Abstract

Background: Agricultural production plays a vital role in the global economy by integrating different sectors and promoting capital circulation across industries. In this context, the dairy sector emerges as a promising avenue for investment. This study aims to assess the economic feasibility of establishing a dairy plant for the production of parmesan and mozzarella cheeses in Lavras, MG, considering both deterministic and probabilistic scenarios. Methods: The analysis was conducted in three stages: data collection, deterministic economic feasibility analysis using traditional financial indicators (NPV, IRR, profitability rate, and payback), and a probabilistic assessment using the Monte Carlo simulation with 100,000 iterations to incorporate uncertainty into the model. Results: The deterministic results indicated a positive Net Present Value (NPV), Internal Rate of Return (IRR) exceeding the Minimum Attractiveness Rate (MAR), and a profitability rate above 1.5, validating the investment’s viability. The probabilistic analysis reinforced these findings, with over 80% of simulated scenarios resulting in a positive NPV and over 77% showing IRR above the MAR. Key variables influencing profitability included market share, Class AB cheese consumer percentage, parmesan markup, operational costs, and per capita cheese consumption. Conclusions: The study confirms the economic feasibility of implementing the proposed dairy plant. The integration of Monte Carlo Simulation enhanced the robustness of the analysis by accounting for uncertainty, providing valuable insights for strategic decision-making. The project presents strong potential for regional development, job creation, and income generation.

1. Introduction

Farming plays an important role in strengthening the economy in Brazil. Its contribution is present in the Gross Domestic Product (GDP), representing around 10.2% of this quantity, according to data from [1]. It also represents a reliable source of employment in the country, whether in transport, logistics, agro-industry, or commerce [2]. Its potential covers issues relevant to the current debate on food security and sustainability, in which new alternatives for meeting food needs are discussed, based on more sustainable production patterns [3].

Dairy farming has presented a history of results that also contribute to the regional development of the places where it operates [2]. Furthermore, the use of technologies has helped increase the production efficiency of some properties by reducing lead-time and operational costs [1]. In this context, the dairy market is an economic alternative for small, medium, and large producers in the country [1]. Cheese production is an example, ranging from traditional artisanal methods to modern dairy factories that adopt advanced technologies to guarantee product quality and safety [4].

However, for the success of an enterprise, studies must be conducted a priori to prove its economic feasibility [5], which sometimes represents a bottleneck and the cause of the bankruptcy of these businesses. It is worth highlighting the positive impact of these projects when combined with market studies through a demand and competition analysis, enhancing managers’ knowledge of the sector and their decision-making power [6]. The food sector is marked by the perishability of some foods in a short period; therefore, creating conditions for quick decision-making is a differentiator in this sense [3]. Thus, this study presented the following research questions: What are the variables that have the greatest impact on the economic feasibility of implementing a parmesan and mozzarella-producing dairy center in Lavras, MG? How can the Monte Carlo Simulation contribute to this decision-making scenario?

A study with these characteristics brings contributions to the sector using objective decision-making tools at the economic level [7]. Firstly, it brings knowledge to the investor about the reality of the investment sector; therefore, the decision-making process will occur more quickly and well-founded [5]. Subsequently, the methodology used allows a holistic analysis of the study scenario, providing project managers with an anticipation of possible failures and the influence of external factors [7]. Moreover, it is an enterprise with great potential for regional development, generating employment and income for the population, and stimulating the economy [4].

Economic feasibility analysis is an alternative to support decision-making for managers and potential investors [8,9]. It is possible to analyze the prospects for success of a product or business model by considering all costs and revenue involved in the project [7]. The construction of cash flows will be then possible, facilitating the visualization of annual cash returns. In this context, the challenge of economic feasibility analysis consists of visualizing investment alternatives and predicting their consequences, considering the value of money over time and a pre-determined period [7,9].

In an economic feasibility project, some guidelines can be followed to achieve the analysis objectives. A priori, there is the identification of investment alternatives, where some questions (Where? When? Who? How? Why?) can be answered [6]. Subsequently, a preliminary feasibility study of alternatives can be conducted to successfully select the best options [6,7]. Thus, an effective feasibility study of alternatives can be initiated involving various estimates, forecasts, and disbursement schedules, ensuring the formation of cash flows [5]. Finally, there is the consideration of project risks and uncertainties that correspond to key factors of the project and must be worked on to obtain the best cost–benefit for the investor [5,9].

Another relevant aspect of economic feasibility analysis corresponds to capital acquisition for the project [7]. In this sense, the calculation of the weighted average cost of capital (WACC) is a promising way to estimate the cost of capital for the proposal, based on the weighted average of the cost of equity and third-party capital [7], according to Equation (1).

where

- : Cost of equity capital.

- : Cost of third-party capital.

- : Amount of third-party capital.

- : Amount equity capital.

- : Company income tax rate.

Knowing the percentage value corresponding to the WACC, this can help in the formation of a Minimum Attractiveness Rate (MAR), which corresponds to the minimum percentage value that an investor intends to gain if they invest in a certain alternative. According to [8], the MAR can be represented by the sum of the cost of capital and the business risk. Given the variety of methods for effective feasibility analysis, the investor has the freedom to choose which method(s) to employ. The most common methodologies are Net Present Value (NPV), Internal Return Rate (IRR), Profitability Rate, and project payback time (Discounted Payback) [5].

The NPV corresponds to the sum of the values existing in the cash flow, already discounting the interest embedded in each of the values existing on the other flow dates [7]. Equation (2) represents the NPV calculation.

where

- is the Net Present Value.

- represents the cash flow on date zero.

- represents the cash flow on the nth date.

- is the project analysis deadline.

The Internal Return Rate (IRR) method allows us to find the return on the investment in percentage terms [7]. This corresponds to the remuneration value in which NPV = 0, according to Equation (3).

where

- is the initial investment.

- represents the number of cash flow periods.

- represents the cash flow discount rate.

- is the project analysis deadline.

On the other hand, the Profitability Rate refers to the sum of discounted cash flows divided by the sum of initial investments. The investment return time or discounted payback represents the period in which the investor can recover the invested capital [7,8].

Monte Carlo Simulation has a wide application and has been useful for solving complex analytical problems [10]. This methodology is based on the generation of random numbers to model systems and calculate statistical results [11]. The behavior of a system formed by a set of random variables is then simulated, where the results for the selected outputs are observed [12].

Random variables correspond to probability distributions that are pre-determined according to the particularities of each input [13]. It is worth highlighting the importance of adherence tests for each random variable generated, which allows the model to better adapt to the reality studied [10]. A simulation follows some steps that must be respected to guarantee the effectiveness of this process. Step 1 corresponds to the definition of the simulation model, in which the inputs and outputs are defined, as well as the distribution parameters of each input variable. Subsequently, in Step 2, random samples are generated according to the specified probability distributions. In Step 3, the simulation is carried out, where the values of the input random variables will be used to calculate the results. Finally, Steps 4 and 5 occur, including replication and statistical analysis, respectively [10,13].

In general, simulation is commonly used in different sectors. In the finance field, for example, it can assist in evaluating investments and simulating portfolios [14]. In engineering, it can aid in performance analysis of complex systems and process optimization [15]. In the field of transport and logistics, it can assist in the construction of distribution routes and supply chain management [10].

In general, cheese production is a common activity in the state of Minas Gerais, and is well-recognized nationally and internationally, due to the high standard of perceived quality achieved in some producing regions [4]. Given the above, the general objective of this study was to analyze the economic viability of implementing a parmesan- and mozzarella-producing dairy center in Lavras, MG, in deterministic and probabilistic plans. The specific objectives were to characterize the activity sector; project expected consumption and demand between 2024 and 2030; estimate a Minimum Attractiveness Rate (MAR); build cash flow for the analysis period; calculate economic feasibility indicators; define parameters for the Monte Carlo Simulation; and discuss the results obtained. The results were obtained with the help of the software Excel 365 and Rstudio Version: 2023.12.1+402.

2. Materials and Methods

2.1. Market in the Region

The dairy sector in Brazil plays a significant role in the economy, considering that the country reached the production target of 35 billion liters in 2013, an increase of 35% compared to the 26 billion produced in 2007. It is known that 60% of this milk is directed to cheese production, highlighting the social and economic relevance of this product in the national and international markets. Therefore, the project to implement a parmesan and mozzarella-producing dairy center in the southern region of Minas Gerais, in Lavras, MG, was defined based on a vertical study of the entire production chain, in which potential suppliers and consumers were quoted. Furthermore, the choice for these two types of product was based on the existence of a high demand for both in this region.

According to data from ABIQ [4], the cheese per capita consumption in Brazil grew from 2.5 kg/per capita/year in 2007 to 5.6 kg/per capita/year in 2022. Adopting linear interpolation to estimate the per capita consumption forecast, it can be inferred about the achievement of higher consumption levels, in the order of 6.529 kg/per capita/year in 2024 to 7.974 kg/per capita/year in 2030. Moreover, the population growth rate is also a key factor to calculating the predicted demand; in this study, an average population growth rate of 1.37% per year was used, based on the historical series presented by the IBGE [16]. Another premise of this study corresponded to the definition of demand percentages for each type of product, considering 40% for the consumption of mozzarella and 60% for the consumption of parmesan. Table 1 includes the municipalities to be served, considering an operating radius of 100 km.

Table 1.

Municipalities considered for the analysis.

According to the IBGE [16], Class AB corresponds to the largest portion of the cheese-consuming population in the country, equivalent to 16% of the total population. With this information, total cheese consumption (TCC) for the study region can be obtained by Equation (4).

Table 2 represents the calculations related to total consumption and estimated demand for the dairy center service region in the period 2024–2030.

Table 2.

Cheese consumption and demand forecast for the region under study.

The projected demand for the region corresponded to a percentage of 5% of total cheese consumption. This value is justified by the existence of competing companies already consolidated in the market. However, it is worth highlighting the deterministic nature associated with this quantity, which may form a random variable in the probabilistic field, expanding the possibilities for analyzing investment scenarios.

2.2. Characterization and Study Steps

This study is a descriptive work with a quantitative approach and inductive logic. According to Pandey and Pandey [17], there is no researcher interference in data collection in a descriptive study. Research with a quantitative approach involves measuring variables and characterizing them using statistical and/or mathematical techniques. Finally, research with inductive logic allows the interpretation of an individual reality to construct broad truths.

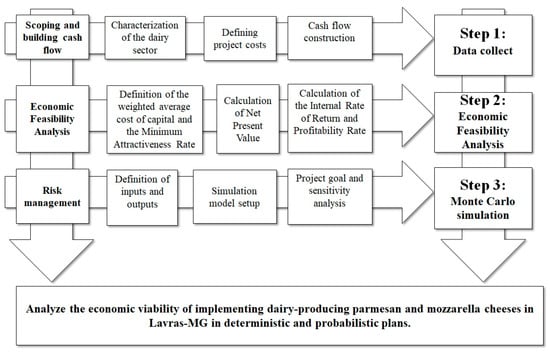

In the case of the study steps described in Figure 1, the scope and construction of the cash flow were defined. Thus, information related to the initial costs and investments necessary for the opening and continuity of the project was gathered. Step 2 involves the economic feasibility analysis (EFA), in which the capital cost required for the enterprise and the corresponding Minimum Attractiveness Rate (MAR) were initially defined.

Figure 1.

Study steps: Step 1 is data collection. Step 2 is the economic feasibility analysis. Step 3 is the Monte Carlo Simulation. All these steps converge to achieve the general objective of this study. Source: Adapted from [18,19,20,21,22].

Net Present Value (NPV), Internal Return Rate (IRR), and Profitability Rate of the project were also calculated in step 2. These indicators make effective contributions to the study, providing a holistic and objective view of the viability of the investment. However, its deterministic character represents a limiting and questionable factor. Therefore, this study advances to step 3, in which the inputs corresponding to project uncertainties were treated, based on a Monte Carlo simulation model.

To address potential uncertainties inherent in the economic feasibility analysis, this study applied Monte Carlo Simulation as a complementary tool to the deterministic assessment. The simulation works by assigning probability distributions to key input variables that have uncertain behaviors—such as market share, production costs, markup rates, and consumer demand. Using these distributions, the model generates 100,000 random scenarios (iterations), each representing a possible state of the business environment. For each iteration, financial indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Rate are recalculated. The aggregated results allow the estimation of probabilities associated with project success or failure, highlighting which variables most influence profitability. This probabilistic approach enhances decision-making by offering a more realistic and risk-aware projection of future outcomes.

3. Results

3.1. Deterministic Analysis

Initially, all expenses relating to the initial project investments were listed, as represented in Table 3.

Table 3.

Initial project investments.

According to Table 3, equipment costs were determined based on the dairy center production capacity, based on the values obtained for demand. In this context, these included the acquisition of the following equipment: drain press, matic-cheese, stretching monoblock, boiler, vacuum sealers, salting tank, expansion tank, tank for storing/receiving fresh milk, pasteurizer, and cold chamber, among others. This totaled an amount of BRL 212,635. Legal expenses included the costs of opening a CNPJ, business license, and share capital, totaling BRL 5500. Maintenance costs incurred 20% of equipment costs, corresponding to the amount of BRL 42,527. Depreciation costs for machinery and equipment varied from 5 to 10% depending on the type of equipment, resulting in an annual amount of BRL42,901.

Operating costs were calculated based on the average salaries of each employee and the percentage of 83% related to labor charges, thus totaling the annual amount of BRL 742,817. For the production cost base, the costs of purchasing fresh milk, yeast/chemical products, and packaging were considered. To calculate the unit production cost of the two types of cheese, a price of BRL 2.78 per liter of milk was considered, with approximately 12 and 9 L needed to manufacture parmesan and mozzarella, respectively. Finally, unit production costs were estimated at BRL 35.93 for parmesan and BRL 28.40 for mozzarella.

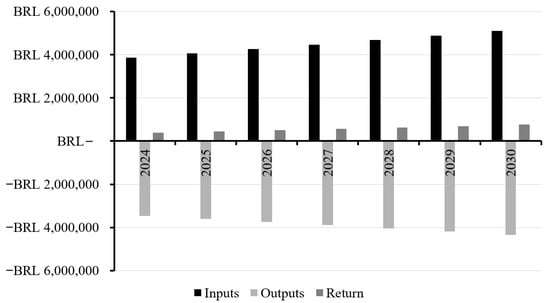

Logistical costs corresponded to fuel consumption and payment of tolls, calculated based on an optimized delivery route based on the minimum distance traveled, totaling an annual cost of BRL 26,024. The total costs were recorded according to Table S1 represented in Supplemental Materials. Therefore, it was possible to construct the project cash flow for the analysis period 2024–2030, as shown in Figure 2.

Figure 2.

Graphical representation of the projected cash flow. Inputs, outputs, and cash returns for the period 2024–2030. Source: The authors (2025).

Financial indicators were then calculated. The project MAR was defined based on the sum of the Weighted Average Cost of Capital (WACC) and project risk. Thus, considering a cost of equity and third parties of 0.25 each, the amount of equity and third-party capital was BRL 550,183.36 for each; in addition, an income tax rate of around 20%, results in a WACC of 22.5% per year. Assuming that the project risk is in the order of 5%, we have a MAR of 27.5% per year. Considering this to be a nominal rate, the real rate can be estimated based on Equation (5).

where the nominal rate considered was 27.5% per year with a number of periods M of 12 months per year, obtaining a real rate of 31.25% per year. Considering an inflation rate of 5.19%, corresponding to the 12-month accumulated IPCA registered until September/2023 by the IBGE (2023) [16], the interest rate without inflation was calculated i’ according to Equation (6), where i is the real or effective rate and α is the inflation rate:

Therefore, the MAR used is an interest rate without inflation i’, in this case, i’ = 24.43% per year. By calculating the financial indicators, i.e., NPV, IRR, Profitability Rate, and Discounted Payback, the values represented in Table 4 were obtained.

Table 4.

Deterministic analysis results.

According to Table 4, the values obtained for NPV and IRR proved the feasibility of the project, since the NPV was positive, and the IRR (41.06% per year) was higher than the MAR (24.43% per year). The Profitability Rate indicated that, for every real investment in the project, a return of BRL 1.52 can be obtained. The discounted Payback presented a considerable value of approximately 4 years to recover the amount initially invested.

3.2. Probabilistic Analysis

The probabilistic step begins with the definition of the inputs and outputs of the Monte Carlo simulation according to [23]. Table 5 corresponds to all inputs for the analysis context, in which all variables that presented an associated degree of uncertainty in the deterministic step were listed. Emphasis is placed on the conversion of these deterministic variables into random variables using probability distributions and the definition of the respective parameters.

Table 5.

Probability distributions and input parameters.

According to Table 5, the key variables identified include market share, Class AB consumer percentage, parmesan and mozzarella cheese markups, per capita cheese consumption, operating costs, Minimum Attractiveness Rate (MAR), production costs (parmesan and mozzarella), population growth rate, IPCA inflation index, sales commission percentage, logistics costs, and administrative costs. These variables capture uncertainties in demand (e.g., consumer behavior, market penetration), costs (e.g., production, logistics), and macroeconomic factors (e.g., inflation, financing rates).

Their influence on decision-making is profound: demand-side variables (e.g., market share, markup flexibility) directly affect revenue potential, while cost-related uncertainties (e.g., operating or production costs) determine expense volatility. For instance, a higher Class AB consumer percentage or parmesan markup could boost profitability by 3.68 and 3.31, respectively, whereas rising operating costs could erode margins. By quantifying these relationships, our Monte Carlo Simulation provides investors with a risk-aware framework to prioritize strategies—such as targeting premium markets or optimizing supply chains—while preparing for adverse scenarios.

The Monte Carlo Simulation incorporated carefully selected probability distributions to model key variables, reflecting their inherent uncertainties and empirical characteristics. For consumption-related variables such as per capita cheese consumption, a PERT distribution was adopted using minimum (5.87 kg/year), most likely (6.52 kg/year), and maximum (8.18 kg/year) values. This choice effectively captures the expected right-skewed nature of consumption patterns while avoiding unrealistic extremes, making it particularly suitable for modeling bounded variables with asymmetric distributions.

Cost variables, including operating costs, logistics costs, and production costs, were similarly modeled using PERT distributions. This approach accounts for the natural variability in cost structures while emphasizing the most probable values. For instance, operating costs were parameterized with a range of BRL 564,040.84 to BRL 1,047,956.01, centered around the most likely value of BRL 742,817.20. The PERT distribution’s ability to smooth extreme values makes it ideal for financial variables where catastrophic outliers are improbable but significant variability exists.

Market share was uniquely modeled using a triangular distribution, defined by optimistic (8%), pessimistic (2%), and most likely (5%) estimates. This distribution provides a simplified yet effective representation of market penetration uncertainty, particularly useful when empirical data are limited but expert estimates are available. The triangular distribution’s linear probability density function offers computational advantages while maintaining reasonable accuracy for bounded variables.

Economic and demographic variables, including the Minimum Attractiveness Rate (MAR), inflation rate (IPCA), population growth, and socioeconomic class distribution, employed PERT distributions to reflect their probabilistic nature. The MAR, for example, was modeled between 22.5% and 32.5% with a central tendency at 27.5%, capturing the uncertainty in capital costs while avoiding unrealistic extremes. This distributional choice ensures that the simulation reflects both economic volatility and the most probable scenarios.

Pricing variables such as cheese markups were also modeled with PERT distributions to represent flexibility in pricing strategies. The parmesan markup, ranging from 100% to 150% with a most likely value of 130%, demonstrates how this distribution can effectively capture strategic pricing decisions within plausible bounds. The consistent use of PERT distributions for these variables ensures comparability while maintaining appropriate representation of their uncertainty profiles.

This systematic approach to distribution selection provides a robust framework for uncertainty quantification in the dairy business feasibility analysis. By aligning distribution choices with variable characteristics and available data, the simulation achieves an optimal balance between computational efficiency and empirical accuracy, ultimately supporting more reliable decision-making under uncertainty.

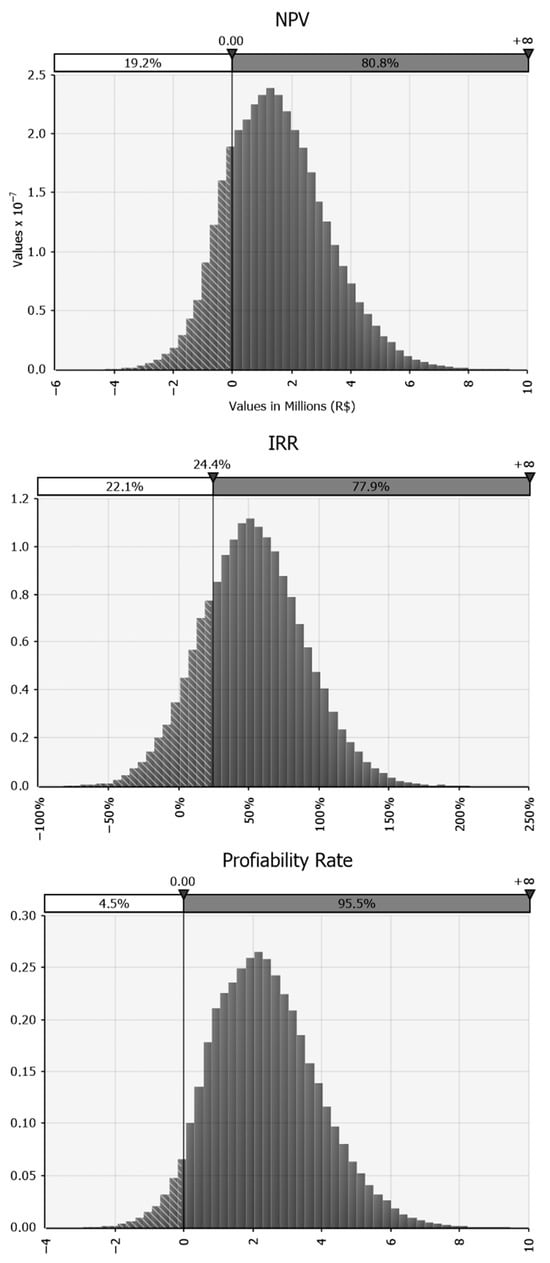

With this information, a Monte Carlo simulation was carried out with 100,000 iterations. The outputs considered included the financial indicators NPV, IRR, and Profitability Rate, according to the results presented in Figure 3.

Figure 3.

Probabilistic histograms from the Monte Carlo Simulation: NPV, IRR, and profitability rate, respectively. Source: Authors (2025).

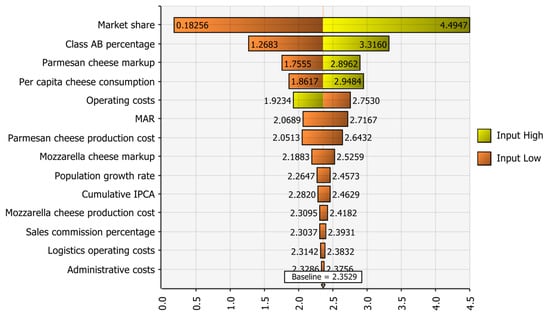

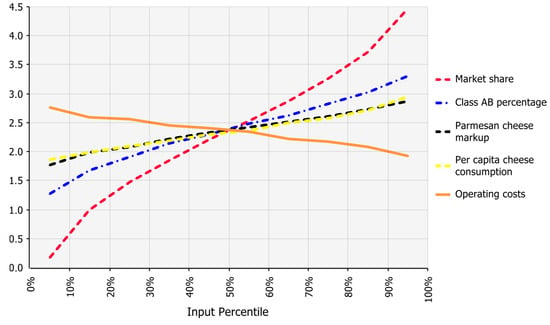

The results were favorable for opening the business, indicating a positive NPV for 80.8% of events, an IRR higher than the MAR (deflated) in 77.9% of events, and a positive Profitability Rate for 95.5% of events, which configures a low-risk investment scenario. Furthermore, the greatest impacts on profitability were observed when variations occurred in inputs: market share, percentage of Class AB cheese-consuming population, parmesan markup, per capita cheese consumption, operation and production costs, and Minimum Attractiveness Rate (MAR) (Figure 4).

Figure 4.

Random variables that most impact the profitability rate. Source: The authors (2025).

The image displays a sensitivity analysis ranking key input variables by their impact on profitability, with market share, Class AB percentage, parmesan cheese markup, and per capita cheese consumption emerging as the most influential drivers of profitability. These variables showed the strongest positive correlations, as their higher values significantly increased the profitability rate. For instance, when market share and Class AB percentage reached their maximum values, the profitability rate rose sharply to 4.49 and 3.31, respectively. Similarly, maximizing the parmesan cheese markup boosted profitability to 2.89, while higher per capita cheese consumption (7.461 kg/year) elevated it to 2.94. In contrast, operating costs had a negative impact—reducing them to BRL 664,288 improved profitability to 2.75. This analysis underscores that strategic focus on demand-side variables (e.g., expanding market share or premium pricing) offers greater leverage for profitability than cost-cutting alone.

According to Figure 5, it is worth highlighting the correlation between these main inputs/indicators and profitability rate. In the analysis of Figure 5, upward slopes can be seen for the selected inputs, except for operating costs. This indicates that, based on the simulation carried out, as increases were made in market share, percentage of Class AB cheese-consuming population, parmesan cheese markup, and per capita cheese consumption, increases in profitability were observed.

Figure 5.

Random variables that most impact the profitability rate by percentile. Source: The authors (2025).

The sensitivity analysis illustrated in Figure 5 highlights clear correlations between profitability and key input variables. Notably, variables such as market share, Class AB percentage, parmesan cheese markup, and per capita cheese consumption demonstrate strong positive correlations with profitability—meaning that as these variables increase, so does the profitability of the project. In contrast, operating costs exhibit a negative correlation, indicating that higher costs reduce profit margins. This insight suggests that while strategies aimed at expanding market share and targeting premium consumer segments can significantly enhance financial returns, investors must also implement strict cost control measures. Pérez-Lechuga et al. [24] developed a stochastic routing model for green cold chains, maximizing timely deliveries under perishability constraints. Actions such as optimizing production processes, improving operational efficiency, and adopting lean management practices are essential to mitigate the negative impact of rising operating costs and preserve profitability under variable market conditions.

In a target analysis focused on these indicators, it is possible to observe their impact on profitability in a different way. In other words, to achieve a 98% probability of positive profitability, it is necessary to adjust these inputs, as shown in Table 6.

Table 6.

Target analysis for the random variables that most impact the profitability rate.

In situations when there is a variation in the per capita cheese consumption from 6.520 to 7.170 kg/per capita/year, we would have a profitability rate of 2.95. If it is possible to expand market share from 5% to 5.5%, we would have a profitability rate of 2.95.

On the other hand, if the investor manages to reduce their operating costs from BRL 742,817 to BRL 668,535, we will have a profitability rate of 2.65. Regarding the input parmesan markup, if a 10% increase was made to the base value (from 130% to 143%), we will have a profitability rate of 2.90. Finally, if there is an expansion of the Class AB percentage from 16% to 17.6%, the new profitability rate will be 2.95.

4. Discussion

Food production is a vital activity for ensuring food security and population health. Therefore, working on mechanisms to increase yield, process efficiency, and quality management is fundamental in achieving population well-being. In the dairy industry, the same occurs with milk production and its derivatives. The economic viability of the project was assessed through both deterministic and probabilistic analyses, incorporating key variables such as market share, consumer behavior (specifically per capita cheese consumption and Class AB population), and operational costs. In the deterministic analysis, financial indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Rate all indicated favorable results—demonstrating a positive return, an IRR above the Minimum Attractiveness Rate (MAR), and a payback period of less than four years. To account for uncertainty, a Monte Carlo Simulation was conducted, revealing that in over 80% of scenarios the NPV remained positive, and the IRR exceeded the MAR in 77% of cases. These results confirm the project’s feasibility under realistic conditions, showing it to be a low-risk and potentially profitable investment.

We acknowledge that the findings of this study are based on data and assumptions specific to Lavras, in the MG region, including local market demand, consumer profiles, production costs, and logistical conditions. As such, the results may not be directly generalizable to other regions with different economic, demographic, or infrastructural characteristics. However, the methodological approach—combining deterministic analysis with Monte Carlo Simulation—can be replicated in other locations by adapting the input variables to local conditions. This provides a flexible framework for evaluating economic feasibility in diverse regional contexts.

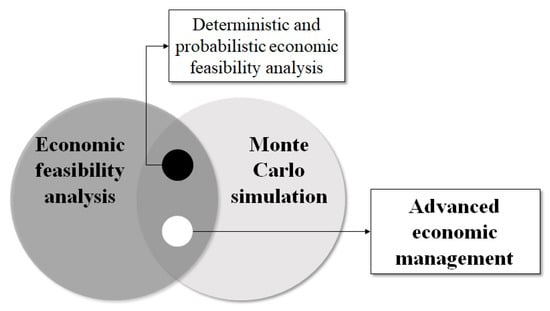

Monte Carlo Simulation presented good results from a financial probabilistic perspective. Some studies in the field of dairy production used Monte Carlo Simulation as a decision-making support for the simplification of production processes [25], milk quality control [26], and even estimating the fat content of different dairy products. This demonstrates the versatility of this technique, as well as its ability to triangulate with other analysis techniques. In this study, Monte Carlo Simulation was introduced as one of the methodological steps to provide a broad view based on a series of probabilistic events related to the dynamics of cheese production. Figure 6 represents a Venn diagram with the interrelationships between the techniques used in this study.

Figure 6.

Advanced economic management scheme. Interrelations: (1) economic feasibility analysis and (2) Monte Carlo Simulation. Source: The authors (2025).

The association of analysis techniques, as represented in Figure 6, allowed a holistic view of the investment project. The combination of economic feasibility analysis and Monte Carlo simulation contributed satisfactorily to expanding the analysis content from the deterministic plan to the probabilistic plan. In this sense, variables that previously presented static behavior and that admitted a degree of uncertainty were treated as random variables.

The simulation in this context revealed a high degree of adherence between the percentages of demand for each product and project profitability. In fact, there is a direct relationship between demand and profitability. However, a factor that should be better worked on is the percentage of dairy consumers. Currently, the region analyzed has a percentage of just 16%. This shows a gap in the performance of industries in this sector, which can act in the development of new products, with specific differences for each consumer profile. For example, the development of products with different fat and lactose contents to attract new consumers.

When it comes to incorporating Monte Carlo simulation, the study indicated an effective contribution to short-term analyses associated with deterministic analysis. This is a static analysis that does not allow for constant adaptations in the value of the variables considered over time. The association of Monte Carlo Simulation proved to be promising in medium and long-term scenarios since there is greater flexibility in the values assumed by the variables in case, they are random, as well as the fact that any monthly variation in the price of milk can be better planned based on the analyses provided by the Monte Carlo Simulation.

Production efficiency is also one of the most common approaches among studies in the area. Some authors such as Kirillova et al. [27], Barros et al. [28], Kovács and Szűcs [29], Oğuz and Yener [30], Pedolin, Six and Nemecek [31], Siafakas et al. [32], and Soteriades et al. [33] contribute to this sense by bringing different perspectives on achieving efficiency in dairy production. For example, Kovács and Szűcs [29] analyzed the production efficiency of Hungarian dairy centers over 10 years. The results revealed a production gap of 22.4% that could have been increased without changes being made to the quantity of production factors.

In this study, costs related to production factors such as labor (operating costs) and raw materials (production costs) can be identified. These costs impact production efficiency as they dictate the quantity of production factors to be used. On the other hand, attention must be paid to reducing waste and correctly allocating production factors to reach the efficiency frontier. The study also considers the use of WACC in which there is a division of equity and third-party capital. This is a measure that provides greater decision-making freedom in the enterprise, granting flexibility for short- and medium-term economic measures [7].

A differential of this study is the triangulation provided by probabilistic sensitivity analysis and deterministic analysis. This occurs since this information is important for adapting the business model due to fluctuations in the dairy market. The superiority of a probabilistic analysis over a deterministic one is highlighted here, as scenarios are constructed for the investor, providing greater clarity over time. The study verified the presence of uncertainty variables in the model, some of a macroeconomic nature, others related to dairy consumption, as well as variables aimed at measuring costs with production factors.

We recognize that the study is based on a set of assumptions, such as projected demand growth, input cost estimates, and market share expectations. However, to mitigate the limitations inherent in these assumptions, we adopted a dual approach combining deterministic analysis with Monte Carlo Simulation. This probabilistic method allows for the incorporation of uncertainty by assigning probability distributions to key variables, generating a range of possible outcomes rather than relying on fixed values. This approach strengthens the robustness of the findings and provides a more realistic and comprehensive assessment of the project’s economic feasibility, even in the presence of variability and potential risks.

Adding value to dairy products through the production of higher-value items like parmesan and mozzarella helps mitigate pricing challenges in the Brazilian dairy market by enabling producers to shift from bulk commodity sales, which are highly sensitive to price volatility and low margins, to specialized products with higher profit potential. This study demonstrates that value-added cheeses like parmesan and mozzarella allow producers to apply strategic markups, especially when targeting higher-income segments (e.g., Class AB consumers), which boosts profitability even in competitive markets. The deterministic and probabilistic analyses confirm this, revealing that markups on these cheeses—particularly parmesan—significantly influence financial viability, offering a buffer against fluctuating input costs and enabling stronger positioning in niche, premium markets. By focusing on these differentiated products, producers reduce dependency on unstable raw milk prices and gain greater control over pricing strategies, thus enhancing resilience and long-term sustainability in the dairy sector.

Cheese is a deteriorating product with strict shelf-life limitations. Under refrigeration, it must be consumed before the expiry date, which makes post-expiration use unfeasible. This characteristic affects all stages of the logistics chain, especially storage, inventory turnover, and transportation. Quick delivery and cold-chain management are essential to avoid financial losses and ensure food safety [26]. Recent adaptive optimization methods for perishables highlight dynamic planning needs under demand uncertainty [34]. The perishability of cheese requires synchronized logistics and short lead times. In regions with fragmented infrastructure, the risk of loss increases due to temperature variations during transport. Pol et al. [35] applied Monte Carlo Simulation to optimize route selection, reducing losses due to traffic variability. Ferrari et al. [25] showed that stochastic models, such as Monte Carlo Simulation, help evaluate quality loss in dairy processing and improve operational decisions. In this sense, anticipating variability is a strategic way to mitigate deterioration in distribution.

From an economic perspective, deterioration affects cost structures and planning. Higher perishability leads to increased operating costs, including refrigeration and transport. Jang et al. [15] emphasized that simulations considering degradation dynamics offer more realistic cost–benefit analyses. This aligns with our results, where the sensitivity analysis showed operational costs as a key factor in profitability. In probabilistic terms, the presence of perishability reinforces the need for robust models to simulate different scenarios. As shown in our study, changes in logistics costs and consumer behavior directly influence the viability of cheese distribution. The simulation captured how deterioration, when poorly managed, can undermine profitability through reduced product life and increased waste [36].

Furthermore, Monte Carlo Simulation helps prioritize actions that reduce risk and optimize performance under perishability constraints. Ferrari et al. [25] and Yang et al. [10] support this approach by applying simulation to improve planning under uncertainty. In our context, this method identified how variations in market share, production cost, and demand levels affect profitability when deterioration is present. Therefore, perishability must be included in early-stage feasibility assessments. It is not just a storage issue—it defines transport frequency, demand precision, and environmental impact. Proper planning for cold-chain logistics and shelf-life management is crucial to reduce losses and enhance sustainability in cheese production. Optimization frameworks for cold chain transport [37] provide systematic insights into preserving quality and reducing emissions.

Comparative Analysis and Transportation Considerations for Deteriorating Products

Cheese is a deteriorating product with a defined shelf life, even under refrigeration. Once the expiration date is reached, consumer behavior trends indicate that the product is no longer used, regardless of visual or sensory acceptability. This characteristic imposes strict requirements on transportation, including the need for short lead times, temperature-controlled environments, and synchronization between production and distribution to reduce inventory turnover time and avoid losses. These logistics constraints become critical in regional markets with varying infrastructure quality and limited distribution windows, particularly for products like mozzarella and parmesan that demand freshness and safety [25,26,35,37].

In this context, our study indirectly models deterioration through stochastic variations in key variables that affect demand and logistics, such as market share, operational costs, and logistics expenses. This approach aligns with the cold chain optimization models explored in Pérez-Lechuga et al. [37] and Pol et al. [35], where perishability is integrated into transportation planning using simulation techniques. Similarly, Ferrari et al. [25] and Griep-Moyer et al. [26] demonstrated how Monte Carlo Simulation enables better control over shelf life and quality loss in dairy production and logistics environments.

While our model does not explicitly include spoilage rates or degradation curves, the effect of perishability is embedded in the cost structure and in the urgency of distribution cycles, which are modeled probabilistically. This is in line with studies such as Avishan et al. [34], which highlight the role of adaptive optimization in managing perishable food under uncertainty, and Yang et al. [10], who advocate for Monte Carlo-based modeling in complex systems to simulate the impact of stochastic inputs.

From a methodological perspective, our approach also differs from models that incorporate advanced resource planning systems, such as those based on performance metrics and optimization tools (e.g., De Melo et al. [19,20,23]), focusing instead on the economic feasibility of dairy ventures through cost and return simulation. Our model bridges deterministic and probabilistic logic, offering a flexible framework applicable to perishables like cheese.

Moreover, perishability directly affects financial viability, as shown in our sensitivity analysis: logistics costs and demand-side uncertainties such as cheese consumption per capita and market share are major profitability drivers. When logistics conditions are unfavorable, deterioration accelerates financial losses, justifying the inclusion of perishability-sensitive parameters in early feasibility assessments. The findings thus support strategic investments in cold chain logistics and frequent delivery scheduling to ensure quality and minimize waste throughout the dairy supply chain [10,15,25,26,34,35,36,37].

5. Conclusions

The dairy market has expanded in Brazil. However, the difficulty in acquiring better sales prices has led some producers to opt for adding value to their products. In this context, the study dealt with an economic feasibility analysis in deterministic and probabilistic plans for the implementation of a parmesan- and mozzarella-producing dairy center in Lavras, MG. This study advanced the perspective of enhancing investor decision-making by using Monte Carlo simulation.

This study has implications such as supporting investor decision-making by generating information that allows events to be anticipated. This includes a sensitivity analysis of the costs involved in the project and a comparison with expected income. The probabilistic results inform the investor about the financial risks of the project and assist in the development of its long-term strategic planning. The creation of jobs increased local income, and regional economic development are also made possible with the implementation of this study.

This study identified a positive correlation between the profitability rate and the random variables market share, the percentage of consumers of Class AB cheese, the parmesan cheese markup, and per capita cheese consumption. However, the random variable operating costs showed a negative correlation. This indicates that the investor will have to properly manage his workforce to increase his margin.

This study presents some limitations that should be considered. The analysis is based on regional data from Lavras, MG, which may not reflect the realities of other regions with different consumer profiles, infrastructure, or market dynamics. Additionally, the assumptions regarding costs, demand growth, and operational parameters may vary over time, influencing the accuracy of the results. Although the Monte Carlo Simulation accounted for uncertainties, the model does not capture extreme events such as economic crises or abrupt supply chain disruptions.

As a future extension, the model can be adapted to other regions by adjusting input variables such as population growth, consumption patterns, and transport costs. Further studies may also integrate environmental indicators into the simulation, assessing the carbon footprint of different logistic strategies. Another potential development involves incorporating multi-product portfolios and comparing the feasibility of different dairy products beyond mozzarella and parmesan, enhancing decision-making in diversified production contexts.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/logistics9040169/s1, Table S1: Total costs for the first two years of the project lifecycle.

Author Contributions

Conceptualization, G.A.d.M. and L.G.d.C.J.; Methodology, G.A.d.M. and J.W.d.P.; Software, G.A.d.M.; Validation, G.A.d.M., M.G.M.P. and L.G.d.C.J.; Formal analysis, G.A.d.M.; Investigation, G.A.d.M.; Resources, G.A.d.M.; Data curation, G.A.d.M.; Writing—original draft preparation, G.A.d.M.; Writing—review and editing, G.A.d.M., T.H.N., M.G.M.P. and A.L.M.S.; Visualization, G.A.d.M.; Supervision, G.A.d.M. and T.H.N.; Project ad-ministration, G.A.d.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Research Support Foundation of the State of Minas Gerais (FAPEMIG) and the APC was funded by University of Brasilia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

The authors would like to thank the Federal University of Lavras (UFLA), the University of Brasilia (UnB), for the support in the development of this research. We are also thankful to the Research Support Foundation of the State of Minas Gerais (FAPEMIG) and the Federal District Research Support Foundation (FAPDF) for research funding.

Conflicts of Interest

The authors have no conflicts of interest.

References

- Sociedade Nacional da Agricultura—SNA. SNA: Valor Bruto da Produção Agropecuária Deve Atingir BRL 1.36 Trilhão em 2023. 2023. Available online: https://sna.agr.br/cna-valor-bruto-da-producao-agropecuaria-deve-atingir-r-1-36-trilhao-em-2023/ (accessed on 10 October 2023).

- Ministério da Agricultura e Pecuária—MAPA. Projeções do Agronegócio. 2023. Available online: https://www.gov.br/agricultura/pt-br/assuntos/politica-agricola/todas-publicacoes-de-politica-agricola/projecoes-do-agronegocio/projecoes-do-agronegocio-2022-2023-a-2032-2033.pdf (accessed on 10 October 2023).

- Organização das Nações Unidas Para a Alimentação e a Agricultura—FAO. COP 26: Com Apoio da FAO, Mapa Lança Coletânea Sobre Gases de Efeito Estufa e Adaptação Agropecuária à Mudança do Clima. 2023. Available online: https://www.fao.org/brasil/noticias/detail-events/pt/c/1454747/ (accessed on 10 October 2023).

- Associação Brasileira das Indústrias de Queijo—ABIQ. Notícias. 2023. Available online: https://www.abiq.com.br/ (accessed on 10 October 2023).

- Copeland, T.E.; Weston, J.F.; Shastri, K. Financial Theory and Corporate Policy; Pearson Addison Wesley: Boston, MA, USA, 2005; Volume 4. [Google Scholar]

- Yao, X.; Yuan, X.; Yu, S.; Lei, M. Economic feasibility analysis of carbon capture technology in steelworks based on system dynamics. J. Clean. Prod. 2021, 322, 129046. [Google Scholar] [CrossRef]

- Brealey, R.A.; Myers, S.C.; Allen, F. Principles of Corporate Finance; McGraw-Hill: New York, NY, USA, 2020. [Google Scholar]

- Monteiro, L.S.; Costa, K.A.; Christo, E.D.S.; Freitas, W.K. Economic feasibility analysis of small hydro power projects. Int. J. Environ. Sci. Technol. 2021, 18, 1653–1664. [Google Scholar] [CrossRef]

- Shahid, Z.; Santarelli, M.; Marocco, P.; Ferrero, D.; Zahid, U. Techno-economic feasibility analysis of renewable-fed Power-to-Power (P2P) systems for small French islands. Energy Convers. Manag. 2022, 255, 115368. [Google Scholar] [CrossRef]

- Yang, J.; Wang, M.; Wu, L.; Liu, Y.; Qiu, S.; Xu, P. A novel Monte Carlo simulation on gas flow in fractal shale reservoir. Energy 2021, 236, 121513. [Google Scholar] [CrossRef]

- Pirsaheb, M.; Hadei, M.; Sharafi, K. Human health risk assessment by Monte Carlo simulation method for heavy metals of commonly consumed cereals in Iran: Uncertainty and sensitivity analysis. J. Food Compos. Anal. 2021, 96, 103697. [Google Scholar] [CrossRef]

- Lozanovski, B.; Downing, D.; Tran, P.; Shidid, D.; Qian, M.; Choong, P.; Brandt, M.; Leary, M. A Monte Carlo simulation-based approach to realistic modelling of additively manufactured lattice structures. Addit. Manuf. 2020, 32, 101092. [Google Scholar] [CrossRef]

- Lin, S.S.; Shen, S.L.; Zhou, A.; Xu, Y.S. Approach based on TOPSIS and Monte Carlo simulation methods to evaluate lake eutrophication levels. Water Res. 2020, 187, 116437. [Google Scholar] [CrossRef]

- Wealer, B.; Bauer, S.; Hirschhausen, C.V.; Kemfert, C.; Göke, L. Investing into third generation nuclear power plants: Review of recent trends and analysis of future investments using Monte Carlo simulation. Renew. Sustain. Energy Rev. 2021, 143, 110836. [Google Scholar] [CrossRef]

- Jang, D.; Kim, J.; Kim, D.; Han, W.B.; Kang, S. Techno-economic analysis and Monte Carlo simulation of green hydrogen production technology through various water electrolysis technologies. Energy Convers. Manag. 2022, 258, 115499. [Google Scholar] [CrossRef]

- Instituto Brasileiro de Geografia e Estatística—IBGE. Projeções da População do Brasil e das Unidades da Federação por Sexo e Idade: 2000–2060; IBGE: Rio de Janeiro, Brazil, 2023. Available online: https://www.ibge.gov.br/estatisticas/sociais/populacao/9109-projecao-da-populacao.html (accessed on 10 October 2023).

- Pandey, P.; Pandey, M.M. Research Methodology: Tools and Techniques; Bridge Center: Buzau, Romania, 2021. [Google Scholar]

- de Melo, G.A.; Peixoto, M.G.M.; Barbosa, S.B.; Alves, A.J.S.; Souza, A.C.L.; Mendonça, M.C.A.; de Castro Júnior, L.G.; Santos, P.G.D.; Serrano, A.L.M. Generating insights to improve the performance of communities supported agriculture: An analysis focused on female participation, governance structure and volume of food distributed. Environ. Dev. Sustain. 2024, 1–19. [Google Scholar] [CrossRef]

- de Melo, G.A.; Peixoto, M.G.M.; Barbosa, S.B.; Mendonça, M.C.A.; Nogueira, T.H.; de Andrade Guerra, J.B.S.O.; de Castro Júnior, L.G.; Serrano, A.L.M.; Ferreira, L.O.G. Fuel flow logistics: An empirical analysis of performance in a network of gas stations using principal component analysis and data envelopment analysis. J. Adv. Manag. Res. 2024, 21, 605–626. [Google Scholar] [CrossRef]

- de Melo, G.A.; Peixoto, M.G.M.; Mendonça, M.C.A.; Musetti, M.A.; Serrano, A.L.M.; Ferreira, L.O.G. Performance measurement of Brazilian federal university hospitals: An overview of the public health care services through principal component analysis. J. Health Organ. Manag. 2024, 38, 351–371. [Google Scholar] [CrossRef]

- Peixoto, M.G.M.; Mendonça, M.C.A.; Castro, C.C.; de Castro, L.G.J.; de Melo, G.A.; Batalha, M.O. Evaluation of the operational efficiency of southeast intermodal terminals in the grain logistics chain using data envelopment analysis. Manag. Decis. Econ. 2022, 43, 3044–3058. [Google Scholar] [CrossRef]

- Alves de Melo, G.; Peixoto, M.G.M.; Barbosa, S.B.; de Mendonça, M.C. The analysis of macro processes of the cashier service in a supermarket organization: A case study of quality management and simulation. Dyna 2022, 89, 19–26. [Google Scholar] [CrossRef]

- de Melo, G.A.; Paes, T.F.A.; da Costa, J.S.; Silva, C.S.J.E.; de Castro Júnior, L.G.; Gomide, L.R.; Peixoto, M.G.M.; Guarnieri, P.; Barbosa, S.B.; Serrano, A.L.M.; et al. Optimizing forest sector performance based on life cycle cost analysis and real options. Sci. Total Environ. 2025, 988, 179675. [Google Scholar] [CrossRef]

- Zhu, X.; Wang, Y.; Guo, J.; Zhang, H.; Liu, B. Cold chain optimisation models: A systematic literature review. Cold Reg. Sci. Technol. 2024, 215, 105689. [Google Scholar] [CrossRef]

- Ferrari, A.; Gutiérrez, S.; Sin, G. Markov Chain Monte Carlo simulation-based optimization for a production scale milk drying process. Comput. Aided Chem. Eng. 2023, 52, 291–296. [Google Scholar]

- Griep-Moyer, E.R.; Trmčić, A.; Qian, C.; Moraru, C.I. Monte Carlo simulation model predicts bactofugation can extend shelf-life of pasteurized fluid milk. J. Dairy Sci. 2022, 105, 9439–9449. [Google Scholar] [CrossRef]

- Kirillova, O.V.; Amirova, E.F.; Kuznetsov, M.G.; Valeeva, G.A.; Zakharova, G.P. Innovative directions of agricultural development aimed at ensuring food security in Russia. BIO Web Conf. 2020, 17, 00068. [Google Scholar] [CrossRef][Green Version]

- Barros, M.V.; Salvador, R.; Maciel, A.M.; Ferreira, M.B.; de Paula, V.R.; de Francisco, A.C.; Rocha, C.H.B.; Piekarski, C.M. An analysis of Brazilian raw cow milk production systems and environmental product declarations of whole milk. J. Clean. Prod. 2022, 367, 133067. [Google Scholar] [CrossRef]

- Kovács, K.; Szűcs, I. Exploring efficiency reserves in Hungarian milk production. Stud. Agric. Econ. 2020, 122, 37–43. [Google Scholar] [CrossRef]

- Oğuz, C.; Yener, A. The use of energy in milk production: A case study from Konya province of Turkey. Energy 2019, 183, 142–148. [Google Scholar] [CrossRef]

- Pedolin, D.; Six, J.; Nemecek, T. Assessing between and within product group variance of environmental efficiency of Swiss agriculture using life cycle assessment and data envelopment analysis. Agronomy 2021, 11, 1862. [Google Scholar] [CrossRef]

- Siafakas, S.; Tsiplakou, E.; Kotsarinis, M.; Tsiboukas, K.; Zervas, G. Identification of efficient dairy farms in Greece based on home grown feedstuffs using the Data Envelopment Analysis method. Livest. Sci. 2019, 222, 14–20. [Google Scholar] [CrossRef]

- Soteriades, A.D.; Foskolos, A.; Styles, D.; Gibbons, J.M. Maintaining production while reducing local and global environmental emissions in dairy farming. J. Environ. Manag. 2020, 272, 111054. [Google Scholar] [CrossRef]

- Avishan, F.; Yanıkoğlu, İ.; Soysal, M. Adaptive optimization approach for production and distribution planning of perishable food products under demand uncertainty. Ann. Oper. Res. 2025, 1–48. [Google Scholar] [CrossRef]

- Pol, S.M.; Rayte, A.; Patil, B.T.; Joshi, K.N. Analysis and optimization of transportation logistics for supply chain management of perishable goods using Monte Carlo Simulation. E3S Web Conf. 2024, 559, 04004. [Google Scholar] [CrossRef]

- Elsharkawy, W.B. Monte Carlo simulation for quantitative determination of fat content in dairy products. J. Food Meas. Charact. 2021, 15, 976–982. [Google Scholar] [CrossRef]

- Pérez-Lechuga, G.; Martínez-Sánchez, J.F.; Venegas-Martínez, F.; Madrid-Fernández, K.N. A routing model for the distribution of perishable food in a green cold chain. Mathematics 2024, 12, 332. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).