Abstract

In this study, we consider an intensity-based model for pricing a commodity-linked bond with credit risk. Recently, the pricing of a commodity-linked bond with credit risk under the structural model has been studied. We extend the result using an intensity-based model, stochastic volatility model, and stochastic convenience yield model. In the intensity-based model, the credit event by the counterparty occurs at the time of first jump in a stochastic Poisson process, in which intensity is modeled as the sum of two CIR prosesses. We assume that the underlying asset follows the stochastic volatility and convenience yield models. Using the measure change technique, we explicitly derive the commodity-linked bond pricing formula in the proposed model. As a result, we provide the explicit solution for the price of the commodity-linked bond with stochastic convenience yield, stochastic volatility, and credit risk as single integrations. In addition, we present several examples to demonstrate the effects of significant parameters on the value of commodity-linked bond using numerical integration. In particular, examples are provided, focusing on the behavior of prices based on effects of recovery rate.

MSC:

91G20; 91G30

1. Introduction

The options that incorporate credit risk are generally referred to as “vulnerable options” and have been the subject of extensive research in the field of finance. Johnson and Stulz [1] investigated vulnerable options by employing structural approaches to include counterparty credit risk in the option pricing model. Within the classical Black–Scholes model, Klein [2] developed an improved approach to pricing vulnerable options, particularly those affected by correlated default risk. After that, studies on pricing of vulnerable options under the structural model have investigated various modifications to the classical Black–Scholes model, including stochastic volatility models, as shown in studies such as [3,4,5,6], jump-diffusion models, as shown in [7,8,9], stochastic interest rate models [10,11], early counterparty risk models [12], and Markov-modulated processes, as shown in [13,14,15]. In addition, the Mellin transforms have been employed to solve the PDE for the pricing of vulnerable options. Many researchers have employed the Mellin transforms for pricing vulnerable options under the structural model. Yoon and Kim [16] were the first to apply Mellin transforms to calculate vulnerable European option prices. Several recent studies have demonstrated that the Mellin transforms can be used to solve the PDE for many types of financial derivatives with credit risk (path-dependent option [17], exchange option [18], and foreign equity option [19]).

In the field of finance, there is another model for describing credit risk. Intensity-based models, also known as reduced form models, are used to investigate vulnerable options. In contrast to structural models, which assume default from a firm’s collapsing financial state, intensity-based models take default as a random process with a specified intensity, equal to the arrival rate of events in a Poisson process. In recent years, the pricing models of vulnerable options under the intensity-based model have been studied. Using the intensity-based model witha Gaussian Ornstein–-Uhlenbeck process, Fard [20] investigated vulnerable European option pricing under a generalized jump-diffusion model, and Koo and Kim [21] presented an explicit pricing method for a catastrophe put option with exponential jump and credit risk. Wang [22] considered an intensity-based model based on for valuing vulnerable options in discrete time—a Generalized Autoregressive Conditional Heteroscedasticity (GARCH) process. Furthermore, Wang [23,24] improved the studies for vulnerable option pricing models in intensity-based models by employing a stochastic volatility model and a nonnegative intensity process with two components (systematic risk and idiosyncratic risk). In this study, we investigate the financial derivative with credit risk based on an intensity-based model. In the intensity-based model, we specifically deal with a commodity-linked bond with credit risk.

The efficient modeling and pricing of commodity derivatives have been studied for decades. Schwartz [25] established a complete framework for valuing commodity-linked bonds in a pioneering paper, based on the option pricing approaches proposed by Black and Scholes [26], which were further expanded by Cox and Ross [27]. In addition there have been extensive valuation approaches that include consideration of commodity price risk, default risk, and interest rate risk. Carr [28] developed the pricing formula of a commodity-linked bond by considering three types of risk (commodity price risk, credit risk, and interest rate risk). Yan [29] provided a closed-form solution for commodity-linked bonds under a multi-factor model, including stochastic volatility and simultaneous jumps. More recently, Ma et al. [30] developed the pricing models for valuing the commodity-linked bonds with counterparty credit risk using Mellin transforms. We study the pricing model of commodity-linked bond with credit risk, inspired by the work of [30]. We employ an intensity-based model for capturing counterparty credit risk. To our knowledge, the intensity-based model has not been applied to the valuation of commodity-linked bond with credit risk. Furthermore, the underlying assets are assumed to have stochastic volatility and stochastic convenience yield. That is, the contribution of this paper is to extend the work of [30] by using the stochastic volatility model, the stochastic convenience yield, and the intensity-based model.

The remainder of this paper is structured as follows. In Section 2, we propose the model used in this study. In Section 3, we derive the explicit pricing formula for the commodity-linked bond under the proposed model. In Section 4, we present some numerical experiments. In Section 5, we provide concluding remarks.

2. Model

In this section, we describe the model for pricing the commodity-linked bond with credit risk and stochastic volatility. We construct the model based on the two-factor model in the work of Schwartz [31] and the stochastic volatility model of Heston [32]. Under the risk neutral measure P, the dynamics are presented by

where is the stochastic convenience yield rate, r is the constant risk-free rate, , , and are constant volatilities, is the speed of adjustment, is the long-run mean yield, is the market price of convenience yield risk, and is the long-term mean of the convenience yield. In addition, and in the variance dynamic are constants, while , , and are the standard Brownian motions, and their correlations are such that and .

We consider the intensity-based model to model the counterparty credit risk. We assume that is a doubly Poisson process with intensity , in which the first jump time of is . Then, we say that the default occurs at . As in Wang [23], means the default time, and is defined by

where T is the maturity. Following the works of Wang [23,24], we assume that the intensity process is given by

where means a systematic risk, , and means an idiosyncratic risk captured by a mean-reverting square root process:

where , and are constants, and is the standard Brownian motion, independent of , and . We also note that a positive value ensures that the process has positive values. In (2), the intensity process consists of two terms. The first term represents systematic risk, whereas the second term describes idiosyncratic risk of bond issuers.

We first consider the financial derivative with credit risk. If the payoff function of the derivative is , as in Fard [20] and Wang [23,24], the value of the derivative with credit risk at time 0 in the intensity-based model is given by

where w is the recovery rate of the derivative and denotes the expectation under the measure P. The first expectation in (4) refers to a default event occurring throughout the lifetime of derivative, while the second expectation in (4) is related to no default events occurring before maturity T.

3. Pricing of Commodity-Linked Bond

In this section, we derive the pricing formula of commodity-linked bond in the proposed model. We follow Carr [28] and Ma et al. [30] in claiming that the firm makes no payments to bond holders prior to the bond’s maturity date, meaning that no dividends or coupons are paid. As a result, the guaranteed payment for commodity-linked bonds is equal to the guaranteed face value of a bond F plus a call option. The holder of this option has the option to acquire the relevant commodity bundle at a predetermined exercise price K. This payoff mechanism is a significant feature of commodity-linked bonds, and the payoff is defined as

Then, from Equation (4), we define the value of the commodity-linked bond at time 0 under the measure Q in the proposed framework. In order to start valuing the proposed bond, we state the following well-known proposition (for more details, see Cox et al. [33]).

Proposition 1.

Assume that the stochastic process is given by . Then, the joint characteristic function of is

where and are complex variables with nonnegative real parts, and

To derive the pricing formula of the bond, we should find the characteristic function , where and are complex variables and . The explicit expression of is presented in the following proposition.

Proposition 2.

In the proposed model, the characteristic function is expressed as

where

Proof.

Recall the dynamics in (1). Then, we can rewrite the dynamics as

where , and are the independent Brownian motions. From the above form of , we have that

Using the dynamics in (2) and (8), we have the following explicit expression of :

The first expectation in (8) can be obtained by applying Proposition 1 and the law of iterated expectations, as follows:

where is the -field generated by . Similarly, is calculated.

In addition, since

where then

This completes the proof. □

We can obtain the characteristic function of the logarithm of the underlying asset in Proposition 2. We derive the commodity-linked bond pricing formula explicitly using the characteristic function. To obtain the bond price, the Fourier inversion technique and the measure change technique are applied.

Proposition 3.

The value at time 0 of the commodity-linked bond with credit risk, under the proposed model, is given by

where

Proof.

In the intensity-based model, the price B of vulnerable commodity-linked bond at time 0 under the risk neutral measure P can be represented as

By using , we have

where

To calculate , we introduce a new measure as

Under the measure , the characteristic function of is given by

In addition, the marginal distribution of under the measure is given by

Then, we have

For , we introduce another measure as

Then, we obtain that

Since and can determined in the similar way using new measures and , the proof is completed. □

4. Numerical Example

In this section, we present several numerical examples to investigate the impact of several variables on commodity-linked bond pricing when the credit risk of counterparty is modeled through an intensity-based model. Based on the studies in [23,30], the parameters in the base case are used: . We also employ the quadrature method to numerically calculate the integrals in Proposition 3.

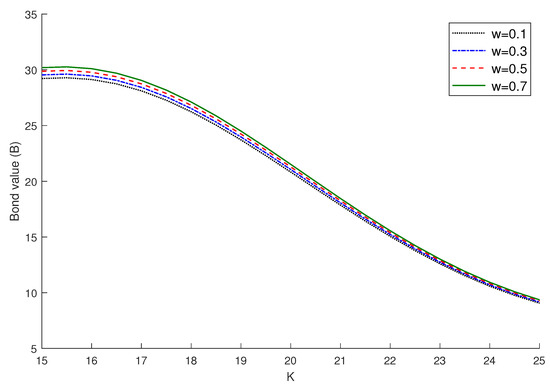

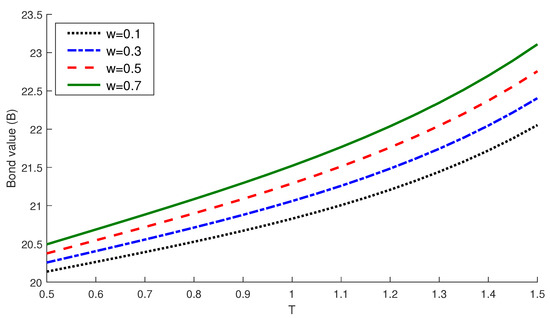

Figure 1 shows bond values against strike price K for four different recovery rates in the proposed model. From Figure 1, we observe that bond values decrease for the strike K from 15 to 25 and have similar values for sufficiently large values of K. Also, as expected, we note that bond values increase as the recovery rate w becomes higher. In other words, the bond prices are higher when there is little credit risk by the counterparty compared to high credit risk cases. Figure 2 shows the bond values against the time to maturity T for different values of recovery rates. The bond values increase with an increase in both T and w.This means that bond prices are an increasing function of maturity. We can also see that the function is exponential, not linear.

Figure 1.

Value of bonds against K for recovery rates .

Figure 2.

Value of bonds against T for recovery rates .

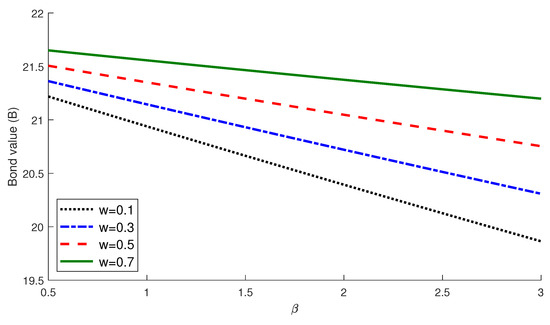

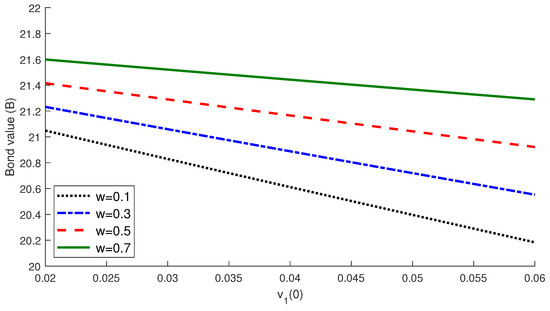

Figure 3 shows bond values against values in the intensity process. We observe that, as grows larger, bond values decrease, as expected. That is, the bond prices are a decreasing function of for all recovery rates. This is because the value of the intensity process increases as increases. As a result, the probability of a default increases, and the prices decrease. Also, because values affect the intensity process, has little impact on the value of bonds when w has a large value (close to 1). Figure 4 shows bond values against initial volatility of the dynamics . We can see that the bond prices are decreasing linear functions of for all recovery rates. That is, from Figure 4, we find that bond values fall as increases. This is because a higher level of connects to a larger default probability.

Figure 3.

Value of bonds against for recovery rates .

Figure 4.

Value of bonds against for recovery rates .

5. Concluding Remarks

In this study, we incorporate the stochastic convenience model and the stochastic volatility model to characterize the dynamics of the underlying assets. Additionally, we examine credit risk of counterparty using an intensity-based model. In the proposed model, we develop the commodity-linked bond pricing formula by using the measure change technique and the closed-form solution of the characteristic function obtained from the law of iterated expectation. Since the pricing formula is explicitly provided with single integral, the bond values are calculated using the numerical integration methods. Finally, we provide the graphs to illustrate the impacts of significant parameters on bond value.

This study is based on the works of Wang [23] and Ma et al. [30]. Wang [23] developed vulnerable option pricing models using the intensity-based model under a stochastic volatility model, and Ma et al. [30] improved the pricing models of the commodity-linked bonds with credit risk under the structural model. As a consequence, the main contribution of this study is an extension of the work of Ma et al. [30], using the credit risk model of Wang [23]. These results will be applicable to various bond-linked derivatives. However, our results have a limitation. In contrast to Ma et al. [30], who studied the valuation of commodity-linked bond with credit risk using the structural model, the credit risk model used in this paper is an intensity-based model. That is, the price of commodity-linked bonds with credit risk should be investigated using the structural model. This will be studied further in the future.

Author Contributions

J.J. and G.K. designed the model; J.J. and G.K. contributed to the analysis of the mathematical model; J.J. proved the propositions in the paper; J.J. and G.K. wrote the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by a grant from Kyung Hee University in 2022 (KHU-20220917).

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Johnson, H.; Stulz, R. The pricing of options with default risk. J. Financ. 1987, 42, 267–280. [Google Scholar] [CrossRef]

- Klein, P. Pricing Black-Scholes options with correlated credit risk. J. Bank. Financ. 1996, 20, 1211–1229. [Google Scholar] [CrossRef]

- Yang, S.J.; Lee, M.K.; Kim, J.H. Pricing vulnerable options under a stochastic volatility model. Appl. Math. Lett. 2014, 34, 7–12. [Google Scholar] [CrossRef]

- Wang, G.; Wang, X.; Zhou, K. Pricing vulnerable options with stochastic volatility. Phys. A Stat. Mech. Its Appl. 2017, 485, 91–103. [Google Scholar] [CrossRef]

- Ma, C.; Yue, S.; Wu, H.; Ma, Y. Pricing Vulnerable Options with Stochastic Volatility and Stochastic Interest Rate. Comput. Econ. 2020, 56, 391–429. [Google Scholar] [CrossRef]

- Jeon, J.; Kim, G.; Huh, J. An asymptotic expansion approach to the valuation of vulnerable options under a multiscale stochastic volatility model. Chaos Solitons Fractals 2021, 144, 110641. [Google Scholar] [CrossRef]

- Xu, W.; Xu, W.; Li, H.; Xiao, W. A jump-diffusion approach to modelling vulnerable option pricing. Financ. Res. Lett. 2012, 9, 48–56. [Google Scholar] [CrossRef]

- Tian, L.; Wang, G.; Wang, X.; Wang, Y. Pricing vulnerable options with correlated credit risk under jump-diffusion processes. J. Futur. Mark. 2014, 34, 957–979. [Google Scholar] [CrossRef]

- Han, X. Valuation of vulnerable options under the double exponential jump model with stochastic volatility. Probab. Eng. Inf. Sci. 2019, 33, 81–104. [Google Scholar] [CrossRef]

- Klein, P.; Inglis, M. Valuation of European options subject to financial distress and interest rate risk. J. Deriv. 1999, 6, 44–56. [Google Scholar] [CrossRef]

- Lv, G.; Xu, P.; Zhang, Y. Pricing of vulnerable options based on an uncertain CIR interest rate model. AIMS Math. 2023, 8, 11113–11130. [Google Scholar] [CrossRef]

- Liao, S.L.; Huang, H.H. Pricing Black–Scholes options with correlated interest rate risk and credit risk: An extension. Quant. Financ. 2005, 5, 443–457. [Google Scholar] [CrossRef]

- Wang, W.; Wang, W. Pricing vulnerable options under a Markov-modulated regime switching model. Commun. Stat. Methods 2010, 39, 3421–3433. [Google Scholar] [CrossRef]

- Niu, H.; Wang, D. Pricing vulnerable options with correlated jump-diffusion processes depending on various states of the economy. Quant. Financ. 2016, 16, 1129–1145. [Google Scholar] [CrossRef]

- Xie, Y.; Deng, G. Vulnerable European option pricing in a Markov regime-switching Heston model with stochastic interest rate. Chaos Solitons Fractals 2022, 156, 111896. [Google Scholar] [CrossRef]

- Yoon, J.H.; Kim, J.H. The pricing of vulnerable options with double Mellin transforms. J. Math. Anal. Appl. 2015, 422, 838–857. [Google Scholar] [CrossRef]

- Guardasoni, C.; Rodrigo, M.R.; Sanfelici, S. A Mellin transform approach to barrier option pricing. IMA J. Manag. Math. 2020, 31, 49–67. [Google Scholar] [CrossRef]

- Kim, G.; Koo, E. Closed-form pricing formula for exchange option with credit risk. Chaos Solitons Fractals 2016, 91, 221–227. [Google Scholar] [CrossRef]

- Kim, D.; Yoon, J.H.; Kim, G. Closed-form pricing formula for foreign equity option with credit risk. Adv. Differ. Equ. 2021, 2021, 1–17. [Google Scholar] [CrossRef]

- Fard, F.A. Analytical pricing of vulnerable options under a generalized jump–diffusion model. Insur. Math. Econ. 2015, 60, 19–28. [Google Scholar] [CrossRef]

- Koo, E.; Kim, G. Explicit formula for the valuation of catastrophe put option with exponential jump and default risk. Chaos Solitons Fractals 2017, 101, 1–7. [Google Scholar] [CrossRef]

- Wang, X. Analytical valuation of vulnerable options in a discrete-time framework. Probab. Eng. Inf. Sci. 2017, 31, 100–120. [Google Scholar] [CrossRef]

- Wang, X. Analytical valuation of vulnerable European and Asian options in intensity-based models. J. Comput. Appl. Math. 2021, 393, 113412. [Google Scholar] [CrossRef]

- Wang, X. Pricing vulnerable fader options under stochastic volatility models. J. Ind. Manag. Optim. 2023, 19, 5749–5766. [Google Scholar] [CrossRef]

- Schwartz, E.S. The pricing of commodity-linked bonds. J. Financ. 1982, 37, 525–539. [Google Scholar]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Cox, J.C.; Ross, S.A. The valuation of options for alternative stochastic processes. J. Financ. Econ. 1976, 3, 145–166. [Google Scholar] [CrossRef]

- Carr, P. A note on the pricing of commodity-linked bonds. J. Financ. 1987, 42, 1071–1076. [Google Scholar]

- Yan, X. Valuation of commodity derivatives in a new multi-factor model. Rev. Deriv. Res. 2002, 5, 251–271. [Google Scholar] [CrossRef]

- Ma, Z.; Ma, C.; Wu, Z. Pricing commodity-linked bonds with stochastic convenience yield, interest rate and counterparty credit risk: Application of Mellin transform methods. Rev. Deriv. Res. 2022, 25, 47–91. [Google Scholar] [CrossRef]

- Schwartz, E.S. The stochastic behavior of commodity prices: Implications for valuation and hedging. J. Financ. 1997, 52, 923–973. [Google Scholar] [CrossRef]

- Heston, S.L. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 1993, 6, 327–343. [Google Scholar] [CrossRef]

- Cox, J.C.; Ingersoll, J.E., Jr.; Ross, S.A. A theory of the term structure of interest rates. In Theory of Valuation; World Scientific: Singapore, 2005; pp. 129–164. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).