Abstract

The Pareto classical distribution is one of the most attractive in statistics and particularly in the scenario of actuarial statistics and finance. For example, it is widely used when calculating reinsurance premiums. In the last years, many alternative distributions have been proposed to obtain better adjustments especially when the tail of the empirical distribution of the data is very long. In this work, an alternative generalization of the Pareto distribution is proposed and its properties are studied. Finally, application of the proposed model to the earthquake insurance data set is presented.

MSC:

62E10; 62F10; 62F15; 62P05

1. Introduction

In general insurance, only a few large claims arising in the portfolio represent the largest part of the payments made by the insurance company. Appropriate estimation of these extreme events is crucial for the practitioner to correctly assess insurance and reinsurance premiums. On this subject, the single parameter Pareto distribution (Arnold 1983; Brazauskas and Serfling 2003; Rytgaard 1990), among others has been traditionally considered as a suitable claim size distribution in relation to rating problems. Concerning this, the single parameter Pareto distribution, apart from its favourable properties, provides a good depiction of the random behaviour of large losses (e.g., the right tail of the distribution). Particularly, when calculating deductibles and excess–of–loss levels for reinsurance, the simple Pareto distribution has been demonstrated convenient, see for instance (Boyd 1988; Mata 2000; Klugman et al. 2008), among others.

In this work, an alternative to the Pareto distribution will be carried out. Properties and applications of this distribution will be studied here. As far as we know, these properties have not been studied for this distribution. In particular, we concentrate our attention to results connected with financial risk and insurance.

The paper is organized as follows. In Section 2, the new proposed distribution is shown, including some of its more relevant properties. Section 3 presents some interesting results connecting with financial risk and insurance. Next, Section 4 deals with parameter estimation, paying special attention to the maximum likelihood method. In Section 5, numerical application by using real insurance data is considered. Finally, some conclusions are given in the last section.

2. The Proposed Distribution

2.1. Probability Density Function

A continuous random variable X is said to have a generalized truncated log-gamma (GTLG) distribution if its probability density function (p.d.f.) is given by

where is the Euler gamma function. Note that, for all we have

As it can be easily seen, the parameter marks a lower bound on the possible values that (1) can take on. When the GTLG distribution reduced to the log-gamma distribution proposed by Consul and Jain (1971) with p.d.f.

Note that Consul and Jain (1971) considered only the case . For this case, they derived the raw moments and the distribution of the product of two independent log-gamma random variables. The p.d.f. (1) can now be obtained by the transformation .

Expression (1) is a particular case of the generalized truncated log–gamma distribution proposed in Amini et al. (2014) and related with the family proposed by Zografos and Balakrishnan (2009). When , we obtain the famous Pareto distribution. In addition, when , we obtain a distribution reminiscent of the distribution proposed in Gómez-Déniz and Calderín (2014). Properties and applications of this distribution will be studied here. In particular, we concentrate attention to results connecting with financial risk and insurance.

Theorem 1.

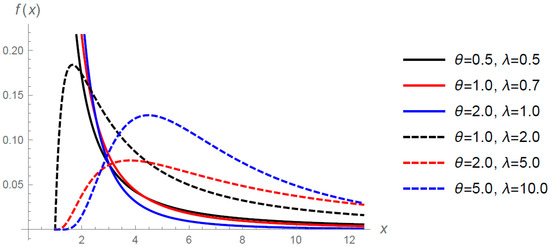

For all is decreasing (increasing-decreasing) if (.

Proof.

The first derivative of given by

which can be seen to be strictly negative if and has a unique zero at if ☐

Note that the mode of is given by if ( if

Figure 1.

Probability density function of GTLG distribution for selected values of and when .

2.2. Hazard Rate Function

The survival function (s.f.) of the GTLG distribution is given by

where is the incomplete gamma function. When is a positive integer, we have

The hazard rate function (h.r.f.) of the GTLG distribution is given by

Note that, and

Theorem 2.

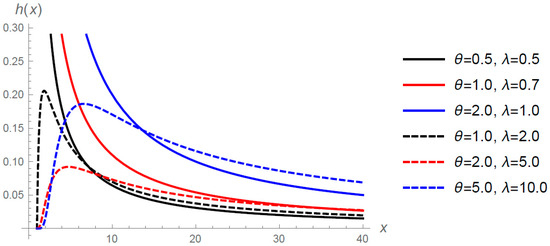

For all is decreasing ( increasing-decreasing) if (.

Proof.

Let

It is straightforward to show that is decreasing if and is increasing-decreasing if . Now by Glaser (1980), is decreasing if and increasing-decreasing if , since when ☐

Figure 2.

Hazard rate function of GTLG distribution for selected values of and when

2.3. Mean Residual Life Function

For the GTLG , we have

where, for , is the mean of the GTLG distribution, and () is the p.d.f. (1) (s.f. (2)) when is replaced by .

The mean residual life function (m.r.l.f.) of the GTLG distribution is given by

Theorem 3.

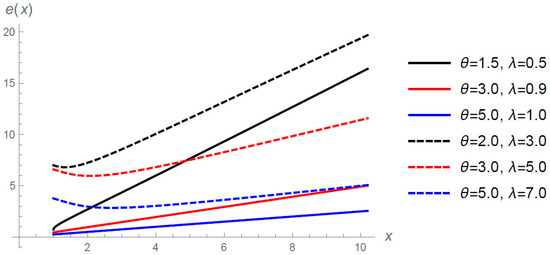

For all the m.r.l.f. is increasing ( decreasing-increasing) if (.

Proof.

Since is decreasing for it follows that, in this case, is increasing. In addition, since is increasing-decreasing for and , it follows that, in this case, is decreasing-increasing, by Gupta and Akman (1995). ☐

From the point of view of a risk manager, the expression is the so-called Expected Shortfall, that is the conditional mean of X given X exceeds a given quantile value x. This is a risk measurement appropriate to evaluate the market risk or credit risk of a portfolio.

Figure 3.

Mean residual life function of GTLG distribution for selected values of and when

It is noted that, unlike the classical Pareto distribution, this expression is not a linear function of x.

2.4. Moments

The GTLG distribution with p.d.f. (1) can be obtained from a monotonic transformation of the gamma distribution, as it can be seen in the next result.

Theorem 4.

Let us assume that Y follows a distribution with p.d.f. , where and . Then the random variable

has p.d.f. (1).

Proof.

The proof follows after a simple change of variable. ☐

Note that has a log-gamma distribution over . That is as indicated before.

Now, by using representation (5) and the moments of the Gamma distribution, the expression for the r-th moment about zero of distribution (1) is easily obtained,

provided and .

In particular, the mean is given by

and the variance is given by

Furthermore, by using the representation given by (5) the following result is obtained

Solving the equation

in , we obtain

This implies that the covariates can be introduced into the model in a simple way.

2.5. Conjugate Distributions

The following results show that both the inverse Gaussian distribution and the gamma distribution are conjugate with respect to the distribution proposed in this work.

Theorem 5.

Let , independent and identically distributed random variables following the p.d.f. (1). Let us suppose that θ follows a prior inverse Gaussian distribution with parameters τ and ϕ, i.e., . Then the posterior distribution of θ given the sample information is a generalized inverse Gaussian distribution , where

Proof.

The result follows after some computations by applying Bayes’ Theorem and arranging parameters. ☐

Theorem 6.

Let , independent and identically distributed random variables following the p.d.f. (1). Let us suppose that θ follows a prior gamma distribution with a shape parameter and a scale parameter , i.e., . Then the posterior distribution of θ given the sample information is again a gamma distribution with shape parameter and scale parameter .

Proof.

Again, the result follows after some algebra by using Bayes’ Theorem and arranging parameters. ☐

2.6. Stochastic Ordering

Stochastic ordering of positive continuous random variables is an important tool for judging the comparative behavior. We will recall some basic definitions, see (Shaked and Shanthikumar 2007).

Let X and Y be random variables with p.d.f.s and (s.f.s and ) (h.r.f.s and ), respectively.

A random variable X is said to be smaller than a random variable Y in the

- (i)

- stochastic order (denoted by ) if for all

- (ii)

- hazard rate order (denoted by ) if for all

- (iii)

- likelihood ratio order (denoted by ) if decreases for all x.

The following implications are well known:

Members of the family of distributions with p.d.f. (1) are ordered with respect to the strongest “likelihood ratio” ordering, as shown in the following theorem.

Theorem 7.

Let X and Y be two continuous random variables distributed according to (1) with p.d.f.’s given by and , respectively. If , then () ()

Proof.

Firstly, let us observe that the ratio

wih derivative

for all , proving the theorem. ☐

Properties for higher-order stochastic dominance in financial economics can be obtained following the line of the work of (Guo and Wong 2016). In this regard, let X and Y be random variables defined on with p.d.f.’s and s.f.’s respectively, satisfying

where and .

A random variable X is said to be smaller than a random variable Y

- (i)

- in the first-order descending stochastic dominance (denoted by ) iff for each .

- (ii)

- in the second-order descending stochastic dominance (denoted by ) iff for each .

- (iii)

- in the N-order descending stochastic dominance (denoted by ) iff for each and for , .

Theorem 8.

Let X and Y be two continuous random variables distributed according to (1) with p.d.f.’s given by and , respectively.

- (i)

- If , then .

- (ii)

- If , then .

- (iii)

- If , then for .

Proof.

- (i)

- For , we haveTherefore, for , .

- (ii)

- For , we haveTherefore, for , .

- (iii)

- For , we haveAlso, for , we haveTherefore, for , .

Now assume that, for , for some , i.e., for each and for , .

Now for , we have

Also, for , we have

Therefore, for , for all . ☐

3. Some Theoretical Financial Results

The integrated tail distribution function (also known as equilibrium distribution function):

is an important probability model that often appears in insurance and many other applied fields (see for example Yang 2004).

For the GTLG , we have

The integrated tail distribution of the GTLG is given by

Under the classical model (see Yang 2004) and assuming a positive security loading, , for the claim size distributions with regularly varying tails we have that, by using (3), it is possible to obtain an approximation of the probability of ruin, , when . In this case the asymptotic approximations of the ruin function is given by

where .

The use of heavy right-tailed distribution is of vital importance in general insurance. In this regard, Pareto and log-normal distributions have been employed to model losses in motor third liability insurance, fire insurance or catastrophe insurance. It is already known that any probability distribution, that is specified through its cumulative distribution function on the real line, is heavy right-tailed if and only if for every , has an infinite limit as x tends to infinity. On this particular subject, (1) decays to zero slower than any exponential distribution and it is long-tailed since for any fixed (see Rytgaard 1990) it is verified that

Therefore, as a long-tailed distribution is also heavy right-tailed, the distribution introduced in this manuscript is also heavy right–tailed.

Another important issue in extreme value theory is the regular variation (see Bingham 1987; Rytgaard 1990). A distribution function is called regular varying at infinity with index if

where the parameter is called the tail index.

Theorem 9.

The GTLG distribution is regularly varying at infinity with index .

Proof.

Using L’Hospital rule, we have

for all . ☐

As a consequence of this result we have that if are i.i.d. random variables with common s.f. (2) and , then

Therefore, if , we have that

This means that for large x the event is due to the event . Therefore, exceedance of high thresholds by the sum are due to the exceedance of this threshold by the largest value in the sample.

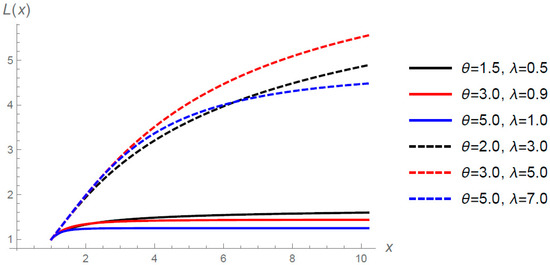

On the other hand, let the random variable X represent either a policy limit or reinsurance deductible (from an insurer’s perspective); then the limited expected value function L of X with cdf , is defined by

Note that represents the expected amount per claim retained by the insured on a policy with a fixed amount deductible of x.

Figure 4.

Limited expected value function of GTLG distribution for selected values of and when

On the other hand, the new distribution can also be applied in rating excess–of–loss reinsurance as it can be seen in the next result.

Theorem 10.

Let X be a random variable denoting the individual claim size taking values only for individual claims greater than d. Let us also assumed that X follows the pdf (1), then the expected cost per claim to the reinsurance layer when the losses excess of m subject to a maximum of l is given by

where , being the exponential integral function.

Proof.

The result follows by having into account that

from which we get the result after some tedious algebra. ☐

4. Maximum Likelihood Estimation

In the following it will be assumed that is a random sample selected from the GTLG distribution with known parameter and unknown parameters from the p.d.f. (1). Then, the log–likelihood function is given by

The maximum likelihood estimates (MLEs) of the parameters are obtained by solving the score equations:

where is the digamma function. Therefore,

where is the solution of the equation:

The second partial derivatives are given by

The expected Fisher’s information matrix is given by

Now the estimated variance-covariance matrix of the MLEs is given by the inverse matrix .

It is known that under certain regularity conditions, the maximum likelihood estimator converges in distribution to a bivariate normal distribution with mean equal to the true parameter value and variance-covariance matrix given by the inverse of the information matrix. That is, , which provides a basis for constructing tests of hypotheses and confidence regions. The regularity conditions are verified by taking into account that the Fisher’s information matrix exists and is non-singular and that the parameter space is a subset of the real line and the range of x is independent of . Furthermore, additional computations provides that and that is bounded.

5. Numerical Application

Because the main application of the heavy tail distributions is the so-called extreme value theory, we consider a data set coming from catastrophic events. The data set represents loss ratios (yearly data in billion of dollars) for earthquake insurance in California from 1971 through 1993 for values larger than zero. The data are given in Embrechts et al. (1999).

For comparison with other heavy tail distributions, we consider the following models:

- (1)

- Pareto distribution:

- (2)

- Shifted log-normal (SLN):

- (3)

- Burr distribution:

- (4)

- Stoppa distribution:

- (5)

- Log-gamma distribution (LG):

Table 1 provides parameter estimates together with standard errors (in brackets) using the maximum likelihood estimation method of the parameters and when . This table also gives the negative log-likelihood (NLL), Akaike’s Information Criteria (AIC), Bayesian information criterion (BIC), and Consistent Akaike’s Information Criteria (CAIC).

Table 1.

Estimated values of the considered models when

A lower value of these measures is desirable. These results show that the proposed GTLG distribution provides better fit than the considered competing distributions. Table 2 shows three goodness-of-fit tests for all considered models and that the classical Pareto model is rejected for this data set.

Table 2.

Test statistics (p-values) of goodness-of-fit tests of the considered models when

6. Conclusions

In this paper, a continuous probability distribution function with positive support suitable for fitting insurance data has been introduced. The distribution, that arises from a monotonic transformation of the classical Gamma distribution, can be considered as a generalization of the log-gamma distribution. This new development, which has a promising approach for data modeling in the actuarial field, may be very useful for practitioners who handle large claims. For that reason, it can be deemed as an alternative to the classical Pareto distribution. Besides, an extensive analysis of its mathematical properties has been provided.

Acknowledgments

The authors would like to express their gratitude to two anonymous referees for their relevant and useful comments. Emilio Gómez-Déniz was partially funded by grant ECO2013-47092 (Ministerio de Economía y Competitividad, Spain and ECO2017-85577-P (Ministerio de Economía, Industria y Competitividad, Agencia Estatal de Investigación)).

Author Contributions

Mohamed E. Ghitany, Emilio Gómez-Déniz and Saralees Nadarajah have contributed jointly to all of the sections of the paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Amini, Morteza, S. M. T. K. MirMostafaee, and Jafar Ahmadi. 2014. Log-gamma-generated families of distributions. Statistics 48: 913–32. [Google Scholar] [CrossRef]

- Arnold, Barry C. 1983. Pareto Distributions. Silver Spring: International Cooperative Publishing House. [Google Scholar]

- Bingham, Nicholas H. 1987. Regular Variation. Cambridge: Cambridge University Press. [Google Scholar]

- Boyd, Albert V. 1988. Fitting the truncated Pareto distribution to loss distributions. Journal of the Staple Inn Actuarial Society 31: 151–58. [Google Scholar] [CrossRef]

- Brazauskas, Vytaras, and Robert Serfling. 2003. Favorable estimator for fitting Pareto models: A study using goodness-of-fit measures with actual data. ASTIN Bulletin 33: 365–81. [Google Scholar] [CrossRef]

- Consul, Prem C., and Gaurav C. Jain. 1971. On the log-Gamma distribution and its properties. Statistische Hefte 12: 100–6. [Google Scholar] [CrossRef]

- Embrechts, Paul, Sidney I. Resnick, and Gennady Samorodnitsky. 1999. Extreme value theory as a risk management tool. North American Actuarial Journal 3: 30–41. [Google Scholar] [CrossRef]

- Glaser, Ronald E. 1980. Bathtub and related failure rate characterizations. Journal of the American Statistical Association 75: 667–72. [Google Scholar] [CrossRef]

- Gómez-Déniz, Emilio, and Enrique Calderín. 2014. A suitable alternative to the Pareto distribution. Hacettepe Journal of Mathematics and Statistics 43: 843–60. [Google Scholar]

- Guo, Xu, and Wing-Keung Wong. 2016. Multivariate stochastic dominance for risk averters and risk seekers. RAIRO-Operations Research 50: 575–86. [Google Scholar] [CrossRef]

- Gupta, Ramesh C., and Akman H. Olcay. 1995. Mean residual life function for certain types of non-monotonic ageing. Communications in Statistics-Stochastic Models 11: 219–25. [Google Scholar]

- Klugman, Stuart A., Harry H. Panjer, and Gordon E. Willmot. 2008. Loss Models: From Data to Decisions, 3rd ed. Hoboken: Wiley. [Google Scholar]

- Mata, Ana J. 2000. Princing excess of loss reinsurance with reinstatements. ASTIN Bulletin 30: 349–68. [Google Scholar] [CrossRef]

- Rytgaard, Mette. 1990. Estimation in the Pareto distribution. ASTIN Bulletin 20: 201–16. [Google Scholar] [CrossRef]

- Shaked, Moshe, and Jeyaveerasingam G. Shanthikumar. 2007. Stochastic Orders. Series: Springer Series in Statistics; New York: Springer. [Google Scholar]

- Yang, Hailiang. 2004. Crámer-Lundberg asymptotics. In Encyclopedia of Actuarial Science. New York: Wiley, pp. 1–6. [Google Scholar]

- Zografos, Konstantinos, and Narayanaswamy Balakrishnan. 2009. On families of beta and generalized gamma-generated distributions and associated inference. Statistical Methodology 6: 344–62. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).