Abstract

This study employs data from Chinese A-share manufacturing firms listed between 2018 and 2024 to examine the nonlinear effects of digital service innovation on corporate value creation and its threshold mechanisms, using a two-way fixed-effects model and a panel threshold model. The results indicate that (1) digital service innovation exhibits a nonlinear relationship with value creation—its impact is initially suppressed at low innovation levels but rises markedly once a certain inflection point is exceeded; (2) ecosystem embedding presents a double-threshold effect: when embedding is high, it substantially strengthens the efficacy of digital service innovation; (3) organizational dynamic capability shows a single-threshold effect: moderate dynamic capability enhances value creation, whereas overly strong capability may inhibit innovation benefits; and (4) digital technology adoption does not display significant threshold characteristics. This research enriches the theory of digital service innovation and offers empirical evidence and practical insights for manufacturing firms in crafting differentiated innovation strategies.

1. Introduction

With the rapid advancement of the digital economy, digital service innovation has become a key approach for manufacturing firms to enhance competitiveness and achieve transformation and upgrading. The 2024 Government Work Report likewise emphasizes deepening the innovative development of the digital economy and promoting the integration of the digital economy with the real economy. Digital service innovation refers to enterprises’ use of digital technologies to develop new service offerings or optimize existing service processes in order to meet diverse customer needs and create new value [1]. However, in practice, manufacturing firms often fail to attain the expected performance improvements from digital service innovation. First, poor cost control and a substantial mismatch between resource investment and anticipated benefits can undermine outcomes. For instance, Azalea Automobile invested heavily in intelligent driving and power-exchange services to enhance user stickiness through digital offerings but could not establish an effective profit model due to high network construction costs, low utilization rates, and protracted payback periods [2]. Second, China Chemical Equipment (Luxembourg) Co., Ltd. (Luxembourg) launched a digital service solution aimed at optimizing production processes and service modes via intelligent technologies but incurred high project costs while market demand fell short of expectations, resulting in a net loss of RMB 2.751 billion and a pronounced imbalance between input and return [3]. These cases suggest a complex relationship between digital service innovation and corporate value creation, with underlying mechanisms that remain unclear. Accordingly, it is necessary to explore in depth the mechanisms through which digital service innovation influences value creation so as to more effectively guide innovation practice in manufacturing enterprises.

Academic views diverge regarding the impact of digital service innovation on corporate value creation. The first view posits a positive contribution: digital service innovation can improve firms’ financial performance by strengthening customer relationships and enhancing service quality [4,5]. The second view argues for a negative impact: the generalizability and ease of replication of digital technologies may weaken innovation distinctiveness and impair performance [6]. The third view holds that the relationship is uncertain or nonlinear: digital service innovation may entail threshold effects, with costs and coordination complexity rising beyond firms’ capability boundaries [7,8]. Such controversy reduces confidence in digital service innovation among Chinese manufacturing firms. Therefore, further elucidation of the mechanisms through which digital service innovation affects value creation is imperative to inform more effective practical actions.

Drawing on the TOE (Technology–Organization–Environment) framework and using data from Shanghai and Shenzhen A-share manufacturing firms listed between 2018 and 2024, this study investigates the nonlinear impact mechanisms of digital service innovation on corporate value creation via panel threshold regression. The marginal contributions are as follows. First, most existing studies assume a linear or simple positive/negative relationship; this paper overcomes the linearity assumption, revealing a “suppressed-then-enhanced” relationship between digital service innovation and value creation in manufacturing firms, thereby expanding theoretical perspectives. Second, by integrating the TOE framework with threshold effect analysis, we identify critical boundary conditions in terms of digital technology maturity, organizational dynamic capability, and ecosystem embeddedness. This enriches understanding of when and under what conditions digital service innovation effectively drives value transformation, and provides theoretical foundation and methodological tools for managers. The rest of the paper is organized as follows. Part II reviews the literature on digital service innovation and proposes research hypotheses; Part III develops the theoretical model and defines variables; Part IV presents empirical analysis and robustness checks; Part V discusses theoretical and practical implications, acknowledges limitations, and suggests future research directions.

2. Theoretical Framework and Hypotheses

2.1. The Relationship Between Digital Service Innovation and Value Creation

Digital service innovation refers to enterprises’ systematic innovation activities leveraging digital technologies (e.g., the Internet of Things, cloud computing, big data, artificial intelligence) guided by the servitization paradigm to digitally reconfigure, extend, and optimize traditional product and service systems [9]. It not only encompasses the in-depth application of technology in customer interaction, operations management, and after-sales service but also emphasizes cross-organizational value co-creation through platform- and network-based collaboration ecosystems [10,11]. Prior literature predominantly examines the positive role of digital service innovation in promoting value creation. For instance, Kohtamäki’s empirical study indicates that digital service innovation significantly enhances customer experience and network effects, thereby improving corporate profitability and market competitiveness [12]. However, some studies suggest that digital service innovation may adversely affect firm performance, exhibiting decoupling or even inversion between innovation investment and value creation [13], implying that innovation and value creation do not always align.

In light of these coexisting positive and negative effects, an increasing number of scholars investigate the dynamic evolution of the relationship between digital service innovation and value creation. First, based on service-dominant logic and service ecosystem theory, the value generated by digital service innovation is not linear through a single link but rather is continuously accumulated and amplified via a cyclic “interaction–feedback–enhancement” process within a networked synergy of multiple actors [14]. This nonlinear dynamic interaction suggests that firms encounter distinct performance trajectories at different innovation stages: initial rapid trial-and-error may depress short-term performance, whereas value release accelerates as interactions deepen, feedback mechanisms mature, and capabilities accumulate [15,16]. Second, digital service innovation can be classified into incremental and breakthrough modes, with corresponding step changes in value contribution [17,18]: incremental innovation can sustain service optimization but often yields limited net benefits due to diminishing returns, whereas implementing multiple breakthrough innovations in parallel or sequentially can trigger value jumps through synergies and network externalities [19,20]. Finally, research identifies an inverted U-shaped relationship between digital technology investment and value creation: at early stages, technologies such as big data and cloud computing enhance service delivery efficiency by increasing resource density and mobility; however, when technological complexity and management costs exceed organizational absorptive and coordination capacities, overinvestment inhibits innovation performance [21,22].

Based on the above theoretical analysis, we propose the following hypothesis.

H1.

Digital service innovation in manufacturing firms exhibits a significant nonlinear relationship with value creation.

2.2. Value Creation in Digital Service Innovation from a TOE Perspective

In the contemporary digital economy, digital service innovation entails the mutual coupling and dynamic evolution of multiple dimensions—technological factors, organizational capabilities, and external ecological environments—rather than a purely technical issue solvable in isolation; it constitutes a complex management challenge requiring systematic coordination and continuous optimization [23]. Studying technological, organizational, or environmental factors in isolation often fails to capture comprehensively the complex pathways through which digital service innovation drives enterprise value creation [24]. The TOE framework emphasizes interactions among technological, organizational, and environmental factors, enabling a systematic elucidation of the evolutionary processes and multiple value-return mechanisms of digital service innovation [25], and explaining why similar initiatives may yield divergent performance outcomes across different firm contexts. Moreover, the TOE perspective provides a theoretical foundation for constructing threshold models to identify key boundary conditions affecting value creation in digital service innovation, guiding firms in timing investments and allocating resources to maximize returns in practice.

- (1)

- Technological dimension

The technological dimension in the TOE framework comprises two core aspects. First is the technology foundation: hardware and platform infrastructures supporting digital service innovation, including cloud computing centers, industrial IoT sensing networks, big data storage, and high-speed networking channels [26]. Second is the technology application level: embedding infrastructures and digital capabilities—such as intelligent algorithms, data analytics tools, and edge computing—deeply into business processes and service delivery to form a closed-loop system of real-time monitoring, intelligent decision-making, and automated execution [27]. The integration of these aspects enables manufacturing firms to operate effectively in scenarios such as predictive maintenance, personalization, and proactive services [28]—for example, acquiring equipment health data via IoT infrastructure and embedding AI-driven analysis into maintenance processes to achieve predictive maintenance [29], using open APIs to deliver analytics results into customer systems for personalized recommendations [30], and automatically triggering early warnings and remote interventions to realize proactive services [31]. Digital technology determines the feasibility and diffusion potential of digital service innovation, but its role is not unidirectionally linear: overall value creation may exhibit nonlinear characteristics across different stages of technological maturity and application depth [32].

Companies can catalyze and amplify service innovation value through digital technologies such as IoT, intelligent automation, and digital platforms [33]. First, IoT collects real-time equipment operation and environmental data via sensors and actuators, enabling manufacturing firms to obtain high-frequency insights during maintenance, operations, and usage, thus launching services like predictive maintenance and energy-efficiency optimization [34]. Second, intelligent automation embeds AI analytics and edge/cloud computing results into service processes; upon detecting anomalies or shifts in customer demand, it automatically triggers responses and executions, improving service timeliness and consistency, reducing labor costs, and supporting large-scale deployment [35]. Finally, digital platforms interconnect internal capabilities with third-party developers, technology providers, and customer systems through open APIs and microservices architectures, broadening data sources and enriching the functional ecosystem, while leveraging network externalities to scale innovation; this significantly amplifies a firm’s service innovation capacity and, in turn, enhances overall value creation [36].

However, higher digital technology maturity does not directly guarantee value growth; its marginal effect often follows an “increasing-then-decreasing” pattern [37]. When the technology base and application capabilities are at low to medium levels, each incremental investment can substantially improve the implementation efficiency and value contribution of digital service innovation; however, once technological maturity surpasses the organization’s absorptive and management capacity, overreliance on advanced technology increases operation, maintenance, and upgrade costs, and may introduce system complexity and data governance challenges, thereby weakening marginal gains in innovation value [38]. For example, large-scale IoT deployments and multi-source data aggregation without robust data governance and analytics pipelines can lead to data redundancy, noise interference, and processing delays [39], impeding the speed of service iterations—such as predictive maintenance and personalized customization—and raising operational costs [40]. Therefore, the impact of digital technology on value creation in digital service innovation may exhibit a significant threshold effect. Based on this reasoning, we propose:

H2a.

The level of digital technology exerts a positive impact and exhibits a threshold effect on value creation of digital service innovation: marginal benefits increase significantly at low maturity stages but diminish once a threshold is exceeded.

- (2)

- Organizational Dimension

In the context of digital service innovation, an organization’s dynamic capabilities manifest in its ability to identify, transform, and realize new service value. These capabilities can be subdivided into data awareness capability, knowledge absorption capability, and service innovation capability, which interlink to support high-quality service innovation in complex environments [41].

First, data awareness capability refers to the firm’s capacity to detect customer needs and service opportunities from multiple data sources, encompassing data collection and processing, interpretation for insight generation, and integration of networked resources to delineate innovation directions [42]. By deploying sensors to capture product usage and customer behavior data, and employing algorithmic tools to extract needs and uncover opportunities, firms can formulate key digital service innovation strategies—such as predictive maintenance and proactive services—thereby laying the groundwork for subsequent innovation activities [43].

Second, knowledge absorption capability denotes the ability to integrate and transform external data, technologies, and resources into viable service innovations [44]. In digital service innovation, firms must extract valuable information from technology providers, platform partners, and customer feedback, then internalize and adapt these inputs into implementable service designs. For example, when developing personalized services, firms integrate external algorithmic models and customer behavioral data into their service architecture to enable rapid response and iterative refinement [45]. This capability determines whether perceived opportunities translate into concrete, deployable digital services, serving as a critical link from opportunity identification to value realization [46].

Third, service innovation capability refers to the firm’s ability to build and iterate product–service systems based on data awareness and knowledge absorption, leveraging digital technologies to co-design offerings and reconfigure processes [47]. Under digital service innovation, firms move beyond single products or static services to modular, dynamically configurable solutions that integrate products, services, and customer interfaces. Service innovation capability encompasses not only solution construction but also the continuous evolution of the product–service portfolio via digital technology, enhancing delivery efficiency and customer experience; it constitutes the key link from design to realization of digital service innovation value [48]. Together, data awareness, knowledge absorption, and service innovation capabilities form a core competence chain—from identifying opportunities to realizing and continuously optimizing value in digital service innovation.

While organizational dynamic capabilities are crucial for digital service innovation, their marginal effect may diminish or even become detrimental once they exceed optimal thresholds [49]. This “over-expansion” risk can be examined along three dimensions. First, at the data awareness level, excessive reliance on massive data collection and analysis may induce information overload and decision delays [50]. On one hand, large volumes of undifferentiated or low-value data increase storage and processing costs; on the other hand, frequent and deep monitoring and feedback loops may lead to “chasing noise,” weakening sensitivity to genuine innovation opportunities, prolonging decision processes, and reducing responsiveness [51].

Second, at the knowledge absorption level, integrating external technologies, models, and feedback beyond the firm’s assimilation capacity can cause resource fragmentation and organizational inertia [52]. Excessive external knowledge inputs without effective screening and internal alignment may result in duplicated efforts or “over-learning,” impeding formation of clear service design paths; moreover, extensive collaboration and absorption activities may bloat internal structures, blur responsibilities, and weaken team focus and execution efficiency [53].

Third, at the service innovation level, overemphasis on modularization and system reconfiguration—continually overlaying various innovative components—can sharply increase system complexity and maintenance costs [54]. Frequent process reconfigurations and architectural upgrades without ongoing validation of actual usage scenarios may yield solutions detached from user pain points [55]; moreover, continuous interface evolution and module integration may introduce compatibility issues or technical debt, complicating subsequent iterations [56]. Additionally, over-reliance on established innovation paths can engender path dependency, reducing agility in responding to new markets or technological shifts [57].

In summary, firms should maintain moderate boundaries in the three dynamic capability dimensions—data awareness, knowledge absorption, and service innovation—to ensure flexibility in opportunity capture, effective resource integration, and continuous evolution of product–service systems, while avoiding information overload, resource redundancy, and uncontrolled system complexity due to capability overinvestment. Striking a balance between flexibility and standardization is essential for sustainable value creation in digital service innovation.

Based on the above analysis, we propose:

H2b.

Organizational dynamic capabilities positively moderate the relationship between digital service innovation and value creation, but this moderating effect exhibits diminishing marginal returns: capability enhancement initially boosts the efficiency of value transformation in digital service innovation, whereas beyond an optimal threshold, marginal gains progressively decline.

- (3)

- Environmental Dimension

The environmental dimension in digital service innovation emphasizes the degree of ecosystem embeddedness of manufacturing firms [58]. In digital service innovation contexts, a single firm rarely completes complex product–service-system (PSS) designs involving products, software, and service processes in isolation; instead, deep embedding within an ecosystem of customers, suppliers, technology providers, platforms, and other stakeholders is essential [59].

Embedding first manifests in access to resources: by participating in industry platforms or alliances, firms can rapidly obtain external technology modules (e.g., algorithmic models, cloud service capabilities), critical data streams (e.g., equipment operation or user behavior data), and market channels (e.g., distribution or customer reach) to compensate for internal gaps in technology, platform operations, or market access, thereby supporting the design and deployment of intelligent PSS [60]. Second, embedding involves institutional arrangements and contractual mechanisms: by jointly formulating or adhering to data-sharing agreements, revenue-sharing rules, and security and compliance standards, ecosystem members establish a trust framework for information exchange and value distribution, reduce cooperation uncertainty and legal risks, and ensure sustained collaboration in digital service innovation [61]. Although this trust framework is not equivalent to PSS design itself, it provides necessary institutional safeguards for multi-party cooperation, enabling continuous iteration and expansion of complex PSS within a predictable environment and controlled risks [62]. Deep ecosystem embedding thus becomes a prerequisite for initiating and scaling digital service innovations and a key driver of sustainable competitive advantage [63].

Deeply embedded ecosystems can significantly accelerate digital service innovation. First, resource complementarity allows firms to integrate external capabilities in designing intelligent PSS [64]. A firm may lack specialized capabilities for PSS design, but by joining a platform or consortium, it gains access to partners’ technology modules, data analytics capabilities, and operational support. For example, when developing remote monitoring and predictive maintenance PSS, manufacturing firms often leverage cloud providers’ data processing, software vendors’ algorithmic models, and channel partners’ customer interfaces to co-develop and rapidly deliver solutions; this synergy shortens development cycles and improves service quality [65]. Second, participation in co-developing standards and API specifications enhances interoperability, reduces interfacing costs among disparate systems and modules, and facilitates rapid combination and iteration of modularized PSS; when firms have influence in ecosystem governance or standard-setting, embedding their innovations into a common framework becomes easier [66]. In addition, ecosystem-scale network externalities amplify innovation value: more connected devices and users generate richer data for AI models, and more partners develop value-added modules to enrich PSS functionalities, creating a virtuous cycle [67]. Meanwhile, the trust foundation established through institutional arrangements and contractual mechanisms lowers barriers to data sharing and joint investment, encouraging long-term collaboration and experimentation, thereby promoting continuous evolution and commercialization of digital service innovation.

The impact of ecosystem embeddedness on value creation in digital service innovation is not monotonically linear but exhibits differential effects across embedding depth intervals [68]. At low embedding levels, firms rely on limited partnerships to acquire external resources; their value creation capacity depends primarily on internal resources and capabilities. As embeddedness increases, firms connect with more ecosystem members and access greater external support, but coordination costs—such as resource integration, standards alignment, and partnership management—also rise and may offset short-term benefits, causing fluctuations in innovation efficiency. Once a high degree of ecosystem embedding is achieved and a stable collaboration network and sharing mechanisms are established, firms can fully leverage ecosystem resources and capabilities for collaborative innovation and co-creation, leading to significant increases in value creation capacity.

Based on the above analysis, we propose:

H2c.

The degree of ecosystem embeddedness exerts a nonlinear effect on the relationship between digital service innovation and value creation, with a threshold beyond which the positive effect of digital service innovation on value creation increases significantly.

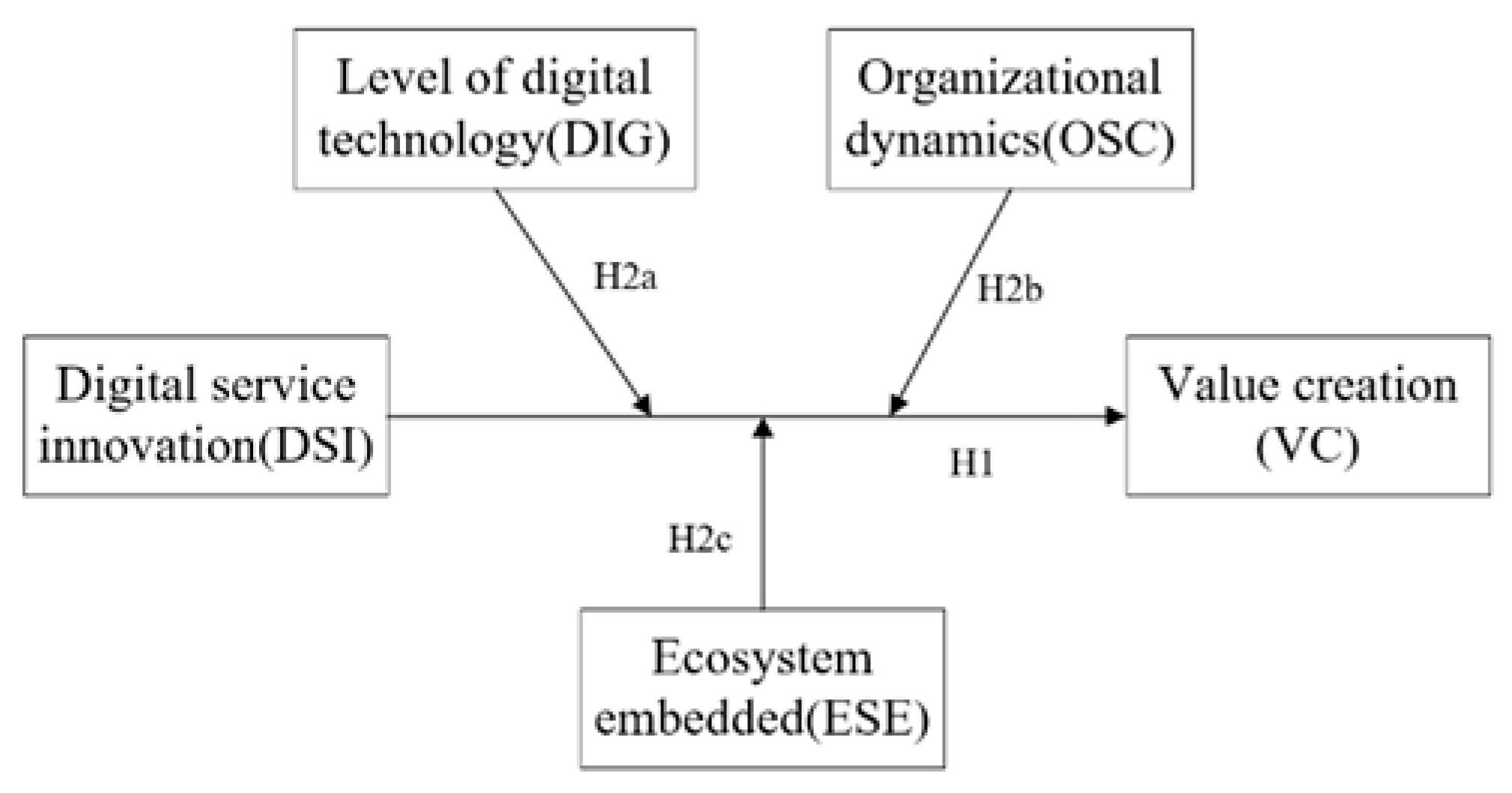

Based on the above hypotheses, this study proposes a theoretical model, as shown in Figure 1, to investigate the impact of digital service innovation on value creation in manufacturing firms.

Figure 1.

Model of digital service innovation impacting value creation in manufacturing firms: assumptions.

3. Method

3.1. Model Building

3.1.1. Baseline Regression Model

To examine the nonlinear effect of digital service innovation on value creation in manufacturing firms, we specify the following baseline model:

where i and t are index firm and year, respectively. denotes the value creation measure for firm i in year t. represents the degree of digital service innovation for firm i in year t, and is its squared term to capture potential curvature. is a vector of control variables. and denote year fixed effects and firm fixed effects, respectively, and is the idiosyncratic error term. The inclusion of allows testing for U-shaped or inverted U-shaped relationships between digital service innovation and value creation.

3.1.2. Panel Threshold Effects Model

To test Hypotheses H2a–H2c regarding threshold effects of technology, organizational capability, and ecosystem factors on the effectiveness of digital service innovation, we employ a panel threshold specification. For a single threshold, the model is:

where is the threshold variable (e.g., digital technology maturity, organizational dynamic capability, or ecosystem embeddedness) for firm i at time t, is the threshold parameter to be estimated, and is the indicator function. Below (in empirical implementation), this formulation can be extended to double or multiple thresholds if data support additional regime shifts. All other terms retain the same interpretation as in the baseline model. By comparing and , we assess how the marginal effect of digital service innovation on value creation differs when the threshold variable is below or above the estimated cut-off .

3.2. Variable Definition

3.2.1. Dependent Variable: Value Creation (VC)

Value creation is proxied by return on assets (ROA), measured as net profit divided by total assets, following prior literature [69]. ROA captures the efficiency with which a firm utilizes its assets to generate earnings, thus providing feedback on the profitability implications of digital service innovation in manufacturing firms.

3.2.2. Independent Variable: Digital Service Innovation (DSI)

Digital service innovation reflects firms’ innovative activities in products and services enabled by digital technologies [70]. We construct a composite index for DSI via the entropy weight method, based on two sub-indicators: digitalization level and service innovation level. Each sub-indicator is measured according to available data (e.g., technology adoption, service process updates), normalized, and then aggregated using entropy weights to form the DSI index.

3.2.3. Threshold Variables

We consider three threshold variables corresponding to technology, organizational, and ecosystem dimensions:

- (1)

- Digital Technology Level (DIG)

The digital technology level encompasses both foundational infrastructure and application capability, reflecting a firm’s capacity to support and leverage digital technologies for service innovation. Specifically, digital technology foundation denotes the basic infrastructural assets—such as cloud computing platforms, IoT sensing networks, data storage facilities, and high-speed networks—that underlie digital service initiatives. Digital technology application refers to the ability to transform these infrastructures and digital capabilities into productivity gains in concrete business scenarios (e.g., operations, management, production). To operationalize DIG, we follow a text-analysis approach [71]; using Python (version 3.10) to parse annual reports of listed manufacturing firms, we identify and count keyword frequencies related to digital technology, categorizing terms into “foundation” versus “application” dimensions. The resulting frequency measures are normalized (e.g., term frequency divided by total word count) for each dimension. When appropriate, these normalized sub-indicators may be aggregated—using methods such as entropy weighting or principal component analysis—into a composite DIG index. This procedure ensures that DIG captures both the presence of technological infrastructure and the depth of its application in firm activities.

- (2)

- Organizational Dynamic Capability (ODC)

Organizational dynamic capability for digital service innovation is proxied by integrating three interlinked sub-capabilities—data awareness, knowledge absorption, and service innovation—and aggregating them into an overall index [72,73,74]. Data awareness capability is measured by the level of data element utilization, as reflected in firms’ disclosures of data infrastructure or analytics practices. Knowledge absorption capability is proxied by R&D expenditure intensity (ratio of annual R&D spending to operating revenue), indicating the firm’s capacity to internalize and transform external knowledge into innovation. Service innovation capability is represented by R&D investment intensity and invention patent counts: we standardize both indicators (e.g., via z-scores) and sum them to reflect the firm’s innovation output potential. Each sub-capability measure is standardized to eliminate scale differences; the overall ODC index is then calculated as the average of the three standardized sub-indicators. This composite captures the firm’s ability to sense and interpret data-driven opportunities, absorb and internalize knowledge, and translate these into iterative service offerings under digital service innovation.

- (3)

- Ecosystem Embeddedness (ESE)

Ecosystem embeddedness refers to the extent to which a firm integrates into and leverages resources within its ecosystem. Referring to the practice of existing literature [62], Python (version 3.10) was used to analyze the text of annual reports of listed companies and crawl related word frequencies to portray the degree of ecological embeddedness of traditional enterprises.

3.2.4. Control Variable

Firm size (Size), total asset turnover (ATO), cashflow ratio (Cashflow), percentage of inventory (INV), proportion of fixed assets (FIXED), and Tobin’s Q (TobinQ) were selected as control variables based on existing studies.

3.3. Sample Selection and Data Sources

We focus on Chinese A-share listed manufacturing firms for the period 2018–2024, subject to the following screening procedures. First, to ensure relevance to digital service innovation, we exclude manufacturing firms without service operations. Drawing on Neely’s classification of manufacturing service scope, we review annual reports, firms’ official websites, and related disclosures to confirm whether a firm engages in service activities; firms lacking any service business are removed. Second, we omit firms that delisted, went bankrupt, or ceased operations during the sample period. Third, we exclude firms labeled ST or *ST and those with severely missing key data. After screening, our final panel comprises 3414 firm-year observations from 569 firms. Continuous variables are winsorized at the 1% tails to mitigate outlier influence. Data are obtained primarily from firms’ annual reports, the Cathay Pacific database, and the Rexis database. All data processing and empirical analyses are conducted in Stata (version 17).

4. Results

4.1. Descriptive Statistics and Multicollinearity Diagnostics

We employ Stata to compute descriptive statistics, the correlation matrix, and variance inflation factors (VIFs) for the main variables; results are reported in Table 1 All pairwise correlation coefficients are below 0.7, and all VIFs fall below the conventional threshold of 10, indicating no serious multicollinearity among explanatory variables. These diagnostics support the validity of subsequent regression analyses.

Table 1.

Descriptive statistics and correlation analysis.

4.2. Benchmark Regression and Robustness Tests

4.2.1. Baseline Regression Analysis

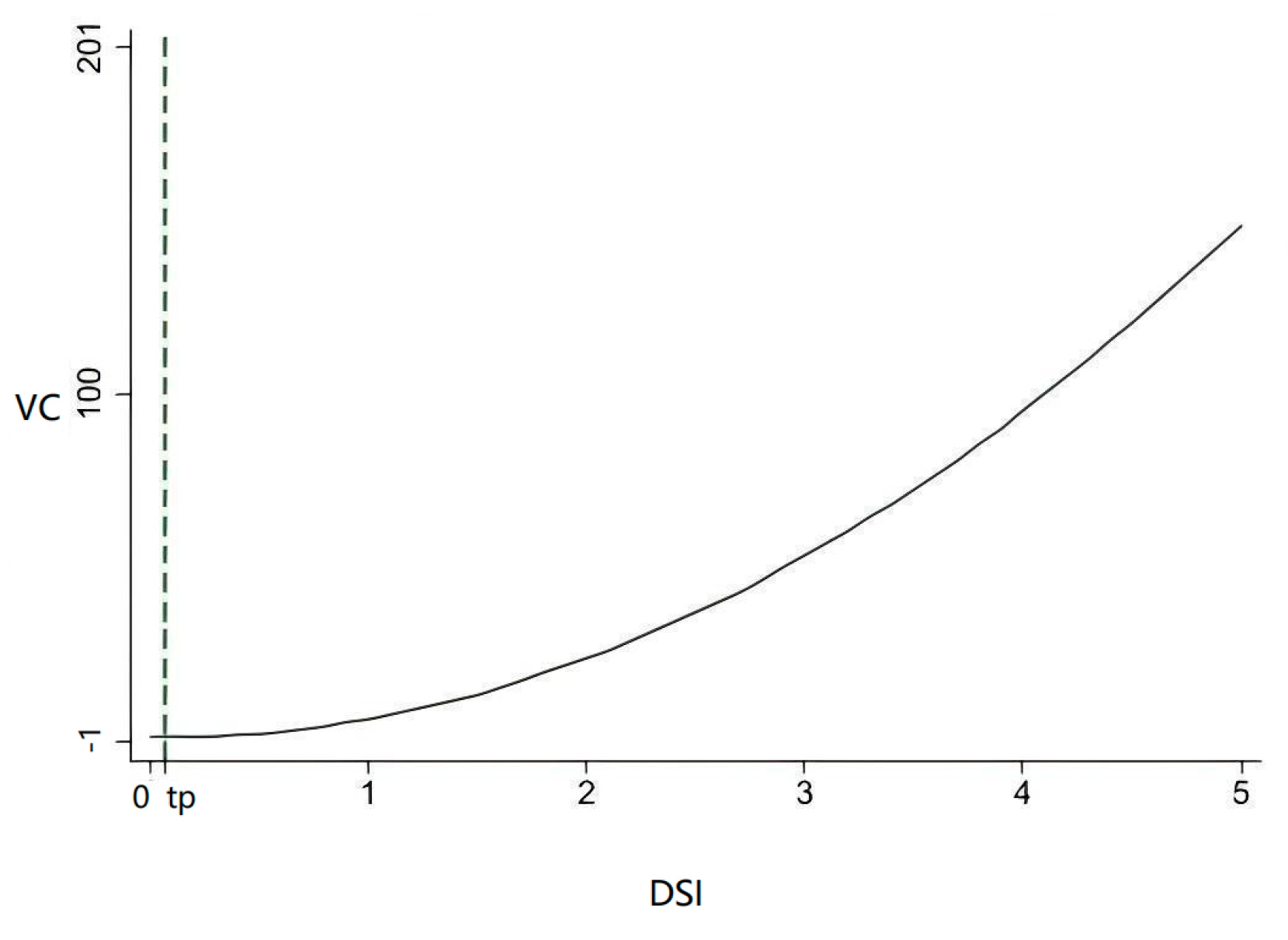

To examine the nonlinear effect of digital service innovation (DSI) on value creation, we estimate a two-way fixed-effects model. The regression results are presented in Table 2. Meanwhile, Figure 2 illustrates the nonlinear relationship between digital service innovation and value creation. The coefficient on the linear term of DSI is −0.8801 and on the squared term is 6.1482; both coefficients are statistically significant at the 5% level. Using Equation (3), the estimated inflection point is 0.0161, which lies within the observed range of DSI. The negative linear coefficient combined with the positive quadratic coefficient implies that when DSI is below 0.0161, its marginal effect on value creation is negative; once DSI exceeds this threshold, the marginal effect becomes positive and grows as DSI increases further. This confirms a U-shaped relationship between digital service innovation and value creation in the sample of manufacturing firms.

Table 2.

Benchmark regression results.

Figure 2.

Regression plot illustrating the nonlinear relationship between digital service innovation and value creation.

To verify the robustness of the identified U-shaped relationship, we conduct the U-test results reported in Table 3. First, we examine the slope at both sides of the estimated threshold: the slope is −0.7533 on the lower regime and 0.8943 on the upper regime; both slopes are statistically significant at the 5% level. These findings indicate that the nonlinear effect is not only evident in the coefficient signs but also statistically significant across the full sample range. Next, we perform a threshold validity check, confirming that the estimated inflection point lies within the observed range of the data. This ensures that the threshold transition effect is genuine rather than an artifact of random sampling or estimation error. Therefore, the U-shaped relationship is robust, and Hypothesis H1 is supported.

Table 3.

U-test results.

4.2.2. Robustness Tests

To mitigate potential bias arising from high volatility in listed firms’ stock prices, which may distort the measurement of corporate value creation, we perform robustness checks by substituting alternative measures of value creation and by trimming extreme observations. Specifically, we replace the primary dependent variable with an alternative proxy and apply winsorization (or trimming) to continuous variables at the 1% tails. The results, reported in Table 4, show that the coefficient signs and statistical significance remain consistent, indicating that our baseline findings are robust to these adjustments.

Table 4.

Robustness tests.

4.3. Threshold Effect Analysis

To further assess the nonlinear impact of digital service innovation (DSI) on value creation, we employ panel threshold models using TOE-based moderators: digital technology (DIG), organizational dynamic capability (ODC), and ecosystem embeddedness (ESE). Table 5 reports the threshold test results. When DIG is the threshold, the single-threshold test is insignificant (F = 3.59, p = 0.720), implying no segmented effect. In contrast, ODC yields a significant single threshold (F = 14.34, p = 0.020) at ω ≈ 0.6138, with no evidence for a second threshold. For ESE, both single (F = 14.86, p = 0.007) and double thresholds (F = 15.95, p = 0.007) are significant but not the triple. Thus, two cut-off points for ESE are identified (5 and 7).

Table 5.

Threshold effect test results.

Based on these results, we estimate threshold regressions (Table 6). For ESE, when ESE ≤ 5, the marginal effect of DSI on value creation is negligible (–0.0017, ns); for 5 < ESE ≤ 7, the effect is −0.8208 (p < 0.05); and for ESE > 7, it turns positive to 0.4092 (p < 0.01). This pattern suggests that low ecosystem embeddedness fails to support value creation, while high embedding unleashes network externalities and collaborative benefits—as exemplified by Haier’s COSMOPlat, which transitioned from pilot-stage digital customization to mature growth once ESE exceeded the second threshold.

Table 6.

Threshold regression results.

For DIG, no significant threshold is found, likely because modern manufacturing firms broadly share a baseline level of digital infrastructure, rendering its marginal heterogeneity negligible, as predicted by technology adoption theory.

For ODC, firms with low dynamic capability (ODC ≤ 0.3887) exhibit a slightly positive marginal effect (0.0395, p < 0.10), whereas those with high capability (ODC > 0.3887) face a negative effect (–0.4215, p < 0.05). This supports dynamic capability theory: beyond a certain threshold, organizations may fall into a “capability trap,” where excessive internal processes and over-optimization hinder market responsiveness. A similar pattern was observed at Gree Electric, where large-scale smart factory initiatives slowed downstream digital service deployment due to internal bureaucracy.

In summary, we find no support for H2a (DIG threshold) or H2b (ODC with positive threshold) but confirm H2c: ecosystem embeddedness has a nonlinear threshold effect. Specifically, only with high ESE and moderate ODC do DSI efforts translate into value creation; otherwise, firms risk limited outcomes or organizational–ecological constraints. These multi-stage TOE insights complement the quadratic and U-test findings and inform strategic timing for digital transformation.

5. Discussion

5.1. Discussion

First, this study finds that digital service innovation (DSI) does not exhibit a simple linear relationship with value creation in manufacturing enterprises but rather demonstrates a “delayed positive effect” curve. Regression results indicate that at low investment levels, DSI significantly inhibits value creation. Only after crossing a critical threshold (0.0161) does it yield a significant positive effect. This suggests that digital service transformation may initially cause short-term performance declines due to factors like resource dispersion and organizational friction. However, as accumulation and adaptation occur, synergistic and platform effects gradually unlock greater value. Previous studies have highlighted similar phenomena. For instance, Kowalkowski [5] and Raddats [4] both noted that service transformation demands high initial investment with low short-term returns, yet long-term benefits gradually materialize. This research not only corroborates this trend but also identifies a specific inflection point through threshold regression. This transforms the previously vague concept of “phased effects” into an actionable threshold, providing a more empirically grounded explanation for corporate strategic decision-making.

Second, this study finds that the role of organizational dynamic capabilities in transforming DSI value is not linearly increasing but exhibits a “moderate optimum” threshold characteristic. Specifically, when dynamic capabilities are low, firms lack sufficient resource integration and adjustment capacity to support service innovation implementation. Beyond a critical threshold (≈0.2216), capabilities significantly enhance value creation. However, excessive enhancement may trigger a “capability trap” due to overlearning, process complexity, and internal resource consumption. This finding reveals the dual-edged nature of dynamic capabilities, aligning with Kohtamäki’s “double-edged sword effect” [12] and Usai’s warnings about risks from excessive dynamic adjustments [6]. Unlike previous studies often grounded in qualitative or conceptual frameworks, this research employs a threshold model to identify specific numerical ranges, thereby empirically refining the nonlinear relationship between dynamic capabilities and innovation performance.

Finally, this study finds that digital technology maturity does not exhibit a significant threshold effect during the sample period. This implies that against the backdrop of relatively high overall digitalization levels in China’s manufacturing sector, differences in digital technologies among enterprises are insufficient to serve as a decisive factor in performance divergence. Existing research also suggests that when an industry’s digital infrastructure is broadly mature [4,5], the marginal impact of technological factors diminishes, and performance differences among enterprises increasingly depend on organizational configuration and ecological embeddedness. Building upon this, the present study further reveals that while digital technology maturity is a necessary condition for driving DSI, its influence diminishes to a background factor in highly digitized environments. The true determinants of performance divergence shift toward organizational capabilities and ecosystem relationships.

In summary, the findings of this study not only validate existing research on the nonlinear effects and contextual dependence of DSI but also clarify the specific manifestations of these effects: along the value creation pathway, a dynamic evolutionary logic of “inhibition–transition–promotion” is identified; at the organizational level, the “moderate optimum” boundary of dynamic capabilities is quantified; and at the technological level, the marginal weakening of digital maturity in a widespread adoption context is revealed. Through these discoveries, this study provides more granular empirical evidence beyond existing research. This advances understanding of the “digital paradox” beyond mere phenomenological description, enabling explanations for divergent value creation pathways under varying conditions. Consequently, it offers both academia and practitioners a more explanatory and actionable cognitive framework.

5.2. Theoretical Contributions

The primary theoretical contributions of this study are reflected in the following three aspects: First, it deepens the nonlinear understanding of the relationship between digital service innovation (DSI) and value creation. Existing research often assumes a linear causal relationship, positing that DSI either continuously enhances performance or is suppressed due to resource crowding out (612), with little attention paid to its phased characteristics. By combining quadratic terms with U-tests, this study reveals a “delayed positive effect” curve for DSI on value creation and identifies a specific threshold (0.0161). This finding not only addresses the “discrepancy between early investments and long-term benefits” emphasized by Kowalkowski [5] and Raddats [4] but also extends this qualitative inference into quantifiable empirical evidence. Consequently, it complements existing research both methodologically and in its conclusions.

Second, we identify and quantify the boundary conditions for the value transformation of digital service innovation. While previous studies acknowledge the importance of technological conditions, organizational capabilities, and ecosystem embeddedness, they often treat these as uniformly positive factors without revealing conditional differences or segmented effects. This paper introduces threshold regression methods within the TOE framework, identifying dual thresholds for ecosystem embeddedness and a single threshold for organizational dynamic capabilities, while digital technology maturity shows no significant threshold effect. Compared to Gao et al., who emphasize the macro-level performance paradox of digital technology integration, this study focuses on service innovation contexts [75]. It further clarifies the boundaries and thresholds for value transformation under different conditions, thereby refining the discussion of the “digital paradox” into an actionable contextual explanation.

Third, it reveals the heterogeneous effects of digital service innovation. Research indicates that DSI yields limited results at low levels of embeddedness, may suppress value due to coordination costs at moderate embeddedness, and significantly enhances performance through network externalities at high embeddedness. Concurrently, organizational dynamic capabilities promote innovation at moderate levels but trigger a “capability trap” when excessive. This conclusion not only corroborates Kohtamäki’s [12] “double-edged sword effect” and Burton’s [13] stage-dependent role of ecological relationships but also transcends existing qualitative descriptions by providing quantitative evidence within a threshold model. Consequently, this paper offers a new theoretical perspective for deepening our understanding of the conditional differentiation effects of DSI.

5.3. Practical Implications

First, it is essential to recognize that the value derived from digital service innovation (DSI) does not grow linearly with investment but rather materializes significantly only after crossing a critical threshold. This insight is crucial for manufacturing firms to determine when innovation efforts become effective. In practice, initiatives such as digital platform development, service process redesign, and customer experience enhancements often involve high upfront costs and low short-term returns. Our findings demonstrate a U-shaped nonlinear effect of DSI on value creation, suggesting that managers should avoid evaluating long-term strategic transformation solely from a short-term performance perspective. During the initial fluctuation phase, firms should maintain strategic resilience and prioritize building organizational capabilities and aligning processes. By establishing stage-based performance evaluation systems, strengthening employee training, and enhancing technology absorption mechanisms, firms can better support the investment process, laying the groundwork for surpassing the tipping point and realizing value release. This guidance can help firms adopt a scientific approach to strategic performance assessment, cultivate patience and path awareness, and avoid misjudging innovation potential due to early negative returns, thereby systematically supporting long-term transformation.

Second, identifying threshold characteristics of ecosystem embeddedness (ESE) and organizational dynamic capability (ODC) in the value conversion process is vital for determining under what conditions DSI is more likely to yield performance improvements. Firms often focus on technology tools and platform construction when pursuing servitization strategies yet may overlook the reliance on external synergies and internal responsiveness required for value creation. If a firm’s ecosystem network is weak, data-sharing mechanisms are incomplete, or internal structures lack cross-functional collaboration and agile adjustment processes, digital services may fail to deliver expected outcomes. Our study shows significant threshold effects for both ESE and ODC: only after reaching certain levels can DSI translate into meaningful value. Therefore, before committing resources to digital service initiatives, firms should systematically assess their ecosystem integration depth and organizational adaptability to confirm the presence of foundational conditions for value creation. This research can help firms delineate the realistic boundaries of DSI effectiveness, optimize investment direction and timing, and achieve effective release of innovation performance on a well-aligned organizational and ecological foundation.

6. Conclusions

6.1. Conclusions

Based on panel data from China’s A-share listed manufacturing firms during 2018–2024, this study employs two-way fixed-effects and threshold regression methods to systematically examine the nonlinear mechanisms through which digital service innovation (DSI) affects value creation. The results indicate that the relationship between DSI and value creation is not linear but rather exhibits an “initial inhibition followed by promotion” pattern. At low levels of innovation, value creation tends to be suppressed; however, once DSI surpasses the critical threshold, scale effects, network externalities, and data feedback mechanisms gradually emerge, significantly enhancing firms’ value creation capabilities. Further threshold effect analysis reveals that ecosystem embeddedness exhibits a double-threshold effect—synergies are absent at low levels, coordination costs may dominate at moderate levels, and only at high levels can firms fully leverage external resources and network externalities to boost value creation. Organizational dynamic capability demonstrates a single-threshold effect, indicating that moderate capability facilitates resource integration and responsiveness, while excessive capability may lead to “overlearning” and path dependence that hinder value creation. By contrast, digital technology maturity shows no significant threshold effect, suggesting that in the current manufacturing sector, it has become a widely shared foundational condition with limited differentiation in shaping performance outcomes.

In summary, three main conclusions are drawn: (1) the relationship between DSI and value creation follows a nonlinear pattern of “inhibition–turning point–promotion,” with its effectiveness dependent on whether the critical threshold can be crossed; (2) ecosystem embeddedness and organizational dynamic capability constitute the key conditions for realizing innovation value—where the former exhibits a “double-threshold” effect and the latter a “single-threshold” effect; And (3) while digital technologies remain a necessary enabler, their widespread adoption has weakened their marginal impact. Overall, for manufacturing firms to fully realize value creation through DSI, they must not only remain strategically patient in overcoming the initial “low-efficiency zone” but also manage appropriate levels of ecosystem embeddedness and organizational capability. This will help avoid coordination costs or capability traps, thereby maximizing the value contribution of digital service innovation.

6.2. Limitations and Future Research

Several limitations suggest avenues for further study. First, the sample is restricted to Chinese A-share listed manufacturing firms (2018–2024), limiting generalizability to SMEs, unlisted firms, or other countries/industries. Future research could adopt cross-country or sectoral comparisons to examine whether nonlinear and threshold effects persist under different institutional or market contexts. Second, this study focuses on the firm level; subsequent work may analyze industry- or ecosystem-level dynamics, exploring how interactions among platform providers, technology vendors, and end users collectively shape digital service innovation and value co-creation. Third, measurement of key constructs (e.g., text-based indices for DIG and ESE) could be enriched with alternative data sources (such as real-time platform analytics or network metrics) and validated via qualitative case studies. Finally, longitudinal changes in thresholds over time and potential feedback loops between DSI and organizational or ecosystem characteristics warrant deeper investigation.

Author Contributions

All authors contributed to the paper. Y.P. carried out the conceptualization of ideas and the formulation or evolution of the overarching research goals and aims. Z.L. analyzed data, wrote the methods and results sections, and wrote the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

The authors gratefully acknowledge the support of the National Social Science Fund of China project “Research on the Restructuring of Manufacturing Firms’ Supply Chain Operation Mechanisms and Performance Improvement Driven by Digital Servitization” (Project No. 24GBL101) and the Youth Fund for Humanities and Social Sciences of the Ministry of Education of China project “Research on Multi-Actor Dynamic Collaborative Operation Decision-Making and Governance Mechanisms in Digital Servitization Scenarios” (Project No. 23YJC630140) for this study.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Opazo Basáez, M.; Vendrell-Herrero, F.; Bustinza, O.F.; Raddats, C. Guest Editorial: Digital Service Innovation: Ontology, Context and Theory. J. Serv. Manag. 2024, 35, 129–140. [Google Scholar] [CrossRef]

- Pisano, A.; Saba, M.; Baldovino, J.A. A Critical Review of NIO’s Business Model. World Electr. Veh. J. 2023, 14, 251. [Google Scholar] [CrossRef]

- Blichfeldt, H.; Faullant, R. Performance Effects of Digital Technology Adoption and Product & Service Innovation—A Process-Industry Perspective. Technovation 2021, 105, 102275. [Google Scholar]

- Raddats, C.; Naik, P.; Ziaee Bigdeli, A. Creating Value in Servitization through Digital Service Innovations. Ind. Mark. Manag. 2022, 104, 1–13. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Wirtz, J.; Ehret, M. Digital Service Innovation in B2B Markets. J. Serv. Manag. 2024, 35, 280–305. [Google Scholar] [CrossRef]

- Usai, A.; Fiano, F.; Messeni Petruzzelli, A.; Paoloni, P.; Farina Briamonte, M.; Orlando, B. Unveiling the Impact of the Adoption of Digital Technologies on Firms’ Innovation Performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, X.; Cai, Z.; Chen, J. The Non-Linear Impact of Digitalization on the Performance of SMEs: A Hypothesis Test Based on the Digitalization Paradox. Systems 2024, 12, 139. [Google Scholar] [CrossRef]

- Adrodegari, F.; Saccani, N. Business Models for the Service Transformation of Industrial Firms. Serv. Ind. J. 2017, 37, 57–83. [Google Scholar] [CrossRef]

- Vargo, S.L.; Fehrer, J.A.; Wieland, H.; Nariswari, A. The Nature and Fundamental Elements of Digital Service Innovation. J. Serv. Manag. 2024, 35, 227–252. [Google Scholar] [CrossRef]

- Sklyar, A.; Kowalkowski, C.; Tronvoll, B.; Sörhammar, D. Organizing for Digital Servitization: A Service Ecosystem Perspective. J. Bus. Res. 2019, 104, 450–460. [Google Scholar] [CrossRef]

- Vendrell-Herrero, F.; Bustinza, O.F.; Parry, G.; Georgantzis, N. Servitization, Digitization and Supply Chain Interdependency. Ind. Mark. Manag. 2017, 60, 69–81. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Parida, V.; Oghazi, P.; Gebauer, H.; Baines, T. Digital Servitization Business Models in Ecosystems: A Theory of the Firm. J. Bus. Res. 2019, 104, 380–392. [Google Scholar] [CrossRef]

- Burton, J.; Story, V.M.; Zolkiewski, J.; Nisha, N. Digital Service Innovation Challenges Faced during Servitization: A Multi-Level Perspective. J. Serv. Manag. 2024, 35, 202–226. [Google Scholar] [CrossRef]

- Ciasullo, M.V.; Polese, F.; Montera, R.; Carrubbo, L. A Digital Servitization Framework for Viable Manufacturing Companies. J. Bus. Ind. Mark. 2021, 36, 142–160. [Google Scholar] [CrossRef]

- Feng, W.; Liu, R. The Role of Innovation Capabilities Upgradation and Digitalization in Value Co-Creation and PSS Innovation Performance. Ind. Mark. Manag. 2024, 123, 330–344. [Google Scholar] [CrossRef]

- Hendricks, L.; Matthyssens, P.; Kowalkowski, C. The Co-Evolution of Actor Engagement and Value Co-Creation on Digital Platforms. Int. J. Prod. Econ. 2025, 279, 109467. [Google Scholar] [CrossRef]

- Skålén, P.; Gummerus, J.; Von Koskull, C.; Magnusson, P.R. Exploring Value Propositions and Service Innovation: A Service-Dominant Logic Study. J. Acad. Mark. Sci. 2015, 43, 137–158. [Google Scholar] [CrossRef]

- Lindhult, E.; Chirumalla, K.; Oghazi, P.; Parida, V. Value Logics for Service Innovation: Practice-Driven Implications for Service-Dominant Logic. Serv. Bus. 2018, 12, 457–481. [Google Scholar] [CrossRef]

- Wilden, R.; Akaka, M.A.; Karpen, I.O.; Hohberger, J. The Evolution and Prospects of Service-Dominant Logic: An Investigation of Past, Present, and Future Research. J. Serv. Res. 2017, 20, 345–361. [Google Scholar] [CrossRef]

- Zhang, X.; Yang, L.; Gao, T.; Zhou, W. The Coordination Mechanism of Value Co-Creation between Developers and Users in Digital Innovation Ecosystems. Electron. Mark. 2024, 34, 1. [Google Scholar] [CrossRef]

- Häikiö, J.; Koivumäki, T. Exploring Digital Service Innovation Process through Value Creation. J. Innov. Manag. 2016, 4, 96–124. [Google Scholar] [CrossRef]

- Iden, J.; Eikebrokk, T.R.; Marrone, M. Process Reference Frameworks as Institutional Arrangements for Digital Service Innovation. Int. J. Inf. Manag. 2020, 54, 102150. [Google Scholar] [CrossRef]

- Opazo-Basáez, M.; Vendrell-Herrero, F.; Bustinza, O.F. Digital Service Innovation: A Paradigm Shift in Technological Innovation. J. Serv. Manag. 2022, 33, 97–120. [Google Scholar] [CrossRef]

- Song, Q.; Chen, X.; Gu, H. How Technological, Organizational, and Environmental Factors Drive Enterprise Digital Innovation: Analysis Based on the Dynamic fsQCA Approach. Sustainability 2023, 15, 12248. [Google Scholar] [CrossRef]

- Zhang, M.; Cheng, R.; Fei, J.; Khanal, R. Enhancing Digital Innovation Ecosystem Resilience through the Interplay of Organizational, Technological, and Environmental Factors: A Study of 31 Provinces in China Using NCA and fsQCA. Sustainability 2024, 16, 1946. [Google Scholar] [CrossRef]

- Shao, L.; Gong, J.; Fan, W. Cost comparison between digital management and traditional management of cotton fields—Evidence from cotton fields in Xinjiang, China. Agriculture 2022, 12, 1105. [Google Scholar] [CrossRef]

- Benmerar, T.Z.; Theodoropoulos, T.; Fevereiro, D.; Rosa, L.; Rodrigues, J.; Taleb, T.; Barone, P.; Giuliani, G.; Tserpes, K.; Cordeiro, L. Towards Establishing Intelligent Multi-Domain Edge Orchestration for Highly Distributed Immersive Services: A Virtual Touring Use Case. Clust. Comput. 2024, 27, 4223–4253. [Google Scholar] [CrossRef]

- Wiese, T.L. Predictive Maintenance Using Artificial Intelligence in Critical Infrastructure: A Decision-Making Framework. Int. J. Eng. Bus. Manag. 2024, 8, 1–4. [Google Scholar] [CrossRef]

- Yu, W.; Liu, Y.; Dillon, T.; Rahayu, W. Edge Computing-Assisted IoT Framework with an Autoencoder for Fault Detection in Manufacturing Predictive Maintenance. IEEE Trans. Ind. Inform. 2023, 19, 5701–5710. [Google Scholar] [CrossRef]

- Şimşek, T.; Öner, M.A.; Kunday, Ö.; Olcay, G.A. A Journey towards a Digital Platform Business Model: A Case Study in a Global Tech-Company. Technol. Forecast. Soc. Chang. 2022, 175, 121372. [Google Scholar] [CrossRef]

- Rahman, M.A.; Rashid, M.M.; Hossain, M.S.; Hassanain, E.; Alhamid, M.F.; Guizani, M. Blockchain and IoT-Based Cognitive Edge Framework for Sharing Economy Services in a Smart City. IEEE Access 2019, 7, 18611–18621. [Google Scholar] [CrossRef]

- Shree, D.; Kumar Singh, R.; Paul, J.; Hao, A.; Xu, S. Digital Platforms for Business-to-Business Markets: A Systematic Review and Future Research Agenda. J. Bus. Res. 2021, 137, 354–365. [Google Scholar] [CrossRef]

- Sathupadi, K.; Achar, S.; Bhaskaran, S.V.; Faruqui, N.; Abdullah-Al-Wadud, M.; Uddin, J. Edge-Cloud Synergy for AI-Enhanced Sensor Network Data: A Real-Time Predictive Maintenance Framework. Sensors 2024, 24, 7918. [Google Scholar] [CrossRef] [PubMed]

- Hijji, M.; Iqbal, R.; Kumar Pandey, A.; Doctor, F.; Karyotis, C.; Rajeh, W.; Alshehri, A.; Aradah, F. 6G Connected Vehicle Framework to Support Intelligent Road Maintenance Using Deep Learning Data Fusion. IEEE Trans. Intell. Transp. Syst. 2023, 24, 7726–7735. [Google Scholar] [CrossRef]

- Larian, H.; Safi-Esfahani, F. InTec: Integrated Things-Edge Computing: A Framework for Distributing Machine Learning Pipelines in Edge AI Systems. Computing 2025, 107, 41. [Google Scholar] [CrossRef]

- Sonkoly, B.; Haja, D.; Németh, B.; Szalay, M.; Czentye, J.; Szabó, R.; Ullah, R.; Kim, B.-S.; Toka, L. Scalable Edge Cloud Platforms for IoT Services. J. Netw. Comput. Appl. 2020, 170, 102785. [Google Scholar] [CrossRef]

- Aboelmaged, M.G. Predicting E-Readiness at Firm-Level: An Analysis of Technological, Organizational and Environmental (TOE) Effects on e-Maintenance Readiness in Manufacturing Firms. Int. J. Inf. Manag. 2014, 34, 639–651. [Google Scholar] [CrossRef]

- Rauf, M.A.; Shorna, S.A.; Joy, Z.H.; Rahman, M.M. Data-Driven Transformation: Optimizing Enterprise Financial Management and Decision-Making with Big Data. Acad. J. Bus. Adm. Innov. Sustain. 2024, 4, 94–106. [Google Scholar] [CrossRef]

- Sadiq Ali Khan, M.; Jamshed, H.; Bano, S.; Anwar, M.N. Big Data Management in Connected World of Internet of Things. Indian J. Sci. Technol. 2017, 10, 1–9. [Google Scholar] [CrossRef][Green Version]

- Dutta, J.; Puthal, D. Advancing eHealth in Society 5.0: A Fuzzy Logic and Blockchain-Enhanced Framework for Integrating IoMT, Edge, and Cloud with AI. IEEE Access 2024, 12, 195710–195730. [Google Scholar] [CrossRef]

- Mele, G.; Capaldo, G.; Secundo, G.; Corvello, V. Revisiting the Idea of Knowledge-Based Dynamic Capabilities for Digital Transformation. J. Knowl. Manag. 2024, 28, 532–563. [Google Scholar] [CrossRef]

- Hoang, G.; Luu, T.T.; Nguyen, T.T.; Tang, T.T.T.; Pham, N.T. Entrepreneurial Leadership Fostering Service Innovation in the Hospitality Firms: The Roles of Knowledge Acquisition, Market-Sensing Capability and Competitive Intensity. Int. J. Contemp. Hosp. Manag. 2024, 36, 1143–1169. [Google Scholar] [CrossRef]

- Bag, S.; Rahman, M.S.; Singh, A.; Bryde, D.; Graham, G. Leveraging Digital Technology Capability for Circular Economy Innovation in the Food Products Supply Chain: A Mixed-Method Study. IEEE Trans. Eng. Manag. 2024, 71, 13997–14010. [Google Scholar] [CrossRef]

- Manosalvas Vaca, C.A.; Manosalvas Vaca, L.; Guerrero Bejarano, M.A.; Silva Siu, D.R. Absorptive Capacity in Inbound and Outbound Open Innovation in Emerging Economy Context. Rev. Venez. Gerenc. 2023, 28, 1069–1084. [Google Scholar] [CrossRef]

- Faccin, K.; Balestrin, A.; Volkmer Martins, B.; Bitencourt, C.C. Knowledge-Based Dynamic Capabilities: A Joint R&D Project in the French Semiconductor Industry. J. Knowl. Manag. 2019, 23, 439–465. [Google Scholar]

- Wen, Y.; Wen, S. The Relationship between Dynamic Capabilities and Global Value Chain Upgrading: The Mediating Role of Innovation Capability. J. Strategy Manag. 2024, 17, 123–139. [Google Scholar] [CrossRef]

- Idries, A.; Krogstie, J.; Rajasekharan, J. Dynamic Capabilities in Electrical Energy Digitalization: A Case from the Norwegian Ecosystem. Energies 2022, 15, 8342. [Google Scholar] [CrossRef]

- Miguel, P.M.D.; De-Pablos-Heredero, C.; Montes, J.L.; García, A. Impact of Dynamic Capabilities on Customer Satisfaction through Digital Transformation in the Automotive Sector. Sustainability 2022, 14, 4772. [Google Scholar] [CrossRef]

- Makhloufi, L.; Laghouag, A.A.; Ali Sahli, A.; Belaid, F. Impact of Entrepreneurial Orientation on Innovation Capability: The Mediating Role of Absorptive Capability and Organizational Learning Capabilities. Sustainability 2021, 13, 5399. [Google Scholar] [CrossRef]

- Mazon, G.; Soares, T.C.; Birch, R.S.; Schneider, J.; Andrade Guerra, J.B.S.O.D.A. Green Absorptive Capacity, Green Dynamic Capabilities and Green Service Innovation: A Study in Brazilian Universities. Int. J. Sustain. High. Educ. 2023, 24, 859–876. [Google Scholar] [CrossRef]

- Jiao, M.; Du, D.; Shi, W.; Hou, C.; Gui, Q. Dynamic Absorptive Capability and Innovation Performance: Evidence from Chinese Cities. Sustainability 2021, 13, 11460. [Google Scholar] [CrossRef]

- Behl, A.; Kamboj, S.; Sharma, N.; Pereira, V.; Salwan, P.; Chavan, M.; Pathak, A.A. Linking Dynamic Absorptive Capacity and Service Innovation for Born Global Service Firms: An Organization Innovation Lens Perspective. J. Int. Manag. 2023, 29, 101044. [Google Scholar] [CrossRef]

- Alves, M.F.R.; Galina, S.V.R. Measuring Dynamic Absorptive Capacity in National Innovation Surveys. Manag. Decis. 2020, 59, 463–477. [Google Scholar] [CrossRef]

- Liu, C.-H.; Horng, J.-S.; Chou, S.-F.; Yu, T.-Y.; Huang, Y.-C.; Lin, J.-Y.; Lapuz, M.C.B. Discovery of the Mutual Relationships among Dynamic Capabilities and Intellectual Capital: The Moderating Roles of Service Innovation. Asia Pac. J. Tour. Res. 2023, 28, 1147–1165. [Google Scholar] [CrossRef]

- Medase, K.; Barasa, L. Absorptive Capacity, Marketing Capabilities, and Innovation Commercialisation in Nigeria. Eur. J. Innov. Manag. 2019, 22, 790–820. [Google Scholar] [CrossRef]

- Sánchez-Sellero, P.; Rosell-Martínez, J.; García-Vázquez, J.M. Absorptive Capacity from Foreign Direct Investment in Spanish Manufacturing Firms. Int. Bus. Rev. 2014, 23, 429–439. [Google Scholar] [CrossRef]

- Rossignoli Cevallos, G.; Guevara Sánchez, D. Dynamic Capabilities and Performance of Family Businesses in Emerging Economies. Bus. Theory Pract. 2024, 25, 263–277. [Google Scholar] [CrossRef]

- Sun, Y.; Zhou, Y. Specialized Complementary Assets and Disruptive Innovation: Digital Capability and Ecosystem Embeddedness. Manag. Decis. 2024, 62, 3704–3730. [Google Scholar] [CrossRef]

- Serrano-Ruiz, J.C.; Ferreira, J.; Jardim-Goncalves, R.; Ortiz, Á. Relational Network of Innovation Ecosystems Generated by Digital Innovation Hubs: A Conceptual Framework for the Interaction Processes of DIHs from the Perspective of Collaboration within and between Their Relationship Levels. J. Intell. Manuf. 2025, 36, 1505–1545. [Google Scholar] [CrossRef]

- Niu, X.; Qin, S. Integrating Crowd-/Service-Sourcing into Digital Twin for Advanced Manufacturing Service Innovation. Adv. Eng. Inform. 2021, 50, 101422. [Google Scholar] [CrossRef]

- Wirtz, B.W.; Müller, W.M. An Integrative Collaborative Ecosystem for Smart Cities—A Framework for Organizational Governance. Int. J. Public Adm. 2023, 46, 499–518. [Google Scholar] [CrossRef]

- Li, Q.; Gao, Q.; Zhang, Y.; Gou, C. How Can Small and Medium-Sized Manufacturing Enterprises Improve Green Innovation Performance through Innovation Ecosystems? Sustainability 2024, 16, 2519. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, D.; Xiao, X. Network Characteristics of Innovation Ecosystem: Knowledge Collaboration and Enterprise Innovation. Sci. Technol. Soc. 2023, 28, 488–510. [Google Scholar] [CrossRef]

- Yuan, N.; Li, M. Research on Collaborative Innovation Behavior of Enterprise Innovation Ecosystem under Evolutionary Game. Technol. Forecast. Soc. Change 2024, 206, 123508. [Google Scholar] [CrossRef]

- Kubler, S.; Robert, J.; Hefnawy, A.; Framling, K.; Cherifi, C.; Bouras, A. Open IoT Ecosystem for Sporting Event Management. IEEE Access 2017, 5, 7064–7079. [Google Scholar] [CrossRef]

- Hervás, R.; Francisco, V.; Concepción, E.; Sevilla, A.F.G.; Méndez, G. Creating an API Ecosystem for Assistive Technologies Oriented to Cognitive Disabilities. IEEE Access 2024, 12, 163224–163240. [Google Scholar] [CrossRef]

- Baldwin, C.Y.; Bogers, M.L.A.M.; Kapoor, R.; West, J. Focusing the Ecosystem Lens on Innovation Studies. Res. Policy 2024, 53, 104949. [Google Scholar] [CrossRef]

- Wojnicka-Sycz, E.; Kaczyński, M.; Sycz, P. Innovative Ecosystems behind Regional Smart Specializations: The Role of Social, Cognitive and Geographical Proximity. J. Entrep. Manag. Innov. 2020, 16, 129–166. [Google Scholar] [CrossRef] [PubMed]

- Asni, N.; Agustia, D. The Mediating Role of Financial Performance in the Relationship between Green Innovation and Firm Value: Evidence from ASEAN Countries. Eur. J. Innov. Manag. 2022, 25, 1328–1347. [Google Scholar] [CrossRef]

- Suseno, Y.; Laurell, C.; Sick, N. Assessing Value Creation in Digital Innovation Ecosystems: A Social Media Analytics Approach. J. Strateg. Inf. Syst. 2018, 27, 335–349. [Google Scholar] [CrossRef]

- Tawaststjerna, T.; Olander, H. Managing Digital Transformation in Digital Business Ecosystems. Int. J. Innov. Manag. 2021, 25, 2140003. [Google Scholar] [CrossRef]

- Mulyana, M.; Nurhayati, T.; Putri, E.R.P. Improvement of Marketing Performance: Role of Market Sensing, Digital Marketing, and Value Creation Ambidexterity. Contad. Adm. 2023, 69, 447. [Google Scholar] [CrossRef]

- Agarwal, R.; Selen, W. Dynamic Capability Building in Service Value Networks for Achieving Service Innovation. Decis. Sci. 2009, 40, 431–475. [Google Scholar] [CrossRef]

- Zhang, L.; Ye, Y.; Meng, Z.; Ma, N.; Wu, C.-H. Enterprise Digital Transformation, Dynamic Capabilities, and ESG Performance: Based on Data from Listed Chinese Companies. J. Glob. Inf. Manag. 2024, 32, 1–20. [Google Scholar] [CrossRef]

- Gao, H.; Xue, X.; Zhu, H.; Huang, Q. Exploring the digitalization paradox: The impact of digital technology convergence on manufacturing firm performance. J. Manuf. Technol. Manag. 2025, 36, 277–306. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).