Abstract

Monetary transactions have advanced into a portable, simple, and comfortable process. Regardless of the advantages of a versatile method of disbursement, the global take-up ratio is inadequate. Consequently, greater insight into the factors that influence acceptance by stakeholders is fundamental for industrialists and scholars. This study analyses the goals and real purpose behind portable disbursement by unifying the definition of its concept, which consolidates the “Mobile Technology Acceptance Model” and the “Theory of Planned Behaviour” as well as an updated profound variable that is more synergistic. The new framework incorporated 12 factors influenced by the user’s insight and was analysed by collecting data based on the PLS-SEM condition mix-mode. Identifying the impact of versatile methods of disbursement will shape essential business choices and the community and will change current lifestyles into contactless ones. This article demonstrates the connection between innovative factors and human preferences concerning the use of portable disbursement. Interestingly, we embrace this uniqueness for an incorporated framework that consolidates MTAM as well as the TPB.

1. Introduction

Mobile payment is an innovative technology and has transformed the way the banking sector functions. It enables individuals to perform transactions and to interact with banking institutions without being physically present in a branch or using automated teller machines (ATM). Mobile payments are defined as performing, initiating, or authorizing a payment using a mobile device. Mobile payments offer convenience, effectiveness, and cost-savings [1]. The global payment trend has switched to non-cash methods, and online payments have become one of the most popular and widespread methods used.

In the United States, 89% of consumers pay using a credit card or debit card; in contrast, only 7.7% prefer mobile payments [2].

The impact of the COVID-19 pandemic has directly influenced the adoption of payment methods alternative to cash to limit physical contact. A recent study reported rapid and drastic habit changes [3], suggesting that research on payment mechanisms should focus on promoting contactless alternatives. This information forms a valid and feasible basis for trying to understand the factors that provoke the adoption and actual use of mobile payments as the world moves toward a cashless society.

In principle, to use mobile payment services, the user must first open an account that links the payment instrument (a card or wallet) to their bank or financial institution. Then, the user enables the instrument to send or receive money to/from merchants/others. On the other side, the merchant/individual who requests payment or accepts mobile payment must also exchange their payment information with a financial institution or bank. Only then will the merchant/individual be able to receive funds and provide consistent payment services among various financial services. Therefore, the payment request received by the consumer is securely sent to the acquirer. The acquirer, who has a direct relationship with the merchant, forwards the payment information to the relevant financial institution so that payment can be completed. The whole cycle of this data flow, starting from the mobile device and the subsequent series of processes, is called a mobile payment service [3,4,5].

A mobile payment service can include using existing payment services provided by the financial institution and bank or a middle person/through IT company. However, the payment has to be linked to other third-party systems to be completed in both cases. Indeed, traditional payment services utilize an IT infrastructure/technology similar to Fintech payment services, so they have some limitations and challenges. For example, suppose that a mobile payment uses an existing traditional payment system and needs to connect merchants from different financial institutions. In that case, a different payment handshake method must be used for each financial institution, even when they use the same service. Additionally, traditional payment systems and platforms that provide a mobile payment service were not explicitly created for payment and were not specialized for user convenience [3,4,5].

A mobile payment service involves different parties, starting from the mobile device, the financial institutions’ issuer and acquirer systems, the network provider, and merchant systems. This raises a security issue and requires proper mutual authentication. The absence of such requirements can cause critical financial damage to the institutions, consumer, merchant, and whole payment system. For example, a middle person attack or malicious attack that changes the payment information can cause false payment details to be delivered, thus redirecting the payment. Such a case can cause money debited from the user account but not received by the merchant or the desired beneficiary account. The customer is charged for the service/product but does not receive the services/ product as the merchant did not receive the money [3,4,5].

The mobile payment service links and integrates with a variety of systems and apps. As a result, different policies and procedures are used to govern transaction flow in these systems, which can compromise end-user convenience and makes it more difficult to access the application if high-security requirements are used. Nevertheless, security factors are background concerns as customers will not see or experience them directly. However, once a security incident occurs, end-user trust in the system is severely impacted [3,4,5].

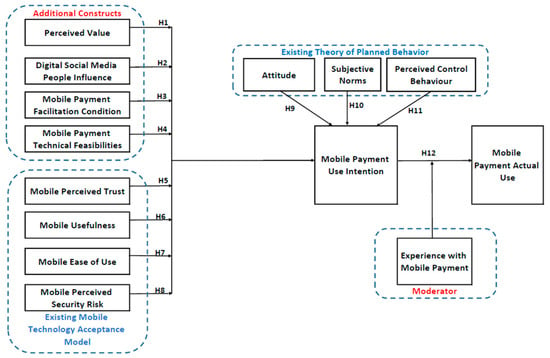

In summary, a reasonable and viable reason to better understand the factors that drive acceptance and use of mobile payments has emerged as the world moves toward a cashless society. To that end, the Mobile Technology Acceptance Model (MTAM) was used to create the base framework for this research. This model has been used in previous studies where the subject matter was mobile devices or mobile services/apps. Moreover, related additional constructs were added to the Theory of Planned Behaviour (TPB) to analyse the practical use of mobile payments from the perspective of human behaviour. This study expands these models and analyses the intention and actual usage behaviour of mobile payments with an additional variable from other dimensions by integrating these two profoundly different models. The new revised model, named “Mobile Payment Technology Acceptance Model and Behaviour (MPTAMB)”, also suggests the moderation of experiences with mobile payments issues.

2. Literature Review

2.1. Mobile Payment

As an emerging technology with tremendous potential, mobile payment is now commonly used for purchasing movie tickets, paying for transportation, and buying many other items. In 2018, 938.2 million people used mobile payments around the world. China, India, and the United States account for more than two-thirds of that population. However, it has not been generally accepted in Western societies due to many factors that affect mobile payment [3].

Mobile payment is a revolutionary form of financial transaction that offers convenience and interactivity [6]. The term “mobile payment” refers to using an electronic channel on a mobile device to pay for bills, goods, and services [7]. Additionally, mobile payment was described as “the use of mobile devices to initiate, approve, and confirm the exchange of financial value in trade for any payment for goods and services” [3,8]. Mobile payment refers to a form of value transfer that works similarly to other payment methods but relies on advanced mobile innovative technologies and features. It is a representation/symbolization of a customer’s financial credentials. While it is still a new tool, the international payment industry sees mobile phones as a good instrument for payment transactions [9].

Mobile payment extends access to financial services by using information and communication technologies, and banks and non-bank retail networks, specifically for customers who cannot be served conveniently or profitably by conventional physical-based locations. Today, creative and technology-based businesses thrive on easy, convenient, and ubiquitous mobile payment systems and rely on mobile technology [8]. As a result, more businesses are shifting their payment strategies to the Internet and mobile commerce [8]. Several key advantages of mobile payment over traditional payment systems have been discussed in the literature, including their quietness and immediacy, which enable customers to use it from anywhere in the world at any time [3,6,7]. In emerging economies, the current situation is favourable for growth and mobile payment is continuing to be adopted. Different factors remain as challenges and obstacles. The Lion’s share is that attempts at fraud by unauthorized individuals with bad intentions known as “middlemen attacks” have increased [7]. As a result, mobile payment consumers are more cautioned against such attacks and hesitate to share their pin, for example, in mobile applications other than primary bank applications or that of the agent.

2.2. Why Do People Accept or Resist Adopting Mobile Payments?

Researcher argued that people do not adopt the use of digital payments due to a lack of trust, habit, a lack of transparency, pervasiveness, and friction [10]. A lack of trust topped the list, with some people hesitant to make payments over the Internet because of potential security threats. The thought of someone else potentially having access to their bank account is a deal-breaker for certain people. People in this category may have no prior experience with the Internet and only a rudimentary understanding of how it operates. Therefore, mobile payments are a big step into the unknown, mainly when no one can guide them or explain the details. Habits are the second reason; everyday life revolves around being paid and paying in cash. It has been the standard method of conducting business in many industries for a long time. There is simply no need to adapt for those who already transact in cash. They responsibly handle their cash and feel secure and in command at all times. The third explanation is that, in countries such as India, having every transaction monitored could lead to problems such as increased surveillance or higher taxes. Some customers prefer cash because it leaves no digital footprint. The fourth explanation is that cash is welcomed almost everywhere. Digital payments, on the other hand, are not. The final explanation is friction; cash is a value transfer that occurs instantly. Despite recent advances, digital payments still require more steps than traditional cash transactions. Some consumers assume that money is genuine if they can count it in hand. It is also a cultural problem because having a wallet full of cash notes can demonstrate power and influence, but when looking at a screen to check a balance, the result does not feel the same.

2.3. Theoretical Framework

The actual use of mobile payment technologies is examined in this study from two angles: from the technology adoption and consumer behaviour angles. The mobile technology acceptance model (MTAM) is grounded in the technology acceptance model (TAM) [11,12] and covers mobile payment as a technology from the perspective of adoption. The Theory of Planned Behaviour (TPB) of examined consumer behaviour [13]. Integrating an additional variable into these two profoundly different theories from other dimensions addresses the shortfalls of previous studies. Additionally, incorporating the adoption of technology and consumer behaviour constructs will extend these models to examine intention and actual use behaviour for mobile payment and address the shortfalls of previous studies, as well. The moderation experience with mobile payments is also proposed in the new revised model and named “Mobile Payment Technology Acceptance Model and Behaviour (MPTAMB)”.

2.3.1. Mobile Technology Acceptance Model (MTAM)

It was developed to examine smartphone Credit Cards (SCCs). SCCs use short-range wireless technology between two devices near each other with a maximum distance between 10 cm or fewer [14]. Additional constructs were added to the original TAM model to accommodate the mobile environment complexity. For the current study, MTAM was used as a base, and other variables were added. Moreover, to overcome the shortfalls of the MTAM, new variables were added.

2.3.2. The Theory of Planned Behaviour

The Theory of Reasoned Actioned (TRA) by Fishbone and Janzen 1975 was modified by Ajzen from 1985 to 1991 by adding perceived behavioural control and called Theory of Planned Behaviour (TPB) [15]. The involvement of the newly added construct in the TRA was found to be very relevant to explain individual intention. According to previous studies, TPB and TAM are the most widely used theories to explain mobile service adoption and to predict all kinds of human behaviours. Many requests to replicate and broaden the TPB are due to its divergent and weak exploratory results [16].

2.4. Hypothesis Development

Perceived value: Customers use a product or service to determine whether the expected benefits are greater than its risk [17]. Therefore, perceived values are reflected in meeting the users’ needs. The notion of perceived value was commonly acknowledged as the purchaser’s general evaluation of the functionality of a mobile application on perceptions of “what is received and what is given” [18]. The perceived value of a product is determined by comparing the predicted advantages to the cost, including hedonic and utilitarian benefits, functionality, pleasure, interaction, accessibility, service quality, and general usefulness. Thus, the perceived value increases if a customer can use mobile payment services with the same success experienced in the physical environment [19].

Hypotheses 1 (H1).

Perceived value influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Digital social media influence: A collection of the online content of social interactions among users allows them to co-create, find, share, and evaluate an online information repository [20]. Digital social media influence involves the impact of consumer opinions on whether that particular behaviour should or should not be performed [21]. The rise in social media is a cornerstone of social commerce. Social media have redefined the organization’s lifestyle and practices over the past decade [20].

Digital social media affects the customer’s intention toward using mobile payment [21]. Therefore, other community members’ social influence affects an individual’s decision [22]. Additionally, the significant direct impact of social influence on intention to use behaviour is a finding from a recent study examining mobile banking adoption in Bangladesh [23].

Hypothesis 2 (H2).

Digital social media influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Facilitation Conditions: The facilitating conditions are the level of consumer belief in the organization and infrastructure in supporting the use of the service [24]. Therefore, consumers most likely use a mobile payment system if they have support services and assistive resources [24].

Facilitating conditions include the user’s knowledge, ability, and resources [7]. It is worth noting that a study focused on intention to continue using mobile money among micro-enterprises with a sample of 584 micro-enterprises [7]. The study adopted the unified theory of acceptance and use of technology (UTAUT). The study confirmed the relationship between the facilitating condition and intention to continue using the technology with a p-value of less than 0.01. This formulates the following hypotheses.

Hypothesis 3 (H3).

The facilitating condition influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Technical feasibilities: The consumer’s technical skills and technological savviness affect the user’s attitude toward using a service [25]. Due to the sensitivity and privacy of the data exchanged in payments, mobile payment adds a new level of complexity [25].

Mobile payment introduces a new level of complexity, considering that the information’s sensitivity and privacy affect the user from two angles [25]. One user might find it tedious and complicated due to the constraints of the features of mobile devices such as the small screen, typing on a screen, difficulty entering information using the mobile device screen, and the perception of inadequate security protection. Therefore, if the mobile payment provider provides technical assistance, this will encourage the actual use of the service [26].

Hypothesis 4 (H4).

A consumer’s technical feasibilities influence an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Mobile Payment Perceived Trust: Trust is “a psychological expectation that others will be sincere in keeping promises and will not behave opportunistically in expectation of a promised service derived from the mobile transaction” [14]. It is essential and curtailed, particularly when related to financial transactions, mainly when the transactions are processed via a wireless network [27]. The term trust in payment services means that the user has a certain level of confidence in the service provider’s ability, integrity, and benevolence [27]. Therefore, building consumer trust leads to a long relationship with the consumer and continued use of mobile payments [27].

In addition, the effect of perceived trust was previously measured on a quantitative study including an analysis of 1245 respondents, and it was found that perceived trust has a substantial impact on the intention to adopt mobile banking. This formulates the following hypotheses.

Hypothesis 5 (H5).

Perceived trust influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Perceived Usefulness and Ease of Use: Perceived usefulness triggers an adequate response (attitude toward using), which forms the behavioural intention to use and ultimately determines the actual behaviour [12]. Process complexity is another factor that affects the intention to use mobile payments. Therefore, the rate of adoption of mobile payments is faster among consumers with convenient access to mobiles and other technologies than those who do not. Similar to the perceived usefulness, financial resources also affect the perceived ease of use. It has an inverse relationship; the higher the perceived financial resources, the lower the intention to use [14]. This formulates the following two hypotheses.

Hypothesis 6 (H6).

Perceived usefulness influences an individual’s intention to use mobile payments and ultimately affects actual user behaviour.

Hypothesis 7 (H7).

Perceived ease of use influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Perceived Security Risk: The feel of a safe environment is essential to adopting any new technology. The user wants to feel that the service is reliable and safe. The privacy of data and financial assets are always a priority in customers’ minds. Data might be lost or stolen from mobile devices or bad applications such as malware, viruses, malicious software, and hacker attacks [28]. Therefore, consumers are more likely to use the mobile payment service if they believe that mobile service providers and retailers are honest; sincerely keep their promises; and take full responsibility in the eventuality of any identity theft, fraud, or security issues [14].

Hypothesis 8 (H8).

Perceived security risk influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Attitude: This can be referred to as the person’s feeling regarding whether the behaviour is favourable or unfavourable [29]. The positive or negative attitude is impacted mainly by the intensity of the behaviour and convictions concerning the likelihood of the result [12,29]. Many previous studies have considered attitude as a common factor for determining the adoption of mobile payments. As a result, it drove the researcher to hypothesize that users’ attitudes toward mobile payment positively influence the adoption of mobile payments [3]. In the context of mobile payment, the more favourable or more robust the attitude toward mobile payment, the more positive the individual’s intention toward actually using mobile payment.

Hypothesis 9 (H9).

Attitude influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Subjective Norms: The belief of whether one’s social group or significant other think that person can perform the behaviour is a social factor that affects behaviour [30,31]. It is related to a person’s perception of the behaviour’s social environment and the perceived pressure from an individual’s reference group to perform the target behaviour [30]. In this study, the subjective norms mean the degree of perceived stress on the respondents from their reference group to actually use mobile payments.

Hypothesis 10 (H10).

Subjective norms influence an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Perceived control behaviour: This refers to the individual perception of whether he or she has the required resources, skills, and opportunities to perform the activity [30]. Therefore, the more required skills, resources, and opportunities an individual has and the easier they find performing the behaviour, the more likely they intend to continue to perform the behaviour.

Hypothesis 11 (H11).

Perceived control behaviour influences an individual’s intention to use mobile payments and ultimately affects the actual user behaviour.

Mobile payment intention use: Behavioural intention to use mediates the relationship between actual use/implementation of technology and the intention to adopt the technology [32]. Previous researchers have reported that technology use has taken off due to consumers’ behavioural intentions and evaluations [32].

Hypothesis 12 (H12).

Individual’s intention to use mobile payments influences actual user behaviour.

Experience with Mobile Payment: The purchaser becomes familiar with utilizing portable disbursement, which affects the intensity of the contribution between various variables and intention in relation to using portable disbursement. The skills needed to utilize mobile innovation requires the integration of knowledge, exposure, and familiarity that a person has towards that innovation [4]. Unique and unpleasant cases such as replacing faulty goods, missing payment activities, and reversing unsuccessful activity also made these purchaser further sceptical of using portable disbursement [33]. Hence, our paper recommends a moderator controlling the encounter, which affects the relationship among actual mobile uses as shown in Figure 1.

Figure 1.

Proposed revised mobile payment technology acceptance model and behaviour (MPTAMB) and the proposed hypothesis.

3. Research Methodology

In this study, we address the availability of mobile payment technology. However, the level of acceptance in actually using mobile payments compared with the other payment channels is very low. This study addresses the common obstacles around the world. This research adopted a mixed methodology. In this method, we designed and distributed a questionnaire to collect primary data from the study participant. The quantitative data collected were generalized and used to identify outliers, and the qualitative data collected were used for an in-depth explanatory analysis to interpret key characteristics [34,35]. The target population is the population of ultimate interest in mobile payment. However, due to practicalities, an entire target population often cannot be studied. The study population is a subset of the target population that can be studied. The sample is a subset of the study populations used in research because not every member of the study population can be measured. Therefore, the target population for this study are people worldwide.

Among the various sampling techniques, convenience sampling was found to be more suitable for this research purpose. The lead researcher here was able to overcome many of the limitations associated with the research using this technique. For example, using this technique, friends or family were used as a more accessible sample, with the respondents being available and easily accessible. Additionally, the lead researcher worked as an e-payment specialist in the information technology authority in the sultanate of Oman, thus allowing them to utilize their connection with all local banks, employees, ministries, and private companies that use the Internet payment gateway. Approaching people in these organizations provides the potential to gather quality data. Therefore, the non-probability convenience sample is the least expensive, least time-consuming, and most convenient for this research purpose. Based on official figures of the sultanate of Oman population [36], after excluding the age groups 0–4 and 5–9, the target population was 3,727,910.

After setting the confidence level at 90%, the calculated sample size was 271. By adding nine more respondents to accommodate incomplete questionnaires, the total was 280. The data were collected using a constructed questionnaire survey and using Google forms. The questionnaire forms were distributed using web tools, emails, and social media. The questionnaire adopted a seven-item Likert scale (1 is “strongly disagree” to 7, which is “strongly Agree”) and open-ended questions. The statistical software used for this study was the SmartPLS. The instruments used in the questionnaire of this study were developed based on a review of existing and past literature. This approach positively affects the instruments’ quality and has the benefit of reusing attested instruments.

Validity and reliability increase the research transparency and reduce the opportunities to insert bias in the research [37]. Cronbach’s alpha (α) was used to assess the validity of the data as it is the most common internal consistency measure [37]. A variable alpha score above 0.7 is generally considered acceptable. The pilot phase respondent data were analysed using the Smart-PLS v.3.3.3.

3.1. Pre-Test

In the end, an ideal survey questionnaire is unattainable. However, researchers can still design valuable surveys. It is vital to pre-test the survey questionnaire before deploying it to assess its usefulness. Pre-testing can help determine the survey’s strengths and weaknesses in question type, wording, and sequence. The pre-test’s importance lies in addressing any potential issues that may arise during data collection. As explained by [25], a pre-test is vital to ensuring any ambiguities in the questions are addressed to ensure participants understand the question is in accordance with what they are designed and intended to assess. Although this study is aided by questionnaires from past literature, pre-testing can also help ensure that the instrument tests the desired variables. Therefore, two approaches were employed to pre-test the questionnaire (participating and undeclared).

Participating: The participants are informed of the purpose of the questionnaire before filling in the questionnaire. This approach was facilitated by an interview with the researcher. During the interview, the participant was asked to explain their reactions to the question forms, wording, and order of questions. This approach was helpful in determining whether the questionnaire was clear and understandable. Four participants were involved in this approach; the first was a professor of economics (associate dean of research and innovation) from Middle East College in the Sultanate of Oman. The second one was a doctorate lecturer at the same university. The other two were experts in the field: the first was a senior employee in the e-channel department at Bank Muscat, and the second was the assistant general manager at the Bank al Izz—Sultanate of Oman.

Undeclared: The participants in this approach were asked to fill out the questionnaire without knowing that it is just a pre-test. It was similar to answer an actual questionnaire. The participant was informed that this practice is voluntary and that his/her response will be used only for the study purpose. No names or emails were requested. As we designed the questionnaire in two languages, two participants chose the Arabic version and the other two chose the English version.

The participating group commented on the sequence of questions and their questionnaire included more instruments to measure the variable, accordingly emphasising the sequence and assessing the applicability of the new instrument after evaluating the length of the questionnaire. While the undeclared group suggested some wording in the Arabic version, they suggested arranging the multiple-choice options horizontally to reduce the amount of scrolling needed. Most of the questions needed scrolling to see the complete list of answers. This phase highlighted valuable feedback and comments on improving the questionnaire before deploying it to an actual study sample.

3.2. Data Collection and Respondent’s Demographic Profile

For a preliminary distribution of the questionnaire, a sample of 10 university doctors and students was chosen to conduct a questionnaire trial-and-error test. Pilot test participants commented on some of the questionnaires and accordingly evaluated the comments and enhanced. Based on the feedback received, four questions were reworded to improve their clarity and understanding. The data in the pilot test were collected using Google forms. The survey link was shared via different applications such as WhatsApp groups, emails, and social media platforms to achieve an adequate sample size for the study. The questionnaire content validity went through the pre-test stage. One hundred and one respondents received and answered the questionnaire. The demographic profile of respondents is shown in Table 1. The respondents voluntarily answered the questionnaire. The first page in the survey was for selecting the preferred language. Then, complete information about the purpose of the survey and confidentiality of the data was provided. In general, the respondents were between the ages 15 and 55 years old, which are a potential group of users of mobile payment applications; 43.5% of the respondents were graduates (bachelor;s degree), 23.7% were postgraduates or above, 13.8% held diplomas, and 18.8 were secondary school or lower graduates. In terms of using mobile payment applications, 5.94% of respondents previously used mobile payments.

Table 1.

Respondents’ demographic profiles.

3.3. Outer Measurement Model Assessment

Table 2 shows that all variables in the measurement model ranged from 0.772 to 0.985 for Cronbach’s alpha, rho_A, and Composite reliability was above the minimum threshold of 0.077 [38]. Therefore, an internal reliability of consistency was established. Table 2 also reports the factor loading for all items. All were above the recommended value of 0.07 when calculating the convergent validity. Similarly, cross-loading for all items was established per the report shown in Table 3.

Table 2.

Loading ractor, Cronbach’s alpha, roh_A, composite reliability, and AVE.

Table 3.

Discriminant validity—cross loadings.

4. Finding and Discussion

This study aimed to examine the influencing factors that affect the intention to use mobile payments and actual use behaviour. This study aimed to unfold and understand why people do not use mobile payments.

The new model consists of 12 variables. The construct perceived value is vital in the proposed model. The quick access, time-savings, loyalty point redemptions, and reduction in fees were found to be relevant in enhancing the perceived value of using mobile payments per the interview responses. The reliability test indicated that this variable was reliable. Cronbach’s alpha scored 0.949 from this first pilot test of 101 participants.

Digital social media influence affects the user’s decision to use mobile payments. Respondents indicated that reviewing online content and the ratings of the service providers makes the user more comfortable with using the mobile payment application. The indicator shows a positive weighting. The preliminary descriptive analysis reported that around 74% of the respondent check online content and act accordingly. Cronbach’s alpha was reported at 0.856, which indicates how reliable this construct is in affecting the actual use of mobile payments.

Perceived security risk of mobile payments, especially on mobile payment systems and in exchanging sensitive data such as bank card details, also influences the decision to use mobile payments. Respondents stated that security is an issue. However, if they were assured by the mobile payment provider about compensations for account hacking or misuse of their account caused by the application. Cronbach’s alpha reported the reliability of the construct at 0.772.

The perceived trust was measured using two instruments (on a seven-item Likert scale). Response for trusting that unauthorized people cannot gain access to their account showed about 67% trust and reported a Cronbach’s alpha value of 0.894. Responses to complete trust in the mobile payment provider scored 73% (strongly agree, 22%; agree 44; and somehow agree 7%). This indicates that most respondents put their trust in mobile payments. The reliability test reports a Cronbach’s alpha of 0.865 for this construct. A summary of all Cronbach’s alpha values is reported in Table 2.

Similarly, the subjective norms scored 0.847; perceived usefulness scored 0.950; technical feasibilities scored 0.840; perceived behaviour control scored 0.960; intention to use scored 0.974; attitude scored 0.979; and perceived ease of use scored 0.958.

5. Significance of the Study

In cautioning against physical contact, the COVID-19 pandemic, has forced the introduction of payment methods alternative to cash. Recently gathered data revealed a rapid and dramatic shift in habits [3], prompting this study to concentrate on payment methods that support contactless payment methods. The other contributions of this research are as follows:

5.1. Theoretical Contribution

The Mobile Payment Technology Acceptance Model and Behaviour (MPTAMB) is the main contribution of this research paper. It integrates the Mobile Technology Acceptance Model (MTAM) and the Theory of Planned Behaviour (TPB) [39,40]. The TPB and the newly added variables that form the basis of the conceptual framework have never been used in conjunction with the MTAM to investigate the influential factors and to determine the actual use of mobile payments. All previous studies used different theories (UTAUT, Extended UTAUT, TAM, and DoI). MTAM with TPB and the newly added construct have also never been used to examine influential factors on the actual use of mobile payment. Therefore, this study is vital to understanding the actual use of mobile payment based on consumer behaviour and acceptance of the technology.

5.2. Managerial Contribution

Mobile payment facilitates a new way of exchanging money; organisations need to have a 360-degree view of different factors in mobile payment. Although there are no direct or significant influences due to the proposed constructs, knowing their effects will shape strategic decision related to adopting mobile payment. Additionally, bank managers should use the findings of this study to raise public awareness of mobile payments by taking appropriate measures to encourage its use. Mobile payments have emerged as a wireless communication channel that adds value to customers while conducting banking transactions. Today, mobile payment is considered a remarkable modern technology that provides banking services using smartphones.

Mobile payment is now regarded as one of the most advanced technologies for providing banking services via smartphones. This research will allow national and foreign businesses operating in a region to better understand the factors that affect the use and continued use of mobile payments. Furthermore, this research will assist them in designing effective advertising strategies and advancing their marketing plans.

5.3. Methodological Contribution

This research’s main methodological contribution is the revised Mobile Payment Technology Acceptance Model and Behaviour (MPTAMB). For this model, the Mobile Technology Acceptance Model (MTAM) and the theory of planned behaviour (TPB) were used as the base. Additional constructs and moderators were added to examine mobile payment adoption and actual use. The TPB complemented exposure to mobile payment methods to look into the actual behaviour of mobile payment, acceptance of the technology, and the consumer behaviour level. This model contributes a different way of looking into researching mobile payment adoption and use.

The expertise acquired from the problem analysis, the interpretive methodology, and the data collection techniques are other analytical contributions. This knowledge may help future research on the implementation and usage of ICT-related policies at the individual level.

Finally, the applicability of theoretical concepts and theories developed in other contexts is a methodological contribution. Therefore, we questioned the differences in the social and cultural settings, and the relevance of specific research models and theories established in developed countries to study an organizational environment and reused at the individual level, where the person voluntarily implements or adopts the new technology. The successful implementation of these theories in this study leads to examples used to interpret human behaviour related to mobile application technologies.

In addition, there is a limitation in quantitative as well as qualitative research methodologies; therefore, the current research uses a mixed methodology, where the quantitative data is validated by the qualitative data. This approach provides an in-depth explanation for the researched questions and provides a rational justification.

5.4. Social Contribution

Mobile payment offers a convenient, effective, and cost-saving method of making payment. The adoption of mobile payments influences society, transforming society into a cashless one [1]. This transformation improves society’s level of security. Individuals will no longer need to carry cash and are no longer vulnerable to being robbed. Therefore, the diffusion of mobile payments can improve safety. In addition, convenience, simplicity, security, and technological integration are all features of mobile payment systems. It is evolving alongside people’s demands, which mobile payment can meet. Therefore, mobile payment diffusion can reduce the hassle of cash movement and let the mobile device handle the task instead. In terms of simplicity, mobile payment replaces even family-related expenses and donations to people with special needs using mobile applications integrated with mobile payment systems that provide a simpler way to make donations. Mobile payment contributions are profoundly touching upon improvements in social life.

In addition, mobile payment is a mechanism that allows individuals to make payments remotely. This leads individuals to accomplish more work and to complete tasks quickly and with less effort. Additionally, people’s actions, movements, orientations, financial and governmental dealings, education, shopping, and many other details are all intertwined with technology. This makes it easier for them to complete tasks that they would not have been able to if the technology did not exist. Therefore, understanding the challenges in mobile payment technology can lead to a change that subsequently leads to a better social life.

6. Conclusions and Future Research

To conclude, using a newly developed model named “Mobile Payment Technology Acceptance Model and Behaviour”, this research examined the willingness to adopt mobile payments. The new and revised model is the main contribution of this research paper. Based on the test conducted, the results showed the potential of our framework and, therefore, the data collection stage in answering our research question. Using the revised Mobile Payment Technology Acceptance Model and Behaviour, this study examined individual intentions and actual use of mobile payment technology. The significance of this research lies in the theoretical, methodical, managerial, and social contributions.

In predicting the actual use of mobile payment methods, the data analysis reported that perceived security risk, technical feasibilities and perceived value were significant variables. Therefore, to provoke the actual use of mobile payment, mobile payment providers should improve the given value of mobile payment, improve the security of mobile payment, and finally allocate strategies to enhance the technical feasibilities of the consumer.

This study examined the actual use of mobile payment by integrating the Mobile Technology Acceptance Model and The Theory of Planned Behaviour. The study was carried out in the Sultanate of Oman. Therefore, the results may not be generalizable to the rest of the world and might not reflect mobile payment acceptance and actual user behaviour in other countries. Future studies are recommended to expand this research to other countries and perhaps include moderators that affect mobile payment usages, such as service fees, brand influence, and marketing advertisement.

Author Contributions

Conceptualization, M.M.K.A.-R. and P.S.J.; methodology, M.M.K.A.-R., P.S.J., H.C.E.; software, M.M.K.A.-R.; validation, M.M.K.A.-R. and P.S.J.; formal analysis, M.M.K.A.-R. and P.S.J.; investigation, M.M.K.A.-R. resources, M.M.K.A.-R. and P.S.J.; data curation, M.M.K.A.-R.; writing—original draft preparation, M.M.K.A.-R.; writing—review and editing, M.M.K.A.-R., P.S.J. and H.C.E.; visualization, M.M.K.A.-R.; supervision, M.M.K.A.-R., P.S.J. and H.C.E.; project administration, M.M.K.A.-R. and P.S.J.; funding acquisition, P.S.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Merhi, M.; Hone, K.; Tarhini, A.; Ameen, N. An empirical examination of the moderating role of age and gender in consumer mobile banking use: A cross-national, quantitative study. J. Enterp. Inf. Manag. 2020, 34, 1144–1168. [Google Scholar] [CrossRef]

- How Behavioural Science Can Unleash Digital Payments Adoption. Available online: https://www.simon-kucher.com/sites/default/files/2018-12/SimonKucher_Report_Payment%20Adoption_Final_0.pdf (accessed on 1 February 2022).

- Flavian, C.; Guinaliu, M.; Lu, Y. Mobile payments adoption—Introducing mindfulness to better understand consumer behaviour. Int. J. Bank Mark. 2020, 38, 1575–1599. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; García-Maroto, I.; Muñoz-Leiva, F.; Ramos-de-Luna, I. Mobile Payment Adoption in the Age of Digital Transformation: The Case of Apple Pay. Sustainability 2020, 12, 5443. [Google Scholar] [CrossRef]

- Kang, J. Mobile payment in Fintech environment: Trends, security challenges, and services. Hum. -Cent. Comput. Inf. Sci. 2018, 8, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Mouakket, S. Investigating the role of mobile payment quality characteristics in the United Arab Emirates: Implications for emerging economies. Int. J. Bank Mark. 2020, 38, 1465–1490. [Google Scholar] [CrossRef]

- Odoom, R.; Kosiba, J.P. Mobile money usage and continuance intention among micro-enterprises in an emerging market—The mediating role of agent credibility. J. Syst. Inf. Technol. 2020, 22, 97–117. [Google Scholar] [CrossRef]

- Kumar, V.; Lai, K.K.; Chang, Y.H.; Bhatt, P.C.; Su, F.P. A structural analysis approach to identify technology innovation and evolution path: A case of the m-payment technology ecosystem. J. Knowl. Manag. 2020, 34, 1144–1168. [Google Scholar] [CrossRef]

- Dimitriadis, S.; Kyrezis, N.; Chalaris, M. A comparison of two multivariate analysis methods for segmenting users of alternative payment means. Int. J. Bank Mark. 2018, 36, 322–335. [Google Scholar] [CrossRef]

- Kothari, S. 5 Reasons Why Consumers Still Don’t Use Digital Payments. Available online: https://economictimes.indiatimes.com/wealth/spend/5-reasons-why-consumers-still-dont-use-digital-payments/articleshow/64699938.cms?from=mdr (accessed on 26 November 2020).

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–339. [Google Scholar] [CrossRef] [Green Version]

- Oertzen, A.-S.; Odekerken-Schröder, G. Achieving continued usage in online banking: A post-adoption study. Int. J. Bank Mark. 2019, 37, 1394–1418. [Google Scholar] [CrossRef] [Green Version]

- Jiang, Y.; Miao, M.; Jalees, T.; Zaman, S.I. Analysis of the moral mechanism to purchase counterfeit luxury goods: Evidence from China. Asia Pac. J. Mark. Logist. 2019, 31, 647–669. [Google Scholar] [CrossRef]

- Ooi, K.-B.; Tan, G.W.-H. Mobile technology acceptance model: An investigation using mobile users to explore smartphone credit cards. Expert Syst. Appl. 2016, 59, 33–46. [Google Scholar] [CrossRef]

- Verma, S.; Chaurasia, S.S.; Bhattacharyya, S.S. The effect of government regulations on continuance intention of in-store proximity mobile payment services. Int. J. Bank Mark. 2020, 38, 34–62. [Google Scholar] [CrossRef]

- Khoi, N.H.; Tuu, H.H.; Olsen, S.O. The role of perceived values in explaining Vietnamese consumers’ attitude and intention to adopt mobile commerce. Asia Pac. J. Mark. Logist. 2018, 30, 1112–1134. [Google Scholar] [CrossRef] [Green Version]

- Ryu, H.-S. What makes users willing or hesitant to use Fintech?: The moderating effect of user type. Ind. Manag. Data Syst. 2018, 118, 541–569. [Google Scholar] [CrossRef]

- Feng, Y.; Chen, X.; Lai, I. The effects of tourist experiential quality on perceived value and satisfaction with bed and breakfast stay in southwestern China. J. Hosp. Tour. Insights 2020, 25, 477–499. [Google Scholar] [CrossRef]

- Lin, K.-Y.; Wang, Y.-T.; Huang, T.K. Exploring the antecedents of mobile payment service usage: Perspectives based on cost-benefit theory, perceived value, and social influences. Online Inf. Rev. 2020, 44, 299–318. [Google Scholar] [CrossRef]

- Hew, J.-J.; Lee, V.-H.; Ooi, K.-B.; Lin, B. Mobile social commerce: The booster for brand loyalty? Comput. Hum. Behav. 2016, 59, 142–154. [Google Scholar] [CrossRef]

- Trinh, H.N.; Tran, H.H.; Vuong, D.H.Q. Determinants of consumers’ intention to use a credit card: A perspective of multifaceted perceived risk. Asian J. Econ. Bank. 2020, 4, 105–120. [Google Scholar] [CrossRef]

- Patten, E.; Ozuem, W.; Howell, K. Service quality in multichannel fashion retailing: An exploratory study. Inf. Technol. People 2020, 33, 1327–1356. [Google Scholar] [CrossRef]

- Islam, M.S.; Karia, N.; Khaleel, M.; Fauzi, F.B.A.; Soliman, M.S.M.; Khalid, J.; Bhuiyan, M.Y.A.; Mamun, M.A.A. Intention to adopt mobile banking in Bangladesh: An empirical study of emerging economy. Int. J. Bus. Inf. Syst. 2019, 31, 136–151. [Google Scholar] [CrossRef]

- Gupta, K.P.; Manrai, R.; Goel, U. Factors influencing adoption of payments banks by Indian customers: Extending UTAUT with perceived credibility. J. Asia Bus. Stud. 2019, 13, 173–195. [Google Scholar] [CrossRef]

- Leong, C.-M.; Tan, K.-L.; Puah, C.-H.; Chong, S.-M. Predicting mobile network operators users m-payment intention. Eur. Bus. Rev. 2021, 33, 104–126. [Google Scholar] [CrossRef]

- Danyali, A.A. Factors influencing customers’ change of behaviours from online banking to mobile banking in Tejarat Bank, Iran. J. Organ. Chang. Manag. 2018, 31, 1226–1233. [Google Scholar] [CrossRef]

- Cao, X.; Yu, L.; Liu, Z.; Gong, M.; Adeel, L. Understanding mobile payment users’ continuance intention: A trust transfer perspective. Internet Res. 2018, 28, 456–476. [Google Scholar] [CrossRef]

- Chaouali, W.; Hedhli, K.E. Toward a contagion-based model of mobile banking adoption. Int. J. Bank Mark. 2019, 37, 69–96. [Google Scholar] [CrossRef] [Green Version]

- Mostafa, R.B. Mobile banking service quality: A new avenue for customer value co-creation. Int. J. Bank Mark. 2020, 38, 1107–1132. [Google Scholar] [CrossRef]

- Mazambani, L.; Mutambara, E. Predicting FinTech innovation adoption in South Africa: The case of cryptocurrency. Afr. J. Econ. Manag. Stud. 2019, 11, 30–50. [Google Scholar] [CrossRef]

- Harb, A.A.; Fowler, D.; Chang, H.J.J.; Blum, S.C.; Alakaleek, W. Social media as a marketing tool for events. J. Hosp. Tour. Technol. 2019, 10, 28–44. [Google Scholar] [CrossRef]

- Farah, M.F.; Hasni, M.J.S.; Abbas, A.K. Mobile-banking adoption: Empirical evidence from the banking sector in Pakistan. Int. J. Bank Mark. 2018, 36, 1386–1413. [Google Scholar] [CrossRef]

- Vashistha, A.; Anderson, R.; Mare, S. Examining the Use and Non-Use of Mobile Payment Systems for Merchant Payments in India. In Proceedings of the 2nd ACM SIGCAS Conference on Computing and Sustainable Societies, Accra, Ghana, 3 July 2019; pp. 1–12. [Google Scholar]

- JosephNg, P.S.; Eaw, H.C. Making Financial Sense from EaaS for MSE during Economic Uncertainty. In Advances in Information and Communication. FICC 2021. Advances in Intelligent Systems and Computing; Arai, K., Ed.; Springer: Cham, Switzerland, 2021; Volume 1363, pp. 976–989. [Google Scholar] [CrossRef]

- JosephNg, P.S. EaaS Optimization: Available yet hidden information technology infrastructure inside the medium-size enterprise. Technol. Forecast. Soc. Chang. 2018, 132, 165–173. [Google Scholar] [CrossRef]

- NCSI. National Centre for Statistics and Information. Popul. Stat. Bull. 2020, 12, 5443. [Google Scholar]

- Mohajan, H. Two Criteria for Good Measurements in Research: Validity and Reliability. Ann. Spiru Haret Univ. 2017, 3, 32. [Google Scholar] [CrossRef] [Green Version]

- See, S.; JosephNg, P.; Phan, K.; Lim, J. JomWowNFC: Why NFC must be used for Merchant & Consumer? In Proceedings of the 2021 Innovations in Power and Advanced Computing Technologies (i-PACT), Kuala Lumpur, Malaysia, 27–29 November 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Al-Saedi, K.; Al-Emran, M.; Ramayah, T.; Abusham, E. Developing a general extended UTAUT model for M-payment adoption. Technol. Soc. 2020, 62, 101293. [Google Scholar] [CrossRef]

- Zhao, H.; Anong, S.T.; Zhang, L. Understanding the impact of financial incentives on NFC mobile payment adoption An experimental analysis. Int. J. Bank Mark. 2019, 37, 1296–1312. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).