Abstract

This work addresses crucial questions about the robustness of the PSDization process for applications in insurance. PSDization refers to the process that forces a matrix to become positive semidefinite. For companies using copulas to aggregate risks in their internal model, PSDization occurs when working with correlation matrices to compute the Solvency Capital Requirement (SCR). We examine how classical operational choices concerning the modelling of risk dependence impacts the SCR during PSDization. These operations refer to the permutations of risks (or business lines) in the correlation matrix, the addition of a new risk, and the introduction of confidence weights given to the correlation coefficients. The use of genetic algorithms shows that theoretically neutral transformations of the correlation matrix can surprisingly lead to significant sensitivities of the SCR (up to 6%). This highlights the need for a very strong internal control around the PSDization step.

1. Introduction

When measuring the insurer’s exposure to numerous risks, and especially to assess their own funds requirement (or Solvency Capital Requirement in insurance, denoted further by SCR, and representing the 99.5th percentile of the aggregated loss distribution), one of the most sensitive steps is the modelling of the dependence between those risks.

This is of course a major question, which, as such, has recently attracted attention from the scientific community. See, for instance, the works by Georgescu et al. (2017), Cifuentes and Charlin (2016), Bernard et al. (2014), Clemente and Savelli (2013), Cheung and Vanduffel (2013), Clemente and Savelli (2011), Devineau and Loisel (2009), Filipovic (2009), Sandström (2007), Denuit et al. (1999), and references therein. This aggregation step allows for taking into account mitigation, or the potentiality of those individual risks occurring simultaneously. According to the European Directive Solvency II (EIOPA (2009)), there are two main approaches to compute aggregated risk measures considering the dependence structure between risks. In the first case, this aggregation is performed through a variance–covariance approach via the Standard Formula, below

where is the 99.5th percentile of the random loss associated to risk i, and is the linear correlation such that . This technique was shown to be valid for elliptical loss distributions, which is not the case in general1.

Another possibility for insurers is to calculate the SCR thanks to their internal model, once the latter has been approved by supervisors. In this case, insurers usually work with copulas for the aggregation of risk factors in order to obtain the full distribution of losses. Copulas can indeed model most general situations of dependence, as shown by the well known Sklar’s theorem. In practice, internal models require the implementation of these successive steps:

- calibration of marginal distributions for each risk factor (e.g., equity, interest rates);

- modelling the dependence between risk factors through a copula;

- aggregation of risks, leading to the entire distribution of the aggregate loss (sometimes an intermediate step links the risk factors to their associated loss thanks to proxy functions, see Section 5.1). Taking the 99.5th percentile of this distribution allows the evaluation of the SCR.

The aggregation thus requires a correlation matrix as an input, whatever the technique (at least when copulas are Gaussian or Student, which is the case for several insurance companies using an internal model). The dimensions of this matrix can be huge in practice (e.g., 1000 × 1000, i.e., with around 500,000 different values), depending on the modular structure chosen (for instance, the dimensions of correlation matrices remain low in the Standard Formula, see Section 2.1). The matrix includes numerous correlation coefficients that can result from empirical statistical measures, expert judgments or automatic formulas. As a matter of fact, it is thus rarely2 positive semidefinite (PSD): this is what is commonly called a pseudo-correlation matrix. Unfortunately, this matrix cannot be used directly to aggregate risks. Indeed, both variance–covariance and copula aggregation techniques require the correlation matrix to be PSD (that is with all eigenvalues ) for the following main reasons:

- Coherence: it is a well-known property that correlation matrices are PSD. Negative eigenvalues indicate that a logical error was made while establishing the coefficients of the matrix. For instance, consider the case of a 3 × 3 matrix: if the coefficients indicate a strong positive correlation between the first and second risk factors, a strong positive correlation between the second and third risk factors, but a strong negative correlation between the first and third risk factors, this will generate a negative eigenvalue corresponding to the coherence mistake made.

- Prudence: taking more risk could decrease the insurer’s SCR if there exists one negative eigenvalue associated to an eigenvector with positive coefficients. For instance, consider the loss vector (100 M€, 10 M€, 40 M€) and the correlation matrixUsing the variance–covariance approach, the riskiest situation in terms of losses (106.20 M€; 16.20 M€; 44.81 M€) leads to a lower SCR (70.48 M€ against 74.16 M€).

- Ability to perform simulations: in the copula approach, the input correlation matrix has to be PSD to apply Choleski decomposition. This is necessary for Gaussian or Student vectors, which are the most common cases for such tasks in practice.

Using PSD correlation matrices is therefore crucial, which explains why it is explicitly required by the Delegated Rules of the Solvency II regulation (EIOPA (2015), see Appendix XVIII). Accordingly, insurers apply algorithms on their pseudo-correlation matrix in order to make it become PSD: this is the so-called PSDization process. Most common algorithms can be separated into three categories: Alternating Projections, Newton and Hypersphere algorithms. One focuses in this paper on the Rebonato–Jäckel algorithm, which belongs to the latter family (see Section 3 for further details about the motivation of this choice).

Considering this framework, the impact on the SCR of standard operations on the correlation matrix should be verified. Our interest lies in studying operational choices such as weighting the correlation coefficients during PSDization (to reflect the confidence experts may have on these coefficients), switching some columns of the matrix (i.e., reordering the risks before aggregation), or adding one dimension (which can correspond to an additional business line with low materiality on the overall SCR). To the authors’ knowledge, the impact of such operations on the PSDization step has not been studied formally in the literature before. Numerical examples support the main idea of this work: transformations of the matrix, with low or null theoretical impact on the SCR, sometimes lead to unexpected changes of this global SCR. For large insurance companies, this is all the more important since a 1% change of SCR can cost millions of euros in terms of capital. This would strongly affect the Return On Equity index, an essential profitability indicator for investors.

The publication is organized as follows: Section 2 introduces the pseudo-correlation matrices to be considered hereafter. Section 3 describes most common PSD algorithms, and motivates our choice. With the help of some significant examples, Section 4 illustrates to which extent PSDization leads to modifying the initial pseudo-correlation coefficients. The cases of higher risk matrix dimensions, weighted correlation coefficients and risk permutations are studied. Finally, real-life sensitivities are assessed in Section 5 thanks to the use of genetic algorithms and simulations, and provide some interesting results concerning the aforementioned operations and their impact on the global SCR of the company.

2. Pseudo-Correlation Matrices under Study

2.1. Correlation Matrices of the Standard Formula

Before studying the algorithms which enable a matrix to be PSD when using an internal model, one must check that the matrices defined by the standard formula are already PSD. As a reminder, the Standard Formula given by the regulation states that risks should be aggregated in a bottom-up approach, with a tree-based structure. This means that individual SCRs first have to be assessed, each one corresponding to a module (Life, Non Life, and so on). Solvency II texts then define several correlation matrices for each level of aggregation. Table 1 shows that the eigenvalues of these matrices are all positive, meaning that they are PSD. Except for the global matrix that can be found in the Directive, all matrices are described in the Delegated Acts (see references in the first column of Table 1).

Table 1.

Eigenvalues of correlation matrices in Solvency II regulation (the matrices are available in EIOPA (2015), with further details concerning the corresponding article or appendix in the table).

2.2. Notations and Correlation Matrices under Study

Throughout the paper, indicates the initial pseudo-correlation matrix to be PSDized, where x refers to the matrix dimension and y is the number of the example. When using weights to apply to the correlation coefficients during PSDization, a weighting matrix is defined. Then, we denote by the PSDized matrix obtained from using the Alternated Projections algorithm; the PSDized matrix with the Newton algorithm; the PSDized matrix with the Hypersphere algorithm and the PSDized matrix with the Hypersphere algorithm using a weighting matrix H. The use of a weighting matrix enables the adjustment in terms of importance of one or several correlation coefficients with respect to other coefficients when making the correlation matrix PSD. This is very useful for insurance companies, since some coefficients can have a bigger impact on the final capital requirement, and the aim would be that PSDization modifies these coefficients as little as possible. It must be noted that some algorithms (Newton, Hypersphere) can be extended to use constraints on the correlation coefficients, such as . However, these extensions are left for future research for two main reasons: very few practitioners use them, and they cause non-trivial theoretical and practical issues (there could be no solution, i.e., PSDized matrix, according to the constrained set).

Our examples are built with the same simple idea: assess the impact of PSDization combined to classical operational choices on various situations to reflect the real world. We thus consider correlation matrices of various dimensions, with positive and negative eigenvalues, and with a high heterogeneity regarding their individual correlation coefficients (positive, negative, far or close to extreme values −1 or +1). The seven examples studied all along the paper are listed in Appendix A, including the 10-dimension correlation matrix that has been created manually. This example was designed with the aim of having a certain coherence with the reality of risk aggregation in insurance. The first risk factor, say , refers to the risk that interest rates decrease ( represents the risk of interest rates increasing). corresponds to unexpected high expenses, relates to the incorrect assessment of the level of expenses, and is the risk of spreads increasing. The risk that market stocks drop is given by , accounts for the longevity risk, is the mass lapse risk, corresponds to the underwriting risk (premium and reserve risk as in the standard formula, see (CEIOPS 2010, p. 118), which could also be modelled by two different risk factors in internal models) in the Health business line; and is the underwriting risk in short-term disability.

Correlation coefficients were determined either by statistical measures built on historical data on financial markets, or by expert opinions. To read the matrix appropriately, the linear correlation between and is the coefficient (or ), located on line 1 column 2 (of course, the coefficient equals in this case). Finally, our pseudo-correlation matrix looks like

Table 2 sums up the eigenvalues of our seven pseudo-correlation matrices: note that none of the considered matrices is PSD. However, some of them are not very far from having this property.

Table 2.

Eigenvalues in our examples, before PSDization.

3. Selection of an Adequate Algorithm for PSDization

PSDization algorithms aim to build the nearest PSD matrix to an initial non-PSD matrix, where the notion of “nearest” is detailed in the sequel. This section briefly presents the main families of PSDization algorithms, and justifies our choice to work with the Hypersphere (or Rebonato-Jäckel) algorithm. Interesting recent works on this topic and more details can be found in (Cutajar et al. 2017).

3.1. Families of Algorithms

3.1.1. Alternating Projections

The Alternating Projections (AP) algorithm, introduced by Higham (2002), leads to the nearest correlation matrix under the W-norm, defined by

where . This norm is also called the Frobenius norm, and is a square matrix with positive coefficients.

The AP algorithm corresponds to a linear optimization, projecting alternately the matrix obtained at each step on two convex closed subsets of the matrix space . It enables in particular to show the uniqueness of the solution under this type of norm.

However, the W-norm does not in general correspond to the norm insurers may be interested in. The H-norm, defined by , where offers more flexibility to weight coefficients according to their materiality on the SCR, or according to the confidence level one has in the coefficients. The W-norm and the H-norm only coincide when W is diagonal () and H is a rank-1 matrix (). Thus, the AP algorithm lacks flexibility in that it does not enable the use of another general matrix to weight freely each individual correlation coefficient.

3.1.2. Newton Algorithm

Newton algorithms with such applications were introduced by Qi and Sun (2006). They were initially designed for the traditional 2-norm, and are therefore computationally quicker than the Alternating Projections. However, their extension to the most general case (i.e., H-norm) requires optimization techniques such as the Uzawa method. Unfortunately, the Uzawa method implies optimization within optimization, and makes the overall algorithm much more time-consuming, as well as much more complex to interpret.

3.1.3. Rebonato–Jäckel Algorithm

Belonging to the family of Hypersphere algorithms, the Rebonato–Jäckel method was initially introduced in Rebonato and Jäckel (1999). Since then, it has been extensively studied in literature, and many publications have proved its efficiency in reaching a robust solution. Its wide success is due to the following theorem (see the proof in (Jäckel 2002)): any correlation matrix can be written as

where the coefficients of the matrix can be written as:

In addition, the angular vector is unique if:

The Hypersphere algorithm thus consists of looking for the solution matrix under the abovementioned form. It offers several advantages; in particular, it is simple to use, easily understandable, and is the most widely used algorithm in the bank and insurance sectors. Moreover, it allows the use of the H-norm and converges fairly quickly. However, its main weakness lies in that it sometimes converges to a local minimum, and therefore does not guarantee that the output is the nearest PSDized correlation matrix. This drawback has to be kept in mind, since it may have other side effects. Let us mention for instance the fact that the order in which risk factors are considered in the correlation matrix matters, although it should not (see Section 4 and Section 5).

3.2. Choice of the Algorithm for the Rest of the Paper

To check the robustness when performing PSDization with these algorithms, one first compares the distances between the initial pseudo-correlation matrix and its PSDized version in the three different cases. Of course, the lower this distance is, the better the algorithm. We use the Frobenius-norm (see Section 3.1.1), since it is common to all algorithms.

Results about PSDized versions for each example are detailed in Appendix B: note that the PSDized correlation matrices are the same when the dimension remains low, whatever the algorithm considered. More precisely, the three algorithms give very similar results with PSDized versions of , , , , , and (same coefficients, up to ). On the contrary, the PSDized versions of are slightly different depending on the algorithm used. As an illustration, we get the following distances:

In this example, it seems that the first two algorithms give better results. The Rebonato-Jäckel algorithm is likely to have selected a locally-optimal solution. Despite not being the best technique in this particular case, we will use the latter for three main reasons in coming analyses: (i) distances do not seem to be significantly different from one method to another; (ii) the Rebonato-Jäckel algorithm enables the easy introduction of confidence weights to the individual correlation coefficients in practice (through the H-norm), which is a key point; and (iii) the Rebonato-Jäckel algorithm is fast and easy to interpret. Indeed, experts know that some initial coefficient values can be particularly reliable, or they can anticipate that some of them will have a significant impact on the global SCR.

3.3. One PSDization Example: The 10-Dimensional Matrix

Trying to replicate the conditions in which insurers use PSDization algorithms, it is clearly more appropriate to consider the H-norm. Indeed, it makes it possible to integrate confidence weights given to correlation coefficients during the PSDization process. PSDization of using the Rebonato-Jackël algorithm and the weighting matrix (see Appendix A) leads to a new correlation matrix (disclosed in Appendix C), with the eigenvalues below

The three last values equal , which is the lower bound defined in the algorithm. This means that the three negative eigenvalues of (see Table 2) have been replaced by the lowest possible value. One then measures the standardized distance between the initial pseudo-correlation matrix and its PSDized version :

It thus seems that PSDization globally had a great impact on the pseudo-correlation matrix. Some coefficients were strongly modified, see for instance (fictional correlation between equity and spreads). Indeed, equals 0.83 at the beginning in , but is close to 0.54 after PSDization in . Such an example highlights the need for insurers to check all the modifications, in order to gain control and monitor their internal model.

4. Sensitivity of the Matrices to PSDization

In this section, we would like to illustrate how the correlation matrix can be modified when performing PSDization by the Rebonato-Jackël algorithm, with toy examples. We specifically investigate how the coefficients of (Appendix A) change during the sole PSDization, and also look at the evolution of individual correlation coefficients when considering other classical operations for practitioners: permutations of some coefficients before PSDization, change of matrix dimension (before PSDization), or weights given to the correlation coefficients during PSDization. For this purpose, we consider the following initial weighting matrix

These operations mainly correspond to the decisions that actuaries have to make when developing internal models for risk aggregation. Note that the impact on the capital requirement can be substantially different from the impact in terms of matrix norm, according to the respective importance of the loss marginals. This impact will be studied in Section 5.

4.1. Impact of Permutations

To study how permutations of risks defining the correlation matrix impact the standard PSDization process, we first consider the permutation such as

As a result, Table 3 shows the obtained modifications of the correlation coefficients:

Table 3.

Modification of initial correlation coefficients due to permutations of risks.

Examining the coefficients, we notice that they are significantly modified: first by the PSDization process itself, but also by the permutation of risks. This last result is surprising, since there should be no theoretical impact with this operation. However, because our algorithm presents local minima issues, the choice of the order of risk factors (arbitrarily made by the insurer) matters when performing PSDization.

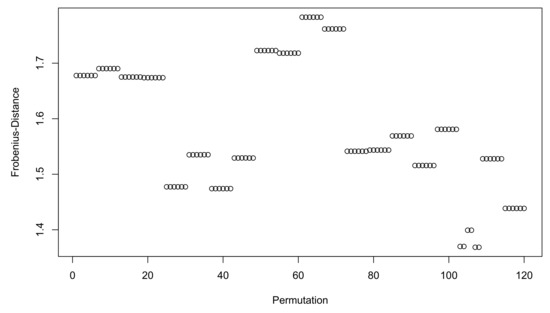

To figure out more comprehensively the impact of permutations, it would be best to look at the exhaustive list of permutations for a given pseudo-correlation matrix. Remember that a D-dimensional matrix admits D! permutations, and let us consider the example . Figure 1 shows the Frobenius distance to the initial matrix for the 5! permutations of , knowing that this distance between and initially equals 1.68 without any permutation. The Frobenius norm is clearly not the norm that the algorithm optimizes, but it simply illustrates to which extent the solution matrix is modified. Two remarks can be made here. First, the distances follow a block pattern caused by the order of the permutations. Second, the permutations do not always lead to an increase in the distance to the initial pseudo-correlation matrix.

Figure 1.

Impact of permutations on the Frobenius norm, in the case of and .

4.2. Adding a Risk: Increase the Matrix Dimension

Another arbitrary element chosen by the actuaries of the company is the number of risk factors to be aggregated. In some cases, it may be necessary to model many risk factors, according to the use of the internal model that is made by the business units (need to model many lines of business when modelling the reserving loss factor for instance). These choices have to be made for risk factors that are not material at Group level, even if they can be important for the concerned subsidiaries. Nevertheless, these choices will impact the final SCR through the modification brought to the overall correlation matrix during PSDization. Still based on the same example, let us consider the following case:

As can be noticed, the correlation is low between the added and the other risks.

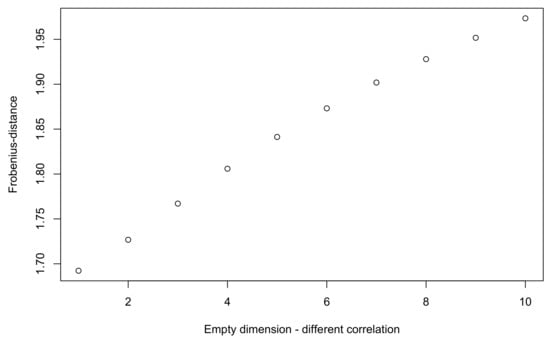

Direct PSDization obviously gives the same results, whereas correlation coefficients are slightly modified after PSDization when introducing the new risk (see Table 4). Changes to these coefficients are difficult to anticipate, but it seems that the impact is lower in this case than with permutations. A natural question would be to understand whether the value of the correlation coefficient that was added is key to explaining the modifications obtained in the PSDized correlation matrix. Figure 2 shows this impact on the Frobenius norm, with a new risk with correlation coefficients that vary from 0.1 to 1. Results are intuitive: the higher the coefficients added, the wider the Frobenius norm. PSDization is indeed a whole process that takes into account every coefficient, including the one that was added.

Table 4.

Modification of initial correlation coefficients due to the addition of a new risk.

Figure 2.

Impact of adding a new dimension on the Frobenius norm (through modified PSDized coefficients), with various correlation coefficients corresponding to the new risk.

4.3. Impact of Confidence Weights

Finally, the choice of the weights associated to the terms of the correlation matrix, which somewhat represents the confidence level given by experts to the individual correlation coefficients, can also have a significant impact on the PSDized matrix. To illustrate this, still keeping in mind the example with the initial weights listed in , we consider the new following weights:

The PSDized matrix is now given in Table 5:

Table 5.

Modification of initial correlation coefficients due to the introduction of weights.

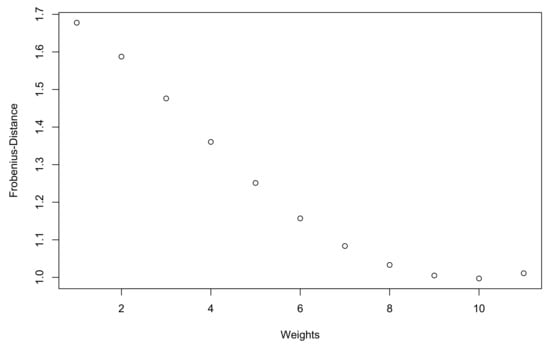

Clearly, correlation coefficients significantly vary. It illustrates that, as expected, the lower the weight, the further the modifications are from the initial coefficient. An increased weight on some correlation coefficients clearly leads to an increased importance in the PSDization process, and thus less modification for them (so as to minimize the Frobenius norm). To generalize and better understand to which extent the weights could impact the correlation coefficients after PSDization, Figure 3 shows the Frobenius norm between the solution and the initial matrix , with weights varying from to a limit weighting matrix given by

Figure 3.

Impact of weights on the Frobenius norm, in the case of the example .

This limit weighting matrix is used for illustration purposes only. It corresponds to increasing linearly by the lowest weights of the matrix , while decreasing the highest weights by the same factor. Figure 3 shows that the Frobenius norm decreases as the weighting matrix is distorted towards the limit , and a closer analysis reveals that this phenomenon is mainly due to the correlation coefficients , , and of (and their transposed coefficients), which exhibit lesser modifications than with the initial weighting matrix since their weights are significantly increased: from 0.1 to 0.5 and respectively from 0.2 to 0.6.

4.4. Summary and Comments on the Other Two Algorithms

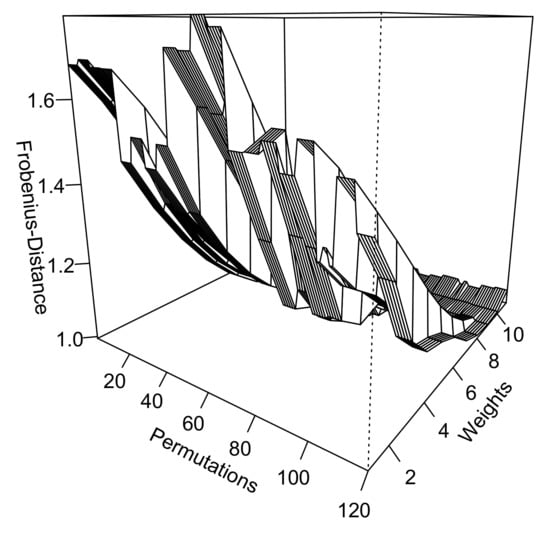

To put it in a nutshell, Figure 4 shows the impact of permutations and weights (the two most prominent operations) on the Frobenius norm, in the conditions stated above. It shows that the impact on the norm is more important when weights vary than when the order of risk factors is changed.

Figure 4.

3D plot: impact of permutations and weights on the Frobenius norm (with and ).

In addition, it must be noted that low dimensions are used in this publication so as to keep computation time at an acceptable level, but when dimensions increase, the initial matrix can be farther from the PSD target. Indeed, Gerschgorin’s circle theorem states that , Spec(G), such as In particular, if G is a pseudo-correlation matrix of dimension , its eigenvalues belong to the interval . To illustrate this practically, a matrix of size was randomly generated (defined as the symmetric part of an initial matrix with 10,000 valuesbetween −1 and 1, and diagonal coefficients forced to 1). The matrix thus obtained has 43 negative eigenvalues, where the lowest one equals −6.74. In this case, must be significantly transformed to become PSD: for all three algorithms, the most modified coefficient changes from 0.96 to 0.10. Nevertheless, the AP and the Newton algorithms still give overall better results than the Rebonato–Jäckel algorithm:

Furthermore, according to the authors’ observations, permutations do not affect the PSD solution when using the AP or the Newton algorithms, whatever the dimension of the correlation matrix. The previously observed sensitivity to permutations is due to the convergence of the Rebonato–Jäckel algorithm to a local minimum. Since a PSD matrix remains PSD after permutations, and since the norms studied do not change under permutation, the PSD solution should remain the same before and after permutation (provided that the algorithm used reaches the absolute minimum). It is therefore expected that the known extensions of the Newton algorithm to integrate weights would not generate a significant sensitivity to permutations.

Finally, let us mention that our conclusions about the addition of a new risk dimension apply to all algorithms. Adding a new dimension modifies the eigenvalues, and can thus require further transformations to become PSD. However, the ability to use weights can help reduce this impact. For example, when adding an empty dimension to with a 10% correlation between the initial and the added risk factors, the ability to set weights associated to this new dimension to 0 (instead of 1 for all other correlation coefficients) enables the Rebonato–Jäckel algorithm to reach the nearest solution:

After these illustrations, we can now move on to the analysis of such transformations on the capital requirement.

5. Analysis of Solvency Capital Requirement Sensitivity

The importance of PSDization on the final correlation matrix (to be used to assess the insurer’s own funds requirement) has now been highlighted. The correlation coefficients chosen by the experts, or even those defined by statistical means can be significantly modified. The aim of this section is to provide some real-life sensitivities concerning the computation of the global SCR thanks to internal models. We would like to see SCR as a function of the main parameters in the actuary’s hand.

To carry this out, genetic algorithms are used to find a range 3 of values to which the SCR belongs; given a copula, realizations of risk factors, and proxy functions (more details later). The implemented algorithms are detailed in Appendix D.1 and Appendix D.2, respectively, for the case of permutations and weights. They correspond to an adaptation of the Rebonato-Jackël algorithm that incorporates these operations. At the end, the range is obtained for a given pseudo-correlation matrix G, a given weighting matrix H, and possibly a given permutation . Hence, we want to evaluate the function g such that , where stands for the effect of on the risk factors represented in G, and represents the nearest (from G) PSD matrix obtained using the Rebonato-Jackël algorithm with weights H. The considered permutation was presented at the beginning of Section 4.1.

5.1. Loss Factors or Risk Factors?

It must first be stated that estimating the loss generated by the occurrence of some given risk is a difficult task. It is easier to describe the behavior of risk factors through marginal distributions. For instance, if the interest rates rise, the potential loss for the insurer depends on impacts on both assets (e.g., value of obligations drops) and liabilities (contract credited rates may vary, which should modify expected lapse rates). To compute the loss associated to the variation of some risk factors, one thus needs a (very) complex transformation. In practice, to save computation time, simple functions (polynomial form) approximate these losses. However, the insurer can sometimes directly evaluate the loss related to one given loss factor: this is the case for example when considering the reserve risk, which can be modeled by classical statistical methods (bootstrap). The insurer’s total loss, P, thus reads

where f is a given (proxy) function, and are random variables, is the set of loss factors and is the set of risk factors.

For our next analysis, Table 6 gives the different functional forms depending on the risk dimension and the risk factors . For the sake of simplicity, one considers that all our marginals ( and ) follow the same distribution but with different parameters. This common distribution is lognormal , since it is widely used in insurance for prudential reasons. Table 7 sums up the parameters involved in the eight different cases under study: vectors (where k refers to the dimension of the vector) will be used to compute the global loss in the case of loss factors aggregation (meaning that ), whereas vectors will be the input of proxy functions defined in Table 6 for risk factors aggregation (). We distinguish these two configurations to see whether taking into account proxy functions gives very different SCR sensibilities as compared to only aggregate risk factors.

Table 6.

Polynomials used as proxy functions to obtain the overall insurer’s loss.

Table 7.

Marginals for each risk factor and corresponding 99.5th percentile.

5.2. Variance–Covariance or Copula Approach, Pros and Cons

Except for the PSDization step itself; which generates different results, another important choice lies in the aggregation approach. Here, one would like to detail the reasons for choosing one of them (i.e., copula or variance–covariance). Let us consider the simplest framework: the loss P only depends on loss factors (no need to apply proxy functions that link risk factors to loss factors). It is then possible to model this loss as follows: .

Individual loss factors have to be modeled and estimated by the actuaries for internal models, or come from standardized shocks if using the Standard Formula. Fortunately, it is likely that extreme events corresponding to the 99.5th percentile of every loss factors do not occur at the same time: there is thus a mitigation effect, which generally implies

As already mentioned in Section 1, the regulation states that the variance–covariance approach can be used to aggregate risks, with the given correlation matrices. This method has some advantages, but also some drawbacks (Embrechts et al. 2013). Of course, it is the easiest way to aggregate risks: the formula is quickly implemented (which allows for computing sensitivities without too much effort), and easy to understand. However, it does not provide the entire distribution of the aggregated loss, knowing that the insurer is sometimes interested in other risk measures than the unique 99.5th percentile. Moreover, this approach is not adequate for modelling nonlinear correlations, which are common when considering the tails of loss distributions. It means that it is very tricky to calibrate the correlation matrix so as to ensure that we can effectively estimate the 99.5th percentile of the aggregated loss. In their paper, Clemente and Savelli (2011) and Sandström (2007) discussed this and proposed a way to modify the Solvency II aggregation formula in order to consider skewed marginal distribution. Finally, the variance–covariance approach is too restrictive since it does not allow the correlation of risk factors, but only the correlation of losses. This makes the interpretation of scenarios generating a huge aggregated loss very difficult.

For all these reasons, internal models are generally developed using copulas: they enable the simulation of a large number of joint replications of risk factors, before applying proxy functions (most of the time). With this technique, insurers obtain the full distribution of P, and thus richer information among which is the quantile of interest (Embrechts and Puccetti (2010), Lescourret and Robert (2006)). Common copulas in the insurance industry (Gaussian and Student copulas) are based on the linear correlation matrix, the marginals being the risk and loss factors. This is linked to the main property of copulas: they allow the definition of the correlation structure and the marginals separately. For example, aggregation with the Gaussian copula can be simulated with the following steps:

- simulation of the marginals stand-alone (stored in the vector , where n stands for the number of risk factors and B the number of random samples);

- simulation of a Gaussian vector Y through the expression , where T represents the Choleski decomposition of the correlation matrix and Z is an independent Gaussian vector of size n;

- ordering X in the same order as Y to ensure that ( stands for the quantile corresponding to x).

5.3. Results Using a Simplified Internal Model

Applications presented hereafter were designed to consider a wide range of operational situations in which the insurer aims to estimate its global SCR.

For a given PSD correlation matrix , and given values for the vector of risk factors (simulated with lognormal distributions), one performs Q = 131,072 = simulations for the aggregation of risk factors (dependence structure). As a matter of fact, there are two sources of uncertainty explaining the variation of SCR values (). First, the genetic algorithm itself is likely to have reached different local solutions depending on the simulation. Second, the simulation of the Gaussian or Student vectors to model the correlation through copulas may change. In order to focus the study on correlation, it must be noted that marginals were simulated initially and then kept fixed. Roughly, it can be assumed that the confidence interval of the global SCR is similar to that of a Gaussian distribution () because of the Central Limit Theorem and of the independence of the simulations of each SCR, i.e.,

where stands for the standard deviation of SCR, and m its mean. Of course, the estimation of these parameters is made simple using their empirical counterparts, denoted by and . Table 8 summarizes the estimated quantities for each case in our framework.

Table 8.

Mean and standard deviation of the global Solvency Capital Requirement (SCR) ( simulations).

Then, we study the impact of our transformations (permutation, weights varying, and higher dimension) as compared to this standard deviation . More precisely, we consider one operation, perform the same number of simulations, and store the minimum and maximum values of the vector . This way, it is possible to define a normalized range (NR) for these values, as expressed below:

If NR is lower than (), the transformation is said to have a limited impact on the SCR. Otherwise, it is considered as a significant impact. The worst cases correspond to situations where NR is greater than (). The multiplier 2 enables us to take into account the fact that there are two sources of uncertainty (genetic algorithm and simulated dependence structure). All the results are stored in Table 9.

Table 9.

Sensitivities of the global SCR to transformations on the correlation matrix (permutation, two different cases for weighting the correlation coefficients, and addition of a new risk), depending on copula, and type of aggregation (risk factors/loss factors). Column ‘Imp.’ describes the strength of the impact of the transformation under study: ‘0’ refers to a limited impact (, see (2)), ‘+’ means a significant impact (), and ‘++’ a very strong impact ().

5.3.1. Impact of Permutations on the Global Solvency Capital Requirement

Of the 14 examples under study (seven pseudo-correlation matrices times Gaussian or Student copula, see Table 9), the permutation systematically has a very strong impact on the global SCR. This change can represent up to 6.7% in practice, although it should have no theoretical impact. This is mainly due to the PSDization process, which leads to the selection of different local minima after a permutation is made. This highlights two phenomenona: the need to control the bias induced by the initial choice of the insurer concerning the order of risk factors, and the need to initially define PSD correlation matrices (revisiting experts’ opinions, and identifying incoherent correlation submatrices).

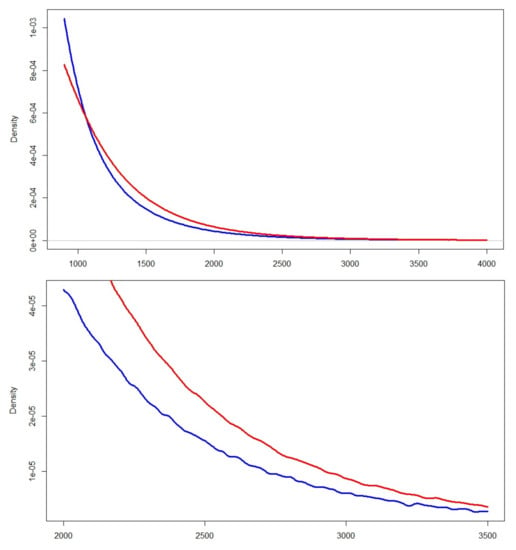

To have a more comprehensive view of this impact, Figure 5 illustrates it on the total loss distribution (rather than the sole 99.5th percentile), with , and considering the aggregation of loss factors. The red curve corresponds to the loss distribution after applying the permutation to in the case of a Gaussian copula, whereas the blue one corresponds to the permutation .

Figure 5.

Illustration of the impact of the permutation on the loss distribution, with a focus on the right on the area around the capital requirement (99.5 percentile).

5.3.2. Impact of the Modification of Weights on Solvency Capital Requirement

Our sensitivities relate to weighting coefficients varying in a given range. This range is defined by weights between and . This sensitivity is denoted by ‘W Sensi1’ in Table 9. Of the 28 examples analyzed here, (seven pseudo-correlation matrices , times (Gaussian or Student copula), times (risk or loss factors)), 17 cases have a very strong impact on the SCR. The range can represent more than 5.4% of the SCR, which is really huge in practice.

The same analysis with stronger constraints (weights belonging to an interval of width 0.2 around the initial weights, i.e., and , see ‘W Sensi2’ in Table 9) shows that of 28 examples, seven cases have a very significant impact on the final SCR, with a range likely to represent more than 4.7% of the SCR. Furthermore, this shows the necessity to properly define correlation coefficients at the very beginning.

5.3.3. Impact of Adding a Dimension to the Correlation Matrix

In practice, the insurer’s global loss often incorporates some negligible loss factor. In the simple case where there are only loss factors affecting the global loss, it means that

where thus tends to 0. The limit case would be , which means that the (n+1)th risk factor would have no impact on the insurer’s loss, but still plays a role through its presence in the correlation matrix and its impact in the PSDization process. The correlation between this risk factor and others is set to 0.1 (as in Section 4.2). We measure the SCR value before and after adding this dimension.

Of the 28 examples analyzed (see ‘dim+1’ in Table 9), almost one third (nine cases exactly) lead to a statistically significant impact on the final SCR (strong or very strong impact on SCR). However, except in one specific case involving an impact value around 6%, most of the impacts seem to be lower than with other operations. Once again, it is important to realize that this transformation should have no theoretical impact. Of course, it suggests that it would be worth conducting deeper analysis on this aspect, especially on the addition of more than one dimension and on the modification of the correlation coefficients of the added risk factor.

6. Conclusions

Insurers using internal models, as well as supervisors, wonder quite rightly about the robustness of their PSDization algorithm. Our study shows and highlights the importance of PSDization through quantified answers to very practical questions on a series of real-life examples. Of the 98 (3 × 28 + 14) examples based on various configurations (different copulas and ways to consider risks, see Table 9), approximately one half (exactly 47) have significant impacts on the global SCR (up to 6%) when studying sensitivities to our three tuning parameters (weights given to individual correlation coefficients, permutations, and addition of a fictive business line). It can be noted that permutations always lead to a significant variation of the overall SCR, with a normalized range (see Equation (2)) often greater than in other cases. Adequate sensitivities should therefore be performed when using the Rebonato–Jäckel algorithm since there is to the authors’ knowledge no way to know a priori which would be the most adapted choice of risk order for a given company. Knowing that these transformations are either theoretically neutral, or should have a limited impact on the global capital requirement, this underlines that practitioners’ choices are fundamental when performing risk aggregation in internal models. Moreover, the use of proxy functions do not seem to change conclusions: SCR sensitivity is similar when considering only loss factors. A strong control of PSDization by supervisors thus makes sense, and a good understanding of the behaviour of the PSDization algorithm is required.

The following best practices were identified: (i) develop a sound internal control framework on both the triggers generating negative eigenvalues (e.g., expert judgments) and the PSDization step itself, and (ii) assess the need for adding a new risk (e.g., new business line) in terms of its impact on the correlation matrix and thus on the global SCR. Regarding the former point, independent validations and systematic reviews of the modifications brought to the correlation matrix by the algorithm should be analyzed, and a wide number of sensitivities has to be implemented to challenge the results. Concerning the dimension of the risk matrix, there seems to be a compromise to find: adding business lines allows for increasing granularity when describing the correlation between risks, but tends to cause more disturbance on the individual correlation coefficients during PSDization. As usual, the best choice lies in an intermediate dimension.

Finally, this work could be extended in several ways, among which the definition of algebraic tests to anticipate inconsistencies in the experts’ choices; and a deeper understanding of the permutations leading to the minimum or maximum values of the SCR. In particular, if these permutations show some similar features, it would be possible to define best practices when ordering risk factors.

Acknowledgments

This work is partially supported by BNP Paribas Cardif (Paris, France), through the Research Chair “Data Analytics and Models for Insurance” (DAMI). We thank Hansjörg Albrecher and Léonard Vincent (University of Lausanne, Switzerland) for useful suggestions, and would also like to thank three anonymous referees for their constructive comments.

Author Contributions

V. Poncelet conceived the experiments; C. Saillard designed and performed the experiments; X. Milhaud and C. Saillard analyzed the data and contributed reagents/materials/analysis tools; X. Milhaud and C. Saillard wrote the paper.

Conflicts of Interest

The authors declare no conflict of interest. The founding sponsors had no role in the design of the study; in the collection, analysis, or interpretation of data; and in the writing of the manuscript.

Appendix A. Pseudo-Correlation Matrices under Study

Let us present the pseudo-correlation matrices, but also the weighting matrices coming from expert judgments to be taken into account during PSDization.

Example 1:

Example 2:

Example 3:

Example 4:

Example 5:

Example 6:

Example 7:

Appendix B. PSDized Matrices without Weighting Coefficients

To be noted that except for the highest dimension under consideration (dimension 10), the three algorithms give the same solution.

Examples 1 and 2: , and , where

Examples 3 and 4: , and , where

Examples 5 and 6: , and , where

Example 7: In this example, the PSDized versions of the initial pseudo-correlation matrix differ depending on the algorithm used:

Appendix C. PSDized Matrices with Weighted Coefficients

Since the only method that allows to integrate weights when looking for the closest PSDized matrix is the Rebonato–Jäckel algorithm, we have here seven results from our seven examples:

Examples 1 and 2:

Examples 3 and 4:

Examples 5 and 6:

Example 7:

Appendix D. Genetic Algorithms Used in This Paper

Appendix D.1. Algorithm with Permutations

(Genetic algorithm for permutations). Process to follow:

- (Creation of the initial population): simulate a random population of N permutations, with the identity: . We have chosen to use N = 6 for stability purposes and computational feasibility.

- (Ranking of the population): use the function which associates to each permutation the adequate SCR (for fixed marginals, fixed weighting matrix, given loss function and copula) to rank the individuals of the population.

- (Reproduction of two individuals): for any couple , create two new individuals by the following permutation composition: and . If the two permutation commute, compose one of them by any transposition .

- (Mutation): the mutation of a permutation corresponds to its composition by a random transposition .

- (Evolution of the population): the population evolves without any of its individuals disappearing, which enables us to obtain at the end of the algorithm both a minimum and a maximum (not corresponding necessarily to the absolute extrema—but only the results of the simulation).

- (End of the algorithm): ends when a maximum number of iterations is obtained (5).

Appendix D.2. Algorithm with Confidence Weights

(Genetic algorithm for weights). Process to follow:

- (Creation of the initial population): simulate a random population of N weighting matrices between and initially chosen: . We have chosen to use N = 8 for stability purposes and computational feasibility.

- (Ranking of the population): use the function which associates to each weighting matrices the adequate SCR (for fixed marginals, given loss function and copula) to rank the individuals of the population.

- (Reproduction of two individuals): for any couple , create two new individuals H’ et H” in the following manner (with H[,j] designating the j-th column of the matrix H, and E(x) the integer part of x):

- (Mutation): the mutation of a weighting matrix corresponds to the random modification of a coefficient of the matrix H considered. The mutation consists in simulating a random coefficient between 0 and 1.

- (Evolution of the population): the population evolves without any of its individuals disappearing, which enables us to obtain at the end of the algorithm both a minimum and a maximum (not corresponding necessarily to the absolute extrema—but only the results of the simulation).

- (End of the algorithm): ends when the maximum number of iterations is obtained (5).

References

- Bernard, Carole, Xiao Jiang, and Ruodu Wang. 2014. Risk aggregation with dependence uncertainty. Insurance: Mathematics and Economics 54: 93–108. [Google Scholar] [CrossRef]

- CEIOPS (Committee of European Insurance and Occupational Pension Supervisors). 2010. European Commission: Quantitative Impact Study 5—Technical Specifications. Available online: http://ec.europa.eu/internal_market/insurance/docs/solvency/qis5/ceiops-calibration-paper_en.pdf (accessed on 12 April 2018).

- Cheung, Ka Chun, and Steven Vanduffel. 2013. Bounds for Sums of Random Variables when the Marginal Distributions and the Variance of the Sum are Given. Scandinavian Actuarial Journal 13: 103–18. [Google Scholar] [CrossRef]

- Cifuentes, Arturo, and Ventura Charlin. 2016. Operational risk and the Solvency II capital aggregation formula: implications of the hidden correlation assumptions. Journal of Operational Risk 11: 23–33. [Google Scholar] [CrossRef]

- Clemente, Gian Paolo, and Nino Savelli. 2013. Internal model techniques of premium and reserve risk for non-life insurers. Mathematical Models in Economics and Finance 8: 21–33. [Google Scholar]

- Clemente, Gian Paolo, and Nino Savelli. 2011. Hierarchical structures in the aggregation of premium risk for insurance underwriting. Scandinavian Actuarial Journal 3: 193–213. [Google Scholar]

- Cutajar, Stefan, Helena Smigoc, and Adrian O’Hagan. 2017. Actuarial Risk Matrices: The Nearest Positive Semidefinite Matrix Problem. North American Actuarial Journal 21: 552–64. [Google Scholar] [CrossRef]

- Denuit, Michel, Christian Genest, and Étienne Marceau. 1999. Stochastic bounds on sums of dependent risks. Insurance: Mathematics and Economics 25: 85–104. [Google Scholar] [CrossRef]

- Devineau, Laurent, and Stéphane Loisel. 2009. Risk aggregation in Solvency II: How to converge the approaches of the internal models and those of the standard formula? Bulletin Français d’Actuariat 9: 107–45. [Google Scholar]

- EIOPA (European Insurance and Occupational Pensions Authority). 2015. Commission Delegated Regulation (EU) 2015/35. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1523605068990&uri=CELEX:32016R0467 (accessed on 12 April 2018).

- EIOPA (European Insurance and Occupational Pensions Authority). 2009. Directive 2009/138/EC (Solvency II). Available online: https://eur-lex.europa.eu/legal-content/FR/TXT/?uri=celex%3A32009L0138 (accessed on 12 April 2018).

- Embrechts, Paul, and Giovanni Puccetti. 2010. Risk aggregation. In Copula Theory and Its Applications. Berlin/Heidelberg: Springer. [Google Scholar]

- Embrechts, Paul, Giovanni Puccetti, and Ludger Rüschendorf. 2013. Model uncertainty and VaR aggregation. Journal of Banking & Finance 37: 2750–64. [Google Scholar]

- Filipovic, Damir. 2009. Multi-level Risk Aggregation. ASTIN Bulletin 39: 565–75. [Google Scholar] [CrossRef]

- Georgescu, Dan I., Nicholas J. Higham, and Gareth W. Peters. 2017. Explicit Solutions to Correlation Matrix Completion Problems, with an Application to Risk Management and Insurance. Technical Report. Manchester: Manchester Institute for Mathematical Sciences, University of Manchester. [Google Scholar]

- Higham, Nicholas J. 2002. Computing the nearest correlation matrix—A problem from finance. IMA Journal of Numerical Analysis 22: 329–43. [Google Scholar] [CrossRef]

- Jäckel, Peter. 2002. Monte Carlo Methods in Finance. Wiley Finance. Hoboken: Wiley and Sons. [Google Scholar]

- Lescourret, Laurence, and Christian Y. Robert. 2006. Extreme dependence of multivariate catastrophic losses. Scandinavian Actuarial Journal 4: 203–25. [Google Scholar] [CrossRef]

- Qi, Houduo, and Defeng Sun. 2006. A quadratically convergent Newton method for computing the nearest correlation matrix. SIAM Journal on Matrix Analysis and Applications 28: 360–85. [Google Scholar] [CrossRef]

- Rebonato, Riccardo, and Peter Jäckel. 1999. The Most General Methodology to Create a Valid Correlation Matrix for Risk Management and Option Pricing Purposes. London: Quantitative Research Centre of the NatWest Group. [Google Scholar]

- Sandström, Arne. 2007. Solvency II: calibration for skewness. Scandinavian Actuarial Journal 2: 126–34. [Google Scholar] [CrossRef]

| 1 | As the Committee of European Insurance and Occupational Pension Supervisors (CEIOPS, now EIOPA) admitted in its Solvency II calibration paper of April 2010 (SEC-10-40). |

| 2 | In the case of few risk factors, common sense would lead to building positive semidefinite (PSD) matrices (even without being aware of the PSD requirements). However, when dealing with higher dimensions, it is much more difficult to obtain a PSD matrix and, in practice, a PSDization algorithm is very often necessary. Matrices used in Appendix A) are therefore to be considered only as examples in low dimensions to illustrate some of the effects due to PSDization and not to be considered as realistic situations. |

| 3 | Be reminded that the genetic algorithms must be seen as “clever” sensitivities rather than fully convergent optimization algorithms. There is no guarantee that the convergence to a minimum is obtained. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).