6.1. Replication Comparison in an Ideal Black–Scholes World

In order to compare the various discrete replications, we consider a simple use case with strikes ranging from 60–140 by an increment of 10; the asset spot is at 100; the maturity is of one year; and there is no interest rate and no dividend rate. In particular, the at-the-money option is included in the replication. Including interest rates or shifting the spot would not change the conclusion.

We first consider the case of constant low volatility of 10%, so that our strike range captures well the distribution of the asset. We then compute the Derman weights according to Equations (

12)–(

15), the trapezoidal weights according to Equations (

18) and (

19) and the Simpson weights according to Equations (

20) and (

21). The replication weights given by the trapezoidal method are close to the weights from Derman’s method, but the weights from Simpson’s method are very different (

Table 1).

Yet another choice of weights is given by Leung and Lorig’s optimal quadratic hedging solution, using the five put and five call options as discrete hedges

Leung and Lorig (

2016).

With each discrete replication, we compute the one-year variance swap price in

Table 2. We also add the price obtained by continuous replication as described in

Section 4, using a cubic spline interpolation. In the case of the flat market volatility considered here, the interpolation choice does not really matter. Simpson’s method results in a price much closer to the continuous integration. If we increased the number of strikes, we would see Simpson’s method converging faster to the continuous replication price than the Derman or trapezoidal methods. We see that with just 10 options, it is possible to replicate a flat surface quite well in theory, if we go beyond a simple trapezoidal approximation.

Leung and Lorig’s (LL) optimal quadratic hedge results in a worse static hedge. If we move in time, or equivalently, if the volatility changes, the replication with the initial LL weights stays further away from the true market price than the replication with the initial Simpson weights. Conversely, the Simpson replication has a much larger quadratic hedging error than the LL replication.

We then compute the discrete weights, variance swap prices under a higher volatility of 40% in

Table 3. We add the variance swap price obtained by continuous replication with an adaptive integration range, as well as with the range truncated to the interval spanned by discrete option strikes,

. The range of strikes becomes too narrow to replicate the log payoff properly: much of the distribution is cut-off as mentioned in (

Demeterfi et al. 1999, p. 27). As a result, none of the discrete replications give a correct price on a simple flat surface. Derman’s method provides an intuitive explanation: a linear approximation is used in the wings, while the payoff

f from Equation (

11) is very far from being linear. This leads to a potentially large error. Effectively, with the discrete replication, we are pricing a corridor variance swap with bounds at the first and last strike instead of a true variance swap

Carr and Lewis (

2004).

The replication from Leung and Lorig is not impacted by the truncation as its weights are calculated using the theoretical continuous variance swap price. Instead of increasing the volatility, we could also have increased the time to maturity and would have obtained the same effect.

With the approximate replication method of

Carr and Lee (

2007), truncating the domain of integration has a much lower effect on a newly-issued volatility swap, as its equivalent payoff is much more linear in the wings. As an illustration, we price a volatility swap by replication, truncating the integration between (40, 160) (see

Table 4).

6.2. Replication Comparison on the SPX500

We now consider a variance swap expiring on 18 January 2019. We start with the market SPX500 option quotes as of 23 January 2018 given in

Appendix A (this corresponds to a maturity

in the ACT/365-day count convention; the corresponding USD LIBOR rate is

). We exclude options with zero bid or ask price as they are not liquid. We then calibrate the Heston stochastic volatility model

Heston (

1993) against the mid price of those options; this results in the parameters of

Table 5. Instead of directly replicating the actual market, we compute the vanilla option prices under the calibrated Heston model for each market strike and use those as the basis of the various variance swap replications. This allows us to compare the replication price with an exact reference price. In the real world, there is no need to go through the Heston model and the variance swap replication is directly computed out of the market option prices.

Under the Heston model, the forward price

F follows:

where

and

are Brownian motions correlated with correlation

, and the continuous variance swap price of maturity

T and strike

K has a simple expression:

We consider two different interpolations for the continuous replication: a spline in variance against log-moneyness and Andreasen and Huge arbitrage-free interpolation

Andreasen and Huge (

2010). The extrapolation choice does not matter here: even if the integration is truncated to the interval spanned by the market option strikes, that is [1275, 3600]. This interval is large enough for the tails to be accurately represented. Note that this is not necessarily the case for more illiquid stocks.

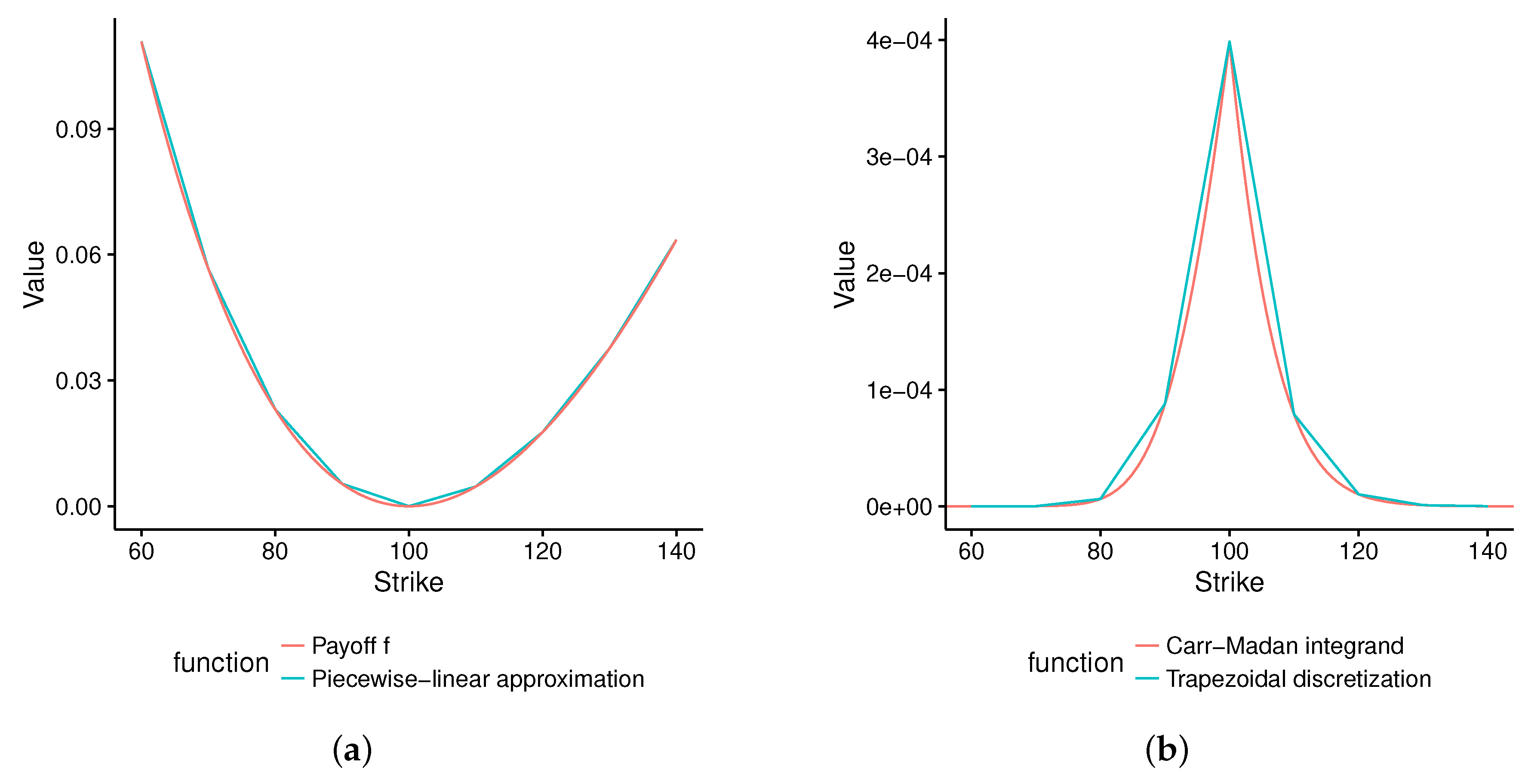

The discretization has a direct impact on the error (

Table 6), even though the range of strikes is relatively dense (78 distinct strikes). With a Hermite-spline discretization of the Carr–Madan integrand represented by Equation (

4), the price error is 0.20% compared to a price error under 0.03% for the continuous approach. The choice of market volatility interpolation does not however matter too much in the continuous replication.

6.3. Jumps Effect

Beside the problem of replicating the log contract with vanilla options in practice, another important issue of the variance swap is its difference compared to the log contract assuming jumps (cubic returns cannot be ignored anymore). This is a popular explanation for the single name variance swap market collapse in 2008, as jumps are more pronounced in single name stocks. In the same period, the volatility swap market has increased.

We will see why with the example of the Bates model

Bates (

1996) as it includes jumps in the asset along with stochastic volatility. In the Bates model, the asset follows:

where

and

are Brownian motions correlated with correlation

,

is the annual frequency of jumps,

Z is a Poisson process with intensity

and

k is the random percentage jump conditional on a jump occurring with the log-normal distribution of jumps sizes

such that

.

thus corresponds to the jump mean, and a higher value will translate to larger jumps, while

is the jump volatility. The additional drift term

in Equation (

29) comes from the no-arbitrage condition.

Sometimes, the Bates model jump parameters are given according the Merton jump model specification, that is using the parameter

. Bates parameters lead to a simpler characteristic function, but for the purpose of variance swap and volatility swaps, Merton’s parameters lead to simpler pricing formulae. Under the Bates model, the strike that makes the value of continuously-monitored variance swap zero is

Broadie and Jain (

2008):

To compute the price of a continuously-monitored volatility swap,

Broadie and Jain (

2008) use the identity:

to obtain:

with:

Note that in absence of jumps, that is with

, Equation (

3) also corresponds to the price of a zero coupon under the Cox–Ingersoll–Ross (CIR) model

Gatheral (

2006). Written as is, Equation (

3) does not behave well numerically since the integrand explodes around zero. The variable transformation

allows restoring a good behavior around zero; we then have:

and:

We consider three sets of Bates parameters: the first one is a somewhat extreme example where jumps are very pronounced, and their effect easily observable; the second one is the result of a calibration of the Eurostoxx 50 index on October 2003 by

Schoutens et al. (

2003); and the third one is the result of the calibration against S&P500 option prices on 2 November 1993 by

Broadie and Jain (

2008) (

Table 7). We also assume zero interest and dividend rates. From those parameters, we compute a dense set of vanilla option prices of a maturity of one year, which will be used for replication-based or local volatility-based pricing. The local volatility model offers an alternative to the model-independent Carr–Lee replication, which will also take into account the volatility smile and not the jumps and is commonly used to price exotics

Windcliff et al. (

2006).

In order to compare the value of the variance (respectively volatility) swap under the Bates model with the value of the same variance or volatility swap under the Dupire local volatility model

Dupire (

1994), we rely on a Monte Carlo simulation of each model with daily time steps, as there is no closed-form formula or simple quadrature technique to compute the price of a volatility swap under the local volatility model. As an indication, we also give the prices of the continuously-monitored variance and volatility swaps using the closed-form formulae for the Bates model, as well as the continuous replication formula for the variance swap and the Carr–Lee correlation-immune replication for the volatility swap

Carr and Lee (

2008).

Table 8 shows that the local volatility Monte Carlo prices are very close to the continuous replication prices, and the Bates Monte Carlo prices are very close to the closed-form formulae. The effect of the discreteness of the observations is small, and our Monte Carlo simulation is accurate.

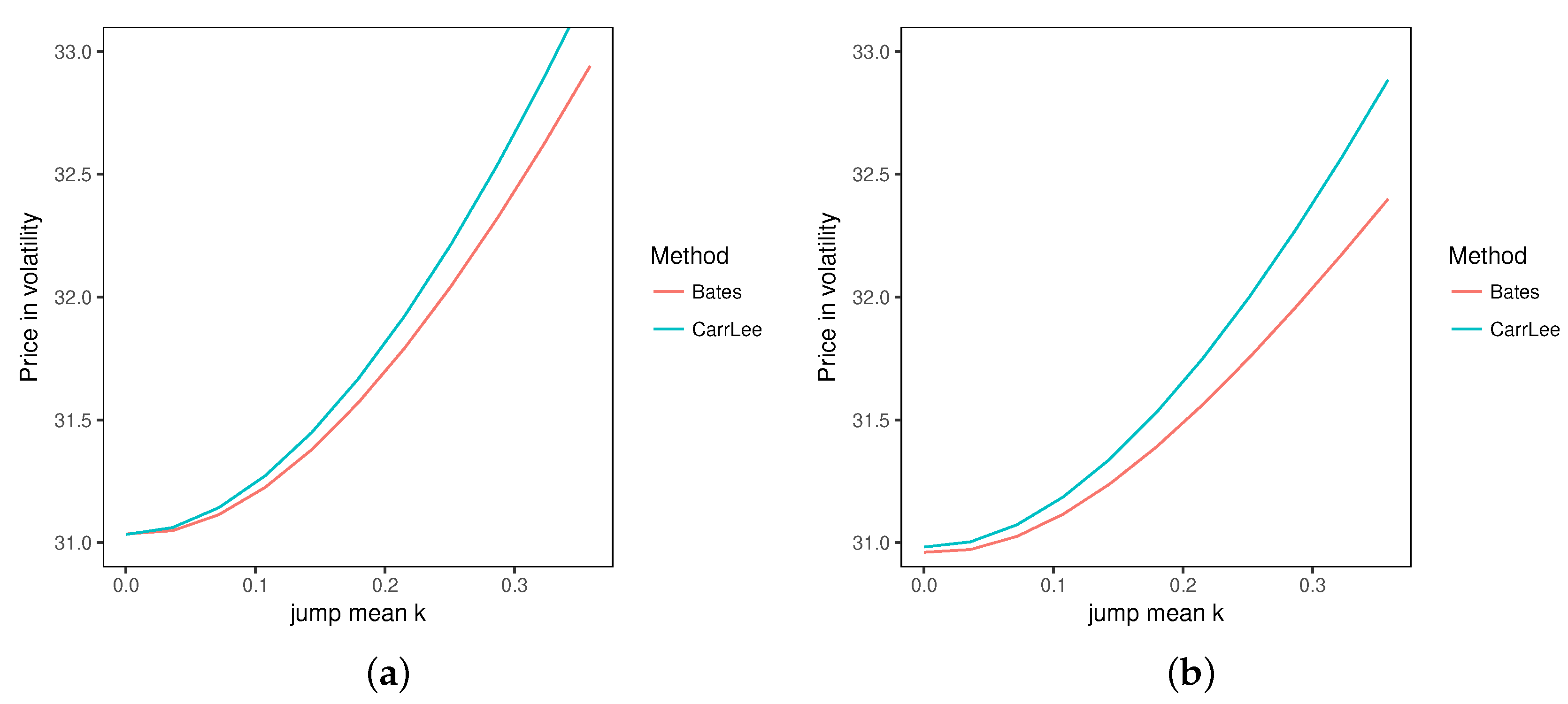

In theory, when there are no jumps (

), the variance swap prices should be the same under local volatility and Bates models as the variance swap payoff can be perfectly replicated by a continuous stream of vanilla options. We can see that when the jump mean

increases, the difference in the variance swap prices computed with Bates and local volatility increases by the same scale: the variance swap contract is indeed very dependent on jumps (

Table 8).

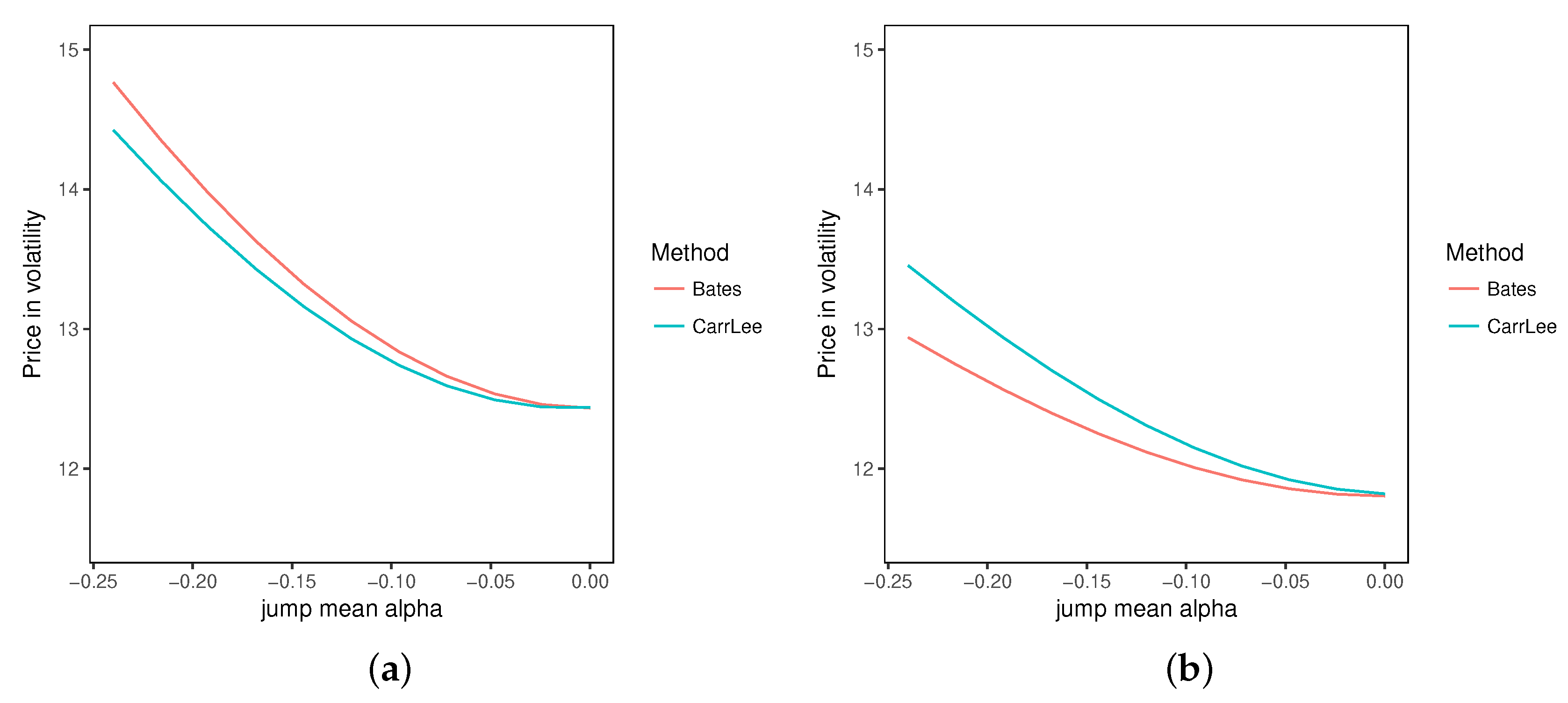

Under the extreme parameter set, the volatility swap is slightly less influenced by jumps, and more importantly, the effect of jumps is opposite: assuming jumps in the model decrease the price of a volatility swap (

Table 9). Note that without jump, the price under local volatility and the price under Bates are different, as contrary to the variance swap, the volatility swap cannot be exactly statically replicated.

The jump mean is of opposite sign in the parameter set from

Schoutens et al. (

2003), and now, the continuous replication overestimates the price of the variance swap (

Figure 2a).

The price of the volatility swap under continuous replication increases as much as the price of the variance swap, while at the same time, the theoretical (Bates) volatility swap price increases less. With the Schoutens et al. parameters, the volatility swap replication is more sensitive to jumps than the variance swap, even though the actual theoretical volatility swap price is less sensitive to jumps.

With the parameters from

Broadie and Jain (

2008), the jump mean is negative, and as expected, the variance swap replication underestimates the theoretical variance swap value, while the volatility swap replication will overestimate the theoretical volatility swap value when the size of the jump increases (

Figure 3b).

The replication price can be seen as the price when there is no jump, using the implied volatilities (or equivalently, option prices) from the Bates model with jumps. This allows easily comparing on one side the effect of the jump mean on the theoretical volatility and variance swaps prices and on the other side the effect of the jump assumption on the volatility and variance swap prices. While overall, the volatility swap is less sensitive to the jump mean than the variance swap, it is more sensitive to the assumption of jumps, as the spread between the replication and the theoretical value becomes larger when the jump size increases in mean absolute value. In fact, a rough approximation on Ito’s lemma for semi-martingales suggests that the volatility swap replication error is quadratic with the jump size, as contrary to the variance swap case, the quadratic term does not cancel out (see

Carr and Wu (

2008)).

Contrary to what is suggested in

Carr and Wu (

2008), we find that the jumps have a sizeable effect on the prices of both variance and volatility swaps under the Bates model calibrated to different markets, possibly because they explore the 30-day volatility, while we look at the one-year effect.