Technology Acceptance in e-Governance: A Case of a Finance Organization

Abstract

1. Introduction

2. Theoretical Background

2.1. Finance Organization

2.2. A Brief Review of Technology Acceptance Theories

2.3. The Role of Theories in the Finance Organization

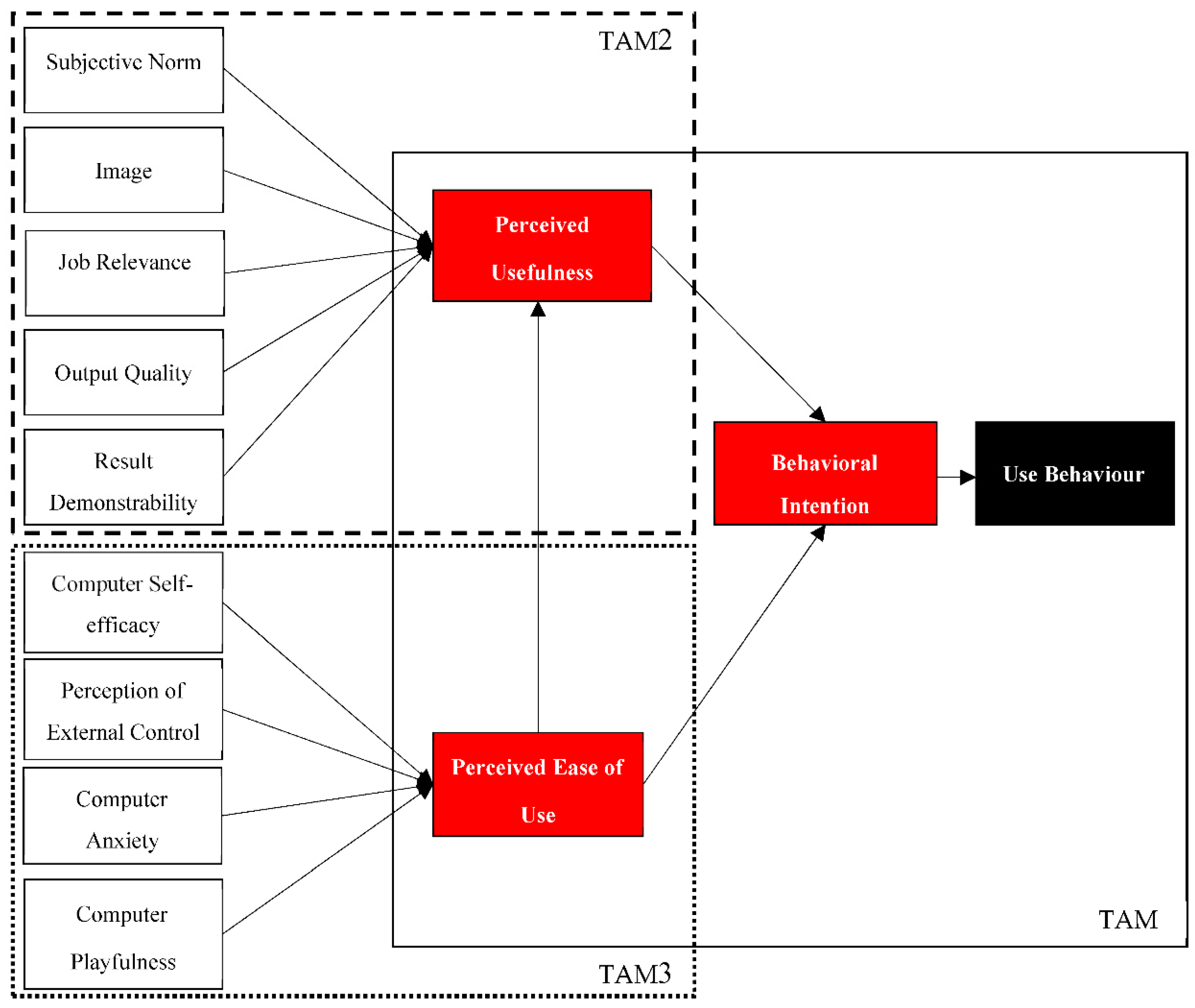

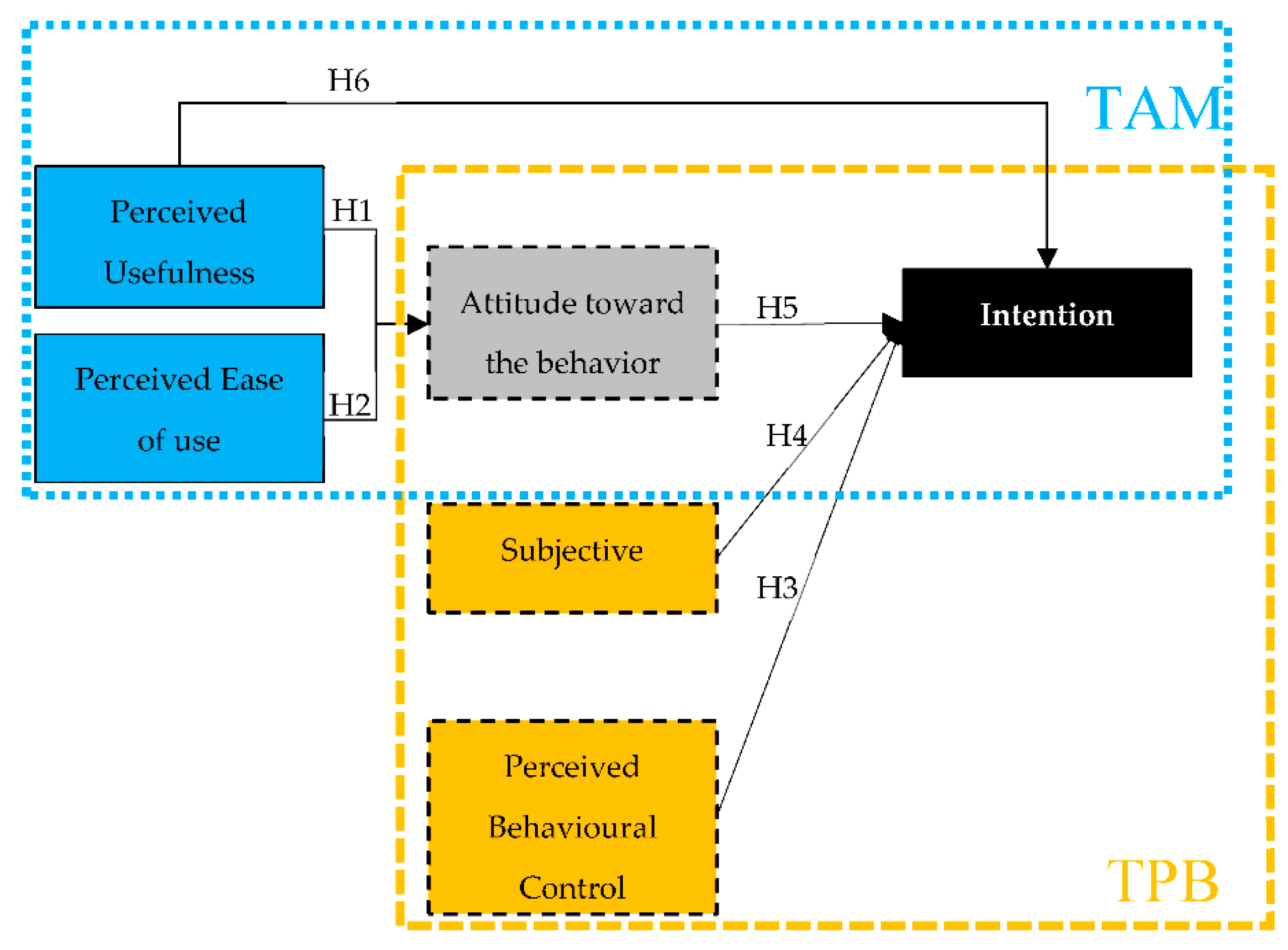

3. A Review of Models and Hypotheses Development

4. Data Analysis

4.1. Statistical Population and Sample

4.2. Composite Reliability

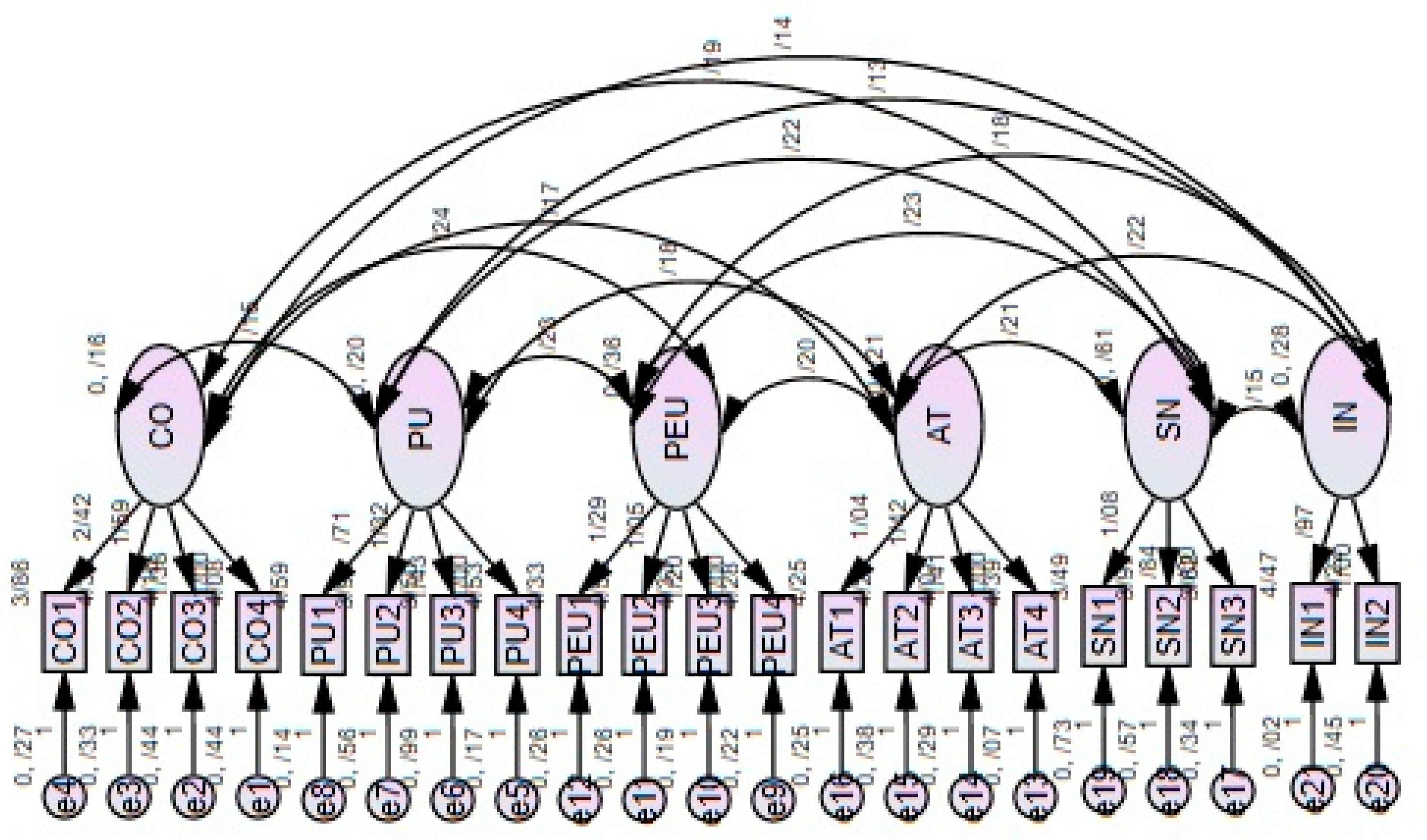

4.3. Convergent Validity

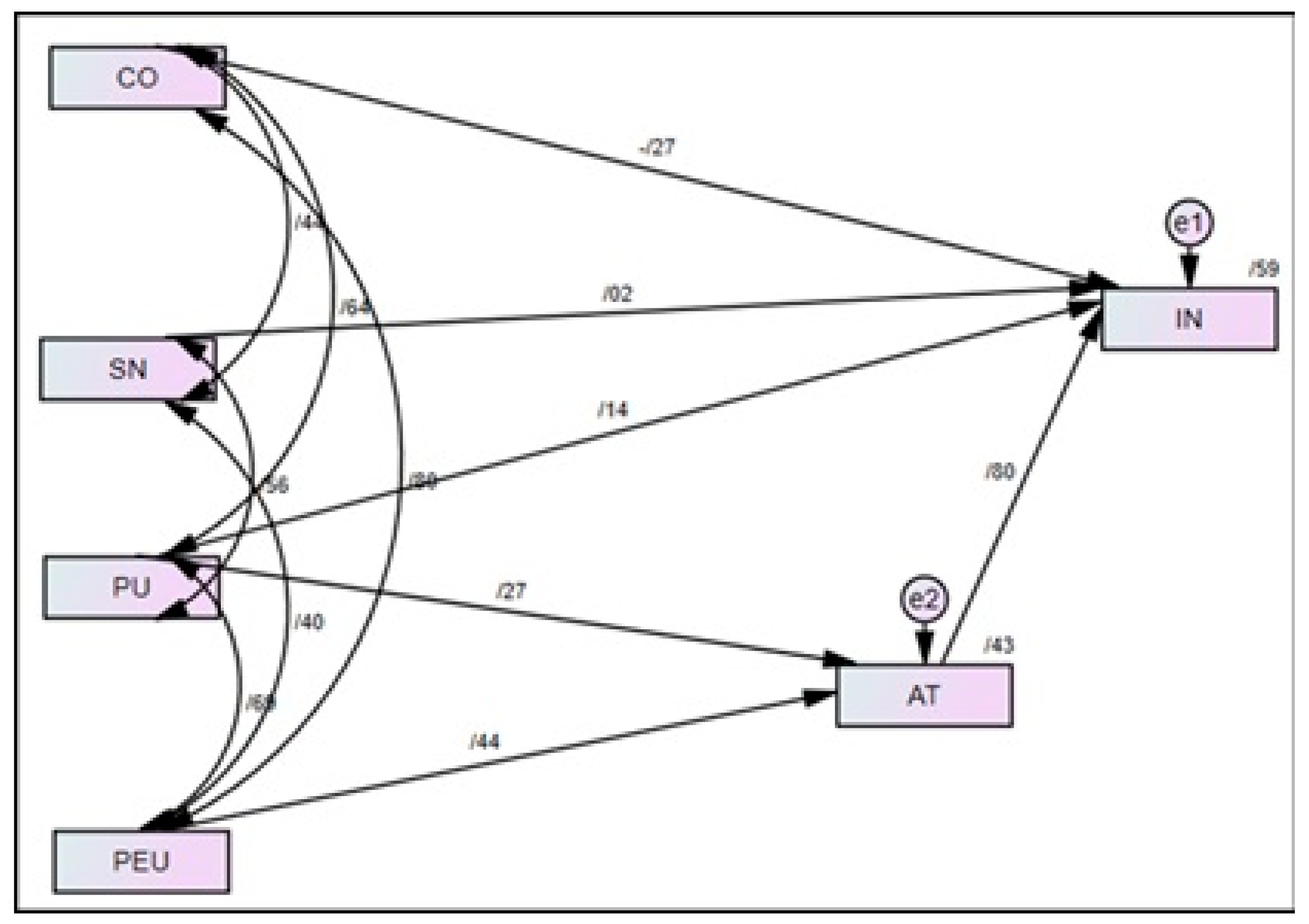

5. Findings

6. Discussion and Conclusions

- According to the results of this research, the role of perceived usefulness on the creation of usage intention, either directly or through the mediating role of a positive attitude in customers, is very important. So financial institutes should pay much more attention to this factor. Usefulness has an impact on usage intention through such mechanisms. It is suggested that banks and financial institutions pay more attention to the short-term benefits of customers. Methods such as discounts or rating schemes can be suggested for higher adoption toward modern banking services.

- Since the impact of attitude on usage intention is so strong, and it stays with customers for too long, it is suggested that banks perform appropriate advertising and social activities to change the attitude of the public. Revealing public and personal benefits in the long term would be effective with respect to the significant role of usefulness on the creation of a positive attitude.

- Another factor that has an impact on attitude is usage intention. It is suggested that banks and financial institutes provide modern technologies and services in a way that is operational very easily and without any complexities. New Internet and mobile applications are some of the most noticeable solutions with a simple and efficient user interface.

- The reverse impact of behavioral control on usage intention is, in fact, a confirmation toward the role of ease of use. In fact, more security layers and validation processes lead to more complexity in financial processes. It is recommended that banks pay attention to this issue during the implementation of modern technologies. Easy and electronic identification and validation processes and paying enough attention to internal security instead of assigning it to the customer are some of the most noticeable solutions in this field.

Author Contributions

Funding

Conflicts of Interest

References

- Adjei-Bamfo, Peter, Theophilus Maloreh-Nyamekye, and Albert Ahenkan. 2019. The role of e-government in sustainable public procurement in developing countries: A systematic literature review. Resources, Conservation and Recycling 142: 189–203. [Google Scholar] [CrossRef]

- Ajzen, Icek. 1991. The Theory of Planned Behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Ajzen, Icek, and Martin Fishbein. 1977. Attitude-behavior Relations: A Theoretical Analysis and Review of Empirical Research. Psychological Bulletin 84: 888. [Google Scholar] [CrossRef]

- Arif, Imtiaz, Sahar Afshan, and Arshian Sharif. 2016. Resistance to mobile banking adoption in a developing country: Evidence from modified TAM. Journal of Finance and Economics Research 1: 25–42. [Google Scholar] [CrossRef]

- Bailey, Arlene, Indianna Minto-Coy, and Dhanaraj Thakur. 2017. IT Governance in E-Government Implementations in the Caribbean: Key Characteristics and Mechanisms. In Information Technology Governance in Public Organizations. Berlin and Heidelberg: Springer, pp. 201–27. [Google Scholar]

- Becerra, Manuel, Randi Lunnan, and Lars Huemer. 2008. Trustworthiness, risk, and the transfer of tacit and explicit knowledge between alliance partners. Journal of Management Studies 45: 691–713. [Google Scholar] [CrossRef]

- Bernanke, Ben S., Thomas Laubach, Frederic S. Mishkin, and Adam S. Posen. 2018. Inflation Targeting: Lessons from the International Experience. Princeton: Princeton University Press. [Google Scholar]

- Blunch, Niels. 2012. Introduction to Structural Equation Modeling Using IBM SPSS Statistics and AMOS. Thousand Oaks: Sage. [Google Scholar]

- Chu, Po-Young, Gin-Yuan Lee, and Yu Chao. 2012. Service quality, customer satisfaction, customer trust, and loyalty in an e-banking context. Social Behavior and Personality: An International Journal 40: 1271–83. [Google Scholar] [CrossRef]

- Cronbach, Lee J. 1951. Coefficient alpha and the internal structure of tests. Psychometrika 16: 297–334. [Google Scholar] [CrossRef]

- Davis, Fred D. 1993. User acceptance of information technology; system characteristics, user perceptions and behavioral impacts. International Journal of Management Machine Studies 38: 475–87. [Google Scholar] [CrossRef]

- Delone, William H., and Ephraim R. McLean. 2003. The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems 19: 9–30. [Google Scholar]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Gregory, Gary D., Liem Viet Ngo, and Munib Karavdic. 2019. Developing e-commerce marketing capabilities and efficiencies for enhanced performance in business-to-business export ventures. Industrial Marketing Management 78: 146–57. [Google Scholar] [CrossRef]

- Hair Jr, Joseph F., G. Tomas M. Hult, Christian Ringle, and Marko Sarstedt. 2016. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks: Sage Publications. [Google Scholar]

- Hasibuan, Raya Puspita Sari, and Hery Syahrial. 2019. Analysis of the Implementation Effects of Accrual-Based Governmental Accounting Standards on the Financial Statement Qualities. Paper presented at the ICOPOID 2019 the 2nd International Conference on Politic of Islamic Development, Bandar Lampung, Indonesia, September 10. [Google Scholar]

- Heng, Stefan. 2004. E-payments: Modern complement to traditional payment systems. E-Conomics Working Paper. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Jahangir, Nadim, and Noorjahan Begum. 2008. The role of perceived usefulness, perceived ease of use, security and privacy, and customer attitude to engender customer adaptation in the context of electronic banking. African Journal of Business Management 2: 32. [Google Scholar]

- Jamshidi, Dariyoush, and Nazimah Hussin. 2016. Forecasting patronage factors of Islamic credit card as a new e-commerce banking service. Journal of Islamic Marketing 7: 378–404. [Google Scholar] [CrossRef]

- Kaabachi, Souheila, Selima Ben Mrad, and Anne Fiedler. 2019. The moderating effect of e-bank structure on French consumers’ trust. International Journal of Bank Marketing. [Google Scholar] [CrossRef]

- Karunakaran, Kavunthi. 2019. Role of e-banking in current scenario. IJRAR-International Journal of Research and Analytical Reviews (IJRAR) 6: 73–76. [Google Scholar]

- Khurshid, Azam, Muhammad Rizwan, and Erum Tasneem. 2014. Factors contributing towards adoption of E-banking in Pakistan. International Journal of Accounting and Financial Reporting 4: 437. [Google Scholar] [CrossRef]

- Kumar, Sangeet. 2020. Advantages and challenges of e-commerce in the Indian Banking System. Studies in Indian Place Names 40: 4064–71. [Google Scholar]

- Kurfalı, Murathan, Ali Arifoğlu, Gül Tokdemir, and Yudum Paçin. 2017. Adoption of e-government services in Turkey. Computers in Human Behavior 66: 168–78. [Google Scholar] [CrossRef]

- Kwateng, Kwame Owusu, Kenneth Afo Osei Atiemo, and Charity Appiah. 2019. Acceptance and use of mobile banking: An application of UTAUT2. Journal of Enterprise Information Management 32: 118–51. [Google Scholar] [CrossRef]

- Mansour, Kaouther Ben. 2016. An analysis of business’ acceptance of internet banking: An integration of e-trust to the TAM. Journal of Business & Industrial Marketing 31: 982–94. [Google Scholar]

- Marakarkandy, Bijith, Nilay Yajnik, and Chandan Dasgupta. 2017. Enabling internet banking adoption. In Journal of Enterprise Information Management. vol. 30, pp. 263–94. [Google Scholar]

- Martins, Carolina, Tiago Oliveira, and Aleš Popovič. 2014. Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management 34: 1–13. [Google Scholar] [CrossRef]

- McNamara, Alan J., and Samad ME Sepasgozar. 2020. Developing a theoretical framework for intelligent contract acceptance. Construction Innovation. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1978. Psychometric Methods. New York: McGraw-Hill. [Google Scholar]

- Osei-Kojo, Alex. 2017. E-government and public service quality in Ghana. Journal of Public Affairs 17: e1620. [Google Scholar] [CrossRef]

- Petrou, Andreas. 2007. Multinational banks from developing versus developed countries: Competing in the same arena? Journal of International Management 13: 376–97. [Google Scholar] [CrossRef]

- Rahman, Mahbub, Nilanjan Kumar Saha, Md Nazirul Islam Sarker, Arifin Sultana, and A. Z. M. Shafiullah Prodhan. 2017. Problems and prospects of electronic banking in Bangladesh: A case study on Dutch-Bangla Bank Limited. American Journal of Operations Management and Information Systems 2: 42–53. [Google Scholar]

- Rakhmawati, Henny and Khoiru Rusydi, and Khoiru Rusydi. 2020. Influence of TAM and UTAUT models of the use of e-filing on tax compliance. International Journal of Research in Business and Social Science (2147–4478) 9: 106–11. [Google Scholar] [CrossRef]

- Ramesh, Vani, Vishal Chandr Jaunky, Randhir Roopchund, and Heemlesh Sigh Oodit. 2020. ‘Customer Satisfaction’, Loyalty and ‘Adoption’of E-Banking Technology in Mauritius. In Embedded Systems and Artificial Intelligence. Berlin and Heidelberg: Springer, pp. 861–73. [Google Scholar]

- Rifat, Afrin, Nabila Nisha, and Mehree Iqbal. 2019. Predicting e-Tax Service Adoption: Integrating Perceived Risk, Service Quality and TAM. Journal of Electronic Commerce in Organizations (JECO) 17: 71–100. [Google Scholar] [CrossRef]

- Rigopoulou, Irini D., Ioannis E. Chaniotakis, and John D. Kehagias. 2017. An extended technology acceptance model for predicting smartphone adoption among young consumers in Greece. International Journal of Mobile Communications 15: 372–87. [Google Scholar] [CrossRef]

- Safeena, Rahmath, Hema Date, Nisar Hundewale, and Abdullah Kammani. 2013. Combination of TAM and TPB in internet banking adoption. International Journal of Computer Theory and Engineering 5: 146. [Google Scholar] [CrossRef]

- Samar, Samar, Ghani Mazuri, and Alnaser Feras. 2017. Predicting customer’s intentions to use internet banking: The role of technology acceptance model (TAM) in e-banking. Management Science Letters 7: 513–24. [Google Scholar]

- Scherer, Ronny, Fazilat Siddiq, and Jo Tondeur. 2019. The technology acceptance model (TAM): A meta-analytic structural equation modeling approach to explaining teachers’ adoption of digital technology in education. Computers & Education 128: 13–35. [Google Scholar]

- Sedik, Tahsin Saadi, Sally Chen, Tarhan Feyzioglu, Manuk Ghazanchyan, Souvik Gupta, Sarwat Jahan, and Juan Manuel Jauregui. 2019. The Digital Revolution in Asia and Its Macroeconomic Effects. Tokyo: Asian Development Bank Institute, No. 1029. [Google Scholar]

- Sepasgozar, Samad M. E., Martin Loosemore, and Steven R. Davis. 2016. Conceptualising information and equipment technology adoption in construction A critical review of existing research. Engineering, Construction and Architectural Management 23: 158–76. [Google Scholar] [CrossRef]

- Sepasgozar, Samad M.E., Sara Shirowzhan, and Cynthia Changxin Wang. 2017. A Scanner Technology Acceptance Model for Construction Projects. Procedia Engineering 180: 1237–46. [Google Scholar] [CrossRef]

- Sepasgozar, Samad M.E., Scott Hawken, Sharifeh Sargolzaei, and Mona Foroozanfa. 2019. Implementing citizen centric technology in developing smart cities: A model for predicting the acceptance of urban technologies. Technological Forecasting and Social Change 142: 105–16. [Google Scholar] [CrossRef]

- Shankar, Amit, and Charles Jebarajakirthy. 2019. The influence of e-banking service quality on customer loyalty. International Journal of Bank Marketing. [Google Scholar] [CrossRef]

- Sharma, Sujeet Kumar, Srikrishna Madhumohan Govindaluri, Saeed Al-Muharrami, and Ali Tarhini. 2017. A multi-analytical model for mobile banking adoption: A developing country perspective. Review of International Business and Strategy 27: 133–48. [Google Scholar] [CrossRef]

- Shek, Daniel T.L., and Lu Yu. 2014. Confirmatory factor analysis using AMOS: A demonstration. International Journal on Disability and Human Development 13: 191–204. [Google Scholar] [CrossRef]

- Shirowzhan, Sara, Willie Tan, and Samad M.E. Sepasgozar. 2020. Digital Twin and CyberGIS for Improving Connectivity and Measuring the Impact of Infrastructure Construction Planning in Smart Cities. ISPRS International Journal of Geo-Information 9: 240. [Google Scholar] [CrossRef]

- Soeng, Reth, Ludo Cuyvers, and Morarith Soeung. 2019. E-commerce Development and Internet Banking Adoption in Cambodia. Developing the Digital Economy in ASEAN, 176–99. [Google Scholar] [CrossRef]

- Syniavska, Olga, Nadiya Dekhtyar, Olga Deyneka, Tetiana Zhukova, and Olena Syniavska. 2019. Security of e-banking systems: Modelling the process of counteracting e-banking fraud. Paper presented at the SHS Web of Conferences, Sakarya, Turkey, June 19–22. [Google Scholar]

- Takele, Yitbarek, and Zeleke Sira. 2013. Analysis of factors influencing customers’intention to the adoption of e-banking service channels in Bahir Dar City: An integration of TAM, TPB and PR. European Scientific Journal 9: 403–17. [Google Scholar]

- Tam, Carlos, and Tiago Oliveira. 2017. Understanding mobile banking individual performance. Internet Research 27: 538–62. [Google Scholar] [CrossRef]

- Twizeyimana, Jean Damascene, and Annika Andersson. 2019. The public value of E-Government–A literature review. Government Information Quarterly 36: 167–78. [Google Scholar] [CrossRef]

- Ullah, Fahim, M.E. Sepasgozar Samad, and Siddra Siddiqui. 2017. An Investigation of Real Estate Technology Utilization in Technologically Advanced Marketplace. Paper presented at the 9th International International Civil Engineering Congress (ICEC-2017) “Striving Towards Resilient Built Environment”, Karachi, Pakistan, December 22–23. [Google Scholar]

- Vakulenko, Yulia, Poja Shams, Daniel Hellström, and Klas Hjort. 2019. Service innovation in e-commerce last mile delivery: Mapping the e-customer journey. Journal of Business Research 101: 461–68. [Google Scholar] [CrossRef]

- Yue, Xiao-Guang, Xue-Feng Shao, Rita Yi Man Li, M. James C. Crabbe, Lili Mi, Siyan Hu, Julien S. Baker, and Gang Liang. 2020. Risk management analysis for novel Coronavirus in Wuhan, China. Journal of Risk Financial Management 13: 22. [Google Scholar] [CrossRef]

- Yue, Xiao-Guang, Xue-Feng Shao, Rita Yi Man Li, M. James C. Crabbe, Lili Mi, Siyan Hu, Julien S. Baker, Liting Liu, and Kechen Dong. 2020. Risk Prediction and Assessment: Duration, Infections, and Death Toll of the COVID-19 and Its Impact on China’s Economy. Journal of Risk and Financial Management 13: 66. [Google Scholar] [CrossRef]

| The Demographic Characteristics | Frequency | Percentage | |

|---|---|---|---|

| Gender | Male | 126 | 63% |

| Female | 74 | 37% | |

| Total | 200 | 100% | |

| Age | Less than 25 | 16 | 8% |

| 26–35 | 112 | 56% | |

| 36–45 | 72 | 36% | |

| Total | 200 | 100% | |

| Education | Associates degree | 20 | 10% |

| Bachelors | 48 | 24% | |

| Masters | 114 | 57% | |

| PhD | 18 | 9% | |

| Total | 200 | 100% | |

| Earnings | Less than 600,000 | 40 | 20% |

| 600,000–1,000,000 | 32 | 16% | |

| 1,000,000–2,000,000 | 56 | 28% | |

| 2,000,000–3,000,000 | 33 | 16/5% | |

| More than 3,000,000 | 32 | 16% | |

| total | 200 | 100% | |

| Variable | Number of Questions | Composite Reliability | Cronbach’s Alpha | Result |

|---|---|---|---|---|

| Usefulness | 4 | 0.831 | 0.742 | Confirmed |

| Ease of use | 4 | 0.921 | 0.885 | Confirmed |

| Subjective norms | 3 | 0.844 | 0.759 | Confirmed |

| Behavioral control | 4 | 0.886 | 0.831 | Confirmed |

| Attitude | 4 | 0.893 | 0.840 | Confirmed |

| Intention for adoption | 2 | 0.886 | 0.748 | Confirmed |

| Construct | Acronym | Loading | AVE |

|---|---|---|---|

| Perceived Usefulness | PU1 | 0.795 | 0.554 |

| PU2 | 0.698 | ||

| PU3 | 0.646 | ||

| PU4 | 0.825 | ||

| PerceivedEase of use | PEU1 | 0.883 | 0.744 |

| PEU2 | 0.832 | ||

| PEU3 | 0.901 | ||

| PEU4 | 0.832 | ||

| Subjective Norms | SN1 | 0.725 | 0.646 |

| SN2 | 0.734 | ||

| SN3 | 0.935 | ||

| Behavioral Control | CO1 | 0.856 | 0.660 |

| CO2 | 0.751 | ||

| CO3 | 0.848 | ||

| CO4 | 0.790 | ||

| Attitude | AT1 | 0.746 | 0.677 |

| AT2 | 0.794 | ||

| AT3 | 0.842 | ||

| AT4 | 0.903 | ||

| Intention for adoption | IN1 | 0.925 | 0.795 |

| IN2 | 0.857 |

| Index | IFI | GFI | NFI |

|---|---|---|---|

| Significant level of fitness | >0.85 | >0.85 | >0.85 |

| Final model | 0.89 | 0.891 | 0.887 |

| Hypothesis No | Relationship | t Statistic | Path Coefficient | Result |

|---|---|---|---|---|

| 1 | Usefulness–>attitude | 3.581 | 0.27 | Confirmed |

| 2 | Ease of use–>attitude | 5.934 | 0.44 | Confirmed |

| 3 | Control–>intention | 4.469 | −0.27 | Confirmed |

| 4 | Norm–>intention | 0.426 | 0.02 | Rejected |

| 5 | Attitude–>intention | 14.07 | 0.8 | Confirmed |

| 6 | Usefulness–>intention | 2.065 | 0.14 | Confirmed |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohammad Ebrahimzadeh Sepasgozar, F.; Ramzani, U.; Ebrahimzadeh, S.; Sargolzae, S.; Sepasgozar, S. Technology Acceptance in e-Governance: A Case of a Finance Organization. J. Risk Financial Manag. 2020, 13, 138. https://doi.org/10.3390/jrfm13070138

Mohammad Ebrahimzadeh Sepasgozar F, Ramzani U, Ebrahimzadeh S, Sargolzae S, Sepasgozar S. Technology Acceptance in e-Governance: A Case of a Finance Organization. Journal of Risk and Financial Management. 2020; 13(7):138. https://doi.org/10.3390/jrfm13070138

Chicago/Turabian StyleMohammad Ebrahimzadeh Sepasgozar, Fatemeh, Usef Ramzani, Sabbar Ebrahimzadeh, Sharifeh Sargolzae, and Samad Sepasgozar. 2020. "Technology Acceptance in e-Governance: A Case of a Finance Organization" Journal of Risk and Financial Management 13, no. 7: 138. https://doi.org/10.3390/jrfm13070138

APA StyleMohammad Ebrahimzadeh Sepasgozar, F., Ramzani, U., Ebrahimzadeh, S., Sargolzae, S., & Sepasgozar, S. (2020). Technology Acceptance in e-Governance: A Case of a Finance Organization. Journal of Risk and Financial Management, 13(7), 138. https://doi.org/10.3390/jrfm13070138