Abstract

In this paper, we consider an insurance risk model with two-sided jumps, where downward and upward jumps typically represent claim amounts and random gains, respectively. We use the Laguerre series to expand the Gerber–Shiu function and estimate it based on observed information. Moreover, we show that the estimator is easily computed and has a fast convergence rate. Numerical examples are also provided to show the efficiency of our method when the sample size is finite.

MSC:

91G05; 91G60

1. Introduction

In this paper, the surplus process of an insurance company is described by the classical risk model

where is the initial surplus and is the constant premium rate per unit time. The claim number process is a homogeneous Poisson process with intensity , and the claim sizes form an independent and identically distributed sequence that may be positive or negative. For later use, the density of is denoted by . We also assume that and are independent. Furthermore, since the size of each jump can be positive or negative, we can think of it as jumping up or down, and the upward and downward jumps can be interpreted as company random gains and random losses, respectively. The size of each upward jump is defined as and its density function is defined as , the mean value is . Similarly, the size of each downward jump is defined as and the corresponding density function is , the mean value is . Hence, we have

where , is an indicator function of the event A. To this end, we define to be the number of upward jumps until time t. Similarly, let be the number of downward jumps until time t. Therefore, the surplus process (1) can be viewed as a risk model with stochastic premium income

For a more detailed introduction of Equations (1) and (3), please refer to Cheung et al. [1]. Related works can be found in [2,3,4,5], among others.

Define the ruin time by , and set if for all . In this paper, we are interested in the Gerber–Shiu expected discounted penalty function that is defined as

where is the Laplace transform argument, and is a measurable penalty function of the and . This function was first introduced by Gerber and Shiu [6]. It has become an important and standard risk measure in ruin theory since various quantities of interests in ruin theory can be obtained for different values of the discount factor and different penalty functions . Interested readers are referred to [7,8,9,10,11,12,13], among others.

The above-mentioned papers assume that some probability characteristics of the surplus process are known, for example, the probability characteristics of the claim sizes and claim number process; however, these are usually unknown for an insurance company. In fact, we can only obtain some discrete data information about the surplus flow levels, claim numbers, and individual claim sizes (income numbers and individual income sizes). According to these data, more and more actuarial researchers use different methods to calculate statistical estimations of ruin probability and Gerber–Shiu function. Shimizu [14,15] used a regularized version of the inverse Laplace transform to estimate the Gerber–Shiu function in the Lévy risk model and the perturbed compound Poisson risk model, respectively; You and Cai [16] used a regularized version of the inverse Laplace transform to consider the nonparametric estimation of the survival probability for a spectrally negative Lévy risk model based on high-frequency data; Zhang and Yang [17,18] estimated the ruin probability based on high-frequency data and low-frequency data, respectively; Shimizu and Zhang [19] estimated the Gerber–Shiu function in a Lévy risk model based on high-frequency data by Fourier inversion transform. In addition, there are some effective estimation methods. Chau et al. [20,21] used the Fourier-cosine series expansion to estimate ruin probability and Gerber–Shiu function in the Lévy risk models; Yang et al. [22] applied two-dimensional Fourier cosine series expansion to estimate the discounted density function of the deficit at ruin; Xie and Zhang [23] applied the Fourier cosine series expansion to estimate the compound Poisson risk model under a constant barrier dividend strategy; Zhang [24] proposed a new estimator of the Gerber–Shiu function by Fourier sinc series expansion in the perturbed compound Poisson risk model; Chan [25,26] proposed a method based on the complex Fourier series expansion and used it in the actuarial field; Wang et al. [27] considered the pricing problem of variable annuities with guaranteed minimum death benefit by a complex Fourier series method under regime-switching jump diffusion models. For more detail on the statistical estimation of risk models, we refer the interested readers to [28,29,30,31,32,33,34,35,36,37,38,39,40].

The main goal of this paper is to use the Laguerre series expansion method to estimate the Gerber–Shiu function. The Laguerre series expansion method has been used by some authors for solving some statistical problems. For example, Comte and Genon-Catalot [41] used the appropriate Laguerre basis to take into account the estimation of the random strength of the mixed Poisson model; Zhang and Su [42,43] applied Laguerre series to approximate the Gerber–Shiu function in the class compound Poisson risk model and the Lévy risk model, respectively; Zhang and Yong [44] studied the valuation of equity-linked annuity contracts with guaranteed minimum death benefits by Laguerre series expansion; Cheung and Zhang [45] proposed to use Laguerre series expansion as a function of the initial earnings level to approximate the ruin probability of the updated risk model; Albrecher et al. [46] considered the bivariate Laguerre expansions approach for joint ruin probabilities in a two-dimensional insurance risk process; Xie and Zhang [47] considered the finite-time dividend and ruin problems in a class of risk models under the constant dividend barrier strategy by Laguerre series expansion; Su et al. [48] considered the random deviation of premium income (or claim loss), so they studied the statistical estimation of Gerber–Shiu function in the compound Poisson risk model perturbed by diffusion. In the actual insurance business, the premium income of insurance companies, especially small companies, is sometimes random. Therefore, this paper considers the two-sided jumps risk model. For more on the Laguerre series expansion method, we refer the interested readers to [49,50,51,52,53].

The remainder of this paper is organized as follows: In Section 2, we first briefly introduce the Laguerre series expansion method, and then derive Laguerre series expansions of . In Section 3, we present how to construct estimators for the aforementioned quantities based on observed sample of the surplus process, and in Section 4, we study the consistency rate of our estimator. Finally, numerical examples are given in Section 5 to illustrate that the performance of the estimator behaves well when the sample size is finite.

2. Preliminaries

2.1. The Laguerre Series Expansion

In this subsection, we present some known results on the Laguerre series expansion method. Throughout, let and denote the classes of absolutely integrable functions and square integrable functions on the positive axis, respectively, and denote by (respectively, ) those complex numbers that have a non-negative (respectively positive) real part, that is

For any complex number s, we denote its real part and imaginary part by and , respectively. For two positive functions with a common domain , we use to mean uniformly in . Similarly, we use to mean uniformly in . For two sequences of functions and , we use to mean uniformly in k and x. Denote the scalar product and -norm on by

For convenience, let C be a generic positive constant that can take different values from line to line. For any , we define its Laplace transform and Fourier transform by and . Furthermore, let be the Dickson–Hipp operator, such that

for any integrable real function f. The operator was first introduced in Dickson and Hipp [54] and has many nice properties, which can be found in Li and Garrido [55]. The Laguerre functions are given by

where is a Laguerre polynomial defined as

It is follows that the Laguerre functions are uniformly bounded, i.e.,

We also note that, for the Laguerre functions and , the following convolution formula holds:

For more details on the above results, refer to Abramowitz and Stegun [56].

Remark 1.

Suppose that the collection is a complete orthonormal basis of satisfying

- (1)

- ;

- (2)

- .

Using the orthonormal property of the Laguerre basis , for any , we can develop it on the Laguerre basis

In practical applications, we need to truncate the above infinite sum. Hence, for all , we have

To evaluate the convergence rate of the bias , we introduce the Sobolev–Laguerre space (see Bongioanni and Torrea [57]) that is defined by

where . Suppose that r is a positive integer. If , then the following properties are equivalent:

- (1)

- .

- (2)

- For function f admits derivatives up to order , with absolutely continuous and for , the functions

2.2. The Laguerre Expansion of Gerber–Shiu Function

In this subsection, we show that the Gerber–Shiu function can be expressed by Laguerre functions. We focus on the distribution, for some and a positive integer n, to model the premium sizes (see Labbé et al. [58]). No specific assumption is made on the claim’s distribution. For , conditioning on the time of the first event (premium or claim), we obtain

hence

where

For any , in the following Lundberg’s fundamental equation (in s)

and are the roots of the above equation.

Remark 2.

Assume, in addition, that (i.e., the annuity income amounts follow the exponential distribution).

The above equation has two positives roots, and . It is clear from Equation (11) that the continuous function is such that , and . Thus, the existence of two distinct roots satisfying is established.

In the following, we suppose that some conditions hold true in this paper, which has also been considered in Shimizu and Zhang [19].

Condition 1.

(Net profit condition.)

The above condition guarantees that the expectation of the surplus process will always be positive at any time . From a practical point of view, we only consider the case of in this paper.

Condition 2.

For the penalty function w, it satisfies

Condition 3.

For the penalty function w, there exist some integers such that

In order to use the Laguerre series expansion method to calculate Equation (9), we need to ensure that . Using inequality , we obtain

As can be seen from Equation (12), in order to determine , we need some Lemmas.

Lemma 1.

For function , by , and Condition 1, we have .

Proof.

Because

Note that

Hence,

This completes the proof. □

Lemma 2.

Under Condition 2, we have .

Proof.

and

which yield

This completes the proof. □

Lemma 3.

As for m, by Conditions 1 and 2, we obtain .

Proof.

In the remainder of this paper, suppose that . Then we can develop them on the Laguerre basis, i.e.,

where for

Plugging the Laguerre series expansion Equations (15)–(17) into the defective renewal Equation (9) and using the convolution Formula (7), we obtain

Furthermore, by changing the order of summation we obtain

and

As a result, Equation (18) gives

After comparing the coefficients for each basis function on both sides of Equation (19), we obtain an infinite triangular system of linear equations,

Furthermore, let , and

Then we can write Equation (20) in the following matrix form

Note that is a lower triangular Toeplitz matrix, and for the non-zero elements in , we have

Furthermore, we have

by Condition 1, then is nonsingular and explicitly invertible.

Hence, for all , truncating the infinite dimension vectors and matrix in Equation (21) leads to

where , , and . As a result, the matrix is nonsingular and explicitly invertible. Then we have

After solving Equation (23), we can obtain , and for a larger K we can approximate the Gerber–Shiu function as follows:

3. Estimation Procedure

In this section, we assume that both Poisson intensity and claim size density are unknown, but we can obtain discrete information about the surplus process and the aggregate claims. Assume that we can observe the surplus process over a long time interval . Let be a fixed inter-observation interval (or sampling interval). Without loss of generality, assume that is an integer, and let .

- (1)

- Data-set of surplus levels:where is the observed surplus level at time .

- (2)

- Data-set of total claim numbers and claim sizes:

- (3)

- Data-set of downward jump numbers and random loss sizes:

- (4)

- Data-set of upward jump numbers and random income sizes:where is the total claim number up to time and .

Next, we shall propose our estimator of the Gerber–Shiu function by Laguerre expansion based on Equation (24). To this end, we need to estimate the vector , or equivalently, and . By the definitions of and , we only need to estimate the following quantities:

By the definitions of and and changing the order of integrals, we can write and as follows:

and

The above two formulae imply that we have to estimate the Poisson intensity , the root , and the expectations appearing in Equations (25) and (26).

According to the property of Poisson distribution, we can estimate p and by

Since the premium size Y follows the distribution, we have , then we can estimate by

which are all unbiased estimates. We estimate the root by , which is a positive root of the following estimating equation:

where is an estimate of the Laplace transform . It follows from Equation (25) that we have

Similarly, we can estimate by

Now, we define the estimates of and by replacing and with and in their definitions, and denote them by and , respectively. Accordingly, the estimate of , denoted by , is defined to be the solution of the following linear system:

Finally, replacing by in Equation (23), we obtain the following estimate of the Gerber–Shiu function:

Remark 3.

The estimator given in Equation (29) is expressed in a two-fold integral, which can be explicitly computed for most of the widely used penalty functions. Here are some examples.

- (1)

- and . In this case, the Gerber–Shiu function becomes the ruin probability and we have and . Then

- (2)

- and . In this case, the Gerber–Shiu function becomes the Laplace transform of ruin time and we have and . Then

- (3)

- and . In this case, the Gerber–Shiu function becomes the expected claim size causing ruin. Then

- (4)

- and . In this case, the Gerber–Shiu function reduces to the expected deficit at ruin. Then

4. Consistency Properties

In this section, we study the asymptotic properties of our estimator. We measure the performance of the estimator by the -norm distance . By -norm inequality, we have

where is the series truncation error and is the error due to statistical estimation. Now, if , we have

due to Remark 1. The polynomial convergence rate in Equation (33) can be improved when m has an exponential decay rate.

Next, it remains to study the convergence rate for , and we obtain the result as follows:

Theorem 1.

Suppose and Conditions 1–3 hold. If , then

Further, if , then

In the following, we present some notations on matrix (and vector) norms. For a vector , its 2-norm is defined by . For a matrix , its spectral norm is defined by , where is the largest eigenvalue of . The Frobenius norm of is defined by

It is known that

For two square matrices and with the same dimension, we have .

By the inequality and the first inequality in Equation (36), we obtain

In order to prove Theorem 1, we can study the convergence rates for the three terms on the right-hand side of Equation (37). To obtain the convergence rates and , we need the following Lemma:

Lemma 4.

Suppose that Condition 2 holds. Then

Moreover, if Conditions 1 and 3 hold and , we have

Proof.

First, under Condition 2 we have

Next, we prove Equation (38). We only consider the case . Under Condition 1 and ,

Because is Poisson-distributed with intensity and is independent from , we have

Hence,

Then, using inequality , we have

By the mean value theorem, it is easy to see that

where is a random number between and . First, to estimate ,

It follows from Condition 3 and Markov’s inequality that

hence

As for , we can obtain

According to , and . Then

Hence,

For the summation , we have

which, together with Condition 3 and Markov’s inequality, yields

Finally, we complete the proof. □

In order to obtain the convergence rates of , and , we have the following propositions:

Proposition 1.

Let Condition 1 hold and . Then

Proposition 2.

Suppose that Condition 1 holds. Then for all ,

Proposition 3.

Let Condition 1 hold and . If , then

In the rest of the section, we give the proof of Propositions 1, 2 and 3 and Theorem 1.

Proof of Proposition 1.

Using the definitions of and , then

where we have put for convenience.

Because is Poisson-distributed with intensity and is independent from , we have

Then

Plugging the above result into Equation (48), we obtain

First, for , we can obtain

It follows from and Markov’s inequality that . Then

Next, to compute , we can obtain

Then,

due to , and .

As for , taking expectation, we have

Due to and Markov’s inequality, hence

Proof of Proposition 2.

First, let and define a sequence by

where

such that is an infinite lower triangular Toeplitz matrix generated by similar to

It is easy to see that

where .

By Lemma 4.3 in Zhang and Su [42], we know that are Fourier coefficients of the function

Let denote the complex unite circle. We have

by Condition 1. Then, by Lemma 3.8 in the work of Böttcher and Grudsky [60], we obtain

The proof is completed. □

Proof of Proposition 3.

Note that and is invertible. By Propositions 1 and 2,

Then, by the result of Theorem 2.5 of Stewart and Sun [61], we have

This completes the proof. □

Finally, by the three terms of (37), Lemma 4, and Propositions 1–3, the proof of Theorem 1 is as follows:

Proof of Theorem 1.

By Lemma 4 and Propositions 1–3, we have

We can minimize the error bound to find the optimal truncation parameter, say , has . (See Zhang and Su [43] and Su et al. [49].)

5. Numerical Illustration

In this section, we provide some numerical examples to show the performance of our estimator when the observed sample size is finite. Throughout this section, we set , and , and we consider the following three claim density functions at the same time:

- (1)

- Exponential density function: .

- (2)

- Erlang (2) density function: .

- (3)

- Combination-of-exponentials density function: .

As in Zhang [24], we estimate the following four classes of Gerber–Shiu functions:

- (1)

- Ruin probability (RP): .

- (2)

- Laplace transform of ruin time (LT): .

- (3)

- Expected claim size causing ruin (ECS): .

- (4)

- Expected deficit at ruin (ED): .

Note that the assumptions of the above three claim density functions all satisfy , and through Equations (9) and (11), we can easily obtain the explicit formulae for the above Gerber–Shiu functions by Laplace inversion. For exponential claim density function, the explicit formulae for these Gerber–Shiu functions are given by

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

For Erlang (2) claim size, the explicit formulae for these Gerber–Shiu functions are given by

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

For combination-of-exponential claim size, the explicit formulae for these Gerber- Shiu functions are given by

- (1)

- .

- (2)

- .

- (3)

- .

- (4)

- .

Here, we consider . For the cut-off parameter K, we use the result of Remark 4.1 in Su et al. [49] with , where means the integer part. Through simulation, we find that even if the truncation parameter K is very small, the satisfactory effect can be obtained. In the case of finite sample size, to test the performance of the estimator, we consider mean value, mean relative error, and integrated mean square error (IMSE) based on 300 experiments, which are computed by

where is the estimate of Gerber–Shiu function in the j-th experiment. For IMSE, we computed the integral on the finite domain instead of , since when u is large, both the true value and the estimates are very close to zero.

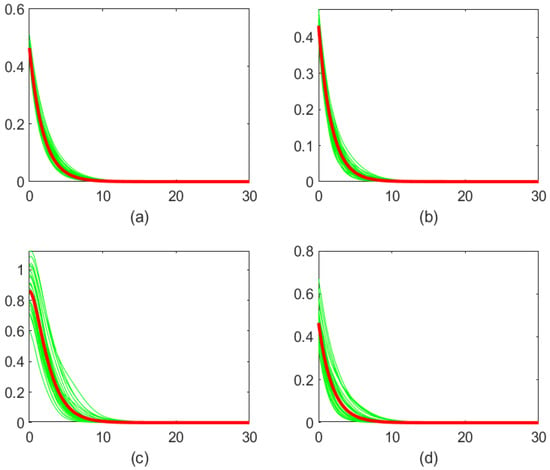

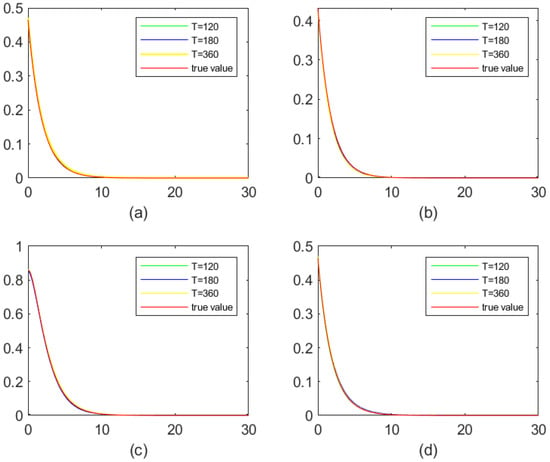

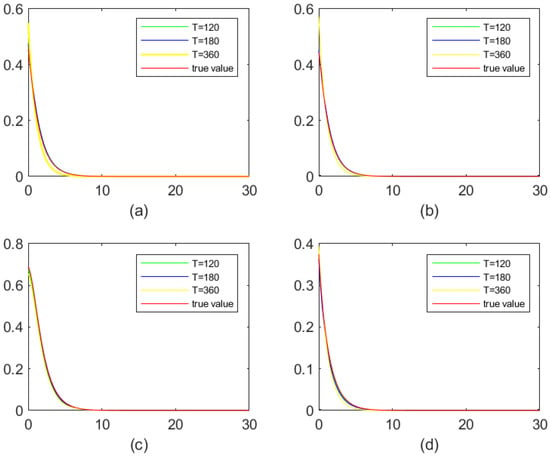

For Figure 1, we consider the comparison between the 30 estimated curves and the value curves when and the exponential claim size density. It is easily observed that the estimated curves are close to each other and close to the true value curve, which indicates that our estimation method has good stability. Next, in Figure 2 and Figure 3, based on 300 experiments, we respectively show the mean value curves and true value curves of the exponential claim size density and the combination-of-exponentials claim size density at different observed intervals T. It is easy to see from the figure above that it is difficult to distinguish the true value curves from the mean value curves when T is larger.

Figure 1.

Estimation of the Gerber–Shiu function for exponential density function: red line (true values) and green lines (30 estimated curves) when T = 180. (a) Ruin probability; (b) Laplace transform of ruin time; (c) expected claim size causing ruin; (d) expected deficit at ruin.

Figure 2.

Estimation of the Gerber–Shiu function for exponential density function: mean curves. (a) Ruin probability; (b) Laplace transform of ruin time; (c) expected claim size causing ruin; (d) expected deficit at ruin.

Figure 3.

Estimation of the Gerber–Shiu function for combination-of-exponentials density function: mean curves. (a) Ruin probability; (b) Laplace transform of ruin time; (c) expected claim size causing ruin; (d) expected deficit at ruin.

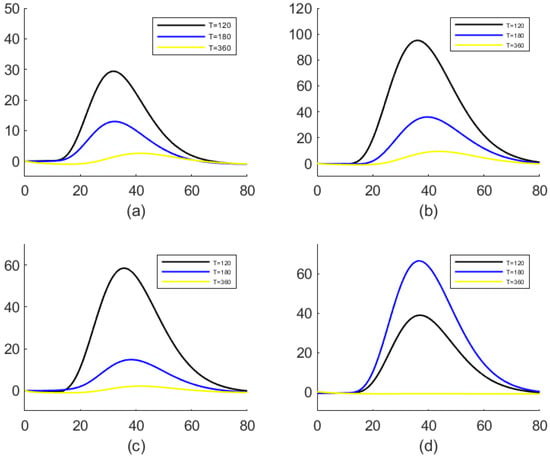

We also provide the situation of the mean relative error curves at the Erlang (2) claim size density in Figure 4. It can be noted that (1) the mean relative error curves first increase and then decrease with the increase in u; (2) when T is larger, the average relative error curve is smaller. This fact can be explained as follows: (1) when the initial surplus u is small, the true value as the denominator is large, which leads to a small mean relative error; (2) with the increase in u, the true value decreases, so the mean relative error increases; (3) as u continues to increase, the estimated value as the numerator decreases faster than the true value as the denominator, which makes the subsequent mean relative error curve drop below zero level.

Figure 4.

Estimation of the Gerber–Shiu function for Erlang (2) density function: mean relative error curves. (a) Ruin probability; (b) Laplace transform of ruin time; (c) expected claim size causing ruin; (d) expected deficit at ruin.

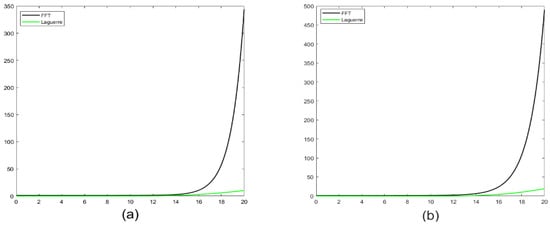

In addition, based on the above 300 repeated experiments, we give a series of IMSE values of Gerber–Shiu function estimation under three kinds of claim distribution assumptions in Table 1. All the numerical experiments in this paper were completed in MATLAB. Taking exponential density as an example, when , we completed 300 independent repeated experiments in 176.06 s. For each claim density function, the IMSE of the Gerber–Shiu function decreases as T increases. This conclusion also shows the stability of the estimation method in this paper. Finally, we compare the Laguerre series expansion method with FFT method used in Shimizu and Zhang [19]. The parameter setting of FFT is the same as in Shimizu and Zhang [19]. First, we present the IMSE values for both methods in Table 2, and we find that the Laguerre series expansion method can lead to smaller IMSEs compared with the FFT method. Moreover, we set and display the mean relative error curves in Figure 5, and we find that the Laguerre series expansion method can yield smaller mean relative errors.

Table 1.

IMSEs for the estimated Gerber–Shiu functions.

Table 2.

IMSEs for the estimated Gerber–Shiu functions.

Figure 5.

Comparing with FFT method for Erlang (2) density function: mean relative error curves. (a) Ruin probability; (b) Laplace transform of ruin time.

6. Conclusions

This paper introduces how to use the Laguerre series expansion method to estimate the Gerber–Shiu function of the two-sided jumps risk model and gives the nonparametric estimation of the corresponding ruin characteristic quantity. First, we prove that the Gerber–Shiu function of the two-sided jumps risk model can be expanded by Laguerre series, then Laguerre coefficient can be obtained by solving system of linear equations, and then the unknown coefficients can be estimated based on sample information on claim numbers and individual claim sizes. We derive the consistency property of this estimator when the sample size is large. Finally, when the sample size is limited, we demonstrate the high accuracy of the estimation method through numerical experiments. More importantly, it should be noted that our methods are not limited to be applied to the two-sided jumps risk model, but can be widely applied to other risk models in insurance. In addition, the following studies could be extended to other mathematical methods and models.

Author Contributions

Software, K.H.; Methodology, K.H. and Y.H.; Writing–original draft, K.H. and Y.H.; Writing–review and editing, Y.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the National Natural Science Foundation of China (Grant Nos. 71701068 and 11601147), and the Natural Science Foundation of Hunan Province (Grant No. 2021JJ30436), and the Scientific Research Fund of Hunan Provincial Education Department, China (Grant Nos. 20B381 and 20K084), and the Natural Science Foundation of Changsha City, China (Grant No. kq2014072).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data in this paper are randomly generated and are not available for readers.

Acknowledgments

The authors would like to thank the editors and reviewers for their help.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cheung, E.C.K.; Liu, H.; Willmot, G.E. Joint moments of the total discounted gains and losses in the renewal risk model with two-sided jumps. Appl. Math. Comput. 2018, 331, 358–377. [Google Scholar] [CrossRef]

- Boucheire, R.J.; Boxma, P.J.; Sigman, K. A note on negative customers, GI/G/1 workload, and risk processes. Probab. Eng. Inf. Sci. 1997, 358, 305–311. [Google Scholar] [CrossRef]

- Zhang, Z.; Yang, H.; Li, S. The perturbed compound Poisson risk model with two-sided jumps. J. Comput. Appl. Math. 2010, 233, 1773–1784. [Google Scholar] [CrossRef]

- Zou, W.; Gao, J.; Xie, J. On the expected discounted penalty function and optimal dividend strategy for a risk model with random incomes and interclaim-dependent claim sizes. J. Comput. Appl. Math. 2014, 255, 270–281. [Google Scholar] [CrossRef]

- Palmowski, Z.; Vatamidou, E. Phase-type approximations perturbed by a heavy-tailed component for the Gerber-Shiu function of risk processes with two-sided jumps. Stoch. Model. 2020, 26, 337–363. [Google Scholar] [CrossRef]

- Gerber, H.U.; Shiu, E.S.W. On the time value of ruin. N. Am. Actuar. J. 1998, 2, 48–478. [Google Scholar] [CrossRef]

- Zhao, X.; Yin, C. The Gerber-Shiu expected discounted penalty function for Lévy insurance risk processes. Acta Math. Appl. Sin. 2010, 26, 575–586. [Google Scholar] [CrossRef]

- Xie, J.; Zou, W. On the expected discounted penalty function for the compound Poisson risk model with delayed claims. Comput. Appl. Math. 2011, 235, 2392–2404. [Google Scholar] [CrossRef]

- Preischl, M.; Thonhauser, S. Optimal reinsurance for Gerber-Shiu functions in the Cramér-Lundberg model. Insur. Math. Econ. 2019, 87, 82–91. [Google Scholar] [CrossRef]

- Li, S.; Lu, Y.; Sendova, K.P. The expected discounted penalty function: From infinite time to finite time. Scand. Actuar. J. 2019, 2019, 336–354. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Z. Computing the Gerber-Shiu function by frame duality projection. Scand. Actuar. J. 2019, 4, 291–307. [Google Scholar] [CrossRef]

- Peng, X.; Su, W.; Zhang, Z. On a perturbed compound Poisson risk model under a periodic threshold-type dividend strategy. J. Ind. Manag. Optim. 2020, 16, 1967–1986. [Google Scholar] [CrossRef]

- Wang, W.; Chen, P.; Li, S. Generalized expected discounted penalty function at general drawdown for Lévy risk processes. Insur. Math. Econ. 2020, 91, 12–25. [Google Scholar] [CrossRef]

- Shimizu, Y. Estimation of the expected discounted penalty function for Leévy insurance risks. Math. Methods Stat. 2011, 20, 125–149. [Google Scholar] [CrossRef]

- Shimizu, Y. Non-parametric estimation of the Gerber-Shiu function for the Winer-Poisson risk model. Scand. Actuar. J. 2012, 1, 56–69. [Google Scholar] [CrossRef]

- You, H.; Cai, C. Nonparametric estimation for a spectrally negative Lévy process based on high frequency data. J. Comput. Appl. Math. 2019, 345, 196–205. [Google Scholar] [CrossRef]

- Zhang, Z.; Yang, H. Nonparametric estimate of the ruin probability in a pure-jump Leévy risk model. Insur. Math. Econ. 2013, 53, 24–35. [Google Scholar] [CrossRef]

- Zhang, Z.; Yang, H. Nonparametric estimation for the ruin probability in a Leévy risk model under low-frequency observation. Insur. Math. Econ. 2014, 59, 168–177. [Google Scholar] [CrossRef]

- Shimizu, Y.; Zhang, Z. Estimating Gerber-Shiu functions from discretely observed Leévy driven surplus. Insur. Math. Econ. 2017, 74, 84–98. [Google Scholar] [CrossRef]

- Chau, K.W.; Yam, S.C.P.; Yang, H. Fourier-cosine method for Gerber-Shiu functions. Insur. Math. Econ. 2015, 61, 170–180. [Google Scholar] [CrossRef]

- Chau, K.W.; Yam, S.C.P.; Yang, H. Fourier-cosine method for ruin probabilities. J. Comput. Appl. Math. 2015, 281, 94–106. [Google Scholar] [CrossRef]

- Yang, Y.; Su, W.; Zhang, Z. Estimating the discounted density of the deficit at ruin by Fourier-cosine series expansion. Stat. Probab. Lett. 2019, 146, 147–155. [Google Scholar] [CrossRef]

- Xie, J.; Zhang, Z. Statistical estimation for some dividend problems under the compound Poisson risk model. Insur. Math. Econ. 2020, 95, 101–115. [Google Scholar] [CrossRef]

- Zhang, Z. Estimating the Gerber-Shiu function by Fourier-Sinc series expansion. Scand. Actuar. J. 2017, 10, 898–979. [Google Scholar] [CrossRef]

- Chan, T.L. Efficient computation of European option prices and their sensitivities with the complex Fourier series method. N. Am. Econ. Financ. 2019, 50, 1–23. [Google Scholar] [CrossRef]

- Chan, T.L. Hedging and pricing early-exercise options with complex Fourier series expansion. N. Am. Econ. Financ. 2019, 22, 1–36. [Google Scholar]

- Wang, Y.; Zhang, Z.; Yu, W. Pricing equity-linked death benefits by complex Fourier series expansion in a regime-switching jump diffusion model. Appl. Math. Comput. 2021, 399, 126301. [Google Scholar] [CrossRef]

- You, H.; Yin, C. Threshold estimation for a spectrally negative Lévy process. Math. Probl. Eng. 2020, 2020, 3561089. [Google Scholar] [CrossRef]

- You, H.; Guo, J.; Jiang, J. Interval estimation of the ruin probability in the classical compound Poisson risk model. Comput. Stat. Data Anal. 2020, 144, 106890. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, W.; Huang, Y. Estimating the Gerber-Shiu function in a compound Poisson risk model with stochastic premium income. Discret. Dyn. Nat. Soc. 2019, 2019, 5071268. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, W.; Huang, Y.; Yu, X.; Fan, H. Estimating the expected discounted penalty function in a compound poisson insurance risk model with mixed premium income. Mathematics 2019, 7, 305. [Google Scholar] [CrossRef]

- Li, J.; Yu, W.; Liu, C. Nonparametric estimation of ruin probability by complex Fourier series expansion in the compound Poisson model. Commun. Stat. Theory Methods 2020, 51, 5048–5063. [Google Scholar] [CrossRef]

- Xie, J.; Zhang, Z. Finite-time dividend problems in a Lévy risk model under periodic observation. Appl. Math. Comput. 2021, 398, 125981. [Google Scholar]

- Huang, Y.; Li, J.; Liu, H.; Yu, W. Estimating ruin probability in an insurance risk model with stochastic premium income based on the CFS method. Mathematics 2021, 9, 982. [Google Scholar] [CrossRef]

- Su, W.; Wang, Y. Estimating the Gerber-Shiu function in Lévy insurance risk model by Fourier-cosine series expansion. Mathematics 2021, 9, 1402. [Google Scholar] [CrossRef]

- Wang, W.; Xie, J.; Zhang, Z. Estimating the time value of ruin in a Lévy risk model under low-frequency observation. Insur. Math. Econ. 2022, 104, 133–157. [Google Scholar] [CrossRef]

- Yang, Y.; Xie, J.; Zhang, Z. Nonparametric estimation of some dividend problems in the perturbed compound Poisson model. Probab. Eng. Inf. Sci. 2022, 37, 418–441. [Google Scholar] [CrossRef]

- Ai, M.; Zhang, Z.; Zhong, W. Valuation of a DB underpin hybrid pension under a regime-switching Lévy model. J. Comput. Appl. Math. 2023, 419, 114736. [Google Scholar] [CrossRef]

- He, Y.; Kawai, R.; Shimizu, Y.; Yamazaki, K. The Gerber-Shiu discounted penalty function: A review from practical perspectives. Insur. Math. Econ. 2023, 109, 1–28. [Google Scholar] [CrossRef]

- Zhong, W.; Cui, Z.; Zhang, Z. Efficient valuation of guaranteed minimum maturity benefits in regime switching jump diffusion models with surrender risk. J. Comput. Appl. Math. 2023, 422, 114914. [Google Scholar] [CrossRef]

- Comte, F.; Genon-Catalot, V. Adaptive Laguerre density estimation for mixed Poisson models. Electron. J. Stat. 2015, 9, 1113–1149. [Google Scholar] [CrossRef]

- Zhang, Z.; Su, W. A new efficient method for estimating the Gerber-Shiu function in the classical risk model. Scand. Actuar. J. 2018, 5, 426–449. [Google Scholar] [CrossRef]

- Zhang, Z.; Su, W. Estimating the Gerber-Shiu function in a Leévy risk model by Laguerre series expansion. J. Comput. Appl. Math. 2019, 346, 133–149. [Google Scholar] [CrossRef]

- Zhang, Z.; Yong, Y. Valuing guaranteed equity-linked contracts by Laguerre series expansion. J. Comput. Appl. Math. 2019, 357, 329–348. [Google Scholar] [CrossRef]

- Cheung, E.C.K.; Zhang, Z. Simple approximation for the ruin probability in renewal risk model under interest force via Laguerre series expansion. Scand. Actuar. J. 2021, 9, 804–831. [Google Scholar] [CrossRef]

- Albrecher, H.; Cheung, E.C.K.; Liu, H.; Woo, J.K. A bivariate Laguerre expansions approach for joint ruin probabilities in a two-dimensional insurance risk process. Insur. Math. Econ. 2022, 103, 96–118. [Google Scholar] [CrossRef]

- Xie, J.; Zhang, Z. Infinite series expansion of some finite-time dividend and ruin related functions. Commun. Stat. Theory Methods 2022. [Google Scholar] [CrossRef]

- Su, W.; Yong, Y.; Zhang, Z. Estimating the Gerber-Shiu function in the perturbed compound Poisson model by Laguerre series expansion. J. Math. Anal. Appl. 2019, 469, 705–729. [Google Scholar] [CrossRef]

- Su, W.; Shi, B.; Wang, Y. Estimating the Gerber-Shiu function under a risk model with stochastic income by Laguerre series expansion. Commun. Stat. Theory Methods 2019, 49, 5686–5708. [Google Scholar] [CrossRef]

- Huang, Y.; Yu, W.; Pan, Y.; Cui, C. Estimating the Gerber-Shiu expected discounted penalty function for Leévy risk model. Discret. Dyn. Nat. Soc. 2019, 2019, 3607201. [Google Scholar] [CrossRef]

- Su, W.; Yu, W. Asymptotically normal estimators of the Gerber-Shiu function in classical insurance risk model. Mathematics 2020, 8, 1638. [Google Scholar] [CrossRef]

- Xie, J.; Yu, W.; Zhang, Z.; Cui, Z. Gerber-Shiu analysis in the compound Poisson model with constant inter-observation times. Probab. Eng. Inf. Sci. 2022, 37, 324–356. [Google Scholar] [CrossRef]

- Cheung, E.C.K.; Lau, H.; Willmot, G.E.; Woo, J.K. Finite-time ruin probabilities using bivariate Laguerre series. Scand. Actuar. J. 2023, 2, 153–190. [Google Scholar] [CrossRef]

- Dickson, D.C.M.; Hipp, C. On the time to ruin for Erlang(2) risk processes. Insur. Math. Econ. 2001, 29, 333–344. [Google Scholar] [CrossRef]

- Li, S.; Garrido, J. On ruin for the Erlang(n) risk process. Insur. Math. Econ. 2004, 34, 391–408. [Google Scholar] [CrossRef]

- Abramowitz, M.; Stegun, I.A. Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables; National Bureau of Standards Applied Mathematics Series; Courier Corporation: North Chelmsford, MA, USA, 1964. [Google Scholar]

- Bongioanni, B.; Torrea, J.L. What is a Sobolev space for the Laguerre function system? Stud. Math. 2009, 192, 147–172. [Google Scholar] [CrossRef]

- Labbeé, C.; Sendov, H.S.; Sendova, K.P. The Gerber-Shiu function and the generalized Crameér-Lundberg model. Appl. Math. Comput. 2011, 218, 3035–3056. [Google Scholar]

- Stenger, F. Numerical Methods Based on Sinc and Analytic Functions; Springer: New York, NY, USA, 1993. [Google Scholar]

- Böttcher, A.B.; Grudsky, S.M. Toeplitz Matrices, Asymptotic Linear Algebra, and Functional Analysis; Birkhauser: Basel, Switzerland, 2000. [Google Scholar]

- Stewart, G.W.; Sun, J.G. Matrix Perturbation Theory; Academic Press: Beijing, China, 1990. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).