Abstract

Investing in energy efficiency (EE) could play a crucial role in transitioning to a future economy, where sustainable growth will be the centre of attention. To reach such EE investments, a mobilisation of capital through the targeted use of funds, innovative schemes and standardisation tools for the respective key actors is required. The European Union Horizon 2020 Triple-A project could assist in securing EE investments that could meet their financial commitments. This manuscript provides a standardised methodology and tools to assess the involved risks and benchmarks the proposed investment ideas, helping investors and policymakers choose the most profitable solution. This manuscript summarises the methodology established, tools developed, and results that emerged from Triple-A’s venture to mainstream EE financing.

1. Introduction

Investing in energy efficiency (EE) is one of the main priorities of the European Union’s (EU) energy and climate policy, offering various benefits. Nevertheless, EE investments are still below policy targets set despite the demonstrated economic potential and environmental benefits. EE investments seem inherently risky due to the multitude of uncertainties associated with the future cash flows of ΕΕ projects, such as the price of energy and technology risk. Thus, the evaluation and benchmarking of EE investment ideas becomes a complex procedure, while also some risk factors present many difficulties to be assessed due to missing information and subjectivity.

The EU funded “Triple-A: Enhancing at an Early Stage the Investment Value Chain of Energy Efficiency Projects” aims to mainstream EE investments by setting the groundwork for building investor and financier confidence. Triple-A offers Standardised Triple-A Tools, Database and Benchmarks to assess EE project ideas and provide recommendations based on lessons learnt from the in-country demonstrations. The Triple-A methodology is being applied at eight (8) strategically selected case study countries, namely Bulgaria, the Czech Republic, Germany, Greece, Italy, Lithuania, Spain and the Netherlands.

This particular initiative has established a Triple-A three-pillar methodology that results in reducing the respective time and effort required at the crucial phase of the ΕΕ investment’s conceptualisation, increasing the transparency and efficiency of respective decision making.

The Triple-A scheme comprises three critical steps (Figure 1):

Figure 1.

Triple-A Methodological Steps.

Step 1—Assess: This is based on Member States risk profiles and mitigation policies, including a web-based database, enabling national and sectoral comparability, market maturity identification and a good practices experience exchange. It includes a risk assessment realisation and incorporation of EU taxonomy-eligible criteria.

Step 2—Agree: This is based on standardised Triple-A Tools, efficient benchmarks, and guidelines, translated in consortium partners’ languages, accelerating and scaling up investments. It has a categorisation of the projects and the Triple-A EE investments selection, which merit attention by the funding organisations.

Step 3—Assign: This is based on in-country demonstrations, replicability and overall exploitation, including recommendations on realistic and feasible investments in the national and sectoral context, as well as on short and medium-term financing. It incorporates funding strategies (warehouse lending, green bonds, EE auctions) and has a portfolio of EE projects that better match the needs of respective beneficiaries.

2. Standardised Triple-A Tools and Database on EE Financing

Triple-A facilitates access to capital markets for EE investments by addressing the lack of a standardisation of assets. The standardised tools and database provide functionalities and capabilities both to project developers and financing institutes, while closing the gap between these two crucial stakeholders’ profiles and linking profitable EE project ideas to real financing schemes. By doing so, the uncertainty felt by financiers in the performance of EE investments is reduced, while investors’ confidence is built [1,2].

2.1. The Triple-A Tools

Three (3) standardised Triple-A tools developed establish a one-stop-shop approach oriented towards all types of stakeholders in EE financing, facilitating project developers to benchmark their projects in a standardised way, while also providing a hub to financers, bankers and investors to finance bankable green projects [3,4,5]. The Triple-A tools are accessible through the Triple-A Standardised Toolbox platform [6], which can be reached directly or through the Triple-A webpage [7].

Assess Tool: This evaluates the maturity of the proposed EE project idea and executes the risk assessment. Through the Assess tool, the compliance with the eligible technical criteria of the EU Taxonomy is also exploited.

Agree Tool: This performs the benchmarking of investment ideas based on financial (net present value, internal rate return, discounted payback period), risk and sustainable development goal (SDGs) indicators and taking advantage of the Electre-Tri multicriteria decision analysis method. The projects are categorised into three (3) classes: Triple-A, Reserved and Rejected. The most promising projects are marked as “Triple-A” projects, and their KPIs’ results range in satisfactory values. In the case that a project has poor performance in the KPIs, it will be marked as Rejected by the Triple-A tool. Tips and methods to increase the performance of the candidate projects are also provided.

Assign Tool: This provides to potential investors the following functionalities regarding the benchmarked project ideas of the previous tools:

- Sends requests for green loans, green mortgages, green bonds and EE auctions.

- Matchmaking between bankable EE projects and financing schemes.

- Pathways to achieve project delivery (contracts, underwriting procedures, etc.).

2.2. The Triple-A Database in Energy Efficiency Financing

The Triple-A web-based database on EE financing [8] incorporates data and functionalities that enable the effective and interactive communication of the Triple-A methodology’s results on the fundamental aspects of EE financing for the key involved actors. The data included in the database refer to the eight Triple-A case study countries, while the content is updated on a regular basis. The data and KPIs reported have emerged by a bottom-up procedure [9], incorporating input from stakeholder consultations. In brief, the data included in the Triple-A database contain critical aspects of EE financing, such as the implementation risks of EE projects, risk mitigation strategies, preferences of investors on EE investments, the financial performance of successfully implemented EE projects, financing models and instruments, the necessity of boosting EE per case study country and the sector based on SDG indices.

3. Triple-A Targeted Stakeholder Engagement

As stakeholder engagement is becoming an essential component aiming to enlighten the gap of all policy- and decision-support processes, a concrete Triple-A stakeholder engagement approach has been developed to involve highly relevant stakeholders, gathering their input in terms of EE financing [10]. Table 1 presents the target groups identified, and the implemented stakeholder consultation activities along with their impact for different stakeholder types.

Table 1.

Triple-A stakeholder engagement actions.

Stakeholders’ active involvement facilitates the better implementation of the Triple-A actions through:

- Input on the identification of risks hampering the implementation of EE investments in each case study country and proposal of alternative mitigations strategies.

- Prioritising the identified risks and defining the criteria weights for risk assessment.

- Reviewing the Triple-A technical reports and providing feedback.

- Participation in Triple-A events, workshops and webinars.

- Signing up and testing the Triple-A tools and database.

- Providing real EE project ideas to be included in the Triple-A pipeline of EE projects.

- Enabling synergies with and data exchange among relevant tools and platforms on sustainable financing.

4. Results

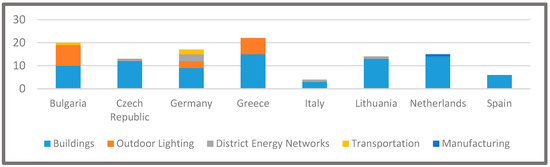

By implementing the Triple-A methodology and engaging with stakeholders, 113 real ΕΕ projects have been identified and inserted in the Triple-A tools for benchmarking. These projects, from eight (8) distinct sectors, are in their conceptualisation phase, and there is a search of possible financing schemes to proceed with the development phase. The distribution of projects per case study country and per Triple-A sector is depicted in Figure 2.

Figure 2.

Distribution of EE projects collected by the Triple-A project.

As portrayed, most of the projects pertain to the building sector, followed by the outdoor lighting sector. In total, the collected projects reflect EUR 470.36 million of investments and are expected to trigger 336.94 GWh of energy savings per year. It is also worth mentioning that almost 60% of the projects were classified as Triple-A or Reserved, which reveals the good performance that they have in the respective KPIs.

5. Conclusions and Next Steps

The Triple-A project has connected investors with project developers with the development of the Triple-A tools, which benchmark ΕΕ projects by deploying a sophisticated risk methodology and a multicriteria method without frustrating investors and project developers with complicated procedures. The methodology has been based on input received from stakeholders, who have been appropriately engaged and their perception of risk has been outlined and incorporated into the methodology.

In this context, project developers could benefit, as the proposed tool is useful and enables them to substantiate the financial performance of their promising EE project ideas. On the other hand, investors and financing institutions could gain confidence, as they are able to identify eligible project ideas according to their preferences in specific criteria.

The main challenge Triple-A faced was during the process of project collection, and was the lack of sufficient project data, as the projects are in the conceptualisation phase. It has also been difficult to convince stakeholders to provide the data needed because of privacy issues.

During the next phase, the most promising project ideas derived from Triple-A will be linked with actual financing schemes. It is expected that 50 to 80 bankable and highly rated Triple-A investments are foreseen to emerge by utilising the Triple-A tools. Finally, the Triple-A project is planning to provide guidelines on EE financing market architecture through national and EU synthesis papers with targeted policy recommendations.

Acknowledgments

The current paper was primarily based on the research conducted within the framework of the EU Horizon 2020 project “Triple-A: Enhancing at an Early Stage the Investment Value Chain of Energy Efficiency Projects” (grant 846569, https://aaa-h2020.eu, accessed on 25 October 2021) [11]. The contents of the paper are the sole responsibility of its authors and do not necessarily reflect the views of the EC.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study, in the collection, analyses, or interpretation of data, in the writing of the manuscript, or in the decision to publish the results.

References

- Karakosta, C.; Papapostolou, A.; Vasileiou, G.; Psarras, J. Financial Schemes for Energy Efficiency Projects: Lessons Learnt from In-Country Demonstrations. In Energy Services Fundamentals and Financing; Borge-Diez, D., Rosales-Asensio, E., Eds.; Elsevier: Cambridge, MA, USA, 2021; ISBN 9780128205921. [Google Scholar]

- Loureiro, T.; Gil, M.; Desmaris, R.; Andaloro, A.; Karakosta, C.; Plesser, S. De-Risking Energy Efficiency Investments through Innovation. Proceedings 2020, 65, 3. [Google Scholar] [CrossRef]

- Final Triple-A Standardised Tools, Deliverable 4.2 of the Triple-A project funded under the European Union’s Hozizon 2020 research and innovation programme GA No. 846569. Available online: https://aaa-h2020.eu/results (accessed on 10 October 2021).

- Mexis, F.D.; Papapostolou, A.; Karakosta, C.; Sarmas, E.; Koutsandreas, D.; Doukas, H. Leveraging Energy Efficiency Investments: An Innovative Web-based Benchmarking Tool. Adv. Sci. Technol. Eng. Syst. J. 2021, 6, 237–248. [Google Scholar] [CrossRef]

- Papapostolou, A.; Mexis, F.D.; Sarmas, E.; Karakosta, C.; Psarras, J. Web-based Application for Screening Energy Efficiency Investments: A MCDA Approach. In Proceedings of the 2020 11th International Conference on Information, Intelligence, Systems and Applications IISA, Piraeus, Greece, 15–17 July 2020; pp. 1–7. [Google Scholar]

- Triple-A Standardised Toolbox Platform. Available online: www.toolbox.aaa-h2020.eu (accessed on 20 October 2021).

- Standardized Triple-A Tools. Available online: https://aaa-h2020.eu/tools (accessed on 26 October 2021).

- Triple-A Updated Web-Based Database on Energy Efficiency Financing and Supporting Documentation, Deliverable 3.5 of the Triple-A project funded under the European Union’s Hozizon 2020 research and innovation programme GA No. 846569. Available online: https://aaa-h2020.eu/results (accessed on 15 October 2021).

- Papapostolou, A.; Karakosta, C.; Mylona, Z.; Psarras, J. Financing Sustainable Energy Efficiency Projects: The Role of Stakeholders. In Proceedings of the XIV Balkan Conference on Operational Research, Operational Research in the Era of Digital Transformation and Business Analytics, Thessaloniki, Greece, 30 September–3 October 2020; pp. 116–120. [Google Scholar]

- Triple-A Stakeholder analysis and engagement plan, Deliverable 2.1 of the Triple-A project funded under the European Union’s Hozizon 2020 research and innovation programme GA No. 846569. Available online: https://aaa-h2020.eu/results (accessed on 20 October 2021).

- Horizon 2020 Triple-A Project. Available online: https://aaa-h2020.eu/ (accessed on 26 October 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).