Abstract

Artificial intelligence adoption in financial services presents uncertain implications for competitive dynamics, particularly for smaller institutions. The literature on AI in finance is growing, but there remains a notable absence regarding the impacts on small- and medium-sized financial services firms. We conduct a meta-analysis combining a systematic literature review, sentiment bibliometrics, and network analysis to examine how AI is transforming competition across different firm sizes in the financial sector. Our analysis of 160 publications reveals predominantly positive academic sentiment toward AI in finance (mean positive sentiment 0.725 versus negative 0.586, Cohen’s d = 0.790, p < 0.0001), with anticipatory sentiment increasing significantly over time (). However, network analysis reveals substantial conceptual fragmentation in the research discourse, with a low connectivity coefficient () indicating that the field lacks unified terminology. These findings expose a critical knowledge gap: while scholars increasingly view AI as competitively advantageous, research has not coalesced around coherent models for understanding differential impacts across firm sizes. The absence of size-specific research leaves practitioners and policymakers without clear guidance on how AI adoption affects competitive positioning, particularly for smaller institutions that may face resource constraints or technological barriers. The research fragmentation identified here has direct implications for strategic planning, regulatory approaches, and employment dynamics in financial services.

1. Introduction

Artificial intelligence (AI) is rapidly reshaping the financial services sector, with implications for competition that remain poorly understood. Large institutions have the capital, data, and infrastructure to deploy AI at scale, while smaller firms face resource constraints that could reinforce structural asymmetries [1]. Understanding how AI adoption alters competitive dynamics across firm sizes is, therefore, a pressing research and policy concern.

Academic discourse frequently emphasizes AI’s transformative benefits while giving limited attention to potential negative consequences such as employment displacement, skill atrophy, or competitive disadvantages for resource-constrained institutions, potentially reflecting positive results bias in academic publishing [2]. Artificial Intelligence adoption among small- and medium-sized enterprises shows promising growth, with 39% of SMEs now using AI applications and 26% leveraging generative AI specifically [3]. However, this surface-level adoption masks significant challenges: only 8% of businesses achieve transformative digital integration, while 72% operate with inadequate security measures [3]. Most importantly, AI implementation projects fail at alarmingly high rates, with industry analyses indicating failure rates often exceeding 80% [4]. This failure epidemic stems not only from technical execution challenges, but from a fundamental strategic gap: existing adoption frameworks fail to address whether AI should be adopted at all for a specific business context.

Current technology adoption models like the Technology-Organization-Environment (TOE) framework [5] and Technology Acceptance Model (TAM) [6] provide structured approaches to assess technical compatibility with existing systems, organizational readiness in terms of skills, process, and culture, and external environmental pressures. However, these models share an important blind spot: they presuppose that adoption is necessary and focus solely on implementation pathways. None incorporate mechanisms to evaluate strategic urgency or whether delaying adoption creates tangible business value erosion. This omission can be detrimental for resource-constrained SMEs, where misaligned AI investments may carry severe consequences. As OECD research confirms, 40% of SMEs cite maintenance costs as a primary barrier, while 39% lack time for training [3], potentially leading to wasted resources when AI solutions address non-critical needs.

Artificial Intelligence (AI) has advanced from theoretical curiosity in the 1950s [7] to required system-level infrastructure across most industries. Breakthroughs in deep learning, natural language processing, machine learning, and, most recently, generative AI [8] have reframed data not merely as an organizational input, but as a strategic asset from which predictive and prescriptive value can be continuously harvested. All industries appear to be capable of being revolutionized by AI technologies, and the financial services sector is among many on the cusp of a transformation as firms begin to embrace and integrate AI within their operations [9]. This reframing is likely to be disruptive, as the proliferation of AI adoption poses imminent threats to small- and medium-sized financial services firms [10]. Large, diversified banks and asset managers already deploy AI at scale to optimize capital modelling, personalize client engagement, and arbitrage microsecond market signals. Conversely, smaller financial services firms may lack critical advantages of capital and scale, which could hinder their ability to deploy AI within their practice. The diffusion of AI, therefore, risks amplifying preexisting structural asymmetries [10,11] in what is already one of the most highly concentrated sectors in the global economy.

Multiple factors shape how AI integration in financial services will reconfigure the competitive landscape [12,13]. These forces are expected to function differently across organizational sizes, creating unique challenges and opportunities for small and medium-sized financial institutions. Power imbalances in finance have historically been a function of scale economies, network effects, and privileged access to information sources. AI amplifies these imbalances. For example, machine learning is an inherently capital and data-intensive exercise that rewards access to large transactional datasets and high-performance computing infrastructure. Furthermore, once a high-performing prediction model is deployed, feedback effects reinforce the incumbent’s advantage. Their superior predictions attract more clients, whose data in turn contribute to subsequent model training, producing a self-reinforcing loop that threatens to lock smaller financial services firms into technically dependent positions by licensing black-box models from the very giants with whom they compete.

AI also has the potential to democratize advanced capabilities and enable greater access to information and insights, offering the potential to level the playing field for financial services firms of all sizes. AI’s modularity and the rise of cloud-based machine learning services create entry points for nimble firms to pursue specialized niches. Open-source models and synthetic data techniques lower the barriers for experimentation.

Several ethical dilemmas arise from the disruptive adoption of AI in the financial sector. First, will AI-derived productivity accrue to shareholders of dominant financial services giants, yielding an amplified power imbalance, or will efficiency gains democratize across the industry? Second, when automated advisory algorithms generate recommendations, what are the dynamics of fiduciary duty with respect to clients, human advisors that have been augmented or overridden, or model owners? Finally, if human expertise atrophies because of an over-reliance on automated decision-making, society risks diluting the interpretive counterweights humans provide against model error and bias. The tragedy of the commons may emerge as financial institutions engage in an arms race for market share, which will cement their dominance while eroding market integrity or trust in the financial system [14].

Given these important challenges and AI evolution facing SME financial institutions, it becomes important to examine how academic research, which shapes both practitioner understanding and policy development, addresses these competitive dynamics. The academic literature serves as a foundational knowledge base for decision-makers, yet its treatment of SME-specific challenges in AI adoption remains unexplored. If academic discourse exhibits positive bias toward AI benefits while underrepresenting implementation failures or competitive disadvantages for smaller firms, this gap could perpetuate the very strategic misalignments causing the 80% failure rate.

Furthermore, the maturity and coherence of academic discourse itself signals whether the field has developed sufficient theoretical grounding to guide practical adoption decisions. A fragmented or nascent academic conversation would suggest that SME financial institutions are making high-stakes AI investments without adequate scholarly foundation. Therefore, this study systematically examines three critical dimensions of the academic literature on AI in financial services by conducted a meta-analysis that combines a systematic literature review, sentiment bibliometrics, and a graph theoretical analysis of the existing literature to understand both the substantive claims about AI’s role in finance and the underlying discourse dynamics that shape how these claims are framed. By analyzing sentiment trends and conceptual connectivity, we reveal how the literature increasingly portrays AI as competitively advantageous, while also exhibiting a lack of theoretical integration across financial disciplines. Considering the above discussion, we finalize the following three research questions:

- R1:

- To what extent do academic studies on AI in financial services explicitly consider the competitive consequences for small- and medium-sized financial services firms?

- R2:

- How is the sentiment toward AI adoption in small- and medium-sized financial services firms characterized in the academic literature?

- R3:

- Is there empirical evidence of lexical convergence or conceptual alignment in academic discourse on AI in finance that would signal field maturation?

While there are several recent systematic literature reviews and meta-analyses that are directly relevant, we were unable to find a quantitative meta-analyses that focused exclusively on small- and medium-sized financial services firms. Most recent work falls into two camps: (A) SLRs/meta-analyses of AI in financial services (all firm sizes) [15,16] and (B) SLRs/meta-analyses of AI adoption in SMEs across sectors [17,18,19,20].

This research begins with a literature review which explores the existing publications on financial institutions, the application of AI in finance, and the context of the smaller financial services firm.

1.1. Financial Institutions

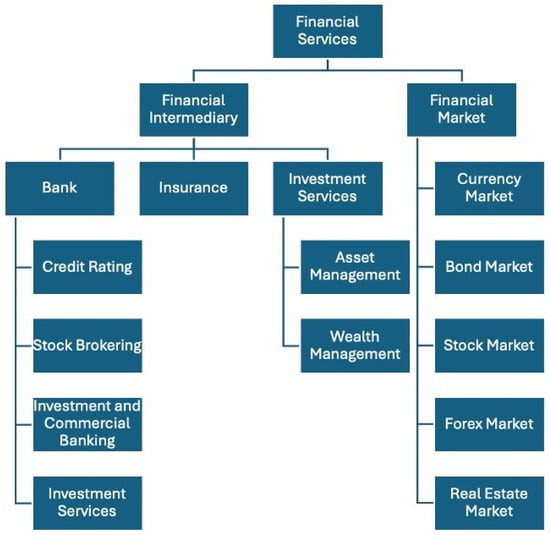

The financial industry has experienced vast innovation spanning the last century, from the introduction of checks, credit cards, automated teller machines, and debit cards, to innovations like internet banking, mobile payments, and crowdfunding driven by fintech advancements [21]. The landscape in which financial institutions operate has been shifting dramatically due to forces like increased competition, deregulation, and globalization, all of which have played a role in the ascent of fintech and AI [22]. There are a myriad of key players and systems within finance, which can be broadly separated into financial markets and institutions. Herrman and Masawi define financial services broadly [23], encompassing financial advisors, asset management, investment banking, mutual funds, stockbrokering, payment providers, and fintech companies. These services involve a wide range of money-related activities, which generally involve the performance of a service in exchange for a fee. This research focuses on banks and investment services providers in their interaction with financial markets and the impact of AI across all aspects of the organization, as shown in Figure 1.

Figure 1.

Financial services structure.

Financial institutions vary not only in the scope of their offerings, but also in their size. It is important to consider the various characteristics of these institutions when striving to understand the impacts of an exogenous variable, AI, as financial organizations are not uniform. When examining financial institutions within the context of size, many measurements may be used, for example, when examining shareholder equity, assets, market share, employees, revenue, physical locations, etc. Generally, large financial institutions are characterized as having over CAD 12 billion in shareholder equity, medium-sized have shareholder equity above CAD 2 billion and below CAD 12 billion, and small-sized financial institutions have shareholder equity below CAD 2 billion [24]. Comparatively, ref. [25] defines small financial institutions as having fewer than 500 employees and the mean book value of assets in their study was USD 3 million, with a median of USD 680,000. Nonetheless, it is important to acknowledge that there exists nuance with respect to categorizing financial institutions based on size, given the many different measurements available and the fact that firms may be categorized differently depending on the type of measurement used.

1.2. AI in Finance

The number of applications of AI in the finance industry has risen substantially, which can be attributed to digitization transformations catalyzed by advancements in computing power and the emphasis on information as a valuable asset [26,27]. A seminal study by Bahrammirzaee (2010) [10] highlights three prominent AI techniques, artificial neural networks, expert systems, and hybrid intelligent systems, and their use cases in credit evaluation, portfolio management, and financial prediction and planning. The findings conclude that these AI methods generally outperform traditional statistical models used in the industry. Some of the most successful applications of AI in finance appear to be in investments, securities, marketing, customer relationships, lending, risk management, and compliance [23]. A study conducted at JP Morgan demonstrated the difficulties in predicting irregular data. However, tasks in other areas of the bank that do not generate significant value added showed more immediate promise for AI through freeing up employee time [9].

The benefits of AI in various areas of finance are robust. In the wealth management industry, AI will support the provision of higher-quality services that are more tailored to the client’s needs, facilitate capturing new client bases, and provide time savings [28]. Useful AI tools include machine learning, robotic process automation, advanced neural networks, natural language processing, computer vision, and, more recently, generative AI [28]. Generally, the automation of repetitive tasks, which AI executes exceptionally well, helps professionals in the finance industry focus more on consultancy and data analysis, which generate more value for clients and their businesses, and such efficiencies ultimately lead to greater profits [12]. Robo-advisors, for example, streamline product selection, banking solutions, and generate time savings in low-complexity tasks [29]. AI’s role in trading has expanded due to the realized improvements in returns, with algorithmic trading increasingly driving investment selection, yet the need for human interpretation of the algorithm remains, underscoring the trend towards passive portfolio management [26]. Nonetheless, AI’s potential reaches beyond prediction based on historical data; the tool can also serve in idea generation and problem-solving [30]. The COVID-19 pandemic catalyzed many organizational and technological changes; however, the adverse effects on banking profits hindered short-term investment in AI [31,32]. Challenges remain for financial institutions implementing AI due to the effect on culture, sentiment among employees, and, perhaps most importantly, privacy and security concerns [29].

1.3. Small- and Medium-Sized Financial Institutions and AI

Small- and medium-sized institutions collectively wield significant influence in the market, which necessitates a nuanced understanding of AI’s varied impacts on these firms [33]. Smaller firms suffer from scale inefficiencies relative to large institutions, which may result in difficulty competing against industry behemoths due to resource constraints and can serve as barriers to entry [11,34]. The success of small- and medium-sized financial services firms is in the best interest of fintech companies, which stand to gain more revenue as more clients shift to AI-driven technologies [26]. Consequently, some research claims the size of institutions matters, and smaller firms must be exceptionally well-run to overcome these challenges [35]. Others argue that the threat posed by large banks is not absolute and depends largely on their ability to provide personalization while maintaining their unit cost advantage [35]. Personalization in the face of complexity is often a competitive advantage for small- and medium-sized firms. Cutting-edge technologies which garner insights into consumer behavior and preferences facilitate a more personalized experience and serve as an opportunity for small- and medium-sized financial institutions [35,36,37,38]. The impact of AI on small- and medium-sized financial services remains uncertain, as some authors demonstrate the great possibilities these technologies wield for small firms, while others reveal that small firms will struggle to compete with industry behemoths.

Smaller firms often excel in serving niche or specialized needs. For example, while larger banks are typically chosen for most merger and acquisition deals, boutique firms are preferred for complex transactions requiring deep industry expertise [38]. Boutique firms face challenges different from larger banks due to limited resources, geographic reach, lending capacity, and service offerings beyond advisory, leaving larger deals to major banks [38].

The uniqueness of small- and medium-sized financial institutions has many forms and often serves to strengthen their product or service offering. Small firms have advantages relative to their larger counterparts when services relate to processing soft information [39]. Small banks are more capable at interpreting soft data and, in turn, are more likely to lend to firms with little or no financial records [25]. Small- and medium-sized financial services firms tend to be more deeply locally embedded in communities, which enables these firms to reduce information asymmetries and improve credit assessments [40]. Nonetheless, there remains concerns that smaller incumbent financial firms will face pressures from nimble fintech companies and dominant banks as adoption of AI remains slow for small- and medium-sized financial firms [41]. The human touch remains important in finance due to the complexity, and is often a competitive edge for smaller firms, and cutting-edge technologies garner advances in this area posing as a major opportunity for small- and medium-sized financial firms [37].

AI creates many opportunities for firms, but it is not without risks. A risk for small- and medium-sized firms is that the promises of cost reduction and differentiation are not guaranteed and will depend on the scale of the organization [26]. Regulators are facing difficulties defining AI, managing ethical threats that come with the technology, and regulating the impact on competition [42]. The lack of regulation poses a concern for many reasons. For example, concerning inaccurate information and determining the liable party when and if things go wrong [11]. For smaller firms, insufficient competition among AI providers, coupled with little regulation, may arbitrarily inflate prices for AI services, which may render these technologies inaccessible to small- and medium-sized firms that are bound tightly by the constraints of capital [11].

Despite the transformative potential of AI for small- and medium-sized firms, the research landscape remains fragmented and challenging to navigate. This study addresses this gap by systematically examining the existing literature through three critical lenses. First, we quantitatively assess the distribution of research focus across key dimensions, high positive impact, low/negative impact, and institution size, to identify potential imbalances in scholarly research. Second, we evaluate whether current research adequately addresses the unique contexts and constraints of smaller financial enterprises as distinct from their larger counterparts. Finally, we examine whether the discourse is stabilizing, such that researchers are harmonizing terminology and integrating concepts across the literature. This is an important consideration for a rapidly evolving domain where knowledge transfer and standardization could significantly accelerate practical implementation. By mapping the latest research, our study provides both researchers and practitioners with a comprehensive understanding of the current state of knowledge and identifies promising directions for future research.

2. Materials and Methods

The research employs a conceptual framework that synthesizes, analyzes, and draws conclusions from the existing scholarly literature, offering a comprehensive understanding of the influence of AI on small- and medium-sized financial institutions. The study utilizes a three-pronged methodological approach: a systematic literature review that identifies and evaluates key scholarly contributions in the field; a sentiment bibliometric analysis that quantifies attitudinal patterns within the academic discourse; and applications of graph theory that visualize and analyze complex networks across research findings to map lexical networks and measure semantic cohesion through co-occurrence analysis of specialized terminology.

A systematic literature review is useful when connecting views from separate disciplines in areas of emerging interest and helps provide new insights or better understandings [43]. This systematic approach ensures that the research is transparent and reproducible. This methodology is appropriate, as this research aims to synthesize the existing knowledge of the competitive nature of the financial services industry and the emerging topic of AI in finance. A sentiment bibliometric review is useful for analyzing current trends in an industry through a systemic overview of the literature [44]. Using a co-word analysis facilitates structuring the data at multiple levels with interacting networks as they transform over time to provide a practical method for extracting patterns and identifying trends [45]. The integration of the systematic literature review, sentiment bibliometric analysis, and graph theory provides a multi-dimensional perspective on the AI landscape in financial institutions. While the literature review empirically documents AI applications, the sentiment analysis reveals attitudinal patterns that could influence adoption rates and implementation approaches. Finally, the graph theoretical analysis allows us to uncover and quantify fragmentation in the lexical structure within the field, highlighting when specialized vocabularies remain isolated or form a cohesive semantic network. In graph theory, nodes and edges mathematically connect points on a graph to show relations between the items [46]. Fragmentation could reflect the nascent nature of AI research in finance or signal maturity through standardized terminology and language integration, suggesting the potential for acceleration in knowledge transfer and implementation across the sector.

This interdisciplinary study follows a triadic framework that adapts reporting conventions from relevant disciplinary standards. The systematic literature review follows the PRISMA 2020 framework, tailored for application within social science contexts to ensure reproducibility and clear documentation of the inclusion criteria, data extraction, and synthesis [47]. The sentiment bibliometric analysis and natural language processing components adhere to best practices in computational social science, incorporating transparent descriptions of algorithmic procedures, keyword extraction, and sentiment classification using open and current large language models (LLM). Graph theoretical modeling is reported using established bibliometric network analysis protocols, with metrics such as node centrality, global/local efficiency, and rich club coefficients calculated via the igraph package in R [48,49]. Each methodological stage has been designed to ensure reproducibility, interdisciplinary clarity, and alignment with emerging standards in computational research applied to business and finance.

3. Systematic Literature Review

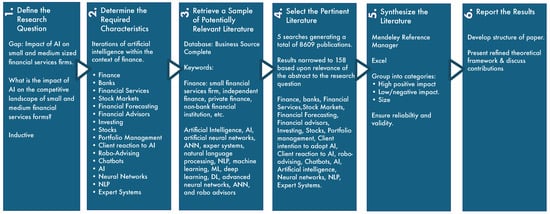

For this research, the SLR will be conducted in six steps and answer thirteen critical questions, as proposed by [50]. The order is as follows: (1) define the research question, (2) determine the required characteristics of primary studies, (3) retrieve a sample of the potentially relevant literature, (4) select the pertinent literature, (5) synthesize the literature, and (6) report the results. The phases will be completed by answering the following questions: (a) What is the research gap and the research question? (b) What is the theoretical approach? (c) How can we define the core theoretical framework? (d) What is the inclusion and exclusion criteria for the literature? (e) Define sources and databases. (f) Define search terms and the search string. (g) Apply the inclusion criteria. (h) Select the data extraction tools. (i) Conduct the coding. (j) Ensure reliability and validity. (k) Decide upon the structure of the paper. (l) Present the theoretical framework and discuss our contributions. (m) Identify an appropriate journal for submission. The process is demonstrated in Figure 2 and complies with PRISMA reporting guidelines [47].

Figure 2.

Systematic literature review process.

The criteria for the research included the search database of Business Source Complete. The keywords include finance, investing, stocks, markets, economics, robo-advising, credit, banks, independent finance, wealth management, artificial intelligence, AI, neural networks, expert systems, natural language processing, machine learning, and deep learning. An example of a search string is “small or medium or large AND financial services industry or bank or finance or private finance or non-bank financial institution or NBFI or microfinance or boutique financ* AND artificial intelligence or ai or a.i. or artificial neural networks or automated planning & scheduling or expert systems or natural language processing or machine learning or deep learning or advanced neural networks or robo-advising”. These keywords are identified from the literature, brainstorming, consulting with industry experts, and the database indexes articles. Boolean operators are used for “and,” “or,” and truncation.

The five-year search period spans 2020–2024 to ensure that the most current articles are selected. The period 2020–2024 captures the exponential growth phase of AI adoption in finance, driven by three converging events: the COVID 19-induced digital push, the release of large-scale transformer models (e.g., GPT 3) [51], BERT large [52], and the subsequent rise of generative AI. These developments fundamentally reinvigorated research agendas after a plateau period [53] and catalyzed a shift from legacy to AI-enabled processes across financial institutions, making 2020 the natural demarcation point for studying the contemporary epistemic landscape that our study hopes to focus on.

The search queries were developed through an iterative process, which included consulting the literature, industry experts, and librarians familiar with the database Business Source Complete. From this process, a set of relevant keywords were generated from the literature pertinent to the topic. The initial search was designed to cast a wide net and identify a broad range of articles. Subsequent searches introduced slight variations to capture additional articles that may not have been retrieved initially. This approach helped reduce the risk of distortion, and ensured that the final set of articles was comprehensive rather than limited by a single search.

The search field includes the article title, abstract, and keywords. The subject areas are finance, economics, technology, and business. All articles are peer-reviewed, from journals, in English, and in their final stage of publication. We did not use quality filtering on journals to ensure greater scope in terms of the collection of the literature. However, the number of citations will be noted in the analysis. The SLR included a robust process of gathering sufficient articles regarding the topic, which retrieved many articles that were refined based on relevance to the topic. The heuristics used for narrowing down based on the title were as follows:

Finance, Banks, Financial Services, Stock Markets, Financial Forecasting, Financial advisors, Investing, Stocks, Portfolio management, Client intention to adopt AI, Client reaction to AI. Roboadvising, Chatbots, AI, Artificial intelligence, Neural networks, NLP, Expert systems.

3.1. Scope and Alignment

The three objectives of this paper are to (i) determine the extent to which academic studies on AI consider the competitive consequences for small- and medium-sized financial services firms, (ii) understand sentiment toward AI adoption in small- and medium-sized financial institutions as characterized in the academic literature, and (iii) identify empirical evidence of lexical convergence or conceptual alignment in academic discourse on AI in finance that would signal field maturities. The keyword logic was designed to generate a vast body of literature that applies to the subject and the aims of this paper. The use of many keywords yielded a result of many papers returned to the authors, but ensured that the search was comprehensive in spanning articles that may not be retrieved by using broad keywords like “AI” or “finance”. The inclusion and exclusion criteria were designed intentionally so as to ensure that the literature directly informs each objective.

The exclusion criteria were designed to filter out only the articles which are not relevant to the objectives of the research while ensuring that the relevant articles remain within our collection group to be used in the analysis. The heuristics included a set of keywords, and, as the articles were being screened, they were contrasted with the list and were required to reasonably capture the set criteria. The list included the following subjects: finance, banks, financial services, stock markets, financial forecasting, financial advisors, investing, stocks, financial products and services, portfolio management, client intention to adopt AI, client reaction to AI, AI, robo-advising, chatbots, neural networks, natural language programming, expert systems, small/medium/large, and competition.

3.2. Sentiment Bibliometric Analysis

As the SLR covered a pivotal time in AI research, with the introduction of GPT technology, an interesting addition to the research involved extracting attitudinal data of the authors by applying computational linguistics methods to analyze potential changes in tone towards the applications of AI in finance over the five-year period of our study. This method extends the SLR and the six-step approach of the search strategy.

The bibliometric analysis was performed on the conclusions/results of the articles retrieved from the process in the SLR. Text analysis was conducted using a multi-stage approach to extract and analyze thematic and emotional content. First, FinBERT [54], a domain-specific Bidirectional Encoder Representations from Transformers (BERT) model trained on financial text, was employed to identify and extract key terms related to finance, artificial intelligence, and technology from the corpus. The extracted terms served as core thematic indicators for subsequent analysis. Second, sentiment classification was assessed at the sentence level using the cardiffnlp/twitter-roberta-basesentiment-latest model, a RoBERTa-based transformer specifically fine-tuned for sentiment analysis on social media text, to classify the sentiment polarity (positive, negative, neutral) of the identified core themes. For each sentence containing a previously identified term, the workflow was as follows: (1) Tokenization with AutoTokenizer and truncation to the maximum sequence length supported. (2) Forward pass through the model producing raw logits for three classes: negative, neutral, and positive. (3) Probability calculation by applying a soft-max function to the logits. (4) Aggregation of sentence level probabilities for all key terms and normalized so that three probabilities sum to 1, yielding a term-level sentiment profile. Finally, the National Research Council (NRC) of Canada’s Emotion Lexicon was applied to determine author attitudinal data by mapping the textual content to eight fundamental emotions (anger, anticipation, disgust, fear, joy, sadness, surprise, trust) and two sentiment dimensions (positive, negative), providing a comprehensive emotional profile of the analyzed text. This sequential analytical framework enabled both thematic extraction and multidimensional emotional characterization of the corpus, fostering an overarching understanding of the attitudinal data found within the literature.

3.3. Graph Theoretical Techniques

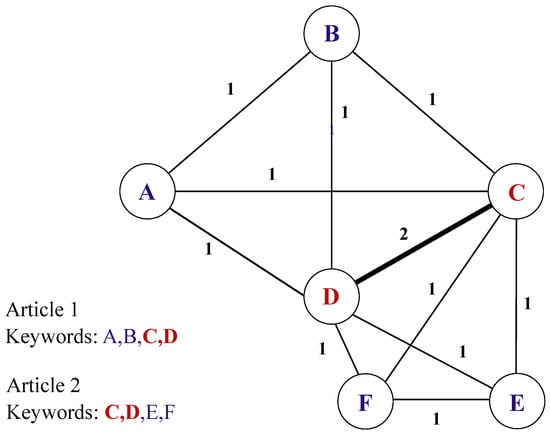

To address R3, we employ a longitudinal lexical co-occurrence network analysis to detect whether the academic discourse on AI in finance exhibits patterns consistent with field maturation. The core premise is that maturing scientific fields demonstrate progressive terminological convergence—initially disparate concepts and vocabulary gradually coalesce into a shared, stable lexicon with clear conceptual hierarchies [55]. We construct annual co-occurrence networks where nodes represent the keywords and phrases extracted from academic articles and the edges represent semantic relationships weighted by co-occurrence frequency within the same document. Edge strength indicates conceptual coupling, where terms appearing together frequently suggest shared theoretical frameworks or methodological approaches. By analyzing network topology over time, we can assess whether the field is fragmenting into isolated sub-discourses or consolidating around core concepts. This network structure reveals how concepts cluster and interconnect within the field’s discourse. For instance, if “machine learning” and “credit risk” consistently co-occur, this indicates an established research stream linking these concepts.

We analyze temporal evolution of network structure using specific metrics that serve as proxies for field maturation. Increasing global efficiency over time suggests that information flows more effectively across the entire network, indicating that concepts are becoming more integrated. Rising local efficiency indicates that clusters of related terms are becoming more tightly interconnected, reflecting deeper specialization within subfields. Increasing degree and betweenness centrality of core terms suggests emergence of foundational concepts that anchor the field’s discourse. A mature field exhibits a stable set of high-centrality "hub" terms around which other concepts organize. The rich club coefficient identifies a densely interconnected core that may exhibit strengthening over time, suggesting the potential formation of canonical knowledge base and potentially field maturation [56].

The methodology involves constructing networks where nodes represent keywords and edges denote the frequency of co-occurrence between these keywords in scholarly articles. This is created by extracting word pairs from the documents, constructing the edge list, removing low-frequency words, and then creating a network for subsequent analysis using graph theoretical techniques, as shown in Figure 3. Our technique calculates network metrics, including node centrality metrics, global and local efficiency metrics, and rich club detection (top 10% by node degree). We use panel data for each calendar year to perform a year-by-year network analysis to provide insights into the field’s evolution. The metrics were calculated using R’s “igraph” package [48,49]. Global efficiency measures how effectively information is exchanged through the entire network. The equation for global efficiency, E, with G networks and N nodes is expressed as follows:

where is the shortest path length between node i and node j.

Figure 3.

Example of a simple keyword co-occurrence network. Nodes indicate keywords published in articles, and edges represent the co-occurrence of words; the numbers on the edges indicate weights proportional to their frequency.

Local efficiency measures the efficiency of communication between a node’s neighbors. The equation for the local efficiency of a node v is

where Nv is the number of neighbors of v, Gv is the subgraph induced by the neighbors of v, and d(u,w) is the shortest distance between nodes u and w in Gv.

The rich club network examines the most highly connected nodes within the network [57]. The rich club coefficient with E>k edges and N>k nodes is

where represents the maximum possible number of nodes. represents the proportion of edges that connect those nodes compared to the maximum number of edges they could potentially share [57].

4. Results

4.1. Systematic Literature Review

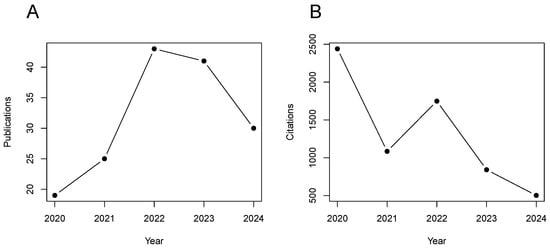

The results were narrowed to 160 articles based on the relevance of the abstract to the research question. The results and search strings are shown in Table 1. The numerous search strings administered in the database Business Source Complete yielded a significant result of 8609 academic articles. Given that the size of this many articles is unfeasible to read within a reasonable timeframe, the authors utilized a screening process aimed at filtering the papers down to a smaller set of core articles with strong relevance to the subject and research questions. The screening process was first directed based on the title of each article, which enabled the authors to pare down the articles to a more feasible set of 250 which are relevant to the topic. Subsequently, the articles were screened based on the abstract, and if more information was necessary to determine if the articles were related to the research questions, the authors examined the content of the paper and made decisions accordingly. The number of publications per year increased from 2020 to a peak of 43 in 2022, followed by a gradual decline. The number of citations per year in the dataset is on a downward trend, except in 2022, which had an uptick in the number of citations, shown in Figure 4.

Table 1.

Search string and results from SLR.

Figure 4.

Systematic literature review: (A) exhibits the distribution over time of publications reviewed, and (B) presents citations associated with reviewed articles by publication date.

The results yielded relatively few research studies focusing on AI in small- and medium-sized financial institutions. Nonetheless, the existing research on the subject elucidates the significant advantages in cost allocation and economies of scale of large banks, which support the digitization process relative to small- and medium-sized banks, although small firms excel in serving smaller enterprises with smaller digital footprints [58]. AI yields many benefits, but the costs are significant, which makes economies of scale important; therefore, the size of the organization is an important determinant in AI research and development [58]. The concentration of competition in financial markets is unlikely to be shaped by AI, but is dependent on boundaries and regulations between large technology companies and financial markets [59]. AI will be transformative for financial services, although the exact impact appears to be complex and uncertain [60].

If the financial sector is revolutionized by AI, risks will emerge. If many firms use machine learning (ML) systems trained on the same data, they may produce similar results, which could amplify herding behavior and systemic risk [60]. For example, if many institutions’ algorithms are triggered to sell securities, algorithmic trading has the potential to induce chain reactions that significantly impact market stability [61]. The opposite may be true for inflating asset price bubbles. However, other authors argue that AI may reduce systemic risk [62].

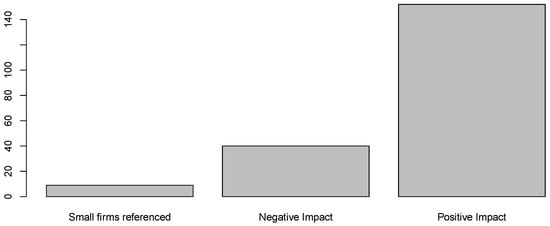

The SLR revealed a disproportionate focus on the positive effects of AI and how it is expected to have a large effect on the industry. We categorized 160 articles as having a high positive impact, shown in Figure 5, with less attention in the literature on the negative impacts yielded by AI, as 40 articles belong to this category. There is even less focus on AI regarding the size of the financial institution. Nine articles in the analysis acknowledged firm size in their research. Of the articles which emphasized the low negative impact AI is expected to have on the industry, there was a noteworthy absence in terms of identifying and discussing labor implications from this technology.

Figure 5.

Frequency of articles in the systematic literature review that reference small firms or assess sectoral impacts in the financial domain. The chart categorizes studies based on their mention of small enterprises and whether their findings portray the financial sector as being positively or negatively impacted.

4.2. Sentiment Bibliometric Analysis

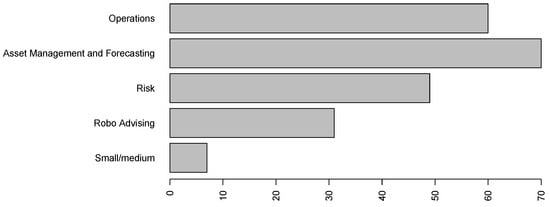

The 160 articles narrowed from the SLR further underwent bibliometric analysis. The number of research reports published annually, according to our sample, significantly increased from 2021 to 2022. The articles were categorized based on five areas of focus in finance, shown in Figure 6. The groupings are small–medium-sized institutions, robo-advising, risk, asset management, and operations. Some articles fell into multiple categories, while others fell within only one group. Asset management yielded the greatest number of articles on that topic. Many of the articles within this category involve asset price forecasting and portfolio optimization. Seventy articles were included in this category. Operations yielded the second-greatest result with 60 articles. Operations broadly encompass AI within the context of the financial business, including implementation and client perception. Risk followed operations with 49 articles and involves credit risk and systematic and unsystematic risk. Thirty-one articles mentioned robo-advising. The category with the fewest mentions was small- to medium-sized financial institutions, with only seven articles. This finding is consistent with that in the SLR, as limited research has been done on AI for small- and medium-sized financial institutions.

Figure 6.

Thematic categories of articles reviewed in our analysis. The horizontal bars represent the frequency of articles within each category, highlighting the distribution of research focus.

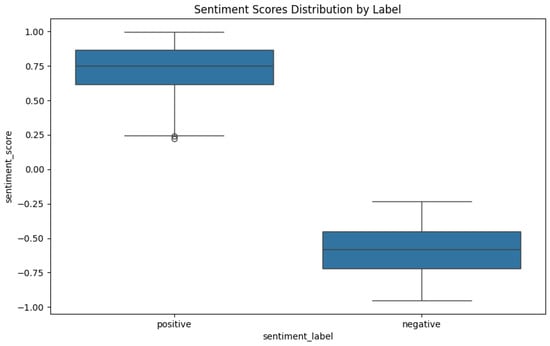

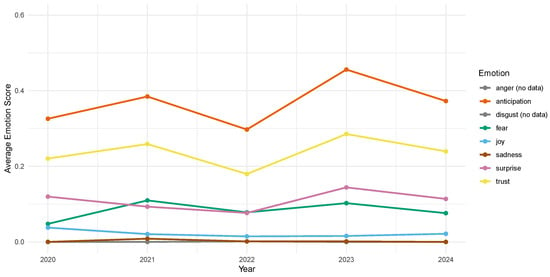

The sentiment analysis revealed that the emotions regarding AI are generally positive, as shown in Figure 7. The mean sentiment was in decline during the release of ChatGPT 3.5 in 2022, but has since increased for positive emotions (Figure 8). The most salient emotional signals throughout the period were anticipation and trust, indicating a prevailing attitude of curiosity and optimism toward AI developments. A linear mixed effects model revealed a statistically significant increase in anticipation over time (), indicating that expressions of anticipatory emotion in AI-related discourse have grown meaningfully throughout the observed period. This pattern implies an emotional orientation that is generally forward-looking and hopeful rather than polarized or reactionary.

Figure 7.

Sentiment scores boxplot.

Figure 8.

Temporal trends in average sentence-level emotion scores from 2020 to 2024, as inferred using the NRC Emotion Lexicon. Emotions were detected across textual data at the sentence level, capturing eight primary affective states: anger, anticipation, disgust, fear, joy, sadness, surprise, and trust.

We compared the absolute magnitudes of positive and negative sentiments to determine if there is a significant difference in their intensity. The analysis revealed that positive sentiments () were significantly stronger than negative sentiments (), indicating a highly significant difference. The effect size, measured by Cohen’s d, was found to be 0.790, suggesting a large effect. This indicates that positive sentiments are not only more frequent, but also considerably more intense than negative sentiments, reflecting a tendency for authors to express stronger positive emotions compared to negative ones.

To assess the impact of the introduction of ChatGPT and similar generative AI technologies on sentiment, a frequency analysis was conducted comparing the distribution of sentiment labels (negative, neutral, and positive) before and after the release of ChatGPT, shown in Table 2. The results are presented in the contingency table below.

Table 2.

Frequency analysis: before versus after the release of ChatGPT.

A Chi-square test of independence was performed to determine if there was a significant association between the period (before vs. after) and sentiment labels (positive, negative, and neutral). The Chi-square statistic () indicated a significant difference in sentiment distribution before and after the release of ChatGPT at the end of 2022, suggesting a renewed optimism for the application of LLMs within the finance domain.

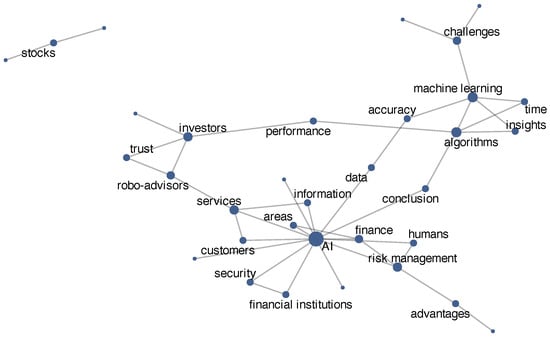

4.3. Graph Theoretical Analysis

Our network analysis of word co-occurrence patterns across the documents revealed a notably low mean global efficiency (). This low mean global efficiency suggests that vocabulary usage across the publications we researched tends to be compartmentalized, with distinct terminological clusters with limited interconnections, as seen with the phrase “stocks” in Figure 9.

Figure 9.

Graph exhibiting keyword co-occurrence. The phrase “Stocks” in this example occurs within a distinct silo of the literature and does not tend to co-occur across the corpus. “AI”, however, is well connected, and was found to be the most commonly used phrase co-occurring with other phrases.

Similarly, mean local efficiency is also low (), suggesting that individual words are not embedded within highly interconnected local substructures. This implies that words do not strongly co-occur with a dense set of neighboring terms, even within terminological clusters. The low local efficiency aligns with the observed compartmentalization, as words and phrases that frequently appear together in one subset of documents do not exhibit substantial cross-cluster connectivity in others.

The mean rich club coefficient is also low (), indicating that highly connected words do not form a disproportionately interconnected core within the network. This suggests the absence of a lexically dominant subset that bridges disparate clusters of terminology. In other words, the network lacks a set of widely shared, central terms that facilitate conceptual integration across different parts of the corpus.

There is an increasing but not statistically significant trend in community modularity (). This suggests that word co-occurrence patterns may be becoming more distinctly separated into well-defined communities over time in the material. Higher modularity indicates that words tend to cluster into relatively isolated semantic groups with limited overlap, reinforcing the idea that distinct terminological subdomains exist within the dataset. The increasing trend in modularity further suggests that these clusters may be more pronounced with time, potentially reflecting a growing specialization of language over time, with less lexical integration between different conceptual areas. Graph metrics by year are shown in Table 3.

Table 3.

Graph theoretical metrics.

5. Discussion

5.1. Systematic Literature Review

The systematic literature review revealed that there is great potential for AI to improve efficiency in the field of finance. The SLR demonstrates that the research on smaller firms appears contradictory, and there is ample room for the subject matter to mature in the literature. The bottom line is that AI is expected to improve profitability, whether that be through credit risk assessment, asset price forecasting, trading, portfolio management, fraud and money laundering detection, hedging strategies, robo-advisory services, risk management, or personalized banking services, among others.

The results show that most publications are overwhelmingly positive on the subject. Academics perceive that AI will have a significant positive impact on the industry. Nearly every article stressed the positive effects generally via greater efficiency through operationalizing AI. Articles highlighting the negative impacts of AI demonstrate how AI does not outperform traditional methods, while others emphasize risks or negative impacts that may arise from the proliferation of AI in financial services. Only nine articles discussed AI in the context of the size of the firm. This includes how large institutions or smaller firms may use AI and the potential opportunities or constraints they face with this technology. The few mentions of AI in different sizes of financial organizations highlight the early stages of academic research on the subject and the need for greater focus in this area.

Challenges remain for firms to operationalize AI. Firms are subject to regulation that must mature as greater understandings of the implications of the technology emerge. Scholars highlight many methods and avenues for AI to improve efficiency within the banking sector, although the technology is being implemented and used in the industry. There is ample opportunity within finance and other fields; however, it remains unknown the real impact that small- and medium-sized firms will endure from this technology.

Of the relatively few articles characterizing AI negatively, there is a notable lack of focus on labor implications from the technology. Reasons for this gap may be due to the fact that the authors of these articles may not be as sensitive to human resource or ethical consequences, as apposed to authors who’s expertise is within that domain. As the research reveals that virtually all aspects of finance may be impacted by AI, the implications for the jobs of individuals are an important dimension to consider. Most articles assert that AI will result in greater efficiency, which consequently translates into higher profitability through a myriad of ways, including reducing costs, improving time savings, accuracy, returns, and gaining more clients, among many others. These advances stand to aid existing beneficiaries of the financial system, who see these developments as positive. To only assess the efficiencies of AI conceptually, without contextualizing the impact on employees, highlights a gap in the literature. The overarching concern of this paper regarding whether small- and medium-sized firms may be displaced by AI is mirrored by the labor implications. If AI renders many jobs obsolete, this may have negative impacts on the well-being of individuals and cities with large financial services sectors.

To extend the discussion of job loss, the theory of technological dominance (TTD) may adversely impact the skills of workers. TTD describes how reliance on intelligent systems, AI, may impact a worker’s decision-making [63]. As emerging studies show nearly all of the US labor force may see varying extents of their work being affected by large language models, particularly those in higher-income jobs, the consequences for human capital due to reliance on this technology become significant [64]. Over the medium/long term, important implications of TTD emerge, like skill atrophy from the reliance on intelligent systems rather than the worker completing the task [63]. The literature appears to lack critical awareness of the long-term impacts of AI in finance, how the de-skilling of workers may reshape labor markets, and the potential negative impacts on the well-being of individuals through job loss and skill atrophy.

5.2. Sentiment Bibliometric Analysis

The bibliometric analysis demonstrates the nascent areas of research regarding AI in finance. Asset management appears to be a primary focus of scholars for applications of AI, trailed by operations, risk, and robo-advising. There are limited existing studies on AI in small- and medium-sized financial institutions. These findings are consistent with those of the systematic literature review.

Research has a generally positive perception of the use of AI in finance. When researchers are discussing AI, they are more exuberant when they express positive emotions and have less emphasis when they present risks, reflecting authors’ tendency to express stronger positive emotions than negative ones. This asymmetry in sentiment likely reflects not only genuine enthusiasm for AI’s promise, particularly its superior performance in areas such as credit scoring and asset price performance, but also structural pressures within academia. In an environment where publication success is often contingent on novel and positive findings and where career progression can hinge on citation metrics and journal prestige, there exists a subtle but persistent incentive to convey optimistic narratives. What is surprising is the conspicuous absence of the downsides of deploying AI in a domain as vital as finance. As this paper reveals the newness and uncertainty of AI in finance, researchers do not exhibit the degree of trepidation one might expect, raising concerns about whether academic discourse is adequately addressing the broader societal and ethical ramifications of its adoption.

5.3. Graph Theoretical Analysis

The overall findings from graph theoretical analysis indicate a fragmented lexical structure, where specialized vocabularies remain relatively isolated rather than contributing to a cohesive, highly integrated semantic network. The network of co-occurrence does not improve over the review period. The global efficiency metric shows how different subfields use specialized terminology that does not integrate well across the literature. Low global efficiency reinforces the lack of densely connected substructures, showing the segmented nature of AI-related research in finance. Low rich club network also shows fragmentation and an absence of dominant, standardized AI-related vocabulary, even in the top 10% of connections. In other words, there is ample opportunity to mature in this field toward a standardized use of terms, which is unsurprising given the nascent field of generative AI in recent years and the wide potential for adoption across many different finance-related fields.

As language becomes more uniform across the industry, this may indicate the speed with which these technologies become adopted. These implications highlight how the thematic fragmentation may hinder knowledge sharing. The lack of shared vocabulary could make adopting best practices or seamlessly integrating AI solutions harder. The increasing modularity may indicate growing specialization, but also shows the risks of silos forming within the industry. Both lexical disconnection and topic dispersion across the corpus of the literature illustrate how these two occurrences have the capacity to strengthen for the benefit of the finance industry.

5.4. Conclusions

This research finds that AI-related studies in the finance industry are disjointed, with certain disciplines, such as asset management, risk, and robo-advising, receiving more attention. Other areas, particularly those concerning smaller financial institutions, lack sufficient academic exploration. While sentiment analysis reflects a positive outlook on AI’s potential, our employment of graph theory reveals that the lexical structure of existing research demonstrates weak connectivity, showing little improvement over time.

Our analysis highlights a clear asymmetry in the academic discourse on AI adoption in financial services. With respect to research questions R1 and R2, small- and medium-sized financial services firms are often portrayed as enthusiastic adopters, with some of the literature emphasizing the use of frameworks such as the TAM or TOE framework to explore enablers of AI implementation. However, this optimism tends to overlook the structural disadvantages these firms face when competing with larger institutions, rarely asking whether AI adoption may erode their competitive position or even be misaligned with their resource base. The prevailing sentiment is more aspirational than critical, potentially reflecting a scholarly bias toward positive findings and technological promise. Regarding research question R3, we find no evidence of trends towards lexical convergence or conceptual alignment in the literature, suggesting that academic discourse on AI in finance remains in a nascent stage. This fragmentation reveals significant room for maturation in the field, and opportunities for deeper critical engagement with the competitive consequences of AI for smaller financial actors.

Our systematic review highlights that AI promises substantial cost savings [35,58], enhanced customer experiences [35,36,37], and innovative product development [29] for small financial institutions. Within the Technology-Organization-Environment (TOE) framework [5], these benefits correspond to a high perceived usefulness of the technology, a primary driver of adoption. However, small- and medium-sized enterprises likely face deficits in internal competencies and, therefore, organizational readiness, which may dampen the potential for success in adoption. While the TOE framework and the Technology Acceptance Model (TAM) [6] offer guidance on how to implement AI, they provide limited insight into whether adoption is advisable or what opportunity cost accrues from delayed implementation. This gap is particularly dangerous for resource-constrained small- and medium-sized firms who cannot afford misaligned investments, yet also cannot afford to fall behind AI-empowered competitors. Our observations of limited research on AI adoption with small- and medium-sized enterprises further emphasize this gap, raising the question of whether researchers unconsciously exclude small- and medium-sized enterprises because they anticipate limited success.

It remains uncertain whether AI will ultimately benefit, disadvantage, or have a neutral effect on smaller firms relative to large financial institutions. The disproportionately positive sentiment observed in the literature is, therefore, a cause for concern, as it may obscure critical unknowns regarding how this rapidly evolving technology will permeate and potentially reshape different segments of the financial ecosystem.

5.5. Limitations

A limitation of this study is the number of articles included in the analysis. If the analysis were to continue beyond the 160 articles examined, different results may have arisen. However, the constraint of time limited the number of articles to feasibly read in the time the research was conducted. Had more articles been read, the set of keywords may have been slightly different, with varying strengths.

Another limitation is the geographical selection of the articles. There was no restriction applied to the geography of the analysis of AI in finance. As different nations may have different rates of investments in AI and levels of adoption, the lack of cohesion and connectivity in the bibliometric analysis and graph theory may reflect this. For example, OECD countries have the highest levels of AI patents [65]. Consequently, this may result in the research being more relevant or the trajectory being stronger or more cohesive. Researchers from these regions may be more sophisticated in AI research, and the results may not be diluted by research from other regions. If the analysis only included OECD countries, other nations with lagging AI development would be excluded, which may result in different findings. An interesting avenue for future research would be to assess AI investment by OECD countries within financial services firms and examine if differences are revealed across the size of firms.

Given that AI has been applied in finance beyond the scope of our timeline [7], future research may benefit from expanding the scope of our timeframe or looking at a different timeframe altogether. An interesting contribution would be to examine the evolution of the results if the data spanned over decades rather than four years.

An additional limitation is that the results encompass the consequences of AI for small- and medium-sized services only as reported in the academic literature. However, it is specified in the first research question that this data is based upon academic research, in practice, reality does not necessarily mimic that of what is described in the academic literature. Although these findings may be novel and important to supporting the corpus of academic literature on the subject of AI in finance, acknowledging the nuance of the experience at the individual firm level is nonetheless important.

5.6. Future Research

This analysis shows that research on AI in finance remains in its early stages, and much work lies ahead. Future studies should examine the effects of AI on small- and medium-sized financial institutions more directly. Researchers might apply similar methods to annual reports from financial firms, using large language models to extract timely insights. They could then link the intensity of AI investment to shifts in profitability or market share. Segmenting results by geography would also allow for cross-national comparisons of AI adoption in finance.

Author Contributions

Conceptualization, M.C. and D.M.; methodology, M.C.; software, D.M.; validation, M.C.; formal analysis, M.C.; investigation, M.C.; data curation, M.C.; writing—original draft preparation, M.C.; writing—review and editing, D.M.; visualization, M.C.; supervision, D.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Muminova, E.; Ashurov, M.; Akhunova, S.; Turgunov, M. AI in Small and Medium Enterprises: Assessing the Barriers, Benefits, and Socioeconomic Impacts. In Proceedings of the 2024 International Conference on Knowledge Engineering and Communication Systems (ICKECS), Chikkaballapur, India, 18–19 April 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Plüddemann, A.; Banerjee, A.; O’Sullivan, J. Catalogue of Bias Collaboration. 2017. Available online: https://catalogofbias.org/biases/positive-results-bias/ (accessed on 1 September 2025).

- Bianchini, M.; Sancho, M.L. SME Digitalisation for Competitiveness; Technical Report; OECD: Paris, France, 2025. [Google Scholar] [CrossRef]

- Ryseff, J.; Bruhl, B.F.D.; Newberry, S.J. The Root Causes of Failure for Artificial Intelligence Projects and How They Can Succeed: Avoiding the Anti-Patterns of AI; Technical Report; RAND Corporation: Santa Monica, CA, USA, 2025. [Google Scholar]

- Baker, J. The Technology–Organization—Environment Framework. In Information Systems Theory: Explaining and Predicting Our Digital Society; Springer: Berlin/Heidelberg, Germany, 2012; Volume 1, pp. 231–245. [Google Scholar] [CrossRef]

- Davis, F. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Turing, A.M. I.—Computing Machinery and Intelligence. Mind 1950, LIX, 433–460. [Google Scholar] [CrossRef]

- Cao, L. AI in Finance: Challenges, Techniques, and Opportunities. ACM Comput. Surv. 2023, 55, 1–38. [Google Scholar] [CrossRef]

- Veloso, M.; Balch, T.; Borrajo, D.; Reddy, P.; Shah, S. Artificial intelligence research in finance: Discussion and examples. Oxf. Rev. Econ. Policy 2021, 37, 564–584. [Google Scholar] [CrossRef]

- Bahrammirzaee, A. A comparative survey of artificial intelligence applications in finance: Artificial neural networks, expert system and hybrid intelligent systems. Neural Comput. Appl. 2010, 19, 1165–1195. [Google Scholar] [CrossRef]

- Wach, K.; Duong, C.D.; Ejdys, J.; Kazlauskaitė, R.; Korzynski, P.; Mazurek, G.; Paliszkiewicz, J.; Ziemba, E. The dark side of generative artificial intelligence: A critical analysis of controversies and risks of ChatGPT. Entrep. Bus. Econ. Rev. 2023, 11, 7–30. [Google Scholar] [CrossRef]

- Dutescu, A.; Mihai, M.S. The External Technological Context of Artificial Intelligence in Financial Services. Audit Financ. 2023, 21, 747–759. [Google Scholar] [CrossRef]

- Lee, J.C.; Chen, X. Exploring users’ adoption intentions in the evolution of artificial intelligence mobile banking applications: The intelligent and anthropomorphic perspectives. Int. J. Bank Mark. 2022, 40, 631–658. [Google Scholar] [CrossRef]

- Hardin, G. The tragedy of the commons: The population problem has no technical solution; it requires a fundamental extension in morality. Science 1968, 162, 1243–1248. [Google Scholar] [CrossRef]

- Vuković, D.B.; Dekpo-Adza, S.; Matović, S. AI integration in financial services: A systematic review of trends and regulatory challenges. Humanit. Soc. Sci. Commun. 2025, 12, 562. [Google Scholar] [CrossRef]

- Rao, U.A.R.; Shahbaz, M.S.S.M.S. The mediating role of job satisfaction between human resource development and project success. NUST Bus. Rev. 2023, 3, 1–12. [Google Scholar] [CrossRef]

- Ayinaddis, S.G. Artificial intelligence adoption dynamics and knowledge in SMEs and large firms: A systematic review and bibliometric analysis. J. Innov. Knowl. 2025, 10, 100682. [Google Scholar] [CrossRef]

- Oldemeyer, L.; Jede, A.; Teuteberg, F. Investigation of artificial intelligence in SMEs: A systematic review of the state of the art and the main implementation challenges. Manag. Rev. Q. 2025, 75, 1185–1227. [Google Scholar] [CrossRef]

- Sánchez, E.; Calderón, R.; Herrera, F. Artificial Intelligence Adoption in SMEs: Survey Based on TOE–DOI Framework, Primary Methodology and Challenges. Appl. Sci. 2025, 15, 6465. [Google Scholar] [CrossRef]

- Paiva, J. Exploring the Drivers of AI Adoption: A Meta-Analysis of Technological, Organizational and Environmental (TOE) Factors. Preprint 2024. [Google Scholar] [CrossRef]

- Suryono, R.R.; Budi, I.; Purwandari, B. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information 2020, 11, 590. [Google Scholar] [CrossRef]

- Liang, H.Y.; Reichert, A.K. The impact of banks and non-bank financial institutions on economic growth. Serv. Ind. J. 2012, 32, 699–717. [Google Scholar] [CrossRef]

- Herrmann, H.; Masawi, B. Three and a half decades of artificial intelligence in banking, financial services, and insurance: A systematic evolutionary review. Strateg. Chang. 2022, 31, 549–569. [Google Scholar] [CrossRef]

- Moody’s Analytics Global Education (Canada), Inc. Canadian Securities Institute. Available online: https://www.csi.ca/en (accessed on 7 September 2025).

- Berger, A.N.; Miller, N.H.; Petersen, M.A.; Rajan, R.G.; Stein, J.C. Does function follow organizational form? Evidence from the lending practices of large and small banks. J. Financ. Econ. 2005, 76, 237–269. [Google Scholar] [CrossRef]

- Ashta, A.; Herrmann, H. Artificial intelligence and fintech: An overview of opportunities and risks for banking, investments, and microfinance. Strateg. Chang. 2021, 30, 211–222. [Google Scholar] [CrossRef]

- Ionascu, A.E.; Barbu, C.A. Digital transformation in the banking sector: A Pre- and Post- COVID-19 analysis. Manag. Res. Pract. 2023, 15, 55–69. [Google Scholar]

- Dzhaparov, P. Artificial Intelligence—A Key Success Factor for Wealth Management Industry. Izv. J. Union Sci.-Varna. Econ. Sci. Ser. 2022, 11, 97–104. [Google Scholar]

- Fares, O.H.; Butt, I.; Lee, S.H.M. Utilization of artificial intelligence in the banking sector: A systematic literature review. J. Financ. Serv. Mark. 2023, 28, 835–852. [Google Scholar] [CrossRef]

- Grewal, D.; Guha, A.; Becker, M. AI is Changing the World: Achieving the Promise, Minimizing the Peril. J. Macromark. 2024, 44, 936–947. [Google Scholar] [CrossRef]

- Agarwal, P.; Swami, S.; Malhotra, S.K. Artificial Intelligence Adoption in the Post COVID-19 New-Normal and Role of Smart Technologies in Transforming Business: A Review. J. Sci. Technol. Policy Manag. 2024, 15, 506–529. [Google Scholar] [CrossRef]

- Anderson, J.; Bholat, D.; Gharbawi, M.; Thew, O. The impact of COVID-19 on artificial intelligence in banking. Bruegel Blogs, 15 April 2021. [Google Scholar]

- Lemos, S.I.C.; Ferreira, F.A.F.; Zopounidis, C.; Galariotis, E.; Ferreira, N.C.M.Q.F. Artificial intelligence and change management in small and medium-sized enterprises: An analysis of dynamics within adaptation initiatives. Ann. Oper. Res. 2022. [Google Scholar] [CrossRef] [PubMed]

- Berger, A.N.; Hunter, W.C.; Timme, S.G. The efficiency of financial institutions: A review and preview of research past, present and future. J. Bank. Financ. 1993, 17, 221–249. [Google Scholar] [CrossRef]

- DeYoung, R.; Hunter, W.C.; Udell, G.F. The Past, Present, and Probable Future for Community Banks. J. Financ. Serv. Res. 2004, 25, 85–133. [Google Scholar] [CrossRef]

- Devlin, J.; Ennew, C.T. Understanding competitive advantage in retail financial services. Int. J. Bank Mark. 1997, 15, 73–82. [Google Scholar] [CrossRef]

- Fitriyanto, A.D.; Mulyono, M. Human Touch Experience: A Strategy for Reducing Consumer Switching Behavior in The Financial Service Industry. Australas. Bus. Account. Financ. J. 2023, 17, 15–27. [Google Scholar] [CrossRef]

- Kurkela, M. “Boutique” Financial Advisors vs. Full-Service Investemnt Banks: An Analysis of Advisor Choice and Deal Outcomes in Mergers and Acquisitions. Master’s Thesis, Aalto University, Espoo, Finland, 2014. [Google Scholar]

- Stein, J.C. Information Production and Capital Allocation: Decentralized versus Hierarchical Firms. J. Financ. 2002, 57, 1891–1921. [Google Scholar] [CrossRef]

- Petersen, M.A.; Rajan, R.G. The Benefits of Lending Relationships: Evidence from Small Business Data. J. Financ. 1994, 49, 3. [Google Scholar] [CrossRef]

- Crosman, P. Fiserv-first data: Why small banks fear big fintech. Am. Bank. 2019, 184, 1–17. [Google Scholar]

- Owczarczuk, M. Ethical and regulatory challenges amid artificial intelligence development: An outline of the issue. Ekon. Prawo 2023, 22, 295–310. [Google Scholar] [CrossRef]

- Post, C.; Sarala, R.; Gatrell, C.; Prescott, J.E. Advancing Theory with Review Articles. J. Manag. Stud. 2020, 57, 351–376. [Google Scholar] [CrossRef]

- Choijil, E.; Méndez, C.E.; Wong, W.K.; Vieito, J.P.; Batmunkh, M.U. Thirty years of herd behavior in financial markets: A bibliometric analysis. Res. Int. Bus. Financ. 2022, 59, 101506. [Google Scholar] [CrossRef]

- Ding, Y.; Chowdhury, G.G.; Foo, S. Bibliometric cartography of information retrieval research by using co-word analysis. Inf. Process. Manag. 2001, 37, 817–842. [Google Scholar] [CrossRef]

- Majeed, A.; Rauf, I. Graph Theory: A Comprehensive Survey about Graph Theory Applications in Computer Science and Social Networks. Inventions 2020, 5, 10. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef]

- Csárdi, G.; Nepusz, T.; Müller, K.; Horvát, S.; Zanini, F.; Noom, D.; Traag, V. Igraph for R: R Interface of the Igraph Library for Graph Theory and Network Analysis (v1.6.0); Zenodo: Geneva, Swizerland, 2023. [Google Scholar] [CrossRef]

- Csardi, G.; Nepusz, T. The igraph software package for complex network research. Int. J. Complex Syst. 2006, 1695, 1–9. [Google Scholar]

- Sauer, P.C.; Seuring, S. How to conduct systematic literature reviews in management research: A guide in 6 steps and 14 decisions. Rev. Manag. Sci. 2023, 17, 1899–1933. [Google Scholar] [CrossRef]

- Brown, T.B.; Mann, B.; Ryder, N.; Subbiah, M.; Kaplan, J.; Dhariwal, P.; Neelakantan, A.; Shyam, P.; Sastry, G.; Askell, A.; et al. Language Models are Few-Shot Learners. Adv. Neural Inf. Process. Syst. 2020, 33, 1877–1901. [Google Scholar]

- Devlin, J.; Chang, M.W.; Lee, K.; Toutanova, K. BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding. In Proceedings of the 2019 Conference of the North American Chapter of the Association for Computational Linguistics: Human Language Technologies, Volume 1 (Long and Short Papers), Minneapolis, MN, USA, 2–7 June 2019; pp. 4171–4186. [Google Scholar]

- McKinsey. The State of AI in 2022—And a Half Decade in Review; Technical Report; McKinsey: Chicago, IL, USA, 2022. [Google Scholar]

- Liu, Z.; Huang, D.; Huang, K.; Li, Z.; Zhao, J. FinBERT: A pre-trained financial language representation model for financial text mining. In Proceedings of the Twenty-Ninth International Joint Conference on Artificial Intelligence, Yokohama, Japan, 7–15 January 2021. [Google Scholar] [CrossRef]

- Radhakrishnan, S.; Erbis, S.; Isaacs, J.A.; Kamarthi, S. Correction: Novel keyword co-occurrence network-based methods to foster systematic reviews of scientific literature. PLoS ONE 2017, 12, e0185771. [Google Scholar] [CrossRef] [PubMed]

- Xu, X.K.; Zhang, J.; Li, P.; Small, M. Changing motif distributions in complex networks by manipulating rich-club connections. Phys. A Stat. Mech. Appl. 2011, 390, 4621–4626. [Google Scholar] [CrossRef][Green Version]

- Colizza, V.; Flammini, A.; Serrano, M.A.; Vespignani, A. Detecting rich-club ordering in complex networks. Nat. Phys. 2006, 2, 110–115. [Google Scholar] [CrossRef]

- Yilin, Z.; Yunjun, Y.; Zhuming, C. AI, SME Financing, and Bank Digitalization. China Econ. Transit. (CET) 2022, 5, 210–241. [Google Scholar]

- Grout, P.A. AI, ML, and competition dynamics in financial markets. Oxf. Rev. Econ. Policy 2021, 37, 618–635. [Google Scholar] [CrossRef]

- Bholat, D.; Susskind, D. The assessment: Artificial intelligence and financial services. Oxf. Rev. Econ. Policy 2021, 37, 417–434. [Google Scholar] [CrossRef]

- Auh, J.K.; Cho, W. Factor-based portfolio optimization. Econ. Lett. 2023, 228, 111137. [Google Scholar] [CrossRef]

- Buckmann, M.; Haldane, A.; Hüser, A.C. Comparing minds and machines: Implications for financial stability. Oxf. Rev. Econ. Policy 2021, 37, 479–508. [Google Scholar] [CrossRef]

- Sutton, S.G.; Arnold, V.; Holt, M. An extension of the theory of technology dominance: Capturing the underlying causal complexity. Int. J. Account. Inf. Syst. 2023, 50, 100626. [Google Scholar] [CrossRef]

- Eloundou, T.; Manning, S.; Mishkin, P.; Rock, D. GPTs are GPTs: An Early Look at the Labor Market Impact Potential of Large Language Models. arXiv 2023, arXiv:2303.10130. [Google Scholar] [CrossRef]

- Parteka, A.; Kordalska, A. Artificial intelligence and productivity: Global evidence from AI patent and bibliometric data. Technovation 2023, 125, 102764. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).