723 | (0.48) | (0.85) |

| 2007 | 0.093897 | 0.037 | 0.206722 | (0.433) | 0.004 | 0.29 | 0.0160 | 0.2590 | 0.0012 | 0.0129 | 0.9810 | 0.0024 | 0.992 | 0.70 | 0.31 | 0.153804 | 1.12 | 0.82 | |

| 2008 | −0.48842 | 0.0295 | 0.214255 | (0.425) | 0.119 | 0.29 | 0.0085 | (0.3233) | (0.0008) | 0.0129 | 0.9810 | (0.0016) | 0.995 | 0.00 | 0.00 | 0.174155 | 1.40 | 1.40 | |

| 2009 | −0.25221 | 0.0159 | 0.087267 | (0.552) | 0.032 | 0.29 | (0.0051) | (0.0871) | 0.0001 | 0.0129 | 0.9810 | 0.0003 | 0.994 | 0.34 | 0.15 | 0.155421 | 1.15 | 0.99 | |

| 2010 | 0.013407 | 0.0133 | 0.07927 | (0.560) | 0.000 | 0.29 | (0.0077) | 0.1785 | (0.0004) | 0.0129 | 0.9810 | (0.0008) | 0.995 | 0.64 | 0.28 | 0.169291 | 1.34 | 1.05 | |

| 2011 | 0.006393 | 0.0225 | 0.148245 | (0.491) | 0.000 | 0.29 | 0.0015 | 0.1715 | 0.0001 | 0.0129 | 0.9810 | 0.0001 | 0.994 | 0.63 | 0.28 | 0.01643 | (0.77) | (1.05) | |

| 2012 | 0.682094 | 0.0159 | 0.207661 | (0.432) | 0.233 | 0.29 | (0.0051) | 0.8472 | (0.0012) | 0.0129 | 0.9810 | (0.0025) | 0.996 | 1.08 | 0.47 | 0.01547 | (0.79) | (1.26) | |

| 2013 | −2.96427 | 0.0082 | 1.040925 | 0.401 | 4.393 | 0.29 | (0.0128) | (2.7991) | 0.0103 | 0.0129 | 0.9810 | 0.0207 | 0.973 | (6.90) | (2.99) | 0.023331 | (0.68) | 2.31 | |

| 2014 | 0.070685 | 0.007 | 1.354018 | 0.715 | 0.002 | 0.29 | (0.0140) | 0.2358 | (0.0010) | 0.0129 | 0.9810 | (0.0019) | 0.996 | 0.70 | 0.31 | 0.018723 | (0.74) | (1.05) | |

| 2015 | 0.406731 | 0.012 | 1.742688 | 1.103 | 0.083 | 0.29 | (0.0090) | 0.5719 | (0.0015) | 0.0129 | 0.9810 | (0.0030) | 0.997 | 0.95 | 0.42 | 0.018835 | (0.74) | (1.16) | |

| 2016 | 0.32568 | 0.0209 | 1.862311 | 1.223 | 0.053 | 0.29 | (0.0001) | 0.4908 | (0.0000) | 0.0129 | 0.9810 | (0.0000) | 0.994 | 0.90 | 0.39 | 0.013584 | (0.81) | (1.21) |

Table A5.

Calculations of Optimal and Excess Debt: Shamil.

Table A5.

Calculations of Optimal and Excess Debt: Shamil.

| Bank | Year | Capital Gains/(Losses), (r ) | Interest Rate (i) | Beta (Productivity of Capital, β) | Beta Variance (αy(t)) | Half Square of Capital Gain Variance | Correlation of Interest and Capital Gain Variables | Interest Rate Variance | Capital Gain Variance | Correlation and Variances of Interest and Capital Gain | Std. Deviation of Interest Rate | Std. Deviation of Capital Gain | 2 x (Correlation and Variances of Interest and Capital Gain) | Risk | Optimal Debt Ratio, ƒ*(t) | Normalized Optimal Debt Ratio | Actual Debt Ratio | Normalized Actual Debt Ratio | Excess Debt |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shamil | 2004 | −0.06515 | 0.013 | 0.137938 | (0.005) | 0.002 | 0.06 | (0.0083) | (0.2037) | 0.0001 | 0.0125 | 0.5135 | 0.0002 | 0.526 | 0.12 | (0.21) | 0.038924 | (1.49) | (1.28) |

| 2005 | 0.838895 | 0.033 | 0.123874 | (0.019) | 0.352 | 0.06 | 0.0117 | 0.7003 | 0.0005 | 0.0125 | 0.5135 | 0.0010 | 0.525 | 1.14 | 1.50 | 0.018369 | (1.68) | (3.19) | |

| 2006 | 0.23448 | 0.049 | 0.075787 | (0.067) | 0.027 | 0.06 | 0.0277 | 0.0959 | 0.0002 | 0.0125 | 0.5135 | 0.0003 | 0.526 | 0.57 | 0.55 | 0.105952 | (0.85) | (1.40) | |

| 2007 | 0.16803 | 0.037 | 0.195192 | 0.052 | 0.014 | 0.06 | 0.0157 | 0.0295 | 0.0000 | 0.0125 | 0.5135 | 0.0001 | 0.526 | 0.49 | 0.42 | 0.115486 | (0.76) | (1.18) | |

| 2008 | −0.14689 | 0.0295 | 0.093179 | (0.050) | 0.011 | 0.06 | 0.0082 | (0.2854) | (0.0001) | 0.0125 | 0.5135 | (0.0003) | 0.526 | (0.08) | (0.55) | 0.335118 | 1.32 | 1.88 | |

| 2009 | −0.02378 | 0.0159 | 0.109571 | (0.033) | 0.000 | 0.06 | (0.0054) | (0.1623) | 0.0001 | 0.0125 | 0.5135 | 0.0001 | 0.526 | 0.20 | (0.08) | 0.286356 | 0.86 | 0.94 | |

| 2010 | −0.63694 | 0.0133 | 0.137254 | (0.006) | 0.203 | 0.06 | (0.0080) | (0.7755) | 0.0004 | 0.0125 | 0.5135 | 0.0008 | 0.525 | (1.35) | (2.69) | 0.292248 | 0.92 | 3.60 | |

| 2011 | −0.02243 | 0.0225 | 0.121374 | (0.021) | 0.000 | 0.06 | 0.0012 | (0.1610) | (0.0000) | 0.0125 | 0.5135 | (0.0000) | 0.526 | 0.19 | (0.10) | 0.279813 | 0.80 | 0.90 | |

| 2012 | −0.0387 | 0.0159 | 0.258069 | 0.115 | 0.001 | 0.06 | (0.0054) | (0.1772) | 0.0001 | 0.0125 | 0.5135 | 0.0001 | 0.526 | 0.17 | (0.13) | 0.099477 | (0.91) | (0.78) | |

| 2013 | 1.47713 | 0.0082 | 0.142039 | (0.001) | 1.091 | 0.06 | (0.0131) | 1.3386 | (0.0011) | 0.0125 | 0.5135 | (0.0021) | 0.528 | 0.98 | 1.24 | 0.250673 | 0.52 | (0.72) | |

| 2014 | −0.07402 | 0.007 | 0.169908 | 0.027 | 0.003 | 0.06 | (0.0143) | (0.2126) | 0.0002 | 0.0125 | 0.5135 | 0.0004 | 0.526 | 0.11 | (0.22) | 0.253831 | 0.55 | 0.77 | |

| 2015 | 0.069478 | 0.012 | 0.154903 | 0.012 | 0.002 | 0.06 | (0.0093) | (0.0691) | 0.0000 | 0.0125 | 0.5135 | 0.0001 | 0.526 | 0.38 | 0.22 | 0.239775 | 0.42 | 0.20 | |

| 2016 | 0.020982 | 0.0209 | 0.137954 | (0.005) | 0.000 | 0.06 | (0.0004) | (0.1176) | 0.0000 | 0.0125 | 0.5135 | 0.0000 | 0.526 | 0.27 | 0.04 | 0.228215 | 0.31 | 0.26 |

Table A6.

Calculations of Optimal and Excess Debt: National Bank of Kuwait.

Table A6.

Calculations of Optimal and Excess Debt: National Bank of Kuwait.

| Bank | Year | Capital Gains/ (Losses), (r ) | Interest Rate (i) | Beta (Productivity of Capital, β) | Beta Variance (αy(t)) | Half Square of Capital Gain Variance | Correlation of Interest and Capital Gain Variables | Interest Rate Variance | Capital Gain Variance | Correlation and Variances of Interest and Capital Gain | Std. Deviation of Interest Rate | Std. Deviation of Capital Gain | 2 x (Correlation and Variances of Interest and Capital Gain) | Risk | Optimal Debt Ratio, ƒ*(t) | Normalized Optimal Debt Ratio | Actual Debt Ratio | Normalized Actual Debt RATIO | Excess Debt |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| National Bank of Kuwait | 2000 | 0.297217 | 0.0209 | 0.064684 | (0.001) | 0.044 | (0.17) | (0.0003) | 0.2393 | 0.0000 | 0.0113 | 0.2373 | 0.0000 | 0.249 | 1.20 | 1.24 | 0.045879 | 1.26 | 0.02 |

| 2001 | 0.104353 | 0.0267 | 0.062055 | (0.003) | 0.005 | (0.17) | 0.0055 | 0.0464 | (0.0000) | 0.0113 | 0.2373 | (0.0001) | 0.249 | 0.55 | 0.35 | 0.044998 | 1.20 | 0.85 | |

| 2002 | 0.486797 | 0.018 | 0.055328 | (0.010) | 0.118 | (0.17) | (0.0032) | 0.4289 | 0.0002 | 0.0113 | 0.2373 | 0.0005 | 0.248 | 1.68 | 1.90 | 0.041164 | 0.94 | (0.97) | |