Abstract

This study exploits the promulgation of China’s E-commerce Law in 2009 as a quasi-natural experiment to construct a difference-in-differences (DID) model, examining the impact and mechanisms of digital economy governance on corporate cost stickiness. Using Chinese-listed manufacturing companies from 2013 to 2020 as research samples, we find that the implementation of the E-commerce Law significantly reduces corporate cost stickiness. Mechanism analysis reveals that the implementation of the E-Commerce Law promotes digital transformation in traditional manufacturing firms and strengthens their supply chain collaboration. These advancements lead to more efficient cost management decisions and reduce corporate cost stickiness. Heterogeneity analysis indicates that this effect is more significant for mature and declining enterprises and state-owned enterprises, as well as in regions with relatively developed economies and low reliance on foreign trade. Further research shows that the implementation of the E-Commerce Law curbs managerial opportunism and enhances managerial ability.

1. Introduction

In recent years, as modern information technologies like the internet, big data, and artificial intelligence have advanced rapidly, determining the best way to synergize the digital economy with manufacturing development has emerged as a key focus in the global economic transformation. E-commerce is a crucial component of the digital economy, distinguished by its vast scale of development, extensive reach, and highly dynamic entrepreneurial and innovative activities. However, the rapid development of e-commerce and technological innovations has rendered traditional regulatory frameworks inadequate, as many existing laws and regulations fail to effectively address emerging business models and transaction methods. This has posed unique regulatory challenges for countries in developing their digital economies [,].

China, as the largest and most dynamic e-commerce market globally, has continually drawn academic interest in discussions about its digital economy development. It is reported that nearly 60% of global e-commerce transactions take place in China, and the country’s annual e-commerce turnover exceeds the combined total of the next five largest markets—namely the United States, the United Kingdom, Germany, France, and Japan. To ensure the sustainable and healthy development of the e-commerce industry, China formally implemented the E-commerce Law on 1 January 2019. China’s E-Commerce Law emphasizes key aspects of transactional processes, adopting a governance model that combines government guidance with industry self-regulation. It provides explicit provisions for areas such as transactional behavior, payment security, data protection, and contract performance, while promoting corporate self-discipline and industry standards. This comprehensive framework has helped safeguard consumer rights, improve law enforcement, and support healthy industry development, while addressing the limitations of traditional laws in coping with emerging e-commerce challenges. As a crucial regulatory measure, the E-commerce Law provides a legal framework and compliance guidelines for manufacturing enterprises’ e-commerce operations, significantly impacting existing business production and operations. Given that manufacturing is a key priority for economic development, cost management is a crucial means for enterprises to achieve a competitive advantage in this sector. Therefore, this paper takes digital economy governance as the entry point, deeply analyzing how the enactment of the E-commerce Law impacts cost management decisions in manufacturing enterprises.

Cost stickiness in enterprises implies that resource inputs are “easier to increase than decrease,” which deeply reflects the characteristics of a company’s resource adjustment decisions. Specifically, cost stickiness refers to the tendency of enterprises to invest heavily in additional resources when business volume increases, leading to input costs far exceeding actual demand. Conversely, when business volume declines, enterprises often do not reduce corresponding resource inputs, resulting in redundant excess resources []. Understanding cost stickiness integrates enterprise cost management behavior into a systematic framework, making it a vital area for scholars studying resource allocation and improving enterprise efficiency [].

Previous literature on cost stickiness mainly focused on the perspectives of corporate governance [], environmental uncertainty [], bank competition [], financing constraints [], managerial ability [], environmental regulations [], and ESG disclosure []. Although extensive research has explored the factors influencing cost stickiness, these studies often assume that no significant changes occur in enterprises’ business models. Given the global shift towards e-commerce, especially in China—the world’s largest e-commerce market—business operations have dramatically transitioned from traditional to e-commerce models. Therefore, studying the relationship between China’s e-commerce governance and corporate cost stickiness is of great significance, contributing to both the assessment of the E-commerce Law’s effectiveness and the broader understanding of factors influencing cost stickiness, offering new perspectives for improving resource allocation efficiency.

This study selects listed manufacturing companies in China’s A-share market from 2013 to 2020 as research samples. Utilizing the DID model, this paper empirically examines the impact of the E-commerce Law on the cost stickiness of enterprises. The results indicate that the implementation of the E-commerce Law significantly reduces cost stickiness. These findings are robust through various tests, including alternative variable measurements, sample substitutions, and placebo tests. Mechanism tests show that the effect of the E-commerce Law on reducing cost stickiness is more pronounced in companies with a lower degree of digital transformation, lower supply chain transparency, and those that are geographically distant from their suppliers and customers. This suggests that the implementation of the E-commerce Law mainly reduces cost stickiness by encouraging traditional manufacturing companies to accelerate digital transformation and enhance supply chain collaboration capabilities. Heterogeneity analysis indicates that this effect is more significant for mature and declining enterprises and state-owned enterprises, as well as in regions with relatively developed economies and low reliance on foreign trade. Further analysis indicates that the enactment of the E-commerce Law has also curbed opportunistic behaviors among company management and enhanced managerial ability.

This study makes several contributions. Firstly, by using the implementation of the E-commerce Law as an exogenous event, the study investigates the impact of digital economy governance actions on the microeconomy, further enriching the literature related to the digital economy. The digital economy is a new economic paradigm that emerged with the rapid development of the information and communications technology industry. Existing literature primarily focuses on developing various methods to construct measurement indicators for the digital economy and studying its impact on the economy based on these metrics [,,]. This paper, however, adopts a new perspective by focusing on digital economy governance, examining the effects of the e-commerce legal regulation on corporate cost decision-making.

Secondly, this paper extends the literature on corporate cost stickiness from the perspective of digital economy governance. Existing studies focus on the impact of the economic policy environment and corporate governance characteristics on cost stickiness [,,,] and managerial ability [], but there is less literature exploring cost stickiness within the context of the digital economy. By using digital economy governance as the research setting, this paper examines how digital transformation and supply chain coordination capabilities affect corporate cost stickiness, thereby enriching the study of factors influencing cost stickiness.

Finally, the E-commerce Law, as China’s first legislative initiative in the e-commerce sector, marks a significant milestone in regulatory development. Existing studies on this topic remain limited, with most focusing on the design and effectiveness of e-commerce regulation through theoretical models or analytical frameworks. To address this gap, this paper provides a comprehensive examination of how the newly established regulatory system influences firm behavior at the micro level. By empirically testing the law’s impact on corporate financial decisions, this study offers valuable evidence for evaluating the effectiveness of e-commerce regulation in emerging markets and provides useful insights for future e-commerce legislation in other developing countries.

2. Institutional Background and Literature Review

2.1. China’s E-Commerce Law

To regulate e-commerce activities, maintain market order, and promote the sustainable and healthy development of e-commerce, China’s Standing Committee of the National People’s Congress officially initiated the legislative process for the E-Commerce Law on 27 December 2013. The law was officially enacted on 1 January 2019, marking a new era where e-commerce activities in China are governed by comprehensive legal regulations. As the first comprehensive law in China’s e-commerce sector, it clearly defines the scope of e-commerce regulation, covering the sale of goods and provision of services through the internet and other information networks.

Specifically, this legislation regulates the digital economy in three main aspects. First, it promotes fair competition in the e-commerce market. The E-Commerce Law mandates that e-commerce operators “should follow the principles of voluntariness, equality, fairness, and good faith, adhere to laws and commercial ethics, and engage in fair market competition,” and “must not abuse their market dominance to exclude or restrict competition.” To effectively regulate e-commerce behaviors, the law also requires the establishment of a market governance system involving relevant departments, e-commerce market organizations, operators, and consumers to strengthen external oversight in the e-commerce market. Second, the law enhances transparency in the e-commerce market. The E-Commerce Law requires e-commerce operators to “continuously display important qualification information, such as business licenses, in a prominent position and fully, truthfully, accurately, and promptly disclose product or service information.” It also mandates that “e-commerce platform operators must promptly update information regarding the identity, address, contact details, and administrative licenses of businesses on their platforms to ensure the timeliness and accuracy of information.” Third, the law strengthens the regulation of e-commerce operators’ conduct. The E-Commerce Law requires operators to register as market entities, fulfill tax obligations, obtain administrative licenses, and issue invoices and receipts according to legal requirements. It also ensures the legality, fairness, and enforceability of contracts through various provisions, such as clarifying the legal validity of electronic contracts, standardizing contract terms, prohibiting invalid clauses, and stipulating contractual obligations. By establishing these regulations, the law provides a solid legal foundation for the sustainable development of China’s digital economy.

2.2. Cost Stickiness

2.2.1. The Pervasiveness of Cost Stickiness

Anderson et al. [] find that sales, administrative, and general expenses of U.S. firms increase more when sales rise than they decrease when sales fall, thus establishing the concept of cost stickiness. This notion provides critical insights into corporate cost management practices and has stimulated a lot of subsequent empirical research. Studies identify similar cost stickiness phenomena in listed companies across various countries, including Japan [], Tehran [], and Egypt []. Meanwhile, Sun and Liu [] find that the stickiness in operating and administrative expenses is more pronounced among Chinese listed companies compared to U.S. companies. Overall, existing research indicates that cost stickiness is a pervasive phenomenon globally and has emerged as a fundamental theoretical framework for understanding corporate cost behavior.

2.2.2. Determinants of Cost Stickiness

Existing research generally suggests that the formation of cost stickiness primarily arises from three mechanisms: adjustment costs, managerial expectations, and agency problems []. First, from the perspective of institutions and policies, regulations such as medical loss ratios, labor protection laws, and price controls constrain firms’ flexibility in adjusting resources, thereby helping to reduce cost stickiness [,]. In addition, technological upgrading and accumulation of data assets enhance resource allocation efficiency and mitigate the impact of supply chain fluctuations on costs [,]. Second, managerial expectations are another important factor. When revenues increase, managers tend to expand expenditures to support business growth; however, when revenues decline, their optimistic expectations of a future rebound often lead to delayed cost reductions, further exacerbating cost stickiness []. Third, agency problems amplify cost stickiness through managerial opportunism. When managers delay cost reductions or maintain excessive resource allocations to serve their own interests, firms’ cost responses to revenue declines are delayed. Highly concentrated ownership may exacerbate such opportunistic behavior, strengthening cost stickiness, whereas moderate concentration or ownership counterbalances can help mitigate it [,]. At the same time, high-quality internal controls reduce information asymmetry and curb resource misuse, thereby alleviating cost stickiness []. Moreover, the market environment also significantly affects cost stickiness. In highly competitive markets, high agency costs make managers reluctant to cut resources during revenue declines, intensifying cost stickiness []; in less competitive markets, commercial credit and external monitoring can help mitigate it []. Cross-country comparisons further show that firms in countries with higher agency costs (e.g., France and Germany) exhibit more pronounced cost stickiness, whereas those in lower-agency-cost countries (e.g., the United States and Japan) adjust costs more flexibly, resulting in lower stickiness [].

Nevertheless, while existing research has made significant progress in elucidating the mechanisms of cost stickiness, most studies implicitly assume relatively stable production models—an assumption reasonably valid in traditional contexts where structural shifts in production modes often require extended periods to materialize. However, with the rapid advancement of intelligent manufacturing and the digital economy, corporate production processes are undergoing a disruptive transformation, progressively shifting from conventional setups toward smart and digitalized operations. In this context, firms face novel challenges and opportunities in cost management decisions, suggesting that traditional frameworks may no longer fully capture the emerging characteristics of cost stickiness.

2.3. Digital Economy Governance

2.3.1. Data Governance

Data governance has emerged as a prominent research area within the field of information systems, focusing on ensuring data quality and unlocking data value through institutionalized and systematic approaches [,]. From an analytical perspective, data governance can first be understood as an organizational framework that defines decision-making authority and accountability, thereby establishing efficient data management and coordination mechanisms [,]. Second, it functions as a value-enabling mechanism, leveraging standardized processes and technological tools to transform data assets into tangible economic and strategic advantages [,]. Regardless of the perspective adopted, data governance is understood as a dynamic and ongoing process that requires the coordinated operation of data, personnel, processes, and technology [].

2.3.2. Platform Governance

In developed economies, digital platforms serve not only as transaction intermediaries but also as key regulators, leveraging efficient governance mechanisms to significantly reduce transaction costs, enhance information transparency, and promote market fairness [,]. Research from Europe and the United States indicates that as platforms accumulate economic power and strengthen their dominant positions, their operations may sometimes extend beyond the boundaries of government oversight, thereby affecting the effectiveness of multi-stakeholder governance. For instance, on multinational platforms such as Google, Amazon, eBay, and Booking.com, merchants can pay fees to secure prioritized visibility, practices that may disrupt competitive order and pose challenges to the long-term development of industries [].

To address these risks, platforms typically establish strict transaction rules and supervisory systems to prevent the proliferation of low-quality or low-priced products and to curb false reputations and other forms of unfair competition [,]. At the same time, sound governance structures enhance transaction efficiency, improve the transparency of information flows, and facilitate the efficient allocation of resources within the platform ecosystem, providing institutional support for B2B marketing and value co-creation []. In the context of the digital economy, platform governance increasingly relies on cost-efficient and flexible mechanisms to improve overall system coordination and strengthen value creation capacity [].

2.3.3. E-Commerce Industry Governance

In academic research on e-commerce governance, a central focus lies in developing effective regulatory mechanisms and governance models tailored to industry characteristics. Zhou [] proposes a multi-layered governance framework that integrates government regulation, industry self-discipline, social collaboration, and market participation to achieve coordinated allocation of regulatory responsibilities across different levels. Furthermore, Zhou [], from an institutional design perspective, analyzes the division of responsibilities between merchants and platforms, emphasizing that e-commerce platforms function not merely as information intermediaries but also bear regulatory obligations for product quality. He and Zhang [], using evolutionary game theory, demonstrate that dynamic and flexible regulatory mechanisms can effectively guide merchant compliance through combined incentive and constraint systems, thereby enhancing overall product quality.

From a comparative international perspective, e-commerce regulatory approaches exhibit institutional variations and diverse policy orientations across countries. Developed economies have developed two typical orientations regarding government-market relations: the United States emphasizes market self-regulation and private sector leadership, with the government primarily promoting corporate self-discipline through guidance regulations and technical standards [,], whereas the European Union strengthens governmental regulatory roles through proactive intervention to protect consumer rights. Through legislation such as the E-Commerce Directive (2000), the Digital Services Act (DSA), and the Digital Markets Act (DMA), the EU has established a relatively comprehensive external regulatory framework, though these regulations remain focused on macro-level market order maintenance rather than operational specifications for e-commerce transaction processes [].

In contrast, developing economies typically maintain incomplete regulatory systems characterized by reactivity and fragmentation. In India, Jain and Jain [] note that regulatory conflicts arising from multiple jurisdictional authorities constrain market efficiency, while effective regulation could significantly enhance consumer welfare. Khandelwal [] observes that Indian policy drafts face trade-offs between restricting transnational retail platforms and protecting domestic markets. Ayilyath’s [] analysis of the Consumer Protection Act (2019) and its supporting rules reveals that, despite introducing Alternative Dispute Resolution (ADR) mechanisms, the system remains predominantly focused on ex-post remedies, lacking systematic and preventive constraints, with regulation lagging behind market development. Meanwhile, China’s E-commerce Law places greater emphasis on specific aspects of transaction processes, reflecting a governance model combining government guidance with industry self-regulation. This legislation not only establishes clear provisions for key aspects including e-commerce transaction behaviors, payment security, data protection, and contract fulfillment, but also promotes corporate self-discipline and industry standardization through institutional design, forming a comprehensive legal protection system aligned with actual e-commerce operations.

3. Hypothesis Development

Existing research primarily attributes the causes of cost stickiness to three factors: resource adjustment costs, agency issues, and management’s optimistic expectations [,,,]. The adjustment cost theory posits that managers’ commitment to resource allocation forms a company’s costs and expenses. The cost of reducing resource input is higher than that of increasing it, leading managers to resist proportionally reducing resources as sales decline. As a result, costs decrease less when business volume drops compared to their increase when business volume rises, causing cost stickiness. This paper argues that the implementation of the E-commerce Law will reduce companies’ adjustment costs by promoting digital transformation and enhancing supply chain coordination within the manufacturing sector, thereby mitigating cost stickiness.

The implementation of the E-commerce Law provides a legal basis for e-commerce governance by making e-commerce operations legally enforceable. This can effectively improve the overall market environment for enterprises to conduct e-commerce business activities. Under conditions of high uncertainty, management is often reluctant to undertake new investment projects []. The E-Commerce Law explicitly defines the content and scope of e-commerce activities, clarifies the legal responsibilities and obligations of operators, and introduces detailed legal provisions specifically for the e-commerce market. The clear legal framework effectively helps companies understand and comply with relevant e-commerce regulations, thereby reducing operational uncertainty and legal risks. In addition, the E-Commerce Law prohibits unfair competition and false advertising, thereby further regulating market order. By fostering a fair competitive environment, the law allows companies to focus on expanding their e-commerce activities without the concern of being undermined by unethical practices.

A favorable market environment encourages companies to transition to e-commerce and develop the digital economy. The integration of traditional businesses with the internet has always been seen as a key measure for effective cost management and resource optimization. As traditional manufacturing enterprises develop the digital economy, they can effectively optimize cost management decisions, thereby reducing cost stickiness. On one hand, companies inevitably adopt digital technologies, such as big data, artificial intelligence, and cloud computing, to achieve smart management and effective cost control []. On the other hand, traditional manufacturing firms can leverage these digital technologies for precise forecasting and real-time monitoring of daily cost inputs, which reduces adjustment costs and effectively mitigates cost stickiness [].

Standardized e-commerce models and information exchange help establish more effective supply chain relationships, enhancing coordination and collaboration capabilities within the supply chain []. The E-Commerce Law requires e-commerce operators to disclose their business licenses, contact details, products, and other relevant information on their platforms. This regulation applies to both platform operators and merchants selling goods or providing services on these platforms. By ensuring that all entities within the supply chain are legitimate and identifiable, this requirement reduces the risk of concealed operations among supply chain participants and enhances overall supply chain transparency. In addition, the E-Commerce Law encourages the creation of an e-commerce credit evaluation system, enabling businesses at each stage of the supply chain to monitor one another. This system not only increases information transparency but also fosters trust among all parties involved in the supply chain. Additionally, the E-Commerce Law requires operators to ensure the timely delivery of goods and services, which places higher demands on supply chain logistics management. This encourages companies to optimize their logistics and supply chain processes to meet the legal requirements for delivery speed and quality, thereby improving overall efficiency and reliability.

The process of moving from raw material preparation to the final product reaching the market is essentially one of continuous communication and coordination with upstream suppliers and downstream customers. According to the bullwhip effect, as product demand information moves upstream in the supply chain, it becomes distorted, potentially leading to inventory overstock []. If a company fails to obtain timely feedback from its customers and suppliers, its production plans and raw material procurement may not align with actual demand, leading to wasted resources and overstock [,]. The enactment of the E-Commerce Law enhances a company’s supply chain coordination capabilities, accelerates information flow across all supply chain stages, improves responsiveness to market changes, and alleviates cost stickiness.

In summary, the implementation of the E-Commerce Law can promote digital transformation and enhance supply chain coordination for companies, thereby reducing cost stickiness. Thus, this paper proposes the following hypothesis:

Hypothesis 1 (H1).

The implementation of the E-commerce Law significantly alleviates corporate cost stickiness.

The life cycle stage of a firm significantly affects its profitability, innovation willingness, and cost-adjustment behavior, resulting in differences in labor cost stickiness across different stages []. Mature and declining firms often face issues such as organizational redundancy and inefficient resource allocation. The implementation of the E-Commerce Law has strengthened digital economy governance and promoted firms’ accelerated digital transformation and supply chain coordination. For mature and declining firms, the legal norms and institutional incentives provided by the law can more effectively facilitate the conversion of fixed costs into variable costs, thereby significantly reducing cost stickiness. Based on this, the study proposes the following hypothesis:

Hypothesis 2 (H2).

The implementation of the E-Commerce Law has a more pronounced effect on reducing cost stickiness in mature and declining firms.

During China’s reform process, a comprehensive support system had not yet been established. State-owned enterprises (SOEs) bear responsibilities related to social stability and public welfare, whereas private enterprises are primarily profit-driven. Given this distinction, the government expects SOEs to continue fulfilling social responsibilities and providing public services to support policy objectives such as economic growth and employment stability []. Compared with private firms, SOEs face higher pressures in resource adjustment and cost management, which often results in greater cost stickiness. The promulgation of the E-Commerce Law strengthens digital economy governance by providing clear legal norms and operational guidance, promoting digital transformation and supply chain coordination. Against this backdrop, SOEs, leveraging their advantages in resources, capital, and technology, are better positioned to take advantage of legal incentives and institutional constraints for intelligent transformation. In implementing the requirements of the E-Commerce Law, SOEs can more effectively optimize resource allocation and adjust cost structures, converting fixed costs into variable costs and thereby significantly reducing cost stickiness. In contrast, private firms are limited by resources and institutional constraints, and their progress in digital transformation and smart manufacturing faces more challenges, so the law’s mitigating effect on cost stickiness is relatively weaker.

Hypothesis 3 (H3).

The implementation of the E-Commerce Law has a more significant effect on reducing cost stickiness in state-owned enterprises.

Regional economic development levels not only determine the resources and technological conditions available to firms but also affect the effectiveness of digital economy governance policies. In economically developed regions, well-established infrastructure, abundant capital, and skilled labor enable firms to implement digital transformation and supply chain management more effectively. In such environments, the implementation of the E-Commerce Law can better leverage institutional incentives and constraints to help firms optimize resource allocation and improve cost-control efficiency through digital means, thereby significantly reducing cost stickiness. In contrast, firms in less-developed regions often face multiple constraints, such as limited financing channels, insufficient technological reserves, and a lack of skilled personnel. Even with the support of the E-Commerce Law, improvements in supply chain coordination and cost management may be constrained, resulting in a less pronounced reduction in cost stickiness. Accordingly, the study proposes:

Hypothesis 4 (H4).

The mitigating effect of the E-Commerce Law on cost stickiness is more pronounced in economically developed regions, whereas it is relatively limited in less-developed regions.

Differences in regional dependence on foreign trade also influence the effectiveness of the E-Commerce Law in reducing cost stickiness. In regions with lower foreign trade dependence, firms are less affected by international market fluctuations, enjoy a more stable market environment, and face more predictable consumer demand. In this context, digital transformation and supply chain coordination driven by the E-Commerce Law can help firms more efficiently capture demand information and adjust production and inventory arrangements in a timely manner, thereby alleviating rigidities in the cost-adjustment process and reducing cost stickiness. In contrast, firms in regions with higher foreign trade dependence are more susceptible to international market price volatility, demand uncertainty, and trade policy changes. Even under the influence of the E-Commerce Law, the implementation of digital and supply chain optimization faces greater challenges, which may limit the law’s effect on reducing cost stickiness. Based on this analysis, the study proposes:

Hypothesis 5 (H5).

The mitigating effect of the E-Commerce Law on cost stickiness is more pronounced in regions with lower foreign trade dependence.

4. Research Design

4.1. Sample Selection

This study selected all A-share manufacturing listed companies in China from 2013 to 2020 as the research sample. Banker et al. [] argued that, due to technological factors, significant differences exist in cost structures across industries. Manufacturing companies generally have more employees and greater numbers of machinery and equipment, leading to a more balanced and clear cost structure. Moreover, competition in the manufacturing sector is more intense, and cost elasticity is less affected by monopolistic pricing. Therefore, this paper focuses on manufacturing firms as the subject of the study. Since 2013, China’s internet technology has experienced rapid growth, leading the e-commerce industry into a period of accelerated development. Therefore, we chose 2013 as the starting point for our sample.

The sample is processed as follows: (1) Exclude samples from the financial and insurance industries; (2) Remove companies in special treatment status (ST and ST* designated firms); (3) Remove companies with liabilities exceeding assets; (4) Delete samples with missing key variables and control variables. All continuous variables in this study are winsorized at the 1% to 99% level to mitigate the impact of extreme values. The final dataset comprises 12,868 observations. The data for the sample companies were obtained from the China Stock Market and Accounting Research Database (CSMAR) and the Chinese Research Data Services Platform’s (CNRDS) database.

4.2. Model Design and Variable Description

According to Holzhacker et al. [], Liu et al. [], Yang and Hu [] and Zeng et al. [], we use the following model to test the hypothesis H:

where ΔLncost is the dependent variable, measuring the change in the natural logarithm of management, selling, and financial fees between year t − 1 and t, ΔLnreve is the change in the natural logarithm of net sales revenue between year t − 1 and t. D is assigned a value of 1 if the sales revenue in year t is lower than in year t − 1, and 0 otherwise. Policy reflects the extent to which a company is affected by the E-commerce Law.

The variable Policy is defined as the interaction term between Post and Treat. Specifically, the E-commerce Law came into effect on 1 January 2019. In this study, the policy shock time is set as 2019. Thus, Post = 1 signifies the period after the implementation of the E-commerce Law (2019 and later), while Post = 0 indicates the period before the law is implemented (before 2019). Laws are uniformly applicable institutional arrangements, meaning that all firms or industries are affected simultaneously, which makes it challenging to directly establish a natural control group. To address this issue, researchers typically use pre-policy characteristics of firms or industries to gauge the extent to which they are influenced by the law, and then classify them into treatment and control groups accordingly [,,,,]. The effectiveness of the E-commerce Law, however, varies across regions depending on the strength of the local legal environment. In regions with a more robust legal framework, the law is implemented more effectively, leading to a greater impact on firms in those areas. To capture this variation, this study employs the Legal Environment Index developed by Wang et al. [] to measure the quality of the legal environment across regions, with higher index values indicating stronger legal environments. Then, we categorize regions into high and low legal environment quality groups based on the annual median of this index prior to the implementation of the E-commerce Law. If a firm is located in a region with a higher-quality legal environment, the variable Treat is assigned a value of 1; otherwise, it is assigned a value of 0. In the robustness test, we also use the proportion of e-commerce companies within the industry to distinguish between the treatment group and the control group.

Model (1) employs a DID method, controlling for firm and year fixed effects. Other control variables mainly include the firm’s size (Size), capital intensity (Ai), employee intensity (Ei), and GDP growth rate (GDP). Details are listed in Table A1 for variable definitions. The standard errors of all regressions are clustered at the firm level. In model (1), β2 is the proxy for cost stickiness. If the sample demonstrates cost stickiness, which indicates that the increase in cost when the business volume increases is higher than the decrease in cost when the business volume decreases, and β2 is expected to be significantly negative. This paper focuses on the coefficient β3 in the model, which indicates the impact of the E-commerce Law on changes in corporate cost stickiness.

Table 1 Panel A shows the descriptive statistics for the main variables of this study. The mean of cost stickiness (ΔLncost) is 0.08, and the mean of sales revenue change (ΔLnreve) is 0.10. The mean of sales revenue decline (D) is 0.29, indicating that 29% of the sample experiences a decrease in sales revenue during the current year. The average value of revenue decline over two consecutive years (Sdec) is 0.12, meaning that 12% of the samples experience a decline in sales revenue for two consecutive years. Among the other variables, the average logarithm of company asset size is 22.13, the average proportion of shares held by the largest shareholder is 32.88%, and the values of other variables are within reasonable ranges. Table 1 Panel B indicates that the correlation coefficients for all key variables are under 0.6. Additionally, the VIF values are listed at the bottom of the table, showing that each variable’s VIF is below 10, which is the threshold for multicollinearity issues. Therefore, multicollinearity is not a concern for the variables in this study.

Table 1.

Descriptive statistics.

5. Empirical Results

5.1. Analysis of the Impact of the E-Commerce Law on Corporate Cost Stickiness

Columns (1) and (2) in Table 2 validate the presence of cost stickiness among listed companies in China. The results in columns (1) and (2) show that the coefficient of ΔLnreve is significantly positive at the 1% level, while the coefficient of D × ΔLnreve is significantly negative at the 1% level. Column (2) includes control variables. The coefficient of ΔLnreve is 0.6511, and the coefficient of D × ΔLnreve is −0.5216. This indicates that a 1% increase in sales revenue leads to a 0.65% increase in total operating costs. In contrast, a 1% decrease in sales revenue leads to only a 0.13% decrease in total operating costs. This finding suggests that cost stickiness generally existed among listed companies in China, which aligned with the expectations of this study.

Table 2.

Baseline regression: The impact of the E-commerce Law on corporate cost stickiness.

Columns (3) and (4) in Table 2 present the regression results for the impact of the E-commerce Law on corporate cost stickiness. Column (3) reports the effect of the E-commerce Law on cost stickiness without including any control variables. The results indicate that the coefficient of D × ΔLnreve is significantly negative at the 1% level, confirming the presence of cost stickiness. The coefficient of the interaction term between Policy and D × ΔLnreve is significantly positive at the 1% level. Column (4) includes control variables and their interaction term between Policy and D × ΔLnreve. The coefficient of the interaction term between Policy and D × ΔLnreve remains significantly positive at the 5% level. These results suggest that, after implementing the E-commerce Law, the greater the impact of the E-commerce Law on enterprises, the more significantly their cost stickiness decreases. This finding supports the hypothesis of this study.

5.2. Robustness Tests

5.2.1. Parallel Trends Test

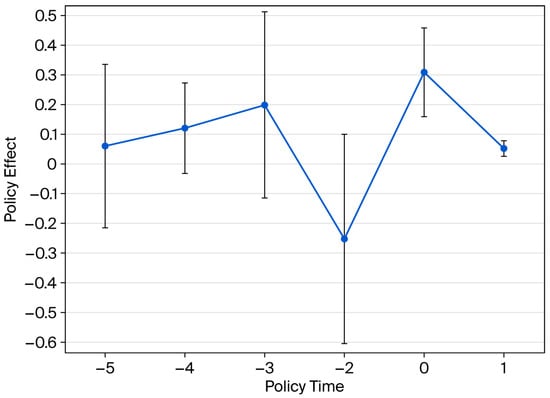

Figure 1 illustrates the dynamic effect of the E-Commerce Law on firms’ cost stickiness, along with 95% confidence intervals. The results show that prior to the policy implementation, the estimated coefficients of Policy × D × ΔLnreve are statistically insignificant and fluctuate slightly around zero, indicating that the parallel trends assumption holds. The regression results indicate that the parallel trends assumption holds.

Figure 1.

Parallel Trends Analysis.

5.2.2. Update the Sample Period

Considering that the Chinese government first introduced the concept of Internet+ in the 2015 Government Work Report and that the e-commerce industry only began to experience rapid growth from 2016 onward, this study adjusts the starting year of the sample to 2016 and updates the ending year to 2023, thereby covering a longer period of policy and market evolution. Based on the 2016–2023 sample of manufacturing firms listed on the Chinese A-share market, we re-conducted the regression analyses. The results reported in Table 3 show that the core variables remain consistent with the original sample analysis, indicating that the study’s conclusions are robust and not sensitive to the choice of sample period.

Table 3.

Robustness tests: alternative sample period.

5.2.3. Alternative Measurement of Variables

Since the specific content of the E-commerce Law mainly targeted corporate e-commerce activities, and detailed data on corporate-level e-commerce activities are currently difficult to obtain, the treatment and control groups are defined based on differences in the degree of e-commerce development at the industry level. Following the research methodology of Nunn and Qian [], a continuous variable is used to define the treatment group. The variable Treat is set to represent the proportion of enterprises within the industry that engaged in e-commerce transactions. Consistent with previous analysis, the study set the policy shock period to 2019 and constructed the variable Policy. We also control year, firm, and province fixed effects, and the regression results are presented in Table 4.

Table 4.

Robustness tests: alternative measures.

Column (1) in Table 4 shows the regression results without control variables. The coefficient of Policy × D × ΔLnreve is significantly positive at the 1% level. Column (2) added relevant control variables to the results in column (1). The coefficient of Policy × D × ΔLnreve remains significantly positive at the 1% level. This result is consistent with the main regression findings of this study.

Considering that the Management Discussion and Analysis (MD&A) section in annual reports of Chinese listed companies serves as a primary channel through which firms communicate their strategic intentions and business plans and is highly forward-looking and strategy-oriented, the frequency of e-commerce-related keywords in this section can, to some extent, reflect a firm’s strategic emphasis on and orientation toward e-commerce development. Building on previous studies that employ textual analysis to construct firm-level measures of specific dimensions of transformation or risk, this study similarly constructs a firm-level e-commerce transformation indicator based on word-frequency statistics to provide a scientific basis for defining treatment and control groups.

Specifically, we first compiled a seed dictionary of e-commerce-related terms, such as e-commerce, online sales, and internet sales, by reviewing existing literature and related sources. Using the Wingo financial text data platform, we expanded this seed dictionary with semantically similar terms identified via a Word2Vec model, thus constructing a specialized lexicon of e-commerce development terms. Second, we constructed a synonym dictionary related to transformation, including words such as change, adjustment, and reform. We then calculated the frequency of e-commerce-related terms appearing within a ±1 sentence window of any synonym of transformation in the MD&A section of annual reports, which serves as a measure of a firm’s degree of e-commerce transformation. Finally, firms whose e-commerce transformation scores in the year prior to the enactment of the E-Commerce Law were above the sample median were defined as the treatment group, with the remaining firms forming the control group, and regression analyses were conducted accordingly. As shown in Columns (3) and (4) of Table 4, the results remain consistent with the main regressions, further confirming the robustness of our findings.

5.2.4. Placebo Test

The study shifts the policy implementation date back by one year and two years, assuming that the E-commerce Law is implemented in 2018 or 2017, and conducts a regression test. The results are presented in Table 5. Columns (1) and (2) report the regression results for the 2018 policy implementation date, while columns (3) and (4) report the results for the 2017 policy implementation date. The results indicate that the coefficient on Policy × D × ΔLnreve is insignificant in columns (1) to (4). This suggests that there is no significant difference in cost stickiness among enterprises with varying levels of e-commerce development around 2018 and 2017, ruling out the influence of other random factors on the main regression results.

Table 5.

Robustness tests: placebo test.

5.2.5. Propensity Score Matching

Our results remain robust against selection bias. To address this, we conduct a 1:1 propensity score matching (PSM) with replacement between treatment and control regions, using city characteristics such as GDP, population, fiscal budget expenditure, and average wages. Table 6 reports the results. Aligning with our primary findings, the coefficient for Policy × D × ΔLnreve is significantly positive, suggesting that our main conclusions are not influenced by sample selection bias.

Table 6.

Robustness tests: propensity score matching.

5.2.6. Instrumental Variable Estimation

The study finds that the enactment of the E-commerce Law significantly reduces cost stickiness in manufacturing companies; however, this result may be influenced by endogeneity issues. To address this, the paper manually collects the number of policy documents issued by various provinces in China to regulate digital economy development, creating the variable IV as an instrumental variable. The instrumental variable approach is used to handle potential endogeneity issues. Local governments issued a series of policy documents during the process of digital economy governance, but these policy documents do not directly affect corporate operating revenue and operating costs. The test results are shown in column (1) of Table 7. From the statistical results, the LM test for instrumental variables yields a p-value of 0.000, strongly rejecting the null hypothesis, indicating a significant correlation between the instrumental variable and the endogenous variable. Furthermore, the F-statistic for the instrumental variable is 11.416, which is greater than 10, rejecting the null hypothesis of “weak instrumental variable.” The results from the two-stage instrumental variable test show that, after controlling for endogeneity factors, the inhibitory effect of digital economy governance on cost stickiness remains significant.

Table 7.

Robustness tests: instrumental variable test or excluding computer, IT, and internet-related manufacturing industries.

5.2.7. Removing Computer-, IT-, and Internet-Related Manufacturing Industries

Given the potential heterogeneity between industries closely related to the internet, such as computer and information technology manufacturing, and other industries, which could bias our results, we exclude these samples and rerun the analysis. As shown in column (2) of Table 7, the results are consistent with the main regression findings, further confirming the robustness of our regression results.

6. Mechanism Analysis

6.1. Corporate Digital Transformation

The theoretical analysis above indicates that the implementation of the E-Commerce Law will further encourage traditional manufacturing enterprises to transition to e-commerce, thereby alleviating cost stickiness for these companies. To facilitate e-commerce transformation, companies often undergo digital transformation to establish the necessary technological foundation and optimize business processes.

The Management Discussion and Analysis (MD&A) section in annual reports of listed companies serves as a key channel through which firms communicate their strategic intentions and operational plans to external stakeholders, exhibiting a strong forward-looking and strategic orientation. The presence of keywords related to digital transformation in these reports reflects the extent to which management emphasizes digitalization in the firm’s development strategy. Accordingly, the frequency of such keywords can serve as a proxy for a firm’s strategic focus and commitment to digital transformation. In recent years, scholars have widely employed word-frequency indicators from annual reports to measure firms’ strategic attention and investment direction in areas such as digital transformation and artificial intelligence [,]. Following Chen et al. [] and Liu and Hu [], this study calculates the frequency of keywords related to digital transformation in the annual reports of listed companies to measure corporate digital transformation. A higher frequency indicates a greater degree of digital transformation. Based on the degree of corporate digital transformation, firms are divided into high and low groups according to the quartile of this value by industry and year, and separate regressions are conducted. Columns (1) and (2) of Table 8 report that, in the sample with a lower degree of corporate digital transformation, the regression coefficient of Policy × D × ΔLnreve is significantly positive at the 5% level. In contrast, for the sample with a higher degree of digital transformation, the coefficient of Policy × D × ΔLnreve is not significant.

Table 8.

Mechanisms.

Columns (3) and (4) of Table 8 report the results of the mechanism test using an alternative measure of AI investment. We measured AI investment by identifying AI-related intangible and fixed asset items from the notes to the financial statements of listed companies and calculating their combined amount as a proportion of total annual assets. Specifically, intangible asset items include keywords such as software, intelligence, and data, while fixed asset items include keywords such as computer and electronic equipment. The findings remain consistent, confirming the robustness of our mechanism analysis. These results suggest that the implementation of the E-Commerce Law has encouraged manufacturing companies to pursue digital transformation, thereby reducing cost stickiness.

6.2. Supply Chain Collaboration Capability

The theoretical analysis indicates that the introduction of the E-Commerce Law will enhance supply chain collaboration capabilities in traditional manufacturing, thereby reducing cost stickiness. This section focuses on analyzing two dimensions: coordination of geographically dispersed supply chains and supply chain transparency.

Geographical distribution is a crucial factor affecting information response speed within a supply chain. The greater the geographical distance between a company and its supply chain partners, the more severe the information asymmetry between the company, suppliers, and customers becomes, making flexible regulation of input quality and standards more complex. This leads to lower supply chain collaboration capabilities []. The enactment of the E-Commerce Law encourages manufacturing companies to adopt e-commerce, optimize logistics management, and enhance communication with supply chain partners, mitigating information blockages. As companies and their suppliers or customers are farther apart (i.e., located in different regions), communication and coordination costs increase, making the E-Commerce Law’s impact on reducing cost stickiness more significant.

Therefore, we perform separate regressions by grouping companies based on whether they and their customers or suppliers are located in the same province, with results presented in Table 8. Columns (5) and (6) of Table 8 present the regression results based on whether the company and its suppliers or customers are located in the same province. The regression coefficient of the variable Policy × D × ΔLnreve is significantly positive only when the company has suppliers or customers in different provinces, while the effect is not significant when they are in the same province. This indicates that the greater the geographical distance and coordination costs between a company and its suppliers or customers, the more the E-Commerce Law reduces cost stickiness, further validating its role in enhancing supply chain collaboration.

Supply chain transparency refers to the extent to which a company discloses sensitive and confidential information about its supply chain partners []. Unlike a company’s internal information environment, supply chain transparency includes information from both upstream and downstream partners. Increased transparency can enhance collaboration, build trust, and improve the efficiency and sustainability of the supply chain [,,].

To measure supply chain transparency, we use the proportion of transaction volume from the top disclosed suppliers and customers among the top five suppliers and customers. A higher value indicates greater transparency. We then divide the sample into two groups based on the industry- and year-specific quartiles of the supply chain transparency to perform regression tests separately for companies with high and low supply chain transparency. Columns (7) and (8) of Table 8 present the regression results. The regression coefficient for Policy × D × ΔLnreve is significantly positive only in the sample with lower supply chain transparency. This indicates that when a company’s supply chain transparency is lower, the implementation of the E-Commerce Law has a more pronounced effect on reducing cost stickiness. In other words, the E-Commerce Law helps mitigate information asymmetry between companies and their suppliers or customers, enhancing coordination and reducing cost stickiness.

7. Further Analysis

7.1. Heterogeneous Effects

7.1.1. Heterogeneity Analysis Based on the Firm-Level

The impact of the implementation of the E-commerce Law on cost stickiness varies according to the stage of a company’s life cycle. Typically, the corporate life cycle is divided into four main stages: startup, growth, maturity, and decline. Compared to companies in the startup and growth stages, those in the maturity and decline stages experience slower business growth and face increased profit pressures, making cost control critical. The implementation of the E-commerce Law can promote digital transformation in these companies, improve supply chain coordination, and help convert more fixed costs into variable costs, enabling flexible downsizing and significantly reducing cost stickiness.

Based on the cash flow classification method proposed by Dickinson [], we divided the sample companies into two categories: startup and growth-stage companies, and maturity and decline-stage companies. As shown in Table 9 Panel A, columns (1) and (2), the coefficient of Policy × D × ΔLnreve is significantly positive for companies in the maturity and decline stages, while it is not significant for companies in the startup and growth stages, aligning with the expectations of this study.

Table 9.

Heterogeneous effects.

The impact of the E-commerce Law on reducing cost stickiness may vary across companies with different ownership structures (such as state-owned and private enterprises). Compared to private enterprises, state-owned enterprises generally have higher fixed costs and face more administrative constraints in decision-making and resource allocation. The implementation of the E-commerce Law can drive digital transformation in these companies and enhance supply chain coordination, thereby significantly improving the timeliness of cost-related decisions at various management levels, precisely identifying cost optimization opportunities, and ultimately reducing cost stickiness.

Therefore, we classified the sample companies into two categories: state-owned enterprises and non-state-owned enterprises. As shown in Table 9 Panel A, columns (3) and (4), the coefficient of Policy × D × ΔLnreve is significantly positive for state-owned enterprises, while it is not significant for non-state-owned enterprises. Similarly, this result aligns with the expectations of this study.

7.1.2. Heterogeneity Analysis Based on the Province-Level

Overall, the impact of the E-commerce Law on reducing corporate cost stickiness varies according to the level of economic development. In economically developed regions, companies can fully leverage digital technologies and supply chain management tools to effectively reduce cost stickiness. In contrast, in economically underdeveloped regions, companies face greater resource and technological constraints, which limit the effectiveness of digitalization and supply chain coordination, leaving the challenge of reducing cost stickiness still present.

Therefore, we divided the sample companies based on the median GDP growth rate of the provinces in which they are located, categorizing them into two groups: economically underdeveloped regions and economically developed regions. As shown in Table 9 Panel B, columns (1) and (2), the coefficient of Policy × D × ΔLnreve is significantly positive in economically developed regions, while it is not significant in economically underdeveloped regions. This result aligns with the expectations of this study.

The impact of the E-Commerce Law on reducing company cost stickiness is closely related to the degree of regional reliance on foreign trade. Enterprises in regions with low dependence on foreign trade are often less affected by fluctuations in the international market and typically face a more stable market environment. As a result, these enterprises can more easily predict changes in consumer demand. Therefore, under the implementation of the E-Commerce Law, they can respond more quickly to market demands through digital tools and supply chain collaboration, flexibly adjust production and inventory, and reduce cost stickiness.

Therefore, we classified the sample companies based on the median proportion of total import and export value to GDP in their respective provinces, dividing them into two categories: regions with high dependence on foreign trade and regions with low dependence on foreign trade. As shown in Table 9 Panel B, columns (3) and (4), the coefficient of Policy × D × ΔLnreve is significantly positive in regions with low dependence on foreign trade, while it is not significant in regions with high dependence on foreign trade. This result also aligns with the expectations of this study.

7.2. Other Consequences

7.2.1. Analysis Based on Managerial Opportunism

Due to the principal-agent problem between shareholders and management, company management often exhibits self-serving tendencies in organizing production and coordinating with external suppliers and customers. Driven by self-interest, management may rapidly expand resources, purchase more equipment, and hire additional staff when business volume increases. However, when business volume decreases, they may resist cutting costs to maintain control over existing resources, leading to cost stickiness within the company. Implementing the E-commerce Law can increase the litigation risks the management faces, thereby constraining opportunistic behaviors. The E-commerce Law strictly penalized businesses that harmed consumer rights, requiring rectification, suspension, or fines within a set period for improper conduct. Disputes arising from e-commerce activities could be resolved through mediation, arbitration, or litigation. These legal provisions increased the litigation risks for businesses attempting to pursue personal gains through deceit, concealment, or betrayal. Management would likely reduce self-serving unethical behavior to avoid the high compensation and reputational damage associated with lawsuits, thereby lowering agency costs [].

In this study, managerial opportunism is measured by the management expense ratio, with a higher ratio indicating more pronounced opportunistic behavior by management. We include this variable as the dependent variable in Model (1) for regression analysis, and the results are presented in Table 10. As shown in Column (1) of Table 10, the implementation of the E-Commerce Law significantly reduces the management expense ratio, indicating a weakening of managerial opportunism.

Table 10.

The impact of the implementation of the E-Commerce Law on managerial opportunism and managerial ability.

7.2.2. Analysis Based on Managerial Ability

The informational effect of managerial ability allows a company to promptly adjust resource allocation and reduce investment in non-viable products. Meanwhile, the governance effect of managerial ability can constrain self-serving behaviors of management, thereby mitigating cost stickiness within the organization. Legitimacy theory indicates that, as a social organization, an enterprise needs to comply with legal regulations, policy requirements, and regulatory systems to gain social recognition of its operational legitimacy, thereby ensuring its survival and development [,]. To gain social recognition of their legitimacy, management is motivated to thoroughly understand and adhere to legal requirements, acquire comprehensive external information, and establish a robust compliance framework. By enhancing their governance capabilities, they can effectively mitigate cost stickiness within the company.

Following Demerjian et al. [], we construct a measure of managerial ability, where a higher value indicates stronger managerial capability. We include this variable as the dependent variable in Model (1) for regression analysis, and the results are presented in Table 10. As shown in Column (2) of Table 10, the implementation of the E-Commerce Law has significantly enhanced managerial ability.

8. Discussion

8.1. Theoretical Contributions

First, this study enriches the literature on the effects of digital economy governance. As summarized, existing research has extensively explored theories and institutions concerning data governance, platform governance, and e-commerce industry governance, primarily focusing on institutional design, responsibility allocation, platform rules, and the optimization of regulatory mechanisms [,,,,,,,,,,,,,]. However, most of these studies remain at the macro or institutional level and lack systematic empirical analysis of the impact of digital economy governance on micro-level corporate behaviors—particularly concerning cost decisions, operational management, and behavioral adjustments [,,]. Consequently, a significant research gap persists regarding how digital economy governance, through laws, regulations, platform policies, or institutional arrangements, influences corporate micro-level behaviors, warranting further exploration. Using the enactment of China’s E-commerce Law as an exogenous shock, this study systematically investigates the impact of e-commerce governance policies on corporate cost stickiness, constructing a causal pathway of “legal institutional constraints—corporate cost decision-making behavior.” This mechanism addresses the current research need to explain how digital economy governance affects corporate conduct and deepens the understanding of how regulation influences corporate cost behavior. As a core dimension of e-commerce regulation, the enactment of the law establishes an institutional foundation for corporate cost decisions. On the one hand, it significantly improves the overall market environment for firms engaged in e-commerce activities, enabling them to focus on expanding their e-commerce operations and thereby enhancing their digital transformation. On the other hand, the law’s implementation mandates that all entities involved in e-commerce transactions disclose relevant information, which increases overall supply chain transparency and trust, thereby strengthening supply chain coordination. These two factors collectively contribute to reducing corporate cost stickiness, clarifying the positive role of e-commerce regulation in improving corporate cost management and operational efficiency. The findings of this study further support and extend existing views on the role of e-commerce regulation in enhancing corporate compliance and governance efficiency [], while broadening the understanding of the effects of digital economy governance.

Second, this study extends the research on factors influencing corporate cost stickiness. Traditional studies primarily attribute cost stickiness to internal firm factors such as resource adjustment costs, agency problems, and managerial optimism []. Although recent research has attempted to broaden the perspective by examining economic policy environments, corporate governance characteristics [,,,], and managerial competence [] as influencing factors, there remains insufficient attention to how external macro-factors affect corporate cost decisions through micro-level mechanisms. Amid the new wave of global technological revolution and industrial transformation, digital innovation and its convergence with the manufacturing sector have emerged as a core agenda in the economic restructuring of the new industrial revolution. Most existing studies operate under traditional business model assumptions and fail to adequately account for the significant evolution of business models in the digital economy era, making it difficult for conventional theories to capture the impact of rapidly evolving business models on cost behavior. By employing the implementation of China’s E-commerce Law as an exogenous shock, this study reveals how legal institutions in the digital economy era influence internal cost management decisions through incentive and constraint mechanisms. More importantly, unlike prior research treating cost stickiness as a unitary outcome, this study uncovers multidimensional pathways through which digital economy governance operates. On the one hand, digital transformation enables firms to leverage technologies such as big data, artificial intelligence, and cloud computing for refined cost management and real-time monitoring, thereby reducing uncertainty in managerial resource adjustment decisions. On the other hand, enhanced supply chain coordination improves information flow and coordination efficiency with upstream and downstream partners, enabling production planning and procurement decisions to better align with actual demand while reducing resource waste and inventory accumulation. Consequently, digital economy governance not only optimizes corporate cost structures but also mitigates cost stickiness through multiple mechanisms, providing new theoretical evidence on how laws and policies shape micro-level corporate cost decisions through their incentive and constraining effects.

Third, this study reveals the differential effects of digital economy governance in reducing corporate cost stickiness through heterogeneity analysis. Existing research typically treats policy effects as aggregate impacts, overlooking potential variations across different types of enterprises and regions, whereas digital economy governance’s influence on corporate cost decisions often exhibits heterogeneity in practice. Using Chinese manufacturing firms as a sample, this study finds that the cost stickiness-reducing effect of digital economy governance is more pronounced in mature and declining firms and state-owned enterprises, as well as in economically developed regions or those with lower reliance on foreign trade. This finding carries multiple theoretical implications: On the one hand, it enriches the cost stickiness literature by incorporating firm characteristics and regional economic environments into the analytical framework, revealing how policy implementation effects are moderated by factors such as firm lifecycle, ownership nature, and regional development levels. On the other hand, it provides a new perspective for understanding how digital economy governance influences micro-level corporate cost decisions. Specifically, under clear institutional constraints and relatively stable market conditions, firms can more readily achieve cost adjustments through digital transformation and supply chain optimization, thereby effectively reducing cost stickiness. These heterogeneity analyses not only supplement existing literature’s deficiencies at the micro-mechanism level but also provide theoretical references for subsequent research to evaluate policy effects across different firm types and regional contexts.

8.2. Managerial Implications

First, the research findings show that the implementation of China’s first law on digital economy governance—the E-commerce Law—has significantly improved firms’ ability to efficiently allocate and utilize resources, thereby reducing cost stickiness. This evidence underscores the importance of strengthening digital economy governance through the rule of law and continuously promoting its orderly and standardized development. In the short term, the government should accelerate the formulation of supporting regulations and implementation standards to ensure that firms can promptly understand and comply with relevant legal requirements. In the long term, it is necessary to establish a regular evaluation and revision mechanism that allows for timely policy adjustments based on data monitoring and market feedback. Such a mechanism would help refine the legislative framework and foster a virtuous interaction between legal systems and market dynamics, enabling the economy to better adapt to the challenges arising from the rapid development of the digital economy. By implementing these phased measures, the government can not only secure the sustainable and well-regulated growth of the digital economy but also provide institutional guarantees for enterprises to utilize resources efficiently and optimize their cost structures. As the world’s largest e-commerce market, China’s governance experience offers valuable insights for other countries and regulatory bodies, particularly in designing effective oversight frameworks, promoting compliance among manufacturing enterprises, advancing digital transformation, and addressing the fast-paced evolution of the e-commerce sector.

Second, it is essential to fully account for the impact of digital transformation and supply chain management on firms’ cost decisions. From the perspective of digital transformation, efforts should be accelerated to empower corporate cost management and control through digital technologies. First, firms can leverage big data, artificial intelligence, and cloud computing to optimize cost management processes, achieve resource integration and information sharing, and enhance managerial efficiency. These technologies improve the flexibility and precision of cost control while promoting the timeliness and efficiency of resource optimization and adjustment. Second, firms should strengthen employees’ digital literacy, comprehensive capabilities, and collaborative skills while encouraging experimentation with new technologies and management models. Such initiatives can facilitate cost control and operational optimization driven by digital empowerment. From the perspective of supply chain management, firms should first adopt diversified supplier management strategies to ensure resilience. When faced with supply chain disruptions or market volatility, diversified sourcing can enable firms to quickly identify alternative solutions, make timely adjustments, and shorten production and cost optimization cycles. Second, it is important to strengthen information sharing with both upstream and downstream supply chain partners—particularly regarding demand, inventory, and cost data—to improve resource allocation efficiency and enhance the agility of decision-making.

8.3. Limitations and Future Research Directions

This study has several limitations, which also suggest directions for future research.

First, the sample primarily focuses on listed manufacturing firms. Given that industries differ in technological structures, cost compositions, and competitive environments, the manifestation of cost stickiness may vary across sectors. Consequently, the conclusions drawn from this study may not be fully generalizable to other industries. Future research could incorporate factors such as industry life cycle and market competition intensity to explore the heterogeneous impacts of digital economy governance on firms’ cost behaviors across different industries.

Second, although the DID method employed in this study provides strong causal inference for identifying policy effects, it is not without limitations. On the one hand, relying solely on a policy implementation dummy may underestimate the indirect effects arising from interactions with other regulatory measures or local policies. On the other hand, the traditional DID framework assumes a time-invariant treatment effect, which limits its ability to capture the dynamic evolution of policy impacts. Future studies could integrate event study methods to more systematically reveal the temporal characteristics of policy effects.

Third, the management discussion and analysis (MD&A) text-based indicators used in this study also have certain constraints. The textual content may be influenced by firms’ public relations strategies or disclosure biases, introducing potential subjectivity into the analysis. Future research could combine survey and interview data to validate the motives and authenticity of managerial disclosures, thereby improving the external validity of text-based measures.

Finally, the heterogeneity analysis in this study mainly considers factors such as firm life cycle, ownership type, and regional development level but does not fully account for variations in the digital environment. Future studies could incorporate variables such as regional e-commerce development, regulatory enforcement intensity, and the share of online sales to more comprehensively identify the boundary conditions under which digital economy governance affects firms’ cost stickiness.

Author Contributions

W.L.: writing—review and editing, writing—original draft, visualization, validation, supervision, resources, project administration, methodology, formal analysis, data curation, conceptualization. Y.D.: writing—review and editing, writing—original draft, visualization. X.T.: writing—review and editing, visualization, validation, supervision, resources, project administration. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Variables and definitions.

Table A1.

Variables and definitions.

| Variable | Definition |

|---|---|

| ΔLnreve | The change in the natural logarithm of management, selling, and financial expenses between year t − 1 and t. |

| ΔLncost | The change in the natural logarithm of net sales revenue between year t − 1 and t. |

| Policy (Treat × Post) | A dummy variable that equals 1 if the firm is affected by the implementation of the E-commerce Law. |

| Treat | If a firm is located in a region with a higher-quality legal environment, the variable Treat is assigned a value of 1; otherwise, it is assigned a value of 0. |

| Post | If the year is 2019 or later, the variable is set to 1; otherwise, it is set to 0. |

| D | A dummy variable that equals 1 if the sales revenue in year t is lower than that in year t-1 and 0 otherwise. |

| Size | The natural logarithm of the total assets. |

| Lev | The ratio of debt to total assets. |

| TOP1 | The proportion of shares held by the largest shareholder. |

| Ai | The ratio of total assets to operating revenue. |

| Ei | The number of employees multiplied by 10,000, scaled by operating revenue. |

| GDP | The growth rate of GDP. |

| Sdec | An indicator variable that equals 1 if sales decrease for two consecutive years (Salei,t-2 > Salei,t−1 > Salei,t) and 0 otherwise. |

| HHI | Herfindahl Index. |

| IV | The number of digital economy regulatory documents issued by each province. |

| Corporate digital transformation | Following Chen et al. [], calculating the frequency of digital transformation words in corporate annual reports |

| Supply chain transparency | The proportion of transaction volume from major suppliers and customers with explicitly disclosed names to the total transaction volume of the top five suppliers and customers. |

| OPP | Management expense ratio. |

| Cap | Following Demerjian [], we construct a measure of managerial ability. |

| Growth stage | According to the cash flow classification method proposed by Dickinson [], the company life cycle is divided into startup, growth, maturity, and decline stages. If the company is in the startup and growth stage, the value of this variable is set to 1; otherwise, it is set to 0. |

| State-ownership | A dummy variable with a value of 1 if a firm is state—owned and 0 otherwise |

| Economically underdeveloped regions | If the GDP growth rate of the province where the company is located is below the sample median, the value is set to 1; otherwise, it is set to 0. |

| Regions with a low dependence on foreign trade | If the share of total imports and exports to GDP in the province where the company is located is below the sample median, the value is set to 1; otherwise, it is set to 0. |

References

- Fraundorfer, M. Brazil’s organization of the NETmundial meeting: Moving forward in global internet governance. Glob. Gov. 2017, 23, 503–521. [Google Scholar] [CrossRef]

- Rodima-Taylor, D.; Grimes, W.W. International remittance rails as infrastructures: Embeddedness, innovation and financial access in developing economies. Rev. Int. Polit. Econ. 2019, 26, 839–862. [Google Scholar] [CrossRef]

- Anderson, M.C.; Banker, R.D.; Janakiraman, S.N. Are selling, general, and administrative costs “sticky”? J. Account. Res. 2003, 41, 47–63. [Google Scholar] [CrossRef]

- Anderson, S.W.; Lanen, W.N. Understanding Cost Management: What Can We Learn from the Evidence on ‘Sticky Costs’? Working Paper. Available online: https://ssrn.com/abstract=975135 (accessed on 29 January 2023).

- Zhang, B.; Yang, L.; Zhou, R. Internal governance and cost stickiness. J. Manag. Account. Res. 2023, 35, 173–194. [Google Scholar] [CrossRef]

- Lee, W.J.; Pittman, J.; Saffar, W. Political uncertainty and cost stickiness: Evidence from national elections around the world. Contemp. Account. Res. 2020, 37, 1107–1139. [Google Scholar] [CrossRef]