Abstract

With the increasing complexity of supply chain structures, effective coordination among stakeholders remains essential to maximize performance. This paper presents a systematic literature review of coordination contracts. Fourteen types were explored, ranging from traditional to smart contracts. This study includes a bibliometric analysis addressing technological, environmental, and risk management challenges. Despite significant progress in the field, most studies focus on dyadic supply chains, failing to cover the multi-echelon complexity. The study concludes by identifying research perspectives, particularly the combined adoption of artificial intelligence and game theory to enhance the analysis and execution of these contracts, thereby fostering resilient logistical systems.

1. Introduction

In a world that is becoming more interconnected, the structure of contemporary supply chains has revealed a growing level of complexity. In this context, supply chain performance primarily depends on coordination among stakeholders and their ability to align with shared goals.

However, achieving high performance is often hindered by misaligned incentives among the various stakeholders within the supply chain. In decentralized supply chains, each actor seeks to maximize their profit within their scope, relying on the information at their disposal without considering the system’s overall objectives. As a result, the overall outcome is often suboptimal for the entire supply chain [1].

Over the past few years, numerous studies have explored coordination mechanisms using contractual agreements. Each type of contract addresses specific requirements, such as revenue sharing, thus maximizing the supply chain’s total profit.

This paper examines the different types of coordination contracts found in the current literature, highlighting their impact in enhancing supply chain performance and identifying potential research gaps for future work.

2. Methodology

In this paper, we applied the systematic literature review (SLR) methodology to gather relevant articles related to supply chain coordination contracts.

To conduct our study, we followed the steps below:

- Define the research questions;

- Identify data sources, selection criteria, and relevant keywords for the study;

- Apply inclusion/exclusion criteria to refine the selection of papers;

- Analyze the data, synthesize the literature, and present the results.

2.1. Research Questions

Following the framework outlined above, we first formulated clear and structured research questions to conduct a comprehensive study to provide a complete overview of supply chain coordination contracts discussed in the existing literature and their impact on overall supply chain performance.

- What types of coordination contracts are examined by researchers and practitioners?

- What is their impact on supply chain performance?

- What approaches are used to evaluate the performance of these contracts?

- What are the limitations and potential future research directions within this field?

2.2. Research Protocol Identification

Several sources are available to extract articles related to our topic. For this paper, we relied on the SCOPUS database. This is one of the largest abstract and citation databases for scientific literature, covering a wide range of disciplines. It is also regarded as more suitable for complex and rapidly evolving research fields than the Web of Science [2].

Our research was limited to peer-reviewed publications in English from 2019 to 2024, sourced from top-tier journals (Scimago Journal & Country Rank — Quartiles 1 and 2).

The choice of keywords was made to generate articles related to the main themes of our research. These keywords were divided into four distinct categories:

- Supply Chain: This is a critical element representing the study’s population.

- Coordination, Collaboration, Cooperation, Integration: These terms are used as synonyms for coordination.

- Contract, Agreement, Accord: These expressions target articles addressing supply chain coordination through formal mechanisms, such as contracts.

- Performance Analysis, Performance Evaluation: These expressions refer to studies examining the impacts of various types of contracts on coordination and supply chain performance.

2.3. Search Refinement

The search query returned 176 papers published in English between 2019 and 2024. Excluding articles published in journals ranked outside Q1 and Q2 reduced this number to 108. Then, we applied an additional filter by retaining only specialty journals.

After reviewing each article’s title, abstract, and keywords, the final filter was applied. Papers that did not focus on supply chain coordination contracts and their impact on the system’s overall performance were excluded. This process resulted in the selection of 28 articles for analysis.

3. Bibliometric Analysis of Publications

The publication selection process reveals that interest in establishing coordination contracts among supply chain stakeholders to achieve the desired performance peaked in 2023.

The main contributions come from journals such as the Journal of Cleaner Production (17.86%), Annals of Operations Research (14.29%), and Computers and Industrial Engineering (10.71%), highlighting the importance of supply chain coordination in various contexts. The European Journal of Operational Research, IEEE Transactions on Systems, Man, and Cybernetics: Systems, and the Transportation Research Part E: Logistics and Transportation Review each contribute (7.14%), while other journals represent (3.57%).

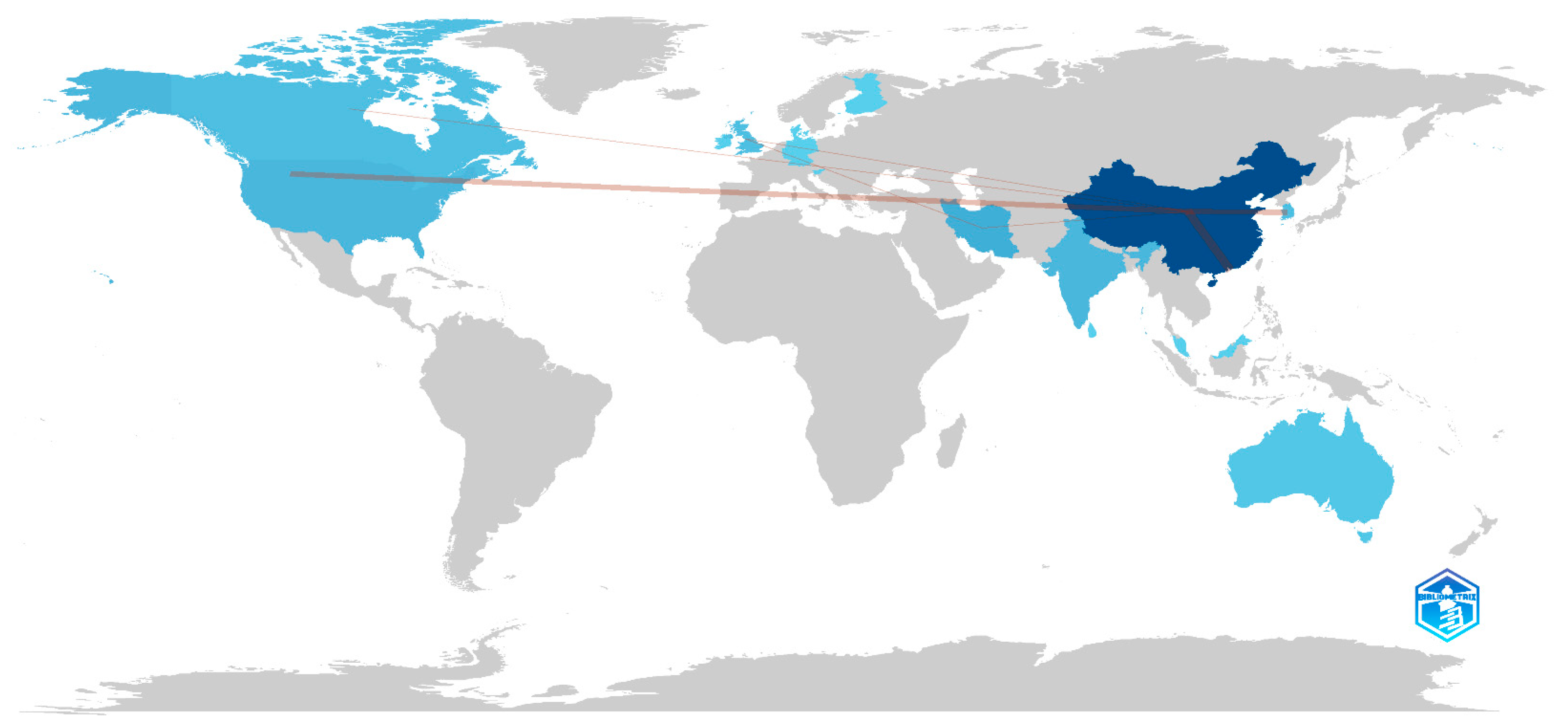

Another classification, based on collaboration between the affiliation countries, as shown in Figure 1, clearly indicates that China is a key player in this dataset. China collaborates with a wide range of global partners, including countries such as Canada, South Korea, India, and the United States. These collaborations span multiple continents — namely Asia, North America, Europe, and Oceania — reflecting the broad geographical scope of these partnerships.

Figure 1.

Inter-country collaboration map.

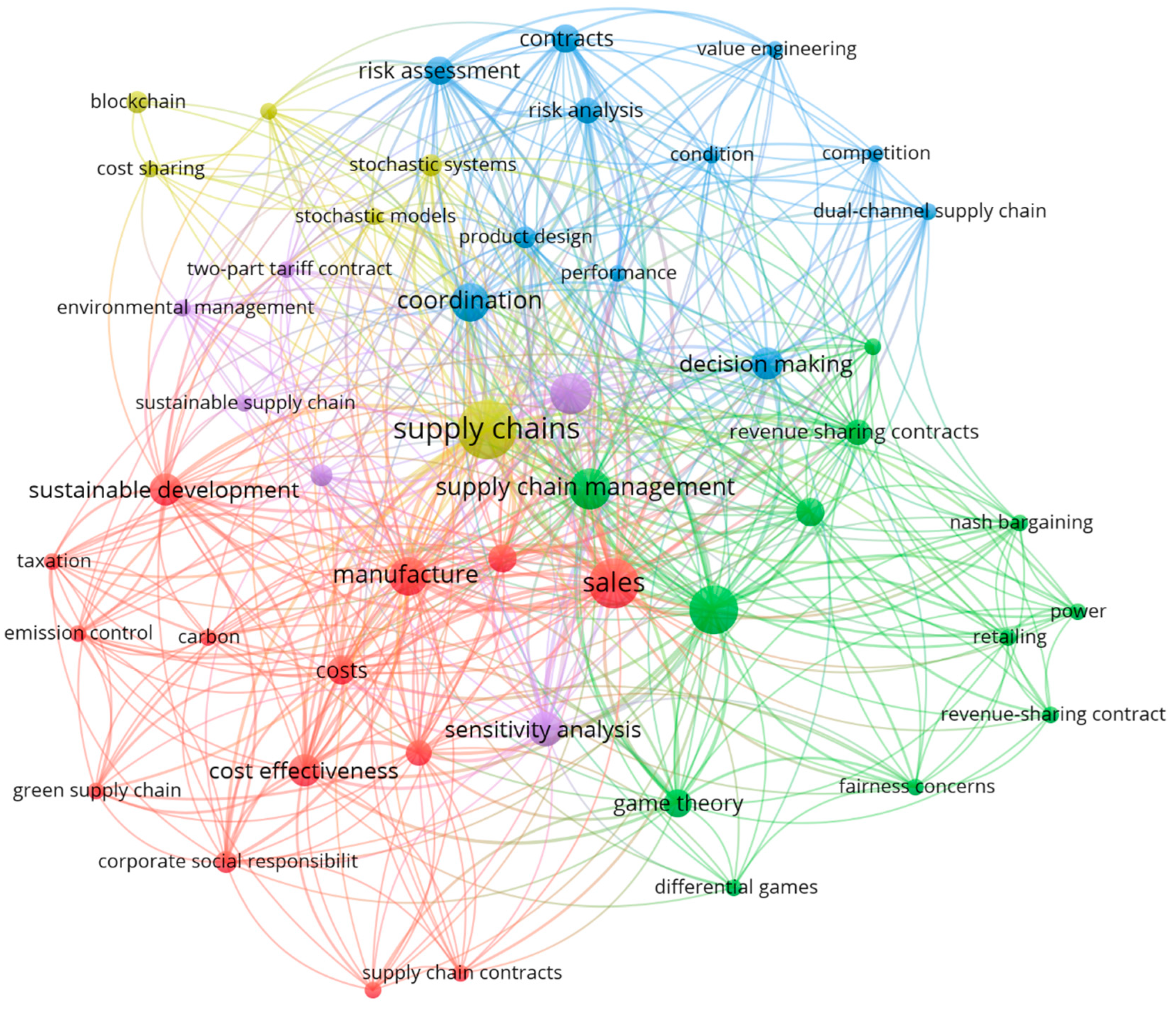

A keyword co-occurrence analysis was conducted to identify the most frequently discussed topics in the contemporary literature regarding supply chain coordination contracts. The co-occurrence map illustrated in Figure 2 was generated by considering keywords that appear at least twice across all the collected documents, resulting in 50 terms distributed over five clusters.

Figure 2.

Keyword co-occurrence network.

The connection of keywords such as “coordination” and “decision-making” associated with other terms like “performance” and “risk assessment” (blue cluster) illustrates the role of coordination mechanisms in enhancing supply chain performance while mitigating risks. The occurrence of the “dual-channel supply chain” concept in this cluster indicates that the selected articles primarily focus on dyadic supply chains.

Concepts such as “sustainable development”, “emission control”, and “corporate social responsibility” associated with financial terms like “cost-effectiveness” (red cluster) highlight the importance of environmental issues and profitability in supply chain management strategies. Similarly, the purple cluster links “profitability” and “environmental management” with several coordination contracts. This underscores the role of coordination contracts in aligning profitability goals while ensuring responsible practices.

The effectiveness evaluation of different types of contracts was conducted using analytical approaches such as “game theory” and “differential games”. This alignment was further strengthened by using “Nash bargaining” to establish a balance between stakeholders, as illustrated by the connection of keywords in the green cluster.

The inclusion of terms such as “stochastic models” or “stochastic systems” (yellow cluster) shows that some publications consider uncertainty factors in assessing the impact of coordination contracts in supply chain management. This cluster, which integrates stochastic systems and traceability technologies, also incorporates the concept of “blockchain”, enabling the creation of smart contracts to automate transactions based on contractual conditions using real-time data generated through stochastic models.

The bibliometric analysis highlights the growing interest in adopting contracts as an important mechanism for coordinating supply chains. The main contributions come from well-regarded journals demonstrating extensive international collaboration, primarily led by China.

Keyword co-occurrence analysis highlights the various research areas that have incorporated coordination contracts to achieve the goals of global supply chains, namely performance improvement, risk management, and addressing economic and environmental concerns. Analytical and technological tools, such as those based on game theory and blockchain, are used to model and evaluate the impact of these coordination mechanisms, strengthening their role and enabling a detailed analysis of the selected articles to better address the pre-established research questions.

4. In-Depth Analysis of Results

4.1. Overview of Coordination Theory

Various disciplines have extensively studied the concept of coordination. Crowston, 1994, provides a simple definition: “Coordination is managing dependencies between activities.” This aligns with the need for synchronized action when tasks are interdependent (Thompson 1967; Galbraith 1973; Lawrence et Lorsch 1967; Stokes 1976; Pfeffer 1978; Rockart et Short 1989; Hart et Estrin 1990; Roberts et Gargano 1991; Crowston, 1997) [3].

According to the systematic literature review conducted by the authors of [4], four classes of coordination mechanisms was proposed [5]:

- Coordination contracts;

- Information technology;

- Information-sharing mechanisms;

- Joint decision-making mechanisms.

In this paper, we focused on coordination through contracts. Several models based on the well-known newsvendor problem or others take into account a set of parameters to structure this coordination model [6], including the following:

- Supply chain structure: This refers to the number of stages in the supply chain and the number of actors at each level. The study conducted by [7] was based on a supply chain consisting of a single manufacturer and a single retailer.

- Information structure: There are two scenarios: complete and symmetric information or incomplete and asymmetric information [6].

- Demand Approach: This approach concerns the nature of demand (deterministic or stochastic) and its sensitivity to environmental factors [6,8,9].

- Methodological approach: Section 4.3 details methodological approaches.

- Contract horizon: This parameter refers to the period during which participants must adhere to the contract terms [6]. This horizon also includes the replenishment periods, which may be single or multiple [4].

- Risk aversion: This concept primarily refers to the idea that a supply chain stakeholder can exhibit risk-neutral or risk-averse behavior [6,10].

4.2. Different Types of Coordination Contracts and Their Impact on Supply Chains

Supply chain coordination through contracts involves a formal agreement with specific terms between multiple parties. Contracts are considered an effective means of ensuring coordination among the various existing mechanisms. The contemporary literature has identified 14 types of contracts.

4.2.1. Wholesale Price Contract

This type of contract is considered the simplest. In it, the retailer sets a wholesale price. This is based on two variables: the wholesale price and the quantity ordered [1].

In the context of a two-level fresh product supply chain, the authors of [11] show that this type of contract can generate more profit for both parties by using cold-chain transportation. However, under a newsvendor model, it is considered non-coordinating because there is no wholesale price ensuring positive profits for both stakeholders [1].

4.2.2. Buyback Contract

In a buy-back contract, the upstream actor charges the retailer a wholesale price for each unit purchased while committing to reimburse the downstream actor an amount for unsold units at the end of the season [1]. This type of contract can sometimes protect excess products from being diverted to gray markets while preserving their brands [12].

Under the newsvendor problem, it is concluded that this type of contract promotes coordination between the two parties. However, it is important to note that the amount paid by the manufacturer to the retailer for each unsold unit must result from a negotiation process based on their respective bargaining power.

4.2.3. Quantity Flexibility Contract

As the name suggests, this type of contract provides the downstream actor with some flexibility to adjust the ordered quantity within predefined limits. The retailer shares demand forecasts with the manufacturer over a specified period. Consequently, the upstream actor commits to ensuring the availability of items [6], while the buyer commits to purchasing a minimum percentage of the shared forecasts [13]. This mechanism thus allows for the distribution of market uncertainty risks among supply chain participants [6].

4.2.4. Revenue-Sharing Contract

The revenue-sharing contract is one of the most studied contracts in the literature. In this agreement, the retailer commits to paying the supplier a percentage of the revenue generated in exchange for a wholesale price charged by the supplier [1].

The research explored has highlighted positive results regarding the impact of this type of contract on coordination and on achieving supply chain goals. In a study conducted on supply chains selling fashionable products, modeled according to the newsvendor problem and aimed at comparing the financing of a traditional supply chain to that of a blockchain-supported chain, the revenue-sharing contract, combined with Nash bargaining, showed positive results in terms of coordination and profits [14].

4.2.5. Cost-Sharing Contract

This contract encourages the supplier to share the retailer’s costs in the context of a strategic activity. The cost-sharing rate is influenced by the importance placed on the relationship: if the supplier values the relationship more, the sharing rate will be higher [15]. On the other hand, the retailer may share the supplier’s costs in the context of an innovative investment, which could impact the supplier’s investment decisions.

An analysis conducted by [16] demonstrated that the cost-sharing contract plays a crucial role in encouraging the integration of green innovation driven by the manufacturer and marketing efforts provided by the retailer.

The authors of [17] suggested a new hybrid contract combining the revenue-sharing contract and the cost-sharing contract (CS-RS). The study demonstrated that the hybrid contract effectively meets the needs of both parties regarding the adoption of blockchain technology and maximizing profit without considering demand uncertainty.

4.2.6. Profit-Sharing Contract

In this contract, the manufacturer charges the retailer a lowered wholesale price per unit sold, and the retailer shares a portion of their net profit with the manufacturer.

The study on financing supply chains for fashion products through blockchain technology demonstrated that this contract, under Nash bargaining, facilitates the coordination of traditional supply chains and those supported by blockchain by setting two parameters: the wholesale price per unit and the retailer’s profit-sharing proportion [14].

4.2.7. Quantity Discount Contract

This type of contract is characterized by a discount on the unit price charged by the supplier if the retailer orders a quantity that exceeds a predefined threshold. Discounts may be applied either exclusively to units exceeding the threshold or to the entire order.

The quantity discount contract can be beneficial in increasing profit and protecting the manufacturer’s brand goodwill, or the opposite in gray markets [12].

The quadratic quantity discount contract, introduced by [18], is a new component of this contract. It is characterized by a discount based on a nonlinear quadratic function, allowing optimal coordination and generating a positive profit.

4.2.8. Two-Part Tariff Contract

Under a two-part tariff contract, the manufacturer charges the retailer a fixed fee and a unit wholesale price, which can be adjusted based on market conditions [19].

In a supply chain accounting for environmental taxes, coordination is unachievable if the retailer is risk-averse [19]. In the case of a sustainable supply chain involving a fairness-sensitive retailer and a socially responsible manufacturer, this contract enables partial coordination, resulting in a reduced overall system profit [20].

4.2.9. Two-Part Credit Contract

In this type of contract, the supplier sets an optimal unit wholesale price and offers a credit period, which can be viewed as a discount. Additionally, the supplier provides the retailer with a subsidy for each unit sold to encourage optimal decision-making. Once the sales period ends, the supplier charges the retailer operational fees, ensuring optimal profit for both parties and the supply chain [21].

4.2.10. BOGO Coordination Contract (Buy One, Get One Free)

The BOGO plan is a marketing strategy that allows consumers to receive additional items for free when purchasing a specific quantity of products. The aim is to generate more profit by increasing sales. The items are sold in bundles. The BOGO contract demonstrated the effectiveness of aligning the interests of both parties [22].

4.2.11. MOQ Contract (Minimum Order Quantity)

As the name suggests, the MOQ contract requires the buyer to order a quantity equal to or exceeding a minimum threshold predefined by the seller.

In the context of a supply chain based on the newsvendor model and operating in the presence of gray markets, [12] argued that this type of contract has the potential to coordinate stakeholders under certain conditions. Specifically, the retailer’s profit decreases as the wholesale price charged by the supplier increases, but it rises when the selling price in gray markets increases. Conversely, the supplier’s profit grows with the wholesale price. However, if the wholesale price equals the manufacturer’s marginal cost, the supplier’s profit becomes zero [12].

4.2.12. Nash Bargaining Contract

This is a cooperative coordination mechanism used when the manufacturer has the exclusive authority to propose an agreement. This contract aims to ensure optimal profit for the entire supply chain. However, achieving this goal depends on the retailer’s fairness-concerned behavior when setting the wholesale price. Although limited to a single negotiation period, this mechanism allows for an equitable distribution of profits [20].

4.2.13. Rubinstein Bargaining Contract

Unlike the Nash bargaining contract, this contract allows both parties to propose alternative offers, enabling a series of negotiations over multiple periods [20].

Using a sustainable supply chain example, the authors of [20] demonstrated that this type of contract can still coordinate the supply chain like a centralized system while improving the profits of both parties and the overall supply chain.

4.2.14. Smart Contract

This is a numerical protocol deployed to automate, execute, and secure the terms of an agreement or contract. Within the supply chain, a smart contract can digitally determine key parameters that help achieve optimal objectives, such as determining the optimal quantity of items to produce or order [23].

Coordination contracts play a crucial role in improving the performance of supply chains. Even with the diversity of objectives, their applicability must be supported by an in-depth understanding of the contractual parameters and the stakeholders’ involvement.

Robust analytical tools and methods have been used to evaluate these contracts, which will be discussed in the following subsection.

4.3. Methodological Approaches for Evaluating the Performance of Coordination Contracts

Several analytical methods are used to determine how effectively these contracts achieve coordination among stakeholders, distribute profits, and minimize losses.

4.3.1. Game Theory

This game involves several players, each selecting a strategy to achieve their objective. The chosen strategies yield specific outcomes, resulting in corresponding gains or losses for each player [1]. The following models are derived from game theory:

- The Nash model: Balances decisions in a static setting, where the supply chain members’ negotiating power and decision-making are equal [24].

- The Stackelberg model: Employed within a leader-follower scenario context of information asymmetry and decision power [24]. In the study conducted by [25], this approach was used to model a supply chain consisting of a cloud service provider (leader) and a manufacturer using this service (follower). The two aforementioned models provide powerful analytical tools. However, they assume the perfect rationality of the stakeholders. Moreover, these models are designed for static games, and while the Stackelberg model can be applied in repeated games, it remains unsuitable for long-term dynamic situations.

- Differential game theory: A field primarily applied to dynamic systems where decisions are interdependent and must be made over relatively long periods [26]. In this context, differential game theory has been used to highlight the coordination dynamics between the supplier and the manufacturer in low-carbon supply chains, considering the limited validity period of low-carbon product certifications [27]. The application of this game theory in this field is still limited to deterministic models due to the mathematical complexity of integrating uncertainty into these models [26].

4.3.2. The Use of Emerging Technologies

- Reinforcement Learning (RL): This learning approach’s origins lie in psychology experiments on learning and behavioral changes in animals aimed at maximizing their rewards [28]. RL achieves defined objectives by interacting with the environment and using autonomous learning over time. In a Stackelberg game context, reinforcement learning ensures an update based on the game results, allowing for the determination of optimal price and demand to solve optimization problems [23].

- Blockchain Technology: Blockchain, a concept introduced by Nakamoto in 2008, underpins the decentralized digital currency “Bitcoin”, enabling peer-to-peer transactions without the involvement of banks [29]. In supply chain management, this technology facilitates the tracking of products or services, information flows, financial transactions, and processes ensuring high traceability [29].

Although adopting emerging technologies is increasingly becoming necessary, studies evaluating coordination contracts in complex supply chains using these technologies remain scarce.

5. Conclusion and Future Research

This study highlights 14 types of coordination contracts explored; each exploited to achieve specific objectives, such as profitability, sustainability, risk management, or other challenges, while emphasizing their role in improving supply chain performance.

The bibliometric analysis revealed a growing interest in adopting these mechanisms as effective tools for coordinating the entire supply chain. It also highlighted that current research trends increasingly focus on technological advancements, environmental challenges, and risk management.

Despite significant progress in research, some gaps persist and require further attention in future research. Most existing research focuses on dyadic supply chains, which fail to reflect the complex configurations of real-world environments involving numerous actors across several levels, coupled with uncertainties and information asymmetries. Moreover, applying artificial intelligence to evaluate coordination contracts in complex supply chains is still relatively uncommon.

Combining best practices from various types of contracts by developing hybrid contracts shows significant potential for achieving optimal results. Furthermore, integrating analytical approaches based on game theory with technological tools such as those derived from artificial intelligence presents a promising opportunity to facilitate the evaluation and execution of these contracts. Empirical studies based on real data are recommended to validate these approaches. These perspectives will support adaptation to the growing dynamics of supply chains in complex and highly uncertain environments.

Author Contributions

Conceptualization, Y.T. and Z.B.; methodology, Y.T. and Z.B.; software, Y.T.; resources, Y.T., Z.B. and M.E.O.; writing—original draft preparation Y.T.; writing—review and editing, Y.T. and Z.B.; visualization, Y.T.; supervision, Z.B. and M.E.O.; project administration, Z.B. and M.E.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Acknowledgments

The authors acknowledge the academic editor, the conference chairman, and the organizing committee for the opportunity to present this work at the International Conference on Smart Management in Industrial and Logistics Engineering (SMILE) at ESITH in Casablanca.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Snyder, L.V.; Shen, Z.-J.M. Supply Chain Contracts. In Fundamentals of Supply Chain Theory, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2019; pp. 563–590. [Google Scholar]

- Feng, Y.; Zhu, Q.; Lai, K.-H. Corporate social responsibility for supply chain management: A literature review and bibliometric analysis. J. Clean. Prod. 2017, 158, 296–307. [Google Scholar] [CrossRef]

- Malone, T.W.; Crowston, K. The Interdisciplinary Study of Coordination. ACM Comput. Surv. 1994, 26, 87–119. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N.; Diabat, A. Overview of coordination contracts within forward and reverse supply chains. J. Clean. Prod. 2013, 47, 319–334. [Google Scholar] [CrossRef]

- Labiad, N.; Beidouri, Z.; Otmane, B. Evaluation of coordination contracts for a two stage Supply Chain under price dependent demand. Int. J. Comput. Sci. 2012, 9, 151. [Google Scholar]

- Li, Z.-P.; Wang, J.-J.; Perera, S.; Shi, J. Coordination of a supply chain with Nash bargaining fairness concerns. Transp. Res. Part E Logist. Transp. Rev. 2022, 159, 102627. [Google Scholar] [CrossRef]

- Hendalianpour, A.; Hamzehlou, M.; Feylizadeh, M.R.; Xie, N.; Shakerizadeh, M.H. Coordination and competition in two-echelon supply chain using grey revenue-sharing contracts. Grey Syst. Theory Appl. 2021, 11, 681–706. [Google Scholar] [CrossRef]

- Guan, Z.; Ye, T.; Yin, R. Channel coordination under Nash bargaining fairness concerns in differential games of goodwill accumulation. Eur. J. Oper. Res. 2020, 285, 916–930. [Google Scholar] [CrossRef]

- Cachon, G.P.; Netessine, S. Game Theory in Supply Chain Analysis. In Handbook of Quantitative Supply Chain Analysis: Modeling in the E-Business Era; Simchi-Levi, D., Wu, S.D., Shen, Z.-J., Eds.; Springer: Boston, MA, USA, 2004; pp. 13–65. [Google Scholar] [CrossRef]

- Sarkar, P.; Wahab, M.I.M.; Fang, L. Weather rebate contracts for different risk attitudes of supply chain members. Eur. J. Oper. Res. 2023, 311, 139–153. [Google Scholar] [CrossRef]

- Yan, B.; Liu, Y.; Fan, J. Two-echelon fresh product supply chain with different transportation modes. Ann. Oper. Res. 2022, 1–24. [Google Scholar] [CrossRef]

- Srivastava, A.; Mateen, A. Supply Chain Contracts in the Presence of Gray Markets. Decis. Sci. 2020, 51, 110–147. [Google Scholar] [CrossRef]

- Mahdiraji, H.A.; Govindan, K.; Yaftiyan, F.; Garza-Reyes, J.A.; Hajiagha, S.H.R. Unveiling coordination contracts’ roles considering circular economy and eco-innovation toward pharmaceutical supply chain resiliency: Evidence of an emerging economy. J. Clean. Prod. 2022, 382, 135135. [Google Scholar] [CrossRef]

- Choi, T.-M. Supply chain financing using blockchain: Impacts on supply chains selling fashionable products. Ann. Oper. Res. 2023, 331, 393–415. [Google Scholar] [CrossRef]

- Xia, L.; Bai, Y.; Ghose, S.; Qin, J. Differential game analysis of carbon emissions reduction and promotion in a sustainable supply chain considering social preferences. Ann. Oper. Res. 2022, 310, 257–292. [Google Scholar] [CrossRef]

- Mondal, C.; Giri, B.C. Pricing and used product collection strategies in a two-period closed-loop supply chain under greening level and effort dependent demand. J. Clean. Prod. 2020, 265, 121335. [Google Scholar] [CrossRef]

- Liu, W.; Liu, X.; Shi, X.; Hou, J.; Shi, V.; Dong, J. Collaborative adoption of blockchain technology: A supply chain contract perspective. Front. Eng. Manag. 2023, 10, 121–142. [Google Scholar] [CrossRef]

- Kwon, Y.W.; Sheu, J.-B.; Yoo, S.H. Quadratic quantity discount contract under price-dependent demand and consumer returns. Transp. Res. Part E: Logist. Transp. Rev. 2022, 164, 102756. [Google Scholar] [CrossRef]

- Chan, H.-L.; Choi, T.-M.; Cai, Y.-J.; Shen, B. Environmental Taxes in Newsvendor Supply Chains: A Mean-Downside-Risk Analysis. IEEE Trans. Syst. Man Cybern. Syst. 2020, 50, 4856–4869. [Google Scholar] [CrossRef]

- Qian, X.; Chan, F.T.S.; Zhang, J.; Yin, M.; Zhang, Q. Channel coordination of a two-echelon sustainable supply chain with a fair-minded retailer under cap-and-trade regulation. J. Clean. Prod. 2020, 244, 118715. [Google Scholar] [CrossRef]

- Mu, X.; Kang, K.; Zhang, J. Dual-channel supply chain coordination considering credit sales competition. Appl. Math. Comput. 2022, 434, 127420. [Google Scholar] [CrossRef]

- Heydari, J.; Heidarpoor, A.; Sabbaghnia, A. Coordinated non–monetary sales promotions: Buy one get one free contract. Comput. Ind. Eng. 2020, 142, 106381. [Google Scholar] [CrossRef]

- Hewa, T.; Porambage, P.; Kovacevic, I.; Weerasinghe, N.; Harjula, E.; Liyanage, M.; Ylianttila, M. Blockchain-Based Network Slice Broker to Facilitate Factory-As-a-Service. IEEE Trans. Ind. Inform. 2023, 19, 519–530. [Google Scholar] [CrossRef]

- Mahdiraji, H.A.; Hafeez, K.; Jafarnejad, A.; Rezayar, A. An analysis of the impact of negative CSR ‘forced labour’ parameter on the profitability of supply chain contracts. J. Clean. Prod. 2020, 271, 122274. [Google Scholar] [CrossRef]

- Liu, S.; Han, W.; Zhang, Z.; Chan, F.T.S. An analysis of performance, pricing, and coordination in a supply chain with cloud services: The impact of data security. Comput. Ind. Eng. 2024, 192, 110237. [Google Scholar] [CrossRef]

- Cachon, G.P.; Netessine, S. Game Theory in Supply Chain Analysis. In Handbook of Quantitative Supply Chain Analysis; Simchi-Levi, D., Wu, S.D., Shen, Z.J., Eds.; International Series in Operations Research & Management Science; Springer: Boston, MA, USA, 2004; Volume 74. [Google Scholar]

- He, L.; Yuan, B.; Bian, J.; Lai, K.K. Differential game theoretic analysis of the dynamic emission abatement in low-carbon supply chains. Ann. Oper. Res. 2023, 324, 355–393. [Google Scholar] [CrossRef]

- Nguyen, T.T.; Nguyen, N.D.; Nahavandi, S. Deep Reinforcement Learning for Multiagent Systems: A Review of Challenges, Solutions, and Applications. IEEE Trans. Cybern. 2020, 50, 3826–3839. [Google Scholar] [CrossRef]

- Chang, S.E.; Chen, Y. When Blockchain Meets Supply Chain: A Systematic Literature Review on Current Development and Potential Applications. IEEE Access 2020, 8, 62478–62494. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).