- Article

A Blockchain Architecture for Hourly Electricity Rights and Yield Derivatives

- Volodymyr Evdokimov,

- Anton Kudin and

- Vakhtanh Chikhladze

- + 1 author

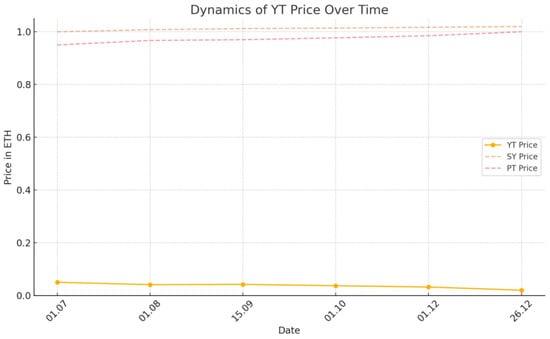

The article presents a blockchain-based architecture for decentralized electricity trading that tokenizes energy delivery rights and cash-flows. Energy Attribute Certificates (EACs) are implemented as NFTs, while buy/sell orders are encoded as ERC-1155 tokens whose tokenId packs a time slot and price, enabling precise matching across hours. A clearing smart contract (Matcher) burns filled orders, mints an NFT option, and issues two ERC-20 assets: PT, the right to consume kWh within a specified interval, and YT, the producer’s claim on revenue. We propose a simple, linearly increasing discounted buyback for YT within the slot and introduce an aggregating token, IndexYT, which accumulates YTs across slots, redeems them at par at maturity, and gradually builds on-chain reserves—turning IndexYT into a liquid, yield-bearing instrument. We outline the PT/YY lifecycle, oracle-driven policy controls for DSO (e.g., transfer/splitting constraints), and discuss transparency, resilience, and capital efficiency. The contribution is a Pendle-inspired split of electricity into Principal/Yield tokens combined with a time-stamped on-chain order book and IndexYT, forming a programmable market for short-term delivery rights and yield derivatives with deterministic settlement.

24 December 2025