Abstract

In this note, we define an operator on a space of Itô processes, which we call Caputo-Itô derivative, then we considerer a Cauchy problem for a stochastic fractional differential equation with this derivative. We demonstrate the existence and uniqueness by a contraction mapping argument and some examples are given.

1. Introduction

Mathematical models based on ordinal or partial differential equations have been successfully used to describe the behavior of systems through the space and time. On the other hand, although the origin is very old, it was not until recent years that fractional order differential equations have gained more attention in different areas of science; for example, they are very useful to describe complex systems with memory effects (see [1,2,3,4,5] and the references therein).

However, in order to describe and forecast a real phenomenon, it is necessary to introduce a component that captures the random behavior caused by a major source of uncertainty, that usually propagates in time. When we add such a component, the model obtained is now governed by a stochastic fractional differential equation [6,7]. On the order hand, the Itô stochastic calculus has been applied in several fields of knowledge; such as, engineering, physics, biology, among others [8,9]. A stochastic process that is closely related to fractional calculus is the fractional Brownian motion (fBm); this is a centered, self-similar, and stationary-increment Gaussian stochastic process; which can be represented by a Riemann–Liouville integral [10]. However, the fBm is not a semimartingale (for Hurst index different from ), and therefore, it is not easy to define a stochastic integral with respecto to this process, under the Itô theory.

In this note, both the Caputo derivative and stochastic integral with respect to a semimartingale are used to define the Caputo-Itô derivative. The obtained processes, from applying the Caputo-Itô operator to a semimartingale, can be seen as a moving average process or a Volterra-type process, which have been studied by authors as [11] who analyses the ambit processes, which are a class of temporal-space Volterra process with semimartingale property, this processes are used to model the turbulence and tumor growth. Basse and Pedersen [12] studied the moving average processes driven by Lévy process. In the study of financial systems, an important characteristic to consider, is the memory effect, several researchers have devoted their work to that aim. Many financial variables have been found with long memory effects, such as Gross Domestic Product (GDP), interest rate, exchange rates, share price and future prices. The Caputo-Itô operator, when using the kernel of the Caputo’s fractional derivative, introduces the memory effect in the system . In [13] a stochastic differential equation model of fractional order is used to describe the effect of memory of trends in financial prices.

In this work, we consider a Cauchy problem for a stochastic fractional differential equation with the Caputo-Itô derivative, proving existence and uniqueness of solutions. Moreover, some examples are given to illustrate the trajectories of the solutions.

2. Preliminaries

In this section we define the fractional order Caputo derivative, the Mittag-Leffler function and the stochastic Itô derivative.

Definition 1.

The fractional Caputo derivative of order α, with respect to time t is given by

where , , and is such that is an absoluty continuos function. Here, Γ is the Gamma function given by

Definition 2.

Let and . Then, the function given by

is called the two parameter Mittag-Leffler function, as long as the series (2) is convergent.

Definition 3.

Letbe an Itô process with () defined by

where and are -adapted processes. Let be a predictable process, such that

- with probability one.

- .

Let us define the stochastic integral for, with respect to, as

Definition 4.

A process () is called self-similar with index , if for all , the processes and have the same distribution, or equivalently, the processes y have the same distribution.

The fractional Brownian motion (fBm) is a self-similar gaussian process with index , [10].

3. The Caputo-Itô Derivative

Let be the Itô process with stochastic differential

under the following conditions,

- with probability one,

We define a Caputo-Itô derivative of by:

where .

Let us note that is a Itô process. If we define and , then . The process is a semimartingale; however, is not necessarily one [14].

Let us consider Itô processes, given by the stochastic differential

where and are functions depending only on t variable, such that the stochastic differential exists. We denote by , the process obtained after applying the Caputo-Itô derivative to the process , that is

Note that is a gaussian process with expected value , its variance is given by , where I is the Riemann–Liouville integral and . For t, , we obtain the covariance function

Example 1.

If we take , then

Note that is not a random function and it depends on the upper limit of the integral, then is not necessarily a martingale; however, it is a Gaussian process with zero mean and variance given by

The variance of process must be finite, then and . On the other hand, since is a Gaussian process with zero mean, then it is fully determined by its covariance function, which we proceed to calculate. Let and with , then

where , then,

Here, is the Gaussian hypergeometric function,

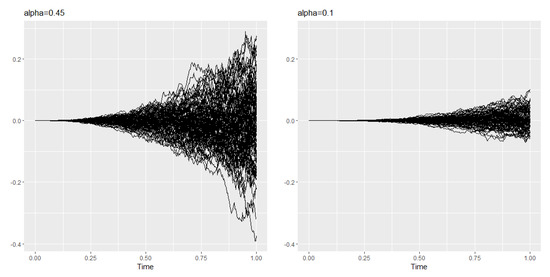

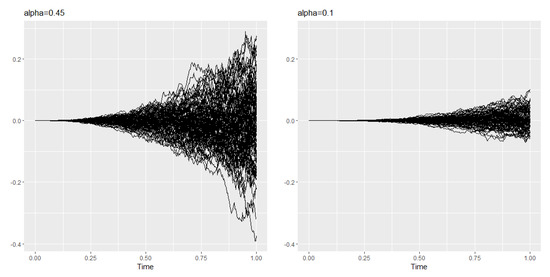

where, , and , with . In Figure 1, we shown samples trajectories of .

Figure 1.

Sample trajectories of , with , (left) and , (right).

In order to prove that and have the same distribution it is sufficient to show that its covariance functions are equal, since is a Gaussian process. Let and , according to Definition 4, we have

Thus, the process is self-similar, with index . The increments of the process are not stationary. In fact, it is sufficient to show that depends on h,

Therefore, does not have stationary increments, unless . Now, to prove that the increments of the process are not independents, it is sufficient to show that the covariance of the increments is not null. Indeed, let us consider , then

We conclude that process is Gaussian, not necessarily a martingale and does not have stationary nor independent increments.

4. Main Problem

We denote , the space real random variables -measurable and square integrable, endowed with the norm and . Thus, with is a Banach space. Let be the Banach space of the continuous mapping from J to , satisfying the condition , and be the closed subspace of the -measurable continuous processes in , where is -measurable, with norm defined by

Note that is a Banach space.

Let’s consider the following stochastic fractional differential equation

where , , . Here, and are suitable functions that will be defined below.

Definition 5.

- is measurable and-adapted.

- satisfy the following equation

where is the Mittag–Leffler function.

According to [15,16], we impose the following conditions:

- C1

- If , is a real number and , we have and , for some w big enough. Thus, we obtainwhere and .

- C2

- The functions and are continuous and there are constants y such that:for all and .

- C3

- The functions . Also, for and there are two continuous functions , , such thatwhere the functions and satisfy the following condition:Here,

Theorem 1.

On the conditions C1 y C2, the stochastic fractional Equation (9) have a unique mild solution in J, if the following inequality holds:

Proof.

Let’s define the function and the operator given by

Note that maps in itself, due to and are continuous functions and is a measurable and -adapted processes. Now, we show that is a contraction mapping in . For , from C1 and C2 it follows that

Therefore, we obtain

Then, by condition (10), is a contraction mapping. Finally, by Banach contracting mapping principle, has a unique fixed point. □

Theorem 2.

Suppose that conditions C1, C2 and C3are true. Then, the stochastic fractional differential Equation (5) has at least one mild solution in J.

Proof.

Let’s define as in the proof of Theorem 1. Now, we must show that is a completely continuous operator. Note that is well defined in .

Step 1. First, we show that is a continuous operator.

Let be a sequence in , such that in . Since the functions and are continuous, we have that

in for each . Thus, the map is continuous in .

Step 2. Now, we show that maps bounded sets in bounded sets on .

We must show that for each , there is a , such that for , we have . Let’s denote ; for each , , we have

Step 3. We show that maps bounded sets sets on equicontinuous sets in .

Let , for each , we have

Then, we obtain

Since y are continuous fucntions, and , as . Then, for the above inequality, we have . Therefore, the set is equicontinuous. Finally, from Step 1 to Step 3, and the Ascoli Theorem, we conclude that is a compact operator.

Step 4. Now, we show that the set

is bounded. Let , then for each , we have

this implies

Let’s consider the function defined by

If we denote by the right hand side of last inequality, we get , , .

Moreover,

Equivalently, by C3, we obtain

The last inequality implies that there is a constant k, such that , , therefore, , . Also, we obtain that , . By Schaefer’s fix point Theorem, we deduce that has a fixed point in J, which satisfies (5). □

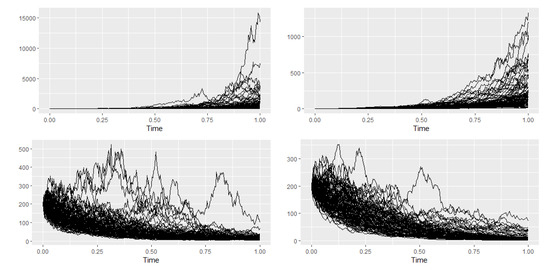

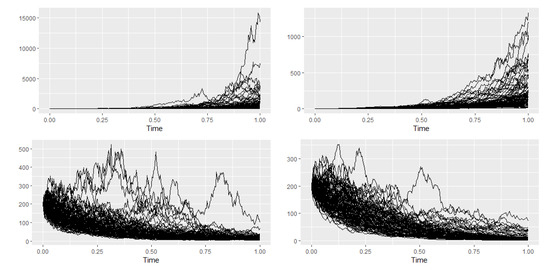

Example 2.

Let us consider the following simplified version of (9):

According to Definition 5 we have that the solution of (11) is given by:

Through the numerical scheme of Euler-Maruyama [17], we simulate some trajectories of the solution process (12) on the interval , see Figure 2. Let for some positive integer N, and . We denote as a numerical approximate to . So, the Euler–Maruyama method is as follow

where are Brownian increments.

Figure 2.

Sample trajectories of , with , , (up-left), sample trajectories of GBM, with , , (up-right), sample trajectories of , with , , (down-left) and sample trajectories of GBM, with , , (down-right).

Author Contributions

Conceptualization, J.S.-O. and F.J.A.-H.; methodology, O.U.L.-C. and M.P.A.-A.; formal analysis, J.S.-O., F.J.A.-H., O.U.L.-C. and M.P.A.-A.; investigation, O.U.L.-C. and F.J.A.-H.; writing—original draft preparation, J.S.-O., F.J.A.-H., O.U.L.-C. and M.P.A-A.; writing—review and editing, J.S.-O., F.J.A.-H., O.U.L.-C. and M.P.A.-A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors would like to thank Universidad Autónoma de Guerrero, and also, Sistema Nacional de Investigadores, CONACyT, Mexico, by partially support recived.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Samko, S.; Kilbas, A.; Marichev, O.I. Fractional Integrals and Derivatives: Theory and Applications; CRC Press: Boca Raton, FL, USA; Gordon and Breach Science Publishers: Philadelphia, PA, USA, 1993. [Google Scholar]

- Petras, I. Fractional-Order Nonlinear Systems Modeling, Analysis and Simulation; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Dipierro, S.; Pellacci, B.; Valdinoci, E.; Verzini, G. Time-fractional equations with reaction terms: Fundamental solutions and asymptotics. Discret. Contin. Dyn. Syst. 2021, 41, 257–275. [Google Scholar] [CrossRef]

- Ragusa, M.A.; Shakhmurov, V.B. A Navier-Stokes-Type Problem with High-Order Elliptic Operator and Applications. Mathematics 2020, 8, 2256. [Google Scholar] [CrossRef]

- Culbreth, G.; Bologna, M.; West, B.J.; Grigolini, P. Caputo Fractional Derivative and Quantum-Like Coherence. Entropy 2021, 23, 211. [Google Scholar] [CrossRef]

- Sanchez-Ortiz, J.; Ariza-Hernandez, F.J.; Arciga-Alejandre, M.P.; Garcia-Murcia, E. Stochastic diffusion equation with fractional laplacian on the first quadrant. Fract. Calc. Appl. Anal. Int. J. Theory Appl. 2019, 22, 795–806. [Google Scholar] [CrossRef]

- Rajendran, M.L.; Balachandran, K.; Trujillo, J.J. Controllability of nonlinear stochastic neutral fractional dynamical systems. Nonlinear Anal. Model. Control. 2017, 22, 702–718. [Google Scholar] [CrossRef]

- Kunita, H. Itô’s stochastic calculus: Its surprising power for applications. Stoch. Process. Their Appl. 2010, 120, 622–652. [Google Scholar] [CrossRef]

- Biane, P. Itô’s stochastic calculus and Heisenberg commutation relations. Stoch. Process. Their Appl. 2010, 120, 698–720. [Google Scholar] [CrossRef]

- Mandelbrot, B.B.; Ness, J.W.V. Fractional Brownian Motions, Fractional Noises and Applications. SIAM Rev. 1968, 10, 422–437. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, O.E.; Schmiegel, J. Ambit Processes with Applications to Turbulence and Tumour Growth. In Stochastic Analysis and Applications; Springer: Berlin/Heidelberg, Germany, 2007; pp. 93–124. [Google Scholar] [CrossRef]

- Basse, A.; Pedersen, J. Lévy driven moving averages and semimartingales. Stoch. Process. Their Appl. 2009, 119, 2970–2991. [Google Scholar] [CrossRef][Green Version]

- Li, Q.; Zhou, Y.; Zhao, X.; Ge, X. Fractional Order Stochastic Differential Equation with Application in European Option Pricing. Discret. Dyn. Nat. Soc. 2014, 2014, 1–12. [Google Scholar] [CrossRef]

- Protter, P. Stochastic Integration and Differential Equations; Springer: Berlin/Heidelberg, Germany, 2005. [Google Scholar]

- Shu, X.B.; Lai, Y.; Chen, Y. The existence of mild solutions for impulsive fractional partial differential equations. Nonlinear Anal. Theory Methods Appl. 2011, 74, 2003–2011. [Google Scholar] [CrossRef]

- Sakthivel, R.; Revathi, P.; Ren, Y. Existence of solutions for nonlinear fractional stochastic differential equations. Nonlinear Anal. Theory Methods Appl. 2013, 81, 70–86. [Google Scholar] [CrossRef]

- Higham, D. An Algorithmic Introduction to Numerical Simulation of Stochastic Differential Equations. SIAM Rev. 2001, 43, 525–546. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).