Abstract

We analyze a supply chain consisting of a capital-constrained supplier and a platform functioning as a marketplace, where the supplier sells products to consumers via the platform, which charges a commission fee for each item sold. Operating in a market characterized by price-sensitive stochastic demand, the supplier must make simultaneous decisions regarding pricing and production quantity before a selling period. The supplier has three financing options for production: bank financing, platform-guaranteed bank financing, and direct platform financing. Using a Stackelberg game approach, we model these interactions and derive key managerial insights. Our findings reveal that financing choices and commission fees significantly impact the supplier’s pricing and production decisions, as well as the platform’s financing preferences. Generally, while the platform favors direct financing, the supplier prefers guaranteed financing under certain conditions.

1. Introduction

1.1. Background and Motivation

In today’s business world, small and medium-sized enterprises (SMEs) are rapidly increasing in number and play a crucial role in driving economic growth in both developed and developing countries. However, as suppliers, SMEs currently face two major challenges because of the tenuous nature of their business establishment: capital and distribution channel. Traditional solutions to the capital constraint mainly involve bank financing (denoted as BF hereafter), but due to the lack of tangible resources, significant operational risks, and severe information asymmetry, bank loans are costly for such suppliers and, in some cases, even unattainable [1]. Supply chain finance, in which members of the supply chain provide financial support to suppliers, is increasingly becoming an alternative to BF for sustainable business development [2,3,4]. Traditional distribution channels typically involve brick-and-mortar establishments, but due to the small business scale, limited network connections, and insufficient investments, establishing offline channels incurs high distribution costs to suppliers. The establishment of online channels is increasingly becoming a reasonable means of responding to this problem [5].

In the above context, suppliers in the role of SMEs urgently need to find an intermediary to secure loans, expand customer bases, and reduce distribution costs. With the rapid development of information technology and digital economy, the emergence of e-commerce platforms (EPs) provides integrated solutions to the aforementioned challenges. Firstly, EPs with very high creditworthiness can act as guarantors, alleviating banks’ concerns about the potential bankruptcy risks of suppliers and, thus, non-repayment [6,7]. We denote this financing scheme as the guarantor financing (denoted as GF hereafter) in this paper. Secondly, these EPs offer online distribution channels for suppliers, facilitating their access to consumers and promoting distribution and production [8]. In the literature on e-commerce, EPs are generally considered to play two roles: resellers similar to wholesalers, and marketplaces acting as agents [9,10,11]. We focus solely on the latter scenario, and the validity of our discussion is supported by numerous real-world examples, such as Amazon.com in the United States and JD.com in China. It is worth noting that, in cases where the EP acts as a reseller, the retail price is set by the EP [12], while in cases where the EP acts as a marketplace, the supplier pays a commission to the EP, and jointly decides retail price and production quantity before selling season [13].

As EPs continue to expand their operations, they actively seek new value-added services as a source of profit. Providing online financial services has become a crucial aspect, with major e-commerce giants such as JD.com launching its own “Internet Commerce Banks” [14]. We denote this financing scheme as direct financing (denoted as DF hereafter) in this paper, which belongs to an internal financing way. Yang et al. [15] showed that, since 2010, over 1.6 million suppliers as SMEs in China have received financing support from Alibaba, with a total loan amount reaching USD 400 billion. Offering online financing as a innovative value-added service can serve as a means to attract interest income. However, it may introduce operational complexities arising from the EPs’ dual roles as a marketplace and a borrower, i.e., the EP needs to determine its interest rate. Furthermore, the discussion about when an EP chooses to act as a guarantor and when it opts to provide financing options itself is currently limited.

Motivated by the above observations, we naturally raise the following research questions:

- Optimal decision-making for each party across financing modes: What are the optimal pricing and production strategies for the supplier under different cases and the platform’s optimal interest rate if he provides? This question assumes that each financing mode impacts operational decisions differently.

- Conditions for the platform’s financing Support: Under what conditions does the platform choose to provide financing support, and what factors may influence his preference for offering DF versus GF? This question assumes that the platform seeks to maximize profit while considering the risks and rewards associated with each financing mode.

- Supplier’s financing choice based on platform’s offering: Given the financing options provided by the platform, how does the supplier determine her preferred financing method? This question assumes that the supplier prioritizes minimizing financing costs while maximizing profitability under capital constraints.

1.2. Contribution and Paper Organization

Considering a supply chain system consisting of a capital-constrained supplier (she), a marketplace platform (he), and an external financing source, i.e., bank (it). This paper investigates the optimal operational decisions for each party. Our paper contributes to the expanding body of research at the intersection of supply chain finance and operation management. Specifically, the theoretical contributions are twofold:

- First, our work expands on the application of the Modigliani–Miller theorem. We illustrate that in the case where the supplier makes joint decisions on her price and production quantity, the outcome under BF still satisfies M&M theory, i.e., the operational decisions can be separated from the financing decision.

- Second, we explore a novel platform-supported financing mode, where the platform acts as a marketplace and the supplier has the pricing power. We extend the traditional price-setting newsvendor model to portray the capital-constrained supplier’s optimal joint decisions in such market.

In terms of practical implications, our findings offer actionable insights for both platforms and suppliers in capital-constrained environments.

- For platforms, the results suggest that DF is generally the most profitable option when available, but GF can be strategically favorable when commission fees are high and DF is not feasible. This provides platforms with clear guidelines on choosing financing schemes to maximize profitability.

- For suppliers, our study highlights that GF often provides the most preferred form of support, but in cases where DF is the only option, suppliers should evaluate BF as a favorable alternative when commission fees are low. These insights help suppliers optimize their operational and financial decisions based on the availability and nature of platform financing support.

This dual focus on theoretical and practical contributions allows our study to bridge the gap between supply chain finance theory and operational practice.

The rest of the paper is organized as follows. We review the related literature in Section 2. Section 3 presents the model preliminaries. Then, we characterize the equilibrium decisions of the supplier and the platform under three financing modes in Section 4. In Section 5, we conduct some numerical studies given parameter values to derive more managerial insights. Finally, in Section 6, we present our concluding remarks and outline potential directions for future research. All proofs can be found in Appendix A.

2. Literature Review

We develop this paper in the context of a capital-constrained supplier operating on a platform acting as marketplace. In such marketplace, the supplier jointly decides the price and production size, and pays the platform a commission fee per transaction. There exist two streams of literature related to our paper: supply chain finance and price-setting newsvendor problem, which is reviewed in this section. We conclude the difference between this work and the closely related literature in Table 1.

Table 1.

Comparison with the related literature.

In the real business world, there are numerous market frictions that prevent the realization of the Modigliani–Miller theorem. This theorem posits that in a perfect (frictionless) financial market, managers can independently make operational decisions irrespective of financial decisions [22]. Therefore, understanding how budget constraints influence operational decisions, such as production quantity and pricing, becomes a crucial topic in the fields of economics and operations management (OM). We focus more on the latter, and readers are referred to the economic analyses in Che and Gale [23]. Scholars in the OM field have integrated financing decisions with operational decisions, giving rise to the research stream of supply chain finance (SCF), as seen in editorial views by Kouvelis [24]. SCF comprises two models: external financing, where financial institutions outside the supply chain systems provide loans to capital-constrained companies, such as bank financing or third-party logistics financing [16,25], and internal financing, where companies within the supply chain systems provide loans to their upstream or downstream counterparts, such as trade credit and buyer credit financing [26,27]. Most of the literature examines the financing equilibrium or preferences of companies by comparing different financing schemes. For comprehensive reviews, please refer to Chen et al. [28], Li et al. [29], and the references provided therein. Next, we will focus on platform financing, an emerging financing mechanism based on the development of digital technology and platform economy [30]. We are interested in the topic that platforms provides financing support to suppliers, and we recommend readers who are interested in platforms providing credit finance/support to consumers to Kuang and Jiang [31], Wei et al. [32] and Xie et al. [33].

Tunca and Zhu [12] were among the pioneers in researching e-commerce platform financing. They studied platforms that purchase products from the upstream supplier and sell them to downstream consumers. The supplier decides the wholesale price, and the platform makes ordering decision before the selling season. Yan et al. [34] investigated a dual-channel supply chain structure, where the supplier with constrained capital can sell products through both online and offline channels. Lu et al. [35] considered contract farming and platform supply chain, where the farmer, facing uncertain output, decides to borrow from the platform or the bank. In the mentioned studies, platforms act as resellers, similar to the wholesaler role in traditional supply chains. Many recent studies on platform operations confirm the advantages of platforms acting as marketplaces compared to resellers, suggesting that the agency selling mode will become a trend [36]. Wang et al. [16] explored coordination issues for online retailers when choosing between bank credit financing and e-commerce platform financing. Gupta and Chen [18] considered manufacturers obtaining financial support from both platforms and retailers (the financing support from retailer is denoted as RF). Yi et al. [6] studied financing issues in an agricultural supply chain context with constant market prices. They compared three financing models, namely bank financing, guarantor financing, and direct financing. Liu et al. [20] investigated the impact of overconfidence, a behavioral factor, on platform financing. Rath et al. [37] compared bank financing and platform financing in an environment without demand randomness. Further, Mandal et al. [38] examined these two financing modes considering the sellers’ competition. The most relevant literature to our study is Gong et al. [13], as they considered joint pricing and ordering decisions of the supply chain participant when the platform acts as a marketplace. However, they assumed the platform would set an interest rate which is competitively priced, while we explore the platform’s optimal interest rate decision under the goal of maximizing the profit.

As analyzed before, when the EP acts as an intermediary for selling products, the SME gains pricing power. Faced with uncertain market demand, the SME needs to make joint decisions on pricing and production quantity. Since the 1950s, extensive research has been conducted in this field, e.g., Mills [39], Karlin and Carr [40]. In the research area of supply chain, this joint decision-making is often referred to as the price-setting newsvendor problem, as reviewed comprehensively by Petruzzi and Dada [41]. They summarized existing work, employed additive and multiplicative demand functions to address the problem, and used the stock factor to substitute the ordering decision. They derived sufficient conditions for the uniqueness and existence of optimal joint decisions with risk-neutral considerations. Zhao and Wang [42] considered how to coordinate the supply under the joint pricing-production decisions. Wang et al. [43] considered consignment contracts with revenue-sharing between suppliers and retailers, where joint decisions are made by the supplier, and a certain proportion of revenue should be shared with the retailer. They compared the efficiency gap between decentralized and centralized systems. Chen et al. [44] considered the effect of risk-preference on the operational performance by employing Conditional Value at Risk (CVaR) as the objective function. Tang et al. [45] introduced a dynamic pricing policy in the newsvendor model to reduce supply chain loss. Zhang et al. [46] derived analytical decisions for pricing and inventory allocation given the form of demand distribution. Our work differs from the mentioned literature by assuming that the SME making this joint price-production decision is capital-constrained. This setup is similar to Yang and Liu [47], but their study focuses on trade credit and pricing postponement, comparing the impact of joint decisions and sequential decisions on different financing methods (bank financing and trade credit). In contrast, we consider a supply chain where the EP participates operation and provides financing support. We explore the optimal strategies and interactions between the EP and the upstream SME.

To sum up, we identify the following limitations in the current literature, and indicate how this work fills them correspondingly:

- Limited analysis of the comparison between three financing modes in a marketplace environment: While many studies address financing and operational decisions simultaneously, few consider the supplier facing several financing modes at the same time within a marketplace. In reality, suppliers with limited capital resources often need to simultaneously optimize pricing and production while managing financing options. Our study bridges this gap by examining how capital constraints influence joint production and pricing decisions under different financing scenarios.

- Limited analysis of platform financing in marketplace models: Although platform financing has been explored, the existing research often assumes the platform acts as a reseller rather than a marketplace intermediary. This distinction is significant as, in marketplace models, suppliers retain pricing control, influencing both demand response and production strategies. Our study addresses this gap by considering a platform as a marketplace where the supplier sets prices, leading to more complex interactions and optimal decisions for both the platform and the supplier.

- Underexplored impact of demand uncertainty and price sensitivity on financing decisions: The current literature rarely addresses how demand uncertainty and consumer price sensitivity affect financing choices and operational decisions in supply chains. In our work, we incorporate these factors into the price-setting newsvendor model, capturing realistic conditions in which the supplier must adapt to varying demand and financing options while optimizing pricing and production simultaneously.

3. Model Formulation

3.1. Demand Form

We consider a random price-dependent market demand , where denotes the randomness and satisfies, i.e., the market demand is price-sensitive. We also predefined that the variance of demand increases with expected demand while the coefficient of variation contains unaffected. Thus, a multiplicative model is appropriate under our setting [48]. Following Karlin and Carr [40], we define the demand function in multiplicative form, and express it as the follows:

where denotes the basic market size and characterizes the price elasticity. We only focus on a price-elastic product, i.e., . The random factor denotes the market uncertainty, which has a probability density function (p.d.f) , a cumulative distribution function (c.d.f) , and a complementary cumulative distribution function . In the next sections, we consider that the random factor follows a uniform distribution on for analytical traceability, which is a commonly used assumption in the OM literature [48,49]. Furthermore, we define the failure rate function as . We then have , since that uniform distributions have increasing failure rate (IFR) properties [50].

3.2. Sequence of Events

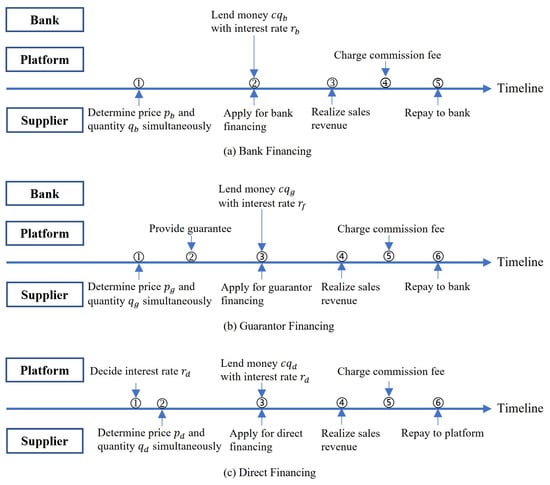

The paper investigates the optimal operational strategies of the supply chain system with a capital-constrained supplier and a marketplace platform. The supplier only sells products via the online channel. She bears a unit production cost c, and pays a commission fee t to the platform per transaction. She can apply for financing from the bank with or without platform guarantee, or from the platform directly. For each case, the detailed sequence of events is illustrated in Figure 1.

Figure 1.

Three financing modes.

- In the BF case (see Figure 1a), first, the supplier determines her production quantity and selling price simultaneously. Then, she borrows money from the bank. After the selling season, the total revenue of the supplier is realized as . The total commission fee charged by the platform is thus given by . Then, the supplier is assigned the remaining sales revenue, and repays the principal plus interest to the bank.

- In the GF case (see Figure 1b), the supplier firstly makes joint decisions of production quantity and selling price . Then, she borrows money from the bank. At this point, the bank lends money to her without any associated risk. After the sales period, she received a total revenue as . The platform charges a total commission fee . Finally, the supplier receives the remaining sales revenue, and repays the principal plus interest to the bank.

- In the DF case (see Figure 1c), the platform firstly announces his interest rate . Then, the supplier jointly determines her selling price and production quantity . She borrows money from the platform. After selling season, she pays the commission fee to the platform, repays the principal plus interest to him, and earns the leftover revenue.

It is important to mention that the supplier bears only limited liability: In the event that she generates sufficient revenue during the sales period, she is obligated to repay both the principal and interest. However, if she falls short, she only returns the amount received from the sales and, subsequently, declares bankruptcy.

3.3. Notations and Assumptions

We make the following assumptions in the paper.

Assumption 1.

The supplier’s initial capital is zero. The platform is endowed with no budget constraint.

Assumption 2.

The capital market is perfect without taxes, transaction fees, and bankruptcy costs.

Assumption 3.

Without compromising generality, the supplier’s sales cost, shortage cost, and residual value of the unsold products at the end of sales horizon are ignored for simplification.

Assumption 4.

The commission fee rate t is seen as an exogenous parameter in our work. It is predetermined before the selling season, which is in parallel with the industrial practice. This setup is consistent with the state-of-the-art literature in this area, see Chen et al. [51], Xu et al. [52].

Assumption 5.

The supplier and the platform are all risk neutral. There is no information asymmetry between the supply chain participants.

We summarize the notations used throughout the paper in Table 2. In the following analysis, the subscript denotes the supplier and the platform, respectively. The subscript indicates the cases of no-budget constraint, bank financing, guarantor financing, and direct financing, respectively. The superscript (*) is used to denote equilibrium values throughout the paper. All the proofs for the lemmas and propositions can be found in Appendix A.

Table 2.

List of notations.

3.4. No-Budget Constraint Case

In this section, we consider a budget-free supplier selling product on the platform. The supplier jointly determines her pricing and production decisions, and pays a fraction of her sales revenue to the platform. Her profit can be written as

The supplier seeks maximum profit by solving . The optimization problem can be seen as a transformation of Petruzzi and Dada [41] and Wang et al. [43]. Following their approach, we define a new variable as the stock factor, where , . The profit function of the supplier can be rewritten as

The optimal decisions can be derived by optimizing over and , i.e., . We conclude the optimum conditions for the stock factor and the supplier’s operational decisions in the following proposition.

Proposition 1.

Given , (i). The optimal solution of is unique,

(ii). The optimal selling price and production quantity are given by

Lemma 1.

(1) The supplier’s optimal price is decreasing in β while increasing in t; and (2) her optimal ordering quantity is increasing in β while decreasing in t.

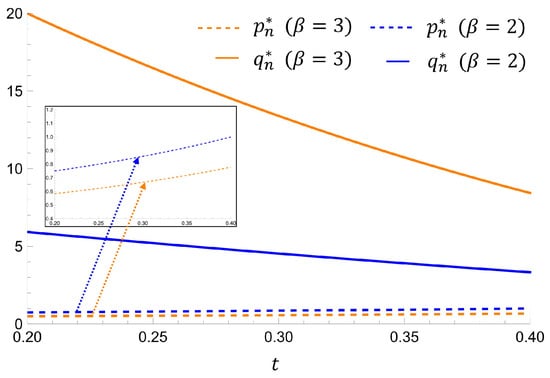

We can obtain some findings from Proposition 1 and Lemma 1: (1) The optimal stock factor depends only on the upper limit of its distribution and the price sensitivity of the market demand. When the market demand is more sensitive to the selling price, i.e., a larger , the optimal stock factor will be lower. (2) Keeping the other parameters unchanged, the optimal price decreases with and increases with t. The intuitions behind are that: when the platform charges a higher commission fee, the supplier will increase her sales price; when the market demand is more sensitive to the price, the supplier will drop her sales price. Given other parameters, increases with and decreases with t, the relationships of which are opposite to that of (see Figure 2).

Figure 2.

The relationships between and t with different (, ).

The supplier finally realizes a total revenue of . We also give the profit function of the platform in the following:

When the supplier optimally determines her joint decisions, the platform realizes a total revenue of .

4. Equilibrium Analysis

4.1. Bank Financing

In this case, we consider the supplier borrows money from the commercial bank. The bank firstly announces an interest rate . Then, the supplier determines her optimal joint decisions. We suppose to avoid meaninglessness. If her total profit is less than the principal plus interest , she goes bankrupt. Therefore, her repayment to the bank is written as

The bank loan is competitively priced [53]. Then, the interest rate charged by the bank should satisfy the following equation:

where represents the risk-free interest rate, and the right side denotes the expected value of repayment.

The profit of the supplier can be written as

where . Following the approach described in the last section, we employ the stock factor to solve the optimization problem. We can rewrite the supplier’s profit function as

Proposition 2.

Under bank financing, (i) the optimal stock factor is unique and equal to that of the benchmark case, and (ii) the optimal selling price and production quantity are given by

The supplier finally realizes a total revenue of . When the supplier sets her optimal decisions, the total revenue of the platform is realized as . Supported by Assumption 2, the result is still consistent with M&M theory in our context [22]. Specifically, when the capital market is perfect and the bank interest rate is competitively priced, the supplier makes her production decision the same as that under the situation without capital constraint, which means that the operational decisions and financing decision are made separately, and the risk-free interest rate reflects the time value of the capital.

Lemma 2.

satisfies the following equation:

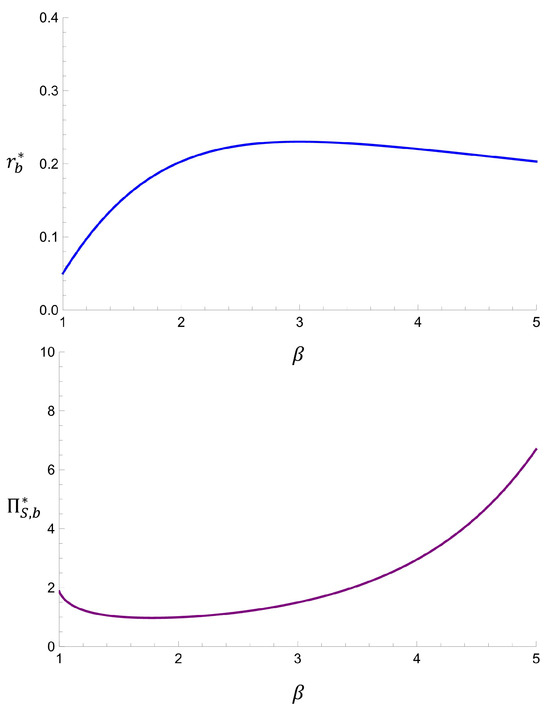

We find a linear positive correlation between and , i.e., in a competitively priced capital market, we can speculate on changes in the bank’s optimal interest rate by observing changes in the risk-free rate. Further, the relationship between , and the price sensitivity of market demand is relatively complex (as shown in Figure 3); it first increases rapidly as increases, and then decreases after reaching the threshold. The possible reason for this change is analyzed as follows: we find that the supplier’s optimal profit exhibits an (almost) opposite trend to the bank’s optimal interest rate, which may indicate that when the bank anticipate that the supplier’s profit is lower, it will charge a higher interest rate to compensate for the default risk accordingly.

Figure 3.

The relationship between and , along with and (, , , ).

4.2. Guarantor Financing

In this case, the bank still plays a role as loan provider as BF case; however, the platform acts as a guarantor at this point, sharing the financial risk for the bank. Specifically, if bankruptcy happens, the platform will repay the supplier’s debt. Hence, the bank charges the supplier a risk-free interest . The profit of the supplier can be written as

Then, we also replace with the stock factor , and rewrite her profit function as

where . We further define , to facilitate expression in the following analysis.

Proposition 3.

Under guarantor financing, (i) the optimal stock factor is unique, and given by:

(ii) The optimal selling price and production quantity are given by

The supplier finally obtains her total revenue, which is given by

Lemma 3.

(1) The supplier’s optimal price is decreasing in β while increasing in t; and (2) her optimal ordering quantity is increasing in β while decreasing in t.

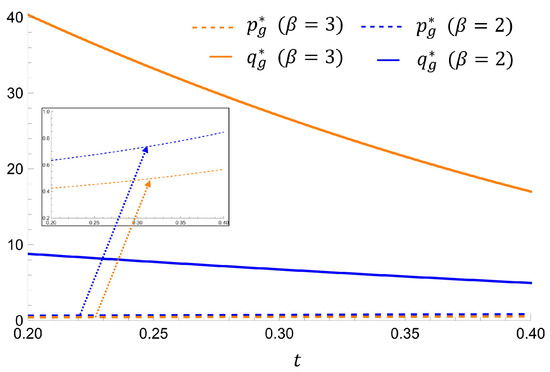

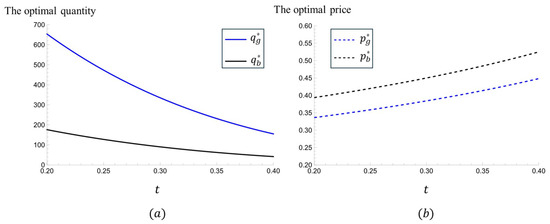

As we can see, the relationships between and the two key parameters ( and t) under GF case remain unchanged compared to those under BF case, respectively (see Figure 2 and Figure 4). When is larger, the supplier tends to decrease her sale price to induce more demand. Accordingly, she will increase her production quantity to satisfy demand. When t is larger, i.e., the platform charges a higher commission fee for more profit, the supplier will increase the price and lower her production scale, which means that the supplier takes actions to hedge the loss caused by the platform’s incentive to have a lager share of her revenue.

Figure 4.

The relationships between and t with different (, , ).

Proposition 4.

Comparing the optimal results under GF case to those under BF case, we find: (1) ; and (2) .

When the platform acts as a guarantor, the bank lends money to the supplier without any risk. As a result, it charges the supplier a risk-free interest, which only reflects the time value of the investment, which is lower than its interest rate () under the BF case. In other words, the supplier’s capital cost of investing in her production under GF is less than that under BF. Correspondingly, she will drop the selling price to induce more demand and produce aggressively (see Figure 5).

Figure 5.

The comparison results of the optimal quantity (a) and the optimal price (b) between BF and GF cases (, , , ).

The platform’s profit function is as follows:

At the point that the supplier optimally make her decisions, the platform correspondingly realizes a total revenue as

4.3. Direct Financing

In this section, we explore operational and financing decisions under platform direct financing. In this case, the platform acts as both a marketplace and a loan provider. We adopt a two-stage Stackelberg game to determine the optimal operational strategies, where the platform is the leader and the supplier acts as the follower.

We resolve the game through backward induction. Firstly, given the platform’s interest rate , the supplier determines and simultaneously to maximize her expected profit,

Then, we rewrite her profit function by replacing with the stock factor as

where .

The platform’s profit function is as follows:

The first term of the first line of Equation (22) represents the profit stemming from the commission fee, and the second and third terms of that denote the repayment from the load provision and the opportunity cost, respectively.

Proposition 5.

Under direct financing case, (1) the optimal stock factor is unique, which equals to that under guarantor financing case; and (2) the equilibrium decisions for the two supply chain players, , are given by

Here, , , and .

The unique optimal stock factor (as well as ) is determined by the upper limit of its distribution B and the price sensitivity of the market demand . Given the other parameters, decreases as increases. Moreover, this decrease in is more pronounced when B is relatively large.

5. Numerical Study

Due to the complexity of the expressions derived from the DF case, it is difficult to perform some rigorously mathematical analysis of decisions, profits, and comparisons between DF case and other cases. Thus, in this section, we conduct some numerical experiments in an attempt to obtain some managerial insights. We give the parameter-values in the following: the supplier’s unit production cost , the market size , the price-sensitivity related factor , the random factor , and the risk-free interest rate . The parameter values are set similar to Wang et al. [16].

Lemma 4.

Comparing the optimal results under GF case to those under DF case, we find: (1) ; and (2) .

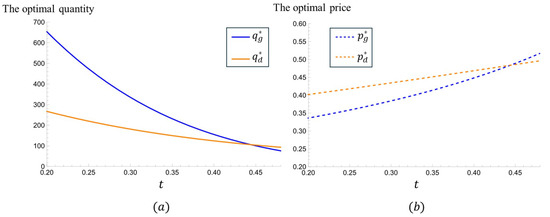

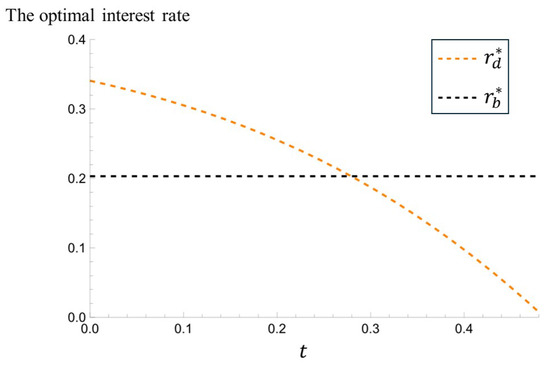

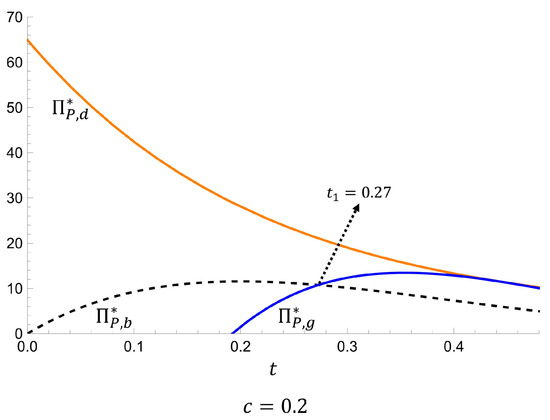

Since is larger than 1, we can see that the ratio of the optimal pricing decision under DF case to that under GF case always shows an opposite trend in magnitude compared to the ratio of the optimal quantity decision under DF case to that under GF case, i.e., when , , vice versa (see Figure 6), and the specific relationship is related to the value comparison between and . Specifically, under DF case, the platform lends money to the supplier while bearing certain default risk. Hence, he charges a higher interest rate than the risk-free rate when his commission fee is at a low level. Under this situation, the supplier will increase the price and lower the production scale, i.e., and with a relatively small t. Furthermore, from Figure 7, we can see that is decreasing in t. When t is large enough and the is smaller than the risk-free rate, the supplier will decrease the price and increase production scale. Hence, the ratios of optimal pricing decision and production quantity between DF and GF are opposite to before, respectively.

Figure 6.

The comparison of supplier’s optimal quantity (a) and optimal price (b) in the DF and GF cases.

Figure 7.

The comparison of the optimal interest rate of the platform and that of the bank in a wider value-range of t.

Lemma 5.

Comparing the optimal results under DF case to those under BF case, we find: (1) ; and (2) .

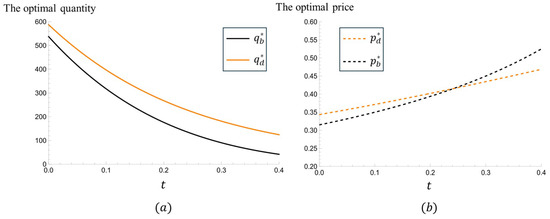

Under the DF case, when the commission fee t is small, the platform charges a high interest rate , which is larger than . At this point, the supplier optimally sets her price larger than . We find that is decreasing in t while maintains its value. Thus, the magnitude of the increase in with t is smaller compared to that of . When t is larger than a certain threshold, is even smaller than . However, is always larger than (see Figure 8), which shows that when the supplier applies DF, she will take riskier production decisions than she would under BF case.

Figure 8.

The comparison of supplier’s optimal quantity (a) and optimal price (b) in the DF and BF cases.

5.1. The Platform’s Choice

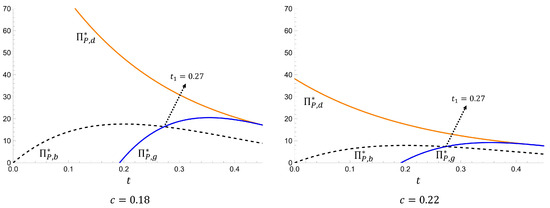

According to the previous analyses, the platform is in a leader position in the supply chain system we study, which is in parallel with the real-life situation. This means that the platform has the right to decide on his own way of adopting financing assistance, and then the supplier (usually an SME) can choose between the financing options offered by the platform and the bank. From Figure 9, we can see that given the parameter values above, the platform’s profit is always larger in the DF case than those in the GF and BF cases, i.e., the platform always tends to provide direct financing support to the supplier when he is capital sufficient. We further find that the difference between his profits in the DF and GF cases decreases as t increases. To illustrate the reason, we show the changes in his optimal interest rate in Figure 7. We find that when the platform charges higher commission fees, he correspondingly lowers his interest rate; however, the loss of profit to him from lowering the interest rate outweighs the increase in profit from raising the commission fee rate, and thus overall he is less profitable.

Figure 9.

The comparison of platform’s profits in the DF, GF, and BF cases.

We further explore whether this insight would be changed under different production costs c. Figure 10 illustrates that although c greatly influences the profits of the platform, the value of it does not alter the conditions under which the platform selects financing strategies. In other words, regardless of different production costs, the platform consistently prefers direct financing. Whether to provide a guarantee depends solely on whether the commission fee exceeds the threshold .

Figure 10.

A comparison of the platform’s profits in the DF, GF, and BF cases under different production costs.

5.2. The Supplier’s Choice

5.2.1. When GF Is Unavailable

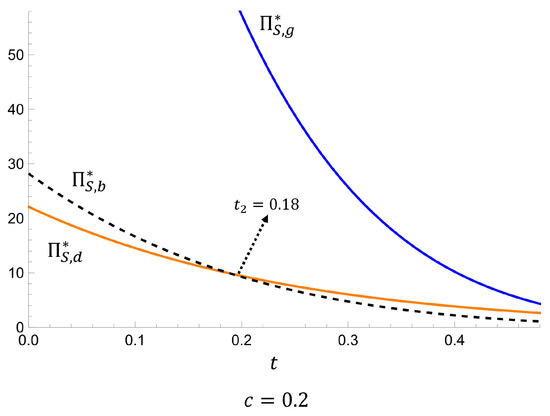

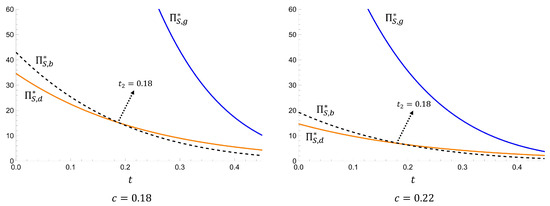

Obviously, when the platform offers DF, GF is not available. Under this situation, the choice of supplier depends on the relationship between the interest rate and commission fee t. We explore the comparison results between DF and BF cases in the following.

If the platform offers DF, the supplier will choose BF when t is relatively small and DF when t is relatively large (see Figure 11). The reasons behind the above are as follows: When the supplier chooses to be financed directly through the platform, she provides the platform with two sources of income, i.e., interest collection and commission fee. As can be seen from Figure 7 and Figure 11, when t is relatively small (), the platform will charge an interest rate that is much larger than , which will decrease the supplier’s profit heavily and make her choose BF. On the contrary, if the platform’s commission rate is very high, he will significantly lower his interest rate (even lower than that of the bank ), which in turn makes the supplier’s profit in the DF case higher than that in the BF case, and thus at this point the supplier tends to choose DF).

Figure 11.

The comparison of supplier’s profits in the GF, DF, and BF cases.

5.2.2. When GF Is Available

For the supplier, when GF is available, it is always better for her to choose the GF option than other two financing options (see Figure 11). Although the analysis in the above shows that the platform’s profits are always higher when he provides DF support than when he provides GF support, in reality, there exist times when the platform is not able to provide this option due to exogenous reasons such as legal and regulatory constraints. Therefore, it is meaningful to analyze the supplier’s choice between GF and BF options, and their profits when the platform only provides GF. Under GF, the platform shares the bankruptcy risk of the supplier through his own creditworthiness in exchange for the risk-free interest rate offered by the bank for the supplier. Hence, only when the commission fee is larger than a certain threshold (, see Figure 9), will the platform have the incentive to offer GF. For the supplier, she can produce in a cheaper way, i.e., under the risk-free interest rate. Undoubtedly, she will increase the production scale and drop the price to achieve a higher profit. Hence, GF is a better choice for supplier for any given commission fee.

We also explore whether these insights would be changed under different production costs c. Figure 12 shows the same trends as that of Figure 11: Regardless of different production costs, the supplier consistently prefers guarantor financing. Moreover, whether to choose direct financing rather than bank financing depends on whether the commission fee exceeds the threshold .

Figure 12.

The comparison of supplier’s profits in the GF, DF, and BF cases under different production costs.

6. Conclusions

Our analysis delves into a supply chain involving a capital-constrained supplier and a platform operating as a marketplace. In this supply chain, the supplier utilizes the platform to sell products to consumers, with the platform charging a commission fee for each sale. In the context of a market with price-sensitive and randomly fluctuating demand, the supplier faces the challenging task of simultaneously determining pricing and production quantity before the sales period. To secure the financial resources necessary for production, the supplier has different choices: obtaining financing from a bank with or without platform guarantee, or seeking a loan directly from the platform. We model their interactions using the Stackelberg game approach. The optimal solutions can be obtained through the solution of the price-setting newsvendor model. In this section, we summarize all of our findings drawn from theoretical derivations and numerical experiments. We also conclude the limitations of this study and provide future research directions.

6.1. Main Findings

Beginning with the baseline scenario of the supplier without financial constraints, we then consider two external financing options: bank financing with and without platform guarantees. Additionally, we explore the internal financing option, i.e., platform direct financing. Our main findings are as follows:

- In the absence of budget constraint, the supplier facing higher commission fee rates and lower price sensitivity tends to set higher optimal prices while reducing production levels. This is because the supplier aims to offset the platform’s profit share by charging consumers more and minimizing excess supply risks. Conversely, with lower commission fee rates and higher price sensitivity, the supplier lowers prices and increases production quantities. This is because the supplier adopts a low-margin-high-volume strategy to achieve substantial profit. These findings hold across both BF and GF cases.

- Under BF case, the supplier’s optimal profit and the bank’s optimal interest rate show an inverse relationship in response to shifts in price sensitivity. Specifically, as the supplier’s optimal profit declines, the bank tends to raise its interest rate, and vice versa. This dynamic indicates that the bank increases interest rates when it anticipates lower profits may gained by the supplier to mitigate potential default risks.

- For the platform, DF generally offers greater benefits than either GF or BF, making the platform more inclined to provide direct financial support to the supplier. However, if the platform simultaneously raises commission rates, the advantage of DF for him diminishes. In other words, with higher commissions, the platform’s profits from offering DF are nearly equivalent to those from providing only a guarantee.

- For the supplier, constrained by the platform’s superior market power, financing options largely depend on the platform’s offerings. The platform is likely to offer GF only if commission fee rates exceed a certain threshold, at which point he assumes some default risk. If GF is available, the supplier will choose it; otherwise, with only DF as an option provided by the platform, the supplier will prefer BF when commission rates are low and DF when rates are high.

6.2. Limitations and Future Directions

While this study provides valuable insights into the interface between operation management and supply chain finance, it is not without limitations, which offer opportunities for further exploration. Specifically, we derive the analytical results under the assumption that the random factor in market demand follows a specific distribution, namely a uniform distribution. This simplification makes the model more accessible for managers. However, the choice of distribution for the random variables plays a crucial role in shaping the model’s underlying assumptions and predictive accuracy. In other words, the optimal decisions and financing strategies we have derived are applicable only under specific market demand conditions, which necessitate validation using historical data. If the market demand does not meet these conditions, our optimal strategies may not be suitable for guiding decision-making.

Addressing the limitation presents avenues for future research to expand upon and refines our findings. It is interesting to explore what degree our findings may hold under non-uniform demand distributions, such as exponential or power or triangle distribution. Understanding the impact of these alternative distributions could enhance our model’s robustness and provide a broader perspective on how our model performs under different market conditions. Also, such discussions could be extended to the general distribution case, and if a closed-form solution cannot be found under such case, a heuristic algorithm can be designed to seek a near-optimal solution and analyze the properties.

Beyond that, we offer some possible directions for research. First, all parties in the supply chain are assumed to be risk-neutral. However, it may be worth exploring the influence of behavioral factors, such as risk aversion on the part of the platform or the supplier. For suppliers, risk aversion often stems from external uncertainties, such as market demand fluctuations or macroeconomic instability. In contrast, for platforms, risk aversion is frequently driven by concerns over the supplier’s potential bankruptcy, as empirical evidence suggests that smaller marketplace platforms and suppliers tend to exhibit cautious behavior when facing such risks. These differing sources of risk aversion can significantly shape the decision-making processes of both parties. Second, the platform typically has access to extensive market information, such as customers’ browsing data and purchasing history, along with powerful data analytics capabilities due to their advanced digital technology and customer reach. As a result, it makes sense to consider the platform’s incentive to share detailed demand information with the supplier. It is also interesting to explore the supplier’s operational decisions and the extent to which the supplier can improve her profitability by better managing demand uncertainty which, in turn, benefits the platform, especially in a capital-constrained context. Finally, an important avenue for future research lies in examining the impact of market competition in the platform where heterogeneous suppliers coexist. These suppliers often differ in production capacity or cost structures, which can significantly influence their financing decisions. Such financial considerations, in turn, shape their subsequent decisions on production quantities and pricing strategies. In these markets, suppliers simultaneously determine their pricing and output levels, with each supplier’s choices affecting not only their own demand but also the demand for others through cross-price elasticity. Understanding how heterogeneity in production characteristics interacts with financing strategies could offer valuable insights into optimizing platform dynamics and supplier performance.

Author Contributions

Conceptualization, L.Z.; methodology, L.Z.; software, L.Z.; validation, L.Z.; formal analysis, L.Z.; investigation, L.Z.; resources, J.Z.; writing—original draft preparation, L.Z.; writing—review and editing, L.Z. and J.Z.; supervision, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Ministry of Education Key Projects of Philosophy and Social Sciences Research under grand number 23JZD009 and the Fundamental Research Funds for the Central Universities under grant number 2022YJS043.

Institutional Review Board Statement

Given the content and methodologies of this study, this type of research does not typically require ethical approval.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Acknowledgments

We sincerely thank all participants and reviewers for their valuable contributions and insights.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Proofs

Appendix A.1. Proof of Proposition 1

Following Petruzzi and Dada [41] and Wang et al. [43], we solve the optimal pair using a sequential procedure. Specifically, we first derive the optimal selling price with given stock factor, and then plug such price into the supplier’s objective function to obtain the optimal stock factor.

Taking the first partial derivative of with respect to , we have

Solving , we obtain . It is easy to see when , , otherwise, . Thus, is unimodal in for any given , i.e., reaches its maximum at with any fixed . The unique optimal selling price is thus derived as follows:

Then, we plug into the supplier’s expected profit function,

and solve it as a single-variable optimization problem, .

Taking the first derivative of with respect to , we have

where . The optimal stock factor is thus derived as according to the first-order condition. In the next step, we will prove the uniqueness of . It is easy to see . Then, we take the first and second derivatives of with regard to , and obtain

According to the IFR property, we know that increases in , i.e., . When , we have , i.e., increases in when and decreases in it when . Thus, is proven unimodal in . We further find and , which show that the solution of available in is unique. Thus, the proof for the uniqueness of is completed. Correspondingly, is proven as the available and unique solution to maximize . □

Appendix A.2. Proof of Lemma 1

We have:

□

Appendix A.3. Proof of Proposition 2

The solution procedure is similar to that of the benchmark case. We firstly find that is unimodal in for any given , and obtain the optimal selling price ,

Then, we plug into the supplier’s expected profit function,

and solve it as a single-variable optimization problem, . Taking the first derivative of concerning , we have

where . The optimal stock factor is obtained according to the first-order condition as . The existence and uniqueness of is proven with the procedure similar to the last proof. We obtain according to . □

Appendix A.4. Proof of Proposition 3

Firstly, take the second order derivative of with respect to ,

Thus, for any given , is proven concave in . The necessary and sufficient condition of optimal stock factor can be given by the first order condition, that is,

We thus obtain . Substituting into the supplier’s profit function, we have

We can solve the supplier’s optimal pricing problem by the first order condition,

and obtain . Substituting into , we can obtain and . □

Appendix A.5. Proof of Lemma 3

We have

□

Appendix A.6. Proof of Proposition 4

We have

□

Appendix A.7. Proof of Proposition 5

We adopt a Stackelberg game to determine the optimal operational strategies and resolve it through backward induction, where the supplier is the game follower and the platform is the game leader.

Firstly, for any given , we can derive the optimal decisions of the supplier, the solution procedure of which is similar to that of proof of Proposition 4. is concave in for any given , since

holds. Then, taking the first order derivative of , we can derive the optimal stock factor by the first order condition, i.e.,

Thus, is obtained. Substitute into the supplier’s profit function, we obtain

Then, the optimal price can be derived from the first order condition

i.e., . Substituting into , we have and .

In the next step, we optimally solve the platform’s interest rate decision given the supplier’s optimal decisions, to maximize his profit, . We give his profit function in the following:

Taking the second derivative of concerning , we have . Thus, the optimal interest rate can be derived from the first-order condition,

where , , and . □

References

- Tang, C.S.; Yang, S.A.; Wu, J. Sourcing from suppliers with financial constraints and performance risk. Manuf. Serv. Oper. Manag. 2018, 20, 70–84. [Google Scholar] [CrossRef]

- Tseng, M.L.; Wu, K.J.; Hu, J.; Wang, C.H. Decision-making model for sustainable supply chain finance under uncertainties. Int. J. Prod. Econ. 2018, 205, 30–36. [Google Scholar] [CrossRef]

- Tseng, M.L.; Lim, M.K.; Wu, K.J. Improving the benefits and costs on sustainable supply chain finance under uncertainty. Int. J. Prod. Econ. 2019, 218, 308–321. [Google Scholar] [CrossRef]

- Su, L.; Cao, Y.; Li, H.; Tan, J. Blockchain-driven optimal strategies for supply chain finance based on a tripartite game model. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1320–1335. [Google Scholar] [CrossRef]

- Shi, S.; Sun, J.; Cheng, T. Wholesale or drop-shipping: Contract choices of the online retailer and the manufacturer in a dual-channel supply chain. Int. J. Prod. Econ. 2020, 226, 107618. [Google Scholar] [CrossRef]

- Yi, Z.; Wang, Y.; Chen, Y.J. Financing an agricultural supply chain with a capital-constrained smallholder farmer in developing economies. Prod. Oper. Manag. 2021, 30, 2102–2121. [Google Scholar] [CrossRef]

- Zhan, J.; Zhang, G.; Chong, H.Y.; Chen, X. Blockchain and Supply-Chain Financing: An Evolutionary Game Approach with Guarantee Considerations. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 1616–1636. [Google Scholar] [CrossRef]

- Siqin, T.; Choi, T.M.; Chung, S.H. Optimal E-tailing channel structure and service contracting in the platform era. Transp. Res. Part Logist. Transp. Rev. 2022, 160, 102614. [Google Scholar] [CrossRef]

- Tian, L.; Vakharia, A.J.; Tan, Y.; Xu, Y. Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar] [CrossRef]

- Wei, J.; Lu, J.; Chen, W.; Xu, Z. Distribution contract analysis on e-Platform by considering channel role and good complementarity. J. Theor. Appl. Electron. Commer. Res. 2020, 16, 445–465. [Google Scholar] [CrossRef]

- Yu, J.; Zhao, J.; Zhou, C.; Ren, Y. Strategic business mode choices for e-commerce platforms under brand competition. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1769–1790. [Google Scholar] [CrossRef]

- Tunca, T.I.; Zhu, W. Buyer intermediation in supplier finance. Manag. Sci. 2018, 64, 5631–5650. [Google Scholar] [CrossRef]

- Gong, D.; Liu, S.; Liu, J.; Ren, L. Who benefits from online financing? A sharing economy E-tailing platform perspective. Int. J. Prod. Econ. 2020, 222, 107490. [Google Scholar] [CrossRef]

- Cai, S.; Yan, Q. Online sellers’ financing strategies in an e-commerce supply chain: Bank credit vs. e-commerce platform financing. Electron. Commer. Res. 2023, 23, 2541–2572. [Google Scholar] [CrossRef]

- Yang, H.; Zhen, Z.; Yan, Q.; Wan, H. Mixed financing scheme in a capital-constrained supply chain: Bank credit and e-commerce platform financing. Int. Trans. Oper. Res. 2022, 29, 2423–2447. [Google Scholar] [CrossRef]

- Wang, C.; Fan, X.; Yin, Z. Financing online retailers: Bank vs. electronic business platform, equilibrium, and coordinating strategy. Eur. J. Oper. Res. 2019, 276, 343–356. [Google Scholar] [CrossRef]

- Zhen, X.; Shi, D.; Li, Y.; Zhang, C. Manufacturer’s financing strategy in a dual-channel supply chain: Third-party platform, bank, and retailer credit financing. Transp. Res. Part Logist. Transp. Rev. 2020, 133, 101820. [Google Scholar] [CrossRef]

- Gupta, D.; Chen, Y. Retailer-direct financing contracts under consignment. Manuf. Serv. Oper. Manag. 2020, 22, 528–544. [Google Scholar] [CrossRef]

- Yan, N.; Zhang, Y.; Xu, X.; Gao, Y. Online finance with dual channels and bidirectional free-riding effect. Int. J. Prod. Econ. 2021, 231, 107834. [Google Scholar] [CrossRef]

- Liu, J.; Yang, Y.; Yu, Y. Ordering and interest rate strategies in platform finance with an overconfident and commerce retailer. Transp. Res. Part Logist. Transp. Rev. 2021, 153, 102430. [Google Scholar] [CrossRef]

- Ma, C.; Dai, Y.; Li, Z. Financing format selection for electronic business platforms with a capital-constrained e-tailer. Transp. Res. Part Logist. Transp. Rev. 2022, 162, 102720. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Che, Y.K.; Gale, I. The optimal mechanism for selling to a budget-constrained buyer. J. Econ. Theory 2000, 92, 198–233. [Google Scholar] [CrossRef]

- Kouvelis, P. OM Forum—Supply Chain Finance Redefined: A Supply Chain-Centric Viewpoint of Working Capital, Hedging, and Risk Management. Manuf. Serv. Oper. Manag. 2023, 25, 2074–2084. [Google Scholar]

- Huang, S.; Fan, Z.P.; Wang, X. Optimal operational strategies of supply chain under financing service by a 3PL firm. Int. J. Prod. Res. 2019, 57, 3405–3420. [Google Scholar] [CrossRef]

- Dong, G.; Wei, L.; Xie, J.; Zhang, W.; Zhang, Z. Two-echelon supply chain operational strategy under portfolio financing and tax shield. Ind. Manag. Data Syst. 2020, 120, 633–656. [Google Scholar] [CrossRef]

- Nigro, G.L.; Favara, G.; Abbate, L. Supply chain finance: The role of credit rating and retailer effort on optimal contracts. Int. J. Prod. Econ. 2021, 240, 108235. [Google Scholar] [CrossRef]

- Chen, L.; Chan, H.K.; Zhao, X. Supply chain finance: Latest research topics and research opportunities. Int. J. Prod. Econ. 2020, 229, 107766. [Google Scholar] [CrossRef]

- Li, J.; He, Z.; Wang, S. A survey of supply chain operation and finance with Fintech: Research framework and managerial insights. Int. J. Prod. Econ. 2022, 247, 108431. [Google Scholar] [CrossRef]

- Siqin, T.; Choi, T.M.; Chung, S.H.; Wen, X. Platform operations in the industry 4.0 era: Recent advances and the 3As framework. IEEE Trans. Eng. Manag. 2022, 71, 1145–1162. [Google Scholar] [CrossRef]

- Kuang, Y.; Jiang, L. Managing presales with two payments and return policy when consumers are time-inconsistent. Prod. Oper. Manag. 2023, 32, 3594–3613. [Google Scholar] [CrossRef]

- Wei, L.; Xie, J.; Zhu, W.; Li, Q. Pricing of platform service supply chain with dual credit: Can you have the cake and eat it? Ann. Oper. Res. 2023, 321, 589–661. [Google Scholar] [CrossRef]

- Xie, J.; Wei, L.; Zhu, W.; Zhang, W. Platform supply chain pricing and financing: Who benefits from e-commerce consumer credit? Int. J. Prod. Econ. 2021, 242, 108283. [Google Scholar] [CrossRef]

- Yan, N.; Liu, Y.; Xu, X.; He, X. Strategic dual-channel pricing games with e-retailer finance. Eur. J. Oper. Res. 2020, 283, 138–151. [Google Scholar] [CrossRef]

- Lu, Q.; Liao, C.; Chen, M.; Shi, V.; Hu, X.; Hu, W. Platform financing or bank financing in agricultural supply chains: The impact of platform digital empowerment. Eur. J. Oper. Res. 2024, 315, 952–964. [Google Scholar] [CrossRef]

- Tsunoda, Y.; Zennyo, Y. Platform information transparency and effects on third-party suppliers and offline retailers. Prod. Oper. Manag. 2021, 30, 4219–4235. [Google Scholar] [CrossRef]

- Rath, S.B.; Basu, P.; Mandal, P.; Paul, S. Financing models for an online seller with performance risk in an E-commerce marketplace. Transp. Res. Part Logist. Transp. Rev. 2021, 155, 102468. [Google Scholar] [CrossRef]

- Mandal, P.; Basu, P.; Choi, T.M.; Rath, S.B. Platform financing vs. bank financing: Strategic choice of financing mode under seller competition. Eur. J. Oper. Res. 2023, 315, 130–146. [Google Scholar] [CrossRef]

- Mills, E.S. Uncertainty and price theory. Q. J. Econ. 1959, 73, 116–130. [Google Scholar] [CrossRef]

- Karlin, S.; Carr, C.R. Prices and optimal inventory policy. Stud. Appl. Probab. Manag. Sci. 1962, 4, 159–172. [Google Scholar]

- Petruzzi, N.C.; Dada, M. Pricing and the newsvendor problem: A review with extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef]

- Zhao, W.; Wang, Y. Coordination of joint pricing-production decisions in a supply chain. IIE Trans. 2002, 34, 701–715. [Google Scholar] [CrossRef]

- Wang, Y.; Li, J.; Shen, Z.J. Channel performance under consignment contract with revenue sharing. Manag. Sci. 2004, 50, 34–48. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, M.; Zhang, Z.G. Technical note-a risk-averse newsvendor model under the cvar criterion. Oper. Res. 2009, 57, 1040–1044. [Google Scholar] [CrossRef]

- Tang, O.; Musa, S.N.; Li, J. Dynamic pricing in the newsvendor problem with yield risks. Int. J. Prod. Econ. 2012, 139, 127–134. [Google Scholar] [CrossRef]

- Zhang, Y.; Hua, G.; Cheng, T.; Zhang, J.; Fernandez, V. Risk pooling through physical probabilistic selling. Int. J. Prod. Econ. 2020, 219, 295–311. [Google Scholar] [CrossRef]

- Yang, Y.; Liu, J. Price timing and financing strategies for a capital-constrained supply chain with price-dependent stochastic demand. Int. J. Prod. Econ. 2023, 261, 108885. [Google Scholar] [CrossRef]

- Granot, D.; Yin, S. On the effectiveness of returns policies in the price-dependent newsvendor model. Nav. Res. Logist. 2005, 52, 765–779. [Google Scholar] [CrossRef]

- Emmons, H.; Gilbert, S.M. Note. The role of returns policies in pricing and inventory decisions for catalogue goods. Manag. Sci. 1998, 44, 276–283. [Google Scholar] [CrossRef]

- Lariviere, M.A. A note on probability distributions with increasing generalized failure rates. Oper. Res. 2006, 54, 602–604. [Google Scholar] [CrossRef]

- Chen, L.; Nan, G.; Liu, Q.; Peng, J.; Ming, J. How do consumer fairness concerns affect an E-commerce Platform’s choice of selling scheme? J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1075–1106. [Google Scholar] [CrossRef]

- Xu, B.; Huang, J.; Zhang, X.; Alejandro, T.B. Strategic Third-Party Product Entry and Mode Choice under Self-Operating Channels and Marketplace Competition: A Game-Theoretical Analysis. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 73–94. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Oper. Res. 2012, 60, 566–580. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).